| Title of Each Class of Securities Offered | Maximum Aggregate Offering Price | Amount of Registration Fee(1) | ||

| Debt Securities | $10,197,320.00 | $1,235.92 |

(1) Calculated in accordance with Rule 457(r) of the Securities Act of 1933, as amended.

| Filed Pursuant to Rule 424(b)(2) Registration Statement No. 333-223208 (To Prospectus dated February 26, 2018, Prospectus Supplement dated February 26, 2018 and Product Supplement EQUITY INDICES SUN-1 dated February 26, 2018) |

1,019,732 Units $10 principal amount per unit CUSIP No. 40436B378 | Pricing Date Settlement Date Maturity Date | August 29, 2019 September 6, 2019 August 25, 2022 |

Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket

| · | Maturity of approximately three years, if not called prior to maturity |

| · | Automatic call of the notes per unit at $10 plus the applicable Call Premium ($1.35 on the first Observation Date, and $2.70 on the final Observation Date) if the Basket is flat or increases above 100% of the Starting Value on the relevant Observation Date |

| · | The Observation Dates will occur approximately one year and two years after the pricing date |

| · | If the notes are not called, at maturity: |

| · | a return of 35% if the Basket is flat or increases up to the Step Up Value |

| · | a return equal to the percentage increase in the Basket if the Basket increases above the Step Up Value |

| · | 1-to-1 downside exposure to decreases in the Basket, with up to 100% of the principal amount at risk |

| · | The Basket is comprised of the EURO STOXX 50® Index, the FTSE® 100 Index, the Nikkei Stock Average Index, the Swiss Market Index®, the S&P/ASX 200® Index and the Hang Seng® Index. The EURO STOXX 50® Index was given an initial weight of 40.00%, each of the FTSE® 100 Index and the Nikkei Stock Average Index was given an initial weight of 20.00%, each of the Swiss Market Index® and the S&P/ASX 200® Index was given an initial weight of 7.50%, and the Hang Seng® Index was given an initial weight of 5.00% |

| · | All payments are subject to the credit risk of HSBC USA Inc. |

| · | No interest payments |

| · | In addition to the underwriting discount set forth below, the notes include a hedging-related charge of $0.075 per unit. See “Supplement to the Plan of Distribution—Role of MLPF&S and BofAS” |

| · | No listing on any securities exchange |

The notes are being issued by HSBC USA Inc. (“HSBC”). Investing in the notes involves a number of risks. There are important differences between the notes and a conventional debt security, including different investment risks and costs. See “Risk Factors” beginning on page TS-7 of this term sheet and beginning on page PS-7 of product supplement EQUITY INDICES SUN-1.

The estimated initial value of the notes on the pricing date is $9.624 per unit, which is less than the public offering price listed below. The market value of the notes at any time will reflect many factorsand cannot be predicted with accuracy. See “Summary” on page TS-2 and “Risk Factors” beginning on page TS-7 of this term sheet for additional information.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or the adequacy of this document, the accompanying product supplement, prospectus or prospectus supplement. Any representation to the contrary is a criminal offense.

| Per Unit | Total | |

| Public offering price(1) | $ 10.00 | $10,197,320.00 |

| Underwriting discount(1) | $ 0.20 | $203,946.40 |

| Proceeds, before expenses, to HSBC | $ 9.80 | $9,993,373.60 |

| (1) | See “Supplement to the Plan of Distribution” below. |

The notes:

| Are Not FDIC Insured | Are Not Bank Guaranteed | May Lose Value |

BofA Merrill Lynch

August 29, 2019

| Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 |

|

Summary

The Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 (the “notes”) are our senior unsecured debt securities and are not a direct or indirect obligation of any third party. The notes are not deposit liabilities or other obligations of a bank and are not guaranteed or insured by the Federal Deposit Insurance Corporation or any other governmental agency of the United States or any other jurisdiction.The notes will rank equally with all of our other senior unsecured debt. Any payments due on the notes, including any repayment of principal, depend on the credit risk of HSBC and its ability to satisfy its obligations as they come due. The notes will be automatically called at the applicable Call Amount if the Observation Level of the Market Measure, which is the international equity index basket described below (the “Basket”), is equal to or greater than the Call Level on the relevant Observation Date. If the notes are not called, at maturity, the notes provide you with a Step Up Payment if the Ending Value of the Basket is equal to or greater than the Starting Value, but is not greater than the Step Up Value. If the Ending Value is greater than the Step Up Value, you will participate on a 1-for-1 basis in the increase in the value of the Basket above the Starting Value. If the Ending Value is less than the Starting Value, you will lose all or a portion of the principal amount of your notes. Any payments on the notes, will be calculated based on the $10 principal amount per unit and will depend on the performance of the Basket, subject to our credit risk. See “Terms of the Notes” below.

The Basket is comprised of the EURO STOXX 50® Index, the FTSE® 100 Index, the Nikkei Stock Average Index, the Swiss Market Index®, the S&P/ASX 200® Index and the Hang Seng® Index (each a “Basket Component”). On the pricing date, the EURO STOXX 50® Index was given an initial weight of 40.00%, each of the FTSE® 100 Index and the Nikkei Stock Average Index was given an initial weight of 20.00%, each of the Swiss Market Index® and the S&P/ASX 200® Index was given an initial weight of 7.50% and the Hang Seng® Index was given an initial weight of 5.00%.

The estimated initial value of the notes is less than the price you pay to purchase the notes. The estimated initial value was determined by reference to our or our affiliates’ internal pricing models and reflects our internal funding rate, which is the borrowing rate we pay to issue market-linked notes, and the market prices for hedging arrangements related to the notes (which may include call options, put options or other derivatives). This internal funding rate is typically lower than the rate we would use when we issue conventional fixed or floating rate debt securities. The difference in the borrowing rate, as well as the underwriting discount and the costs associated with hedging the notes, including the hedging related charge described below, reduced the economic terms of the notes (including the Call Premiums and Call Amounts). The notes are subject to an automatic call, and the initial estimated value is based on an assumed tenor of the notes.

Terms of the Notes

| Issuer: | HSBC USA Inc. (“HSBC”) | Call Settlement Dates: | Approximately the fifth business day following the applicable Observation Date, subject to postponement if the related Observation Date is postponed, as described on page PS-20 of product supplement EQUITY INDICES SUN-1. |

| Principal Amount: | $10.00 per unit | Call Premiums: | $1.35 per unit if called on the first Observation Date (which represents a return of 13.50% over the principal amount), and $2.70 per unit if called on the final Observation Date (which represents a return of 27.00% over the principal amount). |

| Term: | Approximately three years, if not called | Ending Value: | The value of the Basket on the calculation day, calculated as specified in “The Basket” on page TS-9. The scheduled calculation day is subject to postponement in the event of Market Disruption Events, as described beginning on page PS-25 of product supplement EQUITY INDICES SUN-1. |

| Market Measure: | An international equity index basket comprised of the EURO STOXX 50®Index (Bloomberg symbol: “SX5E”), the FTSE®100 Index (Bloomberg symbol: “UKX”), the Nikkei Stock Average Index (Bloomberg symbol: “NKY”), the Swiss Market Index® (Bloomberg symbol: “SMI”), the S&P/ASX 200® Index (Bloomberg symbol: “AS51”) and the Hang Seng® Index (Bloomberg symbol: “HSI”). Each Basket Component is a price return index. | Step Up Value: | 135.00 (135% of the Starting Value). |

| Starting Value: | 100.00 | Step Up Payment: | $3.50 per unit, which represents a return of 35% over the principal amount. |

| Observation Level: | The value of the Basket on the applicable Observation Date, calculated as specified in “The Basket” on page TS-9. | Threshold Value: | 100.00 (100% of the Starting Value). |

| Observation Dates: | September 3, 2020 and August 19, 2021, subject to postponement in the event of Market Disruption Events, as described on page PS-25 of product supplement EQUITY INDICES SUN-1. | Calculation Day: | August 18, 2022 |

| Call Level: | 100.00 (100% of the Starting Value). | Fees Charged: | The public offering price of the notes includes the underwriting discount of $0.20 per unit as listed on the cover page and an additional charge of $0.075 per unit more fully described on page TS-25. |

| Call Amounts (per Unit): | $11.35 if called on the first Observation Date and $12.70 if called on the final Observation Date. | Calculation Agent: | BofA Securities, Inc. (“BofAS”) and HSBC, acting jointly. |

Autocallable Market-Linked Step Up Notes

| TS-2 |

| Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 |

|

Determining Payment on the Notes

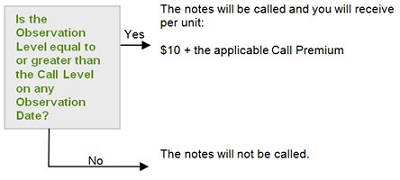

Automatic Call Provision

The notes will be called automatically on an Observation Date if the Observation Level on that Observation Date is equal to or greater than the Call Level. If the notes are called, you will receive $10 per unit plus the applicable Call Premium.

Redemption Amount Determination

If the notes are not automatically called, on the maturity date, you will receive a cash payment per unit determined as follows:

Autocallable Market-Linked Step Up Notes

| TS-3 |

| Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 |

|

The terms and risks of the notes are contained in this term sheet and the documents listed below (together, the “Note Prospectus”). The documents have been filed as part of a registration statement with the SEC, which may, without cost, be accessed on the SEC website as indicated below or obtained from MLPF&S or BofAS by calling 1-800-294-1322:

| · | Product supplement EQUITY INDICES SUN-1 dated February 26, 2018: https://www.sec.gov/Archives/edgar/data/83246/000114420418010874/tv487066_424b2.htm |

| · | Prospectus supplement dated February 26, 2018: https://www.sec.gov/Archives/edgar/data/83246/000114420418010762/tv486944_424b2.htm |

| · | Prospectus dated February 26, 2018: https://www.sec.gov/Archives/edgar/data/83246/000114420418010720/tv487083_424b3.htm |

As a result of the completion of the reorganization of Bank of America’s U.S. broker-dealer business, references to Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”) in the accompanying product supplement EQUITY INDICES SUN-1, as such references relate to MLPF&S’s institutional services, should be read as references to BofAS.

Our Central Index Key, or CIK, on the SEC website is 83246.Before you invest, you should read the Note Prospectus, including this term sheet, for information about us and this offering. Any prior or contemporaneous oral statements and any other written materials you may have received are superseded by the Note Prospectus. You should carefully consider, among other things, the matters set forth under “Risk Factors” in the section indicated on the cover of this term sheet. The notes involve risks not associated with conventional debt securities. Capitalized terms used but not defined in this term sheet have the meanings set forth in product supplement EQUITY INDICES SUN-1. Unless otherwise indicated or unless the context requires otherwise, all references in this document to “we,” “us,” “our,” or similar references are to HSBC.

Investor Considerations

You may wish to consider an investment in the notes if:

| · | You are willing to receive a return on your investment capped at the return represented by the applicable Call Premium if the relevant Observation Level is equal to or greater than the Call Level. |

| · | You anticipate that the notes will be automatically called or that the Basket will not decrease from the Starting Value to the Ending Value. |

| · | You are willing to risk a loss of principal and return if the notes are not automatically called and the Basket decreases from the Starting Value to the Ending Value. |

| · | You are willing to forgo the interest payments that are paid on traditional interest bearing debt securities. |

| · | You are willing to forgo dividends or other benefits of owning the stocks included in the Basket Components. |

| · | You are willing to accept that a secondary market is not expected to develop for the notes, and understand that the market prices for the notes, if any, may be less than the principal amount and will be affected by various factors, including our actual and perceived creditworthiness, our internal funding rate and the fees charged, as described on page TS-2. |

| · | You are willing to assume our credit risk, as issuer of the notes, for all payments under the notes, including the Call Amount or the Redemption Amount. |

The notes may not be an appropriate investment for you if:

| · | You want to hold your notes for the full term. |

| · | You believe that the notes will not be automatically called and the Basket will decrease from the Starting Value to the Ending Value. |

| · | You seek principal repayment or preservation of capital. |

| · | You seek interest payments or other current income on your investment. |

| · | You want to receive dividends or other distributions paid on the stocks included in the Basket Components. |

| · | You seek an investment for which there will be a liquid secondary market. |

| · | You are unwilling or are unable to take market risk on the notes or to take our credit risk as issuer of the notes. |

We urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

Autocallable Market-Linked Step Up Notes

| TS-4 |

| Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 |

|

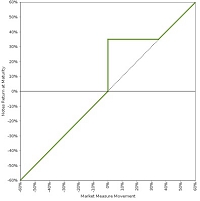

Hypothetical Payout Profile at Maturity

The graph below shows a payout profile at maturity, which would only apply if the notes are not called on any Observation Date.

Autocallable Market-Linked Step Up Notes

| This graph reflects the returns on the notes, based on the Threshold Value of 100% of the Starting Value, the Step Up Payment of $3.50 per unit and the Step Up Value of 135% of the Starting Value. The green line reflects the returns on the notes, while the dotted gray line reflects the returns of a direct investment in the stocks included in the Basket Components, excluding dividends.

This graph has been prepared for purposes of illustration only.

|

Hypothetical Payments at Maturity

The following table and examples are for purposes of illustration only. They are based onhypothetical values and showhypothetical returns on the notes, assuming the notes are not called on any Observation Date.The actual amount you receive and the resulting total rate of return will depend on the actual Ending Value, whether the notes are called on an Observation Date, and term of your investment.

The following table is based on the Starting Value of 100.00, the Threshold Value of 100.00, the Step Up Value of 135.00 and the Step Up Payment of $3.50 per unit. It illustrates the effect of a range of Ending Values on the Redemption Amount per unit of the notes and the total rate of return to holders of the notes. The following examples do not take into account any tax consequences from investing in the notes.

| Ending Value | Percentage Change from the Starting Value to the Ending Value | Redemption Amount per Unit | Total Rate of Return on the Notes | |||

| 0.00 | -100.00% | $0.00 | -100.00% | |||

| 50.00 | -50.00% | $5.00 | -50.00% | |||

| 80.00 | -20.00% | $8.00 | -20.00% | |||

| 85.00 | -15.00% | $8.50 | -15.00% | |||

| 90.00 | -10.00% | $9.00 | -10.00% | |||

| 95.00 | -5.00% | $9.50 | -5.00% | |||

| 100.00(1)(2) | 0.00% | $13.50(3) | 35.00% | |||

| 105.00 | 5.00% | $13.50 | 35.00% | |||

| 110.00 | 10.00% | $13.50 | 35.00% | |||

| 120.00 | 20.00% | $13.50 | 35.00% | |||

| 130.00 | 30.00% | $13.50 | 35.00% | |||

| 135.00(4) | 35.00% | $13.50 | 35.00% | |||

| 140.00 | 40.00% | $14.00 | 40.00% | |||

| 150.00 | 50.00% | $15.00 | 50.00% | |||

| 160.00 | 60.00% | $16.00 | 60.00% |

| (1) | The Starting Value was set to 100.00 on the pricing date. | |

| (2) | This is the Threshold Value. | |

| (3) | This amount represents the sum of the principal amount and the Step Up Payment of $3.50. | |

| (4) | This is the Step Up Value. |

For recenthypothetical values of the Basket, see “The Basket” section below. For recent actual levels of the Basket Components, see “The Basket Components” section below. Each Basket Component is a price return index and as such the Ending Value will not include any income generated by dividends paid on the stocks included in any of the Basket Components, which you would otherwise be entitled to receive if you invested in those stocks directly. In addition, all payments on the notes are subject to issuer credit risk.

Autocallable Market-Linked Step Up Notes

| TS-5 |

| Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 |

|

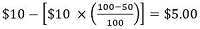

Redemption Amount Calculation Examples

| Example 1 | |

| The Ending Value is 50.00, or 50.00% of the Starting Value: | |

| Starting Value: | 100.00 |

| Threshold Value: | 100.00 |

| Ending Value: | 50.00 |

| Redemption Amount per unit |

| Example 2 | |

| The Ending Value is 110.00, or 110.00% of the Starting Value: | |

| Starting Value: | 100.00 |

| Step Up Value: | 135.00 |

| Ending Value: | 110.00 |

| Redemption Amount per unit,the principal amount plus the Step Up Payment, since the Ending Value is equal to or greater than the Starting Value, but less than the Step Up Value. |

| Example 3 | |

| The Ending Value is 150.00, or 150.00% of the Starting Value: | |

| Starting Value: | 100.00 |

| Step Up Value: | 135.00 |

| Ending Value: | 150.00 |

| Redemption Amount per unit |

Autocallable Market-Linked Step Up Notes

| TS-6 |

| Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 |

|

Risk Factors

We urge you to read the section “Risk Factors” in the product supplement and in the accompanying prospectus supplement. Investing in the notes is not equivalent to investing directly in the stocks included in the Basket Components. You should understand the risks of investing in the notes and should reach an investment decision only after careful consideration, with your advisers, with respect to the notes in light of your particular financial and other circumstances and the information set forth in this term sheet and the accompanying product supplement, prospectus supplement and prospectus.

In addition to the risks in the product supplement identified below, you should review “Risk Factors” in the accompanying prospectus supplement, including the explanation of risks relating to the notes described in the section “— Risks Relating to All Note Issuances.”

| § | If the notes are not automatically called, depending on the performance of the Basket as measured shortly before the maturity date, you may lose up to 100% of the principal amount. | |

| § | Your return on the notes may be less than the yield you could earn by owning a conventional fixed or floating rate debt security of comparable maturity. | |

| § | If the notes are called, your investment return is limited to the return represented by the applicable Call Premium. | |

| § | Your investment return may be less than a comparable investment directly in the stocks included in the Basket Components. | |

| § | Payments on the notes are subject to our credit risk, and actual or perceived changes in our creditworthiness are expected to affect the value of the notes. If we become insolvent or are unable to pay our obligations, you may lose your entire investment. | |

| § | The estimated initial value of the notes is less than the public offering price and may differ from the market value of the notes in the secondary market, if any. We determined the estimated initial value by reference to our or our affiliates’ internal pricing models. These pricing models consider certain assumptions and variables, which can include volatility and interest rates. These pricing models rely in part on certain forecasts about future events, which may prove to be incorrect. Different pricing models and assumptions could provide valuations for the notes that are different from our estimated initial value. The estimated initial value reflects our internal funding rate we use to issue market-linked notes, as well as the mid-market value of the hedging arrangements related to the notes (which may include call options, put options or other derivatives). | |

| § | Our internal funding rate for the issuance of these notes is lower than the rate we would use when we issue conventional fixed or floating rate debt securities. This is one of the factors that may result in the market value of the notes being less than their estimated initial value. As a result of the difference between our internal funding rate and the rate we would use when we issue conventional fixed or floating rate debt securities, the estimated initial value of the notes may be lower if it were based on the levels at which our fixed or floating rate debt securities trade in the secondary market. In addition, if we were to use the rate we use for our conventional fixed or floating rate debt issuances, we would expect the economic terms of the notes to be more favorable to you. | |

| § | The price of your notes in the secondary market, if any, immediately after the pricing date will be less than the public offering price. The public offering price takes into account certain costs, principally the underwriting discount, the hedging costs described on page TS-25, and the costs associated with issuing the notes. The costs associated with issuing the notes will be used or retained by us or one of our affiliates. If you were to sell your notes in the secondary market, if any, the price you would receive for your notes may be less than the price you paid for them. | |

| § | The estimated initial value does not represent a minimum price at which we, MLPF&S, BofAS or any of our respective affiliates would be willing to purchase your notes in the secondary market (if any exists) at any time. The price of your notes in the secondary market, if any, at any time after issuance will vary based on many factors, including the value of the Basket and changes in market conditions, and cannot be predicted with accuracy. The notes are not designed to be short-term trading instruments, and you should, therefore, be able and willing to hold the notes to maturity. Any sale of the notes prior to maturity could result in a loss to you. | |

| § | A trading market is not expected to develop for the notes. None of us, MLPF&S or BofAS is obligated to make a market for, or to repurchase, the notes. There is no assurance that any party will be willing to purchase your notes at any price in any secondary market. | |

| § | Our business, hedging and trading activities, and those of MLPF&S, BofAS and our respective affiliates (including trades in shares of companies included in the Basket Components), and any hedging and trading activities we, MLPF&S, BofAS or our respective affiliates engage in for our clients’ accounts, may affect the market value and return of the notes and may create conflicts of interest with you. | |

| § | Changes in the level of one of the Basket Components may be offset by changes in the levels of the other Basket Components. Due to the different Initial Component Weights, changes in the levels of some Basket Components will have a more substantial impact on the value of the Basket than similar changes in the levels of the other Basket Components. | |

| § | An index sponsor may adjust the relevant Basket Component in a way that affects its level, and has no obligation to consider your interests. | |

| § | You will have no rights of a holder of the securities represented by the Basket Components, and you will not be entitled to receive securities, dividends or other distributions by issuers of those securities. |

Autocallable Market-Linked Step Up Notes

| TS-7 |

| Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 |

|

| § | While we, MLPF&S, BofAS or our respective affiliates may from time to time own securities of the companies included in the Basket Components, we, MLPF&S, BofAS and our respective affiliates do not control any company included in any Basket Component, and have not verified any disclosure made by any other company, except to the extent that the common stock of HSBC Holdings plc, which is our parent company, is included in the FTSE® 100 Index. | |

| § | Your return on the notes may be affected by factors affecting the international securities markets, specifically markets in the countries represented by the Basket Components. In addition, you will not obtain the benefit of any increase in the value of the currencies in which the securities included in the Basket Components trade against the U.S. dollar, which you would have received if you had owned the securities included in the Basket Components during the term of your notes, although the value of the Basket may be adversely affected by general exchange rate movements in the market. | |

| § | There may be potential conflicts of interest involving the calculation agents, one of which is us and one of which is BofAS. We have the right to appoint and remove the calculation agents. | |

| § | The U.S. federal income tax consequences of the notes are uncertain, and may be adverse to a holder of the notes. See “Summary Tax Consequences” below and “U.S. Federal Income Tax Summary” beginning on page PS-32 of product supplement EQUITY INDICES SUN-1. |

Other Terms of the Notes

Market Measure Business Day

The following definition shall supersede and replace the definition of “Market Measure Business Day” set forth in product supplement EQUITY INDICES SUN-1.

A “Market Measure Business Day” means a day on which:

| (A) | each of the Eurex (as to the EURO STOXX 50®Index), the London Stock Exchange (as to the FTSE®100 Index), the Tokyo Stock Exchange (as to the Nikkei Stock Average Index), the SIX Swiss Exchange (as to the Swiss Market Index®), the Australian Stock Exchange (as to the S&P/ASX 200® Index), and the Stock Exchange of Hong Kong (as to the Hang Seng® Index) (or any successor to the foregoing exchanges) are open for trading; and |

| (B) | the Basket Components or any successors thereto are calculated and published. |

Autocallable Market-Linked Step Up Notes

| TS-8 |

| Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 |

|

The Basket

The Basket is designed to allow investors to participate in the percentage changes in the levels of the Basket Components from the Starting Value to the Ending Value of the Basket. The Basket Components are described in the section “The Basket Components” below. Each Basket Component was assigned an initial weight on the pricing date, as set forth in the table below.

For more information on the calculation of the value of the Basket, please see the section entitled “Description of the Notes—Basket Market Measures” beginning on page PS-23 of product supplement EQUITY INDICES SUN-1.

On the pricing date, for each Basket Component, the Initial Component Weight, the closing level, the Component Ratio and the initial contribution to the Basket value were as follows:

| Basket Component | Bloomberg Symbol | Initial Component Weight | Closing Level(1) | Component Ratio(2) | Initial Basket Value Contribution | |||||

| EURO STOXX 50®Index | SX5E | 40.00% | 3,411.33 | 0.01172563 | 40.00 | |||||

| FTSE®100 Index | UKX | 20.00% | 7,184.32 | 0.00278384 | 20.00 | |||||

| Nikkei Stock Average Index | NKY | 20.00% | 20,460.93 | 0.00097747 | 20.00 | |||||

| Swiss Market Index® | SMI | 7.50% | 9,838.48 | 0.00076231 | 7.50 | |||||

| S&P/ASX 200®Index | AS51 | 7.50% | 6,507.395 | 0.00115253 | 7.50 | |||||

| Hang Seng® Index | HSI | 5.00% | 25,703.50 | 0.00019453 | 5.00 | |||||

| Starting Value | 100.00 |

| (1) | These were the closing levels of the Basket Components on the pricing date. |

| (2) | Each Component Ratio equals the Initial Component Weight of the relevant Basket Component (as a percentage) multiplied by 100, and then divided by the closing level of that Basket Component on the pricing date and rounded to eight decimal places. |

The calculation agent will calculate the value of the Basket on each Observation Date and the calculation day by summing the products of the closing level for each Basket Component on such day and the Component Ratio applicable to such Basket Component. If a Market Disruption Event occurs as to any Basket Component on a scheduled Observation Date or the scheduled calculation day, the closing level of that Basket Component will be determined as more fully described in the section entitled “Description of the Notes—Basket Market Measures— Observation Level or Ending Value of the Basket” on page PS-25 of product supplement EQUITY INDICES SUN-1.

Autocallable Market-Linked Step Up Notes

| TS-9 |

Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 |

|

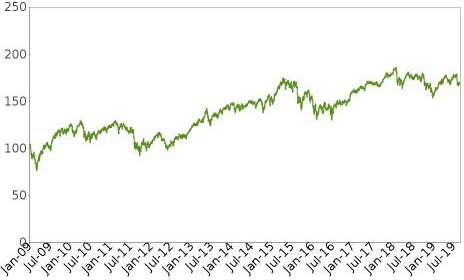

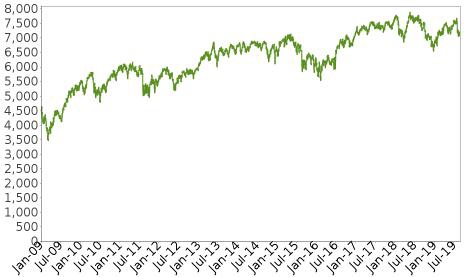

While actual historical information on the Basket did not exist before the pricing date, the following graph sets forth the hypothetical historical performance of the Basket from January 1, 2009 through August 29, 2019. The graph is based upon actual daily historical levels of the Basket Components, hypothetical Component Ratios based on the closing levels of the Basket Components as of December 31, 2008, and a Basket value of 100.00 as of that date. This hypothetical historical data on the Basket is not necessarily indicative of the future performance of the Basket or what the value of the notes may be. Any hypothetical historical upward or downward trend in the value of the Basket during any period set forth below is not an indication that the value of the Basket is more or less likely to increase or decrease at any time over the term of the notes.

Hypothetical Historical Performance of the Basket

Autocallable Market-Linked Step Up Notes

| TS-10 |

Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 |

|

The Basket Components

All disclosures contained in this term sheet regarding the Basket Components, including, without limitation, their make-up, method of calculation, and changes in their components, have been derived from publicly available sources. The information reflects the policies of, and is subject to change by each of STOXX Limited (“STOXX”) with respect to the EURO STOXX 50® Index (the “SX5E”), FTSE International Limited (“FTSE”) with respect to the FTSE® 100 Index (the “UKX”), Nikkei Inc. (“Nikkei”) with respect to the Nikkei Stock Average Index (the “NKY”), the Geneva, Zurich, SIX Group Ltd., certain of its subsidiaries, and the Management Committee of the SIX Swiss Exchange (the “SIX Exchange”), with respect to the Swiss Market Index® (the “SMI”), S&P Dow Jones Indices LLC (“S&P”), a division of S&P Global, with respect to the S&P/ASX 200® Index (the “AS51”), and HSI Services Limited (“HSIL”) with respect to the Hang Seng® Index (the “HSI”) (STOXX, FTSE, Nikkei, S&P, Six Exchange and HSIL together, the “index sponsors”). The index sponsors have no obligation to continue to publish, and may discontinue or suspend the publication of any Basket Component at any time. The consequences of any index sponsor discontinuing publication of a Basket Component are discussed in the section entitled “Description of the Notes—Discontinuance of an Index” beginning on page PS-22 of product supplement EQUITY INDICES SUN-1. None of us, the calculation agents, MLPF&S, or BofAS accepts any responsibility for the calculation, maintenance, or publication of any Basket Component or any successor index.

The EURO STOXX 50®Index

The SX5E was created by STOXX, which is owned by Deutsche Börse AG. Publication of the SX5E began on February 28, 1998, based on an initial index value of 1,000 at December 31, 1991. The SX5E is reported daily on the Bloomberg Professional® service under the symbol “SX5E” and on the STOXX website. Information contained in the STOXX website is not incorporated by reference in, and should not be considered a part of, this term sheet.

Composition and Maintenance of the SX5E

The SX5E is composed of 50 stocks from 12 Eurozone countries (Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain) of the STOXX Europe 600 Supersector indices. The STOXX 600 Supersector indices contain the 600 largest stocks traded on the major exchanges of 18 European countries and are organized into the following 19 Supersectors: automobiles & parts; banks; basic resources; chemicals; construction & materials; financial services; food & beverage; health care; industrial goods & services; insurance; media; oil & gas; personal & household goods; real estate; retail; technology; telecommunications; travel & leisure; and utilities.

The SX5E is weighted by free float market capitalization. Each component’s weight is capped at 10% of the SX5E’s total free float market capitalization. Free float weights are reviewed quarterly and the SX5E’s composition is reviewed annually in September. The review cut-off date is the last trading day of August.

Within each of the 19 EURO STOXX Supersector indices, the component stocks are ranked by free float market capitalization. The largest stocks are added to the selection list until the coverage is close to, but still less than, 60% of the free float market capitalization of the corresponding EURO STOXX Total Market Index Supersector Index. If the next-ranked stock brings the coverage closer to 60% in absolute terms, then it is also added to the selection list. All current component stocks are then added to the selection list. The stocks on the selection list are ranked by free float market capitalization. In exceptional cases, the STOXX Supervisory Board may make additions and deletions to the selection list.

The 40 largest stocks on the selection list are chosen as components. The remaining 10 stocks are selected from the largest remaining current components of the SX5E that are ranked between 41 and 60. If the component number is still below 50, then the largest remaining stocks on the selection list are added until the SX5E contains 50 stocks.

Index Calculation

The SX5E is calculated with the “Laspeyres formula,” which measures the aggregate price changes in the component stocks against a fixed base quantity weight. The formula for calculating the index value can be expressed as follows:

| index = | free float market capitalization of the index |

| divisor of the index |

The “free float market capitalization of the index” is equal to the sum of the product of the price, number of shares, free float factor and weighting cap factor for each component stock as of the time the SX5E is being calculated.

The SX5E is also subject to a divisor, which is adjusted to maintain the continuity of index values despite changes due to corporate actions.

Autocallable Market-Linked Step Up Notes

| TS-11 |

Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 |

|

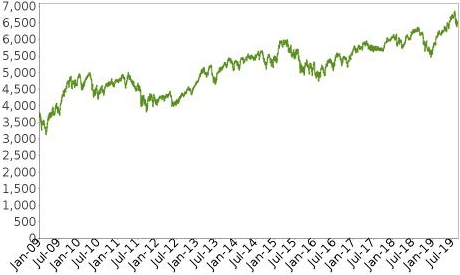

The following graph shows the daily historical performance of the SX5E in the period from January 1, 2009 through August 29, 2019. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the closing level of the SX5E was 3,411.33.

Historical Performance of the SX5E

This historical data on the SX5E is not necessarily indicative of the future performance of the SX5E or what the value of the notes may be. Any historical upward or downward trend in the level of the SX5E during any period set forth above is not an indication that the level of the SX5E is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the levels of the SX5E.

License Agreement

HSBC or one of its affiliates has entered into a nonexclusive license agreement providing for the license to it, in exchange for a fee, of the right to use certain indices owned and published by STOXX in connection with some products, including the notes.

STOXX and its licensors (the “Licensors”) have no relationship to the HSBC USA Inc., other than the licensing of the SX5E and the related trademarks for use in connection with the notes.

STOXX and its Licensors donot:

| § | Sponsor, endorse, sell or promote the notes. |

| § | Recommend that any person invest in the notes or any other securities. |

| § | Have any responsibility or liability for or make any decisions about the timing, amount or pricing of the notes. |

| § | Have any responsibility or liability for the administration, management or marketing of the notes. |

| § | Consider the needs of the notes or the owners of the notes in determining, composing or calculating the SX5E or have any obligation to do so. |

STOXX and its Licensors will not have any liability in connection with the notes. Specifically,

| § | STOXX and its Licensors do not make any warranty, express or implied and disclaim any and all warranty about: |

| o | The results to be obtained by the notes, the owner of the notes or any other person in connection with the use of the SX5E and the data included in the SX5E; |

| o | The accuracy or completeness of the SX5E and its data; |

| o | The merchantability and the fitness for a particular purpose or use of the SX5E and its data; |

| o | STOXX and its Licensors will have no liability for any errors, omissions or interruptions in the SX5E or its data; |

| § | Under no circumstances will STOXX or its Licensors be liable for any lost profits or indirect, punitive, special or consequential damages or losses, even if STOXX or its Licensors knows that they might occur. |

The licensing agreement between HSBC USA Inc. and STOXX is solely for their benefit and not for the benefit of the owners of the notes or any other third parties.

Autocallable Market-Linked Step Up Notes

| TS-12 |

Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 |

|

The FTSE®100 Index

The UKX is a market-capitalization weighted index calculated, published and disseminated by FTSE, an independent company wholly owned by the London Stock Exchange Group (the “LSE”). The UKX is designed to measure the composite performance of the 100 largest UK domiciled blue chip companies that pass screening for size and liquidity traded on the LSE. The UKX was launched on January 3, 1984 and has a base date of December 30, 1983. The UKX is reported by Bloomberg under the ticker symbol “UKX.”

The UKX is calculated by (i) multiplying the per share price of each stock included in the UKX by the number of outstanding shares and by the free float factor applicable to such stock, (ii) calculating the sum of all these products (such sum referred to hereinafter as the “FTSE Aggregate Market Value”) as of the starting date of the UKX and (iii) dividing the FTSE Aggregate Market Value by a divisor which represents the total issued share capital of the UKX on the base date and which can be adjusted to allow changes in the issued share capital of individual underlying stocks (including the deletion and addition of stocks, the substitution of stocks, stock dividends and stock splits) to be made without distorting the UKX. Because of such capitalization weighting, movements in share prices of companies with relatively larger market capitalization will have a greater effect on the level of the entire UKX than will movements in share prices of companies with relatively smaller market capitalization.

The 100 stocks included in the UKX (the “FTSE 100 Index Underlying Stocks”) were selected from a reference group of stocks trading on the LSE which were selected by excluding certain stocks that have low liquidity based on public float, accuracy and reliability of prices, size and number of trading days. The FTSE 100 Index Underlying Stocks were selected from this reference group by selecting 100 stocks with the largest market value. A list of the issuers of the FTSE 100 Index Underlying Stocks is available from FTSE. The UKX is reviewed quarterly by the FTSE Europe/Middle East/Africa Regional Committee (the “Committee”) in order to maintain continuity in the level. The FTSE 100 Index Underlying Stocks may be replaced, if necessary, in accordance with deletion/addition rules which provide generally for the removal and replacement of a stock from the UKX if such stock is delisted or its issuer is subject to a takeover offer that has been declared unconditional or it has ceased to be a viable component of the UKX. To maintain continuity, a stock will be added at the quarterly review if it has risen to 90th place or above and a stock will be deleted if at the quarterly review it has fallen to 111th place or below, in each case ranked on the basis of market value.

Autocallable Market-Linked Step Up Notes

| TS-13 |

Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 |

|

The following graph shows the daily historical performance of the UKX in the period from January 1, 2009 through August 29, 2019. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the closing level of the UKX was 7,184.32.

Historical Performance of the UKX

This historical data on the UKX is not necessarily indicative of the future performance of the UKX or what the value of the notes may be. Any historical upward or downward trend in the level of the UKX during any period set forth above is not an indication that the level of the UKX is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the levels of the UKX.

License Agreement

HSBC or one of its affiliates has entered into a non-exclusive license agreement with FTSE, whereby HSBC and its affiliates and subsidiary companies and certain of its affiliates, in exchange for a fee, will be permitted to use the UKX, which is owned and published by FTSE, in connection with certain products, including the notes.

Neither FTSE nor the LSE makes any representation or warranty, express or implied, to the owners of the notes or any member of the public regarding the advisability of investing in structured products generally or in the notes particularly, or the ability of the UKX to track general stock market performance. FTSE and the LSE’s only relationship with HSBC is the licensing of certain trademarks and trade names of FTSE, respectively, without regard to us or the notes. FTSE and the LSE have no obligation to take the needs of us or the holders of the notes into consideration in determining, composing or calculating the UKX Neither FTSE nor the LSE is responsible for and has not participated in the determination of the timing, price or quantity of the notes to be issued or in the determination or calculation of the amount due at maturity of the notes. Neither FTSE nor the LSE has any obligation or liability in connection with the administration, marketing or trading of the notes.

The notes are not in any way sponsored, endorsed, sold or promoted by FTSE or the LSE, and neither FTSE nor the LSE makes any warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the UKX and/or the figure at which the said component stands at any particular time on any particular day or otherwise. The UKX is compiled and calculated by FTSE. However, neither FTSE nor the LSE shall be liable (whether in negligence or otherwise) to any person for any error in the UKX and neither FTSE nor the LSE shall be under any obligation to advise any person of any error therein.

“FTSE®,” “FTSETM,” “FT-SE®” and “Footsie®” are trade marks of the London Stock Exchange Group companies and are used by FTSE International Limited under license. “All-World,” “All-Share” and “All-Small” are trade marks of FTSE International Limited.

Autocallable Market-Linked Step Up Notes

| TS-14 |

Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 |

|

The Nikkei Stock Average Index

The NKY is a stock index that measures the composite price performance of selected Japanese stocks. The NKY is also called the Nikkei 225 Index. The NKY is based on 225 underlying stocks (the “Nikkei Underlying Stocks”) trading on the Tokyo Stock Exchange (“TSE”), representing a broad cross-section of Japanese industries. All 225 Nikkei Underlying Stocks are stocks listed in the First Section of the TSE. Stocks listed in the First Section of the TSE are among the most actively traded stocks on the TSE. Nikkei’s rules require that the 75 most liquid issues (one-third of the component count of the NKY) be included in the NKY. Nikkei first calculated and published the NKY in 1970; prior to 1970, the TSE calculated the NKY. The NKY is reported by Bloomberg under the ticker symbol “NKY.”

The 225 companies included in the NKY are divided into six sector categories: Technology, Financials, Consumer Goods, Materials, Capital Goods/Others and Transportation and Utilities. These six sector categories are further divided into 36 industrial classifications as follows:

| · | Technology — Pharmaceuticals, Electric Machinery, Automobiles and Auto Parts, Precision Instruments, Communications; |

| · | Financials — Banking, Other Financial Services, Securities, Insurance; |

| · | Consumer Goods — Fishery, Foods, Retail, Services; |

| · | Materials — Mining, Textiles and Apparel, Paper and Pulp, Chemicals, Petroleum, Rubber, Glass and Ceramics, Steel, Nonferrous Metals, Trading Companies; |

| · | Capital Goods/Others — Construction, Machinery, Shipbuilding, Transportation Equipment, Other Manufacturing, Real Estate; and |

| · | Transportation and Utilities — Railway and Bus, Land Transport, Marine Transport, Air Transport, Warehousing, Electric Power, Gas. |

Calculation of the NKY

The NKY is a modified, price-weighted index (i.e., a Nikkei Underlying Stock’s weight in the NKY is based on its price per share rather than the total market capitalization of the issuer) which is calculated by (i) multiplying the per share price of each Nikkei Underlying Stock by the corresponding weighting factor for such Nikkei Underlying Stock (a “Weight Factor”), (ii) calculating the sum of all these products and (iii) dividing such sum by a divisor (the “Divisor”). The Divisor was initially set at 225 for the date of May 16, 1949 (the date on which the TSE was reopened after World War II) using historical numbers from that date. The Divisor is subject to periodic adjustments as set forth below. Each Weight Factor is computed by dividing ¥50 by the presumed par value of the relevant Nikkei Underlying Stock, so that the share price of each Nikkei Underlying Stock when multiplied by its Weight Factor corresponds to a share price based on a uniform par value of ¥50. The stock prices used in the calculation of the NKY are those reported by a primary market for the Nikkei Underlying Stocks (currently the TSE). The level of the NKY is calculated once every 15 seconds during TSE trading hours.

In order to maintain continuity in the NKY in the event of certain changes due to non-market factors affecting the Nikkei Underlying Stocks, such as the addition or deletion of stocks, substitution of stocks, stock splits or distributions of assets to stockholders, the Divisor used in calculating the NKY is adjusted in a manner designed to prevent any instantaneous change or discontinuity in the level of the NKY. Thereafter, the Divisor remains at the new value until a further adjustment is necessary as the result of another change. As a result of such change affecting any Nikkei Underlying Stock, the Divisor is adjusted in such a way that the sum of all share prices immediately after the change multiplied by the applicable Weight Factor and divided by the new Divisor (i.e., the level of the NKY immediately after such change) will equal the level of the NKY immediately prior to the change.

Standards for Listing and Maintenance

A Nikkei Underlying Stock may be deleted or added by Nikkei. Any stock becoming ineligible for listing in the First Section of the TSE due to any of the following reasons will be deleted from the Nikkei Underlying Stocks: (i) bankruptcy of the issuer, (ii) merger of the issuer with, or acquisition of the issuer by, another company, (iii) delisting of such stock, (iv) transfer of such stock to the “Seiri-Post” because of excess debt of the issuer or because of any other reason or (v) transfer of such stock to the Second Section. In addition, a component stock transferred to the “Kanri-Post” (posts for stocks under supervision) becomes a candidate for deletion. Nikkei Underlying Stocks with relatively low liquidity, based on trading value and rate of price fluctuation over the past five years, may be deleted by Nikkei. Upon deletion of a stock from the Nikkei Underlying Stocks, Nikkei will select a replacement for such deleted Nikkei Underlying Stock in accordance with certain criteria. In an exceptional case, a newly listed stock in the First Section of the TSE that is recognized by Nikkei to be representative of a market may be added to the Nikkei Underlying Stocks. In such a case, an existing Nikkei Underlying Stock with low trading volume and deemed not to be representative of a market will be deleted by Nikkei.

A list of the issuers of the Nikkei Underlying Stocks constituting the NKY is available from the Nikkei Economic Electronic Databank System and from the Stock Market Indices Data Book published by Nikkei. Nikkei may delete, add or substitute any stock underlying the NKY.

Autocallable Market-Linked Step Up Notes

| TS-15 |

Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 |

|

The following graph shows the daily historical performance of the NKY in the period from January 1, 2009 through August 29, 2019. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the closing level of the NKY was 20,460.93.

Historical Performance of the NKY

This historical data on the NKY is not necessarily indicative of the future performance of the NKY or what the value of the notes may be. Any historical upward or downward trend in the level of the NKY during any period set forth above is not an indication that the level of the NKY is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the levels of the NKY.

License Agreement

We will enter into an agreement with Nikkei providing us with a non-exclusive license with the right to use the NKY in exchange for a fee. The NKY is the intellectual property of Nikkei. “Nikkei,” “Nikkei Stock Average,” and “Nikkei 225” are the service marks of Nikkei. Nikkei reserves all the rights, including copyright, to the NKY. Nikkei Digital Media, Inc., a wholly owned subsidiary of Nikkei, calculates and disseminates the NKY under exclusive agreement with Nikkei.

The notes are not in any way sponsored, endorsed or promoted by Nikkei. Nikkei does not make any warranty or representation whatsoever, express or implied, either as to the results to be obtained as to the use of the NKY or the figure as which the NKY stands at any particular day or otherwise. The NKY is compiled and calculated solely by Nikkei. However, Nikkei shall not be liable to any person for any error in the NKY and Nikkei shall not be under any obligation to advise any person, including a purchaser or seller of the notes, of any error therein.

In addition, Nikkei gives no assurance regarding any modification or change in any methodology used in calculating the NKY and is under no obligation to continue the calculation, publication and dissemination of the NKY.

Autocallable Market-Linked Step Up Notes

| TS-16 |

Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 |

|

The Swiss Market Index®

The Swiss Market Index® (Bloomberg ticker: “SMI”) (the “SMI”):

| · | was first launched with a base level of 1,500 as of June 30, 1988; and |

| · | is sponsored, calculated, published and disseminated by SIX Group Ltd., certain of its subsidiaries, and the Management Committee of SIX Exchange. |

The SMI is a price return float-adjusted market capitalization-weighted index of the 20 largest stocks traded on the SIX Exchange. The Management Committee of SIX Exchange is supported by an Index Commission (advisory board) in all index-related matters, notably in connection with changes to the index rules and adjustments, additions and exclusions outside of the established review and acceptance period. The Index Commission meets at least twice annually.

Information regarding the Swiss Market Index® may be found on SIX Exchange’s website. Please note that information included in that website is not included or incorporated by reference in this document.

Index Composition and Selection Criteria

The SMI is comprised of the 20 highest ranked stocks traded on the SIX Exchange that have a free float of 20% or more and that are not investment companies. The equity universe is largely Swiss domestic companies; however, in some cases, foreign issuers with a primary listing on the SIX Exchange or investment companies that do not hold any shares of any other eligible company and that have a primary listing on the SIX Exchange may be included.

The ranking of each security is determined by a combination of the following criteria:

| · | average free-float market capitalization over the last 12 months (compared to the capitalization of the entire index universe of Swiss Performance Index, which serves as a benchmark for the overall Swiss equity market and as the index universe for the SMI), and |

| · | cumulative on order book turnover over the last 12 months (compared to the total turnover of the Swiss Performance Index). |

Each of these two factors is assigned a 50% weighting in ranking the stocks eligible for the SMI.

The SMI is reconstituted annually after prior notice of at least two months on the third Friday in September after the close of trading.

The reconstitution is based on data from the previous July 1 through June 30. Provisional interim selection (ranking) lists are also published following the end of the third, fourth and first financial quarters.

The 20 securities with the highest rank are selected for inclusion in the index. In order to reduce turnover, a buffer is applied for securities ranked 19 to 22. Out of the securities ranked 19 to 22, current components are selected with priority over the other securities. New components out of the buffer are selected until 20 components have been reached. If a company has primary listings on several exchanges and less than 50% of that company’s total turnover is generated on the SIX Exchange, it will not be included in the SMI unless it satisfies an additional liquidity criteria. For this purpose, all the components of the Swiss Performance Index are ranked based on their cumulated on order book turnover over the past 12 months relative to the total turnover of the index universe. A security must rank at least 18 or better in order to be selectable for the index. If it ranks 23 or lower, it will be automatically excluded from the index (i.e., without considering its free float).

Maintenance of the SMI

Constituent Changes. In the case of major market changes as a result of capital events such as mergers or new listings, the Management Committee of SIX Exchange can decide at the request of the Index Commission that a security should be admitted to the SMI outside the annual review period as long as it clearly fulfills the criteria for inclusion. For the same reasons, a security can also be excluded if the requirements for admission to the SMI are no longer fulfilled. As a general rule, extraordinary acceptances into the SMI take place after a three-month period on a quarterly basis after the close of trading on the third Friday of March, June, September and December (for example, a security listed on or before the fifth trading day prior to the end of November cannot be included until the following March). If a delisting has been confirmed, it will be removed from the SMI at the next upcoming ordinary quarterly adjustment date (March, June, September and December) with a notice period of at least five days. However, if the delisting would be effective before the ordinary index review, the security is excluded from the index on the effective date of the delisting. If a delisted company is removed before the ordinary index review, it will be replaced by the best ranked candidate on the selection list which is not yet part of the index in order to maintain 20 components.

Capped Weightings and Intra-Quarter Breaches. The weight of any index constituent that exceeds a weight of 18% within the index is reduced to that value at each quarterly index review by applying a capping factor to the calculation of such constituent’s free float market capitalization. A constituent’s number of shares and free float market capitalization are used to determine its capping factor. The excess weight (the difference of the original weight minus the capped weight) is distributed proportionally across the other index constituents. The constituents are also capped to 18% as soon as two index constituents exceed a weight of 20% (an “intra-quarter breach”). If an intra-quarter breach is observed after the close of the markets, the new capping factors are implemented after the close of the following trading day. The weights of the largest components are therefore set again to 18% effective after the close of the following trading day. If an issuer is represented in the index by more than one security, the free float market capitalization of those securities is cumulated for the calculation of the capping factors.

Autocallable Market-Linked Step Up Notes

| TS-17 |

Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 |

|

Number of Shares and Free Float. The securities included in the SMI are weighted according to their free float. This means that large stakes that reach or exceed the threshold of 5% and shares held in firm hands are subtracted from the total market capitalization of that company. The free float is calculated on the basis of outstanding shares. Issued and outstanding equity capital is, as a rule, the total amount of equity capital that has been fully subscribed and wholly or partially paid in and documented in the Commercial Register. Not counting as issued and outstanding equity capital are the approved capital and the conditional capital of a company. The free float is calculated on the basis of listed shares only. If a company offers several different categories of listed participation rights, each is treated separately for purposes of index calculation.

Shares deemed to be held in firm hands are shareholdings that have been acquired by one person or a group of persons (1) who are subject to a shareholder or lockup agreement; or (2) who according to publicly known facts, have a long-term interest in a company.

For the calculation of the number of shares in firm hands, SIX Exchange may also use other sources than the reports submitted to it. In particular, SIX Exchange may use data gained from issuer surveys that it conducts itself.

In general, shares held by custodian nominees, trustee companies, investment funds, pension funds and investment companies are deemed free-floating regardless whether a report has been made to SIX Exchange. SIX Exchange classifies at its own discretion persons and groups of persons who, because of their area of activity or the absence of important information, cannot be clearly assigned.

The free-float rule applies only to bearer shares and registered shares. Capital issued in the form of participation certificates and bonus certificates is taken into full account in calculating the SMI because it does not confer voting rights.

The number of securities in the SMI and the free-float factors are adjusted after the close of trading on four adjustment dates per year, the third Friday of March, June, September and December. Such changes are pre-announced at least one month before the adjustment date, although the index sponsor reserves the right to take account of recent changes before the adjustment date in the actual adjustment, so the definite new securities are announced five trading days before the adjustment date.

In order to avoid frequent slight changes to the weighting and to maintain the stability of the SMI, any extraordinary change of the total number of outstanding securities or the free float will only result in an extraordinary adjustment if it exceeds 10% and 5% respectively and is in conjunction with a corporate action.

Calculation of the Index

The index sponsor calculates the SMI using the “Laspeyres formula,” with a weighted arithmetic mean of a defined number of securities issues. The formula for calculating the index value can be expressed as follows:

Index = | Free Float Market Capitalization of the index Divisor |

The “free float market capitalization of the index” is equal to the sum of the product of the last-paid price, the number of shares, the free-float factor, the capping factor and, if a foreign stock is included, the current CHF exchange rate as of the time the index value is being calculated. The index value is calculated in real time and is updated whenever a trade is made in a component stock. Where any index component stock price is unavailable on any trading day, SIX Exchange will use the last reported price for such component stock. Only prices from the SIX Exchange’s electronic order book are used in calculating the SMI.

Divisor Value and Adjustments

The divisor is a technical number used to calculate the SMI and is adjusted to reflect changes in market capitalization due to corporate events, and is adjusted by SIX Exchange to reflect corporate events, as described in the index rules.

Autocallable Market-Linked Step Up Notes

| TS-18 |

Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 |

|

The following graph shows the daily historical performance of the SMI in the period from January 1, 2009 through August 29, 2019. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the closing level of the SMI was 9,838.48.

Historical Performance of the SMI

This historical data on the SMI is not necessarily indicative of the future performance of the SMI or what the value of the notes may be. Any historical upward or downward trend in the level of the SMI during any period set forth above is not an indication that the level of the SMI is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the levels of the SMI.

License Agreement

These notes are not in any way sponsored, endorsed, sold or promoted by the SIX Exchange and the SIX Exchange makes no warranty or representation whatsoever, express or implied, either as to the results to be obtained from the use of the SMI and/or the figure at which the SMI stands at any particular time on any particular day or otherwise. However, the SIX Exchange shall not be liable (whether in negligence or otherwise) to any person for any error in the SMI and the SIX Exchange shall not be under any obligation to advise any person of any error therein.

SIX Group, SIX Exchange, SPI, Swiss Performance Index (SPI), SPI EXTRA, SPI ex SLI, SMI, Swiss Market Index (SMI), SMI MID (SMIM), SMI Expanded, SXI, SXI Real Estate, SXI Swiss Real Estate, SXI Life Sciences, SXI Bio+Medtech, SLI, SLI Swiss Leader Index, SBI, SBI Swiss Bond Index, SAR, SAR SWISS AVERAGE RATE, SARON, SCR, SCR SWISS CURRENT RATE, SCRON, SAION, SCION, VSMI and SWX Immobilienfonds Index are trademarks that have been registered in Switzerland and/or abroad by SIX Group Ltd respectively SIX Exchange. Their use is subject to a license.

Autocallable Market-Linked Step Up Notes

| TS-19 |

Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 |

|

The S&P/ASX 200® Index

The S&P/ASX 200® Index (Bloomberg ticker: “AS51”):

| · | was first launched in 1979 by the Australian Securities Exchange and was acquired and re-launched by its current index sponsor on April 3, 2000; and |

| · | is sponsored, calculated, published and disseminated by S&P. |

The AS51 includes 200 companies and covers approximately 80% of the Australian equity market by market capitalization. As discussed below, the AS51 is not limited solely to companies having their primary operations or headquarters in Australia or to companies having their primary listing on the Australian Securities Exchange (the “ASX”). All ordinary and preferred shares (if such preferred shares are not of a fixed income nature) listed on the ASX, including secondary listings, are eligible for the AS51. Hybrid stocks, bonds, warrants, preferred stock that provides a guaranteed fixed return and listed investment companies are not eligible for inclusion.

The AS51 is intended to provide exposure to the largest 200 eligible securities that are listed on the ASX by float-adjusted market capitalization. Constituent companies for the AS51 are chosen based on market capitalization, public float and liquidity. All index-eligible securities that have their primary or secondary listing on the ASX are included in the initial selection of stocks from which the 200 index stocks may be selected.

The float-adjusted market capitalization of companies is determined based on the daily average market capitalization over the last six months. The security’s price history over the last six months, the latest available shares on issue and the investable weight factor (the “IWF”), are the factors relevant to the calculation of daily average market capitalization. The IWF is a variable that is primarily used to determine the available float of a security for ASX listed securities.

Number of Shares

When considering the index eligibility of securities for inclusion or promotion into S&P/ASX indices, the number of index securities under consideration is based upon the latest available ASX quoted securities. For domestic securities (companies incorporated in Australia and traded on the ASX, companies incorporated overseas but exclusively listed on the ASX and companies incorporated overseas and traded on other markets but most of its trading activity is on the ASX), this figure is purely based upon the latest available data from the ASX.

Foreign-domiciled securities may quote the total number of securities on the ASX that is representative of their global equity capital; whereas other foreign-domiciled securities may quote securities on the ASX on a partial basis that represents their Australian equity capital. In order to overcome this inconsistency, S&P will quote the number of index securities that are represented by CHESS Depositary Interests (“CDIs”) for a foreign entity. When CDIs are not issued, S&P will use the total securities held on the Australian register (CHESS and, where supplied, the issuer sponsored register). This quoted number for a foreign entity is representative of the Australian equity capital, thereby allowing the AS51 to be increasingly reflective of the Australian market.

The number of CDIs or shares of a foreign entity quoted on the ASX can experience more volatility than is typically the case for ordinary shares on issue. Therefore, an average number on issue will be applied over a six-month period.

Where CDI information is not supplied to the ASX by the company or the company’s share register, estimates for Australian equity capital will be drawn from CHESS data and, ultimately, registry-sourced data.

IWF

The IWF represents the float-adjusted portion of a stock’s equity capital. Therefore any strategic holdings that are classified as either corporate, private or government holdings reduce the IWF which, in turn, results in a reduction in the float-adjusted market capital.

The IWF ranges between 0 and 1, is calculated as 1 – Sum of the % held by strategic shareholders who possess 5% or more of issued shares, and is an adjustment factor that accounts for the publicly available shares of a company. A company must have a minimum IWF of 0.3 to be eligible for index inclusion.

S&P Dow Jones Indices identifies the following shareholders whose holdings are considered to be control blocks and are subject to float adjustment:

| 1. | Government and government agencies; |

| 2. | Controlling and strategic shareholders/partners; |

| 3. | Any other entities or individuals which hold more than 5%, excluding insurance companies, securities companies and investment funds; and |

| 4. | Other restricted portions such as treasury stocks. |

Liquidity Test

Only stocks that are regularly traded are eligible for inclusion. Eligible stocks are considered for index inclusion based on their stock median liquidity (median daily value traded divided by its average float-adjusted market capitalization for the last six months relative to the market capitalization weighted average of the stock median liquidities of the 500 constituents of the All Ordinaries index, another member of the S&P/ASX index family).

Autocallable Market-Linked Step Up Notes

| TS-20 |

Autocallable Market-Linked Step Up Notes Linked to an International Equity Index Basket, due August 25, 2022 |

|

Index Maintenance

S&P rebalances constituents quarterly to ensure adequate market capitalization and liquidity using the previous six months’ data to determine index eligibility. Quarterly review changes take effect the third Friday of March, June, September and December. Eligible stocks are considered for index inclusion based on their float-adjusted market capitalization rank relative to the stated quota of 200 securities. For example, a stock that is currently in the S&P/ASX 300 and is ranked at 175, based on float-adjusted market capitalization, within the universe of eligible securities may be considered for inclusion into the AS51, provided that liquidity hurdles are met.

In order to limit the level of index turnover, eligible securities will only be considered for index inclusion once another stock is excluded due to a sufficiently low rank and/or liquidity, based on the float-adjusted market capitalization. Potential index inclusions and exclusions need to satisfy buffer requirements in terms of the rank of the stock relative to a given index. The buffers are established to limit the level of index turnover that may take place at each quarterly rebalancing.

Between rebalancing dates, an index addition is generally made only if a vacancy is created by an index deletion. Index additions are made according to float-adjusted market capitalization and liquidity. An initial public offering is added to the AS51 only when an appropriate vacancy occurs and is subject to proven liquidity for at least two months. An exception may be made for extraordinary large offerings where sizeable trading volumes justify index inclusion.

Deletions can occur between index rebalancing dates due to acquisitions, mergers and spin-offs or due to suspension or bankruptcies. The decision to remove a stock from the AS51 will be made once there is sufficient evidence that the transaction will be completed. Stocks that are removed due to mergers and acquisitions are removed from the AS51 at the cash offer price for cash-only offers. Otherwise, the best available price in the market is used.

Share numbers for all index constituents are updated quarterly and are rounded to the nearest thousand. The update to the number of issued shares will be considered if the change is at least 5% of the float adjusted shares or $100 million in value.

Share updates for foreign-domiciled securities will take place annually at the March rebalancing. The update to the number of index shares will only take place when the six-month average of CDIs or the Total Securities held in the Australian branch of issuer sponsored register (where supplied) and in CHESS, as of the March rebalancing, differs from the current index shares by either 5% or a market-cap dollar amount greater than A$ 100 million. Where CDI information is not supplied to the ASX by the company or the company’s share register, estimates for Australian equity capital will be drawn from CHESS data and, ultimately, registry-sourced data.

Intra-quarter share changes are implemented at the effective date or as soon as reliable information is available; however, they will only take place in the following circumstances:

| § | changes in a company’s float-adjusted shares of 5% or more due to market-wide shares issuance; |

| § | rights issues, bonus issues and other major corporate actions; and |

| § | share issues resulting from index companies merging and major off-market buy-backs. |

Share changes due to mergers or acquisitions are implemented when the transaction occurs, even if both of the companies are not in the same index and regardless of the size of the change.

IWFs are reviewed annually as part of the September quarterly review. However, any event that alters the float of a security in excess of 5% will be implemented as soon as practicable by an adjustment to the IWF.

The function of the IWF is also to manage the index weight of foreign-domiciled securities that quote shares on the basis of CDIs. Due to the volatility that is displayed by CDIs, unusually large changes in the number of CDIs on issue could result. Where this is the case, the IWF may be used to limit the effect of unusually large changes in the average number of CDIs (and, thereby, limit the potential to manipulate this figure). Where the Australian Index Committee sees fit to apply the IWF in this manner, the rationale for the decision will be announced to the market. This will be reviewed annually at the March-quarter index rebalancing date.

Calculation of the AS51

The AS51 is calculated using a base-weighted aggregate methodology. The value of the AS51 on any day for which an index value is published is determined by a fraction, the numerator of which is the aggregate of the price of each stock in the AS51 times the number of shares of such stock included in the AS51 times that stock’s IWF, and the denominator of which is the divisor, which is described more fully below.

In order to prevent the value of the AS51 from changing due to corporate actions, all corporate actions may require S&P to make an index or divisor adjustment, as described in S&P’s rules. This helps maintain the value of the AS51 and ensures that the movement of the AS51 does not reflect the corporate actions of the individual companies that comprise the AS51.

In situations where an exchange is forced to close early due to unforeseen events, such as computer or electric power failures, weather conditions or other events, S&P will calculate the closing price of the indices based on (1) the closing prices published by the exchange or (2) if no closing price is available, the last regular trade reported for each security before the exchange closed. If the exchange fails to open due to unforeseen circumstances, S&P treats this closure as a standard market holiday. The AS51 will use the prior day’s closing prices and shifts any corporate actions to the following business day. If all exchanges fail to open or in other extreme circumstances, S&P may determine not to publish the AS51 for that day.

S&P reserves the right to recalculate the AS51 under certain limited circumstances.