UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

(Exact name of registrant as specified in charter)

100 Pearl Street, New York, New York 10004

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

(a) The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Alger Capital Appreciation Portfolio

Class I-2 / ALVOX

Semi-Annual SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about the Alger Capital Appreciation Portfolio (“Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Alger. You can also request a copy of the semi-annual report by contacting us at (800) 992-3863.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

| Fund (Class/Ticker) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Alger Capital Appreciation Portfolio

(Class I-2 / ALVOX) | $53 | 0.93% |

Management's Discussion of Fund Performance

What impacted Fund performance over the reporting period?

The Alger Capital Appreciation Portfolio Class I-2 returned 28.08% for the fiscal six-month period ended June 30, 2024, compared to the 20.70% return of the Russell 1000 Growth Index. During the reporting period, the largest sector weightings were Information Technology and Communication Services. The largest sector overweight was Communication Services and the largest sector underweight was Consumer Staples.

Contributors to Performance

The Information Technology and Industrials sectors provided the largest contributions to relative performance. Regarding individual positions, NVIDIA Corp.; Microsoft Corp.; Meta Platforms Inc; Amazon.com, Inc.; and Natera, Inc. were the top contributors to absolute performance.

Detractors from Performance

The Consumer Staples and Financials sectors were the largest detractors from relative performance. Regarding individual positions, Tesla, Inc.; Snowflake, Inc.; Humana Inc.; MongoDB, Inc.; and Adobe Inc. were the top five detractors from absolute performance.

| U.S. FACTOR | IMPACT | SUMMARY |

| Soft-landing Narrative | Positive | During the period, the soft-landing scenario—an economic slowdown without a recession—drove equity markets higher as U.S. GDP for the fourth quarter of 2023 grew 3.4%, exceeding the initial 2.0% consensus, driven by robust consumer spending. |

| AI Enthusiasm | Positive | Continued anticipation about artificial intelligence drove strong gains for related companies, supported by robust operating results and upward earnings revisions. |

| Elevated Inflation | Negative | Inflation concerns resurfaced during the first quarter of 2024, with Consumer Price Index (CPI) and Personal Consumption Expenditure Price Index (PCE) readings coming in higher-than-expected. |

| Revised Federal Reserve Rate Cut Expectations | Negative | Elevated inflation readings during the first quarter of 2024 led to the Federal Reserve postponing an anticipated March rate cut. The revision of the market’s rate cut expectations, initially from a projected six cuts at the beginning of the period down to just one for the year, led to some market volatility in April. |

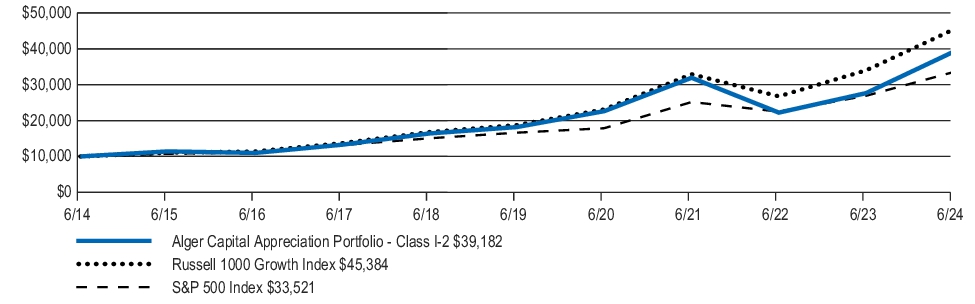

Fund Performance

The following graph and chart compares the initial and subsequent account values at the end of each of the most recently completed semi-annual periods of Class I-2 shares of the Fund. The graph assumes a $10,000 initial investment at the beginning of the first semi-annual period in an appropriate, broad-based securities market index and a more narrowly based index that reflects the market sector in which the Fund invests for the same period.

INITIAL INVESTMENT OF $10,000

39181.80 15588.40 10000.01 22222.21 23517.68 32906.77 10945.39 18947.03 10921.23 11841.97 16803.61 23621.89 11653 27652.91 12174.67 11055.56 16631.55 15338.74 20673.48 27009.73 17951.70 11615 32931.69 15063.51 21412.24 12305.71 11405.92 31933.78 10851 18506.04 10711.13 23110.4 10000.00 12771 12537.03 10026.19 26749.25 32902.82 12821 25381.56 45384 12472.75 18745.76 19991.41 14120.60 13715.94 11389.78 13283.50 10000.02 12912.37 21424.67 28211.66 17393.15 38175.07 27240.4 9280.74 14984.49 14279.60 15199.57 19534.71 10000 16632.74 17881.04 17254.54 22502.89 10000 10742.28 23149.01 22058.99 9645.43 16238.21 19184.23 10000.00 11002.06 9880.50 16930.41 16414.56 23689.66 10806 11385 10000 10000 16857.29 26912.11 11731.77 27177.51 10000.03 17507.68 18081.36 15125.06 10169 31349.74 10747.42 21758.74 10000 14859.11 15651.19 21997.32 11305 10532.53 11234.03 25175.46 18692.47 23175.13 22279.08 18193.16 10909.38 32248.43 14267.32 10713.42 15478.55 18707.01 10981.21 10738 13122.00 10922.55 11171.19 13177.37 33520.67 15677.80 20400.33 10000.00 25870.58 11375.01 15770.01 11254.50 22638.66 34000.12 10000.00 13170.39 17466.98 30850.98

| Average Annual Total Returns (As of June 30, 2024) | 1 Year | 5 Years | 10 Years |

| Alger Capital Appreciation Portfolio Class I-2 | 41.69% | 16.58% | 14.63% |

| Russell 1000 Growth Index | 33.48% | 19.34% | 16.33% |

| S&P 500 Index | 24.56% | 15.05% | 12.86% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

Visit https://www.alger.com/Pages/StrategyFinder.aspx?vehicle=mf for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. All performance figures assume reinvestment of distributions.

Key Fund Statistics

The following table outlines key fund statistics as of the reporting date.

| Fund net assets | $603,172,776% |

| Total number of portfolio holdings1 | $75% |

| Portfolio turnover rate as of the end of the reporting period | $32.21% |

1 | Excludes Money Market Funds. |

| Communication Services | 15.4% |

| Consumer Discretionary | 10.5% |

| Consumer Staples | 0.4% |

| Energy | 0.3% |

| Financials | 3.9% |

| Healthcare | 11.7% |

| Industrials | 7.0% |

| Information Technology | 47.4% |

| Materials | 1.0% |

| Real Estate | 0.8% |

| Utilities | 1.4% |

| Short-Term Investments and Other Net Assets | 0.2% |

| 100.0% |

† | Based on net assets of the Fund. |

Material and Other Fund Changes

On May 23, 2023, the Board of Trustees of the Fund (the “Board”) approved the transition of the Fund’s custodian, and administrator from Brown Brothers Harriman & Company to The Bank of New York. This change was implemented on March 18, 2024.

On August 16, 2024, at a joint special meeting of shareholders, shareholders of the Fund elected three new trustees and one current trustee to the Board.

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available by May 1, 2025 at https://connect.rightprospectus.com/Alger or upon request at (800) 992-3863.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information and fund holdings at https://connect.rightprospectus.com/Alger. Fund proxy voting information is available at https://www.alger.com/ProxyVoting. You can also request this information by contacting us at (800) 992-3863.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.alger.com.

Householding

To reduce expenses, only one copy of the most recent financial reports and prospectus may be mailed to households, even if more than one person in a household holds shares of a Fund. Call an Alger Funds Representative at (800) 992-3863 if you need additional copies of financial reports or prospectuses, or download them at https://connect.rightprospectus.com/Alger. If you do not want the mailing of these documents to be combined with those for other members of your household, contact your broker-dealer or other financial intermediary or the Alger Funds in writing at Alger Family of Funds, c/o UMB Fund Services, Inc. 235 W. Galena Street Milwaukee, WI 53212.

Alger Capital Appreciation Portfolio

Class S

Semi-Annual SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about the Alger Capital Appreciation Portfolio (“Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Alger. You can also request a copy of the semi-annual report by contacting us at (800) 992-3863.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

| Fund (Class/Ticker) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Alger Capital Appreciation Portfolio

(Class S) | $67 | 1.18% |

Management's Discussion of Fund Performance

What impacted Fund performance over the reporting period?

The Alger Capital Appreciation Portfolio Class S returned 27.92% for the fiscal six-month period ended June 30, 2024, compared to the 20.70% return of the Russell 1000 Growth Index. During the reporting period, the largest sector weightings were Information Technology and Communication Services. The largest sector overweight was Communication Services and the largest sector underweight was Consumer Staples.

Contributors to Performance

The Information Technology and Industrials sectors provided the largest contributions to relative performance. Regarding individual positions, NVIDIA Corp.; Microsoft Corp.; Meta Platforms Inc; Amazon.com, Inc.; and Natera, Inc. were the top contributors to absolute performance.

Detractors from Performance

The Consumer Staples and Financials sectors were the largest detractors from relative performance. Regarding individual positions, Tesla, Inc.; Snowflake, Inc.; Humana Inc.; MongoDB, Inc.; and Adobe Inc. were the top five detractors from absolute performance.

| U.S. FACTOR | IMPACT | SUMMARY |

| Soft-landing Narrative | Positive | During the period, the soft-landing scenario—an economic slowdown without a recession—drove equity markets higher as U.S. GDP for the fourth quarter of 2023 grew 3.4%, exceeding the initial 2.0% consensus, driven by robust consumer spending. |

| AI Enthusiasm | Positive | Continued anticipation about artificial intelligence drove strong gains for related companies, supported by robust operating results and upward earnings revisions. |

| Elevated Inflation | Negative | Inflation concerns resurfaced during the first quarter of 2024, with Consumer Price Index (CPI) and Personal Consumption Expenditure Price Index (PCE) readings coming in higher-than-expected. |

| Revised Federal Reserve Rate Cut Expectations | Negative | Elevated inflation readings during the first quarter of 2024 led to the Federal Reserve postponing an anticipated March rate cut. The revision of the market’s rate cut expectations, initially from a projected six cuts at the beginning of the period down to just one for the year, led to some market volatility in April. |

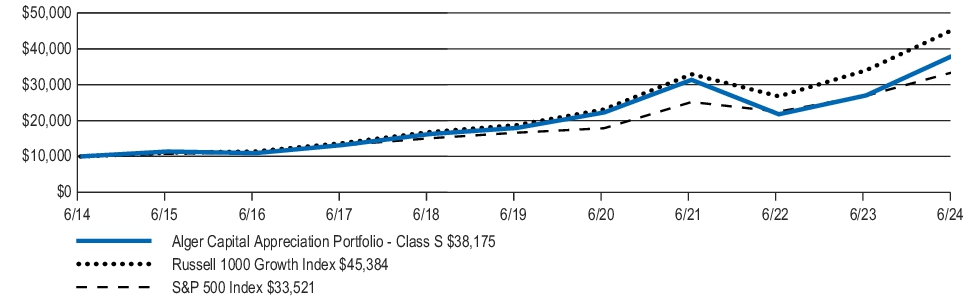

Fund Performance

The following graph and chart compares the initial and subsequent account values at the end of each of the most recently completed semi-annual periods of Class S shares of the Fund. The graph assumes a $10,000 initial investment at the beginning of the first semi-annual period in an appropriate, broad-based securities market index and a more narrowly based index that reflects the market sector in which the Fund invests for the same period.

INITIAL INVESTMENT OF $10,000

| Average Annual Total Returns (As of June 30, 2024) | 1 Year | 5 Years | 10 Years |

| Alger Capital Appreciation Portfolio Class S | 41.34% | 16.29% | 14.33% |

| Russell 1000 Growth Index | 33.48% | 19.34% | 16.33% |

| S&P 500 Index | 24.56% | 15.05% | 12.86% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

Visit https://www.alger.com/Pages/StrategyFinder.aspx?vehicle=mf for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. All performance figures assume reinvestment of distributions.

Key Fund Statistics

The following table outlines key fund statistics as of the reporting date.

| Fund net assets | $603,172,776% |

| Total number of portfolio holdings1 | $75% |

| Portfolio turnover rate as of the end of the reporting period | $32.21% |

1 | Excludes Money Market Funds. |

| Communication Services | 15.4% |

| Consumer Discretionary | 10.5% |

| Consumer Staples | 0.4% |

| Energy | 0.3% |

| Financials | 3.9% |

| Healthcare | 11.7% |

| Industrials | 7.0% |

| Information Technology | 47.4% |

| Materials | 1.0% |

| Real Estate | 0.8% |

| Utilities | 1.4% |

| Short-Term Investments and Other Net Assets | 0.2% |

| 100.0% |

† | Based on net assets of the Fund. |

Material and Other Fund Changes

On May 23, 2023, the Board of Trustees of the Fund (the “Board”) approved the transition of the Fund’s custodian, and administrator from Brown Brothers Harriman & Company to The Bank of New York. This change was implemented on March 18, 2024.

On August 16, 2024, at a joint special meeting of shareholders, shareholders of the Fund elected three new trustees and one current trustee to the Board.

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available by May 1, 2025 at https://connect.rightprospectus.com/Alger or upon request at (800) 992-3863.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information and fund holdings at https://connect.rightprospectus.com/Alger. Fund proxy voting information is available at https://www.alger.com/ProxyVoting. You can also request this information by contacting us at (800) 992-3863.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.alger.com.

Householding

To reduce expenses, only one copy of the most recent financial reports and prospectus may be mailed to households, even if more than one person in a household holds shares of a Fund. Call an Alger Funds Representative at (800) 992-3863 if you need additional copies of financial reports or prospectuses, or download them at https://connect.rightprospectus.com/Alger. If you do not want the mailing of these documents to be combined with those for other members of your household, contact your broker-dealer or other financial intermediary or the Alger Funds in writing at Alger Family of Funds, c/o UMB Fund Services, Inc. 235 W. Galena Street Milwaukee, WI 53212.

Alger Large Cap Growth Portfolio

Class I-2 / AAGOX

Semi-Annual SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about the Alger Large Cap Growth Portfolio (“Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Alger. You can also request a copy of the semi-annual report by contacting us at (800) 992-3863.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

| Fund (Class/Ticker) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Alger Large Cap Growth Portfolio

(Class I-2 / AAGOX) | $46 | 0.82% |

Management's Discussion of Fund Performance

What impacted Fund performance over the reporting period?

The Fund returned 23.28% for the fiscal six-month period ended June 30, 2024, compared to the 20.70% return of the Russell 1000 Growth Index. During the reporting period, the largest sector weightings were Information Technology and Communication Services. The largest sector overweight was Industrials and the largest sector underweight was Information Technology.

Contributors to Performance

The Industrials and Consumer Discretionary sectors provided the largest contributions to relative performance. Regarding individual positions, NVIDIA Corporation; Natera, Inc.; Microsoft Corporation; Amazon.com, Inc.; and Meta Platforms Inc. were the top five contributors to absolute performance.

Detractors from Performance

The Information Technology and Consumer Staples sectors were the largest detractors from relative performance. Regarding individual positions, Tesla, Inc.; Shopify, Inc.; Adobe Inc.; MarketAxess Holdings Inc.; and SLB were the top five detractors from absolute performance.

| U.S. FACTOR | IMPACT | SUMMARY |

| Soft-landing Narrative | Positive | During the period, the soft-landing scenario—an economic slowdown without a recession—drove equity markets higher as U.S. GDP for the fourth quarter of 2023 grew 3.4%, exceeding the initial 2.0% consensus, driven by robust consumer spending. |

| AI Enthusiasm | Positive | Continued anticipation about artificial intelligence drove strong gains for related companies, supported by robust operating results and upward earnings revisions. |

| Elevated Inflation | Negative | Inflation concerns resurfaced during the first quarter of 2024, with Consumer Price Index (CPI) and Personal Consumption Expenditure Price Index (PCE) readings coming in higher-than-expected. |

| Revised Federal Reserve Rate Cut Expectations | Negative | Elevated inflation readings during the first quarter of 2024 led to the Federal Reserve postponing an anticipated March rate cut. The revision of the market’s rate cut expectations, initially from a projected six cuts at the beginning of the period down to just one for the year, led to some market volatility in April. |

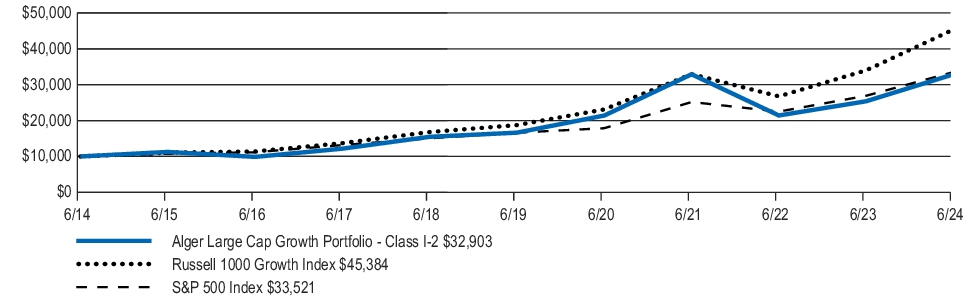

Fund Performance

The following graph and chart compares the initial and subsequent account values at the end of each of the most recently completed semi-annual periods of Class I-2 shares of the Fund. The graph assumes a $10,000 initial investment at the beginning of the first semi-annual period in an appropriate, broad-based securities market index and a more narrowly based index that reflects the market sector in which the Fund invests for the same period.

INITIAL INVESTMENT OF $10,000

| Average Annual Total Returns (As of June 30, 2024) | 1 Year | 5 Years | 10 Years |

| Alger Large Cap Growth Portfolio Class I-2 | 29.63% | 14.62% | 12.65% |

| Russell 1000 Growth Index | 33.48% | 19.34% | 16.33% |

| S&P 500 Index | 24.56% | 15.05% | 12.86% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

Visit https://www.alger.com/Pages/StrategyFinder.aspx?vehicle=mf for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. All performance figures assume reinvestment of distributions.

Key Fund Statistics

The following table outlines key fund statistics as of the reporting date.

| Fund net assets | $339,526,818% |

| Total number of portfolio holdings1 | $53% |

| Portfolio turnover rate as of the end of the reporting period | $36.22% |

1 | Excludes Money Market Funds. |

| Communication Services | 15.0% |

| Consumer Discretionary | 12.9% |

| Energy | 0.9% |

| Exchange Traded Fund | 2.3% |

| Financials | 1.5% |

| Healthcare | 11.0% |

| Industrials | 13.0% |

| Information Technology | 37.0% |

| Mutual Fund | 2.4% |

| Short-Term Investments and Other Net Assets | 4.0% |

| 100.0% |

| † | Based on net assets of the Fund. |

Material and Other Fund Changes

On May 23, 2023, the Board of Trustees of the Fund (the “Board”) approved the transition of the Fund’s custodian, and administrator from Brown Brothers Harriman & Company to The Bank of New York. This change was implemented on March 18, 2024.

On August 16, 2024, at a joint special meeting of shareholders, shareholders of the Fund elected three new trustees and one current trustee to the Board.

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available by May 1, 2025 at https://connect.rightprospectus.com/Alger or upon request at (800) 992-3863.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information and fund holdings at https://connect.rightprospectus.com/Alger. Fund proxy voting information is available at https://www.alger.com/ProxyVoting. You can also request this information by contacting us at (800) 992-3863.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.alger.com.

Householding

To reduce expenses, only one copy of the most recent financial reports and prospectus may be mailed to households, even if more than one person in a household holds shares of a Fund. Call an Alger Funds Representative at (800) 992-3863 if you need additional copies of financial reports or prospectuses, or download them at https://connect.rightprospectus.com/Alger. If you do not want the mailing of these documents to be combined with those for other members of your household, contact your broker-dealer or other financial intermediary or the Alger Funds in writing at Alger Family of Funds, c/o UMB Fund Services, Inc. 235 W. Galena Street Milwaukee, WI 53212.

Alger Growth & Income Portfolio

Class I-2 / AIGOX

Semi-Annual SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about the Alger Growth & Income Portfolio (“Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Alger. You can also request a copy of the semi-annual report by contacting us at (800) 992-3863.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

| Fund (Class/Ticker) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Alger Growth & Income Portfolio

(Class I-2 / AIGOX) | $51 | 0.95% |

Management's Discussion of Fund Performance

What impacted Fund performance over the reporting period?

The Fund returned 14.74% for the fiscal six-month period ended June 30, 2024, compared to the 15.29% return of the S&P 500 Index. During the reporting period, the largest sector weightings were Information Technology and Financials. The largest sector overweight was Information Technology and the largest sector underweight was Consumer Discretionary.

Contributors to Performance

The Industrials and Real Estate sectors provided the largest contributions to relative performance. Regarding individual positions, Microsoft Corporation; Broadcom Inc.; KLA Corporation; Alphabet Inc.; and Eli Lilly and Company were the top five contributors to absolute performance.

Detractors from Performance

The Information Technology and Financials sectors were the largest detractors from relative performance. Regarding individual positions, Starbucks Corporation; Adobe Inc.; McDonald's Corporation; Comcast Corporation; and Crown Castle Inc. were the top five detractors from absolute performance.

| U.S. FACTOR | IMPACT | SUMMARY |

| Soft-landing Narrative | Positive | During the period, the soft-landing scenario—an economic slowdown without a recession—drove equity markets higher as U.S. GDP for the fourth quarter of 2023 grew 3.4%, exceeding the initial 2.0% consensus, driven by robust consumer spending. |

| AI Enthusiasm | Positive | Continued anticipation about artificial intelligence drove strong gains for related companies, supported by robust operating results and upward earnings revisions. |

| Elevated Inflation | Negative | Inflation concerns resurfaced during the first quarter of 2024, with Consumer Price Index (CPI) and Personal Consumption Expenditure Price Index (PCE) readings coming in higher-than-expected. |

| Revised Federal Reserve Rate Cut Expectations | Negative | Elevated inflation readings during the first quarter of 2024 led to the Federal Reserve postponing an anticipated March rate cut. The revision of the market’s rate cut expectations, initially from a projected six cuts at the beginning of the period down to just one for the year, led to some market volatility in April. |

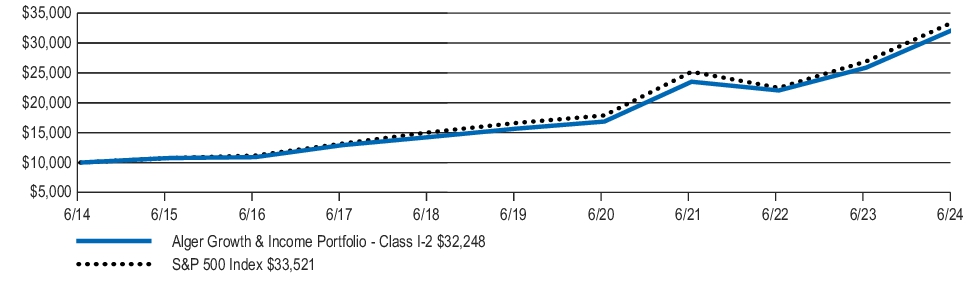

Fund Performance

The following graph and chart compares the initial and subsequent account values at the end of each of the most recently completed semi-annual periods of Class I-2 shares of the Fund. The graph assumes a $10,000 initial investment at the beginning of the first semi-annual period in an appropriate, broad-based securities market index for the same period.

INITIAL INVESTMENT OF $10,000

| Average Annual Total Returns (As of June 30, 2024) | 1 Year | 5 Years | 10 Years |

| Alger Growth & Income Portfolio Class I-2 | 24.65% | 15.52% | 12.42% |

| S&P 500 Index | 24.56% | 15.05% | 12.86% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

Visit https://www.alger.com/Pages/StrategyFinder.aspx?vehicle=mf for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. All performance figures assume reinvestment of distributions.

Key Fund Statistics

The following table outlines key fund statistics as of the reporting date.

| Fund net assets | $41,762,047% |

| Total number of portfolio holdings1 | $78% |

| Portfolio turnover rate as of the end of the reporting period | $1.67% |

1 | Excludes Money Market Funds. |

| Communication Services | 10.3)% |

| Consumer Discretionary | 8.0)% |

| Consumer Staples | 6.2)% |

| Energy | 4.9)% |

| Financials | 12.8)% |

| Healthcare | 12.3)% |

| Industrials | 6.5)% |

| Information Technology | 33.8)% |

| Materials | 1.8)% |

| Real Estate | 2.1)% |

| Utilities | 1.6)% |

| Short-Term Investments and Other Net Assets | (0.3)% |

| 100.0)% |

† | Based on net assets of the Fund. |

Material and Other Fund Changes

On May 23, 2023, the Board of Trustees of the Fund (the “Board”) approved the transition of the Fund’s custodian, and administrator from Brown Brothers Harriman & Company to The Bank of New York. This change was implemented on March 18, 2024.

On August 16, 2024, at a joint special meeting of shareholders, shareholders of the Fund elected three new trustees and one current trustee to the Board.

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available by May 1, 2025 at https://connect.rightprospectus.com/Alger or upon request at (800) 992-3863.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information and fund holdings at https://connect.rightprospectus.com/Alger. Fund proxy voting information is available at https://www.alger.com/ProxyVoting. You can also request this information by contacting us at (800) 992-3863.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.alger.com.

Householding

To reduce expenses, only one copy of the most recent financial reports and prospectus may be mailed to households, even if more than one person in a household holds shares of a Fund. Call an Alger Funds Representative at (800) 992-3863 if you need additional copies of financial reports or prospectuses, or download them at https://connect.rightprospectus.com/Alger. If you do not want the mailing of these documents to be combined with those for other members of your household, contact your broker-dealer or other financial intermediary or the Alger Funds in writing at Alger Family of Funds, c/o UMB Fund Services, Inc. 235 W. Galena Street Milwaukee, WI 53212.

Alger Mid Cap Growth Portfolio

Class I-2 / AMGOX

Semi-Annual SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about the Alger Mid Cap Growth Portfolio (“Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Alger. You can also request a copy of the semi-annual report by contacting us at (800) 992-3863.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

| Fund (Class/Ticker) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Alger Mid Cap Growth Portfolio

(Class I-2 / AMGOX) | $50 | 0.96% |

Management's Discussion of Fund Performance

What impacted Fund performance over the reporting period?

The Fund returned 8.31% for the fiscal six-month period ended June 30, 2024, compared to the 5.98% return of the Russell Midcap Growth Index. During the reporting period, the largest sector weightings were Information Technology and Industrials. The largest sector overweight was Information Technology and the largest sector underweight was Financials.

Contributors to Performance

The Industrials and Communication Services sectors provided the largest contributions to relative performance. Regarding individual positions, Vertiv Holdings Co.; Natera, Inc.; Spotify Technology SA; Diamondback Energy, Inc.; and Amphenol Corporation were the top five contributors to absolute performance.

Detractors from Performance

The Financials and Information Technology sectors were the largest detractors from relative performance. Regarding individual positions, Repligen Corporation; MongoDB, Inc.; Globant SA; Five Below, Inc.; and Lattice Semiconductor Corporation were the top five detractors from absolute performance.

| U.S. FACTOR | IMPACT | SUMMARY |

| Soft-landing Narrative | Positive | During the period, the soft-landing scenario—an economic slowdown without a recession—drove equity markets higher as U.S. GDP for the fourth quarter of 2023 grew 3.4%, exceeding the initial 2.0% consensus, driven by robust consumer spending. |

| AI Enthusiasm | Positive | Continued anticipation about artificial intelligence drove strong gains for related companies, supported by robust operating results and upward earnings revisions. |

| Elevated Inflation | Negative | Inflation concerns resurfaced during the first quarter of 2024, with Consumer Price Index (CPI) and Personal Consumption Expenditure Price Index (PCE) readings coming in higher-than-expected. |

| Revised Federal Reserve Rate Cut Expectations | Negative | Elevated inflation readings during the first quarter of 2024 led to the Federal Reserve postponing an anticipated March rate cut. The revision of the market’s rate cut expectations, initially from a projected six cuts at the beginning of the period down to just one for the year, led to some market volatility in April. |

Fund Performance

The following graph and chart compares the initial and subsequent account values at the end of each of the most recently completed semi-annual periods of Class I-2 shares of the Fund. The graph assumes a $10,000 initial investment at the beginning of the first semi-annual period in an appropriate, broad-based securities market index and a more narrowly based index that reflects the market sector in which the Fund invests for the same period.

INITIAL INVESTMENT OF $10,000

| Average Annual Total Returns (As of June 30, 2024) | 1 Year | 5 Years | 10 Years |

| Alger Mid Cap Growth Portfolio Class I-2 | 12.10% | 8.25% | 8.77% |

| Russell Midcap Growth Index | 15.05% | 9.93% | 10.51% |

| S&P 500 Index | 24.56% | 15.05% | 12.86% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

Visit https://www.alger.com/Pages/StrategyFinder.aspx?vehicle=mf for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. All performance figures assume reinvestment of distributions.

Key Fund Statistics

The following table outlines key fund statistics as of the reporting date.

| Fund net assets | $137,368,384% |

| Total number of portfolio holdings1 | $64% |

| Portfolio turnover rate as of the end of the reporting period | $29.09% |

1 | Excludes Money Market Funds. |

| Communication Services | 8.1% |

| Consumer Discretionary | 11.2% |

| Consumer Staples | 1.2% |

| Energy | 2.7% |

| Exchange Traded Fund | 3.4% |

| Financials | 6.8% |

| Healthcare | 12.3% |

| Industrials | 18.9% |

| Information Technology | 29.3% |

| Materials | 1.7% |

| Real Estate | 4.1% |

| Short-Term Investments and Other Net Assets | 0.3% |

| 100.0% |

† | Based on net assets of the Fund. |

Material and Other Fund Changes

On May 23, 2023, the Board of Trustees of the Fund (the “Board”) approved the transition of the Fund’s custodian, and administrator from Brown Brothers Harriman & Company to The Bank of New York. This change was implemented on March 18, 2024.

On August 16, 2024, at a joint special meeting of shareholders, shareholders of the Fund elected three new trustees and one current trustee to the Board.

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available by May 1, 2025 at https://connect.rightprospectus.com/Alger or upon request at (800) 992-3863.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information and fund holdings at https://connect.rightprospectus.com/Alger. Fund proxy voting information is available at https://www.alger.com/ProxyVoting. You can also request this information by contacting us at (800) 992-3863.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.alger.com.

Householding

To reduce expenses, only one copy of the most recent financial reports and prospectus may be mailed to households, even if more than one person in a household holds shares of a Fund. Call an Alger Funds Representative at (800) 992-3863 if you need additional copies of financial reports or prospectuses, or download them at https://connect.rightprospectus.com/Alger. If you do not want the mailing of these documents to be combined with those for other members of your household, contact your broker-dealer or other financial intermediary or the Alger Funds in writing at Alger Family of Funds, c/o UMB Fund Services, Inc. 235 W. Galena Street Milwaukee, WI 53212.

Alger Small Cap Growth Portfolio

Class I-2 / AASOX

Semi-Annual SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about the Alger Small Cap Growth Portfolio (“Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Alger. You can also request a copy of the semi-annual report by contacting us at (800) 992-3863.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

| Fund (Class/Ticker) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Alger Small Cap Growth Portfolio

(Class I-2 / AASOX) | $53 | 1.05% |

Management's Discussion of Fund Performance

What impacted Fund performance over the reporting period?

The Fund returned 1.69% for the fiscal six-month period ended June 30, 2024, compared to the 4.44% return of the Russell 2000 Growth Index. During the reporting period, the largest sector weightings were Information Technology and Health Care. The largest sector overweight was Health Care and the largest sector underweight was Industrials.

Contributors to Performance

The Consumer Discretionary and Materials sectors provided the largest contributions to relative performance. Regarding individual positions, Wingstop, Inc.; MicroStrategy Incorporated; Viking Therapeutics, Inc.; Manhattan Associates, Inc.; and Q2 Holdings, Inc. were the top five contributors to absolute performance.

Detractors from Performance

The Health Care and Industrials sectors were the largest detractors from relative performance. Regarding individual positions, Cabaletta Bio, Inc.; 908 Devices Inc.; Sprout Social, Inc.; Xometry, Inc.; and DLocal Limited were the top five detractors from absolute performance.

| U.S. FACTOR | IMPACT | SUMMARY |

| Soft-landing Narrative | Positive | During the period, the soft-landing scenario—an economic slowdown without a recession—drove equity markets higher as U.S. GDP for the fourth quarter of 2023 grew 3.4%, exceeding the initial 2.0% consensus, driven by robust consumer spending. |

| AI Enthusiasm | Positive | Continued anticipation about artificial intelligence drove strong gains for related companies, supported by robust operating results and upward earnings revisions. |

| Elevated Inflation | Negative | Inflation concerns resurfaced during the first quarter of 2024, with Consumer Price Index (CPI) and Personal Consumption Expenditure Price Index (PCE) readings coming in higher-than-expected. |

| Revised Federal Reserve Rate Cut Expectations | Negative | Elevated inflation readings during the first quarter of 2024 led to the Federal Reserve postponing an anticipated March rate cut. The revision of the market’s rate cut expectations, initially from a projected six cuts at the beginning of the period down to just one for the year, led to some market volatility in April. |

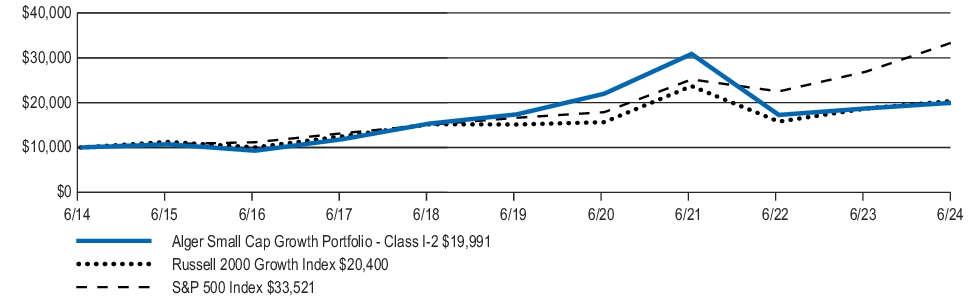

Fund Performance

The following graph and chart compares the initial and subsequent account values at the end of each of the most recently completed semi-annual periods of Class I-2 shares of the Fund. The graph assumes a $10,000 initial investment at the beginning of the first semi-annual period in an appropriate, broad-based securities market index and a more narrowly based index that reflects the market sector in which the Fund invests for the same period.

INITIAL INVESTMENT OF $10,000

| Average Annual Total Returns (As of June 30, 2024) | 1 Year | 5 Years | 10 Years |

| Alger Small Cap Growth Portfolio Class I-2 | 6.87% | 2.82% | 7.17% |

| Russell 2000 Growth Index | 9.14% | 6.17% | 7.39% |

| S&P 500 Index | 24.56% | 15.05% | 12.86% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

Visit https://www.alger.com/Pages/StrategyFinder.aspx?vehicle=mf for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. All performance figures assume reinvestment of distributions.

Key Fund Statistics

The following table outlines key fund statistics as of the reporting date.

| Fund net assets | $148,201,951% |

| Total number of portfolio holdings1 | $105% |

| Portfolio turnover rate as of the end of the reporting period | $17.97% |

1 | Excludes Money Market Funds. |

| Communication Services | 3.1% |

| Consumer Discretionary | 16.8% |

| Consumer Staples | 3.6% |

| Energy | 4.7% |

| Financials | 2.0% |

| Healthcare | 25.1% |

| Industrials | 8.4% |

| Information Technology | 29.7% |

| Materials | 0.7% |

| Short-Term Investments and Other Net Assets | 5.9% |

| 100.0% |

† | Based on net assets of the Fund. |

Material and Other Fund Changes

On May 23, 2023, the Board of Trustees of the Fund (the “Board”) approved the transition of the Fund’s custodian, and administrator from Brown Brothers Harriman & Company to The Bank of New York. This change was implemented on March 18, 2024.

On August 16, 2024, at a joint special meeting of shareholders, shareholders of the Fund elected three new trustees and one current trustee to the Board.

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available by May 1, 2025 at https://connect.rightprospectus.com/Alger or upon request at (800) 992-3863.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information and fund holdings at https://connect.rightprospectus.com/Alger. Fund proxy voting information is available at https://www.alger.com/ProxyVoting. You can also request this information by contacting us at (800) 992-3863.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.alger.com.

Householding

To reduce expenses, only one copy of the most recent financial reports and prospectus may be mailed to households, even if more than one person in a household holds shares of a Fund. Call an Alger Funds Representative at (800) 992-3863 if you need additional copies of financial reports or prospectuses, or download them at https://connect.rightprospectus.com/Alger. If you do not want the mailing of these documents to be combined with those for other members of your household, contact your broker-dealer or other financial intermediary or the Alger Funds in writing at Alger Family of Funds, c/o UMB Fund Services, Inc. 235 W. Galena Street Milwaukee, WI 53212.

Alger Balanced Portfolio

Class I-2 / ABLOX

Semi-Annual SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about the Alger Balanced Portfolio (“Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Alger. You can also request a copy of the semi-annual report by contacting us at (800) 992-3863.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

| Fund (Class/Ticker) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Alger Balanced Portfolio

(Class I-2 / ABLOX) | $57 | 1.09% |

Management's Discussion of Fund Performance

What impacted Fund performance over the reporting period?

The Fund returned 10.88% during the fiscal six-month period ended June 30, 2024. The equity portion of the Fund underperformed the 15.29% return of the S&P 500 Index and the fixed income portion of the Fund underperformed the -0.68% return of the Bloomberg U.S. Government/Credit Bond Index. Regarding the equity portion of the Fund, the largest sector weightings were Information Technology and Financials. The largest sector overweight was Financials and the largest sector underweight was Information Technology.

Contributors to Performance

The Industrials and Financials sectors provided the largest contributions to relative performance. Regarding individual positions, Microsoft Corporation; Broadcom Inc.; KLA Corporation; Alphabet Inc.; and Eli Lilly and Company were the top five contributors to absolute performance.

Detractors from Performance

The Information Technology and Communication Services sectors were the largest detractors from relative performance. Regarding individual positions, Starbucks Corporation; Adobe Inc.; McDonald's Corporation; Comcast Corporation; and Crown Castle Inc. were the top five detractors from absolute performance.

| U.S. FACTOR | IMPACT | SUMMARY |

| Soft-landing Narrative | Positive | During the period, the soft-landing scenario—an economic slowdown without a recession—drove equity markets higher as U.S. GDP for the fourth quarter of 2023 grew 3.4%, exceeding the initial 2.0% consensus, driven by robust consumer spending. |

| AI Enthusiasm | Positive | Continued anticipation about artificial intelligence drove strong gains for related companies, supported by robust operating results and upward earnings revisions. |

| Tighter Credit Spread | Positive for Fixed Income | Credit spreads narrowed during the period due to strong economic data. |

| Elevated Inflation | Negative | Inflation concerns resurfaced during the first quarter of 2024, with Consumer Price Index (CPI) and Personal Consumption Expenditure Price Index (PCE) readings coming in higher-than-expected. |

| Revised Federal Reserve Rate Cut Expectations | Negative | Elevated inflation readings during the first quarter of 2024 led to the Federal Reserve postponing an anticipated March rate cut. The revision of the market’s rate cut expectations, initially from a projected six cuts at the beginning of the period down to just one for the year, led to some market volatility in April. |

| Rising U.S. Government Bond Yields | Negative for Fixed Income | U.S. Government Bond yields rose during the period due to persistent inflation and strong economic data. |

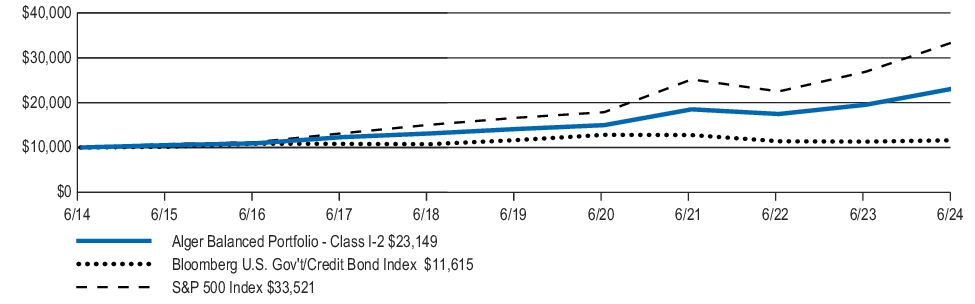

Fund Performance

The following graph and chart compares the initial and subsequent account values at the end of each of the most recently completed semi-annual periods of Class I-2 shares of the Fund. The graph assumes a $10,000 initial investment at the beginning of the first semi-annual period in an appropriate, broad-based securities market index and a more narrowly based index that reflects the market sector in which the Fund invests for the same period.

INITIAL INVESTMENT OF $10,000

| Average Annual Total Returns (As of June 30, 2024) | 1 Year | 5 Years | 10 Years |

| Alger Balanced Portfolio Class I-2 | 18.50% | 10.39)% | 8.76% |

| Bloomberg U.S. Gov't/Credit Bond Index | 2.74% | (0.07)% | 1.51% |

| S&P 500 Index | 24.56% | 15.05)% | 12.86% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

Visit https://www.alger.com/Pages/StrategyFinder.aspx?vehicle=mf for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. All performance figures assume reinvestment of distributions.

Key Fund Statistics

The following table outlines key fund statistics as of the reporting date.

| Fund net assets | $60,143,166% |

| Total number of portfolio holdings1 | $101% |

| Portfolio turnover rate as of the end of the reporting period | $2.99% |

1 | Excludes Money Market Funds. |

| Communication Services | 7.6% |

| Consumer Discretionary | 5.9% |

| Consumer Staples | 4.5% |

| Energy | 3.7% |

| Financials | 9.6% |

| Healthcare | 9.2% |

| Industrials | 4.8% |

| Information Technology | 25.1% |

| Materials | 1.4% |

| Real Estate | 1.5% |

| Utilities | 1.1% |

| Total Equities | 74.4% |

| Corporate Bonds | 25.4% |

| Short-Term Investments and Other Net Assets | 0.2% |

| 100.0% |

† | Based on net assets of the Fund. |

Material and Other Fund Changes

On May 23, 2023, the Board of Trustees of the Fund (the “Board”) approved the transition of the Fund’s custodian, and administrator from Brown Brothers Harriman & Company to The Bank of New York. This change was implemented on March 18, 2024.

On August 16, 2024, at a joint special meeting of shareholders, shareholders of the Fund elected three new trustees and one current trustee to the Board.

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available by May 1, 2025 at https://connect.rightprospectus.com/Alger or upon request at (800) 992-3863.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information and fund holdings at https://connect.rightprospectus.com/Alger. Fund proxy voting information is available at https://www.alger.com/ProxyVoting. You can also request this information by contacting us at (800) 992-3863.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.alger.com.

Householding

To reduce expenses, only one copy of the most recent financial reports and prospectus may be mailed to households, even if more than one person in a household holds shares of a Fund. Call an Alger Funds Representative at (800) 992-3863 if you need additional copies of financial reports or prospectuses, or download them at https://connect.rightprospectus.com/Alger. If you do not want the mailing of these documents to be combined with those for other members of your household, contact your broker-dealer or other financial intermediary or the Alger Funds in writing at Alger Family of Funds, c/o UMB Fund Services, Inc. 235 W. Galena Street Milwaukee, WI 53212.

| (b) | Include a copy of each notice transmitted to stockholders in reliance on Rule 30e-3 under the Act (17 CFR 270.30e-3) that contains disclosures specified by paragraph (c)(3) of that rule. |

Not applicable.

ITEM 2. CODE OF ETHICS.

Not applicable to this semi-annual report.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable to this semi-annual report.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable to this semi-annual report.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable to this semi-annual report.

ITEM 6. INVESTMENTS.

(a) A Schedule of Investments in securities of unaffiliated issuers as of the close of the Reporting Period is included as part of the report to shareholders filed under Item 7 of this Form N-CSR.

(b) Not applicable.

ITEM 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN_END MANAGEMENT INVESTMENT COMPANIES.

Alger Capital Appreciation Portfolio |

SEMI-ANNUAL FINANCIAL STATEMENTS AND OTHER INFORMATION

June 30, 2024 (UNAUDITED)

Table of Contents

ALGER CAPITAL APPRECIATION PORTFOLIO

ALGER CAPITAL APPRECIATION PORTFOLIOSchedule of Investments June 30, 2024 (Unaudited)

| | |

|

|

The Trade Desk, Inc., Cl. A* | | |

|

| | |

| | |

| | |

|

|

| | |

|

| | |

APPLICATION SOFTWARE—4.9% |

| | |

| | |

Cadence Design Systems, Inc.* | | |

| | |

| | |

| | |

|

|

| | |

AUTOMOBILE MANUFACTURERS—0.2% |

| | |

|

| | |

| | |

Madrigal Pharmaceuticals, Inc.* | | |

| | |

| | |

Sarepta Therapeutics, Inc.* | | |

| | |

Vertex Pharmaceuticals, Inc.* | | |

|

|

| | |

|

| | |

| | |

|

|

| | |

CARGO GROUND TRANSPORTATION—0.3% |

Old Dominion Freight Line, Inc. | | |

|

| | |

Flutter Entertainment PLC* | | |

|

|

| | |

COAL & CONSUMABLE FUELS—0.2% |

| | |

See Notes to Financial Statements.

ALGER CAPITAL APPRECIATION PORTFOLIOSchedule of Investments June 30, 2024 (Unaudited) (Continued)

| | |

COMMON STOCKS—98.9% (CONT.) |

CONSTRUCTION & ENGINEERING—0.5% |

| | |

CONSTRUCTION MACHINERY & HEAVY TRANSPORTATION EQUIPMENT—0.5% |

| | |

CONSTRUCTION MATERIALS—0.7% |

Martin Marietta Materials, Inc. | | |

CONSUMER STAPLES MERCHANDISE RETAIL—0.4% |

| | |

|

| | |

|

| | |

|

Constellation Energy Corp. | | |

| | |

| | |

|

|

| | |

ELECTRICAL COMPONENTS & EQUIPMENT—1.5% |

| | |

Vertiv Holdings Co., Cl. A | | |

|

|

| | |

ENVIRONMENTAL & FACILITIES SERVICES—1.3% |

| | |

FINANCIAL EXCHANGES & DATA—1.3% |

| | |

|

| | |

HEALTHCARE DISTRIBUTORS—0.9% |

| | |

HEALTHCARE EQUIPMENT—3.8% |

| | |

| | |

Edwards Lifesciences Corp.* | | |

Intuitive Surgical, Inc.* | | |

| | |

|

|

| | |

HOMEFURNISHING RETAIL—0.0% |

| | |

INTERACTIVE HOME ENTERTAINMENT—0.1% |

Take-Two Interactive Software, Inc.* | | |

See Notes to Financial Statements.

ALGER CAPITAL APPRECIATION PORTFOLIOSchedule of Investments June 30, 2024 (Unaudited) (Continued)

| | |

COMMON STOCKS—98.9% (CONT.) |

INTERACTIVE MEDIA & SERVICES—11.4% |

| | |

Meta Platforms, Inc., Cl. A | | |

| | |

|

|

| | |

INTERNET SERVICES & INFRASTRUCTURE—0.3% |

| | |

LIFE SCIENCES TOOLS & SERVICES—0.6% |

| | |

|

| | |

MOVIES & ENTERTAINMENT—3.5% |

Liberty Media Corp. Series C Liberty Formula One * | | |

| | |

| | |

|

|

| | |

OIL & GAS EXPLORATION & PRODUCTION—0.2% |

| | |

PASSENGER GROUND TRANSPORTATION—0.4% |

| | |

|

| | |

|

Advanced Micro Devices, Inc.* | | |

| | |

| | |

| | |

| | |

| | |

Taiwan Semiconductor Manufacturing Co., Ltd. ADR | | |

|

|

| | |

|

| | |

| | |

|

|

| | |

TECHNOLOGY HARDWARE STORAGE & PERIPHERALS—6.2% |

| | |

Dell Technologies, Inc., Cl. C | | |

|

|

| | |

See Notes to Financial Statements.

ALGER CAPITAL APPRECIATION PORTFOLIOSchedule of Investments June 30, 2024 (Unaudited) (Continued)

| | |

COMMON STOCKS—98.9% (CONT.) |

TRANSACTION & PAYMENT PROCESSING SERVICES—2.0% |

| | |

TOTAL COMMON STOCKS

(Cost $326,163,285) | | |

|

DIVERSIFIED FINANCIAL SERVICES—0.0% |

Chime Financial, Inc.,Series G(a),*,@ | | |

| | |

REAL ESTATE INVESTMENT TRUST—0.8% |

|

| | |

| | |

SPECIAL PURPOSE VEHICLE—0.1% |

DATA PROCESSING & OUTSOURCED SERVICES—0.1% |

Crosslink Ventures C, LLC, Cl. A(a),(b),*,@ | | |

| | |

TOTAL SPECIAL PURPOSE VEHICLE

(Cost $475,000) | | |

SHORT-TERM SECURITIES—0.4% |

|

Dreyfus Treasury Obligations Cash Management Fund,

Institutional Shares, 5.18%(c) | | |

| | |

|

|

Total Investments

(Cost $334,818,784) | | |

Affiliated Securities (Cost $475,000) | | |

Unaffiliated Securities (Cost $334,343,784) | | |

Liabilities in Excess of Other Assets | | |

| | |

| American Depositary Receipts |

| Security is valued in good faith at fair value determined using significant unobservable inputs pursuant to procedures approved by the Board of Trustees. |

| Deemed an affiliate of the Portfolio in accordance with Section 2(a)(3) of the Investment Company Act of 1940. See Note 10 - Affiliated Securities. |

| Rate shown reflects 7-day effective yield as of June 30, 2024. |

| Non-income producing security. |

| Restricted security - Investment in security not registered under the Securities Act of 1933. Sales or transfers of the investment may be restricted only to qualified buyers. |

See Notes to Financial Statements.

ALGER CAPITAL APPRECIATION PORTFOLIOSchedule of Investments June 30, 2024 (Unaudited) (Continued)

| | | | % of net assets

as of

6/30/2024 |

Chime Financial, Inc.,Series G | | | | |

Crosslink Ventures C, LLC, Cl. A | | | | |

| | | | |

See Notes to Financial Statements.

ALGER CAPITAL APPRECIATION PORTFOLIOStatement of Assets and Liabilities June 30, 2024 (Unaudited)

| Alger Capital Appreciation Portfolio |

|

Investments in unaffiliated securities, at value (Identified cost below)* see accompanying schedule of investments | |

Investments in affiliated securities, at value (Identified cost below)** see accompanying schedule of investments | |

Cash and cash equivalents | |

Receivable for investment securities sold | |

Receivable for shares of beneficial interest sold | |

Dividends and interest receivable | |

| |

| |

|

Payable for shares of beneficial interest redeemed | |

Payable for investment securities purchased | |

Accrued investment advisory fees | |

Accrued fund accounting fees | |

Accrued professional fees | |

| |

Accrued administrative fees | |

Accrued distribution fees | |

Accrued transfer agent fees | |

| |

Accrued shareholder administrative fees | |

| |

| |

| |

| |

|

Paid in capital (par value of $.001 per share) | |

| |

| |

| |

| |

| |

See Notes to Financial Statements.

ALGER CAPITAL APPRECIATION PORTFOLIOStatement of Assets and Liabilities June 30, 2024 (Unaudited) (Continued)

| Alger Capital Appreciation Portfolio |

|

| |

| |

SHARES OF BENEFICIAL INTEREST OUTSTANDING — Note 6: |

| |

| |

NET ASSET VALUE PER SHARE: |

| |

| |

| At June 30, 2024, the net unrealized appreciation on investments, based on cost for federal income tax purposes of $335,270,252, amounted to $268,904,185, which consisted of aggregate gross unrealized appreciation of $270,036,091, and aggregate gross unrealized depreciation of $1,131,906. |

See Notes to Financial Statements.

ALGER CAPITAL APPRECIATION PORTFOLIOStatement of Operations for the six months ended June 30, 2024 (Unaudited)

| Alger Capital Appreciation Portfolio |

|

Dividends (net of foreign withholding taxes*) | |

| |

| |

|

Investment advisory fees — Note 3 | |

Administration fees — Note 3 | |

Distribution fees — Note 3 | |

| |

| |

| |

| |

Shareholder administrative fees — Note 3 | |

| |

Transfer agent fees — Note 3 | |

| |

| |

| |

| |

| |

| |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: |

Net realized gain on unaffiliated investments | |

Net realized (loss) on foreign currency transactions | |

| |

Net change in unrealized appreciation on unaffiliated investments | |

Net change in unrealized (depreciation) on affiliated investments | |

Net change in unrealized (depreciation) on foreign currency | |

Total change in unrealized appreciation | |

Net realized and unrealized gain on investments and foreign currency | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | |

* Foreign withholding taxes | |

See Notes to Financial Statements.

ALGER CAPITAL APPRECIATION PORTFOLIOStatements of Changes in Net Assets (Unaudited)

| Alger Capital Appreciation Portfolio |

| For the

Six Months Ended

June 30, 2024 | For the

Year Ended

December 31, 2023 |

| | |

| | |

Net change in unrealized appreciation | | |

Net increase in net assets resulting from operations | | |

Dividends and distributions to shareholders: |

| | |

| | |

Increase (decrease) from shares of beneficial interest transactions: |

| | |

| | |

Net increase (decrease) from shares of beneficial interest transactions — Note 6 | | |

| | |

|

| | |

| | |

See Notes to Financial Statements.

THE ALGER PORTFOLIOSFinancial Highlights for a share outstanding throughout the period (Unaudited)

Alger Capital Appreciation Portfolio | |

| | | | | | |

Net asset value, beginning of period | | | | | | |

INCOME FROM INVESTMENT OPERATIONS: |

| | | | | | |

Net realized and unrealized gain (loss) on investments | | | | | | |

Total from investment operations | | | | | | |

Distributions from net realized gains | | | | | | |

Net asset value, end of period | | | | | | |

| | | | | | |

RATIOS/SUPPLEMENTAL DATA: |

Net assets, end of period (000's omitted) | | | | | | |

Ratio of net expenses to average net assets | | | | | | |

Ratio of net investment loss to average net assets | | | | | | |

| | | | | | |

| Ratios have been annualized; total return and portfolio turnover rate have not been annualized. |

| Amount was computed based on average shares outstanding during the period. |

See Notes to Financial Statements.

THE ALGER PORTFOLIOSFinancial Highlights for a share outstanding throughout the period (Unaudited)

Alger Capital Appreciation Portfolio | |

| | | | | | |

Net asset value, beginning of period | | | | | | |

INCOME FROM INVESTMENT OPERATIONS: |

| | | | | | |

Net realized and unrealized gain (loss) on investments | | | | | | |

Total from investment operations | | | | | | |

Distributions from net realized gains | | | | | | |

Net asset value, end of period | | | | | | |

| | | | | | |

RATIOS/SUPPLEMENTAL DATA: |

Net assets, end of period (000's omitted) | | | | | | |

Ratio of net expenses to average net assets | | | | | | |

Ratio of net investment loss to average net assets | | | | | | |

| | | | | | |

| Ratios have been annualized; total return and portfolio turnover rate have not been annualized. |

| Amount was computed based on average shares outstanding during the period. |

See Notes to Financial Statements.

ALGER CAPITAL APPRECIATION PORTFOLIONOTES TO FINANCIAL STATEMENTS (Unaudited)

NOTE 1 — General:

The Alger Portfolios (the “Fund”) is an open-end registered investment company organized as a business trust under the laws of the Commonwealth of Massachusetts. The Fund qualifies as an investment company as defined in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification 946 – Financial Services – Investment Companies. The Fund operates as a series company currently offering six series of shares of beneficial interest: Alger Capital Appreciation Portfolio, Alger Large Cap Growth Portfolio, Alger Growth & Income Portfolio, Alger Mid Cap Growth Portfolio, Alger Small Cap Growth Portfolio and Alger Balanced Portfolio (collectively, the “Portfolios”). These financial statements include only the Alger Capital Appreciation Portfolio (the “Portfolio”). The Portfolio invests primarily in equity securities and has an investment objective of long-term capital appreciation. Shares of the Portfolio are available to investment vehicles for variable annuity contracts and variable life insurance policies offered by separate accounts of life insurance companies, as well as qualified pension and retirement plans.

The Portfolio offers Class I-2 shares and Class S shares. Each class has identical rights to assets and earnings except that only Class S shares have a plan of distribution and bear the related expenses. Effective April 30, 2021, the Board of Trustees of the Fund (the “Board”) authorized a partial closing of the Portfolio’s Class S shares. Existing investors that hold Class S shares who had an open account with the Portfolio on April 30, 2021 may continue to invest in additional Class S shares of the Portfolio through exchanges, dividend reinvestment and additional purchases as provided in the Portfolio’s prospectus.

On May 23, 2023, the Board approved the transition of the Fund's custodian and administrator from Brown Brothers Harriman & Company to The Bank of New York (collectively, the “Custodian”). This change became effective on March 18, 2024.

NOTE 2 — Significant Accounting Policies:

(a) Investment Valuation: The Portfolio values its financial instruments at fair value using independent dealers or pricing services under policies approved by the Board. Investments held by the Portfolio are valued on each day the New York Stock Exchange (the “NYSE”) is open, as of the close of the NYSE (normally 4:00 p.m. Eastern Time).

The Board has designated, pursuant to Rule 2a-5 under the Investment Company Act of 1940, as amended (the “1940 Act”), the Portfolio's investment adviser, Fred Alger Management, LLC (“Alger Management” or the “Investment Manager”) as its valuation designee (the “Valuation Designee”) to make fair value determinations subject to the Board’s review and oversight. The Valuation Designee has established a Valuation Committee (“Committee”) comprised of

ALGER CAPITAL APPRECIATION PORTFOLIONOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued)

representatives of the Investment Manager and officers of the Portfolio to assist in performing the duties and responsibilities of the Valuation Designee.

The Valuation Designee has established valuation processes including but not limited to: (i) making fair value determinations when market quotations for financial instruments are not readily available in accordance with valuation policies and procedures adopted by the Board; (ii) assessing and managing material risks associated with fair valuation determinations; (iii) selecting, applying and testing fair valuation methodologies; and (iv) overseeing and evaluating pricing services used by the Portfolio. The Valuation Designee regularly reports its fair valuation determinations and related valuation information to the Board. The Committee generally meets quarterly and on an as-needed basis to review and evaluate the effectiveness of the valuation policies and procedures in accordance with the requirements of Rule 2a-5.

Investments in short-term securities held by the Portfolio having a remaining maturity of sixty days or less are valued at amortized cost which approximates market value. Investments in other open-end investment companies registered under the 1940 Act are valued at such investment companies' net asset value per share.

Equity securities, including traded rights, warrants and option contracts for which valuation information is readily available, are valued at the last quoted sales price or official closing price on the primary market or exchange on which they are traded as reported by an independent pricing service. In the absence of quoted sales, such securities are generally valued at the bid price or, in the absence of a recent bid price, the equivalent as obtained from one or more of the major market makers for the securities to be valued.

Securities in which the Portfolio invests may be traded in foreign markets that close before the close of the NYSE. Developments that occur between the close of the foreign markets and the close of the NYSE may result in adjustments to the closing foreign prices to reflect what the Valuation Designee, through its Committee, believes to be the fair value of these securities as of the close of the NYSE. The Portfolio may also fair value securities in other situations, for example, when a particular foreign market is closed but the NYSE is open.

FASB Accounting Standards Codification 820 – Fair Value Measurements and Disclosures (“ASC 820”) defines fair value as the price that the Portfolio would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. ASC 820 established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability and may be observable or unobservable. Observable inputs are based on market

ALGER CAPITAL APPRECIATION PORTFOLIONOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued)

data obtained from sources independent of the Portfolio. Unobservable inputs are inputs that reflect the Portfolio's own assumptions based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below.

• Level 1 – quoted prices in active markets for identical investments

• Level 2 – significant other observable inputs (including quoted prices for similar investments, amortized cost, interest rates, prepayment speeds, credit risk, etc.)

• Level 3 – significant unobservable inputs (including the Portfolio's own assumptions in determining the fair value of investments)

The Portfolio's valuation techniques are generally consistent with either the market or the income approach to fair value. The market approach considers prices and other relevant information generated by market transactions involving identical or comparable assets to measure fair value. The income approach converts future amounts to a current, or discounted, single amount. These fair value measurements are determined on the basis of the value indicated by current market expectations about such future events. Inputs for Level 1 include exchange-listed prices and broker quotes in an active market. Inputs for Level 2 include the last trade price in the case of a halted security, an exchange-listed price which has been adjusted for fair value factors, and prices of closely related securities. Additional Level 2 inputs include an evaluated price which is based upon a compilation of observable market information such as spreads for fixed income and preferred securities. Inputs for Level 3 include, but are not limited to, revenue multiples, earnings before interest, taxes, depreciation and amortization (“EBITDA”) multiples, discount rates, time to exit and the probabilities of success of certain outcomes. Such unobservable market information may be obtained from a company’s financial statements and from industry studies, market data, and market indicators such as benchmarks and indexes. Because of the inherent uncertainty and often limited markets for restricted securities, the valuations assigned to such securities by the Portfolio may significantly differ from the valuations that would have been assigned by the Portfolio had there been an active market for such securities.

(b) Cash and Cash Equivalents: Cash and cash equivalents include U.S. dollars and foreign cash.

(c) Securities Transactions and Investment Income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income is recognized on the accrual basis.

ALGER CAPITAL APPRECIATION PORTFOLIONOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued)

Premiums and discounts on debt securities purchased are amortized or accreted over the lives of the respective securities.

(d) Foreign Currency Transactions: The books and records of the Portfolio are maintained in U.S. dollars. Foreign currencies, investments and other assets and liabilities are translated into U.S. dollars at the prevailing rates of exchange on the valuation date. Purchases and sales of investment securities and income and expenses are translated into U.S. dollars at the prevailing exchange rates on the respective dates of such transactions.

Net realized gains and losses on foreign currency transactions represent net gains and losses from the disposition of foreign currencies, currency gains and losses realized between the trade dates and settlement dates of security transactions, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. The effects of changes in foreign currency exchange rates on investments in securities are included in realized and unrealized gain or loss on investments in the accompanying Statement of Operations.

(e) Lending of Fund Securities: The Portfolio may lend its securities to financial institutions (other than to the Investment Manager or its affiliates), provided that the market value of the securities loaned will not at any time exceed one third of the Portfolio’s total assets including borrowings, as defined in its prospectus. The Portfolio can earn fees on the securities loaned, which are included in income from securities lending in the accompanying Statement of Operations. In order to protect against the risk of failure by the borrower to return the securities loaned or any delay in the delivery of such securities, the loan is collateralized by cash or securities that are maintained with the Custodian, in an amount equal to at least 102% of the current market value of U.S. loaned securities or 105% for non-U.S. loaned securities. The market value of the loaned securities is determined at the close of each business day of the Portfolio. Any required additional collateral is delivered to the Custodian each day and any excess collateral is returned to the borrower on the next business day. In the event the borrower fails to return the loaned securities when due, the Portfolio may take the collateral to replace the securities. If the value of the collateral is less than the purchase cost of replacement securities, the Custodian shall be responsible for any shortfall, but only to the extent that the shortfall is not due to any diminution in collateral value, as defined in the securities lending agreement. The Portfolio is required to maintain the collateral in a segregated account and determine its value each day until the loaned securities are returned. Cash collateral may be invested as determined by the Portfolio. Collateral is returned to the borrower upon settlement of the loan. There were no securities loaned as of June 30, 2024.

(f) Dividends to Shareholders: Dividends and distributions payable to shareholders are recorded by the Portfolio on the ex-dividend date. The Portfolio

ALGER CAPITAL APPRECIATION PORTFOLIONOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued)

declares and pays dividends from net investment income, if available, annually. Dividends from net realized gains, offset by any loss carryforward, are declared and paid annually. Each share class is treated separately in determining the amount of dividends from net investment income payable to holders of its shares.

The characterization of distributions to shareholders for financial reporting purposes is determined in accordance with federal income tax rules. Therefore, the source of the Portfolio’s distributions may be shown in the accompanying financial statements as either from, or in excess of, net investment income, net realized gain on investment transactions, or return of capital, depending on the type of book/tax differences that may exist. Capital accounts within the financial statements are adjusted for permanent book/tax differences. Reclassifications result primarily from the differences in tax treatment of net operating losses and foreign currency transactions. The reclassifications are done annually at year-end and have no impact on the net asset value of the Portfolio and are designed to present the Portfolio’s capital accounts on a tax basis.

(g) Federal Income Taxes: It is the Portfolio’s policy to comply with the requirements of the Internal Revenue Code Subchapter M applicable to regulated investment companies and to distribute all of its taxable income to its shareholders. Provided that the Portfolio maintains such compliance, no federal income tax provision is required.

FASB Accounting Standards Codification 740 – Income Taxes (“ASC 740”) requires the Portfolio to measure and recognize in its financial statements the benefit of a tax position taken (or expected to be taken) on an income tax return if such position will more likely than not be sustained upon examination based on the technical merits of the position. No tax years are currently under investigation. The Portfolio files income tax returns in the U.S. Federal jurisdiction, as well as the New York State and New York City jurisdictions. The statute of limitations on the Portfolio's tax returns remains open for the tax years 2020-2023. Management does not believe there are any uncertain tax positions that require recognition of a tax liability.

(h) Allocation Methods: The Fund accounts separately for the assets, liabilities and operations of the Portfolio. Expenses directly attributable to the Portfolio are charged to the Portfolio’s operations; expenses which are applicable to all Portfolios are allocated among them based on net assets. Income, realized and unrealized gains and losses, and expenses of the Portfolio are allocated among the Portfolio’s classes based on relative net assets, with the exception of distribution fees, transfer agency fees, and shareholder servicing and related fees.

(i) Estimates: These financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America,

ALGER CAPITAL APPRECIATION PORTFOLIONOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued)