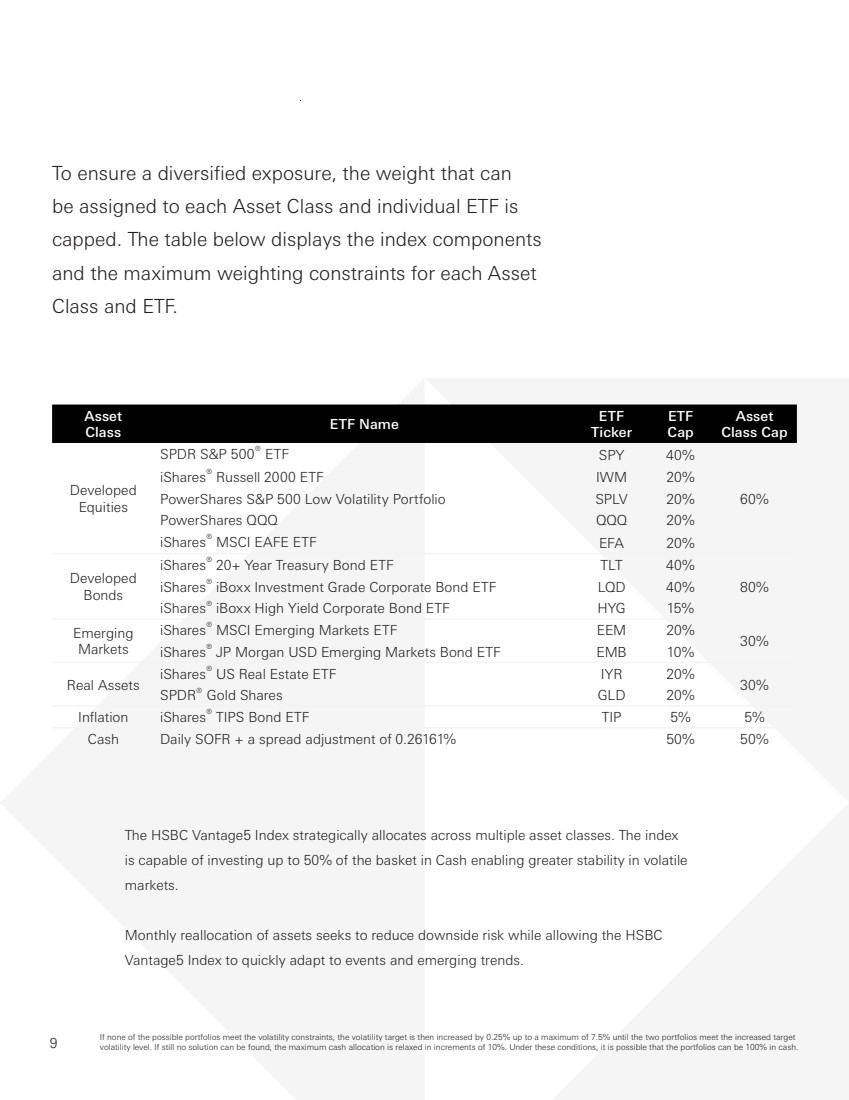

| 13 Risks relating to the index S&P, the Index Calculation Agent, may adjust the Index in a way that affects its level, and S&P has no obligation to consider your interests. The Index is calculated by the S&P Dow Jones Indices LLC (the “Index Calculation Agent”). The Index Calculation Agent is responsible for calculating and maintaining the Index and developing the guidelines and policies governing its composition and calculation. It is entitled to exercise discretion in relation to the Index, including but not limited to the calculation of the level of the Index in the event of an Index Market Disruption Event . Although S&P, acting as the Index Calculation Agent, will make all determinations and take all action in relation to the Index acting in good faith, it should be noted that the policies and judgments for which S&P is responsible could have an impact, positive or negative, on the level of the Index. S&P may also amend the rules governing the Index in certain circumstances. Judgments, policies and determinations concerning the Index are made by S&P, as the Index Administrator. Furthermore, the inclusion of the ETFs in the Index is not an investment recommendation by S&P of the ETFs, or any of the securities, commodities or futures contracts underlying the ETFs. The Index comprises notional assets. The exposures to the ETF constituents and any cash investment are purely notional and will exist solely in the records maintained by or on behalf of the Index Calculation Agent. There is no actual portfolio of assets to which any person is entitled or in which any person has any ownership interest. Consequently, you will not have any claim against any of the underlying assets that comprise the Index. The Index may not be successful, and may not outperform any alternative strategy that might be employed in respect of the ETFs or achieve its target volatility. The Index follows a notional rules-based proprietary strategy that operates on the basis of pre-determined rules. No assurance can be given that the investment strategy on which the Index is based will be successful or that the Index will outperform any alternative strategy that might be employed in respect of the ETFs. Furthermore, no assurance can be given that the Index will achieve its target maximum volatility of 5%. The actual realized volatility of the Index may be greater or less than 5%. The Index has a very limited operating history and may perform in unanticipated ways. The Index was established on March 15, 2017 and therefore has little to no operating history. Hypothetical back-tested performance data prior to the launch of the Index provided in this document refers to simulated performance data created by applying the Index’s calculation methodology to historical prices of the ETFs that comprise the Index. Such simulated performance data has been produced by the retroactive application of a back-tested methodology, and may give more preference towards ETFs or indices that have performed well in the past. The hypothetical back-tested performance of the Index prior to March 15, 2017 cannot fully reflect the actual results that would have occurred had the Index actually been calculated during that period, and should not be relied upon as an indication of the Index’s future performance. As of July 15, 2022, the Index Calculation Agent changed the cash element of the Index from 3-month U.S. dollar LIBOR to daily SOFR plus a spread of 0.26161%. Consequently, any hypothetical historical and historical presentation of the performance of the Index in this document represents a different cash element prior to July 15, 2022. The Index is subject to market risks. The performance of the Index is dependent on the performance of the thirteen ETFs, as constructed in the available Monthly Reference Portfolio, over a change in the Daily Secured Overnight Finance Rate (“SOFR”) plus a spread adjustment of 0.26161% minus 0.85% fees, subtracted daily. As a result, any increase in the level of the Index may be offset by increases in SOFR. The ETFs composing the Index may be replaced by a substitute ETF in certain extraordinary events. Following the occurrence of certain Extraordinary Fund Events with respect to an ETF as described in the Index Methodology, under “Index Components” the affected ETF may be replaced by a substitute ETF. The changing of an ETF may affect the performance of the Index, as the replacement ETF may perform significantly better or worse than the affected ETF. The Index may perform poorly during periods characterized by short-term volatility. The Index’s strategy is based on momentum investing. Momentum investing strategies are effective at identifying the current market direction in trending markets. However, in non-trending, sideways markets, momentum investment strategies are subject to “whipsaws.” A whipsaw occurs when the market reverses and does the opposite of what is indicated by the trend indicator, resulting in a trading loss during the particular period. Consequently, the Index may perform poorly in non-trending, “choppy” markets characterized by short-term volatility. The Index may be partially uninvested. The strategy tracks the excess return of a notional dynamic basket of ETFs and cash over a change in SOFR. The weight of a Cash Investment (if any) for a Monthly Reference Portfolio at any given time represents the portion of the Monthly Reference Portfolio that is uninvested in the applicable ETF basket at that time. As such, any allocation to a Cash Investment within the Index, which also accrues at SOFR, will not affect the level of the Index. The Index will reflect no return for any uninvested portion (i.e., any portion represented by a Cash Investment). Accordingly, to the extent that the Index is allocated to the Cash Investment, it may not reflect the full increase of any relevant ETF component. Under certain circumstances, the Index may be 100% allocated to the Cash Investment. Correlation of performances among the ETFs may reduce the performance of the Index. Performances of the ETFs may become highly correlated from time to time including, but not limited to, a period in which there is a substantial decline in a particular sector or asset type represented by the ETFs and which has a higher weighting in the Index relative to any of the other sectors or asset types, as determined by the Index’s strategy. High correlation during periods of negative returns among ETFs representing any one sector or asset type and which ETFs have a substantial percentage weighting in the Index could have an adverse effect on the index. Please review carefully these risk factors, and any risk factors in an offering document for any security or financial instrument referencing the Index, before making any investment. |