- IEX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

IDEX (IEX) DEF 14ADefinitive proxy

Filed: 16 Mar 18, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to§240.14a-12 | |

IDEX Corporation (Name of Registrant as Specified In Its Charter)

| ||||

(Name of Person(s) Filing Proxy Statement, if Other Than The Registrant)

| ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| ||||

| (2) | Aggregate number of securities to which transaction applies: | |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| ||||

| (4) | Proposed maximum aggregate value of transaction: | |||

| ||||

| (5) | Total fee paid: | |||

| ||||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

1925 West Field Court, Suite 200

Lake Forest, IL 60045

March 16, 2018

Dear Stockholders,

You are cordially invited to attend the Annual Meeting of Stockholders of IDEX Corporation (the Company), which will be held on Wednesday, April 25, 2018, at 9:00 a.m. Central Time, at the Lincolnshire Marriott Resort, Ten Marriott Drive, Lincolnshire, Illinois 60069.

The following pages contain our notice of annual meeting and proxy statement. Please review this material for information concerning the business to be conducted at the 2018 Annual Meeting, including the nominees for election as directors.

As we did last year, we have elected to provide access to our proxy materials and 2017 Annual Report on the Internet and are mailing paper copies to stockholders who have requested them. For further details, please refer to the section entitled Summary beginning on page 1 of the proxy statement.

Whether or not you plan to attend the 2018 Annual Meeting, it is important that your shares be represented. Please vote via telephone, the Internet or proxy card. If you own shares through a bank, broker or other nominee, please execute your vote by following the instructions provided by such nominee.

On behalf of the Board of Directors, I would like to express our appreciation for your continued interest in the Company.

Sincerely,

ANDREW K. SILVERNAIL

Chairman of the Board, President and

Chief Executive Officer

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

| Date and Time | Wednesday,April 25, 2018 at 9:00 a.m. Central Time

| |

| Place | Lincolnshire Marriott Resort, Ten Marriott Drive, Lincolnshire, Illinois 60069

| |

| Agenda | 1. Election of three members of the IDEX Board of Directors, each for a term of three years

| |

2. Advisory vote to approve named executive officer compensation

| ||

3. Ratification of the appointment of Deloitte & Touche LLP as our independent registered accounting firm for 2018

| ||

4. To transact such other business as may properly come before the 2018 Annual Meeting or any adjournment or postponement thereof

| ||

| Voting Recommendations | The Company’s Board of Directors recommends that you vote:

| |

1. “FOR” all the director nominees

| ||

2. “FOR” the approval of the compensation of our named executive officers

| ||

3. “FOR” the ratification of the appointment of Deloitte & Touche LLP

| ||

| Proxy Voting | Your vote is important. You can vote your shares by Internet, by telephone, or by mail. Instructions for each of these methods and the control number that you will need are provided on the proxy card. If your shares are held in “street name” in a stock brokerage account, or by a bank or other nominee, you must provide your broker with instructions on how to vote your shares in order for your shares to be voted on important matters presented at the 2018 Annual Meeting.

| |

| March 16, 2018 | By Order of the Board of Directors

| |

DENISE R. CADE Senior Vice President, General Counsel and Corporate Secretary |

Important Notice Regarding the Availability of Proxy Materials for the 2018 Annual Meeting The Proxy Statement and 2017 Annual Report are available online at: http://phx.corporate-ir.net/phoenix.zhtml?c=83305&p=irol-reportsAnnual

|

TABLE OF CONTENTS

| Page |

| 1 | ||||

| 5 |

| 12 | ||||

| 12 | ||||

Corporate Governance Guidelines and Code of Business Conduct and Ethics | 12 | |||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

Directors’ Outstanding Equity Awards at 2017 Fiscal Year End | 20 | |||

| 21 | ||||

| 24 | ||||

| 24 | ||||

| 29 | ||||

| 33 | ||||

| 36 | ||||

| 36 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| 44 | ||||

| 46 | ||||

| 46 | ||||

Narrative to Nonqualified Deferred Compensation at 2017 Fiscal Year End Table | 47 | |||

| 47 | ||||

| 54 | ||||

| 55 | ||||

| 56 | ||||

| 57 | ||||

| 57 | ||||

| 58 | ||||

| 59 | ||||

STOCKHOLDER PROPOSALS AND DIRECTOR NOMINATIONS FOR 2019 ANNUAL MEETING OF STOCKHOLDERS | 59 | |||

| 59 |

i

|

IDEX Corporation (the Company or IDEX) has prepared this proxy statement (Proxy Statement) in connection with the solicitation by the Company’s Board of Directors (the Board) of proxies for the Annual Meeting of Stockholders to be held on Wednesday, April 25, 2018, at 9:00 a.m. Central Time, at the Lincolnshire Marriott Resort, Ten Marriott Drive, Lincolnshire, Illinois 60069 (the Annual Meeting). The Company commenced distribution of, or otherwise made available, this Proxy Statement and the accompanying materials on March 16, 2018.

Who is entitled to vote at the Annual Meeting?

You are entitled to vote if you owned shares of IDEX’s common stock, par value $0.01 per share (Common Stock) as of the close of business on March 2, 2018, the record date of the Annual Meeting. On the record date, a total of 76,594,537 shares of Common Stock were outstanding. Each share of Common Stock entitles its holder of record to one vote on each matter upon which votes are taken at the Annual Meeting. There is no cumulative voting. No other securities are entitled to be voted at the Annual Meeting.

How do I vote?

Even if you plan to attend the Annual Meeting in person, we encourage you to vote as soon as possible, using one of the methods listed below.

| By Internet | By Telephone | By Mail | In Person | |||

www.proxyvote.com Open until 11:59 p.m. Eastern Time the day before the meeting date. Have your proxy card in hand when you access the website and follow the instructions. | 1-800-690-6903 Open until 11:59 p.m. Eastern Time the day before the meeting date. Have your proxy card in hand when you call and follow the instructions. | Mark, sign and date your proxy card and return it in the postage-paid envelope or return it toVote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717 | If you decide to attend the Annual Meeting, you will be able to vote in person, even if you have previously voted by Internet, telephone or mail. |

If you vote by telephone or over the Internet, you should not mail your proxy card. If your completed proxy card or telephone or Internet voting instructions are received prior to the Annual Meeting, your shares will be voted in accordance with your voting instructions.

If your shares are held in “street name” (that is, they are held in the name of a broker, financial institution or other nominee), you will receive instructions with your materials that you must follow in order to have your shares voted. Please review your voting instruction form to determine whether you will be able to vote by telephone or over the Internet.

1

What is a quorum for the Annual Meeting?

A quorum of stockholders is necessary to take action at the Annual Meeting. A majority of outstanding shares of Common Stock present in person or represented by proxy will constitute a quorum. The Company will appoint election inspectors to determine whether or not a quorum is present, and to tabulate votes cast by proxy or in person. Under certain circumstances, a broker or other nominee may have discretionary authority to vote shares of Common Stock if instructions have not been received from the beneficial owner or other person entitled to vote.

The election inspectors will treat directions to withhold authority, abstentions and brokernon-votes (which occur when a broker or other nominee holding shares for a beneficial owner does not vote on a particular proposal because such broker or other nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner) as present and entitled to vote for purposes of determining the presence of a quorum for the transaction of business at the Annual Meeting.

What are the voting requirements?

| Proposal | Vote Required | Effect of Broker Non-Votes | Effect of Abstentions | |||

Election of Directors | “Plurality Plus” Standard | No effect | No effect | |||

Advisory Vote on Executive Compensation | The affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote on the matter | No effect | “Against” | |||

| Ratification of Auditors | The affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote on the matter | No effect | “Against” |

What is the “Plurality Plus” Standard?

The Company’s Corporate Governance Guidelines provide for a Plurality Plus Standard with respect to the election of directors. Any nominee who receives a greater number of withhold votes than affirmative votes in an uncontested election is required to submit an offer of resignation for consideration by the Nominating and Corporate Governance Committee of the Board within 90 days from the date of election.

The Nominating and Corporate Governance Committee must then consider all of the relevant facts and circumstances and recommend to the Board the action to be taken with respect to the offer of resignation.

2

How does the Board recommend that I vote?

The Board recommends that you vote:

1. FOR the election of the Company’s nominees as directors.

2. FOR the approval of the compensation of the Company’s named executive officers.

3. FOR approval of the ratification of the appointment of auditors.

What happens if I do not specify a choice for a matter when returning my proxy card?

If you sign and return your proxy card but do not give voting instructions, your shares will be voted as recommended by the Board, and in the discretion of the proxy holders as to any other business which may properly come before the Annual Meeting.

What can I do if I change my mind after I vote my shares?

You can revoke a proxy prior to the completion of voting at the Annual Meeting by:

| 1. | Mailing a new proxy card with a later date. |

| 2. | Casting a new vote on the Internet or by telephone. |

| 3. | Sending a written notice of revocation addressed to Denise R. Cade, Senior Vice President, General Counsel and Corporate Secretary, IDEX Corporation, 1925 West Field Court, Suite 200, Lake Forest, Illinois 60045. |

| 4. | Voting in person at the Annual Meeting. |

If your shares are held in “street name,” please contact your broker, financial institution or other nominee and comply with such nominee’s procedures if you want to change or revoke your previous voting instructions.

Who will solicit the proxies and who will pay the cost of this proxy solicitation?

The Company will bear the costs of preparing and mailing this Proxy Statement and other costs of the proxy solicitation made by the Board. Certain of the Company’s officers and employees may solicit the submission of proxies authorizing the voting of shares in accordance with the Board’s recommendations, but no additional remuneration will be paid by the Company for the solicitation of those proxies. Any such solicitations may be made by personal interview, telephone, email or facsimile transmission.

The Company has made arrangements with brokerage firms and other record holders of its Common Stock to forward proxy solicitation materials to the beneficial owners of such Common Stock. The Company will reimburse those brokerage firms and others for their reasonableout-of-pocket expenses in connection with this work.

In addition, the Company has engaged Morrow Sodali LLC, 470 West Avenue, Stamford, Connecticut, to assist in proxy solicitation and collection at a cost of $6,500, plusout-of-pocket expenses.

3

Why did I receive a “Notice of Internet Availability of Proxy Materials” but no proxy materials?

As permitted under rules of the Securities and Exchange Commission (SEC), we are making our proxy materials available to stockholders electronically via the Internet. We believe electronic delivery expedites receipt of our proxy materials by stockholders, while lowering the costs and reducing the environmental impact of the Annual Meeting.

If you receive a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials by mail unless you specifically request them. Instead, the Notice of Internet Availability will provide instructions as to how you may review the proxy materials and submit your voting instructions over the Internet.

If you receive the Notice of Internet Availability by mail and would like to receive a printed copy of the proxy materials, you should follow the instructions in the notice for requesting a printed copy. In addition, the proxy card contains instructions for electing to receive proxy materials over the Internet or by mail in future years.

4

PROPOSALS TO BE VOTED ON AT THE 2018 ANNUAL MEETING

PROPOSAL 1 — ELECTION OF DIRECTORS

The Company’s Restated Certificate of Incorporation, as amended, provides for a three-class Board of Directors, with one class being elected each year for a term of three years. The Board currently consists of nine members, three of whom are Class II directors whose terms will expire at this year’s Annual Meeting, three of whom are Class III directors whose terms will expire at the Annual Meeting to be held in 2019, and three of whom are Class I directors whose terms will expire at the Annual Meeting to be held in 2020.

Overview of IDEX Board of Directors

| ||||||||||

Our Directors Exhibit:

High integrity

Loyalty to the Company and commitment to its success

Proven record of success

Knowledge of corporate governance and practices

Our Directors Bring to the Boardroom:

High level of leadership experience

|

Board Composition

Independent Directors: 8 of 9

Average IDEX Board Tenure: 5.1 years

Average Age: 57

Diversity of gender, race or ethnicity: 2 of 9

|

| ||||||||

Specialized industry expertise

Financial expertise

Extensive knowledge of the Company | ||||||||||

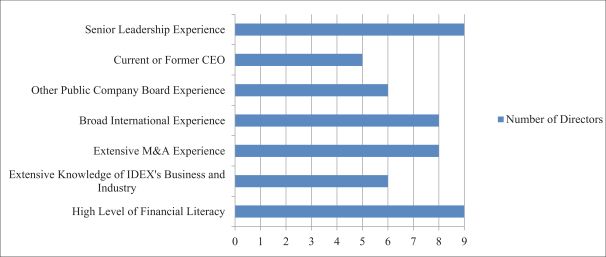

Set forth below is a summary of the Board’s collective qualifications, experiences and backgrounds.

5

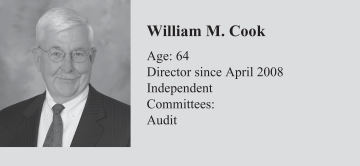

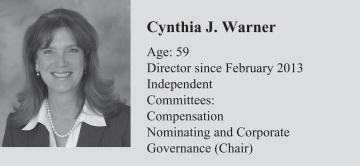

The Board has nominated three individuals for election as Class II directors to serve for a three-year term expiring at the Annual Meeting to be held in 2021, or upon the election and qualification of their successors. The nominees of the Board are William M. Cook, Cynthia J. Warner and Mark A. Buthman, each of whom is currently serving as a director of the Company.

The nominees and the directors serving in Class I and Class III whose terms expire in future years and who will continue to serve after the Annual Meeting are listed below with brief statements setting forth their present principal occupations and other information, including any directorships in other public companies, and their particular experiences, qualifications, attributes and skills that led to the conclusion they should serve as directors. If for any reason any of the nominees are unavailable to serve, proxies solicited hereby may be voted for a substitute. The Board, however, expects the nominees to be available.

6

Our Board of Directors recommends that you vote FOR the election of each of the 2018 director nominees

|

2018 DIRECTOR NOMINEES

Mr. Cook is our Lead Director. He served as Chairman of the Board of Donaldson Company, Inc. from prior to 2009 to April 2016. Mr. Cook retired as the President and Chief Executive Officer of Donaldson in April 2015, having served since prior to 2009.

Mr. Cook’s strong business and organizational leadership skills and his relevant experience in technology industries led to the conclusion that he should serve on the Board of Directors. Throughout his35-year career at Donaldson, a technology-driven global company that manufactures filtration systems designed to remove contaminants from air and liquids, Mr. Cook served in several senior executive positions, and was elected as a director in 2004.

Mr. Cook received a bachelor of science degree in business administration and a master of business administration degree from Virginia Polytechnic Institute and State University.

Mr. Cook is a director of Neenah Paper, Inc.

Ms. Warner has been Executive Vice President, Operations for Andeavor (formerly known as Tesoro Corporation) since August 2016. Prior to that, Ms. Warner served as Andeavor’s Executive Vice President, Strategy and Business Development, since October 2014. From 2012 to 2014, Ms. Warner was Chairman and Chief Executive Officer of Sapphire Energy, Inc. From 2009 to 2011, Ms. Warner was Chairman and President of Sapphire Energy. Prior to 2009, Ms. Warner was Group Vice President, Global Refining, at BP plc.

Ms. Warner’s operating leadership skills, international experience and extensive experience in the energy, refining and transportation industries led to the conclusion that she should serve on the Board of Directors. During her 25 years at BP and Amoco, Inc. (prior to its acquisition by BP), Ms. Warner gained significant knowledge of the global energy industry and served in numerous leadership roles, including overseeing BP’s Global Refining business and its Health Safety Security Environment, with a consistent record of success in coordinating the operations of thousands of employees across BP’s global facilities.

William M. Cook Age: 64 Director since April 2008 Independent Committees: Audit Cynthia J. Warner Age: 59 Director since February 2013 Independent Committees: Compensation Nominating and Corporate Governance (Chair)

7

In her role as Chief Executive Officer of Sapphire Energy, an alternative energy venture, Ms. Warner had oversight responsibility for the raising of substantial investment capital and the successful completion of a new demonstration facility for the company.

Ms. Warner received a bachelor of engineering degree in chemical engineering from Vanderbilt University and a master of business administration degree from Illinois Institute of Technology.

Mr. Buthman retired from Kimberly-Clark Corporation in 2015, where he was Executive Vice President and Chief Financial Officer from January 2003 to April 2015. During his33-year career at Kimberly-Clark, Mr. Buthman held a wide range of leadership roles, led or participated in more than 50 acquisition transactions totaling more than $10 billion in value and was part of an executive team that created more than $20 billion in shareholder value during his tenure as Chief Financial Officer.

Mr. Buthman’s experience as a Chief Financial Officer of a Fortune 150 company with significant international operations and as a public company director led to the conclusion that he should serve on the Board of Directors. Mr. Buthman is a disciplined financial leader with a track record of allocating capital in shareholder-friendly ways and his insight is extremely valuable to our Board of Directors and management.

Mr. Buthman received a bachelor of business administration degree in finance from the University of Iowa.

Mr. Buthman is a director of West Pharmaceutical Services, Inc.

Mark A. Buthman Age: 57 Director since April 2016 Independent Committees: Audit

8

OTHER INCUMBENT DIRECTORS

Class III: Three-Year Term Expires in 2019

Mr. Mrozek served as Vice Chairman and Chief Financial Officer of The ServiceMaster Company, a residential and commercial service company, until his retirement in March 2008.

Mr. Mrozek’s strategic and operating leadership skills, his extensive experience and expertise in the business services industry and his financial reporting expertise led to the conclusion that he should serve on the Board of Directors. Through over 20 years of executive experience in various senior positions in general management, operations and finance at ServiceMaster, including more than eight years as President and Chief Operating Officer of ServiceMaster or one of its largest segments, Mr. Mrozek developed extensive knowledge of the business services industry and gained valuable financial expertise and experience in mergers and acquisitions.

Prior to joining ServiceMaster in 1987, Mr. Mrozek spent 12 years in public accounting with Arthur Andersen & Co. Mr. Mrozek has also acquired substantial experience in corporate governance as a director on the boards of several public and private companies.

Mr. Mrozek received a bachelor of science degree in accountancy with honors from the University of Illinois and is a certified public accountant, on inactive status.

Mr. Mrozek is a director of Advanced Disposal Services, Inc.

Mr. Satterthwaite has served as President of Cummins Distribution Business, a unit of Cummins, Inc., since April 2015. Prior to that, Mr. Satterthwaite served as President of Cummins Power Generation from June 2008 to April 2015.

Mr. Satterthwaite’s business leadership and sales skills, international experience and extensive experience in industrial manufacturing led to the conclusion that he should serve on the Board of Directors. Since joining Cummins in 1988, Mr. Satterthwaite has held various positions at Cummins Power Generation and other divisions of Cummins, including 14 years in managerial and sales positions in the United Kingdom and Singapore.

Prior to joining Cummins, Mr. Satterthwaite spent four years at Schlumberger Limited, an oil field services provider, as a general field engineer.

Mr. Satterthwaite received a bachelor of science degree in civil engineering from Cornell University and a master of business administration degree from Stanford University.

Ernest J. Mrozek Age: 64 Director since July 2010 Independent Committees: Audit (Chair) Livingston L. Satterthwaite Age: 57 Director since April 2011 Independent Committees: Compensation (Chair) Nominating and Corporate Governance

9

Mr. Parry served as Vice Chairman of Illinois Tool Works Inc. (ITW) from 2010 until his retirement in April 2017. From prior to 2009 until 2010, Mr. Parry was Executive Vice President of ITW with responsibility for the Polymers and Fluids Group.

Mr. Parry’s strategic and operating leadership skills and global commercial perspective gained from over 30 years of international business leadership experience, his significant acquisition experience and his extensive expertise in the industrial products manufacturing industry led to the conclusion that he should serve on the Board of Directors. During 18 years of executive and management experience in various senior management positions at ITW, a multinational manufacturer of a diversified range of industrial products and equipment, Mr. Parry successfully grew the operations and profitability of multiple business units and helped ITW complete numerous acquisitions.

Prior to joining ITW in 1994, Mr. Parry spent 17 years in various executive and management positions at Imperial Chemical Industries, which at the time was one of the largest chemical producers in the world.

Mr. Parry received a bachelor of science degree in chemistry, a master of science degree in chemistry and a Ph.D. in polymer chemistry from Victoria University of Manchester, Manchester, England.

Class I: Three-Year Term Expires in 2020

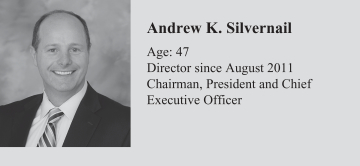

Mr. Silvernail was appointed Chairman of the Board effective January��1, 2012. Mr. Silvernail has served as President and Chief Executive Officer and a director of the Company since August 10, 2011. Prior to his appointment as President and Chief Executive Officer, Mr. Silvernail served since January 2011 as Vice President Group Executive of the Company’s Health & Science Technologies, Global Dispensing and Fire & Safety/Diversified Products business segments. From February 2010 to December 2010, Mr. Silvernail was Vice President Group Executive of the Company’s Health & Sciences Technologies and Global Dispensing business segments. Mr. Silvernail joined IDEX in January 2009 as Vice President Group Executive of Health & Science Technologies.

Mr. Silvernail’s relevant experience with engineering and technology industries in general, together with his extensive management experience, led to the conclusion that he should serve on the Board of Directors.

Mr. Silvernail received a bachelor of science degree in government from Dartmouth College and a master of business administration degree from Harvard University.

Mr. Silvernail is a director of Stryker Corporation.

David C. Parry Age: 64 Director since December 2012 Independent Committees: Compensation Nominating and Corporate Governance Andrew K. Silvernail Age: 47 Director since August 2011 Chairman, President and Chief Executive Officer

10

Ms. Helmkamp has served as Chief Executive Officer of Lenox Corporation since November 2016. Previously, Ms. Helmkamp served as Chief Executive Officer of SVP Worldwide from 2010 through 2014, and as Senior Vice President, North America Product for Whirlpool Corporation from 2008 to 2010.

Ms. Helmkamp’s operating leadership skills and her experience across multiple markets and technologies led to the conclusion that she should serve on the Board of Directors. During her time at SVP Worldwide and Whirlpool Corporation, Ms. Helmkamp was responsible for managing the operations and profitability of global businesses that derived a substantial portion of their revenues from outside of the United States.

In addition, Ms. Helmkamp successfully oversaw numerous new product development and technology initiatives, including the launch of new products and service categories with improved margins and quality. Ms. Helmkamp also has significant mergers and acquisitions experience, both in identifying and evaluating potential targets, as well as leading post-acquisition integration activities.

Ms. Helmkamp received a bachelor of science degree in industrial engineering and a master of business administration degree from Northwestern University.

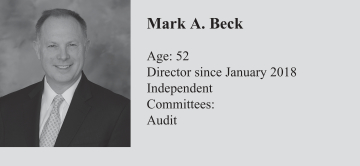

Mr. Beck served as President and Chief Executive Officer ofJELD-WEN Holding, Inc.(JELD-WEN), one of the world’s largest door and window manufacturers, from November 2015 to February 2018, and was a director ofJELD-WEN from May 2016 to February 2018. Prior to JELD-WEN, Mr. Beck served as an Executive Vice President at Danaher Corporation, leading Danaher’s water quality and dental programs, beginning in April 2014. Previously, he spent 18 years with Corning Incorporated in a series of management positions with increasing responsibility, culminating in his appointment as Executive Vice President overseeing Corning’s environmental technologies and life science units in July 2012. He also served on the board of directors ofDow-Corning Corporation from 2010 to 2014.

Mr. Beck’s experience as a chief executive officer of a public company with significant international operations and his track record of innovation and successfully integrating acquired businesses led to the conclusion that he should serve on the Board of Directors.

Mr. Beck received a bachelor of arts degree in business management from Pacific University and a master of business administration degree from Harvard University.

Katrina L. Helmkamp Age: 52 Director since November 2015 Independent Committees: Compensation Nominating and Corporate Governance Mark A. Beck Age: 52 Director since January 2018 Independent Committees: Audit

11

Framework for Corporate Governance

The Board of Directors has the ultimate authority for the management of the Company’s business. The Corporate Governance Guidelines, the charters of the Board committees, the Code of Business Conduct and Ethics, and the Standards for Director Independence provide the framework for the governance of the Company. Copies of the current Corporate Governance Guidelines, the charters of the Board committees, the Code of Business Conduct and Ethics, and the Standards for Director Independence are available under the Investor Relations links on the Company’s website at www.idexcorp.com.

Corporate Governance Guidelines and Code

of Business Conduct and Ethics

The Corporate Governance Guidelines address matters such as election of directors, size and retirement age for the Board, Board composition and membership criteria, the role and responsibilities of the Board and each of its committees, Board evaluations and the frequency of Board meetings (including meetings to be held without the presence of management).

The Code of Business Conduct and Ethics sets forth the guiding principles of business ethics and certain legal requirements applicable to all of the Company’s employees and directors.

The Board has adopted standards for determining whether a director is independent. These standards are based upon the listing standards of the New York Stock Exchange (NYSE) and applicable laws and regulations, and are available on the Company’s website as described above. The Board also reviewed commercial relationships between the Company and organizations with which directors were affiliated by service as an executive officer. The relationships with these organizations involved

the Company’s sale or purchase of products or services in the ordinary course of business that were made onarm’s-length terms and other circumstances that did not affect the relevant directors’ independence under applicable law and NYSE listing standards.

The Board has affirmatively determined, based on these standards and after considering the relationships described immediately above, that the following directors are independent: Messrs. Beck, Buthman, Cook, Mrozek, Parry and Satterthwaite, and Mss. Helmkamp and Warner. The Board has also determined that Mr. Silvernail is not independent because he is the Chairman of the Board, President and Chief Executive Officer of the Company. All standing Board committees are, and throughout fiscal year 2017 were, composed entirely of independent directors.

The Board believes that maintaining a diverse membership with varying backgrounds, skills, expertise and other differentiating personal characteristics promotes inclusiveness, enhances the Board’s deliberations and enables the Board to better represent all of the Company’s constituents. Accordingly, the Board is committed to seeking out highly qualified women and minority candidates as well as candidates with diverse backgrounds, skills and experiences as part of each Board search the Company conducts. The Board considers the following in selecting nominees for the Board:

Experience (in one or more of the following):

| • | high level leadership experience in business or administrative activities; |

| • | specialized expertise in the industries in which the Company competes; |

| • | financial expertise; |

| • | breadth of knowledge about issues affecting the Company; |

12

| • | ability and willingness to contribute special competencies to Board activities; and |

| • | expertise and experience that is useful to the Company and complementary to the background and experience of other Board members, so that an optimal balance and diversity of Board members may be achieved and maintained. |

Personal attributes and characteristics:

| • | personal integrity; |

| • | loyalty to the Company and concern for its success and welfare, and willingness to apply sound independent business judgment; |

| • | awareness of a director’s vital part in the Company’s good corporate citizenship and corporate image; |

| • | time available for meetings and consultation on Company matters; and |

| • | willingness to assume fiduciary responsibilities. |

Qualified candidates for membership on the Board shall not be discriminated against with regard to age, race, color, religion, sex, ancestry, national origin, sexual orientation or disability. In the past, the Company has engaged executive search firms to help identify and facilitate the screening and interviewing of director candidates. Any search firm retained by the Company to find director candidates is instructed to take into account all of the considerations used by our Nominating and Corporate Governance Committee, including diversity. After conducting an initial evaluation of a candidate, the Nominating and Corporate Governance Committee will interview that candidate if it believes the candidate is suitable to be a director. The Nominating and Corporate Governance Committee may also ask the candidate to meet with other members of the Board.

If the Nominating and Corporate Governance Committee believes a candidate would be a valuable addition to the Board, it will recommend to the full Board appointment or election of that candidate. Annually, the Nominating and Corporate Governance Committee reviews the qualifications and backgrounds of the directors, as well as the overall composition of the Board, and recommends to the full Board the slate of directors for nomination for election at the annual meeting of stockholders.

The Company’s Bylaws permit the Board to select its Chairman in the manner it determines to be most appropriate. The Corporate Governance Guidelines provide that, if the Chairman of the Board is not the Chief Executive Officer, and is an independent director, there shall be no Lead Director. If the Chairman of the Board is the Chief Executive Officer or is not an independent director, the independent directors shall elect an independent Lead Director.

William M. Cook has served as Lead Director since immediately following the 2015 Annual Meeting of Stockholders. The responsibilities of the Lead Director include:

| • | coordinating the activities of the independent directors; |

| • | reviewing the Board meeting agendas and providing the Chairman with input on the agendas; |

| • | preparing the agendas for executive sessions of the independent directors and chairing those sessions; |

| • | facilitating communications between the Chairman and other members of the Board; and |

| • | coordinating the performance evaluation of the Chief Executive Officer. |

The independentnon-management directors of the Board meet separately as a group at every

13

regularly scheduled Board meeting. The Lead Director generally presides at thesenon-management executive sessions. During 2017, the Board held twelve meetings.

The Board believes that its current leadership structure provides independent board leadership and engagement while deriving the benefit of having the Chief Executive Officer also serve as Chairman of the Board.

The Chief Executive Officer, as the individual with primary responsibility for managing the Company’sday-to-day operations, is best positioned to chair regular Board meetings and to oversee discussion on business and strategic issues. Coupled with the existence of a Lead Director and regular executive sessions of thenon-management directors, this structure provides independent oversight, including risk oversight, while facilitating the exercise of the Board’s responsibilities.

During 2017, each director attended more than 75% of the aggregate number of meetings of the Board and of committees of the Board of which he or she was a member. The Company encourages its directors to attend the annual meeting of stockholders but has no formal policy with respect to that attendance. All of the current directors then on the Board attended the 2017 Annual Meeting of Stockholders.

The Board oversees an annual assessment of enterprise risk exposure, and the management of such risk, conducted by the Company’s executives.

When assessing enterprise risk, the Board focuses on the achievement of organizational objectives, including strategic objectives, to improve long-term performance and enhance stockholder value. Direct oversight allows the Board to assess management’s inclination for risk, to determine what constitutes an appropriate level of risk for the Company and to discuss with management the means by which to control risk.

The Board selects the Company’s executive officers, delegates responsibilities for the conduct of the Company’s operations to those officers, and monitors their performance.

We value the input of our stockholders and believe that it is important to understand their questions and concerns about the Company. During 2017, we met with a number of our stockholders and prospective stockholders to answer questions about the Company and learn about matters that are important to them. We plan to continue our investor outreach efforts during 2018.

Stockholders and other interested parties may contact the Board and the directors by writing to Denise R. Cade, Senior Vice President, General Counsel and Corporate Secretary, IDEX Corporation, 1925 West Field Court, Suite 200, Lake Forest, Illinois 60045. Inquiries sent by mail will be reviewed, sorted and summarized by Ms. Cade before they are forwarded to any director.

Important functions of the Board are performed by committees comprised of members of the Board. There are three standing committees of the Board: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. Each committee has a written charter that is available on the Company’s website as described above.

Subject to applicable provisions of the Company’s Bylaws and based on the recommendations of the Nominating and Corporate Governance Committee, the Board as a whole appoints the members of each committee each year at its first meeting. The Board may, at any time, appoint or remove committee members or change the authority or

14

responsibility delegated to any committee, subject to applicable law and NYSE listing standards.

The following table summarizes the current membership of the committees of the Board.

| Director | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | |||

| Mark A. Beck | Ö | |||||

| Mark A. Buthman | Ö | |||||

| William M. Cook | Ö | |||||

| Katrina L. Helmkamp | Ö | Ö | ||||

| Ernest J. Mrozek | Ö | |||||

| David C. Parry | Ö | Ö | ||||

| Livingston L. Satterthwaite | Ö | Ö | ||||

| Cynthia J. Warner | Ö | Ö |

Pursuant to its charter, the Audit Committee has the authority and responsibility to:

| • | monitor the integrity of the Company’s financial statements, financial reporting process and systems of internal controls regarding finance, accounting, legal and regulatory compliance; |

| • | monitor the qualifications, independence and performance of the Company’s independent auditor and monitor the performance of the Company’s internal audit function; |

| • | hire and fire the Company’s independent auditor and approve any audit andnon-audit work performed by the independent auditor; |

| • | provide an avenue of communication among the independent auditor, management and the Board; |

| • | prepare the audit committee report that SEC rules require to be included in the Company’s annual proxy statement; and |

| • | administer the Company’s Related Person Transactions Policy (described further below). |

While the Board has the ultimate oversight responsibility for the risk management process, the Audit Committee focuses on financial risk management and exposure, and legal compliance. The Audit Committee receives an annual risk assessment report from the Company’s internal auditors and reviews and discusses the Company’s financial risk exposures and the steps management has taken to monitor, control and report those exposures.

The Board has determined that each of Messrs. Beck, Buthman, Cook and Mrozek is an “audit committee financial expert,” as defined by SEC rules.

The Audit Committee has adopted a written Related Person Transactions Policy regarding the review, approval and ratification of transactions with related persons. All related person transactions are approved by the Audit Committee. If the transaction involves a related person who is an Audit Committee member or immediate family member of an Audit Committee member, that Audit Committee member will not be included in the deliberations or vote regarding approval. In approving the transaction, the Audit Committee must determine that the transaction is fair and reasonable to the Company. At the first Audit Committee meeting of each calendar year, or a subsequent meeting if the Audit Committee so chooses, the Audit Committee reviews any previously approved or ratified related person transactions that remain ongoing and have a remaining term of more than six months or remaining amounts payable to or receivable from the Company of more than $10,000. Based on all relevant facts and circumstances, taking into consideration the Company’s contractual

15

obligations, the Audit Committee determines if it is in the best interests of the Company and its stockholders to continue, modify or terminate any such related person transactions.

During 2017, the Audit Committee held nine meetings.

The Compensation Committee’s primary duties and responsibilities are to:

| • | establish the Company’s compensation philosophy and structure the Company’s compensation programs to be consistent with that philosophy; |

| • | establish the compensation of the Chief Executive Officer and other senior officers; |

| • | develop and recommend to the Board compensation for the directors; and |

| • | prepare the compensation committee report the rules of the SEC require to be included in the Company’s annual proxy statement. |

To assist the Compensation Committee in discharging its responsibilities, the Compensation Committee retained Frederic W. Cook & Co., Inc. (F.W. Cook) to act as an outside consultant. F.W. Cook is engaged by, and reports directly to, the Compensation Committee.

The Compensation Committee has reviewed the nature of the relationship between itself and F.W. Cook, including all personal and business relationships between the committee members, F.W. Cook and the individual compensation consultants who provide advice to the Compensation Committee. Based on its review, the Compensation Committee did not identify any actual or potential conflicts of interest in F.W. Cook’s engagement as an independent consultant.

F.W. Cook works with the Compensation Committee and management to structure the Company’s compensation programs and to evaluate the competitiveness of its executive compensation levels. F.W. Cook’s primary areas of assistance to the Compensation Committee are:

| • | analyzing market compensation data for all executive positions; |

| • | advising on the structure of the Company’s compensation programs; |

| • | advising on the terms of equity awards; |

| • | assessing the relationship between named executive officer compensation and Company financial performance; |

| • | reviewing the risk associated with the Company’s compensation programs; and |

| • | reviewing materials to be used in the Company’s annual proxy statement. |

F.W. Cook periodically provides the Compensation Committee and management market data on a variety of compensation-related topics. The Compensation Committee has authorized F.W. Cook to interact with the Company’s management, as needed, on behalf of the Compensation Committee, to obtain or confirm information.

During 2017, Ms. Helmkamp, Mr. Parry, Mr. Satterthwaite and Ms. Warner served as members of the Compensation Committee. None of these directors (i) was an officer or employee of the Company or any of its subsidiaries during 2017, (ii) was formerly an officer of the Company or any of its subsidiaries, or (iii) had any relationship requiring disclosure by the Company under Item 404 of RegulationS-K under the Securities Act of 1933, as amended. There were no relationships between the Company’s executive officers and the members of the Compensation Committee that require disclosure under Item 407(e)(4) of RegulationS-K.

16

During 2017, the Compensation Committee held six meetings.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee’s primary purpose and responsibilities are to:

| • | develop and recommend to the Board corporate governance principles and a code of business conduct and ethics; |

| • | develop and recommend criteria for selecting new directors; |

| • | identify individuals qualified to become directors consistent with criteria approved by the Board, and recommend that the Board select such individuals as nominees for election to the Board; |

| • | make recommendations to the Board regarding any director who submits an offer of resignation by reason of the plurality plus voting standard under the Company’s Corporate Governance Guidelines; |

| • | screen and recommend to the Board individuals qualified to become Chief Executive Officer in the event of a |

vacancy and any other senior officer whom the committee may wish to approve; and |

| • | oversee evaluations of the Board, individual Board members and Board committees. |

It is the policy of the Nominating and Corporate Governance Committee to consider nominees for the Board recommended by the Company’s stockholders in accordance with the procedures described under “STOCKHOLDER PROPOSALS AND DIRECTOR NOMINATIONS FOR 2019 ANNUAL MEETING OF STOCKHOLDERS” below. Stockholder nominees who are nominated in accordance with these procedures will be given the same consideration as nominees for director from other sources.

During 2017, Ms. Helmkamp, Mr. Parry, Mr. Satterthwaite and Ms. Warner served as members of the Nominating and Corporate Governance Committee.

During 2017, the Nominating and Corporate Governance Committee held three meetings.

The objectives of our director compensation program are to attract highly-qualified individuals to serve on our Board and to align our directors’ interests with the interests of our stockholders. The Compensation Committee periodically reviews the program to ensure that it continues to meet these objectives.

The Company believes that to attract and retain qualified directors, pay levels should be targeted at the 50th percentile (or median) of pay levels for directors at comparable companies. On at least a biennial basis, the Compensation Committee, with the assistance of F.W. Cook, evaluates the competitiveness of director compensation. The primary reference point for the determination of market pay is the peer group of companies. For 2017, the peer group used in this analysis was the same peer group used for the Company’s executive compensation analysis.

For further details on this topic, refer to “Peer Companies” under “Setting Executive Compensation” in the Compensation Discussion and Analysis below. Market composite data derived from pay surveys available to F.W. Cook and to the Company is also used.

17

Our director compensation for 2017 and 2018 is set forth below. The changes for 2018 are detailed in the Company’s Amended and RestatedNon-Employee Director Compensation Policy (the Director Compensation Policy) and reflect market-based adjustments as a result of the analysis described above.

2017

| 2018

| |||

Annual Retainer and Meeting Fees

| $ 85,000

| $ 85,000

| ||

Committee Chair Retainer

| ||||

Audit Committee

| $ 15,000

| $ 15,000

| ||

Compensation Committee

| $ 10,000

| $ 10,000

| ||

Nominating and Corporate Governance Committee

| $ 8,000

| $ 10,000

| ||

Lead Director Fees

| ||||

Annual Retainer

| $ 15,000

| $ 15,000

| ||

Annual Equity Grant

| $ 15,000

| $ 15,000

| ||

Restricted Stock Units

| 100% of Value

| 100% of Value

| ||

Value of Equity Grants Upon Initial Election to the Board

| Pro-rated annual grant

| Pro-rated annual grant

| ||

Restricted Stock Units

| 100% of Value

| 100% of Value

| ||

Value of Annual Equity Grants

| $120,000

| $130,000

| ||

Restricted Stock Units

| 100% of Value

| 100% of Value

|

Under the Director Compensation Policy, equity grants upon initial election to the Board of Directors are made on the date of appointment. Annual equity grants have historically been made on the first regularly scheduled meeting of the Board held each year. Commencing in 2018, annual equity grants will be made on the date of the Annual Meeting. All grants are structured to provide 100% of the expected value in the form of restricted stock unit awards, and are made under the IDEX Corporation Incentive Award Plan (Incentive Award Plan).

The restricted stock units vest in full on the earliest of the third anniversary of the grant, retirement, failure of the director to bere-elected to the Board, or a change in control of the Company. The restricted stock units arenon-transferable until the recipient is no longer serving as a director, and are subject to forfeiture if the director terminates service as a director for reasons other than death, disability,

retirement, or failure to bere-elected to the Board.

Since the start of 2015, directors have had the ability to defer payment of all or a portion of their annual equity grant.

Directors Deferred Compensation Plan

Under the Company’s Directors Deferred Compensation Plan, directors are permitted to defer their cash compensation as of the date their compensation would otherwise be payable. In general, directors must make elections to defer fees payable during a calendar year by the end of the preceding calendar year. Newly appointed directors have up to 30 days from their appointment to elect to defer future fees.

All amounts deferred are recorded in a memorandum account for each director and are credited or debited with earnings or losses as if such amounts had been invested in an interest-

18

bearing account or certain mutual funds, at the option of the director. The deferred compensation credited to the interest-bearing account is adjusted on at least a quarterly basis with hypothetical earnings equal to the lesser of the Barclays Capital Long Term Bond AAA — Corporate Bond Index as of the first business day in November of the calendar year preceding the year for which the earnings are to be credited

or 120% of the long-term applicable federal rate as of the first business day in November.

In accordance with SEC rules, no earnings on deferred compensation are shown in the Director Compensation table below because no “above market” rates were earned on deferred amounts in 2017. Directors must elect irrevocably to receive the deferred funds either in a lump sum or in equal annual installments of up to 10 years, and to begin receiving distributions either at termination of Board service or at a future specified date.

If a director should die before all amounts credited under the Directors Deferred Compensation Plan have been paid, the unpaid balance in the participating director’s account

will be paid to the director’s beneficiary. The memorandum accounts are not funded, and the right to receive future payments of amounts recorded in these accounts is an unsecured claim against the Company’s general assets.

Under the Director Compensation Policy,non-management directors are subject to a stock ownership guideline.Non-management directors are required to maintain direct ownership of shares of Common Stock equal to or greater in value to five times the current annual Board service retainer. No non-management director is permitted to sell shares of Common Stock until the director satisfies the stock ownership guideline, and after a director meets the stock ownership guideline, the director may not sell shares if the sale would put the director below the stock ownership guideline.

As of March 2, 2018, all non-management directors were either in compliance with the stock ownership guideline or were proceeding towards meeting the ownership guideline.

The following table summarizes the total compensation earned in 2017 for the Company’snon-management directors. Mr. Silvernail receives no additional compensation for his service as a director, and Mr. Beck did not receive any compensation in 2017 because he was not appointed to the Board until January 1, 2018.

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) (1) (2) | All Other Compensation ($) (3) | Total ($) | ||||

Mark A. Buthman

|

85,000

|

120,000

|

—

|

205,000

| ||||

William M. Cook

|

100,000

|

135,000

|

—

|

235,000

| ||||

Katrina L. Helmkamp

|

85,000

|

120,000

|

—

|

205,000

| ||||

Gregory F. Milzcik (4)

|

21,250

|

120,000

|

10,000

|

151,250

| ||||

Ernest J. Mrozek

|

100,000

|

120,000

|

10,000

|

230,000

| ||||

David C. Parry

|

93,000

|

120,000

|

10,000

|

223,000

| ||||

Livingston L. Satterthwaite

|

95,000

|

120,000

|

—

|

215,000

| ||||

Cynthia J. Warner

|

85,000

|

120,000

|

—

|

205,000

|

19

| (1) | Reflects the aggregate grant date fair value of the restricted stock units granted in 2017, determined in accordance with FASB ASC Topic 718 using the assumptions set forth in the footnotes to financial statements in the Company’s Annual Report on Form10-K for the year ended December 31, 2017, assuming no forfeitures. |

| (2) | The following table provides information on restricted stock units and stock option awards held by the Company’snon-management directors and the value of those awards as of December 31, 2017. All outstanding awards are in or exercisable for shares of Common Stock. |

Directors’ Outstanding Equity Awards at 2017 Fiscal Year End

Option Awards | Stock Awards

| |||||||||||||||||||||||||||||||

Number of Securities

| Number of

| Market Value

| ||||||||||||||||||||||||||||||

| Name | Grant Date | Type | # Shares (#) | Shares

| Exercisable (#) (a)

| Unexercisable (#) (a)

| Option Exercise Price ($)

| Option Expiration Date

| ||||||||||||||||||||||||

Mark A. Buthman | 04/06/16 | RSU | 1,290 | 170,241 | ||||||||||||||||||||||||||||

| 02/22/17 | RSU | 1,290 | 170,241 | |||||||||||||||||||||||||||||

William M. Cook | 02/24/09 | NQSO | 2,250 | 0 | 2,250 | 0 | 19.98 | 02/24/2019 | ||||||||||||||||||||||||

| 02/23/10 | NQSO | 4,080 | 0 | 4,080 | 0 | 30.82 | 02/23/2020 | |||||||||||||||||||||||||

| 02/22/11 | NQSO | 3,190 | 0 | 3,190 | 0 | 40.89 | 02/22/2021 | |||||||||||||||||||||||||

| 02/21/12 | NQSO | 3,530 | 0 | 3,530 | 0 | 42.86 | 02/21/2022 | |||||||||||||||||||||||||

| 02/15/13 | NQSO | 3,075 | 0 | 3,075 | 0 | 50.45 | 02/15/2023 | |||||||||||||||||||||||||

| 02/20/15 | RSU | 1,595 | 210,492 | |||||||||||||||||||||||||||||

| 02/19/16 | RSU | 1,810 | 238,866 | |||||||||||||||||||||||||||||

| 02/22/17 | RSU | 1,450 | 191,357 | |||||||||||||||||||||||||||||

Katrina L. Helmkamp | 11/05/15 | RSU | 415 | 54,768 | ||||||||||||||||||||||||||||

| 02/19/16 | RSU | 1,610 | 212,472 | |||||||||||||||||||||||||||||

| 02/22/17 | RSU | 1,290 | 170,241 | |||||||||||||||||||||||||||||

Ernest J. Mrozek | 07/01/10 | NQSO | 6,650 | 0 | 6,650 | 0 | 28.20 | 07/01/2020 | ||||||||||||||||||||||||

| 02/22/11 | NQSO | 3,190 | 0 | 3,190 | 0 | 40.89 | 02/22/2021 | |||||||||||||||||||||||||

| 02/21/12 | NQSO | 3,530 | 0 | 3,530 | 0 | 42.86 | 02/21/2022 | |||||||||||||||||||||||||

| 02/15/13 | NQSO | 3,075 | 0 | 3,075 | 0 | 50.45 | 02/15/2023 | |||||||||||||||||||||||||

| 02/20/15 | RSU | 1,405 | 185,418 | |||||||||||||||||||||||||||||

| 02/19/16 | RSU | 1,610 | 212,472 | |||||||||||||||||||||||||||||

| 02/22/17 | RSU | 1,290 | 170,241 | |||||||||||||||||||||||||||||

David C. Parry | 12/06/12 | NQSO | 4,930 | 0 | 4,930 | 0 | 45.08 | 12/06/2022 | ||||||||||||||||||||||||

| 02/15/13 | NQSO | 3,075 | 0 | 3,075 | 0 | 50.45 | 02/15/2023 | |||||||||||||||||||||||||

| 02/20/15 | RSU | 1,405 | 185,418 | |||||||||||||||||||||||||||||

| 02/19/16 | RSU | 1,610 | 212,472 | |||||||||||||||||||||||||||||

| 02/22/17 | RSU | 1,290 | 170,241 | |||||||||||||||||||||||||||||

Livingston L. Satterthwaite | 04/05/11 | NQSO | 4,800 | 0 | 4,800 | 0 | 45.16 | 04/05/2021 | ||||||||||||||||||||||||

| 02/21/12 | NQSO | 3,530 | 0 | 3,530 | 0 | 42.86 | 02/21/2022 | |||||||||||||||||||||||||

| 02/15/13 | NQSO | 3,075 | 0 | 3,075 | 0 | 50.45 | 02/15/2023 | |||||||||||||||||||||||||

| 02/20/15 | RSU | 1,405 | 185,418 | |||||||||||||||||||||||||||||

| 02/19/16 | RSU | 1,610 | 212,472 | |||||||||||||||||||||||||||||

| 02/22/17 | RSU | 1,290 | 170,241 | |||||||||||||||||||||||||||||

Cynthia J. Warner | 02/15/13 | NQSO | 4,610 | 0 | 4,610 | 0 | 50.45 | 02/15/2023 | ||||||||||||||||||||||||

| 02/20/15 | RSU | 1,405 | 185,418 | |||||||||||||||||||||||||||||

| 02/19/16 | RSU | 1,610 | 212,472 | |||||||||||||||||||||||||||||

| 02/22/17 | RSU | 1,290 | 170,241 | |||||||||||||||||||||||||||||

| (a) | All options expire on the 10th anniversary of the grant date. |

| (b) | See footnote 1 to table under “SECURITY OWNERSHIP” below for vesting provisions. |

| (c) | Determined based upon the closing price of the Company’s Common Stock on December 29, 2017. |

| (3) | Reflects matching gifts of up to $10,000 per year directed to Internal Revenue Code 501(c)(3)tax-exempt,non-profit organizations under the IDEX Corporation Matching Gift Program. |

| (4) | Mr. Milzcik retired from the Board in April 2017. |

20

The following table furnishes information as of March 2, 2018, except as otherwise noted, with respect to shares of Common Stock beneficially owned by (i) each director and nominee for director, (ii) each executive officer named in the Summary Compensation Table, (iii) directors, nominees and executive officers of the Company as a group, and (iv) any person who is known by the Company to be a beneficial owner of more than five percent of the outstanding shares of Common Stock.

Except as indicated by the notes to the following table, the holders listed below have sole voting power and investment power over the shares beneficially held by them. Under SEC rules, the number of shares shown as beneficially owned includes shares of Common Stock subject to options that are exercisable currently or will be exercisable within 60 days of March 2, 2018. Shares of Common Stock subject to options that are exercisable within 60 days of March 2, 2018, are considered to be outstanding for the purpose of determining the percentage of shares held by a holder, but not for the purpose of computing the percentage held by others. An * indicates ownership of less than one percent of the outstanding Common Stock.

For purposes of the following table, the address for each of the directors, nominees for director and executive officers of the Company is c/o 1925 West Field Court, Suite 200, Lake Forest, Illinois 60045.

| Name and Address of Beneficial Owner | Shares Beneficially Owned | Percent of Class | ||

Directors and Nominees (other than Named Executive Officers): | ||||

Mark A. Beck(1) | 310 | * | ||

Mark A. Buthman(1) | 2,580 | * | ||

William M. Cook(1) | 32,358 | * | ||

Katrina L. Helmkamp(1) | 3,315 | * | ||

Ernest J. Mrozek(1) | 26,030 | * | ||

David C. Parry(1) | 16,085 | * | ||

Livingston L. Satterthwaite(1) | 20,407 | * | ||

Cynthia J. Warner(1) | 11,695 | * | ||

Named Executive Officers: | ||||

Andrew K. Silvernail(2) | 458,162 | * | ||

William K. Grogan(2)(3) | 25,665 | * | ||

Eric D. Ashleman(2)(3) | 69,868 | * | ||

Denise R. Cade(2)(3) | 16,370 | * | ||

Jeffrey D. Bucklew(2) | 37,830 | * | ||

Directors, Nominees and All Executive Officers as a Group: (16 persons)(4) | 909,373 | 1.2% | ||

Other Beneficial Owners: | ||||

BlackRock Inc.(5) | 7,338,809 | 9.6% | ||

55 East 52nd Street New York, NY 10055 | ||||

T. Rowe Price Associates, Inc.(6) | 7,335,829 | 9.6% | ||

100 East Pratt Street, Baltimore, MD 21202 | ||||

The Vanguard Group(7) | 6,546,359 | 8.6% | ||

100 Vanguard Blvd. Malvern, PA 19355 | ||||

Capital World Investors(8) | 6,024,905 | 7.8% | ||

333 South Hope Street, Los Angeles, CA 90071 | ||||

Wellington Management Company LLP(9) | 4,116,357 | 5.4% | ||

280 Congress Street, Boston, MA 02210 |

21

| (1) | Includes 16,125, 16,445, 8,005, 11,405 and 4,610 shares under exercisable options for Messrs. Cook, Mrozek, Parry and Satterthwaite, and Ms. Warner, respectively. Ms. Helmkamp and Mr. Buthman do not have any options. Includes 415 restricted stock units issued to Ms. Helmkamp on November 5, 2015, which vest on November 5, 2018; 1,610 restricted stock units issued to each of Ms. Helmkamp and Messrs. Mrozek, Parry and Satterthwaite and Ms. Warner on February 19, 2016, which vest on February 19, 2019 (except for Ms. Helmkamp and Mr. Satterthwaite, who each elected to defer vesting); 1,810 restricted stock units issued to Mr. Cook on February 19, 2016, which vest on February 19, 2019; 1,290 restricted stock units issued to Mr. Buthman on April 6, 2016, which vest on April 6, 2019; 1,290 restricted stock units issued to each of Ms. Helmkamp and Messrs. Buthman, Mrozek, Parry and Satterthwaite and Ms. Warner on February 22, 2017, which vest on February 22, 2020 (except for Messrs. Buthman and Satterthwaite, who each elected to defer vesting); 1,450 restricted stock units issued to Mr. Cook on February 22, 2017, which vest on February 22, 2020; and 310 restricted stock units issued to Mr. Beck on January 2, 2018, for which Mr. Beck elected to defer vesting. The restricted shares and restricted stock units held by Messrs. Beck, Buthman and Cook, Ms. Helmkamp, Messrs. Mrozek, Parry, and Satterthwaite, and Ms. Warner may vest earlier than the dates indicated above upon a change in control of the Company, retirement, or failure to bere-elected to the Board. All shares of restricted stock and restricted stock units are eligible for dividends. |

| (2) | Includes 330,231, 16,774, 41,779, 31,040 and 14,250 shares under exercisable options for Messrs. Silvernail, Grogan, Ashleman and Bucklew and Ms. Cade, respectively. |

| (3) | Includes shares of restricted stock awarded by the Company as set forth in the following table. All shares of restricted stock are eligible for dividends and shall vest provided that the executive is employed on the vesting date(s). The restricted shares may vest earlier than the dates indicated below upon a change in control of the Company and certain other events. See “Outstanding Equity Awards at 2017 Fiscal Year End” under “EXECUTIVE COMPENSATION.” |

Name of restricted stock |

Shares of Restricted stock awarded under Incentive Award Plan |

Dates Awarded |

Vesting Dates | |||

William K. Grogan | 5,485 | 01/03/2017 | 01/03/2020 | |||

Eric D. Ashleman | 4,835 | 07/15/2015 | 07/15/2018 | |||

Denise R. Cade | 2,120 | 10/26/2015 | 10/26/2018 |

| (4) | Includes 613,837 shares under options that are exercisable currently or will be exercisable within 60 days of March 2, 2018, and 41,540 unvested shares of restricted stock or restricted stock units. |

| (5) | Based solely on information in Schedule 13G, as of December 31, 2017, filed by BlackRock Inc. (BlackRock) with respect to Common Stock owned by BlackRock and certain subsidiaries, including BlackRock Life Limited, BlackRock International Limited, BlackRock Advisors, LLC, BlackRock Capital Management, Inc., BlackRock (Netherlands) B.V., BlackRock Institutional Trust Company, National Association, BlackRock Asset Management Ireland Limited, BlackRock Financial Management, Inc., BlackRock Japan Co., Ltd., BlackRock Asset Management Schweiz AG, BlackRock Investment Management, LLC, BlackRock Investment Management (UK) Limited, BlackRock Asset Management Canada Limited, BlackRock (Luxembourg) S.A., BlackRock Investment Management (Australia) Limited, BlackRock Advisors (UK) Limited, BlackRock Fund Advisors, BlackRock (Singapore) Limited and BlackRock Fund Managers Ltd. BlackRock has sole power to vote or to direct the vote of 6,826,037 shares of Common Stock and sole power to dispose or to direct the disposition of all 7,338,809 shares of Common Stock. |

| (6) | Based solely on information in Schedule 13G, as of December 31, 2017, filed by T. Rowe Price Associates, Inc. (Price Associates) and T. Rowe Price Mid-Cap Growth Fund, Inc. Price Associates has sole power to vote or to direct the vote of 2,507,380 shares of Common Stock and sole power to dispose or to direct the disposition of all 7,335,829 shares of Common Stock. |

22

| (7) | Based solely on information in Schedule 13G, as of December 31, 2017, filed by Vanguard Group (Vanguard) with respect to Common Stock owned by Vanguard and certain subsidiaries. Vanguard reports beneficial ownership of shares for itself, Vanguard Fiduciary Trust Company, a wholly-owned subsidiary, and Vanguard Investments Australia, Ltd., a wholly-owned subsidiary. Vanguard has sole power to vote or to direct the vote of 60,697 shares of Common Stock, shared power to vote or direct the vote of 16,474 shares of Common Stock, sole power to dispose or to direct the disposition of 6,473,973 shares of Common Stock and shared power to dispose or to direct the disposition of 72,386 shares of Common Stock. |

| (8) | Based solely on information in Schedule 13G, as of December 29, 2017, filed by Capital World Investors, a division of Capital Research and Management Company (Capital World). Capital World has sole power to vote or to direct the vote of 6,005,013 shares of Common Stock and sole power to dispose or to direct the disposition of all 6,024,905 shares of Common Stock. |

| (9) | Based solely on information in Schedule 13G, as of December 29, 2017, filed by Wellington Management Group LLP, Wellington Group Holdings LLP, Wellington Investment Advisors Holdings LLP (together, the Wellington HC Entities) and Wellington Management Company LLP (Wellington Management Company). The Wellington HC Entities each have shared power to vote or to direct the vote of 3,613,389 shares of Common Stock and shared power to dispose or to direct the disposition of all 4,116,357 shares of Common Stock. Wellington Management Company has shared power to vote or to direct the vote of 3,562,911 shares of Common Stock and shared power to dispose or to direct the disposition of 4,002,715 shares of Common Stock. |

23

Compensation Discussion and Analysis

This Compensation Discussion and Analysis describes our executive compensation philosophy and programs, and compensation decisions made under those programs for our named executive officers (NEOs) for fiscal year 2017, who are listed below.

| Name | Title | |

| Andrew K. Silvernail | Chairman, President and Chief Executive Officer | |

| William K. Grogan | Senior Vice President and Chief Financial Officer | |

| Eric D. Ashleman | Senior Vice President and Chief Operating Officer | |

| Denise R. Cade | Senior Vice President, General Counsel and Corporate Secretary | |

| Jeffrey D. Bucklew | Senior Vice President and Chief Human Resources Officer |

Principles of Our Compensation Programs

| Pay-for-Performance | The key principle of our compensation philosophy is pay-for-performance. | |

| Alignment with Stockholders’ Interests | We reward performance that meets or exceeds the performance goals that the Compensation Committee establishes with the objective of increasing stockholder value. | |

Variation Based on Performance | We favor variable pay opportunities that are based on performance over fixed pay. The total compensation received by our NEOs varies based on corporate and individual performance measured against annual and long-term goals. |

Compensation Philosophy

The following table describes our compensation philosophy that guides our pay programs, structure and decisions.

| Compensation Philosophy | How We Deliver | |

| Attract and retain an effective management team | • We offer a total pay package that consists of both compensation and benefits that are targeted to be competitive with the market. • We seek to retain our executives by regularly benchmarking our total compensation package relative to companies of similar size, scope and complexity — our peer group is constructed to include companies within an appropriate range of revenue and market capitalization values. | |

| Motivate and reward management team with a focus onpay-for-performance | • We tie a meaningful portion of total compensation to financial and stock price performance – between 70% to 80% of our compensation mix is tied to performance. • Our compensation program provides a mix of base salary, short-term incentives and long-term incentives — the balance of our compensation elements provides direct line |

24

| Compensation Philosophy | How We Deliver | |

|

| of sight with our objectives, motivating executives to outperform on our goals. • In line with our compensation philosophy to align pay and performance, when the Company outperforms the goals in our incentive plans, payouts can result in above market median levels. | |

| Create a strong financial incentive that aligns with our stockholders and long-term objectives | • Through a combination of appropriate performance metrics and targets, executives are paid according to how the Company performs. • Specific financial measures used in our incentive programs include: – Earnings per share (EPS), cash flow conversion, and organic sales growth in our short-term incentive plan – Total stockholder return (TSR) relative to companies in the Russell Midcap Index in our long-term incentive plan | |

| Align the interests of management and stockholders | • In order to emphasize long-term stockholder returns, we require our executives to maintain significant stock ownership levels through the use of stock ownership guidelines. |

Governance Best Practices

The Company employs compensation principles in delivering executive pay that we believe are supportive of the business strategy and governance best practices.

What We Do

| Ö | AnnualSay-on-Pay Vote: We conduct an annualsay-on-pay advisory vote. At our 2017 Annual Meeting of Stockholders, more than 96% of the votes cast on thesay-on-pay proposal were in favor of the fiscal year 2016 compensation of our NEOs. |

| Ö | Clawback Policy: Our clawback policy allows the Board to recoup any excess incentive compensation paid to our executive officers and other employees if the financial results on which the awards were based are materially restated due to fraud, intentional misconduct or gross negligence of the executive officer or other employee. |

| Ö | Short-Term and Long-Term Incentives/Measures: Our annual and long-term plans provide a balance of incentives and include different measures of performance. |

| Ö | Independent Compensation Consultant: The Compensation Committee engages an independent compensation consultant, who does not provide any services to management. |

| Ö | Stock Ownership Guidelines: To further align the interests of management and our directors with our stockholders, we have significant stock ownership guidelines, which require our executive officers and directors to hold a multiple of their annual compensation in Common Stock. |

| Ö | Limited Perquisites and Related TaxGross-Ups: We provide limited perquisites and taxgross-ups. |

25

| Ö | Mitigate Inappropriate Risk Taking: In addition to our clawback policy, stock ownership guidelines and prohibition of hedging and pledging, we structure our compensation programs so that they minimize inappropriate risk taking by our executive officers and other employees, including using multiple performance metrics and multi-year performance periods and capping our annual incentive awards and performance share awards. |

What We Don’t Do

| × | Gross-ups for Excise Taxes: Our executive severance agreements do not contain agross-up for excise taxes that may be imposed as a result of severance or other payments deemed made in connection with a change in control. |

| × | Reprice Stock Options:Our equity incentive plan prohibits the repricing of stock options and stock appreciation rights without prior stockholder approval. |

| × | Fixed Term Employment Agreements: Employment of our executive officers (other than our CEO) is “at will” and may be terminated by either the Company or the employee at any time. |

| × | Hedging and Pledging: Our insider trading policy prohibits all employees and directors from hedging their economic interest in the Common Stock they hold. |

Fiscal Year 2017 Performance Highlights and Impact on Incentive Compensation

The Company continued to perform against its strategic plan and business plan in 2017, with orders and sales up 9% and 8%, respectively, compared to the prior year, and gross margin of 45%, up 90 basis points. The following illustrates our 2017 performance highlights, and how our incentive programs are designed to drive performance.

| * | A reconciliation from GAAP tonon-GAAP financial measures and other related information is included in Item 6 of the Company’s Annual Report on Form10-K for the fiscal year-ended December 31, 2017. In addition to the adjustments noted in the Form10-K, additional adjustments are used to determine the short-term incentive payouts, including adjustments related to acquisitions and divestitures, actual capital expenditures and actual share count compared to the annual plan. |

These performance highlights and significant recent accomplishments are closely related to performance metrics under our executive compensation plans. For 2017, the executive compensation programs were designed to directly link compensation opportunities to the financial performance

2017 Performance Highlights* Orders up 9% Sales up 8% Adjusted EPS up 15% Cash from operations of $432.8M led to FCF of $388.9M, 117% of Adjusted net income Increased quarterly dividend by 9% Acquired thinXXS Microtechnology and divested Faure Herman Annual TSR of 49% How Incentives Support Performance Short-Term Goals Adjusted EPS Adjusted Cash Flow Conversion Organic Sales Growth Long-Term Goals Relative TSR Incentive Plan Results 2017 Bonus Payout of 181% Adjusted EPS of $4.31 Adjusted Cash Flow Conversion of 117% of adjusted net income Organic Sales Growth of 6% 2015-2017 PSU Payout of 239% Three -year TSR of 81% (78th percentile relative ranking)

26

metrics that we believe are the best measures of success in our business: earnings per share (EPS), cash flow conversion, organic sales growth and relative total stockholder return (TSR).

The 2017 bonus payouts were 181% of target reflecting record performance. Our TSR for the 2015-2017 period was 81%, which resulted in a 78th percentile performance compared to the companies in the S&P Midcap 400 Industrials index and resulted in a 239% payout of performance stock units (PSUs).

NEO Compensation Aligns with Company Performance

The compensation opportunities of our executives are directly tied to the performance of the Company. Ourpay-for-performance philosophy is demonstrated by the following elements of our executive compensation program for 2017: