UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05549

Reynolds Funds, Inc.

(Exact name of registrant as specified in charter)

c/o U.S. Bank Global Fund Services

615 East Michigan Street

Milwaukee, Wisconsin 53202

(Address of principal executive offices) (Zip code)

Frederick L. Reynolds

Reynolds Capital Management, LLC

125 East Harmon Avenue #102

Las Vegas, Nevada 89109

(Name and address of agent for service)

1-800-773-9665

Registrant’s telephone number, including area code

Date of fiscal year end: September 30, 2024

Date of reporting period: September 30, 2024

Item 1. Reports to Stockholders.

| | |

| Reynolds Blue Chip Growth Fund | |

| RBCGX | |

| Annual Shareholder Report | September 30, 2024 | |

This annual shareholder report contains important information about the Reynolds Blue Chip Growth Fund for the period of October 1, 2023, to September 30, 2024. You can find additional information about the Fund at https://reynoldsfunds.com. You can also request this information by contacting us at 800-773-9665.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Reynolds Blue Chip Growth Fund | $241 | 2.00% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the 12-month period ended September 30, 2024, the Fund outperformed its benchmark, the S&P 500 Index.

WHAT FACTORS INFLUENCED PERFORMANCE

U.S. equities gained for the 12 months ended September 30, 2024 driven by resilient corporate profits, extremely strong interest in generative artificial intelligence and the Federal Reserve’s beginning pivot to lower interest rates.

Against this backdrop, security selection was the primary contributor to the Fund’s performance versus the benchmark for the fiscal year, especially within semiconductors and semiconductor equipment. Also, helping our relative result was an underweight in household durables and oil, gas and consumable fuels.

The top individual contributor was an overweight in NVIDIA. The stock was the Fund’s biggest holding. Other notable contributors to performance were an overweight in Amazon, Chipotle Mexican Grill, Costco, CrowdStrike, Meta Platforms, and Netflix. Three other notable contributors to performance were an underweight in Alphabet, Apple, and Microsoft.

In contrast, detractors from performance were an overweight in hotels, restaurants and leisure and technology hardware, storage and peripherals.

Three of the biggest individual relative detractors from performance were an overweight in Airbnb, AutoZone, and Salesforce.

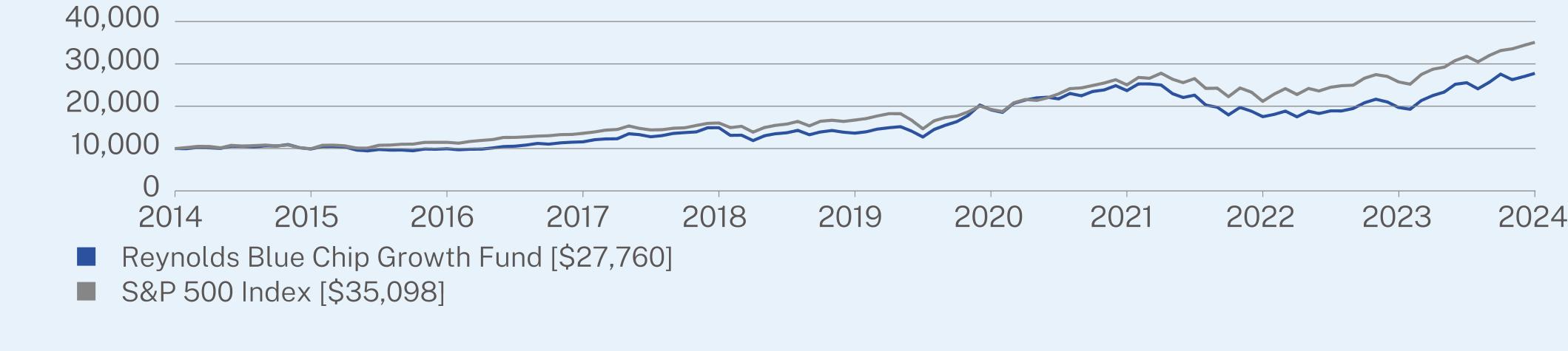

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Reynolds Blue Chip Growth Fund | PAGE 1 | TSR-AR-761724103 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Reynolds Blue Chip Growth Fund | 40.93 | 15.26 | 10.75 |

S&P 500 Index | 36.35 | 15.98 | 13.38 |

Visit https://reynoldsfunds.com for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Net Assets | $64,881,017 |

Number of Holdings | 275 |

Net Advisory Fee | $591,055 |

Portfolio Turnover | 269% |

Visit https://reynoldsfunds.com for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

| |

Sector Breakdown | (%)† |

Information Technology | 42.0% |

Consumer Discretionary | 19.8% |

Communication Services | 19.6% |

Financials | 4.3% |

Industrials | 4.0% |

Health Care | 3.7% |

Consumer Staples | 2.5% |

Energy | 0.6% |

Real Estate | 0.6% |

Cash & Other | 2.9% |

| |

Top Holdings | (%)† |

NVIDIA Corp. | 7.6% |

Meta Platforms, Inc. - Class A | 7.4% |

Amazon.com, Inc. | 6.3% |

Netflix, Inc. | 6.2% |

Microsoft Corp. | 5.3% |

Apple, Inc. | 4.9% |

Booking Holdings, Inc. | 2.9% |

Alphabet, Inc. - Class C | 2.8% |

First American Government Obligations Fund | 2.5% |

Salesforce, Inc. | 2.4% |

| † | Expressed as a percentage of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://reynoldsfunds.com

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 800-773-9665, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| Reynolds Blue Chip Growth Fund | PAGE 2 | TSR-AR-761724103 |

10000990099481158314929136481914323684175331969827760100009939114721360716044167271926025040211652574135098

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s board of directors has determined that it does not have an audit committee financial expert serving on its audit committee. At this time, the registrant believes that the experience provided by each member of the audit committee together offers the registrant adequate oversight for the registrant’s level of financial complexity.

Item 4. Principal Accountant Fees and Services.

(a)-(d) The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 9/30/2024 | FYE 9/30/2023 |

| Audit Fees | $16,500 | $16,500 |

| Audit-Related Fees | 0 | 0 |

| Tax Fees | 4,000 | 4,000 |

| All Other Fees | 0 | 0 |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by Cohen & Company, Ltd. applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 9/30/2024 | FYE 9/30/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

(f) All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full time permanent employees of the principal accountant.

(g) The following table indicates the aggregate non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser for the last two years.

| Non-Audit Related Fees | FYE 9/30/2024 | FYE 9/30/2023 |

| Registrant | $0 | $0 |

| Registrant’s Investment Adviser | 0 | 0 |

(h) The audit committee of the board of directors has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7 of this Form. |

| | |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a)

REYNOLDS BLUE CHIP GROWTH FUND

Annual Financial Statements

September 30, 2024

TABLE OF CONTENTS

Reynolds Blue Chip Growth Fund

Schedule of Investments

September 30, 2024

| | | | | | | |

COMMON STOCKS - 97.4%

|

Aerospace & Defense - 0.8%

| | | | | | |

General Electric Co. | | | 2,500 | | | $471,450 |

Lockheed Martin Corp. | | | 100 | | | 58,456 |

| | | | | | 529,906 |

Air Freight & Logistics - 0.2%

| | | | | | |

C.H. Robinson Worldwide, Inc. | | | 400 | | | 44,148 |

United Parcel Service, Inc. - Class B | | | 450 | | | 61,353 |

| | | | | | 105,501 |

Automobile Components - 0.1%

| | | | | | |

Mobileye Global, Inc. - Class A(a) | | | 2,000 | | | 27,400 |

Modine Manufacturing Co.(a) | | | 400 | | | 53,116 |

| | | | | | 80,516 |

Automobiles - 0.6%

| | | | | | |

Tesla, Inc.(a) | | | 1,475 | | | 385,904 |

Banks - 0.7%

| | | | | | |

JPMorgan Chase & Co. | | | 2,200 | | | 463,892 |

Beverages - 0.1%

| | | | | | |

Diageo PLC - ADR | | | 300 | | | 42,102 |

Monster Beverage Corp.(a) | | | 900 | | | 46,953 |

| | | | | | 89,055 |

Biotechnology - 0.2%

| | | | | | |

Ascendis Pharma AS - ADR(a) | | | 250 | | | 37,327 |

CureVac NV(a) | | | 2,000 | | | 5,880 |

Novavax, Inc.(a) | | | 1,200 | | | 15,156 |

Summit Therapeutics, Inc.(a) | | | 1,500 | | | 32,850 |

Viking Therapeutics, Inc.(a) | | | 500 | | | 31,655 |

| | | | | | 122,868 |

Broadline Retail - 6.6%

| | | | | | |

Alibaba Group Holding Ltd. - ADR | | | 350 | | | 37,142 |

Amazon.com, Inc.(a) | | | 21,950 | | | 4,089,943 |

Coupang, Inc.(a) | | | 2,100 | | | 51,555 |

eBay, Inc. | | | 700 | | | 45,577 |

JD.com, Inc. - ADR | | | 500 | | | 20,000 |

Nordstrom, Inc. | | | 1,500 | | | 33,735 |

| | | | | | 4,277,952 |

Building Products - 0.4%

| | | | | | |

Carlisle Cos., Inc. | | | 100 | | | 44,975 |

Carrier Global Corp. | | | 500 | | | 40,245 |

Johnson Controls International PLC | | | 600 | | | 46,566 |

Trane Technologies PLC | | | 300 | | | 116,619 |

| | | | | | 248,405 |

Capital Markets - 1.5%

| | | | | | |

BlackRock, Inc. | | | 100 | | | 94,951 |

Blackstone, Inc. | | | 250 | | | 38,283 |

Carlyle Group, Inc. | | | 2,400 | | | 103,344 |

Goldman Sachs Group, Inc. | | | 400 | | | 198,044 |

Interactive Brokers Group,

Inc. - Class A | | | 550 | | | 76,648 |

| | | | | | | |

| | | | | | | |

Intercontinental Exchange, Inc. | | | 200 | | | $32,128 |

Jefferies Financial Group, Inc. | | | 600 | | | 36,930 |

KKR & Co., Inc. | | | 400 | | | 52,232 |

Morgan Stanley | | | 1,000 | | | 104,240 |

Nasdaq, Inc. | | | 500 | | | 36,505 |

Robinhood Markets, Inc. - Class A(a) | | | 2,900 | | | 67,918 |

State Street Corp. | | | 500 | | | 44,235 |

Stifel Financial Corp. | | | 400 | | | 37,560 |

T Rowe Price Group, Inc. | | | 500 | | | 54,465 |

| | | | | | 977,483 |

Chemicals - 0.0%(b)

| | | | | | |

Air Products and Chemicals, Inc. | | | 125 | | | 37,217 |

Commercial Services & Supplies - 0.1%

|

Waste Management, Inc. | | | 250 | | | 51,900 |

Communications Equipment - 1.7%

| | | | | | |

Arista Networks, Inc.(a) | | | 1,875 | | | 719,662 |

Ciena Corp.(a) | | | 700 | | | 43,113 |

Cisco Systems, Inc. | | | 1,200 | | | 63,864 |

F5, Inc.(a) | | | 1,200 | | | 264,240 |

| | | | | | 1,090,879 |

Construction & Engineering - 0.1%

| | | | | | |

Quanta Services, Inc. | | | 200 | | | 59,630 |

Consumer Finance - 0.7%

| | | | | | |

American Express Co. | | | 1,300 | | | 352,560 |

SoFi Technologies, Inc.(a) | | | 9,500 | | | 74,670 |

Upstart Holdings, Inc.(a) | | | 700 | | | 28,007 |

| | | | | | 455,237 |

Consumer Staples Distribution & Retail - 2.4%

|

Costco Wholesale Corp. | | | 1,200 | | | 1,063,824 |

Sprouts Farmers Market, Inc.(a) | | | 350 | | | 38,644 |

Target Corp. | | | 650 | | | 101,309 |

Walgreens Boots Alliance, Inc. | | | 2,000 | | | 17,920 |

Walmart, Inc. | | | 4,200 | | | 339,150 |

| | | | | | 1,560,847 |

Containers & Packaging - 0.1%

| | | | | | |

Avery Dennison Corp. | | | 250 | | | 55,190 |

Diversified Consumer Services - 0.0%(b)

|

WW International, Inc.(a) | | | 2,000 | | | 1,756 |

Diversified Telecommunication Services - 0.1%

|

Verizon Communications, Inc. | | | 1,100 | | | 49,401 |

Electric Utilities - 0.2%

| | | | | | |

Constellation Energy Corp. | | | 250 | | | 65,005 |

NextEra Energy, Inc. | | | 450 | | | 38,039 |

| | | | | | 103,044 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Reynolds Blue Chip Growth Fund

Schedule of Investments

September 30, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Electrical Equipment - 0.7%

| | | | | | |

AMETEK, Inc. | | | 200 | | | $34,342 |

Eaton Corp. PLC | | | 150 | | | 49,716 |

Emerson Electric Co. | | | 350 | | | 38,279 |

GE Vernova, Inc.(a) | | | 750 | | | 191,235 |

Rockwell Automation, Inc. | | | 200 | | | 53,692 |

Vertiv Holdings Co. - Class A | | | 900 | | | 89,541 |

| | | | | | 456,805 |

Electronic Equipment, Instruments & Components - 0.8%

| | | | | | |

Amphenol Corp. - Class A | | | 1,100 | | | 71,676 |

CDW Corp./DE | | | 200 | | | 45,260 |

Coherent Corp.(a) | | | 2,400 | | | 213,384 |

Corning, Inc. | | | 1,400 | | | 63,210 |

Jabil, Inc. | | | 300 | | | 35,949 |

Keysight Technologies, Inc.(a) | | | 250 | | | 39,732 |

TE Connectivity PLC | | | 300 | | | 45,297 |

| | | | | | 514,508 |

Energy Equipment & Services - 0.1%

| | | | | | |

Schlumberger NV | | | 1,000 | | | 41,950 |

Entertainment - 6.7%

| | | | | | |

Live Nation Entertainment, Inc.(a) | | | 400 | | | 43,796 |

Netflix, Inc.(a) | | | 5,650 | | | 4,007,376 |

ROBLOX Corp. - Class A(a) | | | 1,000 | | | 44,260 |

Roku, Inc.(a) | | | 500 | | | 37,330 |

Spotify Technology SA(a) | | | 400 | | | 147,412 |

Walt Disney Co. | | | 900 | | | 86,571 |

| | | | | | 4,366,745 |

Financial Services - 1.2%

| | | | | | |

Affirm Holdings, Inc.(a) | | | 1,500 | | | 61,230 |

Apollo Global Management, Inc. | | | 350 | | | 43,718 |

Berkshire Hathaway, Inc. - Class B(a) | | | 600 | | | 276,156 |

Block, Inc.(a) | | | 1,700 | | | 114,121 |

Fidelity National Information

Services, Inc. | | | 1,900 | | | 159,125 |

Fiserv, Inc.(a) | | | 250 | | | 44,913 |

PayPal Holdings, Inc.(a) | | | 600 | | | 46,818 |

Toast, Inc. - Class A(a) | | | 2,000 | | | 56,620 |

| | | | | | 802,701 |

Ground Transportation - 0.2%

| | | | | | |

Avis Budget Group, Inc. | | | 500 | | | 43,795 |

Uber Technologies, Inc.(a) | | | 1,500 | | | 112,740 |

| | | | | | 156,535 |

Health Care Equipment & Supplies - 1.7%

|

Abbott Laboratories | | | 50 | | | 5,700 |

Bausch + Lomb Corp.(a) | | | 2,000 | | | 38,580 |

Boston Scientific Corp.(a) | | | 2,100 | | | 175,980 |

Edwards Lifesciences Corp.(a) | | | 600 | | | 39,594 |

GE HealthCare Technologies, Inc. | | | 1,100 | | | 103,235 |

Intuitive Surgical, Inc.(a) | | | 1,400 | | | 687,778 |

| | | | | | | |

| | | | | | | |

Masimo Corp.(a) | | | 300 | | | $39,999 |

| | | | | | 1,090,866 |

Health Care Providers & Services - 0.4%

|

DaVita, Inc.(a) | | | 600 | | | 98,358 |

Encompass Health Corp. | | | 200 | | | 19,328 |

HCA Healthcare, Inc. | | | 100 | | | 40,643 |

Tenet Healthcare Corp.(a) | | | 450 | | | 74,790 |

Universal Health Services,

Inc. - Class B | | | 150 | | | 34,352 |

| | | | | | 267,471 |

Hotels, Restaurants & Leisure - 7.3%

| | | | | | |

Airbnb, Inc. - Class A(a) | | | 1,050 | | | 133,150 |

Booking Holdings, Inc. | | | 450 | | | 1,895,454 |

Carnival Corp.(a) | | | 2,100 | | | 38,808 |

Cava Group, Inc.(a) | | | 300 | | | 37,155 |

Chipotle Mexican Grill, Inc.(a) | | | 16,700 | | | 962,254 |

Choice Hotels International, Inc. | | | 350 | | | 45,605 |

Darden Restaurants, Inc. | | | 250 | | | 41,032 |

Domino’s Pizza, Inc. | | | 100 | | | 43,014 |

DoorDash, Inc. - Class A(a) | | | 550 | | | 78,502 |

DraftKings, Inc. - Class A(a) | | | 1,200 | | | 47,040 |

Dutch Bros, Inc. - Class A(a) | | | 1,200 | | | 38,436 |

Expedia Group, Inc.(a) | | | 300 | | | 44,406 |

Flutter Entertainment PLC(a) | | | 200 | | | 47,456 |

Hilton Worldwide Holdings, Inc. | | | 850 | | | 195,925 |

Hyatt Hotels Corp. - Class A | | | 1,200 | | | 182,640 |

Marriott International, Inc./MD - Class A | | | 1,350 | | | 335,610 |

McDonald’s Corp. | | | 200 | | | 60,902 |

MGM Resorts International(a) | | | 900 | | | 35,181 |

Norwegian Cruise Line

Holdings Ltd.(a) | | | 3,200 | | | 65,632 |

Royal Caribbean Cruises Ltd. | | | 500 | | | 88,680 |

Shake Shack, Inc. - Class A(a) | | | 850 | | | 87,729 |

Wingstop, Inc. | | | 400 | | | 166,432 |

Yum! Brands, Inc. | | | 300 | | | 41,913 |

| | | | | | 4,712,956 |

Household Durables - 1.1%

| | | | | | |

Garmin Ltd. | | | 250 | | | 44,008 |

KB Home | | | 500 | | | 42,845 |

Lennar Corp. - Class A | | | 1,700 | | | 318,716 |

PulteGroup, Inc. | | | 600 | | | 86,118 |

Sonos, Inc.(a) | | | 2,000 | | | 24,580 |

Toll Brothers, Inc. | | | 850 | | | 131,316 |

Whirlpool Corp. | | | 400 | | | 42,800 |

| | | | | | 690,383 |

Independent Power and Renewable Electricity Producers - 0.1%

| | | | | | |

Vistra Corp. | | | 650 | | | 77,051 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Reynolds Blue Chip Growth Fund

Schedule of Investments

September 30, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Industrial Conglomerates - 0.2%

| | | | | | |

3M Co. | | | 400 | | | $54,680 |

Honeywell International, Inc. | | | 250 | | | 51,678 |

| | | | | | 106,358 |

Insurance - 0.2%

| | | | | | |

Assurant, Inc. | | | 200 | | | 39,772 |

Progressive Corp. | | | 350 | | | 88,816 |

| | | | | | 128,588 |

Interactive Media & Services - 12.6%

| | | | | | |

Alphabet, Inc. - Class A | | | 8,000 | | | 1,326,800 |

Alphabet, Inc. - Class C | | | 11,000 | | | 1,839,090 |

Baidu, Inc. - ADR(a) | | | 350 | | | 36,851 |

Bumble, Inc. - Class A(a) | | | 4,500 | | | 28,710 |

Meta Platforms, Inc. - Class A | | | 8,400 | | | 4,808,496 |

Reddit, Inc. - Class A(a) | | | 1,300 | | | 85,696 |

Snap, Inc. - Class A(a) | | | 5,500 | | | 58,850 |

| | | | | | 8,184,493 |

IT Services - 0.8%

| | | | | | |

Accenture PLC - Class A | | | 125 | | | 44,185 |

Akamai Technologies, Inc.(a) | | | 400 | | | 40,380 |

Cloudflare, Inc. - Class A(a) | | | 1,000 | | | 80,890 |

GoDaddy, Inc. - Class A(a) | | | 250 | | | 39,195 |

International Business

Machines Corp. | | | 250 | | | 55,270 |

Shopify, Inc. - Class A(a) | | | 500 | | | 40,070 |

Snowflake, Inc. - Class A(a) | | | 1,100 | | | 126,346 |

Twilio, Inc. - Class A(a) | | | 600 | | | 39,132 |

VeriSign, Inc.(a) | | | 250 | | | 47,490 |

| | | | | | 512,958 |

Life Sciences Tools & Services - 0.2%

| | | | | | |

Illumina, Inc.(a) | | | 250 | | | 32,602 |

OmniAb, Inc.(a) | | | 2,450 | | | 10,364 |

Thermo Fisher Scientific, Inc. | | | 100 | | | 61,857 |

| | | | | | 104,823 |

Machinery - 0.2%

| | | | | | |

Caterpillar, Inc. | | | 125 | | | 48,890 |

Deere & Co. | | | 200 | | | 83,466 |

Stanley Black & Decker, Inc. | | | 300 | | | 33,039 |

| | | | | | 165,395 |

Media - 0.1%

| | | | | | |

Trade Desk, Inc. - Class A(a) | | | 650 | | | 71,273 |

Metals & Mining - 0.1% | | | | | | |

Freeport-McMoRan, Inc. | | | 800 | | | 39,936 |

Newmont Corp. | | | 1,000 | | | 53,450 |

| | | | | | 93,386 |

Oil, Gas & Consumable Fuels - 0.5%

| | | | | | |

Diamondback Energy, Inc. | | | 450 | | | 77,580 |

EOG Resources, Inc. | | | 350 | | | 43,025 |

Shell PLC - ADR | | | 600 | | | 39,570 |

| | | | | | | |

| | | | | | | |

Targa Resources Corp. | | | 250 | | | $37,003 |

Texas Pacific Land Corp. | | | 150 | | | 132,711 |

Vitesse Energy, Inc. | | | 129 | | | 3,099 |

| | | | | | 332,988 |

Passenger Airlines - 0.6%

| | | | | | |

Allegiant Travel Co. | | | 1,100 | | | 60,566 |

Delta Air Lines, Inc. | | | 2,400 | | | 121,896 |

Ryanair Holdings PLC - ADR | | | 875 | | | 39,532 |

Southwest Airlines Co. | | | 2,100 | | | 62,223 |

United Airlines Holdings, Inc.(a) | | | 1,900 | | | 108,414 |

| | | | | | 392,631 |

Pharmaceuticals - 1.2%

| | | | | | |

Cassava Sciences, Inc.(a) | | | 400 | | | 11,772 |

Eli Lilly & Co. | | | 590 | | | 522,705 |

Johnson & Johnson | | | 600 | | | 97,236 |

Merck & Co., Inc. | | | 50 | | | 5,678 |

Novartis AG - ADR | | | 400 | | | 46,008 |

Novo Nordisk AS - ADR | | | 400 | | | 47,628 |

Sanofi SA - ADR | | | 600 | | | 34,578 |

| | | | | | 765,605 |

Professional Services - 0.5%

| | | | | | |

Amentum Holdings, Inc.(a) | | | 300 | | | 9,675 |

Equifax, Inc. | | | 200 | | | 58,772 |

Jacobs Solutions, Inc. | | | 300 | | | 39,270 |

Leidos Holdings, Inc. | | | 250 | | | 40,750 |

Paychex, Inc. | | | 350 | | | 46,966 |

Paycom Software, Inc. | | | 250 | | | 41,643 |

Paylocity Holding Corp.(a) | | | 200 | | | 32,994 |

TransUnion | | | 650 | | | 68,055 |

| | | | | | 338,125 |

Real Estate Management & Development - 0.4%

|

Anywhere Real Estate, Inc.(a) | | | 3,500 | | | 17,780 |

Redfin Corp.(a) | | | 13,000 | | | 162,890 |

Zillow Group, Inc. - Class C(a) | | | 900 | | | 57,465 |

| | | | | | 238,135 |

Semiconductors & Semiconductor Equipment - 14.2%

| | | | | | |

Advanced Micro Devices, Inc.(a) | | | 4,506 | | | 739,344 |

Applied Materials, Inc. | | | 750 | | | 151,537 |

ARM Holdings PLC - ADR(a) | | | 3,450 | | | 493,384 |

ASML Holding NV | | | 90 | | | 74,993 |

Broadcom, Inc. | | | 4,100 | | | 707,250 |

Enphase Energy, Inc.(a) | | | 450 | | | 50,859 |

First Solar, Inc.(a) | | | 200 | | | 49,888 |

Impinj, Inc.(a) | | | 200 | | | 43,304 |

Intel Corp. | | | 5,900 | | | 138,414 |

KLA Corp. | | | 300 | | | 232,323 |

Lam Research Corp. | | | 100 | | | 81,608 |

Marvell Technology, Inc. | | | 2,500 | | | 180,300 |

Micron Technology, Inc. | | | 1,100 | | | 114,081 |

NVIDIA Corp. | | | 40,800 | | | 4,954,752 |

NXP Semiconductors NV | | | 300 | | | 72,003 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Reynolds Blue Chip Growth Fund

Schedule of Investments

September 30, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Semiconductors & Semiconductor Equipment - (Continued)

| |

Qorvo, Inc.(a) | | | 400 | | | $41,320 |

QUALCOMM, Inc. | | | 550 | | | 93,528 |

Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | | | 4,400 | | | 764,148 |

Teradyne, Inc. | | | 300 | | | 40,179 |

Universal Display Corp. | | | 800 | | | 167,920 |

| | | | | | 9,191,135 |

Software - 17.9%

| | | | | | |

Adobe, Inc.(a) | | | 200 | | | 103,556 |

AppLovin Corp. - Class A(a) | | | 650 | | | 84,857 |

Aspen Technology, Inc.(a) | | | 400 | | | 95,528 |

Autodesk, Inc.(a) | | | 550 | | | 151,514 |

Box, Inc. - Class A(a) | | | 1,400 | | | 45,822 |

C3.ai, Inc. - Class A(a) | | | 8,100 | | | 196,263 |

Cadence Design Systems, Inc.(a) | | | 625 | | | 169,394 |

CommVault Systems, Inc.(a) | | | 900 | | | 138,465 |

Confluent, Inc., Class A - Class A(a) | | | 1,400 | | | 28,532 |

CrowdStrike Holdings,

Inc. - Class A(a) | | | 5,450 | | | 1,528,561 |

CyberArk Software Ltd.(a) | | | 600 | | | 174,966 |

Datadog, Inc. - Class A(a) | | | 850 | | | 97,801 |

Fair Isaac Corp.(a) | | | 150 | | | 291,528 |

Five9, Inc.(a) | | | 1,100 | | | 31,603 |

Fortinet, Inc.(a) | | | 800 | | | 62,040 |

Guidewire Software, Inc.(a) | | | 250 | | | 45,735 |

Intuit, Inc. | | | 200 | | | 124,200 |

JFrog Ltd.(a) | | | 1,500 | | | 43,560 |

Microsoft Corp. | | | 7,950 | | | 3,420,885 |

Monday.com Ltd.(a) | | | 150 | | | 41,666 |

Nice Ltd. - ADR(a) | | | 200 | | | 34,734 |

Oracle Corp. | | | 7,250 | | | 1,235,400 |

Palantir Technologies,

Inc. - Class A(a) | | | 12,500 | | | 465,000 |

Palo Alto Networks, Inc.(a) | | | 2,850 | | | 974,130 |

Salesforce, Inc. | | | 5,700 | | | 1,560,147 |

Samsara, Inc. - Class A(a) | | | 800 | | | 38,496 |

ServiceNow, Inc.(a) | | | 270 | | | 241,485 |

SoundHound AI, Inc. - Class A(a) | | | 3,500 | | | 16,310 |

Synopsys, Inc.(a) | | | 100 | | | 50,639 |

Workday, Inc. - Class A(a) | | | 150 | | | 36,662 |

Zoom Video Communications, Inc. - Class A(a) | | | 600 | | | 41,844 |

Zscaler, Inc.(a) | | | 250 | | | 42,735 |

| | | | | | 11,614,058 |

Specialty Retail - 3.7%

| | | | | | |

AutoNation, Inc.(a) | | | 250 | | | 44,730 |

AutoZone, Inc.(a) | | | 300 | | | 945,012 |

Best Buy Co., Inc. | | | 2,100 | | | 216,930 |

CarMax, Inc.(a) | | | 600 | | | 46,428 |

Carvana Co.(a) | | | 350 | | | 60,938 |

Dick’s Sporting Goods, Inc. | | | 250 | | | 52,175 |

| | | | | | | |

| | | | | | | |

Home Depot, Inc. | | | 375 | | | $151,950 |

Lowe’s Cos., Inc. | | | 570 | | | 154,385 |

RH(a) | | | 150 | | | 50,165 |

Ross Stores, Inc. | | | 1,300 | | | 195,663 |

Signet Jewelers Ltd. | | | 400 | | | 41,256 |

TJX Cos., Inc. | | | 2,300 | | | 270,342 |

Ulta Beauty, Inc.(a) | | | 120 | | | 46,694 |

Victoria’s Secret & Co.(a) | | | 1,400 | | | 35,980 |

Wayfair, Inc. - Class A(a) | | | 1,000 | | | 56,180 |

Williams-Sonoma, Inc. | | | 350 | | | 54,222 |

| | | | | | 2,423,050 |

Technology Hardware, Storage & Peripherals - 6.6%

| | | | | | |

Apple, Inc. | | | 13,600 | | | 3,168,800 |

Dell Technologies, Inc. - Class C | | | 3,050 | | | 361,547 |

Hewlett Packard Enterprise Co. | | | 1,600 | | | 32,736 |

NetApp, Inc. | | | 350 | | | 43,228 |

Seagate Technology Holdings PLC | | | 500 | | | 54,765 |

Super Micro Computer, Inc.(a) | | | 1,290 | | | 537,156 |

Western Digital Corp.(a) | | | 900 | | | 61,461 |

| | | | | | 4,259,693 |

Textiles, Apparel & Luxury Goods - 0.4%

|

Lululemon Athletica, Inc.(a) | | | 400 | | | 108,540 |

NIKE, Inc. - Class B | | | 1,100 | | | 97,240 |

On Holding AG - Class A(a) | | | 700 | | | 35,105 |

Ralph Lauren Corp. | | | 250 | | | 48,468 |

| | | | | | 289,353 |

Wireless Telecommunication Services - 0.1%

|

T-Mobile US, Inc. | | | 250 | | | 51,590 |

TOTALCOMMON STOCKS

(Cost $38,539,362) | | | | | | 63,188,191 |

REAL ESTATE INVESTMENT TRUSTS - 0.2%

|

Specialized REITs - 0.2%

| | | | | | |

American Tower Corp. | | | 250 | | | 58,140 |

Digital Realty Trust, Inc. | | | 250 | | | 40,458 |

| | | | | | 98,598 |

TOTAL REAL ESTATE

INVESTMENT TRUSTS

(Cost $99,912) | | | | | | 98,598 |

| | | Contracts | | | |

RIGHTS - 0.0%

|

Biotechnology- 0.0%

|

OmniAb Operations, Inc. - $12.50 Earnout Shares(a)(c) | | | 189 | | | 0 |

OmniAb Operations, Inc. - $15.00 Earnout Shares(a)(c) | | | 189 | | | 0 |

| | | | | | 0 |

TOTAL RIGHTS

(Cost $0) | | | | | | 0 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Reynolds Blue Chip Growth Fund

Schedule of Investments

September 30, 2024(Continued)

| | | | | | | |

SHORT-TERM INVESTMENTS - 2.5%

|

Money Market Funds - 2.5%

|

First American Government Obligations Fund - Class X, 4.82%(d) | | | 1,653,876 | | | $1,653,876 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $1,653,876) | | | | | | 1,653,876 |

TOTAL INVESTMENTS - 100.1%

(Cost $40,293,150) | | | | | | 64,940,665 |

Liabilities in Excess of Other

Assets - (0.1)% | | | | | | (59,648) |

TOTAL NET ASSETS - 100.0% | | | | | | $64,881,017 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

ADR - American Depositary Receipt

AG - Aktiengesellschaft

NV - Naamloze Vennootschap

PLC - Public Limited Company

SA - Sociedad Anónima

(a)

| Non-income producing security. |

(b)

| Represents less than 0.05% of net assets. |

(c)

| Fair value determined using significant unobservable inputs in accordance with fair value methodologies established and applied by the Adviser, acting as Valuation Designee. These securities represented $0 or 0.0% of net assets as of September 30, 2024.

|

(d)

| The rate shown represents the 7-day annualized effective yield as of September 30, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Reynolds Blue Chip Growth Fund

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2024

| | | | |

ASSETS:

| | | |

Investments in securities, at value (cost $40,293,150) | | | $64,940,665 |

Receivable from shareholders for purchases | | | 1,926 |

Dividends and interest receivable | | | 32,009 |

Prepaid expenses | | | 44,641 |

Total assets | | | 65,019,241 |

LIABILITIES:

| | | |

Payable to shareholders for redemptions | | | 19,219 |

Payable to adviser for management fees, net | | | 49,134 |

Payable for distribution and service fees | | | 7,084 |

Other liabilities | | | 62,787 |

Total liabilities | | | 138,224 |

NET ASSETS | | | $64,881,017 |

Net Assets Consist of:

| | | |

Capital stock, $0.01 par value; 40,000,000 shares authorized; 971,329 shares outstanding | | | $38,937,496 |

Distributable earnings | | | 25,943,521 |

Net assets | | | $ 64,881,017 |

Calculation of Net Asset Value Per Share:

| | | |

Net asset value, offering and redemption price per share ($64,881,017 ÷ 971,329 shares

outstanding) | | | $66.80 |

| | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Reynolds Blue Chip Growth Fund

STATEMENT OF OPERATIONS

For the Year Ended September 30, 2024

| | | | |

INVESTMENT INCOME:

| | | |

Dividends (net of foreign withholding tax of $2,917) | | | $285,420 |

Interest | | | 108,824 |

Total investment income | | | 394,244 |

EXPENSES:

| | | |

Management fees (See Note 2) | | | 593,866 |

Administration fees and expenses | | | 83,465 |

Transfer agent fees and expenses | | | 82,604 |

Distribution and service fees | | | 73,082 |

Professional fees and expenses | | | 63,242 |

Insurance expense | | | 62,587 |

Accounting fees and expenses | | | 43,777 |

Shareholder servicing fees | | | 41,173 |

Registration fees | | | 30,844 |

Chief Compliance Officer fees | | | 28,720 |

Custodian fees and expenses | | | 28,397 |

Board of Directors fees | | | 28,001 |

Printing and postage expenses | | | 17,227 |

Other expenses | | | 13,558 |

Total expenses | | | 1,190,543 |

Less expenses reimbursed by the investment adviser (See Note 2) | | | (2,811) |

Net expenses | | | 1,187,732 |

Net investment loss | | | (793,488) |

NET REALIZED GAIN ON INVESTMENTS AND FOREIGN CURRENCY TRANSACTIONS | | | 7,235,893 |

NET CHANGE IN UNREALIZED APPRECIATION/DEPRECIATION ON INVESTMENTS AND FOREIGN CURRENCY

TRANSLATION | | | 13,464,014 |

NET GAIN ON INVESTMENTS | | | 20,699,907 |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | $19,906,419 |

| | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Reynolds Blue Chip Growth Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | | | |

OPERATIONS:

| | | | | | |

Net investment loss | | | $(793,488) | | | $(509,523) |

Net realized gain on investments and foreign currency transactions | | | 7,235,893 | | | 1,280,752 |

Net change in unrealized appreciation/depreciation on investments and foreign currency translation | | | 13,464,014 | | | 5,404,263 |

Net increase in net assets resulting from operations | | | 19,906,419 | | | 6,175,492 |

DISTRIBUTIONS TO SHAREHOLDERS | | | — | | | (3,002,381) |

FUND SHARE ACTIVITIES:

| | | | | | |

Proceeds from shares issued (47,995 and 33,898 shares, respectively) | | | 2,886,158 | | | 1,560,883 |

Net asset value of shares issued in distributions reinvested

(— and 66,276 shares, respectively) | | | — | | | 2,940,003 |

Cost of shares redeemed (186,664 and 148,988 shares, respectively) | | | (10,521,845) | | | (6,860,981) |

Net decrease in net assets derived from Fund share activities | | | (7,635,687) | | | (2,360,095) |

TOTAL INCREASE IN NET ASSETS | | | 12,270,732 | | | 813,016 |

NET ASSETS AT THE BEGINNING OF THE YEAR | | | 52,610,285 | | | 51,797,269 |

NET ASSETS AT THE END OF THE YEAR | | | $64,881,017 | | | $52,610,285 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Reynolds Blue Chip Growth Fund

FINANCIAL HIGHLIGHTS

(Selected data for each share of the Fund outstanding throughout the year)

| | | | |

PER SHARE OPERATING PERFORMANCE:

|

Net asset value, beginning of year | | | $47.40 | | | $44.70 | | | $77.51 | | | $68.96 | | | $51.48 |

Income from investment operations:

|

Net investment loss(1) | | | (0.78) | | | (0.44) | | | (0.68) | | | (0.93) | | | (0.70) |

Net realized and unrealized gains (losses) on investments | | | 20.18 | | | 5.78 | | | (14.00) | | | 16.45 | | | 20.69 |

Total from investment operations | | | 19.40 | | | 5.34 | | | (14.68) | | | 15.52 | | | 19.99 |

Less distributions:

| | | | | | | | | | | | | | | |

Distributions from net capital gains | | | — | | | (2.64) | | | (18.13) | | | (6.97) | | | (2.51) |

Net asset value, end of year | | | $66.80 | | | $47.40 | | | $44.70 | | | $77.51 | | | $68.96 |

TOTAL RETURN | | | 40.93% | | | 12.53% | | | −25.97% | | | 23.72% | | | 40.26% |

RATIOS/SUPPLEMENTAL DATA:

| | | | | | | | | | | | | | | |

Net assets, end of year (in 000’s) | | | $64,881 | | | $52,610 | | | $51,797 | | | $77,991 | | | $68,718 |

Ratio of expenses to average net assets, net of reimbursement | | | 2.00% | | | 2.00% | | | 1.95% | | | 1.85% | | | 2.00% |

Ratio of expenses to average net assets, before reimbursement | | | 2.00% | | | 2.18% | | | 1.95% | | | 1.85% | | | 2.03% |

Ratio of net investment loss to average net assets | | | (1.34%) | | | (0.95%) | | | (1.18%) | | | (1.25%) | | | (1.25%) |

Portfolio turnover rate | | | 269% | | | 431% | | | 623% | | | 279% | | | 263% |

| | | | | | | | | | | | | | | | |

(1)

| Amount calculated based on average shares outstanding throughout the year. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Reynolds Blue Chip Growth Fund

NOTES TO FINANCIAL STATEMENTS

September 30, 2024

(1) Summary of Significant Accounting Policies —

The following is a summary of significant accounting policies of the Reynolds Funds, Inc. (the “Company”), which is registered as a diversified, open-end management investment company under the Investment Company Act of 1940 (the “Act”), as amended. The Company consists of one fund: Reynolds Blue Chip Growth Fund (the “Fund”). The Company was incorporated under the laws of Maryland on April 28, 1988. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946 Financial Services – Investment Companies.

The investment objective of the Fund is to produce long-term growth of capital by investing in a diversified portfolio of common stocks issued by well-established growth companies commonly referred to as “blue chip” companies, as defined in the Fund’s prospectus.

(a) The following is a summary of the Fund’s pricing procedures. It is intended to be a general discussion and may not necessarily reflect all pricing procedures followed by the Fund.

Each security, excluding short-term investments and money market funds, is valued at the last sale price reported by the principal security exchange on which the issue is traded (other than The Nasdaq OMX Group, Inc., referred to as “Nasdaq”), or if no sale is reported, the latest bid price. Securities which are traded on Nasdaq (including closed-end funds) under one of its three listing tiers, Nasdaq Global Market, Nasdaq Global Select Market and Nasdaq Capital Market, are valued at the Nasdaq Official Closing Price, or if no sale is reported, the latest bid price. Short-term investments with maturities of 60 days or less may be valued on an amortized cost basis to the extent it is equivalent to fair value, which involves valuing an instrument at its cost and thereafter assuming a constant amortization to maturity of any discount or premium, regardless of the impact of fluctuating rates on the fair value of the instrument. Amortized cost will not be used if its use would be inappropriate due to credit or other impairments of the issuer. Money market funds are valued at their net asset value per share. Securities for which quotations are not readily available are valued at fair value as determined by the investment adviser as the valuation designee appointed by the Board of Directors (the “Board”), in accordance with fair value methodologies established and applied by the Reynolds Capital Management, LLC (the “Adviser”). The fair value of a security is the amount which the Fund might receive upon a current sale. The fair value of a security may differ from the last quoted price and the Fund may not be able to sell a security at the fair value. Market quotations may not be available, for example, if trading in particular securities was halted during the day and not resumed prior to the close of trading on the NYSE.

Under accounting principles generally accepted in the United States of America (“GAAP”), fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e., the “exit price”) in an orderly transaction between market participants at the measurement date.

In determining fair value, the Fund uses various valuation approaches. GAAP establishes a fair value hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by generally requiring that the most observable inputs be used when available. Observable inputs are those that market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s assumptions about the inputs market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The inputs or methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

The fair value hierarchy is categorized into three levels based on the inputs as follows:

Level 1 –

Valuations based on unadjusted quoted prices in active markets for identical assets that the Fund has the ability to access.

Level 2 –

Valuations based on quoted prices for similar securities or in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3 –

Valuations based on inputs that are unobservable and significant to the overall fair value measurement.

TABLE OF CONTENTS

Reynolds Blue Chip Growth Fund

NOTES TO FINANCIAL STATEMENTS

September 30, 2024(Continued)

The following table summarizes the Fund’s investments as of September 30, 2024, based on the inputs used to value them:

| | | | | | | | | | | | | |

Investments:

| | | | | | | | | | | | |

Common Stocks | | | $63,188,191 | | | $ — | | | $ — | | | $63,188,191 |

Real Estate Investment Trusts | | | 98,598 | | | — | | | — | | | 98,598 |

Rights | | | — | | | — | | | 0 | | | 0 |

Money Market Funds | | | 1,653,876 | | | — | | | — | | | 1,653,876 |

Total Investments | | | $64,940,665 | | | $— | | | $0 | | | $64,940,665 |

| | | | | | | | | | | | | |

Refer to the Schedule of Investments for further disaggregation of investment categories.

(b) Investment transactions are accounted for on a trade date basis for financial reporting purposes. Net realized gains and losses on sales of securities are computed on the highest amortized cost basis.

(c) The Fund records dividend income on the ex-dividend date and interest income on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations.

(d) GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the year ended September 30, 2024, the Fund had no permanent differences.

(e) The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

(f) No provision has been made for Federal income taxes since the Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all net investment company taxable income and net capital gains to shareholders and otherwise comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. The Fund may utilize earnings and profits distributed to shareholders on redemption of shares as part of the dividends paid deduction.

(g) The Fund has reviewed all open tax years and major jurisdictions, which include Federal and the state of Maryland, and concluded that there are no significant uncertain tax positions that would require recognition in the financial statements as of and for the year ended September 30, 2024. Open tax years are those that are open for exam by taxing authorities and, as of September 30, 2024, open Federal tax years include the tax years ended September 30, 2021 through 2024. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Fund’s Statement of Operations. During the year ended September 30, 2024, the Fund did not incur any interest or penalties. The Fund has no examinations in progress and is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

(h) The Fund’s cash is held in accounts with balances which may exceed the amount of related federal insurance. The Fund has not experienced any loss in such accounts and believes it is not exposed to significant credit risk.

(i) Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not isolate the portion of realized gains or losses and unrealized appreciation or depreciation resulting from changes in foreign exchange rates on securities from the fluctuations arising from changes in market prices of securities held. Reported net realized foreign exchange gains or losses arise from sales of securities, currency gains or losses realized

TABLE OF CONTENTS

Reynolds Blue Chip Growth Fund

NOTES TO FINANCIAL STATEMENTS

September 30, 2024(Continued)

between the trade and settlement dates on securities transactions and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund's books and the U.S. dollar equivalent of the amounts actually received or paid.

(2) Investment Advisory Agreement and Transactions With Related Parties —

The Fund has an investment advisory agreement (the “agreement”) with the Adviser, to serve as investment adviser. The sole owner of the Adviser is Mr. Frederick L. Reynolds. Mr. Reynolds is also an officer and interested director of the Fund. Under the terms of the agreement, the Fund will pay the Adviser a monthly management fee at the annual rate of 1.00% of the daily net assets of the Fund.

The agreement further stipulates that the Adviser will reimburse the Fund for all expenses exceeding an annual rate of 2.00% of its daily average net assets (excluding interest, taxes, brokerage commissions and extraordinary items). The Fund is not obligated to reimburse the Adviser for any expenses reimbursed in previous fiscal years. The Adviser reimbursed expenses of $2,811 for the year ended September 30, 2024.

The Fund has engaged Northern Lights Compliance Services, LLC to provide compliance services including the appointment of the Reynolds Fund's Chief Compliance Officer. They are paid an annual fee of $28,720 for services provided.

The Fund has adopted a Distribution and Service Plan (the “Plan”) pursuant to Rule 12b-1 under the Act. The Plan provides that the Fund may incur certain costs which may not exceed a maximum amount equal to 0.25% per annum of the Fund’s average daily net assets. Payments made pursuant to the Plan may only be used to pay distribution expenses incurred in the current year, and may be less than the maximum amount allowed by the Plan.

Under the Fund’s organizational documents, each director, officer, employee or other agent of the Fund (including the Fund’s investment manager) is indemnified, to the extent permitted by the Act, against certain liabilities that may arise out of performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had prior claims or losses pursuant to these contracts and believes the risk of loss to be remote.

(3) Distributions to Shareholders —

Net investment income and net realized gains, if any, for the Fund are distributed to shareholders at least annually and are recorded on the ex-dividend date. Please see Note 5 for more information.

(4) Investment Transactions —

For the year ended September 30, 2024, purchases and proceeds of sales of investment securities (excluding short-term securities) were $152,973,296 and $159,615,196, respectively. There were no purchases or sales of U.S. Government securities.

(5) Income Tax Information —

The following information for the Fund is presented on an income tax basis as of September 30, 2024:

| | | | |

Tax cost of investments | | | $43,495,016 |

Gross tax unrealized appreciation | | | $25,028,311 |

Gross tax unrealized depreciation | | | (3,582,662) |

Net unrealized appreciation/depreciation | | | 21,445,649 |

Distributable ordinary income | | | 2,054,530 |

Distributable long-term capital gains | | | 3,121,916 |

Other accumulated loss | | | (678,574) |

Total distributable earnings | | | $25,943,521 |

| | | | |

TABLE OF CONTENTS

Reynolds Blue Chip Growth Fund

NOTES TO FINANCIAL STATEMENTS

September 30, 2024(Continued)

The difference between the cost amount for financial statement and federal income tax purposes is due to wash sales. The tax character of distributions paid during the years ended September 30, 2024 and 2023:

The Fund designated as long-term capital gain dividend, pursuant to Internal Revenue Code Section 852(b)(3), the amount necessary to reduce the earnings and profits of the Fund related to net capital gain to zero for the tax year ended September 30, 2024.

As of September 30, 2024, the Fund had a late year ordinary loss of $678,574 and did not have a capital loss carryforward or post-October capital loss. The Fund used a short-term capital loss carryforward of $502,791.

(6) Subsequent Events —

Management has evaluated events and transactions after September 30, 2024 through the date that the financial statements were issued, and has determined that no additional disclosure or recognition in the financial statements is required.

TABLE OF CONTENTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors of

Reynolds Funds, Inc.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Reynolds Funds, Inc. comprising Reynolds Blue Chip Growth Fund (the “Fund”) as of September 30, 2024, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of September 30, 2024, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2024, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2009.

COHEN & COMPANY, LTD.

Milwaukee, Wisconsin

November 21, 2024

TABLE OF CONTENTS

QUALIFIED DIVIDEND INCOME/DIVIDEND RECEIVED DEDUCTION (Unaudited)

The Fund designated 0.00% of dividends declared and paid during the year ended September 30, 2024 from net investment income as qualified dividend income under the Jobs Growth and Tax Relief Reconciliation Act of 2003.

Corporate shareholders may be eligible for a dividend received deduction for certain ordinary income distributions paid by the Fund. The Fund designated 0.00% of dividends declared and paid during the year ended September 30, 2024 from net investment income as qualifying for the dividends received deduction. The deduction is a pass through of dividends paid by domestic corporations (i.e. only equities) subject to taxation.

The percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions under Internal Revenue Section 871(k)(2)(c) for the Fund was 0.00%.

(b) Financial Highlights are included within the financial statements filed under Item 7(a) of this Form.

Item 8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

There were no changes in or disagreements with accountants during the period covered by this report.

Item 9. Proxy Disclosures for Open-End Management Investment Companies.

There were no matters submitted to a vote of shareholders during the period covered by this report.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

See Item 7(a).

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

Not applicable.

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end management investment companies.

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end management investment companies.

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end management investment companies.

Item 15. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 16. Controls and Procedures.

| (a) | The registrant’s Principal Executive Officer and Principal Financial Officer have reviewed the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the registrant and by the registrant’s service provider. |

| (b) | There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable to open-end management investment companies.

Item 18. Recovery of Erroneously Awarded Compensation.

Not applicable.

Item 19. Exhibits.

(2) Any policy required by the listing standards adopted pursuant to Rule 10D-1 under the Exchange Act (17 CFR 240.10D-1) by the registered national securities exchange or registered national securities association upon which the registrant’s securities are listed. Not applicable.

(3) A separate certification for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2(a)). Filed herewith.

(4) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

(5) Change in the registrant’s independent public accountant. Not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | (Registrant) | Reynolds Funds, Inc. | |

| | By (Signature and Title) | /s/ Frederick L. Reynolds | |

| | | Frederick L. Reynolds, Principal Executive Officer and Principal

Financial Officer | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | By (Signature and Title) | /s/ Frederick L. Reynolds | |

| | | Frederick L. Reynolds, Principal Executive Officer and Principal

Financial Officer | |