SEMI-ANNUAL REPORT

March 31, 2023

A No-Load Mutual Fund

1-800-773-9665

www.reynoldsfunds.com

SHAREHOLDER LETTER

(Unaudited)

May 10, 2023

Dear Fellow Shareholders:

Reynolds Blue Chip Growth Fund’s 34th Anniversary

The Reynolds Blue Chip Growth Fund (the “Fund” or “Blue Chip Fund”) celebrated its 34th anniversary last summer. It began operations on August 12, 1988.

Performance Highlights (March 31, 2023)(1)

The annualized average total returns of the Blue Chip Fund and S&P 500® Index for the 1-year, 5-year, and 10-year periods through March 31, 2023 were:

| | Average Annual Total Returns |

| | 1 Year | 5 Year | 10 Year |

| Reynolds Blue Chip Growth Fund | -16.40% | 8.12% | 8.97% |

S&P 500® Index(2) | -7.73% | 11.19% | 12.24% |

The Reynolds Blue Chip Growth Fund’s return was 8.08% and the S&P 500® Index's return was 7.50% in the three months ended March 31, 2023.

| | (1) | Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data current to the most recent month-end may be obtained by visiting www.reynoldsfunds.com or by calling 1-800-773-9665. |

| | (2) | The S&P 500® Index (“S&P”) is a capitalization-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange (“NYSE”). Returns shown include the reinvestment of all dividends. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. It is not possible to invest directly in an index. |

_______________

As stated in the Prospectus dated January 31, 2023, the expense ratio of the Fund is 1.97%. Reynolds Capital Management, LLC (the “Adviser”) has contractually agreed to waive management fees and/or reimburse expenses (excluding interest, taxes, brokerage commissions and other costs incurred in connection with the purchase or sale of portfolio securities, acquired fund fees and expenses, if any, and extraordinary items) to ensure that Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement do not exceed 2.00%.

_______________

Web Site

Our website is www.reynoldsfunds.com. On our website, you can access current information about your investment holdings. You must first request a personal identification number (“PIN”) by calling our shareholder service representatives at 1-800-773-9665. You will be able to view your account list, account detail (including balances), transaction history, distributions, and the current Blue Chip Fund net asset value. Additional information available (PIN not needed) includes the top ten holdings, industry percentages, and quarterly updates of the returns of the Blue Chip Fund.

The U.S. Economy

The U.S. economy began a recovery starting in the summer of 2020 helped by very strong monetary and fiscal stimulus to counter the effects of the coronavirus. The economy was helped by, among other things: (1) very strong government stimulus spending, (2) a very accommodative Federal Reserve, (3) improved consumer confidence, and (4) a strong housing market. The economy is currently slowing down as the Federal Reserve has been removing stimulus and sharply raising interest rates to reduce inflation. The economy also continues to be negatively affected by supply chain constraints partially caused by the war in Ukraine. The economy is also being affected by the strong U.S. dollar. U.S. Gross Domestic Product (“GDP”) increased 2.1% in 2022, 5.9% in 2021, decreased -3.4% in 2020, and increased 2.2% in 2019. GDP is estimated to have increased at an inflation-adjusted annual rate of 1.1% in the quarter ended March 31, 2023 after increasing 2.6% in the quarter ended December 31, 2022. GDP is forecast to increase 1.3% in the quarter ended June 30, 2023. GDP is forecast to increase 1.2% in calendar 2023.

U.S. inflation, as measured by the Consumer Price Index, increased 8.0% in 2022, 4.7% in 2021, 1.2% in 2020, and 1.8% in 2019. Inflation increased at an annualized rate of 5.8% in the quarter ended March 31, 2023 after increasing at an annualized rate of 7.1% in the quarter ended December 31, 2022. Inflation is forecasted to increase at an annualized rate of 4.1% in the quarter ended June 30, 2023. Inflation is forecast to increase 3.9% in calendar 2023.

Opportunistic Investing in Companies of Various Sizes and Diversified Among Various Industries

The Blue Chip Fund usually invests in companies of various sizes as classified by their market capitalizations. A company’s market capitalization is calculated by taking the number of shares the company has outstanding multiplied by its current market price. Other considerations in selecting companies for the Fund include revenue growth rates, product innovations, financial strength, management’s knowledge and experience, plus the overall economic and geopolitical environments and interest rates. The Fund’s investments are diversified among various industries.

The long-term strategy of the Blue Chip Fund is to emphasize investment in worldwide “Blue Chip” growth companies. These companies are defined as companies with a minimum market capitalization of U.S. $1 billion. In the long-term, these companies build value as their earnings grow. This growth in value should ultimately be recognized in higher stock prices for these companies.

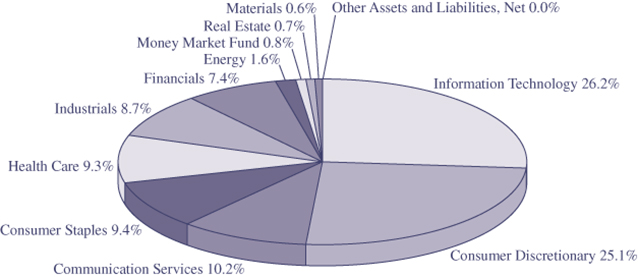

Sector Breakdown(1)(2)(3) as of March 31, 2023

(1) | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC. |

(2) | For presentation purposes within the Fund’s shareholder letter, the Fund has grouped the industry categories by sector. For purposes of categorizing securities for compliance with section 8(b)(1) of the Investment Company Act of 1940, as amended, the Fund uses more specific industry classifications for financial reporting within its Schedule of Investments. |

(3) | Percentages are based on net assets. |

For automatic current daily net asset values: Call 1-800-773-9665 (1-800-7REYNOLDS) twenty-four hours a day, seven days a week and press “any key” then “1”. The updated current net asset value for the Blue Chip Fund is usually available each business day after 5 P.M. (PST).

For the Blue Chip Fund shareholders to automatically access their current account information: Call 1-800-773-9665 (twenty-four hours a day, seven days a week), press “any key” then “2” and enter your 16 digit account number which appears at the top right of your statement.

To speak to a Fund representative regarding the current daily net asset value, current account information and any other questions: Call 1-800-773-9665 and press “0” from 6 A.M. to 5 P.M. (PST).

Shareholder statement frequency: Statements summarizing the Blue Chip Fund accounts held by a shareholder are sent quarterly. In addition, Blue Chip Fund statements are sent whenever a transaction occurs. These transactions are: (1) statements sent for the Blue Chip Fund when a shareholder purchases or redeems shares; (2) Blue Chip Fund statements sent if, and when, any ordinary income or capital gains are distributed.

Tax reporting: Individual 1099 forms, which summarize any dividend income and any long- or short-term capital gains, are sent annually to shareholders each January. The percentage of income earned from various government securities, if any, for the Blue Chip Fund are also reported in January.

Minimum investment: $1,000 for regular and retirement accounts ($100 for additional investments for all accounts – except for the Automatic Investment Plan, which is $50 for regular and retirement plan accounts).

Retirement plans: All types are offered including Traditional IRA, Roth IRA, Coverdell Education Savings Account, SIMPLE IRA Plan, and SEP IRA.

Automatic Investment Plan: There is no charge to automatically debit your checking account to invest in the Blue Chip Fund ($50 minimum) at periodic intervals to make automatic purchases. This is useful for dollar cost averaging for the Blue Chip Fund.

Systematic Withdrawal Plan: For shareholders with a $10,000 minimum starting balance, there is no charge to automatically redeem shares ($100 minimum) in the Blue Chip Fund as often as monthly and send a check to you or transfer funds to your bank account.

NASDAQ symbol: Reynolds Blue Chip Growth Fund – RBCGX

Portfolio Manager: Frederick Reynolds is the portfolio manager of the Blue Chip Fund. He has been the portfolio manager of the Fund since its inception in 1988.

The Blue Chip Fund is No-Load: No front-end sales commissions or deferred sales charges (“loads”) are charged. Some mutual funds impose these marketing charges that are ultimately paid by the shareholder. These marketing charges are either: (1) a front-end fee or “load” in which up to 5% of a shareholder’s assets are deducted from the original investment (some funds even charge a fee when a shareholder reinvests capital gains or dividends); or (2) a back-end penalty fee or “load” which is typically deducted from a shareholder’s account if a shareholder redeems within five years of the original investment. These fees reduce a shareholder’s return. The Blue Chip Fund is No-Load as it does not have these extra charges.

We appreciate your continued confidence in the Reynolds Blue Chip Growth Fund and would like to welcome our new shareholders. We look forward to strong results in the future.

Sincerely,

Frederick L. Reynolds

President

This report is not authorized for use as an offer of sale or a solicitation of an offer to buy shares of the Reynolds Blue Chip Growth Fund unless accompanied or preceded by the Fund’s current prospectus.

Investors in the Fund may lose money. There are risks associated with investments in the types of securities in which the Fund invests. These risks include:

Market Risk – The prices of the stocks in which the Fund invests may decline for a number of reasons. These reasons include factors that are specific to one or more stocks in which the Fund invests as well as factors that affect the equity securities markets generally. The price declines may be steep, sudden and/or prolonged.

Growth Investing Risk – The investment adviser may be wrong in its assessment of a company’s potential for growth and the growth stocks the Fund holds may not grow as the investment adviser anticipates. Finally, there are periods when investing in growth stocks falls out of favor with investors and these stocks may underperform.

Smaller and Medium Capitalization Companies Risk – The Fund invests in smaller and medium capitalization companies, which involve additional risks such as limited liquidity and greater price volatility.

Foreign Securities Risk – The Fund invests in foreign securities which involve greater volatility and political, economic and currency risks and different accounting methods.

Additional risks associated with investing in the Fund are as follows: Technology Companies Risk, Consumer Discretionary Companies Risk, Tax Law Change Risk, High Portfolio Turnover Risk and Liquidity Risk. For details regarding these risks, please refer to the Fund’s Prospectus or Summary Prospectus dated January 31, 2023.

For additional information about the Directors and Officers or for a description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, please call 1-800-773-9665 and request a Statement of Additional Information. One will be mailed to you free of charge. The Statement of Additional Information is also available on the website of the Securities and Exchange Commission (the “Commission”) at http://www.sec.gov. Information on how the Fund voted proxies relating to portfolio securities is available on the Fund’s website at www.reynoldsfunds.com and on the website of the Commission at http://www.sec.gov no later than August 31 for the prior 12 months ending June 30. The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT is available on the website of the Commission at http://www.sec.gov.

You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or a bank) or, if you are a direct investor, by calling 1-800-773-9665.

Distributed by Foreside Fund Services, LLC

Reynolds Blue Chip Growth Fund

EXPENSE EXAMPLE

(Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees, and other fund expenses. The expense example is intended to help a shareholder understand ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the most recent six-month period.

The Actual Expenses comparison provides information about actual account values and actual expenses. A shareholder may use the information in this line, together with the amount invested, to estimate the expenses paid over the period. A shareholder may divide his/her account value by $1,000 (e.g., an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses paid on his/her account during this period.

The Hypothetical Example for Comparison Purposes provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid for the period. A shareholder may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, a shareholder would compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemptions fees, or exchange fees. Therefore, the Hypothetical Example for Comparison Purposes is useful in comparing ongoing costs only, and will not help to determine the relevant total costs of owning different funds. In addition, if these transactional costs were included, shareholder costs would have been higher.

| | Annualized Net | Beginning | Ending | Expenses Paid |

| | Expense Ratio | Account Value | Account Value | During Period |

| | 3/31/23 | 10/1/22 | 3/31/23 | 10/1/22-3/31/23(1) |

Actual Expenses(2) | 2.00% | $1,000.00 | $1,079.70 | $10.37 |

| Hypothetical Example for Comparison Purposes | | | | |

| (5% return before expenses) | 2.00% | $1,000.00 | $1,014.93 | $10.05 |

(1) | Expenses are equal to the Fund’s annualized net expense ratio, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. |

(2) | Based on the actual return of 7.97% for the six month-period ended March 31, 2023. |

Reynolds Blue Chip Growth Fund

STATEMENT OF ASSETS AND LIABILITIES

March 31, 2023 (Unaudited)

| ASSETS: | | | |

| Investments in securities, at value (cost $44,060,800) | | $ | 53,009,109 | |

| Cash | | | 63 | |

| Receivable from investments sold | | | 1,356,615 | |

| Dividends and interest receivable | | | 31,932 | |

| Prepaid expenses | | | 89,602 | |

| Total assets | | | 54,487,321 | |

| LIABILITIES: | | | | |

| Payable for investments purchased | | | 1,265,022 | |

| Payable to shareholders for redemptions | | | 61,123 | |

| Payable to adviser for management fees | | | 43,157 | |

| Payable for distribution and service fees | | | 5,680 | |

| Other liabilities | | | 105,581 | |

| Total Liabilities | | | 1,480,563 | |

| NET ASSETS | | $ | 53,006,758 | |

| NET ASSETS CONSIST OF: | | | | |

| Capital stock, $0.01 par value; 40,000,000 shares authorized; 1,165,531 shares outstanding | | $ | 49,894,433 | |

| Distributable earnings | | | 3,112,325 | |

| Net assets | | $ | 53,006,758 | |

| CALCULATION OF NET ASSET VALUE PER SHARE: | | | | |

| Net asset value, offering and redemption price per share ($53,006,758 ÷ 1,165,531 shares outstanding) | | $ | 45.48 | |

SCHEDULE OF INVESTMENTS

March 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS — 99.2% | | | | | | |

| | | | | | | |

| Aerospace & Defense — 1.3% | | | | | | |

| The Boeing Company (n) | | | 2,700 | | | $ | 573,561 | |

| Raytheon Technologies Corp. | | | 1,000 | | | | 97,930 | |

| | | | | | | | 671,491 | |

| Air Freight & Logistics — 1.9% | | | | | | | | |

| Expeditors International of Washington, Inc. | | | 400 | | | | 44,048 | |

| FedEx Corp. | | | 2,350 | | | | 536,952 | |

| GXO Logistics, Inc. (n) | | | 600 | | | | 30,276 | |

| United Parcel Service, Inc., Class B | | | 2,100 | | | | 407,379 | |

| | | | | | | | 1,018,655 | |

| Automobiles — 1.7% | | | | | | | | |

| Ford Motor Company | | | 3,000 | | | | 37,800 | |

| General Motors Company | | | 1,400 | | | | 51,352 | |

| Tesla, Inc. (n) | | | 3,800 | | | | 788,348 | |

| | | | | | | | 877,500 | |

| Banks — 0.2% | | | | | | | | |

| JPMorgan Chase & Company | | | 800 | | |

| 104,248 | |

| | | | | | | | | |

| Beverages — 0.9% | | | | | | | | |

| The Coca-Cola Company | | | 1,800 | | | | 111,654 | |

| Constellation Brands, Inc., Class A | | | 600 | | | | 135,534 | |

| Monster Beverage Corp. (n) | | | 1,000 | | | | 54,010 | |

| PepsiCo, Inc. | | | 950 | | | | 173,185 | |

| | | | | | | | 474,383 | |

| Biotechnology — 1.8% | | | | | | | | |

| AbbVie, Inc. | | | 950 | | | | 151,401 | |

| Alnylam Pharmaceuticals, Inc. (n) | | | 250 | | | | 50,080 | |

| Biogen, Inc. (n) | | | 550 | | | | 152,916 | |

| BioNTech SE — ADR | | | 200 | | | | 24,914 | |

| Exact Sciences Corp. (n) | | | 600 | | | | 40,686 | |

| Gilead Sciences, Inc. | | | 800 | | | | 66,376 | |

The accompanying notes are an integral part of these financial statements.

Reynolds Blue Chip Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS — 99.2% (Continued) | | | | | | |

| | | | | | | |

| Biotechnology — 1.8% (Continued) | | | | | | |

| Intercept Pharmaceuticals, Inc. (n) | | | 2,700 | | | $ | 36,261 | |

| Moderna, Inc. (n) | | | 750 | | | | 115,185 | |

| Neurocrine Biosciences, Inc. (n) | | | 300 | | | | 30,366 | |

| Regeneron Pharmaceuticals, Inc. (n) | | | 150 | | | | 123,251 | |

| Sarepta Therapeutics, Inc. (n) | | | 300 | | | | 41,349 | |

| Seagen, Inc. (n) | | | 200 | | | | 40,494 | |

| Vertex Pharmaceuticals, Inc. (n) | | | 200 | | | | 63,014 | |

| | | | | | | | 936,293 | |

| Broadline Retail — 3.3% | | | | | | | | |

| Alibaba Group Holding Ltd. — ADR (n) | | | 1,400 | | | | 143,052 | |

| Amazon.com, Inc. (n) | | | 12,600 | | | | 1,301,454 | |

| Dillard's, Inc., Class A | | | 150 | | | | 46,152 | |

| eBay, Inc. | | | 800 | | | | 35,496 | |

| Etsy, Inc. (n) | | | 300 | | | | 33,399 | |

| JD.com, Inc. — ADR | | | 2,100 | | | | 92,169 | |

| Kohl's Corp. | | | 900 | | | | 21,186 | |

| Macy's, Inc. | | | 1,200 | | | | 20,988 | |

| Nordstrom, Inc. | | | 1,600 | | | | 26,032 | |

| Pinduoduo, Inc. — ADR (n) | | | 400 | | | | 30,360 | |

| | | | | | | | 1,750,288 | |

| Building Products — 0.3% | | | | | | | | |

| Lennox International, Inc. | | | 200 | | | | 50,256 | |

| Masco Corp. | | | 800 | | | | 39,776 | |

| Masterbrand, Inc. (n) | | | 500 | | | | 4,020 | |

| Trane Technologies PLC | | | 250 | | | | 45,995 | |

| | | | | | | | 140,047 | |

| Capital Markets — 2.2% | | | | | | | | |

| Ameriprise Financial, Inc. | | | 150 | | | | 45,975 | |

| Blackstone, Inc. | | | 300 | | | | 26,352 | |

| The Charles Schwab Corp. | | | 5,100 | | | | 267,138 | |

| CME Group, Inc. | | | 250 | | | | 47,880 | |

| FactSet Research Systems, Inc. | | | 250 | | | | 103,772 | |

| Futu Holdings Ltd. — ADR (n) | | | 2,100 | | | | 108,885 | |

| The Goldman Sachs Group, Inc. | | | 300 | | | | 98,133 | |

| Interactive Brokers Group, Inc., Class A | | | 500 | | | | 41,280 | |

| Intercontinental Exchange, Inc. | | | 250 | | | | 26,072 | |

| Moody's Corp. | | | 150 | | | | 45,903 | |

| Morgan Stanley | | | 500 | | | | 43,900 | |

| State Street Corp. | | | 700 | | | | 52,983 | |

| T. Rowe Price Group, Inc. | | | 2,200 | | | | 248,380 | |

| Virtus Investment Partners, Inc. | | | 150 | | | | 28,559 | |

| | | | | | | | 1,185,212 | |

| Chemicals — 0.4% | | | | | | |

| Albemarle Corp. | | | 250 | | |

| 55,260 | |

| Ecolab, Inc. | | | 350 | | | | 57,935 | |

| Linde PLC | | | 150 | | | | 53,316 | |

| The Sherwin-Williams Company | | | 200 | | | | 44,954 | |

| | | | | | | | 211,465 | |

| Commercial Services & Supplies — 0.3% | | | | | | | | |

| Cintas Corp. | | | 100 | | | | 46,268 | |

| Copart, Inc. (n) | | | 600 | | | | 45,126 | |

| Waste Connections, Inc. | | | 250 | | | | 34,768 | |

| Waste Management, Inc. | | | 300 | | | | 48,951 | |

| | | | | | | | 175,113 | |

| Communications Equipment — 1.2% | | | | | | | | |

| Arista Networks, Inc. (n) | | | 500 | | | | 83,930 | |

| Cisco Systems, Inc. | | | 7,900 | | | | 412,972 | |

| F5, Inc. (n) | | | 250 | | | | 36,422 | |

| Motorola Solutions, Inc. | | | 350 | | | | 100,146 | |

| | | | | | | | 633,470 | |

| Consumer Finance — 0.3% | | | | | | | | |

| American Express Company | | | 1,100 | | | | 181,445 | |

| | | | | | | | | |

| Consumer Staples Distribution — 7.3% | | | | | | | | |

| Casey's General Stores, Inc. | | | 250 | | | | 54,115 | |

| Costco Wholesale Corp. | | | 2,450 | | | | 1,217,331 | |

| Dollar General Corp. | | | 1,550 | | | | 326,213 | |

| Dollar Tree, Inc. (n) | | | 2,500 | | | | 358,875 | |

| Sysco Corp. | | | 600 | | | | 46,338 | |

| Target Corp. | | | 1,250 | | | | 207,038 | |

| Walgreens Boots Alliance, Inc. | | | 1,400 | | | | 48,412 | |

| Walmart, Inc. | | | 10,800 | | | | 1,592,460 | |

| | | | | | | | 3,850,782 | |

| Distributors — 0.1% | | | | | | | | |

| Genuine Parts Company | | | 300 | | | | 50,193 | |

| | | | | | | | | |

| Electrical Equipment — 0.5% | | | | | | | | |

| Emerson Electric Company | | | 1,100 | | | | 95,854 | |

| Rockwell Automation, Inc. | | | 500 | | | | 146,725 | |

| | | | | | | | 242,579 | |

| Electronic Equipment, Instruments | | | | | | | | |

| & Components — 0.9% | | | | | | | | |

| Amphenol Corp., Class A | | | 500 | | | | 40,860 | |

| CDW Corp. | | | 500 | | | | 97,445 | |

| Cognex Corp. | | | 500 | | | | 24,775 | |

| Coherent Corp. (n) | | | 900 | | | | 34,272 | |

The accompanying notes are an integral part of these financial statements.

Reynolds Blue Chip Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS — 99.2% (Continued) | | | | | | |

| | | | | | | |

| Electronic Equipment, Instruments | | | | | | |

| & Components — 0.9% (Continued) | | | | | | |

| Corning, Inc. | | | 1,200 | | | $ | 42,336 | |

| Jabil, Inc. | | | 400 | | | | 35,264 | |

| Keysight Technologies, Inc. (n) | | | 300 | | | | 48,444 | |

| Littelfuse, Inc. | | | 200 | | | | 53,618 | |

| TE Connectivity Ltd. | | | 400 | | | | 52,460 | |

| Zebra Technologies Corp., Class A (n) | | | 200 | | | | 63,600 | |

| | | | | | | | 493,074 | |

| Energy Equipment & Services — 0.3% | | | | | | | | |

| Halliburton Company | | | 1,500 | | | | 47,460 | |

| Schlumberger NV | | | 1,400 | | | | 68,740 | |

| Transocean, Ltd. (n) | | | 3,000 | | | | 19,080 | |

| | | | | | | | 135,280 | |

| Entertainment — 5.1% | | | | | | | | |

| Electronic Arts, Inc. | | | 500 | | | | 60,225 | |

| Live Nation Entertainment, Inc. (n) | | | 700 | | | | 49,000 | |

| NetEase, Inc. — ADR | | | 400 | | | | 35,376 | |

| Netflix, Inc. (n) | | | 3,900 | | | | 1,347,372 | |

| ROBLOX Corp., Class A (n) | | | 900 | | | | 40,482 | |

| Spotify Technology SA (n) | | | 700 | | | | 93,534 | |

| Take-Two Interactive Software, Inc. (n) | | | 700 | | | | 83,510 | |

| Tencent Music | | | | | | | | |

| Entertainment Group — ADR (n) | | | 2,000 | | | | 16,560 | |

| The Walt Disney Company (n) | | | 8,700 | | | | 871,131 | |

| Warner Bros. Discovery, Inc. (n) | | | 6,800 | | | | 102,680 | |

| | | | | | | | 2,699,870 | |

| Financial Services — 4.5% | | | | | | | | |

| Berkshire Hathaway, Inc., Class B (n) | | | 3,200 | | | | 988,064 | |

| Block, Inc., Class A (n) | | | 400 | | | | 27,460 | |

| Euronet Worldwide, Inc. (n) | | | 800 | | | | 89,520 | |

| Fiserv, Inc. (n) | | | 900 | | | | 101,727 | |

| FleetCor Technologies, Inc. (n) | | | 350 | | | | 73,797 | |

| Global Payments, Inc. | | | 400 | | | | 42,096 | |

| Jack Henry & Associates, Inc. | | | 250 | | | | 37,680 | |

| Mastercard, Inc., Class A | | | 1,050 | | | | 381,581 | |

| PayPal Holdings, Inc. (n) | | | 700 | | | | 53,158 | |

| Visa, Inc., Class A | | | 2,250 | | | | 507,285 | |

| Voya Financial, Inc. | | | 700 | | | | 50,022 | |

| WEX, Inc. (n) | | | 200 | | | | 36,778 | |

| | | | | | | | 2,389,168 | |

| Food Products — 0.5% | | | | | | | | |

| Campbell Soup Company | | | 1,200 | | | | 65,976 | |

| General Mills, Inc. | | | 300 | | | | 25,638 | |

| The Hershey Company | | | 200 | | |

| 50,882 | |

| The J.M. Smucker Company | | | 250 | | | | 39,343 | |

| Kellogg Company | | | 700 | | | | 46,872 | |

| Mondelez International, Inc., Class A | | | 600 | | | | 41,832 | |

| | | | | | | | 270,543 | |

| Ground Transportation — 0.7% | | | | | | | | |

| J.B. Hunt Transport Services, Inc. | | | 250 | | | | 43,865 | |

| Landstar System, Inc. | | | 250 | | | | 44,815 | |

| Lyft, Inc., Class A (n) | | | 3,300 | | | | 30,591 | |

| Norfolk Southern Corp. | | | 200 | | | | 42,400 | |

| Ryder System, Inc. | | | 1,000 | | | | 89,240 | |

| Saia, Inc. (n) | | | 200 | | | | 54,416 | |

| Uber Technologies, Inc. (n) | | | 1,500 | | | | 47,550 | |

| Union Pacific Corp. | | | 200 | | | | 40,252 | |

| | | | | | | | 393,129 | |

| Health Care Equipment & Supplies — 2.9% | | | | | | | | |

| Abbott Laboratories | | | 1,900 | | | | 192,394 | |

| Align Technology, Inc. (n) | | | 200 | | | | 66,828 | |

| Baxter International, Inc. | | | 1,100 | | | | 44,616 | |

| Becton, Dickinson and Company | | | 700 | | | | 173,278 | |

| Dentsply Sirona, Inc. | | | 600 | | | | 23,568 | |

| Edwards Lifesciences Corp. (n) | | | 600 | | | | 49,638 | |

| GE HealthCare Technologies, Inc. (n) | | | 1,233 | | | | 101,143 | |

| Insulet Corp. (n) | | | 150 | | | | 47,844 | |

| Intuitive Surgical, Inc. (n) | | | 1,700 | | | | 434,299 | |

| Masimo Corp. (n) | | | 250 | | | | 46,135 | |

| Medtronic PLC | | | 900 | | | | 72,558 | |

| QuidelOrtho Corp. (n) | | | 400 | | | | 35,636 | |

| ResMed, Inc. | | | 700 | | | | 153,293 | |

| Stryker Corp. | | | 400 | | | | 114,188 | |

| | | | | | | | 1,555,418 | |

| Health Care Providers & Services — 1.4% | | | | | | | | |

| AmerisourceBergen Corp. | | | 300 | | | | 48,033 | |

| Cardinal Health, Inc. | | | 500 | | | | 37,750 | |

| CVS Health Corp. | | | 600 | | | | 44,586 | |

| DaVita, Inc. (n) | | | 400 | | | | 32,444 | |

| Elevance Health, Inc. | | | 150 | | | | 68,971 | |

| HCA Healthcare, Inc. | | | 600 | | | | 158,208 | |

| Humana, Inc. | | | 200 | | | | 97,092 | |

| Laboratory Corp. of America Holdings | | | 200 | | | | 45,884 | |

| McKesson Corp. | | | 150 | | | | 53,407 | |

| Quest Diagnostics, Inc. | | | 250 | | | | 35,370 | |

| UnitedHealth Group, Inc. | | | 250 | | | | 118,148 | |

| | | | | | | | 739,893 | |

The accompanying notes are an integral part of these financial statements.

Reynolds Blue Chip Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS — 99.2% (Continued) | | | | | | |

| | | | | | | |

| Health Care Technology — 0.3% | | | | | | |

| Teladoc Health, Inc. (n) | | | 2,100 | | | $ | 54,390 | |

| Veeva Systems, Inc., Class A (n) | | | 500 | | | | 91,895 | |

| | | | | | | | 146,285 | |

| Hotels, Restaurants & Leisure — 10.5% | | | | | | | | |

| Airbnb, Inc., Class A (n) | | | 1,200 | | | | 149,280 | |

| BJ's Restaurants, Inc. (n) | | | 300 | | | | 8,742 | |

| Booking Holdings, Inc. (n) | | | 450 | | | | 1,193,584 | |

| Carnival Corp. (n) | | | 3,000 | | | | 30,450 | |

| Chipotle Mexican Grill, Inc. (n) | | | 400 | | | | 683,316 | |

| Choice Hotels International, Inc. | | | 400 | | | | 46,876 | |

| Darden Restaurants, Inc. | | | 700 | | | | 108,612 | |

| Domino's Pizza, Inc. | | | 200 | | | | 65,974 | |

| Dutch Bros, Inc., Class A (n) | | | 4,600 | | | | 145,498 | |

| Expedia Group, Inc. (n) | | | 2,000 | | | | 194,060 | |

| Hilton Worldwide Holdings, Inc. | | | 900 | | | | 126,783 | |

| Hyatt Hotels Corp., Class A (n) | | | 800 | | | | 89,432 | |

| Jack in the Box, Inc. | | | 400 | | | | 35,036 | |

| Las Vegas Sands Corp. (n) | | | 1,300 | | | | 74,685 | |

| Marriott International, Inc., Class A | | | 2,200 | | | | 365,288 | |

| McDonald's Corp. | | | 1,300 | | | | 363,493 | |

| MGM Resorts International | | | 10,200 | | | | 453,084 | |

| Restaurant Brands International, Inc. | | | 400 | | | | 26,856 | |

| Royal Caribbean Cruises Ltd. (n) | | | 1,300 | | | | 84,890 | |

| Shake Shack, Inc., Class A (n) | | | 1,100 | | | | 61,039 | |

| Starbucks Corp. | | | 6,000 | | | | 624,780 | |

| Trip.com Group Ltd. — ADR (n) | | | 1,400 | | | | 52,738 | |

| Wingstop, Inc. | | | 300 | | | | 55,074 | |

| Wyndham Hotels & Resorts, Inc. | | | 600 | | | | 40,710 | |

| Wynn Resorts Ltd. (n) | | | 2,600 | | | | 290,966 | |

| Yum! Brands, Inc. | | | 1,600 | | | | 211,328 | |

| | | | | | | | 5,582,574 | |

| Household Durables — 1.1% | | | | | | | | |

| DR Horton, Inc. | | | 400 | | | | 39,076 | |

| KB Home | | | 1,200 | | | | 48,216 | |

| Lennar Corp., Class A | | | 1,500 | | | | 157,665 | |

| Meritage Homes Corp. | | | 500 | | | | 58,380 | |

| PulteGroup, Inc. | | | 1,800 | | | | 104,904 | |

| Sonos, Inc. (n) | | | 2,200 | | | | 43,164 | |

| Sony Group Corp. — ADR | | | 500 | | | | 45,325 | |

| Taylor Morrison Home Corp. (n) | | | 900 | | | | 34,434 | |

| Toll Brothers, Inc. | | | 600 | | | | 36,018 | |

| Whirlpool Corp. | | | 300 | | | | 39,606 | |

| | | | | | | | 606,788 | |

| Household Products — 0.6% | | | | | | |

| The Clorox Company | | | 500 | | |

| 79,120 | |

| Colgate-Palmolive Company | | | 1,200 | | | | 90,180 | |

| The Procter & Gamble Company | | | 1,000 | | | | 148,690 | |

| WD-40 Company | | | 150 | | | | 26,708 | |

| | | | | | | | 344,698 | |

| Industrial Conglomerates — 0.5% | | | | | | | | |

| 3M Company | | | 300 | | | | 31,533 | |

| General Electric Company | | | 1,700 | | | | 162,520 | |

| Honeywell International, Inc. | | | 250 | | | | 47,780 | |

| | | | | | | | 241,833 | |

| Insurance — 0.2% | | | | | | | | |

| Willis Towers Watson PLC | | | 450 | | | | 104,571 | |

| | | | | | | | | |

| Interactive Media & Services — 4.6% | | | | | | | | |

| Alphabet, Inc., Class A (n) | | | 9,600 | | | | 995,808 | |

| Alphabet, Inc., Class C (n) | | | 400 | | | | 41,600 | |

| Baidu, Inc. — ADR (n) | | | 550 | | | | 83,006 | |

| Meta Platforms, Inc., Class A (n) | | | 5,700 | | | | 1,208,058 | |

| Pinterest, Inc., Class A (n) | | | 2,100 | | | | 57,267 | |

| Snap, Inc., Class A (n) | | | 2,800 | | | | 31,388 | |

| TripAdvisor, Inc. (n) | | | 1,700 | | | | 33,762 | |

| | | | | | | | 2,450,889 | |

| IT Services — 2.4% | | | | | | | | |

| Accenture PLC, Class A | | | 700 | | | | 200,067 | |

| Akamai Technologies, Inc. (n) | | | 400 | | | | 31,320 | |

| Cloudflare, Inc., Class A (n) | | | 1,400 | | | | 86,324 | |

| Cognizant Technology | | | | | | | | |

| Solutions Corp., Class A | | | 500 | | | | 30,465 | |

| DXC Technology Company (n) | | | 1,000 | | | | 25,560 | |

| Fastly, Inc., Class A (n) | | | 2,400 | | | | 42,624 | |

| Gartner, Inc. (n) | | | 200 | | | | 65,154 | |

| International Business Machines Corp. | | | 900 | | | | 117,981 | |

| MongoDB, Inc. (n) | | | 200 | | | | 46,624 | |

| Okta, Inc. (n) | | | 500 | | | | 43,120 | |

| Shopify, Inc., Class A (n) | | | 4,200 | | | | 201,348 | |

| Snowflake, Inc., Class A (n) | | | 500 | | | | 77,145 | |

| Twilio, Inc., Class A (n) | | | 600 | | | | 39,978 | |

| VeriSign, Inc. (n) | | | 1,000 | | | | 211,330 | |

| Wix.com Ltd. (n) | | | 600 | | | | 59,880 | |

| | | | | | | | 1,278,920 | |

| Life Sciences Tools & Services — 1.1% | | | | | | | | |

| Agilent Technologies, Inc. | | | 300 | | | | 41,502 | |

| Danaher Corp. | | | 200 | | | | 50,408 | |

| Illumina, Inc. (n) | | | 150 | | | | 34,882 | |

The accompanying notes are an integral part of these financial statements.

Reynolds Blue Chip Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS — 99.2% (Continued) | | | | | | |

| | | | | | | |

| Life Sciences Tools & | | | | | | |

| Services — 1.1% (Continued) | | | | | | |

| IQVIA Holdings, Inc. (n) | | | 250 | | | $ | 49,723 | |

| OmniAb, Inc. (n) | | | 2,450 | | | | 9,016 | |

| PerkinElmer, Inc. | | | 300 | | | | 39,978 | |

| Repligen Corp. (n) | | | 450 | | | | 75,762 | |

| Thermo Fisher Scientific, Inc. | | | 300 | | | | 172,911 | |

| Waters Corp. (n) | | | 300 | | | | 92,889 | |

| | | | | | | | 567,071 | |

| Machinery — 0.7% | | | | | | | | |

| Caterpillar, Inc. | | | 300 | | | | 68,652 | |

| Deere & Company | | | 100 | | | | 41,288 | |

| Dover Corp. | | | 250 | | | | 37,985 | |

| The Middleby Corp. (n) | | | 250 | | | | 36,652 | |

| Nordson Corp. | | | 200 | | | | 44,452 | |

| Parker-Hannifin Corp. | | | 250 | | | | 84,028 | |

| Xylem, Inc. | | | 400 | | | | 41,880 | |

| | | | | | | | 354,937 | |

| Media — 0.4% | | | | | | | | |

| Comcast Corp., Class A | | | 1,400 | | | | 53,074 | |

| Paramount Global, Class B | | | 1,800 | | | | 40,158 | |

| The Trade Desk, Inc., Class A (n) | | | 1,600 | | | | 97,456 | |

| | | | | | | | 190,688 | |

| Metals & Mining — 0.2% | | | | | | | | |

| Freeport-McMoRan, Inc. | | | 1,200 | | | | 49,092 | |

| Nucor Corp. | | | 300 | | | | 46,341 | |

| | | | | | | | 95,433 | |

| Oil, Gas & Consumable Fuels — 1.3% | | | | | | | | |

| APA Corp. | | | 700 | | | | 25,242 | |

| Cheniere Energy, Inc. | | | 300 | | | | 47,280 | |

| Chevron Corp. | | | 400 | | | | 65,264 | |

| Devon Energy Corp. | | | 900 | | | | 45,549 | |

| Diamondback Energy, Inc. | | | 400 | | | | 54,068 | |

| Exxon Mobil Corp. | | | 500 | | | | 54,830 | |

| Marathon Oil Corp. | | | 1,500 | | | | 35,940 | |

| Marathon Petroleum Corp. | | | 400 | | | | 53,932 | |

| Occidental Petroleum Corp. | | | 900 | | | | 56,187 | |

| Phillips 66 | | | 500 | | | | 50,690 | |

| Pioneer Natural Resources Company | | | 250 | | | | 51,060 | |

| Shell PLC — ADR | | | 700 | | | | 40,278 | |

| Texas Pacific Land Corp. | | | 50 | | | | 85,051 | |

| Valero Energy Corp. | | | 300 | | | | 41,880 | |

| Vitesse Energy, Inc. | | | 129 | | | | 2,455 | |

| | | | | | | | 709,706 | |

| Passenger Airlines — 1.1% | | | | | | |

| Allegiant Travel Company (n) | | | 500 | | |

| 45,990 | |

| American Airlines Group, Inc. (n) | | | 3,000 | | | | 44,250 | |

| Delta Air Lines, Inc. (n) | | | 6,000 | | | | 209,520 | |

| Hawaiian Holdings, Inc. (n) | | | 3,300 | | | | 30,228 | |

| JetBlue Airways Corp (n) | | | 3,500 | | | | 25,480 | |

| Southwest Airlines Company | | | 2,900 | | | | 94,366 | |

| United Airlines Holdings, Inc. (n) | | | 3,400 | | | | 150,450 | |

| | | | | | | | 600,284 | |

| Personal Care Products — 0.1% | | | | | | | | |

| The Estee Lauder Companies, Inc., Class A | | | 200 | | | | 49,292 | |

| | | | | | | | | |

| Pharmaceuticals — 1.8% | | | | | | | | |

| Bristol-Myers Squibb Company | | | 700 | | | | 48,517 | |

| Eli Lilly & Company | | | 450 | | | | 154,539 | |

| Jazz Pharmaceuticals PLC (n) | | | 300 | | | | 43,899 | |

| Johnson & Johnson | | | 1,700 | | | | 263,500 | |

| Ligand Pharmaceuticals, Inc. (n) | | | 500 | | | | 36,780 | |

| Merck & Company, Inc. | | | 2,100 | | | | 223,419 | |

| Novartis AG — ADR | | | 400 | | | | 36,800 | |

| Novo Nordisk A/S — ADR | | | 600 | | | | 95,484 | |

| Sanofi — ADR | | | 600 | | | | 32,652 | |

| Viatris, Inc. | | | 3,500 | | | | 33,670 | |

| | | | | | | | 969,260 | |

| Professional Services — 1.1% | | | | | | | | |

| Automatic Data Processing, Inc. | | | 800 | | | | 178,104 | |

| Equifax, Inc. | | | 150 | | | | 30,426 | |

| Jacobs Solutions, Inc. | | | 400 | | | | 47,004 | |

| Legalzoom.com, Inc. (n) | | | 2,800 | | | | 26,264 | |

| Paychex, Inc. | | | 1,000 | | | | 114,590 | |

| SS&C Technologies Holdings, Inc. | | | 800 | | | | 45,176 | |

| Verisk Analytics, Inc. | | | 650 | | | | 124,709 | |

| | | | | | | | 566,273 | |

| Real Estate Management | | | | | | | | |

| & Development — 0.4% | | | | | | | | |

| Compass, Inc., Class A (n) | | | 7,000 | | | | 22,610 | |

| Redfin Corp. (n) | | | 15,000 | | | | 135,900 | |

| Zillow Group, Inc., Class C (n) | | | 1,400 | | | | 62,258 | |

| | | | | | | | 220,768 | |

| Retail Real Estate Investment Trusts — 0.1% | | | | | | | | |

| Simon Property Group, Inc. | | | 500 | | | | 55,985 | |

The accompanying notes are an integral part of these financial statements.

Reynolds Blue Chip Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS — 99.2% (Continued) | | | | | | |

| | | | | | | |

| Semiconductors & Semiconductor | | | | | | |

| Equipment — 6.0% | | | | | | |

| Advanced Micro Devices, Inc. (n) | | | 3,806 | | | $ | 373,026 | |

| Analog Devices, Inc. | | | 250 | | | | 49,305 | |

| Applied Materials, Inc. | | | 350 | | | | 42,990 | |

| Axcelis Technologies, Inc. (n) | | | 300 | | | | 39,975 | |

| Broadcom, Inc. | | | 300 | | | | 192,462 | |

| Cirrus Logic, Inc. (n) | | | 400 | | | | 43,752 | |

| First Solar, Inc. (n) | | | 1,000 | | | | 217,500 | |

| GlobalFoundries, Inc. (n) | | | 1,000 | | | | 72,180 | |

| Intel Corp. | | | 4,000 | | | | 130,680 | |

| Lam Research Corp. | | | 150 | | | | 79,518 | |

| Lattice Semiconductor Corp. (n) | | | 400 | | | | 38,200 | |

| Marvell Technology, Inc. | | | 2,100 | | | | 90,930 | |

| Microchip Technology, Inc. | | | 500 | | | | 41,890 | |

| NVIDIA Corp. | | | 3,350 | | | | 930,529 | |

| NXP Semiconductors N.V. | | | 600 | | | | 111,885 | |

| ON Semiconductor Corp. (n) | | | 500 | | | | 41,160 | |

| Qorvo, Inc. (n) | | | 700 | | | | 71,099 | |

| QUALCOMM, Inc. | | | 600 | | | | 76,548 | |

| Skyworks Solutions, Inc. | | | 700 | | | | 82,586 | |

| SolarEdge Technologies, Inc. (n) | | | 150 | | | | 45,593 | |

| Synaptics, Inc. (n) | | | 400 | | | | 44,460 | |

| Taiwan Semiconductor Manufacturing | | | | | | | | |

| Company Ltd. — ADR | | | 700 | | | | 65,114 | |

| Teradyne, Inc. | | | 600 | | | | 64,506 | |

| Texas Instruments, Inc. | | | 950 | | | | 176,710 | |

| Universal Display Corp. | | | 400 | | | | 62,052 | |

| | | | | | | | 3,184,650 | |

| Software — 13.4% | | | | | | | | |

| Adobe, Inc. (n) | | | 1,200 | | | | 462,444 | |

| ANSYS, Inc. (n) | | | 150 | | | | 49,920 | |

| Aspen Technology, Inc. (n) | | | 250 | | | | 57,217 | |

| Atlassian Corp. (n) | | | 250 | | | | 42,792 | |

| Autodesk, Inc. (n) | | | 850 | | | | 176,936 | |

| C3.ai, Inc., Class A (n) | | | 10,600 | | | | 355,842 | |

| Cadence Design Systems, Inc. (n) | | | 300 | | | | 63,027 | |

| Confluent, Inc., Class A (n) | | | 1,800 | | | | 43,326 | |

| Crowdstrike Holdings, Inc., Class A (n) | | | 1,800 | | | | 247,068 | |

| CyberArk Software Ltd. (n) | | | 550 | | | | 81,389 | |

| Datadog, Inc., Class A (n) | | | 600 | | | | 43,596 | |

| DocuSign, Inc. (n) | | | 2,400 | | | | 139,920 | |

| Fair Isaac Corp. (n) | | | 150 | | | | 105,403 | |

| Five9, Inc. (n) | | | 600 | | | | 43,374 | |

| Fortinet, Inc. (n) | | | 1,600 | | | | 106,336 | |

| Intuit, Inc. | | | 250 | | |

| 111,458 | |

| Microsoft Corp. | | | 3,950 | | | | 1,138,785 | |

| Nice Ltd. — ADR (n) | | | 400 | | | | 91,556 | |

| Oracle Corp. | | | 6,500 | | | | 603,980 | |

| Palo Alto Networks, Inc. (n) | | | 4,500 | | | | 898,830 | |

| Paycom Software, Inc. (n) | | | 150 | | | | 45,602 | |

| Paylocity Holding Corp. (n) | | | 800 | | | | 159,024 | |

| Pegasystems, Inc. | | | 1,000 | | | | 48,480 | |

| PTC, Inc. (n) | | | 350 | | | | 44,881 | |

| Qualys, Inc. (n) | | | 300 | | | | 39,006 | |

| RingCentral, Inc., Class A (n) | | | 700 | | | | 21,469 | |

| Salesforce, Inc. (n) | | | 6,750 | | | | 1,348,515 | |

| SAP SE — ADR | | | 500 | | | | 63,275 | |

| Splunk, Inc. (n) | | | 500 | | | | 47,940 | |

| Synopsys, Inc. (n) | | | 150 | | | | 57,938 | |

| VMware, Inc., Class A (n) | | | 1,586 | | | | 198,012 | |

| Workday, Inc., Class A (n) | | | 250 | | | | 51,635 | |

| Zoom Video | | | | | | | | |

| Communications, Inc., Class A (n) | | | 1,200 | | | | 88,608 | |

| Zscaler, Inc. (n) | | | 400 | | | | 46,732 | |

| | | | | | | | 7,124,316 | |

| Specialized Real Estate | | | | | | | | |

| Investment Trusts — 0.2% | | | | | | | | |

| American Tower Corp. | | | 200 | | | | 40,868 | |

| Life Storage, Inc. | | | 300 | | | | 39,327 | |

| VICI Properties, Inc. | | | 1,200 | | | | 39,144 | |

| | | | | | | | 119,339 | |

| Specialty Retail — 7.2% | | | | | | | | |

| Academy Sports & Outdoors, Inc. | | | 700 | | | | 45,675 | |

| Advance Auto Parts, Inc. | | | 400 | | | | 48,644 | |

| AutoNation, Inc. (n) | | | 300 | | | | 40,308 | |

| AutoZone, Inc. (n) | | | 300 | | | | 737,445 | |

| Best Buy Company, Inc. | | | 7,500 | | | | 587,025 | |

| Burlington Stores, Inc. (n) | | | 250 | | | | 50,525 | |

| CarMax, Inc. (n) | | | 1,000 | | | | 64,280 | |

| Dick's Sporting Goods, Inc. | | | 300 | | | | 42,567 | |

| The Home Depot, Inc. | | | 1,900 | | | | 560,728 | |

| Lowe's Companies, Inc. | | | 3,900 | | | | 779,883 | |

| O'Reilly Automotive, Inc. (n) | | | 150 | | | | 127,347 | |

| RH (n) | | | 150 | | | | 36,532 | |

| Ross Stores, Inc. | | | 1,700 | | | | 180,421 | |

| The TJX Companies, Inc. | | | 3,400 | | | | 266,424 | |

| Tractor Supply Company | | | 250 | | | | 58,760 | |

| Ulta Beauty, Inc. (n) | | | 150 | | | | 81,851 | |

| Victoria's Secret & Co. (n) | | | 1,100 | | | | 37,565 | |

The accompanying notes are an integral part of these financial statements.

Reynolds Blue Chip Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS — 99.2% (Continued) | | | | | | |

| | | | | | | |

| Specialty Retail — 7.2% (Continued) | | | | | | |

| Wayfair, Inc., Class A (n) | | | 1,100 | | | $ | 37,774 | |

| Williams-Sonoma, Inc. | | | 300 | | | | 36,498 | |

| | | | | | | | 3,820,252 | |

| Technology Hardware, | | | | | | | | |

| Storage & Peripherals — 2.3% | | | | | | | | |

| Apple, Inc. | | | 5,950 | | | | 981,155 | |

| Dell Technologies, Inc., Class C | | | 1,700 | | | | 68,357 | |

| Hewlett Packard Enterprise Company | | | 2,500 | | | | 39,825 | |

| HP, Inc. | | | 2,200 | | | | 64,570 | |

| NetApp, Inc. | | | 600 | | | | 38,310 | |

| | | | | | | | 1,192,217 | |

| Textiles, Apparel & Luxury Goods — 1.2% | | | | | | | | |

| Crocs, Inc. (n) | | | 300 | | | | 37,932 | |

| Deckers Outdoor Corp. (n) | | | 100 | | | | 44,955 | |

| Lululemon Athletica, Inc. (n) | | | 400 | | | | 145,676 | |

| NIKE, Inc., Class B | | | 2,500 | | | | 306,600 | |

| Ralph Lauren Corp. | | | 400 | | | | 46,668 | |

| Tapestry, Inc. | | | 1,000 | | | | 43,110 | |

| | | | | | | | 624,941 | |

| Trading Companies & Distributors — 0.3% | | | | | | | | |

| Fastenal Company | | | 700 | | | | 37,758 | |

| United Rentals, Inc. | | | 150 | | | | 59,364 | |

| W.W. Grainger, Inc. | | | 100 | | | | 68,881 | |

| | | | | | | | 166,003 | |

| Wireless Telecommunication | | | | | | | | |

| Services — 0.1% | | | | | | | | |

| T-Mobile US, Inc. (n) | | | 300 | | | | 43,452 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (cost $43,642,655) | | | | | | | 52,590,964 | |

| RIGHTS — 0.0% | | | | | | |

| | | | | | | |

| Biotechnology — 0.0% | | | | | | |

| Achillion Pharmaceuticals, Inc. (f) (n) | | | 3,000 | | |

| 0 | |

| | | | | | | | | |

| Life Sciences Tools & Services — 0.0% | | | | | | | | |

| OmniAb, Inc. ($12.50 Earnout Shares) (f) (n) | | | 189 | | | | 0 | |

| OmniAb, Inc. ($15.00 Earnout Shares) (f) (n) | | | 189 | | | | 0 | |

| | | | | | | | 0 | |

| TOTAL RIGHTS | | | | | | | | |

| (cost $0) | | | | | | | 0 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 0.8% | | | | | | | | |

| First American Government Obligations | | | | | | | | |

| Fund, Class X, 4.65% (y) | | | 418,145 | | | | 418,145 | |

| TOTAL MONEY MARKET FUNDS | | | | | | | | |

| (cost $418,145) | | | | | | | 418,145 | |

| TOTAL INVESTMENTS — 100.0% | | | | | | | | |

| (cost $44,060,800) | | | | | | | 53,009,109 | |

| Other assets and liabilities, net — 0.0% | | | | | | | (2,351 | ) |

| TOTAL NET ASSETS — 100.0% | | | | | | $ | 53,006,758 | |

Percentages for the various classifications are based on net assets.

| (f) – | Security valued at fair value as determined by the investment adviser under the supervision of the Board of Directors. Value determined using significant unobservable inputs. See Note (1)(a) in the Notes to Financial Statements. |

| (n) – | Non-income producing security. |

| (y) – | Rate shown is the 7-day effective yield as of March 31, 2023. |

ADR – American Depositary Receipt

The accompanying notes are an integral part of these financial statements.

Reynolds Blue Chip Growth Fund

STATEMENT OF OPERATIONS

For the Six Months Ended March 31, 2023 (Unaudited)

| INVESTMENT INCOME: | | | |

| Dividends (net of foreign withholding tax of $1,073) | | $ | 264,368 | |

| Interest | | | 97,728 | |

| Total investment income | | | 362,096 | |

| EXPENSES: | | | | |

| Management fees (See Note 2) | | | 261,152 | |

| Professional fees and expenses | | | 57,509 | |

| Transfer agent fees and expenses | | | 39,718 | |

| Administrative fees and expenses | | | 38,003 | |

| Insurance expense | | | 33,905 | |

| Distribution and service fees | | | 33,110 | |

| Custodian fees and expenses | | | 24,281 | |

| Accounting fees and expenses | | | 21,197 | |

| Shareholder servicing fees | | | 17,755 | |

| Registration fees | | | 17,270 | |

| Chief Compliance Officer fees | | | 14,149 | |

| Board of Directors fees | | | 13,961 | |

| Printing and postage expenses | | | 8,130 | |

| Other expenses | | | 6,877 | |

| Total expenses | | | 587,017 | |

| Less expenses reimbursed by the investment adviser (See Note 2) | | | (64,713 | ) |

| Net expenses | | | 522,304 | |

| NET INVESTMENT LOSS | | | (160,208 | ) |

| NET REALIZED GAIN ON INVESTMENTS AND FOREIGN CURRENCY TRANSACTIONS | | | 921,528 | |

| NET CHANGE IN UNREALIZED APPRECIATION/DEPRECIATION ON INVESTMENTS AND FOREIGN CURRENCY TRANSLATIONS | | | 3,169,072 | |

| NET GAIN ON INVESTMENTS | | | 4,090,600 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 3,930,392 | |

STATEMENTS OF CHANGES IN NET ASSETS

For the Six Months Ended March 31, 2023 (Unaudited) and For the Year Ended September 30, 2022

| | | 2023 | | | 2022 | |

| OPERATIONS: | | | | | | |

| Net investment loss | | $ | (160,208 | ) | | $ | (795,527 | ) |

| Net realized gain (loss) on investments and foreign currency transactions | | | 921,528 | | | | (233,316 | ) |

| Net change in unrealized appreciation/depreciation on investments and foreign currency translations | | | 3,169,072 | | | | (17,701,282 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 3,930,392 | | | | (18,730,125 | ) |

| DISTRIBUTIONS TO SHAREHOLDERS | | | (3,002,381 | ) | | | (17,990,953 | ) |

| FUND SHARE ACTIVITIES: | | | | | | | | |

| Proceeds from shares issued (22,984 and 34,892 shares, respectively) | | | 1,027,327 | | | | 1,972,909 | |

| Net asset value of shares issued in distributions reinvested (66,276 and 274,428 shares, respectively) | | | 2,940,003 | | | | 17,566,156 | |

| Cost of shares redeemed (82,541 and 156,687 shares, respectively) | | | (3,685,852 | ) | | | (9,012,154 | ) |

| Net increase in net assets derived from Fund share activities | | | 281,478 | | | | 10,526,911 | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 1,209,489 | | | | (26,194,167 | ) |

| NET ASSETS AT THE BEGINNING OF THE PERIOD | | | 51,797,269 | | | | 77,991,436 | |

| NET ASSETS AT THE END OF THE PERIOD | | $ | 53,006,758 | | | $ | 51,797,269 | |

The accompanying notes are an integral part of these financial statements.

Reynolds Blue Chip Growth Fund

FINANCIAL HIGHLIGHTS

(Selected data for each share of the Fund outstanding throughout the period)

| | | For the Six | | | | | | | | | | | | | | | | |

| | | Months Ended | | |

| |

| | | March 31, 2023 | | | Year Ended September 30, | |

| | | (Unaudited) | | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| PER SHARE OPERATING PERFORMANCE: | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 44.70 | | | $ | 77.51 | | | $ | 68.96 | | | $ | 51.48 | | | $ | 68.35 | | | $ | 57.33 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss(1) | | | (0.14 | ) | | | (0.68 | ) | | | (0.93 | ) | | | (0.70 | ) | | | (0.61 | ) | | | (0.84 | ) |

Net realized and unrealized gains (losses) on investments | | | 3.56 | | | | (14.00 | ) | | | 16.46 | | | | 20.69 | | | | (6.83 | ) | | | 16.46 | |

| Total from investment operations | | | 3.42 | | | | (14.68 | ) | | | 15.52 | | | | 19.99 | | | | (7.44 | ) | | | 15.62 | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions from net capital gains | | | (2.64 | ) | | | (18.13 | ) | | | (6.97 | ) | | | (2.51 | ) | | | (9.43 | ) | | | (4.60 | ) |

| Net asset value, end of period | | $ | 45.48 | | | $ | 44.70 | | | $ | 77.51 | | | $ | 68.96 | | | $ | 51.48 | | | $ | 68.35 | |

TOTAL RETURN(2) | | | 7.97 | % | | | -25.97 | % | | | 23.72 | % | | | 40.26 | % | | | -8.58 | % | | | 28.88 | % |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000's) | | $ | 53,007 | | | $ | 51,797 | | | $ | 77,991 | | | $ | 68,718 | | | $ | 58,180 | | | $ | 79,194 | |

Ratio of expenses to average net assets, net of reimbursement | | | 2.00 | %(3) | | | 1.95 | % | | | 1.85 | % | | | 2.00 | % | | | 2.00 | % | | | 1.96 | % |

| Ratio of net expenses to average | | | | | | | | | | | | | | | | | | | | | | | | |

| net assets, before reimbursement | | | 2.25 | %(3) | | | 1.95 | % | | | 1.85 | % | | | 2.03 | % | | | 2.02 | % | | | 1.96 | % |

Ratio of net investment loss to

average net assets | | | (0.61 | %)(3) | | | (1.18 | %) | | | (1.25 | %) | | | (1.25 | %) | | | (1.16 | %) | | | (1.36 | %) |

| Portfolio turnover rate | | | 226 | % | | | 623 | % | | | 279 | % | | | 263 | % | | | 464 | % | | | 476 | % |

(1) | Amount calculated based on average shares outstanding through the period. |

(2) | Returns for periods less than one year are not annualized. |

(3) | Annualized. |

The accompanying notes are an integral part of these financial statements.

NOTES TO FINANCIAL STATEMENTS

March 31, 2023 (Unaudited)

(1)

| Summary of Significant Accounting Policies — |

| | |

| | The following is a summary of significant accounting policies of the Reynolds Funds, Inc. (the “Company”), which is registered as a diversified, open-end management investment company under the Investment Company Act of 1940 (the “Act”), as amended. The Company consists of one fund: Reynolds Blue Chip Growth Fund (the “Fund”). The Company was incorporated under the laws of Maryland on April 28, 1988. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946 Financial Services – Investment Companies. |

| | |

| | The investment objective of the Fund is to produce long-term growth of capital by investing in a diversified portfolio of common stocks issued by well-established growth companies commonly referred to as “blue chip” companies, as defined in the Fund’s prospectus. |

| | |

| | (a) The following is a summary of the Fund’s pricing procedures. It is intended to be a general discussion and may not necessarily reflect all pricing procedures followed by the Fund. |

| | |

| | Each security, excluding short-term investments and money market funds, is valued at the last sale price reported by the principal security exchange on which the issue is traded (other than The Nasdaq OMX Group, Inc., referred to as “Nasdaq”), or if no sale is reported, the latest bid price. Securities which are traded on Nasdaq (including closed-end funds) under one |

Reynolds Blue Chip Growth Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2023 (Unaudited)

| (1) | Summary of Significant Accounting Policies — (Continued) |

| | |

| | of its three listing tiers, Nasdaq Global Market, Nasdaq Global Select Market and Nasdaq Capital Market, are valued at the Nasdaq Official Closing Price, or if no sale is reported, the latest bid price. Short-term investments with maturities of 60 days or less may be valued on an amortized cost basis to the extent it is equivalent to fair value, which involves valuing an instrument at its cost and thereafter assuming a constant amortization to maturity of any discount or premium, regardless of the impact of fluctuating rates on the fair value of the instrument. Amortized cost will not be used if its use would be inappropriate due to credit or other impairments of the issuer. Money market funds are valued at their net asset value per share. Securities for which quotations are not readily available are valued at fair value as determined by the investment adviser as the valuation designee appointed by the Board of Directors (the “Board”), in accordance with valuation procedures approved by the Board. The fair value of a security is the amount which the Fund might receive upon a current sale. The fair value of a security may differ from the last quoted price and the Fund may not be able to sell a security at the fair value. Market quotations may not be available, for example, if trading in particular securities was halted during the day and not resumed prior to the close of trading on the NYSE. |

| | |

| | Under accounting principles generally accepted in the United States of America (“GAAP”), fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e., the “exit price”) in an orderly transaction between market participants at the measurement date. |

| | |

| | In determining fair value, the Fund uses various valuation approaches. GAAP establishes a fair value hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by generally requiring that the most observable inputs be used when available. Observable inputs are those that market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s assumptions about the inputs market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The inputs or methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. |

| | |

| | The fair value hierarchy is categorized into three levels based on the inputs as follows: |

| | Level 1— | Valuations based on unadjusted quoted prices in active markets for identical assets that the Fund has the ability to access. |

| | | |

| | Level 2— | Valuations based on quoted prices for similar securities or in markets that are not active or for which all significant inputs are observable, either directly or indirectly. |

| | | |

| | Level 3— | Valuations based on inputs that are unobservable and significant to the overall fair value measurement. |

| The following table summarizes the Fund’s investments as of March 31, 2023, based on the inputs used to value them: |

| | Valuation Inputs | Investments in Securities |

| | Level 1 — Common Stocks* | | $ | 52,590,964 | |

| | Money Market Funds | | | 418,145 | |

| | Total Level 1 | | | 53,009,109 | |

| | Level 2 — None | | | — | |

| | Level 3 — Rights | | | 0 | |

| | Total | | $ | 53,009,109 | |

| | | | | | |

| | * Please refer to the Schedule of Investments to view common stocks segregated by industry type. | | | | |

Reynolds Blue Chip Growth Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2023 (Unaudited)

(1)

| Summary of Significant Accounting Policies — (Continued) |

| | |

| | (b) Investment transactions are accounted for on a trade date basis for financial reporting purposes. Net realized gains and losses on sales of securities are computed on the highest amortized cost basis. |

| | |

| | (c) The Fund records dividend income on the ex-dividend date and interest income on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations. |

| | |

| | (d) GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. The primary reasons for these adjustments are because of net operating losses and equalization. For the year ended September 30, 2022, the following table shows the reclassifications made: |

Capital Stock | Distributable Earnings |

| $311,829 | $(311,829) |

| | (e) The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates. |

| | |

| | (f) No provision has been made for Federal income taxes since the Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all net investment company taxable income and net capital gains to shareholders and otherwise comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. The Fund may utilize earnings and profits distributed to shareholders on redemption of shares as part of the dividends paid deduction. |

| | |

| | (g) The Fund has reviewed all open tax years and major jurisdictions, which include Federal and the state of Maryland, and concluded that there are no significant uncertain tax positions that would require recognition in the financial statements as of and for the year ended September 30, 2022. Open tax years are those that are open for exam by taxing authorities and, as of March 31, 2023, open Federal tax years include the tax years ended September 30, 2019 through 2022. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Fund’s Statement of Operations. During the six months ended March 31, 2023, the Fund did not incur any interest or penalties. The Fund has no examinations in progress and is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. |

| | |

| | (h) The Fund’s cash is held in accounts with balances which may exceed the amount of related federal insurance. The Fund has not experienced any loss in such accounts and believes it is not exposed to significant credit risk. |

| | |

| | (i) Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not isolate the portion of realized gains or losses and unrealized appreciation or depreciation resulting from changes in foreign exchange rates on securities from the fluctuations arising from changes in market prices of securities held. Reported net realized foreign exchange gains or losses arise from sales of securities, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund's books and the U.S. dollar equivalent of the amounts actually received or paid. |

Reynolds Blue Chip Growth Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2023 (Unaudited)

| (1) | Summary of Significant Accounting Policies — (Continued) |

| | |

| | (j) The global outbreak of coronavirus disease 2019 (“COVID-19”) has disrupted global economic markets and adversely affected individual companies and investment products. The prolonged economic impact of COVID-19 is uncertain. The operational and financial performance of the issuers of securities in which the Fund invests depends on future developments, including the duration and spread of the outbreak, and such uncertainty may in turn impact the value of the Fund’s investments. |

(2)

| Investment Advisory Agreement and Transactions With Related Parties — |

| | |

| | The Fund has an investment advisory agreement (the “agreement”) with the Adviser, to serve as investment adviser. The sole owner of the Adviser is Mr. Frederick L. Reynolds. Mr. Reynolds is also an officer and interested director of the Fund. Under the terms of the agreement, the Fund will pay the Adviser a monthly management fee at the annual rate of 1.00% of the daily net assets of the Fund. |

| | |

| | The agreement further stipulates that the Adviser will reimburse the Fund for all expenses exceeding an annual rate of 2.00% of its daily average net assets (excluding interest, taxes, brokerage commissions and extraordinary items). The Fund is not obligated to reimburse the Adviser for any expenses reimbursed in previous fiscal years. The Adviser reimbursed expenses of $64,713 for the six months ended March 31, 2023. |

| | |

| | The Fund has adopted a Distribution and Service Plan (the “Plan”) pursuant to Rule 12b-1 under the Act. The Plan provides that the Fund may incur certain costs which may not exceed a maximum amount equal to 0.25% per annum of the Fund’s average daily net assets. Payments made pursuant to the Plan may only be used to pay distribution expenses incurred in the current year, and may be less than the maximum amount allowed by the Plan. |

| | |

| | Under the Fund’s organizational documents, each director, officer, employee or other agent of the Fund (including the Fund’s investment manager) is indemnified, to the extent permitted by the Act, against certain liabilities that may arise out of performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had prior claims or losses pursuant to these contracts and believes the risk of loss to be remote. |

(3)

| Distributions to Shareholders — |

| | |

| | Net investment income and net realized gains, if any, for the Fund are distributed to shareholders at least annually and are recorded on the ex-dividend date. Please see Note 5 for more information. |

| (4) | Investment Transactions — |

| | |

| | For the six months ended March 31, 2023, purchases and proceeds of sales of investment securities (excluding short-term securities) were $134,100,581 and $102,671,260, respectively. There were no purchases or sales of U.S. Government securities. |

Reynolds Blue Chip Growth Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2023 (Unaudited)

| (5) | Income Tax Information — |

| | |

| | The following information for the Fund is presented on an income tax basis as of September 30, 2022: |

| | Tax cost of investments | | $ | 42,457,305 | |

| | Gross tax unrealized appreciation | | $ | 6,081,949 | |

| | Gross tax unrealized depreciation | | | (6,245,492 | ) |

| | Net unrealized appreciation/depreciation | | | (163,543 | ) |

| | Distributable ordinary income | | | — | |

| | Distributable long-term capital gains | | | 2,929,199 | |

| | Other accumulated loss | | | (581,342 | ) |

| | Total distributable earnings | | $ | 2,184,314 | |

| | The difference between the cost amount for financial statement and federal income tax purposes is due to wash sales. |

| | |

| | The tax character of distributions paid during the six months ended March 31, 2023 and the year ended September 30, 2022: |

Six Months Ended March 31, 2023 | Year Ended September 30, 2022 |

| Ordinary Income | Long-Term Capital | Ordinary Income | Long-Term Capital |

Distributions | Gains Distributions | Distributions | Gains Distributions |

| $0 | $3,002,381 | $5,521,630 | $12,469,323 |

| | The Fund designated as long-term capital gain dividend, pursuant to Internal Revenue Code Section 852(b)(3), the amount necessary to reduce the earnings and profits of the Fund related to net capital gain to zero for the tax year ended September 30, 2022. |

| | |

| | As of September 30, 2022, the Fund had a late year ordinary loss of $581,342 and did not have a post-October capital loss or capital loss carryforward. |

(6)

| Subsequent Events — |

| | |

| | Management has evaluated events and transactions after March 31, 2023 through the date that the financial statements were issued, and has determined that no additional disclosure or recognition in the financial statements is required. |

Reynolds Blue Chip Growth Fund

ADVISORY AGREEMENT

(Unaudited)

On November 16, 2022, the Board of Directors of Reynolds Funds, Inc. (the “Directors”) approved the continuation of the investment advisory agreement for the Reynolds Fund Blue Chip Growth Fund (the “Fund”) with the investment adviser, Reynolds Capital Management, LLC (the “Adviser”). As part of the process of approving the continuation of the advisory agreement, the Directors reviewed the fiduciary duties of the Directors with respect to approving the advisory agreement and the relevant factors for the Directors to consider, and the members of the Board of Directors who are not deemed “interested persons” (as that term is defined by the Investment Company Act of 1940) of the Fund (the “Independent Directors”) met in executive session to discuss the approval of the advisory agreement.

In advance of the meetings, the Adviser sent detailed information to the Directors to assist them in their evaluation of the investment advisory agreement, and provided additional information at the meeting. This information included, but was not limited to, a memorandum from Fund counsel that summarized the legal standards applicable to the Directors’ consideration of the advisory agreement; detailed comparative information relating to the Fund’s management fees and other expenses of the Fund; information regarding fees paid and other payments; information on the Adviser’s profitability; information about brokerage commissions; detailed comparative information relating to the Fund’s performance; information about sales and redemptions of the Fund; information about the Fund’s compliance program; and other information the Directors believed was useful in evaluating the approval of advisory agreement.

All of the factors discussed by the Directors were considered as a whole, and were considered separately by the Independent Directors, meeting in executive session. The factors were viewed in their totality by the Directors, with no single factor being the principal or determinative factor in the Directors’ determination of whether to approve the continuation of the investment advisory agreement. The Directors recognized that the management and fee arrangements for the Fund are the result of years of review and discussion between the Independent Directors and the Adviser, that certain aspects of such arrangements may receive greater scrutiny in some years than in others and that the Directors’ conclusions may be based, in part, on their consideration of these same arrangements and information received during the course of the year and in prior years.

Prior to approving the continuation of the investment advisory agreement, the Directors and the Independent Directors in executive session considered, among other items:

• The nature and quality of the investment advisory services provided by the Adviser.

• A comparison of the fees and expenses of the Fund to other similar funds.

• A comparison of the fee structures of other accounts managed by the Adviser.

• Whether economies of scale are recognized by the Fund.

• The costs and profitability of the Fund to the Adviser.

• The performance of the Fund.

• The other benefits to the Adviser from serving as investment adviser to the Fund (in addition to the advisory fee).

The material considerations and determinations of the Board of Directors, including all of the Independent Directors, are as follows:

Nature and Quality of Investment Advisory Services

The Directors noted that the Adviser supervises the investment portfolio of the Fund, directing the day-to-day management of the Fund’s portfolio, including the purchase and sale of investment securities. The Directors then discussed with management the nature of the investment process employed by the Adviser and the resources required to implement the process.

Management noted that in employing its strategy, the Adviser conducts research on target companies and engages in ongoing oversight over the portfolio to address developments in the market. The Directors then discussed staffing at the Adviser, and concluded that the Adviser is sufficiently staffed to meet the investment objectives of the Fund.

Reynolds Blue Chip Growth Fund

ADVISORY AGREEMENT (Continued)

(Unaudited)

The Directors also considered the background and experience of Mr. Reynolds and expertise of, and the amount of attention given to the Fund by, Mr. Reynolds. In addition, the Directors considered the quality of the material service providers to the Fund, who provide administrative and distribution services on behalf of the Fund and are overseen by the Adviser, and the overall reputation and capabilities of the Adviser. The Directors concluded that they were satisfied with the nature, extent and quality of the investment advisory services provided to the Fund by the Adviser, and that the nature and extent of the services provided by the Adviser are appropriate to assure that the Fund’s operations are conducted in compliance with applicable laws, rules and regulations.

Comparative Fees and Expenses

The Directors discussed with management the variables, in addition to the management fees, such as administrative and transaction fees, that impact costs to the shareholders of the Fund. Management reviewed with the Directors the comparison of the Fund’s expense ratios to other similar funds. As part of the discussion with management, the Directors ensured that they understood and were comfortable with the criteria used to determine the mutual funds included in the Morningstar categories for purposes of the 15(c) Materials. The Directors noted that the Fund’s advisory fee and net expense ratio are on the high end of the industry average. They determined that the research intensive nature of advising the Fund justifies the advisory fee paid to the Adviser, and that taking this into account the advisory fee is within a reasonable range of comparable advisory fees. The Directors determined that given the small size of the Fund, the net expense ratio is within a reasonable range of comparable ratios.

Comparison of Fee Structures of Other Accounts

The Directors then inquired of management regarding the distinction between the services performed by the Adviser for separate accounts and those performed by the Adviser for the Fund. The Adviser noted that the management of the Fund involves more comprehensive and substantive duties than the management of institutional separate accounts. Specifically, the Adviser noted the following:

| • | The Adviser provides tailored investment advisory services to the Fund in order to accommodate the cash flow volatility presented by the purchases and redemptions of shareholders. |

| • | With regard to the Fund, the Adviser attempts to serve the needs of thousands of accounts, ranging from direct accounts holding a few thousand dollars to the large omnibus accounts of intermediaries who in turn could service thousands of large and small accounts. |

| • | The Adviser maintains a robust shareholder communication effort for the Fund to reach shareholders through direct contact, through intermediaries, or via the financial press. |

| • | The Adviser coordinates with the Fund’s Chief Compliance Officer and other service providers to insure compliance with regulatory regimens imposed by Federal law and the Internal Revenue Code. |

| • | Separate accounts do not require the same level of services and oversight, nor do they present the same compliance or litigation risk. |

The Directors concluded that the services performed by the Adviser for the Fund require a higher level of service and oversight than the services performed by the Adviser for separate accounts. Based on this determination, the Directors believe that any differential in advisory fees between the Fund and the separate accounts is reasonable, and concluded that the fee rates charged to the Fund in comparison to those charged to the Adviser’s other clients is reasonable.