Exhibit 99.1

1 1 Annual Shareholder Meeting Management Presentation December 2018

2 2 [ Safe Harbor Statement & SEC Cautionary Note ] FORWARD LOOKING STATEMENTS Information provided and statements contained in this presentation and the oral presentation accompanying it as well as in th e Q &A that are not purely historical are forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, a s amended Section 21E of the Securities Exchange Act of 1934 as amended and the Private Securities amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Such forward - looking statements only speak as of the date of this presentation and the Company assumes no obligation to update the information inc lud ed in this presentation. Such forward - looking statements include information concerning our possible or assumed future results of operations, including descriptions of our business strategy. These statements often include words such as “ believe, ” “ expect, ” “ anticipate, ” “ intend, ” “ plan, ” “ estimate, ” or similar expressions. These statements are not guarantees of performance or results and they involve risks, uncertainties, and assumptions. For a further description of these factors, see Item 1A, Risk Factors , i ncluded within our Form 10 - K/A for the year ended December 31, 2017, which was filed on August 14th, 2018. Although we believe that thes e forward - looking statements are based on reasonable assumptions, there are many factors that could affect our actual financial results or results of operations and could cause actual results to differ materially from those in the forward - looking statement s. All future written and oral forward - looking statements by us or persons acting on our behalf are expressly qualified in their entire ty by the cautionary statements contained or referred to above. Except for our ongoing obligations to disclose material information as required by the federal securities laws, we do not have any obligations or intention to release publicly any revisions to any fo rward - looking statements to reflect events or circumstances in the future or to reflect the occurrence forward looking statements t o r eflect events or circumstances in the future or to reflect the occurrence of unanticipated events. CAUTIONARY NOTE TO U.S. INVESTORS The United States Securities and Exchange Commission permits U.S. mining companies, in their filings with the SEC, to disclos e o nly those mineral deposits that a company can economically and legally extract or produce. We use certain terms in this presentat ion (or press release), such as “ measured, ” “ indicated, ” and “ inferred ” “ resources, ” which the SEC guidelines strictly prohibit U.S. registered companies from including in their filings with the SEC. U.S. Investors are urged to consider closely the disclosure in our Fo rm 10 - K which may be secured from us, or from our website at http://www.sec.gov/edgar.shtml.

3 3 Who We Are Applied Minerals is the premier global source of h alloysite clay nanotubes, technical iron oxide, and related technologies . Marketed under the DRAGONITE and AMIRON tradenames , our products address the global need for high performance, ecofriendly solutions for a range of advanced end market applications . Applied Minerals is vertically integrated through 100 % ownership of the Dragon Mine in Eureka, Utah .

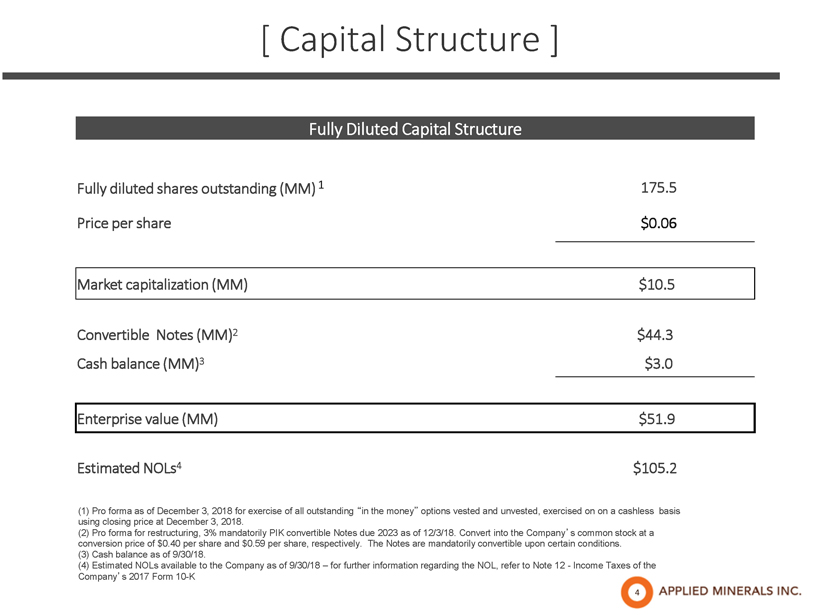

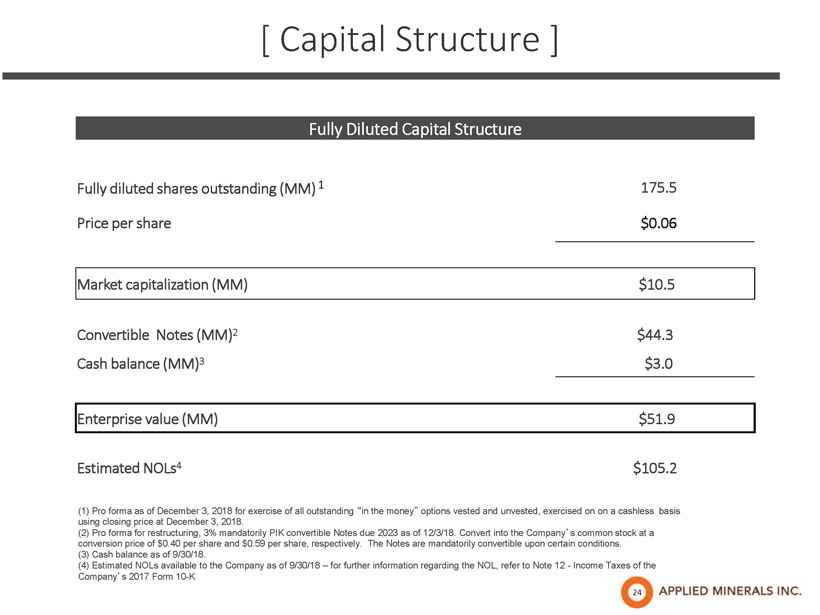

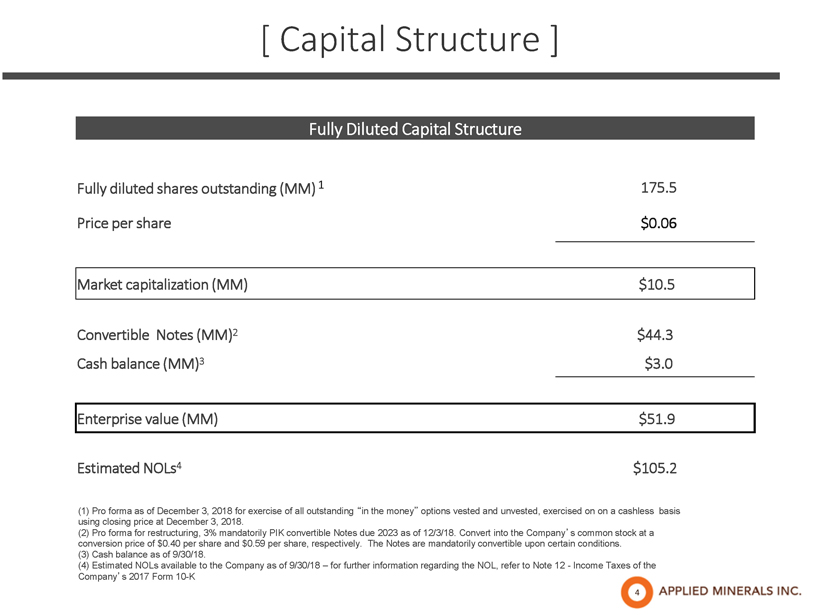

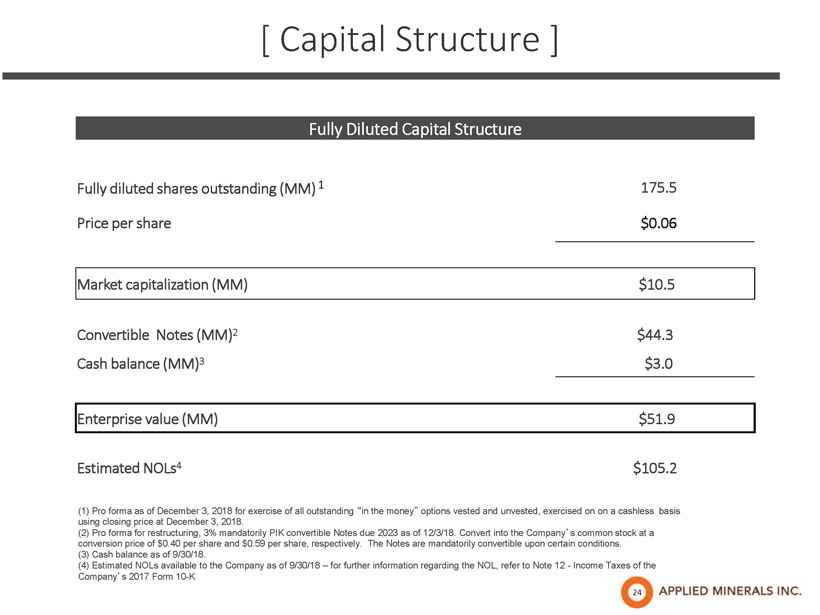

4 4 Fully Diluted Capital Structure Fully diluted shares outstanding (MM) 1 175.5 Price per share $0.06 Market capitalization (MM) $10.5 Convertible Notes (MM) 2 $44.3 Cash balance (MM) 3 $3.0 Enterprise value (MM) $51.9 Estimated NOLs 4 $105.2 (1) Pro forma as of December 3, 2018 for exercise of all outstanding “ in the money ” options vested and unvested, exercised on on a cashless basis using closing price at December 3, 2018. (2) Pro forma for restructuring, 3% mandatorily PIK convertible Notes due 2023 as of 12/3/18. Convert into the Company ’ s common stock at a conversion price of $0.40 per share and $0.59 per share, respectively. The Notes are mandatorily convertible upon certain co ndi tions. (3) Cash balance as of 9/30/18. (4) Estimated NOLs available to the Company as of 9/30/18 – for further information regarding the NOL, refer to Note 12 - Income Taxes of the Company ’ s 2017 Form 10 - K [ Capital Structure ]

5 5 [ 2018 Milestones ] Enhancement of liquidity profile • Sale of surface “waste” piles for net proceeds of $ 4 . 3 MM plus royalties of additional $ 4 . 3 MM over time • Sale of exploration rights to metallic minerals at significant depth of Dragon property for upfront proceeds of $ 0 . 4 MM plus annual renewal customer fees and 5 % Net Profits Interest Progress in industrial applications pipeline • Multiple customer wins achieved during the year • A number of pipeline opportunities a dvancement for anticipated conversion in 2019 Advancement of project pipeline in new higher value cleantech applications • Progress in development of halloysite into Li - ion battery technology with a focus on silicon anode nanotubes • Engaged energy storage veteran to help drive development of lithium ion battery opportunity • Progress in encapsulated halloysite enhanced food packaging – research consortium commercialization deadline of Jan 2020 ( www.nanopack.eu ) • Lithium - ion battery and food packaging technologies offer large potential markets for halloysite

6 6 [Liquidity Enhancement] Sale of 4.5MM tons of surface piles • Net proceeds of $4.3MM • Ability to receive additional $4.3MM as tonnage is removed • Sold for us e as a natural pozzolan to extend Class F fly ash • Cost to beneficiate surface piles would have limited profitability of selling into high - value target markets Sold Exploration Rights for Metallic Minerals to CMC • Upfront license fee of $350,000 • Annual renewal fees of $150,000 - $250,000 • Granted CMC option to purchase rights for $3.0MM and 5% net profits interest (NPI) • Rights to minerals located at depths significantly below halloysite operations • Will not interfere with AMI ’ s ongoing halloysite / iron oxide operations Proceeds expected to bridge Company to positive cash flow

7 [ Industrial Applications ]

8 8 Pigmentary Technical [ Industrial Applications: Customer and Pipeline Opportunities ]

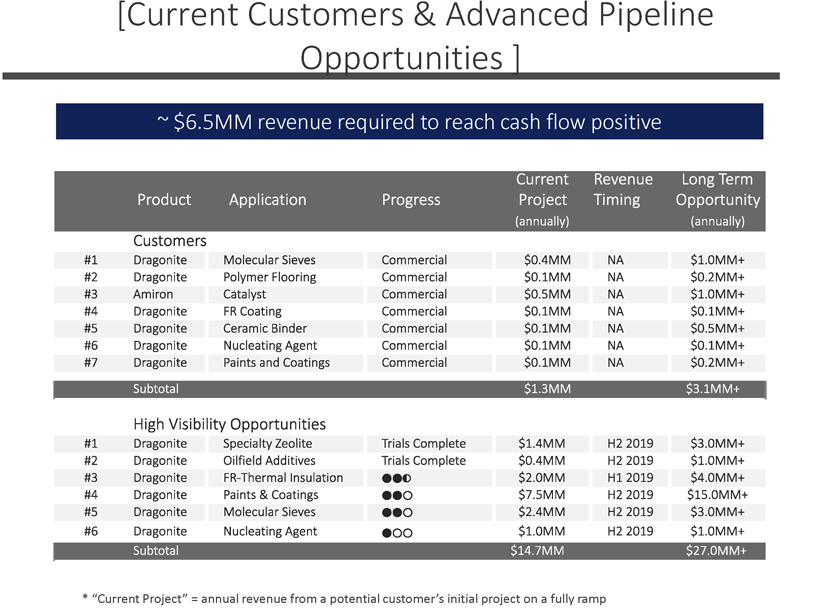

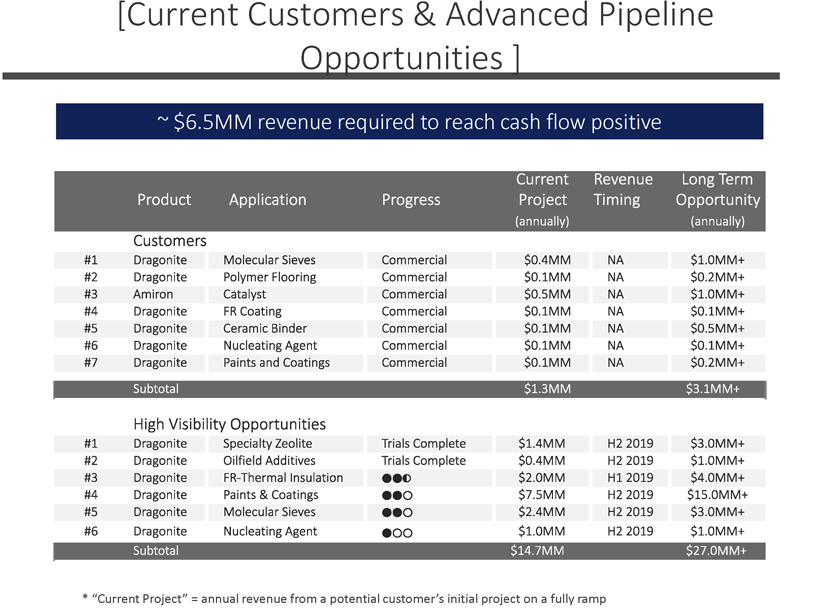

9 9 [Current Customers & Advanced Pipeline Opportunities ] * “ Current Project ” = annual revenue from a potential customer ’ s initial project on a fully ramped basis. ~ $6.5MM revenue required to reach cash flow positive

10 10 Market Size: Zeolite Molecular Sieve Volume Value 2015 1.9M tons $3.2B 2023 2.1M tons $4.4B [ Molecular Sieves ] Product Benefits Improves: • Crush strength • Attrition resistance • Porosity • Selectivity • Yield of end product Commercial Developments • Commercial with global specialty zeolite producer - orders to resume after one year delay • Successful plant trial with 2 nd customer Expected to be commercial 2H 2019 ($1.4MM Rev potential) • 3 rd customer plant trial scheduled 1H 2019 Expected to be commercial 2H 2018 ($2.4MM Rev potential) • Various stages with several other leading companies

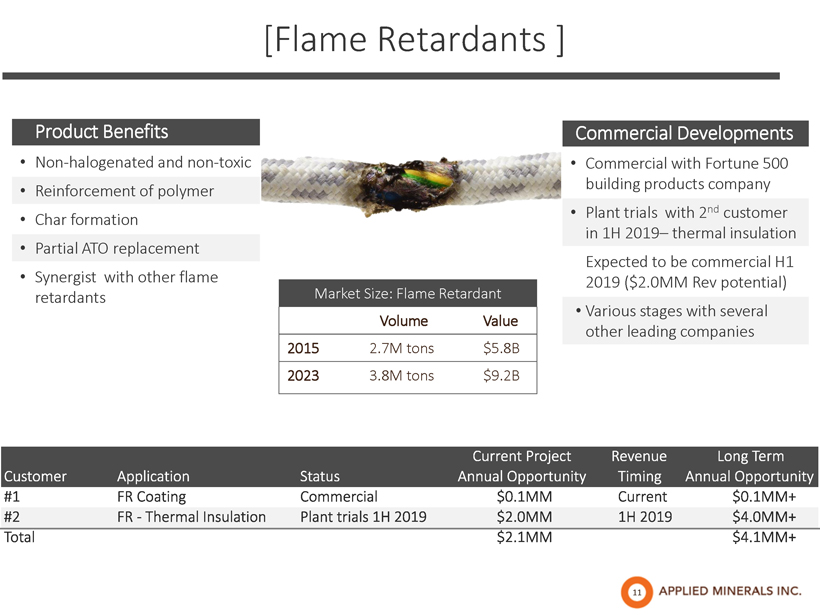

11 11 Market Size: Flame Retardant Volume Value 2015 2.7M tons $5.8B 2023 3.8M tons $9.2B [Flame Retardants ] Product Benefits • Non - halogenated and non - toxic • Reinforcement of polymer • Char formation • Partial ATO replacement • Synergist with other flame retardants Commercial Developments • Commercial with Fortune 500 building products company • Plant trials with 2 nd customer in 1H 2019 – thermal insulation Expected to be commercial H1 2019 ($2.0MM Rev potential) • Various stages with several other leading companies

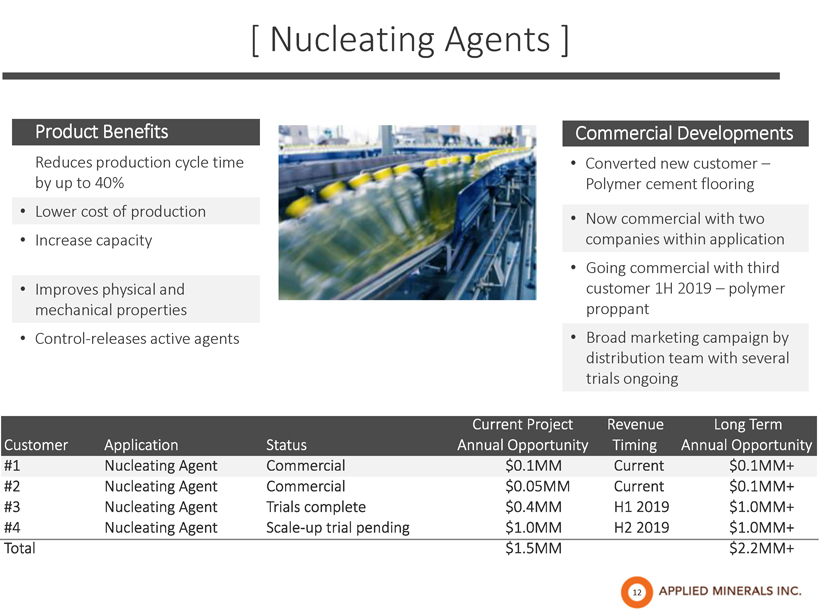

12 12 [ Nucleating Agents ] Product Benefits Reduces production cycle time by up to 40% • Lower cost of production • Increase capacity • Improves physical and mechanical properties • Control - releases active agents Commercial Developments • Converted new customer – Polymer cement flooring • Now commercial with two companies within application • Going commercial with third customer 1H 2019 – polymer proppant • Broad marketing campaign by distribution team with several trials ongoing

13 13 [ BASF Partnership ] Update on Joint Development and Marketing Partnership • In advanced scale up for a $15.0MM opportunity in a paints and coatings application If successful, commercialization anticipated early H2 2019 Leveraging BASF relationships and Technical Expertise • Several other projects ongoing within AMI/BASF joint markets such as honeycomb catalyst supports Update on Toll Manufacture Agreement • Multiple successful production runs for wet beneficiation of Dragonite clay • Helped r educe AMI fixed cost structure and cost of mining • Provides ability to produce enhanced products tailored to specific end markets

14 [ Clean Tech Applications ]

15 [ Encapsulated Halloysite for Enhanced Shelf - Life Food Packaging ]

16 16

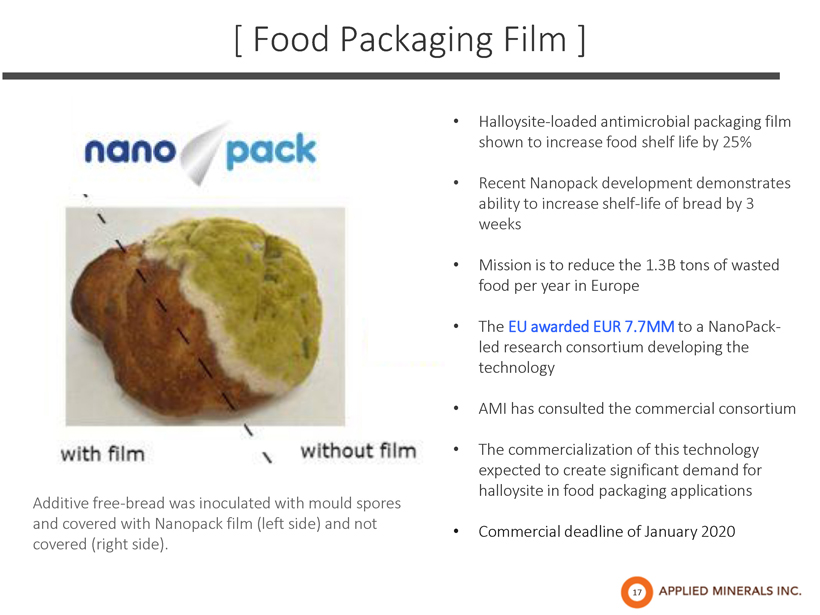

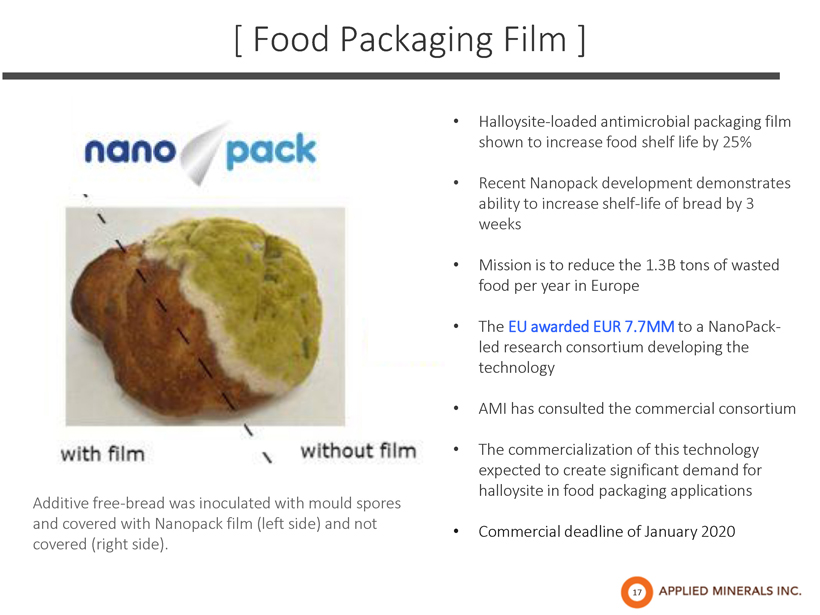

17 17 [ Food Packaging Film ] Additive free - bread was inoculated with mould spores and covered with Nanopack film (left side) and not covered (right side). • Halloysite - loaded antimicrobial packaging film shown to increase food shelf life by 25% • Recent Nanopack development demonstrates ability to increase shelf - life of bread by 3 weeks • Mission is to reduce the 1.3B tons of wasted food per year in Europe • The EU awarded EUR 7.7MM to a NanoPack - led research consortium developing the technology • AMI has consulted the commercial consortium • The commercialization of this technology expected to create significant demand for halloysite in food packaging applications • Commercial deadline of January 2020

18 [Halloysite for Lithium - Ion Batteries ]

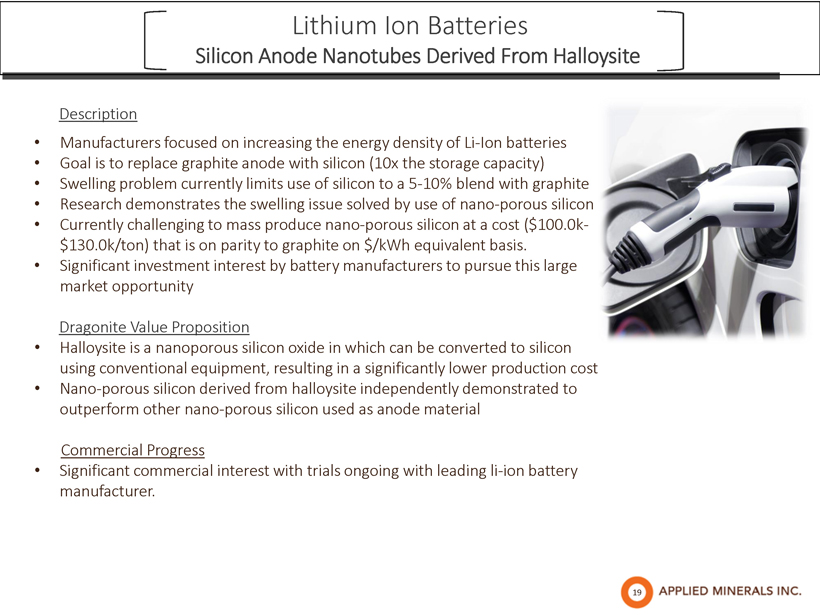

19 19 Description • Manufacturers focused on increasing the energy density of Li - Ion batteries • Goal is to replace graphite anode with s ilicon ( 10x the storage capacity) • Swelling problem currently limits use of s ilicon to a 5 - 10% blend with graphite • Research demonstrates the swelling issue solved by use of nano - porous silicon • Currently challenging to mass produce nano - porous silicon at a cost ($100.0k - $130.0k/ton) that is on parity to graphite on $/kWh equivalent basis. • Significant investment interest by battery manufacturers to pursue this large market opportunity Dragonite Value Proposition • Halloysite is a nanoporous silicon oxide in which can be converted to silicon using conventional equipment, resulting in a significantly lower production cost • Nano - porous silicon derived from halloysite independently demonstrated to outperform other nano - porous silicon used as anode material Commercial Progress • Significant commercial interest with trials ongoing with leading li - ion battery manufacturer. Lithium Ion Batteries Silicon Anode Nanotubes Derived From Halloysite

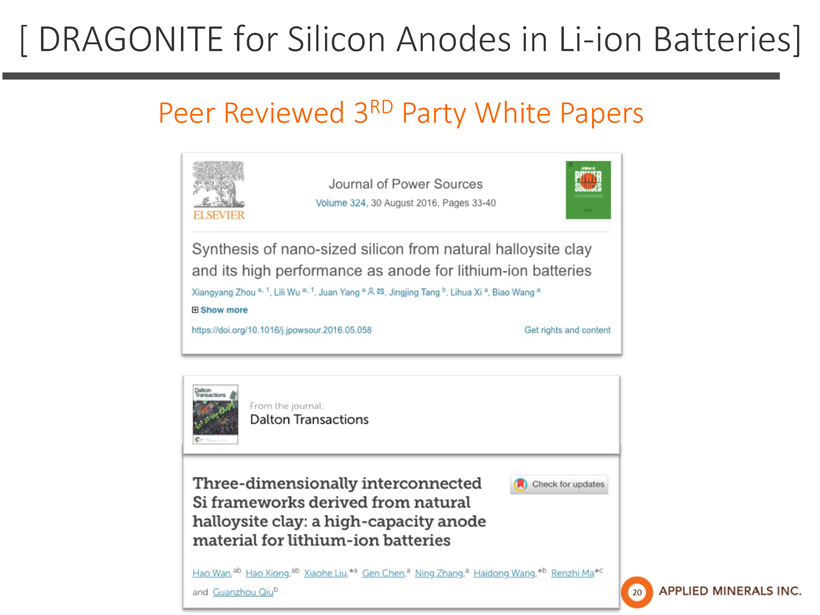

20 20 [ DRAGONITE for Silicon Anodes in Li - ion Batteries] Peer Reviewed 3 RD Party White Papers

21 21 “ Silicon is widely considered to be the next big thing in anode technology, because it has a theoretical charge capacity ten times higher than that of typical graphite anodes . “ It ’ s a race among the battery makers to get more and more silicon in, ” Jeff Dahn, the prominent battery researcher who will begin an exclusive partnership with Tesla in June 2016 , recently told Fortune . ” [ DRAGONITE for Silicon Anodes in Li - ion Batteries] “ In spite of the complex challenges, the sheer number of groups working to solve the problem is very promising . The market for advanced battery technology continues to grow rapidly as prices drop and energy density increases . Unlocking the potential of silicon could give a company the edge needed to become an early leader in the gigantic new industry . ” Click Here for Article

22 22 [ Competitive Landscape: Silicon Anode ] A list of Silicon Anode Focused Startups https:// www.nanalyze.com /2017/03/new - lithium - battery - technology - startups/ AMI provides a public play for new silicon anode technology

23 23 [New Industry Technical Advisor] Engaged Greg Nielson, Ph.D., a leading executive within the field of energy storage and renewable energy • Help drive the commercialization of DRAGONITE halloysite clay for use in a number of lithium - ion battery technologies • Most recently the Chief Scientist of the Solar Technology Department of Vivint Solar, Inc • Pursue commercial partnerships with one or more leading battery technology companies • Expand AMI ’ s portfolio of battery - related IP

24 24 Fully Diluted Capital Structure Fully diluted shares outstanding (MM) 1 175.5 Price per share $0.06 Market capitalization (MM) $10.5 Convertible Notes (MM) 2 $44.3 Cash balance (MM) 3 $3.0 Enterprise value (MM) $51.9 Estimated NOLs 4 $105.2 (1) Pro forma as of December 3, 2018 for exercise of all outstanding “ in the money ” options vested and unvested, exercised on on a cashless basis using closing price at December 3, 2018. (2) Pro forma for restructuring, 3% mandatorily PIK convertible Notes due 2023 as of 12/3/18. Convert into the Company ’ s common stock at a conversion price of $0.40 per share and $0.59 per share, respectively. The Notes are mandatorily convertible upon certain co ndi tions. (3) Cash balance as of 9/30/18. (4) Estimated NOLs available to the Company as of 9/30/18 – for further information regarding the NOL, refer to Note 12 - Income Taxes of the Company ’ s 2017 Form 10 - K [ Capital Structure ]

25 Concluding Remarks Q & A

26 26 Thank you for your attendance

27 27 27 [ Appendix ]

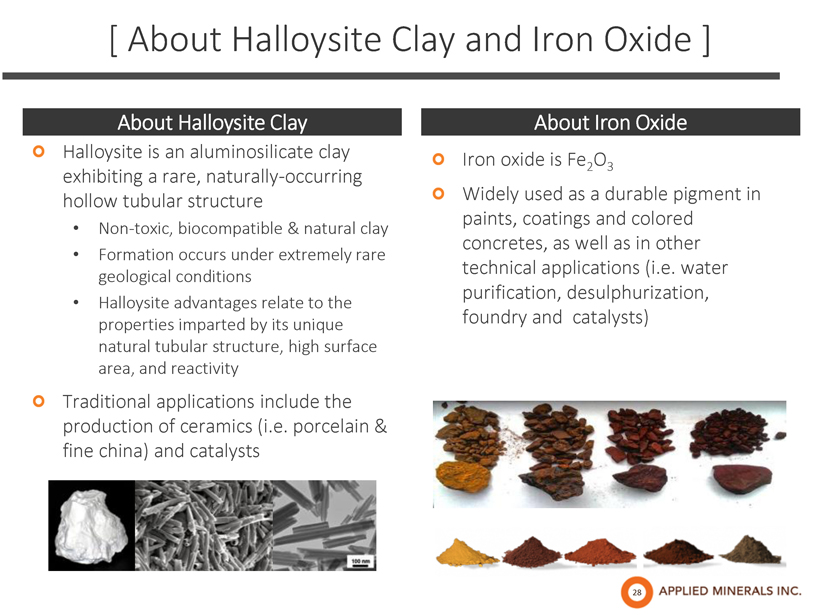

28 28 Halloysite is an aluminosilicate clay exhibiting a rare, naturally - occurring hollow tubular structure • Non - toxic, biocompatible & natural clay • Formation occurs under extremely rare geological conditions • H alloysite advantages relate to the properties imparted by its unique natural tubular structure, high surface area, and reactivity Traditional applications include the production of ceramics (i.e. porcelain & fine china) and catalysts Iron oxide is Fe 2 O 3 Widely used as a durable pigment in paints, coatings and colored concretes, as well as in other technical applications (i.e. water purification, desulphurization, foundry and catalysts) About Halloysite Clay About Iron Oxide [ About Halloysite Clay and Iron Oxide ]

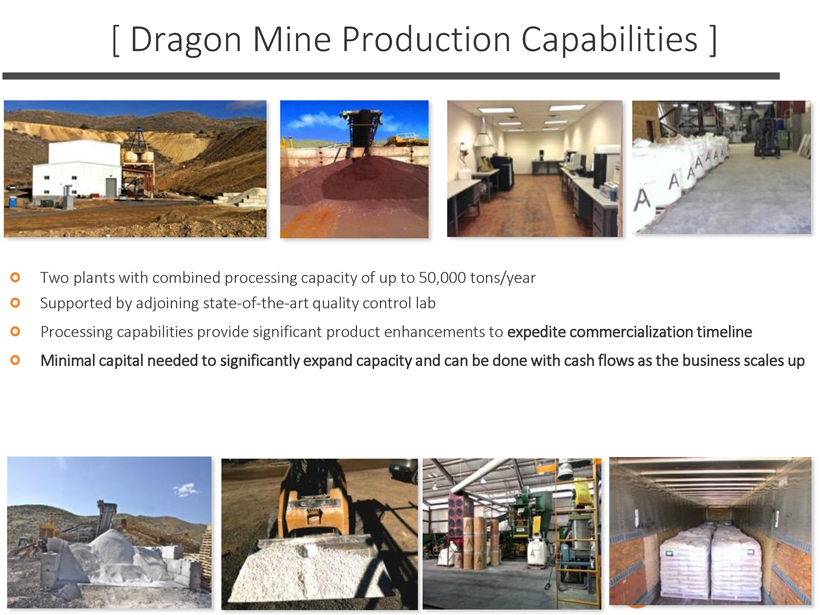

29 29 Two plants with combined processing capacity of up to 50,000 tons/year Supported by adjoining state - of - the - art quality control lab Processing capabilities provide significant product enhancements to expedite commercialization timeline Minimal capital needed to significantly expand capacity and can be done with cash flows as the business scales up [ Dragon Mine Production Capabilities ]

30 30 [ Dragon Mine Operation - Silver City, Utah ]

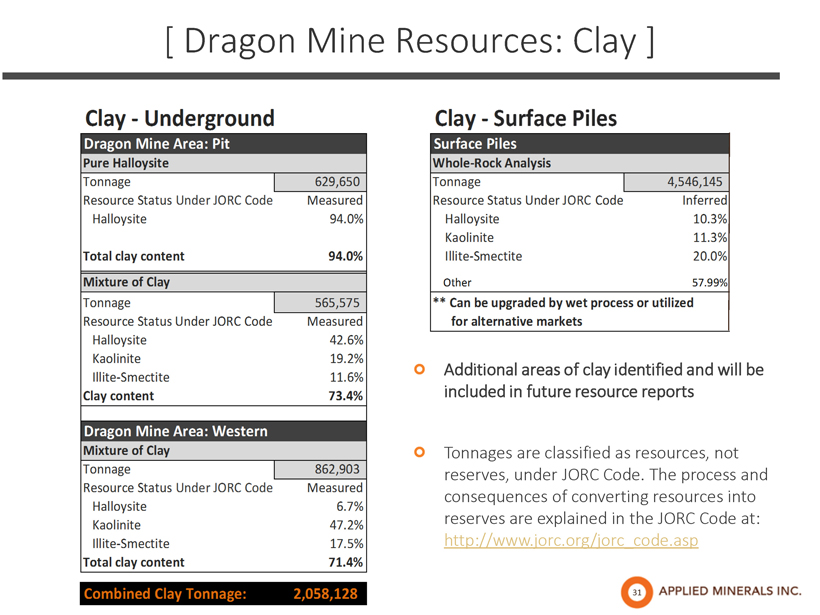

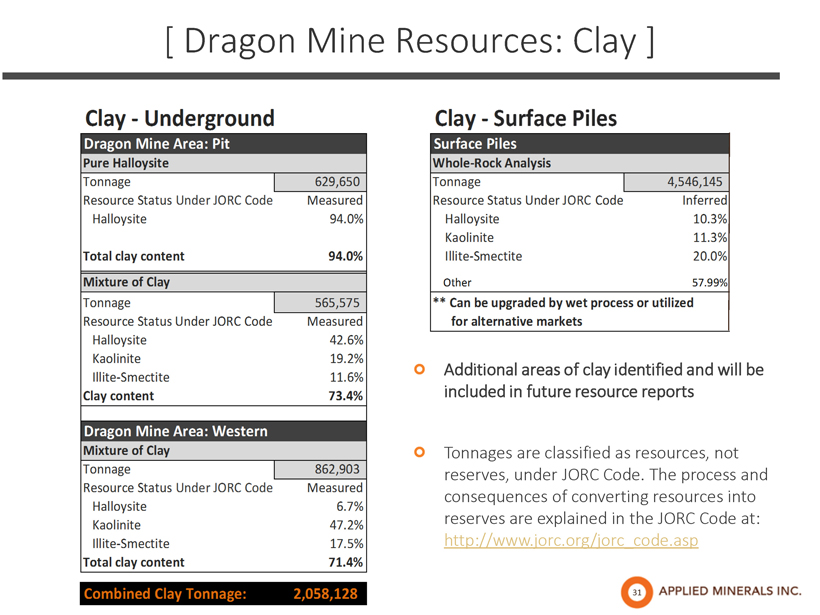

31 31 [ Dragon Mine Resources: Clay ] Additional areas of clay identified and will be included in future resource reports Tonnages are classified as resources, not reserves, under JORC Code. The process and consequences of converting resources into reserves are explained in the JORC Code at: http://www.jorc.org/jorc_code.asp

32 32 Tonnages are classified as resources, not reserves, under JORC Code. The process and consequences of converting resources int o r eserves are explained in the JORC Code at: http://www.jorc.org/jorc_code.asp [ Dragon Mine Resource: Iron oxide ]

33 33 Exclusive Territory: Western and Southwestern United States Products Represented: Dragonite and Amiron Specialty Markets: Paints and coatings, polymer composites, flame retardants, controlled release, env. remediation, agriculture, catalysts and molecular sieves, and cosmetics Exclusive Territory: Midwestern United States Products Represented: Dragonite and Amiron Specialty Markets: Paints and coatings, graphic arts, adhesives, polymer composites, rubber, agriculture, concrete admixtures, and other related markets Exclusive Territory: Eastern and Southern United States, Asia (excluding Japan) Products Represented: Dragonite Specialty Markets: Coatings, adhesives, sealants, elastomers, construction, personal care, lubricants, agriculture, pharma,urethanes [ Sales & Distribution Infrastructure ] (Acquired KODA) Exclusive Territory: Japan Products Represented: Dragonite Specialty Markets: Coatings, automotive, catalysts, plastics, rubber and ceramics

34 34 Lithium Ion Batteries Other Commercial Opportunities for Dragonite Conventional Li - ion electrolytes Description Liquid or gel - based chemical solution that enables the flow of ions (electrical charge) between a battery's anode and cathode material Dragonite Value Proposition • Increases the energy capacity of the battery • Improves its thermal stability • $4.5B market (150,000 tons) Solid Polymer Electrolytes Description Key component in the commercialization of an all solid - state Li - ion battery ("ASSLB ” ), the next generation of technology capable of providing the size, energy storage and safety required by electric vehicle manufacturers. Dragonite Value Proposition • Provides cost - effective conductivity over a wide range of operating temperatures • Provides the storage capacity required by the electric vehicle industry • $100MM market

35 35 A list of Solid State & Li - Sulfur Battery Focused Startups [Competitive Landscape: Solid State & Li - Sulfur Batteries ] Source : https://www.nanalyze.com/2017/03/new - lithium - battery - technology - startups/ AMI provides a public play for solid state battery technology

36 36 Andre M. Zeitoun – President, Chief Executive Officer, and Director 16+ years investing in operational turnarounds with a focus on early stage, emerging growth industries – most recently as a Portfolio Manager with SAC Capital/Cr Intrinsic Investors Responsible for executing the turnaround and rebranding of the Company and its products Successfully led the Company from exploration stage to commercialization Brian Newsome – Head of Sales 20 years of sales experience Previously Sales Manager at BASF Corporation responsible for specialty kaolin sales to paint, coatings, plastics, and rubber markets Chris Carney – Chief Financial Officer 9 years with Applied Minerals in both CFO and Business Development capacity MBA in Finance from Tulane University [Management Team ]

37 37 [ Board of Directors ] Bob Betz – Independent Board Member 50 years industry experience Former President of Henkel Corp North America, Chemicals and Cognis Gmbh, NA. Mario Concha – Chairman of the Board - Independent Board Member 50 years industry experience 7 years as President of Georgia Pacific, Chemicals Division ($1.0B revenue) John Levy – Vice Chairman of the Board – Independent Board Member CEO for Board Advisory – a consulting firm that assists public companies (or companies aspiring to be public) with corporate governance, corporate compliance, financial reporting and financial strategies 30 years of progressive financial, accounting, and business experience CPA with national public accounting firms Ernst & Young, Laventhol & Horwath, and Grant Thornton Ali Zamani – Independent Board Member Portfolio Manager at Gefinor Capital Management and Chief Investment Officer of the GEF Opportunities Fund Background in Portfolio Management at Goldman Sachs with a focus on the energy, materials, utilities and industrials sectors Andre Zeitoun – President, CEO See management bio Alex Zyngier – Independent Board Member Founder and Managing Director of Batuta Capital Advisors, a merchant bank focused on advising/investing in event driven situations Background in finance and consulting: Alden Global/Smith, Goldman Sachs, Deutsche Bank, a McKinsey & Co B.S. in Chemical Engineering and MBA

38 38 [ Board of Directors ] Michael Barry – Board Member Serves as General Counsel and Chief Compliance officer at Samlyn Capital. Prior to Samlyn, Mr. Barry was a Partner at the law firm, Mintz Levin from 2000 - 2009. Michael Pohly – Board Member Serves as Portfolio Manager at Kingdon Capital Management, LLC. Mr. Pohly spent 17 years at Morgan Stanley and ran fixed income and derivatives trading for its prop desk. He joined Kingdon Capital Management in 2009.

39 39 [ Contact Information ] Applied Minerals, Inc. 55 Washington Street, Suite 301 Brooklyn, NY 11201 Phone: 800 - 356 - 6463 www.appliedminerals.com Halloysite Clay