Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

TYCO INTERNATIONAL PUBLIC LIMITED COMPANY

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

WEDNESDAY, MARCH 4, 2015

THE MERRION HOTEL, 24 UPPER MERRION STREET, DUBLIN 2, IRELAND

NOTICE IS HEREBY GIVEN that the 2015 Annual General Meeting of Shareholders of Tyco International public limited company will be held on March 4, 2015 at The Merrion Hotel, 24 Upper Merrion Street, Dublin 2, Ireland at 3:00 pm, local time for the following purposes:

Ordinary Business

| 1. | By separate resolutions, to elect the following individuals as Directors for a period of one year, expiring at the end of the Company’s Annual General Meeting of Shareholders in 2016: |

(a) Edward D. Breen | (b) Herman E. Bulls | (c) Michael E. Daniels | ||

(d) Frank M. Drendel | (e) Brian Duperreault | (f) Rajiv L. Gupta | ||

(g) George R. Oliver | (h) Brendan R. O’Neill | (i) Jürgen Tinggren | ||

(j) Sandra S. Wijnberg | (k) R. David Yost |

| 2. | To ratify the appointment of Deloitte & Touche LLP as the independent auditors of the Company and to authorize the Audit Committee of the Board of Directors to set the auditors’ remuneration. |

Special Business

| 3. | To authorize the Company and/or any subsidiary of the Company to make market purchases of Company shares. |

| 4. | To determine the price range at which the Company can reissue shares that it holds as treasury shares (Special Resolution). |

| 5. | To approve, in a non-binding advisory vote, the compensation of the named executive officers. |

| 6. | To act on such other business as may properly come before the meeting or any adjournment thereof. |

This Notice of Annual General Meeting and proxy statement and the enclosed proxy card are first being sent on or about January 15, 2015 to each holder of record of the Company’s ordinary shares at the close of business on January 5, 2015. The record date for the entitlement to vote at the Annual General Meeting is January 5, 2015 and only registered shareholders of record on such date are entitled to notice of, and to attend and vote at, the Annual General Meeting and any adjournment or postponement thereof. During the meeting, management will also present the Company’s Irish Statutory Accounts for the fiscal year ended September 26, 2014.Whether or not you plan to attend

Table of Contents

the meeting, please complete, sign, date and return the enclosed proxy card to ensure that your shares are represented at the meeting. Shareholders of record who attend the meeting may vote their shares personally, even though they have sent in proxies.

This Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended September 26, 2014 and our Irish Statutory Accounts are available to shareholders at www.proxyvote.com and are also available in the Investor Relations section of our website at www.tyco.com.

By Order of the Board of Directors,

Judith A. Reinsdorf

Executive Vice President and General Counsel

January 15, 2015

PLEASE PROMPTLY COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD. THE PROXY IS REVOCABLE AND IT WILL NOT BE USED IF YOU: GIVE WRITTEN NOTICE OF REVOCATION TO THE PROXY PRIOR TO THE VOTE TO BE TAKEN AT THE MEETING; SUBMIT A LATER-DATED PROXY; OR ATTEND AND VOTE PERSONALLY AT THE MEETING.

Table of Contents

| 2015 Proxy Statement | i |

Table of Contents

Annual General Meeting

Time and Date: | 3:00 pm, local time, on March 4, 2015 | |

Place: | The Merrion Hotel, 24 Upper Merrion Street, Dublin 2, Ireland | |

Record Date: | January 5, 2015 | |

Voting: | Shareholders on the record date are entitled to one vote per share on each matter to be voted upon at the Annual General Meeting | |

Admission: | All shareholders are invited to attend the Annual General Meeting. Registration will commence on the day of the meeting. | |

Proposals to be Voted Upon

| Board Recommendation | ||

1. Elect, by separate resolution, each nominee to the Board of Directors. | FOR each nominee | |

2. By separate resolutions, ratify the appointment of Deloitte & Touche LLP as the independent auditors of the Company and authorize the Audit Committee of the Board of Directors to set the auditors’ remuneration. | FOR | |

3. Authorize the Company and/or any subsidiary of the Company to make market purchases of Company shares. | FOR | |

4. Determine the price range at which the Company can reissue shares that it holds as treasury shares. (Special Resolution). | FOR | |

5. Approve, in a non-binding advisory vote, the compensation of the named executive officers. | FOR | |

| 2015 Proxy Statement | 1 |

Table of Contents

The Nominees to our Board of Directors

We are asking you to voteFOR all the director nominees listed below. All current directors attended at least 90% of the Board and committee meetings on which he or she sits. Detailed information regarding these individuals, along with all other Board nominees, is set forth beginning on page 11. Summary information is set forth below.

Nominee and Principal Occupation | Age | Director Since | Independent | Current Committee Membership | ||||||||||

Edward D. Breen Former Chief Executive Officer and current Chairman of Tyco | 58 | 2002 | Non-executive chair | |||||||||||

Herman E. Bulls Chairman of Jones Lang LaSalle’s Public Institutions specialty practice | 58 | 2014 | ü | Nominating & Governance | ||||||||||

Michael E. Daniels Former Senior Vice President of Global Technology Services group at IBM | 60 | 2010 | ü | Audit | ||||||||||

Frank M. Drendel Non-executive Chairman of CommScope Holding Company | 69 | 2012 | ü | Nominating & Governance | ||||||||||

Brian Duperreault Chief Executive Officer of Hamilton Insurance Group, Ltd. | 67 | 2004 | ü | Nominating & Governance (chair)

Lead Director | ||||||||||

Rajiv L. Gupta Former Chairman and Chief Executive Officer of Rohm & Haas Company | 69 | 2005 | ü | Compensation (chair) | ||||||||||

George R. Oliver Chief Executive Officer of Tyco | 54 | 2012 | N/A | |||||||||||

Brendan R. O’Neill Former Chief Executive Officer of Imperial Chemicals PLC | 66 | 2003 | ü | Audit (chair) | ||||||||||

Jürgen Tinggren Former Chief Executive Officer and current Director of Schindler Group | 56 | 2014 | ü | Audit | ||||||||||

Sandra S. Wijnberg Deputy Head of Mission, Office of the Quartet Representative | 58 | 2003 | ü | Compensation | ||||||||||

R. David Yost Former Chief Executive Officer of AmerisourceBergen | 67 | 2009 | ü | Compensation | ||||||||||

| 2 | 2015 Proxy Statement |

Table of Contents

Non-Binding Advisory Vote on Executive Compensation

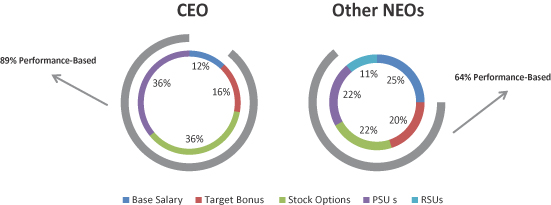

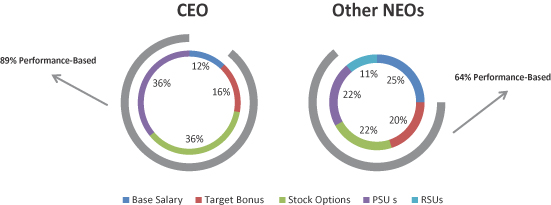

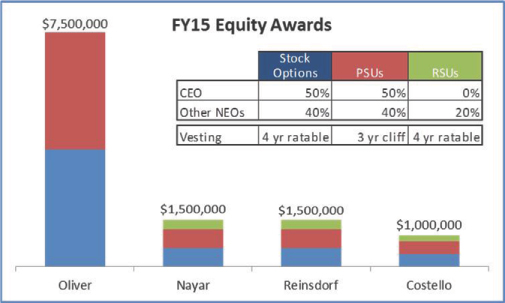

Proposal number five is our annual advisory vote on the Company’s executive compensation philosophy and program. Detailed information regarding these matters is included under the heading “Compensation Discussion & Analysis,” and we urge you to read it in its entirety. We have successfully completed our second full year since the spin-offs of our North American residential security business and our flow control business, and our compensation philosophy and structure for executive officers remains dedicated to the concept of paying for performance, and continues to be heavily weighted with performance based awards, as illustrated below.

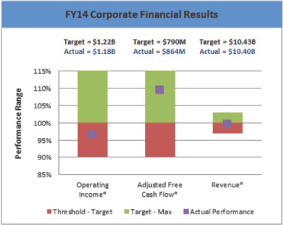

Tyco delivered strong financial results and made substantial operational and strategic progress in fiscal 2014:

| n | Organically, revenue* grew by 3% compared to 1% in the prior year. This reflected strong 6% organic growth in our Global Products business, 2% growth in our installation businesses and 1% growth in our service businesses. |

| n | Segment operating margin before special items* improved 90 basis points over the prior year to 13.9% (12.7% on a GAAP basis); and |

| n | Diluted earnings per share from continuing operations before special items* improved 20% over the prior year to $1.99 per share ($1.71 on a GAAP basis). |

* Non-GAAP metrics. See Non-GAAP Reconciliations.

These results drove the payouts under the Company’s Annual Incentive Program, with Mr. George Oliver, our CEO, achieving a payout of 105% of his target award. We believe this demonstrates our commitment to paying for performance.

As noted above, for our CEO, over 85% of annual targeted direct pay continues to be in the form of at-risk performance-based compensation—consisting of long-term equity awards and the annual performance bonus. Moreover, as a result of this structure, our CEO’s compensation has been correlated to Company performance in fiscal 2014. In addition, we have in place a strong framework that is essential to governing our executive compensation program. The framework and executive compensation philosophy, which are described in more detail in the Compensation Discussion & Analysis, are established by an independent Compensation Committee that is advised by an independent consultant. As a result, our Board of Directors urges you to voteFOR proposal number five and endorse our executive compensation philosophy and program.

| 2015 Proxy Statement | 3 |

Table of Contents

QUESTIONSAND ANSWERS ABOUT THIS

PROXY STATEMENTANDTHE ANNUAL GENERAL MEETING

The following questions and answers are intended to address briefly some commonly asked questions regarding the Annual General Meeting. These questions and answers may not address all questions that may be important to you. For more information, please refer to the more detailed information contained elsewhere in this proxy statement, including the documents referred to or incorporated by reference herein. For instructions on obtaining the documents incorporated by reference, see “Where You Can Find More Information.”

Unless we have indicated otherwise, in this proxy statement references to the “Company,” “Tyco”, “we,” “us,” “our” and similar terms refer to Tyco International public limited company and its consolidated subsidiaries.

Why did I receive this Proxy statement?

We have sent this Notice of Annual General Meeting and Proxy Statement, together with the enclosed proxy card or voting instruction card, because our Board of Directors is soliciting your proxy to vote at the Annual General Meeting on March 4, 2015. This proxy statement contains information about the items being voted on at the Annual General Meeting and important information about Tyco. Our 2014 Annual Report on Form 10-K, which includes our consolidated financial statements for the fiscal year ended September 26, 2014 (the “Annual Report”), is enclosed with these materials.

Who is entitled to vote?

Each holder of Tyco ordinary shares in our register of shareholders (such owners are often referred to as “shareholders of record,” “record holders” or “registered shareholders”) as of the close of business on January 5, 2015, the record date for the Annual General Meeting, is entitled to attend and vote at the Annual General Meeting. On January 5, 2015, there were 419, 916, 852 ordinary shares outstanding and entitled to vote at the Annual General Meeting. Any Tyco shareholder of record as of the record date who does not receive notice of the Annual General Meeting and proxy statement, together with the enclosed proxy card or voting instruction card and the Annual Report, may obtain a copy at the Annual General Meeting or by contacting Tyco at +353-21-423-5000.

We have requested that banks, brokerage firms and other nominees who hold ordinary shares on behalf of the owners of the ordinary shares (such owners are often referred to as “beneficial shareholders” or “street name holders”) as of the close of business on January 5, 2015 forward these materials, together with a proxy card or voting instruction card, to such beneficial shareholders. Tyco has agreed to pay the reasonable expenses of the banks, brokerage firms and other nominees for forwarding these materials.

Finally, Tyco has provided for these materials to be sent to persons who have interests in its ordinary shares through participation in Tyco’s retirement savings plans. These individuals are not eligible to vote directly at the Annual General Meeting. They may, however, instruct the trustees of these plans how to vote the ordinary shares represented by their interests. The enclosed proxy card will also serve as voting instructions for the trustees of the plans.

| 4 | 2015 Proxy Statement |

Table of Contents

How many votes do I have?

Every holder of an ordinary share on the record date will be entitled to one vote per share for each matter presented at the Annual General Meeting. Because each Director’s election is the subject of a separate resolution, every holder of an ordinary share on the record date will be entitled to one vote per share for each separate Director election resolution.

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

Most of our shareholders hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some differences between shares held of record and those owned beneficially.

SHAREHOLDEROF RECORD

If your shares are registered directly in your name, in our share register operated by our transfer agent, Broadridge Corporate Issuer Solutions, Inc., you are considered, with respect to those shares, the shareholder of record and these proxy materials are being sent to you directly by us. As the shareholder of record, you have the right to grant your voting proxy to the persons named in the proxy card (see “How Do I Appoint and Vote via a Proxy?” below), or to grant a written proxy to any other person, which person does not need to be a shareholder, or to attend and vote in person at the Annual General Meeting. We have enclosed a proxy card for you to use in which you can elect to appoint the officers of the Company named therein as your proxy.

BENEFICIAL OWNER

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your broker, bank or other nominee who is considered, with respect to those shares, the shareholder of record. As the beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote your shares and are also invited to attend the Annual General Meeting. However, since you are not the shareholder of record, you may only vote these shares in person at the Annual General Meeting if you follow the instructions described below under “How do I attend the Annual General Meeting?” and “How do I vote?” Your broker, bank or other nominee has enclosed a voting instruction card for you to use in directing your broker, bank or other nominee as to how to vote your shares, which may contain instructions for voting by telephone or electronically.

How do I vote?

A proxy card is being sent to each shareholder of record as of the record date. If you hold your shares in the name of a bank, broker or other nominee, you should follow the instructions provided by your bank, broker or nominee when voting your shares. Otherwise, you can vote in the following ways:

| n | By Mail: If you are a holder of record, you can vote by marking, dating and signing the appropriate proxy card and returning it by mail in the enclosed postage-paid envelope. If you beneficially own your ordinary shares, you can vote by following the instructions on your voting instruction card. |

| n | By Internet or Telephone: You can vote over the Internet at www.proxyvote.com by following the instructions on the proxy card or the voting instruction card or in the Notice of Internet availability of proxy materials previously sent to you. If you are not a holder of record, you can vote using a touchtone telephone by calling 1-800-454-8683. |

| 2015 Proxy Statement | 5 |

Table of Contents

| n | At the Annual General Meeting: If you are planning to attend the Annual General Meeting and wish to vote your ordinary shares in person, we will give you a ballot at the meeting. Shareholders who own their shares in “street name” are not able to vote at the Annual General Meeting unless they have a proxy, executed in their favor, from the holder of record of their shares. |

Even if you plan to be present at the Annual General Meeting, we encourage you to complete and mail the enclosed card to vote your ordinary shares by proxy. Telephone and Internet voting facilities for shareholders will be available 24 hours a day and will close at 11:59 p.m., Eastern Standard Time, on March 3, 2015.

How do I appoint and vote via a proxy?

If you properly fill in your proxy card appointing an officer of the Company as your proxy and send it to us in time to vote, your proxy, meaning one of the individuals named on your proxy card, will vote your shares as you have directed. You may also grant a written proxy to any other person by filling in the proxy card and identifying the person, which person does not need to be a shareholder, or attend and vote in person at the Annual General Meeting. If you sign the proxy card but do not make specific choices, your proxy will vote your shares as recommended by the Board of Directors “FOR” each of the agenda items listed above.

If a new agenda item or a new motion or proposal for an existing agenda item is presented to the Annual General Meeting, the Company officer acting as your proxy will vote in accordance with the recommendation of our Board of Directors. At the time we began printing this proxy statement, we knew of no matters that needed to be acted on at the Annual General Meeting other than those discussed in this proxy statement.

Whether or not you plan to attend the Annual General Meeting, we urge you to submit your proxy. Returning the proxy card or submitting your vote electronically will not affect your right to attend the Annual General Meeting. You must return your proxy cards by the times and dates set forth below under “Returning Your Proxy Card” in order for your vote to be counted.

How do I attend the Annual General Meeting?

All shareholders are invited to attend the Annual General Meeting. For admission to the Annual General Meeting, shareholders of record should bring the admission ticket attached to the enclosed proxy card to the Registered Shareholders check-in area, where their ownership will be verified. Those who have beneficial ownership of shares held by a bank, brokerage firm or other nominee should come to the Beneficial Owners check-in area. To be admitted, beneficial owners must bring account statements or letters from their banks or brokers showing that they own Tyco shares. Registration will begin at 2:00 pm, local time, and the Annual General Meeting will begin at 3:00 pm, local time.

What if I return my proxy or voting instruction card but do not mark it to show how I am voting?

Your shares will be voted according to the specific instructions you have indicated on your proxy or voting instruction card. If you sign and return your proxy or voting instruction card but do not indicate specific instructions for voting, you instruct the proxy to vote your shares, “FOR” each director and “FOR” all other proposals. For any other matter which may properly come before the Annual General Meeting, and any adjournment or postponement thereof, you instruct, by submitting proxies with blank voting instructions, the proxy to vote in accordance with the recommendation of the Board of Directors.

| 6 | 2015 Proxy Statement |

Table of Contents

May I change or revoke my vote after I return my proxy or voting instruction card?

You may change your vote before it is exercised by:

| n | If you voted by telephone or the Internet, submitting subsequent voting instructions through the telephone or Internet; |

| n | Submitting another proxy card (or voting instruction card if you beneficially own your ordinary shares) with a later date; or |

| n | If you are a holder of record, or a beneficial owner with a proxy from the holder of record, voting in person at the Annual General Meeting. |

Your presence without voting at the meeting will not automatically revoke your proxy, and any revocation during the meeting will not affect votes previously taken. If you hold your shares in the name of a bank, broker or other nominee, you should follow the instructions provided by your bank, broker or nominee in revoking your previously granted proxy.

What does it mean if I receive more than one proxy or voting instruction card?

It means you have multiple accounts at the transfer agent and/or with banks and stockbrokers. Please vote all of your shares. Beneficial owners sharing an address who are receiving multiple copies of the proxy materials and Annual Report will need to contact their broker, bank or other nominee to request that only a single copy of each document be mailed to all shareholders at the shared address in the future. In addition, if you are the beneficial owner, but not the record holder, of our shares, your broker, bank or other nominee may deliver only one copy of the proxy statement and Annual Report to multiple shareholders who share an address unless that nominee has received contrary instructions from one or more of the shareholders. We will deliver promptly, upon written or oral request, a separate copy of the proxy statement and Annual Report to a shareholder at a shared address to which a single copy of the documents was delivered. Shareholders who wish to receive a separate written copy of the proxy statement, now or in the future, should submit their request to us by telephone at 353-21-423-5000 or by submitting a written request to Tyco Shareholder Services, Tyco International plc, Unit 1202 Building 1000 City Gate, Mahon, Cork, Ireland.

What vote is required to approve each proposal at the Annual General Meeting?

Tyco intends to present proposals numbered one through five for shareholder consideration and voting at the Annual General Meeting. These proposals are for:

| 1. | By separate resolutions, to elect the following individuals as Directors for a period of one year, expiring at the end of the Company’s Annual General Meeting of Shareholders in 2016: |

(a) Edward D. Breen | (b) Herman E. Bulls | (c) Michael E. Daniels | ||

(d) Frank M. Drendel | (e) Brian Duperreault | (f) Rajiv L. Gupta | ||

(g) George R. Oliver | (h) Brendan R. O’Neill | (i) Jürgen Tinggren | ||

(j) Sandra S. Wijnberg | (k) R. David Yost |

The election of each director nominee requires the affirmative vote of a majority of the votes properly cast (in person or by proxy) at the Annual General Meeting.

| 2015 Proxy Statement | 7 |

Table of Contents

| 2. | To ratify the appointment of Deloitte & Touche LLP as the independent auditors of the Company and to authorize the Audit Committee of the Board of Directors to set the auditors’ remuneration. |

The ratification of the appointment of Deloitte & Touch LLP as the independent auditors of the Company and the authorization of the Audit Committee to set its remuneration requires, in each case, the affirmative vote of a majority of the votes properly cast (in person or by proxy) at the Annual General Meeting.

| 3. | To authorize the Company and/or any subsidiary of the Company to make market purchases of Company shares. |

The authorization for the Company and/or any its subsidiaries to make market purchases of Company shares requires the affirmative vote of a majority of the votes properly cast (in person or by proxy) at the Annual General Meeting.

| 4. | To determine the price range at which the Company can reissue shares that it holds as treasury shares (Special Resolution). |

The authorization of the price range at which the Company may reissue any shares held in treasury requires the affirmative vote of at least 75% of the votes properly cast (in person or by proxy) at the Annual General Meeting.

| 5. | To approve, in a non-binding advisory vote, the compensation of the named executive officers. |

The non-binding approval of the compensation of the Company’s named executive officers requires the affirmative vote of a majority of the votes properly cast (in person or by proxy) at the Annual General Meeting. The advisory vote on executive compensation is non-binding, meaning that our Board of Directors will not be obligated to take any compensation actions or to adjust our executive compensation programs or policies as a result of the vote.

What is the quorum requirement for the Annual General Meeting?

In order to conduct any business at the Annual General Meeting, holders of a majority of Tyco’s ordinary shares which are outstanding and entitled to vote on the record date must be present in person or represented by valid proxies. This is called a quorum. Your shares will be counted for purposes of determining if there is a quorum, whether representing votes for, against or abstained, or broker non-votes, if you:

| n | are present and vote in person at the meeting; |

| n | have voted by telephone or the Internet; OR |

| n | you have submitted a proxy card or voting instruction form by mail. |

What is the effect of broker non-votes and abstentions?

Abstentions and broker non-votes are considered present for purposes of determining the presence of a quorum. Abstentions and broker non-votes will not be considered votes properly cast at the Annual General Meeting. Because the approval of all of the proposals is based on the votes properly cast at the Annual General Meeting, abstentions and broker non-votes will not have any effect on the outcome of voting on these proposals.

| 8 | 2015 Proxy Statement |

Table of Contents

A broker non-vote occurs when a broker holding shares for a beneficial owner does not vote on a particular agenda item because the broker does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. Although brokers have discretionary power to vote your shares with respect to “routine” matters, they do not have discretionary power to vote your shares on “non-routine” matters pursuant to the rules of The New York Stock Exchange (the “NYSE”). We believe the following proposals will be considered non-routine under NYSE rules and therefore your broker will not be able to vote your shares with respect to these proposals unless the broker receives appropriate instructions from you: Proposal No. 1 (Election of Directors) and Proposal No. 5 (Advisory Vote on Executive Compensation). Therefore your broker will not be able to vote your shares with respect to these proposals unless the broker receives appropriate instructions from you.

How will voting on any other business be conducted?

Other than matters incidental to the conduct of the Annual General Meeting and those set forth in this proxy statement, we do not know of any business or proposals to be considered at the Annual General Meeting. If any other business is proposed and properly presented at the Annual General Meeting, the proxy holders must vote in accordance with the instructions given by the shareholder. You may specifically instruct the proxy holder how to vote in such a situation. In the absence of specific instructions, by signing the proxy, you instruct the proxy holder to vote in accordance with the recommendations of the Board of Directors.

Who will count the votes?

Broadridge Financial Solutions will act as the inspector of election and will tabulate the votes.

Important notice regarding the availability of proxy materials for the Annual General Meeting:

Our proxy statement for the Annual General Meeting and the form of proxy card are available at www.proxyvote.com.

As permitted by SEC rules, we are making this proxy statement available to our shareholders electronically via the Internet. On January 15, 2015, we first mailed to our shareholders a Notice containing instructions on how to access this proxy statement and vote online. If you received a Notice by mail, you will not receive a printed copy of the proxy materials in the mail. Instead, the Notice instructs you on how to access and review all of the important information contained in the proxy statement. The Notice also instructs you on how you may submit your proxy over the Internet. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained on the Notice.

Returning Your Proxy Card

Shareholders who are voting by mail should complete and return the proxy card as soon as possible. In order to assure that your proxy is received in time to be voted at the meeting, the proxy card must be completed in accordance with the instructions and received at one of the addresses set forth below by the dates and times specified:

Ireland:

By 5:00 p.m., local time, on March 3, 2015 by hand or mail at:

Tyco International plc

Unit 1202 Building 1000 City Gate,

Mahon, Cork, Ireland

| 2015 Proxy Statement | 9 |

Table of Contents

United States:

By 5:00 p.m., Eastern Standard Time, on March 3, 2015 by mail at:

Broadridge Financial Solutions

c/o Vote Processing

51 Mercedes Way

Edgewood, NY 11717

If your shares are held beneficially in “street name,” you should return your proxy card or voting instruction card in accordance with the instructions on that card or as provided by the bank, brokerage firm or other nominee who holds Tyco shares on your behalf.

Admission to the Annual General Meeting

Shareholders who are registered in the share register on January 5, 2015 will receive the proxy statement and proxy cards from us. Beneficial owners of shares will receive an instruction form from their broker, bank, nominee or custodian acting as shareholder of record to indicate how they wish their shares to be voted. Beneficial owners who wish to vote in person at the Annual General Meeting are requested to obtain a “legal proxy” executed in their favor, from their broker, bank, nominee or other custodian that authorizes you to vote the shares held by them on your behalf. In addition, you must bring to the Annual General Meeting an account statement or letter from the broker, bank or other nominee indicating that you are the owner of the shares. Shareholders of record registered in the share register are entitled to vote and may participate in the Annual General Meeting. Each share carries one vote. For further information, refer to “Who is entitled to vote?”, “What is the difference between holding shares as a shareholder of record and as a beneficial owner?”, “How do I appoint and vote via a proxy?” and “How do I attend the Annual General Meeting?”

Tyco Annual Report

The Tyco International plc 2014 Annual Report containing our audited consolidated financial statements with accompanying notes is available on the Company’s Web site in the Investor Relations Section at www.tyco.com. Copies of these documents may be obtained without charge by contacting Tyco by phone at +353-21-423-5000. Copies may also be obtained without charge by contacting Investor Relations in writing, or may be physically inspected, at the offices of Tyco International plc, Unit 1202 Building 1000 City Gate, Mahon, Cork, Ireland.

| 10 | 2015 Proxy Statement |

Table of Contents

PROPOSAL NUMBER ONE – ELECTIONOF DIRECTORS

Upon the recommendation of the Nominating and Governance Committee, the Board has nominated for election at the Annual General Meeting a slate of 11 nominees, all of whom currently serve on our Board. Biographical information regarding each of the nominees is set forth below. We are not aware of any reason why any of the nominees will not be able to serve if elected. The term of office for members of the Board of Directors commences upon election and terminates upon completion of the first Annual General Meeting of Shareholders following election.

DIRECTOR NOMINEES

Edward D. Breen—Mr. Breen, age 58, was our Chairman and Chief Executive Officer from July 2002 to September 28, 2012. Upon completion of the spin-offs of ADT and Tyco Flow Control in September 2012, Mr. Breen stepped down from his role as Chief Executive Officer and continued as Chairman of the Board of Directors. Prior to joining Tyco, Mr. Breen was President and Chief Operating Officer of Motorola from January 2002 to July 2002; Executive Vice President and President of Motorola’s Networks Sector from January 2001 to January 2002; Executive Vice President and President of Motorola’s Broadband Communications Sector from January 2000 to January 2001; Chairman, President and Chief Executive Officer of General Instrument Corporation from December 1997 to January 2000; and, prior to December 1997, President of General Instrument’s Broadband Networks Group. Mr. Breen was a director of McLeod USA Incorporated from 2001 to 2005 and Comcast Corporation from 2005 to 2011 and he rejoined the Comcast board in 2014. Mr. Breen is a member of the Advisory Board of New Mountain Capital LLC, a private equity firm. Mr. Breen’s extensive experience and leadership in the communications and technology equipment industries, including the cable and broadband industries, and his service as our Chief Executive Officer from 2002 to 2012, render him qualified to serve as one of our directors.

Herman E. Bulls—Mr. Bulls, age 58, joined our Board in March 2014. He is Chairman of Jones Lang LaSalle’s Public Institutions specialty, which he founded, and also serves as International Director of Global Markets for the company focusing on client relationships and mergers and acquisitions. Mr. Bulls is Chief Executive Officer of Bulls Advisory Group, a real estate consulting and advisory firm, and also co-founded and served as President and CEO of Bulls Capital Partners, a commercial mortgage banking firm. Before joining Jones Lang LaSalle, Mr. Bulls completed nearly 12 years of active duty service with the United States Army and retired as a Colonel in the U.S. Army Reserves in 2008. He is a member of the Executive Leadership Council, an organization of senior African American business executives from Fortune 500 companies, and former Chairman of the Executive Leadership Foundation. He is former Vice Chairman, West Point Association of Graduates Board of Directors, and is currently a board member and a member of Leadership Washington and the Real Estate Executive Council. Mr. Bulls is a founding member and served as the inaugural President of the African American Real Estate Professionals of Washington, D.C. He is also a member of the Real Estate Advisory Committee for the New York State Teachers’ Retirement System. Mr. Bulls is on the board of directors of Comfort Systems, USA, Inc., a provider of heating, ventilation and air conditioning services; Rasmussen Inc., a post-secondary for profit educational services organization; USAA, a provider of banking, insurance and investment management services to the military community; and Exelis Inc., an aerospace and defense firm. Mr. Bulls received a bachelor of science degree in engineering from the U.S. Military Academy at West Point and a master of business administration degree in finance from Harvard Business School. Mr. Bulls’ qualifications to serve on our Board include his over 35 years of experience in development, leadership, operations, teaching, investment management and business development/retention.

| 2015 Proxy Statement | 11 |

Table of Contents

Michael E. Daniels—Mr. Daniels, age 60, joined our Board in March 2010. Prior to his retirement in March 2013, Mr. Daniels was the Senior Vice President of the Global Technology Services group of International Business Machines Corporation, a business and IT services company with operations in more than 160 countries around the world. In this role, Mr. Daniels had worldwide responsibility for IBM’s Global Services business operations in outsourcing services, integrated technology services, maintenance, and Global Business Services, the consulting and applications management arm of Global Services. Since he joined IBM in 1976, Mr. Daniels held a number of leadership positions in sales, marketing, and services, and was general manager of several sales and services businesses, including IBM’s Sales and Distribution operations in the United States, Canada and Latin America, its Global Services team in the Asia Pacific region, Product Support Services, Availability Services, and Systems Solutions. Mr. Daniels serves as a director of Thomson Reuters, a provider of intelligent information for businesses, and SS&C Technologies, a provider of specialized software, software enabled-services and software as a service solutions to the financial services industry. He is a graduate of the Holy Cross College in Massachusetts with a degree in political science, and is also a trustee of Holy Cross. Mr. Daniels’ qualifications to serve on our board include his extensive global business experience with IBM, his sales, marketing and services expertise and his deep understanding of enterprise technology.

Frank M. Drendel—Mr. Drendel, age 69, joined our Board in October 2012. He is currently Non-Executive Chairman of the Board of CommScope Holding Company, Inc., a public company that develops infrastructure solutions for communications networks in more than 100 countries. Prior to the acquisition of CommScope by funds affiliated with The Carlyle Group in January 2011, Mr. Drendel served as Chief Executive Officer of CommScope from its founding in 1976. He also served as Chairman since July 1997, when CommScope was spun-off from General Instrument Corporation. While at CommScope, Mr. Drendel also served as a director of GI Delaware, a subsidiary of General Instrument Corporation, and its predecessors from 1987 to 1992, a director of General Instrument Corporation from 1992 until 1997, and a director of NextLevel Systems, Inc. (which was renamed General Instrument Corporation) from 1997 until January 2000. Mr. Drendel was formerly a director of Sprint Nextel Corporation from 2005 to 2008 and a director of Nextel Communications, Inc. from 1997 to 2005. Mr. Drendel is a director of the National Cable & Telecommunications Association. He holds a bachelor’s degree in marketing from Northern Illinois University. Mr. Drendel’s qualifications to serve on our board include his extensive experience as an executive officer in the data communications and technology industries.

Brian Duperreault—Mr. Duperreault, age 67, joined our Board in March 2004. Mr. Duperreault is the Chief Executive Officer of Hamilton Insurance Group, Ltd. He served as President, Chief Executive Officer and director of Marsh & McLennan Companies, Inc. from January 2008 until his retirement in December 2012. Previously he served as Chairman of ACE Limited, an international provider of a broad range of insurance and reinsurance products, from October 1994 to May 2007. He served as Chief Executive Officer of ACE Limited from October 1994 through May 2004, and as its President from October 1994 through November 1999. Prior to joining ACE, Mr. Duperreault was employed with American Insurance Group (“AIG”) since 1973 and served in various senior executive positions with AIG and its affiliates from 1978 until September 1994, most recently as Executive Vice President, Foreign General Insurance and, concurrently, as Chairman and Chief Executive Officer of American International Underwriters Inc. (“AIU”) from April 1994 to September 1994. Mr. Duperreault was President of AIU from 1991 to April 1994, and Chief Executive Officer of AIG affiliates in Japan and Korea from 1989 until 1991. Mr. Duperreault is a member of the Board of Directors of the IESE Business School, the Board of Overseers of the School of Risk Management of St. John’s University and the Bermuda Institute of Ocean Sciences. Previously, Mr. Duperreault also served as a director of the Bank of N.T. Butterfield & Son, Ltd., a provider of international financial services. Mr. Duperreault is our Lead Director and chair of the Company’s Nominating and Governance Committee. Mr. Duperreault’s qualifications to serve on the board include his extensive experience as an executive and board member of publicly traded companies, his experience in risk management and his global business experience and leadership.

| 12 | 2015 Proxy Statement |

Table of Contents

Rajiv L. Gupta—Mr. Gupta, age 69, joined our Board in March 2005. Mr. Gupta served as Chairman and Chief Executive Officer of Rohm and Haas Company, a worldwide producer of specialty materials, from 1999 to 2009. He served as Vice Chairman of Rohm and Haas Company from 1998 to 1999, Director of the Electronic Materials business from 1996 to 1999, and Vice President and Regional Director of the Asia-Pacific Region from 1993 to 1998. Mr. Gupta holds a B.S. degree in mechanical engineering from the Indian Institute of Technology, an M.S. in operations research from Cornell University and an M.B.A. in finance from Drexel University. Mr. Gupta also is a director of the Vanguard Group, Hewlett-Packard Company, Delphi Automotive, plc and a number of private companies. He serves as Chairman of Avantor Performance Materials, Inc., a privately held maker of performance materials. He is also a senior advisor of New Mountain Capital LLC. Mr. Gupta is the chair of the Company’s Compensation Committee. Mr. Gupta’s qualifications to serve on the board include his broad international leadership experience as an executive at Rohm and Haas, his engineering and science background, and his corporate governance experience as a board member and executive in several publicly traded and private companies.

George R. Oliver—Mr. Oliver, age 54, is our Chief Executive Officer, who joined our Board in September 2012. He joined Tyco in July 2006, serving as president of Tyco Safety Products from 2006 to 2010 and as president of Tyco Electrical & Metal Products from 2007 through 2010. He was appointed president of Tyco Fire Protection in 2011. Before joining Tyco, he served in operational leadership roles of increasing responsibility at several General Electric divisions. Mr. Oliver also serves as a director on the board of Raytheon Company, a company specializing in defense, security and civil markets throughout the world, and is a trustee of Worcester Polytechnic Institute. Mr. Oliver has a bachelor’s degree in mechanical engineering from Worcester Polytechnic Institute. Mr. Oliver’s qualifications to serve on the board include his extensive leadership experience as an executive and his position as the Chief Executive Officer of Tyco.

Brendan R. O’Neill—Dr. O’Neill, age 66, joined our Board in March 2003. Dr. O’Neill was Chief Executive Officer and director of Imperial Chemical Industries PLC (“ICI”), a manufacturer of specialty products and paints, until April 2003. Dr. O’Neill joined ICI in 1998 as its Chief Operating Officer and Director, and was promoted to Chief Executive Officer in 1999. Prior to Dr. O’Neill’s career at ICI, he held numerous positions at Guinness PLC, including Chief Executive of Guinness Brewing Worldwide Ltd, Managing Director International Region of United Distillers, and Director of Financial Control. Dr. O’Neill also held positions at HSBC Holdings PLC, BICC PLC and the Ford Motor Company. He has an M.A. from the University of Cambridge and a Ph.D. in chemistry from the University of East Anglia, and is a Fellow of the Chartered Institute of Management Accountants (U.K.). Dr. O’Neill is a director of Informa plc and Towers Watson & Co. He chairs the Audit Committee of Informa plc. Dr. O’Neill was also a director of Rank Group, a hospitality and leisure business from 2005 to 2007, Aegis Group Plc, a global market research company, from 2005 to 2009 and Endurance Specialty Holdings from 2005 to 2014. Dr. O’Neill is the chair of the Audit Committee. Dr. O’Neill is qualified to serve on the board because of his extensive experience in executive positions, his service as a director for a broad spectrum of international companies and his financial acumen and understanding of accounting principles.

Jürgen Tinggren—Mr. Tinggren, age 56, joined our Board in March 2014. He was the chief executive officer of the Schindler Group, a global provider of elevators, escalators and related services, through December 2013 and was elected to the board of directors of Schindler in March 2014. He joined the Group Executive Committee of Schindler in April 1997, initially with responsibility for Europe and thereafter for the Asia/Pacific region and the Technology and Strategic Procurement. In 2007, he was appointed Chief Executive Officer and President of the Group Executive Committee of the Schindler Group. Mr. Tinggren also serves on the Board of the Sika AG Group and Schenker Winkler Holding. He is also a Trustee of The Conference Board. Mr. Tinggren holds a joint M.B.A. from the Stockholm School of Economics and New York University Business School. Mr. Tinggren’s

| 2015 Proxy Statement | 13 |

Table of Contents

qualifications to serve on our board include his extensive global business experience with Schindler, his familiarity with industrial products and service businesses and with European and non-U.S. markets in general, and his experience as the chief executive of a publicly traded global enterprise.

Sandra S. Wijnberg—Ms. Wijnberg, age 58, joined our Board in March 2003. In July 2014 Ms. Wijnberg was named Deputy Head of Mission, Office of the Quartet Representative, which is charged with implementing the Palestinian economic development agenda of the Quartet (the United Nations, the United States, the European Union and Russia.) Since April 2014 she has been on a leave of absence from Aquiline Holdings LLC, a registered investment advisor, where she was Chief Administrative Officer since April 2007. From January 2000 to April 2006, Ms. Wijnberg was the Senior Vice President and Chief Financial Officer at Marsh & McLennan Companies, Inc., a professional services firm with insurance and reinsurance brokerage, consulting and investment management businesses. Before joining Marsh & McLennan Companies, Inc., Ms. Wijnberg held various positions at YUM! Brands, PepsiCo, Inc., Morgan Stanley Group, Inc. and American Express Company. Ms. Wijnberg is a graduate of the University of California, Los Angeles and received an M.B.A. from the University of Southern California. Ms. Wijnberg also served on the board and was chair of the Audit Committee of Tyco Electronics Ltd., a manufacturer of electronic parts and equipment, from 2007 to 2009. Ms. Wijnberg’s qualifications to serve on the board include her significant experience as an executive in leadership positions in a diverse range of businesses and her financial acumen gained as the chief financial officer of a publicly traded company and as a private equity investor.

R. David Yost—Mr. Yost, age 67, joined our Board in March 2009. Mr. Yost served as Director and Chief Executive Officer of AmerisourceBergen, a comprehensive pharmaceutical services provider, from August 2001 to June 2011 when he retired. He was Chairman and Chief Executive Officer of AmeriSource Health Corporation from May 1997 to August 2001, and President and Chief Executive Officer of AmeriSource from May 1997 to December 2000. Mr. Yost also held a variety of other positions with AmeriSource Health Corporation and its predecessors from 1974 to 1997. Mr. Yost also serves as a director of Exelis Inc., a diversified global aerospace, defense and information solutions company, Marsh & McLennan Companies, Inc., and Bank of America. Mr. Yost is a graduate of the U.S. Air Force Academy and holds an M.B.A. from the University of California, Los Angeles. Mr. Yost’s qualifications to serve on the board include his extensive leadership and corporate governance experience gained as the chief executive and director of a large publicly traded company in the pharmaceutical industry.

Election of each Director requires the affirmative vote of a majority of the votes properly cast by the holders of ordinary shares represented at the Annual General Meeting in person or by proxy. Each Director’s election is the subject of a separate resolution and shareholders are entitled to one vote per share for each separate Director election resolution.

The Board unanimously recommends that shareholders voteFOR the election of each nominee for Director to serve until the completion of the next Annual General Meeting.

| 14 | 2015 Proxy Statement |

Table of Contents

PROPOSAL NUMBER TWO – APPOINTMENTOF AUDITORSAND AUTHORITYTO SET REMUNERATION

Deloitte & Touche LLP served as our independent auditors for the fiscal year ended September 26, 2014. The Audit Committee has selected and appointed Deloitte & Touche LLP to audit our financial statements for the fiscal year ending September 25, 2015. The Board, upon the recommendation of the Audit Committee, is asking our shareholders to ratify the appointment of Deloitte & Touche LLP as our independent auditors for the fiscal year ending September 25, 2015 and to authorize the Audit Committee of the Board of Directors to set the independent auditors’ remuneration. Although approval is not required by our Memorandum and Articles of Association or otherwise, the Board is submitting the selection of Deloitte & Touche LLP to our shareholders for ratification because we value our shareholders’ views on the Company’s independent auditors. If the appointment of Deloitte & Touche LLP is not approved by shareholders, it will be considered as notice to the Board and the Audit Committee to consider the selection of a different firm. Even if the appointment is approved, the Audit Committee in its discretion may select a different independent auditor at any time during the year if it determines that such a change would be in the best interests of the Company and our shareholders.

Representatives of Deloitte & Touche LLP will attend the Annual General Meeting and will have an opportunity to make a statement if they wish. They will also be available to answer questions at the meeting.

For independent auditor fee information and information on our pre-approval policy of audit and non-audit services, see below. Please also see the Audit Committee Report included in this Proxy Statement for additional information about our auditors.

The ratification of the appointment of the independent auditors and the authorization for the Audit Committee to set the remuneration for the independent auditors requires the affirmative vote of a majority of the votes properly cast by the holders of ordinary shares represented at the Annual General Meeting in person or by proxy.

The Audit Committee and the Board unanimously recommend a voteFOR these proposals.

Audit and Non-Audit Fees |

Aggregate fees for professional services rendered to Tyco by Deloitte & Touche LLP and its affiliates as of and for the two most recent fiscal years are set forth below. The aggregate fees included are fees billed or reasonably expected to be billed for the applicable fiscal year.

Fiscal Year 2014 | Fiscal Year 2013 | |||||||

| (in millions | ) | (in millions | ) | |||||

Audit Fees | $ | 17.1 | $ | 17.3 | ||||

Audit-Related Fees | 0.9 | 0.2 | ||||||

Tax Fees | 0.1 | 1.9 | ||||||

All Other Fees | 3.5 | — | ||||||

|

|

|

| |||||

Total | $ | 21.6 | $ | 19.4 | ||||

Audit Fees for the fiscal years ended September 26, 2014 and September 27, 2013 were for professional services rendered for the integrated audits of our consolidated financial statements and

| 2015 Proxy Statement | 15 |

Table of Contents

internal controls over financial reporting, quarterly reviews of the condensed consolidated financial statements included in Tyco’s Quarterly Reports on Form 10-Q, statutory audits, consents, international filings and other assistance required to complete the year-end audit of the consolidated financial statements.

Audit-Related Fees for the fiscal years ended September 26, 2014 and September 27, 2013 were for services related to statutorily required attest services in various countries and for accounting and disclosure consultations.

Tax Fees for the fiscal years ended September 26, 2014 and September 27, 2013 were for tax compliance and planning services.

All Other Fees for the fiscal year ended September 26, 2014 were for permitted advisory services related to our global shared service strategy and operations.

All of the services described above were pre-approved by the Audit Committee in accordance with the pre-approval policy described below.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

In March 2004, the Audit Committee adopted a pre-approval policy that provides guidelines for the audit, audit-related, tax and other permissible non-audit services that may be provided by the independent auditors. The policy identifies the guiding principles that must be considered by the Audit Committee in approving services to ensure that the auditors’ independence is not impaired. The policy provides that the Corporate Controller will support the Audit Committee by providing a list of proposed services to the Committee, monitoring the services and fees pre-approved by the Committee, providing periodic reports to the Audit Committee with respect to pre-approved services, and ensuring compliance with the policy.

Under the policy, the Audit Committee annually pre-approves the audit fee and terms of the engagement, as set forth in the engagement letter. This approval includes approval of a specified list of audit, audit-related and tax services. Any service not included in the specified list of services must be submitted to the Audit Committee for pre-approval. No service may extend for more than 12 months, unless the Audit Committee specifically provides for a different period. The independent auditor may not begin work on any engagement without confirmation of Audit Committee pre-approval from the Corporate Controller or his or her delegate.

In accordance with the policy, the chair of the Audit Committee has been delegated the authority by the Committee to pre-approve the engagement of the independent auditors for a specific service when the entire Committee is unable to do so. All such pre-approvals must be reported to the Audit Committee at the next Committee meeting.

| 16 | 2015 Proxy Statement |

Table of Contents

PROPOSAL NUMBER THREE – AUTHORIZATIONTO MAKE MARKET PURCHASESOF COMPANY SHARES

We have historically used open-market share purchases as a means of returning cash to shareholders and managing the size of our base of outstanding shares. These are longstanding objectives that the Board of Directors believes are important to continue. During fiscal 2014, as a Swiss entity, we repurchased approximately 42 million of our registered shares in open-market purchases as part of our share repurchase program. All shares repurchased during fiscal 2014, as well as any shares held in treasury as of the effective date of the merger, were canceled as of November 17, 2014. On December 18, 2014, we received Irish High Court approval to reduce the Company’s share premium and create distributable reserves, which makes it possible for the Company to continue to pay dividends or to repurchase or redeem its ordinary shares.

Under Irish law, neither the Company nor any subsidiary of the Company may make market purchases of the Company’s shares without shareholder approval. Accordingly, shareholders are being asked to authorize the Company, or any of its subsidiaries, to make market purchases of up to 10% of the Company’s issued shares. Under Irish law, this authorization expires after eighteen months unless renewed; accordingly, we expect to propose renewal of this authorization at subsequent annual general meetings.

Such purchases would be made only at price levels which the Directors considered to be in the best interests of the shareholders generally, after taking into account the Company’s overall financial position. The Company currently expects to effect repurchases under our existing share repurchase authorization as redemptions pursuant to Article 3(d) of our Articles of Association. Whether or not this proposed resolution is passed, the Company will retain its ability to effect repurchases as redemptions pursuant to its Articles of Association, although subsidiaries of the Company will not be able to make market purchases of the Company’s shares.

In order for the Company or any of its subsidiaries to make market purchases of the Company’s ordinary shares, such shares must be purchased on a “recognized stock exchange”. The New York Stock Exchange, on which the Company’s ordinary shares are listed, is specified as a recognized stock exchange for this purpose by Irish law. The general authority, if approved by our shareholders, will become effective from the date of passing of the authorizing resolution.

Ordinary Resolution

The text of the resolution in respect of Proposal 3 is as follows:

RESOLVED, that the Company and any subsidiary of the Company is hereby generally authorized to make market purchases of ordinary shares in the Company (“shares”) on such terms and conditions and in such manner as the board of directors of the Company may determine from time to time but subject to the provisions of the Companies Act 1990 (and/or any corresponding provision of any replacement legislation) and to the following provisions:

(a) The maximum number of shares authorized to be acquired by the Company and/or any subsidiary of the Company pursuant to this resolution shall not exceed, in the aggregate, 41,838,715 ordinary shares of US$0.01 each (which represents approximately 10% of the Company’s issued ordinary shares as of the effective date of the merger).

(b) The maximum price to be paid for any ordinary share shall be an amount equal to 110% of the closing price on the New York Stock Exchange for the ordinary shares on the trading day

| 2015 Proxy Statement | 17 |

Table of Contents

preceding the day on which the relevant share is purchased by the Company or the relevant subsidiary of the Company, and the minimum price to be paid for any ordinary share shall be the nominal value of such share.

(c) This general authority will be effective from the date of passing of this resolution and will expire on the earlier of the date of the annual general meeting in 2016 or eighteen months from the date of the passing of this resolution, unless previously varied, revoked or renewed by special resolution in accordance with the provisions of section 215 of the Companies Act 1990 (and/or any corresponding provision of any replacement legislation). The Company or any such subsidiary may, before such expiry, enter into a contract for the purchase of shares which would or might be executed wholly or partly after such expiry and may complete any such contract as if the authority conferred hereby had not expired.

The authorization for the Company and/or any its subsidiaries to make market purchases of Company shares requires the affirmative vote of a majority of the votes properly cast (in person or by proxy) at the Annual General Meeting.

The Board unanimously recommends that shareholders voteFOR this proposal.

| 18 | 2015 Proxy Statement |

Table of Contents

PROPOSAL NUMBER FOUR – DETERMINETHE PRICE RANGEAT WHICHTHE COMPANY MAY REISSUE TREASURY SHARES

Our historical open-market share repurchases and other share buyback activities result in ordinary shares being acquired and held by the Company as treasury shares. We may reissue treasury shares that we acquire through our various share buyback activities in connection with our executive compensation program and our other compensation programs.

Under Irish law, our shareholders must authorize the price range at which we may reissue any shares held in treasury. In this proposal, that price range is expressed as a minimum and maximum percentage of the prevailing market price (as defined below). Under Irish law, this authorization expires after eighteen months unless renewed; accordingly, we expect to propose the renewal of this authorization at subsequent annual general meetings.

The authority being sought from shareholders provides that the minimum and maximum prices at which an ordinary share held in treasury may be reissued are 95% and 120%, respectively, of the average closing price per ordinary share of the Company, as reported by the New York Stock Exchange, for the thirty (30) trading days immediately preceding the proposed date of re-issuance. Any reissuance of treasury shares will be at price levels that the Board considers in the best interests of our shareholders.

Special Resolution

The text of the resolution in respect of Proposal 4 (which is proposed as a special resolution) is as follows:

RESOLVED, that the reissue price range at which any treasury shares held by the Company may be reissued off-market shall be as follows:

(a) the maximum price at which such treasury share may be reissued off-market shall be an amount equal to 120% of the “market price”; and

(b) the minimum price at which a treasury share may be reissued off-market shall be the nominal value of the share where such a share is required to satisfy an obligation under an employee share plan operated by the Company or, in all other cases, an amount equal to 95% of the “market price”; and

(c) for the purposes of this resolution, the “market price” shall mean the average closing price per ordinary share of the Company, as reported by the New York Stock Exchange, for the thirty (30) trading days immediately preceding the proposed date of re-issuance.

FURTHER RESOLVED, that this authority to reissue treasury shares shall expire on the earlier of the date of the annual general meeting of the Company held in 2016 or at eighteen months from the date of the passing of this resolution unless previously varied or renewed in accordance with the provisions of Section 209 of the Companies Act 1990 (and/or any corresponding provision of any replacement legislation).

The authorization of the price range at which the Company may reissue any shares held in treasury requires the affirmative vote of at least 75% of the votes properly cast (in person or by proxy) at the Annual General Meeting.

The Board unanimously recommends that shareholders voteFOR this proposal.

| 2015 Proxy Statement | 19 |

Table of Contents

PROPOSAL NUMBER FIVE – ADVISORY VOTEON EXECUTIVE COMPENSATION

The Board recognizes that providing shareholders with an advisory vote on executive compensation can produce useful information on investor sentiment with regard to the Company’s executive compensation programs. As a result, this proposal provides shareholders with the opportunity to cast an advisory vote on the compensation of our executive management team, as described in the section of this Proxy Statement entitled“Compensation Discussion & Analysis,”and endorse or not endorse our fiscal 2014 executive compensation philosophy, programs and policies and the compensation paid to the Executive Officers.

The advisory vote on executive compensation is non-binding, meaning that our Board will not be obligated to take any compensation actions or to adjust our executive compensation programs or policies, as a result of the vote. Notwithstanding the advisory nature of the vote, the resolution will be considered passed with the affirmative vote of a majority of the votes properly cast by the holders of ordinary shares represented at the Annual General Meeting in person or by proxy.

Although the vote is non-binding, our Board and the Compensation Committee will review the voting results. To the extent there is a significant negative vote, we would communicate directly with shareholders to better understand the concerns that influenced the vote. The Board and the Compensation Committee would consider constructive feedback obtained through this process in making future decisions about executive compensation programs.

Advisory Non-Binding Resolution

The text of the resolution, which if thought fit, will be passed as an advisory non-binding resolution at the Annual General Meeting, is as follows:

RESOLVED, that shareholders approve, on an advisory basis, the compensation of the Company’s Executive Officers, as disclosed in the Compensation Discussion & Analysis section of this Proxy Statement.

The Board unanimously recommends that shareholders voteFOR this proposal.

| 20 | 2015 Proxy Statement |

Table of Contents

Our corporate governance principles are embodied in a formal document that has been approved by Tyco’s Board of Directors (the “Board”). It is posted on our website atwww.tyco.com under the heading “About—Board of Directors.” We will also provide a copy of the corporate governance principles to shareholders upon request. Our corporate governance guidelines and general approach to corporate governance as reflected in our Memorandum and Articles of Association and our internal policies and procedures are guided by U.S. practice and applicable federal securities laws and regulations and NYSE requirements. Although we are an Irish public limited company, we are not subject to, nor have we adopted, the U.K. Corporate Governance Code or any other non-statutory Irish or U.K. governance standards or guidelines. While there are many similarities and overlaps between the U.S. corporate governance standards applied by us and the U.K. Corporate Governance Code and other Irish/U.K. governance standards or guidelines, there are differences, in particular relating to the extent of the authorization to issue share capital and effect share repurchases that may be granted to the Board and the criteria for determining the independence of directors.

References to Board activities in this proxy statement, for example dates of service and remuneration, apply to the Board of Tyco International Ltd., our Swiss parent holding company prior to the merger effected on November 17, 2014 and to the Board of Tyco with effect from November 17, 2014.

Vision and Values of Our Board

Tyco’s Board is responsible for directing and overseeing the management of Tyco’s business in the best interests of the shareholders and consistent with good corporate citizenship. In carrying out its responsibilities, the Board selects and monitors top management, provides oversight for financial reporting and legal compliance, determines Tyco’s governance principles and implements its governance policies. The Board, together with management, is responsible for establishing Tyco’s values and code of conduct and for setting strategic direction and priorities.

While Tyco’s strategy evolves in response to changing market conditions, Tyco’s vision and values are enduring. Our governance principles, along with our vision and values, constitute the foundation upon which Tyco’s governance policies are built. Our vision, values and principles are discussed below.

Tyco believes that good governance requires not only an effective set of specific practices but also a culture of responsibility throughout the firm, and governance at Tyco is intended to optimize both. Tyco also believes that good governance ultimately depends on the quality of its leadership, and it is committed to recruiting and retaining Directors and officers of proven leadership ability and personal integrity.

Tyco Vision: Why We Exist and the Essence of Our Business

Tyco is dedicated to advancing fire safety and security by finding innovative ways to save lives, improve businesses and protect people where they live and work. Our aim is to be our customers’ first choice in every market we serve by exceeding commitments, providing new technology solutions, leveraging our diverse brands, driving operational excellence, and committing to the highest standards of business practices—all of which will drive Tyco’s long-term growth, value, and success.

Tyco Values: How We Seek to Conduct Ourselves

| n | Integrity: We demand of each other and ourselves the highest standards of individual and corporate integrity. We safeguard Company assets. We foster an environment of trust with our co-workers, customers, communities and suppliers. We comply with all Company policies and laws, and create an environment of transparency in which all reporting requirements are met. |

| 2015 Proxy Statement | 21 |

Table of Contents

| n | Excellence: We continually challenge each other to improve our products, our processes and ourselves. We strive always to understand our customers’ businesses and help them achieve their goals. We serve our customers not only by responding to their needs, but also anticipating them. We are dedicated to diversity, fair treatment, mutual respect and trust. We aspire to produce our products and serve our customers with zero harm to people and the environment. |

| n | Teamwork: We foster an environment that encourages innovation, creativity and results through teamwork. We practice leadership that teaches, inspires and promotes full participation and career development. We encourage open and effective communication and interaction across Tyco, and actively work together to keep each other safe. |

| n | Accountability: We honor and hold ourselves accountable for the commitments we make, and take personal responsibility for all actions and results. We create an operating discipline of continuous improvement that is an integral part of our culture. |

Tyco Goals: What We Seek to Achieve

| n | Governance: Adhere to the best standards of corporate governance for Tyco by establishing processes and practices that promote and ensure integrity, compliance and accountability. |

| n | Customers: Fully understand and exceed our customers’ needs, wants and preferences and provide greater value to our customers than our competition. |

| n | Growth: Focus on strategies to achieve organic growth targets and deploy cash for growth and value creation. |

| n | Culture: Build on Tyco’s reputation and image internally and externally while driving initiatives to ensure Tyco remains an employer of choice. |

| n | Operational Excellence: Implement best-in-class operating practices and leverage Tyco-wide opportunities and best practices. |

| n | Financial Strength & Flexibility: Ensure that financial measures and shareholder return objectives are met. |

Board of Directors |

Mission of the Board of Directors: What the Board Intends to Accomplish

The mission of Tyco’s Board is to promote the long-term value and health of Tyco in the interests of the shareholders and set an ethical “tone at the top.” To this end, the Board provides management with strategic guidance, and also ensures that management adopts and implements procedures designed to promote both legal compliance and the highest standards of honesty, integrity and ethics throughout the organization.

Governance Principles: How the Board Oversees the Company

Active Board: The Directors are well informed about Tyco and rigorous in their oversight of management.

Company Leadership: The Directors, together with senior management, set Tyco’s strategic direction, review financial objectives, and establish the ethical tone for the management and leadership of Tyco.

| 22 | 2015 Proxy Statement |

Table of Contents

Compliance with Laws and Ethics: The Directors ensure that procedures and practices are in place designed to prevent and identify illegal or unethical conduct and to permit appropriate and timely redress should such conduct occur.

Inform and Listen to Investors and Regulators: The Directors take steps to see that management discloses appropriate information fairly, fully, timely and accurately to investors and regulators, and that Tyco maintains a two-way communication channel with its investors and regulators.

Continuous Improvement: The Directors remain abreast of new developments in corporate governance and they implement new procedures and practices as they deem appropriate.

Board Responsibilities

The Board is responsible for:

| n | reviewing and approving management’s strategic and business plans; |

| n | reviewing and approving financial plans, objectives and actions, including significant capital allocations and expenditures; |

| n | monitoring management’s execution of corporate plans and objectives; |

| n | advising management on significant decisions and reviewing and approving major transactions; |

| n | identifying and recommending Director candidates for election by shareholders; |

| n | appraising the Company’s major risks and overseeing that appropriate risk management and control procedures are in place; |

| n | selecting, monitoring, evaluating, compensating and, if necessary, replacing the Chief Executive Officer and other senior executives, and seeing that organizational development and succession plans are maintained for these executive positions; |

| n | determining the Chief Executive Officer’s compensation, and approving the compensation of senior officers; |

| n | overseeing that procedures are in place designed to promote compliance with laws and regulations; |

| n | overseeing that procedures are in place designed to promote integrity and candor in the audit of the Company’s financial statements and operations, and in all financial reporting and disclosure; |

| n | designing and assessing the effectiveness of its own governance practices and procedures as well as Board and committee performance; and |

| n | periodically monitoring and reviewing shareholder communication. |

| 2015 Proxy Statement | 23 |

Table of Contents

Board Leadership

The business of Tyco is managed under the direction of Tyco’s Board, in the interest of the shareholders. The Board delegates its authority to senior management for managing the everyday affairs of Tyco. The Board requires that senior management review major actions and initiatives with the Board prior to implementation.

In September 2012, Mr. Breen stepped down from his position as Chief Executive Officer, and continued in his role as chair of the Board. Mr. Oliver assumed the Chief Executive Officer position and Mr. Brian Duperreault became the lead independent Director. The Board believes that having a separate chair and Chief Executive Officer at this time is most appropriate for Tyco. To meet their responsibilities of overseeing management and setting strategic direction, as well as fostering the long-term value of the Company, among other responsibilities, directors are required to spend time and energy in successfully navigating a wide variety of issues and guiding the policies and practices of the companies they oversee. To that end, the Board believes that having a separate non-executive chair who is responsible, along with the lead Director, for leading the Board allows Mr. Oliver, as Chief Executive Officer, to focus his time and energy on running the day-to-day operations of the Company, particularly at a time when Mr. Oliver is relatively new to the role. Having Mr. Breen act as chair also provides a degree of continuity of leadership. Further, Mr. Breen and Mr. Oliver have an open and constructive working relationship that the Board believes allows Mr. Breen to provide wise counsel and ask the tough questions capable of ensuring that the interests of shareholders are being properly served.

Tyco continues to have a strong governance structure, which includes:

| n | a designated lead independent Director with a well-defined role (Mr. Brian Duperreault); |

| n | a Board entirely composed of independent members, with the exception of Messrs. Breen and Oliver; |

| n | annual election of Directors by a majority of votes represented at the Annual General Meeting; |

| n | committees that are entirely composed of independent Directors; and |

| n | established governance and ethics guidelines. |