QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

GENLYTE GROUP INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

THE GENLYTE GROUP INCORPORATED

10350 Ormsby Park Place, Suite 601

Louisville, KY 40223

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

to be held on April 29, 2004

March 19, 2004

To the Stockholders:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of The Genlyte Group Incorporated ("Genlyte") will be held at The Genlyte Group Incorporated, 10350 Ormsby Park Place, Community Room, Lower Level, Louisville, KY 40223, on Thursday, April 29, 2004 at 10:00 AM, local time, for the following purposes:

- (1)

- to elect two members of the Board of Directors;

- (2)

- to transact such other business as may properly come before the meeting and any adjournments or postponements thereof.

Stockholders of record at the close of business on March 8, 2004 are entitled to notice of and to vote at the meeting or any adjournments or postponements thereof.

Your attention is directed to the attached Proxy Statement.Whether or not you expect to be present at the meeting, please complete, sign, date, and mail the enclosed Proxy as promptly as possible in order to save the Company further solicitation expense.There is enclosed with the Proxy an addressed envelope for which no postage is required if mailed in the United States.

|

|

By Order of the Board of Directors, |

|

|

|

| | | R. L. ZACCAGNINI

Secretary |

GENLYTE GROUP INCORPORATED

10350 Ormsby Park Place, Suite 601

Louisville, KY 40223

ANNUAL MEETING OF STOCKHOLDERS

to be held on April 29, 2004

PROXY STATEMENT

March 19, 2004

INTRODUCTION

The Annual Meeting of Stockholders (the "Annual Meeting") of The Genlyte Group Incorporated ("Genlyte") will be held at The Genlyte Group Incorporated, 10350 Ormsby Park Place, Community Room, Lower Level, Louisville, KY 40223, on Thursday, April 29, 2004 at 10:00 AM, local time, for the purposes set forth in the accompanying notice. This proxy statement and the accompanying form of proxy are being furnished in connection with the solicitation by Genlyte's Board of Directors of proxies to be voted at such meeting and at any and all adjournments or postponements thereof.

This proxy statement and accompanying form of proxy are first being sent to stockholders on or about March 19, 2004.

ACTIONS TO BE TAKEN UNDER THE PROXY

All proxies properly executed, duly returned and not revoked will be voted at the Annual Meeting (including any adjournments or postponements thereof) in accordance with the specifications therein, or, if no specifications are made, will be votedFORthe nominees to the Board of Directors named in this proxy statement and listed in the accompanying form of proxy.

If a proxy in the accompanying form is executed and returned, it may nevertheless be revoked at any time prior to the exercise thereof by executing and returning a proxy bearing a later date, by giving notice of revocation to the Secretary of Genlyte, or by attending the Annual Meeting and voting in person.

ELECTION OF DIRECTORS

The Board of Directors of Genlyte currently consists of Larry K. Powers (Chairman), David M. Engelman, John T. Baldwin, Robert D. Nixon and Zia Eftekhar. The directors elected at the Annual Meeting will hold office for a term ending at the Annual Meeting of Stockholders to be held in April of 2007 and until a successor has been duly elected and qualified. Mr. Larry K. Powers and Mr. Zia Eftekhar have been nominated to the Board of Directors for election at the Annual Meeting.

If, for any reason, Messrs. Powers and Eftekhar are not candidates when the election occurs, which is not anticipated, it is intended that the proxies will be voted for the election of a substitute nominee designated by the Board of Directors.

The Board of Directors recommends a vote FOR the election of the nominees as directors.

Genlyte Thomas Group LLC

On August 27, 1998, the Shareholders of Genlyte and Thomas Industries Inc. (Thomas), respectively, approved the formation of a new lighting company to be jointly owned by them as outlined below. This company, a Delaware Limited Liability Company, is named Genlyte Thomas Group LLC ("Genlyte Thomas Group").

1

Genlyte contributed substantially all of its assets to Genlyte Thomas Group in exchange for a 68% interest therein and the assumption by Genlyte Thomas Group of substantially all of Genlyte's liabilities. Thomas contributed substantially all of its lighting assets to Genlyte Thomas Group in exchange for a 32% interest therein and the assumption by Genlyte Thomas Group of certain of its liabilities. (Reference herein to "employees of the company" shall mean employees of the Genlyte Thomas Group unless stated otherwise.)

The day-to-day operations of Genlyte Thomas Group are managed by its executive officers under the supervision of a Management Board. The Management Board is comprised of seven (7) Representatives, five (5) of whom were appointed by Genlyte and two (2) of whom were appointed by Thomas. (On July 24, 2003 Genlyte and Thomas agreed to Genlyte's appointment of five (5) Representatives to the Management Board of Genlyte Thomas instead of only four (4), so long as Genlyte's entire Board is comprised of the current five (5) directors.) The Genlyte Representatives are Messrs. Powers, Eftekhar, Engelman, Nixon and Baldwin (see below). Actions of the Management Board require the approval of a majority of the Representatives, except that certain actions, as outlined in the Proxy Statement dated July 23, 1998, require the approval of a majority of the Management Board including at least one Representative appointed by Thomas. (For further details, see the company's Proxy Statement dated July 23, 1998.)

Nominees for Election as Director

Information about the nominees for election as director, including biographical and employment information, is set forth below.

| Zia Eftekhar (58) | | Mr. Eftekhar was appointed as a director of Genlyte at the February 2001 meeting of the Board of Directors and was elected to the Board of Directors April 25, 2001. Mr. Eftekhar has been President of Lightolier, the largest division of Genlyte Thomas Group, since 1992. During his 36-year career with the company he has held a number of sales, marketing and general management positions with the company. From August 1988 until May 1992 Mr. Eftekhar was responsible for sales, marketing and manufacturing activities of Lightolier. From January 1983 to July 1988 he served as President of the commercial division of Lightolier. Mr. Eftekhar's entire career has been focused in the lighting industry and he is currently a member of the Board of Directors of the American Lighting Association. He also serves as a Representative of the Genlyte Thomas Group Management Board. |

Larry K. Powers (61) |

|

Mr. Powers has served as a director of Genlyte since July 1993 and was elected Chairman of the Board of Genlyte in April, 2000. Mr. Powers was appointed President and Chief Executive Officer of Genlyte in January 1994 and President and Chief Executive Officer of Genlyte Thomas Group LLC in August 1998. He has held a variety of sales, marketing and general management positions in the lighting industry. From September 1979 until April 1989, Mr. Powers was President of Hadco which was acquired by a predecessor of Genlyte in July 1983. Mr. Powers served as President of the HID/Outdoor Division of Genlyte from May 1989 until June 1993. From July 1993 to December 1993, he served as President of Genlyte U.S. Operations and Executive Vice President of Genlyte. He also serves as a Representative on the Genlyte Thomas Group Management Board. |

| | | |

2

Incumbent Directors |

|

|

David M. Engelman (71) |

|

Mr. Engelman, an independent director as determined by the Genlyte Board under applicable NASDAQ Rules, was appointed to the Board of Directors at the December 1993 meeting of the Board of Directors. This appointment took effect on January 1, 1994. Mr. Engelman was employed by General Electric Company from 1954 through 1993 and held a variety of general management positions. He was elected as a Vice President of General Electric in 1982 and was in charge of international electrical distribution and control operations. He is a member of the Compensation Committee and Chairman of the Audit Committee of the Genlyte Board of Directors. He also serves as a Representative on the Genlyte Thomas Group Management Board. |

John T. Baldwin (47) |

|

Mr. Baldwin, an independent director as determined by the Genlyte Board under applicable NASDAQ Rules, was appointed in March 2003 at a Special Meeting of the Board of Directors and elected to the Board of Directors April 24, 2003 for a three-year term. Mr. Baldwin is currently employed as Senior Vice President and Chief Financial Officer of Graphic Packaging Corporation. Mr. Baldwin previously served as Vice President and Chief Financial Officer of Worthington Industries, Inc. from December 1998 to September 8, 2003 and its Treasurer from August 1997 to December 1998. From May 1981 through August 1997, Mr. Baldwin was employed by Tenneco Inc. and held a variety of financial positions at Tenneco in the United States and in London, England. Mr. Baldwin received his J.D. degree from the University of Texas School of Law in 1981 and his B.S. degree from the University of Houston in 1978. He is a member of the Audit Committee and Compensation Committee of the Genlyte Board of Directors. He also serves as a Representative on the Genlyte Thomas Group Management Board. |

Robert D. Nixon (53) |

|

Mr. Nixon, an independent director as determined by the Genlyte Board under applicable NASDAQ Rules, was appointed to the Board at the December 2001 meeting of the Board of Directors and elected to the Board of Directors April 25, 2002 for a three-year term. He is a member of the Genlyte Audit Committee and Chairman of the Compensation Committee. Mr. Nixon currently holds the Fischer Family Chair in Family Entrepreneurship and is an Associate Professor of Management, College of Business and Public Administration, University of Louisville. From July 1994 to June 2001 he was an Assistant Professor, A.B. Freeman School of Business, and Member of the Graduate School Faculty, Tulane University. Mr. Nixon had an extensive business management career, serving as co-founder and director of First Charter Mortgage, co-founder and President of Telnet Telecommunications, co-founder and managing General Partner of Aluminum Recycling Company, and President of Wincor Development, Inc. Mr. Nixon received his Ph.D. from Texas A&M University in 1995, and his B.S. degree from Brigham Young University in 1975. He also serves as a Representative on the Genlyte Thomas Group Management Board. |

3

Board and Committee Meetings; Committee Matters Generally

During 2003, Genlyte's Board of Directors met five times for regular meetings and held two special meetings via teleconference. In addition, the directors received and reviewed monthly reports of the financial performance of Genlyte and Genlyte Thomas Group, and management confers frequently with its directors on an informal basis to discuss company affairs. During 2003, each of the directors attended a majority of the meetings of the Board and the Board Committees of which such director was a member. The Board has established standing Audit and Compensation Committees.

The Board has adopted an Audit Committee Charter (attached to this proxy statement) and has established that the Audit Committee has the sole and direct responsibility and authority for the appointment of its independent accountants to audit Genlyte's and Genlyte Thomas Group's financial statements and to perform services related to the audit, review the scope and results of the audit with the independent accountants, and to oversee the accounting and financial reporting processes of Genlyte and Genlyte Thomas Group. Members of this committee are Messrs. Engelman, Baldwin, and Nixon, with Mr. Engelman serving as Chairman. During 2003, the Audit Committee met six times for regular meetings and two special teleconference meetings. Genlyte certifies that it has and will continue to have, an Audit Committee of at least three members each of whom must: (a) be independent under applicable NASDAQ Rules, (b) not have participated in the preparation of the financial statements of the Company or any subsidiary at any time during the past three years, and (c) be able to read and understand fundamental financial statements, including a balance sheet, income statement, and cash flow statement. Additionally, Genlyte certifies that it has, and will continue to have, at least one member of the Audit Committee who has employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background which results in the individual's financial sophistication, including being or having been a chief executive officer or other senior officer with financial oversight responsibilities (herein "Financial Expert"). The Board of Directors has designated Mr. Baldwin as the Audit Committee's Financial Expert.

During 2003 the Compensation Committee reviewed and recommended the compensation arrangements for all executive officers, approved such arrangements for other senior level employees, and administered and took such other action as required in connection with certain compensation plans of Genlyte Thomas Group. Members of the Compensation Committee are Messrs. Engelman, Baldwin, and Nixon, with Mr. Nixon serving as Chairman. During 2003, the Compensation Committee met four times and reviewed and recommended all stock options, subject to Board approval.

During 2003 a Nominating Committee, comprised of Messrs. Engelman, Powers and Eftekhar met one time. In December 2003 the Board of Directors, after considering securities laws, regulations and NASDAQ Rules, determined that any person thereafter nominated for appointment and/or election to the Board of Directors must first be recommended for the entire Board's selection by a majority of the independent directors as the term "independent director" is defined under applicable NASDAQ Rules, and must otherwise meet all legal criteria for Board membership. The Board also determined that in selecting any person for Board membership, the Board shall take into consideration the makeup of the Board at the time of such person's nomination in light of applicable laws, regulations and rules, including those pertaining to percentage of independent directors on the Board. Genlyte certifies that this process regarding nominations to the Board of Directors has been adopted by Board resolution. Given these determinations by the Board, particularly the required role of the independent directors in the nominating process, and that the entire Board would perform the nominating function only after the independent directors have recommended a nominee, the Board determined to dissolve the standing Nominating Committee.

Independent directors shall meet in executive session (where no members of management shall be present) on a regularly scheduled basis during 2004.

4

Compensation of Directors

During 2003 each director, other than any director employed by the Company, received a retainer of $16,335 and $2,333 for each Board meeting attended. Directors employed by Genlyte are not paid any fees or additional compensation for services rendered as members of the Board or any of its Review committees. Directors, including those employed by the Company, who also serve on the Board of Directors of Canlyte Inc., a wholly-owned subsidiary of the Company, are compensated for attendance at such meetings at the rate of $2,000 (Canadian) per Board meeting, or for committee meetings held on days other than regular Board meeting days.

Compensation Committee Interlocks and Insider Participation

As noted above, Directors Engelman, Baldwin, and Nixon served as members of the Board's Compensation Committee during 2003. Directors Powers and Eftekhar also served on the Canlyte Board of Directors during 2003.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

Number of Shares Outstanding and Record Date

Only holders of record of Genlyte Common Stock, par value $.01 per share ("Genlyte Common Stock"), at the close of business on March 8, 2004 are entitled to notice of, and to vote at, the Annual Meeting. Holders of Genlyte Common Stock are entitled to one vote for each share held on the matters properly presented at the Annual Meeting.

On March 8, 2004, there were 13,595,131 shares of Genlyte Common Stock issued and outstanding. The holders of a majority of the shares entitled to vote, present in person or represented by proxy, will constitute a quorum for the transaction of business at the Annual Meeting. The affirmative vote of a majority of the shares of Genlyte Common Stock present in person or by proxy at the Annual Meeting is required to elect a director.

Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business. Abstentions are counted in tabulations of the votes cast on proposals presented to stockholders, whereas broker non-votes are not counted for purposes of determining whether a proposal has been approved. Under applicable Delaware law, a broker non-vote will have no effect on the outcome of the matters to be acted upon at the Annual Meeting, and an abstention will have the effect of a vote against any proposal requiring an affirmative vote of a majority of the shares present and entitled to vote thereon.

5

Common Stock Ownership of Certain Beneficial Owners and Management

The following table sets forth information regarding the beneficial ownership of Genlyte Common Stock known to Genlyte to be the beneficial owners of more than 5% of the issued and outstanding Genlyte Common Stock as of the dates indicated in the footnotes:

Name and Address

of Beneficial Owner

| | Amount and Nature of Beneficial Ownership of

Common Stock(#)

| | Percent

of Class

| |

|---|

Southeastern Asset Management Inc.

6410 Poplar Ave., Suite 900

Memphis, Tennessee 28119 | | 1,749,149(1 | ) | 12.9 | % |

Glenn W. Bailey

14 Basset Creek Trail

Hobe Sound, Florida 33455 |

|

1,439,600(2 |

) |

10.7 |

% |

FMR Corp.

82 Devonshire Street

Boston, Massachusetts 02109 |

|

1,350,000(3 |

) |

9.9 |

% |

Artisan Partners Limited Partnership

1000 North Water Street, Suite 1770

Milwaukee, Wisconsin 53202 |

|

772,504(4 |

) |

5.7 |

% |

Barclays Global Investors, NA

45 Fremont Street

San Francisco, CA 94105 |

|

700,821(5 |

) |

5.2 |

% |

- 1)

- According to the Schedule 13G filed on February 6, 2004 and furnished to Genlyte by Southeastern Asset Management Inc., Southeastern Asset Management is an investment adviser to Longleaf Partners Small Cap Fund, the beneficial owner of such shares. All of the securities covered by the report are owned legally by Southeastern's investment advisory clients and none are owned directly or indirectly by Southeastern.

- 2)

- Retired member of Board of Directors and Chairman of The Genlyte Group Incorporated. Includes 210,000 shares of Genlyte Common Stock owned by Mr. Bailey's spouse as to which Mr. Bailey disclaims beneficial ownership.

- 3)

- According to the Schedule 13G filed on February 17, 2004 and furnished to Genlyte by FMR Corp., 1,350,000 shares are held through Fidelity Management & Research Company (Fidelity), a wholly owned subsidiary of FMR Corp. and an Investment Advisor registered under Section 203 of the Investment Advisor Act of 1940. Fidelity held the shares as a result of acting as investment advisor to various investment companies registered under Section 8 of the Investment Company Act of 1940.

- 4)

- According to the Schedule 13G filed on January 23, 2004 and furnished to Genlyte by Artisan Partners Limited Partnership ("Artisan Partners"). The 13G states that the shares reported therein were acquired on behalf of discretionary clients of Artisan Partners and that persons other than Artisan Partners are entitled to receive all dividends from, and all proceeds from, the sale of these shares.

- 5)

- According to the Schedule 13G filed on February 13, 2004 and furnished to Genlyte by Barclays Global Investors, NA, shares reported are held by the company in trust accounts for the economic benefit of the beneficiaries of those accounts.

6

The following table presents information regarding beneficial ownership of Genlyte Common Stock by each member of the Board of Directors, the Named Officers (defined infra), and all directors and executive officers as a group as of March 8, 2004.

Name

| | Amount and Nature of

Beneficial Ownership of

Genlyte Common Stock (#)

| | Percent

of Class

| |

|---|

| John T. Baldwin | | 3,000 | | * | |

| Zia Eftekhar | | 76,463 | (1) | * | |

| David M. Engelman | | 14,500 | (2) | * | |

| William G. Ferko | | 46,100 | (3) | * | |

| Robert D. Nixon | | 3,000 | (4) | * | |

| Larry K. Powers | | 209,518 | (5) | 1.5 | % |

| Ronald D. Schneider | | 15,773 | (6) | * | |

| Raymond L. Zaccagnini | | 15,375 | (7) | * | |

| | |

| |

| |

| All directors and executive officers as a group (8 persons including those named) | | 383,729 | (8) | 2.8 | % |

- *

- The percentage of shares owned by such Director or named officer does not exceed 1% of the issued and outstanding Genlyte Common Stock.

- 1)

- Includes 31,250 shares of Genlyte Common Stock which may be acquired upon the exercise of options which are presently exercisable.

- 2)

- Includes 7,500 shares of Genlyte Common Stock owned by Mr. Engelman's spouse as to which Mr. Engelman disclaims beneficial ownership, and 3,000 shares of Genlyte Common Stock which may be acquired upon the exercise of options which are presently exercisable.

- 3)

- Includes 40,000 shares of Genlyte Common Stock which may be acquired upon the exercise of options which are presently exercisable.

- 4)

- Includes 3,000 shares of Genlyte Common Stock which may be acquired upon the exercise of options which are presently exercisable.

- 5)

- Includes 67,500 shares of Genlyte Common Stock which may be acquired upon the exercise of options which are presently exercisable.

- 6)

- Includes 12,250 shares of Genlyte Common Stock which may be acquired upon the exercise of options which are presently exercisable.

- 7)

- Includes 10,000 shares of Genlyte Common Stock which may be acquired upon the exercise of options which are presently exercisable.

- 8)

- Includes an aggregate of 7,500 shares of Genlyte Common Stock owned by the spouses of certain of Genlyte Directors as to which each such Director disclaims beneficial ownership and 164,000 shares of Genlyte Common Stock which may be acquired upon the exercise of options which are presently exercisable.

7

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors was comprised during fiscal 2003 of Mr. David M. Engelman, Mr. Frank Metzger and Mr. Robert Nixon, with Mr. Metzger serving as Chairman through his term expiration on April 24, 2003. He was succeeded as Chairman by Mr. Robert Nixon. John T. Baldwin was appointed a member of the Committee on April 24, 2003. All Committee members are independent directors. The Committee reviews and recommends the compensation arrangements for all executive officers, approves such arrangements for other senior level employees, and administers and takes such other actions as may be required in connection with certain compensation plans of Genlyte and its operating subsidiaries. The Board of Directors reviews and approves recommendations made by the Compensation Committee relating to the compensation of Genlyte's executive officers.

The Compensation Committee has prepared the following report with respect to executive compensation at Genlyte.

Compensation Philosophy

Genlyte and Genlyte Thomas Group's compensation philosophy is to provide competitive pay for competitive performance and superior pay for superior performance. Genlyte and Genlyte Thomas Group seek to ensure that its executive compensation programs and policies relate to and support its overall objective to enhance stockholder value through the profitable management of its operations. To achieve this goal, the following objectives serve as guidelines for compensation decisions:

- •

- Provide a competitive total compensation framework that enables Genlyte to attract, retain and motivate key executives who will contribute to Genlyte and Genlyte Thomas Group's success;

- •

- Ensure that compensation programs are linked to performance on both an individual and operating unit level; and

- •

- Align the interests of employees with the interests of stockholders by encouraging employee stock ownership.

Components of Compensation

Genlyte and Genlyte Thomas Group's compensation strategy incorporates a combination of cash and equity-based compensation as follows:

- •

- A performance management system that relates individual base salary changes to a formal process in which individual performance is reviewed, discussed and evaluated.

- •

- Short-term incentive programs that provide executives with the opportunity to add substantial variable compensation to their annual base salaries through attainment of specific, measurable goals intended to encourage high levels of organizational performance and superior achievement of individual objectives. These short-term incentive payments for 2003 were made during the first quarter of calendar 2004.

- •

- Long-term incentive opportunities in the form of stock options in which rewards are linked directly to stockholder gains. The Company believes that its Stock Option plan is a way to attract, retain and motivate employees. Stock options offer a long-term incentive for employees to reach performance objectives creating ownership attitudes and enhancing shareholder value. These long-term incentive payments in the form of stock option grants were made during the first quarter of calendar 2004.

8

For fiscal year 2003, Genlyte's compensation programs consisted of:

Base Salary

Salary pay levels at Genlyte and Genlyte Thomas Group are competitive with the marketplace. The Compensation Committee uses commercially published surveys prepared by established compensation consulting firms to assure that base compensation levels are positioned relative to the range that is generally paid to executives having similar levels of experience and responsibility at companies of comparable size and complexity. Data is drawn from the electric lighting equipment and supply industry as well as general industry survey data. Consideration is also given to other factors such as individual performance and potential.

Short-Term Incentives

Executives and key employees of Genlyte and Genlyte Thomas Group participate in a short-term incentive program that rewards the achievement of profit and profit-related objectives. These employees are afforded an opportunity to earn substantial variable compensation each year through participation in the Management Incentive Compensation (MIC) Program.

This program combines elements of profit sharing, in which total management performance is rewarded only to the extent also realized by stockholders as measured in Earnings Per Share (EPS), Earnings Before Interest and Taxes (EBIT), and Return on Capital Employed (ROCE), and in terms of individual performance, as measured by achievement of specific, measurable goals established by participants and approved by management. Funding for MIC awards is formula-driven based on achievement of financial goals for each operating unit. The Board of Directors reviews and approves profit and profit-related objectives at the beginning of each year.

By policy, the level of funding which results from the MIC formulas cannot be modified and the total pay out of awards for all MIC participants is limited to 15 percent of Genlyte's profit before taxes each year. In order to maximize results, objectives are typically established at a level of performance above normal expectations. Consideration is also given to past financial performance as a means to ensure that consistent and sustained business results are achieved. Actual individual MIC awards are dependent upon three factors: (1) the requirement that stated objectives are met by both individual participants and their operating units; (2) the relative success and extent to which those objectives are achieved; and (3) the participant's relative level within the organization as determined annually according to policy guidelines.

In 2003, the Compensation Committee and the Board of Directors reviewed and approved the renewal of the MIC Program, related policies, and all recommended MIC awards.

Long-Term Incentives

Genlyte believes that the interests of stockholders and executives become more closely aligned when such executives are provided the opportunity to acquire a proprietary interest through ownership of Common Stock. Through the Genlyte 2003 Stock Option Plan officers and key employees are granted options to purchase Genlyte stock and maintain significant share ownership within the parameters of the program. Most gains are exercisable in installments commencing two years after the date of grant. The option exercise price is set, and has at all times in the past been set, at fair market value, or book value whichever is higher.

Benefits

Genlyte Thomas Group generally assumed all Genlyte benefit plans and other benefit liabilities relating to former Genlyte employees. All executive officers have participated in the same pension,

9

health and benefit programs generally available to other employees who were not the subject of collective bargaining agreements. Additionally, for a period of six to eighteen months following the closing of the Genlyte Thomas Group transaction (the "transition period"), certain tax-qualified salaried and clerical Thomas employees continued to participate in certain tax-qualified Thomas Retirement plans. With the conclusion of the transition period, effective January 1, 2000, these former Thomas salaried and clerical employees began participating in the retirement plans of Genlyte Thomas Group that have been modified to provide an integrated retirement program, and their account balances under the Thomas plans have been transferred to the appropriate plan or plans of Genlyte Thomas Group.

Chief Executive Officer Compensation

Mr. Powers served as Chief Executive Officer of Genlyte and Genlyte Thomas Group in 2003 at a salary of $450,000 per annum. Mr. Powers received $618,830 in incentive compensation for 2003 recognizing a significant improvement in the EPS over the prior year, as well as the level of achievement of Mr. Powers' individual objectives. In 2003, the Compensation Committee recommended and the Board of Directors approved stock option grants of 35,000 shares for Mr. Powers in recognition of its assessment of his ability to enhance the long-term value of Genlyte for the stockholders. These grants were consistent with the overall design of the option program.

Mr. Powers' base salary is normally evaluated on a biennial basis by the Compensation Committee of the Board of Directors. His last salary increase was January 1, 2001. Mr. Powers, along with all salaried employees with base salary in excess of $60,000 annually, was on a salary freeze from December 1, 2001 to December 1, 2002.

Effective January 1, 2004, the Compensation Committee recommended a $50,000 salary increase for Mr. Powers based on a formal analysis of competitive base salaries in like industries, which increase was approved. The next salary review for Mr. Powers is scheduled for January 1, 2006.

Conclusion

In summary, the Compensation Committee continued its policy in fiscal year 2003 of linking executive compensation to the Company's performance. The outcome of this process is that stockholders receive a fair return on their investment while executives are rewarded in an appropriate manner for meeting or exceeding performance objectives. The Committee believes that the Company's compensation levels adequately reflect the Company's philosophy of providing competitive pay for competitive performance and superior pay for superior performance. Likewise, the Committee believes that the Company's executive compensation programs and policies are supportive of its overall objective to enhance stockholder value through the profitable management of its operations.

|

|

Robert Nixon, Chairman

John T. Baldwin

David M. Engelman |

10

AUDIT COMMITTEE REPORT

The responsibilities of the Audit Committee are set forth in an Audit Committee Charter. The Audit Committee reviews and reassesses the Charter on an annual basis. The Company's previous Audit Committee Charter was reviewed and reassessed in 2003 and the result was the adoption of the Audit Committee Charter attached hereto as Annex A on December 18, 2003 by the Board. The Audit Committee's duties and responsibilities are set forth in that Charter. Such duties and responsibilities include providing oversight of the Genlyte and Genlyte Thomas Group (Company) financial reporting process through periodic meetings with the Company's independent auditors and management to review accounting, auditing, internal controls, and financial reporting matters. The management of the Company is responsible for the preparation and integrity of the financial reporting information and related systems of internal controls. The Audit Committee, in carrying out its role, relies on the Company's senior management, including senior financial management, and its independent auditors.

The Committee reviewed and discussed with senior management the Company's audited financial statements included in the 2003 Annual Report to Shareholders. Management confirmed to the Audit Committee that such financial statements (i) have been prepared with integrity and objectivity and are the responsibility of management and (ii) have been prepared in conformity with accounting principles generally accepted in the United States.

The Audit Committee discussed with Ernst & Young LLP, the Company's independent auditors, the matters required to be discussed by SAS 61 (Communications with Audit Committee). SAS 61 requires such independent auditors to provide the Committee with additional information regarding the scope and results of their audit of the Company's financial statements with respect to (i) their responsibility under auditing standards generally accepted in the United States, (ii) significant accounting policies, (iii) management judgments and estimates, (iv) any significant audit adjustments, (v) any disagreements with management, and (vi) any difficulties encountered in performing the audit.

The Committee received from Ernst & Young LLP a letter providing the disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) with respect to any relationships between Ernst & Young LLP and the Company that in its professional judgment may reasonably be thought to bear on independence. Ernst & Young LLP has discussed its independence with the Committee and has confirmed in such letter that, in its professional judgment, it is independent of the Company within the meaning of the federal securities laws. The Committee advised the Company it has determined that the non-audit services rendered by the Company's independent auditors during the Company's most recent fiscal year are compatible with maintaining the independence of such auditors.

Based on the review and discussions described above with respect to the Company's audited financial statements included in the Company's 2003 Annual Report to Shareholders, the Committee recommended to the Board of Directors that such financial statements be included in the Company's Annual Report on Form 10-K.

As specified in the Audit Committee Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company's financial statements are complete and accurate and in accordance with accounting principles generally accepted in the United States. That is the responsibility of management and the Company's independent auditors. In giving its recommendation to the Board of Directors, the Audit Committee relied on (i) management's representation that such financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States and (ii) the report of the Company's independent auditors with respect to such financial statements.

|

|

David M. Engelman, Chairman

John T. Baldwin

Robert D. Nixon

|

11

Independent Auditors

Selection of the independent auditors is made solely by the Audit Committee. The Corporation's independent public accountants for fiscal year ended December 31, 2003, were Ernst & Young LLP ("Ernst & Young"). A representative of Ernst & Young is expected to be present at the Annual Meeting and will have an opportunity to respond to appropriate questions and make a statement if desired to do so.

The Audit Committee has appointed Ernst & Young as Genlyte and Genlyte Thomas Group LLC's principal independent public accountants for the years 2003 through 2005.

Audit Fees

The Company estimates that the aggregate fees billed by Ernst & Young for professional services rendered in connection with (i) the audit of the Company's annual financial statements set forth in the Company's Annual Report on Form 10-K, and (ii) the review of the Company's quarterly financial statements set forth in the Company's Quarterly Reports on Form 10-Q for the four quarters were $429,922 for 2003 and $338,071 for 2002. In 2002, the Company was also billed $11,393 by Arthur Andersen LLP prior to their dismissal as principal independent auditor for the review of the Company's 1stquarter financial statements set forth in Form 10-Q for the period ended March 31, 2002.

Audit Related Fees

The Company estimates that the aggregate fees for audit related services billed by Ernst & Young were $175,600 for 2003 and $131,903 for 2002. For 2003, these fees consisted mainly of due diligence work on potential acquisitions. For 2002, these fees consisted mainly of audits of the Company's Defined Benefit and Contribution Plans and related compliance documents. In 2002, the Company was also billed $31,626 by Arthur Andersen LLP prior to their dismissal as principal independent auditor for audit related services consisting of audits of Defined Benefit and Contribution Plans and audit compliance research.

Tax Related Fees

The Company estimates that the aggregate fees for tax services billed by Ernst & Young were $182,750 for 2003 and $128,580 for 2002. These fees consisted mainly of federal and international tax compliance and planning in both years. In 2002, the Company was also billed $5,980 by Arthur Andersen LLP prior to their dismissal as principal independent auditor for tax planning services.

All Other Fees

The Company paid no fees in this category for the two most recent fiscal years.

Fee Approval Policy

The Audit Committee pre-approved all services to be performed by the principal independent auditor after May 6, 2003, as required under the Sarbanes-Oxley Act of 2002. The Audit Committee has established policies and procedures for the pre-approval of all services by the principal independent auditor and to review with the auditors their fees and plans for all auditing services.

Changes in Accountants

On May 23, 2002, upon the recommendation of the Audit Committee, the Board of Directors of Genlyte dismissed Arthur Andersen LLP as Genlyte's independent auditors and appointed Ernst & Young as Genlyte's independent auditors for the year ending December 31, 2002. Further information

12

is contained in Genlyte's Form 8-K filed with the Securities and Exchange Commission on May 31, 2002, which is incorporated herein by reference.

Executive Compensation

The following table sets forth information concerning annual, long-term and other compensation for services in Genlyte Thomas Group of those persons who were, on December 31, 2003, Genlyte Thomas Group (i) chief executive officer and (ii) other four most highly compensated executive officers (together, the "Named Officers"):

Summary Compensation Table

| | Annual Compensation

| | Long-Term Compensation

|

|---|

Name and Principal Position

| | Year

| | Salary($)

| | MIC($)

| | Other Comp

($)(1)

| | Stock Options(#)

| | All Other Comp($)

|

|---|

Larry K. Powers

Chairman, President

& CEO | | 2003

2002

2001 | | 450,000

450,000

450,000 | | 616,830

419,465

346,163 | | 8,014

8,950

9,020 | (2,3)

(2,3)

(2,3) | 35,000

50,000

60,000 |

(5) | 0

0

0 |

Zia Eftekhar

President

Lightolier Division |

|

2003

2002

2001 |

|

250,000

250,000

250,000 |

|

344,715

301,928

318,450 |

|

8,014

7,750

7,700 |

(2,3)

(2,3)

(2,3) |

12,500

20,000

17,500 |

(5) |

0

0

0 |

William G. Ferko

Vice President

Chief Financial Officer |

|

2003

2002

2001 |

|

223,000

220,000

220,000 |

|

255,240

165,835

138,465 |

|

12,390

11,350

9,690 |

(3,4)

(3,4)

(3,4) |

12,500

20,000

10,000 |

(5) |

0

0

0 |

Ronald D. Schneider

Vice President

Operations |

|

2003

2002

2001 |

|

205,000

197,000

197,000 |

|

126,344

85,844

75,260 |

|

12,390

11,350

9,690 |

(3,4)

(3,4)

(3,4) |

7,500

10,000

5,000 |

(5) |

0

0

0 |

Raymond L. Zaccagnini

Vice President

Administration

Secretary |

|

2003

2002

2001 |

|

180,000

172,500

172,500 |

|

149,315

98,916

87,985 |

|

12,390

11,350

9,690 |

(3,4)

(3,4)

(3,4) |

7,500

10,000

5,000 |

(5) |

0

0

0 |

- 1)

- The named executive officers also received certain personal benefits exempt from reportable compensation under SEC regulations.

- 2)

- Director's fees for Canlyte, Inc., converted to US dollars.

- 3)

- Represents matching contributions made to the Retirement Savings and Investment Plan—401(k).

- 4)

- Represents discretionary Performance Plus contributions made to the Retirement Savings and Investment Plan.

- 5)

- A certain portion of these options were actually granted in February 2001 after review of Company and individual performances with respect to fiscal year 2000 as follows: Mr. Powers—25,000 shares; Mr. Eftekhar—10,000 shares; Mr. Ferko—10,000 shares; Mr. Schneider—5,000 shares; Mr. Zaccagnini—5,000 shares.

13

Option Grants

Shown below is further information on grants of stock options pursuant to the 1998 Stock Option Plan that were granted in 2003.

| |

| |

| |

| |

| | Potential Realizable Value of Assumed Annual Rates of Stock Price Appreciation for Option Term(2)

|

|---|

| |

| | % of

Total Options

Granted to

Employees in

Fiscal Year

| |

| |

|

|---|

Name

| | Options

Granted

(#)(1)

| | Exercise or

Base Price

($/share)

| | Expiration Date

|

|---|

| | 5%($)

| | 10%($)

|

|---|

| Larry K. Powers | | 35,000 | | 13.0 | % | 27.20 | | 2/13/2010 | | 387,560 | | 903,179 |

Zia Eftekhar |

|

12,500 |

|

4.6 |

% |

27.20 |

|

2/13/2010 |

|

138,414 |

|

322,564 |

William G. Ferko |

|

12,500 |

|

4.6 |

% |

27.20 |

|

2/13/2010 |

|

138,414 |

|

322,564 |

Ronald D. Schneider |

|

7,500 |

|

2.8 |

% |

27.20 |

|

2/13/2010 |

|

83,048 |

|

193,538 |

Raymond L. Zaccagnini |

|

7,500 |

|

2.8 |

% |

27.20 |

|

2/13/2010 |

|

83,048 |

|

193,538 |

- 1)

- These options were granted to the Named Officer on the date seven years prior to the indicated expiration date and are exercisable at the rate of 50% per year commencing two years after the date of grant. In the event of certain mergers, consolidations or reorganizations of Genlyte or any disposition of substantially all the assets of Genlyte or any liquidation or dissolution of Genlyte, then in most cases all outstanding options not exercisable in full shall be accelerated and become exercisable in full for a period of 30 days. In addition, in the event of certain changes in control of Genlyte or of its Board of Directors, then any outstanding option not exercisable in full shall in most cases be accelerated and become exercisable in full for the remaining term of the option.

- 2)

- Realizable value is shown net of option exercise price, but before taxes associated with exercise. These amounts represent assumed compounded rates of appreciation and exercise of the options immediately prior to the expiration of their term. Actual gains, if any, are dependent on the future performance of the Common Stock, overall stock market conditions, and the optionee's continued employment through the exercise period. The amounts reflected in this table may not necessarily be achieved.

Option Exercises and Fiscal Year-End Values

Shown below is information with respect to the exercised/unexercised options to purchase Genlyte's Common Stock granted in fiscal 2003 and prior years under Genlyte's 1998 Stock Option Plan to the Named Officers and held by them on December 31, 2003.

14

OPTION EXERCISES AND YEAR-END VALUE TABLE

Aggregated Option Exercises in Fiscal Year 2003 and FY-End Option Values

| |

| |

| | Number of Unexercised

Options at FY-End (#)

| | Value of Unexercised

In-the-Money Options at

FY-End ($)(1)

|

|---|

Name

| | Shares

Acquired on

Exercise(#)

| | Value

Realized ($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Larry K. Powers | | 20,200 | | 606,667 | | 30,000 | | 115,000 | | 967,900 | | 3,421,700 |

| Zia Eftekhar | | — | | — | | 16,250 | | 41,250 | | 563,513 | | 1,213,263 |

| William G. Ferko | | — | | — | | 25,000 | | 37,500 | | 932,312 | | 1,087,900 |

| Ronald D. Schneider | | — | | — | | 4,750 | | 20,000 | | 162,075 | | 582,925 |

| Raymond Zaccagnini | | 2,250 | | 71,435 | | 2,500 | | 20,000 | | 76,575 | | 582,925 |

- 1)

- Based upon the 12/31/03 closing price of $58.38 for Genlyte stock on the NASDAQ National Market System. Realizable value is shown net of option exercise price, but before taxes associated with exercise.

Retirement Plan

During fiscal 2003, Messrs. Eftekhar and Powers were participants in a qualified noncontributory defined benefit plan (the "Retirement Plan"). The Retirement Plan was amended effective January 1, 2000 to freeze the benefits of all participants except "grandfathered participants" based on age and service as of December 31, 1999. Commencing in 2000, participants whose benefits were frozen became eligible for matching contributions and discretionary contributions under the Genlyte Thomas Group Retirement Savings and Investment Plan (the "Savings Plan"), a defined contribution 401(k) plan. Participants who met certain age and service requirements as of December 31, 1999, the "grandfathered participants," will continue to participate in the Retirement Plan. "Grandfathered participants" will be eligible for matching contributions but not discretionary contributions under the Savings Plan. Messrs. Powers and Eftekhar, as grandfathered participants, will remain active participants in the Retirement Plan.

For Employees Retiring at age 65 in 2004(1)

| | Years of Service at Retirement(2)

|

|---|

Average Compensation at Retirement

|

|---|

| | 5

| | 10

| | 15

| | 20

| | 25 or more

|

|---|

| $50,000 | | 3,093 | | 6,186 | | 9,279 | | 12,372 | | 15,465 |

| $100,000 | | 7,343 | | 14,686 | | 22,029 | | 29,372 | | 36,715 |

| $150,000 | | 11,593 | | 23,186 | | 34,779 | | 46,372 | | 57,965 |

| $189,000(3) | | 14,908 | | 29,816 | | 44,724 | | 59,632 | | 74,540 |

| Greater than $189,000(3) | | 14,908 | | 29,816 | | 44,724 | | 59,632 | | 74,540 |

- (1)

- For employees retiring at ages under 65, the estimated annual benefits would be lower.

- (2)

- The amounts are based on the formula which became effective January 1, 1995.

- (3)

- In accordance with the Retirement Plan as amended to reflect the maximum allowable compensation as provided under IRS Section 401(a)(17), such maximum annual compensation is $160,000 for 1999, $170,000 for 2000 and 2001 and $200,000 for 2002 and 2003. Therefore, the highest possible final average compensation for a participant retiring in 2003 is $180,000. However, any accrued benefit as of December 31, 1994 which is based on compensation in excess of $150,000 for years prior to 1994 will be protected.

Remuneration covered by the Retirement Plan in a particular year includes (1) that year's salary (base pay, overtime and commissions), and (2) compensation received in that year under the

15

Management Incentive Compensation Plan. The 2003 remuneration covered by the Retirement Plan includes, for the recipients thereof, Management Incentive Compensation paid during 2003 with respect to 2002 awards.

For each of the following Named Officers of Genlyte Thomas Group, the remuneration received during 2003 and the credited years of service under the Retirement Plan, as of December 31, 2003, recognized by the Retirement Plan were, respectively, as follows:

Name

| | Compensation

| | Years of Service

|

|---|

| Larry K. Powers | | $ | 200,000* | | 24 |

| Zia Eftekhar | | $ | 200,000* | | 36 |

- *

- As limited by the maximum allowable compensation provided under Code 401(a)(17) of $200,000 for 2003.

Pension benefits at age 65 (normal retirement age) for "grandfathered" participants as of January 1, 2003 are calculated as follows: 1.2% of final five-year average pay up to covered compensation level, plus 1.7% of final five-year average pay over the covered compensation level, multiplied by the total years of recognized service, to a maximum of 25 years. All such participants will receive the greater of their benefit under the new formula or the benefit accrued under a prior plan formula as of December 31, 1994. In addition, certain maximum benefit limitations are incorporated in the Retirement Plan. The final five-year average pay is determined by taking the average of the highest consecutive five-year period of earnings within a ten-year period prior to retirement. The term "covered compensation", as defined by the Internal Revenue Service, refers to the 35-year average of the Social Security taxable wage bases applicable to a participant for each year projected to Social Security normal retirement age.

EMPLOYMENT PROTECTION AGREEMENTS

Genlyte has entered into contracts with a group of key employees, including Messrs. Powers, Eftekhar, Ferko, Schneider, and Zaccagnini, that become effective if the employee is employed on the date a change of control (as defined in the agreement) occurs and that provide each such employee with a guarantee that his duties, compensation and benefits will generally continue unaffected for two (2) years following the change of control. In the event that an eligible employee's employment is terminated without cause by Genlyte or if the employee is constructively terminated within two (2) years following the change of control, such employee will receive either (i) the sum of (x) two (2) times the aggregate amount of his then current base salary, plus (y) two (2) times the average of his last three (3) annual awards paid under Genlyte' s Management Incentive Compensation Plan plus (z) the present value of any unvested benefits under Genlyte's qualified plans and the annual cost of the employee's participation in all employee benefit plans of Genlyte or (ii) if it would result in the employee receiving a greater net-after tax amount, a lesser amount equal to the amount that produces the greatest net-after tax amount for the employee. (An employee will be treated as having been constructively terminated if he quits after being removed from office or demoted, his compensation or benefits are reduced, his duties are significantly changed, his ability to perform his duties is substantially impaired or his place of employment is relocated a substantial distance from his principal residence.) These agreements will continue in effect at least until December 31, 2004 and automatically renew for an additional year as of each January 1, unless Genlyte or the employee provides sixty (60) days written notice of non-renewal prior to such January 1.

16

COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires Genlyte's directors and executive officers, and persons who own more than ten percent of Genlyte's Common Stock, to file with the Securities and Exchange Commission ("SEC") initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of Genlyte. officers, directors and greater than 10% shareholders are required by SEC regulation to furnish Genlyte with copies of all Section 16(a) reports they file. During 2003, to the knowledge of the Corporation, all Section 16(a) filing requirements applicable to its officers, directors, and greater than ten percent beneficial owners were complied with.

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires Genlyte's directors and executive officers, and persons who own more than ten percent of Genlyte's Common Stock, to file with the Securities and Exchange Commission ("SEC") initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of Genlyte. Officers, directors and greater than 10% shareholders are required by SEC regulation to furnish Genlyte with copies of all Section 16(a) reports they file.

Mr. Zia Eftekhar inadvertently failed to file on a timely basis a Form 4 report of change in beneficial ownership in connection with his ownership of Genlyte common stock during 2003. Specifically, the sale by Mr. Eftekhar of shares of Genlyte common stock on November 11, 2003 was executed more than two days prior to the filing of a Form 4 by Mr. Eftekhar, which filing reporting such sale was made on November 14, 2003.

2005 PROPOSALS BY HOLDERS OF GENLYTE COMMON STOCK

Any proposal which a stockholder of Genlyte desires to have included in the proxy statement relating to the 2005 Annual Meeting of Stockholders (now scheduled for 10:00 a.m. Thursday April 21, 2005 at the executive offices of Genlyte in Louisville) must be received by Genlyte at its executive offices by no later than November 16, 2004. The executive offices of Genlyte are located at 10350 Ormsby Park Place, Suite 601, Louisville, KY 40223.

17

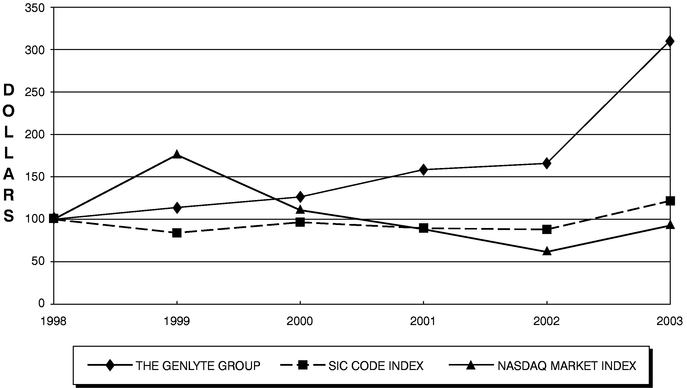

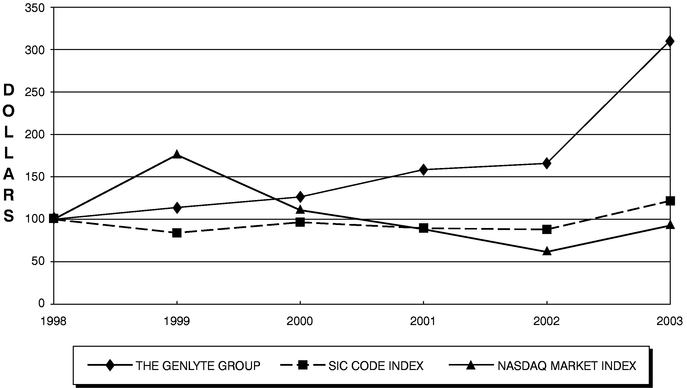

COMPARATIVE STOCK PERFORMANCE

The graph below compares the cumulative total return on the Common Stock of Genlyte with the cumulative total return on the NASDAQ Stock Market Index (U.S. companies) and the Electric Lighting & Wiring Equipment Index (SIC Group 364) from December 31, 1997(1). The graph assumes the investment of $100 in Genlyte Common Stock, the NASDAQ Stock Market Index, and the Electric Lighting & Wiring Equipment Index on January 1, 1998.

COMPARE 5-YEAR CUMULATIVE TOTAL RETURN

AMONG THE GENLYTE GROUP,

NASDAQ MARKET INDEX AND SIC CODE INDEX

ASSUMES $100 INVESTED ON JAN. 1, 1999

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING DEC. 31, 2003

The Genlyte Group Incorporated

NASDAQ Stock Market Index (U.S. Companies)

Electric Lighting & Wiring Equipment Index

- 1)

- Total return calculations for the NASDAQ Stock Market Index, Electric Lighting & Wiring Equipment Index (consisting of approximately 16 companies), and Genlyte Stock were performed by Media General Financial Services.

18

EXPENSES AND OTHER MATTERS

Expenses of Solicitation

Genlyte will pay the costs of preparing, assembling and mailing this proxy statement and the material enclosed herewith. Genlyte has requested brokers, nominees, fiduciaries and other custodians who hold shares of its common stock in their names to solicit proxies from their clients who own such shares and Genlyte has agreed to reimburse them for their expenses in so doing.

In addition to the use of the mails, certain officers, directors and other employees of Genlyte, at no additional compensation, may request the return of proxies by personal interview or by telephone or telegraph.

Contacting the Board

The Company has established procedures to permit confidential communications to the Board of Directors regarding the Company. Shareholders may communicate directly with the Board of Directors by mail or e-mail. The mailing address and e-mail address can be found on our website atwww.Gen1yte.com.Click onInvestor Relationsand thenContact the Boardto access the contact information. Shareholders may also directly contact members of the Board of Directors in person at the Annual Shareholders Meeting. While the Company has no policy requiring Board members to attend the Annual Meeting, generally all do attend; in 2003 all Board members were in attendance at the Annual Meeting.

Code of Ethics

The Company has adopted a Code of Ethics that applies to all salaried management employees and directors. The Code of Ethics is posted on the Company's internet sitewww.Gen1yte.com. Salaried employees and directors are required to review and sign the Code of Ethics policy annually.

Other Items of Business

The Board of Directors does not intend to present any further items of business to the meeting and knows of no such items which will or may be presented by others. However, if any other matter properly comes before the meeting, the persons named in the enclosed proxy form will vote thereon in such manner as they may in their discretion determine.

|

|

By Order of the Board of Directors, |

|

|

|

| | | R. L. ZACCAGNINI

Secretary |

March 19, 2004 |

|

|

19

ANNEX A

Charter of the Audit Committee

Of the Board of Directors of

The Genlyte Group Incorporated

As Adopted by the Board of Directors

December 18, 2003

This Charter sets forth, among other things, the purpose, membership and duties and responsibilities of the Audit Committee (the "Committee") of the Board of Directors (the "Board") of The Genlyte Group Incorporated (the "Corporation").

1. Purpose

The purposes of the Committee are (a) to assist the Board in overseeing (i) the quality and integrity of the Corporation's financial statements, (ii) the qualifications and independence of the Corporation's independent auditor, (iii) the performance of the Corporation's internal audit function and independent auditor and (iv) the Corporation's compliance with legal and regulatory requirements; and (b) to prepare the report of the Committee required to be included in the Corporation's annual proxy statement under the rules of the U.S. Securities and Exchange Commission (the "SEC").

2. Membership

The Committee shall consist of at least three members. The members of the Committee shall be appointed by the Board annually. Each member of the Committee shall satisfy the independence requirements relating to the directors and audit committee members (a) of the National Association of Securities Dealers ("NASD") and (b) under Section 10A-3 of the Securities Exchange Act of 1934 (the "Exchange Act") and any related rules and regulations promulgated thereunder by the SEC. No member may have participated in the preparation of the financial statement of the Corporation or any subsidiary of the Corporation at any time in the three years preceding his or her appointment.

No director may serve as a member of the Committee if such serves on the audit committee of more than two other public companies, unless the Board determines that such simultaneous service would not impair the ability of such director to effectively serve on the Committee.

Each member of the Committee shall be able to read and understand fundamental financial statements, including a company's balance sheet, income statement and cash flow statement. At least one member of the Committee shall qualify as an audit committee financial expert by having employment experience in finance or accounting, professional certification in accounting, or any other comparable experience or background which results in the individual's financial sophistication, including experience as a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities.

3. Structure and Operations

The Board shall designate one member of the Committee as its chairperson. The affirmative vote of a majority of the members of the Committee is necessary for the adoption of any resolution. Unless expressly authorized by the Board, the Committee shall not have the power to create subcommittees. The Committee may delegate to one or more designated members of the Committee the authority to grant pre-approvals of audit and non-audit services pursuant to Section 10A(i)(3) of the Exchange Act and any related rules promulgated thereunder by the SEC, which pre-approvals shall be presented to the full Committee at the next scheduled meeting.

The Committee shall have at least four regularly scheduled meetings per year at such times and places as shall be determined by the Committee chairperson, and may have such additional meetings as the Committee chairperson or a majority of the Committee's members deem necessary or desirable.

The Committee may request (a) any officer or employee of the Corporation, (b) the Corporation's outside counsel or (c) the Corporation's independent auditor to attend any meeting (or portions thereof) of the Committee, or to meet with any members of or consultants to the Committee, and to provide such information as the Committee deems necessary or desirable.

The Committee shall meet separately, at least once every fiscal quarter, with management, with the Corporation's internal auditors (or other personnel responsible for the Corporation's internal audit function) and with the independent auditor.

Members of the Committee may participate in a meeting of the Committee by means of conference call or similar communications arrangements by means of which all persons participating in the meeting can hear each other.

4. Duties and Responsibilities

The Committee's duties and responsibilities shall include each of the items enumerated in this Section 4 and such other matters as may from time to time be delegated to the Committee by the Board.

2

compensation payable by the Corporation for any approved audit or non-audit services to any such independent auditor, including the fees, terms and conditions for the performance of such services.

- (e)

- The Committee shall, at least annually:

- (i)

- obtain a written report by the independent auditor describing, to the extent permitted under applicable auditing standards:

- (A)

- the independent auditor's internal quality-control procedures;

- (B)

- any material issues raised by the most recent quality-control review, or peer review, of the independent auditor, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the independent auditor, and any steps taken to deal with any such issues; and

- (C)

- all relationships between the independent auditor and the Corporation; and

- (ii)

- review the foregoing report and the independent auditor's work throughout the year and evaluate the independent auditor's qualifications, performance and independence, including a review and evaluation of the lead partner on the independent auditor's engagement with the Corporation, and present its conclusions to the Board and, if so determined by the Committee, recommend that the Board take additional action to satisfy itself of the qualifications, performance and independence of the independent auditor.

- (f)

- The Committee shall, at least annually, discuss with the independent auditor, out of the presence of management if deemed appropriate:

- (i)

- the matters required to be discussed by Statement on Auditing Standards 61, as it may be modified or supplemented, relating to the conduct of the audit;

- (ii)

- the audit process, including, without limitation, any problems or difficulties encountered in the course of the performance of the audit, including any restrictions on the independent auditor's activities or access to requested information imposed by management, and management's response thereto, and any significant disagreement with management; and

- (iii)

- the Corporation's internal controls and the responsibilities, budget and staffing of the Corporation's internal audit function, including any "management" or "internal control" letter issued or proposed to be issued by such auditor to the Corporation.

- (g)

- The Committee shall establish policies for the Corporation's hiring of employees or former employees of the independent auditor.

- (h)

- The Committee shall review, and discuss as appropriate with management, the internal auditors and the independent auditor, the report of the independent auditor required by Section 10A(k) of the Exchange Act.

Financial Reporting and Disclosure Matters

- (i)

- The Committee shall review and discuss with management and the independent auditor:

- (i)

- prior to the annual audit, the scope, planning and staffing of the annual audit;

- (ii)

- The Corporation's annual audited financial statements and quarterly financial statements, including the Corporation's disclosures under "Management Discussion and Analysis of

3

- (j)

- The Committee shall recommend to the Board whether the annual audited financial statements should be included in the Corporation's Form 10-K.

- (k)

- The Committee shall review and discuss with management the Corporation's practices regarding earnings press releases and the provision of financial information and earnings guidance by management to analysts and ratings agencies.

- (l)

- The Committee shall periodically review and discuss with management the Corporation's guidelines and policies with respect to the process by which the Corporation undertakes risk assessment and risk management, including discussion of the Corporation's major financial risk exposures and the steps management has taken to monitor and control such exposures.

- (m)

- The Committee shall review and discuss with the CEO and CFO the procedures undertaken in connection with the CEO and CFO certifications for Form 10-Ks and Form 10-Qs, including their evaluation of the Corporation's disclosure controls and procedures and internal controls.

- (n)

- The Committee shall annually obtain from the independent auditor assurance that the audit was conducted in a manner consistent with Section 10A of the Exchange Act.

Internal Audit, Compliance Matters and Other

- (o)

- The Committee shall review the appointment and termination of senior internal audit personnel, and review all significant reports to management prepared by internal audit personnel, and management's responses.

- (p)

- The Committee shall establish and maintain procedures for:

- (i)

- the receipt, retention, and treatment of complaints received by the Corporation regarding accounting, internal accounting controls, or auditing matters; and

- (ii)

- the confidential, anonymous submission by employees of the Corporation of concerns regarding questionable accounting or auditing matters.

4

- (q)

- The Committee shall review with management and the independent auditor any correspondence with regulators or governmental agencies and any employee complaints or published reports that raise material issues regarding the Corporation's financial statements or accounting policies.

- (r)

- The Committee shall review with the Corporation's general counsel any legal matters that may have a material impact on the financial statements or the compliance policies of the Corporation and its subsidiaries, and any material reports or inquiries received by the Corporation or any of its subsidiaries from regulators or governmental agencies.

- (s)

- The Committee shall exercise such other powers and perform such other duties and responsibilities as are incidental to the purposes, duties and responsibilities specified herein and as may from time to time be delegated to the Committee by the Board.

5. Authority and Resources

The Committee may, without further approval by the Board, obtain such advice and assistance, including, without limitation, the performance of special audits, reviews and other procedures, from outside accounting, legal or other advisors as the Committee determines to be necessary or advisable in connection with the discharge of its duties and responsibilities hereunder. Any accounting, legal or other advisor retained by the Committee may, but need not, be in the case of an outside accountant, the same accounting firm employed by the Corporation for the purpose of rendering or issuing an audit report on the Corporation's annual financial statements, or in the case of an outside legal or other advisor, otherwise engaged by the Corporation for any other purpose.

The Corporation shall pay to any independent auditor employed by the Corporation for the purpose of rendering or issuing an audit report or performing other audit, review or attest services and to any outside accounting, legal or other advisor retained by the Committee pursuant to the preceding paragraph such compensation, including without limitation, usual and customary expenses and charges, as shall be determined by the Committee. The Corporation shall pay ordinary administrative expenses of the Committee that are necessary or appropriate in carrying out its duties.

5

\/ DETACH PROXY CARD HERE \/

|

|

|

PLEASE MARK, SIGN AND DATE

THIS PROXY AND RETURN IT

PROMPTLY IN THE ENCLOSED

ENVELOPE. |

|

ý

Votes must be indicated

(x) in Black or Blue ink. |

|

|

This proxy, when properly executed, will be voted in the manner directed herein by the undersigned stockholder. If no contrary specification is indicated, the shares represented by this proxy will be voted FOR the election of the nominees as directors. Please mark boxý in black or blue ink.

The Board of Directors recommends a vote FOR the election of each of the nominees as director.

| 1. | | Election of Directors | | | | | | |

|

|

FOR

ALL o |

|

WITHHOLD

FOR ALL o |

|

EXCEPTIONS o |

|

Check here if you plan to

attend the Annual Meeting

Have written comments or

change of address on this card. |

|

o

ý |

|

|

Nominees: Larry K. Powers, Zia Eftekhar

(INSTRUCTIONS: To withhold authority to vote for any individual nominee, mark the "Exceptions" box and write that nominee's name in the space provided below.) | | | | | | | | |

| *Exceptions |

| | | | |

2. |

In their discretion the proxies shall vote on any other matters that may properly come before such meeting. |

|

The Proxies will vote your shares in accordance with your directions on this card. If no contrary instructions are specified on this card, the Proxies will vote your shares FOR proposals 1 and 2. |

|

|

|

|

|

SCAN LINE |

|

|

|

|

|

Please sign exactly as name appears at the left. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, give your full title as such. If the signer is a corporation, please sign in full corporate name by duly authorized officer. |

| | | Date | | Share Owner sign here | | Co-Owner sign here |

THE GENLYTE GROUP INCORPORATED

P R O X Y

Annual Meeting of Stockholders, April 29, 2004

SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF

THE GENLYTE GROUP INCORPORATED

The undersigned hereby authorizes and appoints WILLIAM G. FERKO and R. L. ZACCAGNINI and each of them, the proxies of the undersigned, with power of substitution in each, to vote all shares of Common Stock, par value $.01 per share, of The Genlyte Group Incorporated held of record on March 8, 2004 by the undersigned at the Annual Meeting of Stockholders to be held at The Genlyte Group Incorporated, 10350 Ormsby Park Place Community Room, Lower Level, Louisville, Kentucky 40223 on April 29, 2004 at 10:00 AM, local time, and at any adjournment thereof on all matters that may properly come before such meeting.

(Continued and to be dated and signed on the reverse side.)

QuickLinks

THE GENLYTE GROUP INCORPORATED 10350 Ormsby Park Place, Suite 601 Louisville, KY 40223VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOFCOMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATIONAUDIT COMMITTEE REPORTSummary Compensation TableOPTION EXERCISES AND YEAR-END VALUE TABLE Aggregated Option Exercises in Fiscal Year 2003 and FY-End Option ValuesEMPLOYMENT PROTECTION AGREEMENTSCOMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 19342005 PROPOSALS BY HOLDERS OF GENLYTE COMMON STOCKCOMPARATIVE STOCK PERFORMANCEEXPENSES AND OTHER MATTERSANNEX A Charter of the Audit Committee Of the Board of Directors of The Genlyte Group Incorporated As Adopted by the Board of Directors December 18, 2003