0000832808alliancebernstein:C000030493Memberalliancebernstein:MediaTekIncMinusFR637248907CTIMember2024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05555

SANFORD C. BERNSTEIN FUND, INC.

(Exact name of registrant as specified in charter)

66 Hudson Boulevard East, New York, New York 10005

(Address of principal executive offices) (Zip code)

Stephen M. Woetzel

AllianceBernstein L.P.

66 Hudson Boulevard East

New York, New York 10005

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: September 30, 2024

Date of reporting period: September 30, 2024

ITEM 1. REPORTS TO STOCKHOLDERS.

Please scan QR code for

Fund Information

California Municipal Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the California Municipal Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/AICYX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $52 | 0.50% |

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, all share classes, except Class C, outperformed the Bloomberg 1-10 Year Blend Index (the “benchmark”). Overall security selection contributed to performance, relative to the benchmark. In particular, security selection within multi-family housing bonds was additive, while yield-curve positioning detracted.

The Portfolio used interest rate swaps for hedging purposes, which added to overall performance.

Top contributors to performance:

Top detractors from performance:

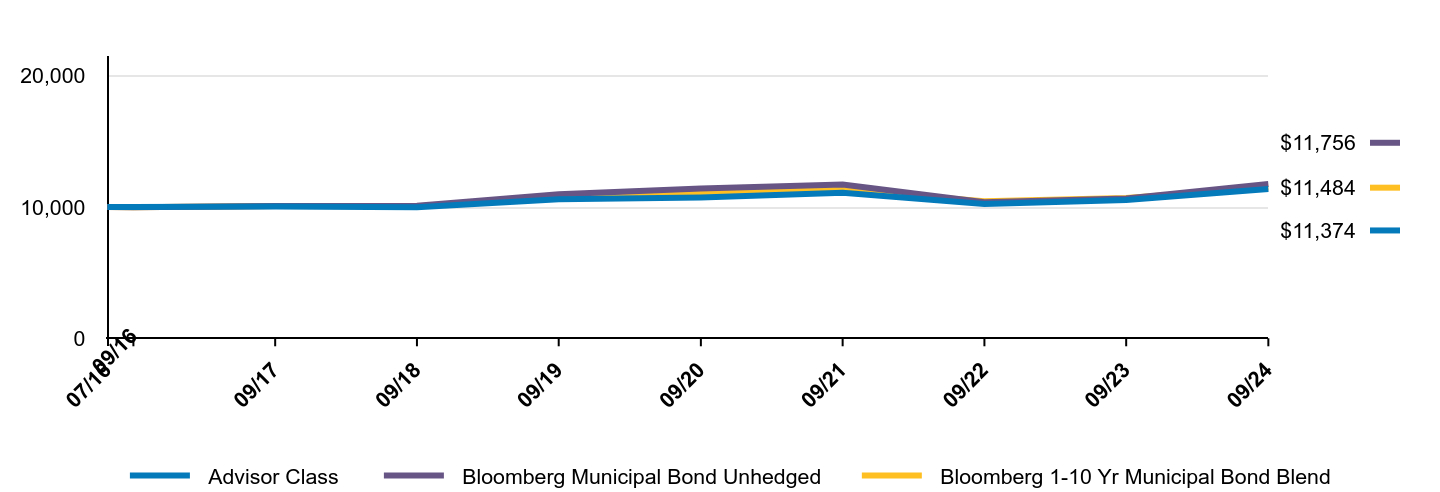

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Advisor Class | Bloomberg Municipal Bond Unhedged | Bloomberg 1-10 Yr Municipal Bond Blend |

|---|

| 07/16 | $10,000 | $10,000 | $10,000 |

| 09/16 | $9,991 | $9,987 | $9,989 |

| 09/17 | $10,019 | $10,074 | $10,089 |

| 09/18 | $10,011 | $10,109 | $10,070 |

| 09/19 | $10,570 | $10,974 | $10,716 |

| 09/20 | $10,849 | $11,423 | $11,156 |

| 09/21 | $11,098 | $11,723 | $11,304 |

| 09/22 | $10,274 | $10,375 | $10,451 |

| 09/23 | $10,611 | $10,651 | $10,690 |

| 09/24 | $11,488 | $11,756 | $11,484 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception 07/25/16 |

|---|

| Advisor Class | 8.19% | 1.67% | 1.71% |

| Bloomberg Municipal Bond Unhedged | 10.63% | 5.67% | 1.99% |

| Bloomberg 1-10 Yr Municipal Bond Blend | 7.44% | 1.39% | 1.70% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/AICYX-A for the most recent performance information.

| Net Assets | $1,030,808,218 |

| # of Portfolio Holdings | 350 |

| Portfolio Turnover Rate | 39% |

| Total Advisory Fees Paid | $4,269,717 |

Graphical Representation of Holdings

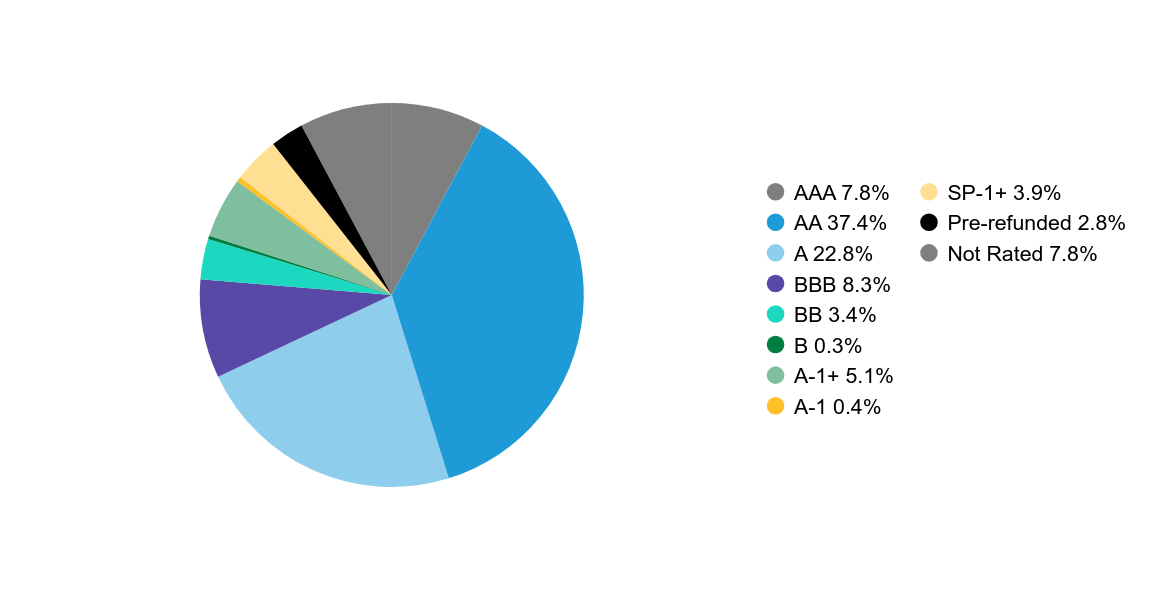

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 7.8% |

| AA | 37.4% |

| A | 22.8% |

| BBB | 8.3% |

| BB | 3.4% |

| B | 0.3% |

| A-1+ | 5.1% |

| A-1 | 0.4% |

| SP-1+ | 3.9% |

| Pre-refunded | 2.8% |

| Not Rated | 7.8% |

| Footnote | Description |

Footnote* | The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating issued by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by AllianceBernstein L.P.(the "Adviser"). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, equities, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment. |

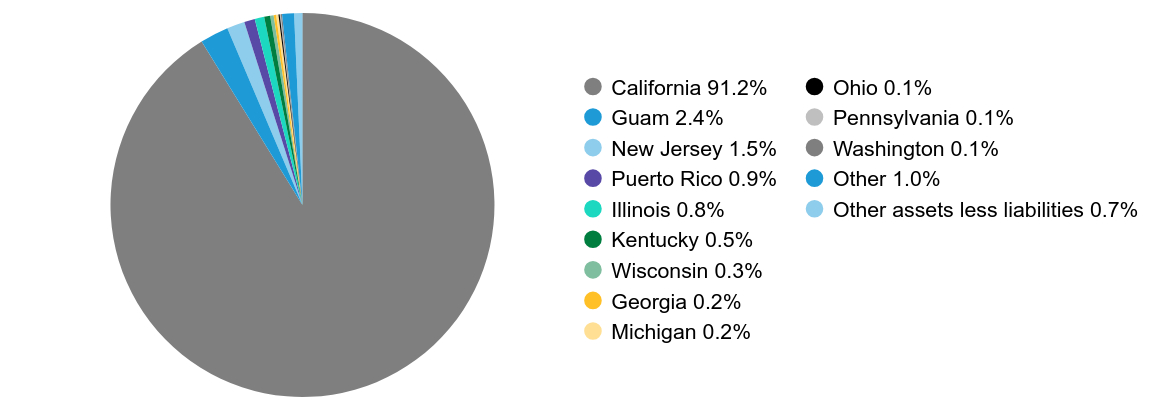

| Value | Value |

|---|

| California | 91.2% |

| Guam | 2.4% |

| New Jersey | 1.5% |

| Puerto Rico | 0.9% |

| Illinois | 0.8% |

| Kentucky | 0.5% |

| Wisconsin | 0.3% |

| Georgia | 0.2% |

| Michigan | 0.2% |

| Ohio | 0.1% |

| Pennsylvania | 0.1% |

| Washington | 0.1% |

| Other | 1.0% |

| Other assets less liabilities | 0.7% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/AICYX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/AICYX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

California Municipal Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the California Municipal Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/SNCAX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Municipal Class | $59 | 0.57% |

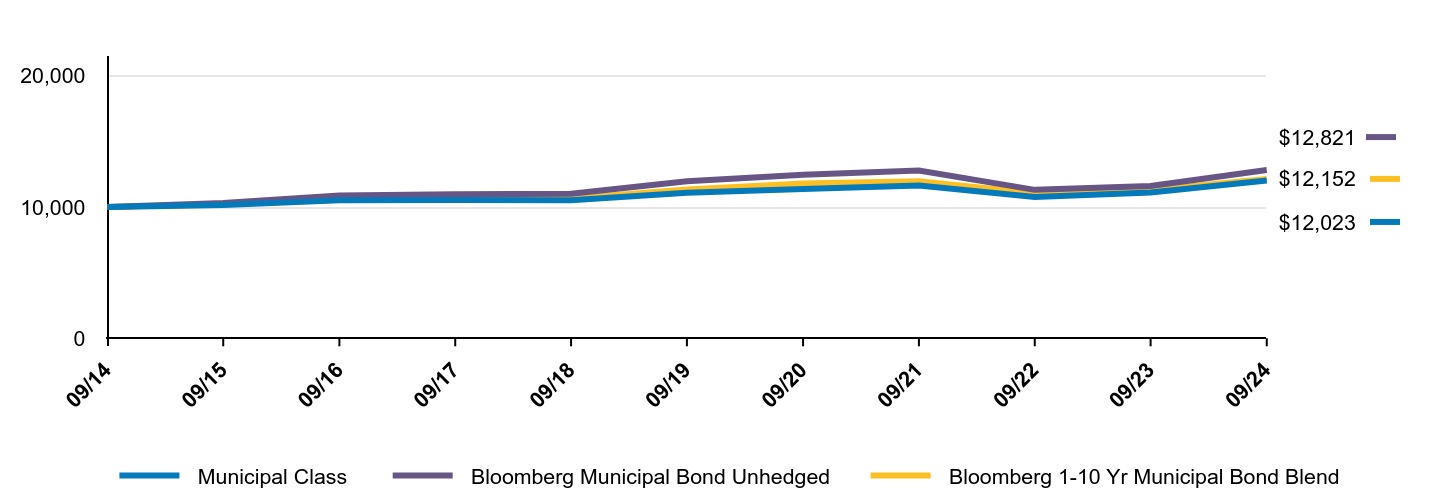

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, all share classes, except Class C, outperformed the Bloomberg 1-10 Year Blend Index (the “benchmark”). Overall security selection contributed to performance, relative to the benchmark. In particular, security selection within multi-family housing bonds was additive, while yield-curve positioning detracted.

The Portfolio used interest rate swaps for hedging purposes, which added to overall performance.

Top contributors to performance:

Top detractors from performance:

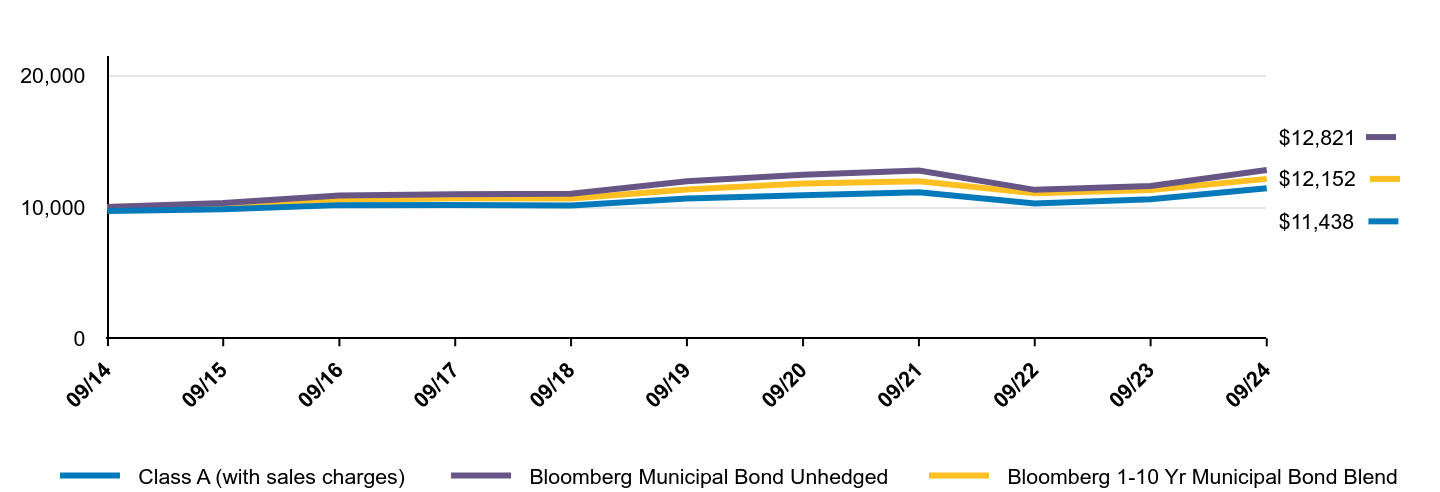

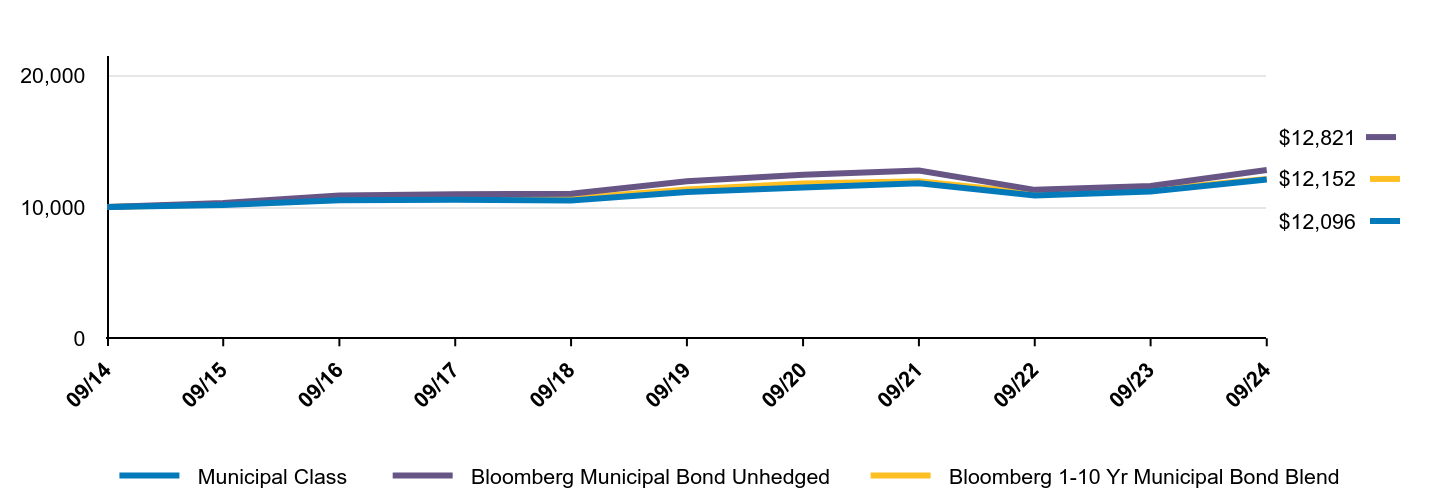

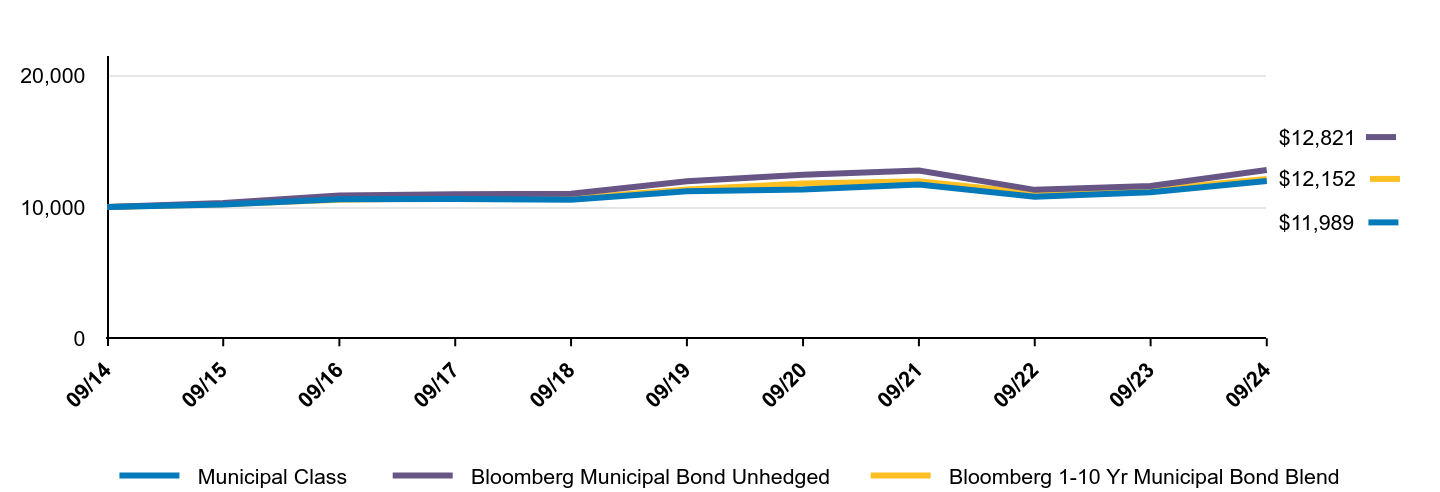

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Municipal Class | Bloomberg Municipal Bond Unhedged | Bloomberg 1-10 Yr Municipal Bond Blend |

|---|

| 09/14 | $10,000 | $10,000 | $10,000 |

| 09/15 | $10,161 | $10,316 | $10,222 |

| 09/16 | $10,513 | $10,892 | $10,569 |

| 09/17 | $10,537 | $10,987 | $10,675 |

| 09/18 | $10,523 | $11,025 | $10,655 |

| 09/19 | $11,101 | $11,968 | $11,339 |

| 09/20 | $11,388 | $12,458 | $11,804 |

| 09/21 | $11,641 | $12,785 | $11,961 |

| 09/22 | $10,773 | $11,315 | $11,058 |

| 09/23 | $11,120 | $11,616 | $11,311 |

| 09/24 | $12,023 | $12,821 | $12,152 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Municipal Class | 8.12% | 1.61% | 1.86% |

| Bloomberg Municipal Bond Unhedged | 10.63% | 5.67% | 2.33% |

| Bloomberg 1-10 Yr Municipal Bond Blend | 7.44% | 1.39% | 1.97% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/SNCAX-A for the most recent performance information.

| Net Assets | $1,030,808,218 |

| # of Portfolio Holdings | 350 |

| Portfolio Turnover Rate | 39% |

| Total Advisory Fees Paid | $4,269,717 |

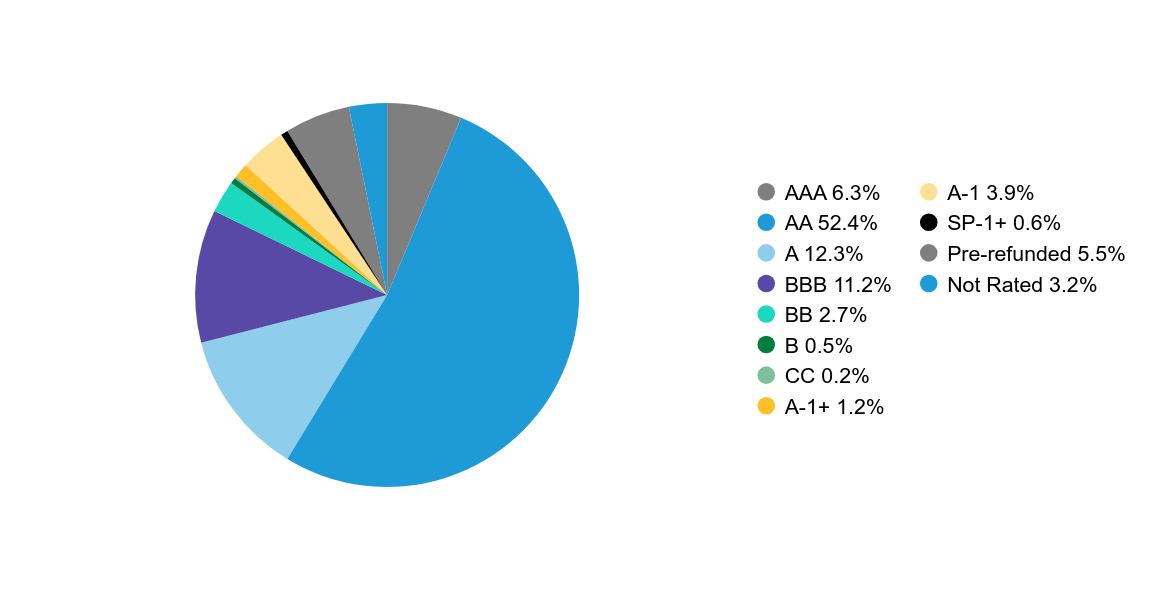

Graphical Representation of Holdings

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 7.8% |

| AA | 37.4% |

| A | 22.8% |

| BBB | 8.3% |

| BB | 3.4% |

| B | 0.3% |

| A-1+ | 5.1% |

| A-1 | 0.4% |

| SP-1+ | 3.9% |

| Pre-refunded | 2.8% |

| Not Rated | 7.8% |

| Footnote | Description |

Footnote* | The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating issued by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by AllianceBernstein L.P.(the "Adviser"). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, equities, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment. |

| Value | Value |

|---|

| California | 91.2% |

| Guam | 2.4% |

| New Jersey | 1.5% |

| Puerto Rico | 0.9% |

| Illinois | 0.8% |

| Kentucky | 0.5% |

| Wisconsin | 0.3% |

| Georgia | 0.2% |

| Michigan | 0.2% |

| Ohio | 0.1% |

| Pennsylvania | 0.1% |

| Washington | 0.1% |

| Other | 1.0% |

| Other assets less liabilities | 0.7% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/SNCAX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/SNCAX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

California Municipal Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the California Municipal Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/AICAX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $78 | 0.75% |

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, all share classes, except Class C, outperformed the Bloomberg 1-10 Year Blend Index (the “benchmark”). Overall security selection contributed to performance, relative to the benchmark. In particular, security selection within multi-family housing bonds was additive, while yield-curve positioning detracted.

The Portfolio used interest rate swaps for hedging purposes, which added to overall performance.

Top contributors to performance:

Top detractors from performance:

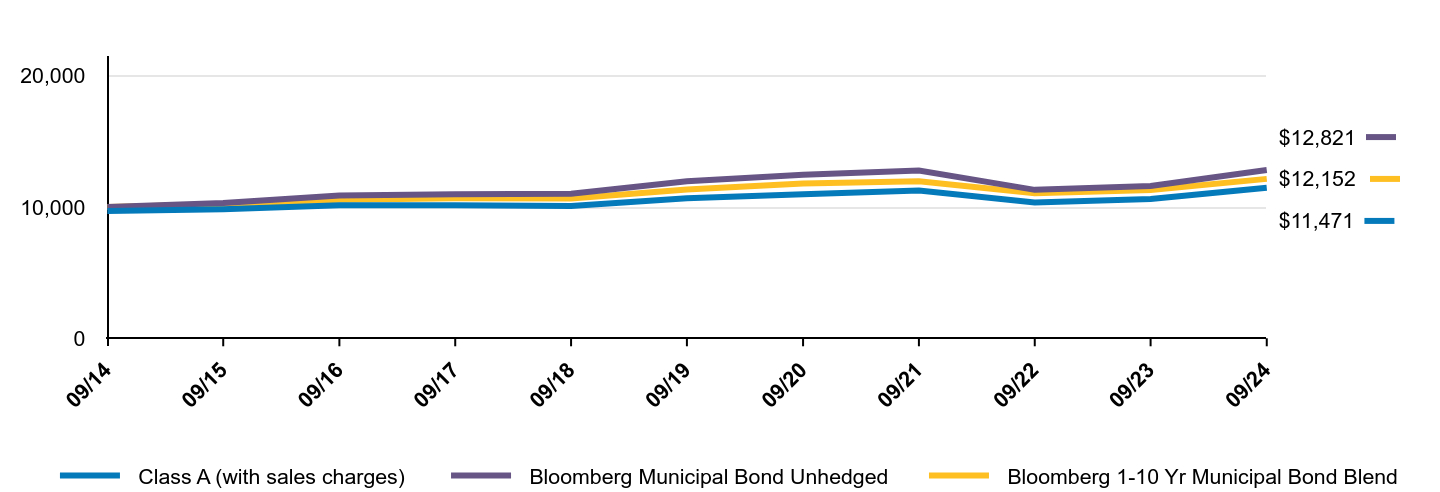

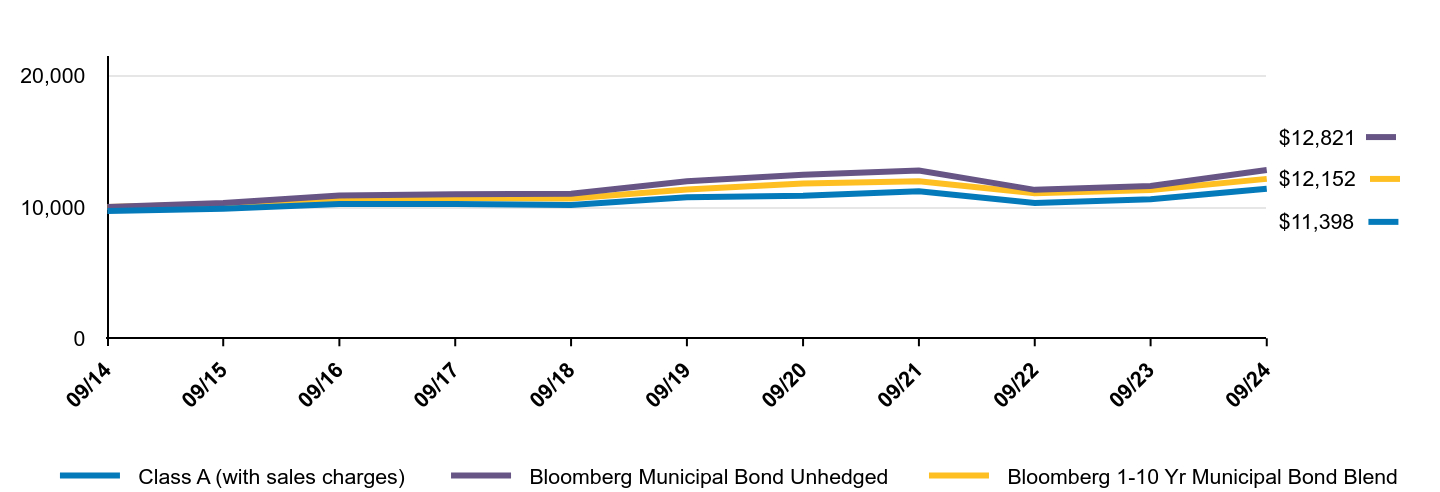

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class A (with sales charges) | Bloomberg Municipal Bond Unhedged | Bloomberg 1-10 Yr Municipal Bond Blend |

|---|

| 09/14 | $9,699 | $10,000 | $10,000 |

| 09/15 | $9,830 | $10,316 | $10,222 |

| 09/16 | $10,150 | $10,892 | $10,569 |

| 09/17 | $10,152 | $10,987 | $10,675 |

| 09/18 | $10,119 | $11,025 | $10,655 |

| 09/19 | $10,657 | $11,968 | $11,339 |

| 09/20 | $10,911 | $12,458 | $11,804 |

| 09/21 | $11,133 | $12,785 | $11,961 |

| 09/22 | $10,281 | $11,315 | $11,058 |

| 09/23 | $10,591 | $11,616 | $11,311 |

| 09/24 | $11,438 | $12,821 | $12,152 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Class A (without sales charges) | 7.91% | 1.42% | 1.66% |

| Class A (with sales charges) | 4.70% | 0.80% | 1.35% |

| Bloomberg Municipal Bond Unhedged | 10.63% | 5.67% | 2.33% |

| Bloomberg 1-10 Yr Municipal Bond Blend | 7.44% | 1.39% | 1.97% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/AICAX-A for the most recent performance information.

| Net Assets | $1,030,808,218 |

| # of Portfolio Holdings | 350 |

| Portfolio Turnover Rate | 39% |

| Total Advisory Fees Paid | $4,269,717 |

Graphical Representation of Holdings

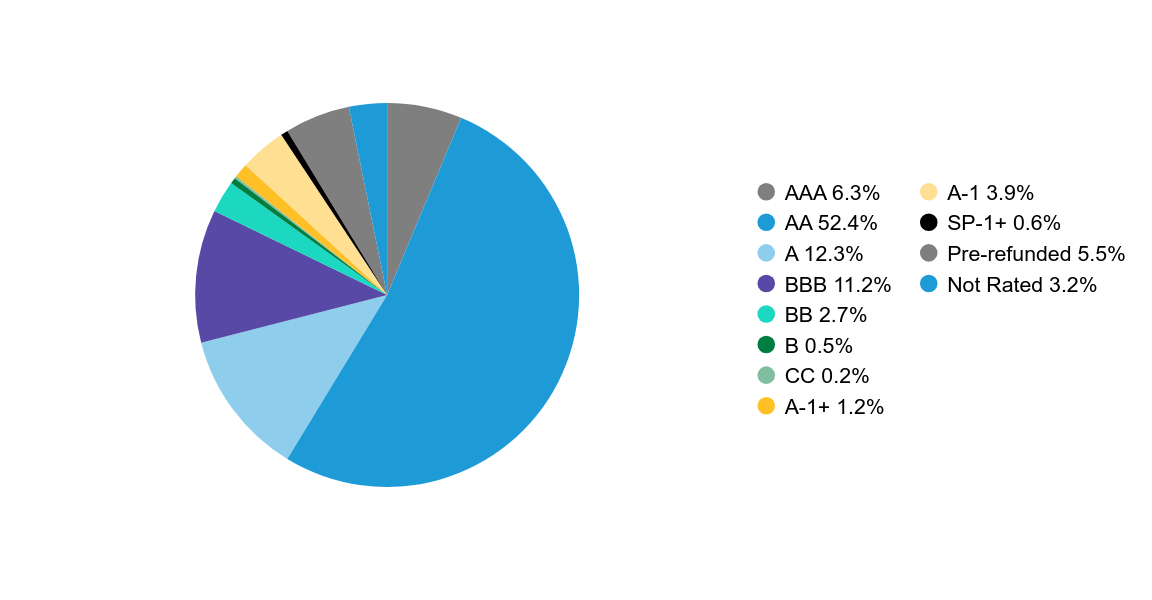

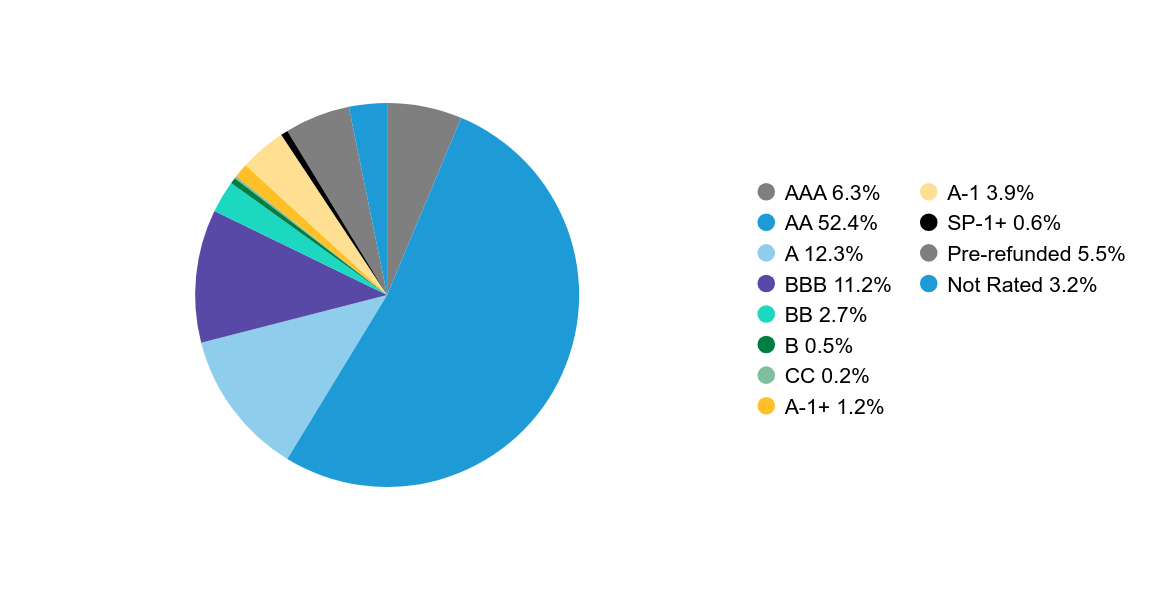

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 7.8% |

| AA | 37.4% |

| A | 22.8% |

| BBB | 8.3% |

| BB | 3.4% |

| B | 0.3% |

| A-1+ | 5.1% |

| A-1 | 0.4% |

| SP-1+ | 3.9% |

| Pre-refunded | 2.8% |

| Not Rated | 7.8% |

| Footnote | Description |

Footnote* | The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating issued by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by AllianceBernstein L.P.(the "Adviser"). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, equities, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment. |

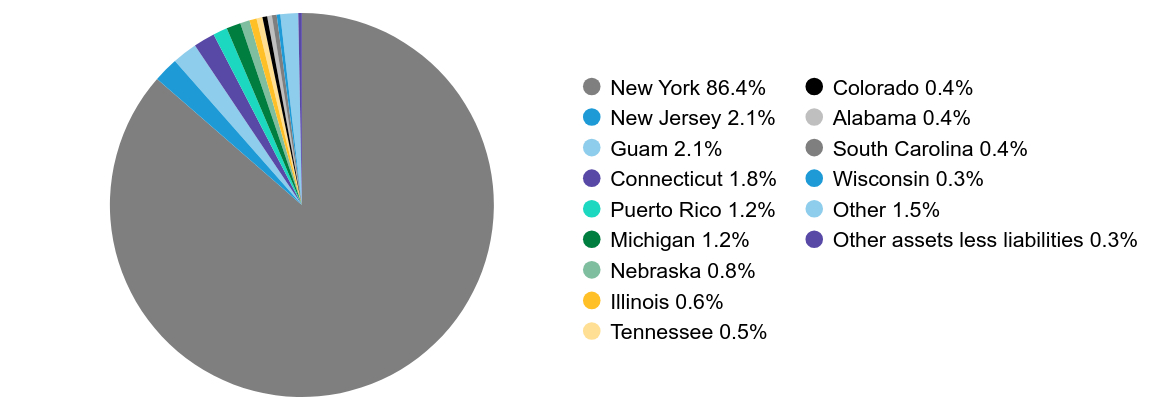

| Value | Value |

|---|

| California | 91.2% |

| Guam | 2.4% |

| New Jersey | 1.5% |

| Puerto Rico | 0.9% |

| Illinois | 0.8% |

| Kentucky | 0.5% |

| Wisconsin | 0.3% |

| Georgia | 0.2% |

| Michigan | 0.2% |

| Ohio | 0.1% |

| Pennsylvania | 0.1% |

| Washington | 0.1% |

| Other | 1.0% |

| Other assets less liabilities | 0.7% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/AICAX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/AICAX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

California Municipal Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the California Municipal Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ACMCX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $155 | 1.50% |

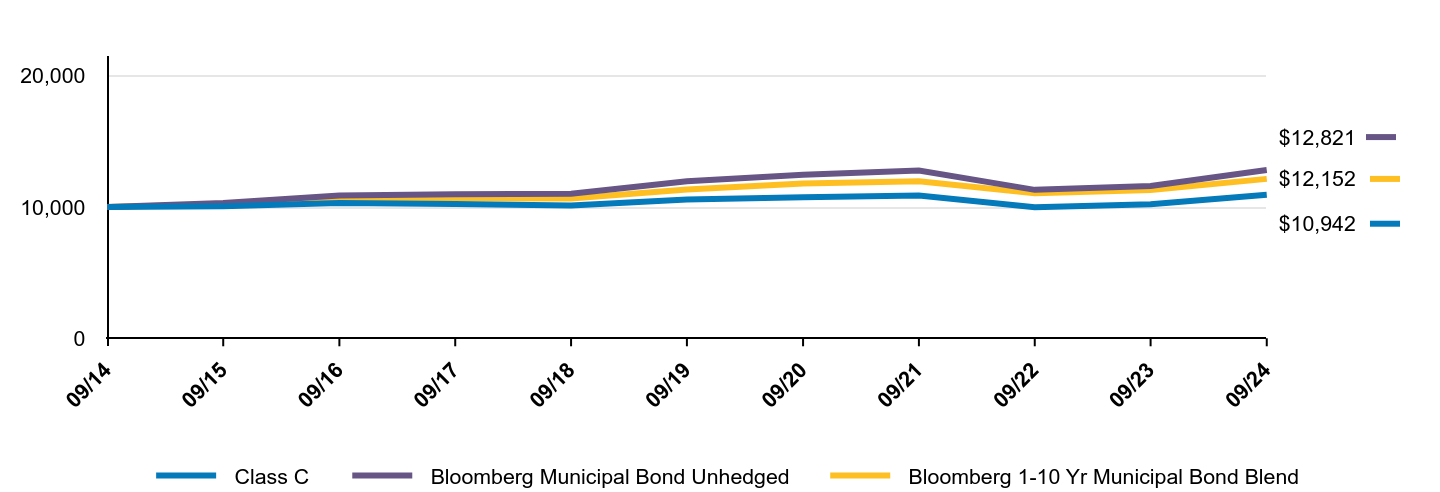

How did the Fund perform last year? What affected the Fund’s performance?

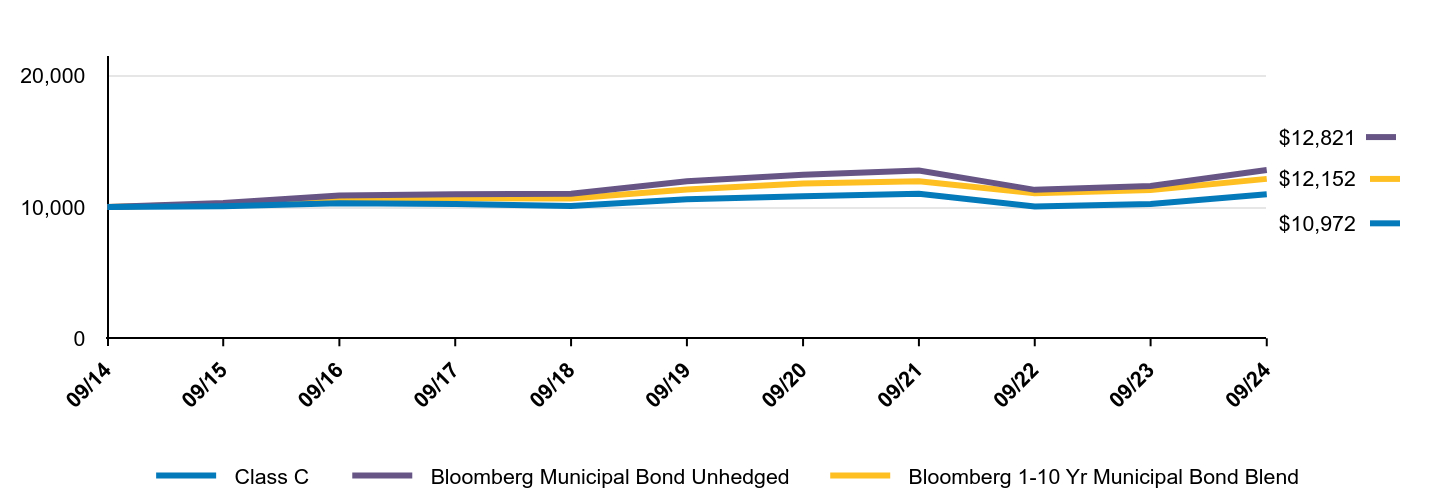

During the 12-month period, all share classes, except Class C, outperformed the Bloomberg 1-10 Year Blend Index (the “benchmark”). Overall security selection contributed to performance, relative to the benchmark. In particular, security selection within multi-family housing bonds was additive, while yield-curve positioning detracted.

The Portfolio used interest rate swaps for hedging purposes, which added to overall performance.

Top contributors to performance:

Top detractors from performance:

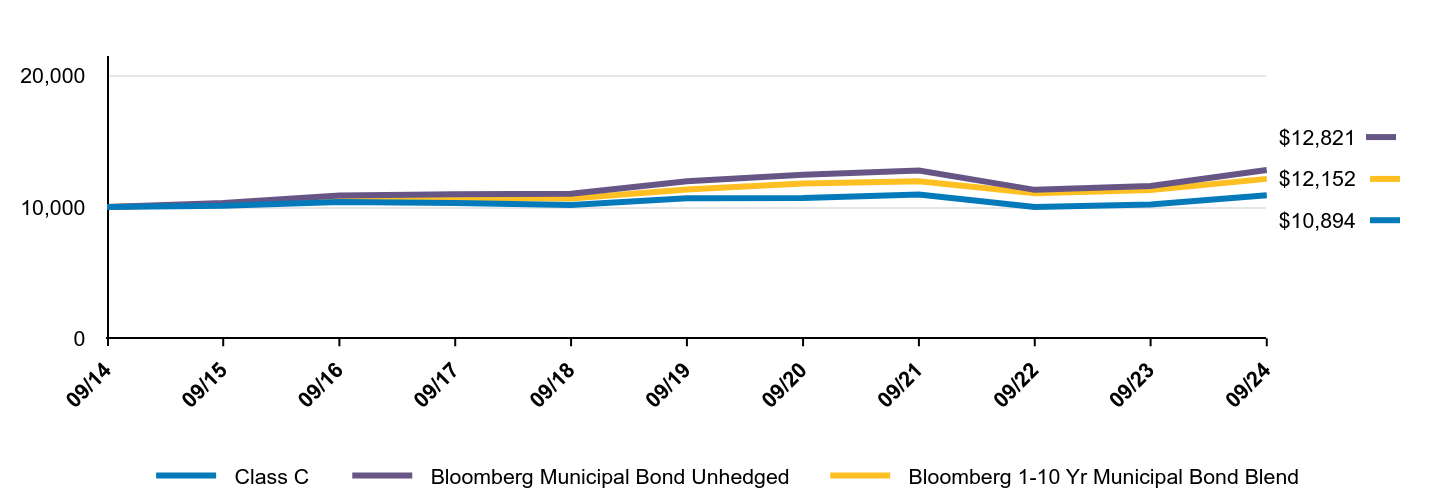

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class C | Bloomberg Municipal Bond Unhedged | Bloomberg 1-10 Yr Municipal Bond Blend |

|---|

| 09/14 | $10,000 | $10,000 | $10,000 |

| 09/15 | $10,063 | $10,316 | $10,222 |

| 09/16 | $10,314 | $10,892 | $10,569 |

| 09/17 | $10,239 | $10,987 | $10,675 |

| 09/18 | $10,121 | $11,025 | $10,655 |

| 09/19 | $10,587 | $11,968 | $11,339 |

| 09/20 | $10,759 | $12,458 | $11,804 |

| 09/21 | $10,888 | $12,785 | $11,961 |

| 09/22 | $9,986 | $11,315 | $11,058 |

| 09/23 | $10,211 | $11,616 | $11,311 |

| 09/24 | $10,942 | $12,821 | $12,152 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Class C | 7.11% | 0.66% | 0.90% |

| Bloomberg Municipal Bond Unhedged | 10.63% | 5.67% | 2.33% |

| Bloomberg 1-10 Yr Municipal Bond Blend | 7.44% | 1.39% | 1.97% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/ACMCX-A for the most recent performance information.

| Net Assets | $1,030,808,218 |

| # of Portfolio Holdings | 350 |

| Portfolio Turnover Rate | 39% |

| Total Advisory Fees Paid | $4,269,717 |

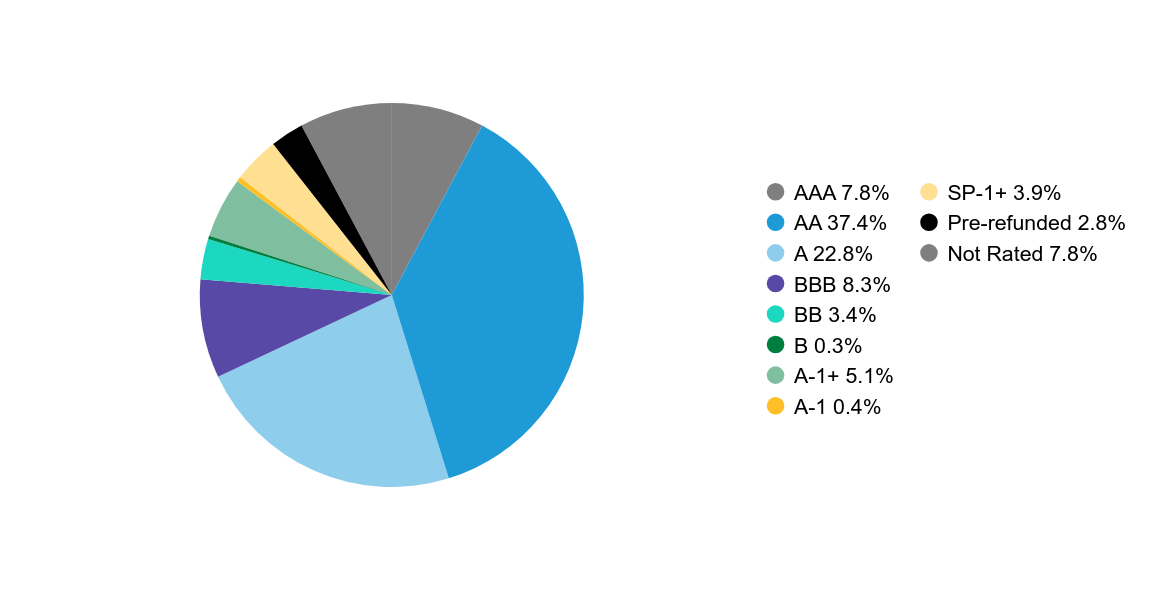

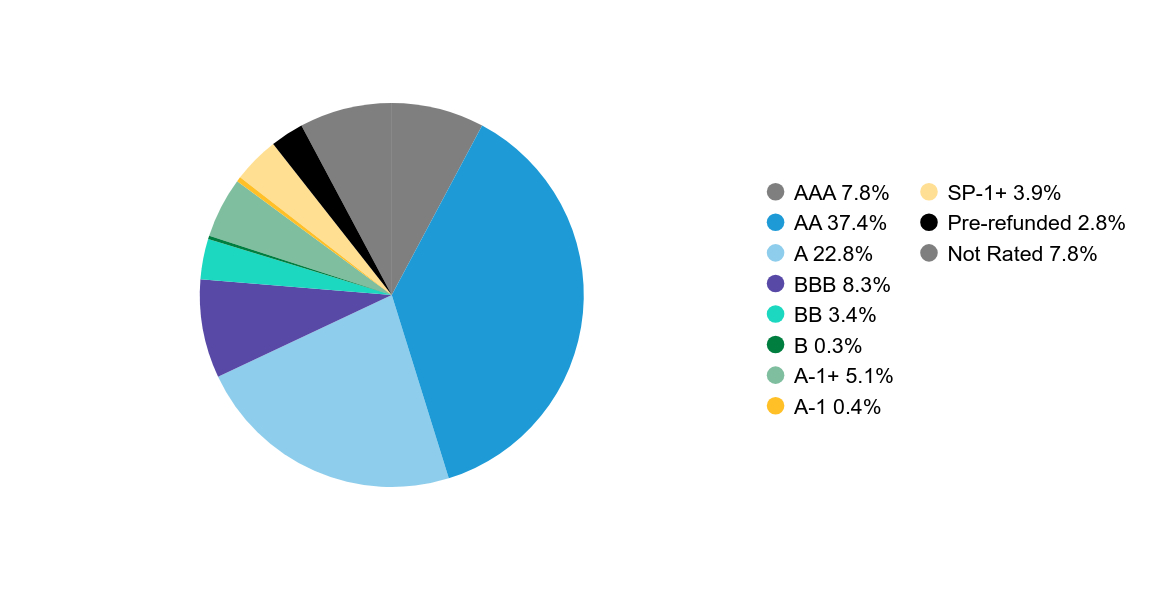

Graphical Representation of Holdings

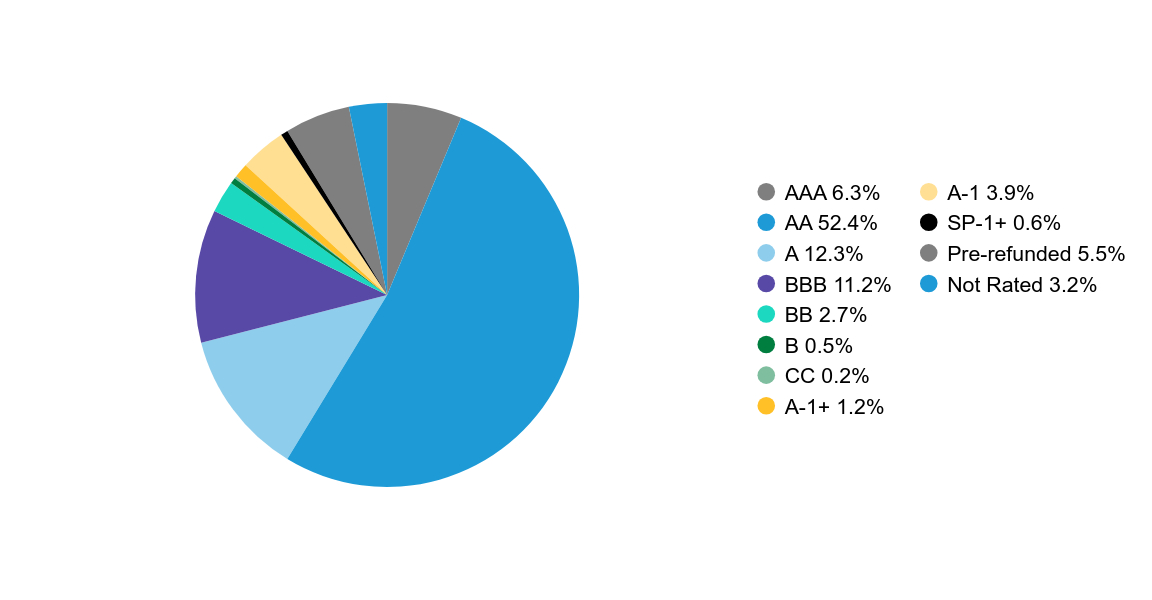

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 7.8% |

| AA | 37.4% |

| A | 22.8% |

| BBB | 8.3% |

| BB | 3.4% |

| B | 0.3% |

| A-1+ | 5.1% |

| A-1 | 0.4% |

| SP-1+ | 3.9% |

| Pre-refunded | 2.8% |

| Not Rated | 7.8% |

| Footnote | Description |

Footnote* | The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating issued by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by AllianceBernstein L.P.(the "Adviser"). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, equities, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment. |

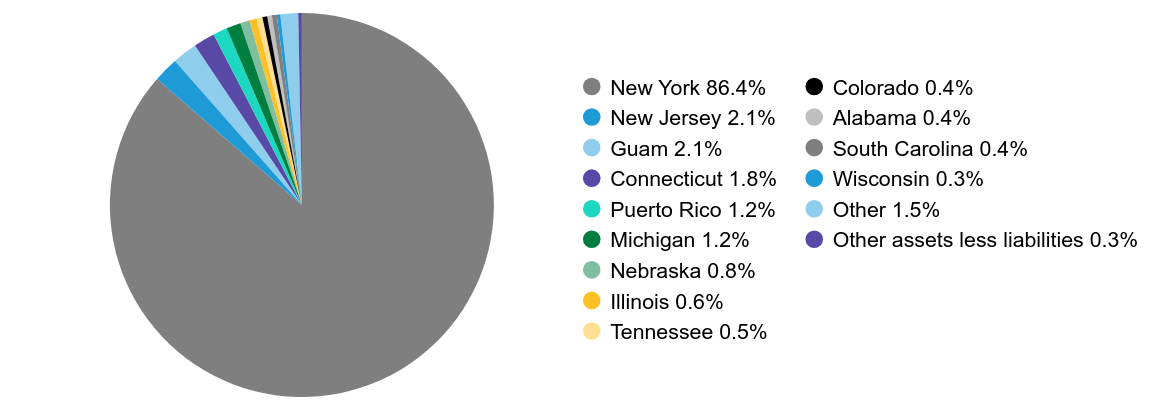

| Value | Value |

|---|

| California | 91.2% |

| Guam | 2.4% |

| New Jersey | 1.5% |

| Puerto Rico | 0.9% |

| Illinois | 0.8% |

| Kentucky | 0.5% |

| Wisconsin | 0.3% |

| Georgia | 0.2% |

| Michigan | 0.2% |

| Ohio | 0.1% |

| Pennsylvania | 0.1% |

| Washington | 0.1% |

| Other | 1.0% |

| Other assets less liabilities | 0.7% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/ACMCX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/ACMCX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the Overlay A Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/BWM/SAOOX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class 1 | $113 | 0.97% |

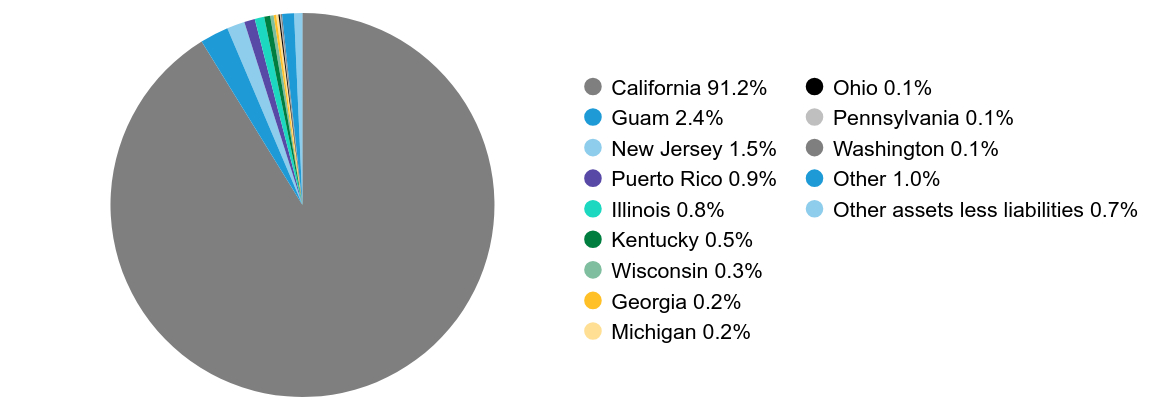

How did the Fund perform last year? What affected the Fund’s performance?

Over the 12-month period, Overlay A underperformed the S&P 500 index (the "benchmark") but outperformed the composite benchmark. This outperformance was due to duration extension, options strategies and tactical equity shifts. An overweight in risk assets also contributed positively. However, higher treasury yields, Middle East conflict and US economic concerns led to a temporary correction, prompting the Portfolio to neutralize its risk asset exposure. As the benchmark rallied, the Portfolio increased its equity exposure, driven by inflation trends and favorable central bank messaging. A reduced equity overweight followed a sell-off due to unexpected US data, but a measured US Federal Reserve (the "Fed") response and labor market normalization improved sentiment. Concerns about US growth, a BOJ hike and US election expectations raised fears of a hard landing. The Fed responded with a 0.50% rate cut, acknowledging progress in reducing inflation. The Portfolio maintained an overweight in return-seeking assets. During the 12-month period, the Portfolio used derivatives such as credit default swaps, futures, currency forwards and total return swaps for hedging and investment purposes, which added to performance, while purchased options detracted.

Top contributors to performance:

Top detractors from performance:

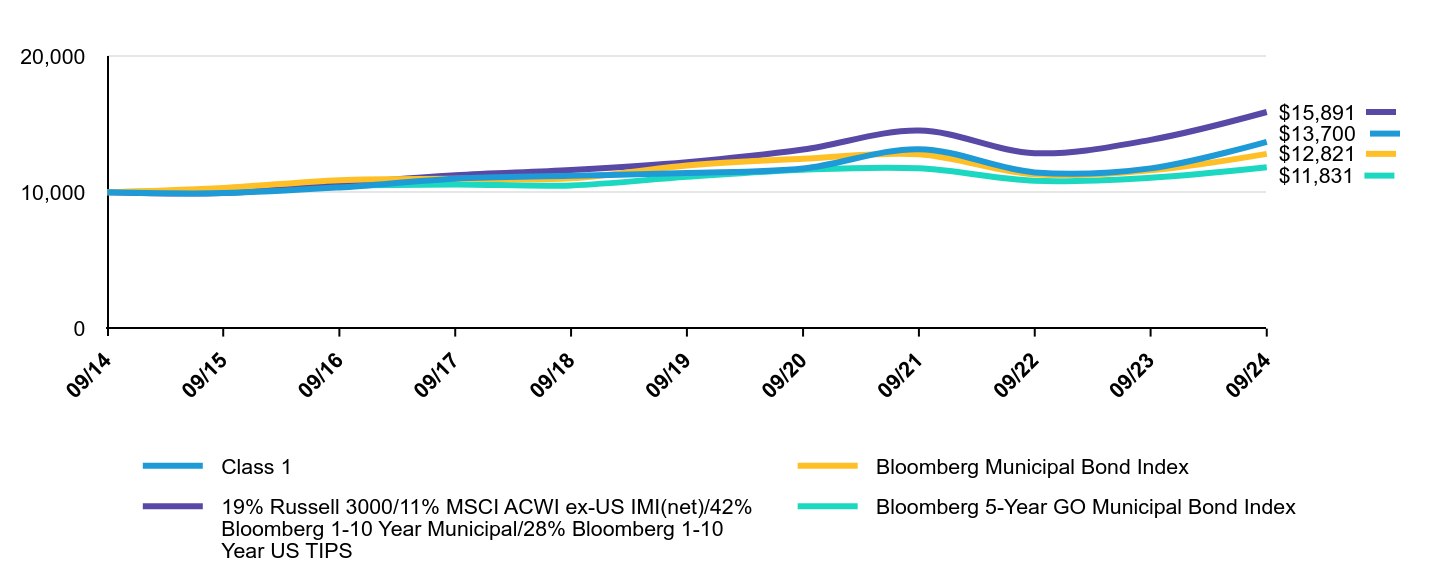

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class 1 | S&P 500 Index | 47.2% Russell 3000/26.5% MSCI ACWI ex-US IMI(net)/6.3% MSCI ACWI Commodity Producers(net)/20% Bloomberg US Agg |

|---|

| 09/14 | $10,000 | $10,000 | $10,000 |

| 09/15 | $9,714 | $9,939 | $9,466 |

| 09/16 | $9,990 | $11,472 | $10,649 |

| 09/17 | $11,393 | $13,607 | $12,205 |

| 09/18 | $11,987 | $16,044 | $13,375 |

| 09/19 | $11,812 | $16,727 | $13,682 |

| 09/20 | $11,759 | $19,260 | $14,719 |

| 09/21 | $14,835 | $25,040 | $18,296 |

| 09/22 | $11,695 | $21,165 | $15,147 |

| 09/23 | $11,781 | $25,741 | $17,689 |

| 09/24 | $15,563 | $35,098 | $22,183 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Class 1 | 32.10% | 5.67% | 4.52% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

| 47.2% Russell 3000/26.5% MSCI ACWI ex-US IMI(net)/6.3% MSCI ACWI Commodity Producers(net)/20% Bloomberg US Agg | 25.40% | 10.15% | 8.29% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/BWM/SAOOX-A for the most recent performance information.

| Net Assets | $507,611,176 |

| # of Portfolio Holdings | 252 |

| Portfolio Turnover Rate | 21% |

| Total Advisory Fees Paid | $3,505,124 |

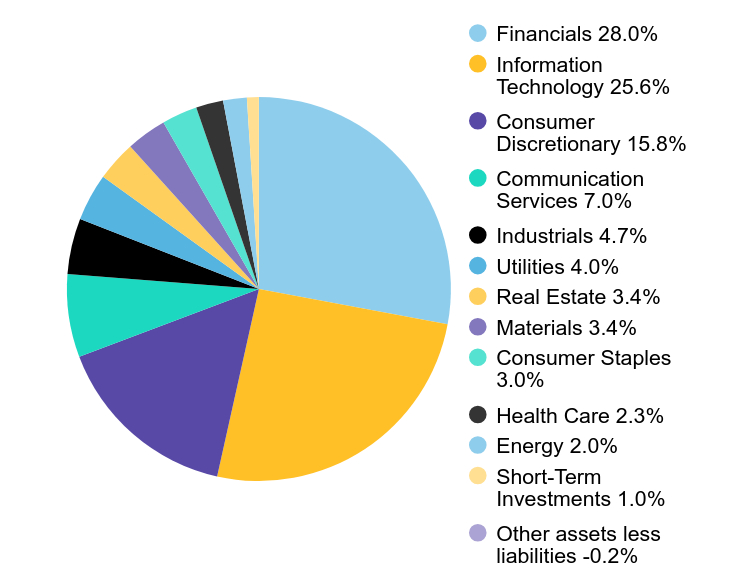

Graphical Representation of Holdings

Portfolio BreakdownFootnote Reference1

| Global Equity | |

| US | 60.7% |

| Developed International | 17.2% |

| Emerging Markets | 13.6% |

| Real Assets | 6.6% |

| Global Bond | |

| US | 41.3% |

| Developed International | 13.4% |

| Footnote | Description |

Footnote1 | The Portfolio's portfolio breakdown includes derivative exposure and is expressed as approximate percentages of the Portfolio's total net assets, based on the Adviser's internal classification. The percentages will vary over time, and the total of the percentages may be less than or greater than 100% in light of the leveraging effect of the derivative transactions. |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/BWM/SAOOX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/BWM/SAOOX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

SCBII-1947-OA-1-0153-0924

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the Overlay A Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/BWM/SAOTX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class 2 | $89 | 0.77% |

How did the Fund perform last year? What affected the Fund’s performance?

Over the 12-month period, Overlay A underperformed the S&P 500 index (the "benchmark") but outperformed the composite benchmark. This outperformance was due to duration extension, options strategies and tactical equity shifts. An overweight in risk assets also contributed positively. However, higher treasury yields, Middle East conflict and US economic concerns led to a temporary correction, prompting the Portfolio to neutralize its risk asset exposure. As the benchmark rallied, the Portfolio increased its equity exposure, driven by inflation trends and favorable central bank messaging. A reduced equity overweight followed a sell-off due to unexpected US data, but a measured US Federal Reserve (the "Fed") response and labor market normalization improved sentiment. Concerns about US growth, a BOJ hike and US election expectations raised fears of a hard landing. The Fed responded with a 0.50% rate cut, acknowledging progress in reducing inflation. The Portfolio maintained an overweight in return-seeking assets. During the 12-month period, the Portfolio used derivatives such as credit default swaps, futures, currency forwards and total return swaps for hedging and investment purposes, which added to performance, while purchased options detracted.

Top contributors to performance:

Top detractors from performance:

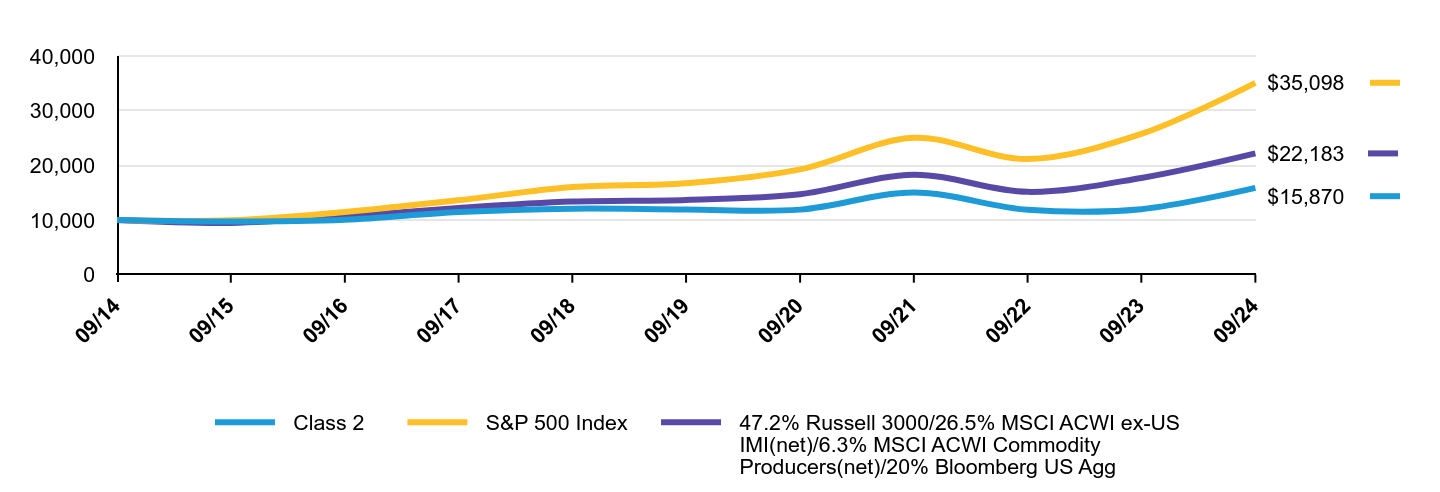

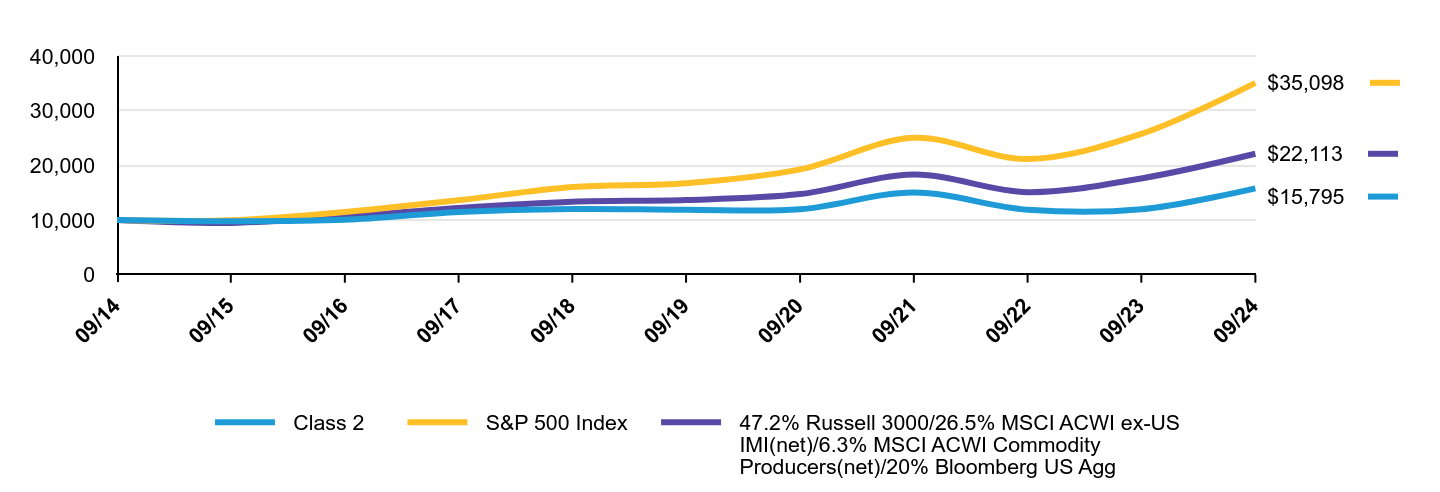

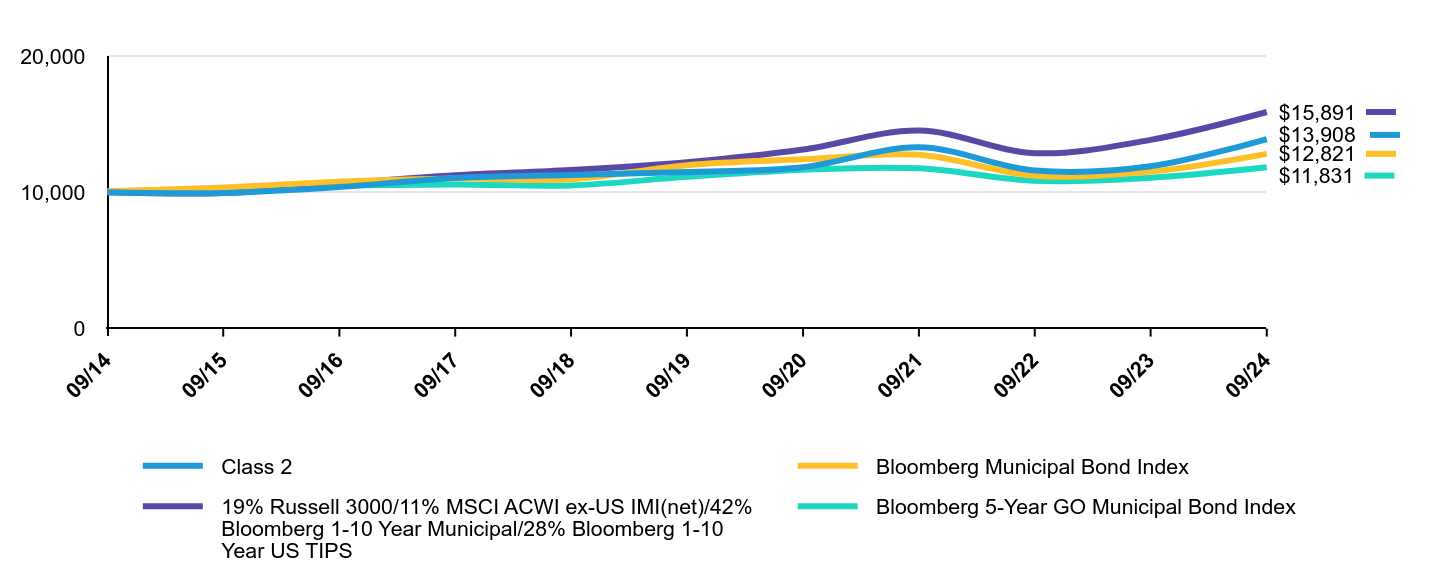

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class 2 | S&P 500 Index | 47.2% Russell 3000/26.5% MSCI ACWI ex-US IMI(net)/6.3% MSCI ACWI Commodity Producers(net)/20% Bloomberg US Agg |

|---|

| 09/14 | $10,000 | $10,000 | $10,000 |

| 09/15 | $9,722 | $9,939 | $9,466 |

| 09/16 | $10,027 | $11,472 | $10,649 |

| 09/17 | $11,462 | $13,607 | $12,205 |

| 09/18 | $12,077 | $16,044 | $13,375 |

| 09/19 | $11,929 | $16,727 | $13,682 |

| 09/20 | $11,899 | $19,260 | $14,719 |

| 09/21 | $15,034 | $25,040 | $18,296 |

| 09/22 | $11,873 | $21,165 | $15,147 |

| 09/23 | $11,989 | $25,741 | $17,689 |

| 09/24 | $15,870 | $35,098 | $22,183 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Class 2 | 32.38% | 5.88% | 4.73% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

| 47.2% Russell 3000/26.5% MSCI ACWI ex-US IMI(net)/6.3% MSCI ACWI Commodity Producers(net)/20% Bloomberg US Agg | 25.40% | 10.15% | 8.29% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/BWM/SAOTX-A for the most recent performance information.

| Net Assets | $507,611,176 |

| # of Portfolio Holdings | 252 |

| Portfolio Turnover Rate | 21% |

| Total Advisory Fees Paid | $3,505,124 |

Graphical Representation of Holdings

Portfolio BreakdownFootnote Reference1

| Global Equity | |

| US | 60.7% |

| Developed International | 17.2% |

| Emerging Markets | 13.6% |

| Real Assets | 6.6% |

| Global Bond | |

| US | 41.3% |

| Developed International | 13.4% |

| Footnote | Description |

Footnote1 | The Portfolio's portfolio breakdown includes derivative exposure and is expressed as approximate percentages of the Portfolio's total net assets, based on the Adviser's internal classification. The percentages will vary over time, and the total of the percentages may be less than or greater than 100% in light of the leveraging effect of the derivative transactions. |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/BWM/SAOTX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/BWM/SAOTX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

SCBII-1947-OA-2-0153-0924

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the Overlay B Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/BWM/SBOOX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class 1 | $94 | 0.86% |

How did the Fund perform last year? What affected the Fund’s performance?

Over the 12-month period, Overlay B outperformed the Bloomberg Global Aggregate Bond Index (the “benchmark”) and their current composite benchmark. This outperformance was due to duration extension, options strategies and tactical equity shifts. An overweight in risk assets also contributed positively. However, higher treasury yields, Middle East conflict and US economic concerns led to a temporary correction, prompting the Portfolio to neutralize its risk asset exposure. As the benchmark rallied, the Portfolio increased its equity exposure, driven by inflation trends and favorable central bank messaging. A reduced equity overweight followed a sell-off due to unexpected US data, but a measured US Federal Reserve (the “Fed”) response and labor market normalization improved sentiment. Concerns about US growth, a BOJ hike and US election expectations raised fears of a hard landing. The Fed responded with a 0.50% rate cut, acknowledging progress in reducing inflation. The Portfolio maintained an overweight in return-seeking assets. During the 12-month period, the Portfolio used derivatives in the form of inflation swaps, futures and total return swaps for hedging and investment purposes, which added to overall performance, while interest rate swaps, credit default swaps, currency forwards and purchased options detracted.

Top contributors to performance:

Top detractors from performance:

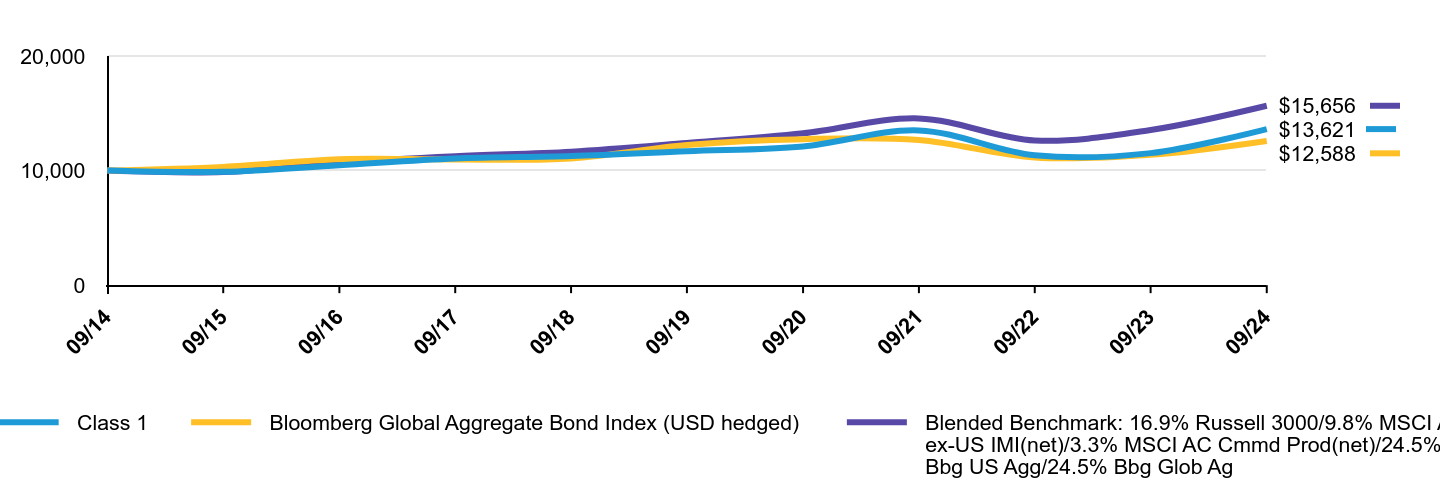

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class 1 | Bloomberg Global Aggregate Bond Index (USD hedged) | Blended Benchmark: 16.9% Russell 3000/9.8% MSCI AC ex-US IMI(net)/3.3% MSCI AC Cmmd Prod(net)/24.5% Bbg US Agg/24.5% Bbg Glob Ag |

|---|

| 09/14 | $10,000 | $10,000 | $10,000 |

| 09/15 | $9,889 | $10,314 | $9,879 |

| 09/16 | $10,466 | $10,989 | $10,699 |

| 09/17 | $11,051 | $10,969 | $11,254 |

| 09/18 | $11,264 | $11,060 | $11,653 |

| 09/19 | $11,687 | $12,237 | $12,407 |

| 09/20 | $12,103 | $12,743 | $13,257 |

| 09/21 | $13,508 | $12,672 | $14,553 |

| 09/22 | $11,334 | $11,145 | $12,624 |

| 09/23 | $11,524 | $11,378 | $13,537 |

| 09/24 | $13,621 | $12,588 | $15,656 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Class 1 | 18.20% | 3.11% | 3.14% |

| Bloomberg Global Aggregate Bond Index (USD hedged) | 10.63% | 0.57% | 2.33% |

| Blended Benchmark: 16.9% Russell 3000/9.8% MSCI AC ex-US IMI(net)/3.3% MSCI AC Cmmd Prod(net)/24.5% Bbg US Agg/24.5% Bbg Glob Ag | 15.65% | 4.76% | 4.58% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/BWM/SBOOX-A for the most recent performance information.

| Net Assets | $386,457,534 |

| # of Portfolio Holdings | 617 |

| Portfolio Turnover Rate | 160% |

| Total Advisory Fees Paid | $2,343,952 |

Graphical Representation of Holdings

Portfolio BreakdownFootnote Reference1

| Global Equity | |

| US | 22.3% |

| Developed International | 6.3% |

| Emerging Markets | 5.0% |

| Global Credit | |

| Investment Grade | 10.5% |

| Real Assets | 3.3% |

| Global Bond | |

| US | 51.7% |

| Developed International | 15.6% |

| Linkers | 25.4% |

| Footnote | Description |

Footnote1 | The Portfolio's portfolio breakdown includes derivative exposure and is expressed as approximate percentages of the Portfolio's total net assets, based on the Adviser's internal classification. The percentages will vary over time, and the total of the percentages may be less than or greater than 100% in light of the leveraging effect of the derivative transactions. |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/BWM/SBOOX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/BWM/SBOOX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

SCBII-1947-OB-1-0153-0924

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the Overlay B Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/BWM/SBOTX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class 2 | $78 | 0.71% |

How did the Fund perform last year? What affected the Fund’s performance?

Over the 12-month period, Overlay B outperformed the Bloomberg Global Aggregate Bond Index (the “benchmark”) and their current composite benchmark. This outperformance was due to duration extension, options strategies and tactical equity shifts. An overweight in risk assets also contributed positively. However, higher treasury yields, Middle East conflict and US economic concerns led to a temporary correction, prompting the Portfolio to neutralize its risk asset exposure. As the benchmark rallied, the Portfolio increased its equity exposure, driven by inflation trends and favorable central bank messaging. A reduced equity overweight followed a sell-off due to unexpected US data, but a measured US Federal Reserve (the “Fed”) response and labor market normalization improved sentiment. Concerns about US growth, a BOJ hike and US election expectations raised fears of a hard landing. The Fed responded with a 0.50% rate cut, acknowledging progress in reducing inflation. The Portfolio maintained an overweight in return-seeking assets. During the 12-month period, the Portfolio used derivatives in the form of inflation swaps, futures and total return swaps for hedging and investment purposes, which added to overall performance, while interest rate swaps, credit default swaps, currency forwards and purchased options detracted.

Top contributors to performance:

Top detractors from performance:

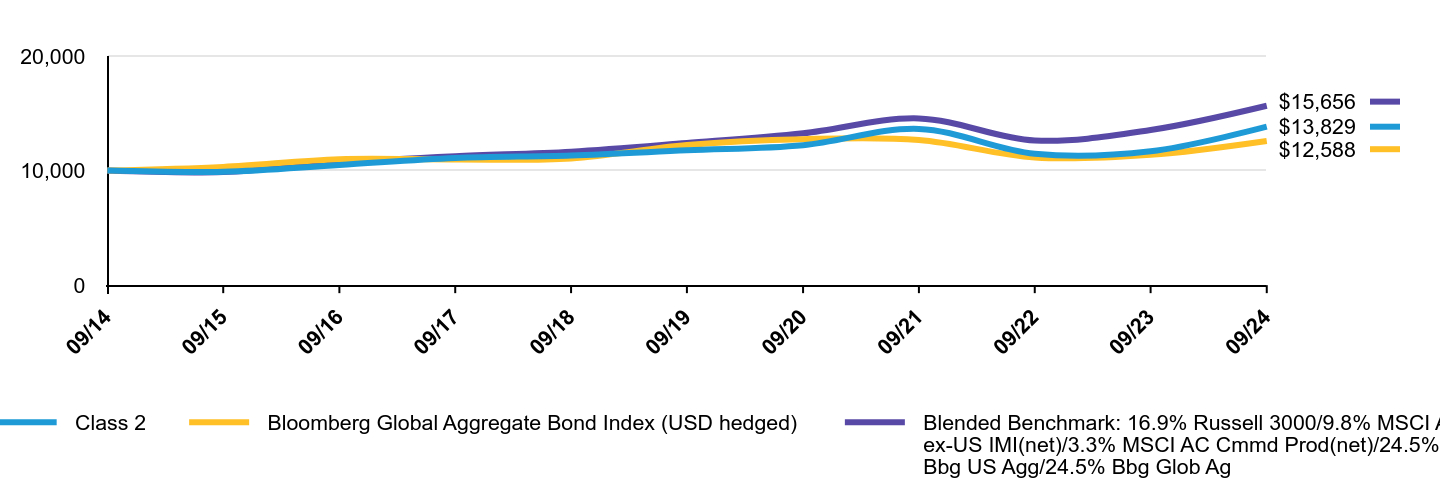

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class 2 | Bloomberg Global Aggregate Bond Index (USD hedged) | Blended Benchmark: 16.9% Russell 3000/9.8% MSCI AC ex-US IMI(net)/3.3% MSCI AC Cmmd Prod(net)/24.5% Bbg US Agg/24.5% Bbg Glob Ag |

|---|

| 09/14 | $10,000 | $10,000 | $10,000 |

| 09/15 | $9,902 | $10,314 | $9,879 |

| 09/16 | $10,488 | $10,989 | $10,699 |

| 09/17 | $11,099 | $10,969 | $11,254 |

| 09/18 | $11,323 | $11,060 | $11,653 |

| 09/19 | $11,772 | $12,237 | $12,407 |

| 09/20 | $12,215 | $12,743 | $13,257 |

| 09/21 | $13,637 | $12,672 | $14,553 |

| 09/22 | $11,467 | $11,145 | $12,624 |

| 09/23 | $11,680 | $11,378 | $13,537 |

| 09/24 | $13,829 | $12,588 | $15,656 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Class 2 | 18.40% | 3.27% | 3.29% |

| Bloomberg Global Aggregate Bond Index (USD hedged) | 10.63% | 0.57% | 2.33% |

| Blended Benchmark: 16.9% Russell 3000/9.8% MSCI AC ex-US IMI(net)/3.3% MSCI AC Cmmd Prod(net)/24.5% Bbg US Agg/24.5% Bbg Glob Ag | 15.65% | 4.76% | 4.58% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/BWM/SBOTX-A for the most recent performance information.

| Net Assets | $386,457,534 |

| # of Portfolio Holdings | 617 |

| Portfolio Turnover Rate | 160% |

| Total Advisory Fees Paid | $2,343,952 |

Graphical Representation of Holdings

Portfolio BreakdownFootnote Reference1

| Global Equity | |

| US | 22.3% |

| Developed International | 6.3% |

| Emerging Markets | 5.0% |

| Global Credit | |

| Investment Grade | 10.5% |

| Real Assets | 3.3% |

| Global Bond | |

| US | 51.7% |

| Developed International | 15.6% |

| Linkers | 25.4% |

| Footnote | Description |

Footnote1 | The Portfolio's portfolio breakdown includes derivative exposure and is expressed as approximate percentages of the Portfolio's total net assets, based on the Adviser's internal classification. The percentages will vary over time, and the total of the percentages may be less than or greater than 100% in light of the leveraging effect of the derivative transactions. |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/BWM/SBOTX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/BWM/SBOTX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

SCBII-1947-OB-2-0153-0924

Tax-Aware Overlay A Portfolio

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the Tax-Aware Overlay A Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/BWM/SATOX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class 1 | $110 | 0.95% |

How did the Fund perform last year? What affected the Fund’s performance?

Over the 12-month period, Tax Aware Overlay A underperformed the S&P 500 Index (the “benchmark”) and outperformed their current composite benchmark. This outperformance was due to duration extension, options strategies and tactical equity shifts. An overweight in risk assets also contributed positively. However, higher treasury yields, Middle East conflict and US economic concerns led to a temporary correction, prompting the Portfolio to neutralize its risk asset exposure. As the benchmark rallied, the Portfolio increased its equity exposure, driven by inflation trends and favorable central bank messaging. A reduced equity overweight followed a sell-off due to unexpected US data, but a measured US Federal Reserve (the “Fed”) response and labor market normalization improved sentiment. Concerns about US growth, a BOJ hike and US election expectations raised fears of a hard landing. The Fed responded with a 0.50% rate cut, acknowledging progress in reducing inflation. The Portfolio maintained an overweight in return-seeking assets. During the 12-month period, the Portfolio used derivatives in the form of credit default swaps, futures, currency forwards and total return swaps for hedging and investment purposes, which added to overall performance, while purchased options detracted.

Top contributors to performance:

Top detractors from performance:

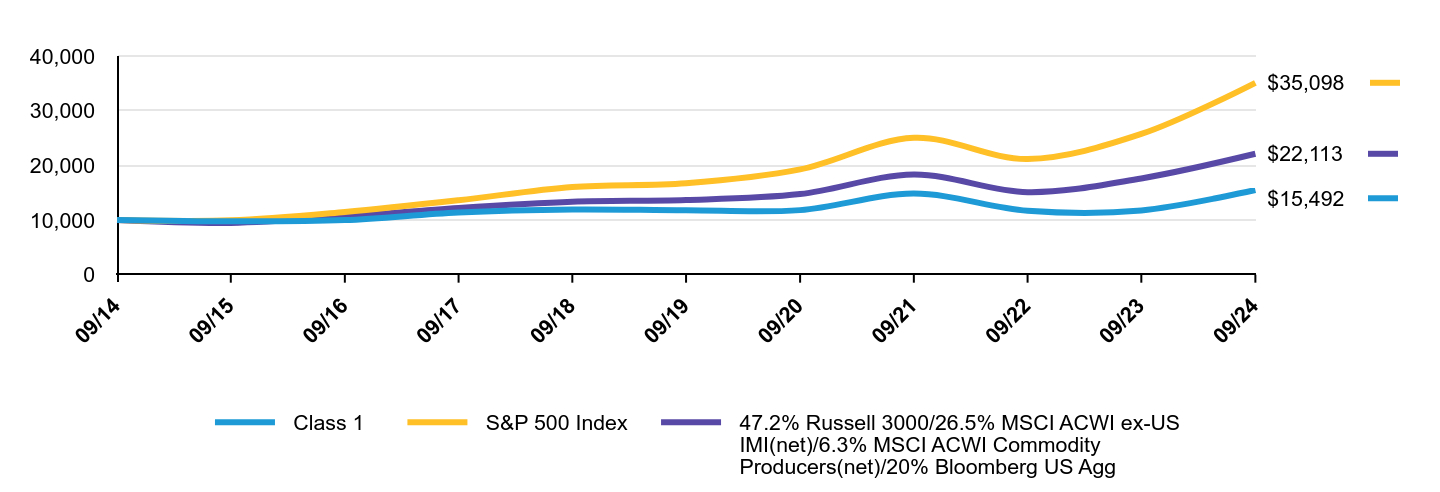

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class 1 | S&P 500 Index | 47.2% Russell 3000/26.5% MSCI ACWI ex-US IMI(net)/6.3% MSCI ACWI Commodity Producers(net)/20% Bloomberg US Agg |

|---|

| 09/14 | $10,000 | $10,000 | $10,000 |

| 09/15 | $9,755 | $9,939 | $9,476 |

| 09/16 | $9,987 | $11,472 | $10,642 |

| 09/17 | $11,384 | $13,607 | $12,204 |

| 09/18 | $11,929 | $16,044 | $13,344 |

| 09/19 | $11,776 | $16,727 | $13,653 |

| 09/20 | $11,810 | $19,260 | $14,746 |

| 09/21 | $14,827 | $25,040 | $18,313 |

| 09/22 | $11,690 | $21,165 | $15,100 |

| 09/23 | $11,747 | $25,741 | $17,608 |

| 09/24 | $15,492 | $35,098 | $22,113 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Class 1 | 31.88% | 5.64% | 4.47% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

| 47.2% Russell 3000/26.5% MSCI ACWI ex-US IMI(net)/6.3% MSCI ACWI Commodity Producers(net)/20% Bloomberg US Agg | 25.59% | 10.12% | 8.26% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/BWM/SATOX-A for the most recent performance information.

| Net Assets | $1,147,528,979 |

| # of Portfolio Holdings | 263 |

| Portfolio Turnover Rate | 19% |

| Total Advisory Fees Paid | $7,138,484 |

Graphical Representation of Holdings

Portfolio BreakdownFootnote Reference1

| Global Equity | |

| US | 61.2% |

| Developed International | 17.2% |

| Emerging Markets | 13.6% |

| Real Assets | 6.9% |

| Global Bond | |

| US | 53.8% |

| Developed International | -% |

| Footnote | Description |

Footnote1 | The Portfolio's portfolio breakdown includes derivative exposure and is expressed as approximate percentages of the Portfolio's total net assets, based on the Adviser's internal classification. The percentages will vary over time, and the total of the percentages may be less than or greater than 100% in light of the leveraging effect of the derivative transactions. |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/BWM/SATOX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/BWM/SATOX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

SCBII-1947-TAOA-1-0153-0924

Tax-Aware Overlay A Portfolio

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the Tax-Aware Overlay A Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/BWM/SATTX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class 2 | $87 | 0.75% |

How did the Fund perform last year? What affected the Fund’s performance?

Over the 12-month period, Tax Aware Overlay A underperformed the S&P 500 Index (the “benchmark”) and outperformed their current composite benchmark. This outperformance was due to duration extension, options strategies and tactical equity shifts. An overweight in risk assets also contributed positively. However, higher treasury yields, Middle East conflict and US economic concerns led to a temporary correction, prompting the Portfolio to neutralize its risk asset exposure. As the benchmark rallied, the Portfolio increased its equity exposure, driven by inflation trends and favorable central bank messaging. A reduced equity overweight followed a sell-off due to unexpected US data, but a measured US Federal Reserve (the “Fed”) response and labor market normalization improved sentiment. Concerns about US growth, a BOJ hike and US election expectations raised fears of a hard landing. The Fed responded with a 0.50% rate cut, acknowledging progress in reducing inflation. The Portfolio maintained an overweight in return-seeking assets. During the 12-month period, the Portfolio used derivatives in the form of credit default swaps, futures, currency forwards and total return swaps for hedging and investment purposes, which added to overall performance, while purchased options detracted.

Top contributors to performance:

Top detractors from performance:

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class 2 | S&P 500 Index | 47.2% Russell 3000/26.5% MSCI ACWI ex-US IMI(net)/6.3% MSCI ACWI Commodity Producers(net)/20% Bloomberg US Agg |

|---|

| 09/14 | $10,000 | $10,000 | $10,000 |

| 09/15 | $9,773 | $9,939 | $9,476 |

| 09/16 | $10,029 | $11,472 | $10,642 |

| 09/17 | $11,458 | $13,607 | $12,204 |

| 09/18 | $12,024 | $16,044 | $13,344 |

| 09/19 | $11,889 | $16,727 | $13,653 |

| 09/20 | $11,956 | $19,260 | $14,746 |

| 09/21 | $15,038 | $25,040 | $18,313 |

| 09/22 | $11,883 | $21,165 | $15,100 |

| 09/23 | $11,960 | $25,741 | $17,608 |

| 09/24 | $15,795 | $35,098 | $22,113 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Class 2 | 32.07% | 5.85% | 4.68% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

| 47.2% Russell 3000/26.5% MSCI ACWI ex-US IMI(net)/6.3% MSCI ACWI Commodity Producers(net)/20% Bloomberg US Agg | 25.59% | 10.12% | 8.26% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/BWM/SATTX-A for the most recent performance information.

| Net Assets | $1,147,528,979 |

| # of Portfolio Holdings | 263 |

| Portfolio Turnover Rate | 19% |

| Total Advisory Fees Paid | $7,138,484 |

Graphical Representation of Holdings

Portfolio BreakdownFootnote Reference1

| Global Equity | |

| US | 61.2% |

| Developed International | 17.2% |

| Emerging Markets | 13.6% |

| Real Assets | 6.9% |

| Global Bond | |

| US | 53.8% |

| Developed International | -% |

| Footnote | Description |

Footnote1 | The Portfolio's portfolio breakdown includes derivative exposure and is expressed as approximate percentages of the Portfolio's total net assets, based on the Adviser's internal classification. The percentages will vary over time, and the total of the percentages may be less than or greater than 100% in light of the leveraging effect of the derivative transactions. |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/BWM/SATTX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/BWM/SATTX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

SCBII-1947-TAOA-2-0153-0924

Please scan QR code for

Fund Information

Diversified Municipal Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the Diversified Municipal Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/AIDYX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $46 | 0.44% |

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, all share classes, except Class C, outperformed the Bloomberg 1-10 Year Blend Index (the “benchmark”). Class C underperformed the benchmark and its Lipper peer group average. Overall security selection contributed, relative to the benchmark. In particular, security selection within multi-family housing was additive, while yield-curve positioning detracted.

The Portfolio used interest rate swaps for hedging purposes, which added to overall performance.

Top contributors to performance:

Top detractors from performance:

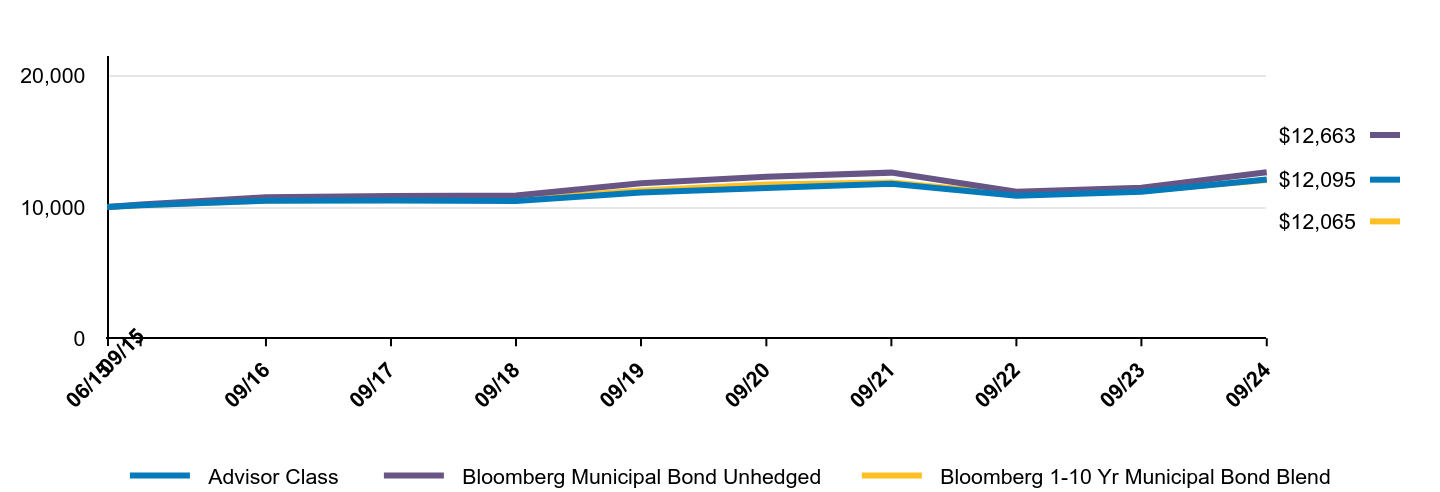

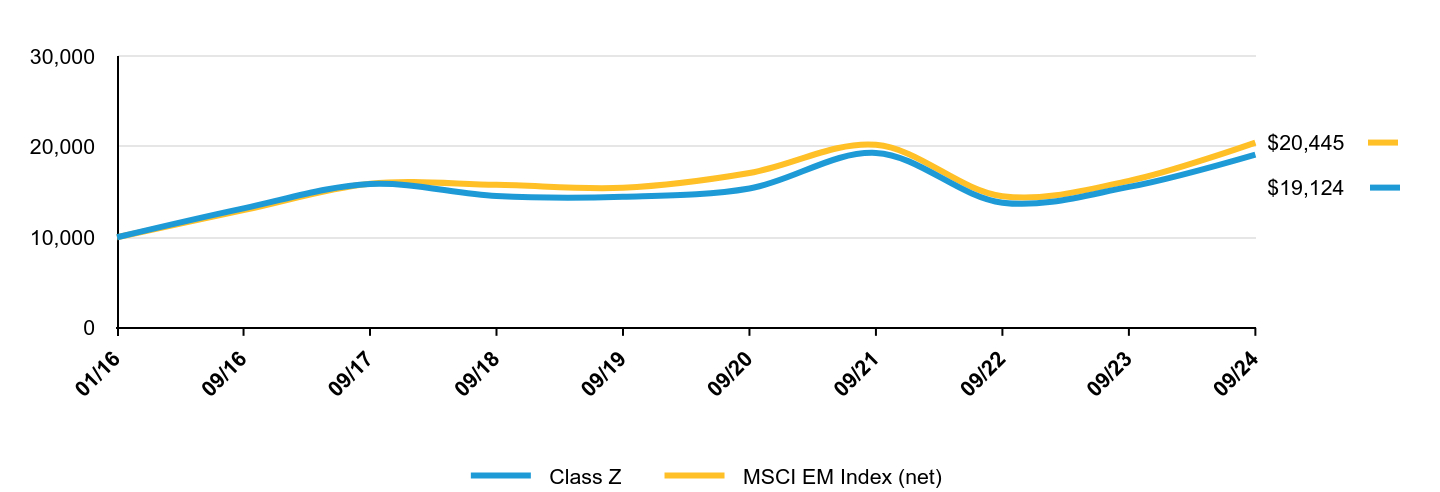

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Advisor Class | Bloomberg Municipal Bond Unhedged | Bloomberg 1-10 Yr Municipal Bond Blend |

|---|

| 06/15 | $10,000 | $10,000 | $10,000 |

| 09/15 | $10,134 | $10,189 | $10,149 |

| 09/16 | $10,475 | $10,757 | $10,494 |

| 09/17 | $10,512 | $10,852 | $10,599 |

| 09/18 | $10,461 | $10,889 | $10,579 |

| 09/19 | $11,112 | $11,820 | $11,258 |

| 09/20 | $11,457 | $12,304 | $11,720 |

| 09/21 | $11,785 | $12,627 | $11,876 |

| 09/22 | $10,859 | $11,175 | $10,979 |

| 09/23 | $11,168 | $11,473 | $11,230 |

| 09/24 | $12,095 | $12,663 | $12,065 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception 06/26/15 |

|---|

| Advisor Class | 8.22% | 1.70% | 2.07% |

| Bloomberg Municipal Bond Unhedged | 10.63% | 5.67% | 2.58% |

| Bloomberg 1-10 Yr Municipal Bond Blend | 7.44% | 1.39% | 2.05% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/AIDYX-A for the most recent performance information.

| Net Assets | $5,044,305,341 |

| # of Portfolio Holdings | 944 |

| Portfolio Turnover Rate | 43% |

| Total Advisory Fees Paid | $17,994,055 |

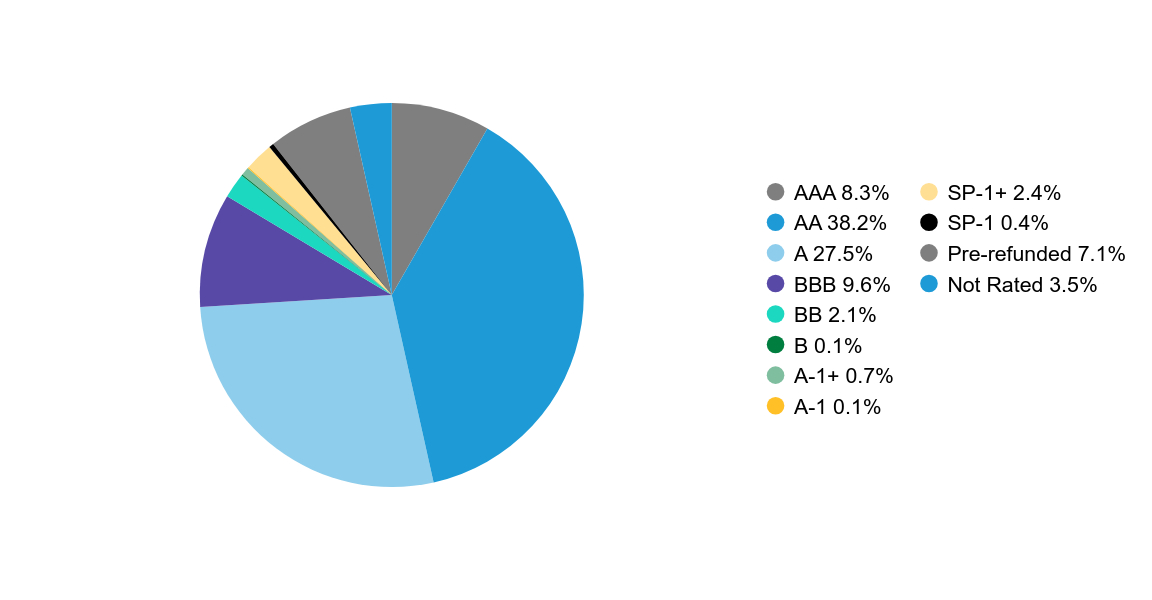

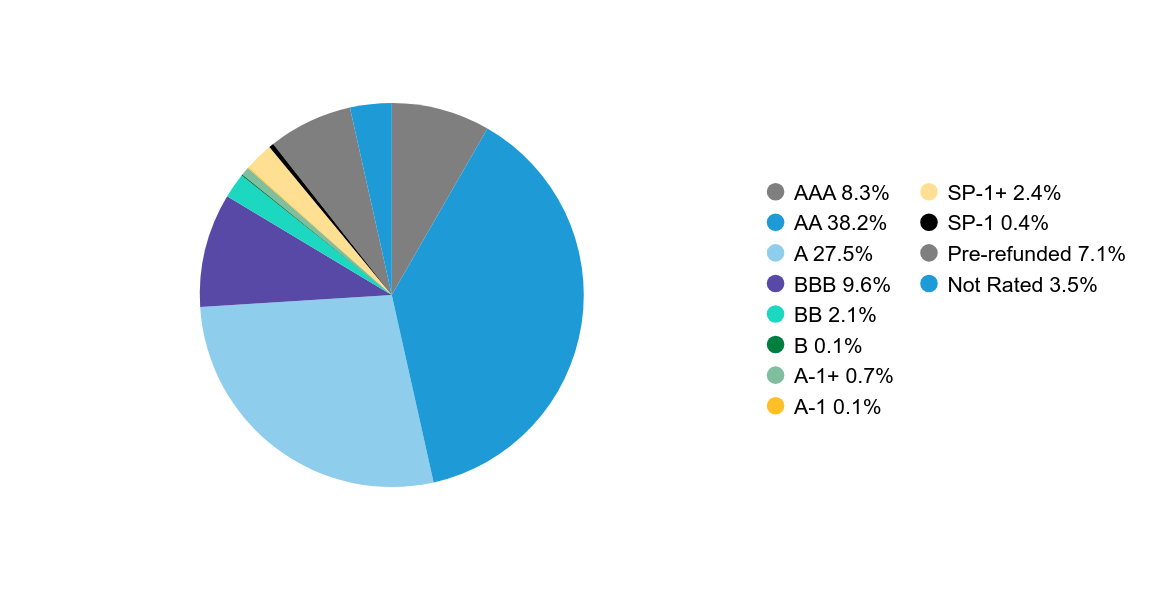

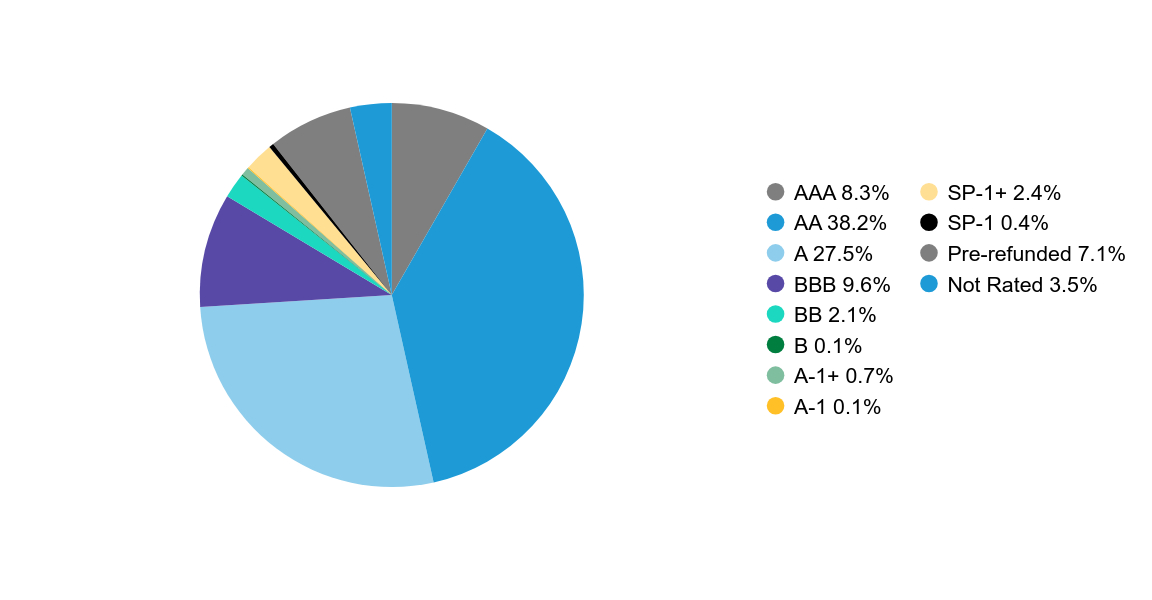

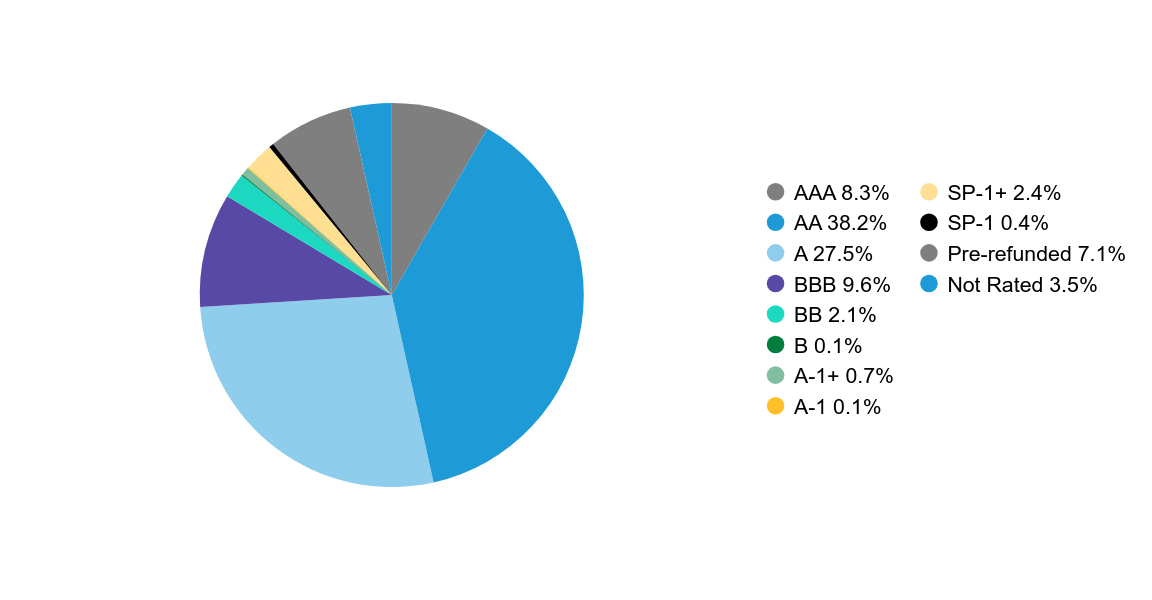

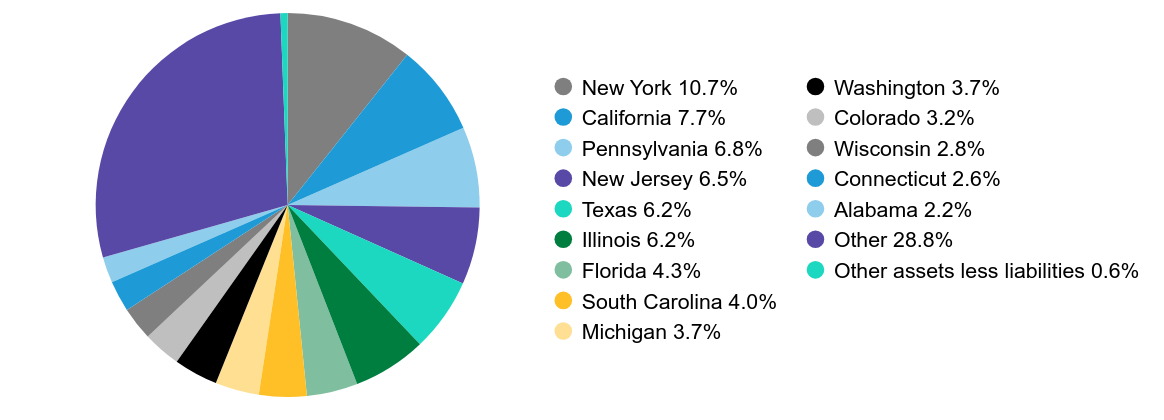

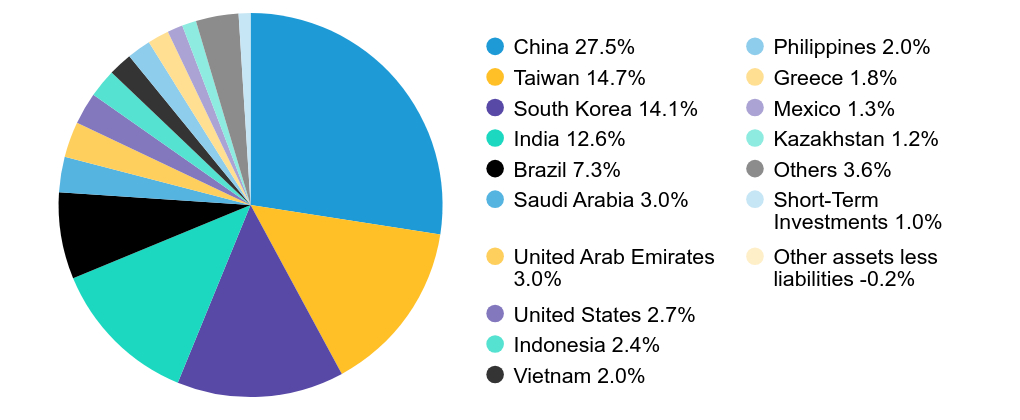

Graphical Representation of Holdings

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 8.3% |

| AA | 38.2% |

| A | 27.5% |

| BBB | 9.6% |

| BB | 2.1% |

| B | 0.1% |

| A-1+ | 0.7% |

| A-1 | 0.1% |

| SP-1+ | 2.4% |

| SP-1 | 0.4% |

| Pre-refunded | 7.1% |

| Not Rated | 3.5% |

| Footnote | Description |

Footnote* | The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating issued by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by AllianceBernstein L.P.(the "Adviser"). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, equities, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment. |

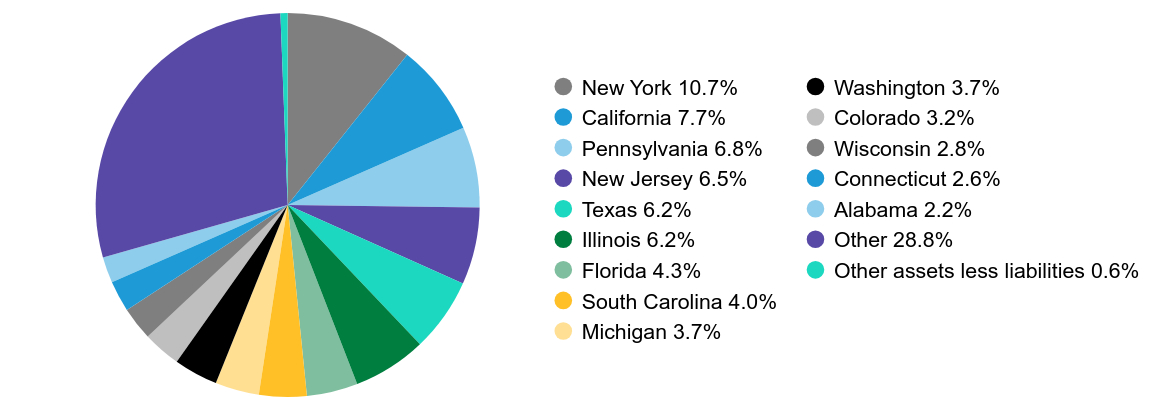

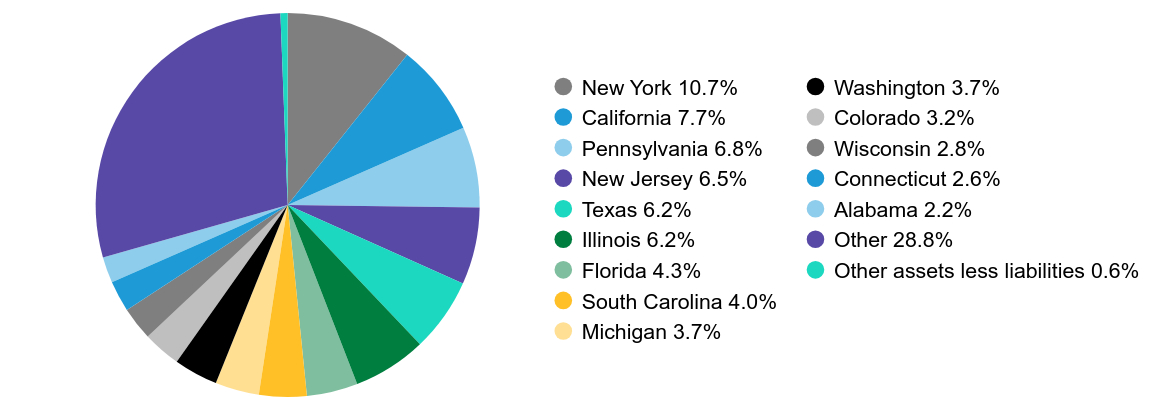

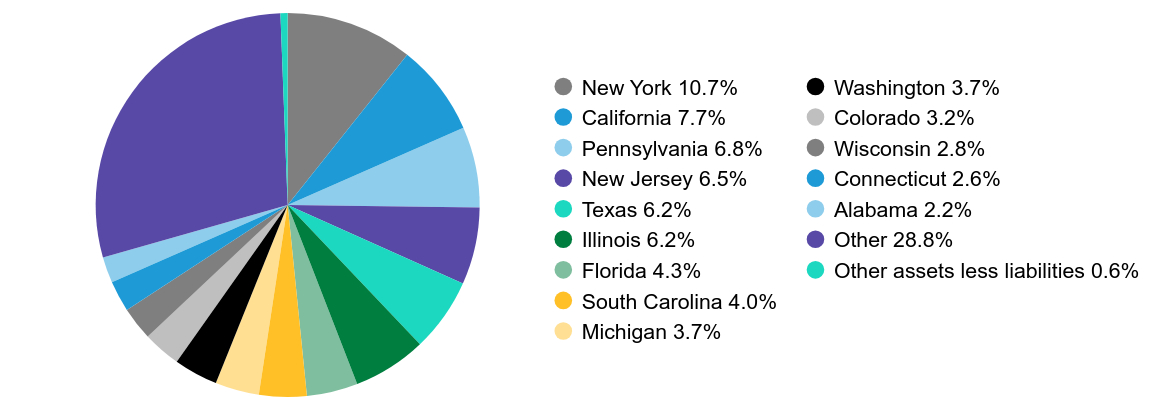

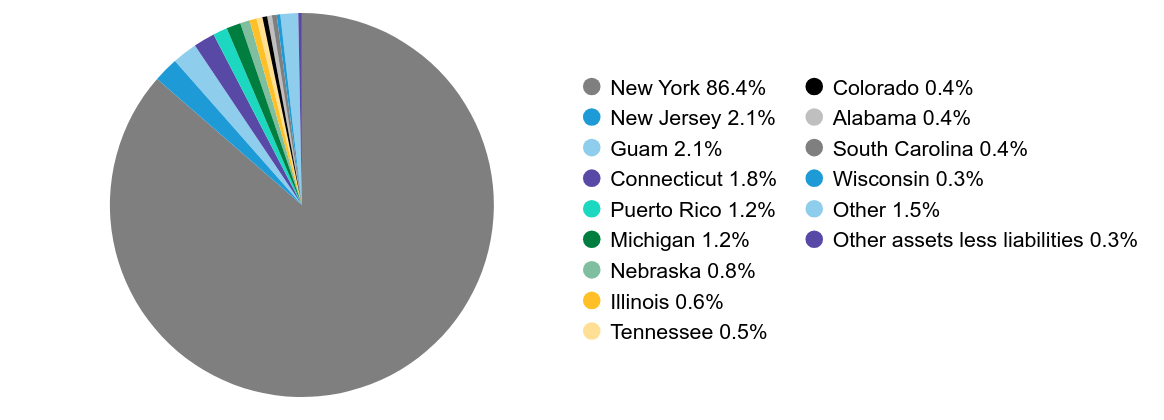

| Value | Value |

|---|

| New York | 10.7% |

| California | 7.7% |

| Pennsylvania | 6.8% |

| New Jersey | 6.5% |

| Texas | 6.2% |

| Illinois | 6.2% |

| Florida | 4.3% |

| South Carolina | 4.0% |

| Michigan | 3.7% |

| Washington | 3.7% |

| Colorado | 3.2% |

| Wisconsin | 2.8% |

| Connecticut | 2.6% |

| Alabama | 2.2% |

| Other | 28.8% |

| Other assets less liabilities | 0.6% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/AIDYX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/AIDYX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

Diversified Municipal Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the Diversified Municipal Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/AIDAX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $72 | 0.69% |

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, all share classes, except Class C, outperformed the Bloomberg 1-10 Year Blend Index (the “benchmark”). Class C underperformed the benchmark and its Lipper peer group average. Overall security selection contributed, relative to the benchmark. In particular, security selection within multi-family housing was additive, while yield-curve positioning detracted.

The Portfolio used interest rate swaps for hedging purposes, which added to overall performance.

Top contributors to performance:

Top detractors from performance:

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class A (with sales charges) | Bloomberg Municipal Bond Unhedged | Bloomberg 1-10 Yr Municipal Bond Blend |

|---|

| 09/14 | $9,700 | $10,000 | $10,000 |

| 09/15 | $9,830 | $10,316 | $10,222 |

| 09/16 | $10,139 | $10,892 | $10,569 |

| 09/17 | $10,150 | $10,987 | $10,675 |

| 09/18 | $10,076 | $11,025 | $10,655 |

| 09/19 | $10,680 | $11,968 | $11,339 |

| 09/20 | $10,976 | $12,458 | $11,804 |

| 09/21 | $11,262 | $12,785 | $11,961 |

| 09/22 | $10,353 | $11,315 | $11,058 |

| 09/23 | $10,620 | $11,616 | $11,311 |

| 09/24 | $11,471 | $12,821 | $12,152 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Class A (without sales charges) | 7.93% | 1.43% | 1.69% |

| Class A (with sales charges) | 4.73% | 0.81% | 1.38% |

| Bloomberg Municipal Bond Unhedged | 10.63% | 5.67% | 2.33% |

| Bloomberg 1-10 Yr Municipal Bond Blend | 7.44% | 1.39% | 1.97% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/AIDAX-A for the most recent performance information.

| Net Assets | $5,044,305,341 |

| # of Portfolio Holdings | 944 |

| Portfolio Turnover Rate | 43% |

| Total Advisory Fees Paid | $17,994,055 |

Graphical Representation of Holdings

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 8.3% |

| AA | 38.2% |

| A | 27.5% |

| BBB | 9.6% |

| BB | 2.1% |

| B | 0.1% |

| A-1+ | 0.7% |

| A-1 | 0.1% |

| SP-1+ | 2.4% |

| SP-1 | 0.4% |

| Pre-refunded | 7.1% |

| Not Rated | 3.5% |

| Footnote | Description |

Footnote* | The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating issued by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by AllianceBernstein L.P.(the "Adviser"). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, equities, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment. |

| Value | Value |

|---|

| New York | 10.7% |

| California | 7.7% |

| Pennsylvania | 6.8% |

| New Jersey | 6.5% |

| Texas | 6.2% |

| Illinois | 6.2% |

| Florida | 4.3% |

| South Carolina | 4.0% |

| Michigan | 3.7% |

| Washington | 3.7% |

| Colorado | 3.2% |

| Wisconsin | 2.8% |

| Connecticut | 2.6% |

| Alabama | 2.2% |

| Other | 28.8% |

| Other assets less liabilities | 0.6% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/AIDAX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/AIDAX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

Diversified Municipal Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the Diversified Municipal Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/AIMCX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $149 | 1.44% |

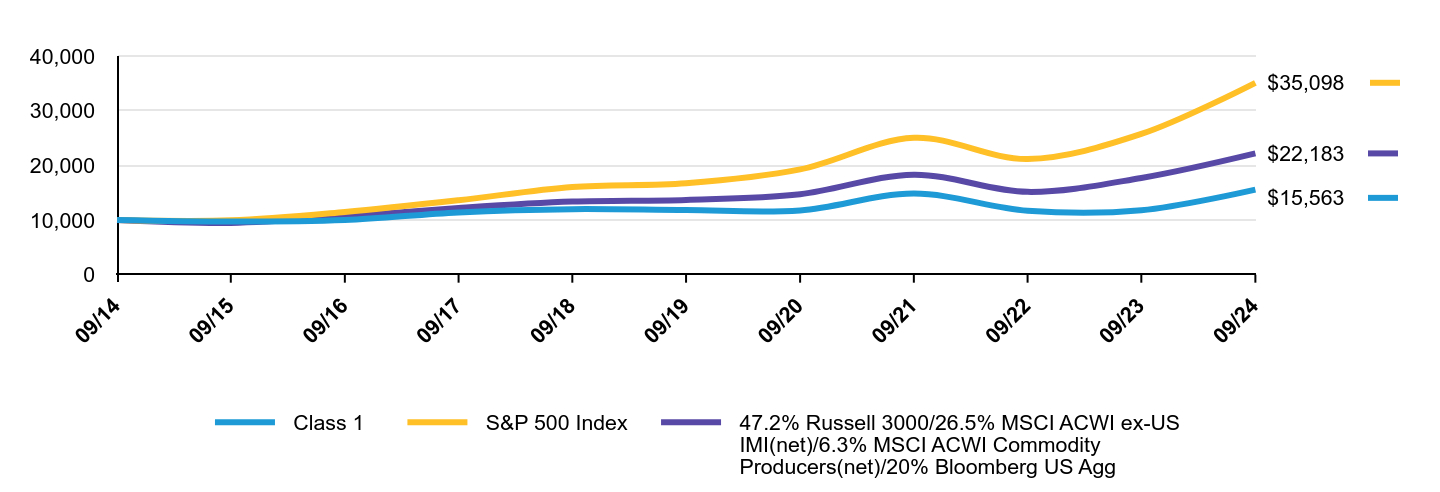

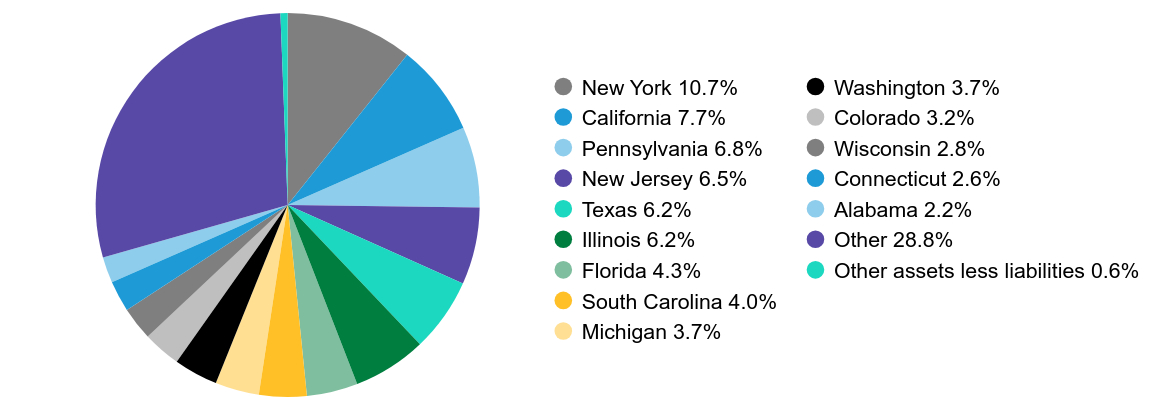

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, all share classes, except Class C, outperformed the Bloomberg 1-10 Year Blend Index (the “benchmark”). Class C underperformed the benchmark and its Lipper peer group average. Overall security selection contributed, relative to the benchmark. In particular, security selection within multi-family housing was additive, while yield-curve positioning detracted.

The Portfolio used interest rate swaps for hedging purposes, which added to overall performance.

Top contributors to performance:

Top detractors from performance:

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class C | Bloomberg Municipal Bond Unhedged | Bloomberg 1-10 Yr Municipal Bond Blend |

|---|

| 09/14 | $10,000 | $10,000 | $10,000 |

| 09/15 | $10,062 | $10,316 | $10,222 |

| 09/16 | $10,301 | $10,892 | $10,569 |

| 09/17 | $10,235 | $10,987 | $10,675 |

| 09/18 | $10,077 | $11,025 | $10,655 |

| 09/19 | $10,601 | $11,968 | $11,339 |

| 09/20 | $10,821 | $12,458 | $11,804 |

| 09/21 | $11,020 | $12,785 | $11,961 |

| 09/22 | $10,046 | $11,315 | $11,058 |

| 09/23 | $10,237 | $11,616 | $11,311 |

| 09/24 | $10,972 | $12,821 | $12,152 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Class C | 7.13% | 0.68% | 0.93% |

| Bloomberg Municipal Bond Unhedged | 10.63% | 5.67% | 2.33% |

| Bloomberg 1-10 Yr Municipal Bond Blend | 7.44% | 1.39% | 1.97% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/AIMCX-A for the most recent performance information.

| Net Assets | $5,044,305,341 |

| # of Portfolio Holdings | 944 |

| Portfolio Turnover Rate | 43% |

| Total Advisory Fees Paid | $17,994,055 |

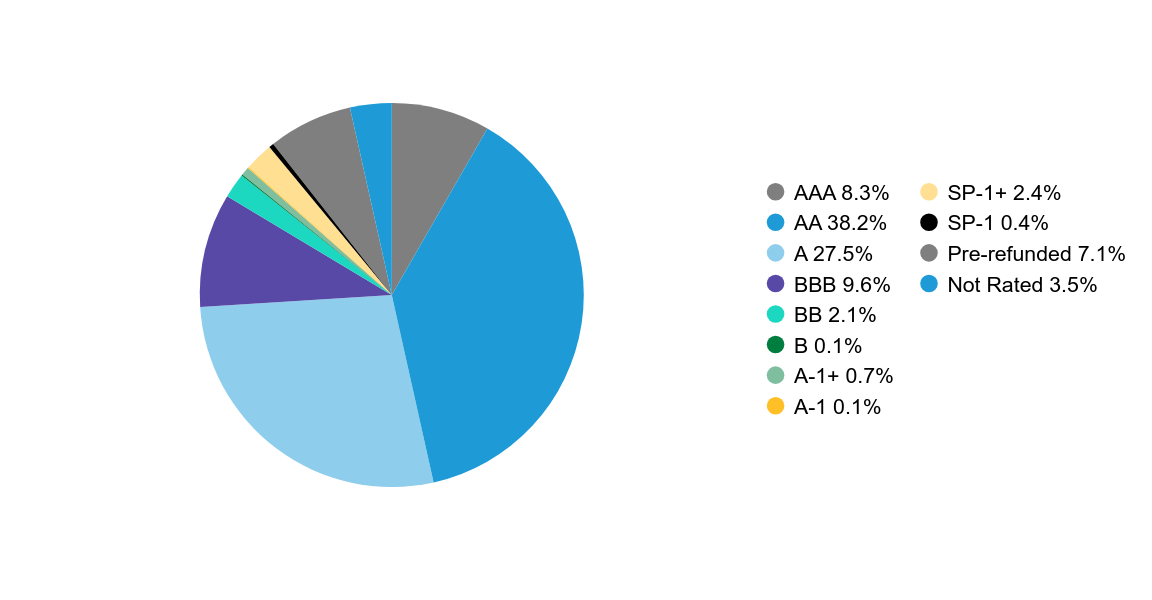

Graphical Representation of Holdings

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 8.3% |

| AA | 38.2% |

| A | 27.5% |

| BBB | 9.6% |

| BB | 2.1% |

| B | 0.1% |

| A-1+ | 0.7% |

| A-1 | 0.1% |

| SP-1+ | 2.4% |

| SP-1 | 0.4% |

| Pre-refunded | 7.1% |

| Not Rated | 3.5% |

| Footnote | Description |

Footnote* | The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating issued by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by AllianceBernstein L.P.(the "Adviser"). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, equities, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment. |

| Value | Value |

|---|

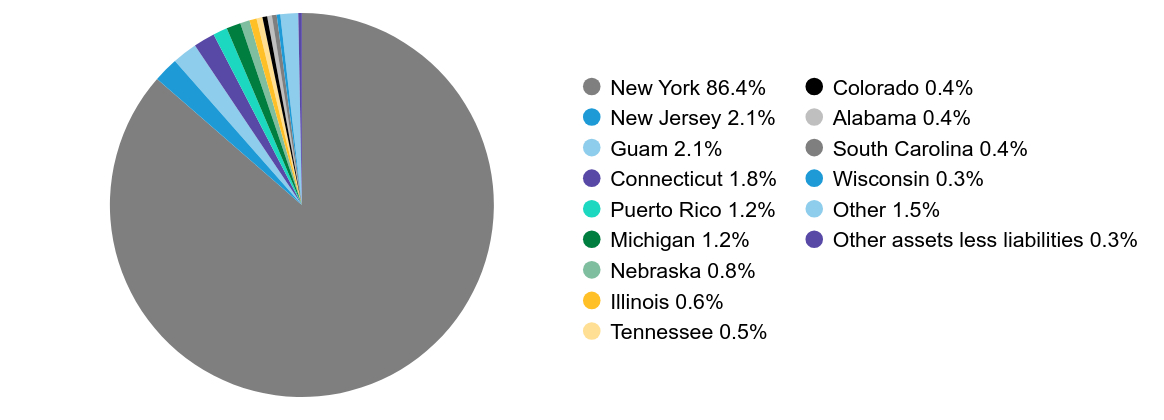

| New York | 10.7% |

| California | 7.7% |

| Pennsylvania | 6.8% |

| New Jersey | 6.5% |

| Texas | 6.2% |

| Illinois | 6.2% |

| Florida | 4.3% |

| South Carolina | 4.0% |

| Michigan | 3.7% |

| Washington | 3.7% |

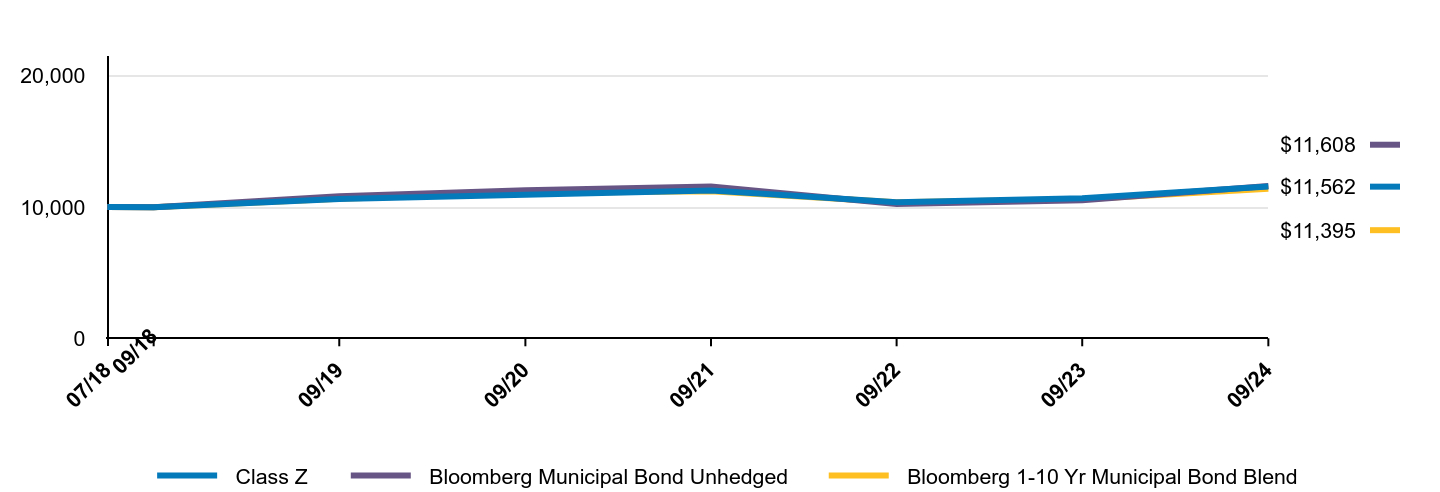

| Colorado | 3.2% |