Filed by Tyco International plc

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Johnson Controls, Inc.

SEC File No.: 001-05097

Date: January 29, 2016

Explanatory Note: The following are excerpts of a presentation given in connection with Tyco International plc’s earnings call.

// Compelling Strategic Rationale

Global, industrial leader with $32 billion in revenue uniquely positioned to provide the most comprehensive portfolio of building and energy solutions

Transaction combines innovation pipelines for devices, controls, sensors, data analytics and advanced solutions to better capture the enormous “smart” market opportunity

Combination accelerates ability to partner with customers to bring advanced building technology and integrated solutions for better overall performance and experience

Compelling value creation through at least $650mm in identified synergies plus significant revenue growth opportunities

SMARTER PLACES

Smart Homes

Smart Buildings

Smart Cities

Smart Operations

- Retailers

- Hospitals

- Stadiums

- Etc.

/ Johnson Controls + tyco

Strength Across

Converging Ecosystem /

tyco

5

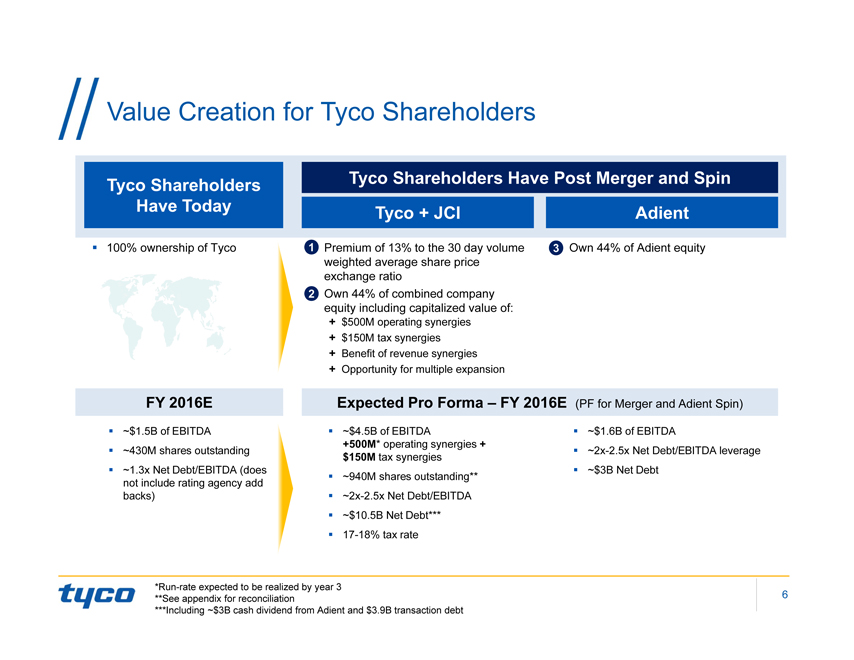

// Value Creation for Tyco Shareholders

Tyco Shareholders Have Today

100% ownership of Tyco

Tyco Shareholders Have Post Merger and Spin

Tyco + JCI

1 Premium of 13% to the 30 day volume weighted average share price exchange ratio

2 Own 44% of combined company equity including capitalized value of:

+ $500M operating synergies

+ $150M tax synergies

+ Benefit of revenue synergies

+ Opportunity for multiple expansion

Adient

3 Own 44% of Adient equity

FY 2016E

~$1.5B of EBITDA

~430M shares outstanding

~1.3x Net Debt/EBITDA (does not include rating agency add backs)

Expected Pro Forma – FY 2016E (PF for Merger and Adient Spin)

$4.5B of EBITDA

+500M* operating synergies +

$150M tax synergies

~940M shares outstanding**

~2x-2.5x Net Debt/EBITDA

~$10.5B Net Debt***

17-18% tax rate

~$1.6B of EBITDA

~2x-2.5x Net Debt/EBITDA leverage

~$3B Net Debt

tyco

*Run-rate expected to be realized by year 3

**See appendix for reconciliation

***Including ~$3B cash dividend from Adient and $3.9B transaction debt

6

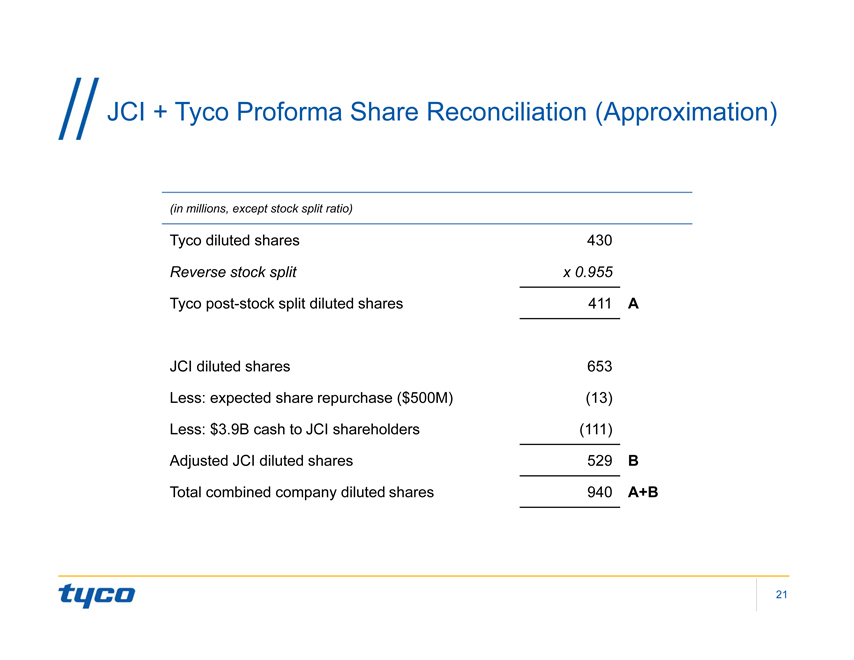

// JCI + Tyco Proforma Share Reconciliation (Approximation)

(in millions, except stock split ratio)

Tyco diluted shares

430

Reverse stock split

x 0.955

Tyco post-stock split diluted shares

411

A

JCI diluted shares

653

Less: expected share repurchase ($500M)

(13)

Less: $3.9B cash to JCI shareholders

(111)

Adjusted JCI diluted shares

529

B

Total combined company diluted shares

940

A+B

tyco

21

NO OFFER OR SOLICITATION

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the proposed transaction between Johnson Controls, Inc. (“JCI”) and Tyco International plc (“Tyco”), Tyco will file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that will include a joint proxy statement of JCI and Tyco that also constitutes a prospectus of Tyco (the “Joint Proxy Statement/Prospectus”). JCI and Tyco plan to mail to their respective shareholders the definitive Joint Proxy Statement/Prospectus in connection with the transaction. INVESTORS AND SECURITY HOLDERS OF JCI AND TYCO ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT JCI, TYCO, THE TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the Joint Proxy Statement/Prospectus (when available) and other documents filed with the SEC by JCI and Tyco through the website maintained by the SEC at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the documents filed with the SEC by JCI by contacting JCI Shareholder Services at Shareholder.Services@jci.com or by calling (800) 524-6220 and will be able to obtain free copies of the documents filed with the SEC by Tyco by contacting Tyco Investor Relations at Investorrelations@tyco.com or by calling (609) 720-4333.

PARTICIPANTS IN THE SOLICITATION

JCI, Tyco and certain of their respective directors, executive officers and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the respective shareholders of JCI and Tyco in connection with the proposed transactions, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the Joint Proxy Statement/Prospectus when it is filed with the SEC. Information regarding JCI’s directors and executive officers is contained in JCI’s proxy statement for its 2016 annual meeting of shareholders, which was filed with the SEC on December 14, 2015. Information regarding Tyco’s directors and executive officers is contained in Tyco’s proxy statement for its 2016 annual meeting of shareholders, which was filed with the SEC on January 15, 2016.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, Tyco’s expectations or

predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible” or “potential,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made and we assume no duty to update forward-looking statements. Actual results may differ materially from current projections.

Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction. Many factors could cause actual results to differ materially from these forward-looking statements, including, in addition to factors previously disclosed in Tyco’s reports filed with the SEC, which are available at www.sec.gov and www.Tyco.com under the “Investor Relations” tab, and those identified elsewhere in this communication, risks relating to the completion of the proposed transaction on anticipated terms and timing, including obtaining shareholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the new combined company’s operations, the ability of Tyco and JCI to integrate their businesses successfully and to achieve anticipated synergies, changes in tax laws or interpretations, access to available financing, potential litigation relating to the proposed transaction, and the risk that disruptions from the proposed transaction will harm Tyco’s business.

Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

STATEMENT REQUIRED BY THE IRISH TAKEOVER RULES

The directors of Tyco accept responsibility for the information contained in this communication relating to Tyco and the directors of Tyco and members of their immediate families, related trusts and persons connected with them. To the best of the knowledge and belief of the directors of Tyco (who have taken all reasonable care to ensure such is the case), the information contained in this communication for which they accept responsibility is in accordance with the facts and does not omit anything likely to affect the import of such information.

Lazard Freres & Co. LLC, which is a registered broker dealer with the SEC, is acting for Tyco International plc and no one else in connection with the proposed transaction and will not be responsible to anyone other than Tyco International plc for providing the protections afforded to clients of Lazard Freres & Co. LLC, or for giving advice in connection with the proposed transaction or any matter referred to herein.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION.

This communication is not intended to be and is not a prospectus for the purposes of Part 23 of the Companies Act 2014 of Ireland (the “2014 Act”), Prospectus (Directive 2003/71/EC) Regulations 2005 (S.I. No. 324 of

2

2005) of Ireland (as amended from time to time) or the Prospectus Rules issued by the Central Bank of Ireland pursuant to section 1363 of the 2014 Act, and the Central Bank of Ireland (“CBI”) has not approved this communication.

3