Exhibit 99.2

The ADT Corporation Form 10

April 10, 2012

Forward-Looking Statements / Safe Harbor

This presentation contains a number of forward-looking statements. Words, and variations of words, such as “expect”, “intend”, “will”, “anticipate”, “believe”, “propose”, “potential”, “continue”, “opportunity”, “estimate”, “project” and similar expressions are intended to identify forward-looking statements. Examples of forward-looking statements include, but are not limited to, our intent to spin-off ADT and Flow Control (and subsequently merge Flow Control with Pentair Inc.), the expectation that these transactions will be tax-free, statements regarding the leadership, resources, potential, priorities, and opportunities for the companies following the spin-offs, the intent for ADT to remain investment grade following the spin-offs, and the timing of the transactions. The forward-looking statements in this press release are based on current expectations and assumptions that are subject to risks and uncertainties, many of which are outside of our control, and could cause results to materially differ from expectations. Such risks and uncertainties include, but are not limited to:

Failure to obtain necessary regulatory approvals or to satisfy any of the other conditions to the proposed transactions;

Adverse affects on the market price of our common stock and on our operating results because of a failure to complete the proposed transactions;

Failure to realize the expected benefits of the proposed transactions;

Negative effects of announcement or consummation of the proposed transactions on the market price of the company’s common stock;

Significant transaction costs and/or unknown liabilities;

General economic and business conditions that affect the companies in connection with the proposed transactions;

Unanticipated expenses such as litigation or legal settlement expenses;

Failure to obtain tax rulings or tax law changes;

Changes in capital market conditions that may affect proposed debt refinancings;

The impacts of the proposed transactions on the company’s employees, customers and suppliers;

Future opportunities that the company’s board may determine present greater potential to increase shareholder value; and

The ability of the companies to operate independently following the transactions.

Actual results could differ materially from anticipated results. For further information regarding risks and uncertainties related to Tyco’s businesses, please refer to the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” sections of Tyco’s SEC filings, including, but not limited to, its annual report on Form 10-K and quarterly reports on Form 10-Q, copies of which may be obtained by contacting Tyco’s Investor Relations Department, Tyco International Management Company LLC, 9 Roszel Road, Princeton, New Jersey 08540 or at Tyco’s Investor Relations website at: http://investors.tyco.com/ under the heading “Investor Relations” and then under the heading “SEC Filings.”

Tyco is under no obligation (and expressly disclaims any obligation) to update its forward-looking statements.

2

Important Information

In connection with the proposed transactions, a definitive proxy statement for the stockholders of Tyco will be filed with the Securities and Exchange Commission (the “SEC”). Tyco will mail the final proxy statement to its stockholders. BEFORE MAKING ANY VOTING DECISION, TYCO’S STOCKHOLDERS AND INVESTORS ARE URGED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED SPIN-OFF TRANSACTIONS. Investors and security holders may obtain, without charge, a copy of the proxy statement, as well as other relevant documents containing important information about Tyco at the SEC’s website (www.sec.gov) once such documents are filed with the SEC. You may also read and copy any reports, statements and other information filed by Tyco at the SEC public reference room at 100 F. Street, N.E., Washington D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information.

Tyco and its directors, executive officers and other members of its management and employees may be deemed to be participants in the solicitation of proxies from its stockholders in connection with the proposed spin-off transactions. Information concerning the interests of Tyco’s participants in the solicitation will be set forth in proxy statement relating to the transactions when it becomes available.

3

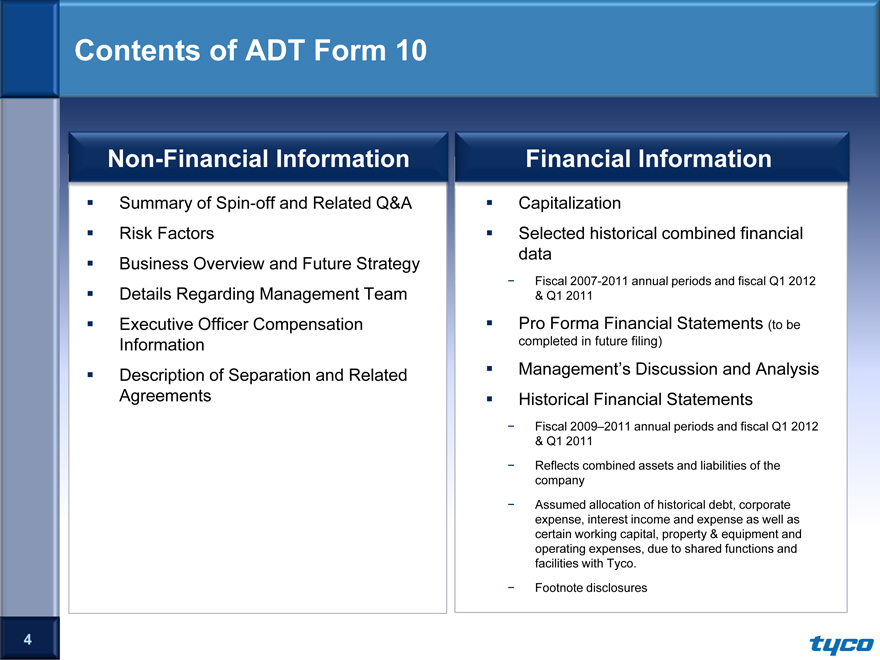

Contents of ADT Form 10

Non-Financial Information

Summary of Spin-off and Related Q&A

Risk Factors

Business Overview and Future Strategy

Details Regarding Management Team

Executive Officer Compensation Information

Description of Separation and Related Agreements

Financial Information

Capitalization

Selected historical combined financial data

Fiscal 2007-2011 annual periods and fiscal Q1 2012

& Q1 2011

Pro Forma Financial Statements (to be

completed in future filing)

Management’s Discussion and Analysis

Historical Financial Statements

Fiscal 2009–2011 annual periods and fiscal Q1 2012

& Q1 2011

Reflects combined assets and liabilities of the company

Assumed allocation of historical debt, corporate expense, interest income and expense as well as certain working capital, property & equipment and operating expenses, due to shared functions and facilities with Tyco.

Footnote disclosures

4

ADT At A Glance

2011 revenue of $3.1B; 89% of which is recurring

6.4M customers, substantially larger than nearest competitor

25% market share in the U.S. and Canada

Trusted and well-known brand

Highly profitable subscriber based business model

Sustained growth of accounts and revenue per customer (ARPU)

5

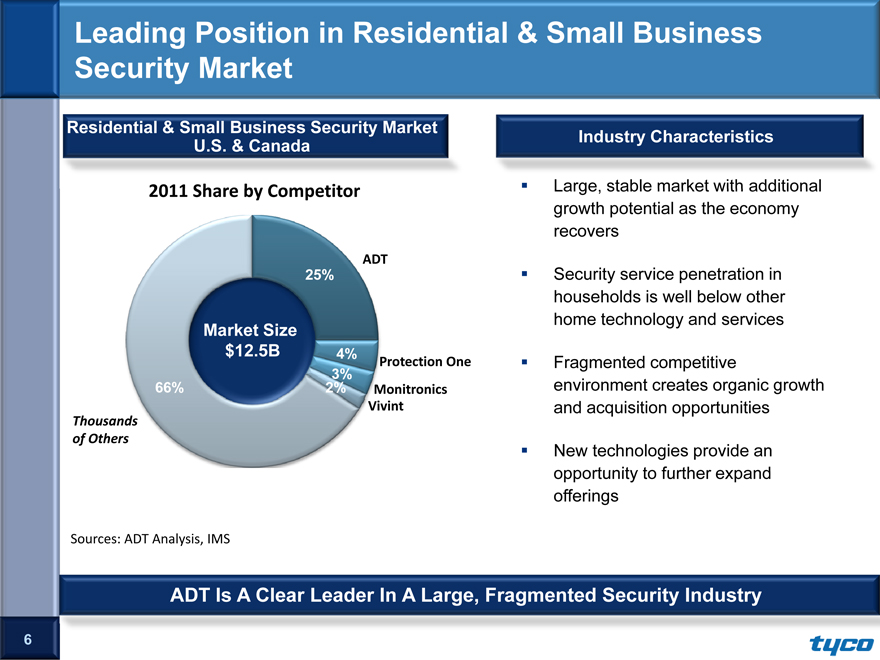

Leading Position in Residential & Small Business Security Market

Residential & Small Business Security Market

U.S. & Canada

2011 Share by Competitor

ADT

25%

Market Size

$12.5B 4% Protection One

3%

66% 2% Monitronics

Vivint

Thousands

of Others

Sources: ADT Analysis, IMS

Industry Characteristics

Large, stable market with additional growth potential as the economy recovers

Security service penetration in households is well below other home technology and services

Fragmented competitive environment creates organic growth and acquisition opportunities

New technologies provide an opportunity to further expand offerings

ADT Is A Clear Leader In A Large, Fragmented Security Industry

6

ADT Strengths

We believe ADT is a clear leader in the security industry, supported by one of the industry’s most trusted, and well-known brands

Attractive business model with strong cash flows

Experienced management team with proven track record in the electronic security industry

Industry leading solutions and services, including pioneering interactive services technologies

Nationwide footprint of branch offices, field resources, and broad partner network, including our dealer channel, affords coverage and scale leverage

We believe our monitoring capabilities allow us to provide superior service and greater peace of mind to customers, setting ADT apart in the security industry

Strong Brand Supported By Attractive Business Model

7

Our Strategic Priorities Support Our Mission

Strengthen & Grow the Core

Invest in Growth Platforms

Grow customer base through channel expansion

Manage costs associated with adding new customers, leveraging mobility tools

Increase average monthly recurring revenue per customer, driving ADT Pulse adoption

Improve customer tenure

Increase share of monitored security market for small businesses

Increase penetration of households through new services and solutions

Explore other adjacent markets that leverage existing assets and core competencies

“Creating Customers For Life”

8

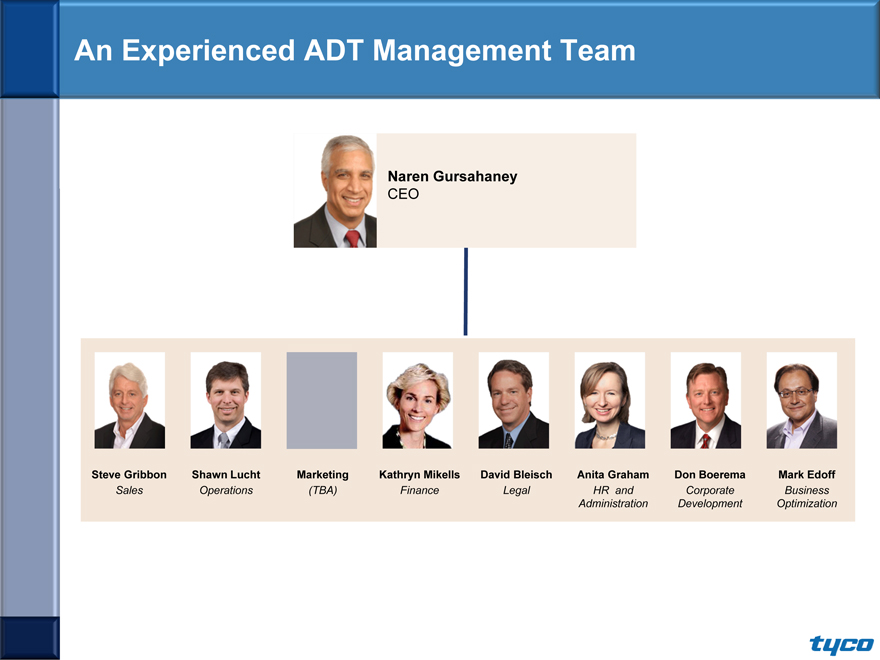

An Experienced ADT Management Team

Naren Gursahaney CEO

Steve Gribbon Shawn Lucht Marketing Kathryn Mikells David Bleisch Anita Graham Don Boerema Mark Edoff

Sales Operations (TBA) Finance Legal HR and Corporate Business

Administration Development Optimization

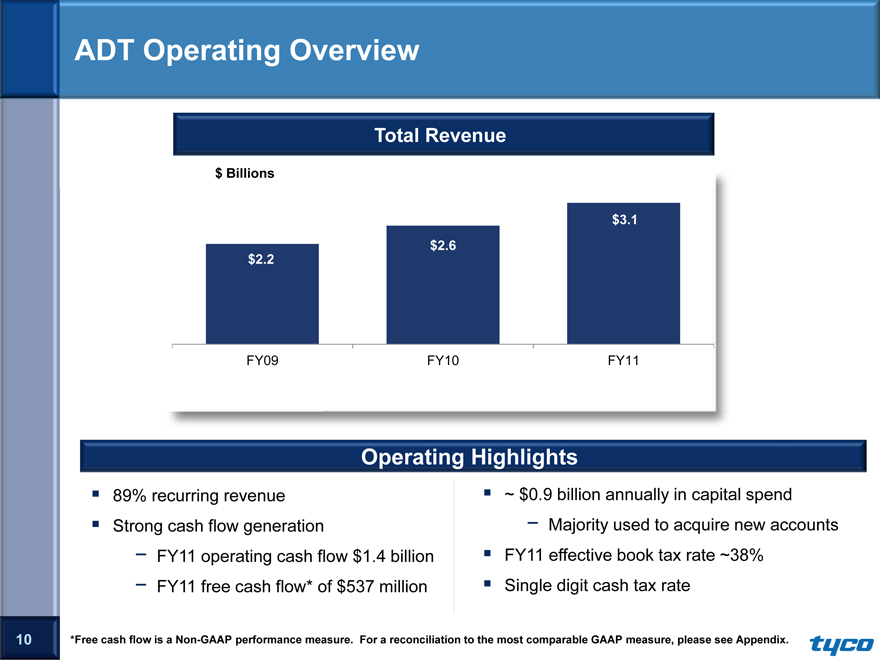

ADT Operating Overview

Total Revenue

$ Billions

$3.1

$2.6

$2.2

FY09 FY10 FY11

Operating Highlights

89% recurring revenue

Strong cash flow generation

— FY11 operating cash flow $1.4 billion

— FY11 free cash flow* of $537 million

~ $0.9 billion annually in capital spend

— Majority used to acquire new accounts

FY11 effective book tax rate ~38%

Single digit cash tax rate

10 *Free cash flow is a Non-GAAP performance measure. For a reconciliation to the most comparable GAAP measure, please see Appendix.

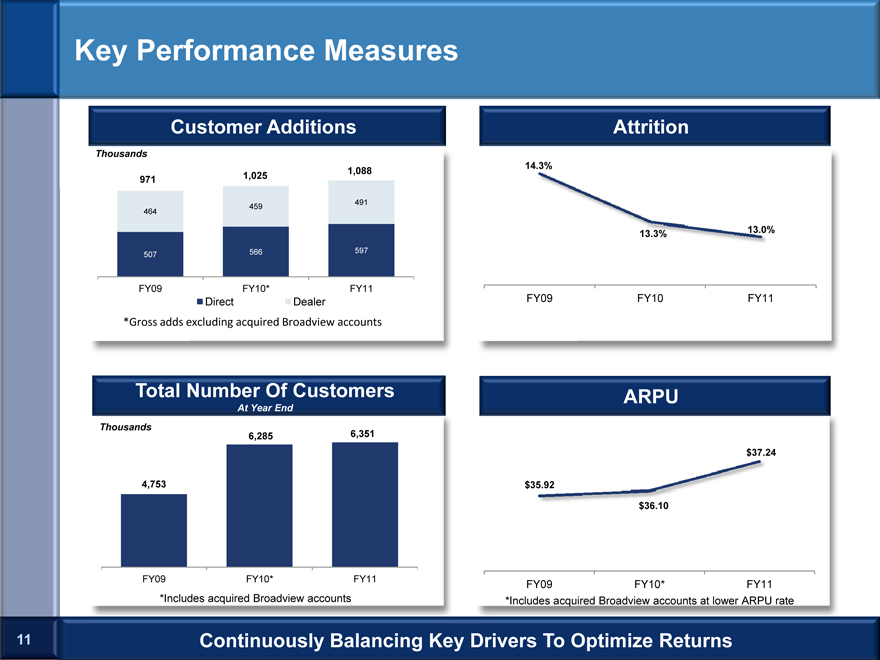

Key Performance Measures

Customer Additions

Thousands

1,088

971 1,025

459 491

464

507 566 597

FY09 FY10* FY11

Direct Dealer

*Gross adds excluding acquired Broadview accounts

Attrition

14.3%

13.3% 13.0%

FY09 FY10 FY11

Total Number Of Customers

At Year End

Thousands 6,285 6,351

4,753

FY09 FY10* FY11

*Includes acquired Broadview accounts

ARPU

$37.24

$35.92

$36.10

FY09 FY10* FY11

*Includes acquired Broadview accounts at lower ARPU rate

11 Continuously Balancing Key Drivers To Optimize Returns

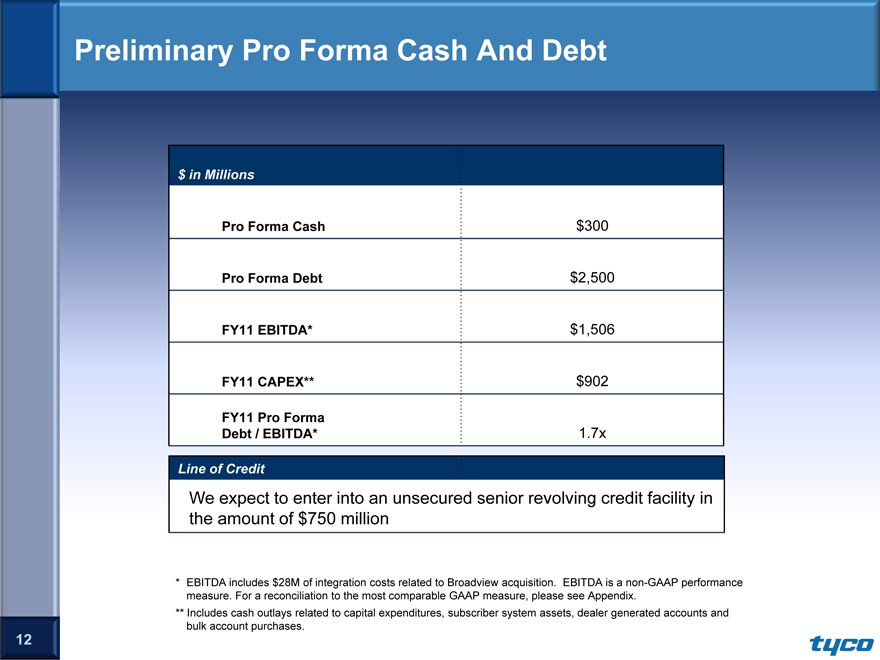

Preliminary Pro Forma Cash And Debt

$ in Millions

Pro Forma Cash $300

Pro Forma Debt $2,500

FY11 EBITDA* $1,506

FY11 CAPEX** $902

FY11 Pro Forma

Debt / EBITDA* 1.7x

Line of Credit

We expect to enter into an unsecured senior revolving credit facility in

the amount of $750 million

* |

| EBITDA includes $28M of integration costs related to Broadview acquisition. EBITDA is a non-GAAP performance |

measure. For a reconciliation to the most comparable GAAP measure, please see Appendix.

** Includes cash outlays related to capital expenditures, subscriber system assets, dealer generated accounts and

bulk account purchases.

12

Capital Structure Provides Financial Flexibility

Strong Balance Sheet

$2.5 billion of term debt at separation expected to preserve investment grade ratings and provide access to both the short-term and long-term capital markets

Capital structure expected to provide flexibility to pursue attractive growth opportunities

Financial Flexibility

ADT expected to have significant flexibility post-separation to deliver on strategic growth plan

Flexibility is further enhanced by strong and robust free cash flow* generation - $0.5 billion in free cash flow generated in FY2011

Management and Board to continuously evaluate optimal capital structure post-separation

Investment Grade Rating Expected

*Free cash flow is a Non-GAAP performance measure. For a reconciliation to the most comparable GAAP measure, please see Appendix.

13

Effective and Cash Tax Rate Outlook

Carve-out financial statements reflect tax attributes generated by the ADT business historically

— Assumes ADT was a separate taxpayer and standalone enterprise for the periods presented

The combined financial statements reflect an effective tax rate, common to domestic corporations, in the range of 37-40%

Tax carryforwards in the combined financial statements are reflected on a hypothetical stand-alone income tax return basis

— Does not include additional pre-existing tax carryforwards that will be allocated to ADT at separation and will therefore be available for use post-separation

14

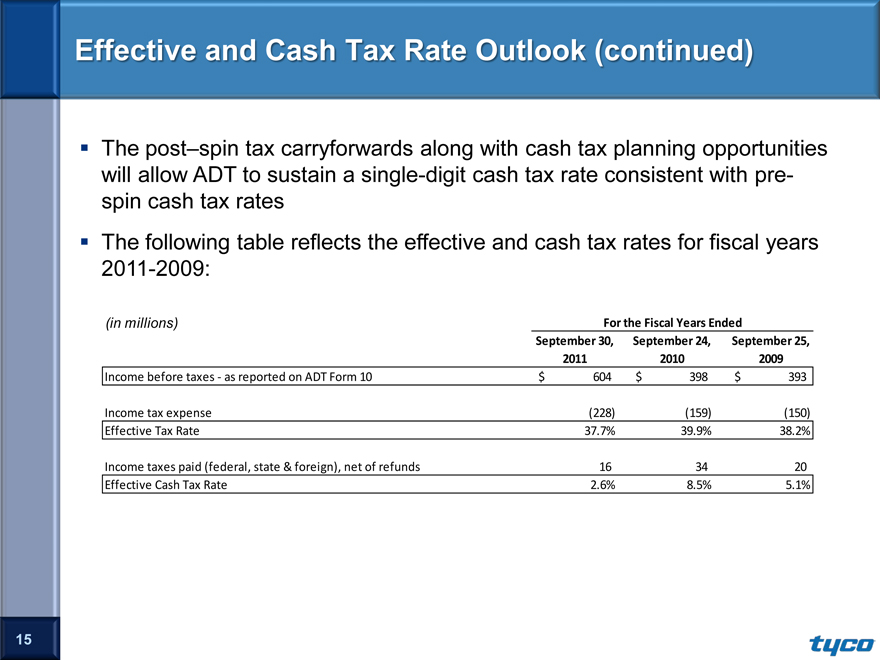

Effective and Cash Tax Rate Outlook (continued)

The post–spin tax carryforwards along with cash tax planning opportunities will allow ADT to sustain a single-digit cash tax rate consistent with pre-spin cash tax rates

The following table reflects the effective and cash tax rates for fiscal years 2011-2009:

(in millions) For the Fiscal Years Ended

September 30, September 24, September 25,

2011 2010 2009

Income before taxes-as reported on ADT Form 10 $ 604 $ 398 $ 393

Income tax expense (228) (159) (150)

Effective Tax Rate 37.7% 39.9% 38.2%

Income taxes paid (federal, state & foreign), net of refunds 16 34 20

Effective Cash Tax Rate 2.6% 8.5% 5.1%

15

Next Steps – Tyco Separation

File Flow Control Documents and Proxy Statement with SEC

SEC Review of Documents

Future updates to include quarterly results, identification of Board members and finalization of capital structure

Issuance of new ADT and Flow Control debt

Settlement of Tyco debt

Execution of ADT Separation Agreement

IRS rulings and tax opinion from counsel

Customary regulatory approval

Final approval from Tyco Board of Directors

Shareholder approval

Effectiveness of Registration Statements

Distribution of spin-co common stock (and consummation of Flow Control merger)

On-Track To Complete Separation At The End Of September 2012

16

Appendix

Non-GAAP Measures

In this presentation, we disclose non-GAAP measures that management believes provide useful information to investors. These measures consist of (1) EBITDA and (2) free cash flow (“FCF”). These measures are not financial measures under GAAP and should not be considered as substitutes for net income, operating profit, cash from operating activities or any other operating performance measure calculated in accordance with GAAP, and they may not be comparable to similarly titled measures reported by other companies. EBITDA is used to measure the operational strength and performance of the business. FCF is used as an additional performance to measure the company’s ability to service debt and make investments. These measures, or measures that are based on them, may be used as components in ADT’s incentive compensation plans.

We believe EBITDA is useful because it measures ADT’s success in acquiring, retaining and servicing its customer base and its ability to generate and grow its recurring revenue while providing a high level of customer service in a cost-effective manner. EBITDA excludes interest expense and the provision for income taxes. Excluding these items eliminates the expenses associated with ADT’s capitalization and tax structure. Because EBITDA excludes interest expense, it does not give effect to cash used for debt service requirements and thus does not reflect available funds for distributions, reinvestment or other discretionary uses. EBITDA also excludes depreciation and amortization, which eliminates the impact of non-cash charges related to capital investments. Depreciation and amortization includes depreciation of subscriber system assets and other fixed assets, amortization of deferred costs and deferred revenue associated with subscriber acquisitions and amortization of dealer and other intangible assets.

There are material limitations to using EBITDA. EBITDA may not be comparable to similarly titled measures reported by other companies. Furthermore, EBITDA does not take into account certain significant items, including depreciation and amortization, interest expense and tax expense, which directly affect net income. These limitations are best addressed by considering the economic effects of the excluded items independently, and by considering EBITDA in conjunction with net income as calculated in accordance with GAAP.

FCF is defined as cash from operations less cash outlays related to capital expenditures, subscriber system assets, dealer generated customer accounts and bulk account purchases. These items are subtracted from cash from operating activities because they represent long-term investments that are required for normal business activities. As a result, FCF is a useful measure of our cash that is free from significant existing obligations and available for other uses.

Furthermore, FCF adjusts for cash items that are ultimately within management’s and the board of directors’ discretion to direct and therefore may imply that there is less or more cash that is available for our programs than the most comparable GAAP measure. This limitation is best addressed by using FCF in combination with the GAAP cash flow numbers.

The tables that follow reconcile EBITDA to net income and FCF to cash flows from operating activities

18

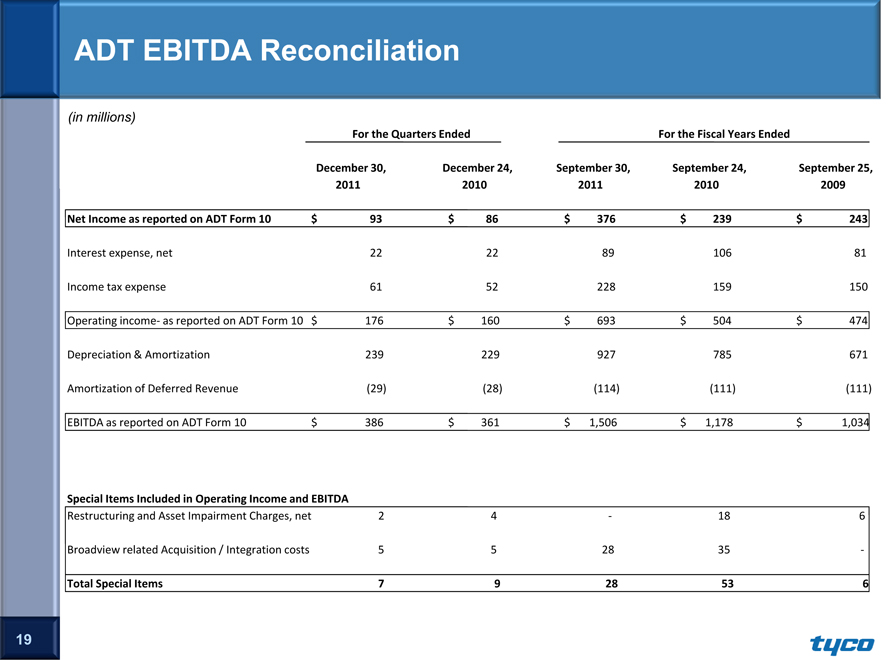

ADT EBITDA Reconciliation

(in millions)

For the Quarters Ended For the Fiscal Years Ended

December 30, December 24, September 30, September 24, September 25,

2011 2010 2011 2010 2009

Net Income as reported on ADT Form 10 $ 93 $ 86 $ 376 $ 239 $ 243

Interest expense, net 22 22 89 106 81

Income tax expense 61 52 228 159 150

Operating income- as reported on ADT Form 10 $ 176 $ 160 $ 693 $ 504 $ 474

Depreciation & Amortization 239 229 927 785 671

Amortization of Deferred Revenue (29) (28) (114) (111) (111)

EBITDA as reported on ADT Form 10 $ 386 $ 361 $ 1,506 $ 1,178 $ 1,034

Special Items Included in Operating Income and EBITDA

Restructuring and Asset Impairment Charges, net 2 4 - 18 6

Broadview related Acquisition / Integration costs 5 5 28 35 -

Total Special Items 7 9 28 53 6

19

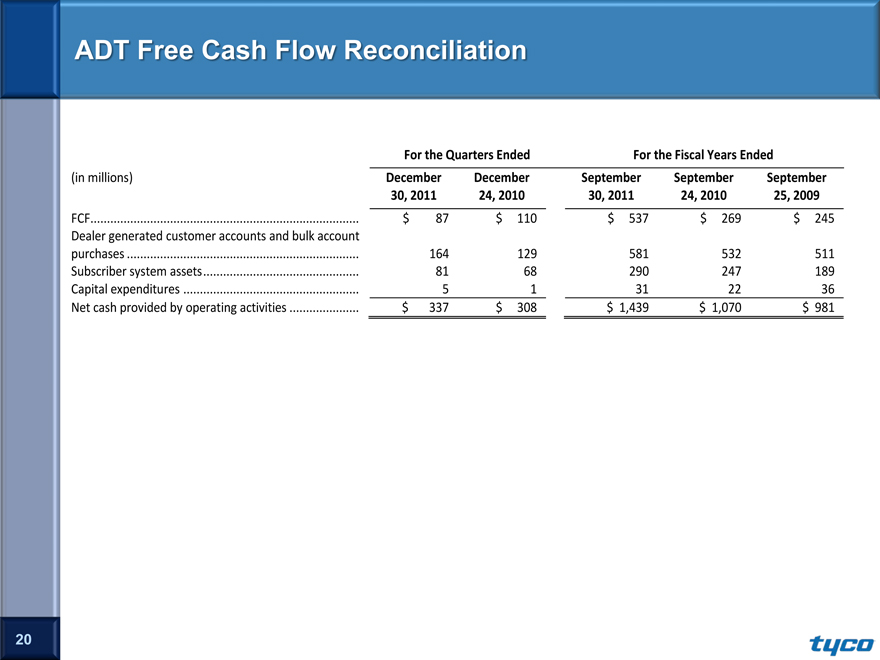

ADT Free Cash Flow Reconciliation

For the Quarters Ended For the Fiscal Years Ended

(in millions) December December September September September

30, 2011 24, 2010 30, 2011 24, 2010 25, 2009

FCF $ 87 $ 110 $ 537 $ 269 $ 245

Dealer generated customer accounts and bulk account

purchases 164 129 581 532 511

Subscriber system assets 81 68 290 247 189

Capital expenditures 5 1 31 22 36

Net cash provided by operating activities $ 337 $ 308 $ 1,439 $ 1,070 $ 981

20