As filed with the Securities and Exchange Commission on January 22, 2024

Securities Act File No. 333-275923

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

| | |

| THE SECURITIES ACT OF 1933 | | ☒ |

| PRE-EFFECTIVE AMENDMENT NO. 1 | | ☒ |

| POST-EFFECTIVE AMENDMENT NO. | | ☐ |

Sanford C. Bernstein Fund, Inc.

(Exact Name of Registrant as Specified in Charter)

1345 Avenue of the Americas

New York, New York 10105

(Address of Principal Executive Offices)

(212) 756-4097

(Registrant’s Telephone Number)

Nancy E. Hay, Esq.

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Copy to:

Margery K. Neale, Esq.

P. Jay Spinola, Esq.

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New York, New York 10019-6099

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933.

Title of the securities being registered: Class 1 and Class 2 shares of common stock, par value $0.001 per share, of Tax-Aware Overlay B Portfolio, a series of the Registrant.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Calculation of Registration Fee under the Securities Act of 1933: No filing fee is due because the Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended.

EXPLANATORY NOTE

This Registration Statement is organized as follows:

| 1. | Letter to Shareholders of Tax-Aware Overlay C Portfolio and Tax-Aware Overlay N Portfolio. |

| 2. | Questions and Answers for Shareholders of Tax-Aware Overlay C Portfolio and Tax-Aware Overlay N Portfolio. |

| 3. | Prospectus/Information Statement regarding the reorganizations of Tax-Aware Overlay C Portfolio and Tax-Aware Overlay N Portfolio into Tax-Aware Overlay B Portfolio. |

| 4. | Statement of Additional Information regarding the reorganizations of Tax-Aware Overlay C Portfolio and Tax-Aware Overlay N Portfolio into Tax-Aware Overlay B Portfolio. |

| 5. | Part C: Other Information |

TAX-AWARE OVERLAY C PORTFOLIO

and

TAX-AWARE OVERLAY N PORTFOLIO

1345 Avenue of the Americas

New York, New York 10105

[●], 2024

Dear Shareholder:

I am writing to inform you about a reorganization that will affect your investment in the following funds:

| | • | | Tax-Aware Overlay C Portfolio and |

| | • | | Tax-Aware Overlay N Portfolio (together, the “Acquired Portfolios,” and each, an “Acquired Portfolio”) |

The Acquired Portfolios are each a series of Sanford C. Bernstein Fund, Inc. (the “SCB Fund”), a Maryland corporation. As provided in an Agreement and Plan of Reorganization (the “Plan”), and discussed in the accompanying Prospectus/Information Statement, each of the Acquired Portfolios will be reorganized (each, a “Reorganization” and together, the “Reorganizations”) into Tax-Aware Overlay B Portfolio (the “Acquiring Portfolio”), also a series of the SCB Fund. Both the Acquired Portfolios and the Acquiring Portfolio are advised by AllianceBernstein L.P. (the “Manager”).

The Acquired Portfolios and the Acquiring Portfolio are each referred to as a “Portfolio” and collectively referred to as the “Portfolios.” When referencing activities following the completion of the Reorganizations, the Acquiring Portfolio may be referred to as the “Combined Portfolio.”

The Board of Directors of the SCB Fund (the “Board”) has determined that the Reorganizations are in the best interests of the Portfolios and concluded that the interests of the shareholders of the Portfolios will not be diluted as a result of the Reorganizations. The Board has also determined that the Reorganizations will not have a material adverse effect on the shareholders of each share class of each Portfolio participating in the Reorganizations.

The enclosed Prospectus/Information Statement contains important information about the Reorganizations. As a result of the Reorganizations, you will receive shares (including fractional shares, if any) of the same class in the Acquiring Portfolio with the same aggregate net asset value as the shares of the Acquired Portfolio you own immediately prior to the applicable Reorganization.

Combining each Acquired Portfolio’s assets with the Acquiring Portfolio’s assets in the applicable Reorganization will consolidate similarly managed funds, creating efficiencies and a larger asset base over which expenses may be spread. The Board has determined that shareholders of each Acquired Portfolio may benefit from the following:

| | • | | the continuity of management, as the Acquiring Portfolio has the same Directors, the same Manager and portfolio management team, and the same service providers, including the same distributors, custodian, transfer agent and accounting agent, as those of the Acquired Portfolios; |

| | • | | that the Portfolios have identical investment objectives and substantially similar principal investment strategies and risks; |

| | • | | that shareholders will remain invested in a portfolio that seeks to manage the volatility of a fixed-income-oriented asset allocation over the long term; |

| | • | | the potential for certain investment efficiencies, as the Combined Portfolio could have the ability to trade in larger positions or negotiate more favorable transaction terms than either Acquired Portfolio; |

| | • | | that certain fixed costs (e.g., printing and mailing of stockholder reports, legal expenses, audit fees and other expenses) would be spread across the larger asset base of the Combined Portfolio, which is expected to result in lower overall expenses over time; |

| | • | | that the Portfolios have identical investment advisory agreements and pay management fees at the same rate; |

| | • | | that each Reorganization is intended to be a tax-free reorganization within the meaning of the regulations under Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”). This means that it is intended that shareholders of an Acquired Portfolio will become shareholders of the Acquiring Portfolio without realizing any gain or loss for federal income tax purposes as a result of the applicable Reorganization itself; and |

| | • | | that the Acquired Portfolios have shrunk in total assets, are expected to shrink further, and may not be economically viable as stand-alone Portfolios. |

The Board also noted that as a result of the Reorganizations and the Acquiring Portfolio’s restriction to invest no more than 25% of its total assets in municipal securities of issuers located in any one state, it was expected that the benefit to Acquired Portfolio shareholders of any state tax exemption from investing in an Acquired Portfolio that invests significantly in municipal securities of a particular state would be lost or largely unavailable.

NO SHAREHOLDER ACTION IS REQUIRED AS A RESULT OF THE REORGANIZATIONS.

In accordance with the Portfolios’ operative documents, and applicable Maryland state and U.S. federal law (including Rule 17a-8 under the Investment Company Act of 1940, as amended), the Reorganizations may be effected without the approval of shareholders of any Portfolio.

I encourage you to carefully review the enclosed materials, which explain the Reorganizations in more detail. If you have any questions or need additional information, please contact your Bernstein financial advisor or call (212) 486-5800.

Alexander Chaloff

President

TAX-AWARE OVERLAY C PORTFOLIO

and

TAX-AWARE OVERLAY N PORTFOLIO

1345 Avenue of the Americas

New York, New York 10105

QUESTIONS AND ANSWERS

The following questions and answers provide an overview of key features of the proposed reorganizations and of the information contained in the attached combined Prospectus and Information Statement (“Prospectus/Information Statement”).

1. What is this document and why was it sent to you?

The attached Prospectus/Information Statement provides you with information about the Agreement and Plan of Reorganization (the “Plan”), whereby each of the Tax-Aware Overlay C Portfolio and the Tax-Aware Overlay N Portfolio (each, an “Acquired Portfolio” and together, the “Acquired Portfolios”), each a series of Sanford C. Bernstein Fund, Inc. (the “SCB Fund”), a Maryland corporation, will transfer all of its assets and liabilities to the Tax-Aware Overlay B Portfolio (the “Acquiring Portfolio”), also a series of the SCB Fund, in exchange for shares of the Acquiring Portfolio, after which each Acquired Portfolio will be liquidated and terminated (together, the “Reorganizations,” and each, a “Reorganization”).

The Acquired Portfolios and the Acquiring Portfolio are each referred to as a “Portfolio” and collectively referred to as the “Portfolios.” When referencing activities following the completion of the Reorganizations, the Acquiring Portfolio may be referred to as the “Combined Portfolio.”

On October 25-26, 2023, the Board of Directors of the SCB Fund (the “Directors”) unanimously approved the Reorganizations and declared each Reorganization to be in the best interests of the applicable Portfolios, and that the interests of each Portfolio’s shareholders will not be diluted as a result of the Reorganizations. The Board has also determined that the Reorganizations will not have a material adverse effect on the shareholders of each share class of each Portfolio participating in the Reorganizations.

2. Do I need to vote for the Reorganization?

No. No vote of shareholders will be taken with respect to the Reorganizations. THE PORTFOLIOS ARE NOT ASKING FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY TO THE PORTFOLIOS WITH RESPECT TO THE REORGANIZATIONS.

3. Do the Portfolios have similar investment objectives and principal investment strategies?

Yes. The investment objectives of the Acquired Portfolios and the Acquiring Portfolio are identical. The investment objective of each Portfolio is to manage the volatility of a fixed-income-oriented asset allocation over the long term, as part of an investor’s overall asset allocation managed by Bernstein Private Wealth Management of AllianceBernstein L.P.

The principal investment strategies (and the principal risks) of the Acquired Portfolios and the Acquiring Portfolio are substantially similar.

The Acquired Portfolios and the Acquiring Portfolio primarily invest in taxable or municipal fixed-income securities. For each Portfolio, AllianceBernstein L.P. (the “Manager”) employs tax management strategies in an attempt to reduce the impact of taxes on shareholders in the respective Portfolio. A substantial portion of the

i

Tax-Aware Overlay N Portfolio’s investments are comprised of New York State municipal securities, and a substantial portion of the Tax-Aware Overlay C Portfolio’s investments are comprised of California municipal securities. The Acquiring Portfolio invests no more than 25% of its total assets in municipal securities of issuers located in any one state. Each Portfolio may invest in non-municipal securities when, in the opinion of the Manager, the inclusion of such non-municipal security will enhance the expected after-tax return of the Portfolio in accordance with the Portfolio’s investment objectives. Because the Tax-Aware Overlay N Portfolio invests significantly in New York State municipal securities, and the Tax-Aware Overlay C Portfolio invests significantly in California municipal securities, shareholders of these Portfolios who live in New York or California and hold shares of the Tax-Aware Overlay N Portfolio or the Tax-Aware Overlay C Portfolio, respectively, may experience larger taxable distributions as a result of the Reorganizations because the Combined Portfolio is expected to hold a smaller proportion of New York or California municipal securities than the applicable Acquired Portfolio. Shareholders should consult their tax advisors in considering how an increase in state or local taxable income may impact their investment goals.

The performance benchmarks for the Acquired Portfolios and the Acquiring Portfolio are the same. The primary benchmark for each Portfolio is the Bloomberg 5-Year General Obligation Municipal Bond Index. Each Portfolio also compares its performance to the same composite benchmark, which is a customized benchmark that uses index returns to represent performance of certain classes. The composite benchmark for each Portfolio is 19% Russell 3000, 11% MSCI ACWI ex USA IMI (net), 42% Bloomberg 1-10 Year Municipal Bond, 28% Bloomberg 1-10 Year US TIPS.

4. What is the purpose of the Reorganizations and what did the Directors consider?

The purpose of the Reorganizations is to transfer all the assets and liabilities of each of the Acquired Portfolios to the Acquiring Portfolio. The Manager proposed the Plan to the Directors, in part, to allow shareholders the potential to realize the benefits offered by the larger Combined Portfolio. As discussed in the Prospectus/Information Statement, the Board determined that shareholders of each Acquired Portfolio may benefit from the following:

| | • | | the continuity of management, as the Acquiring Portfolio has the same Directors, the same Manager and portfolio management team, and the same service providers, including the same distributors, custodian, transfer agent and accounting agent, as those of the Acquired Portfolios; |

| | • | | that the Portfolios have identical investment objectives and substantially similar principal investment strategies and risks; |

| | • | | that shareholders will remain invested in a portfolio that seeks to manage the volatility of a fixed-income-oriented asset allocation over the long term than either Acquired Portfolio; |

| | • | | the potential for certain investment efficiencies, as the Combined Portfolio could have the ability to trade in larger positions or negotiate more favorable transaction terms; |

| | • | | that certain fixed costs (e.g., printing and mailing of stockholder reports, legal expenses, audit fees and other expenses) would be spread across the larger asset base of the Combined Portfolio, which is expected to result in lower overall expenses over time; |

| | • | | that the Portfolios have identical investment advisory agreements and pay management fees at the same rate; and |

| | • | | that each Reorganization is intended to be a tax-free reorganization within the meaning of the regulations under Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”). This means that it is intended that shareholders of an Acquired Portfolio will become shareholders of the Acquiring Portfolio without realizing any gain or loss for federal income tax purposes as a result of the applicable Reorganization itself; and |

| | • | | that the Acquired Portfolios have shrunk in total assets, are expected to shrink further, and may not be economically viable as stand-alone Portfolios. |

ii

The Board also noted that as a result of the Reorganizations and the Acquiring Portfolio’s restriction to invest no more than 25% of its total assets in municipal securities of issuers located in any one state, it was expected that the benefit to Acquired Portfolio shareholders of any state tax exemption from investing in an Acquired Portfolio that invests significantly in municipal securities of a particular state would be lost or largely unavailable.

5. How will the Reorganizations work?

The Plan, among other things, provides for:

| | • | | the transfer of all of the assets of each Acquired Portfolio to the Acquiring Portfolio and the assumption by the Acquiring Portfolio of the liabilities of each Acquired Portfolio in exchange for shares of common stock, par value $0.001 per share, of the Acquiring Portfolio; |

| | • | | the distribution of the shares of the Acquiring Portfolio received by each Acquired Portfolio to shareholders of the Acquired Portfolio; and |

| | • | | the liquidation and termination of each Acquired Portfolio. |

6. How will the Reorganizations affect shareholders of the Acquired Portfolios?

You will receive whole and fractional shares of equal dollar value of the Acquiring Portfolio as follows:

| | |

If you own the following Acquired Portfolio shares: | | You will receive the following Acquiring Portfolio shares: |

| Class 1 | | Class 1 |

| Class 2 | | Class 2 |

No sales charge will be imposed on the shares of the Acquiring Portfolio received by shareholders of an Acquired Portfolio in connection with the Reorganizations.

7. When will the Reorganizations take place?

Each Reorganization is expected to take place on or around February 23, 2024.

8. Who manages the Portfolios?

AllianceBernstein L.P. serves as the investment manager to each of the Acquired Portfolios and the Acquiring Portfolio. As of September 30, 2023, the Manager managed assets totaling approximately $669 billion, of which over $131 billion represented assets of registered investment companies sponsored by the Manager. The 28 registered investment companies managed by the Manager, comprising approximately 94 separate investment portfolios, had approximately 2.7 million shareholder accounts (as of September 30, 2023).

The day-to-day management of, and investment decisions for, each Portfolio are made by Alexander Barenboym, Daniel J. Loewy and Caglasu Altunkopru.

Mr. Barenboym is a Senior Vice President of the Manager, with which he has been associated in a similar capacity to this current position since prior to 2018. Mr. Loewy is a Senior Vice President of the Manager, Chief Investment Officer and Head of Multi-Asset Solutions, and Chief Investment Officer of Dynamic Asset Allocation. Mr. Loewy has been associated with the Manager in similar capacities since prior to 2018. Ms. Altunkopru is a Senior Vice President of the Manager, with which she has been associated since prior to 2018. It is expected that Alexander Barenboym, Daniel J. Loewy and Caglasu Altunkopru will continue to manage the Combined Portfolio following the Reorganizations.

The Acquired Portfolios are overseen by the same Directors as the Acquiring Portfolio.

iii

9. How will the Reorganizations affect the management fees and expenses?

The Acquired Portfolios and the Acquiring Portfolio pay management fees at the same fee rate of 0.65% of the average daily net assets of each Portfolio. As further discussed in the “Fees and Expenses” section of the Prospectus/Information Statement beginning on page 8, the total annual fund operating expenses borne by current shareholders in each class of each Acquired Portfolio are expected to decrease following the Reorganizations. In light of anticipated economies of scale that may be realized by being part of a larger, combined fund, the Acquiring Portfolio may experience a positive impact on performance. However, there can be no guarantee regarding future performance and shareholders in the combined Acquiring Portfolio may lose money.

10. Who is paying the expenses of the Reorganizations?

As further described in the “Expenses Resulting from the Reorganizations” section of the Prospectus/Information Statement beginning on page 43, the total costs and expenses of the Reorganizations are estimated to be approximately $195,132 and each Portfolio will bear an equal portion of the costs and expenses of the Reorganizations, which are estimated to be approximately $65,044 for each Portfolio. However, because of contractual caps on expenses provided by the Manager to each of the Tax-Aware Overlay C Portfolio and the Tax-Aware Overlay N Portfolio, the Manager will effectively bear the expenses of the Reorganizations otherwise to be borne by the Acquired Portfolios, assuming Portfolio expenses exceed the expense caps currently granted by the Manager, which is expected to be the case. As of the date of this Prospectus/Information Statement, it is anticipated that transaction costs of approximately $11,910, or 0.01% of the net assets of the Tax-Aware Overlay C Portfolio, and $10,011, or 0.01% of the net assets of the Tax-Aware Overlay N Portfolio, will be incurred by the respective Acquired Portfolio and its shareholders to reposition its portfolio in connection with the Reorganizations. It is estimated that 23% of the net assets of the Tax-Aware Overlay C Portfolio and 24% of the net assets of the Tax-Aware Overlay N Portfolio will be sold in connection with the Reorganizations. These estimated transaction costs are not included in the estimated $195,132 in total costs and expenses of the Reorganizations referenced above. Additionally, the Acquired Portfolios will bear any market impact costs at the time such portfolio securities are sold.

11. Who do I call if I have questions about the Reorganizations?

If you have any questions about the Reorganizations, please call your Bernstein advisor at (212) 486-5800 (as applicable), or you may call AllianceBernstein Investor Services, Inc. toll-free at (800) 221-5672 from 9:00 a.m. to 5:00 p.m. Eastern time.

12. Do I need to take any action in connection with the Reorganization?

No. You will automatically receive shares of the Acquiring Portfolio and your shares of the applicable Acquired Portfolio will automatically be redeemed on the date of the completion of the Reorganizations. You will receive written confirmation that this change has taken place. No certificates for shares will be issued in connection with the Reorganizations. The aggregate net asset value (“NAV”) of the Acquiring Portfolio shares you receive in the Reorganizations will be equal to the aggregate NAV of the shares you own in the applicable Acquired Portfolio immediately prior to the Reorganizations.

13. Where may I find additional information regarding the Acquired Portfolios and the Acquiring Portfolio?

Additional information relating to the Acquired Portfolios and the Acquiring Portfolio has been filed with the Securities and Exchange Commission (“SEC”) and can be found in the following documents, which are incorporated into the Prospectus/Information Statement by reference:

| | • | | The Statement of Additional Information (“SAI”), dated January [●], 2024, that has been filed with the SEC in connection with this Prospectus/Information Statement; |

iv

| | • | | The Prospectus and SAI for the Acquiring Portfolio, dated January 27, 2023, as supplemented through the date of this Prospectus/Information Statement, only insofar as it relates to the Acquiring Portfolio (SEC File No. 33-21844); |

v

Copies of the annual reports to shareholders of the Acquired Portfolios and the Acquiring Portfolio are available, along with the Prospectus/Information Statement and SAI, upon request, without charge, by writing to the address or calling the telephone number listed below:

| | |

By mail: | | c/o AllianceBernstein Investor Services, Inc. P.O. Box 786003 San Antonio, TX 78278-6003 |

| |

By phone: | | (800) 227-4618 |

| |

On the Internet: | | The annual reports of the shareholders of the Acquired Portfolios and the Acquiring Portfolio, and the Prospectus/Information Statement and SAI, are available at www.bernstein.com or www.abfunds.com. |

You may also view or obtain these documents from the SEC:

| | |

In person: | | at the SEC’s Public Reference Room in Washington, DC |

| |

By phone: | | (202) 551-8090 (for information on the operations of the Public Reference Room only) |

| |

By mail: | | Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, DC 20549 (copies may be obtained at prescribed rates) |

| |

On the Internet: | | www.sec.gov |

Important additional information about the Reorganizations is set forth in the accompanying

Prospectus/Information Statement.

Please read it carefully.

vi

The information in this combined Prospectus and Information Statement is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This combined Prospectus and Information Statement is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 22, 2024

INFORMATION STATEMENT

for

TAX-AWARE OVERLAY C PORTFOLIO

and

TAX-AWARE OVERLAY N PORTFOLIO,

and

PROSPECTUS

for

TAX-AWARE OVERLAY B PORTFOLIO

1345 Avenue of the Americas

New York, New York 10105

(212) 756-4097

Dated [●], 2024

Acquisition of the Assets and Assumption of the Liabilities of

Tax-Aware Overlay C Portfolio and Tax-Aware Overlay N Portfolio

By and in Exchange for Shares of Tax-Aware Overlay B Portfolio

This combined Prospectus and Information Statement (“Prospectus/Information Statement”) is being furnished to the shareholders of the Tax-Aware Overlay C Portfolio and the Tax-Aware Overlay N Portfolio (together, the “Acquired Portfolios”), each a series of Sanford C. Bernstein Fund, Inc. (the “SCB Fund”), a Maryland corporation. As provided in an Agreement and Plan of Reorganization (the “Plan”), each of the Acquired Portfolios will be reorganized (each, a “Reorganization” and together, the “Reorganizations”) into Tax-Aware Overlay B Portfolio (the “Acquiring Portfolio”), also a series of the SCB Fund.

The Acquired Portfolios and the Acquiring Portfolio are each referred to as a “Portfolio” and collectively referred to as the “Portfolios.” When referencing activities following the completion of the Reorganizations, the Acquiring Portfolio may be referred to as the “Combined Portfolio.”

The Board of Directors of the SCB Fund (the “Board”) has determined that the Reorganizations are in the best interests of the Portfolios, and that the interests of the shareholders of the Portfolios will not be diluted as a result of the Reorganizations. The Board has also determined that the Reorganizations will not have a material adverse effect on the shareholders of each share class of each Portfolio participating in the Reorganizations.

WE ARE NOT ASKING FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

As a result of the Reorganizations, the Acquired Portfolios will be reorganized into the Acquiring Portfolio and you will become a shareholder of the Acquiring Portfolio. The Acquired Portfolios and the Acquiring Portfolio pursue identical investment objectives and employ substantially similar investment strategies in seeking to achieve their respective investment objectives.

The investment objective of the Portfolios is to manage the volatility of a fixed-income-oriented asset allocation over the long term, as part of an investor’s overall asset allocation managed by Bernstein Private Wealth Management of AllianceBernstein L.P. For more information on each Portfolio’s investment strategies, see “Comparison of Important Features Investment—The Investment Objectives, Strategies and Principal Risks of the Portfolios” below. AllianceBernstein L.P. serves as investment manager (the “Manager”) for the Acquired Portfolios and the Acquiring Portfolio.

Pursuant to the Plan, each Acquired Portfolio will transfer all of its assets to, and all of its liabilities, as defined in the Plan (“liabilities”), will be assumed by, the Acquiring Portfolio, in exchange for shares of common stock, par value $0.001 per share, of the Acquiring Portfolio, which will be distributed to shareholders of the applicable Acquired Portfolio in redemption and cancellation of shares of the Acquired Portfolio and liquidation and termination of the Acquired Portfolio. Following the Reorganizations, shareholders of each Acquired Portfolio will receive shares of the Acquiring Portfolio as follows: holders of Class 1 Shares of the Acquired Portfolio will receive Class 1 Shares of the Acquiring Portfolio, and holders of Class 2 Shares of the Acquired Portfolio will receive Class 2 Shares of the Acquiring Portfolio.

No sales charge will be imposed on the shares of the Acquiring Portfolio received by shareholders of an Acquired Portfolio in connection with the Reorganizations.

Each Reorganization is expected to qualify as a “reorganization” within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended, for federal income tax purposes. See “Certain Federal Tax Consequences of the Reorganizations” below. Shareholders should consult their tax advisers to determine the actual impact of the Reorganizations in light of their individual tax circumstances.

The aggregate net asset value (“NAV”) of the Acquiring Portfolio shares received in the Reorganizations by each Acquired Portfolio will equal the aggregate NAV of the shares of the respective Acquired Portfolio held by such Acquired Portfolio shareholders immediately prior to the Reorganizations. As a result of the Reorganizations, however, a shareholder’s interest will represent a smaller percentage of ownership in the Combined Portfolio than such shareholder’s percentage of ownership in the applicable Acquired Portfolio immediately prior to the Reorganizations.

This Prospectus/Information Statement sets forth concisely the information shareholders of each Acquired Portfolio should know before the Reorganizations and constitutes an offering of shares of the Acquiring Portfolio being issued in the Reorganizations. Please read it carefully and retain it for future reference.

Additional information about the Tax-Aware Overlay B Portfolio has been filed with the Securities and Exchange Commission (“SEC”) and can be found in the following documents:

| | • | | The Prospectus for the Tax-Aware Overlay B Portfolio, dated January 27, 2023, as supplemented through the date of this Prospectus/Information Statement, only insofar as it relates to the Tax-Aware Overlay B Portfolio, filed with the SEC (No. 33-21844) and incorporated by reference into this Prospectus/Information Statement. |

| | • | | The SAI, dated January [●], 2024, relating to this Prospectus/Information Statement (No. 333-275923), which has been filed with the SEC and is incorporated by reference into this Prospectus/Information Statement. |

You may request a free copy of these documents by calling (212) 486-5800 or by writing to the Tax-Aware Overlay B Portfolio at the above address.

Each Portfolio is subject to the informational requirements of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended, and in accordance therewith, files reports, information statements, proxy materials and other information with the SEC. Materials filed with the SEC can be reviewed and downloaded from the SEC’s website at www.sec.gov.

The SEC has not approved or disapproved these securities or passed upon the adequacy of this Prospectus/Information Statement. Any representation to the contrary is a criminal offense.

Mutual fund shares are not deposits or obligations of, or guaranteed or endorsed by, any bank, and are not insured by the Federal Deposit Insurance Corporation or any other U.S. government agency. Mutual fund shares involve investment risks, including the possible loss of principal.

TABLE OF CONTENTS

SUMMARY

The following is a summary of certain information contained elsewhere in this Prospectus/Information Statement, including the Plan. You should read the more complete information in the rest of this Prospectus/Information Statement, including the Plan (attached as Appendix A to this Prospectus/Proxy Statement) and the SAI relating to this Prospectus/Information Statement. This Prospectus/Information Statement is qualified in its entirety by reference to these documents. You should read these materials for more complete information.

Sanford C. Bernstein Fund, Inc. (the “SCB Fund”) is a Maryland corporation and operates as a series company comprised of multiple portfolios, including the Tax-Aware Overlay C Portfolio and the Tax-Aware Overlay N Portfolio (together, the “Acquired Portfolios”), as well as the Tax-Aware Overlay B Portfolio (the “Acquiring Portfolio”).

The Acquired Portfolios and the Acquiring Portfolio are each referred to as a “Portfolio” and collectively referred to as the “Portfolios.” When referencing activities following the completion of the Reorganizations (as defined below), the Acquiring Portfolio may be referred to as the “Combined Portfolio” in this Prospectus/Information Statement.

AllianceBernstein L.P. serves as investment manager (the “Manager”) for the Acquired Portfolios and the Acquiring Portfolio. The Portfolios are intended to be used as part of a broader investment program administered directly by Bernstein Private Wealth Management of AllianceBernstein L.P. and are NOT designed to be used as stand-alone investments. The Portfolios are only available to the Manager’s private clients.

The investment objectives and investment strategies, principal risks, performance, fees and expenses and other comparative information concerning the Acquired Portfolios and the Acquiring Portfolio are discussed below.

Board Approval and Structure of the Reorganizations

The Directors of the SCB Fund (the “Directors”), including all of the Directors who are not “interested persons” of the SCB Fund (the “Independent Directors”) as defined in the Investment Company Act of 1940, as amended (the “1940 Act”), on behalf of the Acquired Portfolios, unanimously determined that the reorganization of each Acquired Portfolio into the Acquiring Portfolio (together, the “Reorganizations,” and each, a “Reorganization”) would be in the best interests of each of the Portfolios.

Pursuant to each Reorganization, all of the assets and liabilities of the applicable Acquired Portfolio will be transferred to the Acquiring Portfolio in exchange for newly issued shares of the Acquiring Portfolio. Each Acquired Portfolio will distribute the Acquiring Portfolio shares it receives to its shareholders in complete liquidation of the Acquired Portfolio, and shareholders of each Acquired Portfolio will become shareholders of the Acquiring Portfolio.

Shareholders of each Acquired Portfolio will receive shares of the Acquiring Portfolio of equal dollar value to their shares held in the applicable Acquired Portfolio immediately prior to the Reorganization. Shareholders will receive the same class of shares of the Acquiring Portfolio as they held in the Acquired Portfolio as illustrated by the following chart:

| | |

| If a shareholder owns the following Acquired Portfolio shares: | | The shareholder will receive the following Acquiring Portfolio shares: |

| | |

| Class 1 | | Class 1 |

| Class 2 | | Class 2 |

In considering the approval of the Agreement and Plan of Reorganization (the “Plan”), the Board requested and evaluated information provided by the Manager regarding the Reorganizations, including, among other information: (1) the potential benefits of the Reorganizations to shareholders because, among other things, the Portfolios have investment strategies that have significant overlap with one another; there will be no change in

5

the Manager or other fund service providers; the Reorganizations will be tax-free from a federal income tax perspective to shareholders of the Acquired Portfolios; and the interests of the Portfolios’ respective shareholders will not be diluted as a result of the Reorganization; (2) a comparison of each Acquired Portfolio’s and the Acquiring Portfolio’s investment objectives, policies (including fundamental investment policies), strategies, and risks; (3) the experience and qualifications of the Manager and key personnel managing the Acquiring Portfolio; (4) the effect of a Reorganization on its respective Acquired Portfolio’s annual operating expenses, including a comparison of each Acquired Portfolio’s and the Acquiring Portfolio’s management fee; (5) the relative historical performance records of each Acquired Portfolio and the Acquiring Portfolio; (6) that there would be no change in shareholder rights; (7) any fees or expenses that will be borne directly or indirectly by an Acquired Portfolio in connection with its Reorganization, including the costs of repositioning the Acquired Portfolio’s portfolio in anticipation of, or as a result of, the Reorganization; (8) the terms and conditions of the Plan and whether the Reorganizations would result in dilution of shareholder interests; (9) the potential benefits of the Reorganizations to other persons, including the Manager and its respective affiliates; and (10) possible alternatives to the Reorganizations. The Board also considered the recommendation of the Manager, discussions with representatives of the Manager, and the Board’s fiduciary duties under federal and state law.

At its meeting held on October 24-25, 2023, the Board, including the Independent Directors, concluded that each Portfolio’s participation in the Reorganizations is in the Portfolios’ best interests, and that the interests of existing shareholders of the applicable Portfolio would not be diluted as a result of the Reorganizations, and approved the Plan. In approving the Reorganizations, the Board considered various factors it deemed relevant, including the following factors, among others, none of which by itself was considered dispositive. The determinations were made on the basis of the business judgment of the Board after consideration of all of the factors taken as a whole, though individual members of the Board may have placed different weight on various factors and assigned different degrees of materiality to various conclusions:

| | • | | the continuity of management, as the Acquiring Portfolio has the same Directors, the same Manager and portfolio management team, and the same service providers, including the same distributors, custodian, transfer agent and accounting agent, as those of the Acquired Portfolios; |

| | • | | that the Portfolios have identical investment objectives and substantially similar principal investment strategies and risks; |

| | • | | that shareholders will remain invested in a portfolio that seeks to manage the volatility of a fixed-income-oriented asset allocation over the long term; |

| | • | | the potential for certain investment efficiencies, as the Combined Portfolio could have the ability to trade in larger positions or negotiate more favorable transaction terms than either Acquired Portfolio; |

| | • | | that certain fixed costs (e.g., printing and mailing of stockholder reports, legal expenses, audit fees and other expenses) would be spread across the larger asset base of the Combined Portfolio, which is expected to result in lower overall expenses over time; |

| | • | | that the Portfolios have identical investment advisory agreements and pay management fees at the same rate; |

| | • | | the potential impact of shareholders of the Acquired Portfolios receiving an increase in distributions that are taxable in their home state as a result of becoming an investor in the Acquiring Portfolio; |

| | • | | that each Reorganization is intended to be a tax-free reorganization within the meaning of the regulations under Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”). This means that it is intended that shareholders of an Acquired Portfolio will become shareholders of the Acquiring Portfolio without realizing any gain or loss for federal income tax purposes as a result of the applicable Reorganization itself; |

| | • | | that the Acquired Portfolios have shrunk in total assets, are expected to shrink further, and may not be economically viable as stand-alone Portfolios. |

6

| | • | | the expected costs of the Reorganizations to the Portfolios; and |

| | • | | that the Manager and its affiliates are expected to benefit from a Reorganization (e.g., administrative and operational efficiencies or a reduction in certain operational expenses as a result of the elimination of the Acquired Portfolios as separate funds). |

The Board also noted that as a result of the Reorganizations and the Acquiring Portfolio’s restriction to invest no more than 25% of its total assets in municipal securities of issuers located in any one state, it was expected that the benefit to Acquired Portfolio shareholders of any state tax exemption from investing in an Acquired Portfolio that invests significantly in municipal securities of a particular state would be lost or largely unavailable.

Comparison of the Acquired Portfolios and Acquiring Portfolio

The investment objectives of the Acquired Portfolios and the Acquiring Portfolio are identical. The principal investment strategies and risks of the Acquired Portfolios and the Acquiring Portfolio are substantially similar.

The Acquired Portfolios and the Acquiring Portfolio primarily invest in taxable or municipal fixed-income securities. For each Portfolio, the Manager employs tax management strategies in an attempt to reduce the impact of taxes on shareholders in the respective Portfolio. A substantial portion of the Tax-Aware Overlay N Portfolio’s investments are comprised of New York State municipal securities, and a substantial portion of the Tax-Aware Overlay C Portfolio’s investments are comprised of California municipal securities. The Acquiring Portfolio invests no more than 25% of its total assets in municipal securities of issuers located in any one state. Each Portfolio may invest in non-municipal securities when, in the opinion of the Manager, the inclusion of such non-municipal security will enhance the expected after-tax return of the Portfolio in accordance with the Portfolio’s investment objectives. Shareholders of the Tax-Aware Overlay N Portfolio and the Tax-Aware Overlay C Portfolio may receive an increase in distributions that are taxable in their home state as a result of becoming an investor in the Acquiring Portfolio. Because the Tax-Aware Overlay N Portfolio invests significantly in New York State municipal securities, and the Tax-Aware Overlay C Portfolio invests significantly in California municipal securities, shareholders of these Portfolios who live in New York or California and hold shares of the Tax-Aware Overlay N Portfolio or the Tax-Aware Overlay C Portfolio, respectively, may experience larger taxable distributions as a result of the Reorganizations because the Combined Portfolio is expected to hold a smaller proportion of New York or California municipal securities than the applicable Acquired Portfolio. Shareholders should consult their tax advisors in considering how an increase in state or local taxable income may impact their investment goals.

The Acquired Portfolios and the Acquiring Portfolio are classified as “diversified” under the Investment Company Act of 1940, as amended (the “1940 Act”).

The performance benchmarks for the Acquired Portfolios and the Acquiring Portfolio are the same. The primary benchmark for each Portfolio is the Bloomberg 5-Year General Obligation Municipal Bond Index. Each Portfolio also compares its performance to the same composite benchmark, which is a customized benchmark that uses index returns to represent performance of certain classes. The composite benchmark for each Portfolio is 19% Russell 3000, 11% MSCI ACWI ex USA IMI (net), 42% Bloomberg 1-10 Year Municipal Bond, 28% Bloomberg 1-10 Year US TIPS.

The Portfolios pay management fees at the same rate: 0.65% of each Portfolio’s average daily net assets, with a total expense ratio cap of 0.90% for Class 1 shares and 0.75% for Class 2 shares of each Portfolio.

Purchase, Redemption and Exchange of Shares

The Portfolios are subject to the same purchase and redemption procedures. The purchase of a Portfolio’s shares is priced at the next-determined net asset value (“NAV”) after your order is received in proper form. For a complete description of purchase procedures, see the section of this Prospectus/Information Statement entitled “Comparison of Purchase and Redemption Procedures” and Appendix B.

7

Class 1 shares of each Portfolio may be exchanged for shares in any other portfolio of the SCB Fund (other than Class 2 shares of the Overlay A Portfolio, the Tax-Aware Overlay A Portfolio, the Overlay B Portfolio, the Tax-Aware Overlay B Portfolio, the Tax-Aware Overlay C Portfolio and the Tax-Aware Overlay N Portfolio of the SCB Fund (collectively, the “Overlay Portfolios”)). Class 2 shares of each Portfolio may be exchanged for shares of the Intermediate Duration Institutional Portfolio of Sanford C. Bernstein Fund II, Inc.

Shares of the Portfolios may be sold by sending a request to Sanford C. Bernstein & Co., LLC (“Bernstein LLC”), along with duly endorsed share certificates, if issued. Orders for redemption given to a bank, broker-dealer or financial institution authorized by a Portfolio are considered received when such third party receives a written request, accompanied by duly endorsed share certificates, if issued. The bank, broker-dealer or other financial institution is responsible for transmitting the order to the Portfolio.

Your sale price will be the next-determined NAV after the Portfolio receives your redemption request in proper form. Each Portfolio expects, under normal circumstances, to use cash or cash equivalents held by the Portfolio to satisfy redemption requests.

Distributions

Each Portfolio will distribute substantially all of its net investment income (interest and dividends less expenses) and realized net capital gains, if any, from the sale of securities to its shareholders.

The Portfolios are subject to the same distribution features. The Portfolios intend to declare and pay dividends at least annually, generally in December. The Portfolios distribute capital gains distributions at least annually, generally in December. Dividends and capital gains distributions, if any, of the Portfolios will be either reinvested in shares of the same Portfolio on which they were paid or paid in cash. The number of shares you receive if you reinvest your distributions is based upon the NAV of the Portfolio on the record date of the distribution. Such reinvestments automatically occur on the payment date of such dividends and capital gains distributions. In the alternative, you may elect in writing, received by Bernstein LLC not less than five business days prior to the record date, to receive dividends and/or capital gains distributions in cash. You will not receive interest on uncashed dividend, distribution or redemption checks.

If you purchase shares shortly before the record date of a distribution, the share price will include the value of the distribution and you may be subject to tax on this distribution when it is received, even though the distribution represents, in effect, a return of a portion of your purchase price.

The Portfolios may distribute ordinary income dividends and/or capital gains distributions.

Distribution Services

Bernstein LLC, a Delaware limited liability company and registered broker-dealer and investment adviser, provides distribution services for each Portfolio pursuant to a Distribution Agreement between the SCB Fund and Bernstein LLC. Bernstein LLC does not charge a fee for these services. Bernstein LLC is a wholly-owned subsidiary of the Manager.

For more information, please see the section of this Proxy Statement/Prospectus entitled “Comparison of Purchase and Redemption Procedures” and Appendix B.

Fees and Expenses

The following tables describe the fees and expenses that shareholders may pay if they hold shares of the Acquired Portfolios, as well as the unaudited pro forma fees and expenses of the Tax-Aware Overlay B Portfolio that will be in effect after consummation of the Reorganizations. The fees and expenses below of the pro forma Tax-Aware Overlay B Portfolio after the Reorganizations are based on expenses of the Tax-Aware Overlay B Portfolio, Tax-Aware Overlay C Portfolio and Tax-Aware Overlay N Portfolio during the twelve months ended

8

September 30, 2023. As each Reorganization is a separate transaction, the tables provided below set out each Reorganization: (1) the Tax-Aware Overlay C Portfolio into the Tax-Aware Overlay B Portfolio; (2) the Tax-Aware Overlay N Portfolio into the Tax-Aware Overlay B Portfolio; and (3) the Tax-Aware Overlay C Portfolio and Tax-Aware Overlay N Portfolio into the Tax-Aware Overlay B Portfolio. The pro forma numbers are estimated in good faith and are hypothetical.

The Tax-Aware Overlay C Portfolio, the Tax-Aware Overlay N Portfolio and the Tax-Aware Overlay B Portfolio each offer Class 1 and Class 2 shares.

It is estimated that shareholders in each class of each Acquired Portfolio would pay lower total annual fund operating expenses in the Combined Portfolio than they would otherwise experience if the Acquired Portfolios remained as stand-alone Portfolios, due to the fact that each Reorganization will result in shareholders of an Acquired Portfolio owning shares of a larger Combined Portfolio, and certain fixed costs (e.g., printing and mailing of stockholder reports, legal expenses, audit fees and other expenses) would be spread across the larger asset base of the Combined Portfolio.

The Tax-Aware Overlay C Portfolio into the Tax-Aware Overlay B Portfolio

Shareholder Fees and Operating Expenses (unaudited)

Class 1 Shares (for the twelve months ended September 30, 2023)

Shareholder Fees

(fees paid directly from your investment)

| | | | | | | | | | | | |

| | | Tax-Aware

Overlay C

Portfolio –

Class 1 | | | Tax-Aware

Overlay B

Portfolio –

Class 1 | | | Pro Forma

Tax-Aware

Overlay B

Portfolio –

Class 1 After

Reorganization | |

Maximum sales charge (load) imposed on purchases | | | None | | | | None | | | | None | |

Maximum deferred sales charge (load) | | | None | | | | None | | | | None | |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | | | | | | | | | | | |

| | | Tax-Aware

Overlay C

Portfolio –

Class 1 | | | Tax-Aware

Overlay B

Portfolio –

Class 1 | | | Pro Forma

Tax-Aware

Overlay B

Portfolio –

Class 1 After

Reorganization | |

Management Fees | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % |

+ Distribution (12b-1) Fees | | | None | | | | None | | | | None | |

+ Other Expenses | | | | | | | | | | | | |

Shareholder Servicing | | | 0.15 | % | | | 0.15 | % | | | 0.15 | % |

Transfer Agent | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % |

Other Expenses | | | 0.13 | % | | | 0.05 | % | | | 0.05 | % |

+ Total Other Expenses | | | 0.29 | % | | | 0.21 | % | | | 0.21 | % |

+ Acquired Fund Fees and Expenses | | | 0.02 | % | | | 0.02 | % | | | 0.02 | % |

| | | | | | | | | | | | |

= Total annual portfolio operating expenses | | | 0.96 | % | | | 0.88 | % | | | 0.88 | % |

Fee Waiver/Expense Reimbursement(a) | | | (0.04 | %) | | | (0.00 | %) | | | (0.00 | %) |

Total annual portfolio operating expenses after Fee Waiver/Expense Reimbursement | | | 0.92 | % | | | 0.88 | % | | | 0.88 | % |

| | (a) | The Manager has contractually agreed to waive fees and/or to bear expenses of the Portfolio until January 28, 2025 to the extent necessary to prevent total portfolio operating expenses (excluding any acquired fund fees and expenses other than the advisory fees of any affiliated funds in which the Portfolio may invest, interest expense, taxes, extraordinary expenses, and brokerage commissions and other transaction costs), on an annualized basis, from exceeding 0.90% of average daily net assets. |

9

Class 2 Shares (for the twelve months ended September 30, 2023)

Shareholder Fees

(fees paid directly from your investment)

| | | | | | | | | | | | |

| | | Tax-Aware

Overlay C

Portfolio –

Class 2 | | | Tax-Aware

Overlay B

Portfolio –

Class 2 | | | Pro Forma

Tax-Aware

Overlay B

Portfolio –

Class 2 After

Reorganization | |

Maximum sales charge (load) imposed on purchases | | | None | | | | None | | | | None | |

Maximum deferred sales charge (load) | | | None | | | | None | | | | None | |

Annual Fund Operating Expenses

| | | | | | | | | | | | |

| | | Tax-Aware

Overlay C

Portfolio –

Class 2 | | | Tax-Aware

Overlay B

Portfolio –

Class 2 | | | Pro Forma

Tax-Aware

Overlay B

Portfolio –

Class 2 After

Reorganization | |

Management Fees | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % |

+ Distribution (12b-1) Fees | | | None | | | | None | | | | None | |

+ Other Expenses | | | | | | | | | | | | |

Shareholder Servicing | | | None | | | | None | | | | None | |

Transfer Agent | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % |

Other Expenses | | | 0.13 | % | | | 0.05 | % | | | 0.05 | % |

+ Total Other Expenses | | | 0.14 | % | | | 0.06 | % | | | 0.06 | % |

+ Acquired Fund Fees and Expenses | | | 0.02 | % | | | 0.02 | % | | | 0.02 | % |

| | | | | | | | | | | | |

= Total annual portfolio operating expenses | | | 0.81 | % | | | 0.73 | % | | | 0.73 | % |

Fee Waiver/Expense Reimbursement(a) | | | (0.04 | %) | | | (0.00 | %) | | | (0.00 | %) |

Total annual portfolio operating expenses after Fee Waiver/Expense Reimbursement | | | 0.77 | % | | | 0.73 | % | | | 0.73 | % |

| | (a) | The Manager has contractually agreed to waive fees and/or to bear expenses of the Portfolio until January 28, 2025 to the extent necessary to prevent total portfolio operating expenses (excluding any acquired fund fees and expenses other than the advisory fees of any affiliated funds in which the Portfolio may invest, interest expense, taxes, extraordinary expenses, and brokerage commissions and other transaction costs), on an annualized basis, from exceeding 0.75% of average daily net assets. |

The Tax-Aware Overlay N Portfolio into the Tax-Aware Overlay B Portfolio

Shareholder Fees and Operating Expenses (unaudited)

Class 1 Shares (for the twelve months ended September 30, 2023)

Shareholder Fees

(fees paid directly from your investment)

| | | | | | | | | | | | |

| | | Tax-Aware

Overlay N

Portfolio –

Class 1 | | | Tax-Aware

Overlay B

Portfolio –

Class 1 | | | Pro Forma

Tax-Aware

Overlay B

Portfolio –

Class 1 After

Reorganization | |

Maximum sales charge (load) imposed on purchases | | | None | | | | None | | | | None | |

Maximum deferred sales charge (load) | | | None | | | | None | | | | None | |

10

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | | | | | | | | | | | |

| | | Tax-Aware

Overlay N

Portfolio –

Class 1 | | | Tax-Aware

Overlay B

Portfolio –

Class 1 | | | Pro Forma

Tax-Aware

Overlay B

Portfolio –

Class 1 After

Reorganization | |

Management Fees | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % |

+ Distribution (12b-1) Fees | | | None | | | | None | | | | None | |

+ Other Expenses | | | | | | | | | | | | |

Shareholder Servicing | | | 0.15 | % | | | 0.15 | % | | | 0.15 | % |

Transfer Agent | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % |

Other Expenses | | | 0.16 | % | | | 0.05 | % | | | 0.05 | % |

+ Total Other Expenses | | | 0.32 | % | | | 0.21 | % | | | 0.21 | % |

+ Acquired Fund Fees and Expenses | | | 0.03 | % | | | 0.02 | % | | | 0.02 | % |

| | | | | | | | | | | | |

= Total annual portfolio operating expenses | | | 1.00 | % | | | 0.88 | % | | | 0.88 | % |

Fee Waiver/Expense Reimbursement(a) | | | (0.07 | %) | | | (0.00 | %) | | | (0.00 | %) |

Total annual portfolio operating expenses after Fee Waiver/Expense Reimbursement | | | 0.93 | % | | | 0.88 | % | | | 0.88 | % |

| | (a) | The Manager has contractually agreed to waive fees and/or to bear expenses of the Portfolio until January 28, 2025 to the extent necessary to prevent total portfolio operating expenses (excluding any acquired fund fees and expenses other than the advisory fees of any affiliated funds in which the Portfolio may invest, interest expense, taxes, extraordinary expenses, and brokerage commissions and other transaction costs), on an annualized basis, from exceeding 0.90% of average daily net assets. |

Class 2 Shares (for the twelve months ended September 30, 2023)

Shareholder Fees

(fees paid directly from your investment)

| | | | | | | | | | | | |

| | | Tax-Aware

Overlay N

Portfolio –

Class 2 | | | Tax-Aware

Overlay B

Portfolio –

Class 2 | | | Pro Forma

Tax-Aware

Overlay B

Portfolio –

Class 2 After

Reorganization | |

Maximum sales charge (load) imposed on purchases | | | None | | | | None | | | | None | |

Maximum deferred sales charge (load) | | | None | | | | None | | | | None | |

11

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | | | | | | | | | | | |

| | | Tax-Aware

Overlay N

Portfolio –

Class 2 | | | Tax-Aware

Overlay B

Portfolio –

Class 2 | | | Pro Forma

Tax-Aware

Overlay B

Portfolio –

Class 2 After

Reorganization | |

Management Fees | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % |

+ Distribution (12b-1) Fees | | | None | | | | None | | | | None | |

+ Other Expenses | | | | | | | | | | | | |

Shareholder Servicing | | | None | | | | None | | | | None | |

Transfer Agent | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % |

Other Expenses | | | 0.16 | % | | | 0.05 | % | | | 0.05 | % |

+ Total Other Expenses | | | 0.17 | % | | | 0.06 | % | | | 0.06 | % |

+ Acquired Fund Fees and Expenses | | | 0.03 | % | | | 0.02 | % | | | 0.02 | % |

| | | | | | | | | | | | |

= Total annual portfolio operating expenses | | | 0.85 | % | | | 0.73 | % | | | 0.73 | % |

Fee Waiver/Expense Reimbursement(a) | | | (0.07 | %) | | | (0.00 | %) | | | (0.00 | %) |

Total annual portfolio operating expenses after Fee Waiver/Expense Reimbursement | | | 0.78 | % | | | 0.73 | % | | | 0.73 | % |

| | (a) | The Manager has contractually agreed to waive fees and/or to bear expenses of the Portfolio until January 28, 2025 to the extent necessary to prevent total portfolio operating expenses (excluding any acquired fund fees and expenses other than the advisory fees of any affiliated funds in which the Portfolio may invest, interest expense, taxes, extraordinary expenses, and brokerage commissions and other transaction costs), on an annualized basis, from exceeding 0.75% of average daily net assets. |

The Tax-Aware Overlay C Portfolio and the Tax-Aware Overlay N Portfolio into the Tax-Aware Overlay B Portfolio

Shareholder Fees and Operating Expenses (unaudited)

Class 1 Shares (for the twelve months ended September 30, 2023)

Shareholder Fees

(fees paid directly from your investment)

| | | | | | | | | | | | | | | | |

| | | Tax-Aware

Overlay C

Portfolio –

Class 1 | | | Tax-Aware

Overlay N

Portfolio –

Class 1 | | | Tax-Aware

Overlay B

Portfolio –

Class 1 | | | Pro Forma

Tax-Aware

Overlay B

Portfolio –

Class 1 After

Reorganizations | |

Maximum sales charge (load) imposed on purchases | | | None | | | | None | | | | None | | | | None | |

Maximum deferred sales charge (load) | | | None | | | | None | | | | None | | | | None | |

12

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | | | | | | | | | | | | | | | |

| | | Tax-Aware

Overlay C

Portfolio –

Class 1 | | | Tax-Aware

Overlay N

Portfolio –

Class 1 | | | Tax-Aware

Overlay B

Portfolio –

Class 1 | | | Pro Forma

Tax-Aware

Overlay B

Portfolio –

Class 1

After Reorganizations | |

Management Fees | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % |

+ Distribution (12b-1) Fees | | | None | | | | None | | | | None | | | | None | |

+ Other Expenses | | | | | | | | | | | | | | | | |

Shareholder Servicing | | | 0.15 | % | | | 0.15 | % | | | 0.15 | % | | | 0.15 | % |

Transfer Agent | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % |

Other Expenses | | | 0.13 | % | | | 0.16 | % | | | 0.05 | % | | | 0.05 | % |

+ Total Other Expenses | | | 0.29 | % | | | 0.32 | % | | | 0.21 | % | | | 0.21 | % |

+ Acquired Fund Fees and Expenses | | | 0.02 | % | | | 0.03 | % | | | 0.02 | % | | | 0.02 | % |

| | | | | | | | | | | | | | | | |

= Total annual portfolio operating expenses | | | 0.96 | % | | | 1.00 | % | | | 0.88 | % | | | 0.88 | % |

Fee Waiver/Expense Reimbursement(a) | | | (0.04 | %) | | | (0.07 | %) | | | (0.00 | %) | | | (0.00 | %) |

Total annual portfolio operating expenses after Fee Waiver/Expense Reimbursement | | | 0.92 | % | | | 0.93 | % | | | 0.88 | % | | | 0.88 | % |

| | (a) | The Manager has contractually agreed to waive fees and/or to bear expenses of the Portfolio until January 28, 2025 to the extent necessary to prevent total portfolio operating expenses (excluding any acquired fund fees and expenses other than the advisory fees of any affiliated funds in which the Portfolio may invest, interest expense, taxes, extraordinary expenses, and brokerage commissions and other transaction costs), on an annualized basis, from exceeding 0.90% of average daily net assets. |

Class 2 Shares (for the twelve months ended September 30, 2023)

Shareholder Fees

(fees paid directly from your investment)

| | | | | | | | | | | | | | | | |

| | | Tax-Aware

Overlay C

Portfolio –

Class 2 | | | Tax-Aware

Overlay N

Portfolio –

Class 2 | | | Tax-Aware

Overlay B

Portfolio –

Class 2 | | | Pro Forma

Tax-Aware Overlay B

Portfolio –

Class 2

After Reorganizations | |

Maximum sales charge (load) imposed on purchases | | | None | | | | None | | | | None | | | | None | |

Maximum deferred sales charge (load) | | | None | | | | None | | | | None | | | | None | |

13

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | | | | | | | | | | | | | | | |

| | | Tax-Aware

Overlay C

Portfolio –

Class 2 | | | Tax-Aware

Overlay N

Portfolio –

Class 2 | | | Tax-Aware

Overlay B

Portfolio –

Class 2 | | | Pro Forma

Tax-Aware Overlay B

Portfolio –

Class 2

After Reorganizations | |

Management Fees | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % |

+ Distribution (12b-1) Fees | | | None | | | | None | | | | None | | | | None | |

+ Other Expenses | | | | | | | | | | | | | | | | |

Shareholder Servicing | | | None | | | | None | | | | None | | | | None | |

Transfer Agent | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % |

Other Expenses | | | 0.13 | % | | | 0.16 | % | | | 0.05 | % | | | 0.05 | % |

+ Total Other Expenses | | | 0.14 | % | | | 0.17 | % | | | 0.06 | % | | | 0.06 | % |

+ Acquired Fund Fees and Expenses | | | 0.02 | % | | | 0.03 | % | | | 0.02 | % | | | 0.02 | % |

| | | | | | | | | | | | | | | | |

= Total annual portfolio operating expenses | | | 0.81 | % | | | 0.85 | % | | | 0.73 | % | | | 0.73 | % |

Fee Waiver/Expense Reimbursement(a) | | | (0.04 | %) | | | (0.07 | %) | | | (0.00 | %) | | | (0.00 | %) |

| | | | |

Total annual portfolio operating expenses after Fee Waiver/Expense Reimbursement | | | 0.77 | % | | | 0.78 | % | | | 0.73 | % | | | 0.73 | % |

| | (a) | The Manager has contractually agreed to waive fees and/or to bear expenses of the Portfolio until January 28, 2025 to the extent necessary to prevent total portfolio operating expenses (excluding any acquired fund fees and expenses other than the advisory fees of any affiliated funds in which the Portfolio may invest, interest expense, taxes, extraordinary expenses, and brokerage commissions and other transaction costs), on an annualized basis, from exceeding 0.75% of average daily net assets. |

Expense Examples

These examples are intended to help you compare the cost of investing in each Portfolio before the Reorganizations with the cost of investing in the Tax-Aware Overlay B Portfolio after the Reorganizations. They assume that you invest $10,000 in each Portfolio for the time periods indicated, that your investment has a 5% return each year and that each Portfolio’s operating expenses remain the same, except for any contractual and service fee waivers and overall expense limitations that may be in effect during the first year of a period.

These examples assume that all dividends and other distributions are reinvested. These examples illustrate the effect of expenses, but are not meant to suggest actual or expected expenses, which may vary. The assumed return of 5% is not a prediction of, and does not represent, actual or expected performance of any Portfolio.

14

The Tax-Aware Overlay C Portfolio into the Tax-Aware Overlay B Portfolio

Full Redemption — Although your actual costs may be higher or lower, based on the above assumptions you would pay the following expenses if you redeemed your shares at the end of each period:

| | | | | | | | | | | | | | | | |

Class 1 Shares | | One Year | | | Three Years | | | Five Years | | | Ten Years | |

Tax-Aware Overlay C Portfolio – Class 1 | | $ | 94 | | | $ | 302 | | | $ | 527 | | | $ | 1,174 | |

Tax-Aware Overlay B Portfolio – Class 1 | | | 90 | | | | 281 | | | | 488 | | | | 1,084 | |

Tax-Aware Overlay B Portfolio – Class 1 After Reorganization | | | 90 | | | | 281 | | | | 488 | | | | 1,084 | |

| | | | |

Class 2 Shares | | One Year | | | Three Years | | | Five Years | | | Ten Years | |

Tax-Aware Overlay C Portfolio – Class 2 | | $ | 79 | | | $ | 255 | | | $ | 446 | | | $ | 998 | |

Tax-Aware Overlay B Portfolio – Class 2 | | | 75 | | | | 233 | | | | 406 | | | | 906 | |

Tax-Aware Overlay B Portfolio – Class 2 After Reorganization | | | 75 | | | | 233 | | | | 406 | | | | 906 | |

The expense examples would be the same if you did not redeem your shares at the end of each period.

The Tax-Aware Overlay N Portfolio into the Tax-Aware Overlay B Portfolio

Full Redemption — Although your actual costs may be higher or lower, based on the above assumptions you would pay the following expenses if you redeemed your shares at the end of each period:

| | | | | | | | | | | | | | | | |

Class 1 Shares | | One Year | | | Three Years | | | Five Years | | | Ten Years | |

Tax-Aware Overlay N Portfolio – Class 1 | | $ | 95 | | | $ | 311 | | | $ | 546 | | | $ | 1,218 | |

Tax-Aware Overlay B Portfolio – Class 1 | | | 90 | | | | 281 | | | | 488 | | | | 1,084 | |

Tax-Aware Overlay B Portfolio – Class 1 After Reorganization | | | 90 | | | | 281 | | | | 488 | | | | 1,084 | |

| | | | |

Class 2 Shares | | One Year | | | Three Years | | | Five Years | | | Ten Years | |

Tax-Aware Overlay N Portfolio – Class 2 | | $ | 80 | | | $ | 264 | | | $ | 464 | | | $ | 1,042 | |

Tax-Aware Overlay B Portfolio – Class 2 | | | 75 | | | | 233 | | | | 406 | | | | 906 | |

Tax-Aware Overlay B Portfolio – Class 2 After Reorganization | | | 75 | | | | 233 | | | | 406 | | | | 906 | |

The expense examples would be the same if you did not redeem your shares at the end of each period.

The Tax-Aware Overlay C Portfolio and Tax-Aware Overlay N Portfolio into the Tax-Aware Overlay B Portfolio

Full Redemption — Although your actual costs may be higher or lower, based on the above assumptions you would pay the following expenses if you redeemed your shares at the end of each period:

| | | | | | | | | | | | | | | | |

Class 1 Shares | | One Year | | | Three Years | | | Five Years | | | Ten Years | |

Tax-Aware Overlay C Portfolio – Class 1 | | $ | 94 | | | $ | 302 | | | $ | 527 | | | $ | 1,174 | |

Tax-Aware Overlay N Portfolio – Class 1 | | | 95 | | | | 311 | | | | 546 | | | | 1,218 | |

Tax-Aware Overlay B Portfolio – Class 1 | | | 90 | | | | 281 | | | | 488 | | | | 1,084 | |

Tax-Aware Overlay B Portfolio – Class 1 After Reorganizations | | | 90 | | | | 281 | | | | 488 | | | | 1,084 | |

| | | | |

Class 2 Shares | | One Year | | | Three Years | | | Five Years | | | Ten Years | |

Tax-Aware Overlay C Portfolio – Class 2 | | $ | 79 | | | $ | 255 | | | $ | 446 | | | $ | 998 | |

Tax-Aware Overlay N Portfolio – Class 2 | | | 80 | | | | 264 | | | | 464 | | | | 1,042 | |

Tax-Aware Overlay B Portfolio – Class 2 | | | 75 | | | | 233 | | | | 406 | | | | 906 | |

Tax-Aware Overlay B Portfolio – Class 2 After Reorganizations | | | 75 | | | | 233 | | | | 406 | | | | 906 | |

The expense examples would be the same if you did not redeem your shares at the end of each period.

15

Portfolio Turnover

Each Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when shares are held in a taxable account. These transaction costs, which are not reflected in annual fund operating expenses or in the examples above, affect a Portfolio’s performance. During the fiscal year ended September 30, 2023, each Portfolio had the following portfolio turnover rate, expressed as a percentage of the average value of its portfolio:

| | | | | | | | |

Portfolio | | Fiscal Year End | | | Rate | |

Tax-Aware Overlay C Portfolio | | | 9/30/23 | | | | 10 | % |

Tax-Aware Overlay N Portfolio | | | 9/30/23 | | | | 14 | % |

Tax-Aware Overlay B Portfolio | | | 9/30/23 | | | | 7 | % |

Performance of the Portfolios

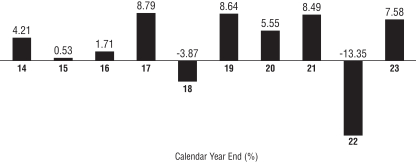

The following bar charts show each Portfolio’s performance for the indicated share class for each full calendar year of operations. The bar chart and Average Annual Total Returns table demonstrate the risk of investing in each Portfolio by showing how returns can change from year to year and by showing how the Portfolio’s average annual total returns for each share class compare with a broad-based securities market index. Past performance (before and after taxes) does not mean that the Portfolio will achieve similar results in the future.

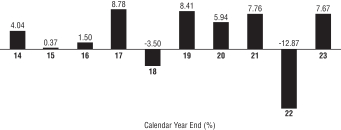

Tax-Aware Overlay C Portfolio (as of December 31, 2023)

The annual returns in the bar chart are for the Portfolio’s Class 1 shares.

During the period shown in the bar chart, the Portfolio’s:

Best Quarter was up 7.34%, 4th quarter, 2023; and Worst Quarter was down -9.31%, 1st quarter, 2020.

Average Annual Total Returns

(For the Periods ended December 31, 2023)

| | | | | | | | | | | | |

| | | ONE

YEAR | | | FIVE

YEARS | | | TEN

YEARS | |

Class 1* | | | | | | | | | | | | |

Return Before Taxes | | | 7.67% | | | | 3.03% | | | | 2.59% | |

Return After Taxes on Distributions | | | 7.54% | | | | 2.42% | | | | 2.01% | |

Return After Taxes on Distributions and Sale of Portfolio Shares | | | 5.47% | | | | 2.51% | | | | 2.10% | |

Class 2 (Return Before Taxes) | | | 7.83% | | | | 3.20% | | | | 2.75% | |

| | - | Are shown for Class 1 shares only and will vary for Class 2 shares because these Classes have different expense ratios; |

16

| | - | Are an estimate, which is based on the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes; actual after-tax returns depend on an individual investor’s tax situation and are likely to differ from those shown; and |

| | - | Are not relevant to investors who hold Portfolio shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. |

Index % (reflects no deductions for fees, expenses or taxes)

| | | | | | | | | | | | |

| | | ONE

YEAR | | | FIVE

YEARS | | | TEN

YEARS | |

| Bloomberg 5-Year General Obligation Municipal Bond Index (reflects no deduction for fees, expenses, or taxes) | | | 4.05% | | | | 1.71% | | | | 1.80% | |

Composite Benchmark* | | | 9.68% | | | | 5.66% | | | | 4.36% | |

| * | The Tax-Aware Overlay C Portfolio measures its performance against a composite benchmark comprised of 19% Russell 3000, 11% MSCI ACWI ex-USA IMI (net), 28% Bloomberg 1-10 Year US TIPS, and 42% Bloomberg 1-10 Year Municipal Bond. |

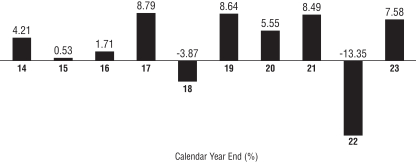

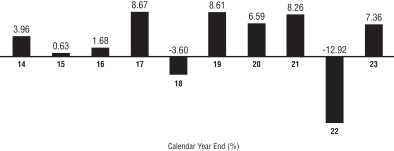

Tax-Aware Overlay N Portfolio (as of December 31, 2023)

The annual returns in the bar chart are for the Portfolio’s Class 1 shares.

During the period shown in the bar chart, the Portfolio’s:

Best Quarter was up 7.69%, 4th quarter, 2023; and Worst Quarter was down -10.21%, 1st quarter, 2020.

Average Annual Total Returns

(For the Periods ended December 31, 2023)

| | | | | | | | | | | | |

| | | ONE

YEAR | | | FIVE

YEARS | | | TEN

YEARS | |

Class 1* | | | | | | | | | | | | |

Return Before Taxes | | | 7.58% | | | | 3.01% | | | | 2.60% | |

Return After Taxes on Distributions | | | 7.43% | | | | 2.51% | | | | 2.07% | |

Return After Taxes on Distributions and Sale of Portfolio Shares | | | 5.36% | | | | 2.54% | | | | 2.13% | |

Class 2 (Return Before Taxes) | | | 7.61% | | | | 3.14% | | | | 2.75% | |

| | - | Are shown for Class 1 shares only and will vary for Class 2 shares because these Classes have different expense ratios; |

| | - | Are an estimate, which is based on the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes; actual after-tax returns depend on an individual investor’s tax situation and are likely to differ from those shown; and |

17

| | - | Are not relevant to investors who hold Portfolio shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. |

Index % (reflects no deductions for fees, expenses or taxes)

| | | | | | | | | | | | |

| | | ONE

YEAR | | | FIVE

YEARS | | | TEN

YEARS | |

| Bloomberg 5-Year General Obligation Municipal Bond Index (reflects no deduction for fees, expenses, or taxes) | | | 4.05% | | | | 1.71% | | | | 1.80% | |

Composite Benchmark* | | | 9.68% | | | | 5.66% | | | | 4.36% | |

| * | The Tax-Aware Overlay N Portfolio measures its performance against a composite benchmark comprised of 19% Russell 3000, 11% MSCI ACWI ex-USA IMI (net), 28% Bloomberg 1-10 Year US TIPS, and 42% Bloomberg 1-10 Year Municipal Bond. |

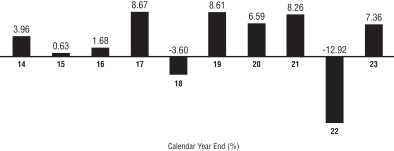

Tax-Aware Overlay B Portfolio (as of December 31, 2023)

The annual returns in the bar chart are for the Portfolio’s Class 1 shares.

During the period shown in the bar chart, the Portfolio’s:

Best Quarter was up 7.47%, 4th quarter, 2023; and Worst Quarter was down -9.24%, 1st quarter, 2020.

Average Annual Total Returns

(For the Periods ended December 31, 2023)

| | | | | | | | | | | | |

| | | ONE

YEAR | | | FIVE

YEARS | | | TEN

YEARS | |

Class 1* | | | | | | | | | | | | |

Return Before Taxes | | | 7.36% | | | | 3.22% | | | | 2.70% | |

Return After Taxes on Distributions | | | 7.36% | | | | 2.71% | | | | 2.18% | |

Return After Taxes on Distributions and Sale of Portfolio Shares | | | 5.20% | | | | 2.70% | | | | 2.22% | |

Class 2 (Return Before Taxes) | | | 7.50% | | | | 3.37% | | | | 2.85% | |

| | - | Are shown for Class 1 shares only and will vary for Class 2 shares because these Classes have different expense ratios; |

| | - | Are an estimate, which is based on the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes; actual after-tax returns depend on an individual investor’s tax situation and are likely to differ from those shown; and |

| | - | Are not relevant to investors who hold Portfolio shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. |

18

Index % (reflects no deductions for fees, expenses or taxes)

| | | | | | | | | | | | |

| | | ONE

YEAR | | | FIVE

YEARS | | | TEN

YEARS | |

Bloomberg 5-Year General Obligation Municipal Bond Index (reflects no deduction for fees, expenses, or taxes) | | | 4.05% | | | | 1.71% | | | | 1.80% | |

Composite Benchmark* | | | 9.68% | | | | 5.66% | | | | 4.36% | |

| * | The Tax-Aware Overlay B Portfolio measures its performance against a composite benchmark comprised of 19% Russell 3000, 11% MSCI ACWI ex-USA IMI (net), 28% Bloomberg 1-10 Year US TIPS, and 42% Bloomberg 1-10 Year Municipal Bond. |

Additional Information

Combined Portfolio. The Acquiring Portfolio is deemed to be the “accounting survivor” in connection with the Reorganizations. As a result, the Combined Portfolio will continue the performance history of the Acquiring Portfolio after the closing of the Reorganizations.

19

COMPARISON OF IMPORTANT FEATURES

The Investment Objectives, Strategies and Principal Risks of the Portfolios