EXHIBIT 99.1

Presentation Materials for Investors June 2018

2 Disclaimer • This presentation includes certain “forward - looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. • These statements are based on current expectations and currently available information. • Actual results may differ materially from these expectations due to certain risks, uncertainties and other important factors, including the risk factors set forth in the most recent annual and periodic reports of Toyota Motor Corporation and Toyota Motor Credit Corporation. • We do not undertake to update the forward - looking statements to reflect actual results or changes in the factors affecting the forward - looking statements. • This presentation does not constitute an offer to sell or a solicitation of an offer to purchase any securities. Any offer or sale of securities will be made only by means of a prospectus and related documentation. • Investors and others should note that we announce material financial information using the investor relations section of our corporate website ( http://www.toyotafinancial.com ) and SEC filings. We use these channels, press releases, as well as social media to communicate with our investors, customers and the general public about our company, our services and other issues. While not all of the information that we post on social media is of a material nature, some information could be material. Therefore, we encourage investors, the media, and others interested in our company to review the information we post on the Toyota Motor Credit Corporation Twitter Feed ( http://www.twitter.com/toyotafinancial ). We may update our social media channels from time to time on the investor relations section of our corporate website .

3 Disclaimer • This presentation includes certain “forward - looking statements” within the meaning of The U.S. Private Securities Litigation Ref orm Act of 1995. • These statements are based on current expectations and currently available information. • Actual results may differ materially from these expectations due to certain risks, uncertainties and other important factors, including the risk factors set forth in the most recent annual and periodic reports of Toyota Motor Corporation and Toyota Mo tor Credit Corporation (“TMCC”). • We do not undertake to update the forward - looking statements to reflect actual results or changes in the factors affecting the forward - looking statements. • This presentation does not constitute or form part of and should not be construed as, an offer to sell or issue or the solici tat ion of an offer to purchase or subscribe for securities of TMCC in any jurisdiction or an inducement to enter into investment activi ty in any jurisdiction. Neither this presentation nor any part thereof, nor the fact of its distribution, shall form the basis of, or b e r elied on in connection with, any contract or commitment or investment decision whatsoever. Any offer or sale of securities by TMCC will be made only by means of a prospectus and related documentation. • Investors and prospective investors in securities of TMCC are required to make their own independent investigation and apprai sal of the business and financial condition of TMCC and the nature of its securities. This presentation does not constitute a recommendation regarding securities of TMCC. Any prospective purchaser of securities in TMCC is recommended to seek its own independent financial advice. • This presentation is made to and directed only at ( i ) persons outside the United Kingdom, or (ii) qualified investors or investment professionals falling within Article 19(5) and Article 49(2)(a) to (d) of the Financial Services and Markets Act 2000 (Financ ial Promotion) Order 2005 (the “Order”), or (iii) high net worth individuals, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order, and (iv) persons who are “qualified investors” within the mea ning of Article 2(1)(e) of the Prospectus Directive (Directive 2003/71/EC) as amended (such persons collectively being referred to as “Relevant Persons”). This presentation must not be acted or relied on by persons who are not Relevant Persons. Any investment or investment activity to which this presentation relates is available only to Relevant Persons and will be engaged in only with Relevant Persons. • This presentation is an advertisement and not a prospectus and investors should not subscribe for or purchase any securities of TMCC referred to in this presentation or otherwise except on the basis of information in the base prospectus of Toyota Motor Finance (Netherlands) B.V., Toyota Credit Canada Inc., Toyota Finance Australia Limited and Toyota Motor Credit Corporation dated 8 September 2017 as supplemented from time to time together with the applicable final terms which are or will be, as applicable, available on the website of the London Stock Exchange plc at www.londonstockexchange.com/exchange/news/market - news/market - news - home.html. • Investors and others should note that we announce material financial information using the investor relations section of our corporate website ( http://www.toyotafinancial.com ) and SEC filings. We use these channels, press releases, as well as social media to communicate with our investors, customers and the general public about our company, our services and other issues. While not all of the information that we post on social media is of a material nature, some information could be material. Therefore, we encourage investors, the media, and others interested in our company to review the information we post on the Toyota Motor Credit Corporation Twitter Feed ( http://www.twitter.com/toyotafinancial ). We may update our social media channels from time to time on the investor relations section of our corporate website .

Toyota ’ s Global Businesses Markets vehicles in over 170 countries/regions. 51 overseas manufacturing companies in 28 countries/regions . OTHER BUSINESSES AUTOMOTIVE Design, Manufacturing, Distribution Consumer Financing Dealer Support & Financing Banking Securities Services Ancillary Products & Services Housing Marine Telecommunications e - Business Intelligent Transport Services Biotechnology & Afforestation 4

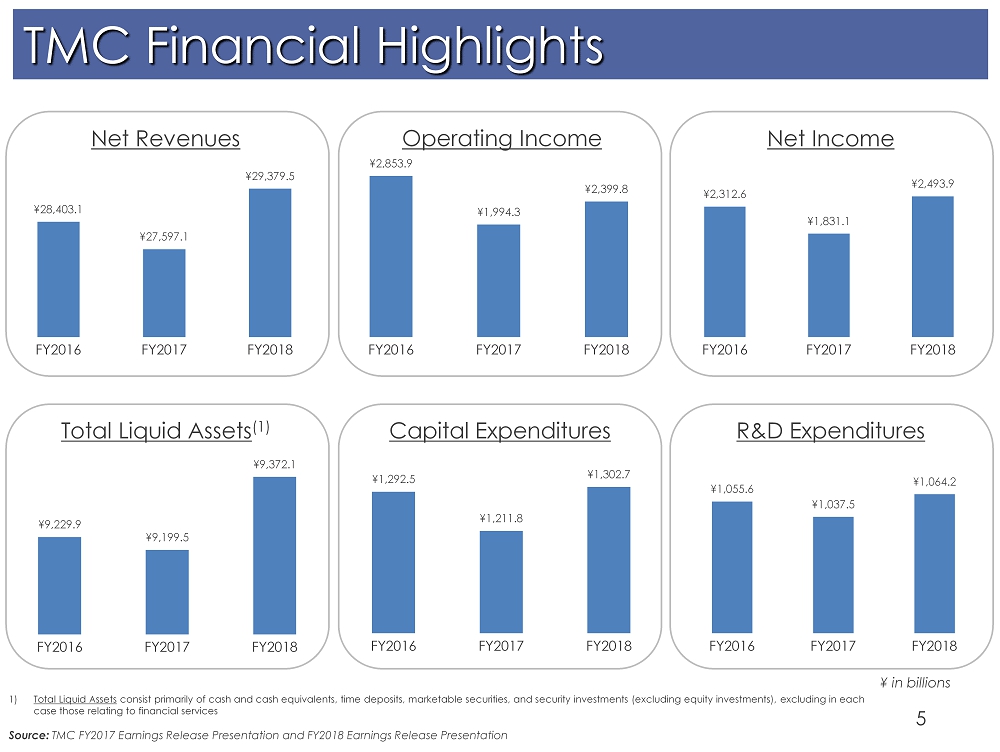

5 TMC Financial Highlights Net Revenues Operating Income Net Income Total Liquid Assets (1) Capital Expenditures R&D Expenditures ¥ in billions 1) Total Liquid Assets consist primarily of cash and cash equivalents, time deposits, marketable securities, and security investments (excluding equ ity investments), excluding in each case those relating to financial services Source : TMC FY2017 Earnings Release Presentation and FY2018 Earnings Release Presentation ¥28,403.1 ¥27,597.1 ¥29,379.5 FY2016 FY2017 FY2018 ¥2,853.9 ¥1,994.3 ¥2,399.8 FY2016 FY2017 FY2018 ¥2,312.6 ¥1,831.1 ¥2,493.9 FY2016 FY2017 FY2018 ¥9,229.9 ¥9,199.5 ¥9,372.1 FY2016 FY2017 FY2018 ¥1,292.5 ¥1,211.8 ¥1,302.7 FY2016 FY2017 FY2018 ¥1,055.6 ¥1,037.5 ¥1,064.2 FY2016 FY2017 FY2018

Toyota Across the United States 6 Source: Toyota USA website 1 All data as of December 2017, except where noted. 2 Toyota vehicles and components assembled using U.S. and globally sourced parts. 3 Parts , materials and components (FY ending 3/17). Goods and Services (CY 2017). 4 2015 Center Automotive Research Study. Includes direct employees, contingent workers and dealer employees. 5 Includes U.S. and Puerto Rico. 6 Global estimate based on FY18 projections of Toyota Motor Corporation. 7 As of CY 2017. 8 2015 Center for Automotive Research Study. Includes direct, dealer and supplier employees and jobs created through their spending.

Toyota Across the United States 7

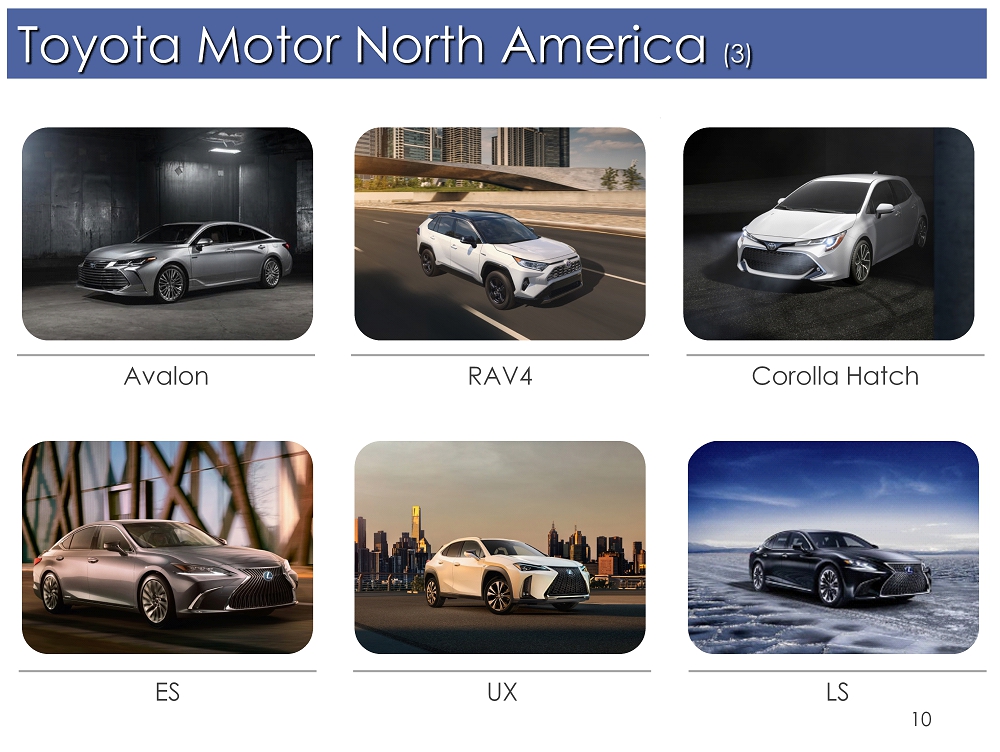

8 • Toyota Motor Sales, USA (TMS) sold 2.4 million vehicles in CY 2017 – Camry was the best - selling passenger car in America for the 16 th consecutive year • Industry - leading investment in next - generation technologies in power - train, safety and production – TMS has one of the most fuel - efficient line - ups of any full - line OEM – Nearly 3.5 million hybrids sold in the US and more than 12 million worldwide (1) – 13 hybrid models (2) and 1 fuel cell vehicle across the North American line - up, and 34 hybrid models worldwide – Mirai is Toyota’s first mass - produced hydrogen fuel cell vehicle – Toyota Research Institute announced with R&D focus on artificial intelligence and robotics • TMS is launching new or refreshed models in 2018. Recent and upcoming vehicle launches: Toyota Motor North America Source: Toyota Motor North America, Inc. Reports (1) As of March 2018 (2) Includes cars and light trucks - Avalon - Tundra TRD Pro - RAV4 - Corolla Hatchback - 4Runner TRD Pro - Tacoma TRD Pro - Lexus LS - Lexus RXL

9 Toyota Motor North America (2) Quality, dependability , safety and product appeal remain high as reflected by numerous 3 rd party accolades 2018 Kelley Blue Book Best Resale Value Toyota No. 1 Brand Winner (3 out of top 5 Best Resale Values for 2017) 2018 Kelley Blue Book Best Overall Luxury Brand and Most Trusted Luxury Brand Lexus Brand Winner 2018 IIHS Top Safety Pick+ Awards 2018 Toyota Camry 10 Toyota and Lexus models Top Safety Pick 2018 J.D. Power and Associates Vehicle Dependability Survey Lexus ranked No. 1 overall 2018 Fortune Toyota ranked one of the “World’s Most Admired Companies” and named the No. 1 Motor Vehicle company (4 th year running) 2018 U.S. News Best Cars for Families 2018 Toyota Camry 2018 U.S. News Best Cars for the Money Toyota Avalon, Toyota Camry, Lexus ES, Lexus RX 350 2017 J.D. Power IQS 13 Toyota/Lexus/Scion models Rank “Top Three” in their segments 2017 Forbes Toyota ranked No. 1 most valuable automotive brand 2017 Consumer Reports Lexus & Toyota No. 1 brands 2017 NY International Auto Show Prius Prime received the World Green Car Award (Toyota held the title for a second year, with the 2016 award going to the Mirai) 2016 NHTSA 5 - Star Overall Safety 10 Toyota/Lexus/Scion models

10 Toyota Motor North America (3) Avalon RAV4 Corolla Hatch ES UX LS

11 Toyota Motor North America (4) MaaS : e - Palette Autonomous: Platform 3.0 Fuel Cell: Mirai / Tri - Gen / Project Portal Heavy - Duty Truck

12 Toyota Financial Services

13 TFS Group Global Presence

14 • Over 4.6 million active finance contracts (1) • AA - (2) /Aa3 (2) rated captive finance company by S&P/Moody’s • Credit support agreement structure with TFSC/TMC (3) Toyota Financial Services Corporation (TFSC) Toyota Motor Credit Corporation (TMCC) Toyota Motor Credit Corporation (TMCC) Toyota Motor Corporation (TMC) (1) As of April 2018. Source : Company Reports (2) Outlook stable (3) The Credit Support Agreements do not apply to securitization transactions

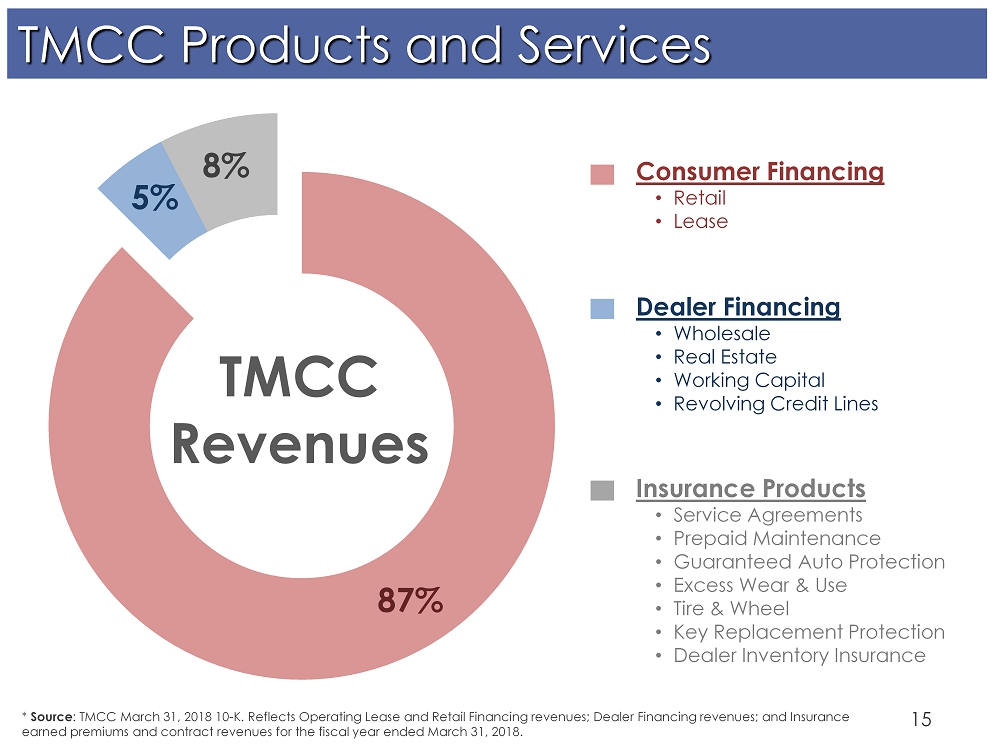

TMCC Revenues 15 TMCC Products and Services Consumer Financing • Retail • Lease Dealer Financing • Wholesale • Real Estate • Working Capital • Revolving Credit Lines Insurance Products • Service Agreements • Prepaid Maintenance • Guaranteed Auto Protection • Excess Wear & Use • Tire & Wheel • Key Replacement Protection • Dealer Inventory Insurance * Source : TMCC March 31, 2018 10 - K. Reflects Operating Lease and Retail Financing revenues; Dealer Financing revenues; and Insurance earned premiums and contract revenues for the fiscal year ended March 31, 2018. 87% 5% 8%

16 Extensive Field Organization • Decentralized dealer and field support • Centralized servicing and collections (circled)

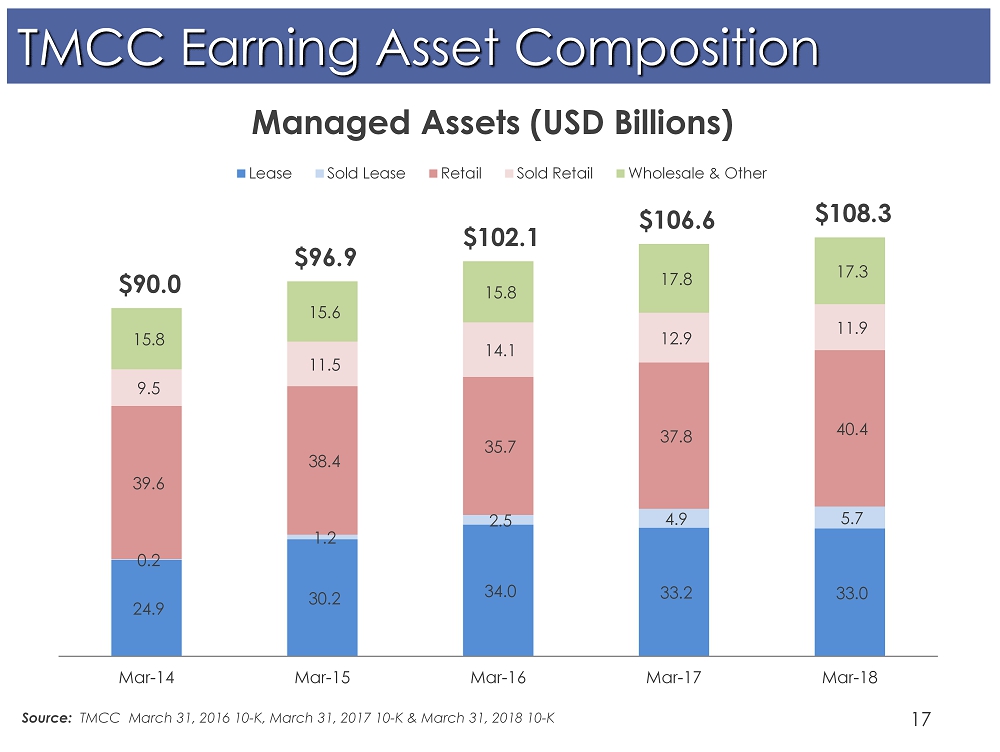

17 TMCC Earning Asset Composition Source: TMCC March 31, 2016 10 - K, March 31, 2017 10 - K & March 31, 2018 10 - K Managed Assets (USD Billions) 24.9 30.2 34.0 33.2 33.0 0.2 1.2 2.5 4.9 5.7 39.6 38.4 35.7 37.8 40.4 9.5 11.5 14.1 12.9 11.9 15.8 15.6 15.8 17.8 17.3 $90.0 $96.9 $102.1 $106.6 $108.3 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Lease Sold Lease Retail Sold Retail Wholesale & Other

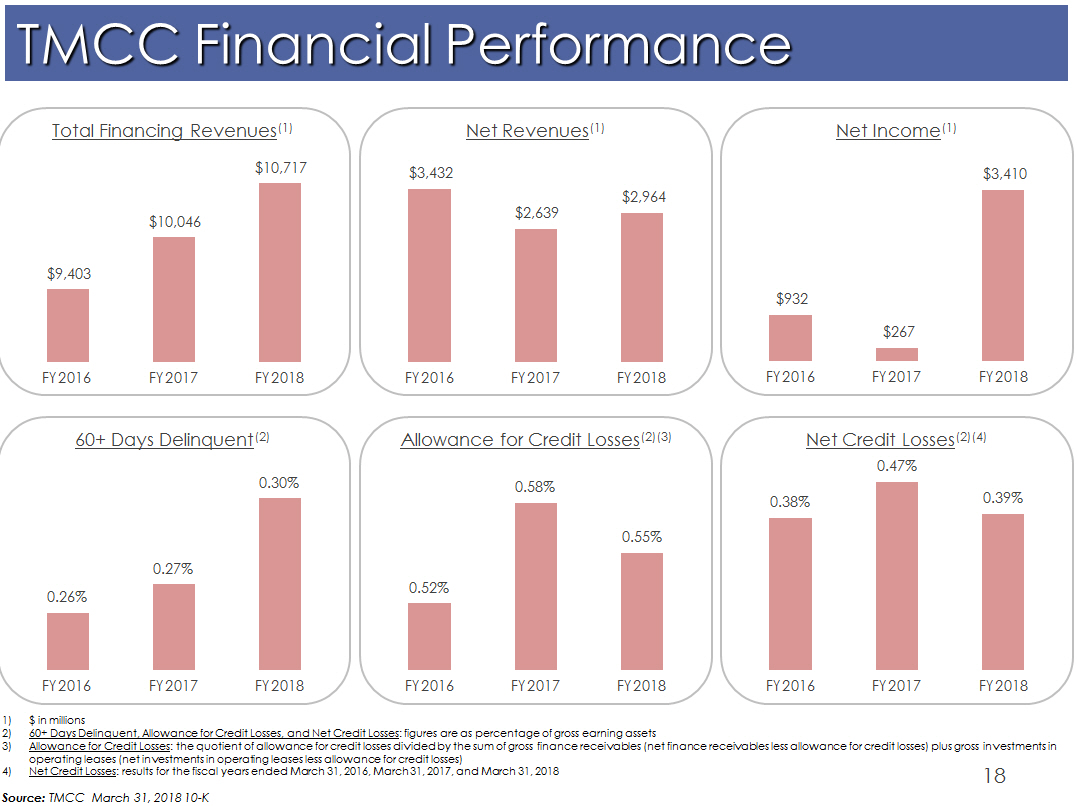

18 TMCC Financial Performance 1) $ in millions 2) 60+ Days Delinquent, Allowance for Credit Losses, and Net Credit Losses : figures are as percentage of gross earning assets 3) Allowance for Credit Losses : the quotient of allowance for credit losses divided by the sum of gross finance receivables (net finance receivables less allowan ce for credit losses) plus gross investments in operating leases (net investments in operating leases less allowance for credit losses ) 4) Net Credit Losses : results for the fiscal years ended March 31, 2016, March 31, 2017, and March 31, 2018 Source : TMCC March 31, 2018 10 - K $9,403 $10,046 $10,717 FY2016 FY2017 FY2018 Total Financing Revenues (1) $3,432 $2,639 $2,964 FY2016 FY2017 FY2018 Net Revenues (1) $932 $267 $3,410 FY2016 FY2017 FY2018 Net Income (1) 0.26% 0.27% 0.30% FY2016 FY2017 FY2018 60+ Days Delinquent (2) 0.52% 0.58% 0.55% FY2016 FY2017 FY2018 Allowance for Credit Losses (2)(3) 0.38% 0.47% 0.39% FY2016 FY2017 FY2018 Net Credit Losses (2)(4)

19 TMCC Funding Programs

20 • A - 1+/P - 1 rated direct commercial paper program • $20.5 billion committed credit facilities (1) • $8.7 billion short - term liquidity investment portfolio (2) • Over $70 billion in readily salable consumer retail loan & lease assets • Access to domestic and international capital markets • Billions of additional capacity in global benchmark markets • Extensive inter - company lending infrastructure • Credit support agreements: TMCC TFSC TMC Exceptional Liquidity (1) As of March 31, 2018 (2) Average balance for the fiscal year ended March 31, 2018 Source : TMCC March 31, 2018 10 - K

21 • TMCC is committed to: – Maintaining funding diversity and exceptional liquidity – Issuing into strong demand with attractive deals – Identifying & developing new markets and investor relationships – Responding quickly to opportunities with best - in - class execution – Managing our business and stakeholder relationships with a long - term view TMCC Funding Program Objectives

Commercial Paper Programs Highlights • A - 1+/P - 1 Direct Commercial Paper Programs – 5 distinct USD commercial paper programs (TMCC, TCPR, TCCI, TFA, and TMFNL) – $15.0 billion multi - party committed credit facilities – $5.5 billion bilateral committed credit facilities – $27.1 billion USCP combined average outstanding for TMCC and TCPR* – Over 700 diverse institutional investors • State and local municipalities • Large corporations • Pension and retirement funds • Financial institutions • Money managers and mutual fund companies – Rates are posted daily on Bloomberg DOCP screen * For the fiscal year ended March 31, 2018 Source : TMCC March 31, 2018 10 - K and Company Reports 22

Innovative Funding Platforms 23 Diversity and Inclusion (D&I) Bonds • Four issuances to date totaling $2.25B • $1.25B offering in April 2016 set record for largest corporate D&I bond • Delivers Tier 2 & Tier 3 investor diversification Green Bonds • Proceeds exclusively finance loans and leases for new hybrid and alternative - fuel Toyota and Lexus vehicles • Auto industry’s first ever green ABS - Three offerings ($4.6B) to date • TMCC’s first unsecured Euro green bond in November 2017 ( € 600mm) November 2017 Toyota Motor Credit Corporation € 600mn 0.00% Green Notes due 2021 € 600mn 0.625% Notes due 2024

24 TMCC FY18 Funding Overview $20.3B Term Debt Funded FY2018 ABS 38% Global 31% MTN 9% EMTN 7% Uridashi 10% Structured 5% *Net of retained Source: Company Reports $12.5B Unsecured $4.8B Public ABS * $3.0B Private ABS *

25 Diversification in Debt Offerings TMCC Long Term Debt Outstanding (USD millions ) * *As of May 31, 2018 Source: Company Reports By Deal Type By Currency Global MTN, $30,600 Public / Private ABS, $13,323 Other, $10,935 EMTN / Eurobonds, $9,275 MTN, $7,128 USD, 57,998 EUR, 7,918 AUD, 3,572 GBP, 1,087 Other, 687

26 Funding Flexibility And Responsiveness Source: Company Reports as of 31 May 2018 Diversification Across USD Curve (1) (1) Unsecured U.S. MTN issuance, excluding Structured Notes and Retail Notes Percentages may not add to 100% due to rounding 45% 27% 53% 20% 15% 20% 3% 2% 5% 5% 7% 20% 11% 9% 20% 14% 14% 28% 37% 22% 22% 37% 9% 26% 21% 22% 29% 13% 5% 4% 6% 14% 7% 6% FY14 FY15 FY16 FY17 FY18 FYTD19 1yr 18mth 2yr 3yr 4yr 5yr 7yr 10yr

27 Key Investment Highlights • Financial strength supported by strong credit ratings • Transparent business model with exceptional liquidity • Rational funding programs with long - term perspective – Diversification in bond offerings – Focus on proactively meeting needs of market – Strong emphasis placed on flexibility and responsiveness • Industry - leading in: – Liquidity management framework – Balance sheet strength – Business model resiliency

28 TMCC Retail Loan Collateral & ABS Transactions

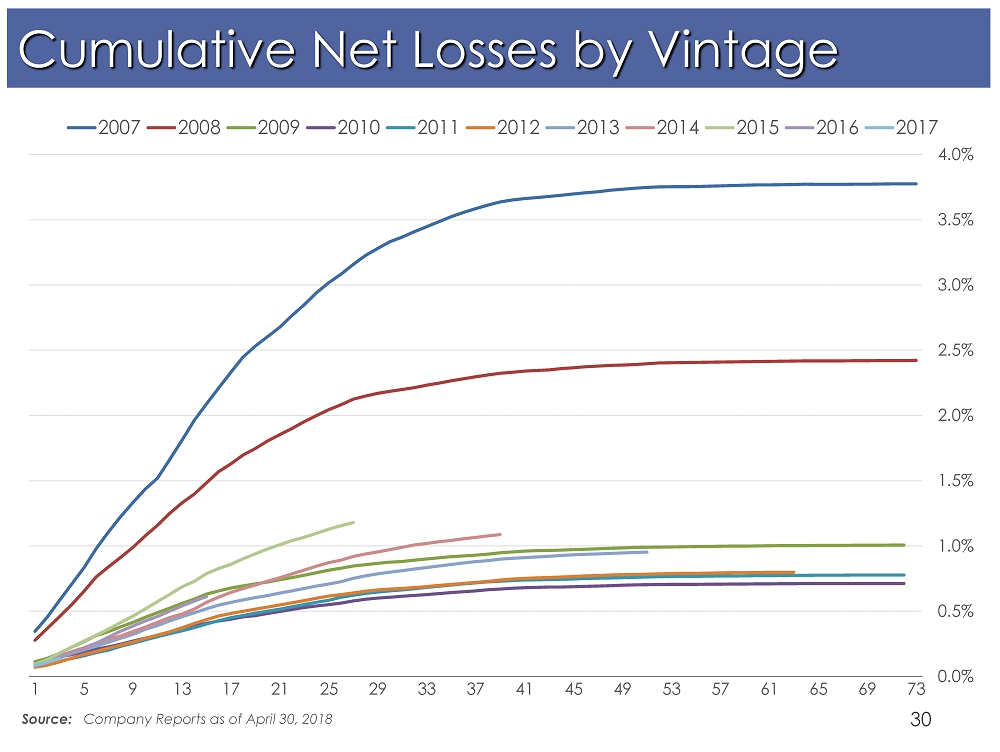

Credit Decisioning & Collections 29 Disciplined Underwriting Consistent and conservative underwriting standards designed to limit delinquencies and credit losses • Key mission is to support Toyota and Lexus brand and vehicle sales • Continued focus on prime originations • Proprietary credit scores that leverage TMCC’s extensive origination history • Regular statistical validations of predictive power Servicing Optimization Optimization of collections strategy and staff supports loss mitigation while enabling portfolio growth • Emphasis on early intervention • Reinforcement of strong compliance management system • Focus on analytics and technology to prioritize high risk accounts and manage loss severities

Source: Company Reports as of April 30, 2018 30 Cumulative Net Losses by Vintage 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 1 5 9 13 17 21 25 29 33 37 41 45 49 53 57 61 65 69 73 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Receivables Principal Balance ($B) Retail Managed Portfolio Performance 31 Contracts Outstanding (#mm) Performance by Principal Balance Outstanding Performance by Contracts Outstanding Source: Company Reports as of 30 April 2018 3.09 3.19 3.12 3.16 3.22 3.21 3.16 3.18 3.16 FY 10 11 12 13 14 15 16 17 18 $43 $45 $45 $47 $49 $50 $50 $51 $53 FY 10 11 12 13 14 15 16 17 18 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 1.4% 1.6% 1.8% FY 10 11 12 13 14 15 16 17 18 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% FY 10 11 12 13 14 15 16 17 18 $51B $53B Apr 2017 Apr 2018 3.17mm 3.16mm Apr 2017 Apr 2018 0.49% 0.49% 0.45% 0.52% 0.35% 0.41% Apr 2017 Apr 2018 Apr 2017 Apr 2018 Apr 2017 Apr 2018 % 60+ Days Past Due Gross Charge Offs Net Losses 0.53% 0.56% 1.02% 1.12% Apr 2017 Apr 2018 Apr 2017 Apr 2018 % 60+ Days Past Due % Repossessed

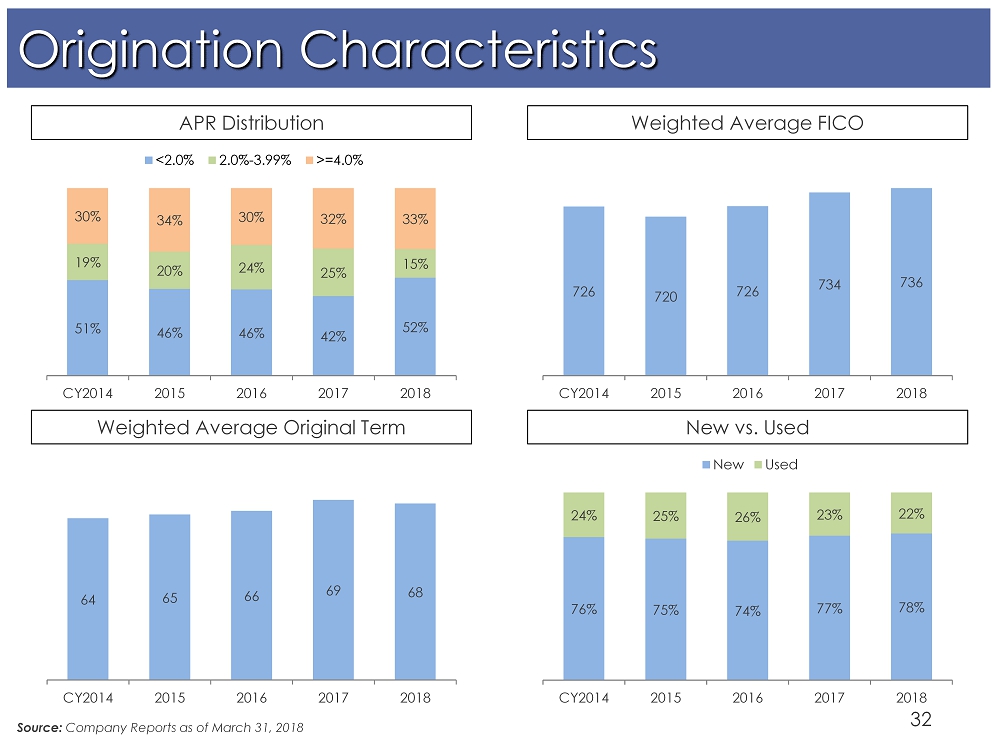

Origination Characteristics APR Distribution 32 Weighted Average FICO Weighted Average Original Term New vs. Used Source: Company Reports as of March 31, 2018 726 720 726 734 736 CY2014 2015 2016 2017 2018 51% 46% 46% 42% 52% 19% 20% 24% 25% 15% 30% 34% 30% 32% 33% CY2014 2015 2016 2017 2018 <2.0% 2.0%-3.99% >=4.0% 64 65 66 69 68 CY2014 2015 2016 2017 2018 76% 75% 74% 77% 78% 24% 25% 26% 23% 22% CY2014 2015 2016 2017 2018 New Used

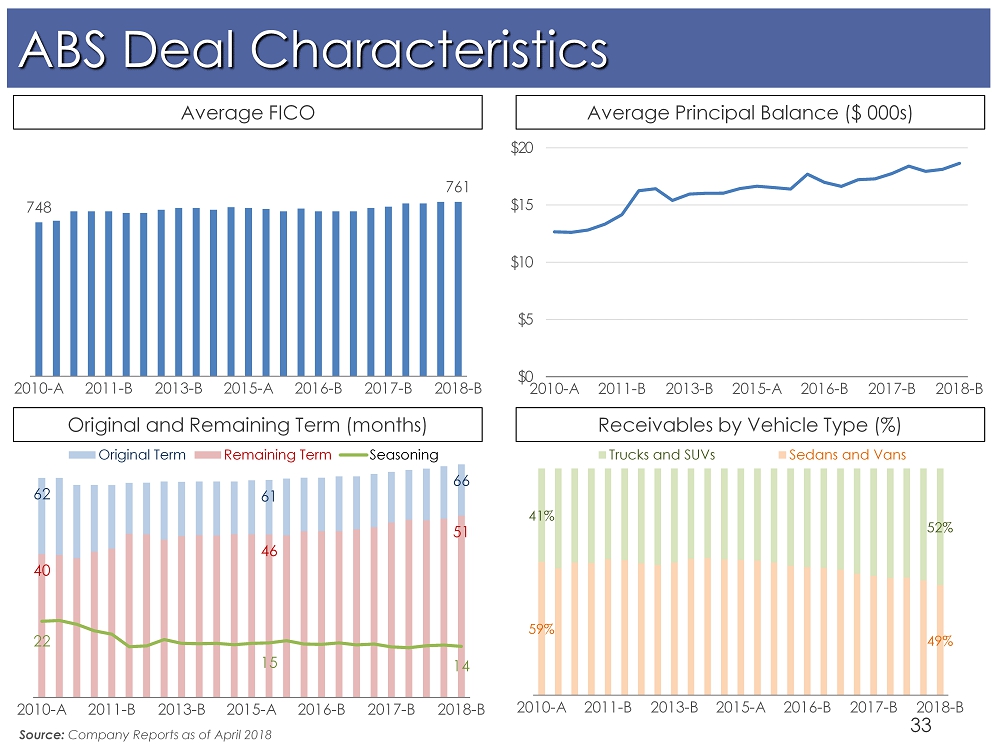

ABS Deal Characteristics Average FICO 33 Average Principal Balance ($ 000s) Original and Remaining Term (months) Receivables by Vehicle Type (%) Source: Company Reports as of April 2018 748 761 2010 - A 2011 - B 2013 - B 2015 - A 2016 - B 2017 - B 2018 - B $0 $5 $10 $15 $20 2010 - A 2011 - B 2013 - B 2015 - A 2016 - B 2017 - B 2018 - B 62 61 66 40 46 51 22 15 14 2010 - A 2011 - B 2013 - B 2015 - A 2016 - B 2017 - B 2018 - B Original Term Remaining Term Seasoning 59% 49% 41% 52% 2010 - A 2011 - B 2013 - B 2015 - A 2016 - B 2017 - B 2018 - B Trucks and SUVs Sedans and Vans

TAOT Cumulative Net Losses 34 Source : Company Reports as of 15 May 2018 payment date 2010, 2011, 2012 Series 2013, 2014, 2015 Series 2017 Series 2016 Series 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 1 5 9 13 17 21 25 29 33 37 41 45 TAOT 2010-A TAOT 2010-B TAOT 2010-C TAOT 2011-A TAOT 2011-B TAOT 2012-A TAOT 2012-B 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 1 5 9 13 17 21 25 29 33 37 41 45 TAOT 2013-A TAOT 2013-B TAOT 2014-A TAOT 2014-B TAOT 2014-C TAOT 2015-A TAOT 2015-B TAOT 2015-C 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 1 5 9 13 17 21 25 29 33 37 41 45 TAOT 2016-A TAOT 2016-B TAOT 2016-C TAOT 2016-D 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 1 5 9 13 17 21 25 29 33 37 41 45 TAOT 2017-A TAOT 2017-B TAOT 2017-C TAOT 2017-D

35 Appendix

36 TMC Consolidated Financials Numbers may not sum to total due to rounding. Source : TMC FY2017 and FY2018 Financial Summaries; FY2017 and FY2018 Earnings Release Presentations (JPY billions) 2016 2017 2018 Net Revenues 28,403.1 27,597.1 29,379.5 Operating Income 2,853.9 1,994.3 2,399.8 Net Income 2,312.6 1,831.1 2,493.9 Consolidated Balance Sheet (JPY billions) 2016 2017 2018 Current assets 18,209.5 17,833.6 18,152.6 Noncurrent finance receivables, net 8,642.9 9,012.2 9,481.6 Investment & other assets 10,834.6 11,707.1 12,406.3 Property, plant & equipment, net 9,740.4 10,197.1 10,267.6 Total Assets 47,427.5 48,750.1 50,308.2 Liabilities 29,339.4 30,081.2 30,386.1 Shareholders' equity 18,088.1 18,668.9 19,922.0 Total Liabilities & Shareholders' Equity 47,427.5 48,750.1 50,308.2 Fiscal Year Ended March 31, Fiscal Year Ended March 31,

37 TMCC Financial Performance (1) Percentage of gross earning assets (2) The quotient of allowance for credit losses divided by the sum of gross finance receivables (net finance receivables less all owa nce for credit losses) plus gross investments in operating leases (net investments in operating leases less allowance for credit losses ) Source: TMCC March 31, 2018 10 - K Consolidated Income Statement (USD millions) 2014 2015 2016 2017 2018 Total Financing Revenues 7,397 8,310 9,403 10,046 10,717 add: Other Income 702 832 1,080 1,200 1,139 less: Interest Expense 5,352 5,593 7,051 8,607 8,892 and Depreciation Net Financing Revenues 2,747 3,549 3,432 2,639 2,964 and Other Revenues Net Income 857 1,197 932 267 3,410 Credit Performance 2014 2015 2016 2017 2018 Over 60 Days Delinquent (1) 0.18% 0.21% 0.26% 0.27% 0.30% Allowance for Credit Losses (1) (2) 0.50% 0.50% 0.52% 0.58% 0.55% Net Credit Losses (1) 0.28% 0.29% 0.38% 0.47% 0.39% Fiscal Year Ended March 31, Fiscal Year Ended March 31,

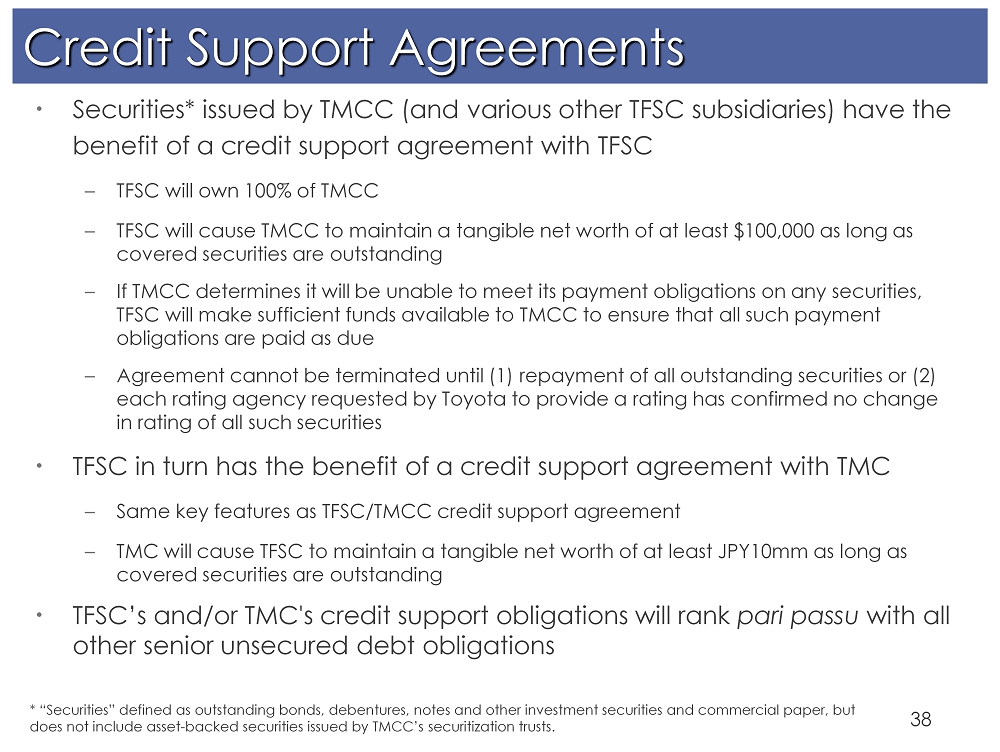

38 Credit Support Agreements • Securities* issued by TMCC (and various other TFSC subsidiaries) have the benefit of a credit support agreement with TFSC – TFSC will own 100% of TMCC – TFSC will cause TMCC to maintain a tangible net worth of at least $100,000 as long as covered securities are outstanding – If TMCC determines it will be unable to meet its payment obligations on any securities, TFSC will make sufficient funds available to TMCC to ensure that all such payment obligations are paid as due – Agreement cannot be terminated until (1) repayment of all outstanding securities or (2) each rating agency requested by Toyota to provide a rating has confirmed no change in rating of all such securities • TFSC in turn has the benefit of a credit support agreement with TMC – Same key features as TFSC/TMCC credit support agreement – TMC will cause TFSC to maintain a tangible net worth of at least JPY10mm as long as covered securities are outstanding • TFSC’s and/or TMC's credit support obligations will rank pari passu with all other senior unsecured debt obligations * “Securities” defined as outstanding bonds, debentures, notes and other investment securities and commercial paper, but does not include asset - backed securities issued by TMCC’s securitization trusts.

39 TMCC Retail Auto Loan Originations (1) Percentages may not add to 100.0% due to rounding. *Data as of March 31, 2018 Origination Profile 39 Source: Company Reports Original Summary Characteristics by Vintage Origination Year: CY2014 2015 2016 2017 2018* Number of Pool Assets 951,133 925,631 883,424 882,329 223,057 Original Pool Balance $24,516,581,298 $24,222,949,274 $23,944,624,507 $24,699,290,739 $6,412,775,230 Average Initial Loan Balance $25,776 $26,169 $27,104 $27,993 $28,749 Weighted Average Interest Rate 3.07% 3.35% 3.24% 3.22% 3.08% Weighted Average Original Term 64 Months 65 Months 66 Months 69 Months 68 Months Weighted Average FICO 726 720 726 734 736 Minimum FICO 381 383 383 383 395 Maximum FICO 887 886 900 900 900 Geographic Distribution of Receivables representing the 5 states with the greatest aggregate original principal balance: State 1 CA - 21.0% CA - 21.3% CA - 21.4% CA - 23.3% CA - 23.5% State 2 TX - 14.0% TX - 15.7% TX - 15.5% TX - 14.4% TX - 16.0% State 3 NY - 4.7% NY - 4.9% NY - 4.8% NY - 4.2% NY - 3.8% State 4 NJ - 4.0% NJ - 3.8% NJ - 4.0% PA - 3.8% VA - 3.7% State 5 IL - 4.2% IL - 3.8% IL - 3.8% NJ - 3.7% PA - 3.7% Distribution of Receivables by Contract Rate: (1) Less than 2.0% 50.8% 46.2% 46.0% 42.4% 52.2% 2.0% - 3.99% 19.4% 19.9% 23.7% 25.3% 15.3% 4.0% - 5.99% 13.5% 14.0% 13.6% 17.0% 16.5% 6.0% - 7.99% 7.7% 8.7% 7.6% 6.7% 7.7% 8.0% - 9.99% 3.6% 4.9% 4.2% 3.7% 3.3% 10.0% - 11.99% 1.7% 2.7% 2.3% 2.2% 2.0% 12.0% - 13.99% 0.7% 1.4% 1.2% 1.2% 1.1% 14.0% - 15.99% 0.6% 0.9% 0.7% 0.7% 0.7% 16.0% and greater 1.9% 1.2% 0.7% 0.8% 1.2% Total 100.00% 100.00% 100.00% 100.00% 100.00% Share of Original Assets: Percentage of Non-Toyota/Non-Lexus 3.8% 4.0% 3.3% 3.0% 3.1% Percentage of 72+ Month Term 11.1% 13.2% 13.4% 15.2% 10.7% Percentage of Used Vehicles 23.7% 24.6% 25.7% 23.0% 21.9%

40 TMCC Retail Loan Delinquency Experience (1) (1) The historical delinquency data reported in this table includes all retail vehicle installment sales contracts purchased by TMCC, excluding those purchased by a subsidiary of TMCC operating in Puerto Rico. Includes contracts that have been sold but are still being servi ced by TMCC. (2) Number of contracts outstanding at end of period. (3) The period of delinquency is based on the number of days payments are contractually past due. A payment is deemed to be pas t due if less than 90% of such payment is made. Managed Portfolio Performance Source: Company Reports 2018 2017 2018 2017 2016 2015 2014 Outstanding Contracts (2) 3,158,043 3,171,305 3,158,375 3,181,143 3,163,189 3,209,872 3,220,641 Number of Accounts Past Due in the following categories 30 - 59 days 34,508 38,330 37,044 36,396 35,795 31,130 32,920 60 - 89 days 10,119 9,515 9,464 8,018 7,822 6,569 6,660 Over 89 days 7,635 7,408 8,063 7,633 6,776 5,616 5,799 Delinquencies as a Percentage of Contracts Outstanding (3) 30 - 59 days 1.09% 1.21% 1.17% 1.14% 1.13% 0.97% 1.02% 60 - 89 days 0.32% 0.30% 0.30% 0.25% 0.25% 0.20% 0.21% Over 89 days 0.24% 0.23% 0.26% 0.24% 0.21% 0.17% 0.18% At April 30, At March 31,

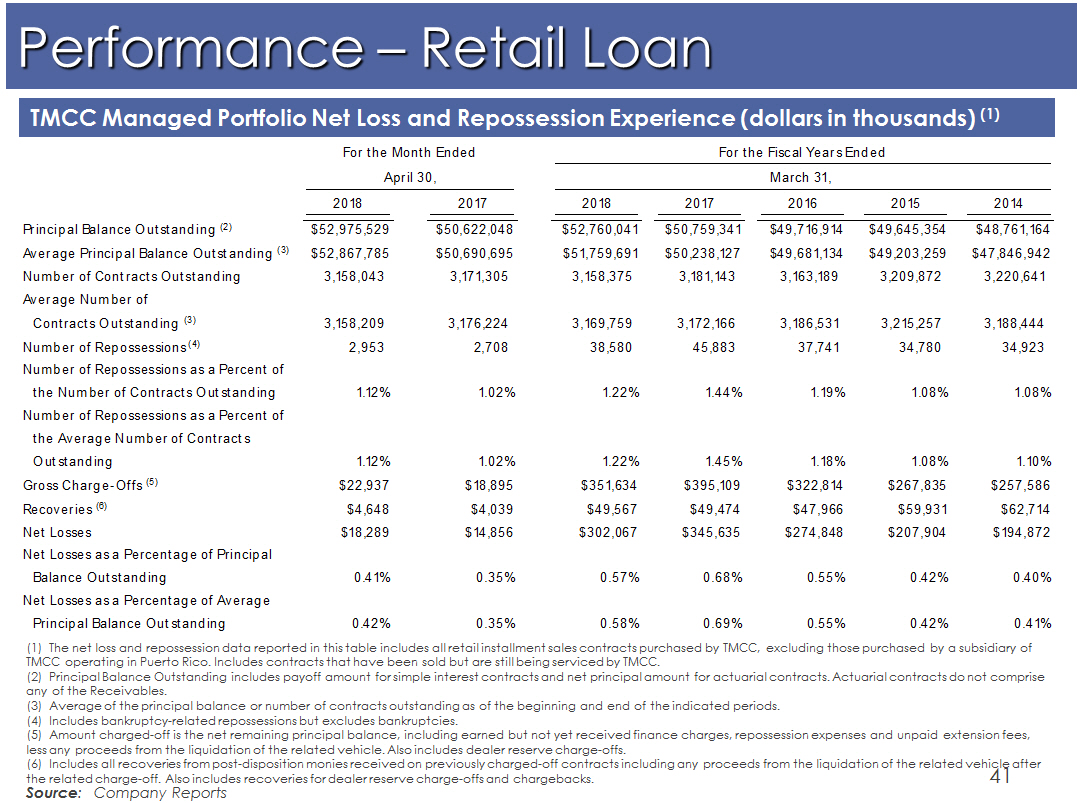

Performance – Retail Loan TMCC Managed Portfolio Net Loss and Repossession Experience (dollars in thousands) (1) 41 Source : Company Reports (1) The net loss and repossession data reported in this table includes all retail installment sales contracts purchased by T MCC , excluding those purchased by a subsidiary of TMCC operating in Puerto Rico. Includes contracts that have been sold but are still being serviced by TMCC. (2) Principal Balance Outstanding includes payoff amount for simple interest contracts and net principal amount for actuaria l c ontracts. Actuarial contracts do not comprise any of the Receivables. (3) Average of the principal balance or number of contracts outstanding as of the beginning and end of the indicated periods . (4) Includes bankruptcy - related repossessions but excludes bankruptcies. (5) Amount charged - off is the net remaining principal balance, including earned but not yet received finance charges, repossess ion expenses and unpaid extension fees, less any proceeds from the liquidation of the related vehicle. Also includes dealer reserve charge - offs. (6) Includes all recoveries from post - disposition monies received on previously charged - off contracts including any proceeds from the liquidation of the related vehicle after the related charge - off. Also includes recoveries for dealer reserve charge - offs and chargebacks. 2018 2017 2018 2017 2016 2015 2014 Principal Balance Outstanding (2) $52,975,529 $50,622,048 $52,760,041 $50,759,341 $49,716,914 $49,645,354 $48,761,164 Average Principal Balance Outstanding (3) $52,867,785 $50,690,695 $51,759,691 $50,238,127 $49,681,134 $49,203,259 $47,846,942 Number of Contracts Outstanding 3,158,043 3,171,305 3,158,375 3,181,143 3,163,189 3,209,872 3,220,641 Average Number of Contracts Outstanding (3) 3,158,209 3,176,224 3,169,759 3,172,166 3,186,531 3,215,257 3,188,444 Number of Repossessions (4) 2,953 2,708 38,580 45,883 37,741 34,780 34,923 Number of Repossessions as a Percent of the Number of Contracts Outstanding 1.12% 1.02% 1.22% 1.44% 1.19% 1.08% 1.08% Number of Repossessions as a Percent of the Average Number of Contracts Outstanding 1.12% 1.02% 1.22% 1.45% 1.18% 1.08% 1.10% Gross Charge-Offs (5) $22,937 $18,895 $351,634 $395,109 $322,814 $267,835 $257,586 Recoveries (6) $4,648 $4,039 $49,567 $49,474 $47,966 $59,931 $62,714 Net Losses $18,289 $14,856 $302,067 $345,635 $274,848 $207,904 $194,872 Net Losses as a Percentage of Principal Balance Outstanding 0.41% 0.35% 0.57% 0.68% 0.55% 0.42% 0.40% Net Losses as a Percentage of Average Principal Balance Outstanding 0.42% 0.35% 0.58% 0.69% 0.55% 0.42% 0.41% April 30, For the Month Ended For the Fiscal Years Ended March 31,

ABS Deal Comparison Toyota Auto Owner Trust (TAOT ) * *Abbreviated for presentation purposes (1) Percentages may not add to 100.00% due to rounding Source : Company Reports 42 Original Summary Characteristics by Prior Securitization: TAOT 2017-A TAOT 2017-B TAOT 2017-C TAOT 2017-D TAOT 2018-A TAOT 2018-B Number of Pool Assets 93,151 106,118 102,754 106,107 105,677 94,829 Original Pool Balance $1,610,505,281.69 $1,884,009,090.55 $1,889,438,548.44 $1,903,254,413.53 $1,914,792,886.79 $1,767,851,358.52 Average Principal Balance $17,289.19 $17,753.91 $18,387.98 $17,937.12 $18,119.30 $18,642.52 Weighted Average Interest Rate 2.20% 2.17% 2.09% 2.12% 2.15% 2.15% Weighted Average Original Term 63 64 64 65 65 66 Weighted Average Remaining Term 48 49 50 50 50 51 Weighted Average FICO 757 758 760 760 761 761 Minimum FICO 620 620 620 620 620 620 Maximum FICO 900 900 900 900 900 900 Geographic Distribution of Receivables representing the 5 states with the greatest aggregate original principal balance: State 1 CA - 24.1% CA - 23.6% CA - 23.9% CA - 25.8% CA - 24.4% CA - 24.5% State 2 TX - 16.3% TX - 16.1% TX - 15.9% TX - 10.9% TX - 15.1% TX - 14.7% State 3 IL - 4.5% IL - 4.7% IL - 4.6% IL - 4.7% IL - 4.4% IL - 4.6% State 4 NJ - 4.1% PA - 4.0% NJ - 4.1% NJ - 4.4% PA - 4.2% PA - 4.3% State 5 PA - 4.0% NY - 3.9% PA - 3.9% PA - 4.4% NJ - 4.0% NJ - 4.0% Distribution of Receivables by Contract Rate: (1) Less than 2.0% 57.96% 58.12% 58.96% 58.12% 56.67% 57.27% 2.0% - 3.99% 24.60% 25.23% 25.80% 26.47% 27.25% 26.44% 4.0% - 5.99% 10.16% 9.70% 9.06% 9.36% 10.25% 10.46% 6.0% - 7.99% 4.10% 3.89% 3.36% 3.22% 3.17% 3.17% 8.0% - 9.99% 2.05% 1.91% 1.88% 1.81% 1.66% 1.67% 10.0% - 11.99% 0.87% 0.88% 0.73% 0.74% 0.76% 0.76% 12.0% - 13.99% 0.20% 0.23% 0.16% 0.22% 0.20% 0.21% 14.0% - 15.99% 0.04% 0.03% 0.03% 0.03% 0.02% 0.02% 16.0% and greater 0.02% 0.01% 0.02% 0.01% 0.00% 0.01% Total 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% Distribution of Receivables by Vehicle Type: (1) Passenger Cars 45.50% 45.10% 44.49% 44.45% 43.83% 42.06% Minivans 8.04% 7.50% 7.13% 7.42% 6.81% 6.44% Light Duty Trucks 13.01% 12.40% 11.92% 11.64% 11.88% 12.64% SUVs 33.44% 35.00% 36.46% 36.49% 37.48% 38.86% Total 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% Distribution of Receivables by Make: (1) Toyota and Scion 85.70% 84.72% 84.80% 86.02% 85.69% 87.20% Lexus 14.30% 15.28% 15.20% 13.98% 14.31% 12.80% Total 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% Share of Original Assets: Percentage with Original Scheduled Payments > 60 months 34.58% 38.87% 42.48% 45.27% 50.29% 54.10% Percentage of Used Vehicles 21.40% 21.42% 21.47% 21.82% 21.39% 19.98%