- JCI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRER14A Filing

Johnson Controls International (JCI) PRER14APreliminary revised proxy

Filed: 23 Jan 04, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

ý | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

o | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

TYCO INTERNATIONAL LTD. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

| Tyco International Ltd. Second Floor 90 Pitts Bay Road Pembroke HM 08, Bermuda | |||

Tele: 441 292-8674 Fax: 441 295-9647 | ||||

January , 2004

Dear Shareholder,

You are cordially invited to attend the 2004 Annual General Meeting of Shareholders of Tyco International Ltd., which will be held on March 25, 2004 at 9:00 a.m., local time, at United States Surgical, North Haven Facility, 195 McDermott Road, North Haven, Connecticut 06473.

Details of the business to be presented at the meeting can be found in the accompanying Notice of Annual General Meeting and Proxy Statement. We hope you are planning to attend the meeting. Your vote is important. Whether or not you are able to attend, it is important that your common shares be represented at the meeting. Accordingly, we ask that you please sign, date and return the enclosed proxy card at your earliest convenience.

On behalf of the Board of Directors and the management of Tyco, I extend our appreciation for your continued support.

Yours sincerely,

/s/ Edward D. Breen

Edward D. Breen

Chairman and Chief Executive Officer

Tyco International Ltd.

Second Floor, 90 Pitts Bay Road, Pembroke HM 08, Bermuda

TYCO INTERNATIONAL LTD.

NOTICE OF 2004 ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD MARCH 25, 2004

NOTICE IS HEREBY GIVEN that the 2004 Annual General Meeting of Shareholders of Tyco International Ltd. will be held on March 25, 2004 at 9:00 a.m., local time, at United States Surgical, North Haven Facility, 195 McDermott Road, North Haven, Connecticut 06473, for the following purposes:

During the meeting, management also will present Tyco's audited consolidated financial statements for the fiscal year ended September 30, 2003.

This Notice of Annual General Meeting and Proxy Statement and the enclosed proxy card were first sent on or about January , 2004 to each holder of record of Tyco common shares at the close of business on January 14, 2004. Each holder of record of Tyco common shares on the date of the meeting is entitled to attend and vote at the Annual General Meeting and any adjournment or postponement thereof.Whether or not you plan to attend the meeting, please sign, date and return the enclosed proxy card to ensure that your common shares are represented at the meeting. Tyco shareholders of record who attend the meeting may vote their common shares personally, even though they have sent in proxies.

By Order of the Board of Directors,

/s/ William B. Lytton

William B. Lytton

Executive Vice President and General Counsel

January , 2004

PLEASE PROMPTLY SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD.THE PROXY IS REVOCABLE AND IT WILL NOT BE USED IF YOU: GIVE WRITTEN NOTICE OF REVOCATION TO THE SECRETARY AT TYCO INTERNATIONAL LTD., SECOND FLOOR, 90 PITTS BAY ROAD, PEMBROKE HM 08, BERMUDA PRIOR TO THE VOTE TO BE TAKEN AT THE MEETING; LODGE A LATER-DATED PROXY; OR ATTEND AND VOTE AT THE MEETING.

| | PAGE | ||

|---|---|---|---|

| INFORMATION ABOUT THIS PROXY STATEMENT AND THE ANNUAL GENERAL MEETING | 1 | ||

| Questions and Answers About Voting Your Common Shares | 1 | ||

| Returning Your Proxy Card | 5 | ||

| CORPORATE GOVERNANCE | 6 | ||

| Corporate Governance Principles | 6 | ||

| Independence of Nominees for Director | 7 | ||

| Communications with the Board of Directors | 8 | ||

| Compensation of Non-Employee Directors | 8 | ||

| PROPOSAL NUMBER ONE—ELECTION OF DIRECTORS | 11 | ||

| Current Directors Nominated for Re-election | 11 | ||

| New Nominee for Director | 14 | ||

| Committees of the Board of Directors | 14 | ||

| Nomination of Directors | 15 | ||

| Executive Officers | 17 | ||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 18 | ||

| EXECUTIVE OFFICER COMPENSATION | 21 | ||

| Summary Compensation Table | 21 | ||

| Option Grants in Last Fiscal Year | 23 | ||

| Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values | 24 | ||

| Retirement Plans | 24 | ||

| Employment, Retention and Severance Agreements | 26 | ||

| Equity Compensation Plan Information | 30 | ||

| BOARD COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION | 31 | ||

| Committee Membership and Duties | 31 | ||

| Compensation for Fiscal Year 2003 | 32 | ||

| Chief Executive Officer Compensation | 33 | ||

| Certain Other Executive Officers | 34 | ||

| Applicable Tax Code Provision | 34 | ||

| Summary | 34 | ||

| Compensation Committee Interlocks and Insider Participation | 34 | ||

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 35 | ||

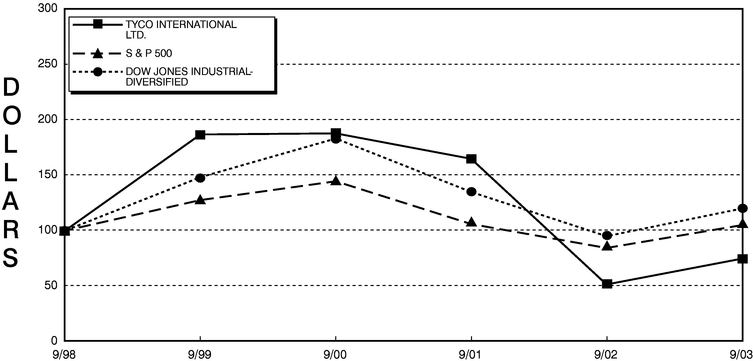

| SHAREHOLDER RETURN PERFORMANCE PRESENTATION | 37 | ||

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 37 | ||

| AUDIT COMMITTEE REPORT | 38 | ||

| PROPOSAL NUMBER TWO—APPOINTMENT OF INDEPENDENT AUDITORS AND AUTHORIZATION OF THE AUDIT COMMITTEE TO SET THEIR REMUNERATION | 38 | ||

| Audit and Non-Audit Fees | 39 | ||

| Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors | 40 | ||

| PROPOSAL NUMBER THREE—ADOPTION OF AMENDED AND RESTATED BYE-LAWS | 40 | ||

| PROPOSAL NUMBER FOUR—APPROVAL OF THE TYCO 2004 STOCK AND INCENTIVE PLAN | 51 | ||

| Description of the 2004 Stock and Incentive Plan | 52 | ||

| Summary of Federal Income Tax Consequences of Awards | 60 | ||

| New Plan Benefits | 61 | ||

i

| PROPOSAL NUMBER FIVE—SHAREHOLDER PROPOSAL ON ENVIRONMENTAL REPORTING | 61 | ||

| Shareholder Proposal | 61 | ||

| Recommendation of the Board of Directors on Proposal Number Five | 63 | ||

| PROPOSAL NUMBER SIX—SHAREHOLDER PROPOSAL TO CHANGE TYCO'S JURISDICTION OF INCORPORATION FROM BERMUDA TO A U.S. STATE | 63 | ||

| Shareholder Proposal | 63 | ||

| Recommendation of the Board of Directors on Proposal Number Six | 64 | ||

| PROPOSAL NUMBER SEVEN—SHAREHOLDER PROPOSAL ON COMMON SENSE EXECUTIVE COMPENSATION | 67 | ||

| Shareholder Proposal | 67 | ||

| Recommendation of the Board of Directors on Proposal Number Seven | 68 | ||

| OTHER MATTERS | 69 | ||

| Costs of Solicitation | 69 | ||

| Presentation of Financial Statements | 69 | ||

| Registered and Principal Executive Offices | 69 | ||

| Shareholder Proposals for the 2005 Annual General Meeting | 70 | ||

| United States Securities and Exchange Commission Reports | 70 | ||

| General | 70 | ||

| APPENDIX A: | Amended and Restated Bye-Laws of Tyco International Ltd. | A-1 | ||

| APPENDIX B: | Tyco International Ltd. 2004 Stock and Incentive Plan | B-1 |

ii

INFORMATION ABOUT THIS PROXY STATEMENT AND

THE ANNUAL GENERAL MEETING

Questions and Answers About Voting Your Common Shares

| Why did I receive this Proxy Statement? | Tyco has sent this Notice of Annual General Meeting and Proxy Statement, together with the enclosed proxy card or voting instruction card, because Tyco's Board of Directors is soliciting your proxy to vote at the Annual General Meeting on March 25, 2004. This Proxy Statement contains information about the items being voted on at the Annual General Meeting and important information about Tyco. Tyco's 2003 Annual Report to Shareholders, which includes the audited consolidated financial statements of Tyco for the fiscal year ended September 30, 2003, is enclosed with or has been sent in advance of these materials. | |||

Tyco has sent these materials to each person who is registered as a holder of its common shares in its register of shareholders (such owners are often referred to as "holders of record") as of the close of business on January 14, 2004. Tyco also is sending these materials to any person who becomes a holder of record of Tyco common shares through March 24, 2004. Any Tyco shareholder who does not receive a copy of this Notice of Annual General Meeting and Proxy Statement, together with the enclosed proxy card or voting instruction card, may obtain a copy at the Annual General Meeting or by contacting Tyco at (441) 292-8674. | ||||

Tyco has requested that banks, brokerage firms and other nominees who hold Tyco common shares on behalf of the owners of the common shares (such owners are often referred to as "beneficial shareholders" or "street name holders") as of the close of business on January 14, 2004 forward these materials, together with a proxy card or voting instruction card, to those beneficial shareholders. Tyco has agreed to pay the reasonable expenses of the banks, brokerage firms and other nominees for forwarding these materials. | ||||

Finally, Tyco has provided for these materials to be sent to persons who have interests in Tyco common shares through participation in the company share funds of the Tyco retirement savings plans and employee share purchase plans. Such persons are not eligible to vote directly at the Annual General Meeting. They may, however, instruct the trustees of such plans how to vote the common shares represented by their interests. The enclosed proxy card will also serve as voting instructions for the trustees of the plans. | ||||

Who is entitled to vote? | Each holder of record of Tyco common shares on the date of the Annual General Meeting is entitled to attend and vote at the Annual General Meeting. A poll will be taken on each proposal to be put to the Annual General Meeting. | |||

1

How many votes do I have? | Every holder of a common share will be entitled to one vote per share for each director to be elected at the Annual General Meeting and to one vote per share on each other matter presented at the Annual General Meeting. On January 14, 2004, there were 2,019,701,106 common shares outstanding and entitled to vote at the Annual General Meeting. | |||

What proposals are being presented at the Annual General Meeting? | Tyco intends to present proposals numbered one through four for shareholder consideration and voting at the Annual General Meeting. These proposals are for: | |||

• | Election of the Board of Directors; | |||

• | Appointment of Deloitte & Touche LLP as the independent auditors and authorization of the Audit Committee of the Board to set the auditor's remuneration; | |||

• | Adoption of Amended and Restated Bye-Laws; and | |||

• | Approval of the Tyco 2004 Stock and Incentive Plan. | |||

In addition, shareholders of Tyco have informed us that they intend to present proposals numbered five through seven at the Annual General Meeting, in which case those proposals will also be voted upon if properly presented at the Annual General Meeting. Other than matters incident to the conduct of the Annual General Meeting, Tyco does not know of any business or proposals to be considered at the Annual General Meeting other than those set forth in this Proxy Statement. If any other business is proposed and properly presented at the Annual General Meeting, the proxies received from our shareholders give the proxy holders the authority to vote on the matter according to their best judgment. | ||||

How do I attend the Annual General Meeting? | All shareholders are invited to attend the Annual General Meeting. For admission to the Annual General Meeting, shareholders of record should bring the admission ticket attached to the enclosed proxy card to the Registered Shareholders check-in area, where their ownership will be verified. Those who have beneficial ownership of common shares held by a bank, brokerage firm or other nominee should come to the Beneficial Owners check-in area.To be admitted, beneficial owners must bring account statements or letters from their banks or brokers showing that they own Tyco common shares. Registration will begin at 8:00 a.m., and the Annual General Meeting will begin at 9:00 a.m. | |||

How do I vote? | You can vote in the following ways: | |||

• | By Mail: If you are a holder of record, you can vote by marking, dating and signing your proxy card and returning it by mail in the enclosed postage-paid envelope. If you | |||

| hold your common shares in street name, you can vote by following the instructions on your voting instruction card. |

2

• | At the Annual General Meeting: If you are planning to attend the Annual General Meeting and wish to vote your common shares in person, we will give you a ballot at the meeting. Shareholders who own their common shares in street name are not able to vote at the Annual General Meeting unless they have a proxy, executed in their favor, from the holder of record of their shares. | |||

Even if you plan to be present at the Annual General Meeting, we encourage you to complete and mail the enclosed card to vote your common shares by proxy. | ||||

What if I return my proxy or voting instruction card but do not mark it to show how I am voting? | Your common shares will be voted according to the instructions you have indicated on your proxy or voting instruction card. If you sign and return your proxy card or voting instruction card but do not indicate instructions for voting, your common shares will be voted "FOR" the election of all nominees to the Board of Directors named on the proxy card, "FOR" proposals two, three, four and five, and "AGAINST" proposals six and seven and, with respect to any other matter which may properly come before the Annual General Meeting, at the discretion of the proxy holders. | |||

May I change or revoke my vote after I return my proxy or voting instruction card? | You may change your vote at any time before it is exercised in one of three ways: | |||

• | Notify our Secretary in writing before the Annual General Meeting that you are revoking your proxy; | |||

• | Submit another proxy card (or voting instruction card if you hold your common shares in street name) with a later date; or | |||

• | If you are a holder of record, or a beneficial holder with a proxy from the holder of record, vote in person at the Annual General Meeting. | |||

What does it mean if I receive more than one proxy or voting instruction card? | It means you have multiple accounts at the transfer agent and/or with banks and stock brokers. Please vote all of your common shares. Beneficial shareholders sharing an address who are receiving multiple copies of proxy materials and Annual Reports will need to contact their broker, bank or other nominee to request that only a single copy of each document be mailed to all shareholders at the shared address in the future. In addition, if you are the beneficial owner, but not the record holder, of Tyco's common shares, your broker, bank or other nominee may deliver only one copy of the Proxy Statement and Annual Report to multiple shareholders who share an address unless that nominee has received contrary instructions from one or more of the shareholders. Tyco will deliver promptly, upon written or oral request, a separate | |||

3

| copy of the Proxy Statement and Annual Report to a shareholder at a shared address to which a single copy of the documents was delivered. Shareholders who wish to receive a separate copy of the Proxy Statement and Annual Report, now or in the future, should submit their request to Tyco by telephone at (441) 292-8674 or by submitting a written request to Tyco Shareholder Services, Tyco International Ltd., Second Floor, 90 Pitts Bay Road, Pembroke HM 08, Bermuda. | ||||

What constitutes a quorum? | Two holders of common shares present in person or by proxy form a quorum for the conduct of business. | |||

What vote is required in order to approve each proposal? | The affirmative vote of a majority of the common shares represented and voting at the Annual General Meeting is required for the election of directors, the appointment of Tyco's independent auditors and authorization for the Audit Committee of the Board of Directors to set the auditors' remuneration, the adoption of Tyco's Amended and Restated Bye-Laws, the approval of the Tyco 2004 Stock and Incentive Plan and the approval of any of the shareholder proposals, if properly presented at the Annual General Meeting. Pursuant to Bermuda law, (i) common shares represented at the Annual General Meeting whose votes are withheld on any matter, (ii) common shares which are represented by "broker non-votes" (i.e., common shares held by brokers which are represented at the Annual General Meeting but with respect to which the broker is not empowered to vote on a particular proposal) and (iii) common shares which abstain from voting on any matter are not included in the determination of the common shares voting on such matter, but are counted for quorum purposes. | |||

How will voting on any other business be conducted? | Other than matters incident to the conduct of the Annual General Meeting, we do not know of any business or proposals to be considered at the Annual General Meeting other than those set forth in this Proxy Statement. If any other business is proposed and properly presented at the Annual General Meeting, the proxies received from our shareholders give the proxy holders the authority to vote on the matter according to their best judgment. | |||

Who will count the votes? | Mellon Investor Services will act as the inspector of election and will tabulate the votes. | |||

4

Returning Your Proxy Card

Tyco shareholders should complete and return the proxy card as soon as possible. To be valid, the proxy card must be completed in accordance with the instructions on it and received at any one of the addresses set forth below by the times (being local times) and dates specified:

In Bermuda: | In the United States: | |

by 5:00 p.m. on March 24, 2004 by hand or mail at: | by 8:00 a.m. on March 25, 2004 by mail at: | |

Tyco International Ltd. Second Floor, 90 Pitts Bay Road Pembroke HM 08, Bermuda | Tyco International Ltd. c/o Mellon Investor Services P.O. Box 3547 South Hackensack, NJ 07606-9247 United States of America | |

In the United Kingdom: | In Australia: | |

by 5:00 p.m. on March 24, 2004 by hand or mail at: | by 5:00 p.m. on March 24, 2004 by hand or mail at: | |

Tyco International Ltd. c/o Tyco Holdings (UK) Limited 5th Floor 30-34 Moorgate London EC2R 6PJ United Kingdom | Tyco International Ltd. c/o Tyco International Pty. Limited Level 6 12 Help Street Chatswood NSW 2067 Australia |

If your common shares are held in street name, you should return your proxy card or voting instruction card in accordance with the instructions on that card or as provided by the bank, brokerage firm or other nominee who holds Tyco common shares on your behalf.

5

Corporate Governance Principles

The Board of Directors has adopted governance principles to provide guidelines for the Company and the Board to ensure effective corporate governance. The governance principles are summarized below, and the full text of the governance principles is posted on the Company's website at www.tyco.com.

Mission of the Board of Directors

The business of Tyco is managed under the direction of the Board. The mission of the Board is to promote the long-term health and growth of Tyco in the interest of its shareholders and to set an ethical "tone at the top."

Board Responsibilities

The Board's responsibilities include:

Board Organization

The Board consists of a substantial majority of independent directors who meet a stringent definition of independence. The independent directors of the Board, acting in executive session, elect a Lead Director to serve as chair of the Nominating and Governance Committee. In fiscal year 2003, the independent directors elected John A. Krol as the Lead Director. The Lead Director, among other things, sets a Board agenda with Board and management input, facilitates communications among directors, works with the Chief Executive Officer to ensure appropriate information flow to the Board and chairs an executive session of the independent directors at each formal Board meeting. The Board also maintains two other standing committees—Audit and Compensation. All three committees are entirely composed of independent directors. Assignments to, and chairs of, the committees are recommended by the Nominating and Governance Committee and selected by the Board. All committees report on their activities to the Board.

Board Operation

The Board normally has six regularly scheduled meetings per year and committee meetings are normally held in conjunction with Board meetings. The Board and committee chairs are responsible for conducting meetings and informal consultations in a fashion that encourages informed, meaningful and

6

probing deliberations. Directors receive the agenda and materials in advance of meetings and may ask for additional information from, or meet with, senior managers at any time. Strategic planning and succession planning sessions are held annually at regular Board meetings.

Board Advisors

The Board and its committees (consistent with their respective charters) may retain their own advisors as they determine necessary to carry out their responsibilities.

Board Evaluation

The Nominating and Governance Committee coordinates an annual evaluation process by the directors of the Board's performance and procedures, including evaluation of individual directors. The three standing committees each conduct an annual evaluation of their performance and procedures, including the adequacy of their charters.

Board Compensation and Share Ownership

Non-employee director compensation consists of cash and an award of stock units. The stock unit component reflects the Board's belief that director compensation should be tied to the performance of Tyco's common shares. The Compensation Committee, in collaboration with the Nominating and Governance Committee, periodically reviews the directors' compensation and recommends changes as appropriate. Directors who are also Tyco employees receive no additional compensation for serving as a director. For more information about director compensation, see "Compensation of Non-Employee Directors" below.

Independence of Nominees for Director

The Board has determined that all of the nominees standing for election at the 2004 Annual General Meeting, other than the Chief Executive Officer, are independent of the Company in that such nominees have no material relationship with the Company either directly or as a partner, shareholder or affiliate of an organization that has a relationship with the Company. The board has made this determination based on the following:

7

Communications with the Board of Directors

The Board has established a process for shareholders to communicate with members of the Board, including the Lead Director. If you have any concern, question or complaint regarding our compliance with any policy or law, or would otherwise like to contact the Board, you can reach the Tyco Board of Directors directly via email at directors@tyco.com. A direct link to this email address can be found on our website at www.tyco.com under the headings "Our Commitment—Governance—Contact Tyco Board." Inquiries can be submitted anonymously and confidentially.

All inquiries are received and reviewed by the Corporate Ombudsman, who prepares a report for the Board summarizing all items received. The Corporate Ombudsman then directs inquiries most properly addressed by other departments, such as customer service or accounts payable, to those departments and follows up with the assigned case owner to ensure that the inquiries are responded to in a timely manner. Any inquiry that presents a matter relevant to accounting, audit or internal controls, or similar issues, is presented in greater detail in the report to the Board, along with the status of any actions taken to address the issue. The Board, or, in the case of accounting, audit or internal controls matters, the Audit Committee, then has the opportunity to discuss these inquiries, internally and with the Corporate Ombudsman, and directs any additional action it determines is necessary or appropriate. All matters remain on the Board report until they have been resolved.

In 2003, the Board took action as a result of two shareholder proposals that it received. First, in response to a shareholder proposal urging the reincorporation of Tyco from Bermuda to Delaware, the Board formed a Special Committee Regarding Bermuda to evaluate the benefits, costs, advantages and disadvantages of remaining a Bermuda company or reincorporating in a different jurisdiction. See "Committees of the Board of Directors—Special Committee Regarding Bermuda" and "Proposal Number Six—Recommendation of the Board of Directors on Proposal Number Six" for more information about the Special Committee and its evaluation of the reincorporation issue.

Second, in response to a shareholder proposal urging the Board to seek shareholder approval for future severance agreements with senior executives that provide benefits in an amount exceeding 2.99 times the sum of the executive's base salary plus bonus, the Board adopted limits on future severance and change-in-control agreements for senior executives. The principal provisions of these policies are as follows:

Compensation of Non-Employee Directors

Fiscal Year 2003 Compensation

The fiscal year 2003 compensation package for non-employee directors consisted of an annual retainer of $80,000 and 20,000 stock options that vest one year after their respective grant date, as noted below. In addition, as approved by the Board of Directors in July 2003, retroactive to March 6, 2003, the date of the 2003 Annual General Meeting, any member of a special committee of the Board received meeting fees in an amount up to $1,500 for each special committee meeting of such committee that he attended. As preparation for their election to the Board, three of the directors who were elected at the March 2003 Annual General Meeting attended all or a portion of the Board meeting held on January 15, 2003, and received a meeting fee as follows: Admiral Blair, $2,500; Dr. O'Neill, $2,500; and Ms. Wijnberg, $1,250. A director who is also an employee receives no additional remuneration for services as a director.

8

The amount of cash retainer and special meeting fees each current and former Board member received during the 2003 fiscal year is summarized in the table below. The cash retainer amount reflects the pro-rated amount of the $80,000 annual retainer received by each Board member, based on the date each became a member of or left the Board. In addition, the table below lists the dates each current Board member received option grants during fiscal year 2003 and the per share exercise price of each such option. The number of options granted (20,000) was not pro-rated. The grant date varied depending on the date on which the Board member first joined the Board as follows:

Directors who did not stand for re-election did not receive the stock option grant. In addition, two former directors, Peter Slusser and John Fort, III, agreed to serve as advisors to the Board for a period of one year and receive an annual retainer of $60,000 for these services. The amounts shown under the Advisor Retainer column in the table below reflect the pro-rated amount of such $60,000 retainer that was paid during the 2003 fiscal year.

| | Fiscal Year 2003 Board Fees | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | Option Grant | ||||||||||

| | | Special Committee Meeting Fees | Advisor Retainer | |||||||||||

| | Retainer | Date | Price | |||||||||||

| Current | ||||||||||||||

| Dennis C. Blair | $ | 45,591 | $ | 7,500 | 3/6/2003 | $ | 14.39 | |||||||

| George W. Buckley | $ | 65,806 | 1/15/2003 | $ | 17.80 | |||||||||

| Bruce S. Gordon | $ | 57,419 | $ | 9,000 | 1/15/2003 | $ | 17.80 | |||||||

| John A. Krol | $ | 80,000 | $ | 18,000 | 10/2/2002 | $ | 13.45 | |||||||

| H. Carl McCall | $ | 45,591 | $ | 18,000 | 3/6/2003 | $ | 14.39 | |||||||

| Mackey J. McDonald | $ | 70,000 | 1/15/2003 | $ | 17.80 | |||||||||

| Brendan R. O'Neill(1) | $ | 45,591 | 3/6/2003 | $ | 14.39 | |||||||||

| Sandra S. Wijnberg | $ | 45,591 | 3/6/2003 | $ | 14.39 | |||||||||

| Jerome B. York | $ | 71,111 | $ | 5,250 | 1/15/2003 | $ | 17.80 | |||||||

Former | ||||||||||||||

| Lord Michael Ashcroft | $ | 9,111 | ||||||||||||

| Joshua M. Berman | $ | 14,409 | ||||||||||||

| Richard S. Bodman | $ | 34,624 | ||||||||||||

| John F. Fort, III | $ | 34,624 | $ | 34,194 | ||||||||||

| Steven W. Foss | $ | 34,624 | ||||||||||||

| Wendy E. Lane | $ | 34,624 | ||||||||||||

| James S. Pasman | $ | 10,000 | ||||||||||||

| W. Peter Slusser | $ | 34,624 | $ | 34,194 | ||||||||||

| Joseph F. Welch | $ | 22,796 | ||||||||||||

9

All options are granted under the Tyco International Ltd. Long Term Incentive Plan (the "LTIP") and, except in the case of replacement options, as described below, have a term of ten years from date of grant. Options vest on the first anniversary of the grant date, assuming the director remains an active member of the Board on such date. Each option provides for an automatic grant of a replacement option to the extent the director uses Tyco common shares that he/she has held for at least six months toward payment of his/her option exercise price. Replacement options are 100% vested at grant, have an exercise price equal to the fair market value on the date of replacement as determined by the share sale price, and have a term ending on the expiration date of the options they replace. Vested options may be exercised for their full remaining term after the director terminates from the Board for any reason except Cause, as defined in the option agreement.

During the 2003 fiscal year, the Board approved a new deferred compensation plan for non-employee directors, effective July 1, 2003, whereby a director may make an irrevocable election to defer some or all of his or her cash remuneration for that year. Under the deferred compensation plan, an unfunded deferred compensation bookkeeping account is established for each director who elects to defer cash remuneration otherwise payable during the year. The director may choose to have his/her deferred compensation account credited with investment income based on a deemed investment in the Interest Income Measurement Fund or a U.S. Equity Index Commingled Measurement Fund. Earnings and/or losses on the Measurement Funds mirror the investment results of funds available under the Company's 401(k) savings plans. Each director may elect to receive a distribution of the amounts credited to his or her deferred compensation account in a lump sum cash payment either at termination from the Board or at the end of five years or any other period in five-year increments after it is deferred, whether or not the director is still a member of the Board at the end of such period. As of the end of the 2003 fiscal year, none of the directors had enrolled in the plan.

In July 2003, the Board approved stock ownership guidelines that require directors to own $240,000 worth of Tyco common shares within three years. The guidelines also provide that the value of vested deferred stock units, described below under Fiscal Year 2004 Compensation, counts toward the ownership requirement.

Fiscal Year 2004 Compensation

For the Board of Directors, the annual cash retainer for fiscal year 2004 remains $80,000. The Lead Director and Chair of the Audit Committee receive an additional annual retainer of $20,000 and the Chairs of the Compensation Committee and the Nominating and Governance Committee each receive an additional annual retainer of $15,000, in recognition of the responsibilities required in these roles. All fees are payable quarterly and pro-rated if the director begins or ends Board service during the quarter. Directors who are members of a special committee of the Board will also receive a fee of up to $1,500 for each meeting of the special committee that they attend.

In addition to the cash fees, on October 1, 2003, each director received a grant of deferred stock units ("DSUs") under the LTIP with a value of $120,000, based on the average fair market value of a common share for the 60-day period ending on September 30, 2003. That value per share was $20.125; therefore, each Board member was credited with 5,963 DSUs. Under the terms of the grant agreements, each DSU is vested when granted and will be distributed in the form of shares within 30 days following termination of service as a member of the Board or upon a change in control. Dividend equivalents are credited to each member's DSU account at the same time and in the same amount as dividends that are paid to shareholders on common shares. Dividend equivalents are used to credit additional DSUs to the account based on the fair market value of shares on the dividend payment date. If the 2004 Stock and Incentive Plan is approved by shareholders, the Compensation Committee will have the discretion to grant stock options, stock appreciation rights and other stock-based awards to non-employee directors, subject to certain limitations. For a description of the proposed plan, see page 51. The Board, based upon the recommendation of the Compensation Committee and the Nominating and Governance Committee, has no current intent to make any changes to director compensation, including equity compensation, in fiscal year 2004.

10

PROPOSAL NUMBER ONE—ELECTION OF DIRECTORS

Upon the recommendation of the Nominating and Governance Committee, the Board has nominated for election at the 2004 Annual General Meeting a slate of 11 nominees, consisting of ten individuals who are currently serving on the Board and one new nominee. The nominees who are currently serving on the Board are Ms. Wijnberg, Admiral Blair, Messrs. Breen, Buckley, Gordon, Krol, McCall, McDonald and York and Dr. O'Neill, and the new nominee is Mr. Brian Duperreault. Biographical information regarding each of the 11 nominees is set forth below.

The election of directors will take place at the Annual General Meeting. Election of each director requires the affirmative vote of a majority of the votes cast by the holders of common shares represented at the Annual General Meeting in person or by proxy. Shareholders are entitled to one vote per share for each of the 11 directors to be elected. If the 11 nominees are elected, the size of Tyco's Board will be set at 11 directors. Tyco is not aware of any reason why any of the nominees will not be able to serve if elected. Each of the directors elected will serve until the 2005 Annual General Meeting and until their successors, if any, are elected and qualified.

Current Directors Nominated for Re-election

| Dennis C. Blair—Admiral Blair (U.S. Navy, Ret.), age 56, joined our Board in March 2003. Admiral Blair is President and Chief Executive Officer of The Institute for Defense Analyses, a federally funded research and development center. Admiral Blair retired as Commander in Chief of the U.S. Pacific Command in 2002 after more than 30 years of service in the armed forces. Previously, Admiral Blair served as Vice Admiral and Director of the Joint Staff and Associate Director of Central Intelligence for Military Support. Admiral Blair graduated from the U.S. Naval Academy and holds a masters degree from Oxford University. Admiral Blair also serves as a director of EDO Corporation. | |

| Edward D. Breen—Mr. Breen, age 47, has been our Chairman and Chief Executive Officer since July 2002. Prior to joining Tyco, Mr. Breen was President and Chief Operating Officer of Motorola from January 2002 to July 2002; Executive Vice President and President of Motorola's Networks Sector from January 2001 to January 2002; Executive Vice President and President of Motorola's Broadband Communications Sector from January 2000 to January 2001; Chairman, President and Chief Executive Officer of General Instrument Corporation from December 1997 to January 2000; and, prior to December 1997, President of General Instrument's Broadband Networks Group. Mr. Breen also serves as a director of McLeod USA Incorporated. | |

| George W. Buckley—Mr. Buckley, age 56, joined our Board in December 2002. He is the Chairman and Chief Executive Officer of Brunswick Corporation, a global leader in the leisure products industry. Mr. Buckley joined Brunswick in 1997 and has held the role of Chairman and Chief Executive Officer for the past three years. Prior to that time, he served as the Chief Technology Officer (for Motors, Controls and Appliance Components) and President of two divisions during his career at Emerson Electric Company from 1993 to 1997. Mr. Buckley did combined postgraduate work at Huddersfield and Southampton Universities and received a Ph.D. in engineering at the University of Huddersfield in 1977. Mr. Buckley also serves as a director of Ingersoll Rand Co. Ltd. |

11

| Bruce S. Gordon—Mr. Gordon, age 57, joined our Board in January 2003. Mr. Gordon was the President of Retail Markets at Verizon Communications, Inc., a provider of wireline and wireless communications, until his retirement in December 2003. Prior to the merger of Bell Atlantic Corporation and GTE, which formed Verizon in July 2000, Mr. Gordon fulfilled a variety of positions at Bell Atlantic Corporation, including Group President, Vice President, Marketing and Sales and Vice President, Sales. Mr. Gordon graduated from Gettysburg College and received a M.S. from Massachusetts Institute of Technology. Mr. Gordon also serves as a director of Southern Company and Office Depot, Inc. | |

| John A. Krol—Mr. Krol, age 67, joined our Board in August 2002. Mr. Krol was the Chairman and Chief Executive Officer of E.I. du Pont de Nemours & Company, where he spent his entire career until his retirement in 1998. E.I. du Pont de Nemours is a global research and technology-based company serving worldwide markets, including food and nutrition, health care, agriculture, fashion and apparel, home and construction, electronics and transportation. Mr. Krol also serves as a director of ACE Limited, Armstrong Holdings, Inc., MeadWestvaco Corporation and Milliken & Company, a private company. Mr. Krol graduated from Tufts University where he received a B.S. and M.S. in chemistry. Mr. Krol is the Lead Director of the Board and Chairman of the Company's Nominating and Governance Committee. | |

| H. Carl McCall—Mr. McCall, age 68, joined our Board in March 2003. Mr. McCall served as Comptroller of the State of New York from 1993 until November 2002, when he became the Democratic nominee for Governor of the State of New York. Prior to his position as Comptroller, Mr. McCall was a Vice President of Citicorp for eight years. He has also served as President of the New York City Board of Education, a U.S. ambassador to the United Nations, Commissioner of the Port Authority of New York and New Jersey, Commissioner of the New York State Division of Human Rights and was elected to three terms as New York State Senator. Mr. McCall received a Bachelor's degree from Dartmouth College and a Master's of divinity from Andover-Newton Theological School. Mr. McCall serves as Vice Chairman of HealthPoint, a private equity fund, and is a director of New Plan, a real estate investment corporation and Standard Commercial Corporation, one of the world's largest leaf tobacco dealers. | |

| Mackey J. McDonald—Mr. McDonald, age 57, joined our Board in November 2002. Mr. McDonald serves as the Chairman, President and Chief Executive Officer of VF Corporation, a designer, manufacturer and marketer of jeanswear, intimate apparel, playwear, workwear and daypacks. Mr. McDonald began his tenure at VF Corporation in 1982 and was named Chairman, President and Chief Executive Officer in 1998. Mr. McDonald graduated from Davidson College and received his M.B.A. in Marketing from Georgia State University. Mr. McDonald also serves as a director of Wachovia Corporation and Hershey Foods Corporation. Mr. McDonald is the Chairman of the Company's Compensation Committee. |

12

| Brendan R. O'Neill—Dr. O'Neill, age 55, joined our Board in March 2003. Dr. O'Neill was Chief Executive Officer and director of Imperial Chemical Industries PLC ("ICI"), a manufacturer of specialty products and paints, until April 2003, when he left ICI. Dr. O'Neill joined ICI in 1998 as its Chief Operating Officer and Director, and was promoted to Chief Executive Officer in 1999. Prior to Dr. O'Neill's career at ICI, he held numerous positions at Guinness PLC, including Chief Executive of Guinness Brewing Worldwide Ltd, Managing Director International Region of United Distillers, and Director of Financial Control. Dr. O'Neill also held positions at HSBC Holdings PLC, BICC PLC and the Ford Motor Company. He has an M.A. from the University of Cambridge and a Ph.D. in chemistry from the University of East Anglia, and is a Fellow of the Chartered Institute of Management Accountants (U.K.). | |

| Sandra S. Wijnberg—Ms. Wijnberg, age 47, joined our Board in March 2003. Ms. Wijnberg is the Senior Vice President and Chief Financial Officer at Marsh & McLennan Companies, Inc., a professional services firm with insurance and reinsurance brokerage, consulting and investment management businesses. Before joining Marsh & McLennan Companies, Inc. in January 2000, Ms. Wijnberg served as a Senior Vice President and Treasurer of Tricon Global Restaurants, Inc. and held various positions at PepsiCo, Inc., Morgan Stanley Group, Inc. and American Express Company. Ms. Wijnberg is a graduate of the University of California, Los Angeles and received an M.B.A. from the University of Southern California. | |

| Jerome B. York—Mr. York, age 65, joined our Board in November 2002. Mr. York is Chief Executive Officer of Harwinton Capital Corporation, a private investment company which he controls. From 2000 to 2003, he was the Chairman, President and Chief Executive Officer of MicroWarehouse, Inc., and prior to that he was the Vice Chairman of Tracinda Corporation from 1995 to 1999, Chief Financial Officer of IBM Corporation from 1993 to 1995 and held various positions at Chrysler Corporation from 1979 to 1993. Mr. York graduated from the United States Military Academy, and received an M.S. from the Massachusetts Institute of Technology and an M.B.A. from the University of Michigan. Mr. York also serves as a director of Metro-Goldwyn-Mayer, Inc. and Apple Computer, Inc. Mr. York is the Chairman of the Company's Audit Committee. |

13

New Nominee for Director

| Brian Duperreault—Mr. Duperreault, age 56, has been nominated to join our Board. Mr. Duperreault has served as Chairman and Chief Executive Officer of ACE Limited, an international provider of a broad range of insurance and reinsurance products, since November 1999, and served as Chairman, President and Chief Executive Officer of ACE Limited from October 1994 through November 1999. Prior to joining ACE, Mr. Duperreault had been employed with AIG since 1973 and served in various senior executive positions with AIG and its affiliates from 1978 until September 1994, most recently as Executive Vice President, Foreign General Insurance and, concurrently, as Chairman and Chief Executive Officer of AIU from April 1994 to September 1994. Mr. Duperreault was President of AIU from 1991 to April 1994, and Chief Executive Officer of AIG affiliates in Japan and Korea from 1989 until 1991. Mr. Duperreault serves as a member of The American Academy of Actuaries, a member of the Board of Trustees of Saint Joseph's University, a member of the College of Insurance's Board of Trustees and a director of the Bank of N.T. Butterfield & Son, Ltd. |

The Board recommends that shareholders voteFOR the election of all 11 nominees for Director.

Committees of the Board of Directors

During the term for fiscal year 2003, the Board met 14 times. All of our directors attended at least 75% of the meetings of the Board and the committees on which they serve, except for Ms. Wijnberg, who attended 74% of such meetings. The Board's governance principles provide that Board members are expected to attend each annual general meeting. At the 2003 Annual General Meeting, all of the current Board members were in attendance.

The Board maintains three standing committees: Audit, Compensation, and Nominating and Governance. In addition, in 2003, the Board appointed two special committees, the Special Committee Regarding Bermuda and the Special Committee Regarding Derivative Litigation. The independent directors of the Board, acting in executive session, elected Mr. Krol to serve as the Lead Director and as chair of the Nominating and Governance Committee. The Lead Director, among other things, sets a Board agenda with Board and management input, facilitates communication among directors, works with the Chief Executive Officer to ensure appropriate information flow to the Board, and chairs an executive session of the independent directors at each formal Board meeting. Assignments to, and chairs of, the committees are recommended by the Nominating and Governance Committee and selected by the Board. All committees report on their activities to the Board.

Audit Committee. The Audit Committee monitors the integrity of Tyco's financial statements, the independence and qualifications of the independent auditors, the performance of Tyco's internal auditors as well as the independent auditors, Tyco's compliance with legal and regulatory requirements and the effectiveness of Tyco's internal controls. The Audit Committee is also responsible for retaining (subject to shareholder approval), evaluating, and, if appropriate, recommending the termination of Tyco's independent auditors. The Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. The Audit Committee held 19 meetings during fiscal year 2003. The current members of the Audit Committee are Ms. Wijnberg, Dr. O'Neill and Mr. York. Mr. York is the committee Chairman. Each of these members is independent under NYSE listing standards currently in effect. If the nominees for director are elected at the 2004 Annual General Meeting, the Audit Committee will consist of Dr. O'Neill and Messrs. Duperreault, Gordon and York. Mr. York will remain the committee Chairman. These

14

members will meet NYSE listing standards for the independence of audit committee members. The Board has determined that Mr. York and Dr. O'Neill are audit committee financial experts.

Compensation Committee. The Compensation Committee reviews and approves compensation and benefits policies and objectives, determines whether Tyco's officers, directors and employees are compensated according to these objectives, and carries out the Board's responsibilities relating to the compensation of Tyco's executives. The Compensation Committee operates under a charter approved by the Board. The charter is posted on Tyco's website. The Compensation Committee held 13 meetings during fiscal year 2003. The Compensation Committee currently consists of Admiral Blair and Messrs. Buckley and McDonald. Mr. McDonald serves as the Chairman. If the nominees for director are elected at the 2004 Annual General Meeting, the Compensation Committee will consist of the same members, and Mr. McDonald will remain the committee Chairman. These members will be independent under NYSE listing standards.

Nominating and Governance Committee. The Nominating and Governance Committee is responsible for identifying individuals qualified to become Board members, recommending to the Board the director nominees for the annual general meeting of shareholders, developing and recommending to the Board a set of corporate governance principles, and playing a general leadership role in Tyco's corporate governance. The Nominating and Governance Committee operates under a charter approved by the Board. The charter is posted on Tyco's website at www.tyco.com. The Nominating and Governance Committee held eight meetings during fiscal year 2003. The current members of the Nominating and Governance Committee are Messrs. Gordon, Krol and McCall. Mr. Krol is the chairman. The members of the Nominating and Governance Committee all meet the independence standards set forth in the NYSE listing standards. If the nominees for director are elected at the 2004 Annual General Meeting, the members of the Nominating and Governance Committee will be Messrs. Krol and McCall and Ms. Wijnberg, with Mr. Krol serving as Chairman. These members will be independent under NYSE listing standards.

Special Committee Regarding Bermuda

The Special Committee Regarding Bermuda was appointed by the Board in March 2003 to evaluate the costs, benefits, advantages and disadvantages of remaining a Bermuda company or reincorporating in a different jurisdiction. The Special Committee Regarding Bermuda held seven meetings during fiscal year 2003 (and eight meetings since its formation). The current members of the Special Committee Regarding Bermuda are Messrs. Gordon, Krol, McCall and York. The chairman of the committee is Mr. Krol. For more information regarding the results of the Special Committee's evaluation, see the Recommendation of the Board of Directors on Proposal Number Six below.

Special Committee Regarding Derivative Litigation

The Special Committee Regarding Derivative Litigation was appointed by the Board in March 2003 for the purpose of considering and investigating the shareholder derivative lawsuits that have been filed against the Company and recommending to the Board whether additional legal action should be pursued by the Company. The Special Committee Regarding Derivative Litigation held eight meetings during fiscal year 2003. The current members of the Special Committee Regarding Derivative Litigation are Admiral Blair and Messrs. Krol and McCall. The chairman of the committee is Mr. Krol.

Nomination of Directors

As provided in its charter, the Nominating and Governance Committee will consider nominations submitted by shareholders. The Nominating and Governance Committee, in accordance with the Board's governance principles, seeks to create a Board that is as a whole strong in its collective knowledge of and diversity of skills and experience with respect to accounting and finance, management

15

and leadership, vision and strategy, business operations, business judgment, crisis management, risk assessment, industry knowledge, corporate governance and global markets. When the Committee reviews a potential new candidate, the Committee looks specifically at the candidate's qualifications in light of the needs of the Board and the Company at that time given the then current mix of director attributes.

General criteria for the nomination of director candidates include:

The Company also strives to have all directors, other than the Chief Executive Officer, be independent. In addition to having such directors meet the NYSE definition of independence, the Board has set its own more stringent standards of independence, as described above under "Corporate Governance—Independence of Nominees for Director" above. The Committee must also ensure that the members of the Board as a group maintain the requisite qualifications under NYSE listing standards for populating the Audit, Compensation and Nominating and Governance Committees. The Board governance principles limit the number of other public company boards of directors on which a non-executive director can serve to three for directors who are fully employed and five for directors who are not fully employed. Directors must also resign from the Board at the annual general meeting following their 70th birthday.

To recommend a nominee, a shareholder should write to Tyco's Secretary at Tyco's registered address in Pembroke, Bermuda. Any such recommendation must include:

The recommendation must also include any additional information required by the Company's Amended and Restated Bye-Laws, if adopted.

To be considered by the Nominating and Governance Committee for nomination and inclusion in the Company's proxy statement for its 2005 Annual General Meeting, shareholder recommendations for director must be received by Tyco's Secretary no later than September , 2004. Once the Company receives the recommendation, the Company will deliver a questionnaire to the candidate which requests additional information about the candidate's independence, qualifications and other information that would assist the Nominating and Governance Committee in evaluating the candidate, as well as certain information that must be disclosed about the candidate in the Company's proxy statement, if

16

nominated. Candidates must complete and return the questionnaire within the time frame provided to be considered for nomination by the Committee.

The Nominating and Governance Committee currently employs a third party search firm to assist it in identifying candidates for director. The Committee also receives suggestions for director candidates from Board members. The new director nominee, Mr. Duperreault, was recommended by one of the non-management directors of the Company. The other ten nominees for director recommended for election by the shareholders at the 2004 Annual General Meeting are all current members of the Board. In evaluating candidates for director, the Committee uses the qualifications described above, and evaluates shareholder candidates in the same manner as candidates from all other sources. Based on the Committee's evaluation of each nominee's satisfaction of the qualifications described above and, for current directors, their performance as directors in fiscal year 2003, the Committee determined to recommend each nominee for election or re-election, as applicable. The Committee has not received any nominations from shareholders for the 2004 Annual General Meeting.

Executive Officers

In addition to Mr. Breen, Tyco's Chief Executive Officer who also serves on the Board and whose biographical information is set forth above, the executive officers of Tyco are:

David J. FitzPatrick—Mr. FitzPatrick, age 49, has been our Executive Vice President and Chief Financial Officer since September 2002. Prior to joining Tyco, Mr. FitzPatrick was Senior Vice President and Chief Financial Officer of United Technologies Corporation from June 1998 to September 2002.

William B. Lytton—Mr. Lytton, age 55, has been our Executive Vice President and General Counsel since September 2002. Prior to joining Tyco, Mr. Lytton was Senior Vice President and General Counsel for International Paper Company from January 1999 to September 2002; and Vice President and General Counsel for International Paper from 1996 to 1999.

Eric M. Pillmore—Mr. Pillmore, age 50, has been our Senior Vice President of Corporate Governance since August 2002. Prior to joining Tyco, Mr. Pillmore was Senior Vice President, Chief Financial Officer and Secretary of Multilink Technology Corporation from July 2000 to August 2002. From April 2000 to May 2000, Mr. Pillmore was Senior Vice President of Finance and Chief Financial Officer of McData Corporation. From January 2000 to April 2000, Mr. Pillmore was Senior Vice President of Finance and Director of Motorola's Broadband Communications Sector. From December 1997 to January 2000, Mr. Pillmore was Chief Financial Officer of General Instrument Corporation.

Juergen W. Gromer—Dr. Gromer, age 59, has been President of Tyco Electronics since April 1999. Dr. Gromer was Senior Vice President, Worldwide Sales and Service, of AMP Incorporated (acquired by Tyco in April 1999) from 1998 to April 1999; President, Global Automotive Division, and Corporate Vice President of AMP from 1996 to 1998; and Vice President and General Manager of various divisions of AMP from 1990 to 1996.

Robert P. Mead—Mr. Mead, age 53, has been President of Tyco Engineered Products and Services (formerly Tyco Flow Control Products) since May 1993, except for a temporary six-month period when he served as a Senior Vice President of Tyco International (US) Inc. from October 2000 to March 2001. Mr. Mead has been associated with Tyco and its predecessors since 1973.

Richard J. Meelia—Mr. Meelia, age 54, has been President of Tyco Healthcare since 1995. Mr. Meelia is a director of Aspect Medical Systems, Inc., a manufacturer of brain monitoring equipment.

17

David E. Robinson—Mr. Robinson, age 44, has been President of Tyco Fire and Security Services since March 2003, and prior to that was President of Tyco Plastics and Adhesives from November 2002. Prior to joining Tyco, Mr. Robinson was Executive Vice President and President of Motorola's Broadband Communications Sector from January 2001 to June 2002; Senior Vice President and General Manager, Digital Network Systems, for Motorola's Broadband Communications Sector from January 2000 to January 2001, and for General Instrument Corporation from April 1998 to January 2000; and Vice President and General Manager, Digital Network Systems from November 1995 to April 1998.

Terry A. Sutter—Mr. Sutter, age 46, has been President of Tyco Plastics & Adhesives since March 2003. Prior to joining Tyco, Mr. Sutter was President of the Specialty Chemicals division of Cytec Industries, one of the world's leading specialty chemicals companies, since August 2002. Prior to joining Cytec, Mr. Sutter was at Honeywell International, formerly AlliedSignal, Inc., where he was President, Industry Solutions from July 2001 to August 2002; Vice President and General Manager, Fluorine Solutions from July 1999 to July 2001; and Vice President, Marketing and Business Development, Specialty Chemicals from July 1998 to July 1999.

Martina Hund-Mejean—Ms. Hund-Mejean, age 43, has been our Senior Vice President, Treasurer since December 2002. Prior to joining Tyco, Ms. Hund-Mejean served as Senior Vice President and Treasurer at Lucent Technologies, Inc. from November 2000 to December 2002. Prior to joining Lucent, she spent 12 years at General Motors where she held various positions of ascending importance, including most recently Assistant Treasurer from 1998 to 2000.

John E. Evard, Jr.—Mr. Evard, Jr., age 57, has been our Senior Vice President, Tax since December 2002. Prior to joining Tyco, Mr. Evard was Vice President, Tax of United Technologies Corporation from August 2000. Prior to joining United Technologies, Mr. Evard held a number of positions at CNH Global N.V. and its predecessor company, Case Corp., including Senior Vice President, Corporate Development, and General Tax Counsel from December 1989 to August 2000.

Dana S. Deasy—Mr. Deasy, age 44, has been our Senior Vice President and Chief Information Officer since July 2003. Prior to joining Tyco, Mr. Deasy served as Vice President and Chief Information Officer of The Americas for Siemens Corporation. Prior to joining Siemens in October 1999, Mr. Deasy was the Chief Information Officer of General Motors Locomotive Group from June 1997 to September 1999.

Laurie Siegel—Ms. Siegel, age 47, has been our Senior Vice President, Human Resources since January 2003. Ms. Siegel was at Honeywell International from 1994 to 2003, where she held positions in the Human Resources function. After leading the compensation organization from 1994 to 1997, she served as Corporate Vice President of Human Resources until 1999. Thereafter, she served as Vice President of Human Resources in the Aerospace and Specialty Materials divisions.

Charles H. Young—Mr. Young, age 40, has been our Senior Vice President of Corporate Marketing and Communications since July 2003. Prior to joining Tyco, Mr. Young was the General Manager of Global Marketing for GE Medical Systems. During his 15-year tenure with GE, he held a number of positions of increasing responsibility, including global marketing leader for GE Medical, General Manager of Corporate Communications for GE Medical, and Director of Communications and Public Affairs for GE Global Research.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the number of shares of common stock beneficially owned as of September 30, 2003, by each director, nominee for director, executive officer named in the Summary

18

Compensation Table under "Executive Officer Compensation" below and the directors and executive officers of the Company as a group.

| Beneficial Owner | Title | Number of Common Shares Beneficially Owned(1) | |||

|---|---|---|---|---|---|

| Dennis C. Blair | Director | 5,963 | (3) | ||

| Edward D. Breen | Chairman and Chief Executive Officer | 2,263,342 | (5)(6) | ||

| George W. Buckley | Director | 5,963 | (3) | ||

| Brian Duperreault | Nominee for Director | 241 | |||

| David J. FitzPatrick | Executive Vice President and Chief Financial Officer | 632,407 | (5)(6) | ||

| John F. Fort III | Advisor to the Board | 177,955 | (5)(7) | ||

| Bruce S. Gordon | Director | 5,963 | (3) | ||

| Juergen W. Gromer | President—Tyco Electronics | 1,902,635 | (2)(5) | ||

| John A. Krol | Lead Director | 36,473 | (3)(5)(8) | ||

| William B. Lytton | Executive Vice President and General Counsel | 274,722 | (5)(6) | ||

| H. Carl McCall | Director | 5,963 | (3) | ||

| Mackey J. McDonald | Director | 5,963 | (3) | ||

| Richard J. Meelia | President—Tyco Healthcare | 1,916,989 | (2)(4)(5) | ||

| Brendan R. O'Neill | Director | 5,963 | (3) | ||

| W. Peter Slusser | Advisor to the Board | 58,061 | (5) | ||

| Sandra S. Wijnberg | Director | 5,963 | (3) | ||

| Jerome B. York | Director | 40,963 | (3) | ||

| All current directors and executive officers as a group (25 persons) | 9,374,021 | (9) |

19

The following table sets forth the information indicated for persons or groups known to the Company to be beneficial owners of more than 5% of the outstanding common shares.

| Name and Address of Beneficial Owner | Number of Common Shares Beneficially Owned | Percentage of Common Stock Outstanding on September 30, 2003 | |||

|---|---|---|---|---|---|

| FMR Corp.(1) 82 Devonshire Street Boston, MA 02109 | 170,825,738 | 8.5 | % | ||

Capital Research & Management Company(2) 333 South Hope Street Los Angeles, CA 90071 | 124,928,000 | 6.2 | % |

20

2003. Capital Research and Management Company is an investment advisor registered under Section 203 of the Investment Advisor Act of 1940 and has indicated that it has sole dispositive power with respect to the 124,928,000 common shares as a result of acting as an investment advisor to various investment companies.

EXECUTIVE OFFICER COMPENSATION

Summary Compensation Table

The table below presents the annual and long-term compensation for services in all capacities to Tyco and its subsidiaries for the periods shown for Tyco's Chief Executive Officer and the other four most highly compensated executive officers of Tyco during fiscal year 2003 (the "Named Officers"). No executive officer who would otherwise have been includable in such table on the basis of compensation for fiscal year 2003 has been excluded by reason of his or her termination of employment or change in executive status during the fiscal year. Because there were no long term incentive plan payouts in fiscal year 2003, the column of the table with respect to such payouts has been omitted. All dollar amounts are in United States dollars unless otherwise indicated.

| | | | | | Long Term Compensation | | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Annual Compensation | | |||||||||||||||||

| | | | Shares Underlying Stock Options | | ||||||||||||||||

| Name & Principal Position | Year | Salary(2) | Bonus(3) | Other Annual Compensation(4) | Restricted Stock/DSU (Value)(5) | All Other Compensation(6) | ||||||||||||||

| Edward D. Breen | 2003 | $ | 1,500,000 | $ | 1,500,000 | $ | 195,721 | — | — | $ | 330,250 | |||||||||

Chairman & CEO | 2002 | $ | 278,846 | $ | 3,779,452 | $ | 180,939 | $ | 11,427,750 | 7,350,000 | $ | 19,014 | ||||||||

Juergen W. Gromer(1) | 2003 | $ | 916,637 | $ | 1,992,328 | — | $ | 713,500 | 450,000 | — | ||||||||||

President, Tyco Electronics | 2002 | $ | 775,549 | $ | 3,392,059 | — | — | 600,000 | — | |||||||||||

2001 | $ | 660,000 | $ | 6,857,575 | — | — | 424,261 | $ | 256 | |||||||||||

Richard J. Meelia | 2003 | $ | 687,192 | $ | 1,190,000 | $ | 88,684 | $ | 713,500 | 450,000 | $ | 288,429 | ||||||||

President, Tyco Healthcare | 2002 | $ | 669,135 | $ | 4,330,199 | $ | 231,601 | — | 696,970 | $ | 615,797 | |||||||||

2001 | $ | 624,519 | $ | 11,887,909 | $ | 214,874 | — | 264,607 | $ | 79,462 | ||||||||||

David J. FitzPatrick | 2003 | $ | 750,000 | $ | 750,000 | $ | 153,846 | — | — | $ | 101,649 | |||||||||

Executive Vice President & CFO | 2002 | $ | 25,962 | $ | 500,000 | $ | 34,341 | $ | 3,257,000 | 1,650,000 | $ | 449 | ||||||||

William B. Lytton | 2003 | $ | 650,000 | $ | 650,000 | $ | 60,454 | — | — | $ | 86,540 | |||||||||

Executive Vice President & General Counsel | 2002 | $ | 2,500 | $ | 250,000 | $ | 38,089 | $ | 2,064,750 | 665,000 | — | |||||||||

21

had the opportunity to earn a portion of their bonus in the form of shares. The annual incentive bonus under the proposed 2004 Stock and Incentive Plan does not include a separate equity component.

22

| Name | Company Matching Contribution (qualified plan) | Company Contribution (non-qualified plan) | ||||

|---|---|---|---|---|---|---|

| Mr. Breen | $ | 10,000 | $ | 251,665 | ||

| Mr. Meelia | $ | 16,000 | $ | 268,540 | ||

| Mr. Lytton | — | $ | 22,417 | |||

Option Grants in Last Fiscal Year

The following table shows all grants of stock options to the Named Officers during fiscal year 2003 under the Tyco International Ltd. Long Term Incentive Plan ("LTIP").

| | Individual Grants | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | No. of Securities Underlying Options Granted | Percent of Total Options Granted to Employees in Fiscal Year(5) | Exercise Price ($/Share) | Expiration Date | Grant Date Present Value(6) | |||||||

| Edward D. Breen | — | — | ||||||||||

| Juergen W. Gromer | 150,000(1 | ) | 0.56 | % | $ | 14.2700 | 3/6/2013 | $ | 1,113,000 | |||

| 300,000(2 | ) | 1.11 | % | $ | 14.2700 | 4/6/2013 | $ | 2,226,000 | ||||

| Richard J. Meelia | 450,000(3 | ) | 1.67 | % | $ | 14.2700 | 3/6/2013 | $ | 3,339,000 | |||

| David J. FitzPatrick(4) | — | — | ||||||||||

| William Lytton | — | — | ||||||||||

23

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

Shown below is information with respect to aggregate option exercises by the Named Officers in the fiscal year ended September 30, 2003 and with respect to unexercised stock options held by them at September 30, 2003.

| | | | | | Value of Unexercised, In-the-Money Options Held at Fiscal Year End(1) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | No. of Securities Underlying Unexercised Options at Fiscal Year End | |||||||||||

| | Number of Shares Acquired On Exercise | | ||||||||||||

| Name | Value Realized | |||||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||||

| Edward D. Breen | — | — | 1,916,667 | 5,433,333 | $ | 20,268,754 | $ | 57,457,496 | ||||||

| Juergen W. Gromer | — | — | 1,165,309 | 1,383,332 | $ | 0 | $ | 2,837,250 | ||||||

| Richard J. Meelia | — | — | 1,372,608 | 1,233,333 | $ | 337,040 | $ | 2,837,250 | ||||||

| David J. FitzPatrick | — | — | 550,001 | 1,099,999 | $ | 2,384,254 | $ | 4,768,496 | ||||||

| William Lytton | — | — | 221,667 | 443,333 | $ | 1,512,523 | $ | 3,025,038 | ||||||

Retirement Plans

Messrs. Breen, FitzPatrick, Lytton and Dr. Gromer participate in defined benefit or actuarial retirement plans ("pension plans") maintained by Tyco or a subsidiary, as described below. Mr. Meelia has an accrued benefit under two frozen defined benefit plans.

24

As part of his employment agreement, Mr. Breen is provided with a Supplemental Retirement Benefit. Commencing at age 60, Mr. Breen will receive a monthly annuity based upon 50% of the highest average of the sum of his monthly base salary and actual annual bonus (spread equally over the bonus period for which it is paid) from Tyco during any consecutive 36-month period within the 60-month period prior to his termination. This monthly annuity is offset by any benefits provided under a defined benefit plan maintained by any prior employer and his benefits attributable to the company match under Tyco's 401(k) and supplemental plans, adjusted to reflect earnings. Assuming a base salary increase of 4% (the assumed pay rate at the end of the initial contract period), Mr. Breen will have a lifetime benefit of $99,897 per month, commencing at his normal retirement age of 60. One-half of this amount will continue to his surviving spouse in the event of his death. Retirement benefits are available at an earlier age but would be reduced by .25% for each month that the benefit commences prior to age 60 and could result in a forfeiture of any unvested portion. Mr. Breen may elect to receive the actuarial equivalent of his annuity in the form of a lump sum payment.

As part of his employment agreement, Mr. FitzPatrick is provided with a Supplemental Retirement Benefit. Commencing at age 62, Mr. FitzPatrick will receive a monthly annuity based upon the sum of 2% multiplied by his years of service plus an additional 10%, multiplied by the highest average of the sum of his monthly base salary and actual annual bonus (spread equally over the bonus period for which it is paid) from Tyco during any consecutive 36-month period within the 60-month period prior to his termination. This monthly annuity is offset by any benefits provided under a defined benefit plan maintained by his immediately preceding employer. Since Mr. FitzPatrick did not participate in 2003 in Tyco's 401(k) plan or the non-qualified SERP, there are no offsets assumed for these plans. Assuming a base salary increase of 4% (the assumed pay rate at the end of the initial contract period), Mr. FitzPatrick will have a lifetime benefit of $49,400 per month, commencing at his normal retirement age of 62. One-half of this amount will continue to his surviving spouse in the event of his death. Retirement benefits are available at an earlier age but would be reduced by .25% for each month that the benefit commences prior to age 62. Mr. FitzPatrick may elect to receive the actuarial equivalent of his annuity in the form of a lump sum payment.

As part of his employment agreement, Mr. Lytton is provided with a Supplemental Retirement Benefit. Commencing at age 62, Mr. Lytton will receive a monthly annuity based upon 6.25% of the highest average of the sum of his monthly base salary and actual annual bonus (spread equally over the bonus period for which it is paid) from Tyco during any consecutive 36-month period within the 60-month period prior to his termination multiplied by his years of service with Tyco. This monthly annuity is offset by any benefits provided under a defined benefit plan maintained by his immediately preceding employer and his benefits attributable to the company match under Tyco's 401(k) and supplemental plans, adjusted to reflect earnings. Assuming a base salary increase of 4% (the assumed pay rate at the end of the initial contract period), Mr. Lytton will have a lifetime benefit of $50,688 per month, commencing at his normal retirement age of 62. Retirement benefits are available at an earlier age but would be reduced by .25% for each month that the benefit commences prior to age 62 and could result in a forfeiture of any unvested portion. Mr. Lytton may elect to receive the actuarial equivalent of his annuity in the form of a lump sum payment.

At the time of Tyco's acquisition of AMP in 1999, Dr. Gromer was a participant in a defined benefit pension plan that covered eligible AMP employees in Germany. As a result, Dr. Gromer is entitled to receive from Tyco upon retirement at age 65 a defined pension benefit that is determined primarily based on his annual base salary as of three years prior to the date of his retirement and his years of service with Tyco at the time of his retirement. The following table sets forth the estimated annual benefits payable under the Tyco Electronics (formerly AMP) pension plan for the compensation

25

amounts and the years of credited service specified in the table, assuming benefits are paid in the form of a single life annuity upon normal retirement at age 65:

| | Years of Credited Service and Related Estimated Annual Benefits Payable Upon Retirement | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Compensation | ||||||||||||

| 15 | 20 | 25 | 30 | |||||||||

$812,467 | $ | 290,242 | $ | 406,427 | $ | 531,574 | $ | 665,596 | ||||

853,090 | 310,067 | 432,649 | 564,080 | 704,268 | ||||||||

893,714 | 330,332 | 459,341 | 597,024 | 743,291 | ||||||||

934,338 | 351,038 | 486,501 | 630,408 | 782,668 | ||||||||

974,961 | 372,159 | 514,131 | 664,230 | 822,436 | ||||||||

Converted from Euros using a conversion rate of €1 to $1.1597

The compensation of Dr. Gromer covered by the pension plan would be the base salary amount that is noted in the "Salary" column of the Summary Compensation Table above, less statutory payments for specified holiday and vacation time. Dr. Gromer's current covered compensation, designated in Euro, is €700,584, which converts to $812,467 using a conversion ratio of 1 Euro to 1.1597 USD. Under the pension plan, no more than a maximum of 30 years of credited service may be recognized for benefit accrual purposes. As of September 30, 2003, for purposes of calculating benefits accrued under the pension plan, Dr. Gromer had 25 years and 9 months of credited service with Tyco. Dr. Gromer is a beneficiary under another AMP pension benefit funded through an insurance policy. At September 30, 2003, Dr. Gromer had accrued a taxable pension of €3,030 ($3,514) per year payable at retirement through this insurance. This amount is subject to increase in future periods only to the extent of dividends on the insurance policy.

Mr. Meelia has a frozen benefit under the tax-qualified Kendall/ADT Pension Plan. The benefit has two parts: a final average pay pension benefit and a cash balance benefit. Under the first part of the plan, Mr. Meelia has a frozen monthly pension benefit of $129 payable at April 1, 2004, his earliest commencement date (age 55). If payable at normal retirement date (age 65), this benefit would be $161 monthly. Under the second part, he has a lump sum cash balance account of $79,697 at September 30, 2003, which equates to an immediately payable monthly annuity of $448. Future benefit accruals under both parts of the plan have been frozen. In addition, Mr. Meelia has a benefit under the frozen non-qualified Kendall SERP. Mr. Meelia's account balance under the Kendall SERP at September 30, 2003 was $103,533. The Kendall SERP benefit will be paid in a lump sum after termination of employment.

Employment, Retention and Severance Agreements

Tyco has entered into employment agreements with Messrs. Breen, FitzPatrick and Lytton. Tyco is also party to a retention agreement with Mr. Meelia and Tyco Electronics Logistics AG has entered into an employment agreement with Dr. Gromer.

26