IDEX PROPRIETARY & CONFIDENTIAL 1 IDEX PROPRIETARY & CONFIDENTIAL Fourth Quarter 2013 Earnings Release January 30, 2014 IDEX PROPRIETARY & CONFIDENTIAL

IDEX PROPRIETARY & CONFIDENTIAL 2 IDEX PROPRIETARY & CONFIDENTIAL Agenda • IDEX Outlook • 2013 Financial Performance • 2013 Segment Performance • Fluid & Metering • Health & Science • Fire & Safety / Diversified • 2014 Guidance Update • Q&A

IDEX PROPRIETARY & CONFIDENTIAL 3 IDEX PROPRIETARY & CONFIDENTIAL Replay Information • Dial toll–free: 855.859.2056 • International: 404.537.3406 • Conference ID: #30410743 • Log on to: www.idexcorp.com

IDEX PROPRIETARY & CONFIDENTIAL 4 IDEX PROPRIETARY & CONFIDENTIAL Cautionary Statement Under the Private Securities Litigation Reform Act This presentation and discussion will include forward-looking statements. Our actual performance may differ materially from that indicated or suggested by any such statements. There are a number of factors that could cause those differences, including those presented in our most recent annual report and other company filings with the SEC.

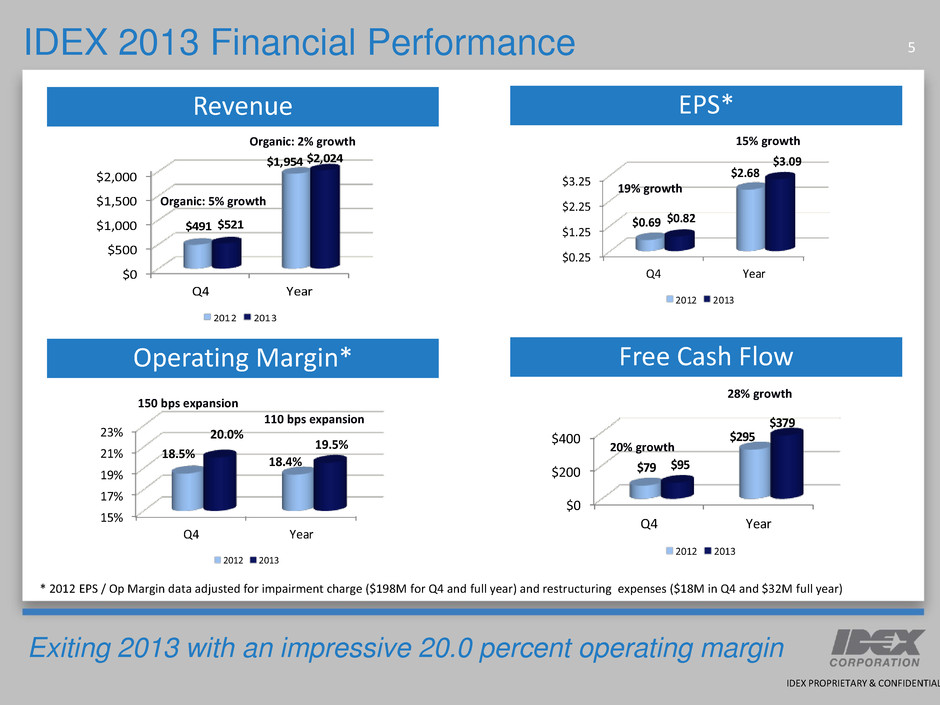

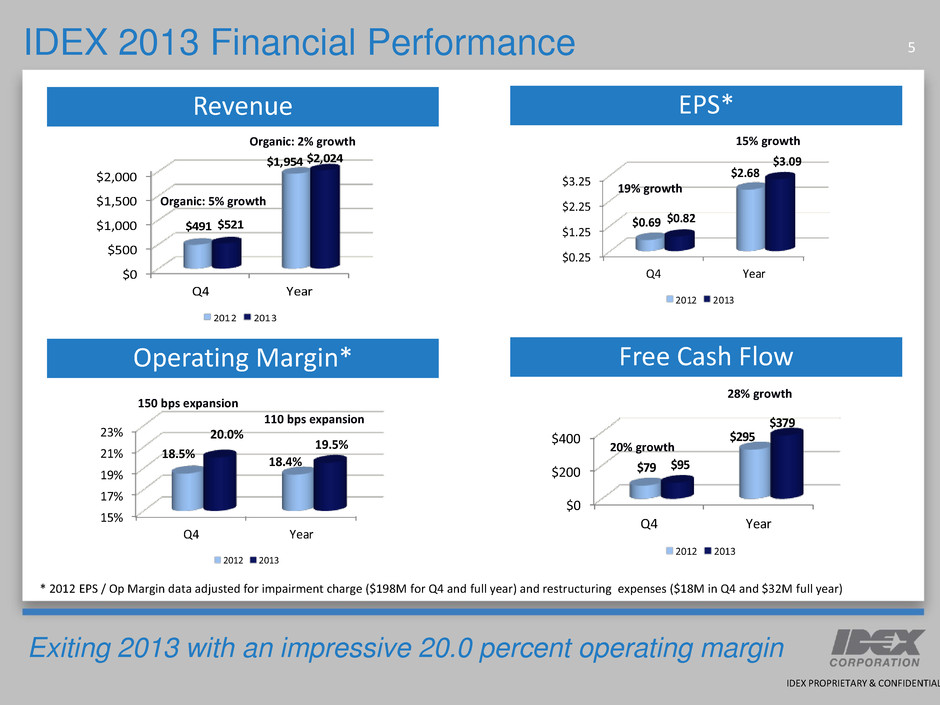

IDEX PROPRIETARY & CONFIDENTIAL 5 IDEX PROPRIETARY & CONFIDENTIAL $0 $200 $400 Q4 Year $79 $295 $95 $379 2012 2013 15% 17% 19% 21% 23% Q4 Year 18.5% 18.4% 20.0% 19.5% 2012 2013 $0.25 $1.25 $2.25 $3.25 Q4 Year $0.82 $3.09 $0.69 $2.68 2012 2013 $0 $500 $1,000 $1,500 $2,000 Q4 Year $491 $1,954 $521 $2,024 2012 2013 IDEX 2013 Financial Performance Revenue Organic: 2% growth 150 bps expansion 20% growth 19% growth EPS* Operating Margin* Free Cash Flow * 2012 EPS / Op Margin data adjusted for impairment charge ($198M for Q4 and full year) and restructuring expenses ($18M in Q4 and $32M full year) Exiting 2013 with an impressive 20.0 percent operating margin Organic: 5% growth 15% growth 110 bps expansion 28% growth

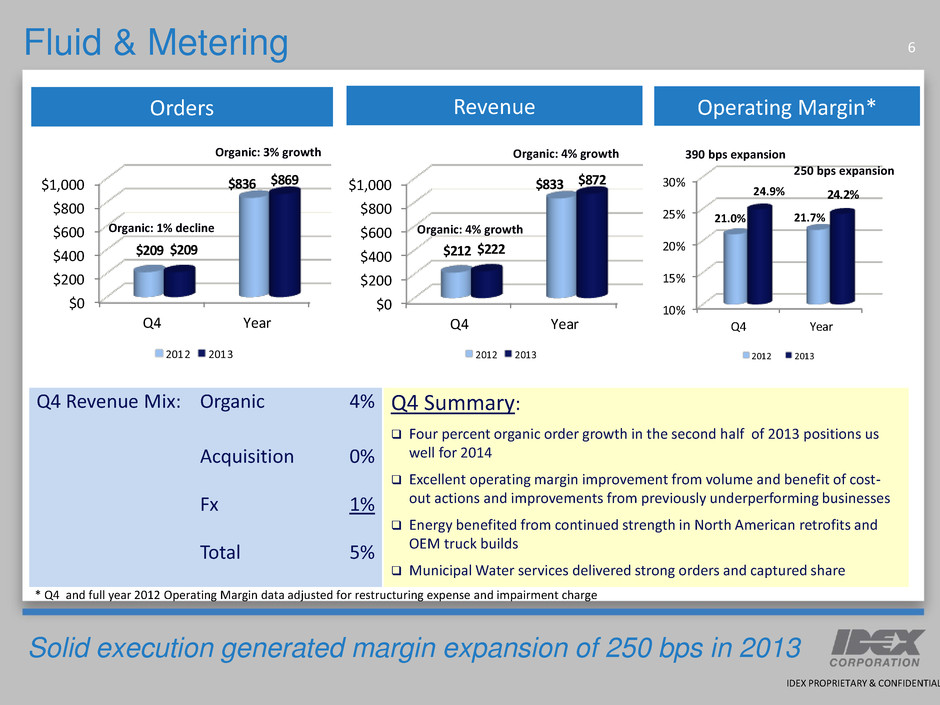

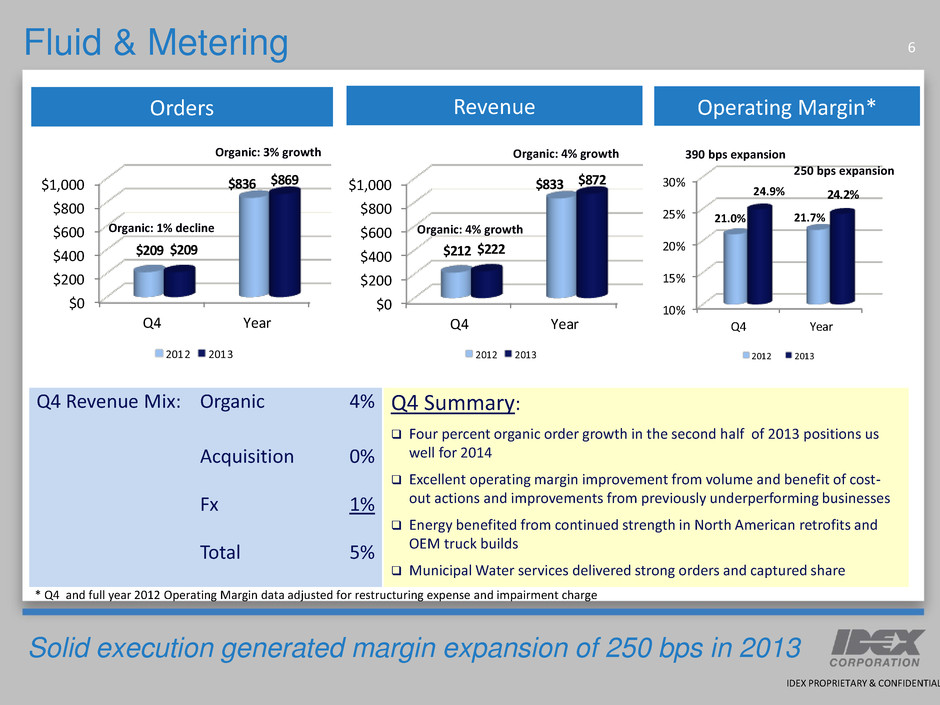

IDEX PROPRIETARY & CONFIDENTIAL 6 IDEX PROPRIETARY & CONFIDENTIAL $0 $200 $400 $600 $800 $1,000 Q4 Year $209 $836 $209 $869 2012 2013 $0 $200 $400 $600 $800 $1,000 Q4 Year $212 $833 $222 $872 2012 2013 10% 15% 20% 25% 30% Q4 Year 21.0% 21.7% 24. % 24.2% 2012 2013 Fluid & Metering Orders Revenue Q4 Revenue Mix: Organic 4% Acquisition 0% Fx 1% Total 5% Q4 Summary: Four percent organic order growth in the second half of 2013 positions us well for 2014 Excellent operating margin improvement from volume and benefit of cost- out actions and improvements from previously underperforming businesses Energy benefited from continued strength in North American retrofits and OEM truck builds Municipal Water services delivered strong orders and captured share Organic: 4% growth 390 bps expansion Organic: 1% decline Operating Margin* * Q4 and full year 2012 Operating Margin data adjusted for restructuring expense and impairment charge Solid execution generated margin expansion of 250 bps in 2013 Organic: 3% growth Organic: 4% growth 250 bps expansion

IDEX PROPRIETARY & CONFIDENTIAL 7 IDEX PROPRIETARY & CONFIDENTIAL $0 $200 $400 $600 $800 $1,000 Q4 Year $170 $674 $190 $723 2012 2013 $0 $200 400 $600 $800 $1,000 Q4 Year $175 $695 $182 $715 2012 2013 10% 13% 15% 18% 20% Q4 Year 18.4% 17.6% 18.2% 19.1% 2012 2013 Health & Science Orders Revenue Organic: 2% growth 20 bps contraction Organic: 10% growth Operating Margin* * Q4 and full year 2012 Operating Margin data adjusted for restructuring expense and impairment charge Q4 Revenue Mix: Organic 2% Acquisition 3% Fx -1% Total 4% Q4 Summary: Fourth quarter order growth across all platforms provides a healthy backlog going into 2014 Margins impacted by targeted cost reductions to optimize operating footprint Scientific Fluidics expects continued growth from new products and benefit of NIH funding constraints easing Material Process continues strong order growth in North America and Asia Outstanding organic order growth in Q4 Organic: 3% growth Organic: 2% decline 150 bps expansion

IDEX PROPRIETARY & CONFIDENTIAL 8 IDEX PROPRIETARY & CONFIDENTIAL $0 $100 $200 $300 $400 $500 Q4 Year $107 $444 $125 $488 2012 2013 $0 $100 $200 $300 $400 $500 Q4 Year $109 $437 $118 $445 2012 2013 10% 15% 20% 25% 30% Q4 ear 24.2% 23.9% 24.3% 23.1% 2012 2013 Fire & Safety/Diversified Orders Revenue Organic: 8% growth 80 bps contraction Organic: 10% growth Operating Margin* * Q4 and full year 2012 Operating Margin data adjusted for restructuring expense Q4 Revenue Mix: Organic 8% Acquisition 0% Fx 1% Total 9% Q4 Summary: Continued organic order growth contributions from FSG and Dispensing create strong momentum for 2014 Dispensing market in North America continues to provide opportunities for share gain Power facility trailer orders in FSG augment a stable core business Band-It grows on strength from blanket North American automotive orders Dispensing and FSG fueling strong momentum into 2014 10 bps expansion Organic: 16% growth Organic: 1% growth

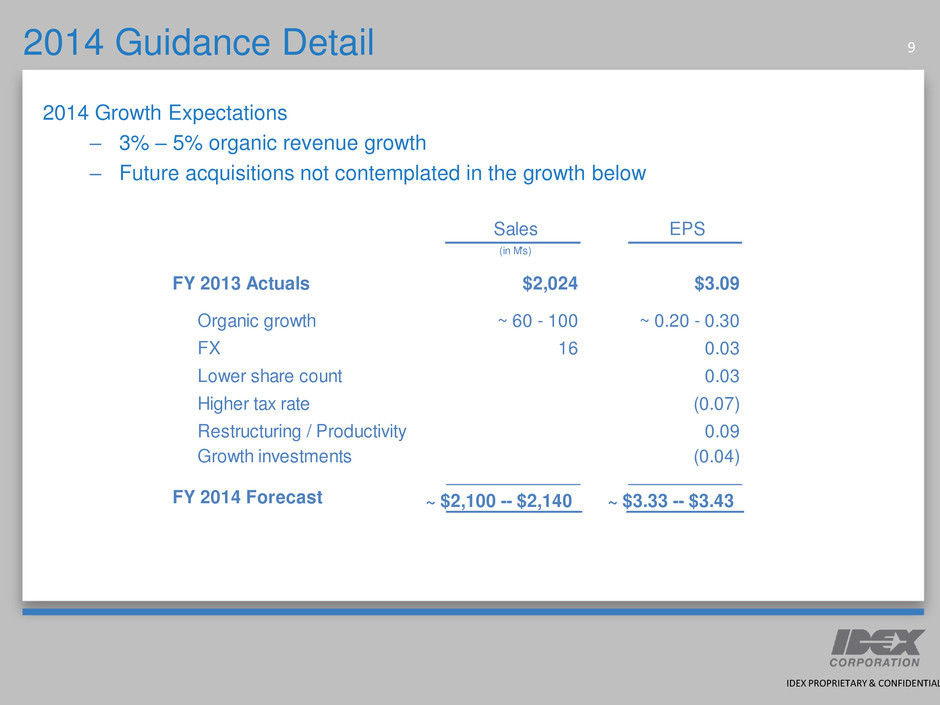

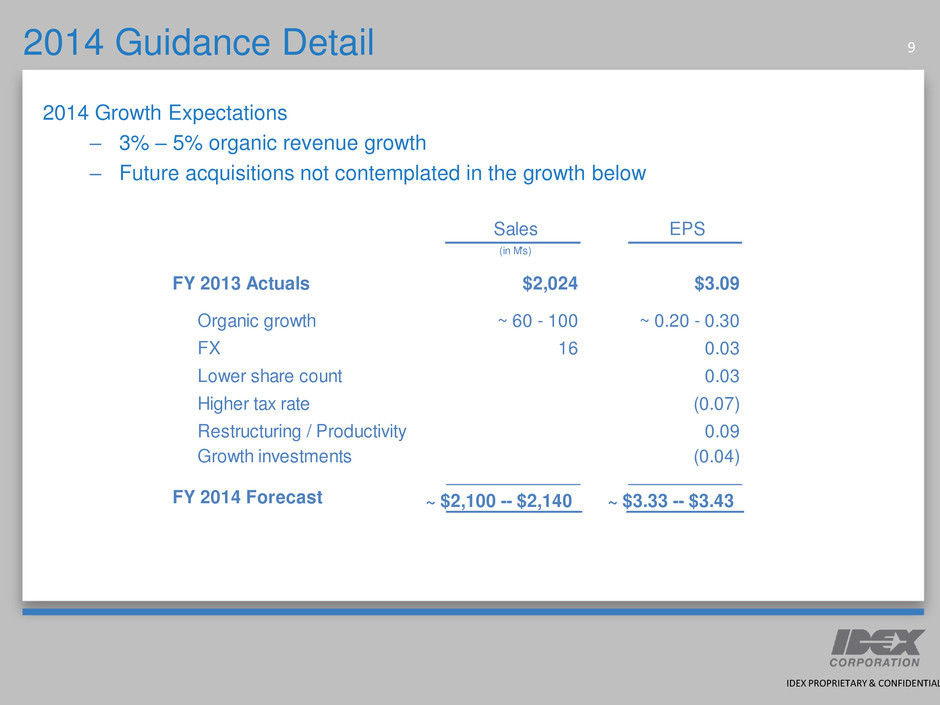

IDEX PROPRIETARY & CONFIDENTIAL 9 IDEX PROPRIETARY & CONFIDENTIAL 2014 Guidance Detail Sales EPS (in M's) FY 2013 Actuals $2,024 $3.09 Organic growth ~ 60 - 100 ~ 0.20 - 0.30 FX 16 0.03 Lower share count 0.03 Higher tax rate (0.07) Restructuring / Productivity 0.09 Growth investments (0.04) FY 2014 Forecast ~ $2,100 -- $2,140 ~ $3.33 -- $3.43 2014 Growth Expectations – 3% – 5% organic revenue growth – Future acquisitions not contemplated in the growth below

IDEX PROPRIETARY & CONFIDENTIAL 10 IDEX PROPRIETARY & CONFIDENTIAL Outlook: 2014 Guidance Summary Q1 2014 • EPS estimate range: $0.83 – $0.85 • Operating margin: ~ 20% FY 2014 • EPS estimate range: $3.33 – $3.43 – Organic revenue growth: ~ 3% – 5% – Operating margin: > 20% – Minimal FX impact • Other modeling items – Tax rate: ~ 29.0% – 29.5% – Cap Ex: ~ $40 - $45M – Free Cash Flow will be 120% – 125% of net income – Continued share repurchases: ~ net 1% reduction – EPS estimate excludes future acquisitions and associated costs and charges

IDEX PROPRIETARY & CONFIDENTIAL 11 IDEX PROPRIETARY & CONFIDENTIAL Q&A