FILE NO 1-9945

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of February 2006

National Australia Bank Limited

ACN 004 044 937

(Registrant’s Name)

Level 24

500 Bourke Street

MELBOURNE VICTORIA 3000

AUSTRALIA

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82

| | Corporate Affairs Australia

800 Bourke Street, Docklands

Victoria 3008 Australia |

| | |

| | |

News Release | | |

| | |

Monday, 13 February 2006

NAB’s updated logo reflects broader strategy

National Australia Bank Executive Director and CEO Australia, Ahmed Fahour, today said the bank’s refreshed logo reinforces continuing changes being made by the organisation to support the needs and aspirations of our customers.

The new logo comprises a modernised red star situated on a black background over a bold, lower case ‘nab’, to replace the word ‘National’.

Executive General Manager Strategy and Marketing Greg Sutherland said: “We are still National Australia Bank and our brand is NAB. Referring to ourselves as ‘NAB’, rather than ‘the National’, is simply in line with the way customers have always referred to us.

“The updated visual identity places greater emphasis on the star and the use of lower case ‘nab’ in the logo is designed to support the contemporary development of our business. We are about being less institutional, and more relevant for our customers and the communities in which they live.”

Mr Fahour said: “Over the last year we have launched popular, customer-focused products and streamlined processes to make ourselves more responsive. We are reinvesting heavily in the business and in staff training.

“Already, we have seen an increase in customer satisfaction and marketshare. Our updated logo complements real improvements in the business.

“This is not a revolutionary change in our visual identity and implementation will be phased. We are not changing our collateral overnight and most stationery and marketing material will be updated as existing stocks run down. Signage in branches will mainly be installed in line with our current refurbishment program.”

Brand information:

• The legal entity is still National Australia Bank Limited.

• Our brand names are National Australia Bank, and NAB.

• NAB can be pronounced nab (as in cab) or N-A-B.

For further information, please contact:

Geoff Lynch

Head of Media Relations Australia

National Australia Bank Limited

T (03) 8634 1564

M 0405 319 819

National Australia Bank Limited ABN 12 004 044 937 |

|

2

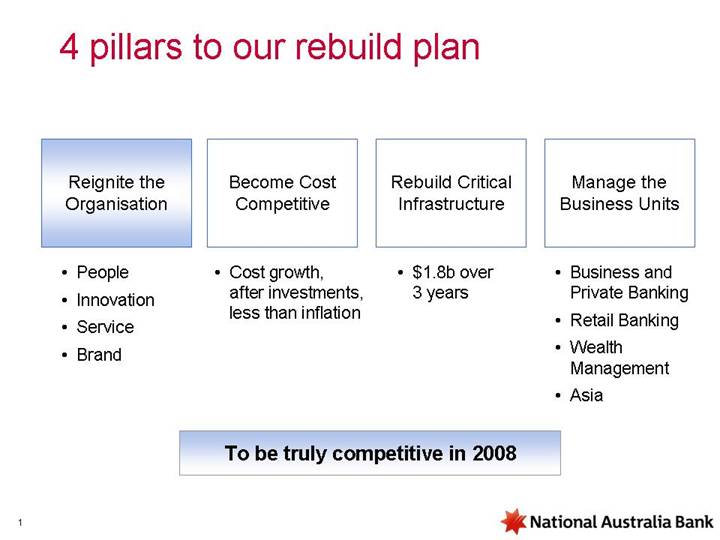

4 pillars to our rebuild plan

Reignite the | | Become Cost | | Rebuild Critical | | Manage the | |

Organisation | | Competitive | | Infrastructure | | Business Units | |

| | | | | | | |

• People | | • Cost growth, after investments, less than inflation | | • $1.8b over 3 years | | • Business and Private Banking | |

• Innovation | | | | | | • Retail Banking | |

• Service | | | | | | • Wealth Management | |

• Brand | | | | | | • Asia | |

To be truly competitive in 2008

1

Brand and people are related

2

Defining who we are

We help our

customers fulfil

their aspirations

We build relationships with our

customers by listening and

understanding them and sharing our

experience and advice

We deliver on our promises | | We are real and open | | We make it easy | | We back our customers |

| | | | | | |

• quality service | | • personable | | • simple | | • deliver insight |

• product knowledge | | • straight forward | | • fast | | • think ahead / open doors |

• accountable | | • take time to explain | | • accessible | | • collaborate and build trust |

• follow through | | | | • flexible | | |

3

Several metrics to judge progress

People | | Customers | | Organisation | |

(Examples) | | (Examples) | | (Examples) | |

| | | | | |

• Satisfaction | | • Satisfaction | | • Innovation | |

• Culture | | • Market share | | • Speed | |

• Rewards | | • Cross-sell | | • Quality | |

| | • Complaints | | | |

“Happy staff à Happy customers à Happy shareholders”

John Stewart

4

Progress – culture

System is freeing up

• More open about issues and less bureaucratic

Goal focussed

• Sense of urgency to achieve

• Targets being hit

Leaders are demonstrating the Corporate Principles

• Visible & embedded

5

Progress – EBA

In principle agreement reached

Innovative deal

• Long term wealth creation

• Employee ownership through shares

Support our cultural transformation

• Flexibility for our people and businesses

• Simplify - - one EBA for Region

• Reward for performance

• Reduce bureaucracy through reduction of grades

Commitment to diversity within our workplace

• ‘Family Friendly’

• Flexible hours

6

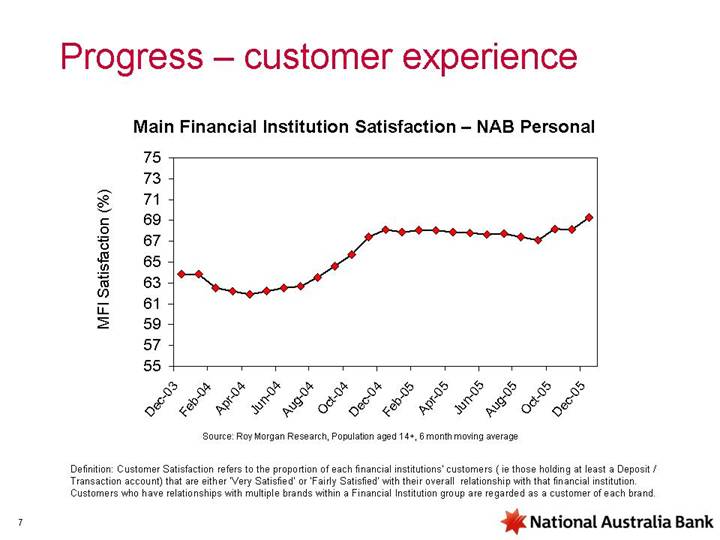

Progress – customer experience

Main Financial Institution Satisfaction – NAB Personal

[CHART]

Source: Roy Morgan Research, Population aged 14+, 6 month moving average

Definition: Customer Satisfaction refers to the proportion of each financial institutions’ customers ( ie those holding at least a Deposit / Transaction account) that are either ‘Very Satisfied’ or ‘Fairly Satisfied’ with their overall relationship with that financial institution. Customers who have relationships with multiple brands within a Financial Institution group are regarded as a customer of each brand.

7

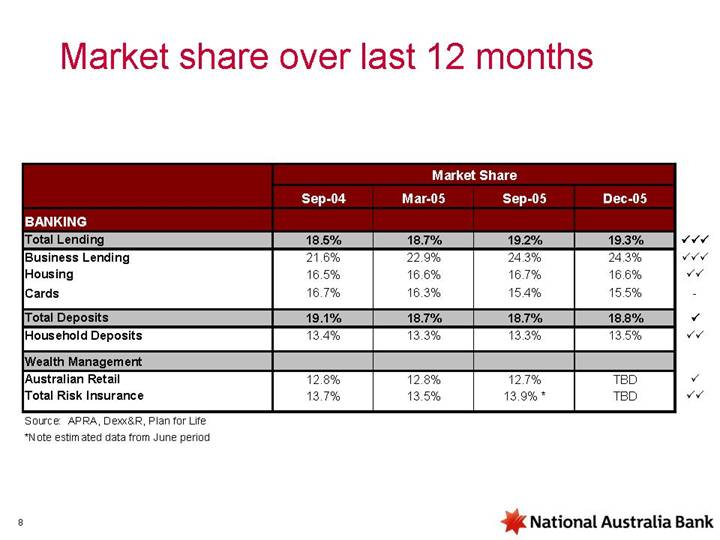

Market share over last 12 months

| | Market Share | | | |

| | Sep-04 | | Mar-05 | | Sep-05 | | Dec-05 | | | |

BANKING | | | | | | | | | | | |

Total Lending | | 18.5 | % | 18.7 | % | 19.2 | % | 19.3 | % | üüü | |

Business Lending | | 21.6 | % | 22.9 | % | 24.3 | % | 24.3 | % | üüü | |

Housing | | 16.5 | % | 16.6 | % | 16.7 | % | 16.6 | % | üü | |

Cards | | 16.7 | % | 16.3 | % | 15.4 | % | 15.5 | % | — | |

Total Deposits | | 19.1 | % | 18.7 | % | 18.7 | % | 18.8 | % | ü | |

Household Deposits | | 13.4 | % | 13.3 | % | 13.3 | % | 13.5 | % | üü | |

Wealth Management | | | | | | | | | | | |

Australian Retail | | 12.8 | % | 12.8 | % | 12.7 | % | TBD | | ü | |

Total Risk Insurance | | 13.7 | % | 13.5 | % | 13.9 | %* | TBD | | üü | |

| | | | | | | | | | | | |

Source: APRA, Dexx&R, Plan for Life

*Note estimated data from June period

8

Business and Private Bank

People and distribution leadership

• e.g. Go national

Service / Process Innovation

• e.g. Fast loan approvals

Market development

• e.g. Education / Health

9

Retail Bank

Development of our local leadership

• e.g. 70 local markets

Product Innovation

• e.g. iSaver

Branch revitalisation

• e.g. Customer First

10

Wealth Management

Revitalise the MLC brand

• People and marketing programs

Enhanced customer proposition

• Customer service

• Adviser / broker proposition

• Integrating banking and wealth

New market development

• Superannuation flows

• Manager of Manager innovation

11

Updating our identity

Australian Head Office |

|

[LOGO] |

| | |

Retail / Business and Private | | Wealth Management |

| | |

[LOGO] | | [LOGO] |

12

SIGNATURE PAGE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorised.

| | NATIONAL AUSTRALIA BANK LIMITED |

| | |

| | |

| | Signature: | /s/ Brendan T Case | |

Date: 15 February 2006 | | Name: Brendan T Case |

| | Title: Associate Company Secretary |