LC Greenwood and Richard Delatore. Each of the nominees for director currently serves as a director of the Company.

on Intelligence, the Government Operations Committee, and the Public Works and Transportation Committee. Mr. Stanton has held a wide variety of public service positions, including service as the youngest City Council President in the history of Cleveland, Ohio and membership on the Board of Regents of the Catholic University of America in Washington, D.C. Mr. Stanton is also former Executive Vice President of Delaware North, a privately held international company which, during Mr. Stanton’s tenure, had annual sales of over $1 billion and became the leading parimutuel wagering company in the United States, with worldwide operations including horse racing, harness racing, dog racing, and Jai-Lai. Delaware North also owned the Boston Garden and the Boston Bruins hockey team. From 1985-1994, Mr. Stanton was a principal and co-founder of Western Entertainment Corporation, which pioneered one of the first Native American Gaming operations in the United States, a 90,000 square foot bingo and casino gaming operation located on the San Manuel Indian Reservation in California, which generated annual revenues in excess of $50 million. Mr. Stanton also serves on the Boards of Directors of the Federal Home Loan Bank of Atlanta and of Lottery and Wagering Solutions, Inc.

Donald J. Duffy,38, has been a director of the Company since June 2001 and serves as Chairman of our Compensation Committee, Chairman of our Audit Committee and as a member of the Nominating Committee. Mr. Duffy is presently a director and president of Integrated Corporate Relations, an investor relations and consulting firm. Mr. Duffy co-founded Meyer, Duffy & Associates in 1994 and Meyer Duffy Ventures in 1999. At Meyer Duffy, Mr. Duffy played an integral role in numerous seed and early stage companies. His expertise is focusing on the development and implementation of business plans including financial forecasting and analysis, management team development, corporate strategy and capital formation. Prior to co-founding Meyer, Duffy & Associates, Mr. Duffy was a Senior Vice President at Oak Hall Capital Advisors where he specialized in investments in the leisure, gaming and technology markets. Prior to Oak Hall, Mr. Duffy was an investment fund partner at Sloate, Weisman, Murray & Company, specializing in investments in the leisure, gaming, technology and retail markets. Mr. Duffy is a graduate of St. John’s University.

Richard Delatore,66, has been a director of the Company since June 2004. Mr. Delatore serves as a member of our Audit Committee and is the Chairman of our Nominating Committee. Mr. Delatore is presently a Vice President with Schiappa & Company which is involved in the coal mining and hauling business and located in Wintersville, Ohio (since 2002). Mr. Delatore is also a commissioner on the Board of Commissioners in Jefferson County, Ohio (since 2000), and is a coal and timber consultant in Steubenville, Ohio (since 1990). Mr. Delatore was a member of the Ohio State Racing Commission from 1995 to 1999. Mr. Delatore chaired the Medication Committee of the Ohio State Racing Commission in 1999. He was also a member of the Steubenville City School Board of Education from 1993 to 2000 and a member of the Jefferson County Joint Vocational School Board of Education from 1995 to 1998. Mr. Delatore received his Bachelor of Science degree in Business Administration from Franciscan University of Steubenville, Ohio.

LC Greenwood,59, has been a director of the Company since November 2002 and serves on our Compensation Committee and on our Nominating Committee. Mr. Greenwood was born in Canton Mississippi, went to Roger High in Canton and was granted an Academic Athletic Scholarship to Arkansas AM & N in Pine Bluff, where he received his Bachelor of Science Degree. After college Mr. Greenwood played thirteen years as a Defensive End with the World

4

Champion Pittsburgh Steelers, won four Super Bowls, was named a member of every All Pro Team during the 1970s, was also All Pro seven times, and played in six Pro Bowls. Today Mr. Greenwood is President of Greenwood Enterprises, a coal and natural gas marketing company; Greenwood/McDonald Supply Co., an electrical supply company; and President/Owner of Greenwood Manufacturing Co., a manufacturer and distributor of packing products. Among Mr. Greenwood’s awards are the Worthen Sport Award, Professional Athlete of the Year in Little Rock, Arkansas, Outstanding Achievement Award, Canton, Mississippi, 1975, Key to the City of Canton, MS and to the State of Mississippi, Key to the State of West Virginia, 25th Anniversary Super Bowl Team, 100 Year Black College All American Team, Arkansas Hall of Fame, and member of the 75th Silver Anniversary Super Bowl Team. In 1975 March 24th was declared “LC Greenwood Day” in Canton, Mississippi. Mr. Greenwood is a Life Member of the N.A.A.C.P. and a Member of AFTRA-American Federation of Television and Radio Artists. He worked on the Miller Lite Campaign, performing in television commercials and promotions for ten years and has been involved in numerous commercials and industrial films since 1971 to the present, including over ten national commercials and numerous local commercials.

The Board held seven (7) meetings and acted five (5) times by written consent during the fiscal year ended December 31, 2005. All directors attended all of the meetings. Messrs. Stanton, Duffy and Delatore, all of whom are independent directors, make up the Board’s Audit Committee. During the fiscal year ended December 31, 2005, the Audit Committee met seven (7) times. In June of 2000, the Board of Directors established a formal Charter for the Audit Committee which was amended and restated in June 2004. A copy of the Amended and Restated Charter of the Audit Committee was included as Exhibit A to the Company’s 2004 Annual Meeting proxy statement.

Messrs. Duffy and Greenwood, both of whom are independent directors, make up the Board’s Compensation Committee. Mr. Duffy joined the Committee in April of 2002, and Mr. Greenwood joined the Committee in November of 2002, when he joined the Board. The Compensation Committee makes recommendations with respect to salaries, bonuses, restricted stock, and deferred compensation for the Company’s executive officers as well as the policies underlying the methods by which the Company compensates its executives. During the fiscal year ended December 31, 2005, the Compensation Committee held one (1) meeting.

The Finance Committee monitors the Company’s relationships with its lenders and investment bankers and negotiates on behalf of the Company with respect to proposed financing arrangements. Mr. Blatt is the sole member of the Board’s Finance Committee.

In November 2005, the Board created a Special Committee comprised of all the independent directors with Mr. Duffy, as chairman and Messrs. Stanton, Greenwood and Delatore comprising the other members of the Committee to consider a management buyout proposal and certain other transactions that may be in the best interest of the Company’s shareholders. The Special Committee held fourteen (14) meetings in 2005.

The Nominating Committee of the Company currently consists of the Company’s independent directors and operates under a written charter adopted by our Board of Directors, which is available on our Internet website atwww.mtrgaming.com under “Investor Relations-Corporate Governance.” Our Board of Directors has determined that each of the members of the

5

Nominating Committee is “independent” within the meaning of the general independence standards in the listing standards of The Nasdaq Stock Market, Inc. The committee (which was established in June 2004) met three (3) times in 2005. The primary purposes and responsibilities of the Nominating Committee are to (1) identify individuals qualified to become directors, consistent with the criteria approved by our Board of Directors set forth in the Nominating Committee Charter, (2) nominate qualified individuals for election to the Board of Directors at the next annual meeting of shareholders, and (3) recommend to our Board of Directors the individual directors to serve on the committees of our Board of Directors.

Director Candidate Recommendations and Nominations by Shareholders. The Nominating Committee’s Charter provides that the Nominating Committee will consider director candidate nominations by shareholders. In evaluating nominations received from shareholders, the Nominating Committee will apply the same criteria and follow the same process set forth in its Charter as it would with its own nominations.

Nominating Committee Process for Identifying and Evaluating Director Candidates. The Nominating Committee evaluates all director candidates in accordance with the director qualification standards described in its Charter. The Nominating Committee evaluates any candidate’s qualifications to serve as a member of our Board of Directors based on the totality of the merits of the candidate and not based on minimum qualifications or attributes. In evaluating a candidate, the Nominating Committee takes into account the background and expertise of individual Board members as well as the background and expertise of our Board of Directors as a whole. In addition, the Nominating Committee will evaluate a candidate’s independence and his or her background and expertise in the context of our Board’s needs. The Nominating Committee Charter requires that the Committee ascertain that each nominee shall have: (i) demonstrated business and industry experience that is relevant to the Company; (ii) the ability to meet the suitability requirements of all relevant regulatory agencies; (iii) freedom from potential conflicts of interest with the Company and independence from management with respect to independent director nominees; (iv) the ability to represent the interests of shareholders; (v) the ability to demonstrate a reasonable level of financial literacy; (vi) the availability to work with the Company and dedicate sufficient time and energy to his or her board duties; (vii) a recognized reputation for integrity, skill, honesty, leadership abilities and moral values; and (viii) the ability to work constructively with the Company’s other directors and management. The Nominating Committee did not receive any recommendations from any shareholders in connection with the Annual Meeting.

Shareholders may communicate with the Board of Directors by sending written correspondence to the Chairman of the Nominating Committee at the following address: MTR Gaming Group, Inc., State Route 2, South, P.O. Box 356, Chester, West Virginia 26034, Attention: Corporate Secretary. The Chairman of the nominating Committee and his or her duly authorized representatives shall be responsible for collecting and organizing shareholder communications. Absent a conflict of interest, the Corporate Secretary is responsible for evaluating the materiality of each shareholder communication and determining whether further distribution is appropriate, and, if so, whether to (i) the full Board, (ii) one or more Board members and/or (iii) other individuals or entities. Additional procedures to be followed by shareholders of the Company in submitting recommendations to the Nominating Committee are attached as an Exhibit to the Committee’s Charter.

6

As a publicly traded corporation registered with and licensed by the Nevada Gaming Commission, the Company has a Compliance Committee which implements and administers the Company’s Compliance Plan. The Committee’s duties include investigating key employees, vendors of goods and services, sources of financing, consultants, lobbyists and others who wish to do substantial business with the Company or its subsidiaries and making recommendations to the Company’s management concerning suitability. There are currently five members of the Compliance Committee including one member of the Company’s Board of Directors and such others as the Nevada gaming regulators require from time to time.

All directors attended the Company’s Annual Meeting of shareholders in July 2005.

Report of the Audit Committee

The purpose of the Audit Committee is to oversee the accounting and financial reporting processes of the Company and the financial statements of the Company. The Board of Directors, in its business judgment, has determined that all members of the Committee are “independent,” as required by applicable listing standards of Nasdaq and the Sarbanes-Oxley Act of 2002 and the rules promulgated thereunder. The Committee operates pursuant to a Charter that was last amended and restated by the Board on June 1, 2004. As set forth in the Charter, management of the Company is responsible for the preparation, presentation and integrity of the Company’s financial statements and for the effectiveness of internal control over financial reporting. Management is responsible for maintaining the Company’s accounting and financial reporting principles and internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The Company’s independent registered public accounting firm is responsible for auditing the Company’s financial statements, expressing an opinion as to their conformity with generally accepted accounting principles and annually auditing Management’s assessment of the effectiveness of internal control over financial reporting (which commenced with respect to the Company’s fiscal year ending December 31, 2004). In addition, the Company’s independent registered public accounting firm will express their own opinion on the effectiveness of the Company’s internal controls over financial reporting. The Audit Committee’s responsibility is to monitor and oversee these processes.

As part of its responsibility to monitor and oversee the Company’s internal controls over financial reporting, during fiscal year 2005, the Audit Committee received and reviewed periodic reports and updates from the Company’s Management and the Company’s independent registered public accounting firm on the progress in meeting the Company’s obligations with regard to documenting and testing its internal controls over financial reporting and remediating any issues that were identified. The Audit Committee also discussed with Management, and the Company’s independent registered public accounting firm, Management’s assessment of the effectiveness of the Company’s internal controls over financial reporting, which was included in the Company’s Annual Report on SEC Form 10-K for the fiscal year ended December 31, 2005.

In the performance of its oversight function, the Committee has considered and discussed the audited financial statements with management and the Company’s independent registered public accounting firm. The Committee has also discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as currently in effect. Finally, the Committee has

7

received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, as currently in effect, and has discussed with the independent registered public accounting firm that firm’s independence.

The members of the Audit Committee are not full-time employees of the Company and are not performing the functions of auditors or accountants. As such, it is not the duty or responsibility of the Audit Committee or its members to conduct “field work” or other types of auditing or accounting reviews or procedures or to set auditor independence standards. Members of the Committee necessarily rely on the information provided to them by Management and the independent accountants. Accordingly, the Audit Committee’s considerations and discussions referred to above do not assure that the audit of the Company’s financial statements has been carried out in accordance with generally accepted accounting standards, that the financial statements are presented in accordance with generally accepted accounting principles or that the Company’s independent registered public accounting firm is in fact “independent.”

Based upon the reports and discussions described in this report, and subject to the limitations on the role and responsibilities of the Committee referred to above and in the Charter, the Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005 as filed with the Securities and Exchange Commission.

Submitted by the Audit Committee of the Company’s Board of Directors,

Donald J. Duffy

James V. Stanton

Richard Delatore

Executive Officers; Officers

The following persons serve as the officers indicated:

| | | | |

Name and Address | | Position | | Principal Occupation Last

5 Years |

| |

| |

|

| | | | |

EDSON R. ARNEAULT*

MTR Gaming Group, Inc.

State Route 2 South

P.O. Box 356

Chester, WV 26034 | | Director, President,

Chief Executive Officer

and Treasurer | | President of the Company

and its subsidiaries |

| | | | |

ROBERT A. BLATT**

1890 Palmer Avenue

Suite 303

Larchmont, NY 10538 | | Director, Vice

President,

Assistant Secretary | | Commercial Development |

8

| | | | |

Name and Address | | Position | | Principal Occupation Last

5 Years |

| |

| |

|

| | | | |

ROSE MARY WILLIAMS***

MTR Gaming Group, Inc.

State Route 2 South

Chester, WV 26034 | | Secretary | | Horse Racing Management |

| | | | |

JOHN W. BITTNER, JR.*****

MTR Gaming Group, Inc.

State Route 2 South

Chester, WV 26034 | | Chief Financial Officer

Accounting | | Accounting and Finance |

| | | | |

DAVID R. HUGHES

Mountaineer Park, Inc.

State Route 2 South

P.O. Box 358

Chester, WV 26034 | | Chief Operating Officer

Mountaineer Park, Inc. | | Casino Management |

| | | | |

WILLIAM H. ROBINSON****

Binions Gambling Hall & Hotel

128 E. Fremont Street

Las Vegas, NV 89101 | | Vice President,

Chief Operating Officer | | Nevada Properties Hotel

and Casino Management |

| | | | |

PATRICK J. ARNEAULT

Mountaineer Park, Inc.

State Route 2 South

P.O. Box 358

Chester, WV 26034 | | Vice President;

Mountaineer Facilities

Management and

Construction | | Oil and Gas;

Facilities Management and

Construction |

| | |

* | | Also an officer and director of Mountaineer Park, Inc., Speakeasy Gaming of Las Vegas, Inc., Speakeasy Gaming of Reno, Inc., Speakeasy Gaming of Fremont, Inc., Scioto Downs, Inc., MTR-Harness, Inc., and Presque Isle Downs, Inc., the Company’s subsidiaries. |

| | |

** | | Also assistant secretary of Mountaineer Park, Inc. |

| | |

*** | | Also secretary of Mountaineer Park, Inc. and MTR-Harness, Inc. Officer of Speakeasy Gaming of Las Vegas, Inc., Speakeasy Gaming of Reno, Inc. and Speakeasy |

| | |

**** | | Also Chief Operating Officer of Speakeasy Gaming of Fremont, Inc. |

| | |

***** | | Also Chief Financial Officer of Scioto Downs, Inc., and MTR-Harness, Inc. |

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of June 14, 2006, the ownership of the presently issued and outstanding shares of our common stock by persons owning more than 5% of such stock, and the ownership of such stock by our officers and directors, individually and as a group. As of June 14, 2006, there were 27,498,026 shares of common stock outstanding. Unless otherwise indicated, the address for each of the stockholders listed below is c/o MTR Gaming Group, Inc., State Route 2 South, P.O. Box 356, Chester, WV 26034.

9

| | | | | | | | |

Name | | Number of

Shares | | Percentage of

Class | |

| |

|

| | |

| |

Edson R. Arneault(1) | | | 3,827,074 | | | 13.20 | % | |

Robert A. Blatt(2) | | | 943,900 | | | 3.27 | % | |

James V. Stanton(3) | | | 71,900 | | | * | | |

Donald J. Duffy(4) | | | 50,000 | | | * | | |

LC Greenwood(5) | | | 0 | | | * | | |

Richard Delatore(6) | | | 0 | | | * | | |

Patrick J. Arneault(7) | | | 50,200 | | | * | | |

Rose Mary Williams(8) | | | 90,666 | | | * | | |

John W. Bittner, Jr.(9) | | | 75,000 | | | * | | |

David R. Hughes | | | 0 | | | * | | |

William H. Robinson | | | 0 | | | * | | |

Total officers and directors as a group (11 persons) | | | 5,109,740 | | | 17.69 | % | |

Litespeed Management LLC, Litespeed Master Fund, Ltd. and Jamie Zimmerman(10) | | | 1,467,000 | | | 5.39 | % | |

| |

|

* | Indicates less than one percent. |

| |

(1) | Includes 3,408,532 shares and options to acquire beneficial ownership of 300,000 shares within 60 days held by Mr. Arneault. Also includes 99,333 shares held by a corporation of which Mr. Arneault is the sole shareholder and 19,209 shares held by a partnership of which Mr. Arneault is a general partner. |

| |

(2) | Includes 790,900 shares held by Mr. Blatt, 3,000 shares held by Mr. Blatt’s wife, and options to acquire beneficial ownership of 150,000 shares exercisable within 60 days held by Mr. Blatt. Mr. Blatt’s mailing address is c/o The CRC Group, Larchmont Plaza, 1890 Palmer Avenue, Suite 303, Larchmont, NY 10538. |

| |

(3) | Includes 56,900 shares held by Mr. Stanton and options to acquire beneficial ownership of 25,000 shares exercisable within 60 days held by Mr. Stanton. Mr. Stanton’s mailing address is 815 Connecticut Avenue, NW, Suite 620, Washington, DC 20006. |

| |

(4) | Mr. Duffy’s business mailing address is c/o Integrated Corporate Relations, 450 Post Road East, Westport, CT 06880. Includes no shares and includes options to acquire beneficial ownership of 50,000 shares exercisable within 60 days held by Mr. Duffy. |

| |

(5) | Mr. Greenwood’s business mailing address c/o Greenwood McDonald Supply Company, Inc., 313 West Main Street Carnegie, PA 15106. |

| |

(6) | Mr. Delatore’s mailing address is c/o the Company at State Route 2 South, P.O. Box 356, Chester, West Virginia 26034. |

| |

(7) | Includes 200 shares held by Mr. Arneault’s minor children and options to acquire ownership of 50,000 shares within 60 days held by Mr. Arneault. |

| |

(8) | Includes no shares and includes options to acquire beneficial ownership of 90,666 shares within 60 days held by Ms. Williams. |

| |

(9) | Includes no shares and includes options to acquire beneficial ownership of 75,000 shares within 60 days held by Mr. Bittner. |

| |

(10) | Litespeed Management LLC and Jamie Zimmerman are located at 237 Park Avenue, Suite 900, New York, New York 10017. The address of Litespeed Master Fund, Ltd. is c/o BNY Alternative Investment Services Ltd., 18 Church Street, Skandia House, Hamilton HM11, Bermuda. Information based solely on filings made by Litespeed Management LLC, Litespeed Master Fund, Ltd. and Jamie Zimmerman with the SEC. |

Section 16(a) Beneficial Ownership Reporting Compliance

Under the provisions of Section 16(a) of the Exchange Act, the Company’s executive officers, directors and 10% beneficial stockholders are required to file reports of their transactions in the Company’s securities with the Commission. Based solely on a review of the Forms 3 and 4 and amendments thereto furnished to the Company during its most recent fiscal year and Forms 5 and amendments thereto furnished to the Company with respect to its most

10

recent fiscal year, the Company believes that as of June 10, 2005, all of its executive officers, directors and greater than 10% beneficial stockholders complied with all filing requirements applicable to them during 2005, except for Roger Szepelak who had one late filing in 2005.

The following table sets forth the compensation awarded, paid to or earned by the most highly compensated executive officers of the Company whose compensation exceeded $100,000 in the fiscal year ended December 31, 2005.

SUMMARY COMPENSATION TABLE

The following table sets forth the compensation awarded, paid to or earned by our most highly compensated executive officers whose compensation exceeded $100,000 in the year ended December 31, 2005.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | Long Term

Compensation

Awards | | | | | | | | | | |

| | | | | | | | |

| | | | | | |

| | | | | Annual Compensation | | Other

Annual

Comp.

($) (1) | | Restricted

Stock

Awards

($) | | Options

SARS

(#) (2) | | Payouts | |

| | | | |

| | | | |

|

|

|

|

| |

| | | | | Salary

($) | | Bonus

($) | | | | | LTIP

Payouts ($) | | | All Other

Comp. ($)(4) |

Name | | | Year | | | | | | | | |

| | |

| |

| |

| |

| |

| |

| |

| | |

|

Edson R. Arneault(3) | | | 2005 | | | 916,125 | | | 100,000 | | | 475,797 | | | — | | | — | | | — | | | 158,125 | |

Chairman, President and | | | 2004 | | | 907,607 | | | 100,000 | | | 535,980 | | | — | | | — | | | — | | | 139,289 | |

Chief Executive Officer | | | 2003 | | | 880,446 | | | 100,000 | | | 505,042 | | | — | | | — | | | — | | | 125,931 | |

MTR Gaming Group, Inc. | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Robert A. Blatt(3) | | | 2005 | | | 227,812 | | | — | | | 19,954 | | | — | | | — | | | — | | | 48,000 | |

Vice President | | | 2004 | | | 244,600 | | | — | | | 12,500 | | | — | | | — | | | — | | | 12,000 | |

| | | 2003 | | | 180,157 | | | — | | | 19,594 | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Roger M. Szepelak(3)(5) | | | 2005 | | | 198,130 | | | — | | | — | | | — | | | 25,000 | | | — | | | — | |

Vice-President and | | | 2004 | | | 196,602 | | | 50,000 | | | — | | | — | | | 25,000 | | | — | | | — | |

Chief Operating Officer | | | 2003 | | | 197,733 | | | 25,000 | | | 12,788 | | | — | | | 25,000 | | | — | | | — | |

Nevada Properties | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

John W. Bittner | | | 2005 | | | 234,770 | | | — | | | 1,300 | | | — | | | 25,000 | | | — | | | — | |

Chief Financial Officer | | | 2004 | | | 244,957 | | | — | | | 1,300 | | | — | | | — | | | — | | | — | |

| | | 2003 | | | 205,481 | | | — | | | 1,300 | | | — | | | 25,000 | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

David M. Hughes | | | 2005 | | | 323,560 | | | — | | | 1,300 | | | — | | | — | | | — | | | — | |

Chief Operating Officer | | | 2004 | | | 321,469 | | | — | | | 1,300 | | | — | | | — | | | — | | | — | |

Mountaineer Park, Inc. | | | 2003 | | | 243,647 | | | — | | | 1,300 | | | — | | | — | | | — | | | — | |

| |

|

(1) | As to Mr. Arneault for 2005 includes $389,671 performance bonus earned but not paid in 2005, $84,826 annual insurance, premiums treated as compensation and an estimated pension contribution of $1,300; 2004 includes $450,112 performance bonus earned but not paid in 2004, $84,568 annual insurance premiums treated as compensation and an estimated pension contribution of $1,300; for 2003 includes $419,174 performance bonus earned but not paid in 2003, $84,568 annual insurance premium treated as compensation and an estimated pension contribution of $1,300: As to Mr. Blatt consists of $19,954 annual insurance premiums treated as compensation in 2005; $12,500 annual insurance premiums treated as compensation in 2004, in 2003 $19,594 in annual insurance premiums treated as compensation: As to Mr. Bittner consists of an estimated pension contribution of $1,300 in 2005, 2004, and 2003. As to Mr. Hughes consists of an estimated pension contribution of $1,300 in 2005, 2004 and 2003. |

| |

(2) | As to Mr. Bittner grants in 2005 and 2003, consist of non-qualified stock options for a term of ten years. The options are fully vested and have an exercise price of $11.30 and $8.00. As to Mr. Szepelak grants in 2005, 2004 and 2003 consisted of non-qualified stock options for a term of ten years. The options are fully vested and have an exercise price of $6.64, $9.02, and $9.85. |

| |

(3) | See “Employment Agreements” below. Mr. Arneault’s employment requires him to defer receipt of all compensation over the amount set forth in Section 162(m) of the Internal Revenue Code. |

| |

(4) | As to Mr. Arneault includes $158,125, $139,289, $125,931 respectively for use of Company owned housing. As to Mr. Blatt includes $48,000 and $12,000 for office expense in 2005 and 2004. The incremental cost to the Company of providing perquisites and other personal benefits during the indicated periods did not exceed, as to any Named Executive Officer, the lesser of $50,000 or 10% of the total salary or 10% of the total salary and bonus paid to such executive officer for any such year and, accordingly, is omitted from the table. |

| |

(5) | Mr. Szepelak’s last day of employment with the Company was April 3, 2006. |

11

OPTION GRANTS IN 2005

The following table contains information concerning the grant of stock options during fiscal year 2005 to the Company’s executive officers named in the Summary Compensation Table.

| | | | | | | | | | | | | | | | | | | |

| | | Number of

Securities

Underlying

Options

Granted | | % of Total

Options

Granted in

Fiscal Year | | Exercise

Price | | Expiration

Date | | Potential Realizable

Value at Assumed

Annual Rates of Stock

Price Appreciation for

Option Term(1) | |

| | | | |

| |

Name | | | | | | 5% | | 10% | |

| |

| |

| |

| |

| |

| |

| |

Roger M. Szepelak | | | 25,000 | | | 11.11% | | 6.64 | | | | 11/1/2015 | | | 154,867 | | | 264,554 | |

John W. Bittner, Jr. | | | 25,000 | | | 11.11% | | 11.30 | | | | 4/13/2015 | | | 177,664 | | | 450,020 | |

| |

|

(1) | In accordance with the rules of the Securities and Exchange Commission, “Potential Realizable Value” has been calculated assuming an aggregate ten-year appreciation of the fair market value of the Company’s common stock on the date of the grant at annual compounded rates of 5% and 10%, respectively. These amounts represent hypothetical gains that could be achieved. Actual gains, if any, on the exercise of stock options will depend on the future performance of the Company’s stock and the date on which the options are exercised. Moreover, the gains shown are net of the option exercise price, but do not include deductions for taxes or other expenses associated with the exercise of the option or the sale of the underlying shares. |

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year End Option Values

The following table sets forth information regarding the number and value of options held by each of the Company’s executive officers named in the Summary Compensation Table as of December 31, 2005.

| | | | | | | | | | | | | | | | | | | |

Name | | Shares

Acquired on

Exercise | | Value

Realized($) | | Number of Securities

Underlying Unexercised

Options at Fiscal Year End | | Value of Unexercised

In-the-Money Options

at Year End ($)(1) | |

| | |

| |

| |

| | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable | |

| |

| |

| |

| |

| |

| |

| |

Edson R. Arneault | | — | | | — | | | 300,000 | | | | — | | $ | 2,373,000 | | | — | |

Robert A. Blatt | | — | | | — | | | 150,000 | | | | — | | $ | 1,186,500 | | | — | |

Roger M. Szepelak | | 50,000 | | | 376,380 | | | 50,000 | | | | — | | $ | 48,750 | | | — | |

John W. Bittner, Jr. | | — | | | — | | | 75,000 | | | | — | | $ | 60,250 | | | — | |

| |

|

(1) | Based on the market price of the Company’s Common Stock of $10.41 on December 31, 2005, as reported by Nasdaq. |

Equity Compensation Plan Information

The following table sets forth information as of December 31, 2005 with respect to compensation plans under which equity securities of the Company are authorized for issuance.

12

| | | | | | | | | | | |

Plan Category | | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights | | Weighted-average

exercise price of

outstanding options,

warrants and rights | | Number of securities

remaining available for future

issuance under equity

compensation plans

(excluding securities reflected

in column (a)) | |

| | |

| |

| |

| |

| | (a) | | (b) | | (c) | |

| |

| |

| |

| |

Equity compensation plans approved by security holders | | | 648,850 | | | 4.74 | | | 295,000 | |

Equity compensation plans not approved by security holders | | | 552,034 | | | 9.00 | | | 25,000 | |

| | |

| | | | | |

| |

Total | | | 1,200,884 | | | | | | 320,000 | |

| | |

| | | | | |

| |

The Company’s equity compensation plans that were not approved by security holders (as no such approval was required) consist of (i) grants of NQSOs as inducement for initial employment by the Company or its subsidiaries; (ii) grants of NQSOs to non-executive employees; and (iii) NQSOs granted under our 2001 Employee Stock Incentive Plan or available for grant under our 2002 Employee Stock Incentive Plan, both of which are “broad-based plans” as defined by the Nasdaq Market Place Rules (i.e., ones in which not more than half of the options/shares may be awarded to officers and directors). In the case of all such plans, the exercise price of options must be not less than fair market value of the common stock on the date of grant. Options granted under the plans may be for terms of up to ten years. The 2001 and 2002 Employee Stock Incentive Plans are to be administered by the board or a committee of the board consisting of not fewer than two non-employee directors. Repricing under the 2001 plan is limited to 10% of the number of options then outstanding thereunder; repricing under the 2002, 2004 and 2005 plans is prohibited.

EMPLOYMENT AGREEMENTS

Pursuant to a January 1, 2001 employment agreement, as amended in December of 2004 and May of 2005, Edson R. Arneault serves as our President and Chief Executive Officer until December 31, 2006 and as chairman of the board of directors until December 31, 2009. The employment agreement provides for, among other things, an annual base salary of $750,000 (subject to automatic annual cost of living increases of 5%), semi-annual cash awards and an annual performance bonus tied to EBITDA growth. Mr. Arneault’s annual compensation for serving as chairman from January 1, 2007 until December 31, 2009 is based upon 25% of the average of the amounts paid during the last three years as President and CEO for base salary and annual bonuses.

The employment agreement also provides for a long-term incentive bonus, subject to a cap, payable after the six-year term as President and Chief Executive Officer based upon growth compared to year 2000 in a variety of objective measurements, including earnings per share, the market price of our common stock, EBITDA and gross revenues. Other factors affecting the long-term bonus are acquisitions of other racetracks and parimutuel facilities, acquisitions of gaming venues that generate positive EBITDA in their first full year of operation, and successful legislative initiatives. A second amendment of the employment agreement in May of 2005

13

adjusts certain payment dates to assure compliance with Section 409A of the Internal Revenue Code, as amended.

The employment agreement entitles Mr. Arneault, at our expense, to lease living and/or office quarters for himself and the Company in any state or jurisdiction in which the Company is currently doing business or commences substantial business operations. The Company may choose to purchase such living or office quarters. In 2001, the Company purchased living quarters in West Virginia for use by Mr. Arneault (the Company does not currently own or lease a residence for Mr. Arneault in any other state). The agreement also provides for the non-exclusive option, until September 1, 2008, for Mr. Arneault to purchase at fair market value (determined by independent appraisal) the current residence and certain surrounding acreage owned by the Company. The agreement also provides the non-exclusive option, exercisable either at the termination of Mr. Arneault’s term as president or chairman (unless he is terminated for cause), to purchase certain personal property, such as furnishings, in Mr. Arneault’s office and the corporate residence for its book value.

The agreement provides that if Mr. Arneault’s period of employment and period as Chairman is terminated by reason of death or physical or mental incapacity, the Company will continue to pay Mr. Arneault or his estate the compensation otherwise payable to the Officer for a period of two years. If Mr. Arneault period of employment and period as Chairman is terminated for a reason other than death or physical or mental incapacity or for cause, the Company will continue to pay Mr. Arneault the compensation that otherwise would have been due him for the remaining period of the amended agreement. If Mr. Arneault’s period of employment and period as Chairman is terminated for cause, the Company will have no further obligation to pay Mr. Arneault, other than compensation unpaid at the date of termination.

In the event that the termination of Mr. Arneault’s period of employment occurs after there has been a change of control of the Company, as defined, and (i) the termination is not for cause or by reason of the death or physical or mental disability of Mr. Arneault or (ii) Mr. Arneault terminates his employment for good reason, as defined in the agreement, then Mr. Arneault will have the right to receive within thirty days of the termination, a sum that is three times his annual base salary and payment by us of the next five annual premium payments for the insurance policy called for by the deferred compensation plan described below.

In October 2004, we entered into an employment agreement with Robert A. Blatt. The agreement is for a term of two years, calls for an annual base salary of $225,000 (subject to automatic annual cost of living increases of 5%) and entitles Mr. Blatt to a cash bonus of up to 50% of the base salary, in the discretion of the Compensation Committee. The employment agreement also entitles Mr. Blatt to participate in our various benefit plans for health insurance, life insurance and the like and reimbursement at the rate of $4,000 per month towards office expense. In the event Mr. Blatt terminates the employment agreement for good reason, as defined, or we terminate the agreement other than for cause, he will be entitled to the compensation otherwise payable to him under the employment agreement. In the event employment is terminated due to death or physical or mental disability Mr. Blatt or his estate would be entitled to the entire compensation otherwise payable to him for the longer of the remaining term of the agreement or eighteen months. In the event Mr. Blatt’s employment is terminated in connection with a change in control of the Company, Mr. Blatt would be entitled to a cash severance payment equal to 1.5 times his annual base salary and payment by us of the

14

next two annual premium payments for the insurance policy called for by the deferred compensation plan described below.

We also have deferred compensation agreements with Messrs. Arneault and Blatt, which provide for certain benefits upon retirement. We currently fund these obligations through the purchase of “split dollar” life insurance policies.

In March 2006, we entered into a three-year employment agreement with William H. Robinson as Vice President and Chief Operating Officer for Speakeasy Gaming of Las Vegas, Inc. and Speakeasy Gaming of Fremont, Inc. The agreement calls for an annual base salary of $275,000 with annual automatic cost of living increases of 5% and periodic increases at the discretion of the Board of Directors. The agreement also entitles Mr. Robinson to a car allowance as well as to participate in our various employee benefit plans. Mr. Robinson is also entitled to a cash bonus equal to 2% of the year-over-year increase, if any, in the EBITDA (as defined therein) for the Binion’s property. In the event Mr. Robinson’s employment is terminated by us other than for cause or a permanent and total disability, he will be entitled to the compensation otherwise payable to him under the employment agreement. In the event Mr. Robinson is terminated in connection with a change of control of the Company, as defined in the agreement, Mr. Robinson would be entitled to a cash payment in the amount of his then current annual base salary.

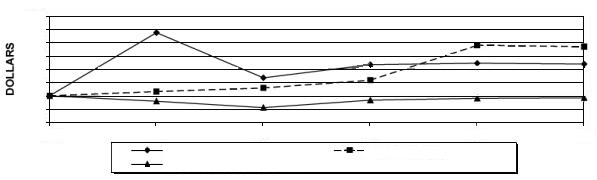

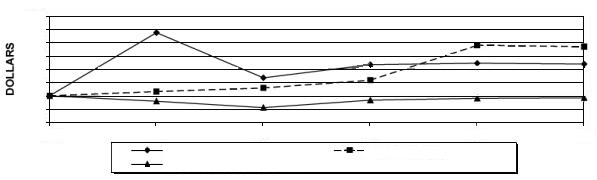

Stock Performance Graph

The following graph demonstrates a comparison of cumulative total returns of the Company, the NASDAQ Market Index (which is considered to be a broad index) and an industry peer group index based upon companies which are publicly traded with the same four digit standard industrial classification code (“SIC”) as the Company (SIC 7999 - Amusement and Recreational Services) for the past five years since December 31, 2000. The following graph assumes $100 invested in each of the above groups and the reinvestment of dividends.

15

COMPARE 5-YEAR CUMULATIVE TOTAL RETURN

AMONG MTR GAMING GROUP, INC.,

NASDAQ MARKET INDEX AND SIC CODE INDEX

400

350

300

250

200

150

100

50

0

2000

2001

2002

2003

2004

2005

MTR GAMING GROUP, INC.

NASDAQ MARKET INDEX

SIC CODE INDEX

ASSUMES $100 INVESTED JAN. 1, 2001

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING DEC. 31, 2005

16

| | | | | | | | | | | | | | | | | | | |

| | Year Ended | |

| |

| |

Index Description | | 12/20/2000 | | 12/31/2001 | | 12/31/2002 | | 12/31/2003 | | 12/31/2004 | | 12/31/2005 | |

| |

| |

| |

| |

| |

| |

| |

MTR GAMING GROUP, INC. | | | 100.00 | | | 336.84 | | | 167.58 | | | 216.84 | | | 222.32 | | | 219.16 | |

SIC CODE INDEX(1) | | | 100.00 | | | 115.83 | | | 129.49 | | | 158.38 | | | 289.86 | | | 284.34 | |

NASDAQ MARKET INDEX | | | 100.00 | | | 79.71 | | | 55.60 | | | 83.60 | | | 90.63 | | | 92.62 | |

| |

(1) | The peer group consists of the following companies: Boyd Gaming Corp.; Dover Motorsports, Inc.; Gametech International, Inc.; Isle of Capris Casinos; Lakes Entertainment Inc.; MGM Mirage, Inc.; Multimedia Games, Inc.; Nevada Gold and Casinos; Vail Resorts, Inc.; Winn Resorts Ltd.; and Youbet.com, Inc. |

Compensation of Directors

The Company’s non-employee directors receive an annual stipend of $24,000 and a per meeting fee of $1,500 (except that Mr. Duffy, in his capacity as Chairman of the Special Committee of the Board of Directors, receives $2,000 per meeting of the Special Committee). Directors who are employees of the Company do not receive compensation for attendance at Board meetings. All board members are reimbursed for expenses they incur in attending meetings.

Compensation Committee Interlocks and Insider Participation

The current members of the Company’s Compensation Committee are Messrs. Duffy and Greenwood, both of whom are independent directors. No executive officer of the Company has served as a director or member of the compensation committee (or other committee serving an equivalent function) of any other entity whose executive officers served as a director or member of the Compensation Committee of the Company.

Notwithstanding anything to the contrary, the reports of the Compensation and the Audit Committee and the performance graph on page16 shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

The Compensation Committee is authorized to review all compensation matters involving directors and executive officers and Committee approval is required for any compensation to be paid to executive officers or directors who are employees of the Company.

Board Compensation Committee Report on Executive Compensation

Policy

The Committee’s decisions with respect to executive compensation will be guided by the general principle that compensation be designed: (i) to assure that the Company’s executives

17

receive fair compensation relative to their peers at similar companies; (ii) to assure that the Company’s shareholders are receiving fair value for the compensation paid to the Company’s executives; and (iii) to allow the Company to secure and retain the services of high quality executives.

The Company’s compensation program currently consists of three elements: a base salary; annual incentives in the form of cash or restricted stock bonuses; and long-term incentives in the form of stock options and/or cash. The Committee believes that annual incentives, or bonuses, should be used to reward an executive for exceptional performance. The determination of what constitutes exceptional performance is generally a subjective judgment by the Committee based on the executive’s contribution to the Company’s revenues, legislative and regulatory efforts, recruitment of high quality personnel, elevating public awareness and perception of the Company’s gaming and resort businesses, and development of the Company’s prospects. With respect to compensation for the Company’s current CEO, annual and long-term performance bonuses are calculated pursuant to a formula tied to objective criteria.

Stock options allow the Company to motivate executives to increase stockholder value. This type of incentive also allows the Company to recruit members of the management team whose contributions and skills are important to its long-term success. The Committee intends to employ a combination of cash incentives, stock and option awards.

Chief Executive Officer Compensation; Employment Agreement

During the fiscal year ended December 31, 2005, Mr. Arneault’s base salary and bonuses were based upon a September 2001 employment agreement, which was effective as of January 1, 2002, and replaced an agreement entered into in February 1999, and which was amended in December 2004 and again in May 2005. The performance bonus for 2005 is based upon an objective formula tied to growth in the Company’s EBITDA for 2005 compared to 2000 as set forth in Mr. Arneault’s employment agreement, as amended.

Donald J. Duffy

LC Greenwood

CERTAIN TRANSACTIONS

Mr. Patrick J. Arneault serves as Vice President of Development of Mountaineer. During the year ended December 31, 2005, Mr. Arneault’s total compensation was $222,560. Patrick J. Arneault is the brother of Edson R. Arneault, our President, Chief Executive Officer and Chairman. Mr. Arneault has worked for Mountaineer since February 2000.

Ms. Aimee Zildjian is a management employee of the Company. During the year ended December 31, 2005, Ms. Zildjian total compensation was $92,654. Ms. Zildjian is the daughter of Edson R. Arneault, our President, Chief Executive Officer and Chairman.

In December 2005, we entered into an Expense Reimbursement Agreement with TBR Acquisition Group, LLC (“TBR”), an entity controlled by Edson R. Arneault, the Chief Executive Officer, President and Chairman of our Board of Directors, and Robert A. Blatt, Executive Vice President and a director on our Board, which provides for reimbursement, under certain circumstances, including entering into a definitive agreement for an “Alternative

18

Transaction” (as defined in the agreement) within twelve months from the date of the agreement by the Company of a superior proposal, of up to $250,000 of the actual, out-of-pocket expenses incurred by TBR in connection with its proposal to acquire all of the issued and outstanding shares of our common stock not already owned by TBR or its affiliates. The term “Alternative Transaction” is defined in the agreement to mean any (i) acquisition of the Company by merger or business combination transaction, or for a “merger of equals” with the Company, (ii) acquisition by any person (other than TBR and its controlling persons, or any of their respective affiliates or associates) of all or substantially all of the assets of the Company and its subsidiaries, taken as a whole, or (iii) acquisition by any person of all of the outstanding shares of common stock of the Company. To date, we have not provided nor been obligated to provide any reimbursement under the agreement.

ITEM 2

RATIFICATION OF SELECTION OF AUDITORS

The Board has selected the firm of Ernst & Young LLP (“E&Y”), independent public accountants, to serve as auditors for the fiscal year ending December 31, 2006, subject to ratification by the stockholders.

The following table summarizes principal accounting fees and services billed for calendar 2005.

| | | | | | | |

| | 2005 | | 2004 | |

| |

| |

| |

Audit Fees: | | | | | | | |

Annual Audit of the Financial Statements (including expenses) | | $ | 934,188 | | $ | 762,585 | |

Other Audit-Specific Matters | | | 74,920 | | | 54,750 | |

| |

|

| |

|

| |

Total Audit Fees | | $ | 1,009,108 | | $ | 817,335 | |

| | | | | | | |

Tax Services: | | | | | | | |

Tax Compliance | | $ | 55,965 | | $ | 29,832 | |

Other Tax Services | | | 66,345 | | | 45,944 | |

| |

|

| |

|

| |

Total Tax Fees | | $ | 122,310 | | $ | 75,776 | |

| | | | | | | |

All Other Services | | $ | — | | $ | — | |

The Audit Committee’s charter provides for the pre-approval of audit and non-audit services performed by the Company’s independent auditor. Under the charter, the Audit Committee may pre-approve specific services, including fee levels, by the independent auditor in a designated category (audit, audit-relation, tax services and all other services). The Audit Committee may delegate, in writing, this authority to one or more if its members, provided that

19

the member or members to whom such authority is delegated must report their decisions to the Audit Committee at its next scheduled meeting. All audit services provided by Ernst & Young LLP are pre-approved by the Audit Committee.

It is expected that a member of E&Y will be present at the Annual Meeting and will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

FINANCIAL INFORMATION

The Financial Statements of the Company included in the Company’s Annual Report to Stockholders that accompanies this Proxy Statement are incorporated herein by reference.

OTHER MATTERS

Stockholder Proposals for Next Meeting

Proposals of stockholders intended for inclusion in the proxy statement for the Annual Meeting of Stockholders to be held in 2007 must be received by the Company’s executive offices not later than February 22, 2007. Proponents should submit their proposals by Certified Mail-Return Receipt Requested. Proposals received after that date will be deemed untimely.

Notice Regarding Abandoned Property Law of New York State

The Company has been informed by its Transfer Agent, Continental Stock Transfer & Trust Company, that New York State now requires the Company’s Transfer Agent to report and escheat all shares held by the Company’s record shareholders if there has been no written communication received from the shareholder for a period of five years. This regulation pertains specifically to corporate issuers who do not pay dividends and their shareholders with New York, foreign or unknown addresses. The law mandates escheatment of shares even though the certificates are not in the Transfer Agent’s possession, and even though the shareholder’s address of record is apparently correct.

The Transfer Agent has advised the Company that the law requires the Transfer Agent to search its records as of June 30 each year in order to determine those New York resident shareholders from whom it has had no written communication within the past five years. Written communication would include transfer activity, voted proxies, address changes or other miscellaneous written inquiries. For those shareholders who have not contacted the Transfer Agent in over five years, a first-class letter must be sent notifying them that their shares will be escheated in November if they do not contact the Transfer Agent in writing prior thereto. All written responses will be entered in the Transfer Agent’s files, but those who do not respond will have their shares escheated. Shareholders will be able to apply to New York State for the return of their shares.

Accordingly, shareholders that may be subject to New York’s Abandoned Property Law should make their inquiries and otherwise communicate, with respect to the Company, in writing. Shareholders should contact their attorneys with any questions they may have regarding this matter.

20

No Other Business

Management is not aware at this date that any other business matters will come before the meeting. If, however, any other matters should properly come before the meeting, it is the intention of the persons named in the proxy to vote thereon in accordance with their judgment.

| |

June 22, 2006 | MTR GAMING GROUP, INC. |

| Rose Mary Williams, Secretary |

21

REVOCABLE PROXY

MTR GAMING GROUP, INC.

ANNUAL MEETING OF STOCKHOLDERS

July 26, 2006

This Proxy is Solicited on Behalf of the Board of Directors.

The undersigned hereby appoints Edson R. Arneault and Robert A. Blatt and each of them, with full power of substitution as the proxies of the undersigned to vote all undersigned’s shares of the Common Stock of MTR Gaming Group, Inc. (the Corporation) at the Annual Meeting of the Corporation’s Stockholders to be held at the New York Marriott East Side, 525 Lexington Avenue, New York, New York 10017 on July 26, 2006 at 10:00 a.m. and at any adjournments or postponements thereof, with the same force and effect as the undersigned might or could do if personally present:

The Board of Directors recommends a vote FOR ITEMS 1 and 2.

| | | | | |

1. | ELECTION OF DIRECTORS | | | | |

| | | | | |

| FOR all nominees listed below | o | | WITHHOLD AUTHORITY | o |

| | | | | | | | | | |

Edson R. Arneault | | Robert A. Blatt | | James V. Stanton | | Donald J. Duffy | | LC Greenwood | | Richard Delatore |

This proxy will be voted in the Election of Directors in the manner described in the Proxy Statement for the Annual Meeting of Stockholders. (INSTRUCTION: To withhold authority to vote for one or more individual nominees write such name or names in the space provided below.)

| |

2. | PROPOSAL TO CONFIRM THE SELECTION OF ERNST & YOUNG LLP AS INDEPENDENT PUBLIC ACCONTANTS FOR THE CORPORATION FOR THE FISCAL YEAR ENDING DECEMBER 31, 2006. |

| |

3. | In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting. |

This proxy when properly executed will be voted in the manner described herein by the undersigned stockholder. If no direction is made, this proxy will be voted FOR Proposals 1 and 2.

| |

| DATED __________________________, 2006 |

| |

|

|

| Signature |

| |

|

|

| Signature if held jointly |

| |

| Please sign exactly as name appears below. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by President or other authorized person. If a partnership, please sign in full partnership name by authorized person. |

| |

| PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE |