UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-01700

Franklin Gold and Precious Metals Fund

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Alison Baur, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code:

(650)312-2000

Date of fiscal year end: 7/31

Date of reporting period: 7/31/24

Item 1. Reports to Stockholders.

| a.) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1). |

| b.) | Include a copy of each notice transmitted to stockholders in reliance on Rule 30e-3 under the Act (17 CFR 270.30e-3) that contains disclosures specified by paragraph (c)(3) of that rule. |

Not Applicable.

| | |

Franklin Gold and Precious Metals Fund | |

| Class A [FKRCX] |

| Annual Shareholder Report | July 31, 2024 |

|

This annual shareholder report contains important information about Franklin Gold and Precious Metals Fund for the period August 1, 2023, to July 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Class A | $101 | 0.92% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended July 31, 2024, Class A shares of Franklin Gold and Precious Metals Fund returned 18.56%. The Fund compares its performance to the FTSE Gold Mines Index and the S&P 500 Index, which returned 25.52% and 22.15%, respectively, for the same period.

| |

Top contributors to performance: |

| ↑ | Holdings in gold-focused mining companies (roughly 84% of total net assets) outperformed the benchmark, FTSE Gold Mines Index, in both absolute and relative terms. |

| ↑ | Several smaller, single-asset and development-stage mining companies, a key feature of our longer-term investment strategy, delivered some of the strongest gains. |

| ↑ | Strategic underweighting in some of the world’s largest gold miners aided relative returns as share-price gains for Barrick Gold, Newmont and select large-capitalization peers lagged the index. |

| |

Top detractors from performance: |

| ↓ | Off-benchmark positions in platinum- and palladium-focused miners were weak given the sharp decline in palladium prices; producers of copper and other base metals also underperformed, especially in the latter half of the period. |

| ↓ | Within the portfolio’s core gold industry allocation, company-specific issues led to selloffs in several overweighted or off-index holdings including Orla Mining, SSR Mining (sold by period-end), Victoria Gold (sold by period-end), Allied Gold (purchased during the period) and Ascot Resources. The Fund also lacked exposure to a few index constituents that more than doubled in value such as Harmony Gold Mining. |

| ↓ | Relative gains in the gold industry were reduced by lighter-than-index exposures to select large-cap gold miners that topped the benchmark average, including Kinross Gold (sold by period-end) and Agnico Eagle Mines. |

| Franklin Gold and Precious Metals Fund | PAGE 1 | 132-ATSR-0924 |

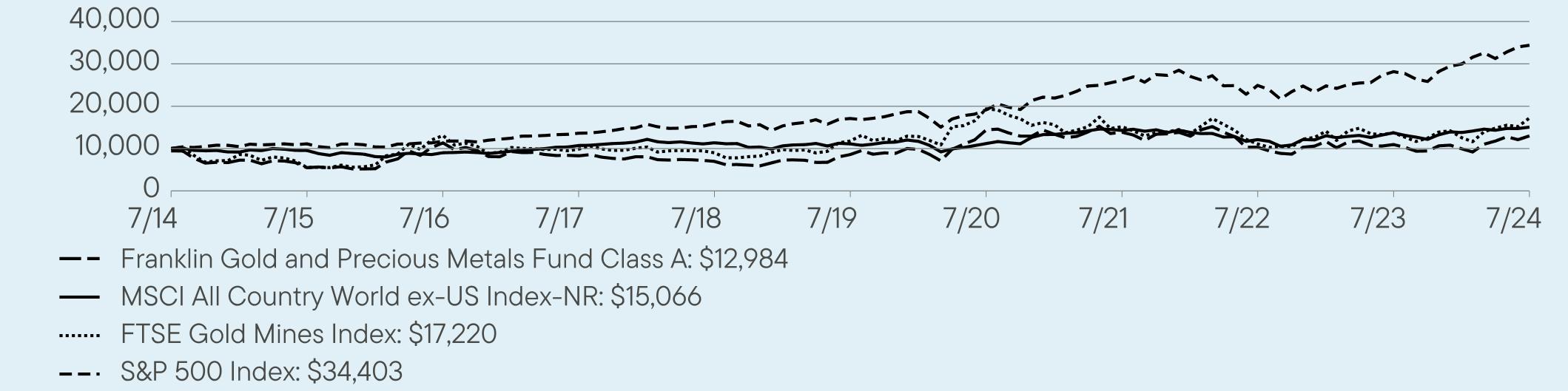

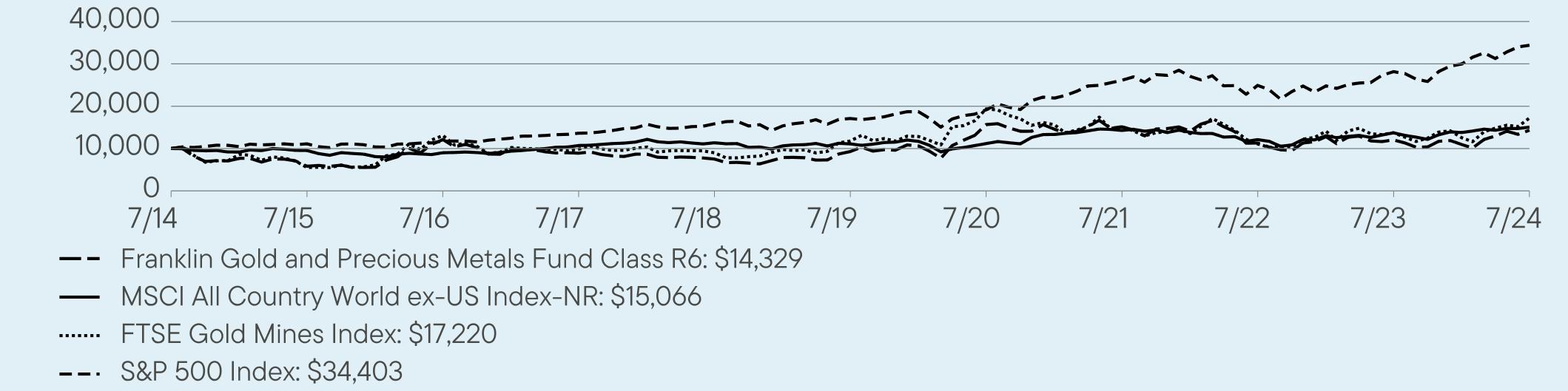

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – ($9,450 AFTER MAXIMUM APPLICABLE SALES CHARGE) –

Class A 7/31/2014 — 7/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended July 31, 2024

| | | |

| | 1 Year | 5 Year | 10 Year |

Class A | 18.56 | 8.65 | 3.23 |

Class A (with sales charge) | 12.07 | 7.43 | 2.65 |

MSCI All Country World ex-US Index-NR | 9.75 | 6.29 | 4.18 |

FTSE Gold Mines Index | 25.52 | 7.89 | 5.58 |

S&P 500 Index | 22.15 | 14.99 | 13.15 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

Performance for periods prior to September 10, 2018, has been restated to reflect the current maximum sales charge, which is lower than the maximum sales charge prior to that date.

For current month-end performance, please call Franklin Templeton at (800) DIAL BEN/342-5236 or visit https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of July 31, 2024)

| |

Total Net Assets | $1,028,007,322 |

Total Number of Portfolio Holdings* | 206 |

Total Management Fee Paid | $4,416,532 |

Portfolio Turnover Rate | 14.50% |

| * | Does not include derivatives, except purchased options, if any. |

| Franklin Gold and Precious Metals Fund | PAGE 2 | 132-ATSR-0924 |

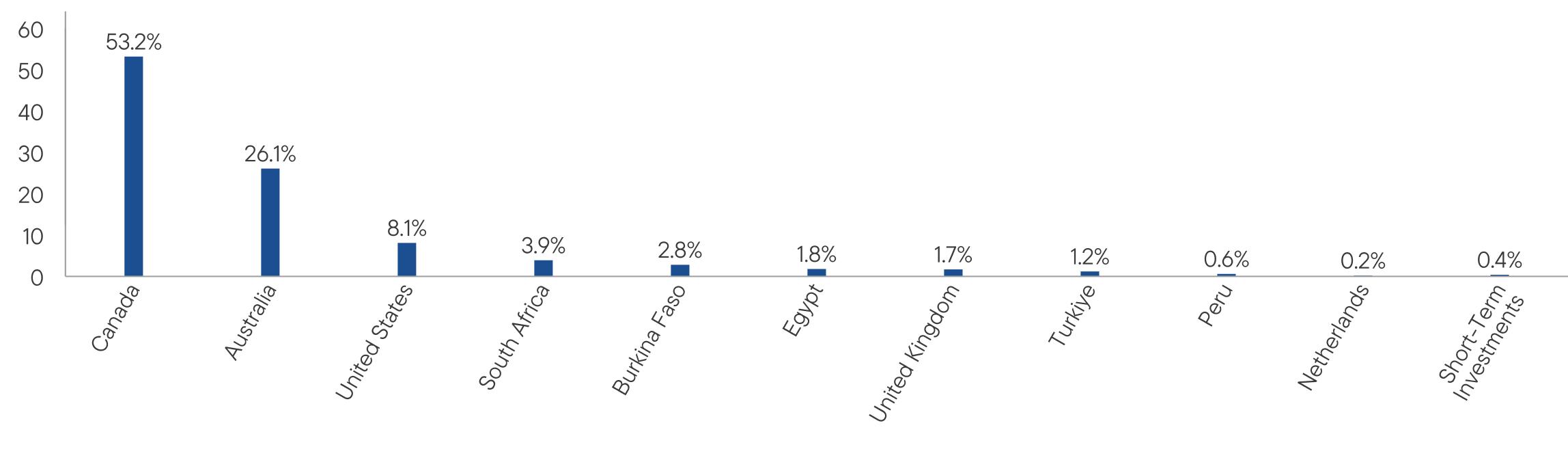

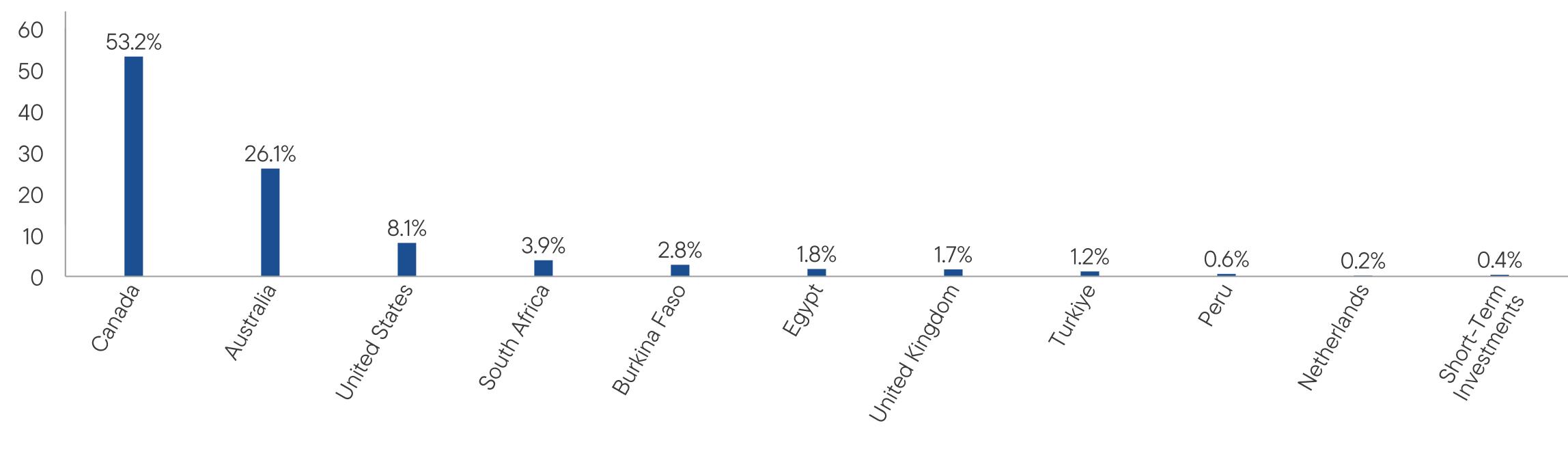

WHAT DID THE FUND INVEST IN? (as of July 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) DIAL BEN/342-5236. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| Franklin Gold and Precious Metals Fund | PAGE 3 | 132-ATSR-0924 |

94505479113358291697185761441113863103101095112984100009543901410727113641110611179142851210513728150661000055301308998708990117791937815167110921371917220100001112111745136291584317108191532613424921281653440353.226.18.13.92.81.81.71.20.60.20.4

| | |

Franklin Gold and Precious Metals Fund | |

| Class C [FRGOX] |

| Annual Shareholder Report | July 31, 2024 |

|

This annual shareholder report contains important information about Franklin Gold and Precious Metals Fund for the period August 1, 2023, to July 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Class C | $182 | 1.67% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended July 31, 2024, Class C shares of Franklin Gold and Precious Metals Fund returned 17.62%. The Fund compares its performance to the FTSE Gold Mines Index and the S&P 500 Index, which returned 25.52% and 22.15%, respectively, for the same period.

| |

Top contributors to performance: |

| ↑ | Holdings in gold-focused mining companies (roughly 84% of total net assets) outperformed the benchmark, FTSE Gold Mines Index, in both absolute and relative terms. |

| ↑ | Several smaller, single-asset and development-stage mining companies, a key feature of our longer-term investment strategy, delivered some of the strongest gains. |

| ↑ | Strategic underweighting in some of the world’s largest gold miners aided relative returns as share-price gains for Barrick Gold, Newmont and select large-capitalization peers lagged the index. |

| |

Top detractors from performance: |

| ↓ | Off-benchmark positions in platinum- and palladium-focused miners were weak given the sharp decline in palladium prices; producers of copper and other base metals also underperformed, especially in the latter half of the period. |

| ↓ | Within the portfolio’s core gold industry allocation, company-specific issues led to selloffs in several overweighted or off-index holdings including Orla Mining, SSR Mining (sold by period-end), Victoria Gold (sold by period-end), Allied Gold (purchased during the period) and Ascot Resources. The Fund also lacked exposure to a few index constituents that more than doubled in value such as Harmony Gold Mining. |

| ↓ | Relative gains in the gold industry were reduced by lighter-than-index exposures to select large-cap gold miners that topped the benchmark average, including Kinross Gold (sold by period-end) and Agnico Eagle Mines. |

| Franklin Gold and Precious Metals Fund | PAGE 1 | 232-ATSR-0924 |

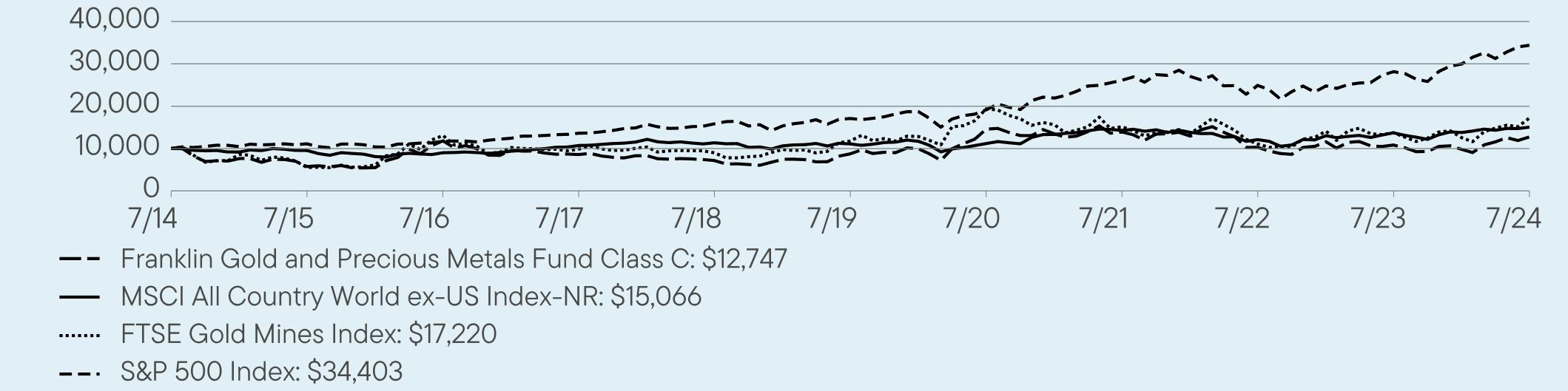

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – Class C 7/31/2014 — 7/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended July 31, 2024

| | | |

| | 1 Year | 5 Year | 10 Year |

Class C | 17.62 | 7.83 | 2.46 |

Class C (with sales charge) | 16.62 | 7.83 | 2.46 |

MSCI All Country World ex-US Index-NR | 9.75 | 6.29 | 4.18 |

FTSE Gold Mines Index | 25.52 | 7.89 | 5.58 |

S&P 500 Index | 22.15 | 14.99 | 13.15 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

For current month-end performance, please call Franklin Templeton at (800) DIAL BEN/342-5236 or visit https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of July 31, 2024)

| |

Total Net Assets | $1,028,007,322 |

Total Number of Portfolio Holdings* | 206 |

Total Management Fee Paid | $4,416,532 |

Portfolio Turnover Rate | 14.50% |

| * | Does not include derivatives, except purchased options, if any. |

| Franklin Gold and Precious Metals Fund | PAGE 2 | 232-ATSR-0924 |

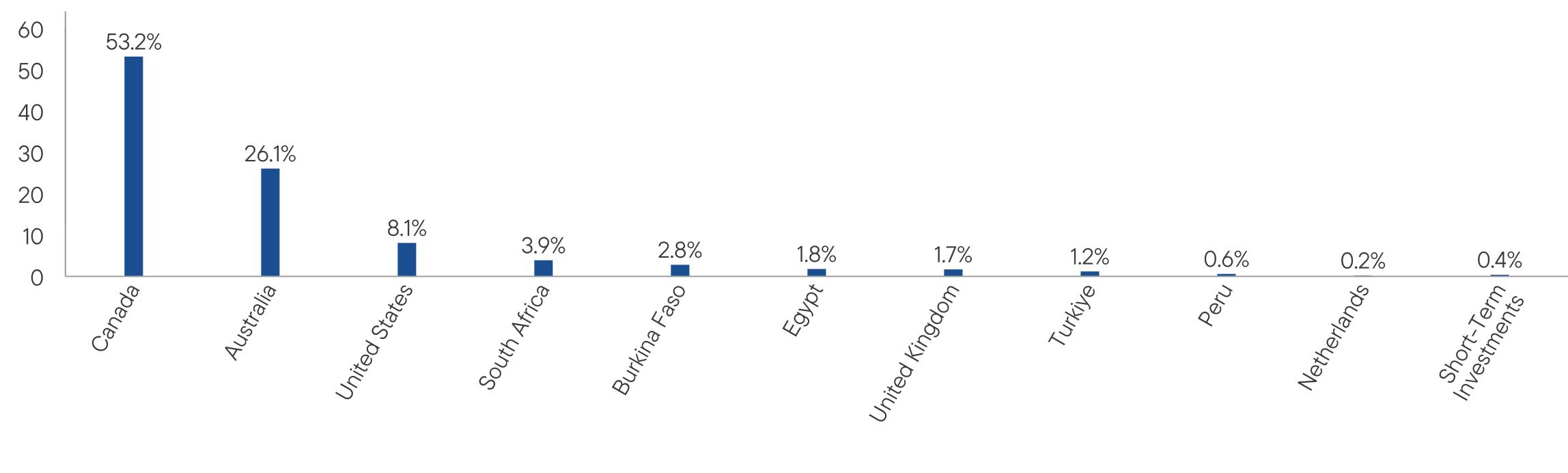

WHAT DID THE FUND INVEST IN? (as of July 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) DIAL BEN/342-5236. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| Franklin Gold and Precious Metals Fund | PAGE 3 | 232-ATSR-0924 |

100005755118228582716587431458213922102781083812747100009543901410727113641110611179142851210513728150661000055301308998708990117791937815167110921371917220100001112111745136291584317108191532613424921281653440353.226.18.13.92.81.81.71.20.60.20.4

| | |

Franklin Gold and Precious Metals Fund | |

| Class R6 [FGPMX] |

| Annual Shareholder Report | July 31, 2024 |

|

This annual shareholder report contains important information about Franklin Gold and Precious Metals Fund for the period August 1, 2023, to July 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Class R6 | $60 | 0.55% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended July 31, 2024, Class R6 shares of Franklin Gold and Precious Metals Fund returned 19.01%. The Fund compares its performance to the FTSE Gold Mines Index and the S&P 500 Index, which returned 25.52% and 22.15%, respectively, for the same period.

| |

Top contributors to performance: |

| ↑ | Holdings in gold-focused mining companies (roughly 84% of total net assets) outperformed the benchmark, FTSE Gold Mines Index, in both absolute and relative terms. |

| ↑ | Several smaller, single-asset and development-stage mining companies, a key feature of our longer-term investment strategy, delivered some of the strongest gains. |

| ↑ | Strategic underweighting in some of the world’s largest gold miners aided relative returns as share-price gains for Barrick Gold, Newmont and select large-capitalization peers lagged the index. |

| |

Top detractors from performance: |

| ↓ | Off-benchmark positions in platinum- and palladium-focused miners were weak given the sharp decline in palladium prices; producers of copper and other base metals also underperformed, especially in the latter half of the period. |

| ↓ | Within the portfolio’s core gold industry allocation, company-specific issues led to selloffs in several overweighted or off-index holdings including Orla Mining, SSR Mining (sold by period-end), Victoria Gold (sold by period-end), Allied Gold (purchased during the period) and Ascot Resources. The Fund also lacked exposure to a few index constituents that more than doubled in value such as Harmony Gold Mining. |

| ↓ | Relative gains in the gold industry were reduced by lighter-than-index exposures to select large-cap gold miners that topped the benchmark average, including Kinross Gold (sold by period-end) and Agnico Eagle Mines. |

| Franklin Gold and Precious Metals Fund | PAGE 1 | 364-ATSR-0924 |

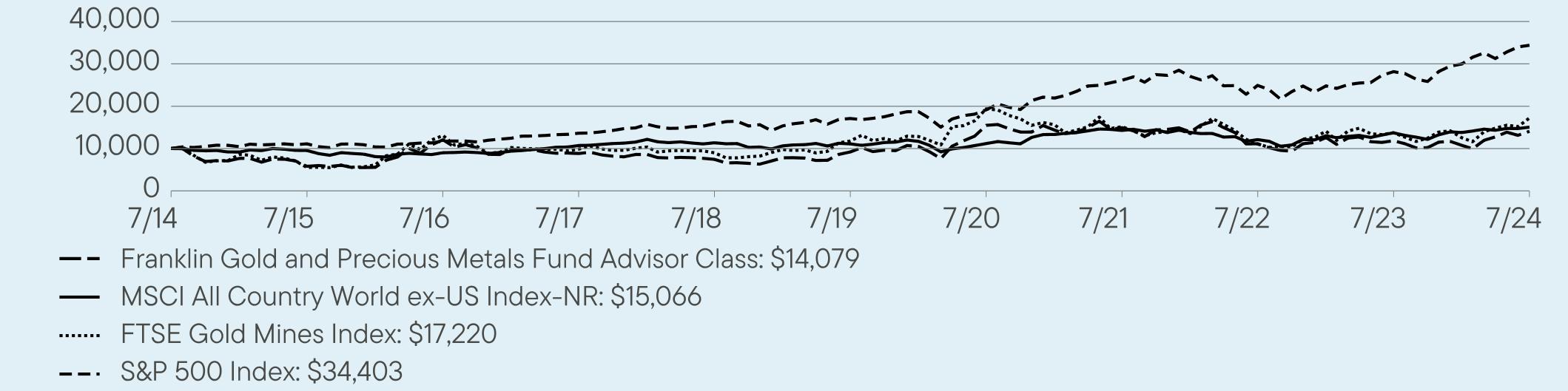

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – Class R6 7/31/2014 — 7/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended July 31, 2024

| | | |

| | 1 Year | 5 Year | 10 Year |

Class R6 | 19.01 | 9.05 | 3.66 |

MSCI All Country World ex-US Index-NR | 9.75 | 6.29 | 4.18 |

FTSE Gold Mines Index | 25.52 | 7.89 | 5.58 |

S&P 500 Index | 22.15 | 14.99 | 13.15 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

For current month-end performance, please call Franklin Templeton at (800) DIAL BEN/342-5236 or visit https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of July 31, 2024)

| |

Total Net Assets | $1,028,007,322 |

Total Number of Portfolio Holdings* | 206 |

Total Management Fee Paid | $4,416,532 |

Portfolio Turnover Rate | 14.50% |

| * | Does not include derivatives, except purchased options, if any. |

| Franklin Gold and Precious Metals Fund | PAGE 2 | 364-ATSR-0924 |

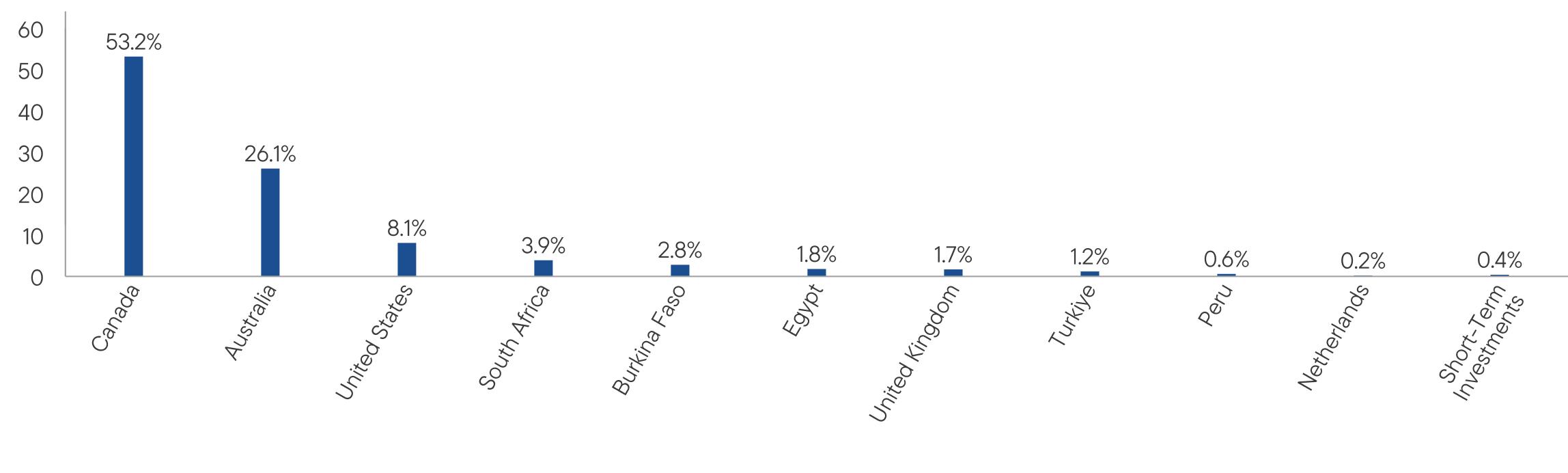

WHAT DID THE FUND INVEST IN? (as of July 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) DIAL BEN/342-5236. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| Franklin Gold and Precious Metals Fund | PAGE 3 | 364-ATSR-0924 |

100005826121258908752792921567115129112931204014329100009543901410727113641110611179142851210513728150661000055301308998708990117791937815167110921371917220100001112111745136291584317108191532613424921281653440353.226.18.13.92.81.81.71.20.60.20.4

| | |

Franklin Gold and Precious Metals Fund | |

| Advisor Class [FGADX] |

| Annual Shareholder Report | July 31, 2024 |

|

This annual shareholder report contains important information about Franklin Gold and Precious Metals Fund for the period August 1, 2023, to July 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Advisor Class | $73 | 0.67% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended July 31, 2024, Advisor Class shares of Franklin Gold and Precious Metals Fund returned 18.81%. The Fund compares its performance to the FTSE Gold Mines Index and the S&P 500 Index, which returned 25.52% and 22.15%, respectively, for the same period.

| |

Top contributors to performance: |

| ↑ | Holdings in gold-focused mining companies (roughly 84% of total net assets) outperformed the benchmark, FTSE Gold Mines Index, in both absolute and relative terms. |

| ↑ | Several smaller, single-asset and development-stage mining companies, a key feature of our longer-term investment strategy, delivered some of the strongest gains. |

| ↑ | Strategic underweighting in some of the world’s largest gold miners aided relative returns as share-price gains for Barrick Gold, Newmont and select large-capitalization peers lagged the index. |

| |

Top detractors from performance: |

| ↓ | Off-benchmark positions in platinum- and palladium-focused miners were weak given the sharp decline in palladium prices; producers of copper and other base metals also underperformed, especially in the latter half of the period. |

| ↓ | Within the portfolio’s core gold industry allocation, company-specific issues led to selloffs in several overweighted or off-index holdings including Orla Mining, SSR Mining (sold by period-end), Victoria Gold (sold by period-end), Allied Gold (purchased during the period) and Ascot Resources. The Fund also lacked exposure to a few index constituents that more than doubled in value such as Harmony Gold Mining. |

| ↓ | Relative gains in the gold industry were reduced by lighter-than-index exposures to select large-cap gold miners that topped the benchmark average, including Kinross Gold (sold by period-end) and Agnico Eagle Mines. |

| Franklin Gold and Precious Metals Fund | PAGE 1 | 632-ATSR-0924 |

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – Advisor Class 7/31/2014 — 7/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended July 31, 2024

| | | |

| | 1 Year | 5 Year | 10 Year |

Advisor Class | 18.81 | 8.91 | 3.48 |

MSCI All Country World ex-US Index-NR | 9.75 | 6.29 | 4.18 |

FTSE Gold Mines Index | 25.52 | 7.89 | 5.58 |

S&P 500 Index | 22.15 | 14.99 | 13.15 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

For current month-end performance, please call Franklin Templeton at (800) DIAL BEN/342-5236 or visit https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of July 31, 2024)

| |

Total Net Assets | $1,028,007,322 |

Total Number of Portfolio Holdings* | 206 |

Total Management Fee Paid | $4,416,532 |

Portfolio Turnover Rate | 14.50% |

| * | Does not include derivatives, except purchased options, if any. |

| Franklin Gold and Precious Metals Fund | PAGE 2 | 632-ATSR-0924 |

WHAT DID THE FUND INVEST IN? (as of July 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) DIAL BEN/342-5236. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| Franklin Gold and Precious Metals Fund | PAGE 3 | 632-ATSR-0924 |

100005810120568838745191871547714921111291185014079100009543901410727113641110611179142851210513728150661000055301308998708990117791937815167110921371917220100001112111745136291584317108191532613424921281653440353.226.18.13.92.81.81.71.20.60.20.4

Item 2. Code of Ethics.

(a) The Registrant has adopted a code of ethics that applies to its principal executive officers and principal financial and accounting officer.

(c) N/A

(d) N/A

(f) Pursuant to Item 19(a)(1), the Registrant is attaching as an exhibit a copy of its code of ethics that applies to its principal executive officers and principal financial and accounting officer.

Item 3. Audit Committee Financial Expert.

(a) (1) The Registrant has an audit committee financial expert serving on its audit committee.

(2) The audit committee financial expert is Mary C. Choksi and she is “independent” as defined under the relevant Securities and Exchange Commission Rules and Releases.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

The aggregate fees paid to the principal accountant for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or for services that are normally provided by the principal accountant in connection with statutory and regulatory filings or engagements were $58,851 for the fiscal year ended July 31, 2024, and $55,075 for the fiscal year ended July 31, 2023.

The aggregate fees paid to the principal accountant for assurance and related services rendered by the principal accountant to the registrant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of Item 4 were $0 for the fiscal year ended July 31, 2024, and $3,000 for the fiscal year ended July 31, 2023. The services for which these fees were paid included attestation services.

There were no fees paid to the principal accountant for assurance and related services rendered by the principal accountant to the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant that are reasonably related to the performance of the audit of their financial statements.

There were no fees paid to the principal accountant for professional services rendered by the principal accountant to the registrant for tax compliance, tax advice and tax planning.

The aggregate fees paid to the principal accountant for professional services rendered by the principal accountant to the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant for tax compliance, tax advice and tax planning were $140,000 for the fiscal year ended July 31, 2024, and $70,000 for the fiscal year ended July 31, 2023. The services for which these fees were paid included global access to tax platform International Tax View.

The aggregate fees paid to the principal accountant for products and services rendered by the principal accountant to the registrant not reported in paragraphs (a)-(c) of Item 4 were $0 for the fiscal year ended July 31, 2024, and $445 for the fiscal year ended July 31, 2023. The services for which these fees were paid included review of materials provided to the fund Board in connection with the investment management contract renewal process.

The aggregate fees paid to the principal accountant for products and services rendered by the principal accountant to the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant not reported in paragraphs (a)-(c) of Item 4

were $163,638 for the fiscal year ended July 31, 2024 and $94,715 for the fiscal year ended July 31, 2023. The services for which these fees were paid included professional fees in connection with SOC 1 Reports, professional services relating to the readiness assessment over Greenhouse Gas Emissions and Energy, professional fees relating to security counts and fees in connection with license for accounting and business knowledge platform Viewpoint.

(e) (1) The registrant’s audit committee is directly responsible for approving the services to be provided by the auditors, including:

| (i) | pre-approval of all audit and audit related services; |

| (ii) | pre-approval of all non-audit related services to be provided to the Fund by the auditors; |

(iii) pre-approval of all non-audit related services to be provided to the registrant by the auditors to the registrant’s investment adviser or to any entity that controls, is controlled by or is under common control with the registrant’s investment adviser and that provides ongoing services to the registrant where the non-audit services relate directly to the operations or financial reporting of the registrant; and

(iv) establishment by the audit committee, if deemed necessary or appropriate, as an alternative to committee pre-approval of services to be provided by the auditors, as required by paragraphs (ii) and (iii) above, of policies and procedures to permit such services to be pre-approved by other means, such as through establishment of guidelines or by action of a designated member or members of the committee; provided the policies and procedures are detailed as to the particular service and the committee is informed of each service and such policies and procedures do not include delegation of audit committee responsibilities, as contemplated under the Securities Exchange Act of 1934, to management; subject, in the case of (ii) through (iv), to any waivers, exceptions or exemptions that may be available under applicable law or rules.

(e) (2) None of the services provided to the registrant described in paragraphs (b)-(d) of Item 4 were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of regulation S-X.

(f) No disclosures are required by this Item 4(f).

(g) The aggregate non-audit fees paid to the principal accountant for services rendered by the principal accountant to the registrant and the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant were $303,638 for the fiscal year ended July 31, 2024, and $168,160 for the fiscal year ended July 31, 2023.

(h) The registrant’s audit committee of the board has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling,

controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence.

(i) N/A

(j) N/A

Item 5. Audit Committee of Listed Registrants. N/A

Item 6. Schedule of Investments.

(a) Please see schedule of investments contained in the Financial Statements and Financial Highlights included under Item 7 of this Form N-CSR.

(b) N/A

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Franklin

Gold

and

Precious

Metals

Fund

Financial

Statements

and

Other

Important

Information

Annual

|

July 31, 2024

Financial

Statements

and

Other

Important

Information—Annual

Financial

Highlights

and

Schedule

of

Investments

2

Financial

Statements

11

Notes

to

Financial

Statements

15

Report

of

Independent

Registered

Public

Accounting

Firm

29

Tax

Information

30

Changes

In

and

Disagreements

with

Accountants

31

Results

of

Meeting(s)

of

Shareholders

31

Remuneration

Paid

to

Directors,

Officers

and

Others

31

Board

Approval

of

Management

and

Subadvisory

Agreements

31

Franklin

Gold

and

Precious

Metals

Fund

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

Year

Ended

July

31,

2024

2023

2022

2021

2020

Class

A

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

year)

Net

asset

value,

beginning

of

year

...................

$17.42

$16.40

$24.23

$28.04

$16.68

Income

from

investment

operations

a

:

Net

investment

income

(loss)

b

....................

0.09

0.10

0.13

0.04

(0.04)

Net

realized

and

unrealized

gains

(losses)

...........

3.03

0.92

(5.90)

(1.20)

11.40

Total

from

investment

operations

....................

3.12

1.02

(5.77)

(1.16)

11.36

Less

distributions

from:

Net

investment

income

..........................

(0.52)

—

(2.06)

(2.65)

—

Net

asset

value,

end

of

year

.......................

$20.02

$17.42

$16.40

$24.23

$28.04

Total

return

c

...................................

18.56%

6.22%

(25.63)%

(3.80)%

68.05%

Ratios

to

average

net

assets

Expenses

d

....................................

0.92%

e

0.92%

e

0.88%

0.90%

e

0.93%

e

Net

investment

income

(loss)

......................

0.55%

0.58%

0.58%

0.17%

(0.20)%

Supplemental

data

Net

assets,

end

of

year

(000’s)

.....................

$690,180

$679,841

$656,071

$921,127

$938,555

Portfolio

turnover

rate

............................

14.50%

12.92%

17.60%

18.91%

17.00%

a

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchases

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

b

Based

on

average

daily

shares

outstanding.

c

Total

return

does

not

reflect

sales

commissions

or

contingent

deferred

sales

charges,

if

applicable.

d

Benefit

of

waiver

and

payments

by

affiliates

rounds

to

less

than

0.01%.

e

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Franklin

Gold

and

Precious

Metals

Fund

Financial

Highlights

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

a

Year

Ended

July

31,

2024

2023

2022

2021

2020

Class

C

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

year)

Net

asset

value,

beginning

of

year

...................

$15.29

$14.50

$21.71

$25.42

$15.24

Income

from

investment

operations

a

:

Net

investment

(loss)

b

..........................

(0.03)

(0.02)

(0.03)

(0.13)

(0.16)

Net

realized

and

unrealized

gains

(losses)

...........

2.64

0.81

(5.23)

(1.09)

10.34

Total

from

investment

operations

....................

2.61

0.79

(5.26)

(1.22)

10.18

Less

distributions

from:

Net

investment

income

..........................

(0.40)

—

(1.95)

(2.49)

—

Net

asset

value,

end

of

year

.......................

$17.50

$15.29

$14.50

$21.71

$25.42

Total

return

c

...................................

17.62%

5.45%

(26.18)%

(4.53)%

66.80%

Ratios

to

average

net

assets

Expenses

d

....................................

1.67%

e

1.67%

e

1.63%

1.65%

e

1.68%

e

Net

investment

(loss)

............................

(0.18)%

(0.15)%

(0.17)%

(0.59)%

(0.94)%

Supplemental

data

Net

assets,

end

of

year

(000’s)

.....................

$47,302

$51,872

$58,538

$93,615

$106,271

Portfolio

turnover

rate

............................

14.50%

12.92%

17.60%

18.91%

17.00%

a

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchases

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

b

Based

on

average

daily

shares

outstanding.

c

Total

return

does

not

reflect

sales

commissions

or

contingent

deferred

sales

charges,

if

applicable.

d

Benefit

of

waiver

and

payments

by

affiliates

rounds

to

less

than

0.01%.

e

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Franklin

Gold

and

Precious

Metals

Fund

Financial

Highlights

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

Year

Ended

July

31,

2024

2023

2022

2021

2020

Class

R6

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

year)

Net

asset

value,

beginning

of

year

...................

$19.17

$17.98

$26.32

$30.20

$17.90

Income

from

investment

operations

a

:

Net

investment

income

b

.........................

0.16

0.17

0.22

0.13

0.03

Net

realized

and

unrealized

gains

(losses)

...........

3.35

1.02

(6.45)

(1.28)

12.27

Total

from

investment

operations

....................

3.51

1.19

(6.23)

(1.15)

12.30

Less

distributions

from:

Net

investment

income

..........................

(0.58)

—

(2.11)

(2.73)

—

Net

asset

value,

end

of

year

.......................

$22.10

$19.17

$17.98

$26.32

$30.20

Total

return

....................................

19.01%

6.62%

(25.36)%

(3.46)%

68.66%

Ratios

to

average

net

assets

Expenses

before

waiver

and

payments

by

affiliates

......

0.63%

0.64%

0.64%

0.69%

0.72%

Expenses

net

of

waiver

and

payments

by

affiliates

.......

0.55%

c

0.53%

c

0.52%

0.56%

c

0.56%

c

Net

investment

income

...........................

0.87%

0.94%

0.94%

0.49%

0.17%

Supplemental

data

Net

assets,

end

of

year

(000’s)

.....................

$50,087

$40,916

$30,969

$25,458

$20,574

Portfolio

turnover

rate

............................

14.50%

12.92%

17.60%

18.91%

17.00%

a

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchases

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

b

Based

on

average

daily

shares

outstanding.

c

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Franklin

Gold

and

Precious

Metals

Fund

Financial

Highlights

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

a

Year

Ended

July

31,

2024

2023

2022

2021

2020

Advisor

Class

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

year)

Net

asset

value,

beginning

of

year

...................

$18.89

$17.74

$26.00

$29.88

$17.73

Income

from

investment

operations

a

:

Net

investment

income

b

.........................

0.14

0.15

0.20

0.11

0.01

Net

realized

and

unrealized

gains

(losses)

...........

3.29

1.00

(6.36)

(1.28)

12.14

Total

from

investment

operations

....................

3.43

1.15

(6.16)

(1.17)

12.15

Less

distributions

from:

Net

investment

income

..........................

(0.56)

—

(2.10)

(2.71)

—

Net

asset

value,

end

of

year

.......................

$21.76

$18.89

$17.74

$26.00

$29.88

Total

return

....................................

18.81%

6.48%

(25.42)%

(3.59)%

68.47%

Ratios

to

average

net

assets

Expenses

c

.....................................

0.67%

d

0.67%

d

0.63%

0.65%

d

0.68%

d

Net

investment

income

...........................

0.79%

0.83%

0.84%

0.41%

0.05%

Supplemental

data

Net

assets,

end

of

year

(000’s)

.....................

$240,439

$236,987

$239,115

$307,110

$280,317

Portfolio

turnover

rate

............................

14.50%

12.92%

17.60%

18.91%

17.00%

a

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchases

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

b

Based

on

average

daily

shares

outstanding.

c

Benefit

of

waiver

and

payments

by

affiliates

rounds

to

less

than

0.01%.

d

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Franklin

Gold

and

Precious

Metals

Fund

Schedule

of

Investments,

July

31,

2024

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

a

Country

Shares

a

Value

a

Common

Stocks

98.9%

Copper

0.8%

a

Faraday

Copper

Corp.

.................................

Canada

4,400,000

$

2,644,748

a

Imperial

Metals

Corp.

..................................

Canada

1,765,330

2,659,149

a

SolGold

plc

..........................................

Australia

20,000,000

2,817,487

a

Vizsla

Copper

Corp.

...................................

Canada

528,571

26,795

8,148,179

Diversified

Metals

&

Mining

6.6%

a

Aclara

Resources,

Inc.

.................................

United

Kingdom

444,972

174,012

a

Adventus

Mining

Corp.

.................................

Canada

3,850,000

1,421,950

a,b

Adventus

Mining

Corp.,

144A

............................

Canada

1,500,000

554,007

a

Arizona

Metals

Corp.

...................................

Canada

150,000

218,344

a,b

Arizona

Metals

Corp.,

144A

..............................

Canada

1,244,000

1,810,798

a

Aston

Minerals

Ltd.

....................................

Australia

36,000,000

230,931

a

AuMega

Metals

Ltd.

...................................

Australia

10,813,044

325,225

a

Azimut

Exploration,

Inc.

.................................

Canada

1,700,000

615,563

a,b

Bluestone

Resources,

Inc.,

144A

..........................

Canada

6,215,000

1,507,785

a

Bravo

Mining

Corp.

....................................

Canada

2,830,000

6,455,806

a,b

Bravo

Mining

Corp.,

144A

...............................

Canada

415,000

946,699

a

Chalice

Mining

Ltd.

....................................

Australia

2,522,810

1,912,917

a

Contango

ORE,

Inc.

...................................

United

States

156,457

3,575,042

a

Ivanhoe

Electric,

Inc.

...................................

United

States

448,900

4,453,088

a

Ivanhoe

Mines

Ltd.,

A

..................................

Canada

200,000

2,614,332

a

Magna

Mining,

Inc.

....................................

Canada

2,210,000

1,120,324

a

Max

Resource

Corp.

...................................

Canada

6,000,000

260,709

a

Meridian

Mining

UK

Societas

.............................

Netherlands

7,000,000

2,129,123

a,b

NorthIsle

Copper

&

Gold,

Inc.,

144A

.......................

Canada

4,430,000

1,700,330

a,c,d

Phoenix

Industrial

Minerals

Pty.

Ltd.

.......................

Australia

45,900,000

51,020

a

Prime

Mining

Corp.

....................................

Canada

5,290,000

7,432,089

a

Sunrise

Energy

Metals

Ltd.

..............................

Australia

1,159,999

292,009

a,b,c

Vizsla

Royalties

Corp.,

144A

.............................

Canada

2,166,667

94,145

a

Vizsla

Silver

Corp.

.....................................

Canada

5,000,000

10,536,988

a,c

Vizsla

Silver

Corp.

.....................................

Canada

1,758,333

76,402

a,b

Vizsla

Silver

Corp.,

144A

................................

Canada

6,500,000

13,698,085

a

Western

Copper

&

Gold

Corp.

............................

Canada

3,360,000

3,747,257

67,954,980

Environmental

&

Facilities

Services

0.0%

†

a

Clean

TeQ

Water

Ltd.

..................................

Australia

679,999

117,824

a

Gold

84.8%

Agnico

Eagle

Mines

Ltd.,

(CAD

Traded)

.....................

Canada

229,559

17,710,048

Agnico

Eagle

Mines

Ltd.,

(USD

Traded)

.....................

Canada

440,000

33,954,800

Alamos

Gold,

Inc.,

(CAD

Traded),

A

........................

Canada

1,476,316

25,156,762

Alamos

Gold,

Inc.,

(USD

Traded),

A

........................

Canada

1,134,500

19,320,535

a

Allied

Gold

Corp.

......................................

Canada

2,163,859

5,124,248

Anglogold

Ashanti

plc

..................................

United

Kingdom

619,823

17,404,630

a

Artemis

Gold,

Inc.

.....................................

Canada

3,386,800

28,917,241

a,c,d,e

Ascot

Resources

Ltd.

..................................

Canada

3,300,000

933,762

a,b,e

Ascot

Resources

Ltd.,

144A

.............................

Canada

32,420,000

10,447,840

a

Atex

Resources,

Inc.

...................................

Canada

6,970,000

6,359,996

a

Aurum

Resources

Ltd.

.................................

Australia

2,161,756

544,184

a

Ausgold

Ltd.

.........................................

Australia

116,666,667

2,519,631

a,c,d,e

Awale

Resources

Ltd.

..................................

Canada

3,500,000

1,456,875

B2Gold

Corp.

........................................

Canada

6,113,694

18,329,792

a,e

Banyan

Gold

Corp.

....................................

Canada

22,517,629

3,098,345

Barrick

Gold

Corp.

....................................

Canada

1,913,383

35,416,719

a

Bellevue

Gold

Ltd.

.....................................

Australia

14,194,000

12,812,841

a

Belo

Sun

Mining

Corp.

.................................

Canada

3,500,000

139,407

a,b

Belo

Sun

Mining

Corp.,

144A

.............................

Canada

3,800,000

151,356

Franklin

Gold

and

Precious

Metals

Fund

Schedule

of

Investments

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

a

a

Country

Shares

a

Value

a

Common

Stocks

(continued)

Gold

(continued)

a

Black

Cat

Syndicate

Ltd.

................................

Australia

17,126,504

$

4,088,678

a

Calibre

Mining

Corp.

...................................

Canada

9,216,453

14,283,383

a

Catalyst

Metals

Ltd.

...................................

Australia

6,588,915

8,294,156

Centamin

plc

.........................................

Egypt

11,478,716

18,745,104

Centerra

Gold,

Inc.

....................................

Canada

307,100

2,059,417

a,c

Cerrado

Gold,

Inc.

.....................................

Canada

2,709,000

392,367

a

De

Grey

Mining

Ltd.

...................................

Australia

9,828,393

7,879,486

Dundee

Precious

Metals,

Inc.

............................

Canada

297,415

2,513,548

a

Eldorado

Gold

Corp.

...................................

Turkiye

743,724

12,608,595

a

Emerald

Resources

NL

.................................

Australia

9,220,000

22,447,132

Endeavour

Mining

plc

..................................

Burkina

Faso

1,305,114

28,713,737

a,e

Falcon

Metals

Ltd.

.....................................

Australia

9,225,414

1,809,611

a,c,d

Firefinch

Ltd.

.........................................

Australia

18,028,500

530,457

a

FireFly

Metals

Ltd.

....................................

Australia

9,137,185

4,783,811

G

Mining

Ventures

Corp.

................................

Canada

5,522,812

38,755,874

a

Galiano

Gold,

Inc.

.....................................

Canada

5,614,362

10,327,320

a

Genesis

Minerals

Ltd.

..................................

Australia

8,436,549

11,634,133

a,e

Geopacific

Resources

Ltd.

..............................

Australia

60,464,743

948,837

Gold

Fields

Ltd.

.......................................

South

Africa

439,800

7,657,347

a,c

Greenheart

Gold,

Inc.

..................................

Canada

1,112,500

233,642

a,e

Heliostar

Metals

Ltd.

...................................

Canada

16,787,500

4,133,505

a,c,d,e

Heliostar

Metals

Ltd.,

144A

..............................

Canada

1,180,000

266,310

a

Hochschild

Mining

plc

..................................

Peru

2,688,520

6,273,415

a

i-80

Gold

Corp.

.......................................

Canada

2,015,000

2,145,092

a,b

i-80

Gold

Corp.,

144A

..................................

Canada

675,000

718,579

a,e

Integra

Resources

Corp.,

(CAD

Traded)

....................

Canada

4,439,520

4,050,980

a,e

Integra

Resources

Corp.,

(USD

Traded)

....................

Canada

740,000

686,868

a,f

K92

Mining,

Inc.

......................................

Canada

1,770,357

10,128,414

a

Kingsgate

Consolidated

Ltd.

.............................

Australia

2,800,000

2,778,366

a,c,d,e

Liberty

Gold

Corp.

.....................................

Canada

3,900,000

1,100,343

a,e

Liberty

Gold

Corp.

.....................................

Canada

16,329,800

4,848,621

a,b,e

Liberty

Gold

Corp.,

144A

................................

Canada

2,600,000

771,988

a

Lion

One

Metals

Ltd.

...................................

Canada

7,144,310

1,655,632

a

Mawson

Gold

Ltd.

.....................................

Canada

13,426,000

5,542,108

a,c,d,e

Monarch

Mining

Corp.

..................................

Canada

15,500,000

—

a

Montage

Gold

Corp.

...................................

Canada

4,000,000

5,127,277

a

New

Gold,

Inc.

.......................................

Canada

5,800,000

13,398,000

a,e

Newcore

Gold

Ltd.

....................................

Canada

12,620,000

2,970,272

Newmont

Corp.

.......................................

United

States

546,614

26,822,349

Newmont

Corp.,

CDI

...................................

United

States

967,765

46,708,479

Northern

Star

Resources

Ltd.

............................

Australia

717,254

6,655,913

a,e

O3

Mining,

Inc.

.......................................

Canada

5,100,000

4,395,119

OceanaGold

Corp.

....................................

Australia

8,228,488

20,260,607

a,c,d

Omai

Gold

Mines

Corp.

.................................

Canada

17,500,000

1,612,735

a,e

Onyx

Gold

Corp.

......................................

Canada

1,400,750

243,458

a,e

Onyx

Gold

Corp.

......................................

Canada

1,300,000

225,948

a

Ora

Banda

Mining

Ltd.

.................................

Australia

40,107,692

11,536,686

a

Orla

Mining

Ltd.

......................................

Canada

3,361,364

12,512,156

a,b

Orla

Mining

Ltd.,

144A

..................................

Canada

2,000,000

7,444,690

a,b

Osisko

Development

Corp.,

144A

.........................

Canada

804,049

1,601,285

a

Osisko

Mining,

Inc.

....................................

Canada

7,526,923

17,824,556

a,e

Pantoro

Ltd.

.........................................

Australia

333,043,083

18,712,673

Perseus

Mining

Ltd.

...................................

Australia

22,616,211

37,677,047

a

Predictive

Discovery

Ltd.

................................

Australia

80,569,192

9,482,430

a

Probe

Gold,

Inc.

......................................

Canada

705,000

633,088

a,c,d

Probe

Gold,

Inc.

......................................

Canada

600,000

506,788

a,b

Probe

Gold,

Inc.,

144A

.................................

Canada

5,200,000

4,669,587

Ramelius

Resources

Ltd.

...............................

Australia

4,587,234

5,853,209

Franklin

Gold

and

Precious

Metals

Fund

Schedule

of

Investments

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

a

Country

Shares

a

Value

a

Common

Stocks

(continued)

Gold

(continued)

a

Red

5

Ltd.

...........................................

Australia

108,807,082

$

27,903,205

a

Resolute

Mining

Ltd.

...................................

Australia

28,033,333

12,040,469

a

Robex

Resources,

Inc.

.................................

Canada

3,050,000

6,184,596

a,e

RTG

Mining,

Inc.

......................................

Australia

4,167,708

120,729

a,e

RTG

Mining,

Inc.,

CDI

..................................

Australia

82,487,582

2,265,249

a

Saturn

Metals

Ltd.

.....................................

Australia

13,277,469

1,618,148

a

Skeena

Resources

Ltd.

.................................

Canada

2,543,550

16,559,738

a

Southern

Cross

Gold

Ltd.

...............................

Canada

4,102,272

5,875,973

a

Spartan

Resources

Ltd.

.................................

Australia

17,950,259

14,973,517

a

St.

Augustine

Gold

and

Copper

Ltd.,

(CAD

Traded)

............

United

States

3,355,336

157,944

a,b

St.

Augustine

Gold

and

Copper

Ltd.,

(CAD

Traded),

144A

.......

United

States

16,383,333

771,204

a,b

St.

Augustine

Gold

and

Copper

Ltd.,

(USD

Traded),

144A

.......

United

States

10,000,000

470,725

a

St.

Barbara

Ltd.

.......................................

Australia

9,008,021

1,342,386

a

STLLR

Gold,

Inc.

.....................................

Canada

325,000

270,667

a,b

STLLR

Gold,

Inc.,

144A

.................................

Canada

4,370,010

3,639,433

a,e

Talisker

Resources

Ltd.

.................................

Canada

5,280,000

1,586,849

a

Torex

Gold

Resources,

Inc.

..............................

Canada

1,175,000

18,626,752

a,b

Torex

Gold

Resources,

Inc.,

144A

.........................

Canada

180,000

2,853,460

a,e

Troilus

Gold

Corp.

.....................................

Canada

14,525,000

4,049,770

a

West

African

Resources

Ltd.

.............................

Australia

9,704,984

9,538,514

a,c,d,e

Wiluna

Mining

Corp.

Ltd.

................................

Australia

19,510,000

261,511

871,591,059

Precious

Metals

&

Minerals

4.0%

Anglo

American

Platinum

Ltd.

............................

South

Africa

66,556

2,583,597

a,e

Aurion

Resources

Ltd.

..................................

Canada

7,475,000

3,031,466

Impala

Platinum

Holdings

Ltd.

............................

South

Africa

1,590,000

8,168,795

Impala

Platinum

Holdings

Ltd.,

ADR

.......................

South

Africa

1,206,100

6,126,988

Northam

Platinum

Holdings

Ltd.

..........................

South

Africa

739,019

5,789,241

a,e

Platinum

Group

Metals

Ltd.,

(CAD

Traded)

..................

South

Africa

3,234,285

5,363,734

a,e

Platinum

Group

Metals

Ltd.,

(USD

Traded)

..................

South

Africa

2,268,243

3,765,283

a,b,e

Platinum

Group

Metals

Ltd.,

(USD

Traded),

144A

.............

South

Africa

36,628

60,744

a

Sable

Resources

Ltd.

..................................

Canada

12,000,000

391,064

a,e

TDG

Gold

Corp.

......................................

Canada

2,080,000

180,758

a,b,e

TDG

Gold

Corp.,

144A

.................................

Canada

5,370,000

466,669

a,e

Thesis

Gold,

Inc.

......................................

Canada

5,465,500

2,533,164

a,e

Thesis

Gold,

Inc.

......................................

Canada

4,273,553

1,980,718

a,c,d,e

Thesis

Gold,

Inc.

......................................

Canada

1,405,000

614,199

41,056,420

Research

&

Consulting

Services

0.1%

a

Chrysos

Corp.

Ltd.

....................................

Australia

490,000

1,621,156

a

Silver

2.6%

a

Aya

Gold

&

Silver,

Inc.

..................................

Canada

690,000

7,785,205

a

GoGold

Resources,

Inc.

................................

Canada

9,262,858

10,330,450

Pan

American

Silver

Corp.

..............................

Canada

148,021

3,402,387

a,e

Silver

Mountain

Resources,

Inc.

..........................

Canada

13,400,000

679,292

a,e

Silver

Tiger

Metals,

Inc.

.................................

Canada

3,560,000

618,749

a,b,e

Silver

Tiger

Metals,

Inc.,

144A

............................

Canada

21,500,000

3,736,829

26,552,912

Total

Common

Stocks

(Cost

$823,640,175)

.....................................

1,017,042,530

Franklin

Gold

and

Precious

Metals

Fund

Schedule

of

Investments

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

a

a

Country

Rights

a

Value

a

a

a

Rights

0.1%

Silver

0.1%

a

Pan

American

Silver

Corp.,

CVR

,

2/22/29

...................

Canada

1,850,600

$

851,276

Total

Rights

(Cost

$856,772)

..................................................

851,276

Warrants

a

a

a

Warrants

0.6%

Diversified

Metals

&

Mining

0.1%

a,b,c

Aston

Minerals

Ltd.,

144A,

10/16/25

.......................

Australia

5,500,000

4,420

a,c,d

Contango

ORE,

Inc.,

6/11/27

.............................

United

States

25,000

143,227

a,b,c

Vizsla

Royalties

Corp.,

144A,

2/20/49

......................

Canada

2,166,667

15,691

a,c,d

Vizsla

Silver

Corp.,

144A,

11/15/24

........................

Canada

1,500,000

988,521

a,c

Vizsla

Silver

Corp.,

12/21/25

.............................

Canada

1,758,333

12,734

1,164,593

Gold

0.5%

a,c,d,e

Ascot

Resources

Ltd.,

7/25/26

............................

Canada

3,300,000

371,729

a,c,d,e

Awale

Resources

Ltd.,

5/08/26

...........................

Canada

1,750,000

246,601

a,c,d

G

Mining

Ventures

Corp.,

144A,

8/20/24

....................

Canada

3,750,000

1,418,963

a,c,d,e

Heliostar

Metals

Ltd.,

144A,

1/11/25

.......................

Canada

650,000

4,018

a,c,d,e

Heliostar

Metals

Ltd.,

144A,

12/08/25

......................

Canada

1,720,833

105,965

a,e

Integra

Resources

Corp.,

3/13/27

.........................

Canada

500,000

170,185

a,c,d,e

Liberty

Gold

Corp.,

5/17/26

..............................

Canada

1,950,000

139,760

a,c

Marathon

Gold

Corp.,

9/19/24

............................

Canada

3,225,000

168,064

a,c,d,e

Monarch

Mining

Corp.,

144A,

4/06/27

......................

Canada

6,000,000

—

a,c,d,e

Onyx

Gold

Corp.,

144A,

7/06/25

..........................

Canada

650,000

16,116

a,b

Osisko

Development

Corp.,

144A,

3/27/27

..................

Canada

608,333

38,548

a,c

Osisko

Mining,

Inc.,

8/28/24

.............................

Canada

350,000

1,319

a,c,d

Robex

Resources,

Inc.,

6/26/26

...........................

Canada

3,050,000

2,283,812

a,b,c,e

RTG

Mining,

Inc.,

144A,

9/08/24

..........................

Australia

12,000,000

447

a,b,c

STLLR

Gold,

Inc.,

144A,

11/28/26

.........................

Canada

537,600

46,918

a,c,d,e

Talisker

Resources

Ltd.,

144A,

2/11/25

.....................

Canada

4,500,000

39

a,c,d,e

Troilus

Gold

Corp.,

144A,

11/20/25

........................

Canada

2,000,000

69,708

a,c,d,e

Wiluna

Mining

Corp.

Ltd.,

12/31/24

........................

Australia

9,755,000

—

5,082,192

Precious

Metals

&

Minerals

0.0%

†

a,c,d,e

TDG

Gold

Corp.,

144A,

7/07/26

...........................

Canada

310,000

3,589

a,c,d,e

Thesis

Gold,

Inc.,

144A,

9/29/24

..........................

Canada

1,000,000

—

3,589

Silver

0.0%

†

a,e

Silver

Mountain

Resources,

Inc.,

2/09/26

....................

Canada

1,500,000

5,431

a,e

Silver

Mountain

Resources,

Inc.,

4/24/28

....................

Canada

3,100,000

33,675

39,106

Total

Warrants

(Cost

$–)

......................................................

6,289,480

Total

Long

Term

Investments

(Cost

$824,496,947)

...............................

1,024,183,286

a

Short

Term

Investments

0.4%

a

a

Country

Shares

a

Value

a

a

a

a

a

a

Money

Market

Funds

0.4%

g,h

Institutional

Fiduciary

Trust

-

Money

Market

Portfolio,

5.002%

....

United

States

4,363,217

4,363,217

Total

Money

Market

Funds

(Cost

$4,363,217)

...................................

4,363,217

Franklin

Gold

and

Precious

Metals

Fund

Schedule

of

Investments

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Short

Term

Investments

(continued)

a

a

Country

Shares

a

Value

a

a

a

a

a

a

i

Investments

from

Cash

Collateral

Received

for

Loaned

Securities

0.0%

†

Money

Market

Funds

0.0%

†

g,h

Institutional

Fiduciary

Trust

-

Money

Market

Portfolio,

5.002%

....

United

States

44,000

$

44,000

Total

Investments

from

Cash

Collateral

Received

for

Loaned

Securities

(Cost

$44,000)

....................................................................

44,000

Total

Short

Term

Investments

(Cost

$4,407,217

)

.................................

4,407,217

a

Total

Investments

(Cost

$828,904,164)

100.0%

..................................

$1,028,590,503

Other

Assets,

less

Liabilities

(0.0)%

†

...........................................

(583,181)

Net

Assets

100.0%