FRANKLIN UNIVERSAL TRUST

Semiannual Report

Franklin Universal Trust

Your Fund’s Goals and Main Investments: Franklin Universal Trust’s primary investment objective is to provide high, current income consistent with preservation of capital. Its secondary objective is growth of income through dividend increases and capital appreciation.

*Percentage of total investments of the Fund. Total investments of the Fund include long-term and short-term investments, excluding long-term debt issued by the Fund.

Dear Shareholder:

We are pleased to bring you Franklin Universal Trust’s semiannual report for the period ended February 28, 2011.

Performance Overview

For the six months under review, the Fund’s cumulative total returns were +11.49% based on net asset value and +7.25% based on market price, as shown in the Performance Summary on page 6. For comparison, the Credit Suisse (CS) High Yield Index, which is designed to mirror the investable universe of the U.S. dollar-denominated high yield debt market, produced a +9.42% total return, and utilities stocks, as measured by the Standard & Poor’s (S&P) 500 Utilities Index, which tracks all electric utility stocks in the broad S&P 500 Index, posted a +6.64% total return for the same period.1

1. Source: © 2011 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. STANDARD & POOR’S®, S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC. Standard & Poor’s does not sponsor, endorse, sell or promote any S&P index-based product. The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

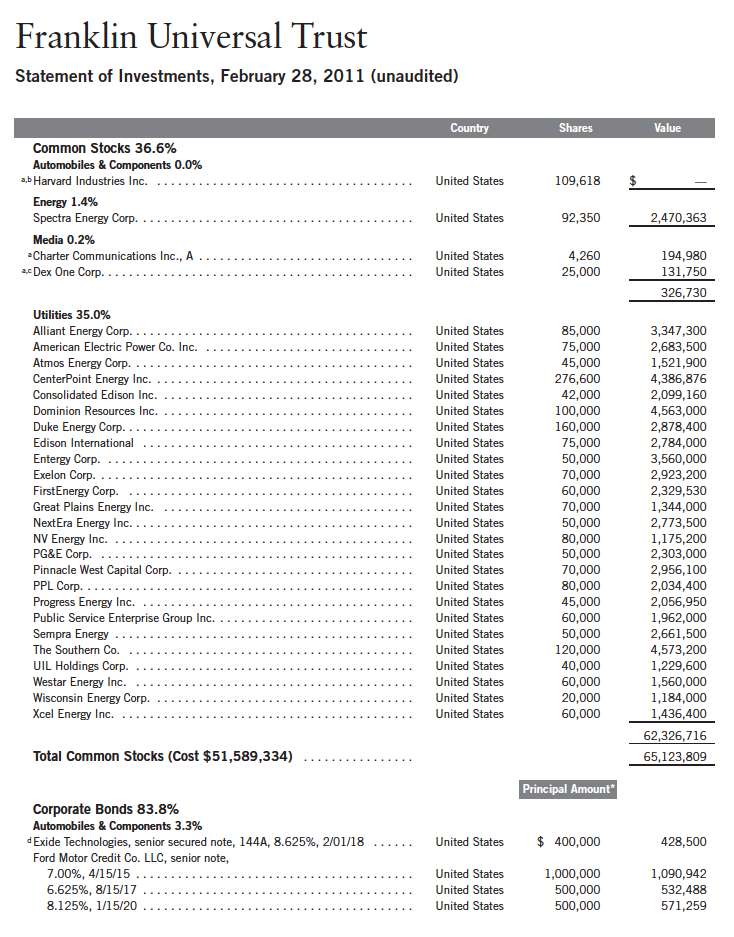

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 12.

Semiannual Report | 1

Economic and Market Overview

The U.S. economy expanded during the six-month reporting period largely due to rising exports, shrinking imports and greater consumer and business spending. The nation’s economic activity as measured by gross domestic product registered annualized growth rates of 2.6% and 3.1% in the third and fourth quarters of 2010. The job market improved, and nonfarm payroll employment increased for five consecutive months while the unemployment rate declined modestly from 9.6% at the beginning of the period to 8.9% in February.2 Remaining challenges to sustained economic recovery included elevated debt concerns and a struggling housing sector.

Crude oil prices began the reporting period at $80 per barrel and rose steadily during the period due to improved global demand. Geopolitical instability in North Africa and the Middle East caused oil prices to reach a six-month high of $97 on February 25, where they ended the period. The pace of inflation accelerated during the period, and February’s inflation rate was an annualized 2.1%.2 Similarly, core inflation, which excludes food and energy costs, rose at an annualized 1.1% rate.2

Early in the period, consumers were concerned about disappointing employment numbers, a plunge in home sales spurred by the expiration of a homebuyer tax credit, and fears of a renewed economic slowdown. On several occasions, the Federal Reserve Board (Fed) reiterated it would maintain the federal funds target rate within a range of 0% to 0.25% for an extended period. In November, to promote a stronger recovery and help maintain inflation levels the Fed believed consistent with its dual mandate to foster maximum employment and price stability, the Fed announced its intention to buy $600 billion of longer term Treasury securities by the end of the second quarter of 2011.

Investor concerns about weak economic data, the potential spillover effects of the European debt crisis and geopolitical instability in North Africa and the Middle East led to market volatility. At times, wary investors favored short-term Treasuries, and Treasury yields dipped to very low levels for much of the period. Late in the period, encouraging corporate earnings reports, the prospect of Fed intervention and extension of Bush-era tax cuts boosted investor confidence and fueled an equity market rally, which dampened Treasury prices. For the six-month period under review, Treasury prices fell and yields rose, reflecting general investor optimism. The two-year Treasury bill yield began the period at 0.47% and ended at 0.69%, while the 10-year Treasury note yield rose from 2.47% to 3.42%.

| 2. Source: Bureau of Labor Statistics. |

2 | Semiannual Report

Investment Strategy

We invest primarily in two asset classes: high yield bonds and utility stocks. Within the high yield portion of the portfolio, we use fundamental research to invest in a diversified portfolio of bonds. Within the utility portion of the portfolio, we focus on companies with attractive dividend yields and with a history of increasing their dividends.

Manager’s Discussion

The Fund’s primary asset classes, high yield corporate bonds and utility stocks, benefited from the U.S. economic recovery’s increased momentum during the period under review. Fueled by the government’s commitment to supportive policies, the rally in high yield corporate bonds continued largely unabated. With the exception of November 2010, when renewed concerns about the European sovereign debt crisis caused a temporary global market sell-off, high yield bonds, as measured by the CS High Yield Index, returned more than 1.0% each month of the period.1 Yield spreads over U.S. Treasury securities, a key measure of high yield bond valuations, tightened from 7.0 percentage points at the beginning of the period to 5.1 percentage points in February 2011.3 New-issue activity reached record levels in calendar year 2010, and the beginning of 2011 indicated new-issue activity was likely to remain robust. Although 10-year U.S. Treasury yields rose nearly one percentage point over the period, they remained at historically low levels. At the same time, the high yield market’s yield declined to record-low levels. Seeking to take advantage of these record-low yields, companies refinanced their debt to lower financing costs, extend maturities and increase shareholder-friendly activities such as dividends and share buybacks. For the overall period under review, high yield bonds returned +9.42%.1

Utility stocks, as measured by the S&P 500 Utilities Index, returned +6.64% as the increase in interest rates partially dampened their performance despite the benefit of a strong stock market in general.1 In addition, utility stocks’ defensive nature caused them to lag the broader market rally. For example, the S&P 500 Index returned +27.73%, far outpacing utility stocks.1

High Yield Corporate Bonds

The Fund benefited from its overweighted position in the gaming industry and underweighted position in the transportation sector relative to the CS High Yield Index.4 Bonds of gaming companies had lagged the market rally during

3. Source: Credit Suisse.

4. The Fund’s gaming holdings are in the consumer services industry in the SOI.

*Excludes money market funds.

**Percentage of total investments of the Fund. Total investments of the Fund include long-term and short-term investments, excluding long-term debt issued by the Fund.

Semiannual Report | 3

the Fund’s prior fiscal year, but as signs of demand stability emerged in regional gaming markets and Las Vegas, the sector made up lost ground. Transportation companies generally suffered from weakness in the dry bulk and tanker segments of the shipping industry, as the supply of new vessels exceeded the demand for shipping services. In addition, bonds of airline companies entered the period trading at lower yields than the overall market and therefore under-performed as the market rallied.

The Fund’s performance was impeded by overweighted positions in the pay television and health care sectors relative to the CS High Yield Index.5 These sectors are considered somewhat defensive given the steady demand for their services across different economic environments. Accordingly, they did not benefit as much as cyclical sectors during the economic recovery. Likewise, bonds in these sectors had not declined as much as certain other sectors’ bonds during the recession and therefore lagged the high yield market’s rally.

Utility Stocks

As noted earlier, the utilities sector trailed the overall equity market. While improved prospects for U.S. economic growth benefited all sectors of the broader equity market, the benefits to the utilities sector, the only sector with single-digit returns for the period, were less pronounced. Fundamentally, weak electricity demand persisted, which hurt pricing for utility companies that operate in unregulated markets, such as Exelon and Public Service Enterprise Group. Some regulated utility companies responded to weak electricity demand by cutting capital spending programs slightly. Overall, however, the industry’s capital spending programs remained well above historical levels and provided a decent source of growth. In our analysis, the outlook for utility stocks remained favorable, as necessary infrastructure investments provided a means for growth, while generally strong balance sheets positioned utility companies to capture that growth. The Fund’s utility holdings continued to be focused on regulated, dividend-paying utilities.

5. The Fund’s pay television holdings are in the media industry, while health care holdings are in the health care equipment and services industry and pharmaceuticals, biotechnology and life sciences industry in the SOI.

4 | Semiannual Report

Thank you for your continued participation in Franklin Universal Trust. We look forward to serving your future investment needs.

Sincerely,

| Christopher J. Molumphy, CFA Senior Portfolio Manager |

| Glenn I. Voyles, CFA Portfolio Manager Franklin Universal Trust |

CFA® is a trademark owned by CFA Institute.

The foregoing information reflects our analysis, opinions and portfolio holdings as of February 28, 2011, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Semiannual Report | 5

Performance Summary as of 2/28/11

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses. Capital gain distributions are net profits realized from the sale of portfolio securities. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Total returns do not reflect any sales charges paid at inception or brokerage commissions paid on secondary market purchases. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown.

Endnotes

The risks associated with higher yielding, lower rated securities include higher risk of default and loss of principal. These securities carry a greater degree of credit risk relative to investment-grade securities. In addition to having sensitivity to other factors, securities issued by utility companies are particularly sensitive to interest rate movements. The Fund’s share price and yield will be affected by interest rate movements. Special risks are associated with foreign investing, including currency volatility, economic instability and political developments of countries where the Fund invests. Emerging markets involve heightened risks related to the same factors, in addition to those associated with their relatively small size and lesser liquidity. The manager applies various techniques and analyses in making investment decisions for the Fund, but there can be no guarantee that these decisions will produce the desired results.

1. Total return calculations represent the cumulative and average annual changes in value of an investment over the periods indicated. Six-month return has not been annualized.

2. Assumes reinvestment of distributions based on net asset value.

3. Assumes reinvestment of distributions based on the dividend reinvestment and cash purchase plan.

4. Distribution rate is based on an annualization of the Fund’s 3.8 cent per share February dividend and the NYSE closing price of $6.45 on 2/28/11.

6 | Semiannual Report

Important Notice to Shareholders

Share Repurchase Program

The Fund’s Board previously authorized an open-market share repurchase program, pursuant to which the Fund may purchase Fund shares, from time to time, up to 10% of the Fund’s common shares in open-market transactions, at the discretion of management. This authorization remains in effect.

Semiannual Report | 7

Dividend Reinvestment and Cash Purchase Plan

The Fund’s Dividend Reinvestment and Cash Purchase Plan (Plan) offers you a prompt and simple way to reinvest dividends and capital gain distributions in shares of the Fund. The Plan also allows you to purchase additional shares of the Fund by making voluntary cash payments. BNY Mellon Investment Servicing (US) Inc. (Plan Agent), P.O. Box 358035, Pittsburgh, PA 15252-8035, acts as your Plan Agent in administering the Plan. The complete Terms and Conditions of the Dividend Reinvestment and Cash Purchase Plan are contained in the Fund’s Dividend Reinvestment and Cash Purchase Plan Brochure. Participants may contact the Plan Agent at the address above to obtain a copy of the Brochure.

You are automatically enrolled in the Plan unless you elect to receive dividends or distributions in cash. If you own shares in your own name, you should notify the Plan Agent, in writing, if you wish to receive dividends or distributions in cash.

If the Fund declares a dividend or capital gain distribution payable either in cash or in stock of the Fund and the market price of shares on the valuation date equals or exceeds the net asset value, the Fund will issue new shares to you at the higher of net asset value or 95% of the then current market price. Whenever the Fund declares a distribution from capital gains or an income dividend payable in either cash or shares, if the net asset value per share of the Fund’s common stock exceeds the market price per share on the valuation date, the Plan Agent shall apply the amount of such dividend or distribution payable to participants to the purchase of shares (less their pro rata share of brokerage commissions incurred with respect to open market purchases in connection with the reinvestment of such dividend or distribution). If the price exceeds the net asset value before the Plan Agent has completed its purchases, the average purchase price may exceed the net asset value, resulting in fewer shares being acquired than if the Fund had issued new shares. All reinvestments are in full and fractional shares, carried to three decimal places. The Fund will not issue shares under the Plan at a price below net asset value.

The Plan permits you on a voluntary basis to submit in cash payments of not less than $100 each up to a total of $5,000 per month to purchase additional shares of the Fund. It is entirely up to you whether you wish to buy additional shares with voluntary cash payments, and you do not have to send in the same amount each time if you do. These payments should be made by check or money order payable to BNY Mellon Investment Servicing (US) Inc. and sent to Investment Services, P.O. Box 382009, Pittsburgh, PA 15250-8009, Attn: Franklin Universal Trust.

8 | Semiannual Report

Your cash payment will be aggregated with the payments of other participants and invested on your behalf by the Plan Agent in shares of the Fund that are purchased in the open market.

The Plan Agent will invest cash payments on approximately the 5th of each month in which no dividend or distribution is payable and, during each month in which a dividend or distribution is payable, will invest cash payments beginning on the dividend payment date. Under no circumstances will interest be paid on your funds held by the Plan Agent. Accordingly, you should send any voluntary cash payments you wish to make shortly before an investment date but in sufficient time to ensure that your payment will reach the Plan Agent not less than two business days before an investment date. Payments received less than two business days before an investment date will be invested during the next month or, if there are more than 30 days until the next investment date, will be returned to you. You may obtain a refund of any cash payment by written notice, if the Plan Agent receives the written notice not less than 48 hours before an investment date.

There is no direct charge to participants for reinvesting dividends and capital gain distributions, since the Plan Agent’s fees are paid by the Fund. However, when shares are purchased in the open market, each participant will pay a pro rata portion of any brokerage commissions incurred. The Plan Agent will deduct a $5.00 service fee from each of your voluntary cash payments.

The automatic reinvestment of dividends and capital gain distributions does not relieve you of any taxes which may be payable on dividends or distributions. In connection with the reinvestment of dividends and capital gain distributions, if the Fund issues new shares, shareholders receiving such shares generally will be treated as having a distribution equal to the market value of the shares received, and if shares are purchased on the open market, shareholders generally will be treated as having received a distribution equal to the cash distribution that would have been paid.

The Fund does not issue new shares in connection with voluntary cash payments. All investments are in full and fractional shares, carried to three decimal places. If the market price exceeds the net asset value at the time the Plan Agent purchases the additional shares, you will receive shares at a price greater than the net asset value.

You will receive a monthly account statement from the Plan Agent showing total dividends and capital gain distributions, date of investment, shares acquired and price per share, and total shares of record held by you and by the

Semiannual Report | 9

Plan Agent for you. You are entitled to vote all shares of record, including shares purchased for you by the Plan Agent, and, if you vote by proxy, your proxy will include all such shares.

As long as you participate in the Plan, the Plan Agent will hold the shares it has acquired for you in safekeeping, in its name or in the name of its nominee. This convenience provides added protection against loss, theft or inadvertent destruction of certificates. However, you may request that a certificate representing your Plan shares be issued to you.

You may withdraw from the Plan without penalty at any time by notifying the Plan Agent, in writing, at the address above. If you withdraw, you will receive, without charge, stock certificates issued in your name for all full shares. The Plan Agent will convert any fractional shares you hold at the time of your withdrawal to cash at current market price and send you a check for the proceeds.

If you hold shares in your own name, please address all notices, correspondence, questions, or other communications regarding the Plan to the Plan Agent at the address noted above. If your shares are not held in your name, you should contact your brokerage firm, bank, or other nominee for more information and to determine if your nominee will participate in the Plan on your behalf.

The Fund or the Plan Agent may amend or terminate the Plan. You will receive written notice at least 90 days before the effective date of termination or of any amendment. In the case of termination, you will receive written notice at least 90 days before the record date of any dividend or capital gain distribution by the Fund.

10 | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 11

12 | Semiannual Report

Semiannual Report | 13

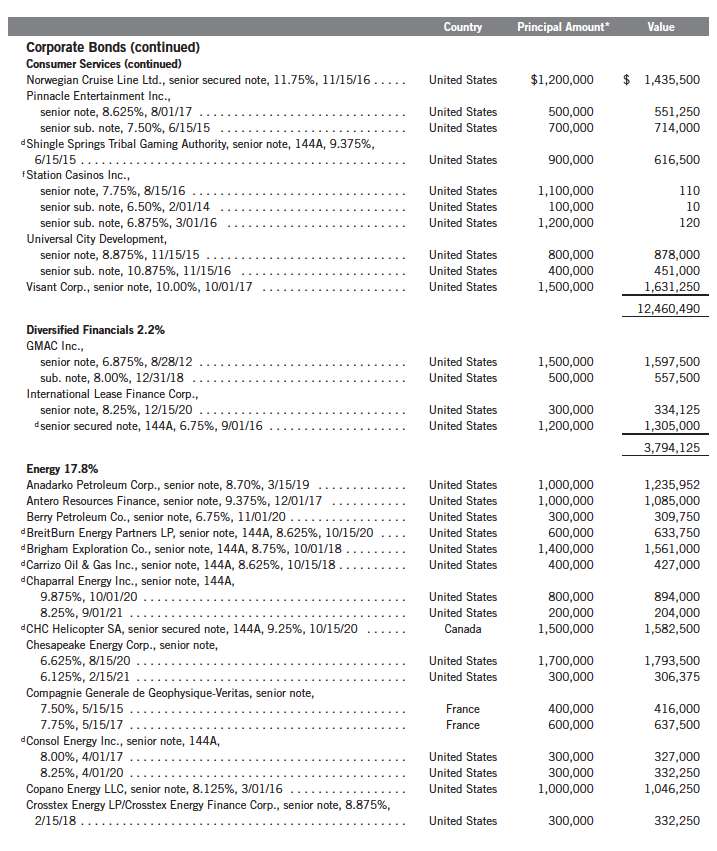

Franklin Universal Trust

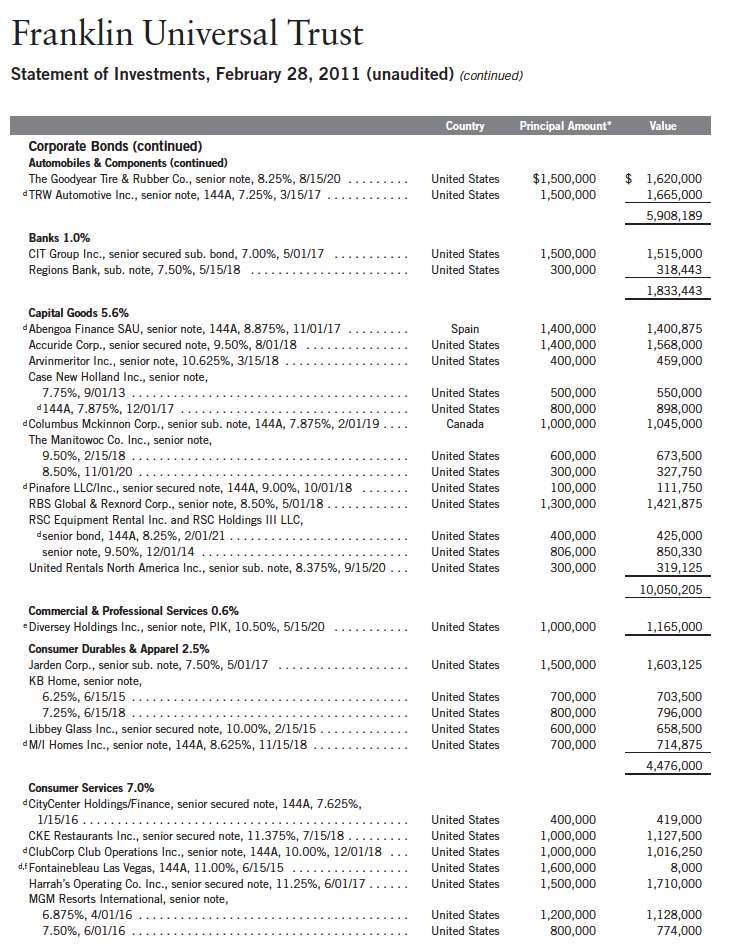

Statement of Investments, February 28, 2011 (unaudited) (continued)

14 | Semiannual Report

16 | Semiannual Report

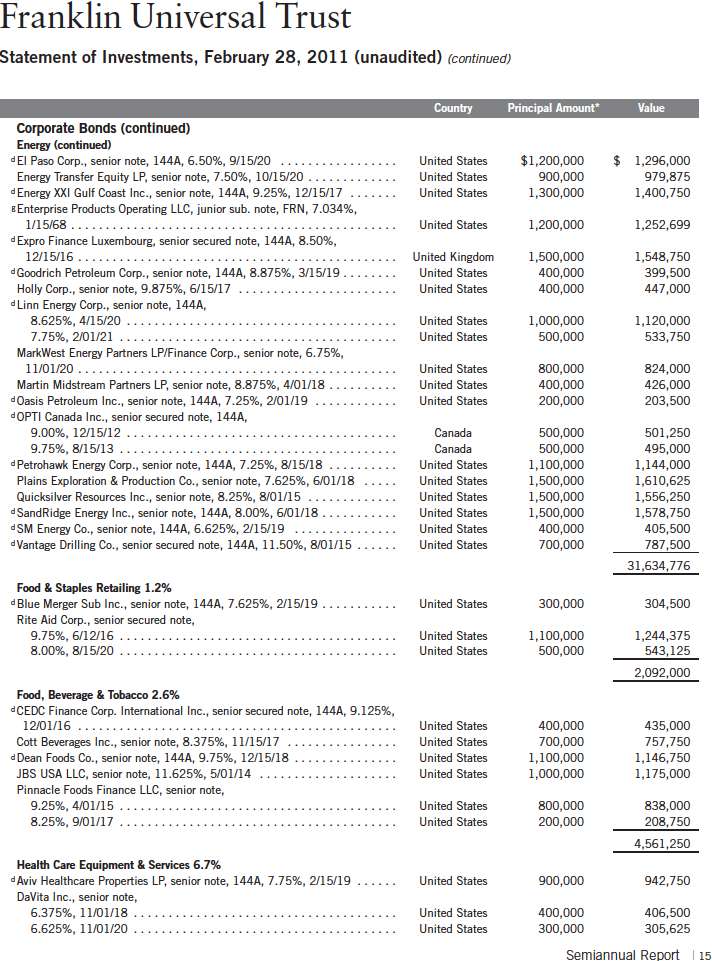

Franklin Universal Trust

Statement of Investments, February 28, 2011 (unaudited) (continued)

Semiannual Report | 17

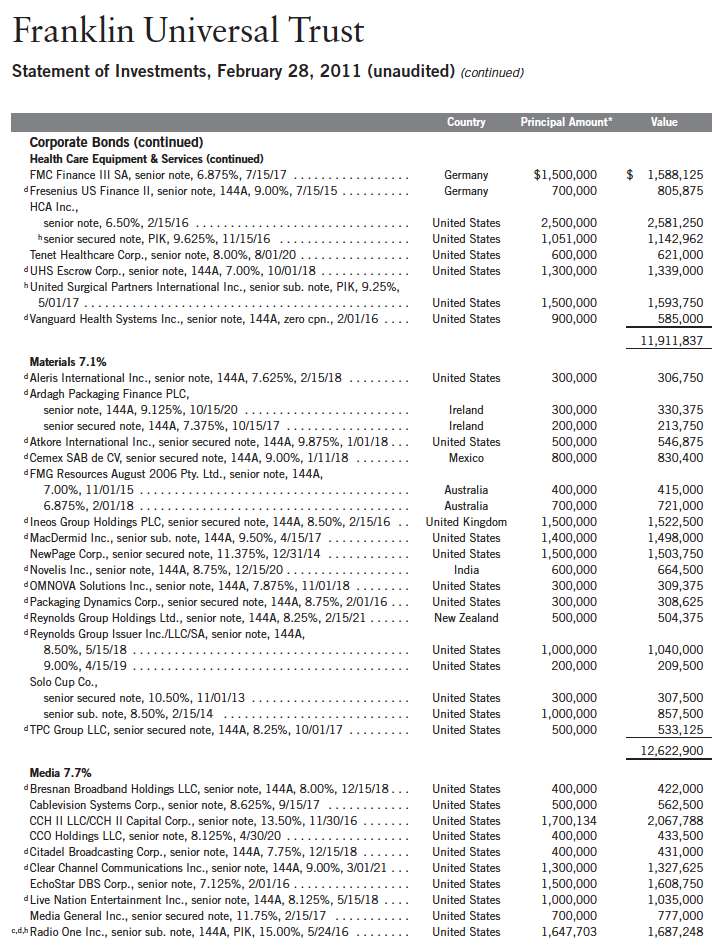

Franklin Universal Trust

Statement of Investments, February 28, 2011 (unaudited) (continued)

18 | Semiannual Report

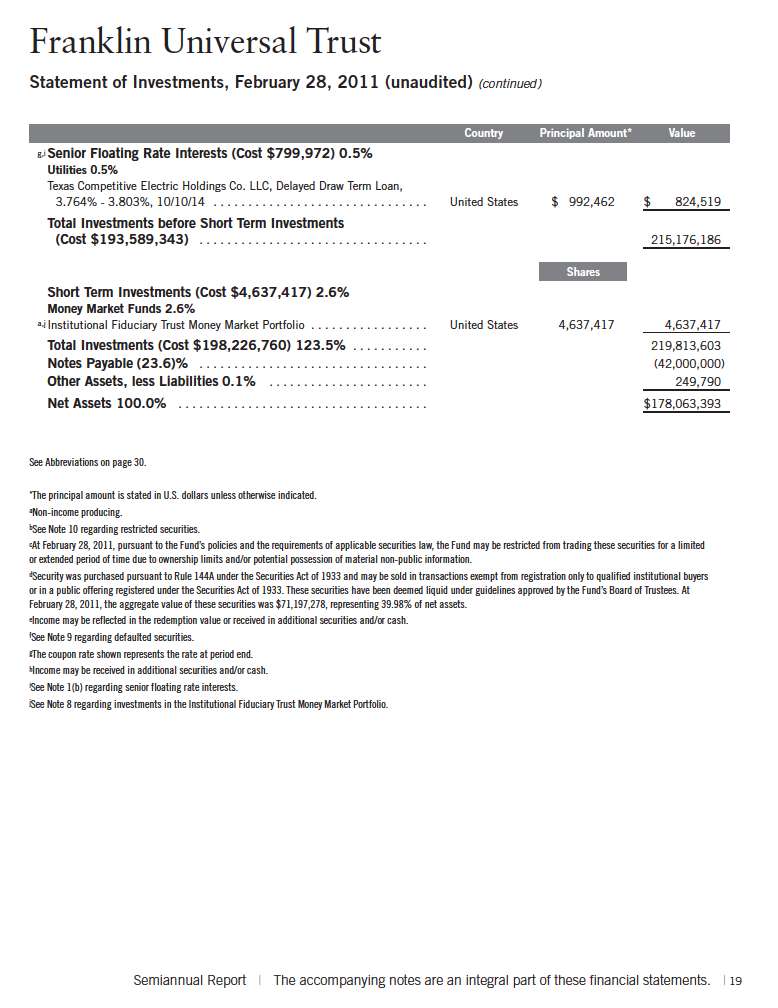

20 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 21

22 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 23

Franklin Universal Trust

Notes to Financial Statements (unaudited)

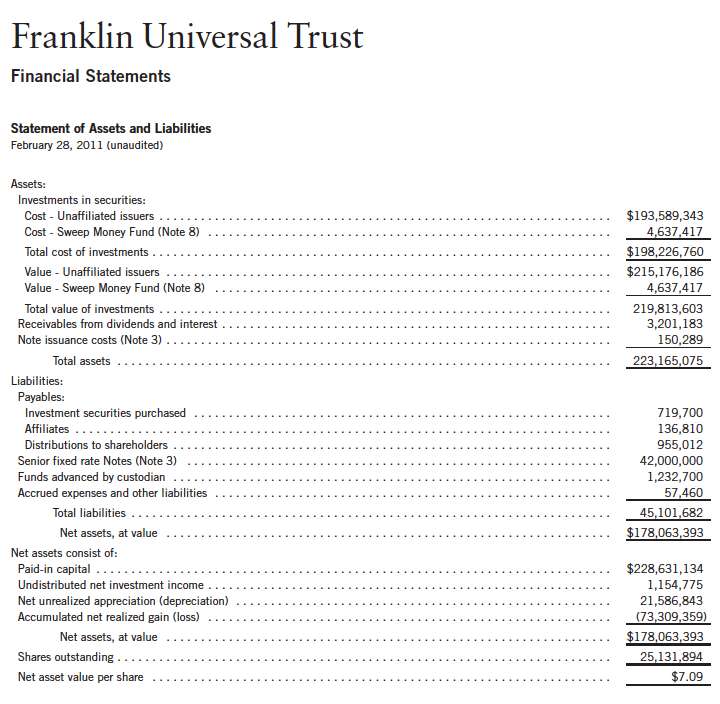

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Franklin Universal Trust (Fund) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as a closed-end investment company.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in securities and other financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Senior Fixed Rate Notes are carried at cost. Under procedures approved by the Fund’s Board of Trustees, the Fund may utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Over-the-counter securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities. Investments in open-end mutual funds are valued at the closing net asset value.

Debt securities generally trade in the over-the-counter market rather than on a securities exchange. The Fund’s pricing services use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services also utilize proprietary valuation models which may consider market characteristics such as benchmark yield curves, option-adjusted spreads, credit spreads, estimated default rates, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair value.

The Fund has procedures to determine the fair value of securities and other financial instruments for which market prices are not readily available or which may not be reliably priced. Under these procedures, the Fund primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. The Fund may also use an income-based valuation approach in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed.

24 | Semiannual Report

Franklin Universal Trust

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| b. | Senior Floating Rate Interests |

The Fund invests in senior secured corporate loans that pay interest at rates which are periodically reset by reference to a base lending rate plus a spread. These base lending rates are generally the prime rate offered by a designated U.S. bank or the London InterBank Offered Rate (LIBOR). Senior secured corporate loans often require prepayment of principal from excess cash flows or at the discretion of the borrower. As a result, actual maturity may be substantially less than the stated maturity.

Senior secured corporate loans in which the Fund invests are generally readily marketable, but may be subject to some restrictions on resale.

c. Income Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required. The Fund files U.S. income tax returns as well as tax returns in certain other jurisdictions. The Fund’s application of those tax rules is subject to its understanding. The Fund records a provision for taxes in its financial statements including penalties and interest, if any, for a tax position taken on a tax return (or expected to be taken) when it fails to meet the more likely than not (a greater than 50% probability) threshold and based on the technical merits, the tax position may not be sustained upon examination by the tax authorities. As of February 28, 2011, and for all open tax years, the Fund has determined that no provision for income tax is required in the Fund’s financial statements. Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation. The Fund is not aware of any tax position for which it is reasonably possible that the total amounts of unrecognized tax effects will significantly change in the next twelve months.

d. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Amortization of premium and accretion of discount on debt securities are included in interest income. Facility fees are recognized as income over the expected term of the loan. Dividend income is recorded on the ex-dividend date. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Semiannual Report | 25

Franklin Universal Trust

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| e. | Accounting Estimates |

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

f. Guarantees and Indemnifications

Under the Fund’s organizational documents, its officers and trustees are indemnified by the Fund against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote.

2. SHARES OF BENEFICIAL INTEREST

At February 28, 2011, there were an unlimited number of shares authorized ($0.01 par value). During the periods ended February 28, 2011 and August 31, 2010, there were no shares issued; all reinvested distributions were satisfied with previously issued shares purchased in the open market.

The Fund’s Board of Trustees previously authorized an open-market share repurchase program pursuant to which the Fund may purchase, from time to time, Fund shares in open-market transactions, at the discretion of management. This authorization remains in effect. During the periods ended February 28, 2011 and August 31, 2010, there were no shares repurchased.

3. SENIOR FIXED RATE NOTES

On August 29, 2008, the Fund issued $65 million principal amount of a new class of five-year senior fixed rate notes (Notes). The Notes are general unsecured obligations of the Fund and rank senior to trust shares and all existing or future unsecured indebtedness of the Fund. The Notes bear interest, payable semi-annually, at the rate of 5.87% per year, to maturity on August 28, 2013. The Fund is required to maintain on a monthly basis a specified discounted asset value for its portfolio in compliance with guidelines established in the Notes Agreement, and is required under the 1940 Act to maintain asset coverage for the Notes of at least 300%. The Fund has met these requirements during the period ended February 28, 2011. The issuance costs of $427,946 incurred by the Fund are deferred and amortized on an interest method basis over the term of the Notes. Subject to certain restrictions and make whole premiums, the Fund may prepay the Notes at any time. At February 28, 2011, if the Notes were fully prepaid, the make whole premium related to the current balance of the Notes would have been approximately $4,664,236.

26 | Semiannual Report

Franklin Universal Trust

Notes to Financial Statements (unaudited) (continued)

3. SENIOR FIXED RATE NOTES (continued)

During the year ended August 31, 2009, the Fund made early partial prepayments of $23,000,000 and incurred make whole premiums in the amount of $1,701,222. Upon completion of these early prepayments, the balance of the Notes was reduced to $42,000,000. In connection with the early Notes prepayments, the Fund expensed $145,034 of previously incurred Note issuance costs.

Based on the Notes’ current credit rating, remaining time to maturity, stated coupon rates, and other covenants, at February 28, 2011, the estimated fair value of the Notes was approximately $45,683,749.

4. TRANSACTIONS WITH AFFILIATES

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and trustees of the Fund are also officers and/or directors of the following subsidiaries:

| Subsidiary | Affiliation | |

| Franklin Advisers, Inc. (Advisers) | Investment manager | |

| Franklin Templeton Services, LLC (FT Services) | Administrative manager |

a. Management Fees

The Fund pays an investment management fee to Advisers of 0.75% per year of the average weekly managed assets. Managed assets are defined as the Fund’s gross asset value minus the sum of accrued liabilities, other than the principal amount of the Notes.

b. Administrative Fees

Under an agreement with Advisers, FT Services provides administrative services to the Fund. The fee is paid by Advisers based on average daily net assets, and is not an additional expense of the Fund.

5. EXPENSE OFFSET ARRANGEMENT

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the period ended February 28, 2011, there were no credits earned.

Semiannual Report | 27

Franklin Universal Trust

Notes to Financial Statements (unaudited) (continued)

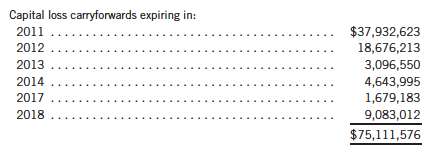

6. INCOME TAXES

For tax purposes, capital losses may be carried over to offset future capital gains, if any. At August 31, 2010, the capital loss carryforwards were as follows:

For tax purposes, realized capital losses occurring subsequent to October 31 may be deferred and treated as occurring on the first day of the following fiscal year. At August 31, 2010, the Fund deferred realized capital losses of $1,813,179.

At February 28, 2011, the cost of investments and net unrealized appreciation (depreciation) for income tax purposes were as follows:

Net investment income differs for financial statement and tax purposes primarily due to differing treatments of defaulted securities, payments-in-kind, bond discounts and premiums, and Note issuance costs.

Net realized gains (losses) differ for financial statement and tax purposes primarily due to differing treatments of defaulted securities, payments-in-kind, and bond discounts and premiums.

7. INVESTMENT TRANSACTIONS

Purchases and sales of investments (excluding short term securities) for the period ended February 28, 2011, aggregated $53,527,086 and $53,840,762, respectively.

8. INVESTMENTS IN INSTITUTIONAL FIDUCIARY TRUST MONEY MARKET PORTFOLIO

The Fund may invest in the Institutional Fiduciary Trust Money Market Portfolio (Sweep Money Fund), an open-end investment company managed by Advisers. Management fees paid by the Fund are reduced on assets invested in the Sweep Money Fund, in an amount not to exceed the management and administrative fees paid by the Sweep Money Fund.

28 | Semiannual Report

Franklin Universal Trust

Notes to Financial Statements (unaudited) (continued)

9. CREDIT RISK AND DEFAULTED SECURITIES

At February 28, 2011, the Fund had 68.26% of its portfolio invested in high yield, senior secured floating rate notes, or other securities rated below investment grade. These securities may be more sensitive to economic conditions causing greater price volatility and are potentially subject to a greater risk of loss due to default than higher rated securities.

The Fund held defaulted securities and/or other securities for which the income has been deemed uncollectible. At February 28, 2011, the aggregate value of these securities represents less than 0.05% of the Fund’s portfolio. The Fund discontinues accruing income on securities for which income has been deemed uncollectible and provides an estimate for losses on interest receivable. The securities have been identified on the accompanying Statement of Investments.

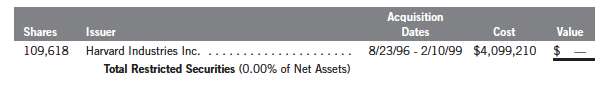

10. RESTRICTED SECURITIES

The Fund may invest in securities that are restricted under the Securities Act of 1933 (1933 Act) or which are subject to legal, contractual, or other agreed upon restrictions on resale. Restricted securities are often purchased in private placement transactions, and cannot be sold without prior registration unless the sale is pursuant to an exemption under the 1933 Act. Disposal of these securities may require greater effort and expense, and prompt sale at an acceptable price may be difficult. The Fund may have registration rights for restricted securities. The issuer generally incurs all registration costs.

At February 28, 2011, the Fund held investments in restricted securities, excluding certain securities exempt from registration under the 1933 Act deemed to be liquid, as follows:

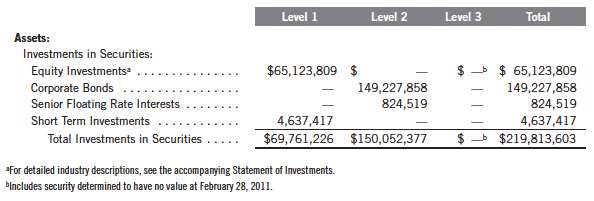

11. FAIR VALUE MEASUREMENTS

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s investments and are summarized in the following fair value hierarchy:

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speed, credit risk, etc.)

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

Semiannual Report | 29

Franklin Universal Trust

Notes to Financial Statements (unaudited) (continued)

11. FAIR VALUE MEASUREMENTS (continued)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

The following is a summary of the inputs used as of February 28, 2011, in valuing the Fund’s assets and liabilities carried at fair value:

12. SUBSEQUENT EVENTS

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

| ABBREVIATIONS Selected Portfolio FRN - Floating Rate Note PIK - Payment-in-kind |

30 | Semiannual Report

Franklin Universal Trust

Shareholder Information

Board Review of Investment Management Agreement

At a meeting held March 1, 2011, the Board of Trustees (Board), including a majority of non-interested or independent Trustees, approved renewal of the investment management agreement for Franklin Universal Trust (Fund). In reaching this decision, the Board took into account information furnished throughout the year at regular Board meetings, as well as information prepared specifically in connection with the annual renewal review process. Information furnished and discussed throughout the year included investment performance reports on the Fund, information on its share price discount to net asset value, and other related financial information, as well as periodic reports on expenses, legal, compliance, pricing, brokerage commissions and execution and other services provided by the Investment Manager (Manager) and its affiliates. Information furnished specifically in connection with the renewal process included a report prepared by Lipper, Inc. (Lipper), an independent organization, as well as additional material, including a Fund profitability analysis prepared by management. The Lipper reports compared the Fund’s investment performance and expenses with those of other funds deemed comparable to the Fund as selected by Lipper. The Fund profitability analysis discussed the profitability to Franklin Templeton Investments from its overall U.S. fund operations, as well as on an individual fund-by-fund basis. Additional material accompanying such profitability analysis included information on a fund-by-fund basis listing portfolio managers and other accounts they manage, as well as information on management fees charged by the Manager and its affiliates to U.S. funds and other accounts, including management’s explanation of differences where relevant. Such material also included a memorandum prepared by management describing project initiatives and capital investments relating to the services provided to the Fund by the Franklin Templeton Investments organization, as well as a memorandum relating to economies of scale.

In considering such materials, the independent Trustees received assistance and advice from and met separately with independent counsel. In approving continuance of the investment management agreement for the Fund, the Board, including a majority of independent Trustees, determined that the existing management fee structure was fair and reasonable and that continuance of the investment management agreement was in the best interests of the Fund and its shareholders. While attention was given to all information furnished, the following discusses some primary factors relevant to the Board’s decision.

NATURE, EXTENT AND QUALITY OF SERVICE. The Board was satisfied with the nature and quality of the overall services provided by the Manager and its affiliates to the Fund and its shareholders. In addition to investment performance and expenses discussed later, the Board’s opinion was based, in part, upon periodic reports furnished it showing that the investment policies and restrictions for the Fund were consistently complied with as well as other reports periodically furnished the Board covering matters such as the compliance of portfolio managers and other management personnel with the code of ethics adopted throughout the Franklin Templeton fund complex, the

Semiannual Report | 31

Franklin Universal Trust

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

adherence to fair value pricing procedures established by the Board, and the accuracy of net asset value calculations. Favorable consideration was given to management’s efforts and expenditures in establishing back-up systems and recovery procedures to function in the event of a natural disaster, it being noted by the Board that such systems and procedures had functioned smoothly during the Florida hurricanes and blackouts experienced in previous years. Among other factors taken into account by the Board were the Manager’s best execution trading policies, including a favorable report by an independent portfolio trading analytical firm. Consideration was also given to the experience of the Fund’s portfolio management team, the number of accounts managed and general method of compensation. In this latter respect, the Board noted that a primary factor in management’s determination of the level of a portfolio manager’s bonus compensation was the relative investment performance of the funds he or she managed and that a portion of such bonus was required to be invested in a predesignated list of funds within such person’s fund management area so as to be aligned with the interests of shareholders. Particular attention was given to management’s conservative approach and diligent risk management procedures, including continuous monitoring of counterparty credit risk and attention given to derivatives and other complex instruments. The Board also took into account, among other things, the strong financial position of the Manager’s parent company and its commitment to the fund business as evidenced by its subsidization of money market funds.

INVESTMENT PERFORMANCE. The Board placed significant emphasis on the investment performance of the Fund in view of its importance to shareholders. Consideration was given to performance reports and discussions with portfolio managers at Board meetings during the year, as well as the Lipper report furnished for the agreement renewals. The Lipper report prepared for the Fund showed its investment performance in comparison with a performance universe consisting of the Fund and all leveraged, closed-end, high current yield funds as selected by Lipper during 2010, as well as the previous 10 years ended December 31, 2010. Such report considered both income return and total return on a net asset value basis without regard to market discounts or premiums to accurately reflect investment performance. The Lipper report showed the Fund’s income return to be in the lowest quintile of such performance universe for the one-year period and on an annualized basis for each of the previous three-, five- and 10-year periods, as well. The Lipper report showed the Fund’s total return to be in the lowest quintile of its performance universe in 2010, and on an annualized basis to be in the second-lowest quintile of such universe for the previous three-year period, and the middle quintile of such universe for the previous five- and 10-year periods. In discussing such performance, management pointed out the Fund’s mandate to invest between 20 percent and 30 percent of its assets in utilities stocks differed from the Lipper performance universe, which included pure high yield funds, and that its relative performance within such universe reflected such difference. The Board believed this explanation was reasonable and the Fund’s performance to be acceptable in view of such mandate and the Fund’s investment objective of high, current income

32 | Semiannual Report

Franklin Universal Trust

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

consistent with preservation of capital. In doing so, the Board noted, as shown in the Lipper report, that the Fund’s income return exceeded 7% for 2010 as well as for the previous three-, five- and 10-year periods on an annualized basis, and its total return exceeded 13.5% for the one-year period, and on an annualized basis was above the average for its performance universe for the three-year period.

COMPARATIVE EXPENSES. Consideration was given to a comparative analysis of the management fee and total expense ratio of the Fund compared with a Lipper expense group consisting of the Fund and seven other leveraged, closed-end, high current yield funds as selected by Lipper. Lipper expense data is based upon information taken from each fund’s most recent annual report, which reflects historical asset levels that may be quite different from those currently existing, particularly in a period of market volatility. While recognizing such inherent limitation and the fact that expense ratios generally increase as assets decline and decrease as assets grow, the Board believed the independent analysis conducted by Lipper to be an appropriate measure of comparative expenses. In reviewing comparative costs, Lipper provides information on the Fund’s contractual investment management fee in comparison with the contractual investment management fee rate that would have been charged by other funds within its Lipper expense group assuming they were similar in size to the Fund, as well as the actual total expenses of the Fund in comparison with those of its Lipper expense group. The Lipper contractual investment management fee analysis considers administrative fees to be part of investment management fees and showed the Fund’s contractual management fee rate to be below the median of its Lipper expense group and its actual total expense ratio to be above, but within 23 basis points of, the median of such group. The Board believed the investment management fee and total expenses of the Fund, as shown in the Lipper report, to be acceptable.

MANAGEMENT PROFITABILITY. The Board also considered the level of profits realized by the Manager and its affiliates in connection with the operation of the Fund. In this respect, the Board reviewed the Fund profitability analysis that addresses the overall profitability of Franklin Templeton’s U.S. fund business, as well as its profits in providing management and other services to each of the individual funds during the 12-month period ended September 30, 2010, being the most recent fiscal year-end for Franklin Resources, Inc., the Manager’s parent. In reviewing the analysis, attention was given to the methodology followed in allocating costs to the Fund, it being recognized that allocation methodologies are inherently subjective and various allocation methodologies may each be reasonable while producing different results. In this respect, the Board noted that, while being continuously refined and reflecting changes in the Manager’s own cost accounting, such allocation methodology was consistent with that followed in profitability report presentations made in prior years and that the Fund’s independent registered public accounting firm had been engaged by the Manager to review the reasonableness of the allocation methodologies solely for use by the Fund’s Board in reference to the profitability analysis. In reviewing and discussing such analysis, management discussed with the Board its belief that costs incurred in establishing the infrastructure necessary for the type of fund operations conducted by the Manager and its affiliates may not be fully reflected in the expenses allocated to the Fund in determining its profitability, as

Semiannual Report | 33

Franklin Universal Trust

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

well as the fact that the level of profits, to a certain extent, reflected operational cost savings and efficiencies initiated by management. In addition, the Board considered a third-party study comparing the profitability of the Manager’s parent on an overall basis as compared to other publicly held managers broken down to show profitability from management operations exclusive of distribution expenses, as well as profitability including distribution expenses. The Board also considered the extent to which the Manager and its affiliates might derive ancillary benefits from fund operations, including potential benefits resulting from allocation of fund brokerage and the use of commission dollars to pay for research. Based upon its consideration of all these factors, the Board determined that the level of profits realized by the Manager and its affiliates from providing services to the Fund was not excessive in view of the nature, quality and extent of services provided.

ECONOMIES OF SCALE. The Board also considered whether the Manager realizes economies of scale as the Fund grows larger and the extent to which any such benefit is shared with the Fund and its shareholders. The Board believed that a manager’s ability to realize economies of scale and the sharing of such benefit is a more relevant consideration in the case of an open-end fund whose size increases as a result of the continuous sale of its shares. A closed-end investment company such as the Fund does not continuously offer shares, and growth following its initial public offering will primarily result from market appreciation, which benefits its shareholders. While believing economies of scale to be less of a factor in the context of a closed-end fund, the Board believes at some point an increase in size may lead to economies of scale that should be shared with the Fund and its shareholders and intends to monitor future growth of the Fund accordingly.

Proxy Voting Policies and Procedures

The Fund’s investment manager has established Proxy Voting Policies and Procedures (Policies) that the Fund uses to determine how to vote proxies relating to portfolio securities. Shareholders may view the Fund’s complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954) 527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 500 East Broward Boulevard, Suite 1500, Fort Lauderdale, FL 33394, Attention: Proxy Group. Copies of the Fund’s proxy voting records are also made available online at franklintempleton.com and posted on the U.S. Securities and Exchange Commission’s website at sec.gov and reflect the most recent 12-month period ended June 30.

Quarterly Statement of Investments

The Fund files a complete statement of investments with the U.S. Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission’s website at sec.gov. The filed form may also be viewed and copied at the Commission’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling (800) SEC-0330.

34 | Semiannual Report

Franklin Universal Trust

Shareholder Information (continued)

Certifications

The Fund’s Chief Executive Officer – Finance and Administration is required by the New York Stock Exchange’s Listing Standards to file annually with the Exchange a certification that she is not aware of any violation by the Fund of the Exchange’s Corporate Governance Standards applicable to the Fund. The Fund has filed such certification.

In addition, the Fund’s Chief Executive Officer – Finance and Administration and Chief Financial Officer and Chief Accounting Officer are required by the rules of the U.S. Securities and Exchange Commission to provide certain certifications with respect to the Fund’s Form N-CSR and Form N-CSRS (which include the Fund’s annual and semiannual reports to shareholders) that are filed semiannually with the Commission. The Fund has filed such certifications with its Form N-CSR for the year ended August 31, 2010. Additionally, the Fund expects to file, on or about April 29, 2011, such certifications with its Form N-CSRS for the six months ended February 28, 2011.

Semiannual Report | 35

This page intentionally left blank.

| Item 2. Code of Ethics. |

| (a) | The Registrant has adopted a code of ethics that applies to its principal executive officers and principal financial and accounting officer. |

| (c) | N/A |

| (d) | N/A |

| (f) | Pursuant to Item 12(a)(1), the Registrant is attaching as an exhibit a copy of its code of ethics that applies to its principal executive officers and principal financial and accounting officer. |

Item 3. Audit Committee Financial Expert.

(a)(1) The Registrant has an audit committee financial expert serving on its audit committee.

(2) The audit committee financial expert is John B. Wilson and he is "independent" as defined under the relevant Securities and Exchange Commission Rules and Releases.

Item 4. Principal Accountant Fees and Services. N/A

Item 5. Audit Committee of Listed Registrants.

Members of the Audit Committee are: Michael Luttig, Frank A. Olson and John B. Wilson.

| Item 6. Schedule of Investments. |

| N/A |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

The board of trustees of the Fund has delegated the authority to vote proxies related to the portfolio securities held by the Fund to the Fund’s manager Franklin Advisers, Inc. in accordance with the Proxy Voting Policies and Procedures (Policies) adopted by the investment manager.

The investment manager has delegated its administrative duties with respect to the voting of proxies to the Proxy Group within Franklin Templeton Companies, LLC (Proxy Group), an affiliate and wholly owned subsidiary of Franklin Resources, Inc. All proxies received by the Proxy Group will be voted based upon the investment manager’s instructions and/or policies. The investment manager votes proxies solely in the interests of the Fund and its shareholders.

To assist it in analyzing proxies, the investment manager subscribes to RiskMetrics Group (RiskMetrics), an unaffiliated third-party corporate governance research service that provides in-depth analyses of shareholder meeting agendas, vote recommendations, recordkeeping and vote disclosure services. In addition, the investment manager subscribes to Glass, Lewis & Co., LLC (Glass Lewis), an unaffiliated third-party analytical research firm, to receive analyses and vote recommendations on the shareholder meetings of publicly held U.S. companies. Although RiskMetrics’ and/or Glass Lewis’ analyses are

2

thoroughly reviewed and considered in making a final voting decision, the investment manager does not consider recommendations from RiskMetrics, Glass Lewis or any other third party to be determinative of the investment manager’s ultimate decision. As a matter of policy, the officers, directors/trustees and employees of the investment manager and the Proxy Group will not be influenced by outside sources whose interests conflict with the interests of the Fund and its shareholders. Efforts are made to resolve all conflicts in the interests of the investment manager’s clients. Material conflicts of interest are identified by the Proxy Group based upon analyses of client, distributor, broker dealer and vendor lists, information periodically gathered from directors and officers, and information derived from other sources, including public filings. In situations where a material conflict of interest is identified, the Proxy Group may defer to the voting recommendation of RiskMetrics, Glass Lewis or those of another independent third-party provider of proxy services; or send the proxy directly to the Fund with the investment manager’s recommendation regarding the vote for approval. If the conflict is not resolved by the Fund, the Proxy Group may refer the matter, along with the recommended course of action by the investment manager, if any, to an interdepartmental Proxy Review Committee (which may include portfolio managers and/or research analysts employed by the investment manager), for evaluation and voting instructions. The Proxy Review Committee may defer to the voting recommendation of RiskMetrics, Glass Lewis or those of another independent third-party provider of proxy services; or send the proxy directly to the Fund. Where the Proxy Group or the Proxy Review Committee refers a matter to the Fund, it may rely upon the instructions of a representative of the Fund, such as the board or a committee of the board.

Where a material conflict of interest has been identified, but the items on which the investment manager’s vote recommendations differ from Glass Lewis, RiskMetrics, or another independent third-party provider of proxy services relate specifically to (1) shareholder proposals regarding social or environmental issues or political contributions, (2) “Other Business” without describing the matters that might be considered, or (3) items the investment manager wishes to vote in opposition to the recommendations of an issuer’s management, the Proxy Group may defer to the vote recommendations of the investment manager rather than sending the proxy directly to the Fund for approval.

To avoid certain potential conflicts of interest, the investment manager will employ echo voting, if possible, in the following instances: (1) when the Fund invests in an underlying fund in reliance on any one of Sections 12(d)(1)(E), (F), or (G) of the 1940 Act, the rules thereunder or pursuant to any SEC exemptive orders thereunder; (2) when the Fund invests uninvested cash in affiliated money market funds pursuant to the rules under the 1940 Act or any exemptive orders thereunder (“cash sweep arrangement”); or (3) when required pursuant to the Fund’s governing documents or applicable law. Echo voting means that the investment manager will vote the shares in the same proportion as the vote of all of the other holders of the Fund’s shares.

The recommendation of management on any issue is a factor that the investment manager considers in determining how proxies should be voted. However, the investment manager does not consider recommendations from management to be determinative of the investment manager’s ultimate decision. As a matter of practice, the votes with respect to most issues are cast in accordance with the position of the company's management. Each issue, however, is considered on its own merits, and the investment manager will not support the position of the company's management in any situation where it deems that the ratification of

3

management’s position would adversely affect the investment merits of owning that company’s shares.

Investment Manager’s proxy voting policies and principles The investment manager has adopted general proxy voting guidelines, which are summarized below. These guidelines are not an exhaustive list of all the issues that may arise and the investment manager cannot anticipate all future situations. In all cases, each proxy will be considered based on the relevant facts and circumstances.

Board of directors. The investment manager supports an independent board of directors, and prefers that key committees such as audit, nominating, and compensation committees be comprised of independent directors. The investment manager will generally vote against management efforts to classify a board and will generally support proposals to declassify the board of directors. The investment manager may withhold votes from directors who have attended less than 75% of meetings without a valid reason. While generally in favor of separating Chairman and CEO positions, the investment manager will review this issue as well as proposals to restore or provide for cumulative voting on a case-by-case basis, taking into consideration factors such as the company’s corporate governance guidelines or provisions and performance.

Ratification of auditors of portfolio companies. The investment manager will closely scrutinize the role and performance of auditors. On a case-by-case basis, the investment manager will examine proposals relating to non-audit relationships and non-audit fees. The investment manager will also consider, on a case-by-case basis, proposals to rotate auditors, and will vote against the ratification of auditors when there is clear and compelling evidence of accounting irregularities or negligence.

Management and director compensation. A company’s equity-based compensation plan should be in alignment with the shareholders’ long-term interests. The investment manager believes that executive compensation should be directly linked to the performance of the company. The investment manager evaluates plans on a case-by-case basis by considering several factors to determine whether the plan is fair and reasonable, including the RiskMetrics quantitative model utilized to assess such plans and/or the Glass Lewis evaluation of the plans. The investment manager will generally oppose plans that have the potential to be excessively dilutive, and will almost always oppose plans that are structured to allow the repricing of underwater options, or plans that have an automatic share replenishment “evergreen” feature. The investment manager will generally support employee stock option plans in which the purchase price is at least 85% of fair market value, and when potential dilution is 10% or less.

Severance compensation arrangements will be reviewed on a case-by-case basis, although the investment manager will generally oppose “golden parachutes” that are considered to be excessive. The investment manager will normally support proposals that require a percentage of directors’ compensation to be in the form of common stock, as it aligns their interests with those of shareholders.

Anti-takeover mechanisms and related issues. The investment manager generally opposes anti-takeover measures since they tend to reduce shareholder rights. However, as with all proxy issues, the investment manager conducts an independent review of each anti-takeover proposal. On occasion, the investment manager may vote with management when the research analyst has concluded that the proposal is not onerous and would not harm the Fund or its shareholders’ interests. The investment manager generally supports proposals that require shareholder rights’ plans (“poison pills”) to be subject to a shareholder vote and

4

will closely evaluate such plans on a case-by-case basis to determine whether or not they warrant support. In addition, the investment manager will generally vote against any proposal to issue stock that has unequal or subordinate voting rights. The investment manager generally opposes any supermajority voting requirements as well as the payment of “greenmail.” The investment manager generally supports “fair price” provisions and confidential voting.

Changes to capital structure. The investment manager realizes that a company's financing decisions have a significant impact on its shareholders, particularly when they involve the issuance of additional shares of common or preferred stock or the assumption of additional debt. The investment manager will review, on a case-by-case basis, proposals by companies to increase authorized shares and the purpose for the increase. The investment manager will generally not vote in favor of dual-class capital structures to increase the number of authorized shares where that class of stock would have superior voting rights. The investment manager will generally vote in favor of the issuance of preferred stock in cases where the company specifies the voting, dividend, conversion and other rights of such stock and the terms of the preferred stock issuance are deemed reasonable.

Mergers and corporate restructuring. Mergers and acquisitions will be subject to careful review by the research analyst to determine whether they would be beneficial to shareholders. The investment manager will analyze various economic and strategic factors in making the final decision on a merger or acquisition. Corporate restructuring proposals are also subject to a thorough examination on a case-by-case basis.

Social and corporate policy issues. The investment manager will generally give management discretion with regard to social, environmental and ethical issues, although the investment manager may vote in favor of those that are believed to have significant economic benefits or implications for the Fund and its shareholders.

Global corporate governance. Many of the tenets discussed above are applied to the investment manager’s proxy voting decisions for international investments. However, the investment manager must be flexible in these instances and must be mindful of the varied market practices of each region.

The investment manager will attempt to process every proxy it receives for all domestic and foreign issuers. However, there may be situations in which the investment manager cannot process proxies, for example, where a meeting notice was received too late, or sell orders preclude the ability to vote. If a security is on loan, the investment manager may determine that it is not in the best interests of the Fund to recall the security for voting purposes. Also, the investment manager may abstain from voting under certain circumstances or vote against items such as “Other Business” when the investment manager is not given adequate information from the company.

Shareholders may view the complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954)527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 500 East Broward Boulevard, Suite 1500, Fort Lauderdale, FL 33394, Attention: Proxy Group. Copies of the Fund’s proxy voting records are available online at franklintempleton.com and posted on the SEC website at sec.gov. The proxy voting records are updated each year by August 31 to reflect the most recent 12-month period ended June 30.

5

Item 8. Portfolio Managers of Closed-End Management Investment Company.

N/A

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

N/A

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no changes to the procedures by which shareholders may recommend nominees to the Registrant's Board of Trustees that would require disclosure herein.

Item 11. Controls and Procedures.

(a) Evaluation of Disclosure Controls and Procedures. The Registrant maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in the Registrant’s filings under the Securities Exchange Act of 1934 and the Investment Company Act of 1940 is recorded, processed, summarized and reported within the periods specified in the rules and forms of the Securities and Exchange Commission. Such information is accumulated and communicated to the Registrant’s management, including its principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure. The Registrant’s management, including the principal executive officer and the principal financial officer, recognizes that any set of controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives.

Within 90 days prior to the filing date of this Shareholder Report on Form N-CSR, the Registrant had carried out an evaluation, under the supervision and with the participation of the Registrant’s management, including the Registrant’s principal executive officer and the Registrant’s principal financial officer, of the effectiveness of the design and operation of the Registrant’s disclosure controls and procedures. Based on such evaluation, the Registrant’s principal executive officer and principal financial officer concluded that the Registrant’s disclosure controls and procedures are effective.

| (b) Changes in Internal Controls. |

There have been no significant changes in

the Registrant’s internal controls or in other factors that could significantly affect the internal controls subsequent to the date of their evaluation in connection with the preparation of this Shareholder Report on Form N-CSR.

Item 12. Exhibits.

(a) (1) Code of Ethics

(a)(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 of Laura F. Fergerson, Chief Executive Officer - Finance and Administration, and Gaston Gardey, Chief Financial Officer and Chief Accounting Officer

(b) Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 of Laura F. Fergerson, Chief Executive Officer - Finance and Administration, and Gaston Gardey, Chief Financial Officer and Chief Accounting Officer

6

| SIGNATURES |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Franklin Universal Trust

| By /s/ LAURA F. FERGERSON Laura F. Fergerson Chief Executive Officer – Finance and Administration Date: April 27, 2011 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By /s/ LAURA F. FERGERSON Laura F. Fergerson Chief Executive Officer – Finance and Administration Date: April 27, 2011 |

| By /s/ GASTON GARDEY Gaston Gardey Chief Financial Officer and Chief Accounting Officer Date: April 27, 2011 |

7