Exhibit 99.1

Presentation Materials for Investors May 2018

2 Disclaimer • This presentation includes certain “forward - looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. • These statements are based on current expectations and currently available information. • Actual results may differ materially from these expectations due to certain risks, uncertainties and other important factors, including the risk factors set forth in the most recent annual and periodic reports of Toyota Motor Corporation and Toyota Motor Credit Corporation. • We do not undertake to update the forward - looking statements to reflect actual results or changes in the factors affecting the forward - looking statements. • This presentation does not constitute an offer to sell or a solicitation of an offer to purchase any securities. Any offer or sale of securities will be made only by means of a prospectus and related documentation. • Investors and others should note that we announce material financial information using the investor relations section of our corporate website ( http://www.toyotafinancial.com ) and SEC filings. We use these channels, press releases, as well as social media to communicate with our investors, customers and the general public about our company, our services and other issues. While not all of the information that we post on social media is of a material nature, some information could be material. Therefore, we encourage investors, the media, and others interested in our company to review the information we post on the Toyota Motor Credit Corporation Twitter Feed ( http://www.twitter.com/toyotafinancial ). We may update our social media channels from time to time on the investor relations section of our corporate website . 2

3 Disclaimer • This presentation includes certain “forward - looking statements” within the meaning of The U.S. Private Securities Litigation Ref orm Act of 1995. • These statements are based on current expectations and currently available information. • Actual results may differ materially from these expectations due to certain risks, uncertainties and other important factors, including the risk factors set forth in the most recent annual and periodic reports of Toyota Motor Corporation and Toyota Mo tor Credit Corporation (“TMCC”). • We do not undertake to update the forward - looking statements to reflect actual results or changes in the factors affecting the forward - looking statements. • This presentation does not constitute or form part of and should not be construed as, an offer to sell or issue or the solici tat ion of an offer to purchase or subscribe for securities of TMCC in any jurisdiction or an inducement to enter into investment activi ty in any jurisdiction. Neither this presentation nor any part thereof, nor the fact of its distribution, shall form the basis of, or b e r elied on in connection with, any contract or commitment or investment decision whatsoever. Any offer or sale of securities by TMCC will be made only by means of a prospectus and related documentation. • Investors and prospective investors in securities of TMCC are required to make their own independent investigation and apprai sal of the business and financial condition of TMCC and the nature of its securities. This presentation does not constitute a recommendation regarding securities of TMCC. Any prospective purchaser of securities in TMCC is recommended to seek its own independent financial advice. • This presentation is made to and directed only at ( i ) persons outside the United Kingdom, or (ii) qualified investors or investment professionals falling within Article 19(5) and Article 49(2)(a) to (d) of the Financial Services and Markets Act 2000 (Financ ial Promotion) Order 2005 (the “Order”), or (iii) high net worth individuals, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order, and (iv) persons who are “qualified investors” within the mea ning of Article 2(1)(e) of the Prospectus Directive (Directive 2003/71/EC) as amended (such persons collectively being referred to as “Relevant Persons”). This presentation must not be acted or relied on by persons who are not Relevant Persons. Any investment or investment activity to which this presentation relates is available only to Relevant Persons and will be engaged in only with Relevant Persons. • This presentation is an advertisement and not a prospectus and investors should not subscribe for or purchase any securities of TMCC referred to in this presentation or otherwise except on the basis of information in the base prospectus of Toyota Motor Finance (Netherlands) B.V., Toyota Credit Canada Inc., Toyota Finance Australia Limited and Toyota Motor Credit Corporation dated 8 September 2017 as supplemented from time to time together with the applicable final terms which are or will be, as applicable, available on the website of the London Stock Exchange plc at www.londonstockexchange.com/exchange/news/market - news/market - news - home.html. • Investors and others should note that we announce material financial information using the investor relations section of our corporate website ( http://www.toyotafinancial.com ) and SEC filings. We use these channels, press releases, as well as social media to communicate with our investors, customers and the general public about our company, our services and other issues. While not all of the information that we post on social media is of a material nature, some information could be material. Therefore, we encourage investors, the media, and others interested in our company to review the information we post on the Toyota Motor Credit Corporation Twitter Feed ( http://www.twitter.com/toyotafinancial ). We may update our social media channels from time to time on the investor relations section of our corporate website .

Toyota ’ s Global Businesses Markets vehicles in over 170 countries/regions. 51 overseas manufacturing companies in 28 countries/regions . OTHER BUSINESSES AUTOMOTIVE Design, Manufacturing, Distribution Consumer Financing Dealer Support & Financing Banking Securities Services Ancillary Products & Services Housing Marine Telecommunications e - Business Intelligent Transport Services Biotechnology & Afforestation 4

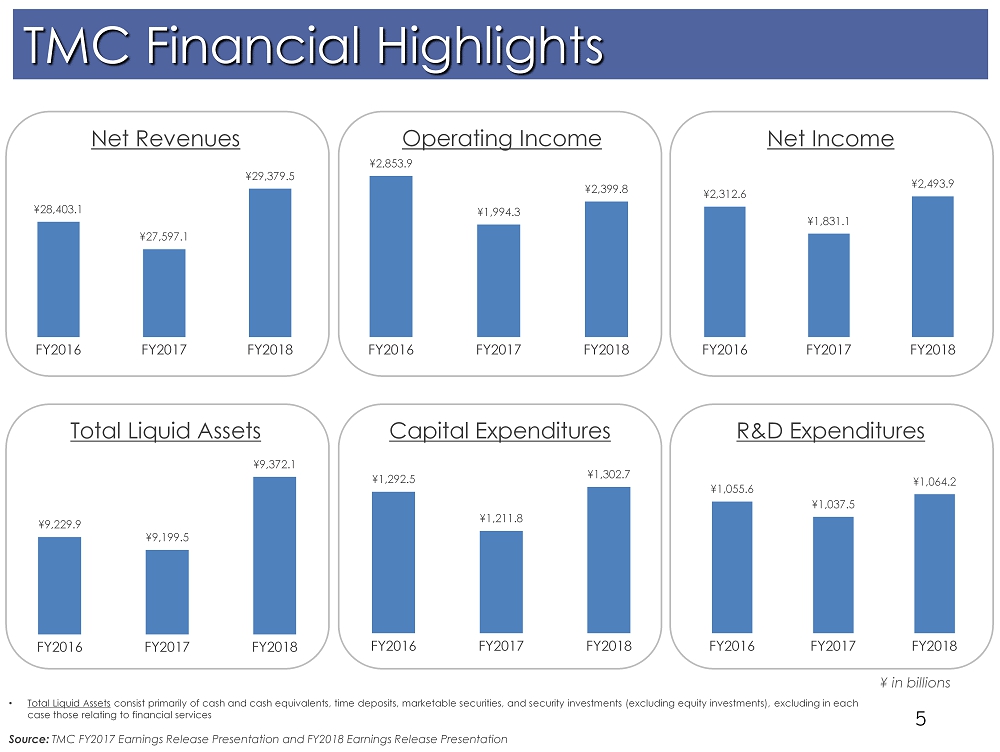

5 TMC Financial Highlights Net Revenues Operating Income Net Income Total Liquid Assets Capital Expenditures R&D Expenditures ¥ in billions • Total Liquid Assets consist primarily of cash and cash equivalents, time deposits, marketable securities, and security investments (excluding equ ity investments), excluding in each case those relating to financial services Source : TMC FY2017 Earnings Release Presentation and FY2018 Earnings Release Presentation ¥28,403.1 ¥27,597.1 ¥29,379.5 FY2016 FY2017 FY2018 ¥2,853.9 ¥1,994.3 ¥2,399.8 FY2016 FY2017 FY2018 ¥2,312.6 ¥1,831.1 ¥2,493.9 FY2016 FY2017 FY2018 ¥9,229.9 ¥9,199.5 ¥9,372.1 FY2016 FY2017 FY2018 ¥1,292.5 ¥1,211.8 ¥1,302.7 FY2016 FY2017 FY2018 ¥1,055.6 ¥1,037.5 ¥1,064.2 FY2016 FY2017 FY2018

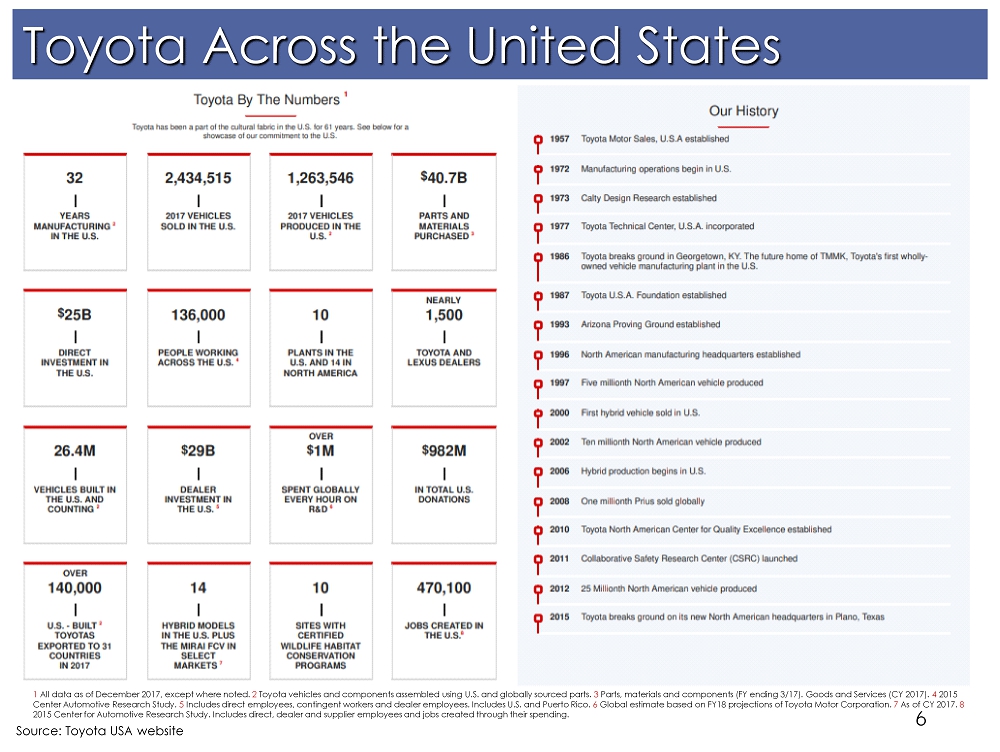

Toyota Across the United States 6 Source: Toyota USA website 1 All data as of December 2017, except where noted. 2 Toyota vehicles and components assembled using U.S. and globally sourced parts. 3 Parts , materials and components (FY ending 3/17). Goods and Services (CY 2017). 4 2015 Center Automotive Research Study. 5 Includes direct employees, contingent workers and dealer employees. Includes U.S. and Puerto Rico. 6 Global estimate based on FY18 projections of Toyota Motor Corporation. 7 As of CY 2017. 8 2015 Center for Automotive Research Study. Includes direct, dealer and supplier employees and jobs created through their spending.

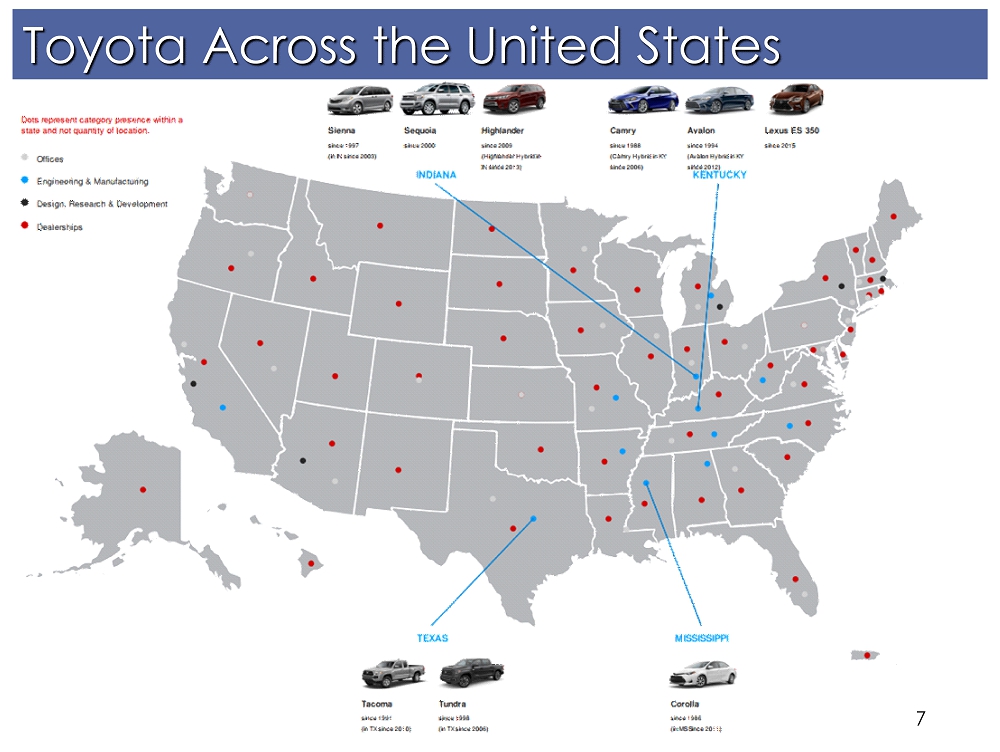

Toyota Across the United States 7

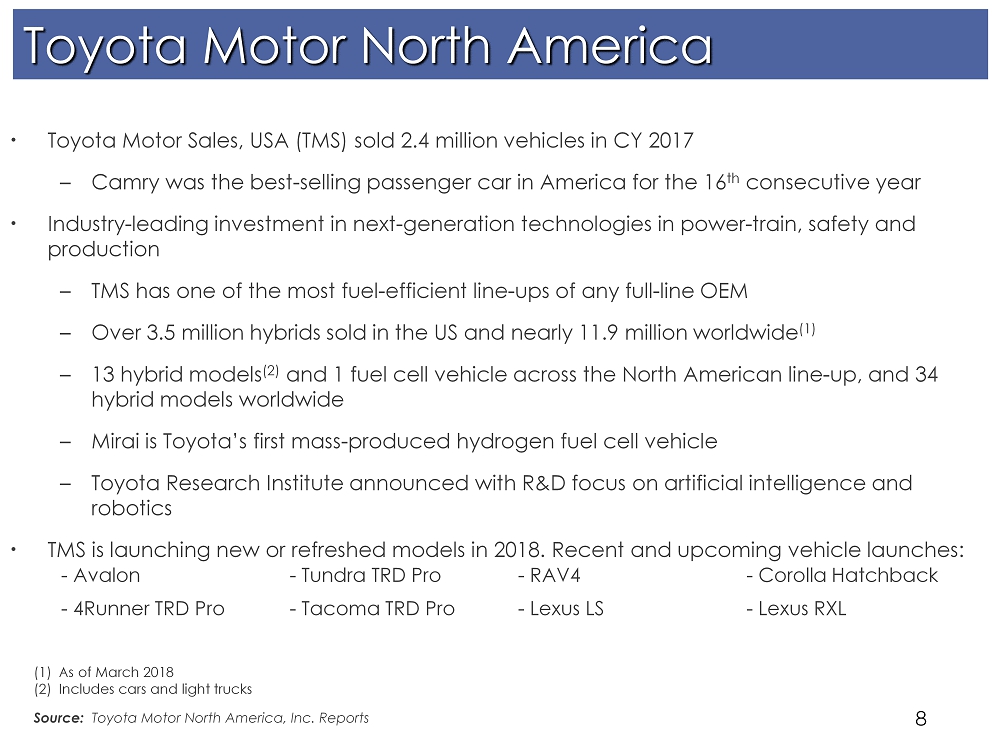

8 • Toyota Motor Sales, USA (TMS) sold 2.4 million vehicles in CY 2017 – Camry was the best - selling passenger car in America for the 16 th consecutive year • Industry - leading investment in next - generation technologies in power - train, safety and production – TMS has one of the most fuel - efficient line - ups of any full - line OEM – Over 3.5 million hybrids sold in the US and nearly 11.9 million worldwide (1) – 13 hybrid models (2) and 1 fuel cell vehicle across the North American line - up, and 34 hybrid models worldwide – Mirai is Toyota’s first mass - produced hydrogen fuel cell vehicle – Toyota Research Institute announced with R&D focus on artificial intelligence and robotics • TMS is launching new or refreshed models in 2018. Recent and upcoming vehicle launches: Toyota Motor North America Source: Toyota Motor North America, Inc. Reports (1) As of March 2018 (2) Includes cars and light trucks - Avalon - Tundra TRD Pro - RAV4 - Corolla Hatchback - 4Runner TRD Pro - Tacoma TRD Pro - Lexus LS - Lexus RXL

9 Toyota Motor North America (2) Quality, dependability , safety and product appeal remain high as reflected by numerous 3 rd party accolades 2018 Kelley Blue Book Best Resale Value Toyota No. 1 Brand Winner (3 out of top 5 Best Resale Values for 2017) 2017 Kelley Blue Book Best Electric/Hybrid Buy of 2017 2017 Toyota Prius Prime 2018 IIHS Top Safety Pick+ Awards 2018 Toyota Camry 10 Toyota and Lexus models Top Safety Pick 2018 J.D. Power and Associates Vehicle Dependability Survey Lexus ranked No. 1 overall 2018 Fortune Toyota ranked one of the “World’s Most Admired Companies” and named the No. 1 Motor Vehicle company (4 th year running) 2017 NY International Auto Show Prius Prime received the World Green Car Award (Toyota held the title for a second year, with the 2016 award going to the Mirai) 2017 J.D. Power IQS 13 Toyota/Lexus/Scion models Rank “Top Three” in their segments 2017 U.S. News Best Car for the Money 2017 Toyota Prius 2017 Forbes Toyota ranked No. 1 most valuable automotive brand 2017 Consumer Reports Lexus & Toyota No. 1 brands 2016 NHTSA 5 - Star Overall Safety 10 Toyota/Lexus/Scion models 2016 Kelley Blue Book Best Resale Value for Luxury Brand Lexus (5 th year running)

10 Toyota Motor North America (3) Camry RAV4 Corolla Hatch ES UX LS

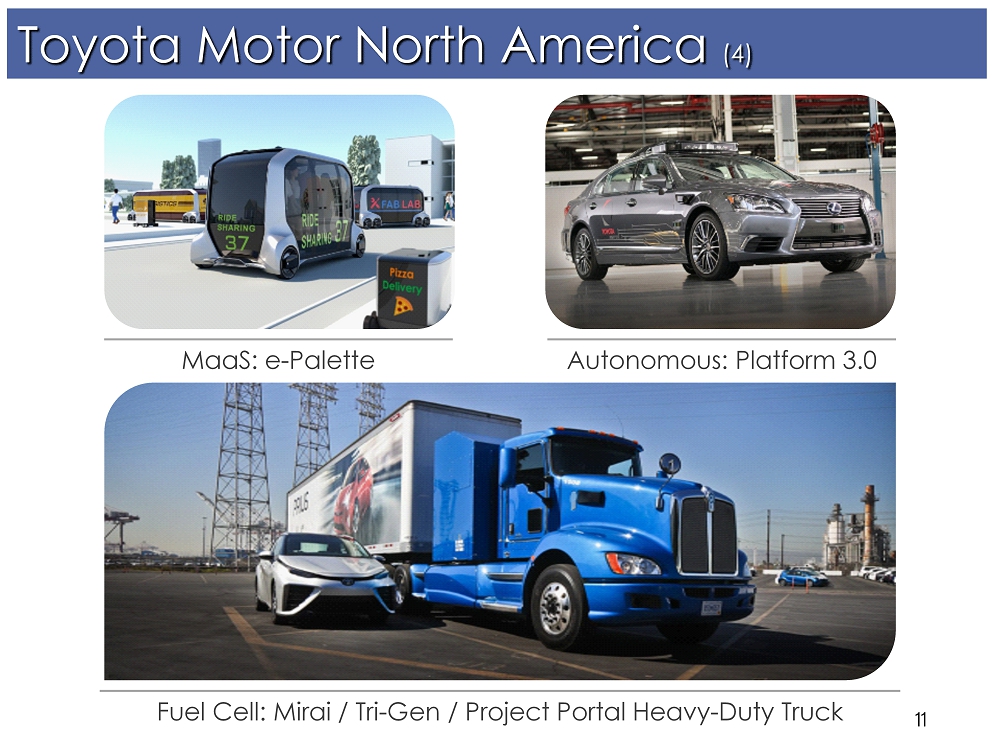

11 Toyota Motor North America (4) MaaS : e - Palette Autonomous: Platform 3.0 Fuel Cell: Mirai / Tri - Gen / Project Portal Heavy - Duty Truck

12 Toyota Financial Services

13 TFS Group Global Presence

14 • Over 4.6 million active finance contracts (1) • AA - (2) /Aa3 (2) rated captive finance company by S&P/Moody’s • Credit support agreement structure with TFSC/TMC (3) Toyota Financial Services Corporation (TFSC) Toyota Motor Credit Corporation (TMCC) Toyota Motor Credit Corporation (TMCC) Toyota Motor Corporation (TMC) (1) As of March 2018. Source : Company Reports (2) Outlook stable (3) The Credit Support Agreements do not apply to securitization transactions

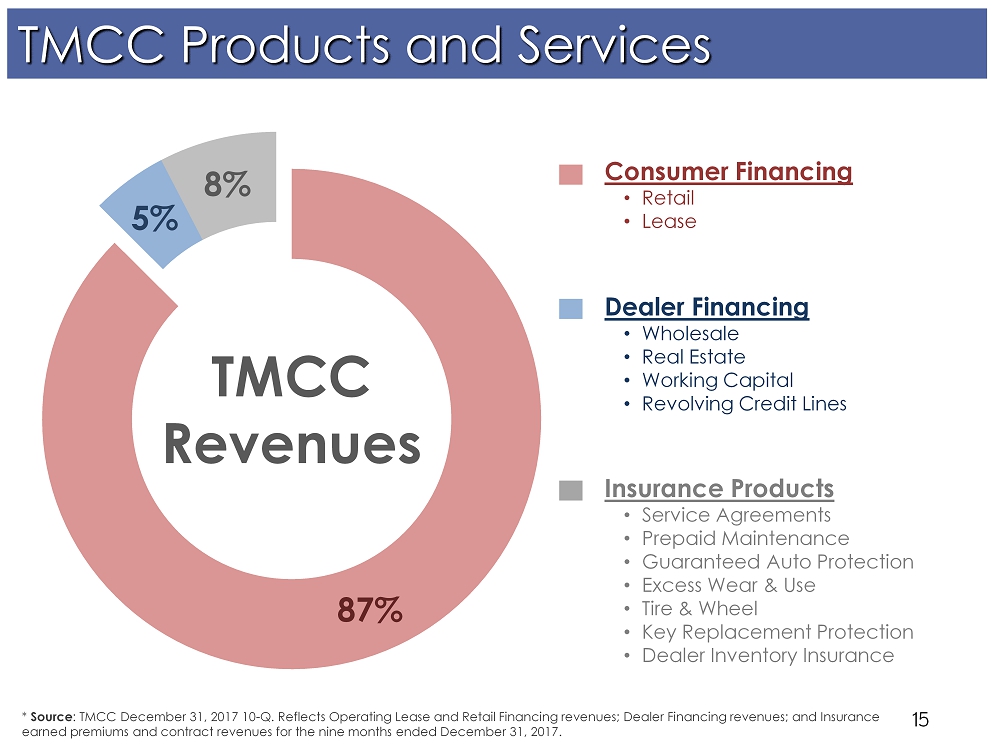

87% 5% 8% TMCC Revenues 15 TMCC Products and Services Consumer Financing • Retail • Lease Dealer Financing • Wholesale • Real Estate • Working Capital • Revolving Credit Lines Insurance Products • Service Agreements • Prepaid Maintenance • Guaranteed Auto Protection • Excess Wear & Use • Tire & Wheel • Key Replacement Protection • Dealer Inventory Insurance * Source : TMCC December 31, 2017 10 - Q. Reflects Operating Lease and Retail Financing revenues; Dealer Financing revenues; and Insurance earned premiums and contract revenues for the nine months ended December 31, 2017.

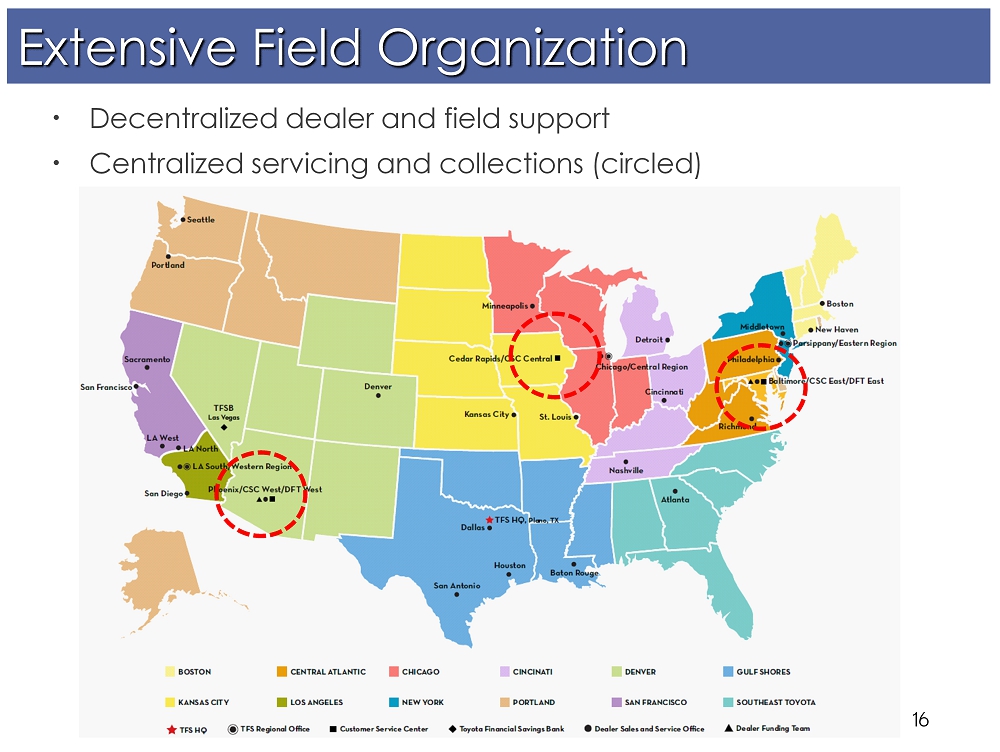

16 Extensive Field Organization • Decentralized dealer and field support • Centralized servicing and collections (circled)

24.9 30.2 34.0 33.2 33.4 0.2 1.2 2.5 4.9 5.5 39.6 38.4 35.7 37.8 39.9 9.5 11.5 14.1 12.9 12.1 15.8 15.6 15.8 17.8 17.0 $90.0 $96.9 $102.1 $106.6 $107.9 Mar - 14 Mar - 15 Mar - 16 Mar - 17 Dec - 17 Lease Sold Lease Retail Sold Retail Wholesale & Other 17 TMCC Earning Asset Composition Source: TMCC March 31, 2015 10 - K, March 31, 2016 10 - K, March 31, 2017 10 - K & December 31, 2017 10 - Q Managed Assets (USD Billions)

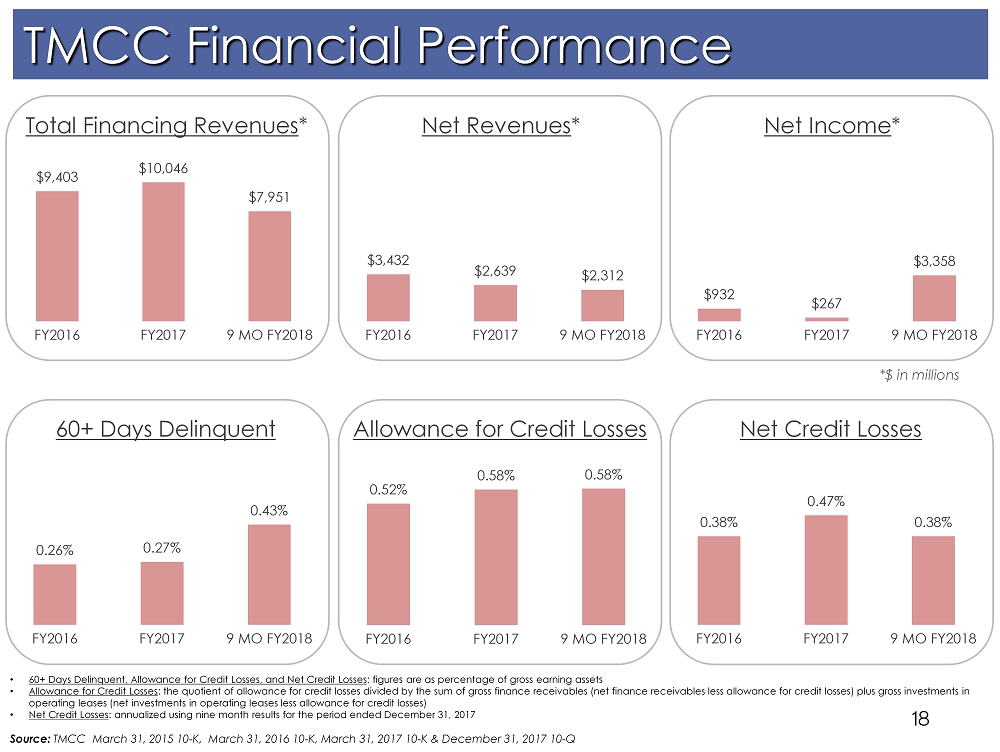

0.38% 0.47% 0.38% FY2016 FY2017 9 MO FY2018 0.52% 0.58% 0.58% FY2016 FY2017 9 MO FY2018 0.26% 0.27% 0.43% FY2016 FY2017 9 MO FY2018 $932 $267 $3,358 FY2016 FY2017 9 MO FY2018 $3,432 $2,639 $2,312 FY2016 FY2017 9 MO FY2018 $9,403 $10,046 $7,951 FY2016 FY2017 9 MO FY2018 18 TMCC Financial Performance Total Financing Revenues * Net Revenues * Net Income * 60+ Days Delinquent Allowance for Credit Losses Net Credit Losses • 60+ Days Delinquent, Allowance for Credit Losses, and Net Credit Losses : figures are as percentage of gross earning assets • Allowance for Credit Losses : the quotient of allowance for credit losses divided by the sum of gross finance receivables (net finance receivables less allowan ce for credit losses) plus gross investments in operating leases (net investments in operating leases less allowance for credit losses ) • Net Credit Losses : annualized using nine month results for the period ended December 31, 2017 Source : TMCC March 31, 2015 10 - K, March 31, 2016 10 - K, March 31, 2017 10 - K & December 31, 2017 10 - Q *$ in millions

19 TMCC Funding Programs

20 • TMCC is committed to: – Maintaining funding diversity and exceptional liquidity – Issuing into strong demand with attractive deals – Identifying & developing new markets and investor relationships – Responding quickly to opportunities with best - in - class execution – Managing our business and stakeholder relationships with a long - term view TMCC Funding Program Objectives

Commercial Paper Programs Highlights • A - 1+/P - 1 Direct Commercial Paper Programs – 5 distinct USD commercial paper programs (TMCC, TCPR, TCCI, TFA, and TMFNL) – $15.0 billion multi - party committed credit facilities – $5.5 billion bilateral committed credit facilities – $27.0 billion USCP combined average outstanding for TMCC and TCPR* – Over 700 diverse institutional investors • State and local municipalities • Large corporations • Pension and retirement funds • Financial institutions • Money managers and mutual fund companies – Rates are posted daily on Bloomberg DOCP screen * For the quarter ended December 31, 2017 Source : TMCC December 31, 2017 10 - Q and Company Reports 21

Innovative Funding Platforms 22 Diversity and Inclusion (D&I) Bonds • Four issuances to date totaling $2.25B • $1.25B offering in April 2016 set record for largest corporate D&I bond • Delivers Tier 2 & Tier 3 investor diversification Green Bonds • Proceeds exclusively finance loans and leases for new hybrid and alternative - fuel Toyota and Lexus vehicles • Auto industry’s first ever green ABS - Three offerings ($4.6B) to date • TMCC’s first unsecured Euro green bond in November 2017 ( € 600mm) November 2017 Toyota Motor Credit Corporation € 600mn 0.00% Green Notes due 2021 € 600mn 0.625% Notes due 2024

23 TMCC FYTD Funding Overview $20.3B Term Debt Funded FY2018* ABS 38% Global 31% MTN 9% EMTN 7% Uridashi 10% Structured 5% * Percentages may not add to 100% due to rounding **Net of retained Source: Company Reports $12.5B Unsecured $4.8B Public ABS ** $3.0B Private ABS **

Other, 687 GBP, 1,087 AUD, 3,572 EUR, 7,918 USD, 56,318 24 Diversification in Debt Offerings TMCC Long Term Debt Outstanding (USD millions) Source: Company Reports as of 31 March 2018 By Deal Type By Currency Global MTN, $29,600 ABS, $13,657 Other, $11,185 EMTN, $9,275 MTN, $5,864

39% 45% 27% 53% 20% 15% 4% 3% 2% 5% 5% 7% 12% 11% 9% 20% 14% 12% 14% 28% 37% 22% 22% 27% 26% 21% 22% 29% 13% 5% 4% 6% 6% 7% 6% FY13 FY14 FY15 FY16 FY17 FY18 1yr 18mth 2yr 3yr 5yr 7yr 10yr 25 Funding Flexibility And Responsiveness Source: Company Reports as of 31 March 2018 Diversification Across USD Curve (1) (1) Unsecured U.S. MTN issuance, excluding Structured Notes and Retail Notes Percentages may not add to 100% due to rounding

26 Key Investment Highlights • Financial strength supported by strong credit ratings • Transparent business model with exceptional liquidity • Rational funding programs with long - term perspective – Diversification in bond offerings – Focus on proactively meeting needs of market – Strong emphasis placed on flexibility and responsiveness • Industry - leading in: – Liquidity management framework – Balance sheet strength – Business model resiliency

27 TMCC Retail Loan Collateral & ABS Transactions

28 Credit Decisioning & Collections 28 Disciplined Underwriting Consistent and conservative underwriting standards designed to limit credit losses • Key mission is to support Toyota and Lexus brand and vehicle sales • Continued focus on prime originations • Proprietary credit scores that leverage TMCC’s extensive origination history • Regular statistical validations of predictive power Servicing Optimization Optimization of collections strategy and staff supports loss mitigation while enabling portfolio growth • Emphasis on early intervention • Reinforcement of strong compliance management system • Focus on analytics and technology to prioritize high risk accounts and manage loss severities

Origination Characteristics APR Distribution 29 29 Weighted Average FICO Weighted Average Original Term New vs. Used Source: Company Reports as of 31 December 2017 51% 51% 46% 46% 42% 20% 19% 20% 24% 25% 29% 30% 34% 30% 32% CY2013 2014 2015 2016 2017 <2.0% 2.0%-3.99% >=4.0% 727 726 720 726 734 CY2013 2014 2015 2016 2017 63 64 65 66 69 CY2013 2014 2015 2016 2017 76% 76% 75% 74% 77% 24% 24% 25% 26% 23% CY2013 2014 2015 2016 2017 New Used

3.18 3.16 3.21 3.22 3.16 3.12 3.19 3.09 3.05 17 16 15 14 13 12 11 10 FY09 $51 $50 $50 $49 $47 $45 $45 $43 $43 17 16 15 14 13 12 11 10 FY09 Receivables Principal Balance ($B) Retail Managed Portfolio Performance 30 30 Contracts Outstanding (#mm) Performance by Principal Balance Outstanding Performance by Contracts Outstanding Source: Company Reports as of 31 December 2017 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 17 16 15 14 13 12 11 10 FY09 % 60+ DPD Gross Charge Offs Net Losses 0.63% Dec 2016 0.68% Dec 2017 0.77% Dec 2016 0.66% Dec 2017 0.66% Dec 2016 0.56% Dec 2017 $51B Dec 2016 $52B Dec 2017 3.19mm Dec 2016 3.16mm Dec 2017 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 17 16 15 14 13 12 11 10 FY09 % 60+ DPD % Repossessed 0.68% Dec 2016 0.75% Dec 2017 1.48% Dec 2016 1.16% Dec 2017

Source: Company Reports 31 31 Cumulative Net Losses by Vintage 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 1 5 9 13 17 21 25 29 33 37 41 45 49 53 57 61 65 69 73 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

ABS Deal Characteristics Average FICO 32 Average Principal Balance ($ 000s) Original and Remaining Term (months) Receivables by Vehicle Type (%) Source: Company Reports as of April 2018 748 761 2010 - A 2011 - B 2013 - B 2015 - A 2016 - B 2017 - B 2018 - B $0 $5 $10 $15 $20 2010 - A 2011 - B 2013 - B 2015 - A 2016 - B 2017 - B 2018 - B 62 61 66 40 46 51 2010 - A 2011 - B 2013 - B 2015 - A 2016 - B 2017 - B 2018 - B Original Term Remaining Term Seasoning 59% 49% 41% 52% 2010 - A 2011 - B 2013 - B 2015 - A 2016 - B 2017 - B 2018 - B Trucks and SUVs Sedans and Vans

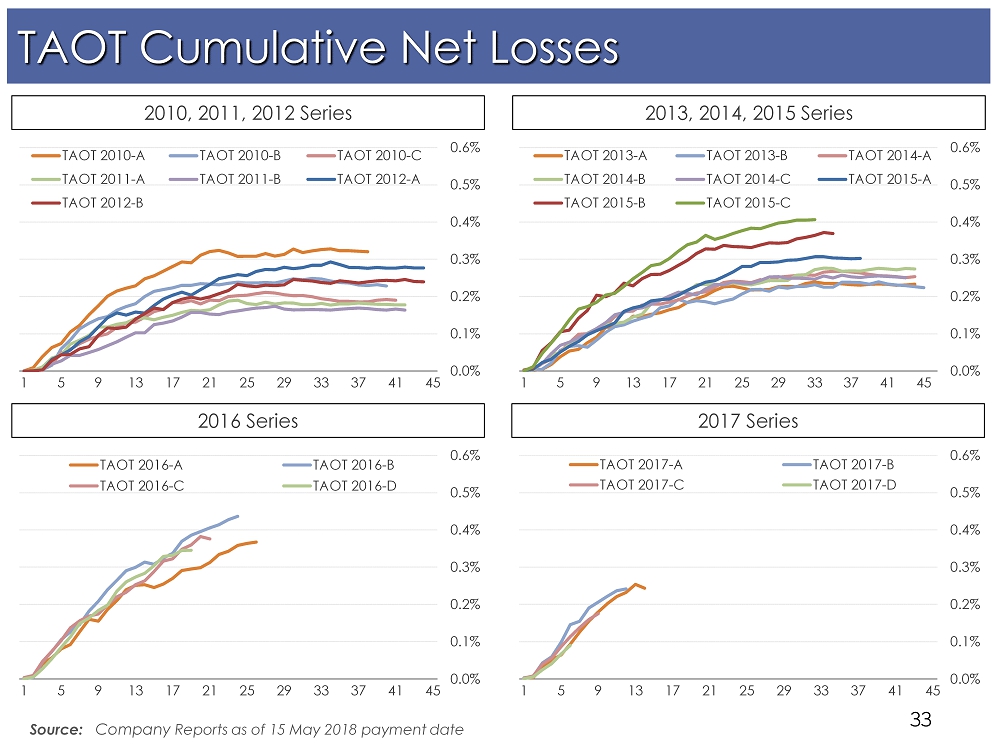

TAOT Cumulative Net Losses 33 33 Source : Company Reports as of 15 May 2018 payment date 2010, 2011, 2012 Series 2013, 2014, 2015 Series 2017 Series 2016 Series 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 1 5 9 13 17 21 25 29 33 37 41 45 TAOT 2010-A TAOT 2010-B TAOT 2010-C TAOT 2011-A TAOT 2011-B TAOT 2012-A TAOT 2012-B 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 1 5 9 13 17 21 25 29 33 37 41 45 TAOT 2013-A TAOT 2013-B TAOT 2014-A TAOT 2014-B TAOT 2014-C TAOT 2015-A TAOT 2015-B TAOT 2015-C 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 1 5 9 13 17 21 25 29 33 37 41 45 TAOT 2016-A TAOT 2016-B TAOT 2016-C TAOT 2016-D 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 1 5 9 13 17 21 25 29 33 37 41 45 TAOT 2017-A TAOT 2017-B TAOT 2017-C TAOT 2017-D