- ------------------------------------------------------------------------------

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT NO. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by

Rule14a-6(e)(2))

[ ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[X] Soliciting Material Pursuant to Rule 14a-12

BURLINGTON RESOURCES INC.

- ------------------------------------------------------------------------------

(Name of Registrant as Specified in its Charter)

- ------------------------------------------------------------------------------

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

------------------------------------------------------------------

(2) Aggregate number of securities to which transaction applies:

------------------------------------------------------------------

(3) Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

------------------------------------------------------------------

(4) Proposed maximum aggregate value of transaction:

------------------------------------------------------------------

(5) Total fee paid:

------------------------------------------------------------------

[ ] Fee paid previously with preliminary materials:

[ ] Check box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration statement number, or the

Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

------------------------------------------------------------------

(2) Form, Schedule or Registration Statement No.:

------------------------------------------------------------------

(3) Filing Party:

------------------------------------------------------------------

(4) Date Filed:

------------------------------------------------------------------

- ------------------------------------------------------------------------------

On December 13, 2005, ConocoPhillips and Burlington Resources Inc. made a

joint analyst presentation concerning the proposed acquisition by

ConocoPhillips of Burlington Resources Inc. The following consists of the

slides and fact sheet used in connection with the analyst presentation.

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING

INFORMATION FOR THE PURPOSE OF "SAFE HARBOR" PROVISIONS OF THE

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

Except for the historical and factual information contained herein,

the matters set forth in this filing, including statements as to the

expected benefits of the acquisition such as efficiencies, cost savings,

market profile and financial strength, and the competitive ability and

position of the combined company, and other statements identified by words

such as "estimates, "expects," "projects," "plans," and similar expressions

are forward-looking statements within the meaning of the "safe harbor"

provisions of the Private Securities Litigation Reform Act of 1995. These

forward-looking statements are subject to risks and uncertainties that may

cause actual results to differ materially, including required approvals by

Burlington Resources shareholders and regulatory agencies, the possibility

that the anticipated benefits from the acquisition cannot be fully

realized, the possibility that costs or difficulties related to the

integration of Burlington Resources operations into ConocoPhillips will be

greater than expected, the impact of competition and other risk factors

relating to our industry as detailed from time to time in each of

ConocoPhillips' and Burlington Resources' reports filed with the SEC.

Readers are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of their dates. Burlington Resources Inc.

undertakes no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or

otherwise.

ADDITIONAL INFORMATION

In connection with the proposed transaction, ConocoPhillips will file

a Form S-4, Burlington Resources will file a proxy statement and both

companies will file other relevant documents concerning the proposed merger

transaction with the Securities and Exchange Commission (SEC). INVESTORS

ARE URGED TO READ THE FORM S-4 AND THE PROXY STATEMENT WHEN THEY BECOME

AVAILABLE, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION REGARDING THE MERGER. Investors may

obtain a free copy of the Form S-4 and the proxy statement (when available)

and the other documents free of charge at the website maintained by the SEC

at www.sec.gov.

ConocoPhillips, Burlington Resources and their respective directors

and executive officers may be deemed to be participants in the solicitation

of proxies from Burlington Resources' stockholders in connection with the

merger. Information about the directors and executive officers of

ConocoPhillips and their ownership of ConocoPhillips stock will be set

forth in the proxy statement for ConocoPhillips' 2006 Annual Meeting of

Stockholders. Information about the directors and executive officers of

Burlington Resources and their ownership of Burlington Resources stock is

set forth in Burlington Resources' proxy statement for its 2005 annual

meeting, which was filed with the SEC on March 10, 2005. Investors may

obtain additional information regarding the interests of such participants

by reading the Form S-4 and proxy statement for the merger when they become

available.

Investors should read the Form S-4 and proxy statement carefully when

they become available before making any voting or investment decision.

Jim Mulva

Chairman & CEO

ConocoPhillips

Bobby Shackouls

Chairman & CEO

Burlington Resources

December 13, 2005

Creating a Leading

North American

Gas Supplier

1

Agenda

Introduction Gary Russell

Transaction Overview & Jim Mulva

Strategic Rationale

Burlington Resources Overview Bobby Shackouls

Portfolio Impact Jim Mulva

Financial Impact Jim Mulva

2

CAUTIONARY STATEMENT

FOR THE PURPOSES OF THE “SAFE HARBOR” PROVISIONS

OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

The following presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbors created thereby. You can identify our forward-looking statements by words such as “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” and similar expressions. Forward-looking statements relating to ConocoPhillips’ operations are based on management’s expectations, estimates and projections about ConocoPhillips and the petroleum industry in general on the date the presentations are given. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Further, certain forward-looking statements are based upon assumptions as to future events that may not prove to be accurate. Therefore, actual outcomes and results may differ materially from what is expressed or forecast in such forward-looking statements.

Factors that could cause actual results or events to differ materially include, but are not limited to, the failure to receive required approvals by Burlington Resources shareholders and regulatory agencies, the possibility that the anticipated benefits from the acquisition cannot be fully realized, the possibility that costs or difficulties related to the integration of Burlington Resources’ operations into ConocoPhillips will be greater than expected; crude oil and natural gas prices; refining and marketing margins; potential failure to achieve, and potential delays in achieving expected reserves or production levels from existing and future oil and gas development projects due to operating hazards, drilling risks, and the inherent uncertainties in interpreting engineering data relating to underground accumulations of oil and gas; unsuccessful exploratory drilling activities; lack of exploration success; potential disruption or unexpected technical difficulties in developing new products and manufacturing processes; potential failure of new products to achieve acceptance in the market; unexpected cost increases or technical difficulties in constructing or modifying company manufacturing or refining facilities; unexpected difficulties in manufacturing, transporting or refining synthetic crude oil; international monetary conditions and exchange controls; potential liability for remedial actions under existing or future environmental regulations; potential liability resulting from pending or future litigation; general domestic and international economic and political conditions, as well as changes in tax and other laws applicable to ConocoPhillips’ business. Other factors that could cause actual results to differ materially from those described in the forward-looking statements include other economic, business, competitive and/or regulatory factors affecting ConocoPhillips’ business generally as set forth in ConocoPhillips’ filings with the Securities and Exchange Commission (SEC), including our Form 10-Q for the quarter ending September 30, 2005. Unless legally required, ConocoPhillips is under no obligation (and expressly disclaims any such obligation) to update or alter its forward-looking statements, whether as a result of new information, future events or otherwise.

Cautionary Note to U.S. Investors – The U.S. Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. We use certain terms in this presentation such as “oil/gas resources,” “Syncrude,” and/or “Society of Petroleum Engineers (SPE) proved reserves” that the SEC’s guidelines strictly prohibit us from including in filings with the SEC. U.S. investors are urged to consider closely the oil and gas disclosures in our Form 10-K for the year ended December 31, 2004.

This presentation includes certain non-GAAP financial measures, as indicated. Such non-GAAP measures are intended to supplement, not substitute

for, comparable GAAP measures. Investors are urged to consider closely the GAAP reconciliation tables provided in the presentation Appendix.

3

Transaction Overview

$92 per BR share based on COP closing <<>>

price on December 9, 2005

For each BR share:

$46.50 cash

0.7214 COP shares

Enterprise value: $35.6B

Including net debt

Principal conditions to closing

BR shareholder approval – Q1 2006

Regulatory clearances – 1H 2006

4

Securing Management Strengths

Two BR directors to join COP Board

Bobby Shackouls

Bill Wade

Talent retention plan

Randy Limbacher to become EVP

Responsible for North and South America E&P

Key technical / operational talent

Integration planning teams formed

5

Strategic Rationale

Creates leading North American gas position

High-quality, long-lived, low-risk gas reserves

Significant unconventional resource plays

Enhances production growth / N.A. gas supply

Near-term conventional / unconventional

Long-term LNG and Arctic gas

Enhances business mix

Increases E&P, OECD, and North American gas

Significant free cash flow

Synergies of $375 MM

Access to technical capabilities

6

Burlington Resources Overview

7

BR – A Premier N.A. Gas Company

Note: Reserves are YE 2004 numbers, with NGLs converted to Gas, per BR convention

Production is FY 2005 (E), based on Q3 actuals

Reserves

Oil

Gas

Reserves Production

United States 1329 MMBOE 249 MBOE/d

Canada 460 MMBOE 164 MBOE/d

Rest of World 212 MMBOE 62 MBOE/d

TOTAL 2001 MMBOE 475 MBOE/d

NGL

Reserves

North

America

ROW

8

San Juan

High quality, long-lived gas reserves

7.5

2.4

5.1

Reserves (TCFE)

1610

770

840

Acreage (M acres)

1308

564

744

Production (MMCFED)

Total

COP

BR

BR

COP

Significant synergy potential

Production enhancement

Operating and admin expenses

Lower gathering & transportation costs

Better utilization of COP 50% owned

Blanco Gas Processing Plant

Colorado

New Mexico

9

BR - High Impact Resource Plays

South Louisiana

Deep Bossier

Barnett Shale

35,000 net acres

13 – 14,000’ targeted depths

Similar to Barnett Shale

Woodford Shale

28,000 net core acres

92,000 net non-core acres

70,000 acres Parker, Hood,

Johnson Counties

Seismic covering 65% of acreage

position

215 risked locations

200,000 net acres

Franklin Block tested at 640 acre

spacing

200 Mmcfd gross (115 Mmcfd

net)

Savell field development

Five rigs deployed

660,000 net acres fee land

Pine Prairie Redell

Four Isle Dome

Bakken Shale

67,000 net acres

Unconventional oil exploration

Ramping up drilling program

6 Mpd net of production

Additional EOR Options

Production expected to grow from

25 MBOPD to over 35 MBOPD in

2007

Cedar Creek Anticline

Conventional

Unconventional

10

Western Canada

Strong Conventional Gas Position

Over 1 million net acres of land

Conventional and tight gas

200 locations planned in 2005

Production 358 MMcfed

Deep Basin / Foothills

820,000 net acres of land

570 square miles of 3D seismic to

identify drilling opportunities

Production 128 MMcfed

Kaybob

728,000 net acres of land

150 gross operated wells planned

in 2005

Production 210 MMcfed

O’Chiese

Southern Plains

1,300,000 net acres of land

Includes the Viking-Kinsella

property

Production 182 MMcfed

Northern Plains

738,000 net acres of land

Significant trend extension

opportunities for future growth.

Production 97 MMcfed

11

Portfolio Impact

12

Compelling Transaction for

BR Shareholders

Expanded position in global energy

Attractive premium / cash component

Ongoing value by joining a major global

integrated energy company

Creates better long-term growth options

Leveraging technical strengths to broader

portfolio

13

Strengthens N.A. Gas Position

COP

COP and BR

BR

14

Note: Production figures are based on YE 2004 Filings

COP volumes do not include fuel gas production.

CVX pro forma for UCL

North American Gas Production

15

Major U.S. Gas Supplier

Delivering gas to the U.S. from various supply sources

#1 in N. A. gas production

50% owner in DEFS

A leading gas marketer

Developing multiple LNG projects and

re-gasification capabilities

Major existing positions in both Alaskan

North Slope gas and Mackenzie Delta

16

Enhanced Business Mix

COP

Pro Forma w/ BR

Non-OECD

38%

OECD

62%

Non-OECD

31%

OECD

69%

OECD Mix

Based on Reserves

Note: Capital Employed is estimated YE 2005, with LUK (at 10% equity) allocated 70% E&P, 30% R&M.

Reserves are YE 2004.

Gas

35%

Oil

65%

Oil

59%

Gas

41%

Oil / Gas Mix

Based on Reserves

Capital Employed

By Business Segment

Midstream &

Chemicals

R&M

31%

E&P

61%

Other

3%

5%

E&P

74%

R&M

21%

Midstream &

Chemicals

3%

Other

2%

17

Reserves are YE 2004 actual, excludes Syncrude for COP.

CVX pro forma for UCL.

COP includes the additional 4.8% LUK equity purchased through Q3 2005.

Production is 2004 average except for COP and BR (both 2005 (E)).

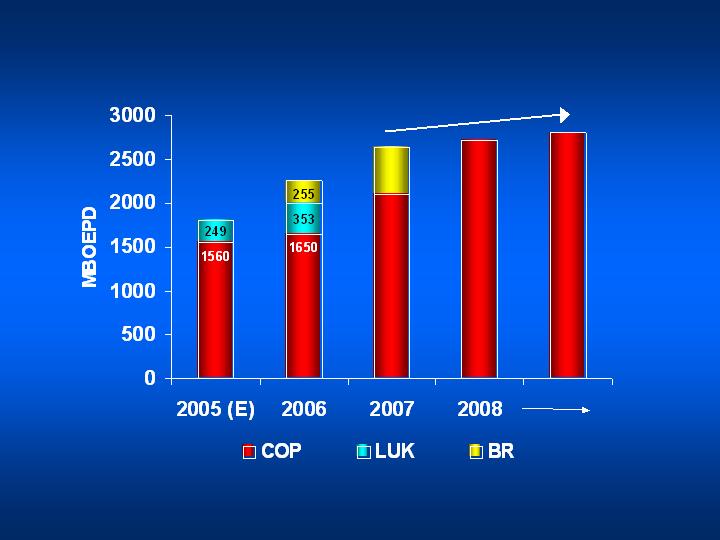

Pro Forma Operating Impact

18

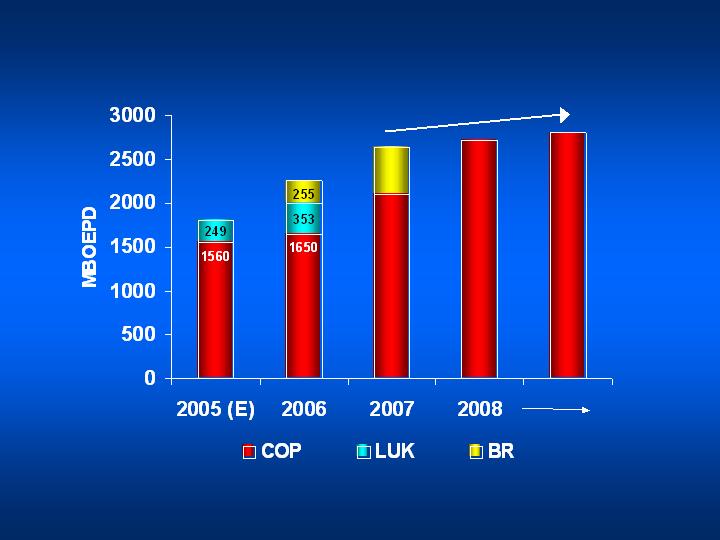

Pro Forma Production Profile

CAGR ~3%

Note: Production is company estimates.

2006 includes 6 months of BR production.

Lukoil average equity is assumed at 13% in 2005, 18% in 2006, & 20% thereafter

COP includes equity affiliates and Syncrude.

19

Synergy Estimate

$375 MM Pre-Tax

Corporate G&A redundancies

Consolidation of regional E&P offices

Exploration portfolio optimization

Operating expense reductions

Revenue enhancements

20

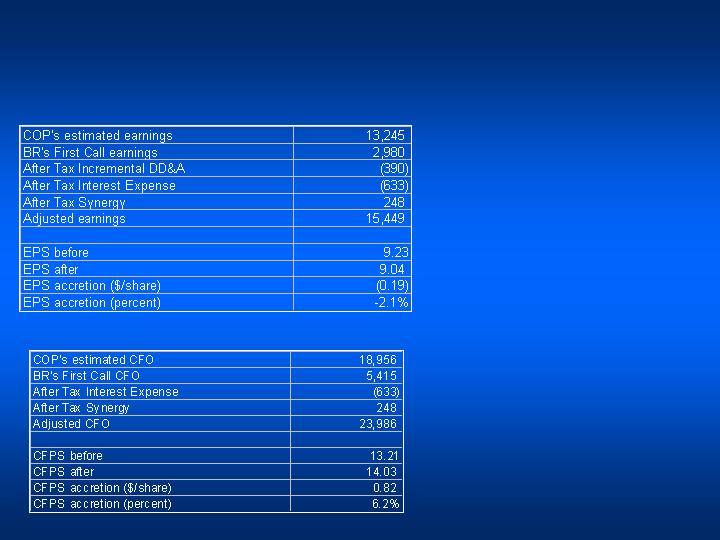

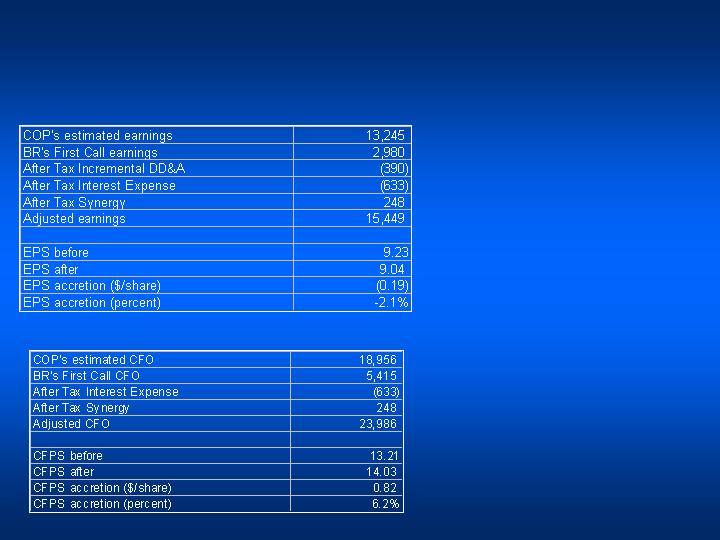

Financial Summary

Accretive to CFPS

Slightly dilutive to 2006 EPS (First Call estimates)

Slightly accretive to 2006 EPS (Strip Pricing)

Dilutive to GAAP ROCE / Accretive to Adjusted ROCE

Lowers E&P unit production cost

Excess cash flow quickly reduces incremental debt

21

CFPS

Accretion / Dilution

2.2%

3.5%

Strip1

-3.9%

-2.1%

First Call

2007

2006

EPS

8.6%

10.6%

Strip1

4.1%

6.2%

First Call

2007

2006

1 FC consensus earnings adjusted for strip pricing

22

Discretionary Cash Flow

First Call Prices

(15.4)

(17.2)

Capital Expenditures & other

22.8

23.1

Cash Flow from Operations

7.4

5.9

Net Cash Flow

13.6

14.9

Net Income

2007

2006

$ Billion

Note: Capital expenditures and other includes LUK, share purchases, and loans to affiliates.

Capital expenditures are from company sources

23

Debt Ratio Impact

First Call Prices

Equity $B

Balance sheet

debt $B

Debt to capital

ratio %

Based on 2006 & 2007 First Call Prices

Equity includes minority interest.

All excess cash flow applied to pay down debt.

Assumes initial net debt @ closing of $29B

24

Discretionary Cash Flow

NYMEX Strip Prices

(15.4)

(17.2)

Capital Expenditures & other

28.6

28.8

Cash Flow from Operations

13.2

11.6

Net Cash Flow

19.2

20.2

Net Income

2007

2006

$ Billion

Note: Capital expenditures and other includes LUK, share purchases, and loans to affiliates.

Capital expenditures are from company sources

25

Debt Ratio Impact

NYMEX Strip Prices

Equity $B

Balance sheet

debt $B

Debt to capital

ratio %

Based on 2006 & 2007 NYMEX Strip prices

Equity includes minority interest.

All excess cash flow applied to pay down debt.

Assumes initial net debt @ closing of $29B

26

2006 ROCE

GAAP / Adjusted

1 FC consensus earnings adjusted for strip pricing

Strip1

First Call Estimates

COP

Pro Forma

27

Compelling Strategic Opportunity

High quality, long-lived, low-risk reserves

Enhances production growth and lowers unit

operating cost

Secures access to significant unconventional

resource plays

Rebalances portfolio towards E&P with significant

OECD / North American gas

Long-term financial strength enhanced

Improved competitiveness Shareholder value creation

28

Appendix

29

$92 / BR share

2006 to 2007 First Call estimates

Number of fully diluted shares, MM

COP – 1406

BR – 381.1

First Call Prices

2006 – Oil – $57.50 ; Gas - $8.52 ; Crack - $8.50

2007 – Oil - $53.32 ; Gas – $7.68; Crack - $8.25

Strip Prices

2006 – Oil – $61.78 ; Gas - $11.83 ; Crack - $11.29

2007 – Oil - $62.68 ; Gas – $10.66; Crack - $9.86

Proforma includes:

Incremental DD&A from purchase accounting write-up

Goodwill of $19B (True - $11.2B; Deferred tax - $8.1 )

Incremental debt

Synergies of $375 MM pre-tax

COP’s Wilhelmshaven refinery acquisition

Financial Analysis - Premises

30

Accretion/Dilution Reconciliation

First Call Pricing

EPS

CFPS

COP FD shares 11/30/05 – 1435 million

Additional shares issued – 274.8 million

Stepped-up PP&E - $26.7 billion

Resultant Goodwill:

$11.1 billion True

$8.2 billion Deferred Taxes

Goodwill based on early April, 2005

JS Herolds Appraisal Report.

Will ultimately be based on third party

appraisal.

Cash portion to be funded with cash on

hand and incremental debt.

31

Accretion/Dilution Reconciliation

Strip Pricing Sensitivity

December 9 Prices – Close of Markets

COP and BR Published Sensitivities

32

[LOGO ConocoPhilips] [LOGO - BURLINGTON RESOURCES]

CONOCOPHILLIPS OVERVIEW

ConocoPhillips is an international, integrated energy company. It is the

third-largest integrated energy company in the United States, based on

market capitalization, and oil and gas production and reserves; and one of

the largest refiners in the United States. Worldwide, of

nongovernment-controlled companies, ConocoPhillips has the eighth-largest

total of proved reserves and is the fifth-largest refiner. Following the

acquisition of Burlington Resources, ConocoPhillips will become a leading

natural gas producer in North America and will have:

o Pro-forma reserves of 10.5 BBOE as of December 31, 2004,

excluding 0.3 BBOE associated with ConocoPhillips' Syncrude

operations, of which 52 percent is in North America; and

o Pro-forma 2005 production of 2.3 MMBOE/d, including LUKOIL and

Syncrude, of which 50 percent is in North America.

CONOCOPHILLIPS FACTS & FIGURES

Net Income $8.129 billion (FY2004)

Stock NYSE: COP

Headquarters Houston, Texas

Employees 35,800, as of December 31, 2004

Activities Petroleum exploration and production

Petroleum refining, marketing, supply and transportation

Natural gas gathering, processing and marketing, including

a 50% interest in Duke Energy Field Services LLC

Chemicals and plastics production and distribution through

a 50% interest in Chevron Phillips Chemical Company LLC

Investments in emerging businesses, including technology

solutions, gas-to-liquids, power generation and emerging

technologies

BURLINGTON RESOURCES OVERVIEW

Burlington Resources is one of the world's largest independent oil and

natural gas exploration and production companies, and holds one of the

industry's leading positions in North American natural gas reserves and

production. At year-end 2004, Burlington Resources had a reserves base of

12 trillion cubic feet equivalent of natural gas, concentrated in North

America. These reserves supply nearly 85 percent of current production,

with a key focus being the Rocky Mountain gas fairway of the U.S. and

Canada.

BURLINGTON RESOURCES FACTS & FIGURES

Net Income $1.527 billion (FY2004)

Stock NYSE: BR

Headquarters Houston, Texas

Employees 2,300, as of December 31, 2004

Activities Exploration, development, production and sale of natural gas

and crude oil, primarily in major producing basins in the

U.S., as well as in Canada and selected other international

areas.