Exhibit 99.2

The ADT Corporation

INVESTOR DAY PRESENTATION

SEPTEMBER 18, 2012

Safe Harbor

Some of the statements included herein constitute “forward-looking statements” regarding business strategies, market potential, future financial performance and other matters. Words such as “anticipates,” “estimates,” “expects,” “projects,” “forecasts,” “intends,” “plans,” “believes” and words and terms of similar substance used in connection with any discussion of future operating or financial performance identify forward-looking statements. These forward-looking statements are based on management’s current expectations and beliefs about future events. As with any projection or forecast, they are inherently susceptible to uncertainty and changes in circumstances. Except for our ongoing obligations to disclose material information under the U.S. federal securities laws, neither we nor Tyco are under any obligation to, and expressly disclaim any obligation to, update or alter any forward-looking statements whether as a result of such changes, new information, subsequent events or otherwise.

Various factors could adversely affect our operations, business or financial results in the future and cause our actual results to differ materially from those contained in the forward-looking statements.

Our actual results could differ materially from management’s expectations because of these factors, including:

competition in the markets we serve, including new entrants in these markets;

our ability to develop or acquire new technology;

failure to maintain the security of our information and technology networks;

allegations that we have infringed the intellectual property rights of third parties;

unauthorized use of our brand name;

risks associated with Tyco’s ownership of the ADT® brand name outside of the United States and Canada;

failure to enforce our intellectual property rights;

our dependence on certain software technology that we license from third parties;

failure or interruption in products or services of third-party providers;

our greater exposure to liability for employee acts or omissions or system failures;

an increase in the rate of customer attrition;

downturns in the housing market and consumer discretionary income;

risks associated with our non-compete and non-solicit arrangements with Tyco;

entry of potential competitors upon the expiration of non-competition agreements;

shifts in consumers’ choice of, or telecommunication providers’ support for, telecommunication services and equipment;

interruption to our monitoring facilities;

interference with our customer’s access to some of our products and services through the Internet by broadband service providers;

potential impairment of our deferred tax assets;

changes in U.S. and non-U.S. governmental laws and regulations; ??risks associated with acquiring and integrating customer accounts;

potential loss of authorized dealers and affinity marketing relationships;

failure to realize expected benefits from acquisitions;

risks associated with pursuing business opportunities that diverge from our current business model;

potential liabilities for obligations of The Brink’s Company under the Coal Act;

capital market conditions, including availability of funding sources;

failure to fully realize expected benefits from the spin-off; and

difficulty in operating as an independent public company separate from Tyco.

Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. These factors should not be construed as exhaustive. If one or more of these or other risks or uncertainties materialize or if our underlying assumptions prove to be incorrect, actual results may vary materially from what we projected. Consequently, actual events and results may vary significantly from those included in or contemplated or implied by our forward-looking statements. The forward-looking statements included herein are made only as of the date hereof, and we undertake no obligation to publicly update or review any forward-looking statement made by us or on our behalf, whether as a result of new information, future developments, subsequent events or circumstances or otherwise. The information contained herein should be considered in conjunction with our Form 10 and related exhibits originally filed with the Securities and Exchange Commission on April 10, 2012 and most recently amended September 7, 2012 including the sections entitled “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” the financial statements and the related notes thereto and other financial data included elsewhere in the Form 1 0.

Introduction to Today’s Presentation

Naren Gursahaney

Chief Executive Officer

Kathryn Mikells

Chief Financial Officer

Don Boerema

Chief Corporate Development Officer

Agenda

Introduction to ADT

Residential and Small Business Security Market Strategic Priorities Financial Overview Closing Remarks Q&A

Creating Customers for Life – and Value for Our Shareholders

Strategy builds on demonstrated capabilities, providing for significant growth opportunities Business model provides strong returns and predictable, recurring cash flows

Our Mission

Creating customers for Life

Our Strategic Priorities

Strengthen the core

Extend our leadership position

Invest for growth

Comprehensive Portfolio of Offerings with Industry Leading Solutions and Services

Residential Security

Fast Alarm Service 24/7

Burglar Alarm Monitoring Fire & Smoke Monitoring

Carbon Monoxide Monitoring Flood & Temp Monitoring

Panic Button

Medical Alert System

Small Business Solutions

Intrusion Detection &

Monitoring

Access Control Systems &

Management

Video Surveillance &

Monitoring

24/7 Alarm & Video Monitoring

Adding Lifestyle to Life Safety

24/7 Life Safety Monitoring

Remote System Arm / Disarm

Custom Notifications & Scheduled Events Lighting and Climate Control Remote Video Monitoring & Video Clips

Robust Solutions for Multiple Customer Segments

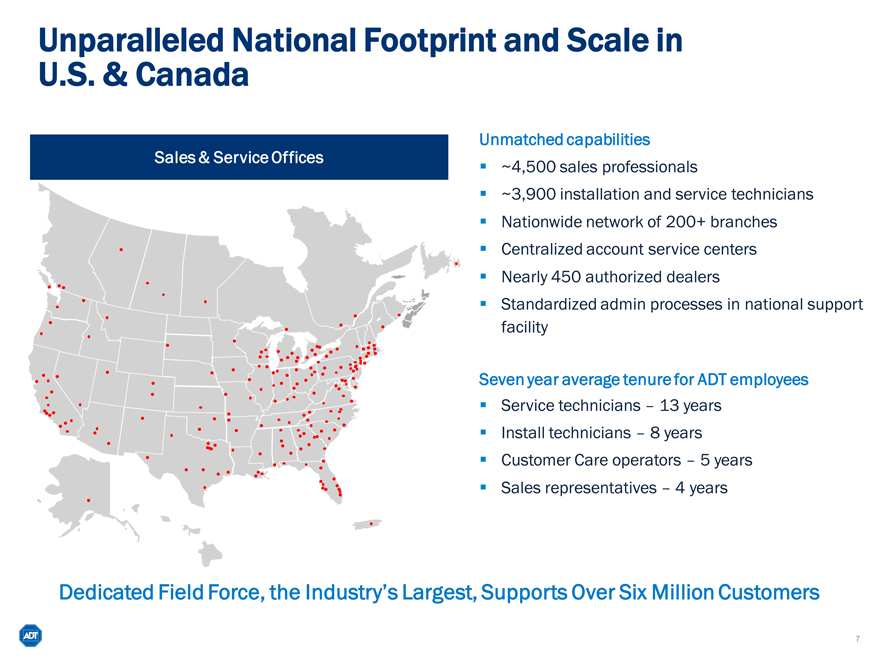

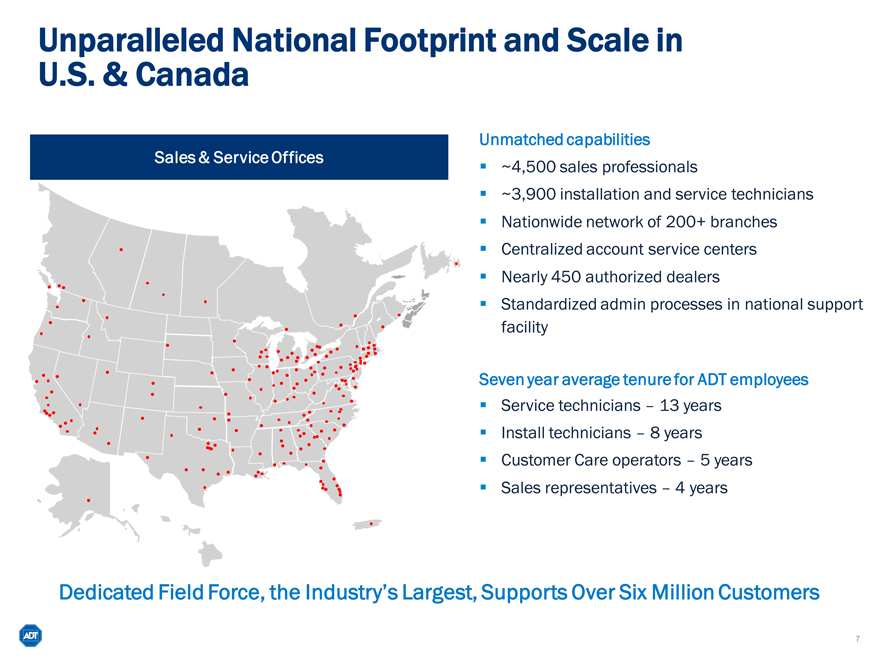

Unparalleled National Footprint and Scale in U.S. & Canada

Sales & Service Offices

Unmatched capabilities

~4,500 sales professionals

~3,900 installation and service technicians

Nationwide network of 200+ branches

Centralized account service centers

Nearly 450 authorized dealers

Standardized admin processes in national support facility

Seven year average tenure for ADT employees

Service technicians – 13 years

Install technicians – 8 years

Customer Care operators – 5 years

Sales representatives – 4 years

Dedicated Field Force, the Industry’s Largest, Supports Over Six Million Customers

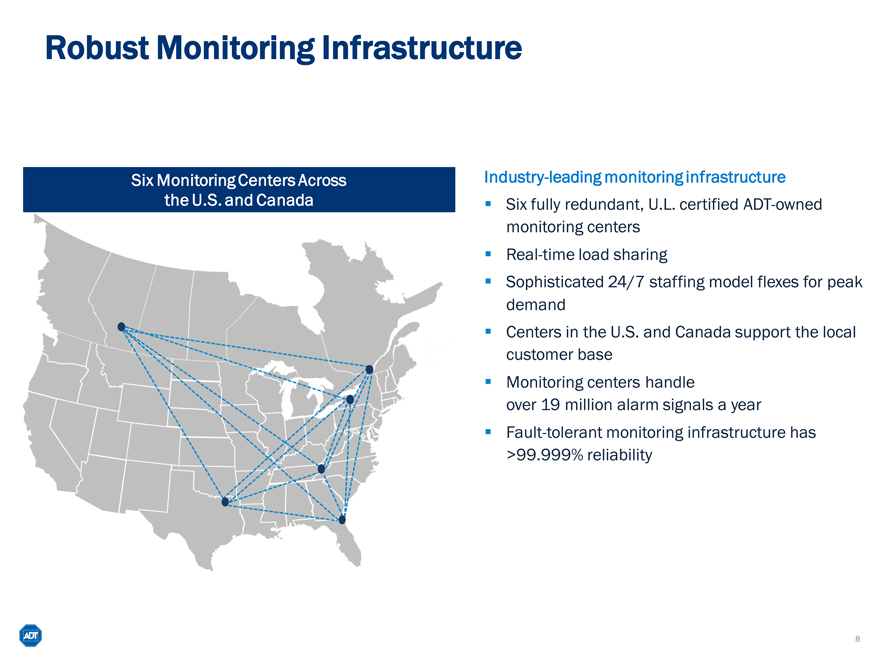

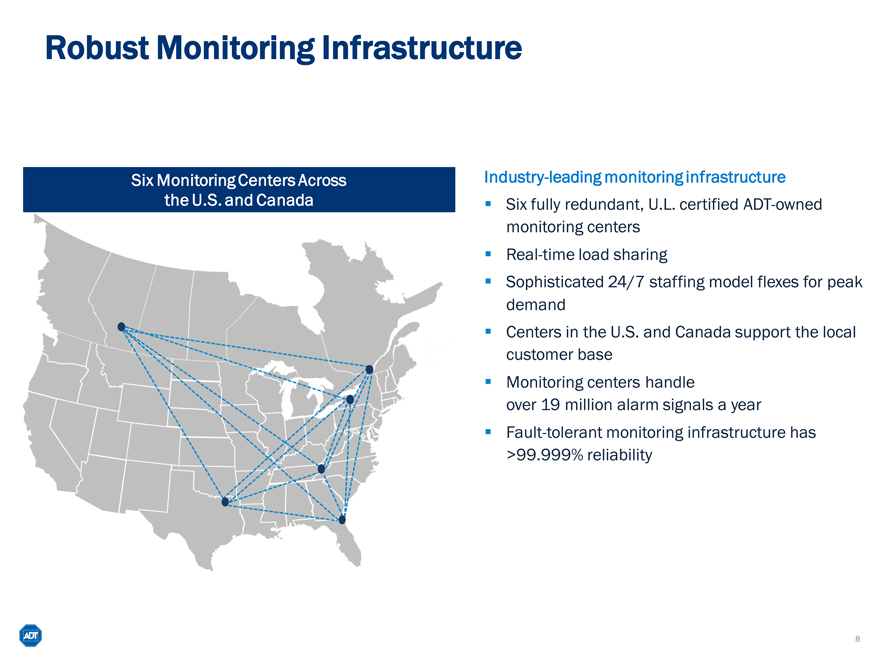

Robust Monitoring Infrastructure

Six Monitoring Centers Across the U.S. and Canada

Industry-leading monitoring infrastructure

Six fully redundant, U.L. certified ADT-owned monitoring centers

Real-time load sharing

Sophisticated 24/7 staffing model flexes for peak demand

Centers in the U.S. and Canada support the local customer base

Monitoring centers handle over 19 million alarm signals a year

Fault-tolerant monitoring infrastructure has >99.999% reliability

Well-Established and Expanding Channel Partner Network

Channel Partner Network

Exclusive Authorized Dealers Lead Generation

450 authorized dealers

Largest dealer network in North America

Dealers are certified and trained to sell and service ADT security products

Diverse lead generation partners

Affinity partnerships with USAA and AARP

Strategic sales partners drive new customer prospects and close leads

Emerging partnerships with homebuilders

(Pulte Homes) and utilities (Florida Power and Light)

Localized related home services partners via ADTpays.com program

ADTpays.com

9

Leading Brand Awareness Supports ADT’s

Leadership Position

Reputation for Service Excellence

Blue Ribbon Award

Display

ADT.com

Search Engines

Mobile and Tablet

Email

Television

Social Media

Known and considered

ADT is the clear market leader, being most top-of-mind with consumers by commanding a 90% aided brand awareness1

Advertising and marketing

Multichannel marketing across paid, earned, owned and borrowed media platforms drives category intender response

75% aided advertising awareness1

Additional marketing spend by authorized dealers amplifies brand message

1 | | Monthly Brand Tracking Study, among security intenders |

10

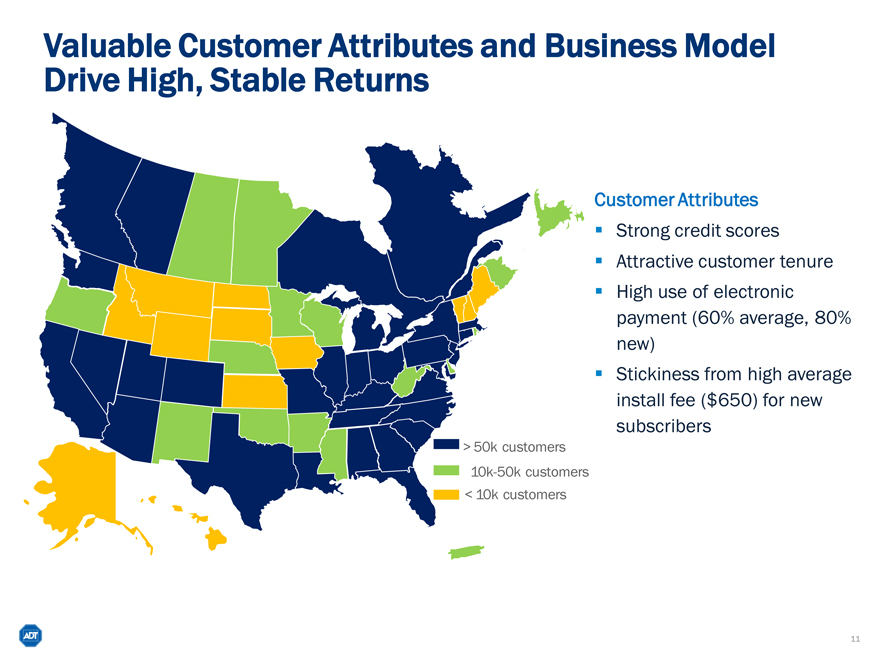

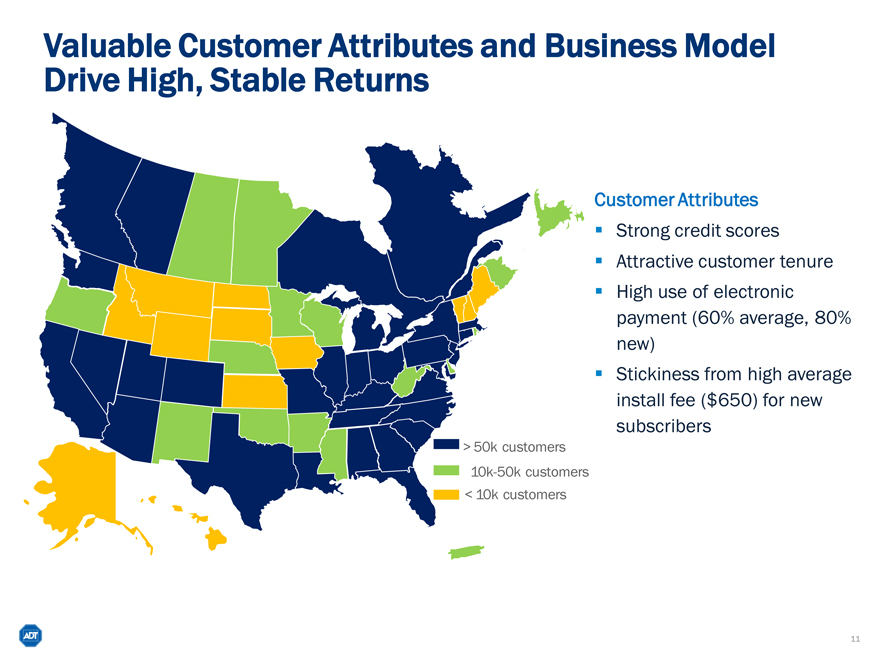

Valuable Customer Attributes and Business Model Drive High, Stable Returns

Customer Attributes

Strong credit scores

Attractive customer tenure

High use of electronic payment (60% average, 80% new)

Stickiness from high average install fee ($650) for new subscribers

> 50k customers 10k-50k customers

< 10k customers

11

Strong Board Leadership

BRUCE GORDON

? Chairman, ADT

? Lead Director, Tyco Int’l; Chair

Nominating & Governance Committee, 2008-2012

? President, Retail Markets, Verizon, 2000-2003

THOMAS COLLIGAN

? Dir, Office Depot, 2010-Pres

? Dir, CNH Global, 2010-Pres

? Dir, Targus, 2010-Pres

? Vice Chair, PwC, 2001-2004

TIMOTHY DONAHUE

? Director, Tyco Int’l, 2008-2012

? Director, Covidien; Chair CHRC, 2008-2012

? Executive Chairman, Sprint Nextel, 2005-2006

? President & CEO, Nextel, 1999-2005

BOB DUTKOWSKY

? CEO, Tech Data, 2006-Pres

? President, CEO & Chairman, Egenera, 2004-2006

NAREN GURSAHANEY

? CEO, ADT, 2012-Pres

? President, Tyco Security Solutions, 2007-2012

? President, VP, GE, 1999-2003

BRIDGETTE HELLER

? EVP & President, Merck Consumer, 2010-Pres

? President, Johnson & Johnson, Global Baby, Kids

& Wound, 2005-2010

KATHLEEN HYLE

? COO, Constellation Energy Resources, 2008-2012

? SVP, Finance and CFO Constellation Energy Nuclear Group and UniStar Nuclear Energy, 2003-2008

DINESH PALIWAL

? Director, Tyco International

? Chairman & CEO, Harman International, 2007-Pres

Experienced Corporate Executives

Note: List is not inclusive of all positions held by each Director

12

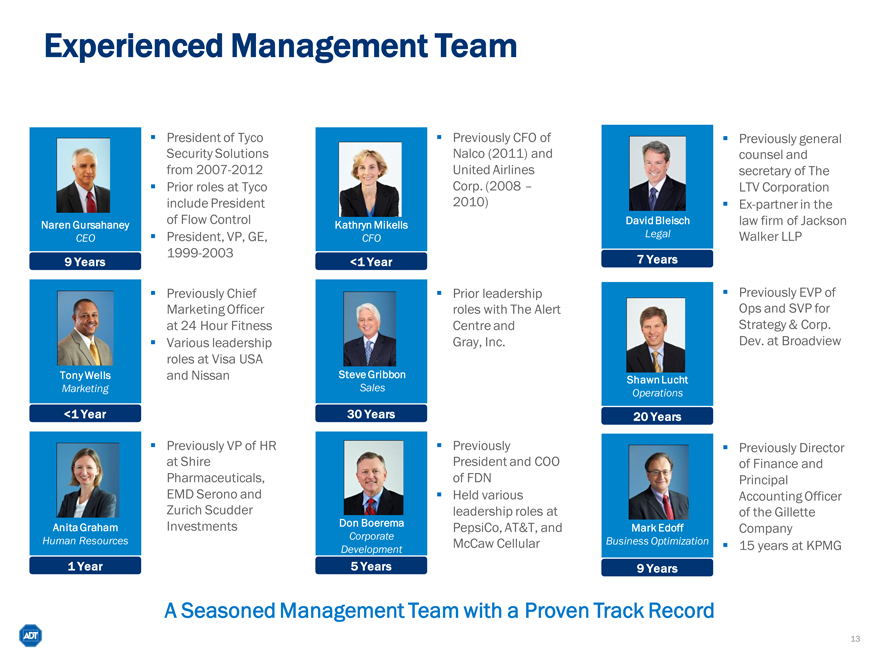

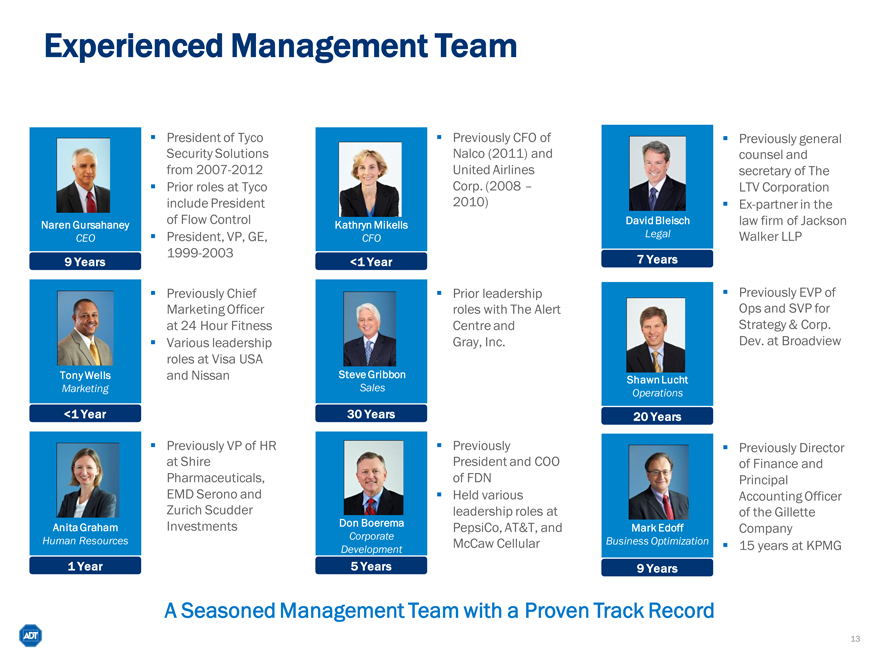

Experienced Management Team

Naren Gursahaney

CEO

9 Years

President of Tyco Security Solutions from 2007-2012

Prior roles at Tyco include President of Flow Control

President, VP, GE, 1999-2003

Tony Wells

Marketing

<1 Year

Previously Chief Marketing Officer at 24 Hour Fitness

Various leadership roles at Visa USA and Nissan

Anita Graham

Human Resources

Previously VP of HR at Shire Pharmaceuticals, EMD Serono and Zurich Scudder Investments

Kathryn Mikells

CFO

<1 Year

Previously CFO of Nalco (2011) and United Airlines Corp. (2008 – 2010)

Steve Gribbon

Sales

30 Years

Prior leadership roles with The Alert Centre and Gray, Inc.

Don Boerema

Corporate Development

Previously

President and COO of FDN

Held various leadership roles at PepsiCo, AT&T, and McCaw Cellular

David Bleisch

Legal

Previously general counsel and secretary of The LTV Corporation

Ex-partner in the law firm of Jackson Walker LLP

Shawn Lucht

Operations

20 Years

Previously EVP of Ops and SVP for Strategy & Corp.

Dev. at Broadview

Mark Edoff

Business Optimization

9 Years

Previously Director of Finance and Principal Accounting Officer of the Gillette Company

15 years at KPMG

A Seasoned Management Team with a Proven Track Record

13

Agenda

Introduction to ADT

Residential and Small Business Security Market Strategic Priorities Financial Overview Closing Remarks Q&A

14

The Clear Leader in a Fragmented Market

Share of North American Residential & Small Business Security Market

0%

25% &

4%

Protection 1

3%

2% Monitronics Vivint

66%

2012 Est. Market

Size ~$13.0B

Thousands of Others

ADT advantages

Customer base ~6x the next largest competitor

Unrivaled brand strength

National install and service coverage in U.S. and Canada

Large, established, and exclusive dealer network

Robust, fully redundant, UL-certified and company operated monitoring capabilities

Purchasing leverage

Leading interactive services platform (ADT Pulse)

15

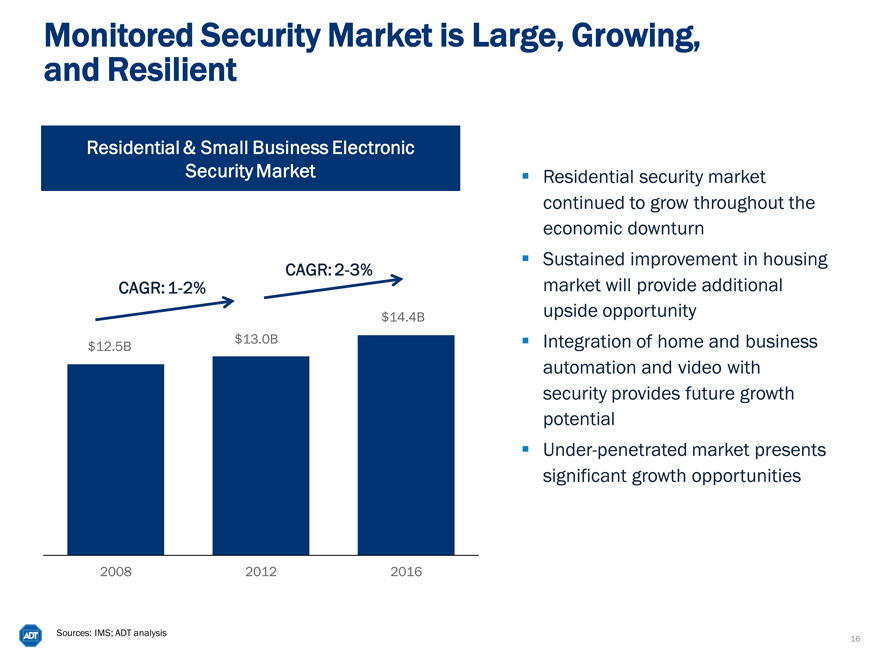

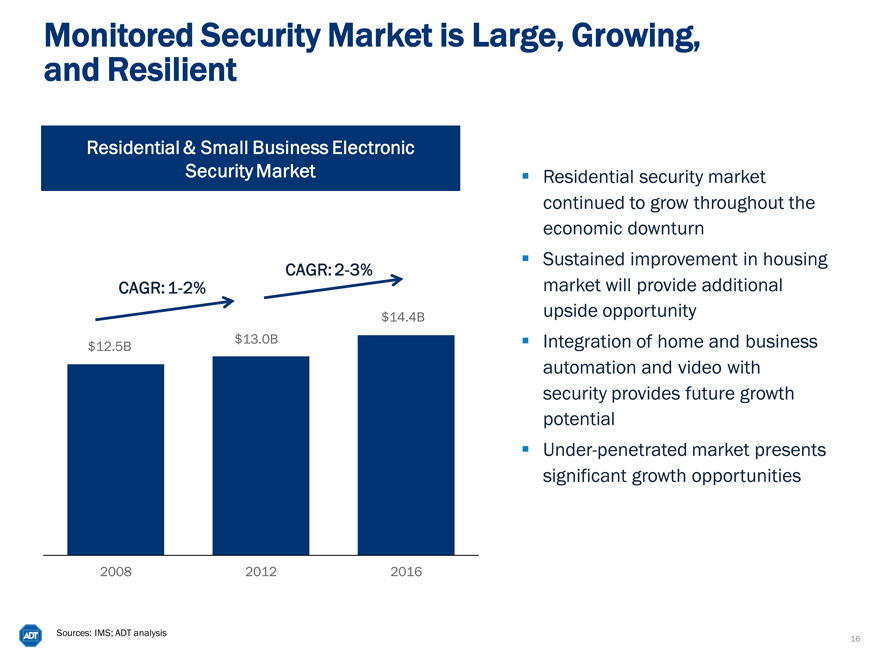

Monitored Security Market is Large, Growing, and Resilient

Residential & Small Business Electronic Security Market

CAGR: 2-3%

CAGR: 1-2%

$12.5B

$13.0B

$14.4B

2008

2012

2016

Residential security market continued to grow throughout the economic downturn

Sustained improvement in housing market will provide additional upside opportunity Integration of home and business automation and video with security provides future growth potential

Under-penetrated market presents significant growth opportunities

16

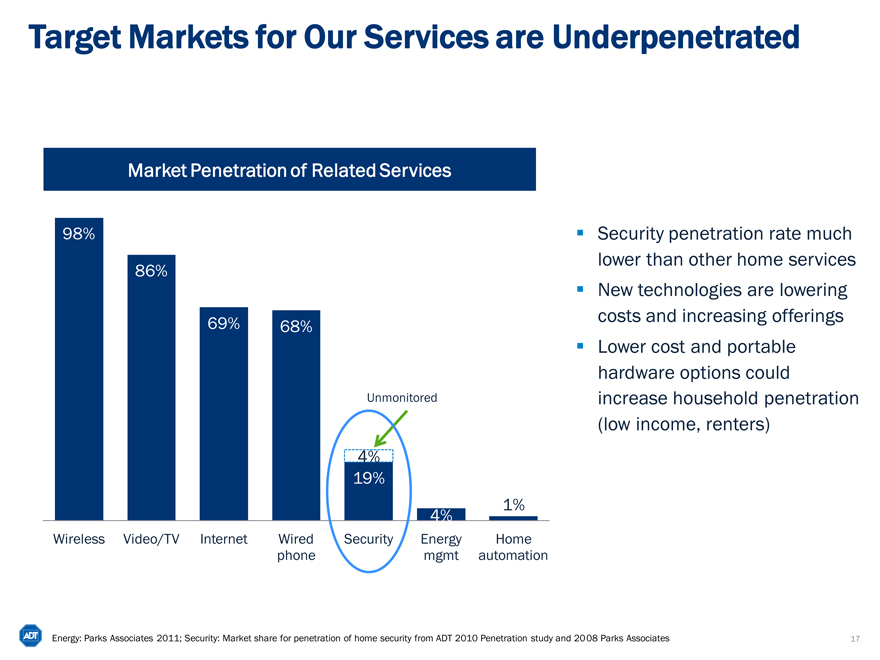

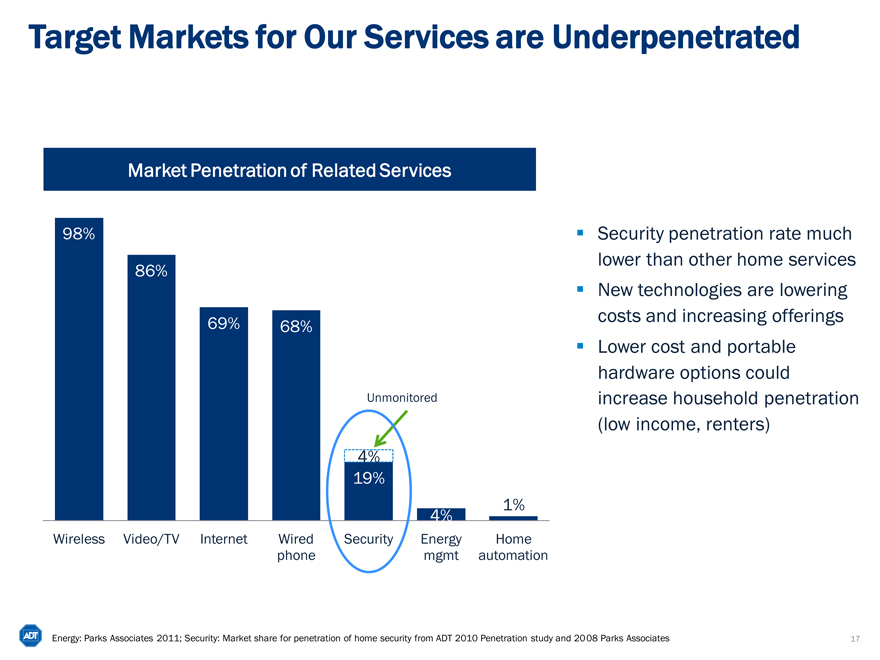

Target Markets for Our Services are Underpenetrated

Market Penetration of Related Services

98%

86%

69%

68%

Unmonitored

4%

19%

1%

4%

Wireless Video/TV Internet Wired Security Energy Home phone mgmt automation

Security penetration rate much lower than other home services

New technologies are lowering costs and increasing offerings

Lower cost and portable hardware options could increase household penetration (low income, renters)

Energy: Parks Associates 2011; Security: Market share for penetration of home security from ADT 2010 Penetration study and 20 08 Parks Associates

17

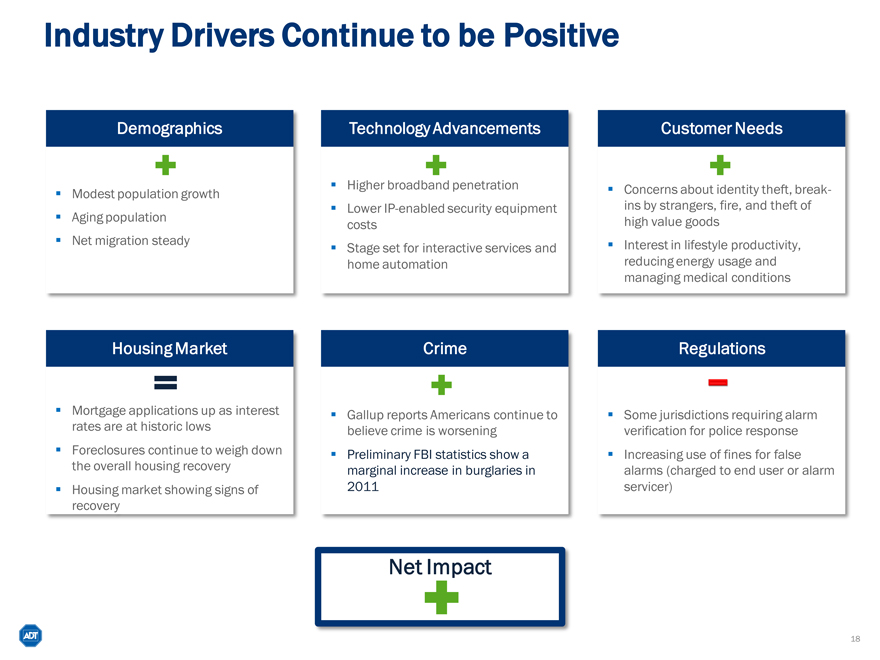

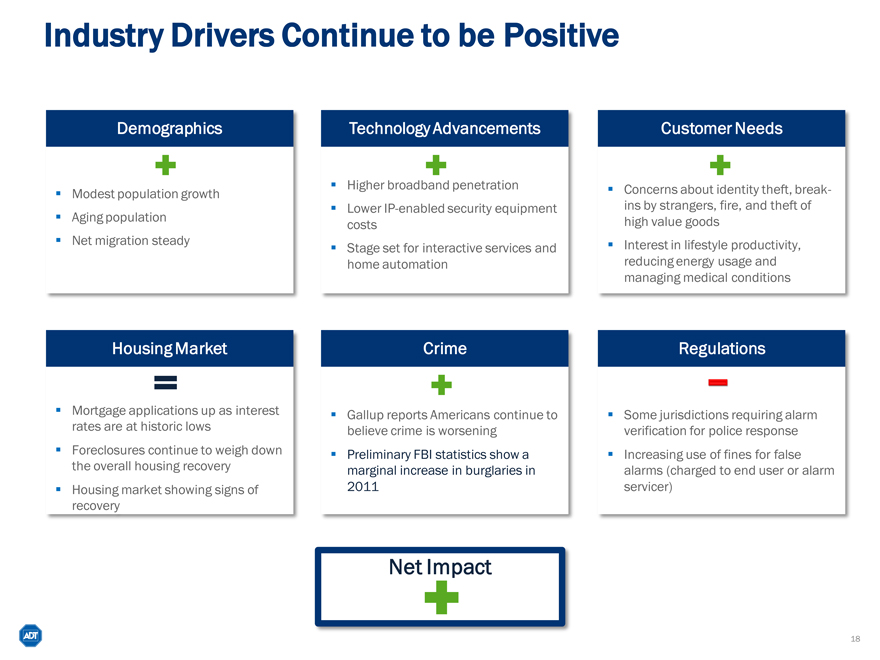

Industry Drivers Continue to be Positive

Demographics

Modest population growth

Aging population

Net migration steady

Technology Advancements

Higher broadband penetration

Lower IP-enabled security equipment costs

Stage set for interactive services and home automation

Customer Needs

Concerns about identity theft, break-ins by strangers, fire, and theft of high value goods

Interest in lifestyle productivity, reducing energy usage and managing medical conditions

Housing Market

Mortgage applications up as interest rates are at historic lows

Foreclosures continue to weigh down the overall housing recovery

Housing market showing signs of recovery

Crime

Gallup reports Americans continue to believe crime is worsening

Preliminary FBI statistics show a marginal increase in burglaries in 2011

Regulations

Some jurisdictions requiring alarm verification for police response

Increasing use of fines for false alarms (charged to end user or alarm servicer)

Net Impact

18

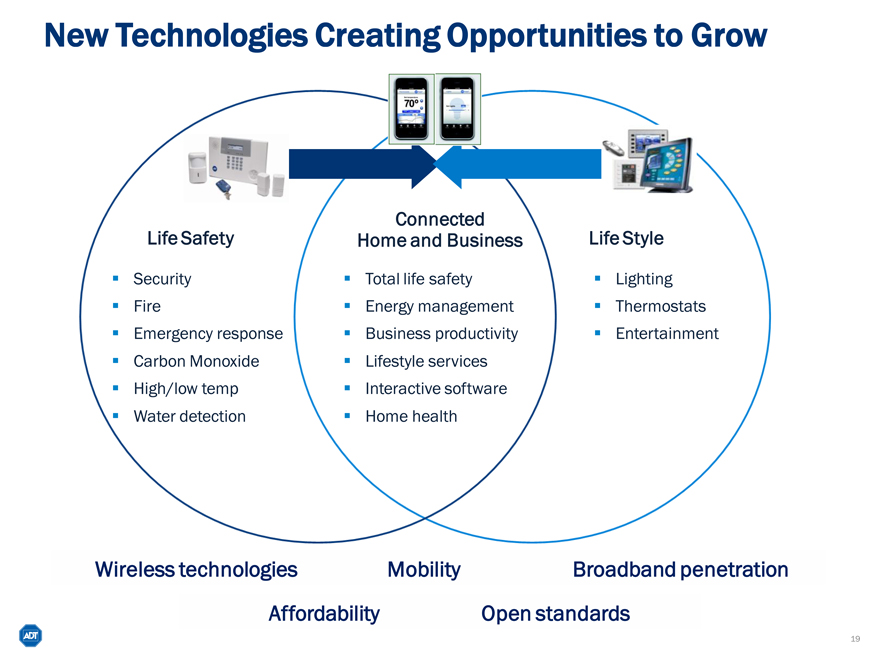

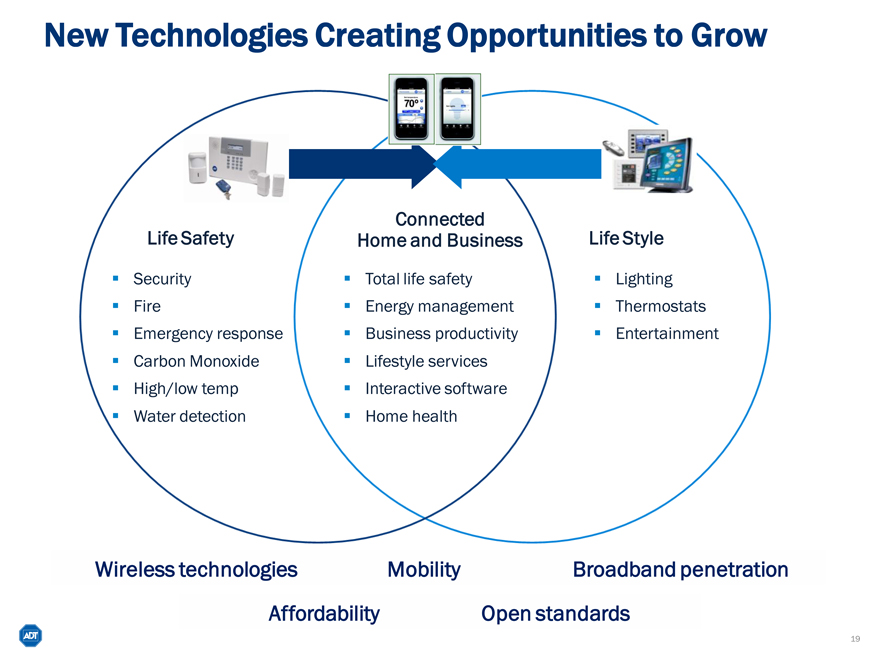

New Technologies Creating Opportunities to Grow

Life Safety

Security

Fire

Emergency response

Carbon Monoxide

High/low temp

Water detection

Connected

Home and Business

Total life safety

Energy management

Business productivity

Lifestyle services

Interactive software

Home health

Life Style

Lighting

Thermostats

Entertainment

Wireless technologies

Mobility

Broadband penetration

Affordability

Open standards

19

Agenda

Introduction to ADT

Residential and Small Business

Security Market

Strategic Priorities

Financial Overview

Closing Remarks

Q&A

20

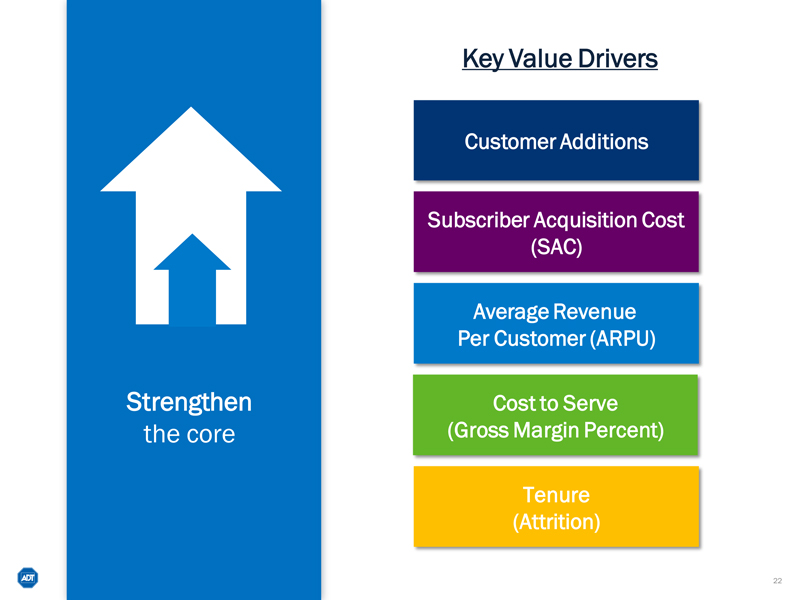

Our Strategic Priorities

Strengthen the core

Extend our leadership position

Invest for growth

21

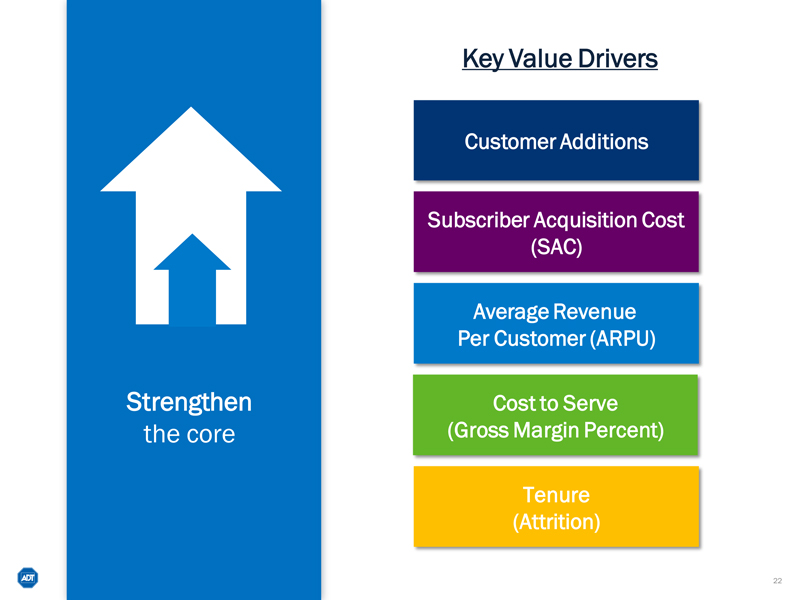

Strengthen the core

Key Value Drivers

Customer Additions

Subscriber Acquisition Cost (SAC)

Average Revenue Per Customer (ARPU)

Cost to Serve (Gross Margin Percent)

Tenure

(Attrition)

22

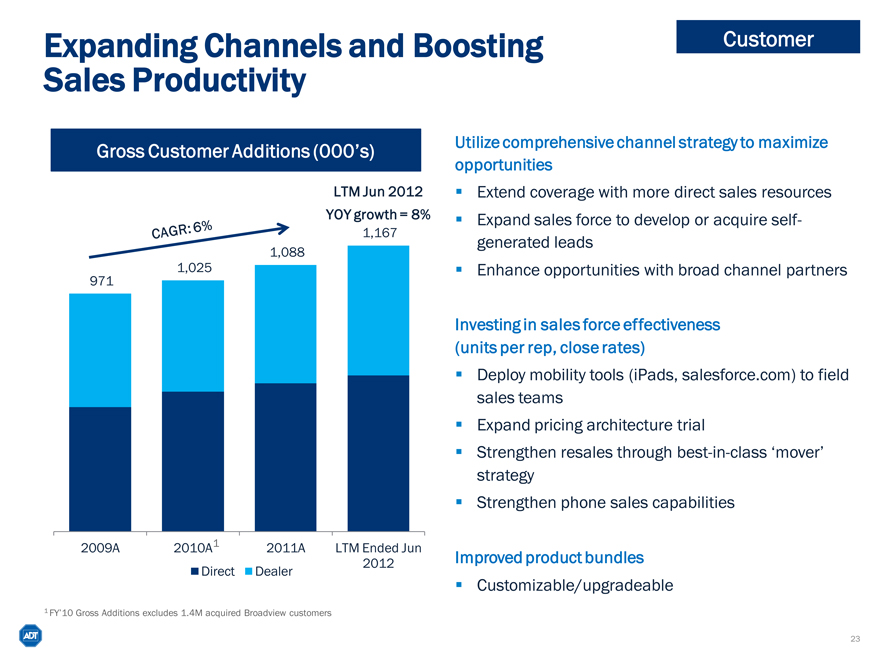

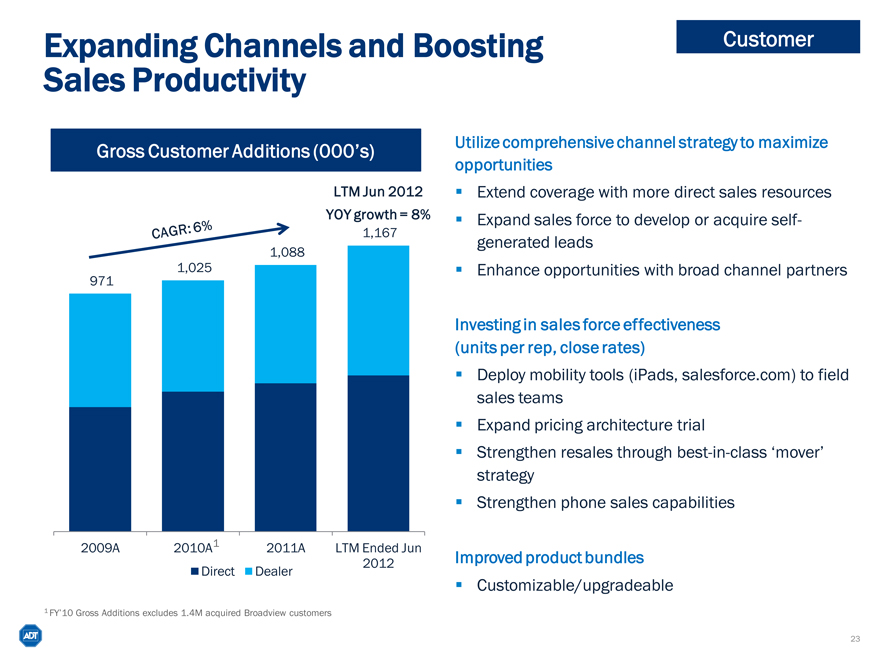

Expanding Channels and Boosting Sales Productivity

Gross Customer Additions (000’s)

LTM Jun 2012

YOY growth = 8%

971

1,025

1,088

1,167

2009A

2010A1

2011A

LTM Ended Jun 2012

Direct

Dealer

Utilize comprehensive channel strategy to maximize opportunities

Extend coverage with more direct sales resources

Expand sales force to develop or acquire self-generated leads

Enhance opportunities with broad channel partners

Investing in sales force effectiveness (units per rep, close rates)

Deploy mobility tools (iPads, salesforce.com) to field sales teams

Expand pricing architecture trial

Strengthen resales through best-in-class ‘mover’ strategy

Strengthen phone sales capabilities

Improved product bundles

Customizable/upgradeable

1 | | FY’10 Gross Additions excludes 1.4M acquired Broadview customers |

23

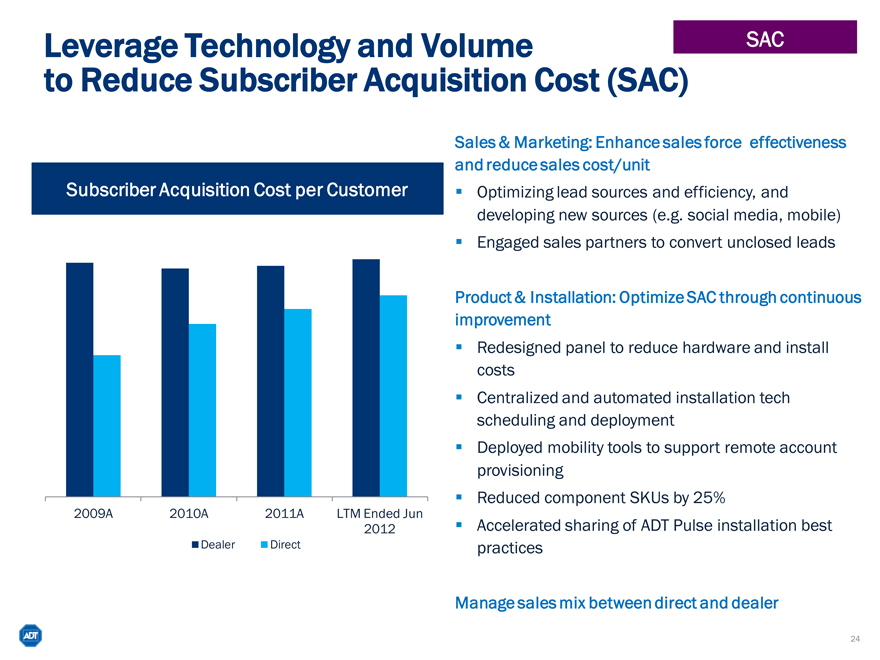

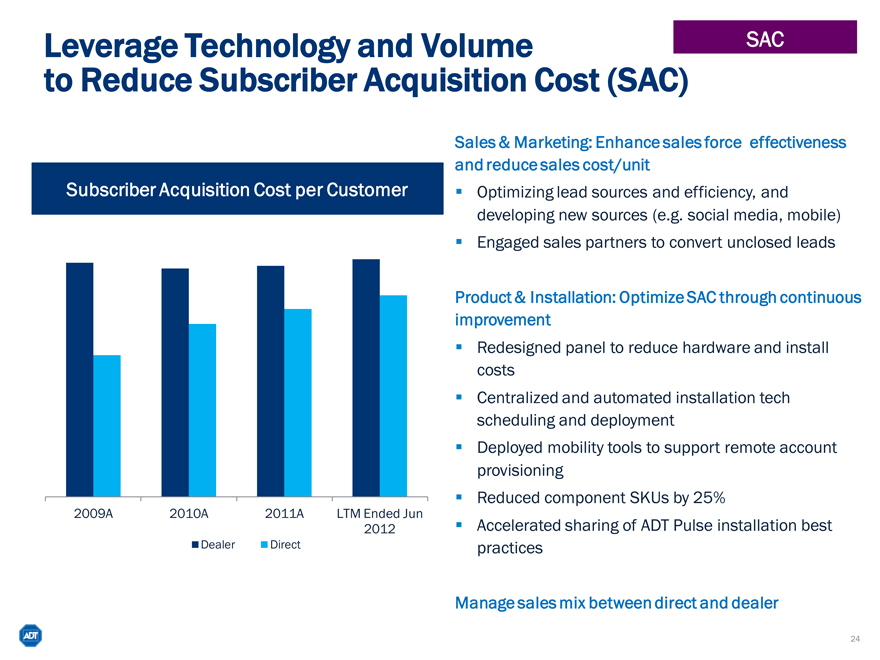

Leverage Technology and Volume to Reduce Subscriber Acquisition Cost (SAC)

SAC

Subscriber Acquisition Cost per Customer

2009A

2010A

2011A

LTM Ended Jun 2012

Dealer

Direct

Sales & Marketing: Enhance sales force effectiveness and reduce sales cost/unit

Optimizing lead sources and efficiency, and developing new sources (e.g. social media, mobile)

Engaged sales partners to convert unclosed leads

Product & Installation: Optimize SAC through continuous improvement

Redesigned panel to reduce hardware and install costs

Centralized and automated installation tech scheduling and deployment

Deployed mobility tools to support remote account provisioning

Reduced component SKUs by 25%

Accelerated sharing of ADT Pulse installation best practices

Manage sales mix between direct and dealer

24

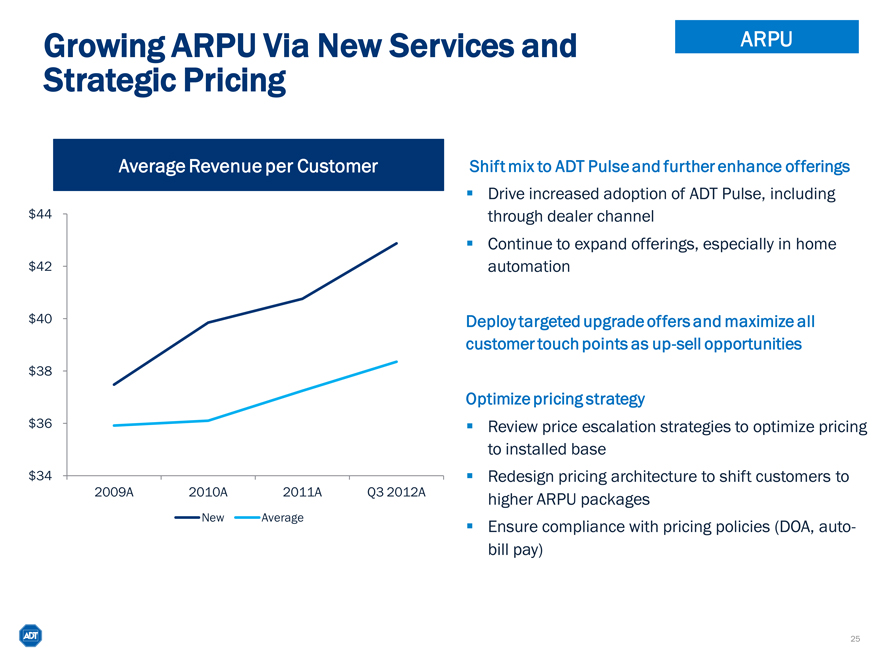

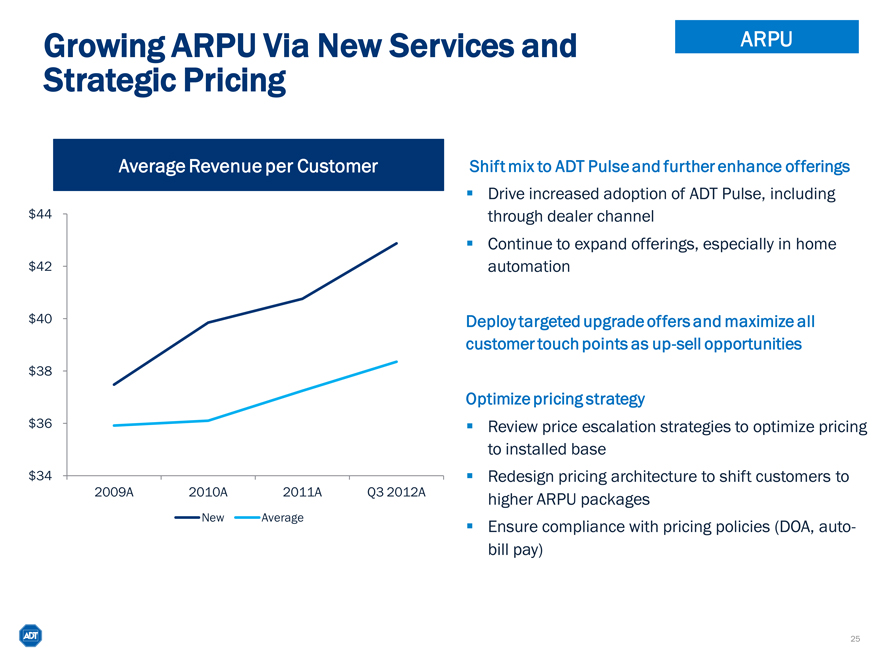

Growing ARPU Via New Services and Strategic Pricing

ARPU

Average Revenue per Customer

$44

$42

$40

$38

$36

$34

2009A

2010A

2011A

Q3 2012A

New

Average

Shift mix to ADT Pulse and further enhance offerings

Drive increased adoption of ADT Pulse, including through dealer channel

Continue to expand offerings, especially in home automation

Deploy targeted upgrade offers and maximize all customer touch points as up-sell opportunities

Optimize pricing strategy

Review price escalation strategies to optimize pricing to installed base

Redesign pricing architecture to shift customers to higher ARPU packages

Ensure compliance with pricing policies (DOA, auto-bill pay)

25

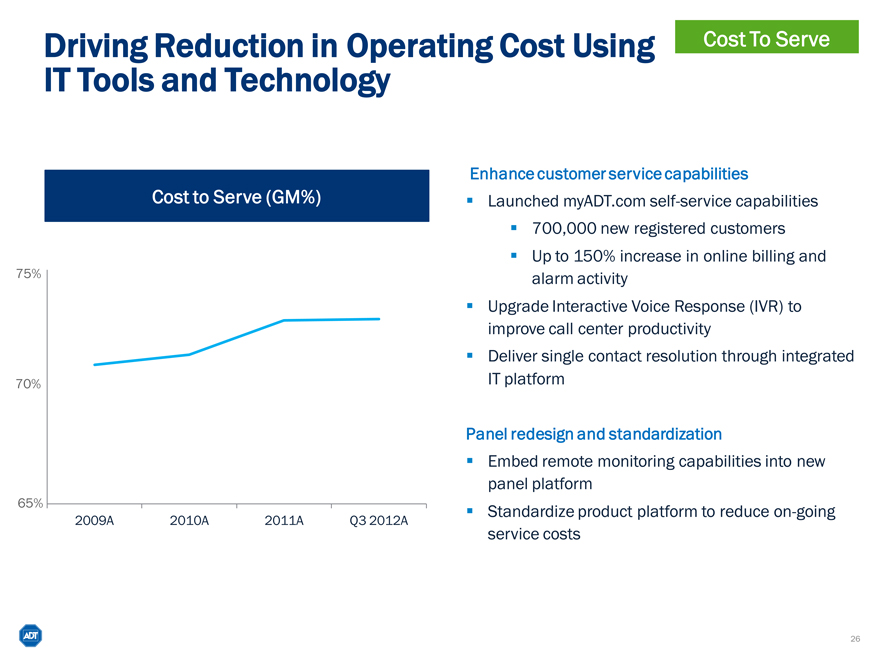

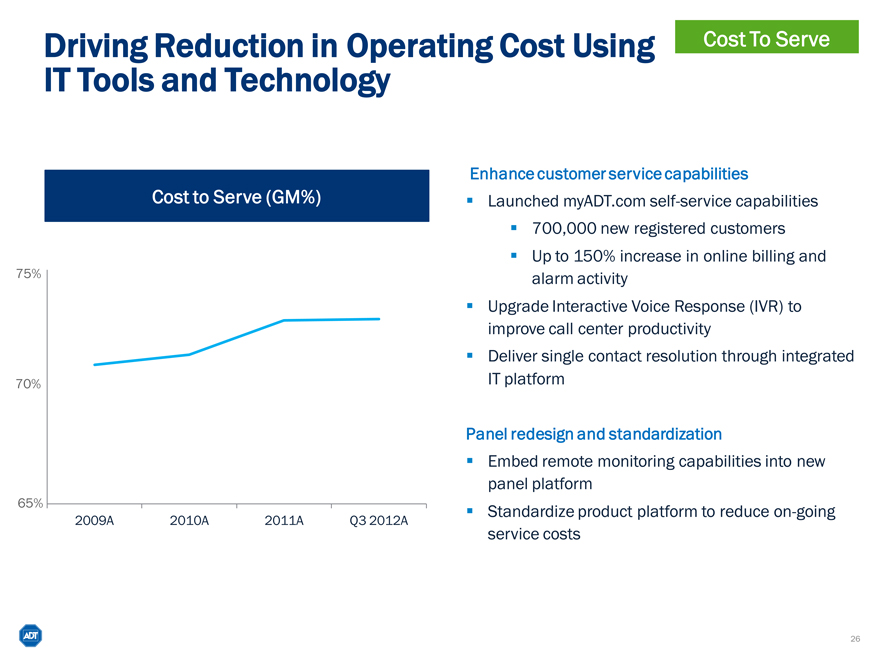

Driving Reduction in Operating Cost Using IT Tools and Technology

Cost To Serve

Cost to Serve (GM%)

75%

70%

65%

2009A

2010A

2011A

Q3 2012A

Enhance customer service capabilities

Launched myADT.com self-service capabilities

700,000 new registered customers

Up to 150% increase in online billing and alarm activity

Upgrade Interactive Voice Response (IVR) to improve call center productivity

Deliver single contact resolution through integrated IT platform

Panel redesign and standardization

Embed remote monitoring capabilities into new panel platform

Standardize product platform to reduce on-going service costs

26

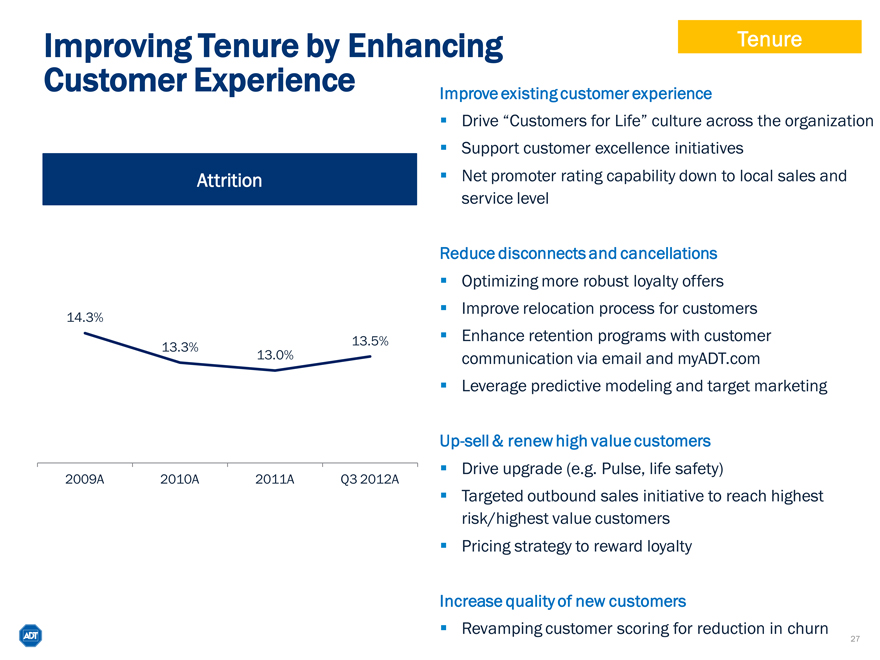

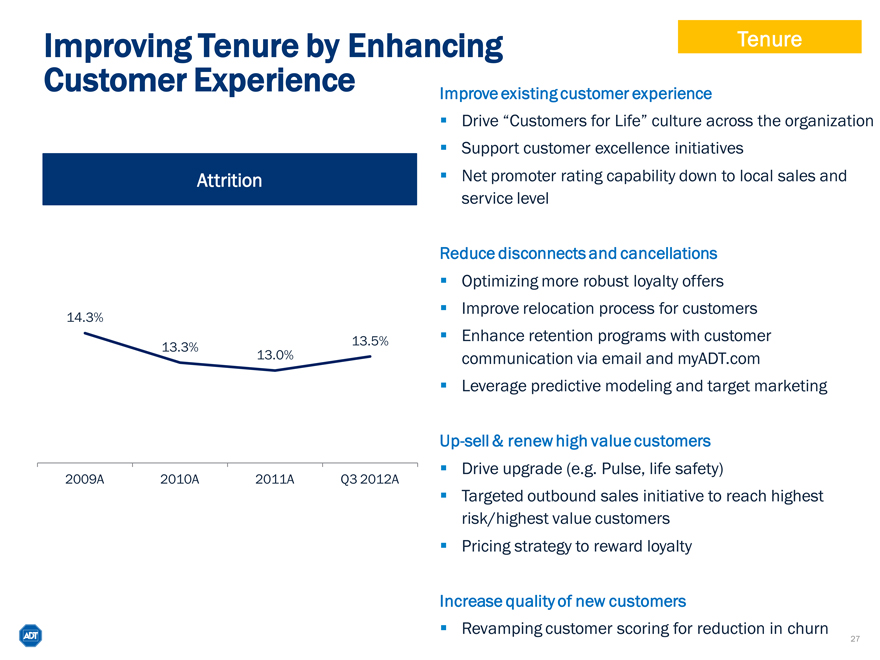

Improving Tenure by Enhancing Customer Experience

Tenure

Attrition

14.3%

13.3%

13.5%

13.0%

2009A

2010A

2011A

Q3 2012A

Improve existing customer experience

Drive “Customers for Life” culture across the organization

Support customer excellence initiatives

Net promoter rating capability down to local sales and service level

Reduce disconnects and cancellations

Optimizing more robust loyalty offers

Improve relocation process for customers

Enhance retention programs with customer communication via email and myADT.com

Leverage predictive modeling and target marketing

Up-sell & renew high value customers

Drive upgrade (e.g. Pulse, life safety)

Targeted outbound sales initiative to reach highest risk/highest value customers

Pricing strategy to reward loyalty

Increase quality of new customers

Revamping customer scoring for reduction in churn

27

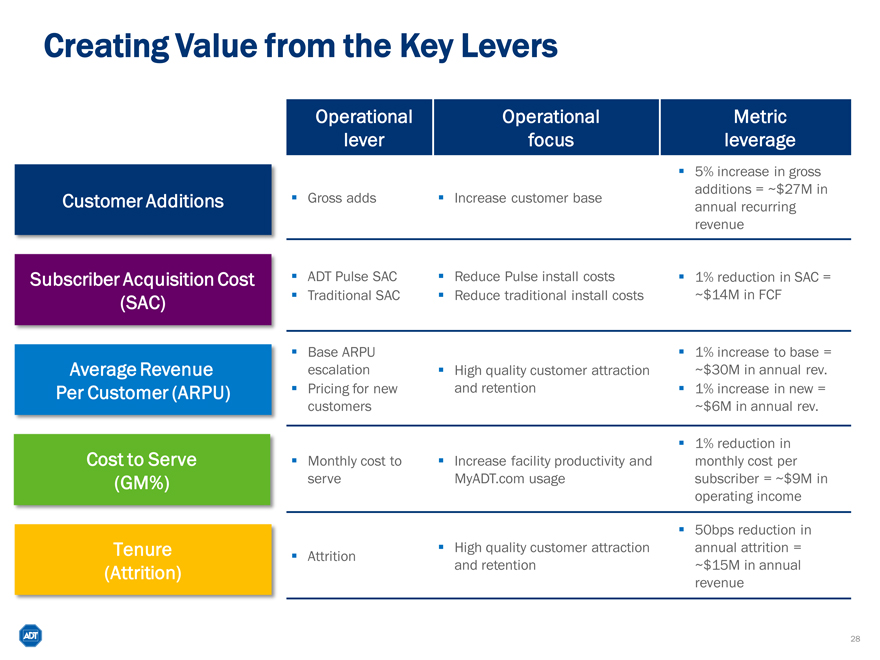

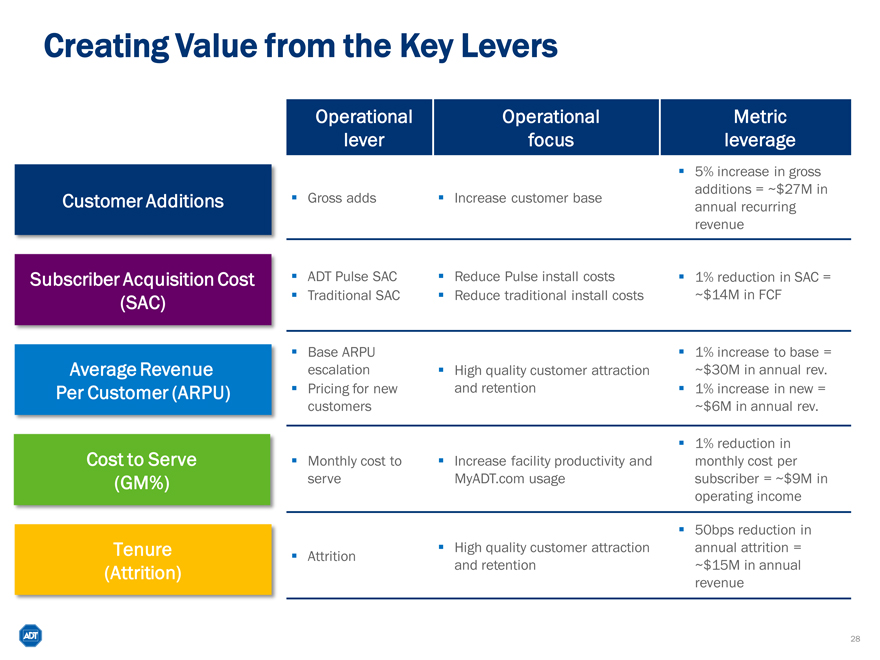

Creating Value from the Key Levers

Customer Additions

Subscriber Acquisition Cost (SAC)

Average Revenue Per Customer (ARPU)

Cost to Serve (GM%)

Tenure (Attrition)

Operational lever

Gross adds

ADT Pulse SAC

Traditional SAC

Base ARPU escalation

Pricing for new customers

Monthly cost to serve

Attrition

Operational focus

Increase customer base

Reduce Pulse install costs

Reduce traditional install costs

High quality customer attraction and retention

Increase facility productivity and MyADT.com usage

High quality customer attraction and retention

Metric leverage

5% increase in gross additions = ~$27M in annual recurring revenue

1% reduction in SAC = ~$14M in FCF

1% increase to base = ~$30M in annual rev.

1% increase in new = ~$6M in annual rev.

1% reduction in monthly cost per subscriber = ~$9M in operating income

50bps reduction in annual attrition = ~$15M in annual revenue

28

Extend our leadership position

Marketing

Sales

Install & Service

Monitoring

Products & Solutions

29

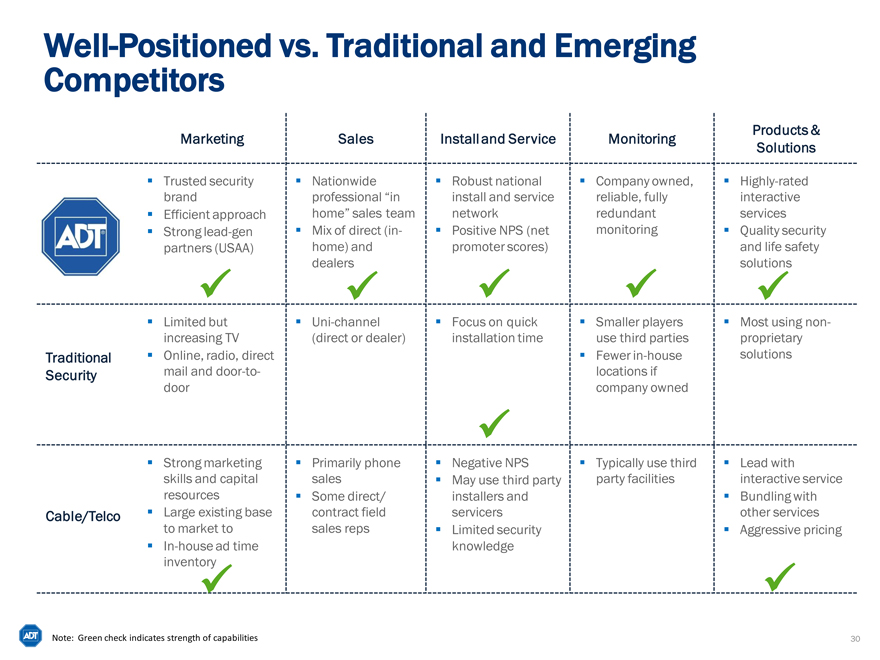

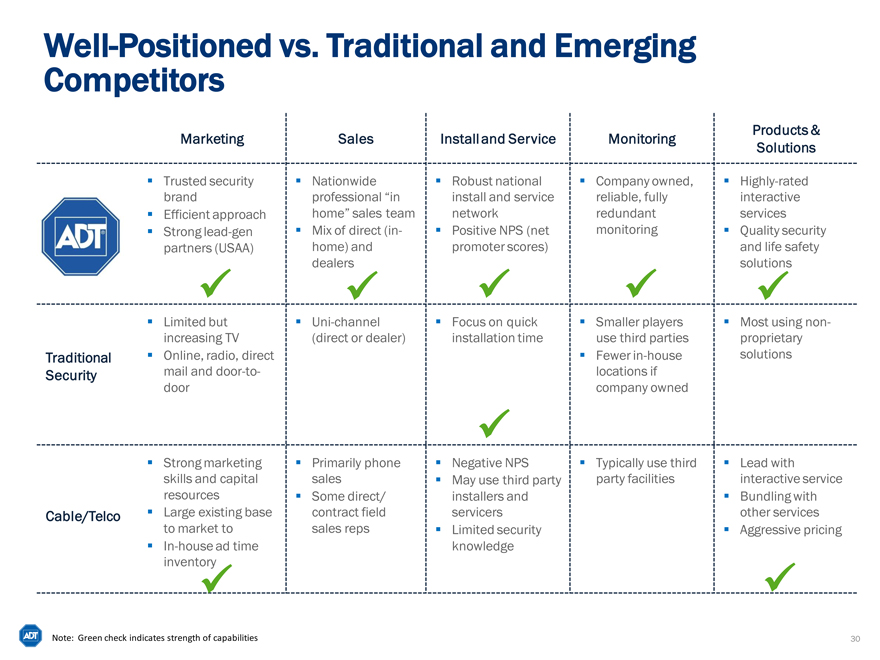

Well-Positioned vs. Traditional and Emerging Competitors

Traditional

Security

Cable/Telco

Marketing

Trusted security brand

Efficient approach

Strong lead-gen partners (USAA)

Limited but increasing TV

Online, radio, direct mail and door-to-door

Strong marketing skills and capital resources

Large existing base to market to In-house ad time inventory

Sales

Nationwide professional “in home” sales team

Mix of direct (in-home) and dealers

Uni-channel (direct or dealer)

Primarily phone sales

Some direct/ contract field sales reps

Install and Service

Robust national install and service network

Positive NPS (net promoter scores)

Focus on quick installation time

Negative NPS

May use third party installers and servicers

Limited security knowledge

Monitoring

Company owned, reliable, fully redundant monitoring

Smaller players use third parties

Fewer in-house locations if company owned

Typically use third party facilities

Products & Solutions

Highly-rated interactive services

Quality security and life safety solutions

Most using non-proprietary solutions

Lead with interactive service

Bundling with other services

Aggressive pricing

Note: Green check indicates strength of capabilities

30

Utilize Full Breadth of Marketing Channels to Attract New Customers

Marketing

Strengthen our capabilities in online marketing vehicles

Social media – lead generation and customer feedback

Mobile/App – lead generation and easy access to account information

Leverage advertising to reinforce ADT’s key differentiators

Trust and technology

Reliability and timely response

Build new partnerships and programs to target potential customers

Mover’s program

Lifestyle (e.g. new parents, business travelers)

Improve marketing analytic capabilities

Micro segmentation of existing customer base

Usage analysis of security and automation functions

31

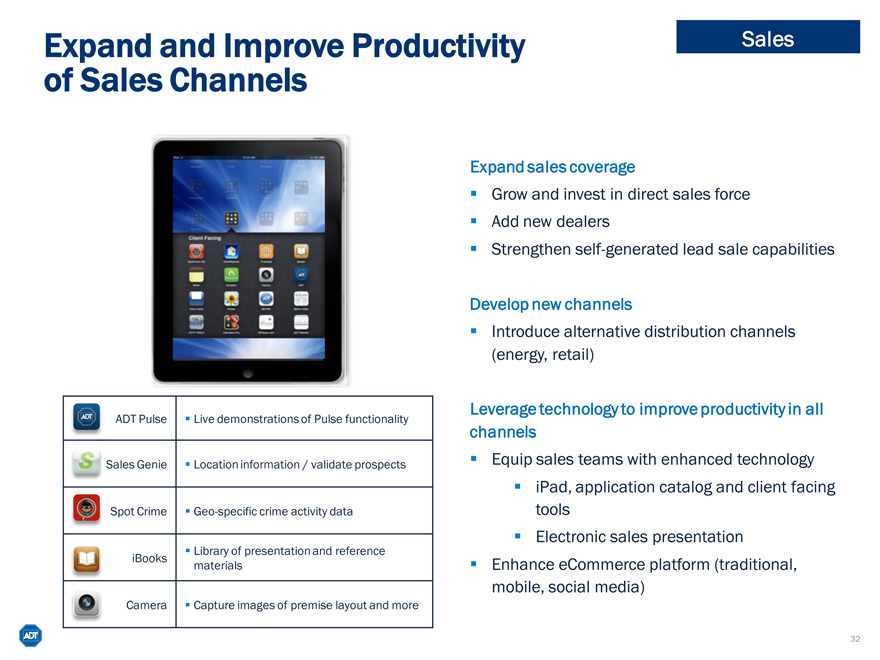

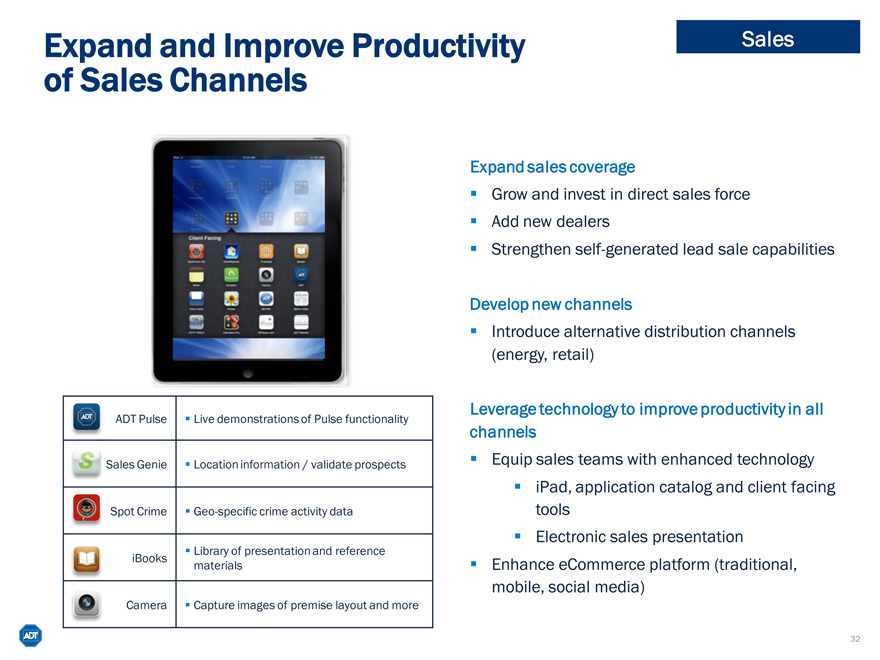

Expand and Improve Productivity of Sales Channels

Sales

ADT Pulse

Live demonstrations of Pulse functionality

Sales Genie

Location information / validate prospects

Spot Crime

Geo-specific crime activity data

Library of presentation and reference

iBooks

materials

Camera

Capture images of premise layout and more

Expand sales coverage

Grow and invest in direct sales force

Add new dealers

Strengthen self-generated lead sale capabilities

Develop new channels

Introduce alternative distribution channels (energy, retail)

Leverage technology to improve productivity in all channels

Equip sales teams with enhanced technology

iPad, application catalog and client facing tools

Electronic sales presentation

Enhance eCommerce platform (traditional, mobile, social media)

32

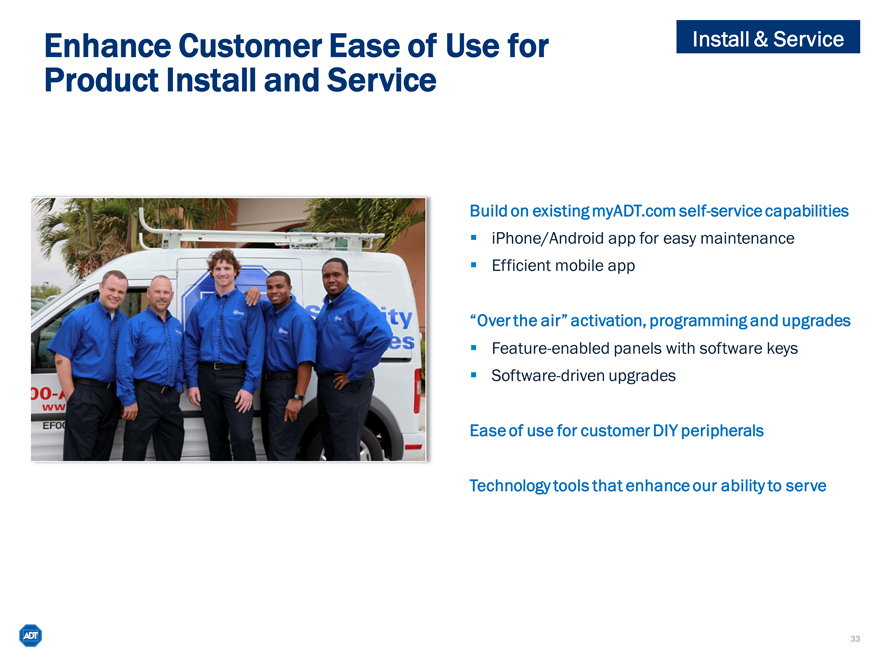

Enhance Customer Ease of Use for Product Install and Service

Install & Service

Build on existing myADT.com self-service capabilities

iPhone/Android app for easy maintenance

Efficient mobile app

“Over the air” activation, programming and upgrades

Feature-enabled panels with software keys

Software-driven upgrades

Ease of use for customer DIY peripherals

Technology tools that enhance our ability to serve

33

Build on Best-in-Class Monitoring Capabilities

Monitoring

Continuous improvement in life safety

Analytics on 25 million annual alarm signals

Continuous training and recognition programs for in-house call center reps

Enhanced customer-selected notification methods

Messages (text messages or e-mails)

Calls (automated or live)

Continued investment in infrastructure

Basic wireline telecommunication connection to wireless

3G technology to Internet Protocol

34

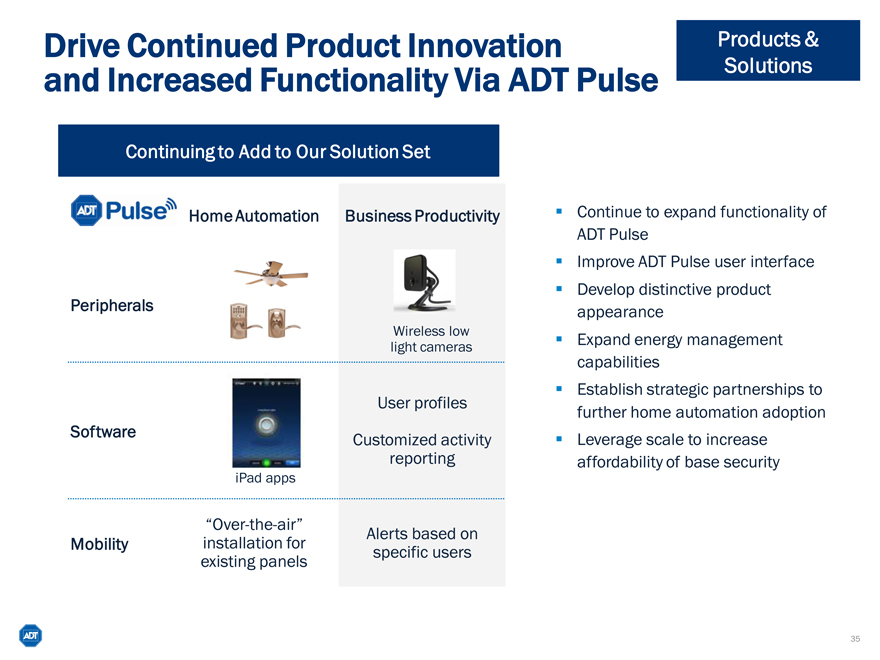

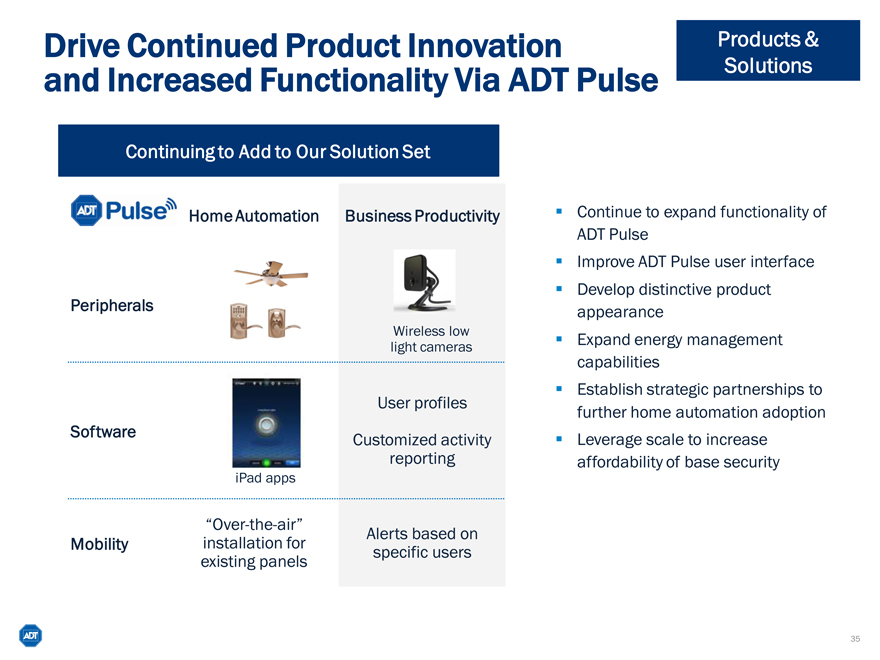

Drive Continued Product Innovation and Increased Functionality Via ADT Pulse

Products & Solutions

Continuing to Add to Our Solution Set

Home Automation

Business Productivity

Peripherals

Wireless loW light cameras

User profiles

Software

Customized activity reporting

iPad apps

Mobility

“Over-the-air” installation for existing panels

Alerts based on specific users

Continue to expand functionality of ADT Pulse

Improve ADT Pulse user interface

Develop distinctive product appearance

Expand energy management capabilities

Establish strategic partnerships to further home automation adoption

Leverage scale to increase affordability of base security

35

Invest for growth

Residential

Small Business

Health Monitoring

36

ADT Pulse Interactive Solutions

37

ADT Pulse Features & Capabilities

38

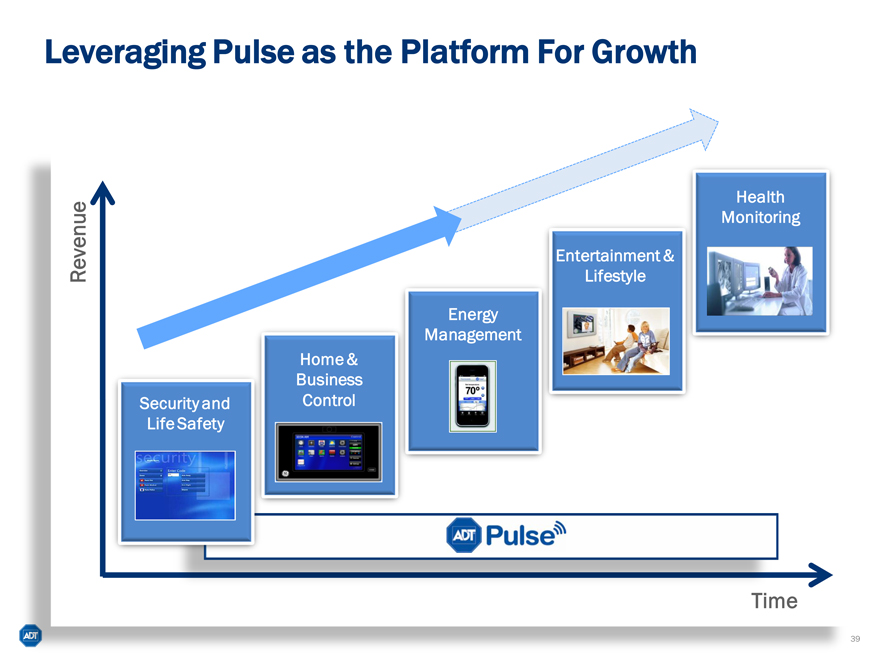

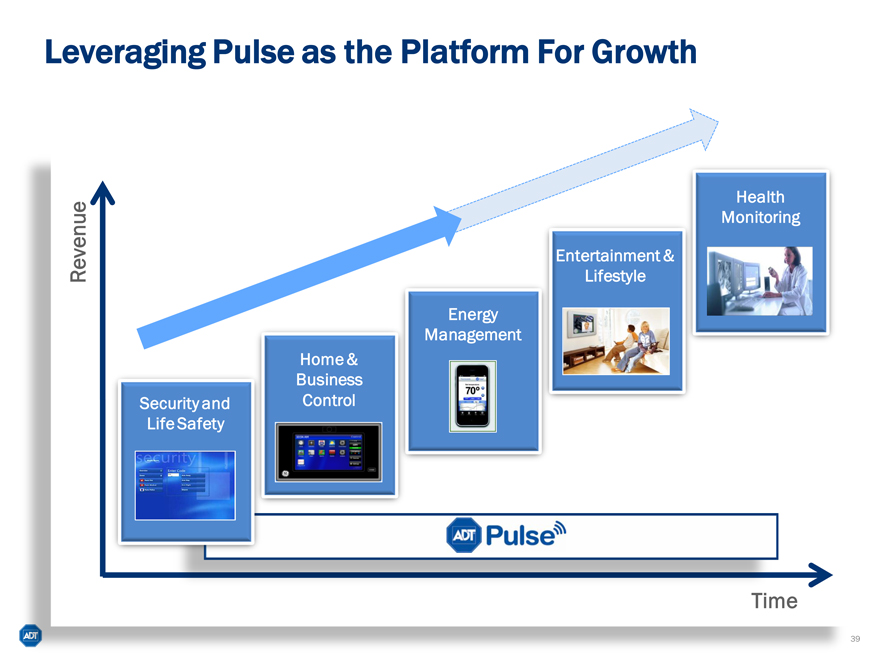

Leveraging Pulse as the Platform For Growth

Revenue

Security and Life Safety

Home & Business Control

Energy Management

Entertainment & Lifestyle

Health Monitoring

39

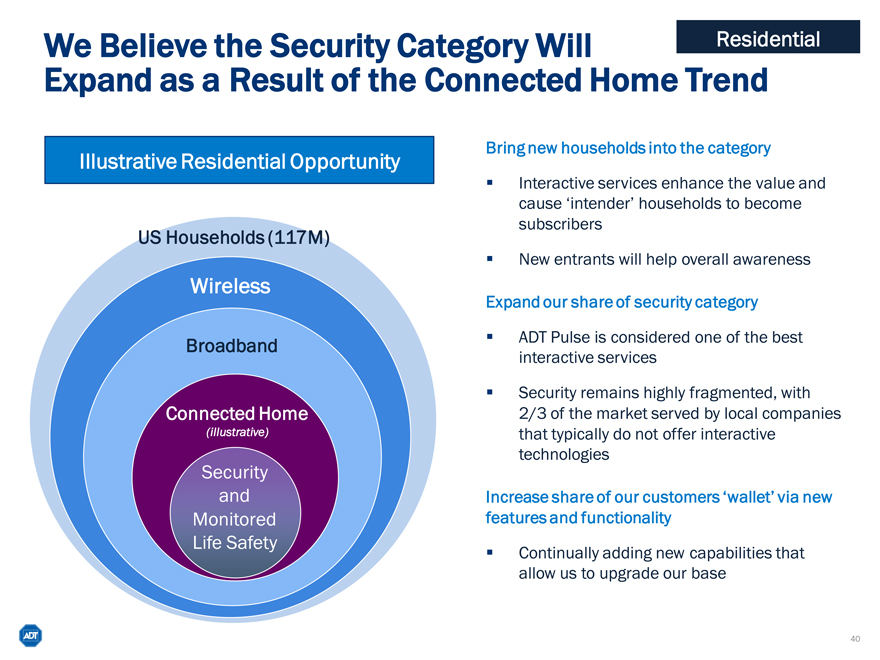

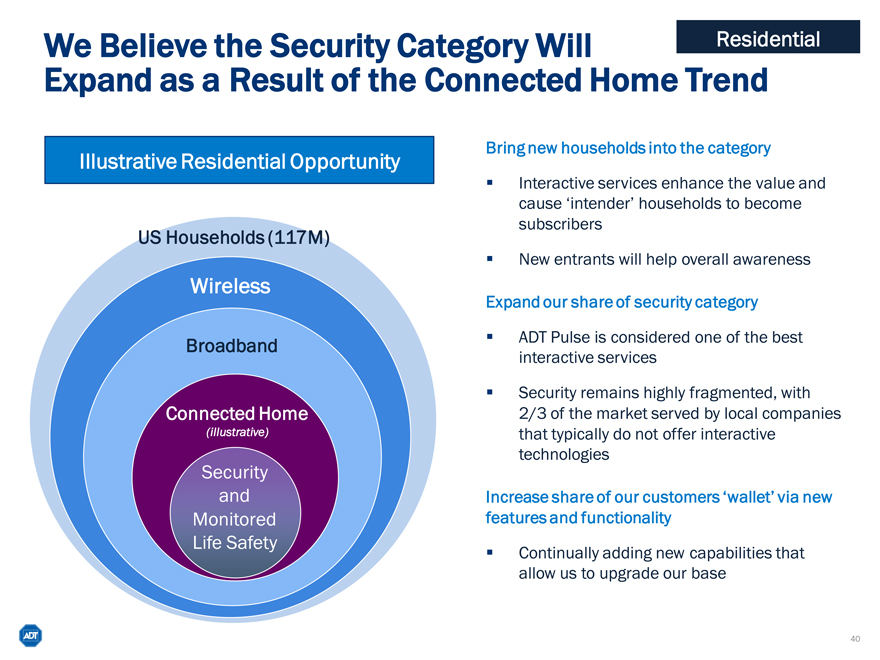

We Believe the Security Category Will Expand as a Result of the Connected Home Trend

Residential

Illustrative Residential Opportunity

US Households Households (117M)

Wireless

Broadband

Connected Home (illustrative)

Security and Monitored Life Safety

Bring new households into the category

Interactive services enhance the value and cause ‘intender’ households to become subscribers New entrants will help overall awareness

Expand our share of security category

ADT Pulse is considered one of the best interactive services

Security remains highly fragmented, with 2/3 of the market served by local companies that typically do not offer interactive technologies

Increase share of our customers ‘wallet’ via new features and functionality

Continually adding new capabilities that allow us to upgrade our base

40

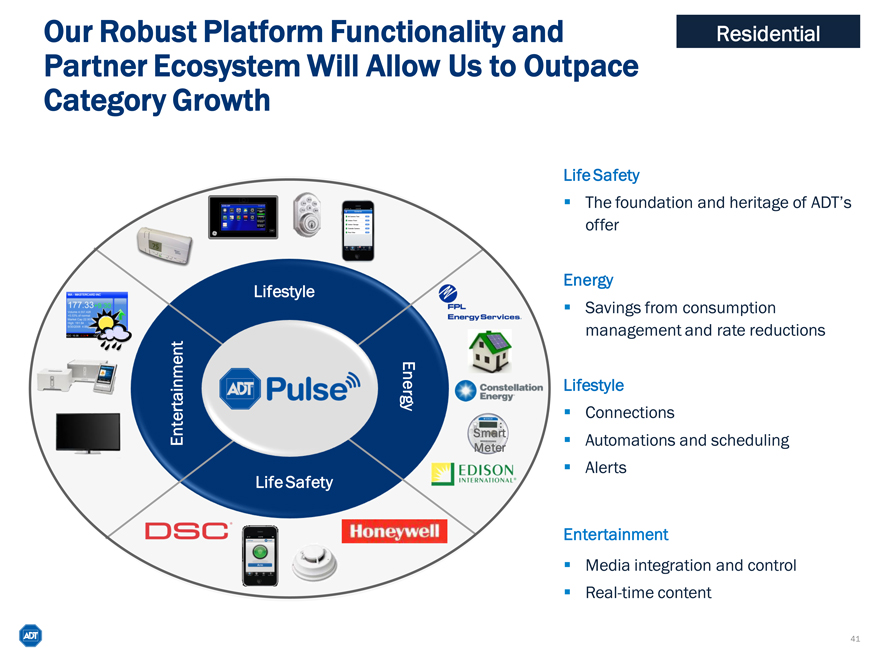

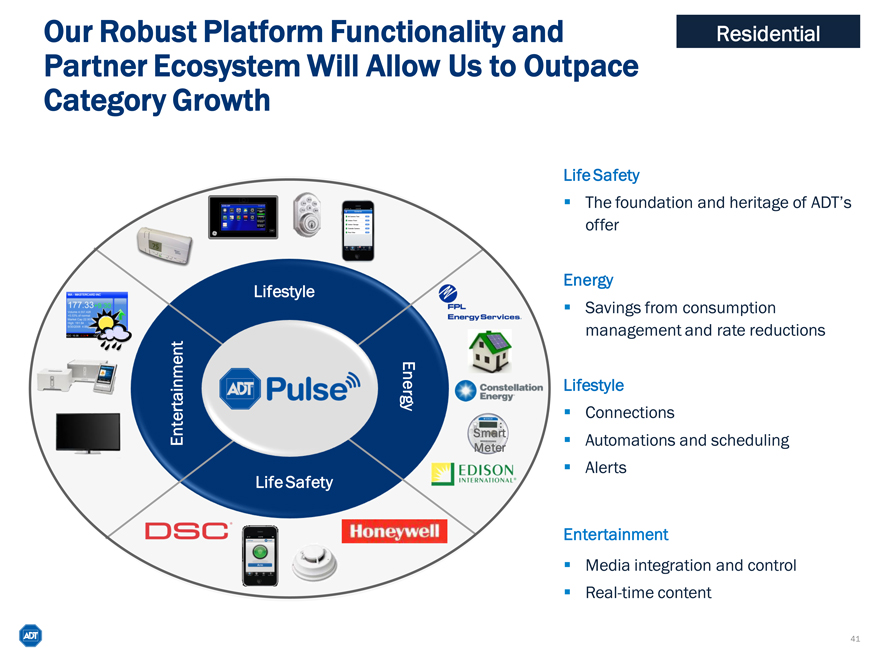

Our Robust Platform Functionality and Partner Ecosystem Will Allow Us to Outpace Category Growth

Residential

Life Safety

The foundation and heritage of ADT’s offer

Energy

Savings from consumption management and rate reductions

Lifestyle

Connections

Automations and scheduling

Alerts

Entertainment

Media integration and control

Real-time content

41

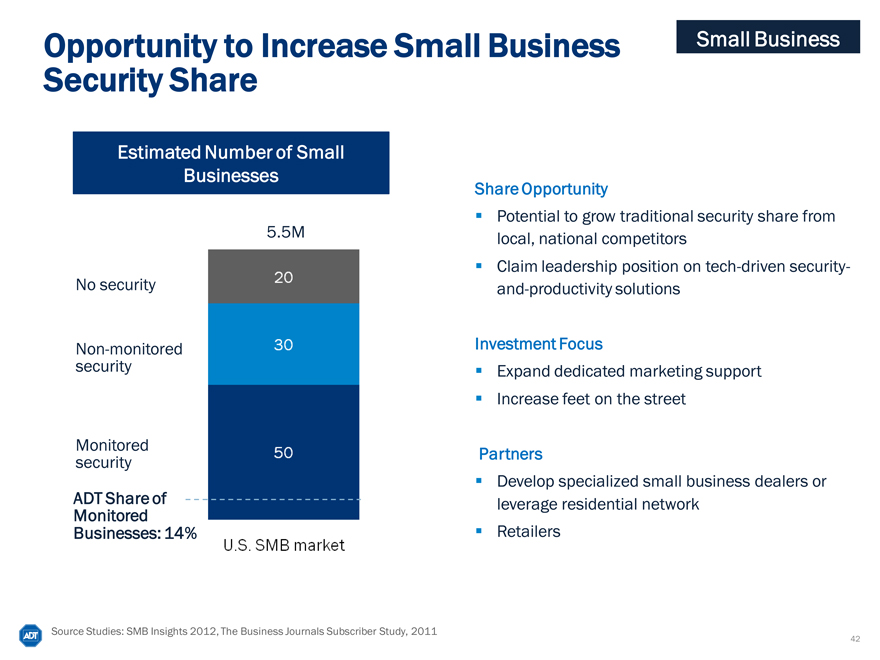

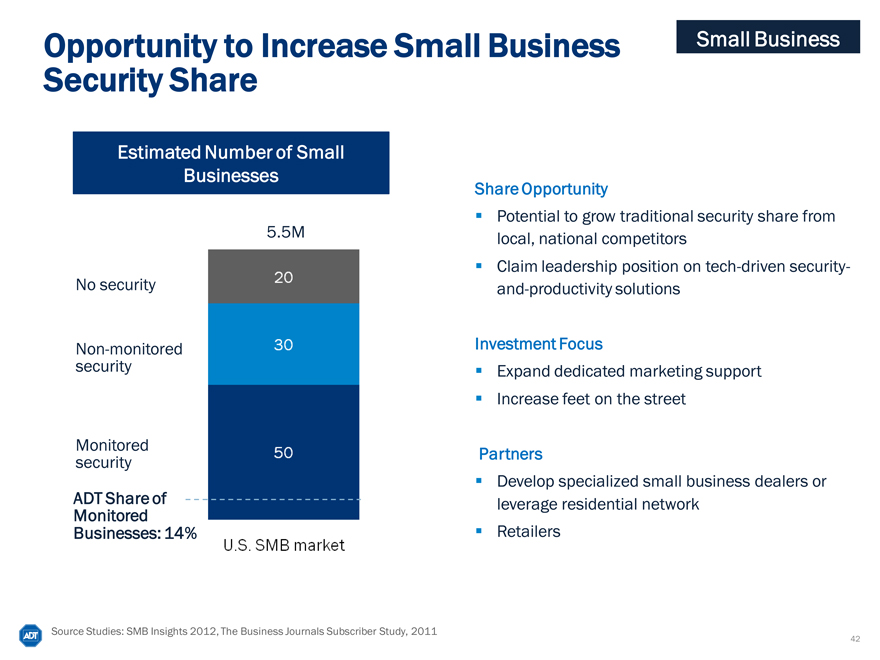

Opportunity to Increase Small Business Security Share

Small Business

Estimated Number of Small Businesses

5.5M

No security 20

Non-monitored

security

Monitored 30

security

ADT Share of

Monitored 50

Businesses: 14%

Share Opportunity

Potential to grow traditional security share from local, national competitors

Claim leadership position on tech-driven security-and-productivity solutions

Investment Focus

Expand dedicated marketing support

Increase feet on the street

Partners

Develop specialized small business dealers or leverage residential network

Retailers

Source Studies: SMB Insights 2012, The Business Journals Subscriber Study, 2011

42

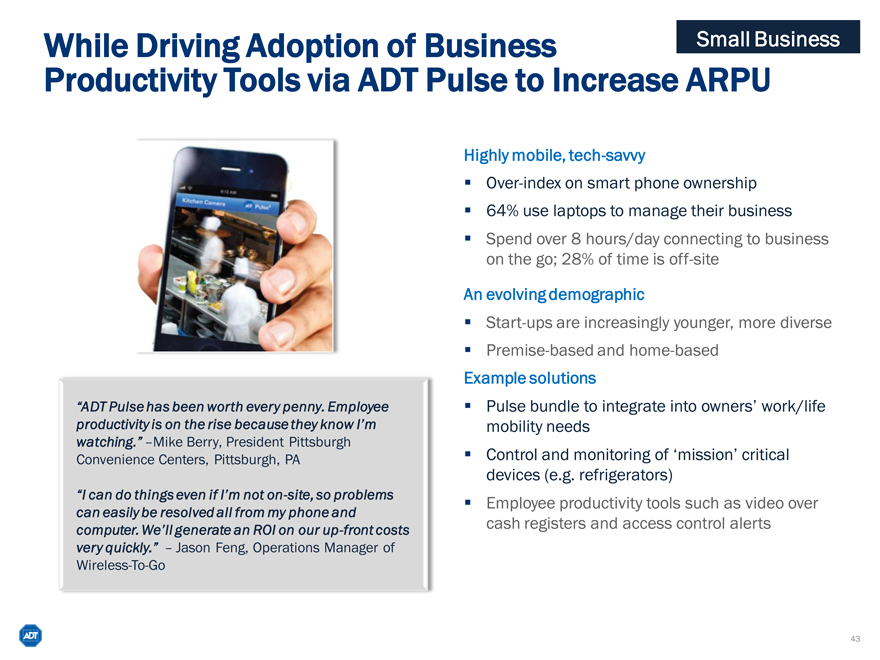

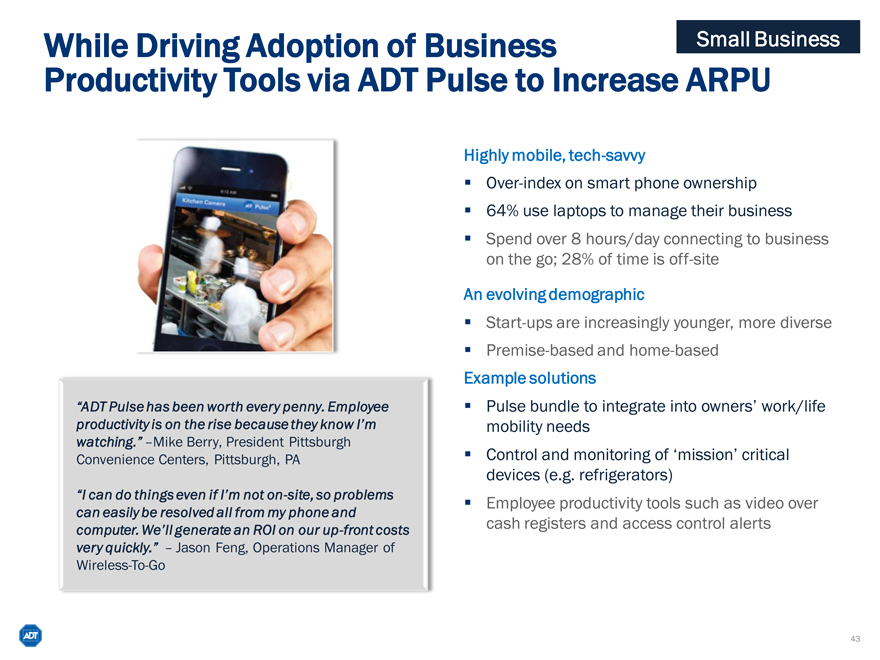

While Driving Adoption of Business

Productivity Tools via ADT Pulse to Increase ARPU

Small Business

“ADT Pulse has been worth every penny. Employee productivity is on the rise because they know I’m watching.” –Mike Berry, President Pittsburgh

Convenience Centers, Pittsburgh, PA

“I can do things even if I’m not on-site, so problems can easily be resolved all from my phone and computer. We’ll generate an ROI on our up-front costs very quickly.” – Jason Feng, Operations Manager of

Wireless-To-Go

Highly mobile, tech-savvy

Over-index on smart phone ownership

64% use laptops to manage their business

Spend over 8 hours/day connecting to business on the go; 28% of time is off-site

An evolving demographic

Start-ups are increasingly younger, more diverse

Premise-based and home-based

Example solutions

Pulse bundle to integrate into owners’ work/life mobility needs

Control and monitoring of ‘mission’ critical devices (e.g. refrigerators)

Employee productivity tools such as video over cash registers and access control alerts

43

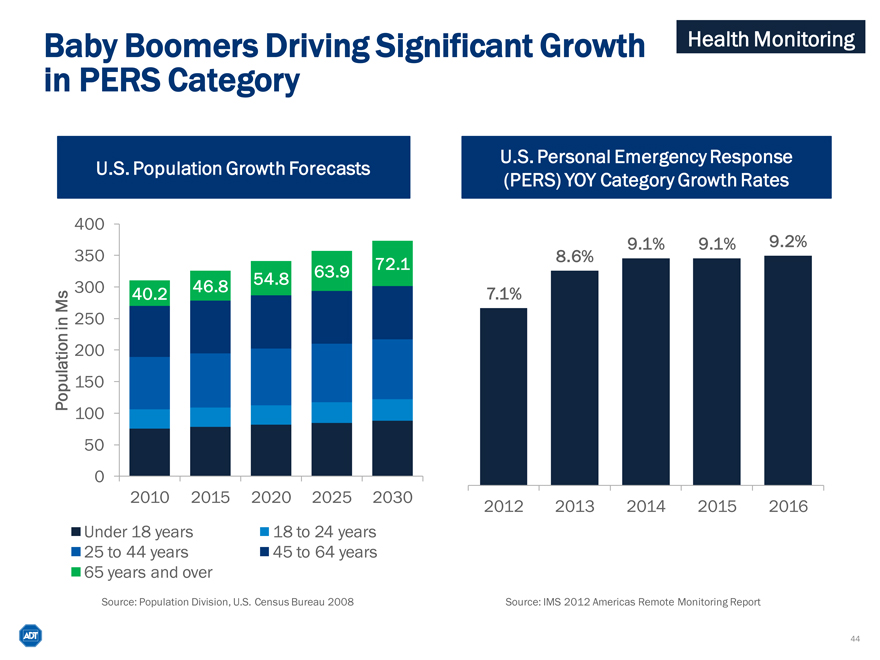

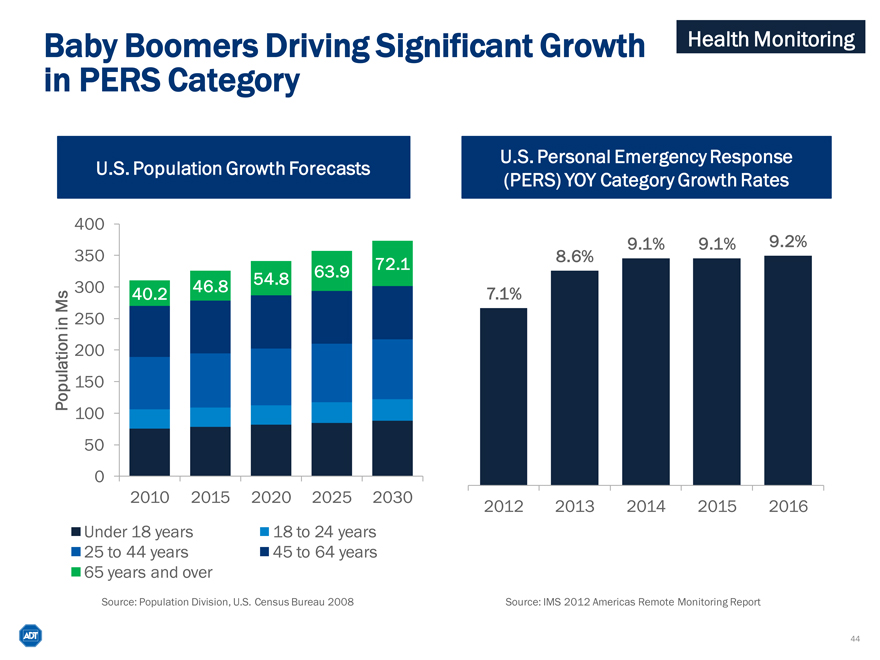

Baby Boomers Driving Significant Growth in PERS Category

Health Monitoring

U.S. Population Growth Forecasts

U.S. Personal Emergency Response (PERS) YOY Category Growth Rates

400

350

54.8 63.9 72.1

300 40.2 46.8

250

200

Population in Ms 150

100

50

0

2010 2015 2020 2025 2030

9.1% 9.1% 9.2%

8.6%

7.1%

2012 2013 2014 2015 2016

Under 18 years 18 to 24 years

25 to 44 years 45 to 64 years

65 years and over

Source: Population Division, U.S. Census Bureau 2008

Source: IMS 2012 Americas Remote Monitoring Report

44

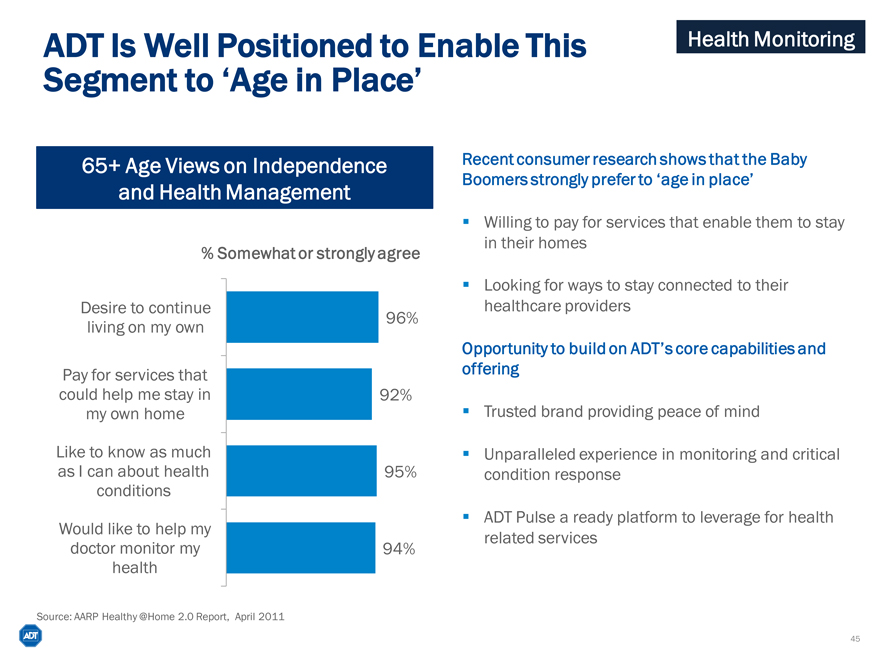

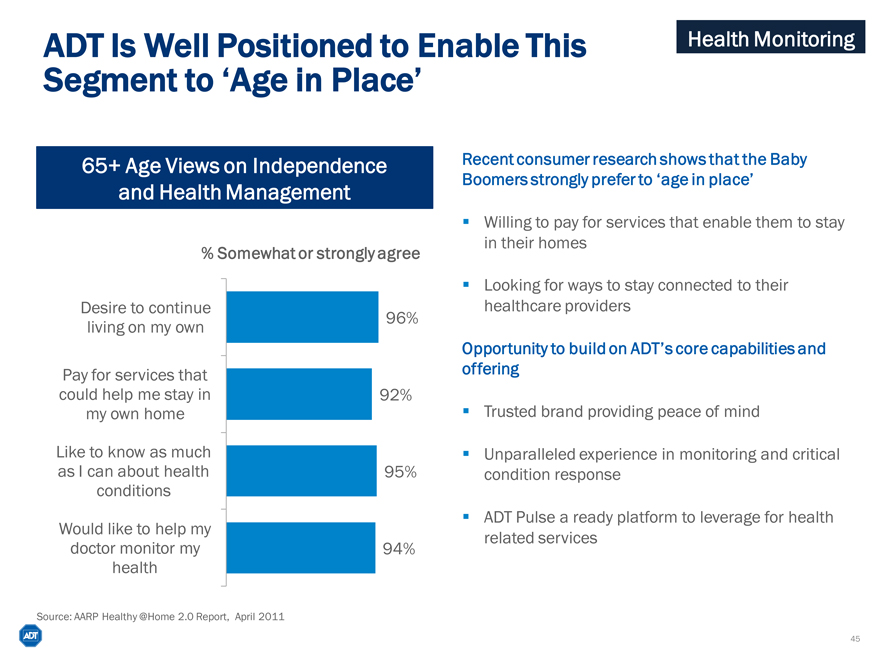

ADT Is Well Positioned to Enable This

Segment to ‘Age in Place’

Health Monitoring

65+ Age Views on Independence and Health Management

% Somewhat or strongly agree

Desire to continue living on my own

Pay for services that could help me stay in my own home

Like to know as much as I can about health conditions

Would like to help my doctor monitor my health

96% 92% 95% 94%

Recent consumer research shows that the Baby

Boomers strongly prefer to ‘age in place’

Willing to pay for services that enable them to stay in their homes

Looking for ways to stay connected to their healthcare providers

Opportunity to build on ADT’s core capabilities and offering

Trusted brand providing peace of mind

Unparalleled experience in monitoring and critical condition response

ADT Pulse a ready platform to leverage for health related services

Source: AARP Healthy @Home 2.0 Report, April 2011

45

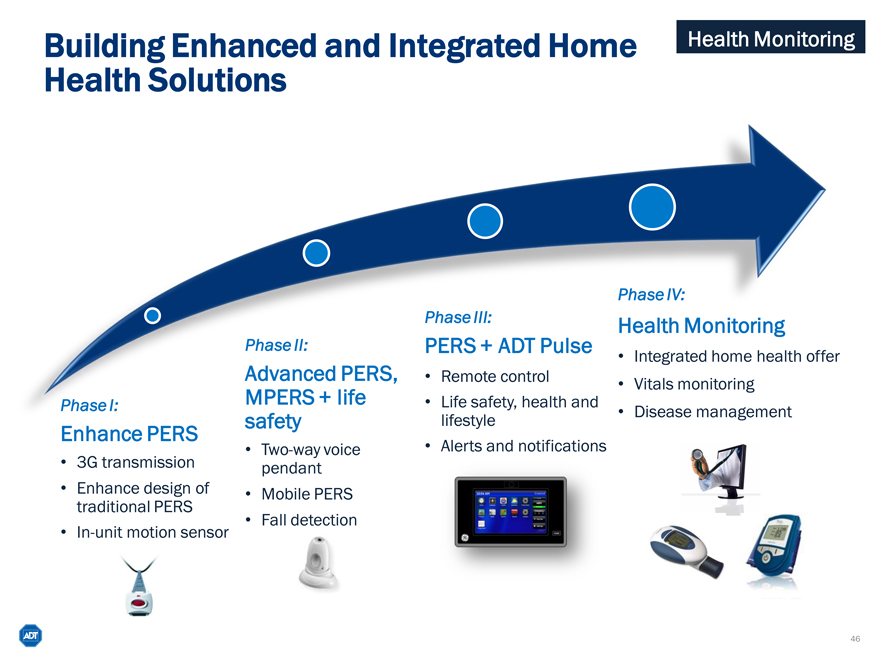

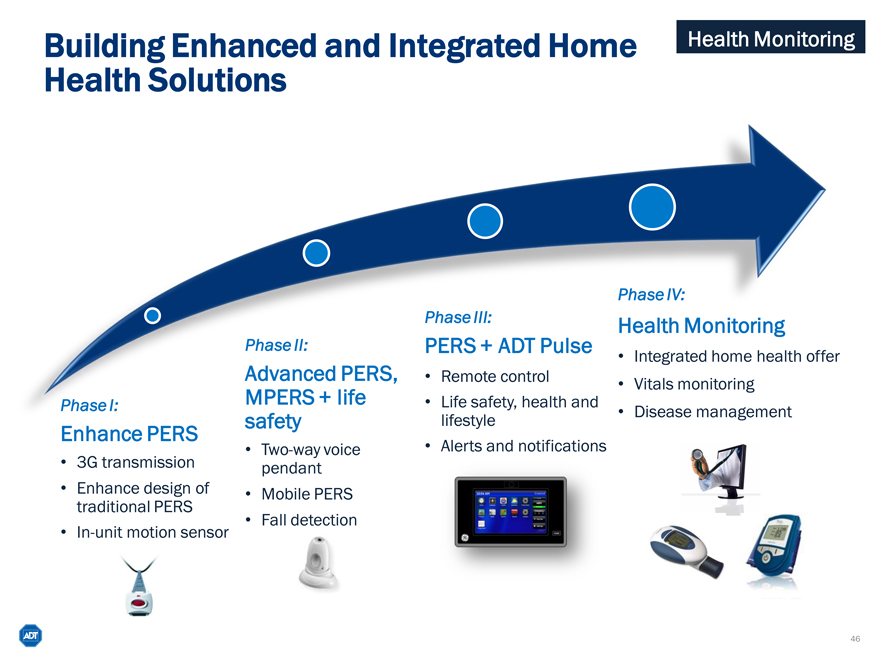

Building Enhanced and Integrated Home Health Solutions

Health Monitoring

Phase I:

Enhance PERS

3G transmission

Enhance design of traditional PERS

In-unit motion sensor

Phase II:

Advanced PERS, MPERS + life safety

Two-way voice pendant

Mobile PERS

Fall detection

Phase III:

PERS + ADT Pulse

Remote control

Life safety, health and lifestyle

Alerts and notifications

Phase IV:

Health Monitoring

Integrated home health offer

Vitals monitoring

Disease management

46

Agenda

Introduction to ADT

Residential and Small Business Security Market Strategic Priorities Financial Overview Closing Remarks Q&A

47

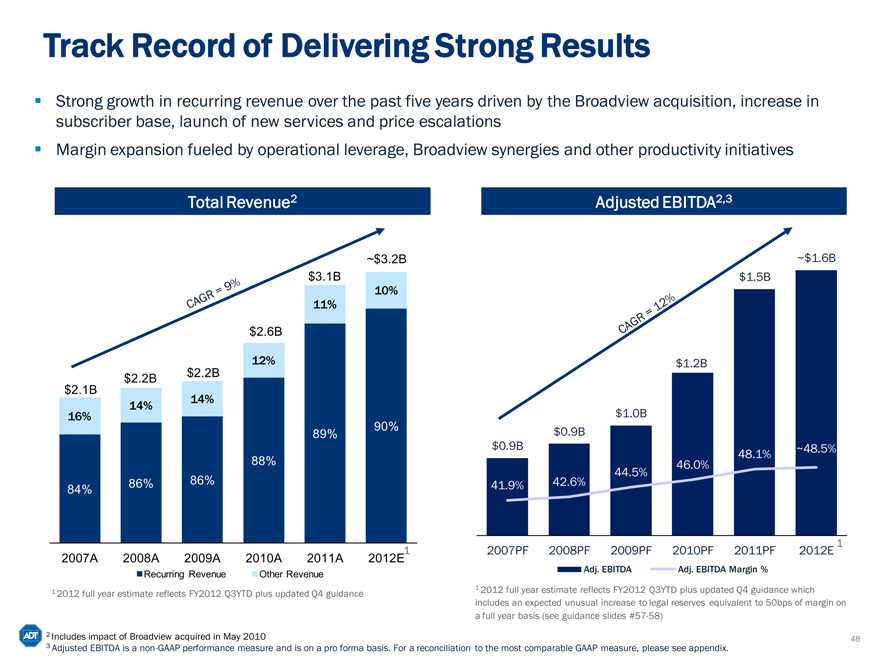

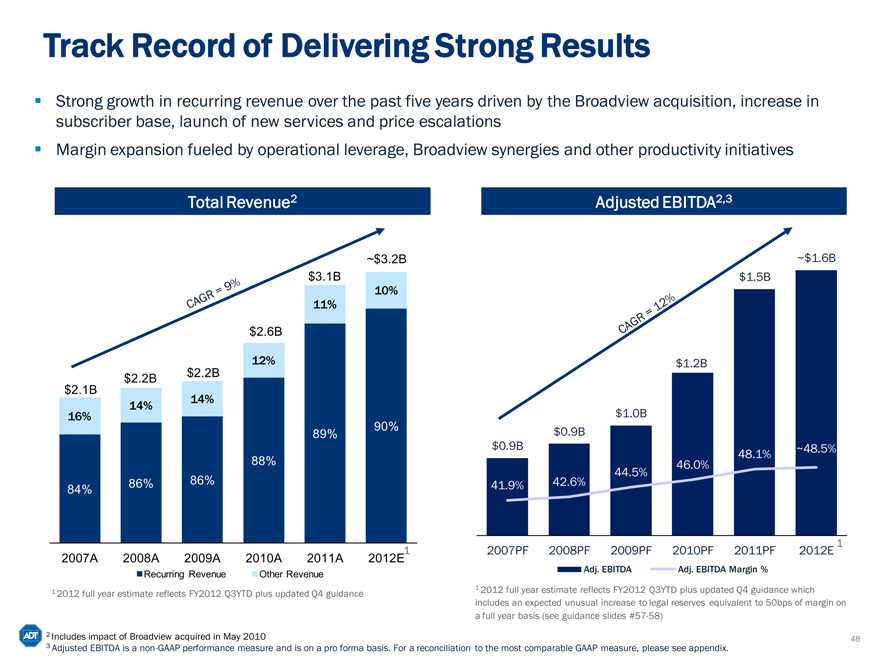

Track Record of Delivering Strong Results

Strong growth in recurring revenue over the past five years driven by the Broadview acquisition, increase in subscriber base, launch of new services and price escalations Margin expansion fueled by operational leverage, Broadview synergies and other productivity initiatives

Total Revenue2

CAGR = 9% ~$3.2B

$3.1B

10%

11%

$2.6B

12%

$2.2B $2.2B

$2.1B

14% 14%

16%

89% 90%

88%

84% 86% 86%

2007A 2008A 2009A 2010A 2011A 2012E1

Recurring Revenue Other Revenue

1 | | 2012 full year estimate reflects FY2012 Q3YTD plus updated Q4 guidance |

Adjusted EBITDA2,3

CAGR = 12% ~$1.6B

$1.5B

$1.2B

$1.0B

$0.9B

$0.9B 48.1% ~48.5%

44.5% 46.0%

41.9% 42.6%

2007PF 2008PF 2009PF 2010PF 2011PF 2012E 1

Adj. EBITDA Adj. EBITDA Margin %

1 2012 full year estimate reflects FY2012 Q3YTD plus updated Q4 guidance which includes an expected unusual increase to legal reserves equivalent to 50bps of margin on a full year basis (see guidance slides #57-58)

2 | | Includes impact of Broadview acquired in May 2010 |

3 Adjusted EBITDA is a non-GAAP performance measure and is on a pro forma basis. For a reconciliation to the most comparable GAAP measure, please see appendix.

48

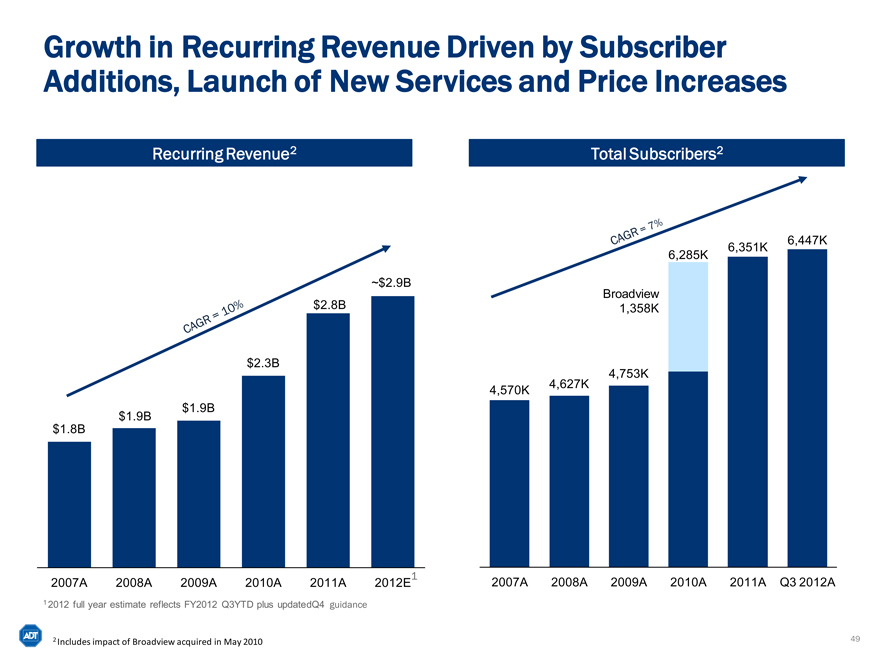

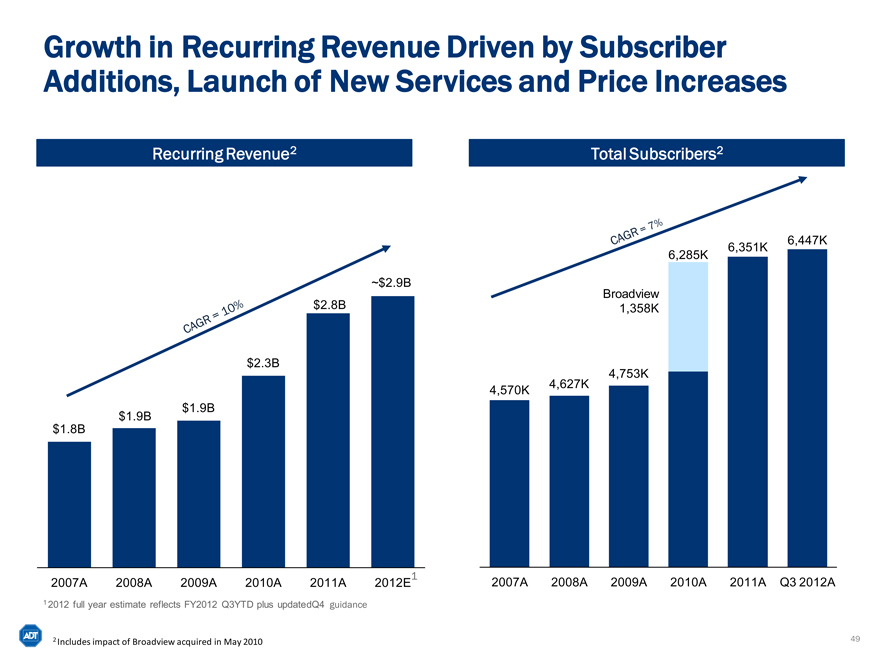

Growth in Recurring Revenue Driven by Subscriber Additions, Launch of New Services and Price Increases

Recurring Revenue2

CAGR = 10% ~$2.9B

$2.8B

$2.3B

$1.9B

$1.9B

$1.8B

2007A 2008A 2009A 2010A 2011A 2012E1

1 | | 2012 full year estimate reflects FY2012 Q3YTD plus updatedQ4 guidance |

Total Subscribers2

CAGR = 7% 6,351K 6,447K

6,285K

Broadview

1,358K

4,753K

4,570K 4,627K

2007A 2008A 2009A 2010A 2011A Q3 2012A

2 | | Includes impact of Broadview acquired in May 2010 |

49

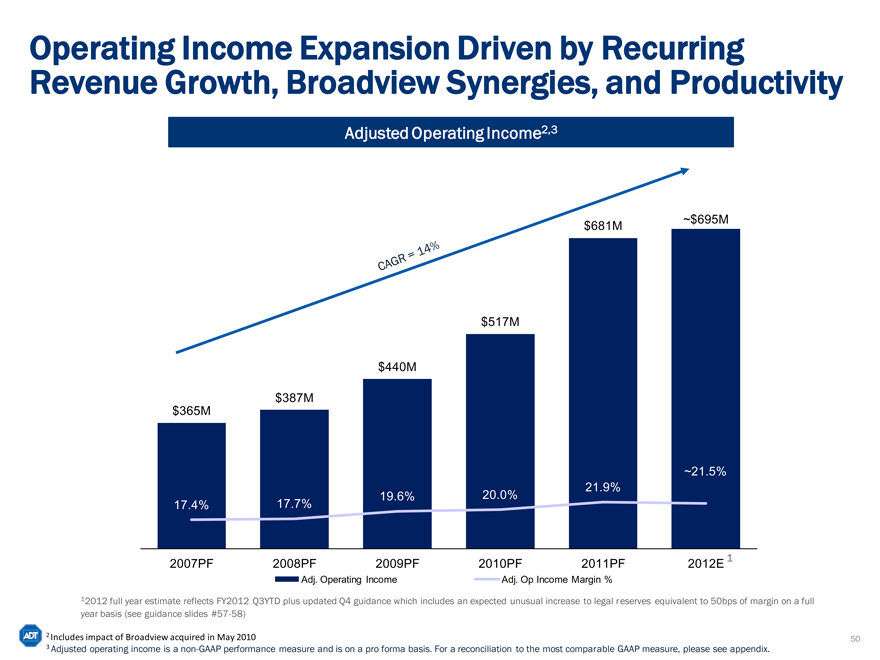

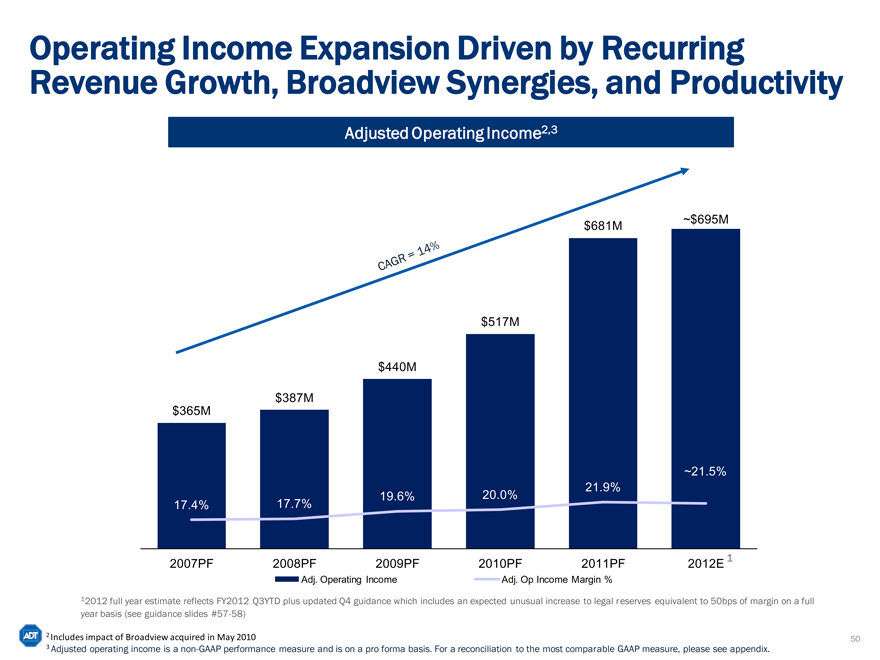

Operating Income Expansion Driven by Recurring Revenue Growth, Broadview Synergies, and Productivity

Adjusted Operating Income2,3

CAGR = 14% $681M ~$695M

$517M

$440M

$387M

$365M

~21.5%

21.9%

17.4% 17.7% 19.6% 20.0%

2007PF 2008PF 2009PF 2010PF 2011PF 2012E 1

Adj. Operating Income Adj. Op Income Margin %

12012 full year estimate reflects FY2012 Q3YTD plus updated Q4 guidance which includes an expected unusual increase to legal reserves equivalent to 50bps of margin on a full year basis (see guidance slides #57-58)

2 | | Includes impact of Broadview acquired in May 2010 |

3 Adjusted operating income is a non-GAAP performance measure and is on a pro forma basis. For a reconciliation to the most comparable GAAP measure, please see appendix.

50

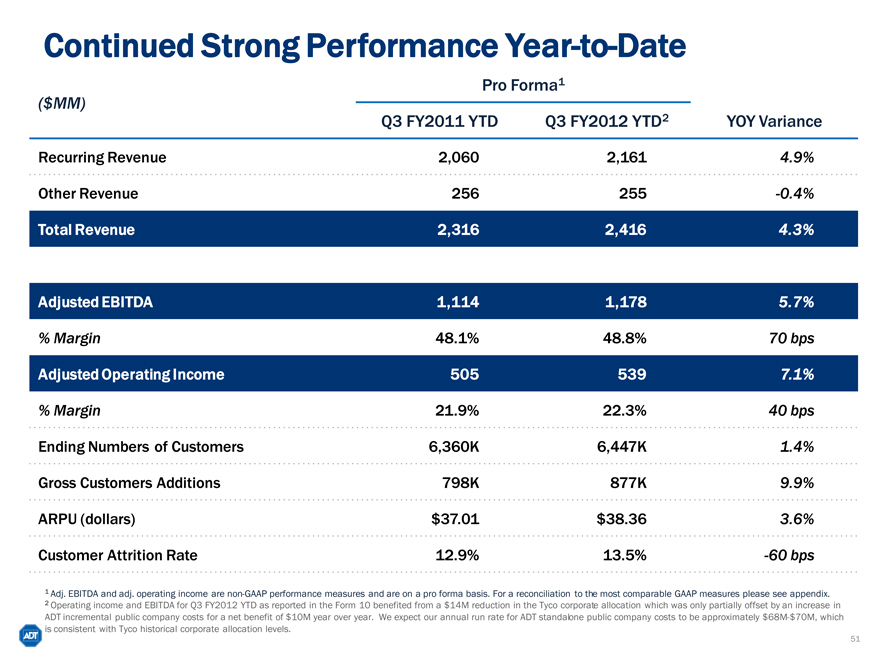

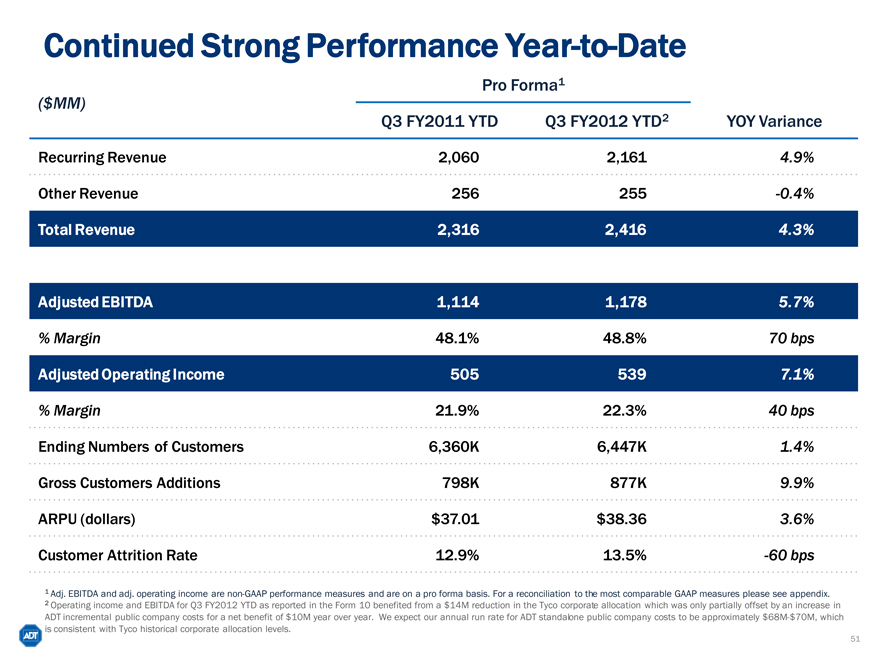

Continued Strong Performance Year-to-Date

Pro Forma1

($MM)

Q3 FY2011 YTD Q3 FY2012 YTD2 YOY Variance

Recurring Revenue 2,060 2,161 4.9%

Other Revenue 256 255 -0.4%

Total Revenue 2,316 2,416 4.3%

Adjusted EBITDA 1,114 1,178 5.7%

% Margin 48.1% 48.8% 70 bps

Adjusted Operating Income 505 539 7.1%

% Margin 21.9% 22.3% 40 bps

Ending Numbers of Customers 6,360K 6,447K 1.4%

Gross Customers Additions 798K 877K 9.9%

ARPU (dollars) $37.01 $38.36 3.6%

Customer Attrition Rate 12.9% 13.5% -60 bps

1 Adj. EBITDA and adj. operating income are non-GAAP performance measures and are on a pro forma basis. For a reconciliation to the most comparable GAAP measures please see appendix.

2 Operating income and EBITDA for Q3 FY2012 YTD as reported in the Form 10 benefited from a $14M reduction in the Tyco corporate allocation which was only partially offset by an increase in ADT incremental public company costs for a net benefit of $10M year over year. We expect our annual run rate for ADT standalone public company costs to be approximately $68M-$70M, which is consistent with Tyco historical corporate allocation levels.

51

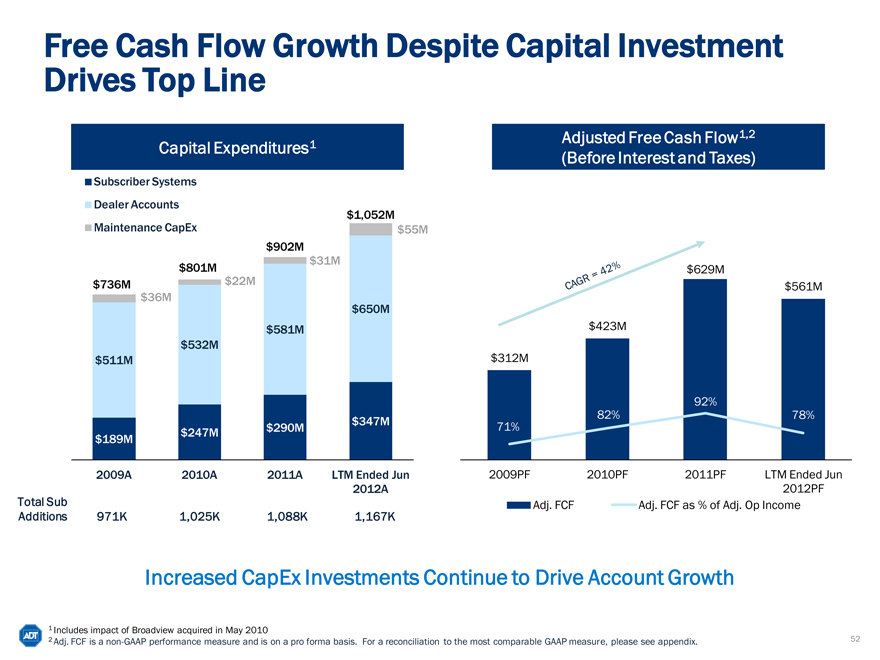

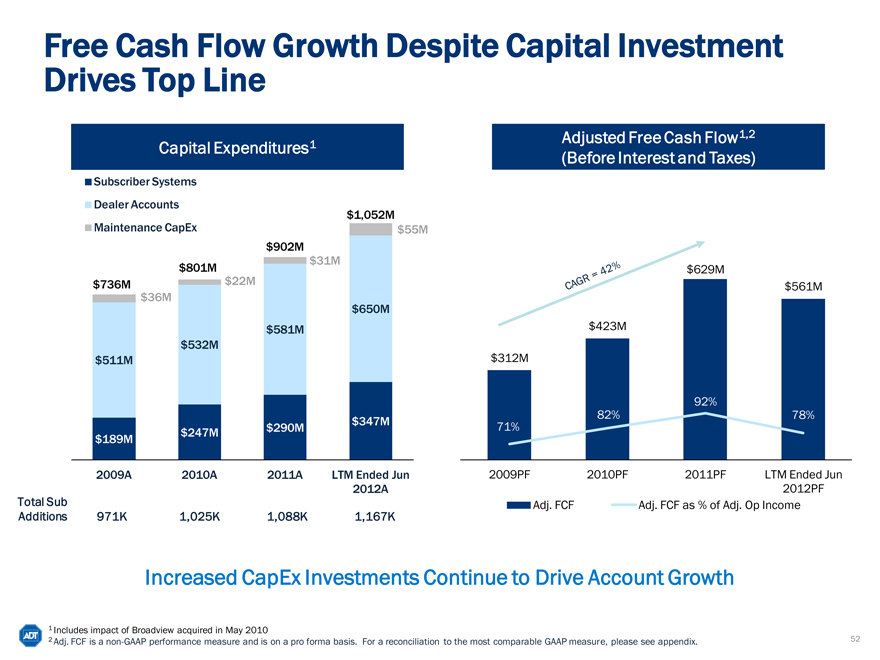

Free Cash Flow Growth Despite Capital Investment Drives Top Line

Capital Expenditures1

Subscriber Systems

Dealer Accounts

$1,052M

Maintenance CapEx $55M

$ 902M

$801M $31M

$736M $ 22M

$36M

$650M

$581M

$532M

$511M

$347M

$189M $247M $290M

2009A 2010A 2011A LTM Ended Jun

2012A

Total Sub

Additions 971K 1,025K 1,088K 1,167K

Adjusted Free Cash Flow1,2 (Before Interest and Taxes)

$629M

CAGR = 42% $561M

$423M

$312M

92%

82% 78%

71%

2009PF 2010PF 2011PF LTM Ended Jun

2012PF

Adj. FCF Adj. FCF as % of Adj. Op Income

Increased CapEx Investments Continue to Drive Account Growth

1 | | Includes impact of Broadview acquired in May 2010 |

2 Adj. FCF is a non-GAAP performance measure and is on a pro forma basis. For a reconciliation to the most comparable GAAP measure, please see appendix.

52

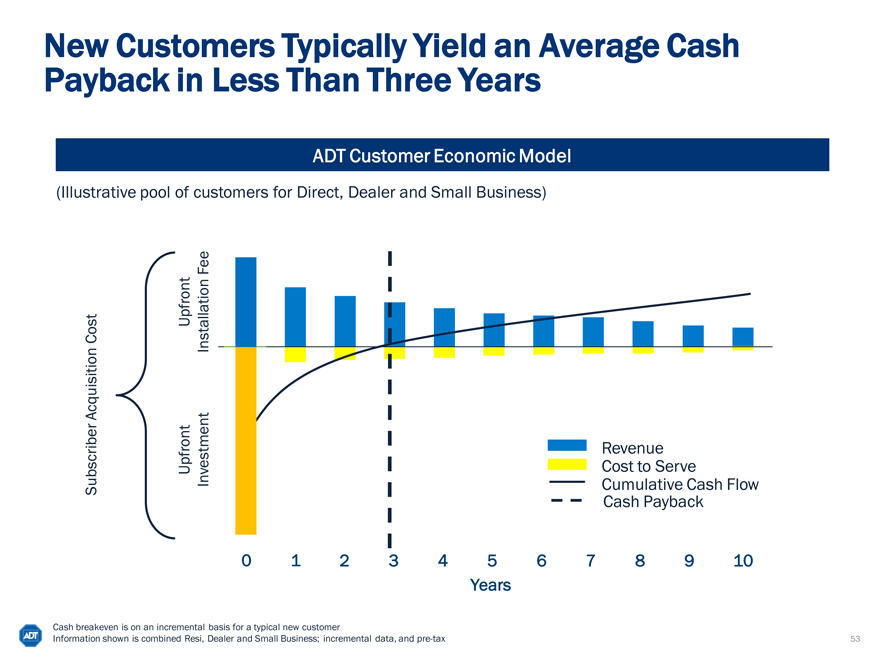

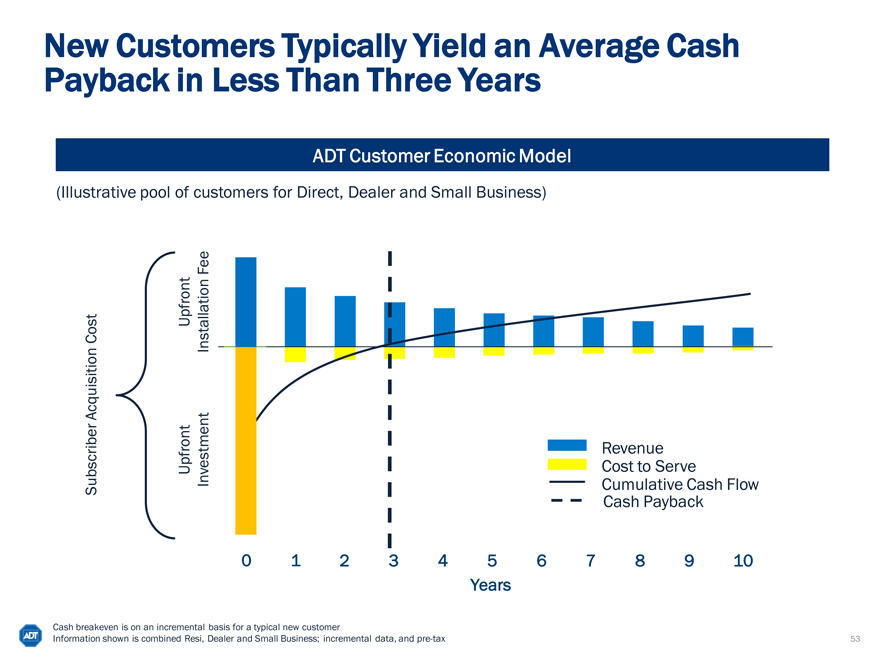

New Customers Typically Yield an Average Cash Payback in Less Than Three Years

ADT Customer Economic Model

(Illustrative pool of customers for Direct, Dealer and Small Business)

Subscriber Acquisition Cost

Upfront Upfront Investment Installation Fee

Revenue Cost to Serve

Cumulative Cash Flow Cash Payback

0 1 2 3 4 5 6 7 8 9 10

Years

Cash breakeven is on an incremental basis for a typical new customer

Information shown is combined Resi, Dealer and Small Business; incremental data, and pre-tax

53

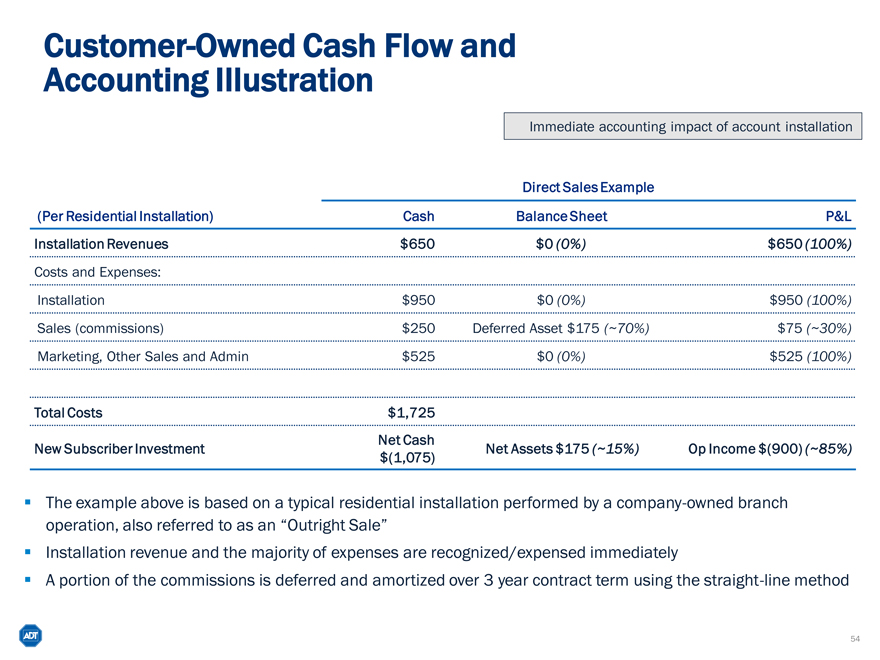

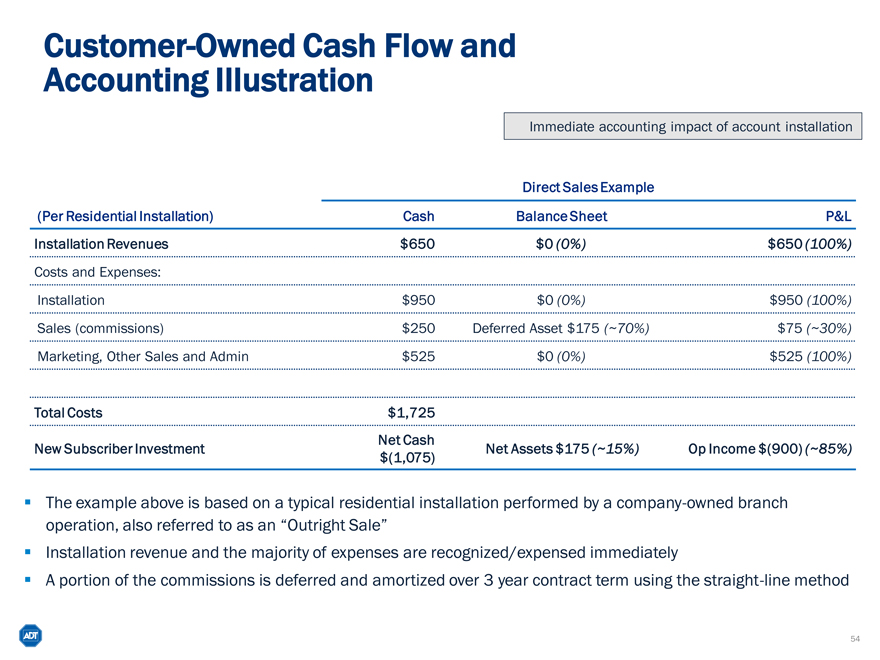

Customer-Owned Cash Flow and Accounting Illustration

Immediate accounting impact of account installation

Direct Sales Example

(Per Residential Installation) Cash Balance Sheet P&L

Installation Revenues $650 $0 (0%) $650 (100%)

Costs and Expenses:

Installation $950 $0 (0%) $950 (100%)

Sales (commissions) $250 Deferred Asset $175 (~70%) $75 (~30%)

Marketing, Other Sales and Admin $525 $0 (0%) $525 (100%)

Total Costs $1,725

Net Cash

New Subscriber Investment Net Assets $175 (~15%) Op Income $(900) (~85%)

$(1,075)

The example above is based on a typical residential installation performed by a company-owned branch operation, also referred to as an “Outright Sale”

Installation revenue and the majority of expenses are recognized/expensed immediately

A portion of the commissions is deferred and amortized over 3 year contract term using the straight-line method

54

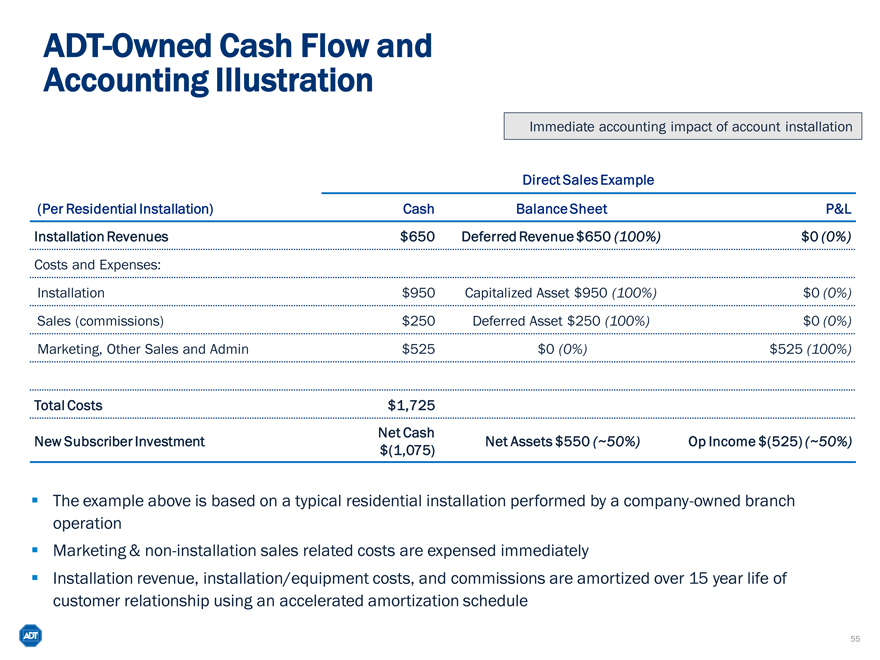

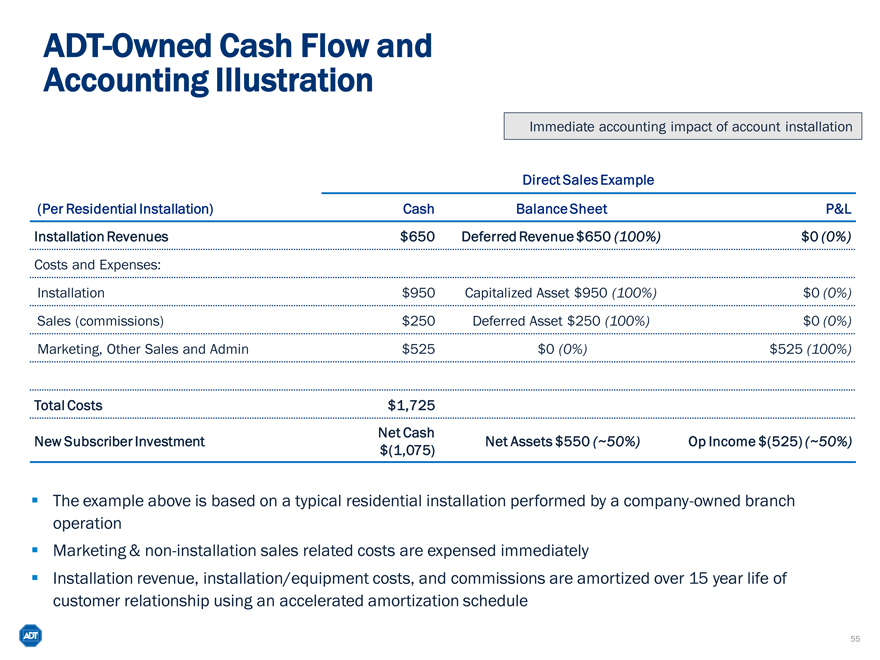

ADT-Owned Cash Flow and Accounting Illustration

Immediate accounting impact of account installation

Direct Sales Example

(Per Residential Installation) Cash Balance Sheet P&L

Installation Revenues $650 Deferred Revenue $650 (100%) $0 (0%)

Costs and Expenses:

Installation $950 Capitalized Asset $950 (100%) $0 (0%)

Sales (commissions) $250 Deferred Asset $250 (100%) $0 (0%)

Marketing, Other Sales and Admin $525 $0 (0%) $525 (100%)

Total Costs $1,725

Net Cash

New Subscriber Investment Net Assets $550 (~50%) Op Income $(525) (~50%)

$(1,075)

The example above is based on a typical residential installation performed by a company-owned branch operation Marketing & non-installation sales related costs are expensed immediately Installation revenue, installation/equipment costs, and commissions are amortized over 15 year life of customer relationship using an accelerated amortization schedule

55

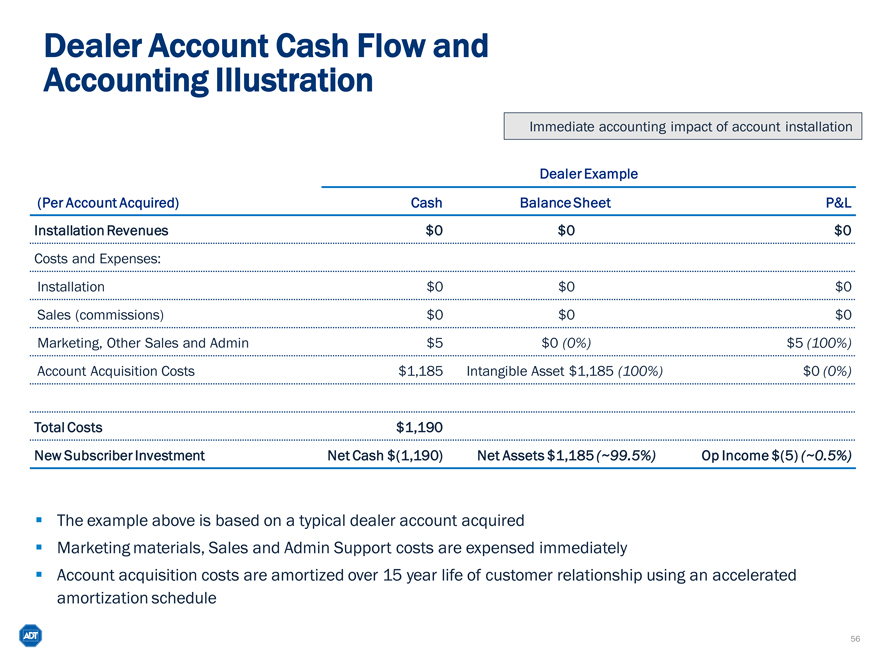

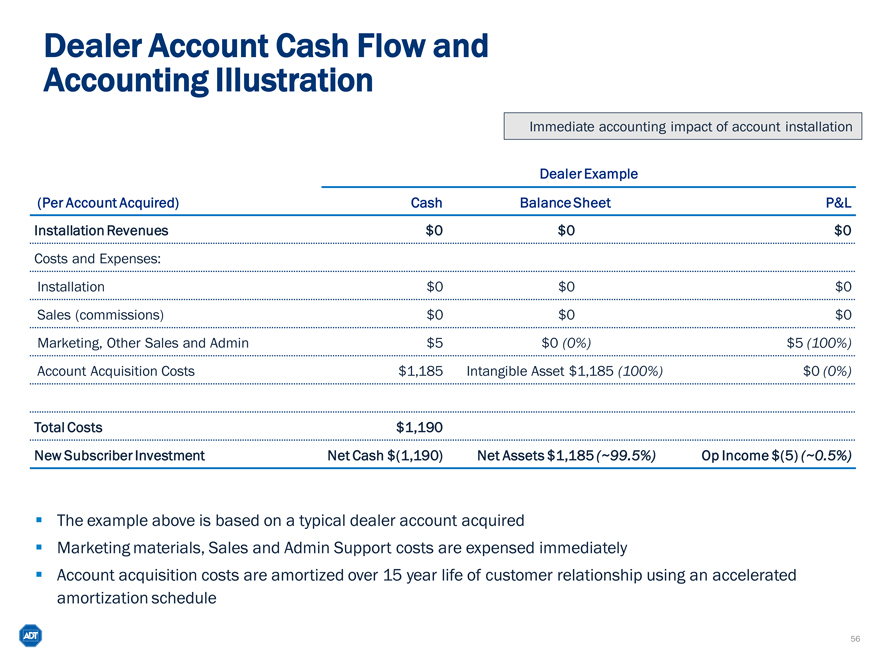

Dealer Account Cash Flow and Accounting Illustration

Immediate accounting impact of account installation

Dealer Example

(Per Account Acquired) Cash Balance Sheet P&L

Installation Revenues $0 $0 $0

Costs and Expenses:

Installation $0 $0 $0

Sales (commissions) $0 $0 $0

Marketing, Other Sales and Admin $5 $0 (0%) $5 (100%)

Account Acquisition Costs $1,185 Intangible Asset $1,185 (100%) $0 (0%)

Total Costs $1,190

New Subscriber Investment Net Cash $(1,190) Net Assets $1,185 (~99.5%) Op Income $(5) (~0.5%)

The example above is based on a typical dealer account acquired

Marketing materials, Sales and Admin Support costs are expensed immediately

Account acquisition costs are amortized over 15 year life of customer relationship using an accelerated amortization schedule

56

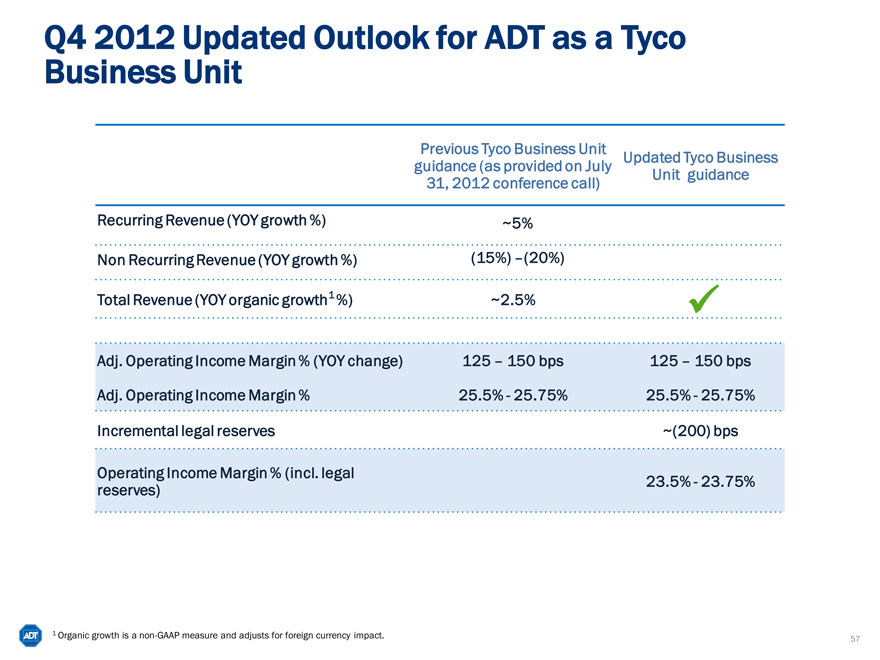

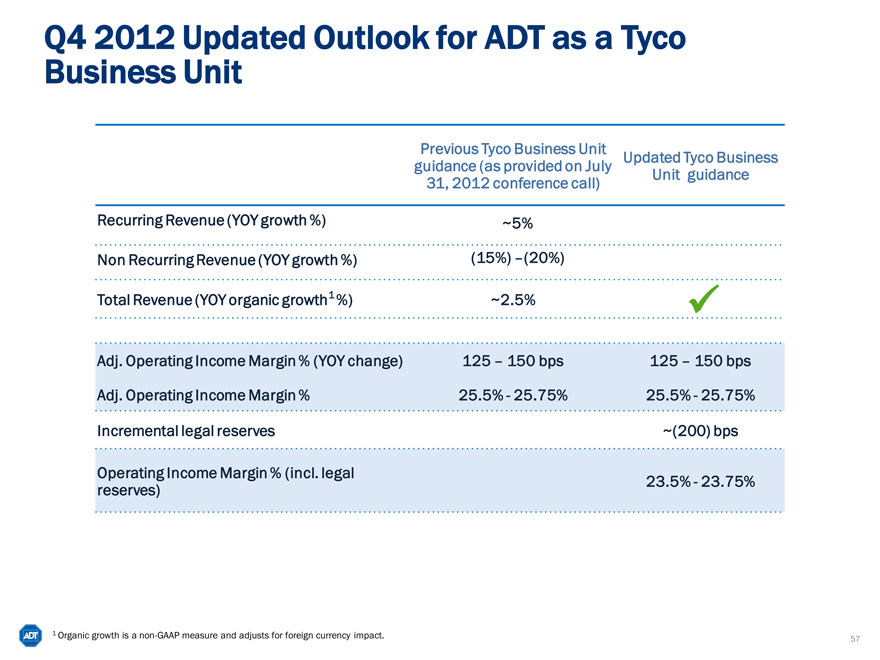

Q4 2012 Updated Outlook for ADT as a Tyco Business Unit

Previous Tyco Business Unit Updated Tyco Business

guidance (as provided on July Unit guidance

31, 2012 conference call)

Recurring Revenue (YOY growth %) ~5%

Non Recurring Revenue (YOY growth %) (15%) –(20%)

Total Revenue (YOY organic growth1 %) ~2.5%

Adj. Operating Income Margin % (YOY change) 125 – 150 bps 125 – 150 bps

Adj. Operating Income Margin % 25.5%—25.75% 25.5%—25.75%

Incremental legal reserves ~(200) bps

Operating Income Margin % (incl. legal 23.5%—23.75%

reserves)

1 | | Organic growth is a non-GAAP measure and adjusts for foreign currency impact. |

57

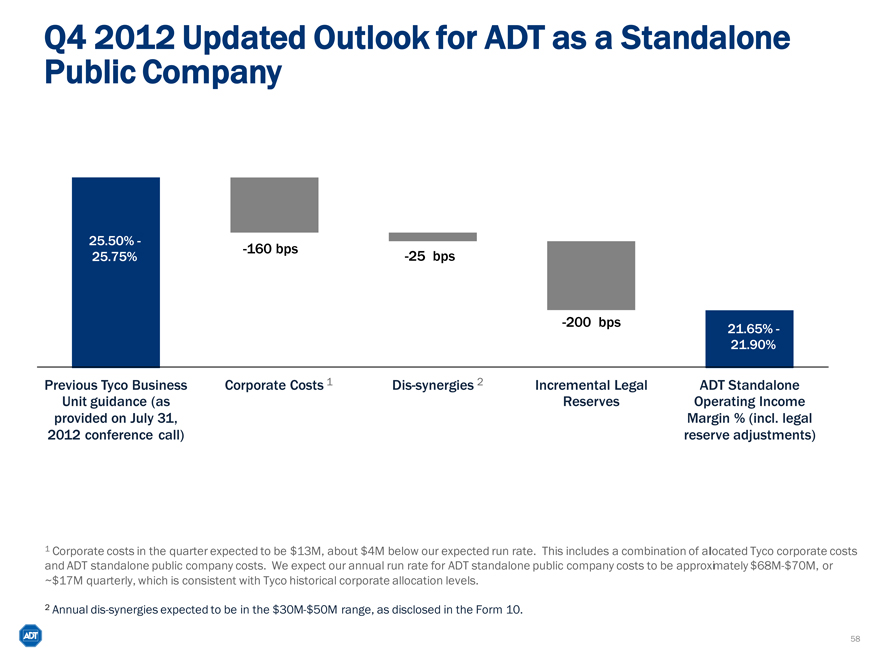

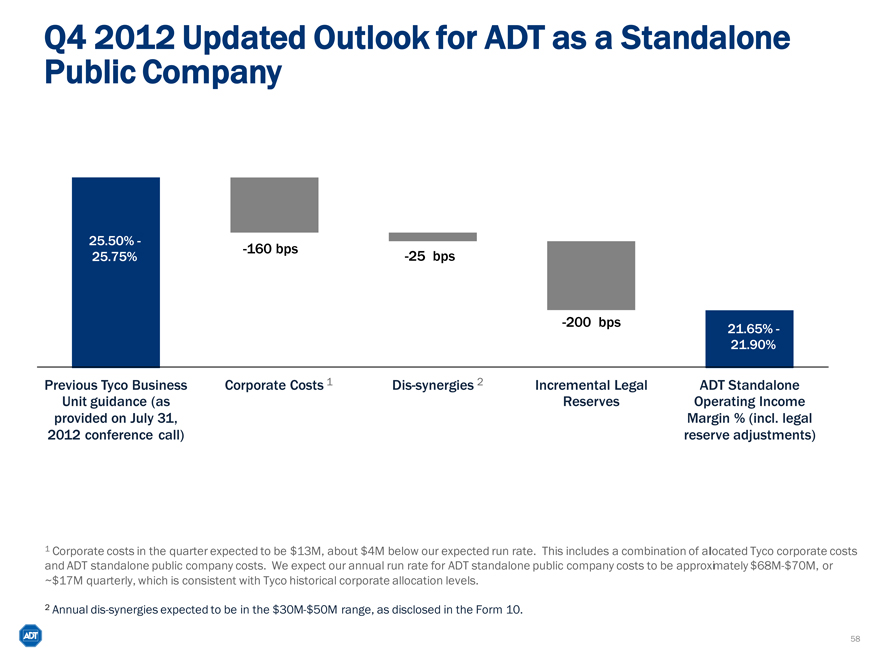

Q4 2012 Updated Outlook for ADT as a Standalone Public Company

25.50%— -160 bps

25.75% -25 bps

23.65%—

23.9%

-200 bps 21.65% -

21.90%

Previous Tyco Business Corporate Costs 1 Dis-synergies 2 Incremental Legal ADT Standalone

Unit guidance (as Reserves Operating Income

provided on July 31,

Margin % (incl. legal

2012 conference call)

reserve adjustments)

1 Corporate costs in the quarter expected to be $13M, about $4M below our expected run rate. This includes a combination of allocated Tyco corporate costs and ADT standalone public company costs. We expect our annual run rate for ADT standalone public company costs to be approximately $68M-$70M, or

~$17M quarterly, which is consistent with Tyco historical corporate allocation levels.

2 | | Annual dis-synergies expected to be in the $30M-$50M range, as disclosed in the Form 10. |

58

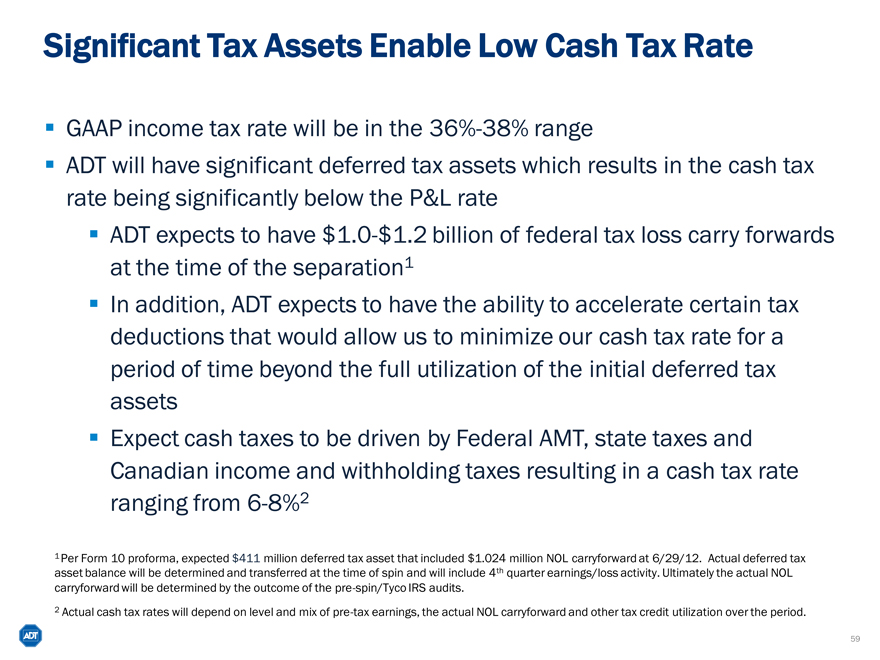

Significant Tax Assets Enable Low Cash Tax Rate

GAAP income tax rate will be in the 36%-38% range

ADT will have significant deferred tax assets which results in the cash tax rate being significantly below the P&L rate

ADT expects to have $1.0-$1.2 billion of federal tax loss carry forwards at the time of the separation1

In addition, ADT expects to have the ability to accelerate certain tax deductions that would allow us to minimize our cash tax rate for a period of time beyond the full utilization of the initial deferred tax assets

Expect cash taxes to be driven by Federal AMT, state taxes and

Canadian income and withholding taxes resulting in a cash tax rate ranging from 6-8%2

1 Per Form 10 proforma, expected $411 million deferred tax asset that included $1.024 million NOL carryforward at 6/29/12. Actual deferred tax asset balance will be determined and transferred at the time of spin and will include 4th quarter earnings/loss activity. Ultimately the actual NOL carryforward will be determined by the outcome of the pre-spin/Tyco IRS audits.

2 Actual cash tax rates will depend on level and mix of pre-tax earnings, the actual NOL carryforward and other tax credit utilization over the period.

59

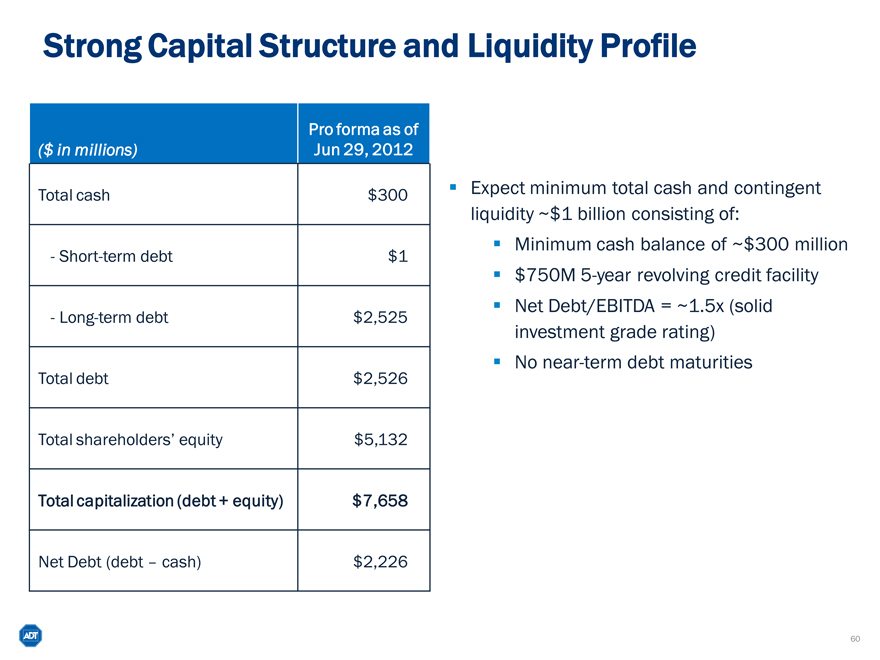

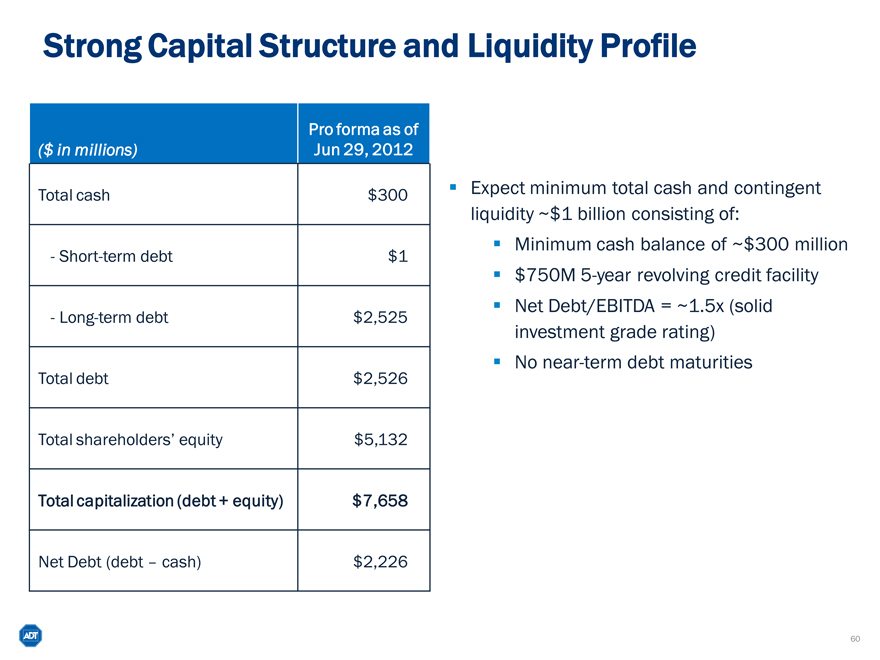

Strong Capital Structure and Liquidity Profile

($ in millions) Pro forma as of Jun 29, 2012

Total cash $300

- Short-term debt $1

- Long-term debt $2,525

Total debt $2,526

Total shareholders’ equity $5,132

Total capitalization (debt + equity) $7,658

Net Debt (debt – cash) $2,226

Expect minimum total cash and contingent liquidity ~$1 billion consisting of:

Minimum cash balance of ~$300 million

$750M 5-year revolving credit facility

Net Debt/EBITDA = ~1.5x (solid investment grade rating)

No near-term debt maturities

60

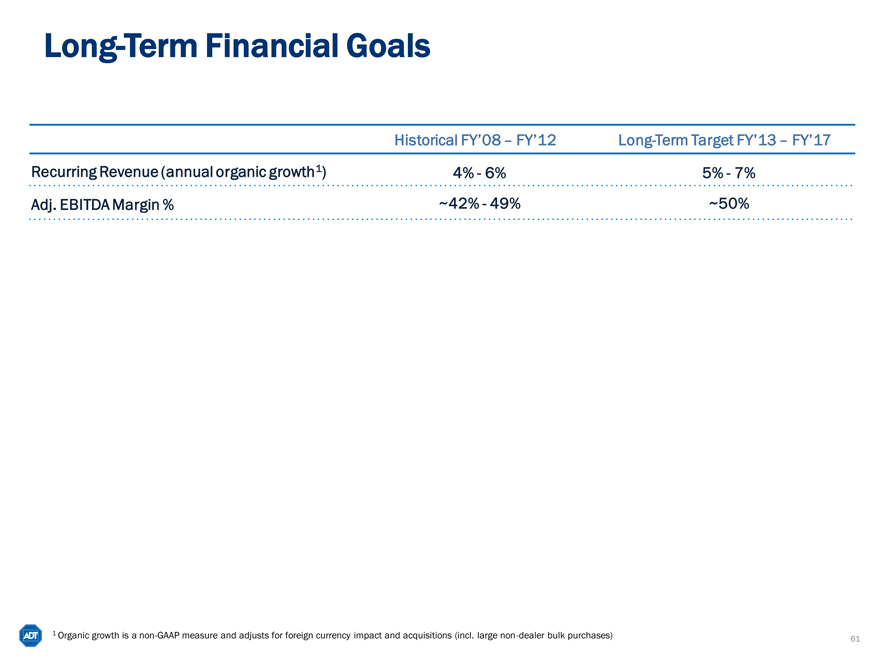

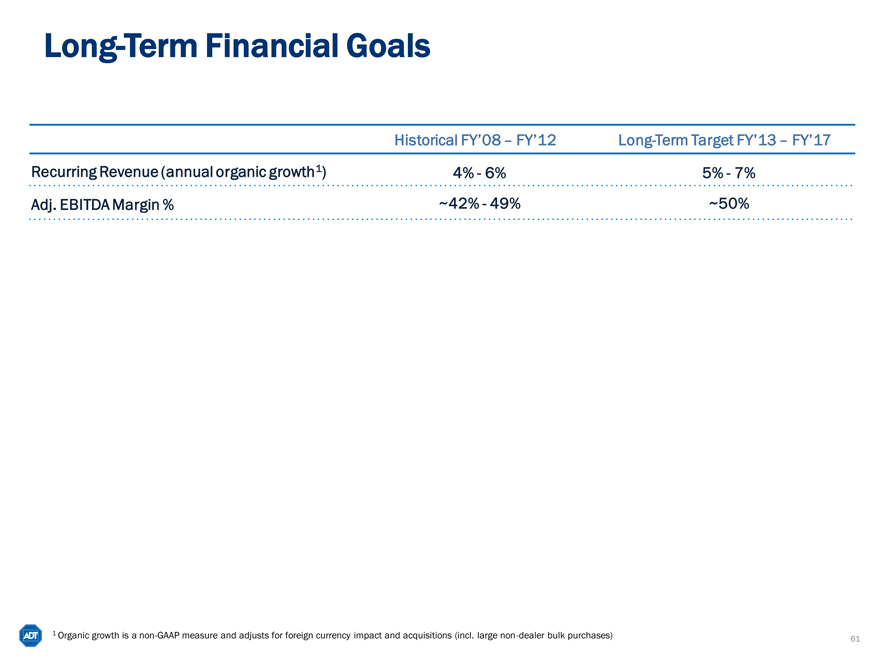

Long-Term Financial Goals

Historical FY’08 – FY’12 Long-Term Target FY’13 – FY’17

Recurring Revenue (annual organic growth1) 4%— 6% 5%—7%

Adj. EBITDA Margin % ~42% —49% ~50%

1 Organic growth is a non-GAAP measure and adjusts for foreign currency impact and acquisitions (incl. large non-dealer bulk purchases)

61

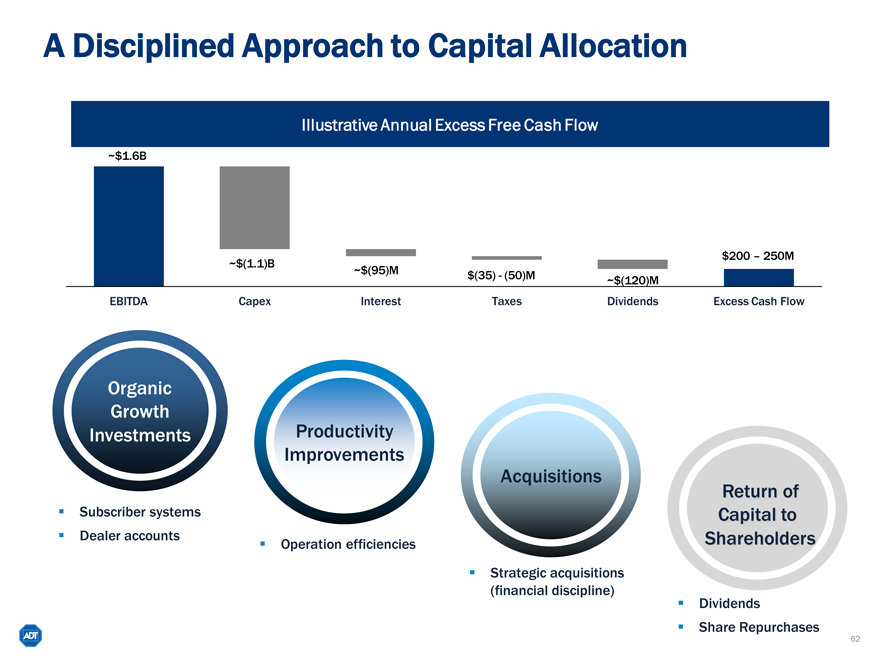

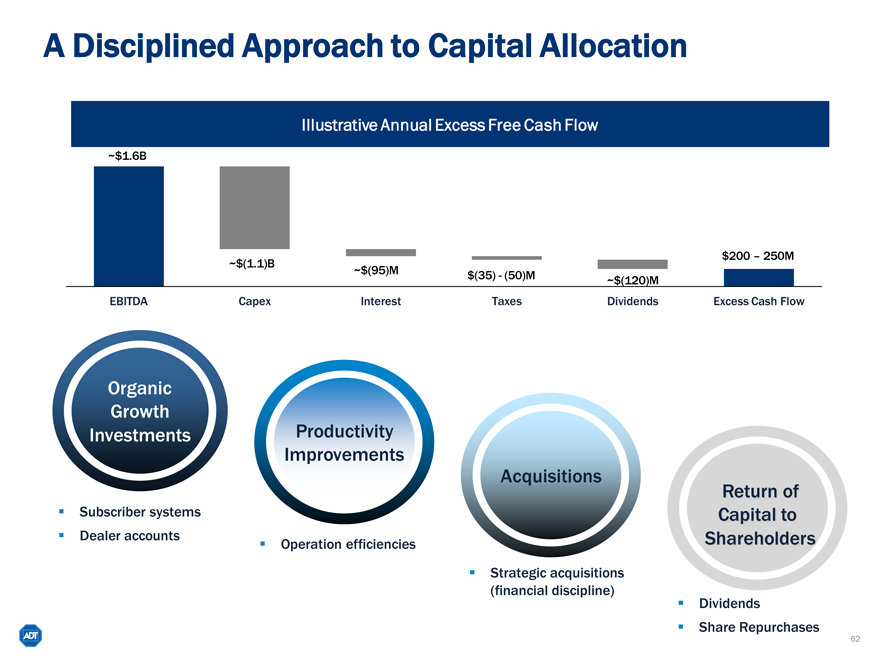

A Disciplined Approach to Capital Allocation

Illustrative Annual Excess Free Cash Flow

~$1.6B

$200 – 250M

~$(1.1)B ~$(95)M

$(35)—(50)M ~$(120)M

EBITDA Capex Interest Taxes Dividends Excess Cash Flow

Organic Growth Investments

Productivity Improvements

Acquisitions

Return of Capital to Shareholders

Subscriber systems Dealer accounts

Operation efficiencies

Strategic acquisitions (financial discipline)

Dividends

Share Repurchases

62

Agenda

Introduction to ADT

Residential and Small Business Security Market Strategic Priorities Financial Overview Closing Remarks Q&A

63

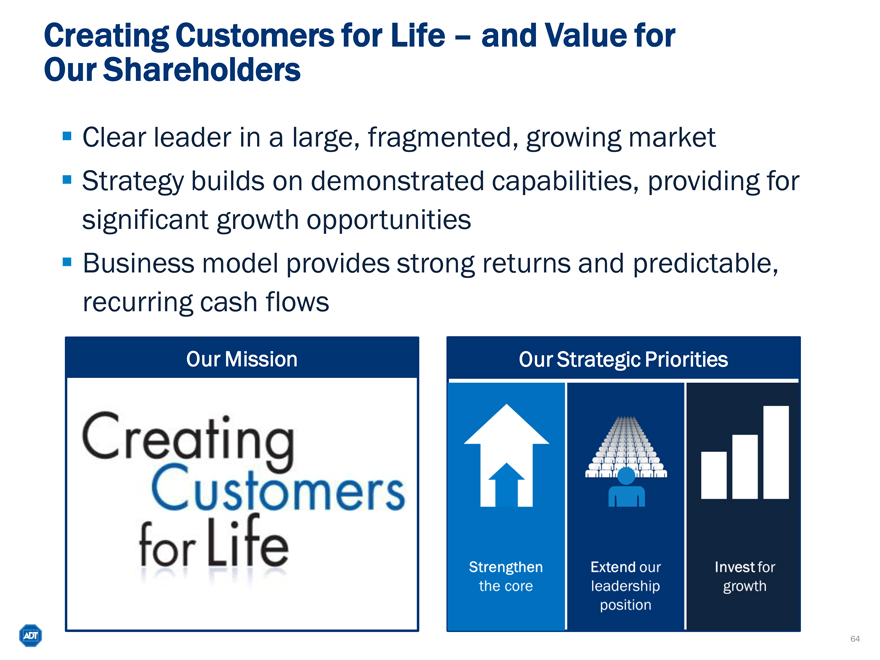

Creating Customers for Life – and Value for Our Shareholders

Clear leader in a large, fragmented, growing market Strategy builds on demonstrated capabilities, providing for significant growth opportunities Business model provides strong returns and predictable, recurring cash flows

Our Mission

Creating Customers for life

Our Strategic Priorities

Strengthen the core

Extend our leadership position

Invest for growth

64

Agenda

Introduction to ADT

Residential and Small Business Security Market Strategic Priorities Financial Overview Closing Remarks Q&A

65

Q&A

Appendix

67

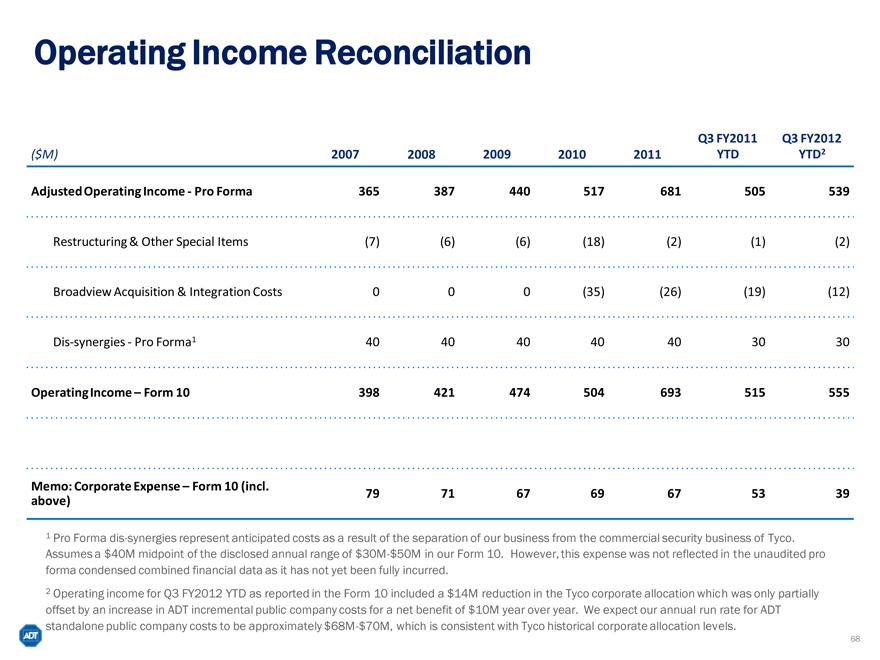

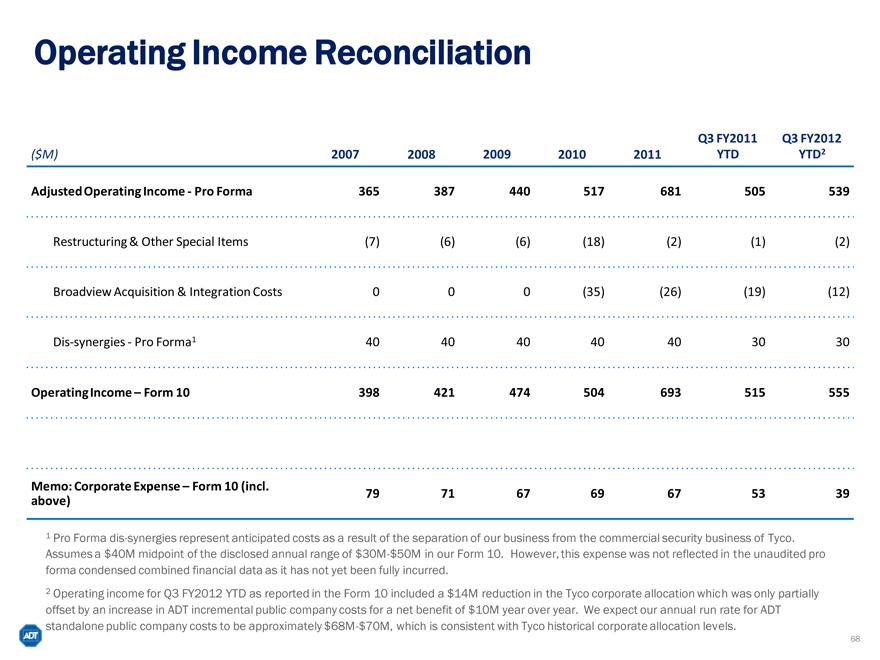

Operating Income Reconciliation

Q3 FY2011 Q3 FY2012

($M) 2007 2008 2009 2010 2011 YTD YTD2

Adjusted Operating Income—Pro Forma 365 387 440 517 681 505 539

Restructuring & Other Special Items (7) (6) (6) (18) (2) (1) (2)

Broadview Acquisition & Integration Costs 0 0 0 (35) (26) (19) (12)

Dis-synergies—Pro Forma1 40 40 40 40 40 30 30

Operating Income – Form 10 398 421 474 504 693 515 555

Memo: Corporate Expense – Form 10 (incl.

above) 79 71 67 69 67 53 39

1 Pro Forma dis-synergies represent anticipated costs as a result of the separation of our business from the commercial security business of Tyco.

Assumes a $40M midpoint of the disclosed annual range of $30M-$50M in our Form 10. However, this expense was not reflected in the unaudited pro forma condensed combined financial data as it has not yet been fully incurred.

2 Operating income for Q3 FY2012 YTD as reported in the Form 10 included a $14M reduction in the Tyco corporate allocation which was only partially offset by an increase in ADT incremental public company costs for a net benefit of $10M year over year. We expect our annual run rate for ADT standalone public company costs to be approximately $68M-$70M, which is consistent with Tyco historical corporate allocation levels.

68

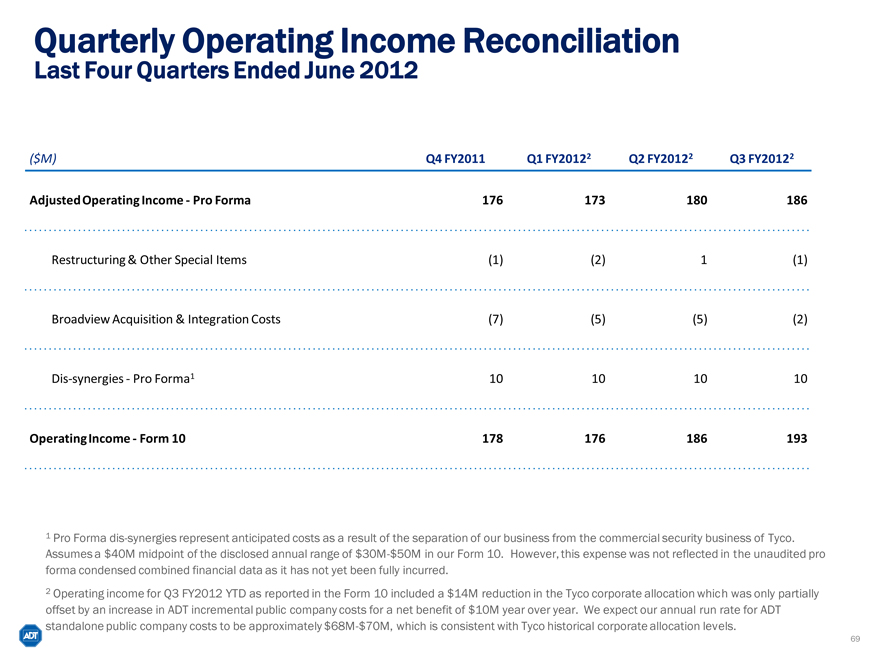

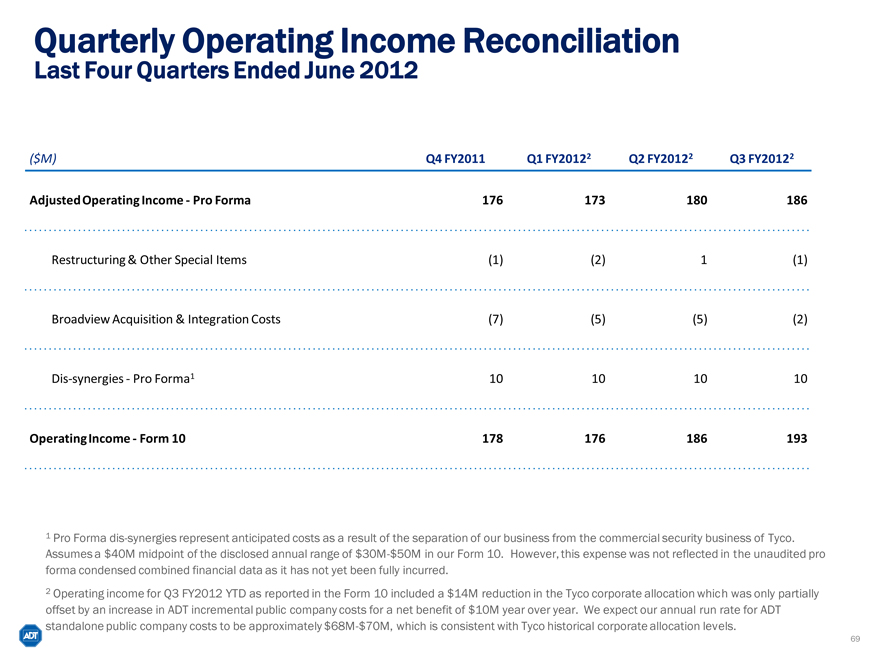

Quarterly Operating Income Reconciliation

Last Four Quarters Ended June 2012

($M) Q4 FY2011 Q1 FY20122 Q2 FY20122 Q3 FY20122

Adjusted Operating Income—Pro Forma 176 173 180 186

Restructuring & Other Special Items (1) (2) 1 (1)

Broadview Acquisition & Integration Costs (7) (5) (5) (2)

Dis-synergies—Pro Forma1 10 10 10 10

Operating Income—Form 10 178 176 186 193

1 Pro Forma dis-synergies represent anticipated costs as a result of the separation of our business from the commercial security business of Tyco.

Assumes a $40M midpoint of the disclosed annual range of $30M-$50M in our Form 10. However, this expense was not reflected in the unaudited pro forma condensed combined financial data as it has not yet been fully incurred.

2 Operating income for Q3 FY2012 YTD as reported in the Form 10 included a $14M reduction in the Tyco corporate allocation which was only partially offset by an increase in ADT incremental public company costs for a net benefit of $10M year over year. We expect our annual run rate for ADT standalone public company costs to be approximately $68M-$70M, which is consistent with Tyco historical corporate allocation levels.

69

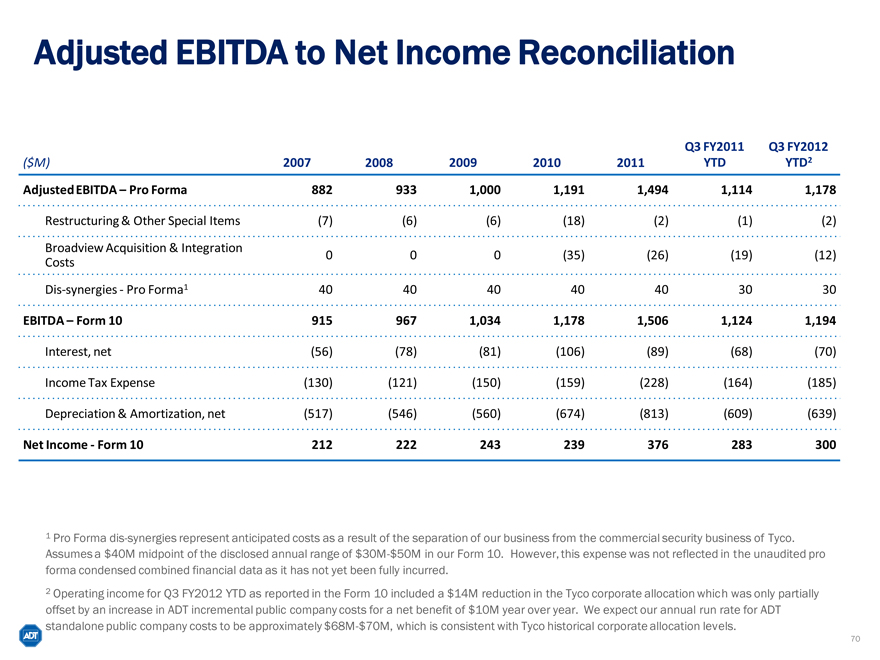

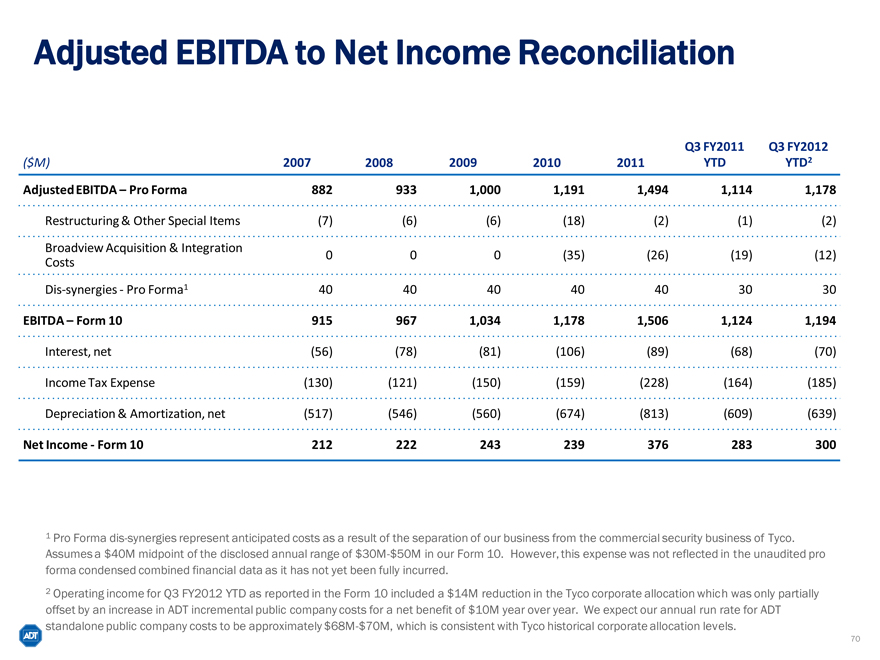

Adjusted EBITDA to Net Income Reconciliation

Q3 FY2011 Q3 FY2012

($M) 2007 2008 2009 2010 2011 YTD YTD2

Adjusted EBITDA – Pro Forma 882 933 1,000 1,191 1,494 1,114 1,178

Restructuring & Other Special Items (7) (6) (6) (18) (2) (1) (2)

Broadview Acquisition & Integration

Costs 0 0 0 (35) (26) (19) (12)

Dis-synergies—Pro Forma1 40 40 40 40 40 30 30

EBITDA – Form 10 915 967 1,034 1,178 1,506 1,124 1,194

Interest, net (56) (78) (81) (106) (89) (68) (70)

Income Tax Expense (130) (121) (150) (159) (228) (164) (185)

Depreciation & Amortization, net (517) (546) (560) (674) (813) (609) (639)

Net Income—Form 10 212 222 243 239 376 283 300

1 Pro Forma dis-synergies represent anticipated costs as a result of the separation of our business from the commercial security business of Tyco.

Assumes a $40M midpoint of the disclosed annual range of $30M-$50M in our Form 10. However, this expense was not reflected in the unaudited pro forma condensed combined financial data as it has not yet been fully incurred.

2 Operating income for Q3 FY2012 YTD as reported in the Form 10 included a $14M reduction in the Tyco corporate allocation which was only partially offset by an increase in ADT incremental public company costs for a net benefit of $10M year over year. We expect our annual run rate for ADT standalone public company costs to be approximately $68M-$70M, which is consistent with Tyco historical corporate allocation levels.

70

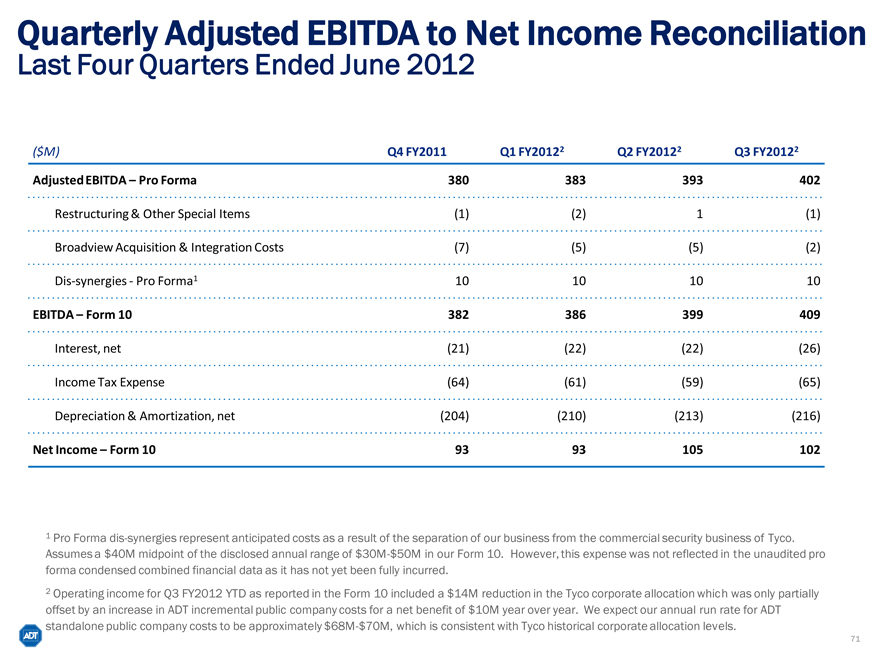

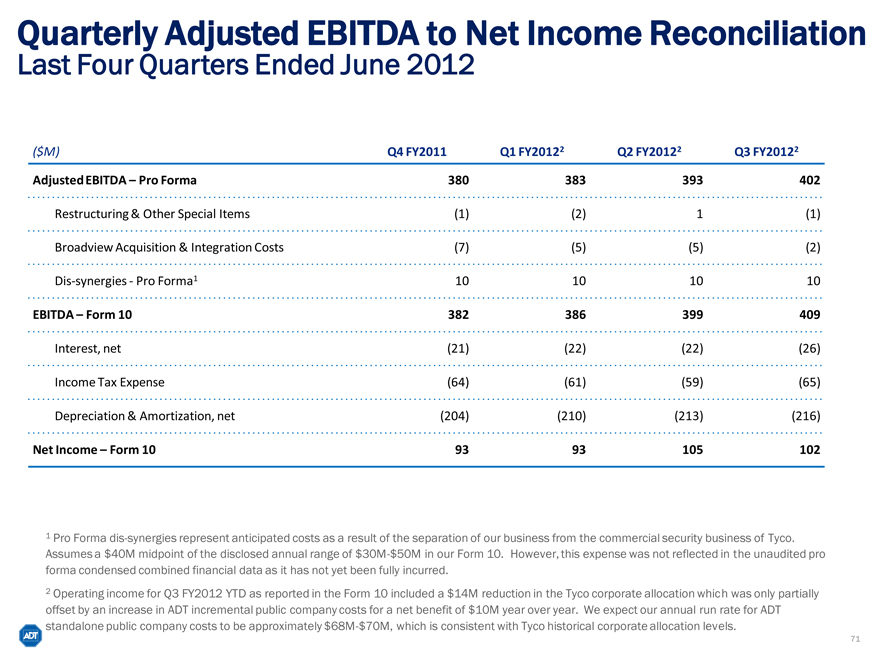

Quarterly Adjusted EBITDA to Net Income Reconciliation

Last Four Quarters Ended June 2012

($M) Q4 FY2011 Q1 FY20122 Q2 FY20122 Q3 FY20122

Adjusted EBITDA – Pro Forma 380 383 393 402

Restructuring & Other Special Items (1) (2) 1 (1)

Broadview Acquisition & Integration Costs (7) (5) (5) (2)

Dis-synergies—Pro Forma1 10 10 10 10

EBITDA – Form 10 382 386 399 409

Interest, net (21) (22) (22) (26)

Income Tax Expense (64) (61) (59) (65)

Depreciation & Amortization, net (204) (210) (213) (216)

Net Income – Form 10 93 93 105 102

1 Pro Forma dis-synergies represent anticipated costs as a result of the separation of our business from the commercial security business of Tyco.

Assumes a $40M midpoint of the disclosed annual range of $30M-$50M in our Form 10. However, this expense was not reflected in the unaudited pro forma condensed combined financial data as it has not yet been fully incurred.

2 Operating income for Q3 FY2012 YTD as reported in the Form 10 included a $14M reduction in the Tyco corporate allocation which was only partially offset by an increase in ADT incremental public company costs for a net benefit of $10M year over year. We expect our annual run rate for ADT standalone public company costs to be approximately $68M-$70M, which is consistent with Tyco historical corporate allocation levels.

71

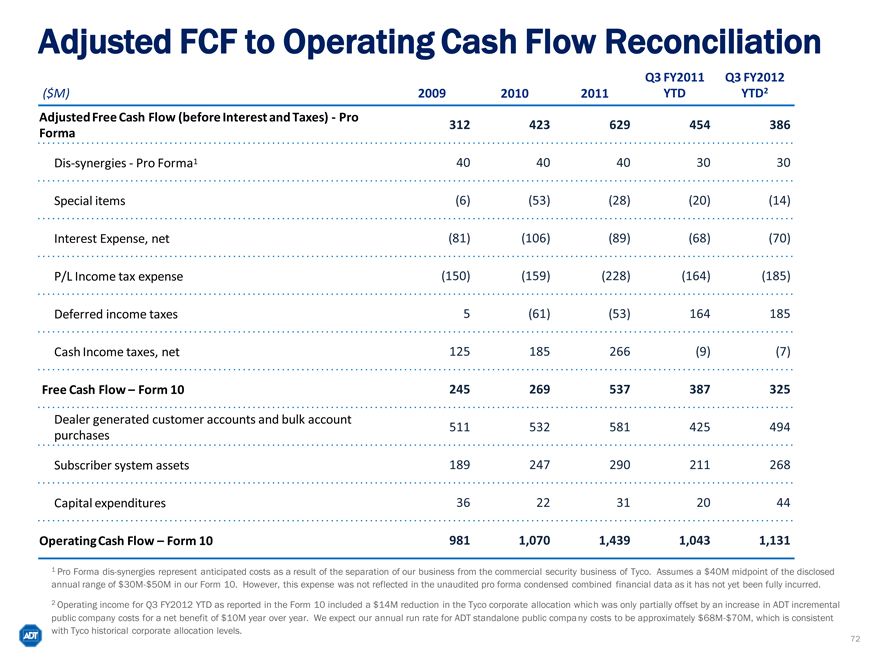

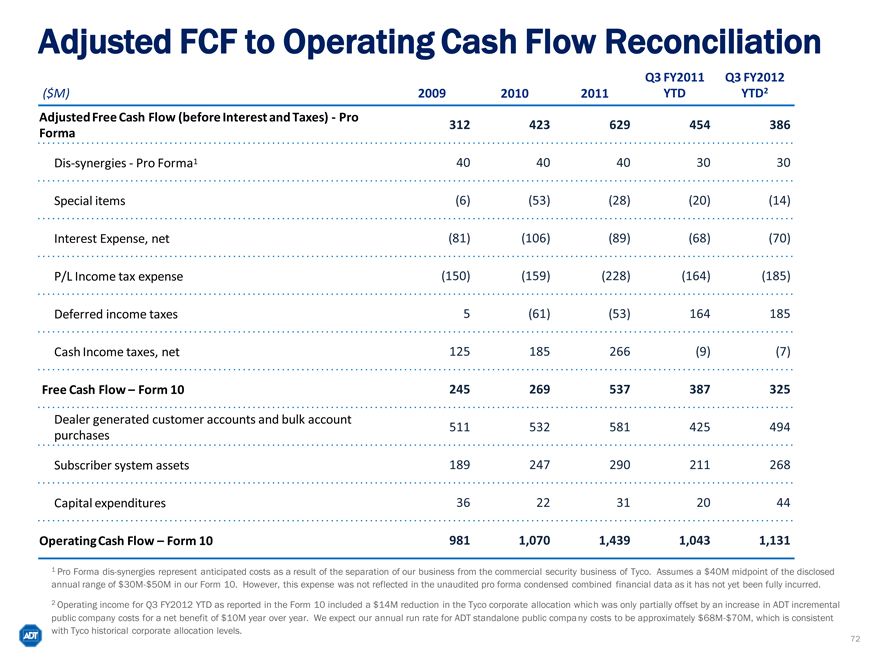

Adjusted FCF to Operating Cash Flow Reconciliation

Q3 FY2011 Q3 FY2012

($M) 2009 2010 2011 YTD YTD2

Adjusted Free Cash Flow (before Interest and Taxes)—Pro 312 423 629 454 386

Forma

Dis-synergies—Pro Forma1 40 40 40 30 30

Special items (6) (53) (28) (20) (14)

Interest Expense, net (81) (106) (89) (68) (70)

P/L Income tax expense (150) (159) (228) (164) (185)

Deferred income taxes 5 (61) (53) 164 185

Cash Income taxes, net 125 185 266 (9) (7)

Free Cash Flow – Form 10 245 269 537 387 325

Dealer generated customer accounts and bulk account 511 532 581 425 494

purchases

Subscriber system assets 189 247 290 211 268

Capital expenditures 36 22 31 20 44

Operating Cash Flow – Form 10 981 1,070 1,439 1,043 1,131

1 Pro Forma dis-synergies represent anticipated costs as a result of the separation of our business from the commercial security business of Tyco. Assumes a $40M midpoint of the disclosed annual range of $30M-$50M in our Form 10. However, this expense was not reflected in the unaudited pro forma condensed combined financial data as it has not yet been fully incurred.

2 Operating income for Q3 FY2012 YTD as reported in the Form 10 included a $14M reduction in the Tyco corporate allocation which was only partially offset by an increase in ADT incremental public company costs for a net benefit of $10M year over year. We expect our annual run rate for ADT standalone public company costs to be approximately $68M-$70M, which is consistent with Tyco historical corporate allocation levels.

72

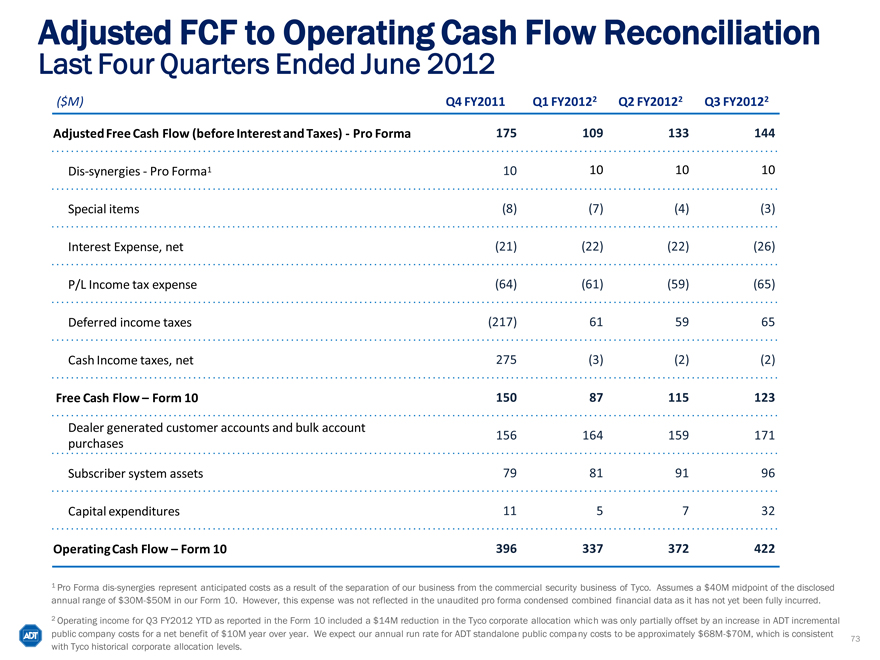

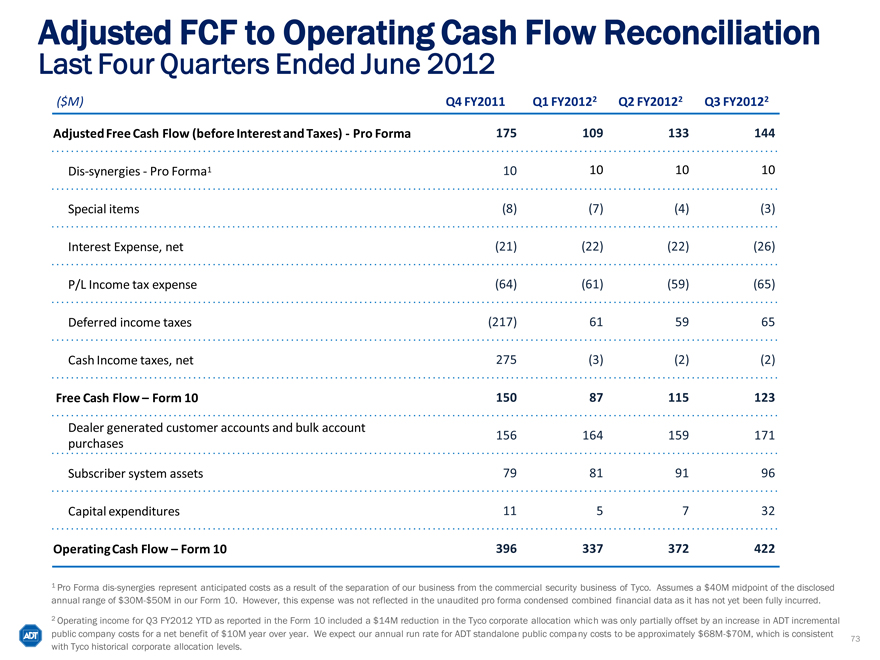

Adjusted FCF to Operating Cash Flow Reconciliation

Last Four Quarters Ended June 2012

($M) Q4 FY2011 Q1 FY20122 Q2 FY20122 Q3 FY20122

Adjusted Free Cash Flow (before Interest and Taxes)—Pro Forma 175 109 133 144

Dis-synergies—Pro Forma1 10 10 10 10

Special items (8) (7) (4) (3)

Interest Expense, net (21) (22) (22) (26)

P/L Income tax expense (64) (61) (59) (65)

Deferred income taxes (217) 61 59 65

Cash Income taxes, net 275 (3) (2) (2)

Free Cash Flow – Form 10 150 87 115 123

Dealer generated customer accounts and bulk account 156 164 159 171

purchases

Subscriber system assets 79 81 91 96

Capital expenditures 11 5 7 32

Operating Cash Flow – Form 10 396 337 372 422

1 Pro Forma dis-synergies represent anticipated costs as a result of the separation of our business from the commercial security business of Tyco. Assumes a $40M midpoint of the disclosed annual range of $30M-$50M in our Form 10. However, this expense was not reflected in the unaudited pro forma condensed combined financial data as it has not yet been fully incurred.

2 Operating income for Q3 FY2012 YTD as reported in the Form 10 included a $14M reduction in the Tyco corporate allocation which was only partially offset by an increase in ADT incremental public company costs for a net benefit of $10M year over year. We expect our annual run rate for ADT standalone public company costs to be approximately $68M-$70M, which is consistent with Tyco historical corporate allocation levels.

73