UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. __)

Filed by the Registrant [ ]

Filed by a Party other than the Registrant [ ]

| Check the appropriate box: |

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

| PRIDE INTERNATIONAL, INC. |

|

| (Name of Registrant as Specified In Its Charter) |

| |

| |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

|

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

|

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

|

| 4) | Proposed maximum aggregate value of transaction: |

| | | |

|

| 5) | Total fee paid: |

| | | |

|

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

| 1) | Amount Previously Paid: |

| | | |

|

| 2) | Form, Schedule or Registration Statement No.: |

| | | |

|

| 3) | Filing Party: |

| | | |

|

| 4) | Date Filed: |

| | | |

|

April 18, 2002

To Our Stockholders:

We are pleased to invite you to attend the annual meeting of stockholders of Pride International, Inc., which will be held at 9:00 a.m., Houston time, on May 16, 2002, at the St. Regis hotel, 1919 Briar Oaks Lane, Houston, Texas.

At this meeting, we will ask you to elect eight directors to serve one-year terms and to ratify PricewaterhouseCoopers LLP as our independent accountants for 2002. The meeting also will provide us an opportunity to review with you our business and affairs during 2001.

Whether or not you plan to attend the annual meeting, please sign, date and return the proxy card in the accompanying envelope. Your vote is important no matter how many shares you own. If you do attend the meeting and desire to vote in person, you may do so even though you have previously submitted your proxy.

We look forward to seeing you at the meeting.

Sincerely,

| | | |

PAUL A. BRAGG PAUL A. BRAGG

President and Chief Executive Officer | |

ROBERT L. BARBANELL

Chairman of the Board |

TABLE OF CONTENTS

PRIDE INTERNATIONAL, INC.

NOTICE OF 2002 ANNUAL MEETING OF STOCKHOLDERS

To be held on May 16, 2002

The Annual Meeting of Stockholders of Pride International, Inc. will be held at the St. Regis hotel, 1919 Briar Oaks Lane, Houston, Texas 77027 on May 16, 2002, at 9:00 a.m., Houston time, for the following purposes:

Proposal 1. To elect eight directors to serve for a term of one year.

| | |

| | Proposal 2. | To ratify the appointment of PricewaterhouseCoopers LLP as Pride’s independent accountants for 2002. |

Attached to this notice is a proxy statement setting forth information with respect to the above items and certain other information.

The board of directors has established March 25, 2002 as the record date for the determination of stockholders entitled to notice of and to vote at the annual meeting. For a period of ten days prior to the annual meeting, a complete list of stockholders of record entitled to vote at the annual meeting will be available at Pride’s executive offices for inspection by stockholders during ordinary business hours for proper purposes.

Stockholders, whether or not they expect to be present at the meeting, are requested to sign and date the enclosed proxy card and return it promptly in the envelope enclosed for that purpose. Any person giving a proxy has the power to revoke it at any time, and stockholders who are present at the meeting may withdraw their proxies and vote in person.

| |

| | By order of the Board of Directors |

| |

| |  |

| |

| | ROBERT W. RANDALL |

| | Secretary |

April 18, 2002

5847 San Felipe, Suite 3300

Houston, Texas 77057

PRIDE INTERNATIONAL, INC.

5847 San Felipe, Suite 3300

Houston, Texas 77057

PROXY STATEMENT

FOR

2002 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement is furnished in connection with the solicitation of proxies by the Pride board of directors for use at the 2002 Annual Meeting of Stockholders of Pride to be held on May 16, 2002, or at any adjournment or postponement thereof, at the time and place and for the purposes specified in the accompanying notice of annual meeting.

All properly executed written proxies delivered pursuant to this solicitation, and not later revoked, will be voted at the annual meeting in accordance with the instructions given in the proxy. When voting regarding the election of directors, stockholders may vote in favor of all nominees, withhold their votes as to all nominees or withhold their votes as to specific nominees. When voting regarding the ratification of independent accountants, stockholders may vote for or against the proposal or may abstain from voting. Stockholders should vote their shares on the enclosed proxy card. If no choice is indicated, proxies that are signed and returned will be voted “FOR” the election of all director nominees and “FOR” ratification of the appointment of PricewaterhouseCoopers LLP as Pride’s independent accountants for 2002.

All shares of Pride common stock represented by properly executed and unrevoked proxies will be voted if such proxies are received in time for the meeting. Such proxies, together with this proxy statement and Pride’s 2001 Annual Report to Stockholders, are first being sent to stockholders on or about April 18, 2002.

QUORUM, VOTE REQUIRED AND REVOCATION OF PROXIES

The board of directors has established March 25, 2002 as the record date for the determination of stockholders entitled to notice of and to vote at the annual meeting. At the record date, 132,863,557 shares of common stock were outstanding. Each share of common stock is entitled to one vote upon each matter to be voted on at the meeting. The presence, in person or by proxy, of the holders of a majority of the outstanding shares of common stock at the annual meeting is necessary to constitute a quorum.

The eight nominees for director will be elected by a plurality of the votes of shares of Pride common stock present in person or by proxy at the meeting. Cumulative voting is not permitted in the election of directors. The ratification of PricewaterhouseCoopers LLP as Pride’s independent accountants for 2002 is subject to the approval of a majority of the shares of Pride common stock present in person or by proxy at the meeting and entitled to vote on the matter.

Abstentions and broker non-votes (proxies submitted by brokers that do not indicate a vote for a proposal because they do not have discretionary voting authority and have not received instructions as to how to vote on the proposal) are counted as present in determining whether the quorum requirement is satisfied. For purposes of determining the outcome of any question as to which the broker has physically indicated on the proxy that it does not have discretionary authority to vote, these shares will be treated as not present and not entitled to vote with respect to that question, even though those shares are considered entitled to vote for quorum purposes and may be entitled to vote on other questions. Because the vote required for approval of the ratification of independent accountants is a majority of the shares present in person or by proxy at the annual meeting and entitled to vote on the proposal, abstentions will have the same effect as votes against the proposal, but broker non-votes will not affect the outcome of the voting.

Any holder of Pride common stock has the right to revoke his or her proxy at any time prior to the voting thereof at the annual meeting by (1) filing a written revocation with the Secretary prior to the voting of such

proxy, (2) giving a duly executed proxy bearing a later date or (3) attending the annual meeting and voting in person.

Attendance by a stockholder at the annual meeting will not itself revoke his or her proxy. If you hold your Pride shares in the name of a bank, broker or other nominee, you should follow the instructions provided by your bank, broker or nominee in revoking your previously granted proxy.

COST AND METHOD OF PROXY SOLICITATION

Pride will bear the cost of the solicitation of proxies. In addition to solicitation by mail, directors, officers and employees of Pride may solicit proxies from stockholders by telephone, facsimile or telegram or in person. Pride will supply banks, brokers, dealers and other custodian nominees and fiduciaries with proxy materials to enable them to send a copy of such material by mail to each beneficial owner of shares of Pride common stock that they hold of record and will, upon request, reimburse them for their reasonable expenses in doing so. In addition, Pride has engaged Georgeson Shareholder Communications, Inc. to assist in the solicitation of proxies for a fee of $10,000 plus reimbursement of certain out-of-pocket expenses.

ELECTION OF DIRECTORS

(Item 1 on Proxy Card)

The board of directors has nominated the eight people listed below for reelection as directors, each to serve until the next annual meeting of stockholders or until their successors are elected and qualified. If any of the nominees become unavailable for any reason, which is not anticipated, the board of directors in its discretion may designate a substitute nominee. If you have filled out the accompanying proxy card, your vote will be cast for the substitute nominee.

Nominees for Election

Each of the nominees for director has been approved by the board of directors for submission to the stockholders. Set forth below is the current principal occupation (which, unless otherwise indicated, has been his principal occupation during the last five years), age and other information for each nominee:

Robert L. Barbanell, 71, became a director of Pride in connection with Pride’s acquisition of Marine Drilling Companies, Inc. in September 2001. Mr. Barbanell was a director of Marine from June 1995 until September 2001. Mr. Barbanell has served as President of Robert L. Barbanell Associates, Inc., a financial consulting firm, since July 1994. He is also a director of Cantel Medical Corp. and Blue Dolphin Energy Company.

Paul A. Bragg, 46, has been chief executive officer and a director of Pride since March 1999 and president since February 1997 and was chief operating officer from February 1997 to April 1999. He joined Pride in July 1993 as its vice president and chief financial officer. From 1988 until he joined Pride, Mr. Bragg was an independent business consultant and managed private investments. He previously served as vice president and chief financial officer of Energy Service Company, Inc. (now ENSCO International Incorporated), an oilfield services company, from 1983 through 1987.

David A. B. Brown, 58, became a director of Pride in September 2001 in connection with Pride’s acquisition of Marine. Mr. Brown was a director of Marine from June 1995 until September 2001. Mr. Brown has served as president of The Windsor Group, Inc., a strategy consulting firm, since 1984. Mr. Brown was chairman of the board of the Comstock Group, Inc. from 1988 to 1990. Mr. Brown is a director of BTU International Inc., EMCOR Group, Inc., Technical Communications Corporation and NS Group, Inc.

J. C. Burton, 63, became a director of Pride in September 2001 in connection with Pride’s acquisition of Marine. Mr. Burton was a director of Marine from May 1998 until September 2001. He served in various engineering and managerial positions with Amoco Corporation from 1963 until his retirement in March 1998. Most recently, he was group vice president, International Operations Group for Amoco Exploration and Production Company.

2

Jorge E. Estrada, 54, has been a director of Pride since October 1993. In January 2002, Mr. Estrada became employed by Pride as a representative for business development. For more than five years, Mr. Estrada has been president and chief executive officer of JEMPSA Media and Entertainment, a company specializing in the Spanish and Latin American entertainment industry. Previously, Mr. Estrada served as president — worldwide drilling division of Geosource and vice president of Geosource Exploration Division — Latin America.

William E. Macaulay, 57, has been a director of Pride since July 1999. Mr. Macaulay is chairman and chief executive officer of First Reserve Corporation and First Reserve GP IX, Inc., which manage three investment funds that own 14.7% of the outstanding Pride common stock. He is a director of the following publicly held companies: Chicago Bridge & Iron Company N.V., an international engineering and construction company, National-Oilwell, Inc., a distributor of oilfield equipment and machinery, Dresser, Inc., a manufacturer and marketer of equipment and services to customers in the energy industry, Weatherford International, Inc., an oilfield services company, and Maverick Tube Corporation, a manufacturer of oilfield tubulars, line pipe and structural steel.

Ralph D. McBride, 56, has been a director of Pride since September 1995. Mr. McBride has been a partner with the law firm of Bracewell & Patterson, L.L.P. in Houston, Texas, since 1980. Bracewell & Patterson provides legal services to Pride from time to time. Pride paid $875,000 to Bracewell & Patterson for services rendered during 2001.

David B. Robson, 62, became a director of Pride in September 2001 in connection with Pride’s acquisition of Marine. Mr. Robson was a director of Marine from May 1998 until September 2001. Mr. Robson has been serving as chairman of the board and chief executive officer of Veritas DGC Inc. since August 1996. Prior thereto, he held similar positions with Veritas Energy Services Inc. and its predecessors since 1974.

Vote Required and Board Recommendation

If a quorum is present at the annual meeting, the eight nominees receiving the greatest number of votes cast will be elected as directors.Your board of directors unanimously recommends a vote “FOR” election of the eight director nominees.

Compensation of Directors

General. The annual retainer for each outside director is $9,000 per quarter, or $36,000 annually. Mr. Barbanell, the chairman of the board, receives $18,000 per quarter, or $72,000 annually. Each outside director also receives a fee of (i) $1,000 for each board meeting attended and (ii) $1,000 for each committee meeting attended that is not on the date of a board meeting or $500 for each committee meeting attended that is on the date of a board meeting.

In addition, each director who is not an employee of Pride has received stock options under Pride’s 1993 Directors’ Stock Option Plan. A maximum of 400,000 shares of common stock is available for purchase upon exercise of options granted under the plan. Under the terms of the plan, each eligible director automatically receives an initial option grant of 10,000 shares upon becoming a director and, as long as the director remains eligible, may receive an annual grant as determined by the board of directors or the Executive, Finance and Nominating Committee following the calendar year in which such director receives the initial grant. The exercise price of options is the fair market value per share on the date the option is granted. Options expire ten years from the date of grant. Each option becomes exercisable as to 50% of the shares covered at the end of one year from the date of grant and the remaining 50% at the end of two years from the date of the grant. The plan provides for adjustments of options in cases of mergers, stock splits and similar capital reorganizations and for immediate vesting in the event of a change in control of Pride. Approval by the board of directors of Pride’s acquisition of Marine Drilling Companies, Inc. constituted such a change in control.

3

In July 2001, James B. Clement, formerly Pride’s chairman of the board and currently an advisory director of Pride, Mr. McBride and each other eligible director at that date were granted options to purchase 7,500 shares, 6,000 shares and 5,000 shares of Pride common stock, respectively, at an exercise price of $14.65 per share. In addition, each of Messrs. Barbanell, Brown, Burton and Robson was granted in May 2001 options to purchase 5,500 shares of Marine common stock at an exercise price of $28.10 per share, which options were assumed by Pride on a one-for-one basis in connection with the Marine acquisition.

Arrangements with Mr. Estrada. During 2001, Pride and Mr. Estrada had a consulting arrangement whereby Mr. Estrada was paid a fee for the successful completion by Pride of an acquisition referred to Pride by Mr. Estrada. The amount of the fee was based on the total dollar amount of the transaction and could not exceed $1.0 million per transaction. Pride agreed to pay Mr. Estrada an amount equal to $15,000 per month creditable against the fees payable under the arrangement. In addition, Pride agreed, on a case-by-case basis, to pay Mr. Estrada a business development fee from revenues generated by projects identified by Mr. Estrada. Fees paid to Mr. Estrada in 2001 under the agreement totaled $798,000. Effective as of January 2002, Pride and Mr. Estrada have entered into an employment/non-competition/confidentiality agreement that supersedes all prior agreements between the parties. See “Compensation of Executive Officers — Employment Agreements.”

Advisory Directors. James B. Clement, Remi Dorval, Christian J. Boon Falleur and James T. Sneed, who were directors of Pride prior to Pride’s acquisition of Marine in September 2001, and Howard I. Bull and Robert C. Thomas, who were directors of Marine prior to that acquisition, currently serve as advisory directors of Pride for a period of two years from the closing of the acquisition. These advisory directors receive annual directors’ fees of $30,000 for such service.

Organization of the Board of Directors

The board of directors is responsible for the overall affairs of Pride. To assist it in carrying out its duties, the board has delegated certain authority to an Executive, Finance and Nominating Committee, an Audit Committee and a Compensation Committee. During 2001, the board of directors of Pride held 13 meetings. Each director attended at least 75% of the total number of meetings of the board of directors and of the committees of the board on which he served.

The Executive, Finance and Nominating Committee currently consists of Messrs. Barbanell, Macaulay and Bragg. The committee may exercise the power and authority of the board of directors, subject to certain limitations, when the board is not in session. The committee also may serve as a nominating committee by recommending nominees for election as directors of Pride. The committee will consider nominees recommended by stockholders. To be considered by the committee for the 2003 annual meeting of stockholders, recommendations should be submitted in writing to the Secretary of Pride at Pride’s principal office by December 1, 2002. The recommendation should include information that will enable the committee to evaluate the qualifications of the proposed nominee. The committee held no meetings during 2001.

The Audit Committee currently consists of Messrs. Brown, Burton and Barbanell. The committee is primarily responsible for assisting the board of directors in monitoring the quality and integrity of the accounting, auditing and financial reporting practices of Pride and the independence of the firm of independent public accountants hired to audit Pride’s financial statements. The board of directors has adopted a written charter for the Audit Committee. The committee held four meetings during 2001.

The Compensation Committee currently consists of Messrs. McBride, Robson and Burton. The committee recommends and approves employment agreements, salaries and incentive plans, stock options and employee benefit plans for officers and key employees. The committee held six meetings during 2001. There are no matters relating to interlocks or insider participation that Pride is required to report.

4

RATIFICATION OF APPOINTMENT OF INDEPENDENT PUBLIC ACCOUNTANTS

(Item 2 on Proxy Card)

PricewaterhouseCoopers LLP has been appointed by the board of directors as independent public accountants for Pride and its subsidiaries for the year ending December 31, 2002. This appointment is being presented to the stockholders for ratification. Representatives of PricewaterhouseCoopers are expected to be present at the annual meeting and will be provided an opportunity to make statements if they desire to do so and to respond to appropriate questions from stockholders.

Vote Required and Board Recommendation

If a quorum is present at the annual meeting, the ratification of the appointment of PricewaterhouseCoopers requires the affirmative vote of at least a majority of the votes cast.Your board of directors recommends a vote “FOR” such ratification.

If the stockholders fail to ratify the appointment of PricewaterhouseCoopers as Pride’s independent accountants, it is not anticipated that PricewaterhouseCoopers will be replaced in 2002. Such lack of approval will, however, be considered by the Audit Committee in selecting Pride’s independent accountants for 2003.

COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934

Section 16(a) of the Securities Exchange Act of 1934 requires Pride’s executive officers and directors to file initial reports of ownership and reports of changes in ownership of Pride common stock with the Securities and Exchange Commission and, pursuant to rules promulgated under Section 16(a), such individuals are required to furnish Pride with copies of Section 16(a) reports they file. Based solely on a review of the copies of such reports furnished to Pride, Pride is not aware of any failure by any of its executive officers or directors to comply with the Section 16(a) reporting requirements during 2001.

5

SECURITY OWNERSHIP

The following table sets forth information as of March 25, 2002 with respect to the beneficial ownership of Pride common stock by (1) each stockholder of Pride who is known by Pride to be a beneficial owner of more than 5% of Pride common stock, (2) the directors of Pride and the persons named in the “Summary Compensation Table” below and (3) all executive officers and directors of Pride as a group. Unless otherwise indicated, all of such stock is owned directly, and the indicated person or entity has sole voting and investment power.

| | | | | | | | | | |

| | Number of | | |

| | Shares | | Percent |

| | Beneficially | | of |

| Name and Address | | Owned(1) | | Class |

| |

| |

|

| First Reserve Corporation(2) | | | 11,660,234 | | | | 8.8% | |

| | 411 West Putnam Avenue | | | | | | | | |

| | Suite 109 | | | | | | | | |

| | Greenwich, Connecticut 06830 | | | | | | | | |

| First Reserve GP IX, Inc.(2) | | | 7,874,015 | | | | 5.9 | |

| | 411 West Putnam Avenue | | | | | | | | |

| | Suite 109 | | | | | | | | |

| | Greenwich, Connecticut 06830 | | | | | | | | |

| James W. Allen | | | 764,148 | | | | * | |

| Robert L. Barbanell | | | 40,560 | | | | * | |

| John R. Blocker, Jr. | | | 322,616 | | | | * | |

| Paul A. Bragg | | | 886,168 | | | | * | |

| David A. B. Brown | | | 17,698 | | | | * | |

| J. C. Burton | | | 22,595 | | | | * | |

| Gary W. Casswell | | | 104,720 | | | | * | |

| Jorge E. Estrada | | | — | | | | * | |

| William E. Macaulay(2) | | | 19,534,249 | | | | 14.7 | |

| Ralph D. McBride | | | 51,333 | | | | * | |

| John C. G. O’Leary | | | 363,806 | | | | * | |

| David B. Robson | | | 22,595 | | | | * | |

| All current executive officers and directors as a group (17 persons) (2) | | | 22,843,734 | | | | 16.8 | |

| | |

| | * | Less than 1% of issued and outstanding shares of Pride common stock. |

| |

| (1) | The number of shares beneficially owned by the directors and executive officers includes shares that may be acquired within 60 days of March 25, 2002 by exercise of stock options as follows: Mr. Allen — 761,000; Mr. Barbanell — 15,500; Mr. Blocker — 311,100; Mr. Bragg — 838,650; Mr. Brown — 13,000; Mr. Burton — 20,500; Mr. Casswell — 103,600; Mr. Macaulay — 12,500; Mr. McBride — 41,333; Mr. O’Leary — 358,920; and Mr. Robson — 20,500; |

| |

| (2) | First Reserve Fund VIII, L.P. and First Reserve Fund VII, Limited Partnership own beneficially and of record 10,765,071 shares and 882,663 shares, respectively, of Pride common stock. Fund VII and Fund VIII also may be deemed to beneficially own the 12,500 shares that may be acquired by Mr. Macaulay within 60 days of March 25, 2002 by exercise of stock options. First Reserve GP VII, L.P. shares voting and investment power with respect to the shares owned by Fund VII, and First Reserve GP VIII, L.P. shares voting and investment power with respect to the shares owned by Fund VIII. First Reserve Corporation shares voting and investment power with respect to all such shares. First Reserve Corporation is the managing general partner of First Reserve GP VII, L.P. and First Reserve GP VIII, L.P., which are, in turn, the general partners of Fund VII and Fund VIII. First Reserve Fund IX, L.P. owns beneficially and of record 7,874,015 shares of Pride common stock. The shares owned beneficially and of record by Fund IX are beneficially owned by, and such fund shares voting and investment power with respect to such shares with, First Reserve GP IX, L.P. and First Reserve GP IX, Inc. First Reserve GP IX, Inc. is the managing general partner of First Reserve GP IX, L.P., which is, in turn, the general partner of Fund IX. William E. Macaulay, a director of Pride and chairman and chief executive officer of First Reserve Corporation and First Reserve GP IX, Inc., disclaims beneficial ownership of the shares owned by Fund VII, Fund VIII and Fund IX. The business address of Mr. Macaulay is c/o First Reserve Corporation, 411 West Putnam Avenue, Suite 109, Greenwich, Connecticut 06830. |

6

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In March 2001, as part of Pride’s increase in ownership to 100% of two fourth-generation semisubmersible drilling rigs, thePride Carlos Walter and thePride Brazil, Pride issued to First Reserve Fund VIII, L.P. and First Reserve Fund VII, Limited Partnership, investment partnerships managed by First Reserve Corporation, a total of 519,468 shares of common stock pursuant to Fund VIII’s and Fund VII’s original investment in the rigs. In connection with Pride’s March 2002 offering of 2 1/2% Convertible Senior Notes Due 2007, First Reserve Fund IX, L.P., an investment partnership managed by First Reserve GP IX, Inc., purchased through the initial purchaser of the notes 7,874,015 shares of Pride common stock from certain purchasers of the notes. In connection with such purchase, Pride’s board of directors has taken action under its stockholder rights plan to increase the applicable percentage of beneficial stock ownership that triggers the plan, only as it applies to the First Reserve funds and their affiliates, from 15% to 19%.

As a result of these and previous purchases of Pride common stock by Fund VII and Fund VIII, Fund VII, Fund VIII and Fund IX currently own of record a total of 19,521,749 shares of Pride common stock, or 14.7% of the total shares outstanding. Fund VII and Fund VIII also hold a 11.9% interest in the joint venture that is constructing two fourth-generation semisubmersible drilling rigs, theAmethyst 4 and theAmethyst 5, which interest is exchangeable for 527,652 shares of Pride common stock beginning in June 2002 (or earlier in certain events). Pride currently owns a 26.4% interest in the joint venture.

Pride, Fund VII, Fund VIII and Fund IX have entered into a stockholders agreement providing that, as long as Fund VII, Fund VIII, Fund IX or any of their affiliates, referred to in this proxy statement to as the “First Reserve Group,” own Company Securities that represent at least 5% of the voting power of Pride, Fund VIII is entitled to nominate one director to Pride’s board of directors. “Company Securities” include Pride common stock and other securities that are convertible into, exchangeable for or exercisable for the purchase of, or otherwise give the holder any rights in, Pride common stock or any class or series of Pride’s preferred stock entitled to vote generally for the election of directors or otherwise. Fund VIII’s director nominee currently is William E. Macaulay, chairman and chief executive officer of First Reserve. Fund VIII may assign its right to nominate a director to Fund VII or Fund IX. In addition, the stockholders agreement provides that:

| | |

| | • | Members of the First Reserve Group are restricted from acquiring Company Securities without Pride’s consent if the effect would be to increase the First Reserve Group’s ownership of Company Securities to an amount exceeding 19% of either the voting power of Pride or the number of outstanding shares of any class or series of Company Securities. |

| |

| | • | Members of the First Reserve Group are restricted from transferring any Company Securities they own except in accordance with the stockholders agreement, which permits, among others, sales registered under the Securities Act of 1933, sales effected in compliance with Rule 144 under the Securities Act and other privately negotiated sales. Members of the First Reserve Group will, however, use their reasonable efforts to refrain from knowingly transferring more than 5% of the voting power of Pride to one person pursuant to sales registered under the Securities Act or other privately negotiated sales unless Pride consents. |

| |

| | • | Members of the First Reserve Group will vote all Company Securities they beneficially own with respect to each matter submitted to Pride’s stockholders involving a business combination or other change in control of Pride that has not been approved by the Board of Directors either (a) in the manner recommended by the Board or (b) proportionately with all other holders of Company Securities voting with respect to such matter. The First Reserve Group will, however, retain the power to vote for the election of the First Reserve nominee to Pride’s board. No member of the First Reserve Group will take any action, or solicit proxies in any fashion, inconsistent with the provisions of this paragraph. |

| |

| | • | No member of the First Reserve Group will join a group or otherwise act in concert with any other person for the purpose of acquiring, holding, voting or disposing of any Company Securities, other than the First Reserve Group itself. |

7

These restrictions generally will not apply during any period that the First Reserve director designee is not serving as a director either (a) as a result of a failure of Pride or its board to comply with the terms of the stockholders agreement or (b) if such designee is not elected by the stockholders.

Members of the First Reserve Group also are provided demand and piggyback registration rights with respect to Pride common stock they own.

COMPENSATION OF EXECUTIVE OFFICERS

The following table discloses compensation for the years ended December 31, 2001, 2000 and 1999 for the Chief Executive Officer and the four other most highly compensated executive officers of Pride.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Long-Term | | |

| | | | | | | | Compensation | | |

| | | | | | | | Awards | | |

| | | | | |

| | |

| | | | Annual Compensation | | Shares | | |

| | | |

| | Underlying | | All Other |

| Name and Principal Position | | Year | | Salary | | Bonus | | Options | | Compensation(1) |

| |

| |

| |

| |

| |

|

| Paul A. Bragg | | | 2001 | | | $ | 508,461 | | | $ | 621,000 | | | | 329,500 | | | $ | 5,078 | |

| | President and Chief | | | 2000 | | | | 418,462 | | | | 836,924 | | | | 86,000 | | | | 10,980 | |

| | Executive Officer | | | 1999 | | | | 402,141 | | | | 598,858 | | | | 129,000 | | | | 10,511 | |

| James W. Allen | | | 2001 | | | | 333,846 | | | | 301,875 | | | | 141,500 | | | | 4,907 | |

| | Senior Vice President and | | | 2000 | | | | 308,461 | | | | 370,153 | | | | 64,000 | | | | 10,732 | |

| | Chief Operating Officer | | | 1999 | | | | 298,846 | | | | 222,517 | | | | 50,000 | | | | 10,093 | |

| John C.G. O’Leary | | | 2001 | | | | 249,231 | | | | 179,400 | | | | 116,500 | | | | 11,198 | |

| | Vice President — | | | 2000 | | | | 234,230 | | | | 210,807 | | | | 57,000 | | | | 11,071 | |

| | International Marketing | | | 1999 | | | | 227,846 | | | | 127,238 | | | | 50,000 | | | | 10,311 | |

| John R. Blocker, Jr. | | | 2001 | | | | 254,615 | | | | 138,879 | | | | 91,500 | | | | 11,222 | |

| | Vice President — | | | 2000 | | | | 241,257 | | | | 180,943 | | | | 30,000 | | | | 78 | |

| | Latin American Operations | | | 1999 | | | | 199,174 | | | | 93,791 | | | | 15,500 | | | | — | |

| Gary W. Casswell | | | 2001 | | | | 219,231 | | | | 185,607 | | | | 91,500 | | | | 878 | |

| | Vice President — | | | 2000 | | | | 204,230 | | | | 153,173 | | | | 27,500 | | | | 760 | |

| | Eastern Hemisphere Operations | | | 1999 | | | | 190,768 | | | | 89,830 | | | | 15,500 | | | | 594 | |

| |

| (1) | Includes matching contributions deposited into Pride’s 401(k) plan and premiums paid on behalf of the executive for life and accidental death insurance, which for 2001 are as follows: |

| | | | | | | | | |

| | 401(k) | | Insurance |

| | Contribution | | Premiums |

| |

| |

|

| Paul A. Bragg | | $ | 3,570 | | | $ | 1,508 | |

| James W. Allen | | | 3,570 | | | | 1,337 | |

| John C.G. O’Leary | | | 10,200 | | | | 998 | |

| John R. Blocker, Jr. | | | 10,200 | | | | 1,022 | |

| Gary W. Casswell | | | — | | | | 878 | |

Option Grants, Exercise and Valuation

During 2001, options were granted to the named executive officers as shown in the first table below. All such options have an exercise price equal to the fair market value of Pride common stock on the grant date. Such options generally are exercisable as to one-fifth of the shares covered thereby at the end of each six-month period after the grant date. Each option permits tax withholding to be paid by the withholding of shares of common stock issuable upon exercise of the option. Shown in the second table below is information with respect to unexercised options held at December 31, 2001.

8

Option Grants in 2001

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | Individual Grants | | | | |

| |

| | | | Potential Realizable Value at |

| | Number of | | % of Total | | | | | | Assumed Annual Rates of |

| | Securities | | Options | | | | | | Stock Price Appreciation for |

| | Underlying | | Granted to | | Exercise | | | | Option Term(1) |

| | Options | | Employees | | Price | | Expiration | |

|

| Name | | Granted | | in 2001 | | ($ per Share) | | Date | | 5% | | 10% |

| |

| |

| |

| |

| |

| |

|

| Paul A. Bragg | | | 329,500 | | | | 22.8 | % | | $ | 14.65 | | | | 07/17/2011 | | | $ | 3,035,784 | | | $ | 7,693,274 | |

| James W. Allen | | | 141,500 | | | | 9.8 | | | | 14.65 | | | | 07/17/2011 | | | | 1,303,683 | | | | 3,303,788 | |

| John C.G. O’Leary | | | 116,500 | | | | 8.1 | | | | 14.65 | | | | 07/17/2011 | | | | 1,073,350 | | | | 2,720,080 | |

| John R. Blocker, Jr. | | | 91,500 | | | | 6.3 | | | | 14.65 | | | | 07/17/2011 | | | | 843,018 | | | | 2,136,372 | |

| Gary W. Casswell | | | 91,500 | | | | 6.3 | | | | 14.65 | | | | 07/17/2011 | | | | 843,018 | | | | 2,136,372 | |

| |

| (1) | The amounts under these columns result from calculations assuming 5% and 10% annual growth rates through the actual option term as set by the SEC and are not intended to forecast future price appreciation of Pride common stock. The gains reflect a future value based upon growth at these prescribed rates. |

Aggregated Option Exercises in Last Fiscal Year and

Fiscal Year-End Option Value

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | Number of Shares Underlying | | Value of Unexercised |

| | | | | | Unexercised Options at | | In-the-Money Options at |

| | Shares | | | | Fiscal Year End(1) | | Fiscal Year-End(2) |

| | Acquired on | | Value | |

| |

|

| | Exercise | | Realized | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

| |

| |

| |

| |

| |

| |

|

| Paul A. Bragg | | | — | | | | — | | | | 686,750 | | | | 420,500 | | | $ | 2,318,375 | | | $ | 725,700 | |

| James W. Allen | | | — | | | | — | | | | 687,900 | | | | 231,600 | | | | 3,399,735 | | | | 526,340 | |

| John C. G. O’Leary | | | — | | | | — | | | | 298,220 | | | | 195,481 | | | | 741,854 | | | | 452,858 | |

| John R. Blocker, Jr. | | | — | | | | — | | | | 269,700 | | | | 132,300 | | | | 935,830 | | | | 279,820 | |

| Gary W. Casswell | | | — | | | | — | | | | 62,700 | | | | 106,800 | | | | 214,375 | | | | 146,600 | |

| |

| (1) | Number of options shown includes all options (both in and out of the money) at December 31, 2001. |

| |

| (2) | Value reflects those options in-the-money based on a closing price of $15.10 per share at December 31, 2001, less the option exercise price. Options are in-the-money if the market value of the shares covered thereby exceeds the option exercise price. |

Employment Agreements

Pride is a party to employment agreements with Messrs. Bragg, Allen and O’Leary, each for a term ending on February 4, 2003, with Mr. Casswell for a term ending August 15, 2003, with Mr. Blocker for a term ending October 15, 2003 and with Mr. Estrada for a term ending December 31, 2004. Each agreement is subject to automatic renewals for successive one-year terms until either party terminates the contract effective upon the anniversary date of the respective agreement, with at least one year’s advance notice. Each agreement provides that if the executive is terminated involuntarily for reasons not associated with a Change in Control and not due to cause (as defined), the executive will receive (1) two full years (one year for Messrs. Casswell and Blocker) of base salary (not less than the highest annual base salary during the preceding three years); (2) two years (one year for Messrs. Casswell and Blocker) of life, health, accident and disability insurance benefits for himself and dependents; (3) an amount equal to two times the target award (one times the target award for Messrs. Casswell and Blocker) for Pride’s annual incentive compensation plan described below under “Report of the Compensation Committee on Executive Compensation”; and (4) immediate vesting of the executive’s options and awards. Mr. Estrada will receive one year of base salary (not less than the highest annual base salary during the preceding three years); one year of life, health, accident and disability insurance benefits for himself and dependents; and immediate vesting of his options and awards. The agreements treat death, disability, specified constructive

9

terminations of an executive or Pride’s failure to renew an agreement at the end of its term as an involuntary termination of the executive.

Each agreement also provides for compensation due to involuntary termination following a Change in Control. “Change in Control” is defined to include the acquisition by a person of 20% or more of Pride’s voting power, specified changes in a majority of the board of directors, a merger resulting in existing stockholders having less than 50% of the voting power in the surviving company and sale or liquidation of Pride. Pride’s acquisition of Marine in September 2001 did not constitute a Change in Control. In the event of a Change in Control, the term of the agreements will be extended for a period of three years (two years for Messrs. Casswell, Blocker and Estrada) from the date of the Change in Control. In the event of a termination during the extended term of the agreement (including voluntary resignations by the executive within six months after a Change in Control), the executive will be entitled to receive (1) salary and benefits equal to three full years (two full years for Messrs. Casswell and Blocker) of compensation; (2) bonus equal to three times (two times for Messrs. Casswell and Blocker) the maximum award for the year of termination; (3) life, health and accident and disability insurance continued for three years (two years for Messrs. Casswell and Blocker) or until reemployment; and (4) immediate vesting of the executive’s options and awards. Mr. Estrada will be entitled to receive salary and benefits equal to two full years of compensation; life, health and accident and disability insurance continued for the duration of his COBRA entitlement or until reemployment; and immediate vesting of his options and awards. The agreements with Messrs. Bragg, Allen and O’Leary also provide that Pride will reimburse the executive for certain taxes incurred by the executive as a result of payments following a Change in Control.

In addition, each executive’s agreement provides a noncompete clause for two years (one year for Messrs. Casswell, Blocker and Estrada) after termination (voluntary or involuntary) assuming that it was not due to a Change in Control. In the event of a Change in Control, the noncompete clause is void.

Report of the Compensation Committee on Executive Compensation

The Compensation Committee consists of three outside directors, Messrs. Burton, McBride (Chairman) and Robson, who are neither officers or employees of Pride nor eligible to participate in any of the compensation programs the Committee administers. The Committee meets at least semiannually to review, recommend and approve employment agreements, salaries, incentive plans, stock options and employee benefit plans for officers and key employees. The key elements of the Committee’s compensation program are base salary, annual incentive awards and long-term incentive awards. The Committee was advised by an outside consulting firm regarding all elements of its compensation program in 2001.

Base Salary. Under the Committee’s program, the base salary for the executive officers and other key employees is established to position the individual in the median to upper salary level for the individual’s peers in the contract drilling industry. Specific compensation for individual executives will vary within this target range as a result of the subjective judgment of the Committee. Pride has employment agreements with all its executive officers. During 2001, these executives, excluding Mr. Bragg, received base salary increases ranging from 3.4% to 27.8% (equal to a weighted average of 11.0%).

Annual Incentive Compensation. The second component of the program is the annual incentive compensation plan. The plan provides incentives to each executive officer to maximize Pride’s profitability, return on equity and stock price performance relative to Pride’s peer group. Bonuses are paid on a discretionary basis by the Committee based on targets established for each of these elements. A total of $1.3 million of incentive bonuses was paid for 2001 to Pride’s executive officers, excluding Mr. Bragg.

Long-Term Incentive Compensation.The final component of the Committee’s compensation program is Pride’s 1998 Long-Term Incentive Plan. Under the plan, the Committee is authorized to grant key employees, including the named executive officers, stock options and other stock and cash awards in an effort to provide long-term incentives to such executives. The Committee currently views stock options as the most effective way to tie the long-term interests of management directly to those of the stockholders. In awarding stock options to executives other than the Chief Executive Officer, the Committee reviews and approves or modifies recommendations made by the Chief Executive Officer.

10

Factors used in determining individual award size are competitive practice (awards needed to attract and retain management talent), rank within Pride (internal equity), responsibility for asset management (size of job) and ability to affect profitability. In each individual case, previous option and performance unit grants are considered in determining the size of new awards. Considering these factors, the Committee makes a subjective determination as to the level of each award.

Chief Executive Officer Compensation.The Committee applies the executive compensation program described above in determining the Chief Executive Officer’s total compensation. In 2001, the Committee reviewed Mr. Bragg’s base salary, comparing it to the salary of his peers in the international contract drilling industry, and recommended to the board of directors that his base salary be increased from $430,000 to $600,000 effective July 2001 and that his maximum bonus be changed from 200% of his weighted-average base salary during the year to 150% of his base salary at the end of the year. For 2001, Pride awarded Mr. Bragg an incentive bonus of $621,000, which represented an incentive compensation award of 104% of Mr. Bragg’s base salary at December 31, 2001. In addition, the Committee awarded options to Mr. Bragg to purchase an additional 329,500 shares of Pride common stock (at the market value of such stock on the date of the award).

Supplemental Retirement Plan.The Committee has implemented a supplemental Executive Retirement Plan for executives that are selected from time to time by Pride’s Chief Executive Officer and approved by the Committee. Currently, Messrs. Bragg and Allen participate in the Plan.

Limit on Deductibility of Compensation.Section 162(m) of the Internal Revenue Code of 1986 denies a compensation deduction for federal income tax purposes for certain compensation in excess of $1 million paid to specified individuals. “Performance based” compensation meeting specified standards is deductible without regard to the $1 million cap. The Committee does not anticipate any material payment of compensation in 2001 or 2002 in excess of what is deductible under Section 162(m); however, the Committee reserves the right to structure future compensation of Pride’s executive officers without regard for whether such compensation is fully deductible if, in the Committee’s judgment, it is in the best interests of Pride and its stockholders to do so.

The Committee believes its practices are fair and equitable for both the executive officers and the stockholders of Pride.

| |

| | Respectfully submitted, |

| |

| | J.C. Burton |

| | Ralph D. McBride |

| | David B. Robson |

11

Shareholder Return Performance Presentation

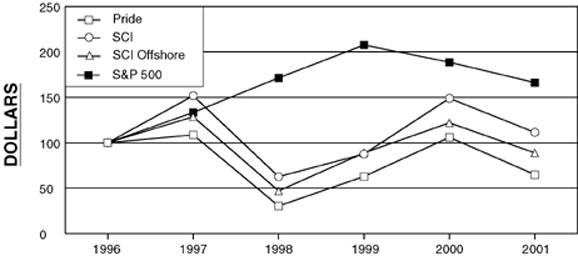

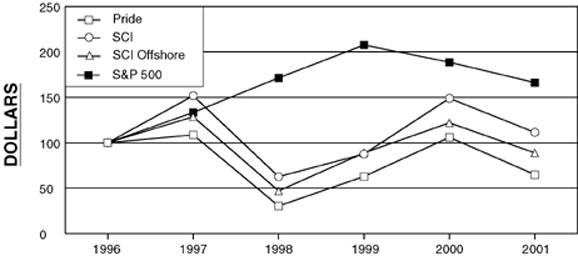

Presented below is a line graph comparing for the last five years the yearly change in Pride common stock against the Simmons & Company International Index (which includes upstream oil service and equipment companies in the January 2002 SCI Monthly Performance & Valuation Guide), the Simmons & Company International Offshore Drillers Index (which currently includes Pride, Atwood Oceanics, Inc., Chiles Offshore Inc., Diamond Offshore Drilling, Inc., ENSCO International Incorporated, Fred.Olsen Energy ASA, GlobalSantaFe Corporation, Noble Drilling Corporation, Parker Drilling Company, Rowan Companies, Inc., Smedvig ASA and Transocean Sedco Forex, Inc.) and the S&P 500 Index. The graph assumes that the value of the investment in Pride common stock and each index was $100 at December 31, 1996 and that all dividends were reinvested.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | December 31, |

| |

|

| | 1996 | | 1997 | | 1998 | | 1999 | | 2000 | | 2001 |

| |

| |

| |

| |

| |

| |

|

| Pride | | | 100.0 | | | | 108.6 | | | | 30.4 | | | | 62.9 | | | | 105.9 | | | | 64.9 | |

| SCI | | | 100.0 | | | | 151.6 | | | | 62.6 | | | | 87.6 | | | | 148.8 | | | | 111.3 | |

| SCI Offshore | | | 100.0 | | | | 128.5 | | | | 47.0 | | | | 88.8 | | | | 121.8 | | | | 88.8 | |

| S&P 500 | | | 100.0 | | | | 133.2 | | | | 171.3 | | | | 207.4 | | | | 188.5 | | | | 166.1 | |

12

AUDIT COMMITTEE REPORT

The Audit Committee consists of Messrs. Barbanell, Brown (Chairman) and Burton. The Audit Committee is primarily responsible for assisting the board of directors in monitoring the quality and integrity of the accounting, auditing and financial reporting practices of Pride and the independence of the firm of independent public accountants hired to audit Pride’s financial statements. Each of the members of the Audit Committee is “independent” as defined by listing standards of the NYSE.

Pride’s management is responsible for preparing Pride’s financial statements and the independent auditors are responsible for auditing those financial statements and issuing a report thereon. Accordingly, the Committee’s responsibility is one of oversight. In this context, the Audit Committee discussed with PricewaterhouseCoopers, Pride’s independent auditors for 2001, those matters PricewaterhouseCoopers communicated to and discussed with the Audit Committee under applicable auditing standards, including information regarding the scope and results of the audit and other matters required to be discussed by Statement on Auditing Standards No. 61, “Communication with Audit Committees.” These communications and discussions are intended to assist the Audit Committee in overseeing the financial reporting and disclosure process. The Audit Committee also discussed with PricewaterhouseCoopers its independence from Pride and received a written statement from PricewaterhouseCoopers concerning independence as required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees.” This discussion and disclosure informed the Audit Committee of the independence of PricewaterhouseCoopers and assisted the Audit Committee in evaluating such independence. The Audit Committee also considered whether the provision of services by PricewaterhouseCoopers not related to the audit of Pride’s financial statements and to the review of Pride’s interim financial statements is compatible with maintaining the independence of PricewaterhouseCoopers. Finally, the Audit Committee reviewed and discussed with Pride management, the internal auditors of Pride and PricewaterhouseCoopers the audited consolidated balance sheet of Pride as of December 31, 2001 and 2000, and the related consolidated statements of operations, stockholders’ equity and cash flows for each of the years ended December 31, 1999, 2000 and 2001. PricewaterhouseCoopers informed the Audit Committee that Pride’s audited financial statements had been prepared in accordance with accounting principles generally accepted in the United States.

Based on the review and discussions referred to above, and such other matters deemed relevant and appropriate by the Audit Committee, the Audit Committee recommended to the board of directors, and the board has approved, that these financial statements be included in Pride’s Annual Report on Form 10-K for the year ended December 31, 2001.

| |

| | Respectfully submitted, |

| |

| | Robert L. Barbanell |

| | David A.B. Brown |

| | J.C. Burton |

FEES PAID TO PRICEWATERHOUSECOOPERS LLP

Audit Fees

The aggregate fees for professional services rendered by PricewaterhouseCoopers for the audit of Pride’s financial statements for the year ended December 31, 2001 and the reviews of the financial statements included in Pride’s Quarterly Reports on Form 10-Q filed during 2001 were approximately $1.3 million.

Financial Information Systems Design and Implementation Fees

PricewaterhouseCoopers did not provide Pride any financial information systems design and implementation services as used in Paragraph (c)(4)(ii) of Rule 2-01 of Regulation S-X for the year ended December 31, 2001.

13

All Other Fees

The aggregate fees for all other services rendered by PricewaterhouseCoopers for the year ended December 31, 2001 were approximately $787,000.

ADDITIONAL INFORMATION

Stockholder Proposals for the 2003 Annual Meeting

To be included in the proxy materials for the 2003 Annual Meeting of Stockholders, stockholder proposals that are submitted for presentation at that annual meeting and are otherwise eligible for inclusion in the proxy statement must be received by Pride no later than December 19, 2002. Proxies granted in connection with that annual meeting may confer discretionary authority to vote on any stockholder proposal if notice of the proposal is not received by Pride in accordance with the advance notice requirements of Pride’s bylaws discussed below. It is suggested that proponents submit their proposals by certified mail, return receipt requested. No stockholder proposals have been received for inclusion in this proxy statement.

Pride’s bylaws provide the manner in which stockholders may give notice of business to be brought before an annual meeting. In order for an item to be properly brought before the meeting by a stockholder, the stockholder must be a holder of record at the time of the giving of notice and must be entitled to vote at the annual meeting. The item to be brought before the meeting must be a proper subject for stockholder action, and the stockholder must have given timely advance written notice of the item. For notice to be timely, it must be delivered to, or mailed and received at, the principal office of Pride not less than 120 days prior to the scheduled annual meeting date (regardless of any postponements of the annual meeting to a later date). Accordingly, if the 2003 annual meeting were held on May 16, 2003, notice would have to be delivered or received by January 16, 2003. If, however, the date of the scheduled annual meeting date differs by more than 30 days from the date of the previous year’s annual meeting, and if Pride gives less than 100 days’ prior notice or public disclosure of the scheduled annual meeting date, then notice of an item to be brought before the annual meeting may be timely if it is delivered or received not later than the close of business on the 10th day following the earlier of notice to the stockholders or public disclosure of the scheduled annual meeting date. The notice must set forth, as to each item to be brought before the annual meeting, a description of the proposal and the reasons for conducting such business at the annual meeting, the name and address, as they appear on Pride’s books, of the stockholder proposing the item and any other stockholders known by the stockholder to be in favor of the proposal, the number of shares of each class or series of capital stock beneficially owned by the stockholder as of the date of the notice, and any material interest of the stockholder in the proposal.

Discretionary Voting of Proxies on Other Matters

Management does not intend to bring before the annual meeting any matters other than those disclosed in the notice of annual meeting of stockholders attached to this proxy statement, and it does not know of any business that persons other than management intend to present at the meeting. If any other matters are properly presented at the annual meeting for action, the persons named in the enclosed form of proxy and acting thereunder generally will have discretion to vote on those matters in accordance with their best judgment.

Annual Report on Form 10-K

Copies of Pride’s Annual Report on Form 10-K for the year ended December 31, 2001, as filed with the SEC, are available without charge to stockholders upon request to Earl W. McNiel, Chief Financial Officer, at the principal executive offices of Pride International, Inc., 5847 San Felipe, Suite 3300, Houston, Texas 77057.

14

PRIDE INTERNATIONAL, INC.

PROXY-2002 ANNUAL MEETING OF STOCKHOLDERS

MAY 16, 2002

The undersigned acknowledges receipt of the Notice of 2002 Annual Meeting of Stockholders and Proxy Statement dated April 18, 2002. Paul A. Bragg and Robert W. Randall, each with full power of substitution and resubstitution, and acting alone, are hereby constituted proxies of the undersigned and authorized to attend the Annual Meeting of Stockholders of Pride International, Inc. (the “Company”) to be held on May 16, 2002, or any adjournment or postponement of such meeting, and to represent and vote all shares of common stock of the Company that the undersigned is entitled to vote.

(CONTINUED, AND TO BE SIGNED, ON THE OTHER SIDE)

| [X] | | Please mark your votes as in this example. | |

| | | | | |

| | | FOR | WITHHELD | |

| | All nominees | [ ] | [ ] | |

| | |

| | Nominees: Robert L. Barbanell, Paul A. Bragg,

David A. B. Brown, J. C. Burton, Jorge E.

Estrada M., William E. Macaulay, Ralph D.

McBride and David B. Robson |

| | | | FOR, except withheld from the following nominees: |

| |

| | | |

|

| |

| | 2. | | Ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent accountants for 2002. |

| | | | | |

| FOR | | AGAINST | | ABSTAIN |

| [ ] | | [ ] | | [ ] |

This proxy is revocable. The undersigned hereby revokes any proxy or proxies to vote or act with respect to such shares heretofore given by the undersigned.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS. THIS PROXY WILL BE VOTED IN ACCORDANCE WITH THE INSTRUCTIONS SPECIFIED ABOVE AND, IN THE ABSENCE OF SUCH SPECIFICATIONS, WILL BE VOTED “FOR” ALL DIRECTOR NOMINEES AND “FOR” ITEM 2. IF ANY OTHER BUSINESS PROPERLY COMES BEFORE THE MEETING OR ANY ADJOURNMENT OR POSTPONEMENT THEREOF, THIS PROXY WILL BE VOTED IN THE DISCRETION OF THE PROXIES NAMED HEREIN.

PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY PROMPTLY USING THE ENCLOSED ENVELOPE.

| |

|

| (Signature) |

| |

|

| (Signature if held jointly) |

| |

|

|

(Printed Name) | | |

| Dated:_______________________________________________________ |

| |

| Please sign exactly as your stock is registered. Joint owners should each sign personally. Executors, administrators, trustees, etc. should so indicate when signing. |