Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted byRule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to§ 240.14a-12 |

JOHNSON CONTROLS INTERNATIONAL PUBLIC LIMITED COMPANY

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange ActRules 14a-6(i)(1)and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange ActRule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange ActRule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

WEDNESDAY, MARCH 6, 2019

THE MERRION HOTEL, 24 UPPER MERRION STREET, DUBLIN 2, IRELAND

NOTICE IS HEREBY GIVEN that the 2019 Annual General Meeting of Shareholders of Johnson Controls International plc will be held on March 6, 2019 at The Merrion Hotel, 24 Upper Merrion Street, Dublin 2, Ireland at 3:00 pm, local time for the following purposes:

Ordinary Business

| 1. | By separate resolutions, to elect each of the following individuals as Directors for a period of one year, expiring at the end of the Company’s Annual General Meeting of Shareholders in 2020: |

(a) Jean Blackwell | (b) Pierre Cohade | (c) Michael E. Daniels | ||

(d) Juan Pablo del Valle Perochena | (e) W. Roy Dunbar | (f) Gretchen R. Haggerty | ||

(g) Simone Menne | (h) George R. Oliver | (i) Jürgen Tinggren | ||

(j) Mark Vergnano | (k) R. David Yost | (l) John D. Young |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as the independent auditors of the Company and to authorize the Audit Committee of the Board of Directors to set the auditors’ remuneration. |

Special Business

| 3. | To authorize the Company and/or any subsidiary of the Company to make market purchases of Company shares. |

| 4. | To determine the price range at which the Company canre-allot shares that it holds as treasury shares (special resolution). |

| 5. | To approve, in anon-binding advisory vote, the compensation of the named executive officers. |

| 6. | To approve the Directors’ authority to allot shares up to approximately 33% of issued share capital. |

| 7. | To approve the waiver of statutorypre-emption rights with respect to up to 5% of issued share capital (special resolution). |

| 8. | To act on such other business as may properly come before the meeting or any adjournment thereof. |

This notice of Annual General Meeting and proxy statement and the enclosed proxy card are first being sent on or about January 18, 2019 to each holder of record of the Company’s ordinary shares at

Table of Contents

the close of business on January 2, 2019. The record date for the entitlement to vote at the Annual General Meeting is January 2, 2019 and only registered shareholders of record on such date are entitled to notice of, and to attend and vote at, the Annual General Meeting and any adjournment or postponement thereof. During the meeting, management will also present the Company’s Irish Statutory Accounts for the fiscal year ended September 30, 2018.Whether or not you plan to attend the meeting, please complete, sign, date and return the enclosed proxy card to ensure that your shares are represented at the meeting. Shareholders of record who attend the meeting may vote their shares personally, even though they have sent in proxies. In addition to the above resolutions, the business of the Annual General Meeting shall include, prior to the proposal of the above resolutions, the consideration of the Company’s statutory financial statements and the report of the Directors and of the statutory auditors and a review by the shareholders of the Company’s affairs.

This proxy statement and our Annual Report on Form10-K for the fiscal year ended September 30, 2018 and our Irish Statutory Accounts are available to shareholders at www.proxyvote.com and are also available in the Investor Relations section of our website at www.johnsoncontrols.com.

By Order of the Board of Directors,

John Donofrio

Executive Vice President and General Counsel

January 18, 2019

PLEASE PROMPTLY COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD. THE PROXY IS REVOCABLE AND IT WILL NOT BE USED IF YOU: GIVE WRITTEN NOTICE OF REVOCATION TO THE PROXY PRIOR TO THE VOTE TO BE TAKEN AT THE MEETING; SUBMIT A LATER-DATED PROXY; OR ATTEND AND VOTE PERSONALLY AT THE MEETING.

ANY SHAREHOLDER ENTITLED TO ATTEND AND VOTE AT THE MEETING MAY APPOINT ONE OR MORE PROXIES USING THE ENCLOSED PROXY CARD (OR THE FORM IN SECTION 184 OF THE COMPANIES ACT 2014) TO ATTEND, SPEAK AND VOTE ON THAT SHAREHOLDER’S BEHALF. THE PROXY NEED NOT BE A SHAREHOLDER. PROXIES MAY BE APPOINTED VIA THE INTERNET OR PHONE IN THE MANNER SET OUT IN THE ENCLOSED PROXY CARD. ALTERNATIVELY THEY MAY BE APPOINTED BY DEPOSITING THE ENCLOSED PROXY CARD (OR OTHER VALID SIGNED INSTRUMENT OF PROXY) WITH JOHNSON CONTROLS INTERNATIONAL PLC C/O BROADRIDGE, 51 MERCEDES WAY, EDGEWOOD, NY 11717 BY 5:00 P.M., EASTERN STANDARD TIME, ON MARCH 5, 2019 (WHICH WILL THEN BE FORWARDED TO JOHNSON CONTROLS INTERNATIONAL PLC’S REGISTERED ADDRESS ELECTRONICALLY) OR WITH JOHNSON CONTROLS INTERNATIONAL PLC, ONE ALBERT QUAY, CORK, IRELAND BY 5:00 P.M. LOCAL TIME ON MARCH 5, 2019. IF YOU WISH TO APPOINT A PERSON OTHER THAN THE INDIVIDUAL SPECIFIED IN THE ENCLOSED PROXY CARD, PLEASE CONTACT OUR COMPANY SECRETARY AND ALSO NOTE THAT YOUR NOMINATED PROXY MUST ATTEND THE MEETING IN PERSON IN ORDER FOR YOUR VOTES TO BE CAST.

Table of Contents

Unless we have indicated otherwise in this proxy statement, references to the “Company,” “Johnson Controls,” “we,” “us,” “our” and similar terms refer to Johnson Controls International plc and its consolidated subsidiaries.

| 2019 Proxy Statement | i |

Table of Contents

Annual General Meeting

| Time and Date: | 3:00 pm, local time, on March 6, 2019 | |

Place: | The Merrion Hotel, 24 Upper Merrion Street, Dublin 2, Ireland | |

Record Date: | January 2, 2019 | |

Voting: | Shareholders on the record date are entitled to one vote per share on each matter to be voted upon at the Annual General Meeting | |

Admission: | All shareholders are invited to attend the Annual General Meeting. Registration will commence on the day of the meeting. | |

Proposals to be Voted Upon

| Board Recommendation | ||

1. Elect, by separate resolution, each nominee to the Board of Directors. | FOR each nominee | |

2. To approve and ratify, by separate resolutions, the appointment of PricewaterhouseCoopers LLP as the independent auditors of the Company and to authorize the Audit Committee of the Board of Directors to set the auditors’ remuneration. | FOR both 2(a) and 2(b) | |

3. To authorize the Company and/or any subsidiary of the Company to make market purchases of Company shares. | FOR | |

4. To determine the price range at which the Company canre-allot shares that it holds as treasury shares. | FOR | |

5. To approve, in anon-binding advisory vote, the compensation of the named executive officers. | FOR | |

6. To approve the Directors’ authority to allot shares up to approximately 33% of issued share capital. | FOR | |

7. To approve the waiver of statutorypre-emption rights with respect to up to 5% of issued share capital. | FOR | |

| 2019 Proxy Statement | 1 |

Table of Contents

The Nominees to our Board of Directors

We are asking you to voteFOR all the director nominees listed below. All current directors attended at least 89% of the Board and committee meetings on which he or she sits. Detailed information regarding these individuals, along with all other Board nominees, is set forth under Proposal Number One. Summary information is set forth below.

| Nominee and Principal Occupation | Age | Director Since | Independent | Current Committee Membership | ||||||||||

Jean Blackwell Former Executive Vice President & Chief Financial Officer of Cummins Inc. | 64 | 2018 | ✓ | Compensation | ||||||||||

Pierre Cohade Former Chief Executive Officer of Triangle Tyre Co. Ltd. | 57 | 2018 | ✓ | Audit | ||||||||||

Michael E. Daniels Retired Senior Vice President of Global Technology at IBM | 64 | 2010 | ✓ | Compensation (chair); Executive | ||||||||||

Juan Pablo del Valle Perochena Chairman of Mexichem | 46 | 2016 | ✓ | Governance (chair); Executive | ||||||||||

W. Roy Dunbar Founder and Chief Executive Officer, Sustainable Star, LLC | 57 | 2017 | ✓ | Compensation | ||||||||||

Gretchen R. Haggerty Former Executive Vice President & Chief Financial Officer of United States Steel Corporation | 63 | 2018 | ✓ | Audit | ||||||||||

Simone Menne Former Chief Financial Officer, Boehringer Ingelheim | 58 | 2018 | ✓ | Audit | ||||||||||

George R. Oliver Chairman and Chief Executive Officer of Johnson Controls | 58 | 2012 | Executive | |||||||||||

Jürgen Tinggren Former Chief Executive Officer and Director of Schindler Group | 60 | 2014 | ✓ | Audit (chair); Executive | ||||||||||

Mark Vergnano President, Chief Executive Officer and Director, The Chemours Company | 60 | 2016 | ✓ | Compensation | ||||||||||

R. David Yost Former Chief Executive Officer of AmerisourceBergen | 71 | 2009 | ✓ | Governance | ||||||||||

John D. Young Group President of Pfizer Innovative Health | 54 | 2017 | ✓ | Governance | ||||||||||

Non-Binding Advisory Vote on Executive Compensation

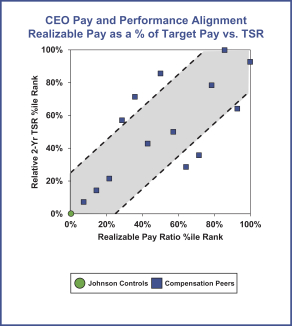

Proposal Number Five is our annual advisory vote on the Company’s executive compensation philosophy and program. Detailed information regarding these matters is included under the heading “Compensation Discussion & Analysis,” and we urge you to read it in its entirety. Our compensation philosophy and structure for executive officers remains dedicated to the concept of paying for performance and continues to be heavily weighted with performance-based awards.

| 2 | 2019 Proxy Statement |

Table of Contents

PROPOSAL NUMBER ONE – ELECTIONOF DIRECTORS

Upon the recommendation of the Governance Committee, the Board has nominated for election at the Annual General Meeting a slate of 11 nominees, all of whom currently serve on our Board. Biographical information regarding each of the nominees is set forth below. We are not aware of any reason why any of the nominees will not be able to serve if elected. The term of office for members of the Board of Directors commences upon election and terminates upon completion of the first Annual General Meeting of Shareholders following election. Brian Duperreault, who has served as a director since March 2004, has informed the Board of Directors of his decision to not stand for reelection. Mr. Duperreault will retire from the Board effective as of the conclusion of the Company’s 2019 Annual General Meeting.

| Director Since | Other Public Directorships | |||||||||||||

|

| Age:

|

|

| 64

|

|

| June 2018

|

| Celanese Corporation Ingevity Corporation

| ||||

|

| Committee:

|

|

| Compensation

|

| |||||||||

|

| Independent:

|

|

| Yes

|

| |||||||||

| Jean Blackwell |

Ms. Blackwell served as Chief Executive Officer of Cummins Foundation and Executive Vice President, Corporate Responsibility, of Cummins Inc., a global power leader that designs, manufactures, distributes and services diesel and natural gas engines and engine-related component products, from March 2008 until her retirement in March 2013. She previously served as Executive Vice President and Chief Financial Officer from 2003 to 2008, Vice President, Cummins Business Services from 2001 to 2003, Vice President, Human Resources from 1998 to 2001, and Vice President and General Counsel from 1997 to 1998 of Cummins Inc. Prior thereto, Ms. Blackwell was a partner at the Indianapolis law firm of Bose McKinney & Evans LLP from 1984 to 1991. She has also served in state government, including as Executive Director of the Indiana State Lottery Commission and State of Indiana Budget Director. Ms. Blackwell serves as a director of Celanese Corporation, a global technology and specialty materials company, and Ingevity Corporation, a leading global manufacturer of specialty chemicals and high performance carbon materials. Ms. Blackwell previously served as a member of the Board of Directors of Essendant Inc., a leading national wholesale distributor of business products, from 2007 to 2018 and Phoenix Companies Inc., a life insurance company, from 2004 to 2009.

Skills and Qualifications

| ∎ | Senior Leadership Experience: Extensive experience as a business leader, including serving as the Chief Financial Officer of Cummins Inc. |

| ∎ | Financial: Deep financial acumen as CFO and senior finance leader in engine-related industry |

| ∎ | Corporate Governance: Experience serving on the board of directors of multiple international companies |

| 2019 Proxy Statement | 3 |

Table of Contents

| ∎ | International: Significant knowledge of the global marketplace gained from her business experience and background |

| ∎ | Sustainability and Corporate Responsibility: Extensive experience with ESG topics through service as CEO of Cummins Foundation and Executive Vice President of Corporate Responsibility for Cummins Inc. |

| ∎ | Talent Management: Experience leading global teams |

| Director Since | Other Public Directorships | |||||||||||||

|

| Age:

|

|

| 57

|

|

| December 2018

|

| CEAT Ltd. Acorn International Inc.

| ||||

|

| Committee:

|

|

| Audit

|

| |||||||||

|

| Independent:

|

|

| Yes

|

| |||||||||

| Pierre Cohade | ||||||||||||||

Mr. Cohade served as the Chief Executive Officer of Triangle Tyre, China’s largest private tire manufacturer from 2015 to 2016. From 2013 to 2015, Mr. Cohade was a Senior Advisor at ChinaVest, Wells Fargo’s investment banking affiliate in China. During 2012, he served as an independent consultant for various private equity concerns. Prior thereto he served as the President, Asia Pacific, of The Goodyear Tire & Rubber Company from 2004 to 2011. From 2003 to 2004, Mr. Cohade served as the Division Executive Vice President of the Global Water and Beverage division of Danone SA. From 1985 to 2003, Mr. Cohade served in roles of increasing responsibility at Eastman Kodak Co., ultimately serving as the Chairman of Kodak’s Europe, Africa, Middle East and Russia Region. Mr. Cohade serves as a director of CEAT Ltd. (one of India’s leading tire manufacturers), Acorn International Inc., (a leading marketing and branding company in China focused on content creation, distribution, and product sales through digital media), and Deutsche Bank China. Mr. Cohade is currently the Chairman of IMA in China, a leading peer group forum for CEOs and senior executives located in China, and is an independent advisor to companies on China, strategy and operations.

Skills and Qualifications

| ∎ | Senior Leadership Experience: Extensive experience as a business leader in a number of industries |

| ∎ | Financial: Experience leading large business units at The Goodyear Tire & Rubber Company, Danone SA, and Eastman Kodak Co. |

| ∎ | International: Significant experience in a number of senior global positions, with extensive experience and expertise in China |

| ∎ | Marketing and Consumer Focus: Deep experience in the consumer products industry |

| ∎ | Manufacturing and Operations: Experience in overseeing manufacturing and operations in China at The Goodyear Tire & Rubber Company and Triangle Tyre |

| ∎ | Talent Management: Experience leading global teams |

| 4 | 2019 Proxy Statement |

Table of Contents

| Director Since | Other Public Directorships | |||||||||||||

|

| Age:

|

|

| 64

|

|

| March 2010

|

| Thomson Reuters SS&C Technologies, Inc.

| ||||

|

| Committee:

|

|

| Compensation, Executive

|

| |||||||||

|

| Independent:

|

|

| Yes

|

| |||||||||

| Michael E. Daniels |

Prior to his retirement in March 2013, Mr. Daniels was the Senior Vice President and Group Executive of IBM Services, a business and IT services company with operations in more than 160 countries around the world. In this role, Mr. Daniels had worldwide responsibility for IBM’s Global Services business operations in outsourcing services, integrated technology services, maintenance, and Global Business Services, the consulting and applications management arm of Global Services. Since he joined IBM in 1976, Mr. Daniels held a number of leadership positions in sales, marketing, and services, and was general manager of several sales and services businesses, including IBM’s Sales and Distribution operations in the United States, Canada and Latin America; its Global Services team in the Asia Pacific region; Product Support Services; Availability Services; and Systems Solutions. Mr. Daniels serves as a director of Thomson Reuters, a provider of intelligent information for businesses, and SS&C Technologies, a provider of specialized software, software enabled-services and software as a service solutions to the financial services industry.

Skills and Qualifications

| ∎ | Senior Leadership Experience: Decades of senior leadership experience at IBM |

| ∎ | Industry Experience: Broad and extensive global business experience in a wide range of global roles as an executive at IBM, including decades of experience in the service space |

| ∎ | Technology, Cyber Security and IT: Deep understanding of critical areas of enterprise service functions and information technology, including cyber security |

| ∎ | International: Experience as a senior manager of a global organization as well as international experience living and working in a variety of cultures |

| ∎ | Talent Management: Experience leading global teams at IBM and in service on the compensation committee of public companies |

| Director Since | Other Public Directorships | |||||||||||||

|

| Age:

|

| 46 | September 2016 | Mexichem, S.A.B. Elementia S.A.B. Grupo Lala S.A.B. | ||||||||

| Committee: |

| Governance, Executive

|

| |||||||||||

| Independent: | Yes | |||||||||||||

Juan Pablo del Valle Perochena |

Mr. Perochena has been the Chairman of Mexichem, S.A.B. de C.V., a chemical and petrochemical producer and seller and a subsidiary of Kaluz, S.A. de C.V., since April 2011. He became a member of

| 2019 Proxy Statement | 5 |

Table of Contents

our Board in connection with the merger of Johnson Controls, Inc. and a subsidiary of Tyco International plc in September 2016, “the Merger.” He has been a board member of Mexichem since 2001, and serves on the boards of Kaluz, S.A. de C.V., Elementia S.A. de C.V., a manufacturer and marketer of building materials in the Americas, and Grupo Lala S.A.B., a dairy products company based in Mexico. He is a former director of Grupo Pochteca S.A.B., a manufacturer and marketer of specialty chemicals.

Skills and Qualifications

| ∎ | Senior Leadership Experience: Significant experience as an executive officer and board member of several Mexican companies |

| ∎ | Industry Experience: Deep knowledge of the manufacturing industry from his experiences at Mexichem |

| ∎ | International: Significant knowledge of the global marketplace gained from his business experience and background |

| ∎ | Construction and Real Estate Development: Mr. del Valle Perochena’s service with Kaluz, S.A. de C.V. gives him unique insight into the construction industry and real estate development |

| ∎ | Talent Management: Experience leading global teams |

| Director Since | Other Public Directorships | |||||||||||||

| Age: | 57 | June 2017 | Humana, Inc. SiteOne Landscape Supplies | ||||||||||

|

| Committee:

|

| Compensation | |||||||||||

| Independent: | Yes | |||||||||||||

| W. Roy Dunbar |

Mr. Dunbar was Chairman of the Board of Network Solutions, a technology company and web service provider, and was the Chief Executive Officer from January 2008 until October 2009. Mr. Dunbar also served as the President of Global Technology and Operations for MasterCard Incorporated from September 2004 until January 2008. Prior to MasterCard, Mr. Dunbar worked at Eli Lilly and Company for 14 years, serving as President of Intercontinental Operations, and earlier as Chief Information Officer. He currently serves as a member of the Board of Directors of Humana and SiteOne Landscape Supply, Inc. and previously served on the boards of Lexmark International and iGate.

Skills and Qualifications

| ∎ | Senior Leadership Experience: Extensive experience leading across functional disciplines |

| ∎ | International: Significant experience as a leader and director across US and international markets |

| ∎ | Talent Management: Experience in global leadership and service as a director on the compensation committees of multiple companies |

| ∎ | Multi-Disciplinary: Career-spanning depth of experience across numerous disciplines including healthcare, information technology, payments, insurance and renewable energy |

| 6 | 2019 Proxy Statement |

Table of Contents

| Director Since | Other Public Directorships | |||||||||||||

| Age: | 63 | March 2018 | USG Corporation Teleflex Corporation | ||||||||||

|

| Committee:

|

| Audit | |||||||||||

| Independent: | Yes | |||||||||||||

Gretchen R. Haggerty |

Ms. Haggerty retired in August 2013 after a37-year career with United States Steel Corporation, an integrated global steel producer, and its predecessor, USX Corporation, which, in addition to its steel production, also managed and supervised energy operations, principally through Marathon Oil Corporation. From March 2003 until her retirement, she served as Executive Vice President & Chief Financial Officer and also served as Chairman of the U. S. Steel & Carnegie Pension Fund and its Investment Committee. Earlier, she served in various financial executive positions at U. S. Steel and USX, beginning in November 1991 when she became Vice President & Treasurer. Ms. Haggerty is currently a director of USG Corporation, a leading manufacturer of building materials, and Teleflex Incorporated, a global provider of medical technology products.

Skills and Qualifications

| ∎ | Senior Leadership Experience: Decades of senior leadership experience at United States Steel Corporation and USX Corporation |

| ∎ | Financial: Deep financial acumen as CFO and senior finance leader in steel and energy industries |

| ∎ | Corporate Governance: Experience serving on the board of directors of multiple international companies |

| ∎ | International: Significant knowledge of the global marketplace gained from her business experience and background |

| ∎ | Talent Management: Experience leading global teams |

| Director Since | Other Public Directorships | |||||||||||||

| Age: | 58 | March 2018 | Bayerische Motoren Werke AG Deutsche Post DHL Group | ||||||||||

|

| Committee:

|

| Audit | |||||||||||

| Independent: | Yes | |||||||||||||

Simone Menne |

Ms. Menne served as Chief Financial Officer at Boehringer Ingelheim GmbH, Germany’s second largest pharmaceutical company, from September 2016 to December 2017. She previously served as the Chief Financial Officer at Deutsche Lufthansa AG (“Lufthansa”) from January 2016 to August 2016 and as a member of its Executive Board from July 2012 to August 2016. She also served as Chief Officer of Finances and Aviation Services at Lufthansa from July 2012 to January 2016. Prior thereto

| 2019 Proxy Statement | 7 |

Table of Contents

she served in a number of roles of increasing responsibility at Lufthansa from 1989 to 2012. She currently serves on the Supervisory Boards of Bayerische Motoren Werke AG and Deutsche Post DHL Group. She also serves on the Börsensachverständigenkommission (Exchange Experts Commission, BSK) of Deutsche Börse AG.

Skills and Qualifications

| ∎ | Senior Leadership Experience: Decades of senior leadership experience at Lufthansa and Boehringer Ingelheim |

| ∎ | Corporate Governance: Experience serving on the supervisory boards of multiple international companies |

| ∎ | Financial: Deep financial acumen as CFO and senior finance leader in transportation and pharmaceutical industries |

| ∎ | International: Significant knowledge of the global marketplace gained from her business experience and background |

| ∎ | Talent Management: Experience leading global teams |

| Director Since | Other Public Directorships | |||||||||||||

|

| Age:

|

| 58 | September 2012 | Raytheon Company | ||||||||

|

| Committee:

|

| Executive | |||||||||||

| Independent: | No | |||||||||||||

| George R. Oliver |

Mr. Oliver became our Chairman and Chief Executive Officer in September 2017. He previously served as our President and Chief Operating Officer following the completion of the merger. Prior to that, Mr. Oliver was Tyco’s Chief Executive Officer, a position he held since September 2012. He joined Tyco in July 2006, serving as president of Tyco Safety Products from 2006 to 2010 and as president of Tyco Electrical & Metal Products from 2007 through 2010. He was appointed president of Tyco Fire Protection in 2011. Before joining Tyco, he served in operational leadership roles of increasing responsibility at several General Electric divisions. Mr. Oliver also serves as a director on the board of Raytheon Company, a company specializing in defense, security and civil markets throughout the world, and is a trustee of Worcester Polytechnic Institute, his alma mater, and serves on the Pro Football Hall Board of Trustees.

Skills and Qualifications

| ∎ | Senior Leadership Experience: Extensive leadership experience over several decades as an executive at Tyco (now the Company) and GE |

| ∎ | Industry Experience: Nearly a decade of experience with Tyco, first as president of several of its business units and then as CEO |

| ∎ | International: Experience as a director, CEO and a senior manager of global organizations |

| ∎ | Talent Management: Experience leading global teams at Johnson Controls, Tyco and GE |

| ∎ | Executive Insight: Mr. Oliver offers valuable insights and perspective on the day to day management of the Company’s affairs |

| 8 | 2019 Proxy Statement |

Table of Contents

| Director Since | Other Public Directorships | |||||||||||||

|

| Age:

|

| 60 | March 2014 | OpenText Corporation | ||||||||

| Committee: |

| Audit, Executive

|

| |||||||||||

| Independent: | Yes | |||||||||||||

| Jürgen Tinggren |

Mr. Tinggren joined our Board in March 2014. He was the chief executive officer of the Schindler Group, a global provider of elevators, escalators and related services, through December 2013 and was a member of the Board of Directors of Schindler from March 2014 to 2016. He joined the Group Executive Committee of Schindler in April 1997, initially with responsibility for Europe and thereafter for the Asia/Pacific region and the Technology and Strategic Procurement. In 2007, he was appointed Chief Executive Officer and President of the Group Executive Committee of the Schindler Group. Mr. Tinggren also serves on the Board of OpenText Corporation and is a Trustee of The Conference Board. From 2011 to 2014 he was a director of Schenker-Winkler Holding and from 2014 to 2018 he was a director of the Sika AG Group.

Skills and Qualifications

| ∎ | Senior Leadership Experience: Extensive global business experience as the CEO and a senior leader of Schindler |

| ∎ | International: Experience as senior executive and director of European based organizations, deep understanding of international markets |

| ∎ | Industry Experience: Deep understanding of building services, industrial products and installation and service businesses |

| ∎ | Financial: Deep financial understanding as CEO of Schindler |

| ∎ | Business Development/M&A: Significant experience with mergers and acquisitions |

| ∎ | Talent Management: Experience leading global teams as CEO of Schindler |

| Director Since | Other Public Directorships | |||||||||||||

|

| Age:

|

| 60 | September 2016 | The Chemours Company | ||||||||

|

| Committee:

|

| Compensation | |||||||||||

| Independent: | Yes | |||||||||||||

| Mark Vergnano |

Mr. Vergnano has been the President, Chief Executive Officer and a director of the Chemours Company, a titanium technologies, fluoroproducts, and chemical solutions producer, since July 2015. He joined our Board in September 2016 upon the completion of the merger with Johnson Controls, Inc.

| 2019 Proxy Statement | 9 |

Table of Contents

Previously, Mr. Vergnano served as Executive Vice President, E. I. du Pont de Nemours and Company from 2009 to June 2015. While at DuPont, he served as group vice president—Safety & Protection from 2006 to 2009, vice president and general manager—DuPont Surfaces and Building Innovations from 2005 to 2006, and vice president and general manager—DuPont Nonwovens from 2003 to 2005.

Mr. Vergnano joined DuPont in 1980 as a process engineer and held a variety of manufacturing, technical and management assignments in DuPont’s global organization. Mr. Vergnano also serves as the Chairman of the Board of Directors for the National Safety Council, and serves as the Vice Chairman of the American Chemistry Council.

Skills and Qualifications

| ∎ | Senior Leadership Experience: Extensive global business experience as an executive and CEO of Chemours and DuPont |

| ∎ | International: Experience as senior executive of a multinational company |

| ∎ | Industry Experience: Deep understanding of the operations, global sales and marketing in the chemical manufacturing industry |

| ∎ | Financial: Deep financial understanding as CEO of Chemours |

| ∎ | Talent Management: Experience leading global teams as CEO of Chemours and in managing a variety of business units at DuPont |

| Director Since | Other Public Directorships | |||||||||||||

| Age: | 71 | March 2009 | Marsh & McLennan Companies, Inc. Bank of America | ||||||||||

|

| Committee:

|

| Governance | |||||||||||

| Independent: | Yes | |||||||||||||

| R. David Yost |

Mr. Yost served as Director and Chief Executive Officer of AmerisourceBergen, a comprehensive pharmaceutical services provider, from August 2001 to June 2011 when he retired. He was Chairman and Chief Executive Officer of AmeriSource Health Corporation from May 1997 to August 2001, and President and Chief Executive Officer of AmeriSource from May 1997 to December 2000. Mr. Yost also held a variety of other positions with AmeriSource Health Corporation and its predecessors from 1974 to 1997. Mr. Yost also serves as a director of Marsh & McLennan Companies, Inc. and Bank of America, and is a member of the board of the United States Air Force Academy Endowment, and serves on its Executive Committee.

Skills and Qualifications

| ∎ | Senior Leadership Experience: Extensive leadership experience gained as the CEO and a director of AmerisourceBergen |

| 10 | 2019 Proxy Statement |

Table of Contents

| ∎ | Corporate Governance: Significant corporate governance experience serving as a director of multiple public companies |

| ∎ | Risk Management: Exposure to complex risk management concepts gained as a director of Marsh & McLennan and Bank of America |

| ∎ | Talent Management: Experience leading global teams as CEO of AmerisourceBergen |

| Director Since | Other Public Directorships | |||||||||||||

|

| Age:

|

| 54 | December 2017 | |||||||||

|

| Committee:

|

| Governance | |||||||||||

| Independent: | Yes | |||||||||||||

| John D. Young |

Mr. Young has served as Group President of Pfizer Innovative Health since January 2018. From June 2016 to January 2018 he served as Group President, Pfizer Essential Health. He was Group President, Global Established Pharma Business for Pfizer from January 2014 until June 2016 and President and General Manager, Pfizer Primary Care from June 2012 until December 2013. He also served as Pfizer’s Primary Care Business Unit’s Regional President for Europe and Canada from 2009 until June 2012 and U.K. Country Manager from 2007 until 2009.

Skills and Qualifications

| ∎ | Senior Leadership Experience: Extensive experience as a business leader with 30 years’ experience with Pfizer |

| ∎ | Financial: Experience leading large business units at Pfizer |

| ∎ | International: Significant experience in a number of senior global positions at Pfizer |

| ∎ | Innovation and Technical Expertise: Specialized expertise in developing healthcare solutions in a variety of medical disciplines |

| ∎ | Talent Management: Experience leading global teams |

Election of each Director requires the affirmative vote of a majority of the votes properly cast by the holders of ordinary shares represented at the Annual General Meeting in person or by proxy. Each Director’s election is the subject of a separate resolution and shareholders are entitled to one vote per share for each separate Director election resolution.

The Board unanimously recommends that shareholders voteFOR the election of each nominee for Director to serve until the completion of the next Annual General Meeting.

| 2019 Proxy Statement | 11 |

Table of Contents

PROPOSAL NUMBER TWO – APPOINTMENTOF AUDITORSAND AUTHORITYTO SET REMUNERATION

PricewaterhouseCoopers LLP (“PwC”) served as our independent auditors for the fiscal year ended September 30, 2018. The Audit Committee has selected and appointed PwC to audit our financial statements for the fiscal year ending September 30, 2019. The Board, upon the recommendation of the Audit Committee, is asking our shareholders to ratify the appointment of PwC as our independent auditors for the fiscal year ending September 30, 2019 and to authorize the Audit Committee of the Board of Directors to set the independent auditors’ remuneration. Although approval is not required by our Memorandum and Articles of Association or otherwise, the Board is submitting the selection of PwC to our shareholders for ratification because we value our shareholders’ views on the Company’s independent auditors. If the appointment of PwC is not approved by shareholders, it will be considered as notice to the Board and the Audit Committee to consider the selection of a different firm. Even if the appointment is approved, the Audit Committee, in its discretion, may select a different independent auditor at any time during the year if it determines that such a change would be in the best interests of the Company and our shareholders.

Representatives of PwC will attend the Annual General Meeting and will have an opportunity to make a statement if they wish. They will also be available to answer questions at the meeting.

For independent auditor fee information, information on ourpre-approval policy of audit andnon-audit services, and the Audit Committee Report, please see below.

The ratification of the appointment of the independent auditors and the authorization for the Audit Committee to set the remuneration for the independent auditors requires the affirmative vote of a majority of the votes properly cast by the holders of ordinary shares represented at the Annual General Meeting in person or by proxy.

The Audit Committee and the Board unanimously recommend a voteFOR these proposals.

Aggregate fees for professional services rendered to the Company by its independent auditors as of and for the two most recent fiscal years are set forth below. The aggregate fees include fees billed or reasonably expected to be billed for the applicable fiscal year. Fees for fiscal year 2018 include fees billed or reasonably expected to be billed by PwC.

Fiscal Year 2018 | Fiscal Year 2017 | |||||||

| (in millions | ) | (in millions | ) | |||||

Audit Fees | $ | 26.9 | $ | 26.1 | ||||

Audit-Related Fees | 2.7 | 1.8 | ||||||

Tax Fees | 6.1 | 5.9 | ||||||

All Other Fees | 1.1 | 0.4 | ||||||

|

|

|

| |||||

Total | $ | 36.8 | $ | 34.2 | ||||

PwC Fees

Audit Fees for the fiscal year ended September 30, 2018 were for professional services rendered by PwC and include fees for services performed to comply with auditing standards of the PCAOB

| 12 | 2019 Proxy Statement |

Table of Contents

(United States), including the annual audit of our consolidated financial statements including reviews of the interim financial statements contained in Johnson Controls’ Quarterly Reports on Form10-Q, issuance of consents and the audit of our internal control over financial reporting. This category also includes fees for audits provided in connection with statutory filings or services that generally only the principal auditor reasonably can provide to a client, such as assistance with and review of documents filed with the SEC.

Audit-Related Fees for the fiscal year ended September 30, 2018 were for services rendered by PwC and include fees associated with assurance and related services that are reasonably related to the performance of the audit or review of our financial statements. This category includes fees related to assistance in financial due diligence related to mergers, acquisitions, and divestitures, carve-outs associated with divestitures andspin-off transactions, consultations concerning financial accounting and reporting standards, issuance of comfort letters associated with debt offerings, general assistance with implementation of SEC and Sarbanes-Oxley Act requirements, audits of pension and other employee benefit plans, and audit services not required by statute or regulation.

Tax Fees for the fiscal year ended September 30, 2018 were for services rendered by PwC and primarily include fees associated with tax audits, tax compliance, tax consulting, transfer pricing, and tax planning. This category also includes tax planning on mergers and acquisitions and restructurings, as well as other services related to tax disclosure and filing requirements.

All Other Fees for the fiscal years ended September 30, 2018 were for services rendered by PwC and primarily include fees associated with information technology consulting, training seminars related to accounting, finance and tax matters, and other advisory services.

Policy on Audit CommitteePre-Approval of Audit and PermissibleNon-Audit Services of Independent Auditors

In March 2004, the Audit Committee adopted apre-approval policy that provides guidelines for the audit, audit-related, tax and other permissiblenon-audit services that may be provided by the independent auditors. The policy identifies the guiding principles that must be considered by the Audit Committee in approving services to ensure that the auditors’ independence is not impaired. The policy provides that the Corporate Controller will support the Audit Committee by providing a list of proposed services to the Committee, monitoring the services and feespre-approved by the Committee, providing periodic reports to the Audit Committee with respect topre-approved services, and ensuring compliance with the policy.

Under the policy, the Audit Committee annuallypre-approves the audit fee and terms of the engagement, as set forth in the engagement letter. This approval includes approval of a specified list of audit, audit-related and tax services. Any service not included in the specified list of services must be submitted to the Audit Committee forpre-approval. No service may extend for more than 12 months, unless the Audit Committee specifically provides for a different period. The independent auditor may not begin work on any engagement without confirmation of Audit Committeepre-approval from the Corporate Controller or his or her delegate.

In accordance with the policy, the chair of the Audit Committee has been delegated the authority by the Committee topre-approve the engagement of the independent auditors for a specific service when the entire Committee is unable to do so. All suchpre-approvals must be reported to the Audit Committee at the next Committee meeting.

| 2019 Proxy Statement | 13 |

Table of Contents

The Audit Committee of the Board is composed of four Directors, each of whom the Board has determined meets the independence and experience requirements of the NYSE and the SEC. The Audit Committee operates under a charter approved by the Board, which is posted on our website. As more fully described in its charter, the Audit Committee oversees Johnson Controls’ financial reporting process on behalf of the Board. Management has the primary responsibility for the financial statements and the reporting process. Management assures that the Company develops and maintains adequate financial controls and procedures, and monitors compliance with these processes. Johnson Controls’ independent auditors are responsible for performing an audit in accordance with auditing standards generally accepted in the United States to obtain reasonable assurance that Johnson Controls’ consolidated financial statements are free from material misstatement and expressing an opinion on the conformity of the financial statements with accounting principles generally accepted in the United States. The internal auditors are responsible to the Audit Committee and the Board for testing the integrity of the financial accounting and reporting control systems and such other matters as the Audit Committee and Board determine.

In this context, the Audit Committee has reviewed the U.S. GAAP consolidated financial statements for the fiscal year ended September 30, 2018, and has met and held discussions with management, the internal auditors and the independent auditors concerning these financial statements, as well as the report of management and the report of the independent registered public accounting firm regarding the Company’s internal control over financial reporting required by Section 404 of the Sarbanes-Oxley Act. Management represented to the Committee that Johnson Controls’ U.S. GAAP consolidated financial statements were prepared in accordance with U.S. GAAP. In addition, the Committee has discussed with the independent auditors the auditors’ independence from Johnson Controls and its management as required under Public Company Accounting Oversight Board Rule 3526, Communication with Audit Committees Concerning Independence, and the matters required to be discussed by Public Company Accounting Oversight Board Auditing Standard AU Section 380 (Communication with Audit Committees) andRule 2-07 of SECRegulation S-X.

In addition, the Audit Committee has received the written disclosures and the letter from the independent auditor required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditor’s communications with the Audit Committee concerning independence. Based upon the Committee’s review and discussions referred to above, the Committee recommended that the Board include Johnson Controls’ audited consolidated financial statements in Johnson Controls’ Annual Report onForm 10-K for the fiscal year ended September 30, 2018 filed with the Securities and Exchange Commission and that such report be included in Johnson Controls’ annual report to shareholders for the fiscal year ended September 30, 2018.

Submitted by the Audit Committee,

Jürgen Tinggren, Chair

Gretchen R. Haggerty

Simone Menne

Mark P. Vergnano

| 14 | 2019 Proxy Statement |

Table of Contents

PROPOSAL NUMBER THREE – AUTHORIZATIONTO MAKE MARKET PURCHASESOF COMPANY SHARES

We have historically used open-market share purchases as a means of returning cash to shareholders and managing the size of our base of outstanding shares. These are longstanding objectives that management believes are important to continue.

Under Irish law, neither the Company nor any subsidiary of the Company may make market purchases or overseas market purchases of the Company’s shares without shareholder approval. Accordingly, shareholders are being asked to authorize the Company, or any of its subsidiaries, to make market purchases and overseas market purchases of up to 10% of the Company’s issued shares. This authorization expires after eighteen months unless renewed; accordingly, we expect to propose renewal of this authorization at subsequent Annual General Meetings.

Such purchases would be made only at price levels which the Directors considered to be in the best interests of the shareholders generally, after taking into account the Company’s overall financial position. The Company currently expects to effect repurchases under our existing share repurchase authorization as redemptions pursuant to Article 3(d) of our Articles of Association. Whether or not this proposed resolution is passed, the Company will retain its ability to effect repurchases as redemptions pursuant to its Articles of Association, although subsidiaries of the Company will not be able to make market purchases or overseas market purchases of the Company’s shares unless the resolution is adopted.

In order for the Company or any of its subsidiaries to make overseas market purchases of the Company’s ordinary shares, such shares must be purchased on a market recognized for the purposes of the Companies Act 2014. The New York Stock Exchange, on which the Company’s ordinary shares are listed, is specified as a recognized stock exchange for this purpose by Irish law. The general authority, if approved by our shareholders, will become effective from the date of passing of the authorizing resolution.

Ordinary Resolution

The text of the resolution in respect of Proposal 3 is as follows:

RESOLVED, that the Company and any subsidiary of the Company is hereby generally authorized to make market purchases and overseas market purchases of ordinary shares in the Company (“shares”) on such terms and conditions and in such manner as the Board of Directors of the Company may determine from time to time but subject to the provisions of the Companies Act 2014 and to the following provisions:

(a) The maximum number of shares authorized to be acquired by the Company and/or any subsidiary of the Company pursuant to this resolution shall not exceed, in the aggregate, 91,270,000 ordinary shares of US$0.01 each (which represents slightly less than 10% of the Company’s issued ordinary shares).

(b) The maximum price to be paid for any ordinary share shall be an amount equal to 110% of the closing price on the New York Stock Exchange for the ordinary shares on the trading day preceding the day on which the relevant share is purchased by the Company or the relevant subsidiary of the Company, and the minimum price to be paid for any ordinary share shall be the nominal value of such share.

| 2019 Proxy Statement | 15 |

Table of Contents

(c) This general authority will be effective from the date of passing of this resolution and will expire on the earlier of the date of the Annual General Meeting in 2020 or eighteen months from the date of the passing of this resolution, unless previously varied, revoked or renewed by ordinary resolution in accordance with the provisions of section 1074 of the Companies Act 2014. The Company or any such subsidiary may, before such expiry, enter into a contract for the purchase of shares which would or might be executed wholly or partly after such expiry and may complete any such contract as if the authority conferred hereby had not expired.

The authorization for the Company and/or any its subsidiaries to make market purchases and overseas market purchases of Company shares requires the affirmative vote of a majority of the votes properly cast (in person or by proxy) at the Annual General Meeting.

The Board unanimously recommends that shareholders voteFOR this proposal.

| 16 | 2019 Proxy Statement |

Table of Contents

PROPOSAL NUMBER FOUR – DETERMINETHE PRICE RANGEATWHICHTHE COMPANYCAN RE-ALLOT TREASURY SHARES

Our historical open-market share repurchases and other share buyback activities result in ordinary shares being acquired and held by the Company as treasury shares. We mayre-allot treasury shares that we acquire through our various share buyback activities in connection with our executive compensation program and our other compensation programs.

Under Irish law, our shareholders must authorize the price range at which we mayre-allot any shares held in treasury (including by way ofre-allotmentoff-market). In this proposal, that price range is expressed as a minimum and maximum percentage of the prevailing market price (as defined below). Under Irish law, this authorization expires after eighteen months unless renewed; accordingly, we expect to propose the renewal of this authorization at subsequent Annual General Meetings.

The authority being sought from shareholders provides that the minimum and maximum prices at which an ordinary share held in treasury may be re-alloted are 95% and 120%, respectively, of the average closing price per ordinary share of the Company, as reported by the New York Stock Exchange, for the thirty (30) trading days immediately preceding the proposed date ofre-allotment, save that the minimum price for are-allotment to satisfy an obligation under an employee share plan is the par value of a share. Anyre-allotment of treasury shares will be at price levels that the Board considers in the best interests of our shareholders.

Special Resolution

The text of the resolution in respect of Proposal 4 (which is proposed as a special resolution) is as follows:

RESOLVED, that there-allotment price range at which any treasury shares held by the Company may be re-alloted shall be as follows:

(a) the maximum price at which such treasury share may be re-alloted shall be an amount equal to 120% of the “market price”; and

(b) the minimum price at which a treasury share may be re-alloted shall be the nominal value of the share where such a share is required to satisfy an obligation under an employee share plan operated by the Company or, in all other cases, an amount equal to 95% of the “market price”; and

(c) for the purposes of this resolution, the “market price” shall mean the average closing price per ordinary share of the Company, as reported by the New York Stock Exchange, for the thirty (30) trading days immediately preceding the proposed date ofre-allotment.

FURTHER RESOLVED, that this authority tore-allot treasury shares shall expire on the earlier of the date of the Annual General Meeting of the Company held in 2020 or eighteen months after the date of the passing of this resolution unless previously varied or renewed in accordance with the provisions of section 109 and/or 1078 (as applicable) of the Companies Act 2014 (and/or any corresponding provision of any amended or replacement legislation) and is without prejudice or limitation to any other authority of the Company tore-allot treasury shareson-market.

| 2019 Proxy Statement | 17 |

Table of Contents

The authorization of the price range at which the Company mayre-allot any shares held in treasury requires the affirmative vote of at least 75% of the votes properly cast (in person or by proxy) at the Annual General Meeting.

The Board unanimously recommends that shareholders voteFOR this proposal.

| 18 | 2019 Proxy Statement |

Table of Contents

PROPOSAL NUMBER FIVE – ADVISORY VOTEON EXECUTIVE COMPENSATION

The Board recognizes that providing shareholders with an advisory vote on executive compensation can produce useful information on investor sentiment with regard to the Company’s executive compensation programs. As a result, this proposal provides shareholders with the opportunity to cast an advisory vote on the compensation of our executive management team, as described in the section of this proxy statement entitled“Compensation Discussion & Analysis,”and endorse or not endorse our fiscal 2018 executive compensation philosophy, programs and policies and the compensation paid to the Named Executive Officers.

The advisory vote on executive compensation isnon-binding, meaning that our Board will not be obligated to take any compensation actions or to adjust our executive compensation programs or policies, as a result of the vote. Notwithstanding the advisory nature of the vote, the resolution will be considered passed with the affirmative vote of a majority of the votes properly cast by the holders of ordinary shares represented at the Annual General Meeting in person or by proxy.

Although the vote isnon-binding, our Board and the Compensation Committee will review the voting results. To the extent there is a significant negative vote, we would communicate directly with shareholders to better understand the concerns that influenced the vote. The Board and the Compensation Committee would consider constructive feedback obtained through this process in making future decisions about executive compensation programs.

AdvisoryNon-Binding Resolution

The text of the resolution, which if thought fit, will be passed as an advisorynon-binding resolution at the Annual General Meeting, is as follows:

RESOLVED, that shareholders approve, on an advisory basis, the compensation of the Company’s Named Executive Officers, as disclosed in the Compensation Discussion & Analysis section of this proxy statement.

The Board unanimously recommends that shareholders voteFOR this proposal.

| 2019 Proxy Statement | 19 |

Table of Contents

PROPOSAL NUMBER SIX – AUTHORIZATIONFOR DIRECTORSTO ALLOT COMPANY SHARES

Under Irish law, directors of an Irish public limited company must have authority from its shareholders to issue any shares, including shares which are part of the company’s authorized but unissued share capital. The Company’s current authorization, approved by shareholders at our 2018 Annual General Meeting, is to issue up to 33% of the authorized but unissued share capital of the Company, which authorization will expire on March 6, 2019 – the date of the 2019 Annual General Meeting. We are presenting this proposal to renew the Board’s authority to issue authorized but unissued shares on the terms set forth below. If this proposal is not passed, the Company will have a limited ability to issue new ordinary shares.

It is customary practice in Ireland to seek shareholder authority to issue shares up to an aggregate nominal value of up to 33% of the aggregate nominal value of the company’s issued share capital and for such authority to be renewed each year. Therefore, in accordance with customary practice in Ireland, we are seeking approval to issue up to a maximum of 33% of our issued ordinary capital for a period expiring on the earlier of the date of the Company’s Annual General Meeting in 2020 or September 6, 2020, unless otherwise varied, revoked or renewed. The Directors of the Company expect to propose renewal of this authorization at subsequent Annual General Meetings.

Granting the Board this authority is a routine matter for public companies incorporated in Ireland and is consistent with Irish market practice. This authority is fundamental to our business and enables us to issue shares, including, if applicable, in connection with funding acquisitions and raising capital. We are not asking you to approve an increase in our authorized share capital or to approve a specific issuance of shares. Instead, approval of this proposal will only grant the Board the authority to issue shares that are already authorized under our Articles of Association upon the terms below. In addition, because we are a NYSE-listed company, our shareholders continue to benefit from the protections afforded to them under the rules and regulations of the NYSE and SEC, including those rules that limit our ability to issue shares in specified circumstances. This authorization is required as a matter of Irish law and is not otherwise required for other companies listed on the NYSE with whom we compete. Accordingly, approval of this resolution would merely place us on par with other NYSE-listed companies.

Ordinary Resolution

The text of the resolution in respect of Proposal 6 (which is proposed as an ordinary resolution) is as follows:

“RESOLVED that the directors be and are hereby generally and unconditionally authorized to exercise all powers to allot and issue relevant securities (within the meaning of section 1021 of the Companies Act 2014) up to an aggregate nominal value of US $3,012,000 (being equivalent to approximately 33% of the aggregate nominal value of the issued share capital of the Company as at the last practicable date prior to the issue of the notice of this meeting) and the authority conferred by this resolution shall expire on the earlier of the date of the Company’s Annual General Meeting in 2020 or September 6, 2020, unless previously renewed, varied or revoked; provided that the Company may make an offer or agreement before the expiry of this authority, which would or might require any such securities to be allotted after this authority has expired, and in that case, the directors may allot relevant securities in pursuance of any such offer or agreement as if the authority conferred hereby had not expired.”

| 20 | 2019 Proxy Statement |

Table of Contents

As required under Irish law, the resolution in respect of this proposal is an ordinary resolution that requires the affirmative vote of a majority of the votes properly cast (in person or by proxy) at the Annual General Meeting.

The Board unanimously recommends that shareholders voteFOR this proposal.

| 2019 Proxy Statement | 21 |

Table of Contents

PROPOSAL NUMBER SEVEN – WAIVEROF STATUTORY PRE-EMPTION RIGHTS

Under Irish law, unless otherwise authorized, when an Irish public limited company issues shares for cash to new shareholders, it is required first to offer those shares on the same or more favorable terms to existing shareholders of the company on apro-rata basis (commonly referred to as thepre-emption right). Our current authorization, approved by shareholders at our 2018 Annual General Meeting, will expire on March 6, 2019, the date of the 2019 Annual General Meeting. We are therefore proposing to renew the Board’s authority toopt-out of thepre-emption right on the terms set forth below.

It is customary practice in Ireland to seek shareholder authority toopt-out of thepre-emption rights provision in the event of the issuance of shares for cash, if the issuance is limited to up to 5% of a company’s issued ordinary share capital. It is also customary practice for such authority to be renewed on an annual basis.

Therefore, in accordance with customary practice in Ireland, we are seeking this authority, pursuant to a special resolution, to authorize the directors to issue shares for cash up to a maximum of approximately 5% of the Company’s authorized share capital without applying statutorypre-emption rights for a period expiring on the earlier of the Annual General Meeting in 2020 or September 6, 2020, unless otherwise varied, renewed or revoked. We expect to propose renewal of this authorization at subsequent Annual General Meetings.

Granting the Board this authority is a routine matter for public companies incorporated in Ireland and is consistent with Irish customary practice. Similar to the authorization sought for Proposal 6, this authority is fundamental to our business and, if applicable, will facilitate our ability to fund acquisitions and otherwise raise capital. We are not asking you to approve an increase in our authorized share capital. Instead, approval of this proposal will only grant the Board the authority to issue shares in the manner already permitted under our Articles of Association upon the terms below. Without this authorization, in each case where we issue shares for cash, we would first have to offer those shares on the same or more favorable terms to all of our existing shareholders. This requirement could cause delays in the completion of acquisitions and capital raising for our business. This authorization is required as a matter of Irish law and is not otherwise required for other companies listed on the NYSE with whom we compete. Accordingly, approval of this resolution would merely place us on par with other NYSE-listed companies.

Special Resolution

The text of the resolution in respect of Proposal 7 (which is proposed as a special resolution) is as follows:

“RESOLVED that the directors be and are hereby empowered pursuant to section 1023 of the Companies Act 2014 to allot equity securities (as defined in section 1023 of that Act) for cash, pursuant to the authority conferred by proposal 6 of the notice of this meeting as ifsub-section (1) of section 1022 of that Act did not apply to any such allotment, provided that this power shall be limited to the allotment of equity securities up to an aggregate nominal value of US $456,000 (being equivalent to approximately 5% of the aggregate nominal value of the issued share capital of the Company as at the last practicable date prior to the issue of the notice of this meeting) and the authority conferred by this resolution shall expire on the earlier of the Company’s Annual General Meeting in 2020 or September 6, 2020, unless previously renewed, varied or revoked; provided that the Company may make an offer or agreement before the expiry of this authority,

| 22 | 2019 Proxy Statement |

Table of Contents

which would or might require any such securities to be allotted after this authority has expired, and in that case, the directors may allot equity securities in pursuance of any such offer or agreement as if the authority conferred hereby had not expired.”

As required under Irish law, the resolution in respect of Proposal 7 is a special resolution that requires the affirmative vote of at least 75% of the votes cast. In addition, under Irish law, the Board may only be authorized toopt-out ofpre-emption rights if it is authorized to issue shares, which authority is being sought in Proposal 6.

The Board unanimously recommends that shareholders voteFOR this proposal.

| 2019 Proxy Statement | 23 |

Table of Contents

Vision and Values of Our Board

Our vision is a more comfortable, safe, and sustainable world. In addition to achieving financial performance objectives, our Board and management believe that we must assume a leadership position in the area of corporate governance to fulfill our vision. Our Board believes that good governance requires not only an effective set of specific practices but also a culture of responsibility throughout the company, and governance at Johnson Controls is intended to optimize both. Johnson Controls also believes that good governance ultimately depends on the quality of its leadership, and it is committed to recruiting and retaining Directors and officers of proven leadership ability and personal integrity. Our Board has adopted Corporate Governance Guidelines which provide a framework for the effective governance of Johnson Controls. These guidelines address matters such as the Board’s duties, director independence, director responsibilities, Board structure and operation, director criteria and qualifications, Board succession planning, Board compensation, management evaluation and development, Board orientation and training, Lead Director responsibilities and our Code of Ethics. The Governance Committee regularly reviews developments in corporate governance and updates the Corporate Governance Guidelines and other governance materials as it deems necessary and appropriate.

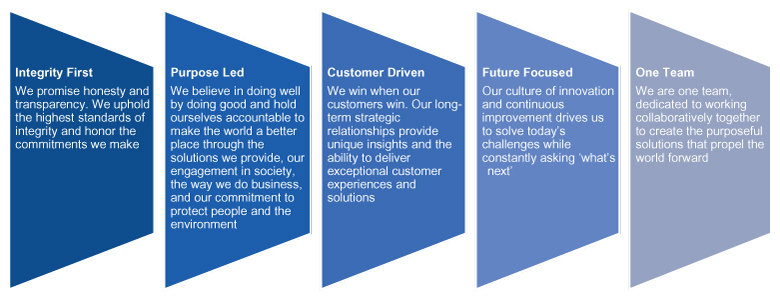

Johnson Controls’ Values: How We Seek to Conduct Ourselves

Integrity First We promise honesty and transparency. We uphold the highest standards of integrity and honor the commitments we make Purpose Led We believe in doing well by doing good and hold ourselves accountable to make the world a better place through the solutions we provide, our engagement in society, the way we do business, and our commitment to protect people and the environment Customer Driven We win when our customers win. Our long-term strategic relationships provide unique insights and the ability to deliver exceptional customer experiences and solutions Future Focused Our culture of innovation and continuous improvement drives us to solve today's challenges while constantly asking what's next' One Team We are one team, dedicated to working collaboratively together to create the purposeful solutions that propel the world forward

Mission of the Board of Directors: What the Board Intends to Accomplish

The mission of Johnson Controls’ Board is to promote the long-term value and health of Johnson Controls in the interests of the shareholders and set an ethical “tone at the top.” To this end, the Board provides management with strategic guidance, and also ensures that management adopts and implements procedures designed to promote both legal compliance and the highest standards of honesty, integrity and ethics throughout the organization.

| 24 | 2019 Proxy Statement |

Table of Contents

Board Responsibilities

All corporate authority is exercised by the Board except for those matters reserved to the shareholders. The Board has retained oversight authority—defining and overseeing the implementation of and compliance with standards of accountability and monitoring the effectiveness of management policies and decisions in an effort to ensure that the Company is managed in such a way to achieve its objectives. The Board delegates its authority to management for managing the everyday affairs of the Company. The Board requires that senior management review major actions and initiatives with the Board prior to implementation. Management, not the Board, is responsible for managing the Company.

Focus Areas of our Board | Strategy and Operations

Ensuring that processes are in place designed to maintain the integrity and ethical conduct of the Company; reviewing and approving strategic plans and profit plans; reviewing corporate performance and staying apprised of relations with shareholders

| |

Talent

Overseeing and evaluating management’s systems and senior management performance and compensation; and providing advice and counsel to senior management and plan for effective succession

| ||

Governance and Risk Management

Overseeing and evaluating management’s systems and processes for the identification, assessment, management, mitigation, and reporting of major risks; establishing corporate governance standards

| ||

Board Composition and Effectiveness

Recommending candidates to the shareholders for election to the Board; setting standards for Director qualification, orientation and continuing education; reviewing and assessing the Board’s leadership structure; and undertaking an annual performance evaluation regarding the effectiveness of the Board |

Board Leadership

The Board’s leadership structure generally includes a combined Chairman and CEO role with a strong, independentnon-executive lead director. The Board believes our overall corporate governance measures help ensure that strong, independent directors continue to effectively oversee our management and key issues related to strategy, risk and integrity; executive compensation; CEO evaluation; and succession planning. In choosing generally to combine the roles of Chairman and CEO, the Board takes into consideration the importance ofin-depth, industry-specific knowledge and a thorough understanding of our business environment and risk management practices in setting agendas and leading the Board’s discussions. Combining the roles also provides a clear leadership structure for the management team and serves as a vital link between management and the Board. This allows the Board to perform its oversight role with the benefit of management’s perspective on our business strategy and all other aspects of the business. Because our CEO has anin-depth knowledge

| 2019 Proxy Statement | 25 |

Table of Contents

of the complexity of a large and diversified international company, our businesses and their management structures, and our overall company strategy—all of which are of critical importance to our performance—the Board believes that our CEO generally is best suited to serve as Chairman and help ensure that the independent directors’ attention is devoted to the issues of greatest importance to Johnson Controls and our shareholders. Our Board periodically reviews its determination to have a single individual act both as Chairman and CEO.

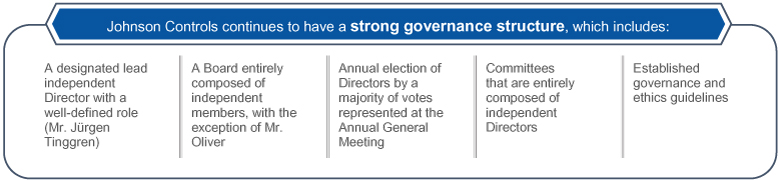

Johnson Controls continues to have a strong governance structure, which includes:A designated lead independent Director with a well-defined role (Mr. Jurgen Tinggren)A Board entirely composed of independent members, with the exception of Mr. OliverAnnual election of Directors by a majority of votes represented at the Annual General MeetingCommittees that are entirely composed of independent DirectorsEstablished governance and ethics guidelines

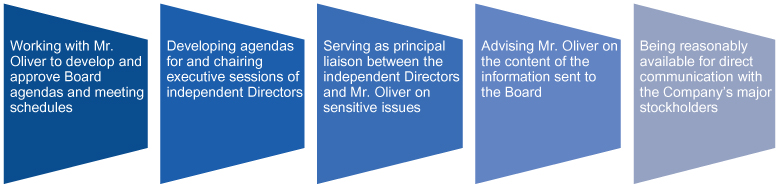

The Lead Director acts as an intermediary between the Board and senior management. Among other things, the Lead Director’s duties include:

Working with Mr. Oliver to develop and approve Board agendas and meeting schedulesDeveloping agendas for and chairing executive sessions of independent DirectorsServing as principal liaison between the independent Directors and Mr. Oliver on sensitive issuesAdvising Mr. Oliver on the content of the information sent to the BoardBeing reasonably available for direct communication with the Companys major stockholders

Board Oversight of Risk

The Board’s role in risk oversight at Johnson Controls is consistent with Johnson Controls’ leadership structure, with management havingday-to-day responsibility for assessing and managing Johnson Controls’ risk exposure and the Board and its committees providing oversight in connection with those efforts, with particular focus on the most significant risks facing Johnson Controls. The Board performs its risk oversight role in several ways. Board meetings regularly include strategic overviews by the CEO that describe the most significant issues, including risks, affecting Johnson Controls. In addition, the Board is regularly provided with business updates from the leaders of Johnson Controls’ business units, and updates from the General Counsel and other functional leaders. The Board reviews the risks associated with Johnson Controls’ financial forecasts, business plan and operations. These risks are identified and managed in connection with Johnson Controls’ robust enterprise risk management (“ERM”) process. The Company’s ERM process provides the enterprise with a common framework and terminology to ensure consistency in identification, reporting and management of key risks. It is also directly linked to the strategic planning process, and includes a formal process to identify and document the key risks to Johnson Controls perceived by a variety of stakeholders in the enterprise. The results of the ERM process are presented to the Board at least annually.

| 26 | 2019 Proxy Statement |

Table of Contents

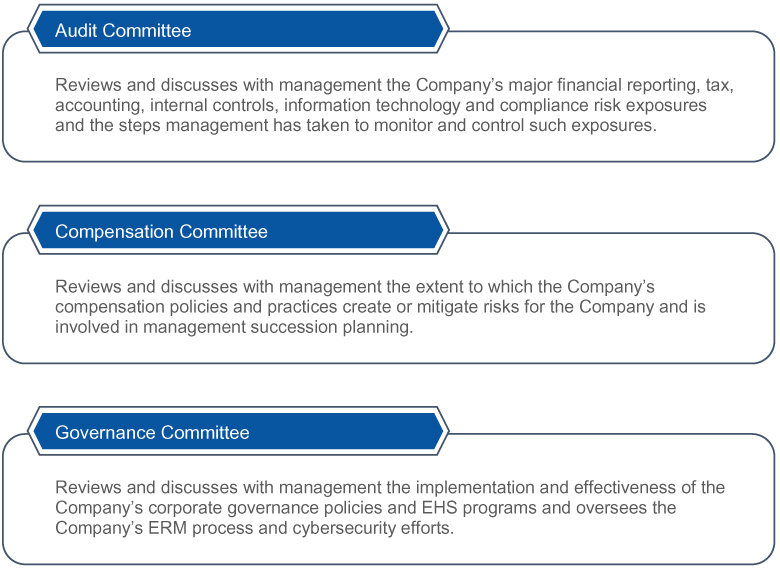

The Board has delegated to each of its committees responsibility for the oversight of specific risks that fall within the committee’s areas of responsibility. For example:

Audit Committee Reviews and discusses with management the Company's major financial reporting, tax, accounting, internal controls, information technology and compliance risk exposures and the steps management has taken to monitor and control such exposures. Compensation Committee Reviews and discusses with management the extent to which the Company's compensation policies and practices create or mitigate risks for the Company and is involved in management succession planning. Governance Committee Reviews and discusses with management the implementation and effectiveness of the Company's corporate governance policies and EHS programs and oversees the Company's ERM process and cybersecurity efforts.

Board Capabilities

The Johnson Controls Board as a whole is strong in its diversity, vision, strategy and business judgment. It possesses a robust collective knowledge of management and leadership, business operations, crisis management, risk assessment, industry knowledge, accounting and finance, corporate governance and global markets.

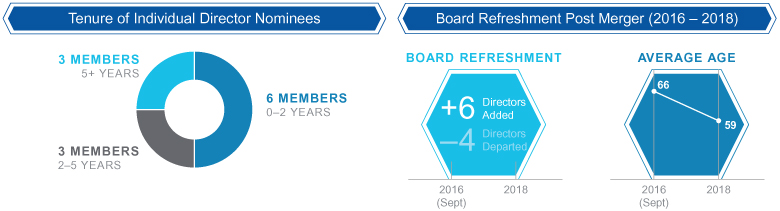

Since January 1, 2018, the Company has added 4 new Directors to its Board. In adding these Directors, the Board was focused on finding executives with deep financial expertise, experience with the complexities global manufacturing as well as expertise with operating in China. In connection with these efforts, the following Directors were added to the Board

| ∎ | Gretchen R. Haggerty, the former Chief Financial Officer of United States Steel Corporation; |

| ∎ | Simone Menne, the former Chief Financial Officer of Boehringer Ingelheim GmbH and Deutsche Lufthansa AG; |

| ∎ | Jean Blackwell, who served in several executive level roles at Cummins Inc., including Chief Financial Officer and General Counsel, and most recently as the Chief Executive Officer of the Cummins Foundation and Executive Vice President of Corporate Responsibility; and |

| 2019 Proxy Statement | 27 |

Table of Contents

| ∎ | Pierre Cohade, an executive with extensive experience operating in China, including at Triangle Tyre and The Goodyear Tire & Rubber Company. |

As a result of these director recruitment efforts, the Company also significantly increased the gender diversity of its Board.

The culture of the Board is such that it can operate swiftly and effectively in making key decisions and facing major challenges. Board meetings are conducted in an environment of trust, open dialogue and mutual respect that encourages constructive commentary. The Board strives to be informed, proactive and vigilant in its oversight of Johnson Controls and protection of shareholder assets. Below is a summary of the key attributes of our Directors:

Key Attributes12 Director NomineesCorporate Governance/Legal/Regulatory 4Gender/Racial Diversity 4Public Company CEO 4Independence 11International Operations and Sales 12IT/Cyber 2M&A/Strategy Development 10Operating/Manufacturing Experience 8Public Company CFO 3Public Company Board 11

Board Committees

To conduct its business the Board maintains three standing committees: Audit, Compensation and Governance, and each of these NYSE required committees are entirely composed of independent Directors. The Board also maintains an Executive Committee comprised of the Chairman, Lead Director and each committee chair that meets to review matters as delegated to it by the Board. All committees report on their activities to the Board.

The Lead Director may also convene “special committees” to review discrete matters that require the consideration of a Board committee, but do not fit within the mandate of any of the standing committees. Special committees report their activities to the Board.

To ensure effective discussion and decision making while at the same time having a sufficient number of independent Directors for its three standing committees, the Board is normally constituted of between ten and thirteen Directors. The minimum and maximum number of Directors is set forth in Johnson Controls’ Articles of Association.

| 28 | 2019 Proxy Statement |

Table of Contents

The Governance Committee reviews the Board’s governance guidelines annually and recommends appropriate changes to the Board.

Board Meetings

The Board meets at least four times annually, and additional meetings may be called in accordance with our Articles of Association. Frequent board meetings are critical not only for timely decisions but also for Directors to be well informed about Johnson Controls’ operations and issues. One of these meetings will be scheduled in conjunction with the Annual General Meeting of shareholders and Board members are required to be in attendance at such meeting either in person or by telephone. The Lead Director and the Chair of the Board are responsible for setting meeting agendas with input from the other Directors.