Exhibit 99.1

TOYOTA FINANCIAL SERVICES 1 •• PROTECTED 関係者外秘 Bank of America Captive Finance Company Conference Presentation Materials for Investors February 2025

TOYOTA FINANCIAL SERVICES 2 •• PROTECTED 関係者外秘 Disclaimer • This presentation includes certain “forward - looking statements” within the meaning of The U.S. Private Securities Litigation Ref orm Act of 1995. • These statements are based on current expectations and currently available information. • Actual results may differ materially from these expectations due to certain risks, uncertainties and other important factors, in cluding the risk factors set forth in the most recent annual and periodic reports of Toyota Motor Corporation and Toyota Motor Credit Corporation. • We do not undertake to update the forward - looking statements to reflect actual results or changes in the factors affecting the f orward - looking statements. • This presentation does not constitute an offer to sell or a solicitation of an offer to purchase any securities. Any offer or sa le of securities will be made only by means of a prospectus and related documentation. • Investors and others should note that we announce material financial information using the investor relations section of our cor porate website ( http://www.toyotafinancial.com ) and SEC filings. We use these channels, press releases, as well as social media to communicate with our investors, customers and the general public about our company, our services and other issues. While not all of the information that we post on our website or social media is of a material nature, some information could be material. Ther efo re, we encourage investors, the media, and others interested in our company to review the information we post on the investor relati ons section of our website and our X (formerly Twitter) Feed ( http://www.x.com/toyotafinancial ). We may update our social media channels from time to time on the investor relations section of our corporate website.

TOYOTA FINANCIAL SERVICES 3 •• PROTECTED 関係者外秘 Disclaimer • This presentation includes certain “forward - looking statements” within the meaning of The U.S. Private Securities Litigation Ref orm Act of 1995. • These statements are based on current expectations and currently available information. • Actual results may differ materially from these expectations due to certain risks, uncertainties and other important factors, in cluding the risk factors set forth in the most recent annual and periodic reports of Toyota Motor Corporation and Toyota Motor Credit Corporation (“TMCC”). • We do not undertake to update the forward - looking statements to reflect actual results or changes in the factors affecting the f orward - looking statements. • This presentation does not constitute or form part of and should not be construed as, an offer to sell or issue or the solici tat ion of an offer to purchase or subscribe for securities of TMCC in any jurisdiction or an inducement to enter into investment activity in any jurisdiction. Neither this presentation nor any part thereof, nor the fact of its distribution, sh all form the basis of, or be relied on in connection with, any contract or commitment or investment decision whatsoever. Any offer or sale of securities by TMCC will be made only by means of a prospectus and related documentation. • Investors and prospective investors in securities of TMCC are required to make their own independent investigation and apprai sal of the business and financial condition of TMCC and the nature of its securities. This presentation does not constitute a recommendation regarding securities of TMCC. Any prospective purchaser of securities in TMCC is recommended to s eek its own independent financial advice. • This presentation and its contents are directed only at and may only be communicated to (a) persons in member states of the E uro pean Economic Area who are “qualified investors” within the meaning of Article 2 of the Prospectus Regulation (EU) 2017/1129 and (b) persons in the United Kingdom who are “qualified investors” within the meaning of Article 2 of the Prospectus Regulation (EU) 2017/1129 as it forms part of United Kingdom domestic law by virtue of the European Union (Withdrawal) Act 2018, as amended (“EUWA”) who are ( i ) persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial S erv ices and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”), or (ii) high net worth entities and other persons to whom it may lawfully be communicate d, falling within Article 49(2)(a) to (d) of the Order, or (iii) other persons to whom it may otherwise lawfully be communicated (all such persons in (a) through (b) are collectively referred to as “Relevant Persons”); and in all cases are c apa ble of being categorized as ( i ) in the European Economic Area, an eligible counterparty or a professional client, each as defined in Directive 2014/65/EU (as amended) or (ii) in the United Kingdom, an eligible counterparty (as defined in the FC A H andbook Conduct of Business Sourcebook) or a professional client (as defined in Regulation (EU) No 600/2014 as it forms part of United Kingdom domestic law by virtue of the EUWA) (such persons in ( i ) and (ii) being referred to as “Eligible Persons”). • This presentation must not be acted or relied on by persons who are not both Relevant Persons and Eligible Persons. Any inves tme nt or investment activity to which this presentation relates is available only to persons who are both Relevant Persons and Eligible Persons and will be engaged in only with persons who are both Relevant Persons and Eligible Persons. • This presentation is an advertisement and not a prospectus and investors should not subscribe for or purchase any securities of TMCC referred to in this presentation or otherwise except on the basis of information in the Euro Medium Term Note Programme base prospectus of Toyota Motor Finance (Netherlands) B.V., Toyota Credit Canada Inc., Toyota Finance Australi a L imited and Toyota Motor Credit Corporation dated, 13 September 2024, as supplemented from time to time (together, the “Prospectus”) together with the applicable final terms which are or will be, as applicable, available on the w ebs ite of the London Stock Exchange plc at https://www.londonstockexchange.com/news?tab=news - explorer. Investors should read the Prospectus before making an investment decision in order to fully understand the potential risks an d r ewards associated with the decision to invest in any securities of TMCC issued under the Euro Medium Term Note Programme. Approval of the Prospectus by the Central Bank of Ireland and the United Kingdom’s Financial Conduct Authori ty should not be understood as an endorsement of securities issued by TMCC under the Euro Medium Term Note Programme. • Investors and others should note that we announce material financial information using the investor relations section of our cor porate website ( http://www.toyotafinancial.com ) and SEC filings. We use these channels, press releases, as well as social media to communicate with our investors, customers and the general public about our company, our services and other is sues. While not all of the information that we post on our website or social media is of a material nature, some information could be material. Therefore, we encourage investors, the media, and others interested in our company to rev iew the information we post on the investor relations section of our website and our X (formerly Twitter) Feed ( http://www.x.com/toyotafinancial ). We may update our social media channels from time to time on the investor relations section of our corporate website.

TOYOTA FINANCIAL SERVICES 4 •• PROTECTED 関係者外秘 Presenters • Toyota Motor Credit Corporation • Shaun Lee, National Manager, Derivatives and Debt Capital Markets • Rick Kahn, Manager, Debt Capital Markets • Tyler Anderson, Manager, Derivative and Debt Capital Markets

TOYOTA FINANCIAL SERVICES 5 •• PROTECTED 関係者外秘 Toyota’s Global Business Markets vehicles in approximately 200 countries and regions 53 overseas manufacturing organizations in 26 countries and regions besides Japan Over 380,000 employees worldwide AUTOMOTIVE Design, Manufacturing, Distribution Consumer Financing Dealer Support & Financing Banking Securities Services Ancillary Products & Services OTHER BUSINESSES Housing Marine Telecommunications e - Business Intelligent Transport Services Biotechnology & Afforestation

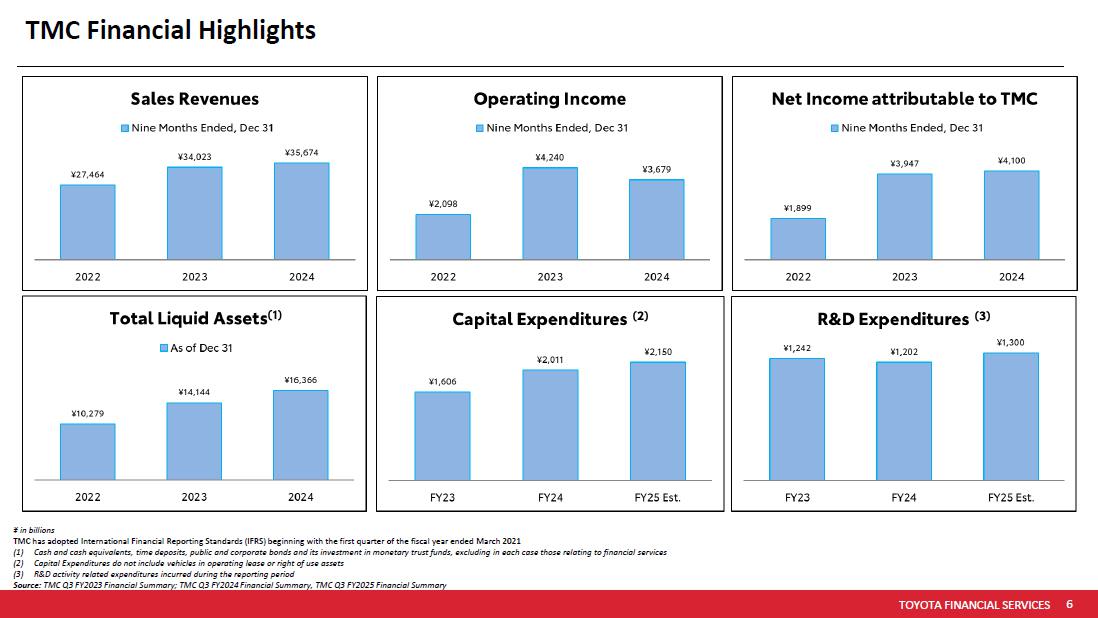

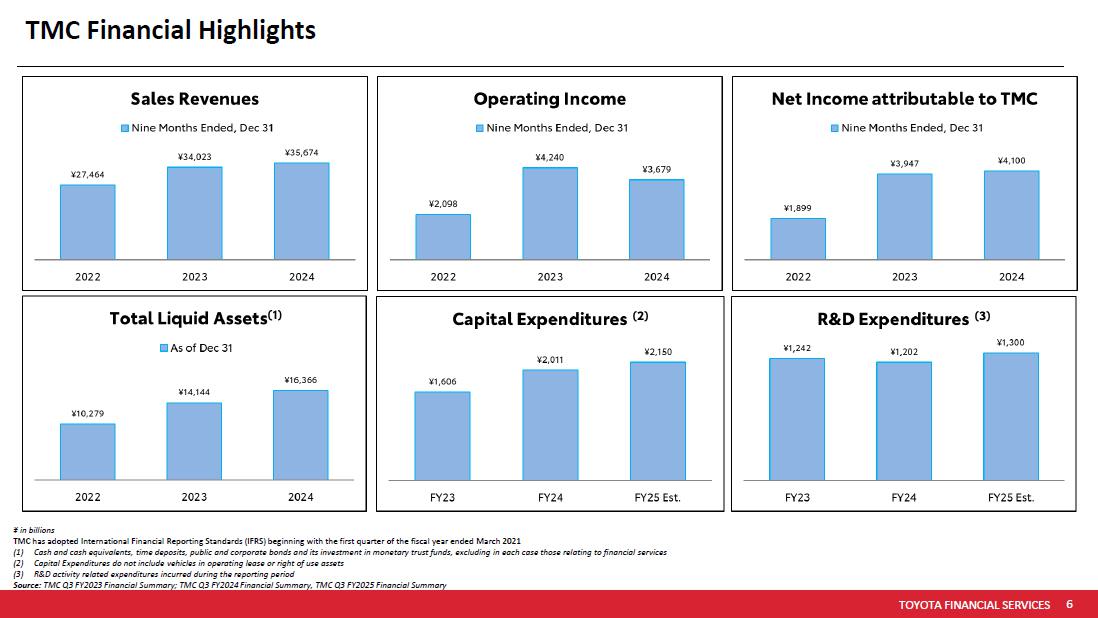

TOYOTA FINANCIAL SERVICES 6 •• PROTECTED 関係者外秘 TMC Financial Highlights ¥ in billions TMC has adopted International Financial Reporting Standards (IFRS) beginning with the first quarter of the fiscal year ended Mar ch 2021 (1) Cash and cash equivalents, time deposits, public and corporate bonds and its investment in monetary trust funds, excluding in ea ch case those relating to financial services (2) Capital Expenditures do not include vehicles in operating lease or right of use assets (3) R&D activity related expenditures incurred during the reporting period Source: TMC Q3 FY2023 Financial Summary; TMC Q3 FY2024 Financial Summary, TMC Q3 FY2025 Financial Summary

TOYOTA FINANCIAL SERVICES 7 •• PROTECTED 関係者外秘 Toyota Operations Across the US Source : Toyota USA website

TOYOTA FINANCIAL SERVICES 8 •• PROTECTED 関係者外秘 Toyota Motor North America, Inc. $20B+ Announced new investments into U.S. manufacturing operations since 2021 to support electrification efforts 35.3M+ Vehicles assembled in US since 1986 with over 60 years of US presence $48.9B+ Direct investment in the U.S. as of December 31, 2024 30 BEV models expected globally by 2030 #1 Toyota was the number one retail brand for the 12 th consecutive year 43.1% TMNA sales CYTD 2024 were electrified vehicles (1) Source : Toyota Motor North America, Inc. Reports (1) Electrified vehicles include hybrid, plug - in hybrid, battery electric, and fuel cell.

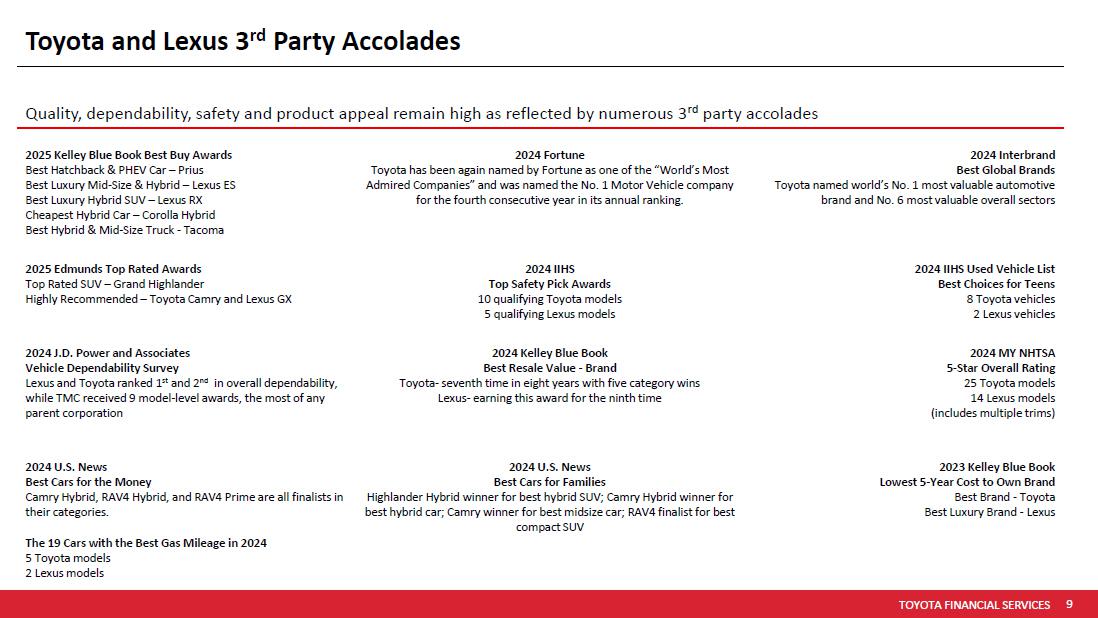

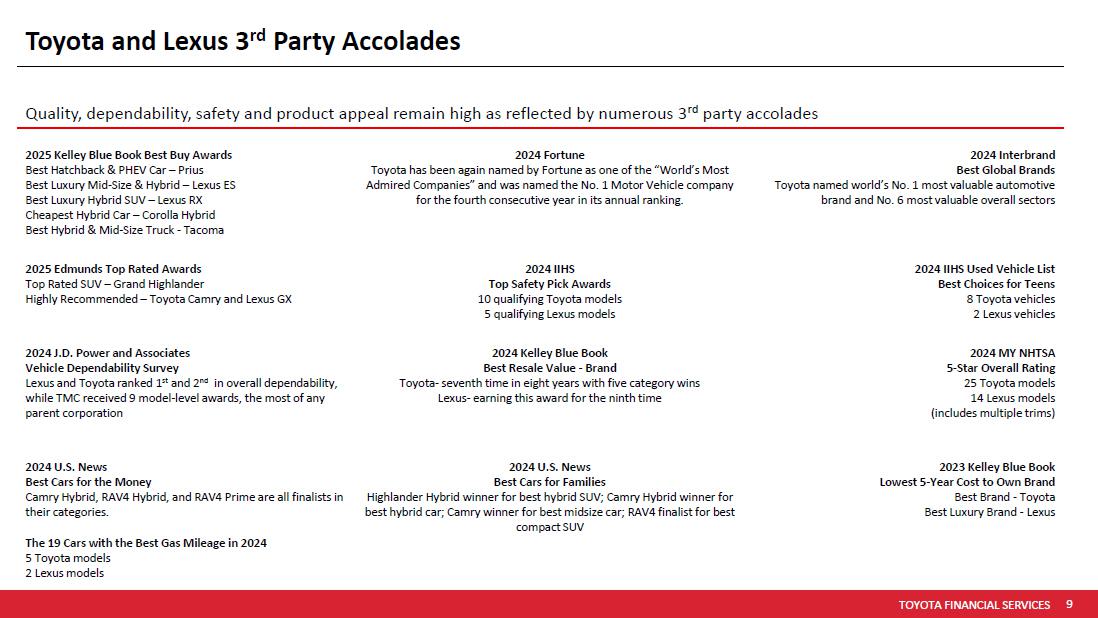

TOYOTA FINANCIAL SERVICES 9 •• PROTECTED 関係者外秘 Toyota and Lexus 3 rd Party Accolades Quality, dependability, safety and product appeal remain high as reflected by numerous 3 rd party accolades 2024 Interbrand Best Global Brands Toyota named world’s No. 1 most valuable automotive brand and No. 6 most valuable overall sectors 2024 Fortune Toyota has been again named by Fortune as one of the “World’s Most Admired Companies” and was named the No. 1 Motor Vehicle company for the fourth consecutive year in its annual ranking. 2025 Kelley Blue Book Best Buy Awards Best Hatchback & PHEV Car – Prius Best Luxury Mid - Size & Hybrid – Lexus ES Best Luxury Hybrid SUV – Lexus RX Cheapest Hybrid Car – Corolla Hybrid Best Hybrid & Mid - Size Truck - Tacoma 2024 IIHS Used Vehicle List Best Choices for Teens 8 Toyota vehicles 2 Lexus vehicles 2024 IIHS Top Safety Pick Awards 10 qualifying Toyota models 5 qualifying Lexus models 2025 Edmunds Top Rated Awards Top Rated SUV – Grand Highlander Highly Recommended – Toyota Camry and Lexus GX 2024 MY NHTSA 5 - Star Overall Rating 25 Toyota models 14 Lexus models (includes multiple trims) 2024 Kelley Blue Book Best Resale Value - Brand Toyota - seventh time in eight years with five category wins Lexus - earning this award for the ninth time 2024 J.D. Power and Associates Vehicle Dependability Survey Lexus and Toyota ranked 1 st and 2 nd in overall dependability, while TMC received 9 model - level awards, the most of any parent corporation 2023 Kelley Blue Book Lowest 5 - Year Cost to Own Brand Best Brand - Toyota Best Luxury Brand - Lexus 2024 U.S. News Best Cars for Families Highlander Hybrid winner for best hybrid SUV; Camry Hybrid winner for best hybrid car; Camry winner for best midsize car; RAV4 finalist for best compact SUV 2024 U.S. News Best Cars for the Money Camry Hybrid, RAV4 Hybrid, and RAV4 Prime are all finalists in their categories. The 19 Cars with the Best Gas Mileage in 2024 5 Toyota models 2 Lexus models

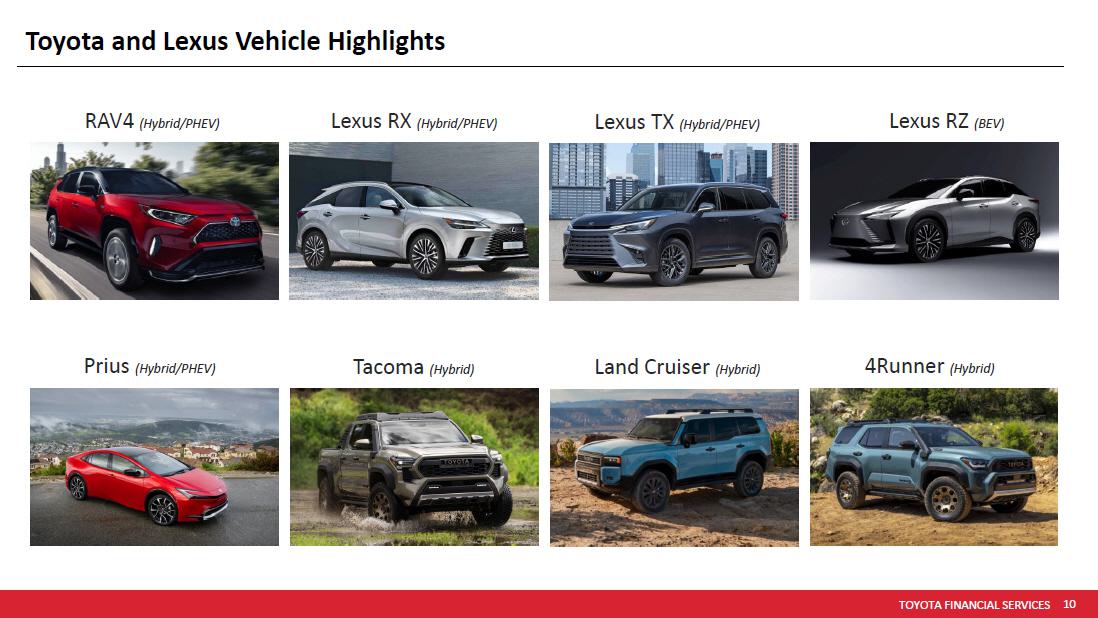

TOYOTA FINANCIAL SERVICES 10 •• PROTECTED 関係者外秘 Toyota and Lexus Vehicle Highlights Lexus RX (Hybrid/PHEV) Lexus TX (Hybrid/PHEV) Prius (Hybrid/PHEV) Tacoma (Hybrid) Land Cruiser (Hybrid) Lexus RZ (BEV) 4Runner (Hybrid) RAV4 (Hybrid/PHEV)

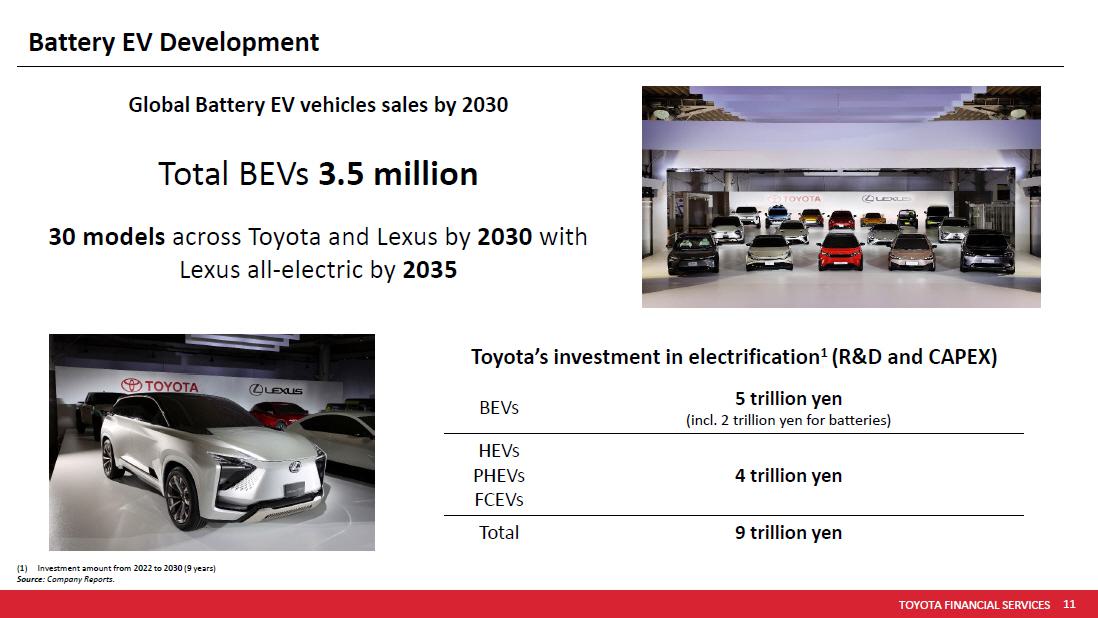

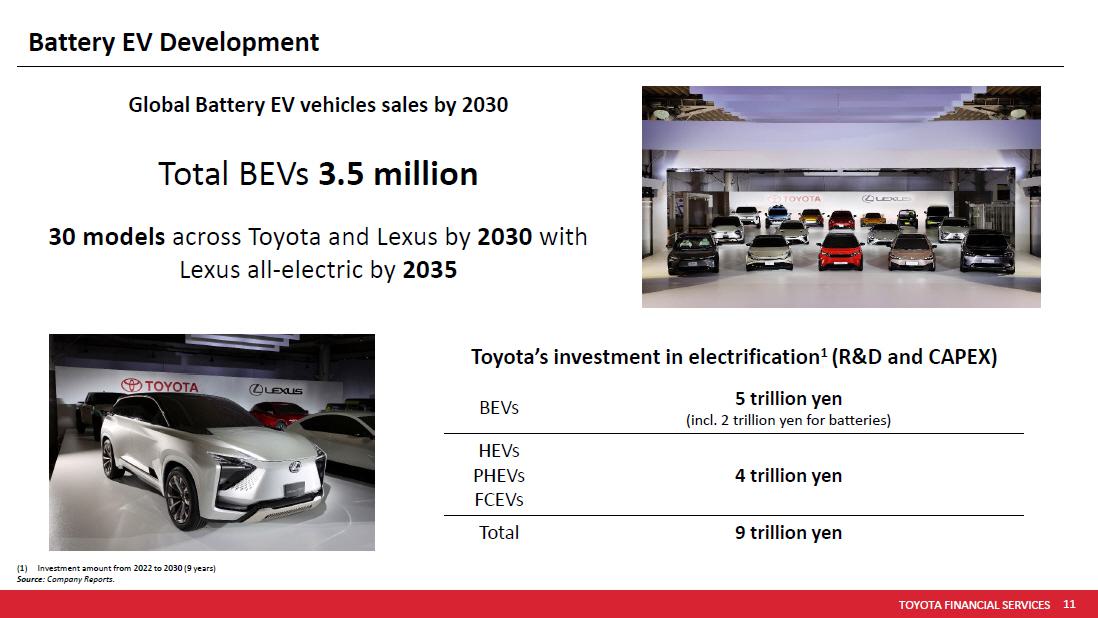

TOYOTA FINANCIAL SERVICES 11 •• PROTECTED 関係者外秘 Battery EV Development Global Battery EV vehicles sales by 2030 Total BEVs 3.5 million 30 models across Toyota and Lexus by 2030 with Lexus all - electric by 2035 Toyota’s investment in electrification 1 (R&D and CAPEX) 5 trillion yen (incl. 2 trillion yen for batteries) BEVs 4 trillion yen HEVs PHEVs FCEVs 9 trillion yen Total (1) Investment amount from 2022 to 2030 (9 years) Source : Company Reports.

TOYOTA FINANCIAL SERVICES 12 •• PROTECTED 関係者外秘 Toyota Financial Services

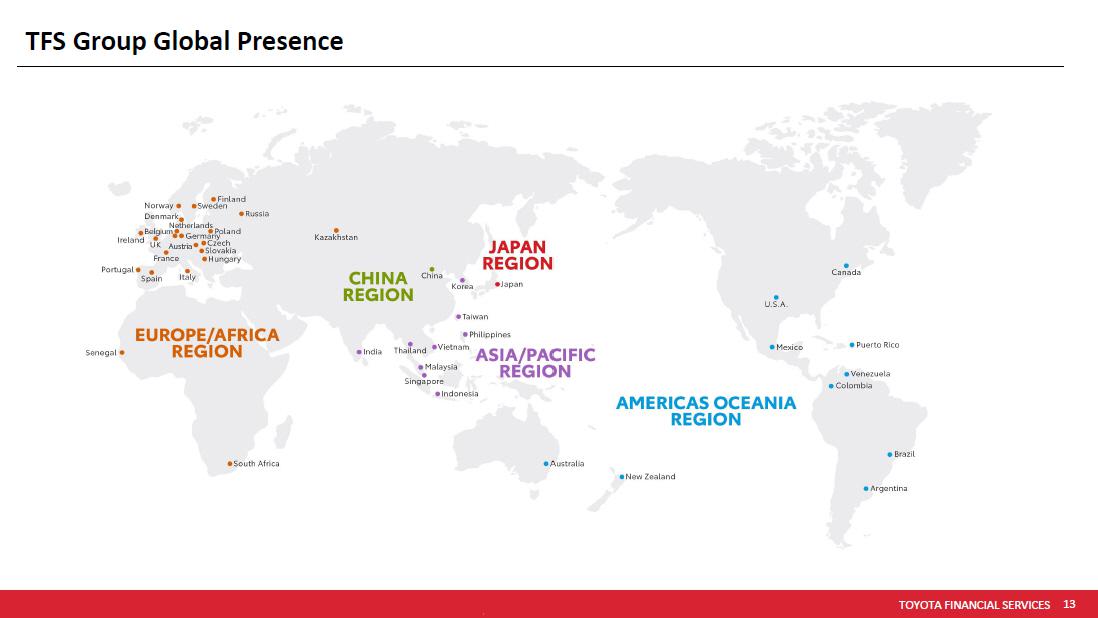

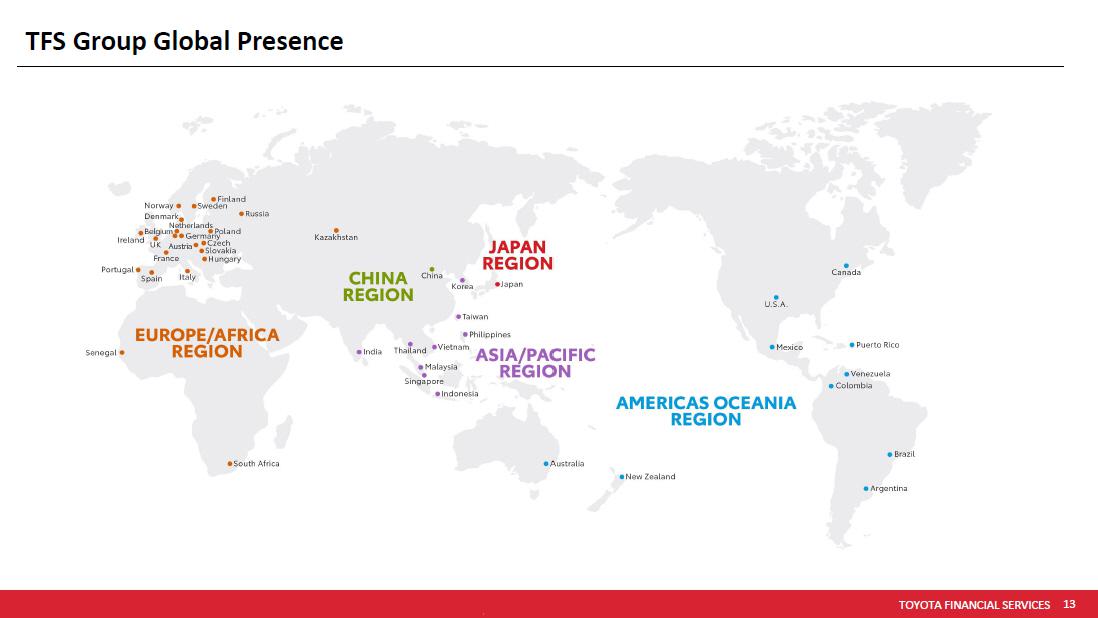

TOYOTA FINANCIAL SERVICES 13 •• PROTECTED 関係者外秘 TFS Group Global Presence

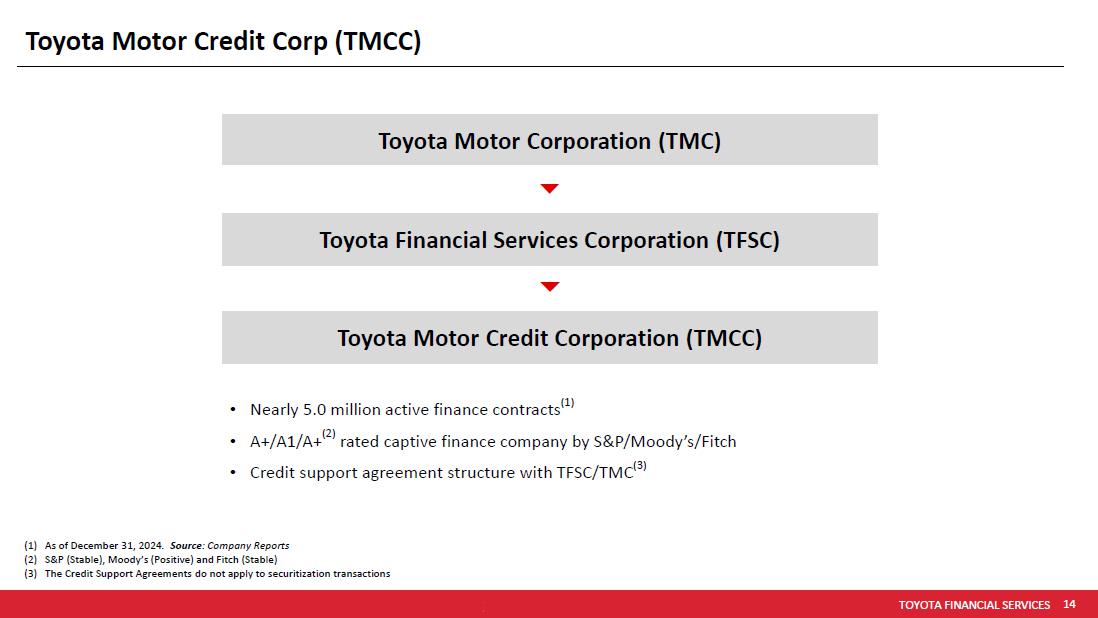

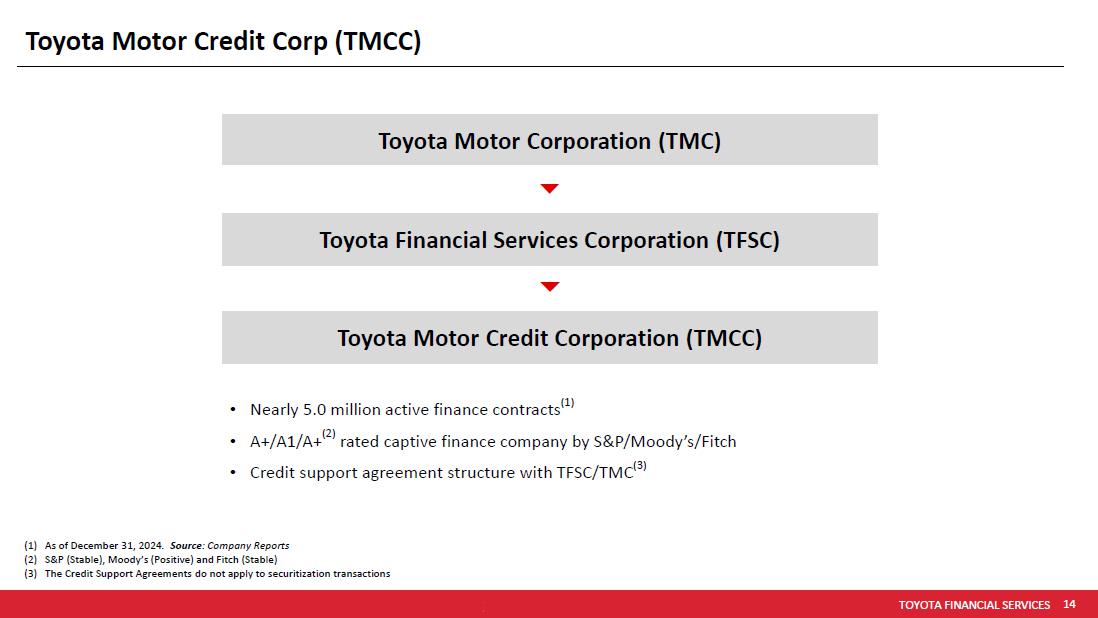

TOYOTA FINANCIAL SERVICES 14 •• PROTECTED 関係者外秘 Toyota Motor Credit Corp (TMCC) Toyota Motor Corporation (TMC) Toyota Financial Services Corporation (TFSC) Toyota Motor Credit Corporation (TMCC) • Nearly 5.0 million active finance contracts (1) • A+/A1/A+ (2) rated captive finance company by S&P/Moody’s/Fitch • Credit support agreement structure with TFSC/TMC (3) (1) As of December 31, 2024 . Source : Company Reports (2) S&P (Stable), Moody’s (Positive) and Fitch (Stable) (3) The Credit Support Agreements do not apply to securitization transactions

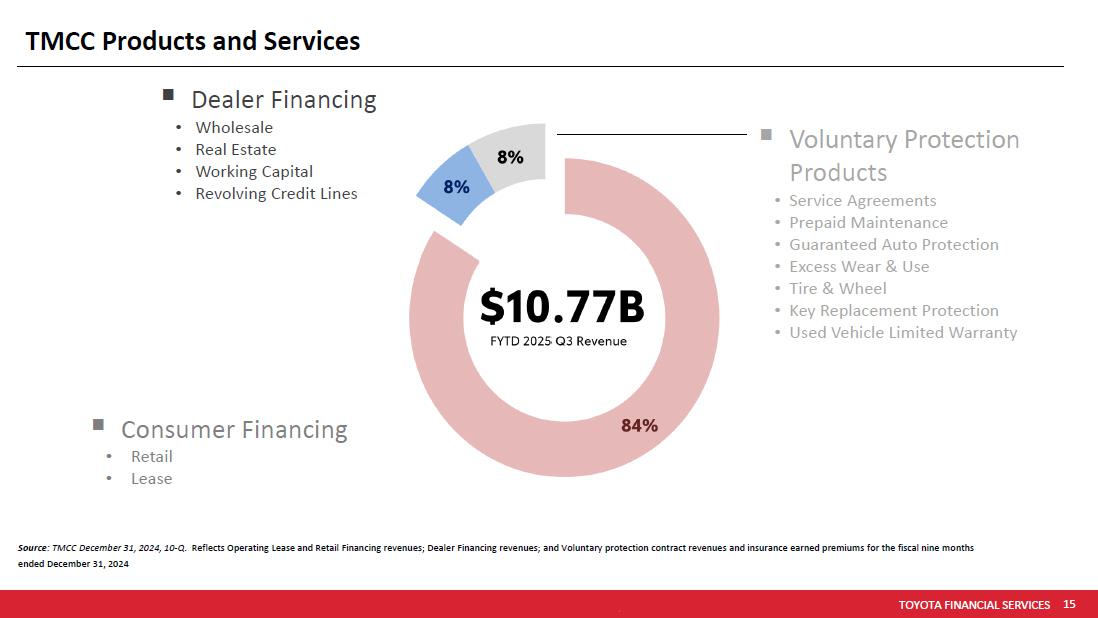

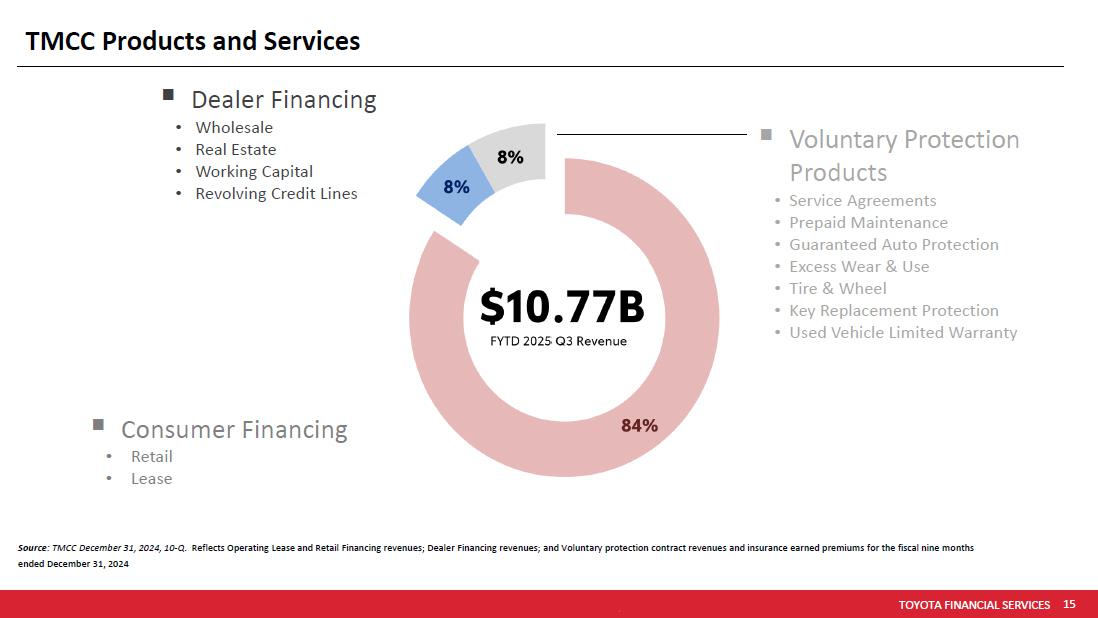

TOYOTA FINANCIAL SERVICES 15 •• PROTECTED 関係者外秘 ▪ Voluntary Protection Products • Service Agreements • Prepaid Maintenance • Guaranteed Auto Protection • Excess Wear & Use • Tire & Wheel • Key Replacement Protection • Used Vehicle Limited Warranty TMCC Products and Services ▪ Dealer Financing • Wholesale • Real Estate • Working Capital • Revolving Credit Lines ▪ Consumer Financing • Retail • Lease Source : TMCC December 31, 2024, 10 - Q . Reflects Operating Lease and Retail Financing revenues; Dealer Financing revenues; and Voluntary protection contract revenues and insurance earned premiums for the fiscal nine months ended December 31, 2024

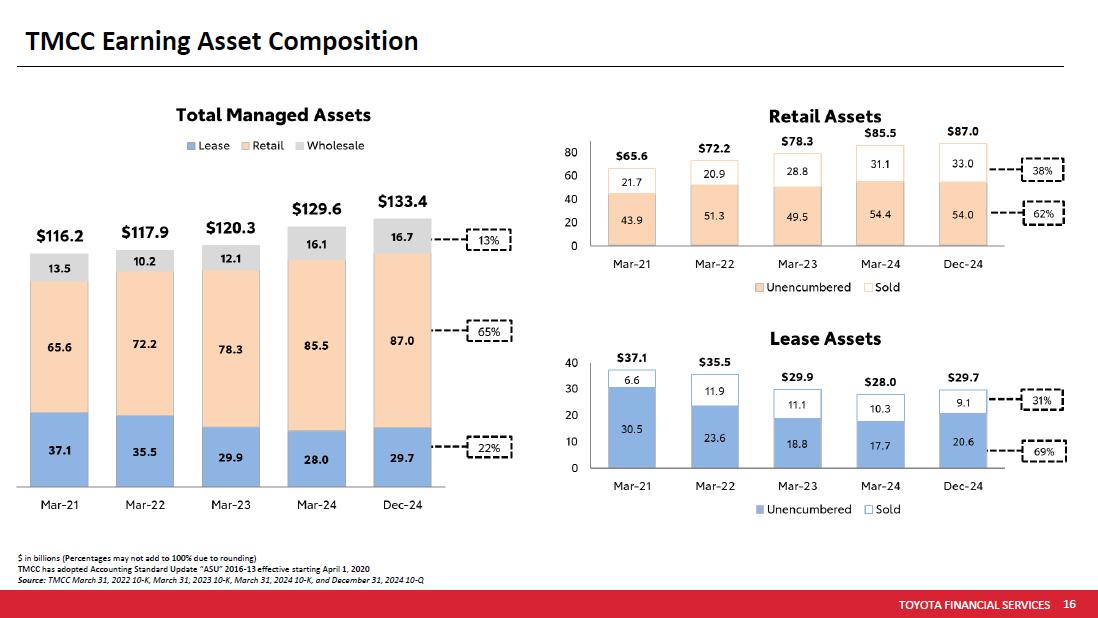

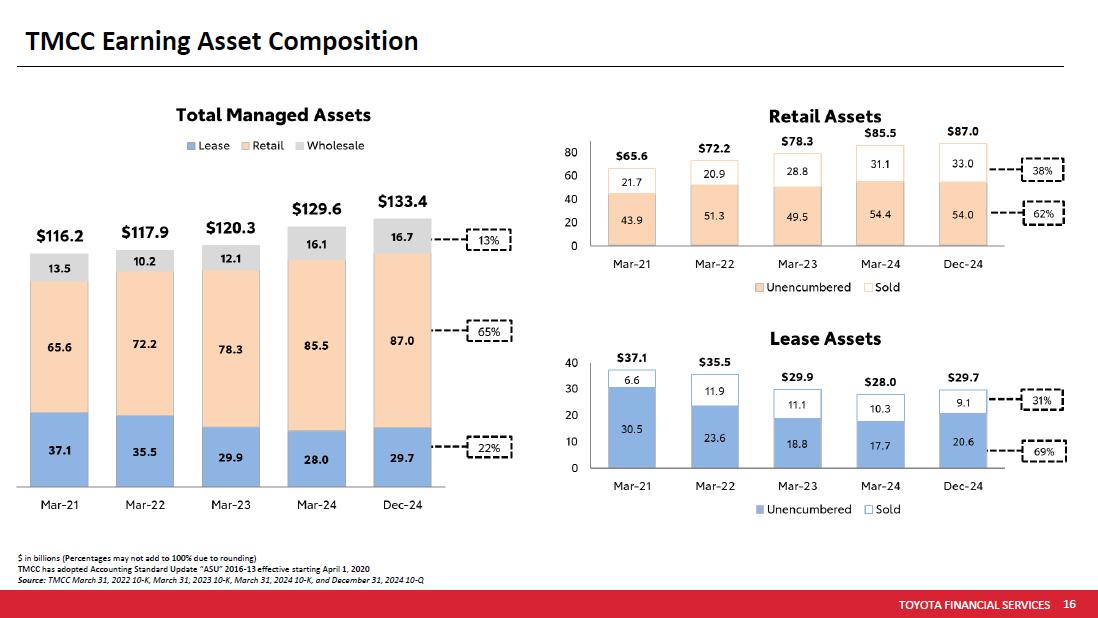

TOYOTA FINANCIAL SERVICES 16 •• PROTECTED 関係者外秘 TMCC Earning Asset Composition $ in billions (P ercentages may not add to 100% due to rounding) TMCC has adopted Accounting Standard Update “ASU” 2016 - 13 effective starting April 1, 2020 Source: TMCC March 31, 2022 10 - K, March 31, 2023 10 - K, March 31, 2024 10 - K, and December 31, 2024 10 - Q

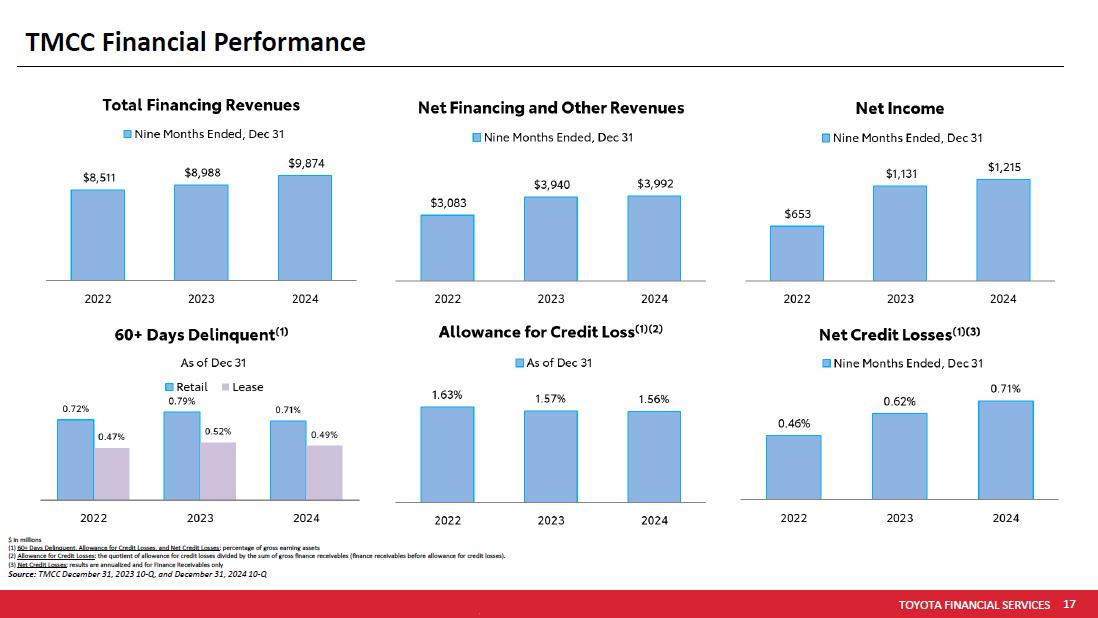

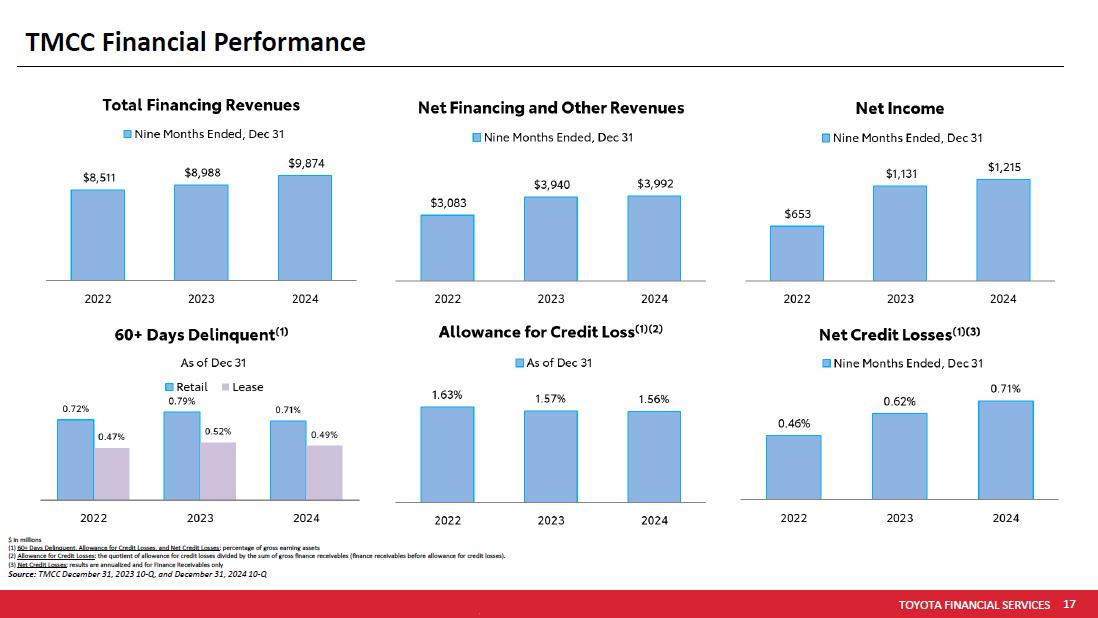

TOYOTA FINANCIAL SERVICES 17 •• PROTECTED 関係者外秘 TMCC Financial Performance $ in millions (1) 60+ Days Delinquent, Allowance for Credit Losses, and Net Credit Losses : percentage of gross earning assets (2) Allowance for Credit Losses : the quotient of allowance for credit losses divided by the sum of gross finance receivables (finance receivables before all owa nce for credit losses). (3) Net Credit Losses : results are annualized and for Finance Receivables only Source: TMCC December 31, 2023 10 - Q, and December 31, 2024 10 - Q

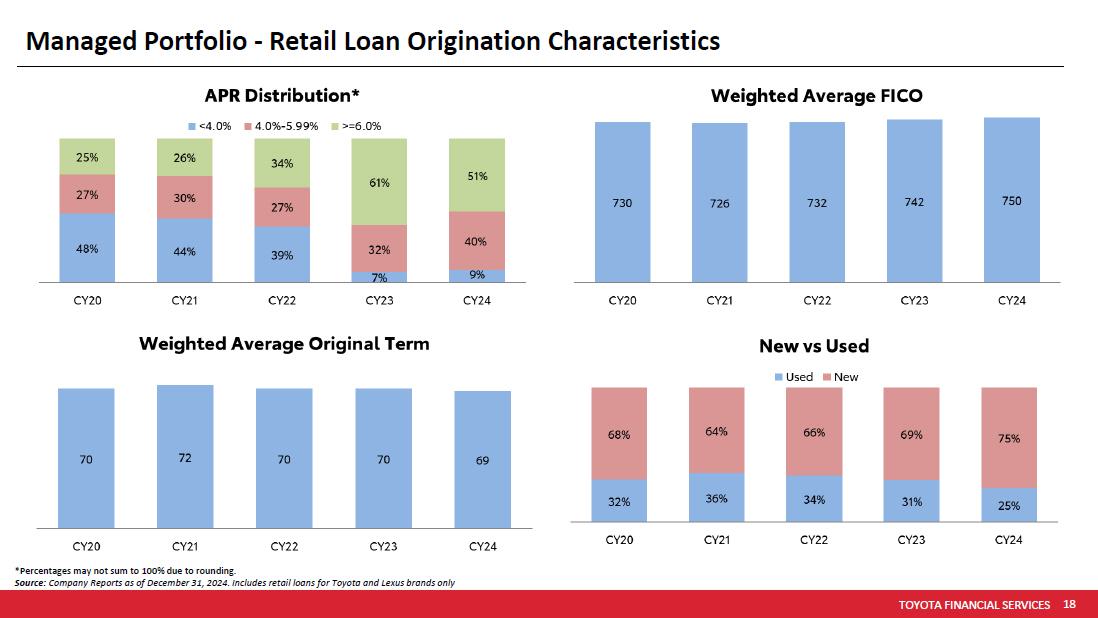

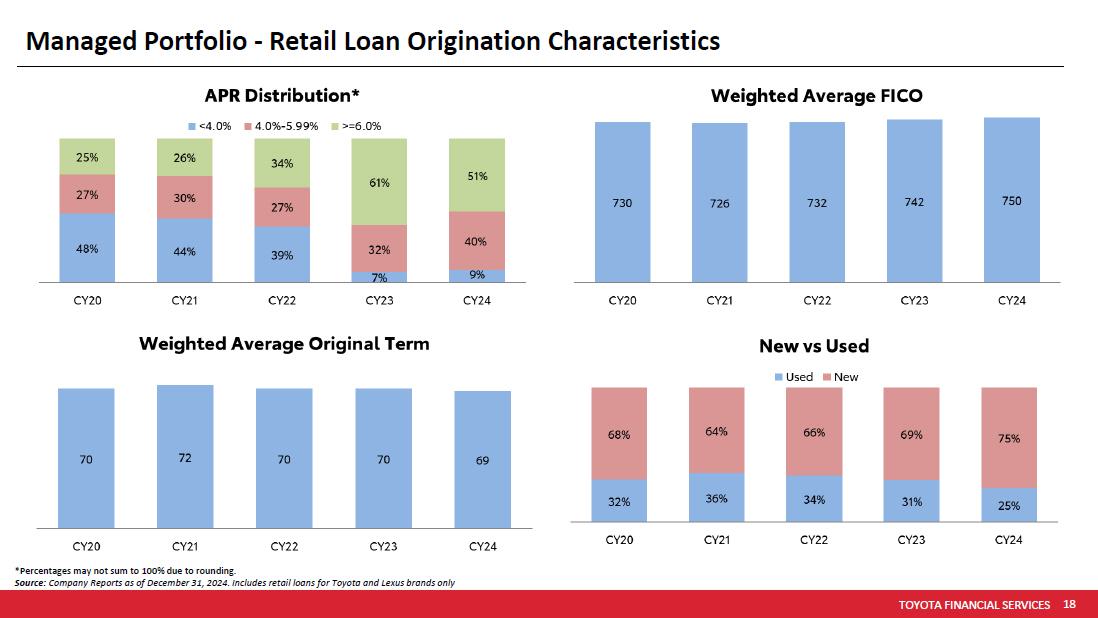

TOYOTA FINANCIAL SERVICES 18 •• PROTECTED 関係者外秘 Managed Portfolio - Retail Loan Origination Characteristics *Percentages may not sum to 100% due to rounding . Source: Company Reports as of December 31, 2024. Includes retail loans for Toyota and Lexus brands only

TOYOTA FINANCIAL SERVICES 19 •• PROTECTED 関係者外秘 Retail Loan Managed Portfolio Performance Source: Company Reports as of December 31, 2024

TOYOTA FINANCIAL SERVICES 20 •• PROTECTED 関係者外秘 TMCC Funding Programs

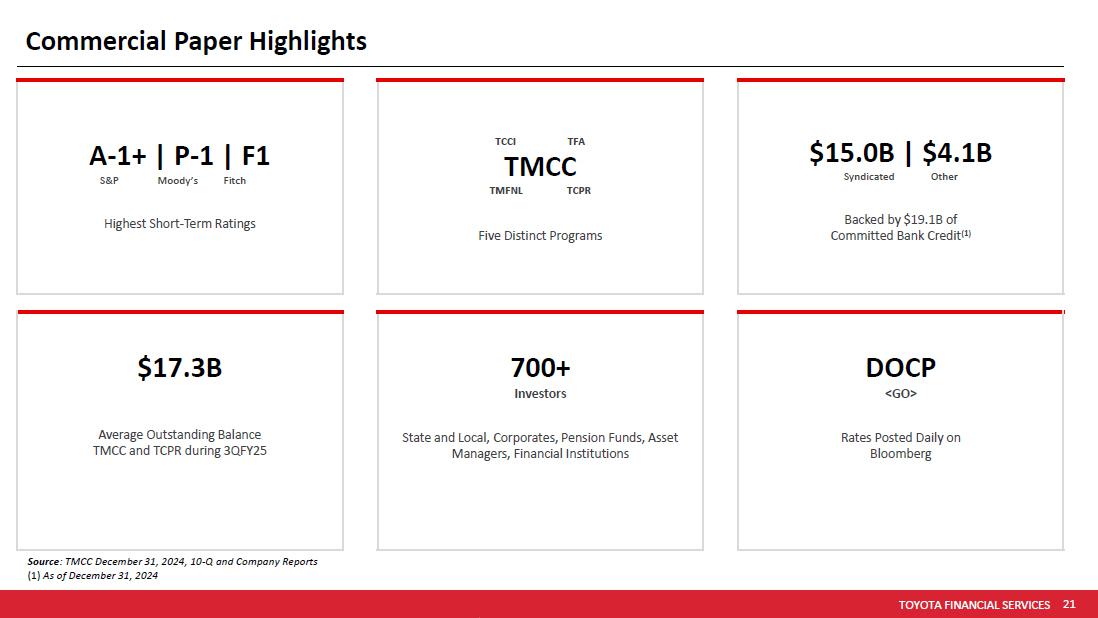

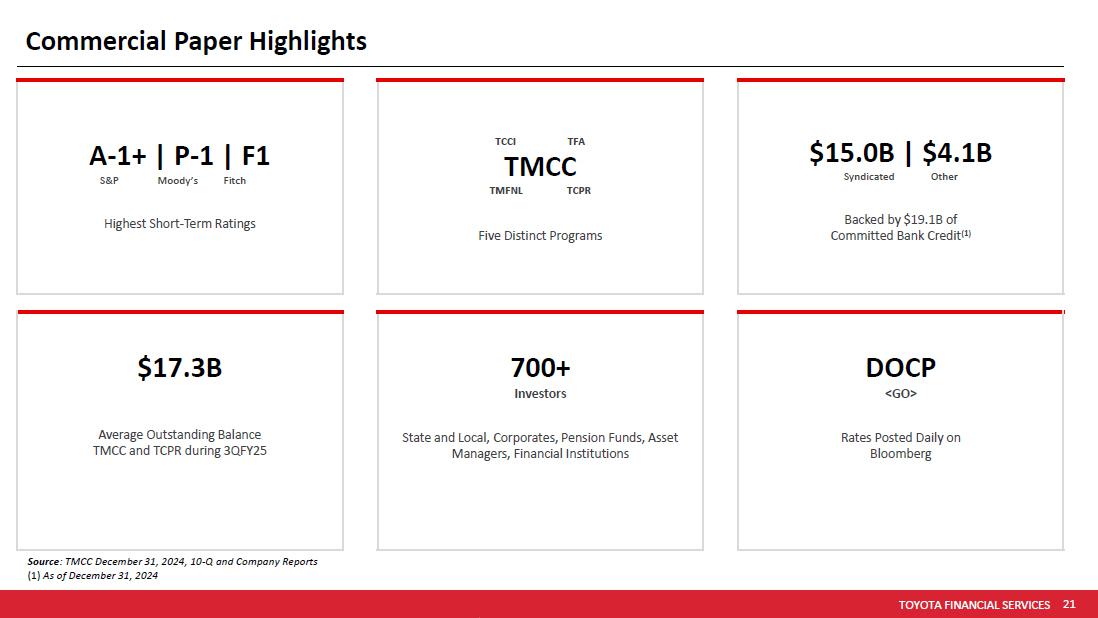

TOYOTA FINANCIAL SERVICES 21 •• PROTECTED 関係者外秘 Commercial Paper Highlights Source : TMCC December 31, 2024, 10 - Q and Company Reports (1) As of December 31 , 2024 $15.0B | $4.1B Syndicated Other Backed by $19.1B of Committed Bank Credit (1) TCCI TFA TMCC TMFNL TCPR Five Distinct Programs A - 1+ | P - 1 | F1 S&P Moody’s Fitch Highest Short - Term Ratings DOCP <GO> Rates Posted Daily on Bloomberg 700+ Investors State and Local, Corporates, Pension Funds, Asset Managers, Financial Institutions $17.3B Average Outstanding Balance TMCC and TCPR during 3QFY25

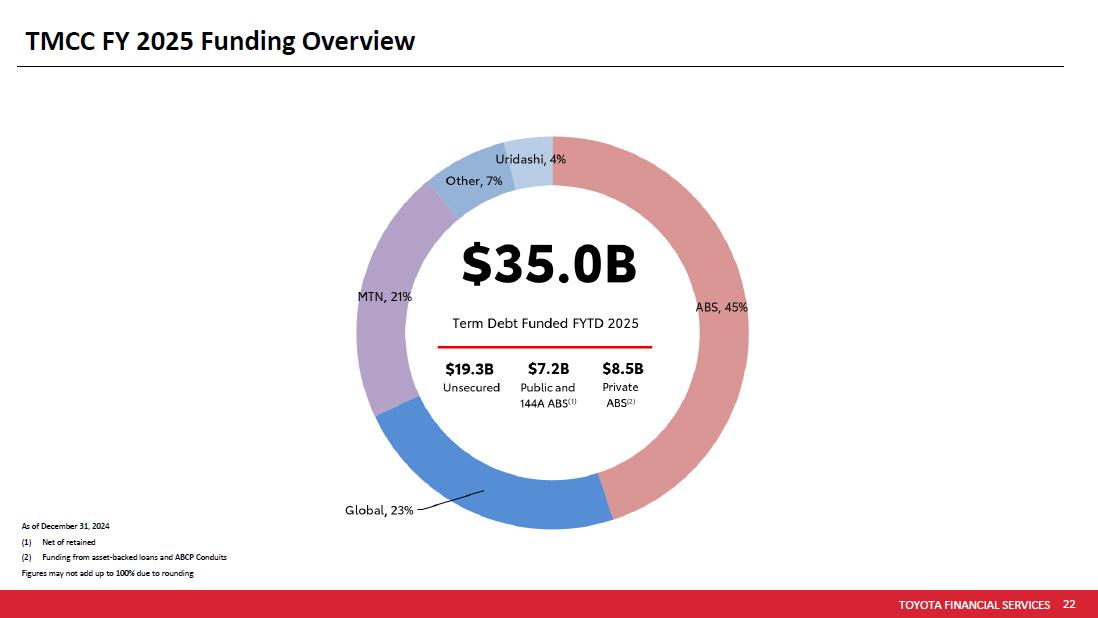

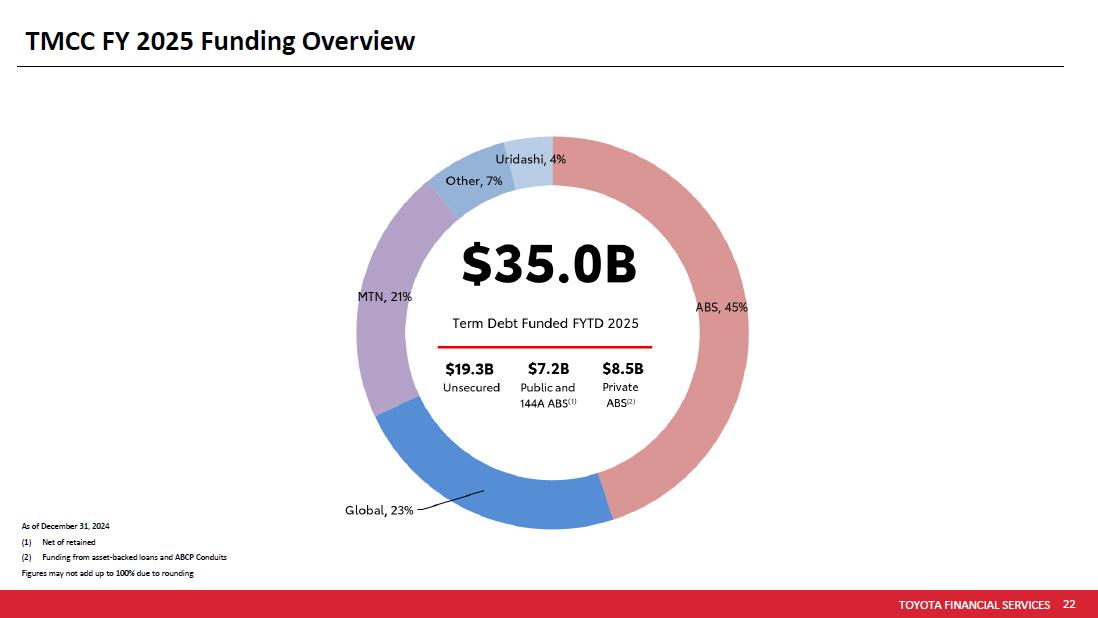

TOYOTA FINANCIAL SERVICES 22 •• PROTECTED 関係者外秘 TMCC FY 2025 Funding Overview As of December 31, 2024 (1) Net of retained (2) Funding from asset - backed loans and ABCP Conduits Figures may not add up to 100% due to rounding

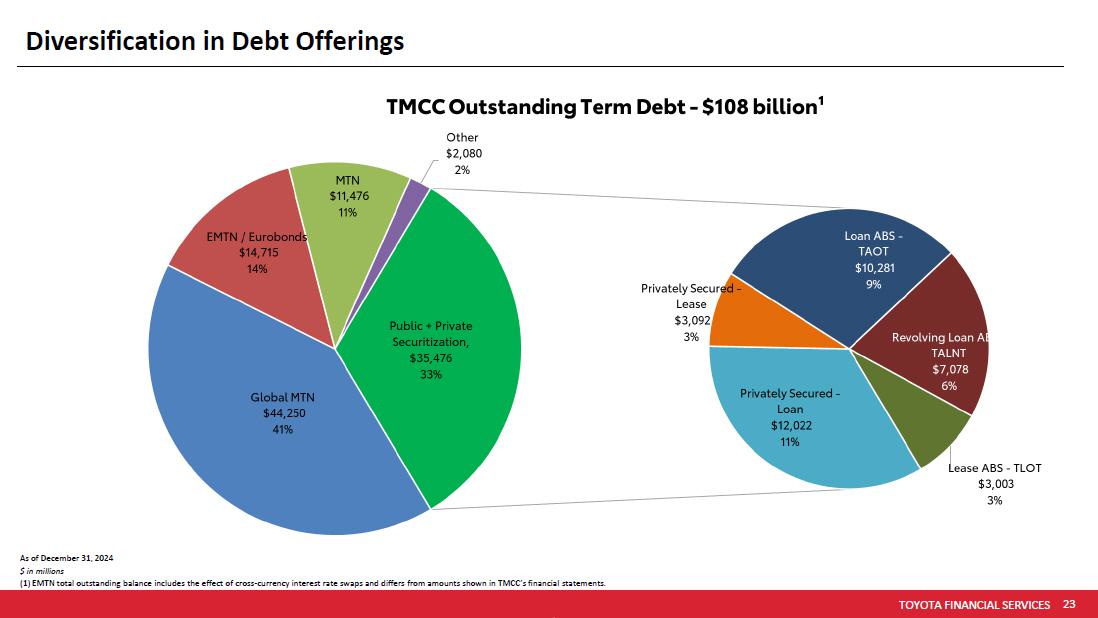

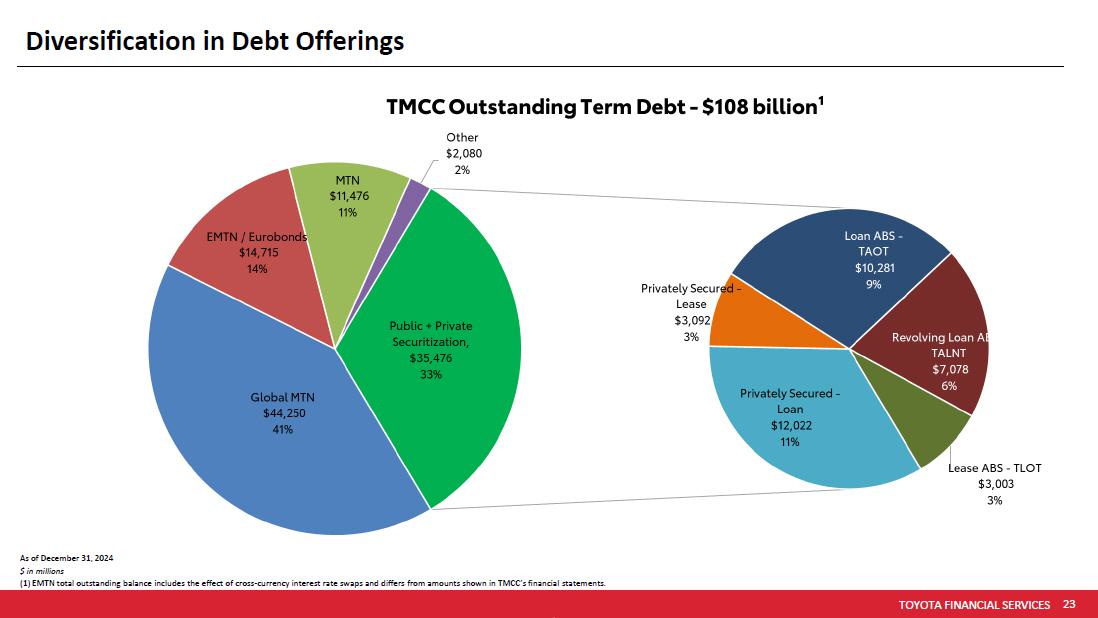

TOYOTA FINANCIAL SERVICES 23 •• PROTECTED 関係者外秘 Diversification in Debt Offerings As of December 31, 2024 $ in millions (1) EMTN total outstanding balance includes the effect of cross - currency interest rate swaps and differs from amounts shown in T MCC’s financial statements.

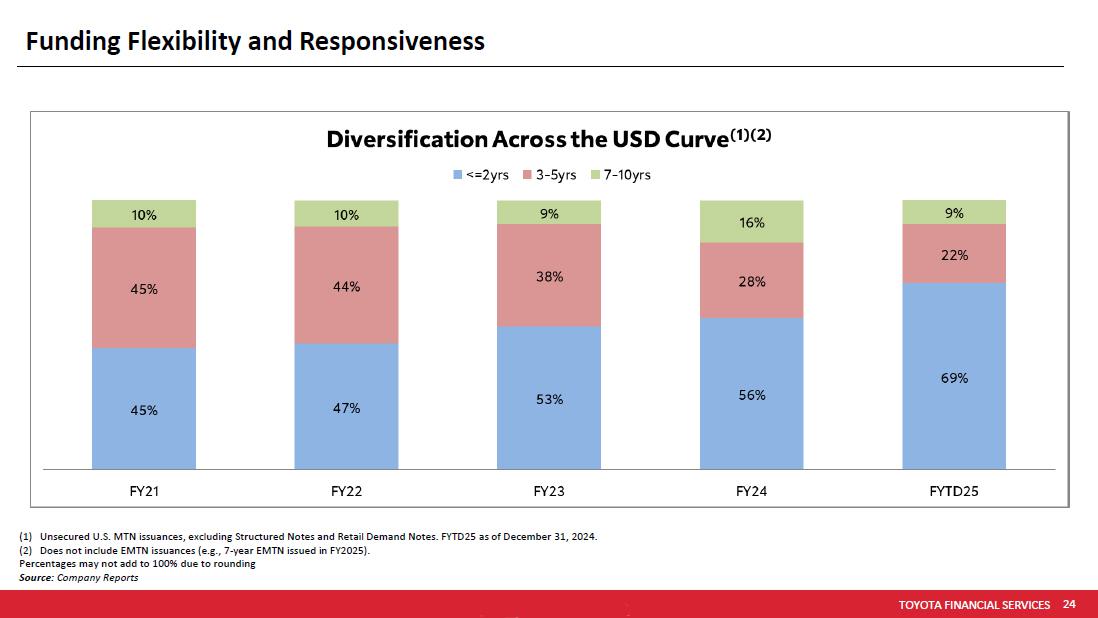

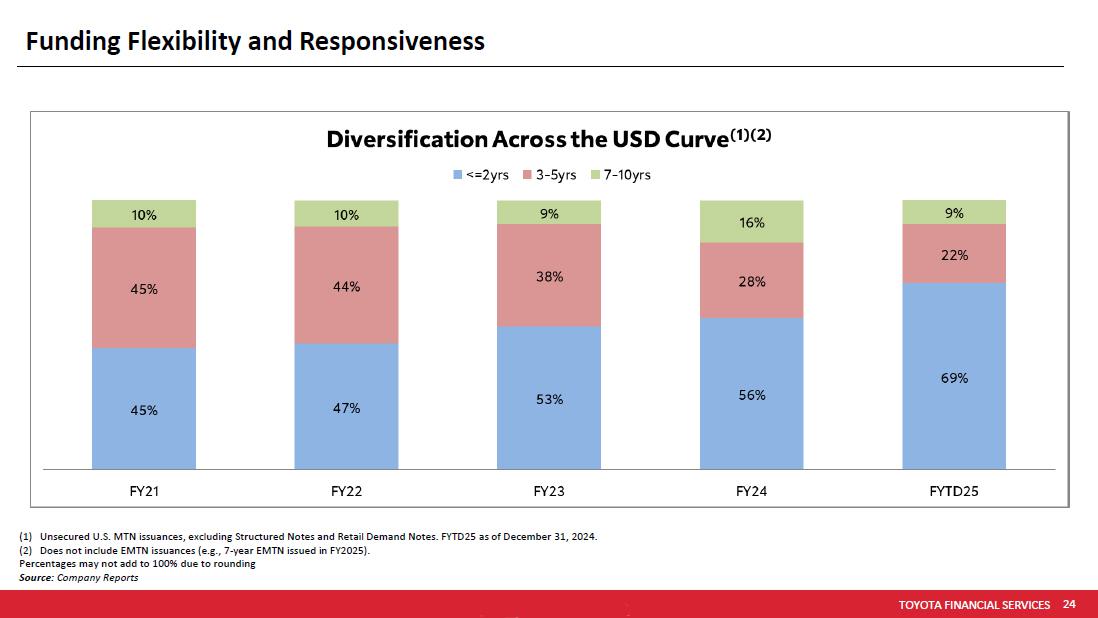

TOYOTA FINANCIAL SERVICES 24 •• PROTECTED 関係者外秘 Funding Flexibility and Responsiveness (1) Unsecured U.S. MTN issuances, excluding Structured Notes and Retail Demand Notes. FYTD25 as of December 31, 2024. (2) Does not include EMTN issuances (e.g., 7 - year EMTN issued in FY2025). Percentages may not add to 100% due to rounding Source: Company Reports