SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under Rule 14a-12

WIND RIVER SYSTEMS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1. | Title of each class of securities to which transaction applies: |

| | 2. | Aggregate number of securities to which transaction applies: |

| | 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 6. | Amount Previously Paid: |

| | 7. | Form, Schedule or Registration Statement No.: |

500 WIND RIVER WAY

ALAMEDA, CA 94501

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JULY 10, 2002

TO THE STOCKHOLDERS OF WIND RIVER SYSTEMS, INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Wind River Systems, Inc., a Delaware corporation (“Wind River”), will be held on Wednesday, July 10, 2002 at 9:00 a.m. local time at Wind River’s headquarters located at 500 Wind River Way, Alameda, California for the following purposes:

| | 1. | | To elect seven directors to serve until the next Annual Meeting of Stockholders and until their successors have been elected and qualified; |

| | 2. | | To approve an amendment to the Wind River 1993 Employee Stock Purchase Plan to increase the number of shares of common stock authorized for issuance under such plan by 1,500,000 shares plus annual increases of up to 300,000 shares in each of the five years commencing in 2003 so long as such increases consist of shares repurchased in the open market; |

| | 3. | | To ratify the selection of PricewaterhouseCoopers LLP as Wind River’s independent accountants for the fiscal year ending January 31, 2003; and |

| | 4. | | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on May 15, 2002, as the record date for the determination of stockholders entitled to notice of and to vote at this Annual Meeting and at any adjournment or postponement thereof.

By Order of the Board of Directors,

Michael W. Zellner

Secretary

Alameda, California

May 30, 2002

|

All stockholders are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for that purpose. You may also vote by telephone or the Internet. Even if you have given your proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain from the record holder a proxy issued in your name. |

|

WIND RIVER SYSTEMS, INC.

500 WIND RIVER WAY

ALAMEDA, CA 94501

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed proxy is solicited on behalf of the Board of Directors of Wind River Systems, Inc., a Delaware corporation (“Wind River”), for use at the Annual Meeting of Stockholders to be held on Wednesday, July 10, 2002, at 9:00 a.m. local time (the “Annual Meeting”), or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held at Wind River’s headquarters located at 500 Wind River Way, Alameda, California. Wind River intends to mail this proxy statement and accompanying proxy card on or about May 30, 2002 to all stockholders entitled to vote at the Annual Meeting.

Record Date and Outstanding Shares

Only holders of record of common stock at the close of business on May 15, 2002 will be entitled to notice of and to vote at the Annual Meeting. At the close of business on May 15, 2002, Wind River had outstanding and entitled to vote 78,933,187 shares of common stock held of record by approximately 817 stockholders.

Voting and Solicitation

Each holder of record of common stock on such date will be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting.

All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Abstentions will be counted towards the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether a matter has been approved.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote. The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting will be required to approve the amendment to the Employee Stock Purchase Plan and to ratify the selection of PricewaterhouseCoopers LLP.

Wind River will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of this proxy statement, the proxy card and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of common stock beneficially owned by others to forward to such beneficial owners. Wind River may reimburse persons representing beneficial owners of common stock for their costs of forwarding solicitation materials to such beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, telegram or personal solicitation by directors, officers or other regular employees of Wind River. No additional compensation will be paid to directors, officers or other regular employees for such services.

1

Voting via the Internet or by Telephone

Stockholders may grant a proxy to vote their shares by means of the telephone or on the Internet. The law of Delaware, under which Wind River is incorporated, specifically permits electronically transmitted proxies, provided that each such proxy contains or is submitted with information from which the inspector of election can determine that such proxy was authorized by the stockholder.

The telephone and Internet voting procedures below are designed to authenticate stockholders’ identities, to allow stockholders to grant a proxy to vote their shares and to confirm that stockholders’ instructions have been recorded properly. Stockholders voting via the Internet should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, that must be borne by the stockholder.

For Shares Registered in Your Name

Stockholders of record may go to http://www.voteproxy.com to grant a proxy to vote their shares by means of the Internet. They will be required to provide the company number and control number contained on their proxy cards. The voter will then be asked to complete an electronic proxy card. The votes represented by such proxy will be generated on the computer screen and the voter will be prompted to submit or revise them as desired. Votes submitted by using the Internet must be received by 5:00 p.m., Eastern Time on July 9, 2002. Any stockholder using a touch-tone telephone may also grant a proxy to vote shares by calling 1-800-PROXIES and following the recorded instructions. Votes submitted by telephone must be received by 5:00 p.m., Eastern Time on July 9, 2002.

For Shares Registered in the Name of a Broker or Bank

Most beneficial owners whose stock is held in street name receive instruction for granting proxies from their banks, brokers or other agents, rather than Wind River’s proxy card. A number of brokers and banks are participating in a program provided through ADP Investor Communication Services that offers the means to grant proxies to vote shares by means of the telephone and the Internet. If your shares are held in an account with a broker or bank participating in the ADP Investor Communications Services program, you may grant a proxy to vote those shares telephonically by calling the telephone number shown on the instruction form received from your broker or bank, or via the Internet at ADP Investor Communication Services’ web site at http://www.proxyvote.com. Votes submitted pursuant to instructions under this paragraph must be received by 5:00 p.m., Eastern Time on July 9, 2002.

General Information for All Shares Voted via the Internet or by Telephone

Submitting your proxy via the Internet or by telephone will not affect your right to vote in person should you decide to attend the Annual Meeting.

Revocability of Proxies

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by filing with the Secretary of the Corporation at Wind River’s principal executive office, 500 Wind River Way, Alameda, California, 94501, a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the meeting and voting in person. Attendance at the meeting will not, by itself, revoke a proxy.

Deadline for Submission of Stockholder Proposals for the 2003 Meeting

The deadline for submitting a stockholder proposal for inclusion in Wind River’s proxy statement and form of proxy for Wind River’s 2003 Annual Meeting of Stockholders pursuant to Rule 14a-8 of the Securities and

2

Exchange Commission (“SEC”) is January 30, 2003. Stockholder proposals intended for consideration for inclusion in Wind River’s proxy statement and form of proxy relating to the 2003 Annual Meeting of Stockholders should be made in accordance with SEC Rule 14a-8. If a stockholder intends to submit a stockholder proposal at our 2003 Annual Meeting which is not eligible for inclusion in the proxy statement and form of proxy relating to that meeting, the stockholder must present the proposal to Wind River not later than the close of business on March 1, 2003 nor earlier than the close of business on January 30, 2003 in accordance with the provisions of Wind River’s Amended and Restated Bylaws. Stockholders are also advised to review Wind River’s Amended and Restated Bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations. In addition, the proxy solicited by the Board of Directors for the 2003 Annual Meeting of Stockholders will confer discretionary authority to vote on any stockholder proposal presented at that meeting, if Wind River is not provided with notice of such proposal on or prior to March 1, 2003.

3

PROPOSAL 1

ELECTION OF DIRECTORS

Wind River’s Board of Directors is currently comprised of seven members. Each director to be elected will hold office until the next annual meeting of stockholders and until his successor is elected and has qualified, or until such director’s earlier death, resignation or removal. Each nominee listed below is currently a director of Wind River, having been elected by the stockholders at the last annual meeting of stockholders.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the seven nominees named below. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as management may propose. Each person nominated for election has agreed to serve if elected and management has no reason to believe that any nominee will be unable to serve.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF EACH NAMED NOMINEE.

Nominees

Set forth below is biographical information for each person nominated:

Jerry L. Fiddler, 50, co-founded Wind River in February 1983, and currently serves as Chairman of the Board. From February 1983 to March 1994, he served as Chief Executive Officer of Wind River. He served as interim Chief Executive Officer from April to September 1999. Prior to founding Wind River, he was a computer scientist in the Real-Time Systems Group at Lawrence Berkeley Laboratory. Mr. Fiddler holds a B.A. in music and photography and a M.S. in computer science from the University of Illinois. Mr. Fiddler is also a director of several privately held companies.

Narendra K. Gupta, 53, became a director and Vice Chairman of Wind River in February 2000 in connection with Wind River’s acquisition of Integrated Systems, Inc. He is a founder of Integrated Systems and was a director since its formation in 1980. Before joining Wind River, Dr. Gupta was Chairman of the Board of Integrated Systems from March 1993. Dr. Gupta was Chief Executive Officer from 1988 to May 1994, and President from Integrated Systems’ formation in 1980 to May 1994. Dr. Gupta holds a B.Tech in engineering from the India Institute of Technology, a M.S. in engineering from the California Institute of Technology and a Ph.D. in engineering from Stanford University. He was elected a Fellow of the Institute of Electrical and Electronics Engineers (IEEE) in 1991. Dr. Gupta is also a director of Numerical Technologies, Inc., a semiconductor process technology company,TIBCO Software Inc., an e-business infrastructure software company, and several privately held companies and non-profit organizations.

Thomas St. Dennis, 48, joined Wind River in September 1999 as President and Chief Executive Officer, and as a director. From July 1992 to September 1999, Mr. St. Dennis was at Applied Materials, Inc., a semiconductor equipment manufacturer, where he last served as Group Vice President and President of the Planarization and Dielectric Deposition Products Business Group. From 1987 to 1992, Mr. St. Dennis was Vice President of Technology at the Silicon Valley Group, Inc., also a semiconductor equipment manufacturer. From 1983 to 1987, he served as Vice President of Sales and Marketing at Semiconductor Systems, Inc., a semiconductor company. Mr. St. Dennis holds a B.S. and a M.S. in physics from the University of California at Los Angeles. Mr. St. Dennis is a director of JNI Corporation, a storage data networks company. Mr. St. Dennis is also a director of a privately held company.

James W. Bagley, 63, has been Chief Executive Officer and a director of Lam Research Corporation, a manufacturer of semiconductor processing equipment, since August 1997. Since September 1998, Mr. Bagley

4

has also served as Chairman of the Board of Directors of Lam Research. From June 1996 until its merger with Lam Research in August 1997, Mr. Bagley served as Chairman of the Board and Chief Executive Officer of OnTrak Systems, Inc., a manufacturer of wafer processing systems. Prior to joining OnTrak, Mr. Bagley was employed by Applied Materials, Inc., a semiconductor equipment manufacturer, most recently as Chief Operating Officer and Vice Chairman of the Board. Mr. Bagley began his career in the semiconductor industry with Texas Instruments, Inc., where he held various positions over a 15-year period. He is currently a director of Teradyne, Inc., an automated test equipment company for the electronics and communications industries, and Micron Technology, Inc., a manufacturer of semiconductor memory products and personal computers. Mr. Bagley holds a B.S. and an M.S. in electrical engineering from Mississippi State University.

John C. Bolger, 55, became a director of Wind River in February 2000 in connection with Wind River’s acquisition of Integrated Systems. From July 1993 to February 2000, Mr. Bolger was a director of Integrated Systems. Mr. Bolger is currently a private investor and is a retired Vice President, Finance and Administration, and Secretary of Cisco Systems, Inc., a networking systems company. Mr. Bolger is also a director of Integrated Device Technology, Inc., a semiconductor manufacturer; Sanmina-SCI Corporation, a contract assembly manufacturer; Mission West Properties, a real estate investment trust; and JNI Corporation, a storage data networks company. He holds a B.A. in English Literature from the University of Massachusetts and a M.B.A. from Harvard University.

William B. Elmore, 49, was elected a director of Wind River in August 1990. He has been a general partner of Foundation Capital, a venture capital investment firm, since 1995. From 1987 to 1995, he was a general partner of Inman & Bowman, a venture capital firm. Mr. Elmore currently serves as a director of Onyx Software, Inc., a customer relationship management software company, and several privately held companies. Mr. Elmore holds a B.S. and a M.S. in electrical engineering from Purdue University and a M.B.A. from Stanford University.

Grant M. Inman, 60, is currently Director of Inman Investment Management, a private venture capital investment firm. From 1985 to 1998, he was a General Partner of Inman & Bowman, a venture capital firm. Mr. Inman serves as a director of Lam Research Corporation, a semiconductor equipment manufacturer, Paychex, Inc., a payroll and HR outsourcing services company, and several privately held companies. He is a trustee of the University of California, Berkeley Foundation. Mr. Inman holds a B.A. in economics from the University of Oregon and a M.B.A. in finance from the University of California, Berkeley.

Board Committees and Meetings

During the fiscal year ended January 31, 2002, the Board of Directors held five meetings and acted by unanimous written consent six times. The Board has an Audit Committee, a Compensation Committee, a Non-Officer Stock Option Committee and a Nominating Committee. During the fiscal year ended January 31, 2002, each director attended over 75% of the board meetings held during the period he was a director, and each member of the Audit and Compensation Committees attended over 50% of the committee meetings held during the period during which he was a member of the committee.

The Audit Committee (i) recommends to the Board the independent accountants to audit Wind River’s accounts and records; (ii) reviews, with Wind River management and the independent accountants, the scope and plans for audit procedures to be utilized, results of audits, and internal reviews; (iii) reviews the adequacy and effectiveness of Wind River’s internal accounting controls; and (iv) performs any other duties and functions required by any organization under which Wind River’s securities may be listed. The current members of the Audit Committee are James W. Bagley, John C. Bolger and Grant M. Inman. Until his resignation from the Board of Directors in May 2001, David B. Pratt served on the Audit Committee. The Audit Committee met four times during fiscal year 2002. The Board of Directors has determined that all of the members of the Audit Committee are independent (as independence is defined in Rule 4200(a)(14) of the National Association of Securities Dealers, Inc. listing standards). The Board of Directors has adopted a written charter for the Audit Committee.

5

The Compensation Committee makes recommendations concerning salaries and incentive compensation, awards stock options to employees and consultants under Wind River’s stock option plans and otherwise determines compensation levels and performs such other functions regarding compensation as the Board may delegate. The current members of the Compensation Committee are James W. Bagley, William B. Elmore and Grant M. Inman. Until his resignation from the Board of Directors in May 2001, David B. Pratt served on the Compensation Committee. The Compensation Committee acted four times during fiscal year 2002.

The Non-Officer Stock Option Committee, which is comprised of Thomas St. Dennis, makes stock option grants to employees who are not officers of Wind River. During fiscal 2002, the Non-Officer Stock Option Committee generally acted by written consent once a month to grant options to recently hired or promoted employees.

The Nominating Committee (i) recommends candidates for election to the Board of Directors, (ii) consults with the Chairman of the Board on committee assignments, and (iii) considers candidates for the Board recommended by stockholders. The current members of the Nominating Committee are Messrs. Bagley, Bolger, Elmore, Gupta and Inman. Until his resignation from the Board of Directors in May 2001, David B. Pratt served on the Nominating Committee.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board of Directors Compensation Committee. None of the members of our Compensation Committee is an officer or employee of Wind River or its subsidiaries.

6

PROPOSAL 2

APPROVAL OF AMENDMENT OF THE

1993 EMPLOYEE STOCK PURCHASE PLAN

In March 1993, the Board of Directors adopted, and the stockholders subsequently approved, Wind River’s 1993 Employee Stock Purchase Plan (the “ESPP”). As of January 31, 2002, an aggregate of 3,000,000 shares of common stock were reserved for issuance under the ESPP. As of April 30, 2002, 2,048,484 shares of Wind River’s common stock had been issued under the ESPP and 951,516 shares of common stock remained available for future issuance under the ESPP.

In May 2002, the Board amended the ESPP, subject to stockholder approval, to increase the number of shares of common stock authorized for issuance under the ESPP by 1,500,000 shares plus annual increases of up to 300,000 shares in each of the next five years so long as such increases consist of shares repurchased in the open market. The Board adopted this amendment in order to ensure that the ESPP has enough shares reserved for issuance each period based on historical employee contribution rates and the current stock price.

During the fiscal year ended January 31, 2002, shares of common stock were purchased in the amounts and at the weighted average prices per share under the ESPP as follows: all current executive officers as a group 2,471 shares ($14.84) and 3,136 shares ($14.07), and all employees (excluding executive officers) as a group 285,412 shares ($14.84) and 269,485 shares ($14.07).

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2.

The essential features of the ESPP, as amended, are outlined below:

Purpose

The purpose of the ESPP is to provide a means by which employees of Wind River (and any subsidiary of Wind River designated by the Board to participate in the ESPP) may be given an opportunity to purchase common stock of Wind River through payroll deductions, to assist Wind River in retaining the services of its employees, to secure and retain the services of new employees, and to provide incentives for such persons to exert maximum efforts for the success of Wind River. All of Wind River’s employees may participate in the ESPP if they meet the eligibility requirements discussed below.

The rights to purchase common stock granted under the ESPP are intended to qualify as options issued under an “employee stock purchase plan” as that term is defined in Section 423(b) of the Internal Revenue Code of 1986, as amended (the “Code”).

Administration

The Board administers the ESPP and has the final power to construe and interpret both the ESPP and the rights granted under it. The Board has the power, subject to the provisions of the ESPP, to determine when and how rights to purchase common stock of Wind River will be granted, the provisions of each offering of such rights (which need not be identical), and whether employees of any parent or subsidiary of Wind River will be eligible to participate in the ESPP.

The Board has the power to delegate administration of the ESPP to a committee composed of one or more members of the Board, and has delegated administration of the ESPP to the Compensation Committee. As used herein with respect to the ESPP, the “Board” refers to the Compensation Committee and to the Board.

7

Offerings

The ESPP is implemented by offerings of rights to all eligible employees from time to time by the Board. Generally, each offering is six months long and commences each January 1 or July 1 and terminates on June 30 and December 31, respectively.

Eligibility

Any person who is customarily employed at least 20 hours per week by Wind River, or by any parent or subsidiary of Wind River designated by the Board (each an “affiliate”), on the first day of an offering is eligible to participate in that offering. Officers of Wind River and any designated affiliate who are “highly compensated” as defined in the Code are eligible to participate in the offerings under the ESPP. However, no employee is eligible to participate in the ESPP if, immediately after the grant of purchase rights, the employee would own, directly or indirectly, stock possessing 5% or more of the total combined voting power or value of all classes of stock of Wind River or of any parent or subsidiary of Wind River (including any stock which such employee may purchase under all outstanding rights and options). In addition, no employee may purchase more than $25,000 worth of common stock (determined at the fair market value of the shares at the time such rights are granted) under all employee stock purchase plans of Wind River and its affiliates in any calendar year.

Participation in the Plan

Eligible employees enroll in the ESPP by delivering to Wind River, prior to the commencement date of the offering, an agreement authorizing payroll deductions of up to a maximum percentage specified by the Board of such employees’ total compensation during the offering. Employees are entitled to contribute up to a maximum of 15% of their compensation each year.

Purchase Price

The purchase price per share at which shares of common stock are sold in an offering under the ESPP is the lower of (i) 85% of the fair market value of a share of common stock on first day of the offering or (ii) 85% of the fair market value of a share of common stock on the last day of the offering.

Payment of Purchase Price; Payroll Deductions

The purchase price of the shares is accumulated by payroll deductions during the offering. A participant may reduce or terminate his or her payroll deductions at any time during the offering, except during the last 10 days. A participant may not increase or begin such payroll deductions after the beginning of an offering, except, if the Board provides, in the case of an employee who first becomes eligible to participate as of a date specified during the offering. All payroll deductions made for a participant are credited to his or her account under the ESPP and deposited with the general funds of Wind River. A participant may make additional payments into such account only if specifically provided for in the offering.

Purchase of Stock

By executing an agreement to participate in the ESPP, the employee is entitled to purchase shares under the ESPP. In connection with offerings made under the ESPP to date, the Board has specified that employees may not purchase more than 1,000 shares in any offering and may not purchase more than $7,500 of stock in any offering. The Board may change those limits for future offerings. If the aggregate number of shares to be purchased upon exercise of rights granted in the offering would exceed the maximum aggregate number of shares of common stock available, the Board would make a pro rata allocation of available shares in a uniform and equitable manner. Unless the employee’s participation is discontinued, his or her right to purchase shares is exercised automatically at the end of the offering at the applicable price. See “Withdrawal” below.

8

Withdrawal

A participant may withdraw from a given offering by terminating his or her payroll deductions and by delivering to Wind River a notice of withdrawal from the ESPP in the manner and within the times prescribed by the Board. Upon any withdrawal from an offering by the employee, Wind River will distribute to the employee his or her accumulated payroll deductions without interest, less any accumulated deductions previously applied to the purchase of shares of common stock on the employee’s behalf during such offering, and such employee’s interest in the offering will be automatically terminated. Once an employee withdraws from an offering, the employee may not re-enroll in that offering. However, an employee’s withdrawal from one offering will not have any effect upon such employee’s eligibility to participate in subsequent offerings under the ESPP.

Termination of Employment

Rights granted pursuant to any offering under the ESPP terminate immediately upon cessation of an employee’s employment for any reason, and Wind River will distribute to the employee all of his or her accumulated payroll deductions, without interest.

Restrictions on Transfer

Rights granted under the ESPP are not transferable and may be exercised only by the person to whom such rights are granted. However, employees may designate a beneficiary in the event the of the employee’s death subsequent to the end of an offering but prior to delivery of shares of common stock or cash, or to receive cash from the employee’s account in the event of the employee’s death during an offering.

Duration, Amendment and Termination

The Board may suspend or terminate the ESPP at any time. The Board may amend the ESPP at any time. However, except for adjustments upon changes in securities, such as stock-splits, or for amendments solely to benefit the administration of the ESPP, to take into account a change in legislation or to obtain or maintain favorable tax, exchange control or regulatory treatment for participating employees or the company, no amendment will be effective unless approved by the stockholders of Wind River to the extent that stockholder approval is necessary for the ESPP to satisfy the requirements of Section 423 of the Code or other applicable laws or regulations.

Stock Subject to ESPP

Subject to stockholder approval, 4,500,000 shares of common stock has been reserved for issuance under the ESPP plus annual increases of up to 300,000 in each of the five years commencing in 2003 provided, however, those shares must be repurchased by Wind River in the open market. The Board of Directors may set the annual increase lower than 300,000. If rights granted under the ESPP expire, lapse or otherwise terminate without being exercised, the shares of common stock not purchased under such rights become available for re-issuance under the ESPP.

Adjustments upon Changes in Stock

If any change is made in the stock subject to the ESPP, or subject to any rights granted under the ESPP without consideration by Wind River (through merger, consolidation, reorganization, recapitalization, stock dividend, dividend in property other than cash, stock split, liquidating dividend, combination of shares, exchange of shares, change in corporate structure or other transaction not involving the receipt of consideration by Wind River), the ESPP and outstanding rights will be appropriately adjusted in the class(es) and maximum number of shares subject to the ESPP and the class(es) and number of shares and price per share of stock subject to outstanding rights.

9

Effect of Certain Corporate Events

In the event of a sale, lease, license or disposition of all or substantially all of the consolidated assets of Wind River, a sale or other disposition of at least 50% of the outstanding securities of Wind River, a merger or consolidation or similar transaction in which Wind River is not the surviving corporation, a merger or consolidation or similar transaction following which Wind River is the surviving corporation but the shares of common stock outstanding immediately preceding the transaction are converted or exchanged by virtue of the transaction into other property, whether in the form of securities, cash or otherwise, then (i) any surviving or acquiring corporation may assume such outstanding rights or substitute similar rights for those outstanding under the ESPP or (ii) if the surviving or acquiring corporation does not continue or assume such rights or substitute similar rights, the participants’ accumulated payroll deductions may be used to purchase common stock within five business days prior to the transaction described above and the participant’s rights under the then-ongoing offering shall terminate immediately after such purchase.

Federal Income Tax Information

Rights granted under the ESPP are intended to qualify for favorable federal income tax treatment associated with rights granted under an employee stock purchase plan that qualifies under provisions of Section 423 of the Code.

A participant will be taxed on amounts withheld for the purchase of shares of common stock as if such amounts were actually received. Other than this, no income will be taxable to a participant until disposition of the acquired shares, and the method of taxation will depend upon the holding period of the acquired shares.

If the stock is disposed of at least two years after the beginning of the offering period and at least one year after the stock is transferred to the participant, then the lesser of (i) the excess of the fair market value of the stock at the time of such disposition over the exercise price or (ii) the excess of the fair market value of the stock as of the beginning of the offering period over the exercise price (determined as of the beginning of the offering period) will be treated as ordinary income. Any further gain or any loss will be taxed as a long-term capital gain or loss. Such capital gains currently are generally subject to lower tax rates than ordinary income.

If the stock is sold or disposed of before the expiration of either of the holding periods described above, then the excess of the fair market value of the stock on the exercise date over the exercise price will be treated as ordinary income at the time of such disposition. The balance of any gain will be treated as capital gain. Even if the stock is later disposed of for less than its fair market value on the exercise date, the same amount of ordinary income is attributed to the participant, and a capital loss is recognized equal to the difference between the sales price and the fair market value of the stock on such exercise date. Any capital gain or loss will be short-term or long-term, depending on how long the stock has been held.

There are no federal income tax consequences to Wind River by reason of the grant or exercise of rights under the ESPP. Wind River is entitled to a deduction to the extent amounts are taxed as ordinary income to a participant (subject to the requirement of reasonableness and the satisfaction of tax reporting obligations).

10

PROPOSAL 3

RATIFICATION OF SELECTION OF INDEPENDENT ACCOUNTANTS

The Board of Directors has selected PricewaterhouseCoopers LLP as Wind River’s independent accountants for the fiscal year ending January 31, 2003 and has further directed that management submit the selection of independent accountants for ratification by the stockholders at the Annual Meeting. PricewaterhouseCoopers LLP has audited Wind River’s financial statements since the fiscal year ended January 31, 1990. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Stockholder ratification of the selection of PricewaterhouseCoopers LLP as Wind River’s independent accountants is not required by Wind River’s Amended and Restated Bylaws or otherwise. However, the Board is submitting the selection of PricewaterhouseCoopers LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee and the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee and the Board in their discretion may direct the appointment of different independent accountants at any time during the year if they determine that such a change would be in the best interests of Wind River and its stockholders.

Audit Fees

During the fiscal year ended January 31, 2002, Wind River incurred an aggregate of $705,700 for services provided by PricewaterhouseCoopers LLP for the audit of Wind River’s financial statements for the fiscal year and for the review of Wind River’s interim financial statements.

Financial Information Systems Design and Implementation Fees

During the fiscal year ended January 31, 2002, PricewaterhouseCoopers LLP did not provide any information technology consulting services to Wind River.

All Other Fees

During fiscal year ended January 31, 2002, Wind River incurred an aggregate of $946,500 for professional services other than audit and information technology consulting, of which $679,000 was related to tax advisory services primarily relating to the consolidation of international subsidiaries.

The Audit Committee has determined that the rendering of the other non-audit services by PricewaterhouseCoopers LLP is compatible with maintaining the auditor’s independence.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 3.

11

EQUITY COMPENSATION PLAN INFORMATION

The following table gives information about Wind River’s common stock that may be issued upon the exercise of options, warrants and rights under all of its existing equity compensation plans as of January 31, 2002, including the 1987 Equity Incentive Plan, the 1998 Equity Incentive Plan, the 1998 Non-Officer Stock Option Plan, the 1995 Non-Employee Directors’ Stock Option Plan and the 1993 Employee Stock Purchase Plan. The figures below do not include the any increases in the ESPP share reserve described in Proposal 2 and subject to stockholder approval at the Annual Meeting.

Plan Category

| | (a) Number of securities to be issued upon exercise of outstanding options, warrants and rights

| | | (b) Weighted average exercise price of outstanding options, warrants and rights

| | (c) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

|

| Equity compensation plans approved by security holders | | 7,076,194 | (1) | | $ | 21.1749 | | 2,338,770 |

| Equity compensation plans not approved by security holders | | 9,363,514 | (2) | | $ | 23.7674 | | 1,839,138 |

| | |

|

| | | | |

|

| Total | | 16,439,708 | | | $ | 22.6515 | | 4,177,908 |

| | |

|

| | | | |

|

| (1) | | Excludes outstanding options to purchase an aggregate of 2,064,208 shares with a weighted average exercise price of $13.4152, which were assumed by Wind River in connection with the acquisitions of AudeSi Technologies, Inc., Embedded Support Tools Corporation, Integrated Systems, Inc., Rapid Logic, Inc. and RouterWare, Inc. No shares are available for grant under any of the options plans of the acquired companies. |

| (2) | | Issued under our 1998 Non-Officer Stock Option Plan and the Non-Qualified Stock Option Agreement entered into between Wind River and Marla Ann Stark, Vice President and General Counsel, each of which is described below. |

All of the option plans listed above or described in the table have been approved by Wind River’s stockholders, except the 1998 Non-Officer Stock Option Plan and the Non-Qualified Stock Option Agreement entered into between Wind River and Marla Ann Stark, which are described below. Neither the NSO Plan nor the Non-Qualified Stock Option Agreement is required to be, and neither has been, approved by Wind River’s stockholders.

1998 Non-Officer Stock Option Plan. As of January 31, 2002, we had reserved 11,250,000 million shares of common stock for issuance under the 1998 Non-Officer Stock Option Plan (the “NSO Plan”) for employees. As of January 31, 2002, approximately 8,963,514 million shares are reserved for issuance upon exercise of outstanding options and approximately 1,839,138 million shares are available for grant under the NSO Plan. The NSO Plan provides for the granting of non-qualified stock options to employees, excluding executive officers. The exercise price must be at least 85% of the fair market value of our common stock at the grant date, and to date, all grants have been made at 100% of the fair market value of our common stock on the date of grant. Options granted under the NSO Plan generally vest as to 25% of the shares thereunder on the first anniversary of the date of grant and thereafter at a rate of 1/48 per month; however, the Board of Directors may set different vesting schedules, including performance-based acceleration.

Non-Qualified Stock Option Agreement. In October 1999, in connection with the hiring of Marla Ann Stark, our Vice President and General Counsel, we entered into a Non-Qualified Stock Option Agreement under which we granted Ms. Stark an option to purchase 400,000 shares of common stock at an exercise price of $18.375, the fair market value of our common stock on the date of grant. The option vests as to 25% of the shares on the first anniversary of the date of grant and thereafter at a rate of 1/48 per month.

12

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of Wind River’s common stock as of May 15, 2002 by: (i) each director and nominee for director; (ii) each of the executive officers named in the Summary Compensation Table; (iii) all executive officers and directors of Wind River as a group; and (iv) all those known by Wind River to be beneficial owners of more than five percent of its common stock.

| | | Beneficial Ownership (1)

| |

Name and Address of Beneficial Owner

| | Number of Shares

| | Percent of Total

| |

| Narendra K. Gupta (2) | | 4,536,037 | | 5.75 | % |

| Jerry L. Fiddler (3) | | 4,399,808 | | 5.57 | % |

| Thomas St. Dennis (4) | | 897,202 | | 1.14 | % |

| James W. Bagley (5) | | 6,000 | | * | |

| John C. Bolger (6) | | 22,640 | | * | |

| William B. Elmore (7) | | 312,407 | | * | |

| John C. Fogelin (8) | | 179,489 | | * | |

| Grant M. Inman (9) | | 143,250 | | * | |

| Stephen A. Kennedy (10) | | 73,449 | | * | |

| Peter J. Richards (11) | | 216,760 | | * | |

| Marla Ann Stark (12) | | 283,723 | | * | |

| All executive officers and directors as a group (13 persons) (13) | | 11,515,209 | | 14.59 | % |

| (1) | | This table is based upon information supplied by officers, directors, and principal stockholders and Schedule 13Gs filed with the Securities and Exchange Commission. Unless indicated in the footnotes to this table and subject to community property laws where applicable, Wind River believes that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 78,933,187 shares outstanding on May 15, 2002, adjusted as required by rules promulgated by the Securities and Exchange Commission. Except as otherwise noted, the address for all beneficial owners is c/o Wind River Systems, Inc., 500 Wind River Way, Alameda, CA 94501. |

| (2) | | Includes 3,508,236 shares held by the Narendra and Vinita Gupta Living Trust dated 12/2/94, of which Mr. Gupta is a trustee; 920,000 shares held by the Gupta Irrevocable Children Trust, of which Mr. Gupta is also a trustee; and 7,176 shares held in an account benefiting Mr. Gupta’s daughter under the Uniform Gift to Minors Act, of which Mr. Gupta is the custodian. Also includes 100,625 shares subject to stock options exercisable within 60 days after May 15, 2002. Mr. Gupta disclaims beneficial ownership of the shares held in the Gupta Irrevocable Children Trust and held in his daughter’s name. |

| (3) | | Includes 2,652,930 shares held by the Fiddler and Alden Family Trust, of which Mr. Fiddler is a trustee; 300,000 shares held by the Jazem I Family Partners LP—Fund 5, of which Mr. Fiddler is a general partner; 555,000 shares held by Jazem II Family Partners LP, of which Mr. Fiddler is a general partner; 247,953 shares held by Jazem III Family Partners LP, of which Mr. Fiddler is a partner; and 300,000 shares held by Jazem IV Family Partners LP, of which Mr. Fiddler is a partner. Also includes 343,925 shares subject to stock options exercisable within 60 days after May 15, 2002. |

| (4) | | Includes 139,000 shares held by the St. Dennis Family Trust, of which Mr. St. Dennis is a trustee. Also includes 756,666 shares subject to stock options exercisable within 60 days after May 15, 2002. |

| (5) | | Shares subject to stock options exercisable within 60 days after May 15, 2002. |

| (6) | | Includes 18,500 shares subject to stock options exercisable within 60 days after May 15, 2002. |

| (7) | | Includes 233,907 shares held by the Elmore Living Trust, of which Mr. Elmore is a trustee, and 15,000 shares held by Elmore Family Investments, LP, of which Mr. Elmore is a partner. Also includes 63,500 shares subject to stock options exercisable within 60 days after May 15, 2002. |

13

| (8) | | Includes 174,780 shares subject to stock options exercisable within 60 days after May 15, 2002. |

| (9) | | Includes 79,000 shares held by the Inman Living Trust UAD 5/9/89, of which Mr. Inman is a trustee; and 42,000 shares held by the Grant N. Inman SSB Keogh PS Custodian the West Ven Keogh, of which Mr. Inman is a custodian. Also includes 22,250 shares subject to stock options exercisable within 60 days after May 15, 2002. |

| (10) | | Includes 72,916 shares subject to stock options exercisable within 60 days after May 15, 2002. |

| (11) | | Shares subject to stock options exercisable within 60 days after May 15, 2002. |

| (12) | | Includes 282,187 shares subject to stock options exercisable within 60 days after May 15, 2002. |

| (13) | | Includes 2,490,777 shares subject to stock options held by officers and directors exercisable within 60 days after May 15, 2002. |

14

EXECUTIVE COMPENSATION

Compensation of Directors

The Wind River Board of Directors is comprised of seven members, five of whom are not employees of Wind River (each a “Non-Employee Director”). Each Non-Employee Director receives a quarterly retainer of $5,000 and a per-meeting fee of $1,000 for each Board meeting attended and $500 for each committee meeting attended. In accordance with Wind River policy, directors may be reimbursed for certain expenses in connection with attendance at Board and committee meetings. In addition, effective May 2001, the Non-Employee Directors are eligible to receive health benefits under Wind River’s health plans available generally to all salaried employees of Wind River.

Directors Jerry Fiddler and Thomas St. Dennis are also employees of Wind River and are not separately compensated for their service as directors. Mr. St. Dennis serves as President and Chief Executive Officer and has an employment agreement with Wind River. Mr. Fiddler, who serves as Chairman of the Board, is an at-will employee and is paid a salary determined by the Compensation Committee of the Board of Directors. As employees, Messrs. St. Dennis and Fiddler are entitled to all of the employee benefits available to and policies applicable to employees generally or to executive officers as a class. See “—Employment, Severance and Change of Control Agreements” below for a description of the employment agreement for Mr. St. Dennis and the severance and change of control arrangements applicable to Messrs. Fiddler and St. Dennis.

All Non-Employee Directors participate in Wind River’s 1995 Non-Employee Directors’ Stock Option Plan (the “Directors’ Plan”). The Directors’ Plan provides for the automatic grant of options to purchase common stock of Wind River to Non-Employee Directors. Stock options granted under the Directors’ Plan have an exercise price equal to the fair market value of the common stock on the date of grant and expire ten years from the date of grant. Under the Directors’ Plan, each person who is elected for the first time as a Non-Employee Director is automatically granted an option upon the date of his or her election to the Board, which vests in four equal annual installments. Additionally, on April 1 of each year, each person who is then a Non-Employee Director is automatically granted an option vesting in full one year from the grant date, provided the optionee had attended at least 75% of the meetings of the Board and any committees on which he or she served that were held during such period. The Directors’ Plan currently provides that the initial grants are for 24,000 shares and yearly grants for 6,000 shares. As of April 30, 2002, options to purchase 216,125 shares were outstanding under the Directors’ Plan, options to purchase 16,875 shares had been exercised, and 104,500 shares remained available for grant.

During the fiscal year ended January 31, 2002, options were granted under the Directors’ Plan covering an aggregate of 30,000 shares to Messrs. Bolger, Elmore, Inman and Pratt at an exercise price per share of $23.25. Options covering 24,000 shares were granted to Mr. Bagley at an exercise price per share of $22.52 upon his initial election as a Non-Employee Director in June 2001. All options have exercise prices equal to the fair market value of the common stock on the dates of grant.

15

Compensation of Executive Officers

Summary Compensation

The following table shows for the fiscal years ended January 31, 2002, 2001 and 2000 compensation awarded or paid to, or earned by, each person who served as Wind River’s Chief Executive Officer during the fiscal year ended January 31, 2002 and its other four most highly compensated executive officers at January 31, 2002 (the “Named Executive Officers”):

| | | Fiscal Year

| | Annual Compensation (1)

| | Long-Term Compensation Awards

| | All Other |

| | | | | Shares Underlying | |

Name and Principal Position

| | | Salary

| | Bonus (2)

| | Other (3)

| | Options (#)(4)

| | Compensation (5)

|

Thomas St. Dennis (6) President and Chief Executive Officer | | 2002 2001 2000 | | $ $ $ | 382,291 400,000 160,769 | | $ $ $ | — — 1,281,312 | | $ $ $ | — — — | | 270,000 80,000 1,100,000 | | $ $ $ | 17,742 12,327 6,905 |

|

Jerry L. Fiddler Chairman of the Board of Directors | | 2002 2001 2000 | | $ $ $ | 325,000 325,000 252,619 | | $ $ $ | — — 164,063 | | $ $ $ | — — — | | 50,000 104,376 55,000 | | $ $ $ | 7,241 5,448 3,656 |

|

Stephen A. Kennedy (7) Vice President of Worldwide Sales and Marketing | | 2002 2001 2000 | | $ $ $ | 157,977 — — | | $ $ $ | 106,020 — — | | $ $ $ | — — — | | 270,000 — — | | $ $ $ | — — — |

|

Peter J. Richards (8) Vice President of Americas Sales | | 2002 2001 2000 | | $ $ $ | 217,374 220,000 212,500 | | $ $ $ | 68,148 78,952 112,308 | | $ $ $ | — 45,859 48,079 | | 26,500 26,460 80,000 | | $ $ $ | 9,991 6,949 6,949 |

|

Marla Ann Stark (9) Vice President, General Counsel and Assistant Secretary | | 2002 2001 2000 | | $ $ $ | 249,021 250,000 78,685 | | $ $ $ | — — 32,125 | | $ $ $ | — — — | | 40,000 10,000 400,000 | | $ $ $ | 4,474 2,548 — |

| (1) | | In accordance with the rules of the SEC, the compensation described in this table does not include medical, group life insurance or other benefits received by the Named Executive Officers which are available generally to all salaried employees of Wind River, and certain perquisites and other personal benefits received by the Named Executive Officers which do not exceed the lesser of $50,000 or 10% of any such officer’s salary and bonus disclosed in this table. |

| (2) | | Includes bonuses and sales commissions earned in respective fiscal year and paid the following fiscal year pursuant to Wind River’s sales commission and management incentive bonus arrangements and its patent incentive award program. |

| (3) | | The amount shown for Mr. Richards for fiscal year 2000 includes $41,229 and $6,850 for relocation and travel expenses, respectively, for Mr. Richards and his spouse. The amount shown for Mr. Richards for fiscal year 2001 includes $39,784 and $6,075 for relocation and travel expenses, respectively, for Mr. Richards and his spouse. |

| (4) | | With the exception of the options granted to Mr. Fiddler in fiscal year 2000, all options granted have exercise prices equal to 100% of the fair market value of the common stock at the time of the grant. The options granted to Mr. Fiddler have exercise prices equal to 110% of the fair market value of the common stock at the time of the grant. |

| (5) | | Amounts represent the cash value compensation of the split-dollar life insurance policy maintained for each Named Executive Officer and the life insurance premiums paid by Wind River on behalf of each Named Executive Officer. Of the life insurance premiums paid in fiscal year 2002, the following amounts were |

16

| | reported as taxable income to each individual: Mr. St. Dennis ($1,775), Mr. Fiddler ($138), Mr. Richards ($1,030) and Ms. Stark ($700).The dollar value of the cash value compensation was determined by using the demand loan approach for the benefit provided by the whole life portion of the premium paid by Wind River for each Named Executive Officer. |

| (6) | | Mr. St. Dennis joined Wind River in September 1999. |

| (7) | | Mr. Kennedy joined Wind River in May 2001. |

| (8) | | Mr. Richards resigned from Wind River in April 2002. |

| (9) | | Ms. Stark joined Wind River in October 1999. |

Stock Option Grants and Exercises

Wind River’s Named Executive Officers are awarded stock options under the 1987 Equity Incentive Plan and 1998 Equity Incentive Plan (collectively, the “Equity Plans”). Additionally, in the case of Ms. Stark, Wind River entered into a Non-Qualified Stock Option Agreement at the time Ms. Stark was hired. The following table shows for the fiscal year ended January 31, 2002, certain information regarding options granted to the Named Executive Officers:

Option Grants in Last Fiscal Year

Name

| | Number of Shares Underlying Options Granted (1)

| | % of Total Options Granted to Employees in Fiscal Year

| | Per Share Exercise Price

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (2)

|

| | | | | | 5%

| | 10%

|

| Thomas St. Dennis | | 270,000 | | 5.47% | | $ | 14.99 | | 11/6/11 | | $ | 2,545,325 | | $ | 6,450,354 |

| Jerry L. Fiddler | | 50,000 | | 1.01% | | $ | 14.99 | | 11/6/11 | | $ | 471,357 | | $ | 1,194,510 |

| Stephen A. Kennedy | | 250,000 20,000 | | 5.07% 0.41% | | $ $ | 22.54 10.25 | | 5/13/11 9/26/11 | | $ $ | 3,543,821 128,923 | | $ $ | 8,980,739 326,717 |

| Peter J. Richards | | 26,500 | | 0.54% | | $ | 10.25 | | 9/26/11 | | $ | 170,824 | | $ | 432,900 |

| Marla Ann Stark | | 40,000 | | 0.81% | | $ | 10.25 | | 9/26/11 | | $ | 257,847 | | $ | 653,434 |

| (1) | | Options generally become exercisable as to 25% of the shares subject to the option on the first anniversary of the date of grant and thereafter at a rate of 1/48 of the shares per month. |

| (2) | | The potential realizable value is based on the term of the option at its time of grant. In accordance with rules promulgated by the Securities and Exchange Commission, it is calculated by assuming that the stock price on the date of grant appreciates at the indicated annual rate, compounded annually for the entire term of the option and that the option is exercised and sold on the last day of its term for the appreciated stock price. Unless the market price of Wind River’s common stock appreciates over the option term, no value will be realized from these option grants. There can be no assurance that the values shown in this table will be achieved. |

17

Aggregated Option Exercises in Fiscal Year 2002

and Value of Options at End of Fiscal Year 2002

The following table sets forth for each of the Named Executive Officers the number and value of shares acquired upon exercise of stock options during fiscal year 2002 and the number and value of securities underlying unexercised options held by the Named Executive Officers at January 31, 2002:

Name

| | Shares Acquired on Exercise

| | Value Realized (1)

| | Number of Securities Underlying Unexercised Options at End of Fiscal 2002

| | Value of Unexercised In-the-Money Options at End of Fiscal 2002 (2)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| Thomas St. Dennis | | — | | $ | — | | 614,165 | | 755,835 | | $ | 1,134,563 | | $ | 1,743,937 |

| Jerry L. Fiddler | | — | | $ | — | | 324,568 | | 123,683 | | $ | 987,953 | | $ | 199,723 |

| Stephen A. Kennedy | | — | | $ | — | | — | | 270,000 | | $ | — | | $ | 155,400 |

| Peter J. Richards | | 20,000 | | $ | 74,200 | | 198,574 | | 181,386 | | $ | 7,325 | | $ | 315,780 |

| Marla Ann Stark | | — | | $ | — | | 231,562 | | 218,438 | | $ | — | | $ | 310,800 |

| (1) | | Based on the fair market value of the common stock on the date of exercise less the exercise price paid for such shares and multiplied by the number of shares exercised. |

| (2) | | Calculated based on the last sale price of Wind River common stock on January 31, 2002 ($18.02) as reported on the Nasdaq National Market minus the exercise price and multiplied by the number of in-the-money shares. |

Employment, Severance and Change of Control Agreements

Other than the employment agreement with Mr. St. Dennis described below, Wind River has not entered into any employment agreement with executive officers.

Employment Agreement with Thomas St. Dennis. In September 1999, Wind River and Mr. St. Dennis entered into an employment agreement providing for the employment of Mr. St. Dennis as President and Chief Executive Officer. Under the agreement, for fiscal 2000, Mr. St. Dennis received an annualized base salary of $400,000, an annualized bonus of $800,000 for on-plan performance, as determined by the Board of Directors, and a sign-on bonus of $959,121. The agreement also provided that for subsequent fiscal years Mr. St. Dennis would receive a bonus equal to twice his base salary, as determined by the Compensation Committee of the Board of Directors each year, for on-plan performance and an additional performance bonus of up to 50% of such amount for performance exceeding plan.

In accordance with the terms of the employment agreement, in September 1999, the Board of Directors granted Mr. St. Dennis an option to purchase 1,100,000 shares of Wind River common stock, at an exercise price of $16.00. In addition, Wind River agreed to lend Mr. St. Dennis, under a secured promissory note, up to $2.4 million to purchase shares of Wind River common stock during the first six months of his employment with Wind River, secured by a pledge of personal property. See “Certain Relationships and Related Transactions—Loans to Officers” for more information about this loan.

In the event Mr. St. Dennis’ employment with Wind River is terminated other than for Cause, or if he resigns his employment with Good Reason (as each term is defined in the employment agreement), in each case other than within 12 months of a change of control (in which event Mr. St. Dennis would receive benefits under the Change in Control Incentive and Severance Benefit Plan described below), Mr. St. Dennis will provide certain consulting services for one year thereafter in exchange for compensation in an amount equal to his annual salary at the time of such termination and a pro rata share of the target on-plan bonus for the year.

Change in Control Incentive and Severance Benefit Plan. In November 1995, the Compensation Committee of the Board of Directors adopted the Change in Control Incentive and Severance Benefit Plan (the

18

“Change of Control Plan”) to provide an incentive to officers of Wind River with the title of Vice President or above in the event of certain change of control transactions, and severance benefits in the event of certain terminations of employment within 12 months of the change of control.

Upon the occurrence of a change of control, all executive officers except the Chief Executive Officer will receive acceleration of vesting for all shares subject to stock options that otherwise would have vested within one year of the date of the change of control. The Chief Executive Officer will receive two years’ worth of accelerated vesting, except to the extent that the option acceleration would create adverse tax consequences for the Chief Executive Officer and Wind River under the golden parachute provisions of sections 280G and 49999 of the Internal Revenue Code of 1986, as amended, in which case the Chief Executive Officer will have accelerated the maximum number of shares allowed under the golden parachute provisions. Jerry Fiddler, the Chairman of the Board of Directors, is an executive officer of Wind River and is covered by the Change of Control Plan.

If an executive officer other than the Chief Executive Officer is terminated without Cause or voluntarily terminates with Good Reason (as each term is defined in the Change of Control Plan), within 12 months of a change in control, the executive will receive continued compensation for 12 months (including an estimated bonus amount), continued health insurance for the same period, and accelerated vesting of stock options that otherwise would vest within one year of the date of termination. In addition, for the Chief Executive Officer, any shares that would have received acceleration of vesting on account of the change in control but did not because of the limitation to avoid the golden parachute tax provisions shall receive accelerated vesting on the termination date. If the total severance payments would cause an executive to become liable for golden parachute excise tax payments, then Wind River shall pay that executive’s excise tax liability and all other taxes associated with Wind River’s payment of the excise tax in order to leave the executive in the same after-tax position as if no excise tax had been imposed.

Vice Presidents’ Severance Benefit Plan. In May 2001, the Compensation Committee of the Board of Directors adopted the Vice Presidents’ Severance Benefit Plan (the “Severance Plan”) to provide for the payment of severance benefits to certain eligible employees whose employment with Wind River is involuntarily terminated. Eligible employees under the Severance Plan are vice president level or above; however, the Chairman of the Board of Directors and the Chief Executive Officer are not eligible under the Severance Plan. Employees who are eligible for benefits under the Change of Control Plan are not eligible under the Severance Plan, with the result that the Severance Plan shall have no eligible employees for a period of 12 months following a “Change of Control” as such term is defined in the Change of Control Plan. The Severance Plan provides that Wind River will (i) make a cash lump sum payment equal to 52 weeks of base salary and (ii) pay the first twelve months COBRA continuation coverage premium on behalf of the employee, if the employee elects COBRA continuation coverage. All other non-health benefits will terminate as of the employee’s termination date. In order to receive benefits, an employee must execute a general waiver and release, as well as a non-competition agreement. Additionally, no employee is eligible for benefits under the Severance Plan if the employee is involuntarily terminated for reasons related to job performance or if the employee voluntarily terminates his or her employment, including by resignation, retirement or failure to return from a leave of absence as scheduled.

19

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Loans to Officers

In September 1999, Wind River agreed to lend Mr. St. Dennis, its President and Chief Executive Officer, up to $2,400,000 to purchase Wind River common stock, of which Mr. St. Dennis borrowed $1,900,000. The loan bears interest at the rate of 5.98% per annum, and has a nine-year term. The loan may be accelerated if certain events of default occur, including termination of Mr. St. Dennis’ employment with Wind River. As of April 30, 2002, principal and interest outstanding under the loan totaled $1,920,367.

In April 1999, Wind River loaned Mr. Richards, its Vice President of Americas Sales, $145,000 to purchase real property. The loan, which bore interest at the rate of 7% per annum, had a five-year term and was secured by personal property, was repaid in full in July 2001. In addition, in October 2000, Wind River loaned Mr. Richards $100,000 for relocation expenses. The loan, which bore interest at the rate of 7% per annum and had a term of 15 months, was repaid in full in January 2002.

The Board of Directors considers loans to executive officers on a case-by-case basis and may approve loans to executive officers in the future.

Indemnification and Limitation of Director and Officer Liability

Wind River has entered into indemnity agreements with certain officers and directors which provide, among other things, that Wind River will indemnify such officer or director, under the circumstances and to the extent provided for therein, for expenses, damages, judgments, fines and settlements he may be required to pay in actions or proceedings which he is or may be made a party by reason of his position as a director, officer or other agent of Wind River, and otherwise to the full extent permitted under Delaware law and Wind River’s Amended and Restated Bylaws.

20

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

ON EXECUTIVE COMPENSATION

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of Wind River under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language contained in such filing.

The Board of Directors has delegated to the Compensation Committee of the Board of Directors (the “Committee”) the authority to establish and maintain the compensation programs for all employees, including executives. The Committee evaluates performance and determines compensation policies and levels for Wind River’s executive officers. The Committee is presently comprised of three Non-Employee Directors, none of whom has any interlocking or other type of relationship that would call into question his independence as a Committee member.

The objectives of Wind River’s executive compensation policies are to attract, retain and reward executive officers who contribute to Wind River’s success, to align the financial interests of executive officers with the performance of Wind River, to strengthen the relationship between executive pay and stockholder value, to motivate executive officers to achieve Wind River’s business objectives and to reward individual performance. In carrying out these objectives, the Committee considers the level of compensation paid to executive officers in positions of companies similarly situated in size and products, the individual performance of each executive officer, corporate performance, and the responsibility and authority of each position relative to other positions within Wind River.

Executive compensation consists of base salary, cash awards under the management incentive bonus program and stock options. The Committee, working with an outside compensation consultant, has targeted executive officers’ base salaries and cash bonuses at the 50th percentile of companies in comparable industries with revenues of similar size and has targeted equity awards at the 60th percentile. The companies used for comparison purposes may, but need not be, included in the Nasdaq Computer and Data Processing Stocks Index. Each of these components is discussed in turn below.

Base Salary

In establishing base salaries for executive officers, the Committee considers the individual executive’s performance, level of responsibility, and comparative data as described above. Salaries for executives are reviewed on an annual basis using a subjective analysis of the executive’s individual performance, Wind River’s financial performance and changes in salary levels at comparable companies. In fiscal 2002, the base salary of all Wind River executive officers was reduced by 10% as part of the cost-cutting measures adopted by Wind River during the second fiscal quarter.

Management Incentive Program

The management incentive bonus program is designed to motivate Wind River’s executive officers by awarding cash bonuses based upon achievement of corporate performance targets. At the beginning of the fiscal year, corporate performance targets for Wind River are established, and the Committee sets a target bonus, as a percentage of base salary, for each executive. The determination of awards at the end of the fiscal year is based upon the extent to which the corporate performance targets are satisfied. The amount and nature of such targets may vary from year to year. No bonuses were paid under the management incentive program during fiscal 2002.

Stock Options

The Equity Plans were established to provide executive officers with an opportunity to share, along with the stockholders of Wind River, in Wind River’s long-term performance. Stock options generally have a four-year

21

vesting schedule and generally expire ten years from the date of grant. Certain stock options vest in accordance with corporate performance criteria established from time to time by the Committee. The exercise price of stock options is typically 100% of fair market value of the underlying stock on the date of grant. The Committee considers, periodically, the grant of stock-based compensation to all executive officers. Such grants are made on the basis of a subjective analysis of individual performance, Wind River’s financial performance, and the number of shares subject to the executive’s existing options, as well as whether the executive’s existing options are in-the-money or underwater.

Section 162(m) of the Code limits Wind River to a deduction for federal income tax purposes of no more than $1 million paid to certain Named Executive Officers in a taxable year. Compensation above $1 million may be deducted if it is “performance-based compensation” within the meaning of the Code. The Committee has determined that stock options granted under the Equity Plans with exercise prices at least equal to the fair market value of Wind River’s common stock on the date of grant shall be treated as “performance-based compensation.”

Chief Executive Officer Compensation

The base salary established for Mr. St. Dennis for fiscal year 2002 was determined based upon reference to external competitive pay practices, the above described compensation approach to executive officers and a subjective assessment by the Committee of Mr. St. Dennis’ performance. In addition, as a result of Wind River’s performance during fiscal year 2002, Mr. St. Dennis did not receive a bonus for fiscal year 2002. However, in recognition of Mr. St. Dennis’ individual performance during difficult economic times, the Board of Directors granted Mr. St. Dennis an option to purchase 270,000 shares of common stock in November 2001.

COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

James W. Bagley

William B. Elmore

Grant M. Inman

22

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of Wind River under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language contained in such filing.

Management is responsible for Wind River’s internal controls and financial reporting process. PricewaterhouseCoopers LLP is responsible for performing an independent audit of Wind River’s consolidated financial statements in accordance with auditing standards generally accepted in the United States and to issue a report on those financial statements. The Audit Committee is responsible for monitoring and overseeing these activities.

In this context, the Audit Committee reviewed and discussed with management and PricewaterhouseCoopers LLP the audited consolidated financial statements of Wind River for the fiscal year ended January 31, 2002. The Audit Committee has discussed with PricewaterhouseCoopers LLP the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

The Audit Committee has also received and reviewed the written disclosures and the letter from PricewaterhouseCoopers LLP required by Independence Standards Board Standard No. 1 (Independence Discussion with Audit Committees) and the Audit Committee has discussed the independence of PricewaterhouseCoopers LLP with that firm.

Based on the Audit Committee’s review and discussions described above, the Audit Committee recommended to the Board that Wind River’s audited consolidated financial statements for the fiscal year ended January 31, 2002 be included in Wind River’s Annual Report on Form 10-K for the fiscal year ended January 31, 2002 for filing with the Securities and Exchange Commission. The Audit Committee and the Board have also selected, subject to stockholder ratification, PricewaterhouseCoopers LLP as Wind River’s independent accountants for the fiscal year ending January 31, 2003.

AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

James W. Bagley

John C. Bolger

Grant M. Inman

23

PERFORMANCE MEASUREMENT COMPARISON*

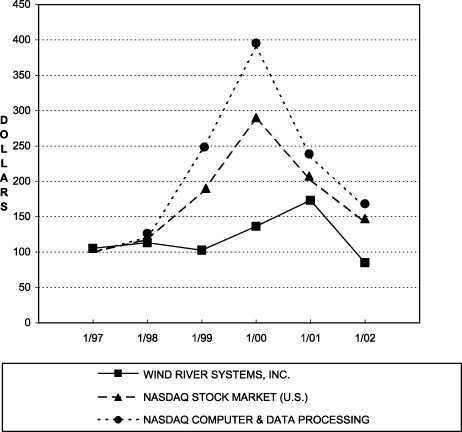

The following graph shows a comparison of cumulative returns for Wind River’s common stock, the Nasdaq Stock Market (United States companies) and the Nasdaq Computer and Data Processing Stocks Index on January 31, 1997, and at the end of fiscal years 1998 through 2002. The graph assumes an investment of $100 in each of Wind River’s common stock, Nasdaq Stock Market (United States companies) and Nasdaq Computer and Data Processing Stocks Index and that all dividends were reinvested.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN**

AMONG WIND RIVER SYSTEMS, INC.,

THE NASDAQ STOCK MARKET (U.S.) INDEX AND

THE NASDAQ COMPUTER & DATA PROCESSING INDEX

| | ** | | $100 invested on 1/31/97 in stock or index, including reinvestment of dividends. Fiscal year ending January 31. |

| * | | The material in this section is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of Wind River under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language contained in such filing. |

24

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires Wind River’s directors and executive officers, and persons who own more than ten percent of a registered class of Wind River’s equity securities, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of common stock and other equity securities of Wind River. Officers, directors and greater than ten percent stockholders are required by Securities and Exchange Commission regulation to furnish Wind River with copies of all Section 16(a) forms they file.

To Wind River’s knowledge, based solely on a review of the copies of such reports furnished to Wind River, during the fiscal year ended January 31, 2002, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were complied with.

OTHER MATTERS

The Board of Directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance with their best judgment.

By Order of the Board of Directors,

Michael W. Zellner

Secretary

Alameda, California

May 30, 2002

25

Appendix A

WIND RIVER SYSTEMS, INC.

AMENDED AND RESTATED

EMPLOYEE STOCK PURCHASE PLAN