UNITEDSTATES

SECURITIESANDEXCHANGECOMMISSION

Washington,D.C.20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05576

Name of Fund: BlackRock Global Allocation Fund, Inc.

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: Anne F. Ackerley, Chief Executive Officer, BlackRock

Global Allocation Fund, Inc., 55 East 52nd Street, New York, NY 10055.

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 10/31/2010

Date of reporting period: 04/30/2010

Item 1 – Report to Stockholders

BlackRock Global Allocation

Fund, Inc.

SEMI-ANNUAL REPORT

APRIL 30, 2010 I (UNAUDITED)

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

| |

| Table of Contents | |

| | Page |

| Dear Shareholder | 3 |

| Semi-Annual Report: | |

| Fund Summary | 4 |

| About Fund Performance | 6 |

| Disclosure of Expenses | 6 |

| Portfolio Information | 7 |

| Financial Statements: | |

| Consolidated Schedule of Investments | 8 |

| Consolidated Statement of Assets and Liabilities | 24 |

| Consolidated Statement of Operations | 25 |

| Consolidated Statements of Changes in Net Assets | 26 |

| Financial Highlights | 27 |

| Notes to Consolidated Financial Statements | 32 |

| Officers and Directors | 42 |

| Additional Information | 43 |

| Mutual Fund Family | 46 |

2 BLACKROCK GLOBAL ALLOCATION FUND, INC.

APRIL 30, 2010

Dear Shareholder

Although overall global economic and financial conditions have generally improved over the past year, the period ended with high levels of market

volatility and diminishing investor confidence sparked by the sovereign debt crisis in Europe, concerns over the strength of the economic recovery

and uncertainty surrounding the future of interest rate policies. Additionally, as the period drew to a close, the increasing likelihood of more stringent

financial market regulations added to the overall sense of investment uncertainty. Despite the uneven nature of recent market conditions, we continue

to believe that the “Great Recession” likely ended at some point last summer, thanks primarily to massive fiscal and monetary stimulus, and that the

global economy remains in recovery mode.

Global equity markets bottomed in early 2009 and since that time have moved unevenly higher as investors were lured back into the markets by

depressed valuations, desire for higher yields and improvements in corporate earnings prospects. There have been several corrections along the way

and volatility levels have remained elevated — reflections of mixed economic data, lingering deflation issues (especially in Europe) and uncertainty

surrounding financial regulations. On balance, however, improving corporate revenues and profits and a positive macro backdrop helped push stock

prices higher over the last twelve and six months. From a geographic perspective, US equities have outpaced their international counterparts in recent

months, as the domestic economic recovery has been more pronounced and as credit-related issues have held European markets down.

Within fixed income markets, yields have been moving unevenly as improving economic conditions have been acting to push Treasury yields higher

(and prices correspondingly lower), while concerns over ongoing deflation threats have acted as a counterweight. As the period drew to a close,

Treasury yields were falling as investors flocked to the “safe haven” asset class in the face of escalating uncertainty. Over the course of the last twelve

and six months, however, Treasuries underperformed other areas of the bond market, particularly the high yield sector, which has been benefiting from

increased investor demand. Meanwhile, municipal bonds slightly outperformed taxable sectors over both the six- and twelve-month periods thanks to

continued high demand levels, but have continued to face the headwinds of ongoing state and local budget problems. As in the taxable arena, high

yield municipals have been outperforming the rest of the market.

Regarding cash investments, yields on money market securities remain near all-time lows (producing returns only marginally above zero percent), with

the Federal Open Market Committee reiterating that economic circumstances are likely to necessitate an accommodative interest rate stance for an

“extended period.”

| | |

| Against this backdrop, the major market averages posted the following returns: | | |

| Total Returns as of April 30, 2010 | 6-month | 12-month |

| US equities (S&P 500 Index) | 15.66% | 38.84% |

| Small cap US equities (Russell 2000 Index) | 28.17 | 48.95 |

| International equities (MSCI Europe, Australasia, Far East Index) | 2.48 | 34.43 |

| 3-month Treasury bill (BofA Merrill Lynch 3-Month Treasury Bill Index) | 0.04 | 0.15 |

| US Treasury securities (BofA Merrill Lynch 10-Year US Treasury Index) | (0.54) | (1.32) |

| Taxable fixed income (Barclays Capital US Aggregate Bond Index) | 2.54 | 8.30 |

| Tax-exempt fixed income (Barclays Capital Municipal Bond Index) | 3.68 | 8.85 |

| High yield bonds (Barclays Capital US Corporate High Yield 2% Issuer Capped Index) | 11.60 | 42.53 |

Past performance is no guarantee of future results. Index performance shown for illustrative purposes only. You cannot invest directly in an index.

Global financial markets continue to show signs of improvement, but questions about the strength and sustainability of the recovery abound. Through

periods of uncertainty, as ever, BlackRock’s full resources are dedicated to the management of our clients’ assets. For additional market perspective

and investment insight, visit www.blackrock.com/shareholdermagazine, where you’ll find the most recent issue of our award-winning Shareholder®

magazine, as well as its quarterly companion newsletter, Shareholder Perspectives. As always, we thank you for entrusting BlackRock with your

investments, and we look forward to your continued partnership in the months and years ahead.

THIS PAGE NOT PART OF YOUR FUND REPORT

3

Fund Summary as of April 30, 2010

Portfolio Management Commentary

How did the Fund perform?

• For the six-month period, the Fund’s Institutional, Investor A, Investor B

and Class R Shares outperformed its Reference Benchmark — which

comprises the S&P 500 Index (36%), FTSE World Index (ex-US) (24%),

BofA Merrill Lynch Current 5-Year US Treasury Index (24%), and Citigroup

Non-US Dollar World Government Bond Index (16%) — while Investor C

Shares performed in line with the benchmark. All share classes trailed

the broad-based all-equity benchmark, the FTSE World Index. The Fund

invests in both equities and bonds; therefore, the Reference Benchmark

provides a truer representation of the Fund’s composition and a more

meaningful comparison.

What factors influenced performance?

• Contributing favorably to the Fund’s performance relative to its Reference

Benchmark were its underweights in Spain, Italy, France and Australia.

The Fund also benefited from its stock selection in Japan and Russia.

From a sector perspective, underweights and stock selection in finan-

cials, consumer staples and utilities; stock selection in health care;

and an overweight in materials all contributed positively.

• In the fixed income portion, the Fund’s overweight in convertible bonds

contributed positively to relative performance.

• Detracting from the Fund’s relative performance was its underweight

and stock selection in the United States, as well as stock selection in

India, United Kingdom, Germany and China. From a sector perspective,

underweights and stock selection in the consumer discretionary and

industrials sectors, as well as an overweight and stock selection in

energy, detracted from relative performance.

Describe recent portfolio activity.

• During the period, the Fund’s overall equity allocation increased from

57% of net assets to 60%. Within equities, increases in the US, Asia,

Africa/Middle East and Latin America were modestly offset by a

decrease in Europe. On a sector basis, the Fund increased its weightings

in materials, information technology, consumer discretionary, financials,

industrials and energy, while reducing its weightings in utilities, consumer

staples, and health care.

• The Fund’s allocation to fixed income remained at 33% of net assets,

as increases in nominal US Treasuries and corporate bonds were offset

by decreases in US TIPS, Japanese government bonds and convertible

bonds. Reflecting the above changes, the Fund’s cash equivalent hold-

ings decreased from 10% of net assets to 7%.

Describe Fund positioning at period end.

• Relative to its Reference Benchmark, the Fund was neutral in equities,

underweight in fixed income and, consequently, overweight in cash

equivalents. Within the equity segment, the Fund was underweight in

Europe and the US, while being overweight in Asia and maintaining an

overweight position in Latin America.

• On a sector basis, the Fund was overweight in materials, telecommunica-

tion services, energy and health care, with underweights in consumer

discretionary, financials, consumer staples, utilities, information technol-

ogy and industrials.

• As for currency exposure, the Fund was underweight in the euro, the

British pound and the Australian dollar. The Fund had overweight posi-

tions in the US dollar, the Brazilian real and the Russian ruble, along

with several Asian currencies, including the Singapore dollar, the

Malaysian ringgit and the Indian rupee.

• The Fund’s period end cash position was 7%. Cash helped mitigate

portfolio volatility, served as a source of funds for new investments and

contributed to reducing the overall portfolio interest rate duration during

the period.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions.

These views are not intended to be a forecast of future events and are no guarantee of future results.

Derivative Financial Instruments

The Fund may invest in various derivative instruments, including financial

futures contracts, swaps, options and foreign currency exchange con-

tracts, as specified in Note 2 of the Notes to Consolidated Financials

Statements, which may constitute forms of economic leverage. Such

instruments are used to obtain exposure to a market without owning or

taking physical custody of securities or to hedge market, equity and/or

foreign currency exchange rate risks. Such derivative instruments involve

risks, including the imperfect correlation between the value of a deriva-

tive instrument and the underlying asset, possible default of the coun-

terparty to the transaction or illiquidity of the derivative instrument. The

Fund’s ability to successfully use a derivative instrument depends on the

investment advisor’s ability to accurately predict pertinent market move-

ments, which cannot be assured. The use of derivative instruments may

result in losses greater than if they had not been used, may require the

Fund to sell or purchase portfolio securities at inopportune times or for

distressed values, may limit the amount of appreciation the Fund can

realize on an investment or may cause the Fund to hold a security that it

might otherwise sell. The Fund’s investments in these instruments are

discussed in detail in the Notes to Consolidated Financial Statements.

4 BLACKROCK GLOBAL ALLOCATION FUND, INC.

APRIL 30, 2010

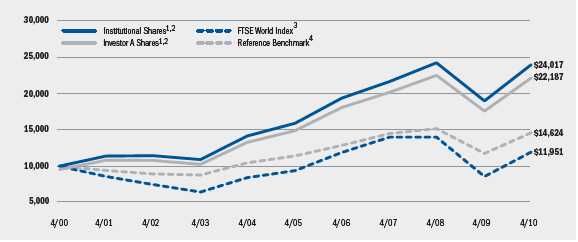

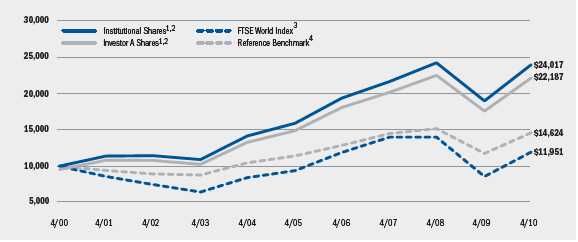

Total Return Based on a $10,000 Investment

1 Assuming maximum sales charge, transaction costs and other operating expenses, including advisory fees, if any. Institutional Shares do not

have a sales charge.

2 The Fund invests in a portfolio of US and foreign equity securities, debt and money market securities, whose composition varies with respect to

types of securities and markets in response to changing market and economic trends.

3 This unmanaged capitalization-weighted index is comprised of 2,200 equities from 24 countries in 12 regions, including the United States.

4 The Reference Benchmark is an unmanaged weighted index comprised as follows: 36% of the S&P 500 Index; 24% FTSE World Index

(Excluding US); 24% BofA Merrill Lynch Current 5-Year US Treasury Index; and 16% Citigroup Non-US Dollar World Government Bond Index.

Descriptions of these indexes can be found in the footnotes below.

| | | | | | | |

| Performance Summary for the Period Ended April 30, 2010 | | | | | | |

| | | | | Average Annual Total Returns5 | | |

| | | 1 Year | | 5 Years | | 10 Years |

| | 6-Month | w/o sales | w/sales | w/o sales | w/sales | w/o sales | w/sales |

| | Total Returns | charge | charge | charge | charge | charge | charge |

| Institutional | 7.03% | 26.27% | N/A | 8.55% | N/A | 9.16% | N/A |

| Investor A | 6.88 | 25.96 | 19.35% | 8.27 | 7.11% | 8.88 | 8.30% |

| Investor B | 6.47 | 24.93 | 20.43 | 7.40 | 7.10 | 8.20 | 8.20 |

| Investor C | 6.44 | 25.07 | 24.07 | 7.44 | 7.44 | 8.05 | 8.05 |

| Class R | 6.76 | 25.58 | N/A | 7.93 | N/A | 8.62 | N/A |

| FTSE World Index | 9.88 | 39.33 | N/A | 4.95 | N/A | 1.80 | N/A |

| Reference Benchmark | 6.44 | 24.33 | N/A | 5.06 | N/A | 3.87 | N/A |

| US Stocks: S&P 500 Index6 | 15.66 | 38.84 | N/A | 2.63 | N/A | (0.19) | N/A |

| Non-US Stocks: FTSE World Index | | | | | | | |

| (Excluding US)7 | 5.42 | 39.67 | N/A | 6.73 | N/A | 3.78 | N/A |

| US Bonds: BofA Merrill Lynch Current | | | | | | | |

| 5-Year US Treasury Index8 | 1.71 | 2.14 | N/A | 5.40 | N/A | 6.18 | N/A |

| Non-US Bonds: Citigroup Non-US Dollar | | | | | | | |

| World Government Bond Index9 | (5.16) | 6.82 | N/A | 4.20 | N/A | 6.88 | N/A |

5 Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund

Performance” on page 6 for a detailed description of share classes, including any related sales charges and fees.

6 This unmanaged index covers 500 industrial, utility, transportation and financial companies of the US markets (mostly New York Stock Exchange (“NYSE”) issues) representing

about 75% of NYSE market capitalization and 30% of NYSE issues.

7 This unmanaged capitalization-weighted index is comprised of 1,630 companies in 28 countries, excluding the United States.

8 This unmanaged index is designed to track the total return of the current coupon five-year U.S. Treasury bond.

9 This unmanaged market capitalization-weighted index tracks 10 government bond indexes, excluding the United States.

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

BLACKROCK GLOBAL ALLOCATION FUND, INC.

APRIL 30, 2010

5

About Fund Performance

• Institutional Shares are not subject to any sales charge. Institutional

Shares bear no ongoing distribution or service fees and are available only

to eligible investors.

• Investor A Shares incur a maximum initial sales charge (front-end load)

of 5.25% and a service fee of 0.25% per year (but no distribution fee).

• Investor B Shares are subject to a maximum contingent deferred sales

charge of 4.50% declining to 0% after six years. In addition, Investor B

Shares are subject to a distribution fee of 0.75% per year and a service

fee of 0.25% per year. These shares automatically convert to Investor A

Shares after approximately eight years. (There is no initial sales charge for

automatic share conversions.) All returns for periods greater than eight

years reflect this conversion. Investor B Shares are only available through

exchanges, dividend reinvestments by existing shareholders or for pur-

chase by certain qualified employee benefit plans.

• Investor C Shares are subject to a 1% contingent deferred sales charge

if redeemed within one year of purchase. In addition, Investor C Shares

are subject to a distribution fee of 0.75% per year and a service fee of

0.25% per year.

• Class R Shares do not incur a maximum initial sales charge (front-end

load) or deferred sales charge. These shares are subject to a distribution

fee of 0.25% per year and a service fee of 0.25% per year. Class R Shares

are available only to certain retirement plans. Prior to January 3, 2003

Class R Share performance results are those of Institutional Shares

(which have no distribution or service fees) restated to reflect Class R

Share fees.

Performance information reflects past performance and does not guaran-

tee future results. Current performance may be lower or higher than the

performance data quoted. Refer to www.blackrock.com/funds to obtain

performance data current to the most recent month-end. Performance

results do not reflect the deduction of taxes that a shareholder would

pay on fund distributions or the redemption of fund shares. The Fund

may charge a 2% redemption fee for sales or exchanges of shares within

30 days of purchase or exchange. Performance data does not reflect this

potential fee. Figures shown in the performance tables on the previous

page assume reinvestment of all dividends and capital gain distributions,

if any, at net asset value on the ex-dividend date. Investment return and

principal value of shares will fluctuate so that shares, when redeemed, may

be worth more or less than their original cost. Dividends paid to each class

of shares will vary because of the different levels of service, distribution

and transfer agency fees applicable to each class, which are deducted

from the income available to be paid to shareholders. The Fund’s invest-

ment advisor waived a portion of its fee. Without such waiver, the Fund’s

returns would have been lower.

Disclosure of Expenses

Shareholders of this Fund may incur the following charges: (a) expenses

related to transactions, including sales charges, redemption fees and

exchange fees; and (b) operating expenses including advisory fees, serv-

ice and distribution fees including 12b-1 fees and other Fund expenses.

The expense example below (which is based on a hypothetical investment

of $1,000 invested on November 1, 2009 and held through April 30,

2010) is intended to assist shareholders both in calculating expenses

based on an investment in the Fund and in comparing these expenses

with similar costs of investing in other mutual funds.

The table below provides information about actual account values and

actual expenses. In order to estimate the expenses a shareholder paid

during the period covered by this report, shareholders can divide their

account value by $1,000 and then multiply the result by the number cor-

responding to their share class under the heading entitled “Expenses Paid

During the Period.”

The table also provides information about hypothetical account values and

hypothetical expenses based on the Fund’s actual expense ratio and an

assumed rate of return of 5% per year before expenses. In order to assist

shareholders in comparing the ongoing expenses of investing in this Fund

and other funds, compare the 5% hypothetical example with the 5% hypo-

thetical examples that appear in other funds’ shareholder reports.

The expenses shown in the table are intended to highlight shareholders’

ongoing costs only and do not reflect any transactional expenses, such as

sales charges, redemption fees or exchange fees. Therefore, the hypotheti-

cal example is useful in comparing ongoing expenses only, and will not

help shareholders determine the relative total expenses of owning differ-

ent funds. If these transactional expenses were included, shareholder

expenses would have been higher.

| | | | | | |

| | | Actual | | | Hypothetical2 | |

| | Beginning | Ending | | Beginning | Ending | |

| | Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid |

| | November 1, 2009 | April 30, 2010 | During the Period1 | November 1, 2009 | April 30, 2010 | During the Period1 |

| Institutional | $1,000 | $1,070.30 | $4.11 | $1,000 | $1,020.83 | $4.01 |

| Investor A | $1,000 | $1,068.80 | $5.44 | $1,000 | $1,019.54 | $5.31 |

| Investor B | $1,000 | $1,064.70 | $9.68 | $1,000 | $1,015.43 | $9.44 |

| Investor C | $1,000 | $1,064.40 | $9.32 | $1,000 | $1,015.77 | $9.10 |

| Class R | $1,000 | $1,067.60 | $7.13 | $1,000 | $1,017.91 | $6.95 |

1 For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.80% for Institutional, 1.06% for Investor A, 1.89% for Investor B, 1.82% for

Investor C and 1.39% for Class R), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period shown).

2 Hypothetical 5% annual return before expenses are calculated by pro rating the number of days in the most recent fiscal half year divided by 365.

6 BLACKROCK GLOBAL ALLOCATION FUND, INC.

APRIL 30, 2010

| |

| Portfolio Information as of April 30, 2010 | |

| | Percent of |

| | Long-Term |

| Ten Largest Holdings (Equity Investments) | Investments |

| SPDR Gold Trust | 2% |

| Exxon Mobil Corp. | 1 |

| Microsoft Corp. | 1 |

| Petroleo Brasileiro SA — ADR | 1 |

| Bristol-Myers Squibb Co. | 1 |

| Apple, Inc. | 1 |

| International Business Machines Corp. | 1 |

| General Electric Co. | 1 |

| JPMorgan Chase & Co. | 1 |

| Wells Fargo & Co. | 1 |

| |

| | Percent of |

| | Long-Term |

| Geographic Allocation | Investments |

| United States | 55% |

| Japan | 8 |

| Canada | 4 |

| Brazil | 4 |

| Germany | 4 |

| United Kingdom | 3 |

| Singapore | 2 |

| China | 2 |

| South Korea | 2 |

| India | 2 |

| Malaysia | 2 |

| Russia | 2 |

| Other1 | 10 |

1 Other includes a 1% holding in each of the following countries: Hong Kong,

Luxembourg, Australia, Switzerland, Taiwan, France, United Arab Emirates,

Kazakhstan, Turkey and Mexico.

| | | |

| Overall Asset Exposure | | | |

| | Percent of Fund’s Net Assets | Reference Benchmark5 |

| | 4/30/10 | 10/31/09 | Percentages |

| US Equities | 322% | 30%2 | 36% |

| European Equities | 82 | 82 | 13 |

| Pacific Basin Equities | 122 | 132 | 8 |

| Other Equities | 8 | 6 | 3 |

| Total Equities | 603 | 573 | 60 |

| US Dollar Denominated Fixed Income Securities | 23 | 21 | 24 |

| US Issuers | 19 | 18 | — |

| Non-US Issuers | 4 | 3 | — |

| Non-US Dollar Denominated Fixed Income Securities | 10 | 12 | 16 |

| Total Fixed Income Securities | 33 | 33 | 40 |

| Cash & Short-Term Securities4 | 7 | 10 | — |

2 Includes value of financial futures contracts.

3 Includes Preferred Stock.

4 Cash & Short-Term Securities are reduced by the market (or nominal) value of long financial futures contracts.

5 The Reference Benchmark is an unmanaged weighted index comprised as follows: 36% of the S&P 500 Index; 24% FTSE World Index (Excluding US) Equities; 24% BofA

Merrill Lynch 5-Year US Treasury Bond Index; and 16% Citigroup World Government Bond Index (Excluding US). Descriptions of these indexes are found on page 5 of this

report to shareholders in the “Performance Summary” section.

BLACKROCK GLOBAL ALLOCATION FUND, INC.

APRIL 30, 2010

7

Consolidated Schedule of Investments April 30, 2010 (Unaudited)

(Percentages shown are based on Net Assets)

| | |

| Common Stocks | Shares | Value |

| Australia — 0.7% | | |

| BHP Billiton Ltd. | 3,557,951 | $ 130,065,328 |

| CSL Ltd. | 1,319,134 | 39,417,561 |

| Newcrest Mining Ltd. | 713,422 | 21,535,142 |

| Rio Tinto Ltd. | 304,357 | 19,886,731 |

| Telstra Corp. Ltd. | 7,614,267 | 22,308,977 |

| Woodside Petroleum Ltd. | 1,016,416 | 42,150,074 |

| | | 275,363,813 |

| Austria — 0.0% | | |

| Telekom Austria AG | 715,944 | 9,510,556 |

| Belgium — 0.1% | | |

| RHJ International (a) | 4,018,600 | 34,363,368 |

| RHJ International — ADR (a)(b) | 899,200 | 7,710,233 |

| | | 42,073,601 |

| Brazil — 2.3% | | |

| All America Latina Logistica SA | 1,967,160 | 17,597,778 |

| Banco Itau Holding Financeira SA | | |

| (Preference Shares) | 1,883,300 | 40,824,245 |

| Banco Santander Brasil SA | 1,605,400 | 18,573,044 |

| Cia Brasileira de Distribuicao Grupo Pao | | |

| de Acucar (Preference Shares) | 2,075,269 | 70,630,182 |

| Cia Energetica de Minas Gerais — ADR | 750,253 | 12,116,583 |

| Cosan Ltd. (a) | 3,326,600 | 35,328,492 |

| Cyrela Brazil Realty SA | 4,140,400 | 49,663,363 |

| Hypermarcas SA (a) | 7,636,800 | 104,606,477 |

| Mrv Engenharia e Participacoes SA | 3,671,300 | 25,703,852 |

| NET Servicos de Comunicacao SA (Preference | | |

| Shares) (a) | 1,683,600 | 19,884,544 |

| Petroleo Brasileiro SA — ADR | 8,656,500 | 328,427,610 |

| Petroleo Brasileiro SA — ADR | 750,410 | 31,839,896 |

| SLC Agricola SA | 3,248,300 | 30,497,487 |

| Usinas Siderurgicas de Minas Gerais SA | | |

| (Preference ‘A’ Shares) | 435,800 | 14,242,944 |

| Vale SA, Class A (Preference Shares) | 2,430,800 | 65,222,213 |

| Vivo Participacoes SA — ADR | 2,591,075 | 68,585,755 |

| | | 933,744,465 |

| Canada — 2.9% | | |

| Agrium, Inc. | 364,300 | 22,735,963 |

| Alamos Gold, Inc. | 2,562,000 | 38,059,244 |

| BCE, Inc. | 101,700 | 3,061,170 |

| Barrick Gold Corp. | 2,943,340 | 128,182,457 |

| Canadian Natural Resources Ltd. | 680,300 | 52,342,282 |

| Canadian Pacific Railway Ltd. | 617,326 | 36,335,808 |

| Canadian Pacific Railway Ltd. | 661,729 | 39,008,006 |

| Cenovus Energy, Inc. | 40,400 | 1,183,720 |

| Daylight Resources Trust | 3,433,600 | 37,858,161 |

| Eldorado Gold Corp. | 4,464,700 | 68,565,977 |

| EnCana Corp. | 40,400 | 1,336,028 |

| Goldcorp, Inc. | 3,480,600 | 150,466,338 |

| Golden Star Resources Ltd. (a) | 1,480,500 | 6,718,946 |

| IAMGOLD Corp. | 7,032,948 | 125,678,781 |

| | |

| Common Stocks | Shares | Value |

| Canada (concluded) | | |

| IAMGOLD, International African Mining Gold Corp. | 1,938,829 | $ 34,699,657 |

| Kinross Gold Corp. | 1,847,839 | 35,053,506 |

| Kinross Gold Corp. | 6,757,794 | 129,062,024 |

| New Gold, Inc. (a) | 345,500 | 2,023,750 |

| Potash Corp. of Saskatchewan, Inc. | 162,700 | 17,978,350 |

| Rogers Communications, Inc., Class B | 887,700 | 31,610,997 |

| Silver Wheaton Corp. (a) | 1,269,800 | 24,786,496 |

| Sino-Forest Corp. (a) | 2,458,600 | 43,711,672 |

| Suncor Energy, Inc. | 740,900 | 25,345,811 |

| TELUS Corp. | 327,200 | 12,104,918 |

| Talisman Energy, Inc. | 222,100 | 3,780,379 |

| Thomson Reuters Corp. | 46,900 | 1,682,772 |

| Vittera, Inc. (a) | 987,000 | 8,356,172 |

| Yamaha Gold, Inc. | 10,223,247 | 111,612,334 |

| | | 1,193,341,719 |

| Chile — 0.1% | | |

| Banco Santander Chile SA — ADR | 280,900 | 18,508,501 |

| Sociedad Quimica y Minera de Chile SA (c) | 419,900 | 15,116,400 |

| | | 33,624,901 |

| China — 1.5% | | |

| Beijing Enterprises Holdings Ltd. | 18,294,400 | 117,864,252 |

| Chaoda Modern Agriculture Holdings Ltd. | 68,410,408 | 78,214,153 |

| China BlueChemical Ltd. | 24,318,000 | 15,035,419 |

| China Communications Services Corp. Ltd. | 363,600 | 182,557 |

| China Huiyan Juice Group Ltd. | 5,886,000 | 4,471,765 |

| China Life Insurance Co. Ltd. | 6,459,100 | 29,740,902 |

| China Life Insurance Co. Ltd. — ADR | 448,966 | 30,345,612 |

| China Mobile Ltd. | 5,823,500 | 57,006,512 |

| China Pacific Insurance Group Co. Ltd. | 2,842,100 | 11,878,460 |

| China Shenhua Energy Co. Ltd., Class H | 13,222,000 | 56,737,188 |

| China South Locomotive and Rolling Corp. | 9,394,800 | 7,074,384 |

| China Telecom Corp., Ltd. | 31,090,700 | 14,264,111 |

| China Unicom Ltd. | 6,974,200 | 8,686,952 |

| Denway Motors Ltd. | 35,777,000 | 21,012,361 |

| Dongfeng Motor Group Co. Ltd. | 2,708,300 | 3,846,458 |

| Guangshen Railway Co. Ltd. | 37,814,700 | 14,700,831 |

| Jiangsu Express | 3,231,500 | 3,034,221 |

| Ping An Insurance Group Co. of China Ltd. | 1,910,800 | 16,358,070 |

| Shanghai Industrial Holdings Ltd. | 1,348,900 | 5,827,902 |

| Tianjin Development Holdings Ltd. (d) | 78,266,800 | 49,162,740 |

| Tianjin Port Development Holdings Ltd. | 124,907,400 | 35,127,398 |

| Xiamen International Port Co. Ltd. | 35,751,900 | 6,698,422 |

| Yanzhou Coal Mining Co. Ltd. | 296 | 823 |

| Zhongsheng Group Holdings Ltd. (a) | 5,925,800 | 8,242,839 |

| | | 595,514,332 |

| Egypt — 0.1% | | |

| Telecom Egypt | 10,449,481 | 34,719,873 |

| Finland — 0.0% | | |

| Fortum Oyj | 437,475 | 11,304,028 |

| | | | | | | |

| Portfolio Abbreviations | | | | | | |

| To simplify the listings of portfolio holdings in the | BRL | Brazilian Real | HOLDRS | Holding Company | SGD | Singapore Dollar |

| Consolidated Schedule of Investments, the names | CAD | Canadian Dollar | | Depositary Receipts | SPDR | Standard & Poor’s |

| and descriptions of many of the securities have | CHF | Swiss Frank | JPY | Japanese Yen | | Depositary Receipts |

| been abbreviated according to the following list: | CNY | Chinese Yuan | KRW | South Korean Won | THB | Thai Baht |

| | | ETF | Exchange-Traded Fund | MSCI | Morgan Stanley Capital | TRY | Turkish Lira |

| ADR | American Depositary Receipts | EUR | Euro | | International | TWD | Taiwan Dollar |

| AUD | Australian Dollar | GBP | British Pound | MYR | Malaysian Ringgit | USD | US Dollar |

| | | GDR | Global Depositary Receipts | NZD | New Zealand Dollar | ZAR | South African Rand |

| See Notes to Consolidated Financial Statements. | HKD | Hong Kong Dollar | PLN | Polish Zloty | | |

8 BLACKROCK GLOBAL ALLOCATION FUND, INC.

APRIL 30, 2010

Consolidated Schedule of Investments (continued)

(Percentages shown are based on Net Assets)

| | |

| Common Stocks | Shares | Value |

| France — 0.5% | | |

| AXA SA | 580,758 | $ 11,541,075 |

| AXA SA — ADR | 32,800 | 628,448 |

| Cie Generale d’Optique Essilor International SA | 984,960 | 60,043,089 |

| France Telecom SA | 2,320,680 | 50,803,596 |

| Sanofi-Aventis | 215,400 | 14,694,290 |

| Sanofi-Aventis — ADR | 31,400 | 1,071,054 |

| Thales SA | 267,700 | 9,969,496 |

| Total SA | 920,893 | 50,103,376 |

| | | 198,854,424 |

| Germany — 0.1% | | |

| Allianz AG, Registered Shares | 105,590 | 12,105,382 |

| Bayer AG | 343,935 | 21,969,596 |

| Bayer AG — ADR | 12,200 | 758,840 |

| Bayerische Motoren Werke AG | 134,420 | 6,648,018 |

| | | 41,481,836 |

| Hong Kong — 0.6% | | |

| Cheung Kong Holdings Ltd. | 2,304,700 | 28,421,219 |

| Cheung Kong Infrastructure Holdings Ltd. | 4,441,400 | 16,584,770 |

| China Dongxiang Group Co. | 22,262,700 | 15,110,984 |

| HSBC Holdings Plc, Hong Kong Registered | 2,372,000 | 24,222,327 |

| Hutchison Whampoa Ltd. | 4,021,397 | 27,599,269 |

| The Link Real Estate Investment Trust | 23,389,200 | 57,379,854 |

| Ports Design Ltd. | 90,500 | 221,608 |

| Shougang Concord International | | |

| Enterprises Co. Ltd. | 41,337,400 | 7,469,514 |

| Sinopharm Group Co. | 4,019,300 | 18,115,371 |

| Wharf Holdings Ltd. | 5,316,575 | 28,753,691 |

| | | 223,878,607 |

| India — 0.6% | | |

| Adani Power Ltd. (a) | 9,496,989 | 26,571,177 |

| Bharat Heavy Electricals Ltd. | 980,000 | 54,661,630 |

| Container Corp. of India | 302,200 | 8,802,105 |

| Hindustan Lever Ltd. | 2,534,200 | 13,668,849 |

| Housing Development Finance Corp. | 335,000 | 21,086,292 |

| Larsen & Toubro Ltd. | 687,300 | 24,820,939 |

| Reliance Industries Ltd. | 2,677,800 | 61,923,629 |

| State Bank of India Ltd. | 945,000 | 48,672,310 |

| | | 260,206,931 |

| Indonesia — 0.1% | | |

| Bumi Resources Tbk PT | 92,172,233 | 23,655,093 |

| Telekomunikasi Indonesia Tbk PT | 38,580,400 | 33,306,330 |

| | | 56,961,423 |

| Ireland — 0.1% | | |

| Accenture Plc | 62,700 | 2,736,228 |

| Covidien Plc | 611,425 | 29,342,286 |

| Ingersoll-Rand Plc | 80,900 | 2,991,682 |

| Warner Chilcott Plc, Class A (a) | 99,900 | 2,833,164 |

| | | 37,903,360 |

| Israel — 0.2% | | |

| AFI Development Plc — GDR (a) | 2,841,706 | 5,967,583 |

| Teva Pharmaceutical Industries Ltd. — ADR | 1,245,300 | 73,136,469 |

| | | 79,104,052 |

| Italy — 0.0% | | |

| Assicurazioni Generali SpA | 254,900 | 5,380,431 |

| Intesa Sanpaolo SpA | 3,624,100 | 11,944,743 |

| | | 17,325,174 |

| | |

| Common Stocks | Shares | Value |

| Japan — 6.1% | | |

| Astellas Pharma, Inc. | 588,200 | $ 20,595,786 |

| The Bank of Kyoto Ltd. | 2,206,500 | 19,387,252 |

| Canon, Inc. | 1,507,900 | 68,976,315 |

| Coca-Cola Central Japan Co., Ltd. | 605,107 | 7,805,265 |

| Coca-Cola West Holdings Co., Ltd. | 1,801,300 | 31,869,627 |

| Daihatsu Motor Co., Ltd. | 1,448,400 | 13,966,810 |

| Daikin Industries Ltd. | 140,300 | 5,290,750 |

| Daiwa House Industry Co., Ltd. | 2,185,600 | 23,516,434 |

| Denso Corp. | 881,400 | 25,722,072 |

| East Japan Railway Co. | 1,070,394 | 71,602,723 |

| Fanuc Ltd. | 200,900 | 23,723,452 |

| Fuji Heavy Industries Ltd. | 5,679,500 | 31,786,622 |

| Fujitsu Ltd. | 1,332,100 | 9,367,279 |

| Futaba Industrial Co., Ltd. | 1,795,900 | 14,509,992 |

| Hitachi Chemical Co., Ltd. | 1,286,100 | 27,930,721 |

| Hokkaido Coca-Cola Bottling Co., Ltd. | 514,300 | 2,565,825 |

| Honda Motor Co., Ltd. | 1,272,700 | 43,065,055 |

| Hoya Corp. | 2,212,900 | 61,206,527 |

| JGC Corp. | 2,433,700 | 42,023,272 |

| KDDI Corp. | 14,845 | 71,575,529 |

| Kinden Corp. | 1,864,500 | 16,545,393 |

| Kirin Holdings Co., Ltd. | 3,299,900 | 47,276,858 |

| Kubota Corp. | 7,774,500 | 68,285,235 |

| Kuraray Co., Ltd. | 1,552,400 | 20,322,527 |

| Kyowa Hakko Kirin Co. Ltd. | 2,045,700 | 21,464,768 |

| Mikuni Coca-Cola Bottling Co., Ltd. | 1,376,800 | 10,914,259 |

| Mitsubishi Corp. | 5,258,700 | 124,567,542 |

| Mitsubishi Tanabe Pharma Corp. | 994,900 | 13,163,423 |

| Mitsubishi UFJ Financial Group, Inc. | 8,675,400 | 45,207,808 |

| Mitsui & Co., Ltd. | 5,716,100 | 85,907,812 |

| Mitsui OSK Lines Ltd. | 3,085,800 | 23,069,999 |

| Mitsui Sumitomo Insurance Group Holdings, Inc. | 4,039,820 | 116,114,760 |

| Murata Manufacturing Co., Ltd. | 659,600 | 39,034,241 |

| NGK Insulators Ltd. | 785,300 | 15,476,670 |

| NKSJ Holdings, Inc. (a) | 8,096,670 | 58,784,574 |

| NTT DoCoMo, Inc. | 76,513 | 119,038,309 |

| NTT Urban Development Co. | 11,600 | 11,254,497 |

| Nintendo Co., Ltd. | 77,700 | 26,101,564 |

| Nippon Electric Glass Co. | 564,700 | 8,611,307 |

| Nippon Telegraph & Telephone Corp. | 974,000 | 39,645,282 |

| Nomura Holdings, Inc. | 3,999,900 | 27,647,766 |

| Okumura Corp. | 6,032,300 | 20,514,122 |

| Rinnai Corp. | 285,400 | 13,997,097 |

| Rohm Co., Ltd. | 401,400 | 29,747,767 |

| Sekisui House Ltd. | 5,630,400 | 53,669,384 |

| Seven & I Holdings Co., Ltd. | 2,586,600 | 66,142,190 |

| Shimachu Co., Ltd. | 326,400 | 6,787,147 |

| Shin-Etsu Chemical Co., Ltd. | 1,764,000 | 101,686,780 |

| Shionogi & Co., Ltd. | 1,205,600 | 21,763,368 |

| Sony Corp. — ADR | 73,100 | 2,501,482 |

| Sony Financial Holdings, Inc. | 2,855 | 10,296,345 |

| Sumitomo Chemical Co., Ltd. | 23,989,500 | 113,358,247 |

| Sumitomo Electric Industries Ltd. | 773,900 | 9,523,577 |

| Sumitomo Mitsui Financial Group, Inc. | 989,800 | 32,734,511 |

| Suzuki Motor Corp. | 3,635,800 | 76,423,647 |

| TDK Corp. | 342,400 | 21,913,840 |

| Tadano Ltd. | 623,100 | 3,365,426 |

| Terumo Corp. | 256,900 | 13,087,886 |

| Toda Corp. | 5,426,500 | 19,648,925 |

| Toho Co., Ltd. | 1,490,300 | 25,694,756 |

| Tokio Marine Holdings, Inc. | 4,307,700 | 128,242,894 |

| Tokyo Gas Co., Ltd. | 11,253,900 | 47,824,076 |

| Toyota Industries Corp. | 2,132,930 | 62,238,986 |

See Notes to Consolidated Financial Statements.

BLACKROCK GLOBAL ALLOCATION FUND, INC.

APRIL 30, 2010

9

Consolidated Schedule of Investments (continued)

(Percentages shown are based on Net Assets)

| | |

| Common Stocks | Shares | Value |

| Japan (concluded) | | |

| Toyota Motor Corp. | 949,900 | $ 36,702,199 |

| Ube Industries Ltd. | 9,213,400 | 23,288,046 |

| West Japan Railway Co. | 6,570 | 23,880,771 |

| | | 2,519,955,371 |

| Kazakhstan — 0.2% | | |

| KazMunaiGas Exploration Production — GDR | 3,335,200 | 82,045,920 |

| Luxembourg — 0.0% | | |

| Millicom International Cellular SA | 35,400 | 3,125,112 |

| Malaysia — 0.4% | | |

| Axiata Group Bhd (a) | 8,327,900 | 10,143,130 |

| British American Tobacco Malaysia Bhd | 1,116,300 | 15,364,722 |

| Genting Malaysia Bhd | 4,962,588 | 4,479,952 |

| IOI Corp. Bhd | 5,300,199 | 8,996,292 |

| PLUS Expressways Bhd | 28,203,461 | 30,336,343 |

| Telekom Malaysia Bhd | 5,774,000 | 6,266,644 |

| Tenaga Nasional Bhd | 9,129,244 | 24,266,672 |

| YTL Power International | 72,118,280 | 49,439,088 |

| | | 149,292,843 |

| Mexico — 0.2% | | |

| America Movil, SA de CV — ADR | 1,138,800 | 58,625,424 |

| Fomento Economico Mexicano, SA de CV — ADR | 275,400 | 13,034,682 |

| | | 71,660,106 |

| Netherlands — 0.1% | | |

| Koninklijke KPN NV | 1,413,691 | 21,209,601 |

| Koninklijke Philips Electronics NV | 745,000 | 25,016,484 |

| Koninklijke Philips Electronics NV, New York | | |

| Registered Shares | 156,000 | 5,201,040 |

| Unilever NV — ADR | 263,800 | 7,982,588 |

| | | 59,409,713 |

| Norway — 0.1% | | |

| DnB NOR ASA | 351,900 | 4,164,778 |

| Statoil ASA | 1,386,700 | 33,530,008 |

| | | 37,694,786 |

| Philippines — 0.0% | | |

| First Gen Corp. (a) | 1,836,047 | 417,546 |

| Philippine Long Distance Telephone Co. — ADR | 317,200 | 17,839,328 |

| | | 18,256,874 |

| Russia — 1.2% | | |

| Kuzbassrazrezugol (a) | 48,029,996 | 24,014,998 |

| LSR Group OJCS — GDR | 6,813,100 | 58,252,005 |

| MMC Norilsk Nickel — ADR | 2,810,574 | 53,963,021 |

| Novorossiysk Commercial Sea Port — GDR | 4,994,420 | 67,424,670 |

| OAO Rosnft Oil Co. — GDR | 1,978,400 | 16,044,824 |

| Polyus Gold Co. ZAO — ADR | 2,815,642 | 70,081,329 |

| RusHydro — ADR (a) | 19,330,960 | 112,119,568 |

| Sberbank | 25,942,300 | 70,044,210 |

| Surgutneftegaz — ADR | 1,404,700 | 13,428,932 |

| Uralkali — GDR | 87,200 | 1,879,160 |

| VimpelCom Ltd. — ADR (a) | 2,261,700 | 39,398,814 |

| | | 526,651,531 |

| Singapore — 0.8% | | |

| CapitaLand Ltd. | 1,089,100 | 2,941,903 |

| DBS Group Holdings Ltd. | 1,950,000 | 21,471,435 |

| Fraser and Neave Ltd. | 8,636,300 | 30,687,669 |

| Keppel Corp. Ltd. | 6,983,500 | 49,551,215 |

| MobileOne Ltd. | 10,659,700 | 16,535,433 |

| Noble Group Ltd. | 5,019,217 | 10,886,119 |

| | |

| Common Stocks | Shares | Value |

| Singapore (concluded) | | |

| Oversea-Chinese Banking Corp. | 8,213,100 | $ 52,160,605 |

| Parkway Holdings Ltd. | 13,622,885 | 33,345,490 |

| Parkway Life Real Estate Investment Trust | 444,195 | 428,966 |

| Sembcorp Marine Ltd. | 4,569,000 | 13,981,265 |

| Singapore Press Holdings Ltd. | 4,836,300 | 14,445,537 |

| Singapore Telecommunications Ltd. | 22,502,010 | 49,634,622 |

| United Overseas Bank Ltd. | 1,100,000 | 16,092,916 |

| | | 312,163,175 |

| South Africa — 0.1% | | |

| Anglo Platinum Ltd. | 86,098 | 9,343,323 |

| Gold Fields Ltd. — ADR | 552,700 | 7,428,288 |

| Impala Platinum Holdings Ltd. | 306,000 | 8,627,695 |

| Katanga Mining Ltd. (a) | 4,941,133 | 5,837,133 |

| Sasol Ltd. | 150,000 | 6,069,300 |

| | | 37,305,739 |

| South Korea — 0.9% | | |

| Cheil Industries, Inc. | 291,511 | 20,897,005 |

| KT Corp. — ADR | 2,190,500 | 49,505,300 |

| KT&G Corp. | 671,400 | 33,922,858 |

| Korean Reinsurance Co. | 332,322 | 2,897,836 |

| LG Corp. | 318,800 | 21,737,202 |

| LG Display Co. Ltd. | 628,500 | 26,729,144 |

| LS Corp. | 301,800 | 24,615,169 |

| Meritz Fire & Marine Insurance Co. Ltd. | 335,766 | 2,173,605 |

| POSCO | 58,830 | 26,381,335 |

| POSCO — ADR | 257,300 | 28,858,768 |

| Paradise Co. Ltd. | 1,984,226 | 5,775,022 |

| SK Telecom Co., Ltd. | 257,970 | 40,258,810 |

| Samsung Electronics Co., Ltd. | 104,900 | 79,759,545 |

| Samsung Fine Chemicals Co., Ltd. | 486,600 | 23,285,962 |

| | | 386,797,561 |

| Spain — 0.1% | | |

| Iberdrola Renovables | 1,298,100 | 5,032,508 |

| Telefonica SA | 1,345,573 | 30,457,379 |

| Telefonica SA — ADR (c) | 184,398 | 12,498,496 |

| | | 47,988,383 |

| Switzerland — 0.8% | | |

| Credit Suisse Group AG | 81,300 | 3,715,410 |

| Credit Suisse Group AG | 558,640 | 25,640,332 |

| Nestle SA, Registered Shares | 2,047,063 | 100,164,672 |

| Noble Corp. | 65,600 | 2,590,544 |

| Novartis AG, Registered Shares | 703,485 | 35,867,011 |

| Roche Holding AG | 244,915 | 38,669,430 |

| Transocean Ltd. (a) | 470,100 | 34,058,745 |

| Tyco Electronics Ltd. | 330,794 | 10,625,103 |

| Tyco International Ltd. | 324,946 | 12,604,656 |

| UBS AG | 1,809,100 | 28,026,905 |

| Weatherford International Ltd. (a) | 1,102,800 | 19,971,708 |

| Zurich Financial Services AG | 125,469 | 27,815,829 |

| | | 339,750,345 |

| Taiwan — 0.8% | | |

| Asustek Computer, Inc. | 7,539,646 | 14,538,119 |

| Catcher Technology Co. Ltd. | 2,314,400 | 6,105,943 |

| Cheng Shin Rubber Industry Co. Ltd. | 5,093,000 | 10,946,212 |

| Chunghwa Telecom Co., Ltd. | 10,994,967 | 21,584,180 |

| Chunghwa Telecom Co., Ltd. — ADR | 2,287,159 | 44,645,344 |

| Compal Electronics, Inc. | 5,328,000 | 7,404,766 |

| Delta Electronics, Inc. | 12,761,011 | 42,299,597 |

| Far EasTone Telecommunications Co., Ltd. | 15,692,000 | 19,099,023 |

| HON HAI Precision Industry Co., Ltd. | 5,339,375 | 25,065,846 |

See Notes to Consolidated Financial Statements.

10 BLACKROCK GLOBAL ALLOCATION FUND, INC.

APRIL 30, 2010

Consolidated Schedule of Investments (continued)

(Percentages shown are based on Net Assets)

| | |

| Common Stocks | Shares | Value |

| Taiwan (concluded) | | |

| HTC Corp. | 3,397,950 | $ 45,531,416 |

| MediaTek, Inc. | 1,118,000 | 18,930,022 |

| Taiwan Cement Corp. | 24,323,534 | 21,857,968 |

| Taiwan Semiconductor Manufacturing Co., Ltd. | 20,548,824 | 40,216,107 |

| | | 318,224,543 |

| Thailand — 0.2% | | |

| Hana Microelectronics Pcl | 10,790,310 | 7,937,239 |

| PTT Chemical PCL | 2,151,660 | 6,882,918 |

| PTT Public Company THB10 | 3,289,870 | 26,131,868 |

| Siam Commercial Bank Pcl | 12,829,483 | 32,514,839 |

| | | 73,466,864 |

| Turkey — 0.3% | | |

| BIM Birlesik Magazalar AS | 431,400 | 24,113,335 |

| Tupas Turkiye Petrol Rafine | 1,048,300 | 23,305,834 |

| Turk Telekomunikasyon AS | 5,908,400 | 22,028,497 |

| Turkcell Iletisim Hizmet AS | 2,541,700 | 16,473,914 |

| Turkiye Garanti Bankasi AS | 7,562,400 | 36,636,287 |

| | | 122,557,867 |

| United Kingdom — 1.5% | | |

| Anglo American Plc (a) | 1,353,100 | 57,474,183 |

| Antofagasta Plc | 1,623,800 | 24,619,875 |

| AstraZeneca Group Plc — ADR (c) | 96,100 | 4,250,503 |

| BG Group Plc | 1,210,900 | 20,467,478 |

| BP Plc | 5,703,291 | 49,743,741 |

| BP Plc — ADR | 178,800 | 9,324,420 |

| British American Tobacco Plc | 688,343 | 21,644,790 |

| Diageo Plc — ADR | 1,333,400 | 90,857,876 |

| Ensco International Plc — ADR | 68,700 | 3,241,266 |

| Guinness Peat Group Plc | 31,656,001 | 20,162,927 |

| HSBC Holdings Plc | 9,466,600 | 96,393,251 |

| HSBC Holdings Plc — ADR | 492,200 | 25,048,058 |

| Lloyds TSB Group Plc | 37,602,306 | 37,621,021 |

| Prudential Plc | 734,700 | 6,450,250 |

| Royal Dutch Shell Plc — ADR | 334,516 | 20,990,879 |

| Shire Pharmaceuticals Plc — ADR | 32,200 | 2,120,048 |

| Standard Chartered Plc | 873,407 | 23,297,785 |

| Unilever Plc | 663,206 | 19,929,522 |

| Unilever Plc — ADR | 414,100 | 12,464,410 |

| Vodafone Group Plc | 22,040,961 | 48,839,726 |

| Vodafone Group Plc — ADR | 1,470,386 | 32,642,569 |

| | | 627,584,578 |

| United States — 28.9% | | |

| 3M Co. | 754,900 | 66,936,983 |

| ACE Ltd. | 2,095,400 | 111,454,326 |

| The AES Corp. (a) | 164,000 | 1,892,560 |

| AOL, Inc. (a) | 51,803 | 1,210,118 |

| AT&T, Inc. | 9,383,570 | 244,535,834 |

| Abbott Laboratories | 1,919,400 | 98,196,504 |

| Advance Auto Parts, Inc. | 65,800 | 2,967,580 |

| Advanced Micro Devices, Inc. (a) | 2,280,000 | 20,656,800 |

| Aetna, Inc. | 2,100,400 | 62,066,820 |

| Alliance Resource Partners LP | 395,462 | 19,164,089 |

| The Allstate Corp. | 484,300 | 15,822,081 |

| Altria Group, Inc. | 1,860,300 | 39,419,757 |

| Amdocs Ltd. (a) | 96,200 | 3,072,628 |

| American Commercial Lines, Inc. (a)(d) | 705,245 | 14,386,998 |

| American Tower Corp., Class A (a) | 301,700 | 12,312,377 |

| American Water Works Co, Inc. | 434,200 | 9,456,876 |

| AmerisourceBergen Corp. | 663,700 | 20,475,145 |

| Amgen, Inc. (a) | 920,900 | 52,822,824 |

| | |

| Common Stocks | Shares | Value |

| United States (continued) | | |

| Amphenol Corp., Class A | 127,800 | $ 5,905,638 |

| Anadarko Petroleum Corp. | 915,800 | 56,926,128 |

| Analog Devices, Inc. | 222,800 | 6,668,404 |

| Apache Corp. | 575,100 | 58,522,176 |

| Apple, Inc. (a) | 1,095,300 | 286,004,736 |

| Arch Capital Group Ltd. (a) | 301,000 | 22,749,580 |

| Ascent Media Corp., Class A (a) | 3,255 | 96,088 |

| Axis Capital Holdings Ltd. | 19,200 | 598,464 |

| BMC Software, Inc. (a) | 140,500 | 5,530,080 |

| Bank of America Corp. | 12,528,016 | 223,374,525 |

| The Bank of New York Mellon Corp. | 3,967,448 | 123,506,656 |

| Baxter International, Inc. | 343,085 | 16,200,474 |

| Biogen Idec, Inc. (a) | 51,200 | 2,726,400 |

| Boeing Co. | 1,264,700 | 91,602,221 |

| Boston Scientific Corp. (a) | 2,639,200 | 18,157,696 |

| Bristol-Myers Squibb Co. | 11,621,477 | 293,907,153 |

| Broadcom Corp., Class A | 428,600 | 14,782,414 |

| Bunge Ltd. | 604,149 | 31,989,690 |

| CA, Inc. | 3,130,400 | 71,404,424 |

| CF Industries Holdings, Inc. | 721,300 | 60,351,171 |

| CMS Energy Corp. | 702,100 | 11,416,146 |

| CNA Financial Corp. (a) | 15,700 | 441,484 |

| CVS Caremark Corp. | 1,438,000 | 53,105,340 |

| Cablevision Systems Corp., Class A | 121,300 | 3,328,472 |

| Capital One Financial Corp. | 70,000 | 3,038,700 |

| Cardinal Health, Inc. | 82,800 | 2,872,332 |

| CareFusion Corp. (a) | 107,000 | 2,951,060 |

| CenturyTel, Inc. | 585,849 | 19,983,309 |

| Cephalon, Inc. (a) | 41,700 | 2,677,140 |

| Check Point Software Technologies Ltd. (a) | 83,800 | 2,984,956 |

| Chesapeake Energy Corp. | 771,500 | 18,361,700 |

| Chevron Corp. | 2,765,850 | 225,250,824 |

| Chubb Corp. | 783,900 | 41,444,793 |

| Cigna Corp. | 883,500 | 28,325,010 |

| Cisco Systems, Inc. (a) | 5,370,817 | 144,582,394 |

| Citigroup, Inc. (a)(c) | 27,728,523 | 121,173,646 |

| The Coca-Cola Co. | 553,400 | 29,579,230 |

| Cognizant Technology Solutions Corp. (a) | 219,300 | 11,223,774 |

| Colgate-Palmolive Co. | 650,800 | 54,732,280 |

| Comcast Corp., Class A | 6,232,163 | 123,022,898 |

| Comerica, Inc. | 83,200 | 3,494,400 |

| Complete Production Services, Inc. (a) | 1,257,600 | 18,977,184 |

| Computer Sciences Corp. (a) | 191,150 | 10,014,349 |

| Comverse Technology, Inc. (a) | 2,528,350 | 23,210,253 |

| ConAgra Foods, Inc. | 569,225 | 13,928,936 |

| ConocoPhillips | 2,131,100 | 126,139,809 |

| Consol Energy, Inc. | 3,004,047 | 134,220,820 |

| Constellation Brands, Inc., Class A (a) | 402,400 | 7,351,848 |

| Constellation Energy Group, Inc. | 81,600 | 2,884,560 |

| Corning, Inc. | 6,927,389 | 133,352,238 |

| Crown Holdings, Inc. (a) | 601,900 | 15,649,400 |

| DIRECTV, Class A (a) | 767 | 27,788 |

| DISH Network Corp. | 604,800 | 13,396,320 |

| DTE Energy Co. | 63,900 | 3,078,063 |

| Darden Restaurants, Inc. | 65,900 | 2,949,025 |

| DaVita, Inc. (a) | 545,600 | 34,061,808 |

| Dell, Inc. (a) | 4,781,019 | 77,356,887 |

| Devon Energy Corp. | 1,000,700 | 67,377,131 |

| Discover Financial Services, Inc. | 3,550 | 54,883 |

| Discovery Communications, Inc., Class A (a) | 32,150 | 1,244,205 |

| Discovery Communications, Inc., Class C (a) | 32,250 | 1,076,183 |

| The Dow Chemical Co. | 2,127,400 | 65,587,742 |

| Dr. Pepper Snapple Group, Inc. | 398,852 | 13,054,426 |

| E.I. du Pont de Nemours & Co. | 1,476,900 | 58,839,696 |

See Notes to Consolidated Financial Statements.

BLACKROCK GLOBAL ALLOCATION FUND, INC.

APRIL 30, 2010

11

Consolidated Schedule of Investments (continued)

(Percentages shown are based on Net Assets)

| | |

| Common Stocks | Shares | Value |

| United States (continued) | | |

| EMC Corp. (a) | 2,491,749 | $ 47,368,148 |

| EXCO Resources, Inc. | 2,152,800 | 39,934,440 |

| Eastman Chemical Co. | 43,100 | 2,884,252 |

| Eaton Corp. | 43,600 | 3,364,176 |

| eBay, Inc. (a) | 1,085,600 | 25,848,136 |

| El Paso Corp. | 6,858,216 | 82,984,414 |

| Electronic Arts, Inc. (a) | 1,745,200 | 33,804,524 |

| Eli Lilly & Co. | 693,400 | 24,248,198 |

| Endo Pharmaceuticals Holdings, Inc. (a) | 186,100 | 4,075,590 |

| Endurance Specialty Holdings Ltd. | 874,500 | 32,225,325 |

| Entergy Corp. | 467,500 | 38,003,075 |

| Everest Re Group Ltd. | 168,900 | 12,946,185 |

| Exelon Corp. | 707,300 | 30,831,207 |

| Expedia, Inc. | 120,500 | 2,845,005 |

| Extreme Networks, Inc. (a) | 68,041 | 226,577 |

| Exxon Mobil Corp. | 6,458,798 | 438,229,444 |

| FMC Corp. | 1,545,100 | 98,330,164 |

| FPL Group, Inc. | 1,131,200 | 58,878,960 |

| Family Dollar Stores, Inc. | 44,900 | 1,776,244 |

| Fidelity National Information Services, Inc. | 230,800 | 6,067,732 |

| Fidelity National Title Group, Inc., Class A | 3,735,950 | 56,711,721 |

| Fluor Corp. | 29,300 | 1,548,212 |

| Forest Laboratories, Inc. (a) | 273,200 | 7,447,432 |

| Freeport-McMoRan Copper & Gold, Inc., Class B | 649,713 | 49,072,823 |

| The Gap, Inc. | 126,900 | 3,138,237 |

| Garmin Ltd. (c) | 81,900 | 3,061,422 |

| General Communication, Inc., Class A (a) | 650,400 | 3,999,960 |

| General Electric Co. | 14,349,800 | 270,637,228 |

| General Mills, Inc. | 389,800 | 27,745,964 |

| Genzyme Corp. (a) | 955,000 | 50,844,200 |

| Gilead Sciences, Inc. (a) | 1,350,700 | 53,582,269 |

| Global Industries Ltd. (a) | 4,869,500 | 32,625,650 |

| Google, Inc., Class A (a)(c) | 249,529 | 131,112,518 |

| H.J. Heinz Co. | 393,098 | 18,424,503 |

| Halliburton Co. | 1,423,100 | 43,618,015 |

| Hanesbrands, Inc. (a) | 50,375 | 1,434,176 |

| Harris Corp. | 99,300 | 5,111,964 |

| Hartford Financial Services Group, Inc. | 495,400 | 14,153,578 |

| HealthSouth Corp. (a) | 862,875 | 17,654,423 |

| Hess Corp. | 630,900 | 40,093,695 |

| Hewitt Associates, Inc., Class A (a) | 67,100 | 2,750,429 |

| Hewlett-Packard Co. | 1,879,500 | 97,677,615 |

| Hologic, Inc. (a) | 3,999,600 | 71,472,852 |

| Hospira, Inc. (a) | 54,600 | 2,936,934 |

| Humana, Inc. (a) | 786,500 | 35,958,780 |

| ITT Corp. | 48,600 | 2,700,702 |

| Intel Corp. | 3,455,700 | 78,893,631 |

| International Business Machines Corp. | 2,105,090 | 271,556,610 |

| International Game Technology | 1,753,500 | 36,963,780 |

| International Paper Co. | 528,433 | 14,130,298 |

| Intuit, Inc. (a)(c) | 86,600 | 3,131,456 |

| JDS Uniphase Corp. (a) | 309,992 | 4,026,796 |

| JPMorgan Chase & Co. | 5,859,966 | 249,517,352 |

| Johnson & Johnson | 3,705,600 | 238,270,080 |

| KBR, Inc. | 800,000 | 17,664,000 |

| Kimberly-Clark Corp. | 40,000 | 2,450,400 |

| King Pharmaceuticals, Inc. (a) | 280,600 | 2,749,880 |

| Kraft Foods, Inc. | 2,987,568 | 88,432,013 |

| L-3 Communications Holdings, Inc. | 11,500 | 1,076,055 |

| LSI Corp. (a) | 217,928 | 1,311,927 |

| Lexmark International, Inc., Class A (a) | 806,800 | 29,891,940 |

| Liberty Media Corp., Series A (a) | 76 | 4,210 |

| Liberty Media Holding Corp. — Capital (a) | 192 | 8,500 |

| | |

| Common Stocks | Shares | Value |

| United States (continued) | | |

| Liberty Media Holding Corp. — Interactive (a) | 47,753 | $ 733,964 |

| Life Technologies Corp. (a) | 500,000 | 27,355,000 |

| Limited Brands, Inc. | 116,200 | 3,114,160 |

| Lockheed Martin Corp. | 897,700 | 76,205,753 |

| Lorillard, Inc. | 214,800 | 16,833,876 |

| Lubrizol Corp. | 34,200 | 3,089,628 |

| MEMC Electronic Materials, Inc. (a)(c) | 164,000 | 2,127,080 |

| Magnitogorsk Iron & Steel Works — ADR | 1,270,600 | 17,381,808 |

| Manpower, Inc. | 9,700 | 544,170 |

| Marathon Oil Corp. | 2,232,436 | 71,772,817 |

| Marco Polo Investment Holdings Ltd. | 4,274 | — |

| Mattel, Inc. | 1,390,300 | 32,046,415 |

| McDermott International, Inc. (a) | 3,025,800 | 82,937,178 |

| McDonald’s Corp. | 621,800 | 43,892,862 |

| The McGraw-Hill Cos., Inc. | 49,400 | 1,665,768 |

| McKesson Corp. | 571,100 | 37,012,991 |

| Mead Johnson Nutrition Co. | 1,232,455 | 63,607,003 |

| MeadWestvaco Corp. | 103,500 | 2,812,095 |

| Medco Health Solutions, Inc. (a) | 1,020,000 | 60,098,400 |

| Medtronic, Inc. | 2,421,000 | 105,773,490 |

| Merck & Co, Inc. | 4,518,558 | 158,330,272 |

| MetLife, Inc. | 620,375 | 28,276,692 |

| Mettler Toledo International, Inc. (a) | 125,400 | 15,735,192 |

| Microsoft Corp. | 12,870,650 | 393,069,651 |

| Molson Coors Brewing Co., Class B | 67,400 | 2,989,864 |

| Morgan Stanley | 1,906,700 | 57,620,474 |

| Motorola, Inc. (a) | 4,493,750 | 31,770,812 |

| Murphy Oil Corp. | 258,100 | 15,524,715 |

| Mylan, Inc. | 141,200 | 3,110,636 |

| NCB Holdings Ltd. (a) | 34,970 | — |

| NII Holdings, Inc. (a) | 84,500 | 3,584,490 |

| NRG Energy, Inc. (a) | 478,100 | 11,555,677 |

| Nabors Industries Ltd. (a) | 305,800 | 6,596,106 |

| National Oilwell Varco, Inc. | 1,411,300 | 62,139,539 |

| National Semiconductor Corp. | 189,400 | 2,799,332 |

| Newmont Mining Corp. | 2,435,968 | 136,609,085 |

| News Corp., Class A | 2,145,400 | 33,082,068 |

| Northern Trust Corp. | 1,519,474 | 83,540,681 |

| Northrop Grumman Corp. | 764,200 | 51,835,686 |

| Novell, Inc. (a) | 531,300 | 2,980,593 |

| Occidental Petroleum Corp. | 947,581 | 84,012,531 |

| Oracle Corp. | 4,929,200 | 127,370,528 |

| PPG Industries, Inc. | 42,000 | 2,955,540 |

| PPL Corp. | 612,200 | 15,158,072 |

| Pall Corp. | 200,000 | 7,798,000 |

| Parker Hannifin Corp. | 47,300 | 3,272,214 |

| PartnerRe Ltd. | 172,900 | 13,413,582 |

| PerkinElmer, Inc. | 688,877 | 17,256,369 |

| Perrigo Co. | 698,700 | 42,641,661 |

| Pfizer, Inc. | 11,924,716 | 199,381,252 |

| PharMerica Corp. (a) | 17,575 | 339,198 |

| Philip Morris International, Inc. | 1,160,600 | 56,962,248 |

| Pitney Bowes, Inc. | 117,100 | 2,974,340 |

| Platinum Underwriters Holdings Ltd. | 368,500 | 13,711,885 |

| Polo Ralph Lauren Corp. | 34,300 | 3,083,570 |

| Polycom, Inc. (a) | 1,721,600 | 56,038,080 |

| Praxair, Inc. | 269,300 | 22,559,261 |

| Precision Castparts Corp. | 390,300 | 50,091,102 |

| Pride International, Inc. (a) | 78,200 | 2,371,806 |

| Principal Financial Group, Inc. | 445,200 | 13,008,744 |

| The Procter & Gamble Co. | 2,562,859 | 159,307,315 |

| The Progressive Corp. | 1,038,300 | 20,859,447 |

| QUALCOMM, Inc. | 3,900,675 | 151,112,149 |

| Qwest Communications International, Inc. | 8,773,201 | 45,883,841 |

See Notes to Consolidated Financial Statements.

12 BLACKROCK GLOBAL ALLOCATION FUND, INC.

APRIL 30, 2010

Consolidated Schedule of Investments (continued)

(Percentages shown are based on Net Assets)

| | |

| Common Stocks | Shares | Value |

| United States (concluded) | | |

| R.R. Donnelley & Sons Co. | 116,800 | $ 2,510,032 |

| Ralcorp Holdings, Inc. (a) | 86,262 | 5,740,736 |

| Raytheon Co. | 455,300 | 26,543,990 |

| RenaissanceRe Holdings Ltd. | 369,500 | 20,673,525 |

| Reynolds American, Inc. | 19,500 | 1,041,690 |

| Ross Stores, Inc. | 59,600 | 3,337,600 |

| RusHydro | 63,635,122 | 3,595,384 |

| Ryder System, Inc. | 76,200 | 3,544,824 |

| SUPERVALU, Inc. | 201,876 | 3,007,952 |

| Safeway, Inc. | 121,000 | 2,855,600 |

| SanDisk Corp. (a) | 96,000 | 3,829,440 |

| Sara Lee Corp. | 4,325,500 | 61,508,610 |

| Schlumberger Ltd. | 1,238,288 | 88,438,529 |

| Seagate Technology Holdings (a) | 145,000 | 2,663,650 |

| Seahawk Drilling, Inc. (a) | 3,646 | 60,742 |

| Sears Holdings Corp. (a)(c) | 29,100 | 3,519,645 |

| Smith International, Inc. | 204,587 | 9,771,075 |

| Sohu.com, Inc. (a) | 121,000 | 5,826,150 |

| The Southern Co. | 238,900 | 8,256,384 |

| Spirit Aerosystems Holdings, Inc., Class A (a) | 2,511,500 | 55,705,070 |

| Sprint Nextel Corp. (a) | 3,443,800 | 14,636,150 |

| The St. Joe Co. (a)(c) | 1,174,800 | 38,815,392 |

| State Street Corp. | 1,261,500 | 54,875,250 |

| Stryker Corp. | 52,500 | 3,015,600 |

| TJX Cos., Inc. | 67,900 | 3,146,486 |

| Target Corp. | 56,200 | 3,196,094 |

| Tellabs, Inc. | 260,600 | 2,366,248 |

| Teradata Corp. (a) | 168,700 | 4,904,109 |

| Texas Instruments, Inc. | 1,589,200 | 41,335,092 |

| Thermo Fisher Scientific, Inc. (a) | 789,100 | 43,621,448 |

| Time Warner Cable, Inc. | 142,955 | 8,041,219 |

| Time Warner, Inc. | 569,333 | 18,833,536 |

| Total System Services, Inc. | 246,900 | 3,952,869 |

| Transatlantic Holdings, Inc. | 208,200 | 10,353,786 |

| The Travelers Cos., Inc. | 1,445,458 | 73,342,539 |

| URS Corp. (a) | 59,900 | 3,075,865 |

| U.S. Bancorp | 3,258,200 | 87,222,014 |

| Unifi, Inc. (a) | 1,607,511 | 6,156,767 |

| Union Pacific Corp. | 1,902,692 | 143,957,677 |

| United Technologies Corp. | 223,300 | 16,736,335 |

| UnitedHealth Group, Inc. | 2,410,200 | 73,053,162 |

| UnumProvident Corp. | 129,800 | 3,176,206 |

| Valero Energy Corp. | 1,131,300 | 23,519,727 |

| Validus Holdings Ltd. | 553,874 | 14,162,558 |

| VeriSign, Inc. (a) | 112,000 | 3,054,240 |

| Verizon Communications, Inc. | 6,364,718 | 183,876,703 |

| Viacom, Inc., Class B (a) | 2,256,700 | 79,729,211 |

| WABCO Holdings, Inc. (a) | 4,300 | 142,717 |

| Wal-Mart Stores, Inc. | 2,761,706 | 148,165,527 |

| Waters Corp. (a) | 515,300 | 37,096,447 |

| Watson Pharmaceuticals, Inc. (a) | 71,300 | 3,053,066 |

| WellPoint, Inc. (a) | 1,591,000 | 85,595,800 |

| Wells Fargo & Co. | 7,529,900 | 249,314,989 |

| Western Digital Corp. (a) | 281,041 | 11,547,975 |

| Whirlpool Corp. | 33,000 | 3,592,710 |

| Windstream Corp. | 506,166 | 5,593,134 |

| XL Capital Ltd., Class A | 5,388,166 | 95,909,355 |

| XTO Energy, Inc. | 752,900 | 35,777,808 |

| Xerox Corp. | 5,128,000 | 55,895,200 |

| Xilinx, Inc. | 111,400 | 2,871,892 |

| | | 11,857,006,175 |

| Total Common Stocks — 52.6% | | 21,635,850,581 |

| | | |

| Fixed Income Securities | | | |

| | | Par | |

| Asset-Backed Securities | | (000) | Value |

| United States — 0.0% | | | |

| Latitude CLO Ltd., Series 2005-1I, | | | |

| Class SUB, 0.41%, 12/15/17 | USD | 7,900 | $ 395,000 |

| Total Asset-Backed Securities — 0.0% | | | 395,000 |

| Corporate Bonds | | | |

| Brazil — 0.1% | | | |

| BES Investimento do Brasil SA, | | | |

| 5.63%, 3/25/15 (b) | | 9,784 | 9,701,989 |

| Banco Santander Brasil SA, | | | |

| 4.50%, 4/06/15 (b) | | 15,962 | 15,483,140 |

| Cosan Finance Ltd., 7.00%, 2/01/17 (b) | | 7,050 | 7,279,125 |

| | | | 32,464,254 |

| Canada — 0.5% | | | |

| Daylight Reources Trust, | | | |

| 6.25%, 12/31/14 (f) | CAD | 12,191 | 12,961,488 |

| PetroBakken Energy Ltd., | | | |

| 3.13%, 2/08/16 (f) | USD | 82,200 | 81,576,924 |

| Rogers Wireless Communications, Inc., | | | |

| 7.63%, 12/15/11 | CAD | 6,169 | 6,559,072 |

| Sino-Forest Corp. (b): | | | |

| 5.00%, 8/01/13 (f) | USD | 69,707 | 78,594,643 |

| 10.25%, 7/28/14 | | 25,000 | 27,625,000 |

| | | | 207,317,127 |

| China — 0.3% | | | |

| Celestial Nutrifoods Ltd., | | | |

| 53.57%, 6/12/11 (a)(e)(f) | SGD | 89,400 | 44,037,802 |

| China Petroleum & Chemical Corp., | | | |

| 5.95%, 4/24/14 (e)(f) | HKD | 306,660 | 43,446,610 |

| Pine Agritech Ltd., | | | |

| 27.64%, 7/27/12 (e)(f) | USD | 411,100 | 40,958,214 |

| | | | 128,442,626 |

| Europe — 0.3% | | | |

| European Investment Bank: | | | |

| 12.59%, 9/21/10 (b)(e) | BRL | 127,600 | 68,576,971 |

| 4.38%, 4/15/13 | EUR | 32,667 | 47,002,839 |

| Series 1158/0100, 3.63%, 10/15/11 | | 14,195 | 19,637,866 |

| | | | 135,217,676 |

| France — 0.0% | | | |

| Compagnie Generale des | | | |

| Etablissements Michelin, Series ML, | | | |

| 8.68%, 1/01/17 (e)(f) | | 9,251 | 13,627,346 |

| Germany — 0.0% | | | |

| Fresenius Finance Jersey Ltd., | | | |

| 5.63%, 8/14/11 (f) | | 6,700 | 10,348,041 |

| Hong Kong — 0.5% | | | |

| CITIC Resources Finance Ltd., | | | |

| 6.75%, 5/15/14 (b) | USD | 25,486 | 25,995,720 |

| FU JI Food and Catering | | | |

| Services Holdings Ltd., | | | |

| 47.99%, 10/18/10 (a)(e)(f)(g) | CNY | 190,300 | 5,018,754 |

| Hongkong Land CB 2005 Ltd., | | | |

| 2.75%, 12/21/12 (f) | USD | 7,400 | 10,609,750 |

See Notes to Consolidated Financial Statements.

BLACKROCK GLOBAL ALLOCATION FUND, INC.

APRIL 30, 2010

13

Consolidated Schedule of Investments (continued)

(Percentages shown are based on Net Assets)

| | | |

| | | Par | |

| Corporate Bonds | | (000) | Value |

| Hong Kong (concluded) | | | |

| Hutchison Whampoa International, Ltd.: | | | |

| 6.25%, 1/24/14 | USD | 12,497 | $ 13,758,022 |

| 4.63%, 9/11/15 | | 40,425 | 41,878,683 |

| 4.63%, 9/11/15 (b) | | 33,249 | 34,497,334 |

| 7.63%, 4/09/19 (b) | | 29,327 | 34,511,750 |

| 5.75%, 9/11/19 (b) | | 6,392 | 6,692,130 |

| Noble Group Ltd., 8.50%, 5/30/13 (b) | | 11,419 | 12,817,827 |

| | | | 185,779,970 |

| India — 1.0% | | | |

| Gujarat NRE Coke Ltd., | | | |

| 0.00%, 4/12/11 (e)(f) | | 10,000 | 18,000,000 |

| Housing Development Finance Corp., | | | |

| 0.00%, 9/27/10 (e)(f) | | 24,000 | 47,280,000 |

| Jaiprakash Associates Ltd., | | | |

| 0.00%, 9/12/12 (e)(f) | | 8,838 | 11,555,685 |

| Punj Lloyd Ltd., 0.00%, 4/08/11 (e)(f) | | 16,088 | 18,340,320 |

| REI Agro Ltd., 5.50%, 11/13/14 (b)(f) | | 46,977 | 48,621,195 |

| Reliance Communications Ltd. (e)(f): | | | |

| 0.00%, 5/10/11 | | 38,247 | 45,513,930 |

| 0.00%, 3/01/12 | | 115,900 | 132,464,776 |

| Suzlon Energy Ltd., 27.31%, 6/12/12 (e)(f) | | 24,650 | 26,029,414 |

| Tata Motors Ltd., 13.85%, 7/12/12 (e)(f) | | 4,300 | 5,479,038 |

| Tata Steel Ltd., 1.00%, 9/05/12 (f) | | 26,100 | 31,581,000 |

| | | | 384,865,358 |

| Japan — 0.1% | | | |

| The Mie Bank Ltd., 1.00%, 10/31/11 (f) | JPY | 374,000 | 3,929,307 |

| Nagoya Railroad Co. Ltd., | | | |

| 1.21%, 3/30/12 (e)(f) | | 154,000 | 1,705,009 |

| Suzuki Motor Corp., Series 9, | | | |

| 3.95% 3/29/13 (e)(f) | | 3,695,000 | 40,303,881 |

| | | | 45,938,197 |

| Kazakhstan — 0.3% | | | |

| KazMunaiGaz Finance Sub BV (b): | | | |

| 9.13%, 7/02/18 | USD | 87,610 | 103,160,775 |

| 7.00%, 5/05/20 (h) | | 32,152 | 31,587,089 |

| | | | 134,747,864 |

| Luxembourg — 0.9% | | | |

| Acergy SA, Series ACY, | | | |

| 2.25%, 10/11/13 (f) | | 11,100 | 12,037,972 |

| Actelion Finance SCA, | | | |

| 0.00%, 11/22/11 (e)(f) | CHF | 11,670 | 11,040,797 |

| Evraz Group SA: | | | |

| 8.88%, 4/24/13 (b) | USD | 11,550 | 12,069,750 |

| 8.25%, 11/10/15 | | 5,415 | 5,604,525 |

| 9.50%, 4/24/18 (b) | | 30,895 | 32,748,700 |

| Gaz Capital SA, 2.89%, 11/15/12 | JPY | 1,800,000 | 18,216,667 |

| TNK-BP Finance SA : | | | |

| 7.50%, 7/18/16 (b) | USD | 12,021 | 12,862,470 |

| 6.63%, 3/20/17 (b) | | 55,521 | 56,770,222 |

| 7.88%, 3/13/18 (b) | | 71,795 | 77,538,600 |

| Series 2, 7.50%, 7/18/16 | | 6,643 | 7,224,263 |

| UBS Luxembourg SA for OJSC Vimpel | | | |

| Communications: | | | |

| 8.25%, 5/23/16 | | 18,790 | 20,387,150 |

| 8.25%, 5/23/16 (b) | | 2,481 | 2,691,885 |

| VIP Finance Ireland Ltd. for OJSC Vimpel | | | |

| Communications, 9.13%, 4/30/18 (b) | | 91,544 | 104,245,730 |

| | | | 373,438,731 |

| | | |

| | | Par | |

| Corporate Bonds | | (000) | Value |

| Malaysia — 0.7% | | | |

| Berjaya Land Bhd, 8.00%, 8/15/11 (f) | MYR | 71,700 | $ 23,030,098 |

| Cherating Capital Ltd., | | | |

| 2.00%, 7/05/12 (f)(i) | USD | 36,500 | 41,564,375 |

| IOI Resources, 8.48%, 1/15/13 (e)(f) | | 48,610 | 49,703,725 |

| Johor Corp., Series P3, 1.00%, 7/31/12 | MYR | 179,132 | 65,813,924 |

| Rafflesia Capital Ltd., | | | |

| 1.25%, 10/04/11 (f)(i) | USD | 73,500 | 91,808,329 |

| | | | 271,920,451 |

| Mexico — 0.3% | | | |

| BBVA Bancomer SA/Texas, | | | |

| 7.25%, 4/22/20 (b) | | 38,464 | 39,031,152 |

| Petroles Mexicanos, 6.00%, 3/05/20 (b) | | 63,010 | 65,014,994 |

| | | | 104,046,146 |

| Netherlands — 0.1% | | | |

| ASM International NV (f): | | | |

| 4.25%, 12/06/11 | | 1,481 | 1,905,010 |

| 4.25%, 12/06/11 (b) | | 4,180 | 5,324,275 |

| Pargesa Netherlands NV, | | | |

| 1.75%, 6/15/14 (f) | CHF | 35,790 | 31,261,999 |

| | | | 38,491,284 |

| Norway — 0.2% | | | |

| Siem Industries, Inc., | | | |

| 0.00% 7/12/17 (e)(f) | USD | 34,000 | 34,918,000 |

| Subsea 7, Inc. (f): | | | |

| 2.80%, 6/06/11 | | 34,100 | 34,867,250 |

| 6.39%, 6/29/17 (e) | | 19,300 | 19,821,100 |

| | | | 89,606,350 |

| Philippines — 0.1% | | | |

| First Gen Corp., 2.50%, 2/11/13 (f) | | 23,500 | 26,966,250 |

| Singapore — 1.1% | | | |

| CapitaLand Ltd. (f): | | | |

| 2.10%, 11/15/16 | SGD | 64,750 | 46,561,360 |

| 3.13%, 3/05/18 | | 139,750 | 103,642,223 |

| 2.95%, 6/20/22 | | 178,250 | 116,666,401 |

| Keppel Land Ltd., 2.50%, 6/23/13 (f) | | 26,000 | 19,266,772 |

| Olam International Ltd., | | | |

| 6.00%, 10/15/16 (f) | USD | 37,000 | 42,246,600 |

| Wilmar International Ltd., | | | |

| 17.30%, 12/18/12 (e)(f) | | 30,400 | 43,373,808 |

| Yanlord Land Group Ltd., | | | |

| 5.85%, 7/13/14 (f) | SGD | 68,000 | 51,485,076 |

| Ying Li International Real Estate Ltd., | | | |

| 4.00%, 3/03/15 (f) | | 66,000 | 42,384,879 |

| | | | 465,627,119 |

| South Korea — 0.4% | | | |

| Hyundai Motor Manufacturing Czech sro, | | | |

| 4.50%, 4/15/15 (b) | USD | 32,993 | 33,296,503 |

| Korea Electric Power Corp.: | | | |

| 5.13%, 4/23/34 | | 38,562 | 40,460,176 |

| 7.59%, 4/01/96 (j) | | 31,040 | 20,176,000 |

| Zeus Cayman, 4.20%, 8/19/13 (e)(f) | JPY | 8,049,000 | 83,371,993 |

| | | | 177,304,672 |

| Spain — 0.1% | | | |

| Telvent GIT SA, 5.50%, 4/15/15 (b)(f) | USD | 32,544 | 36,021,001 |

| Sweden — 0.1% | | | |

| Svensk Exportkredit AB, | | | |

| 10.50%, 9/29/15 (i) | TRY | 31,190 | 19,890,189 |

See Notes to Consolidated Financial Statements.

14 BLACKROCK GLOBAL ALLOCATION FUND, INC.

APRIL 30, 2010

Consolidated Schedule of Investments (continued)

(Percentages shown are based on Net Assets)

| | | |

| | | Par | |

| Corporate Bonds | | (000) | Value |

| Trinidad — 0.0% | | | |

| Petroleum Co. of Trinidad & Tobago Ltd., | | | |

| 9.75%, 8/14/19 (b) | USD | 9,851 | $ 11,525,670 |

| United Arab Emirates — 0.5% | | | |

| Abu Dhabi National Energy Co., | | | |

| 6.50%, 10/27/36 | | 6,431 | 6,077,295 |

| Aldar Funding Ltd., 5.77%, 11/10/11 (f) | | 16,977 | 16,955,779 |

| Dana Gas Sukuk Ltd., 7.50%, 10/31/12 (f) | | 213,800 | 194,718,350 |

| | | | 217,751,424 |

| United Kingdom — 0.5% | | | |

| Lloyds TSB Bank Plc, 13.00% (k) | GBP | 46,296 | 81,460,899 |

| Petropavlovsk 2010 Ltd., | | | |

| 4.00%, 2/18/15 (f) | USD | 43,600 | 48,729,976 |

| Shire Plc, 2.75%, 5/09/14 (f) | | 84,592 | 84,645,885 |

| | | | 214,836,760 |

| United States — 6.2% | | | |

| The AES Corp., 8.38%, 3/01/11 | GBP | 3,349 | 5,252,268 |

| Advanced Micro Devices, Inc., | | | |

| 6.00%, 5/01/15 (f) | USD | 329,904 | 317,944,980 |

| Amgen, Inc., 0.38%, 2/01/13 (f) | | 118,176 | 118,914,600 |

| Amylin Pharmaceuticals, Inc., | | | |

| 3.00%, 6/15/14 (f) | | 42,182 | 37,120,160 |

| Archer-Daniels-Midland Co., | | | |

| 0.88%, 2/15/14 (f) | | 9,107 | 8,947,628 |

| Banco do Brasil SA, 4.50%, 1/22/15 (b) | | 19,181 | 19,217,762 |

| CF Industries, Inc., 7.13%, 5/01/20 | | 22,380 | 23,554,950 |

| Cell Genesys, Inc., 3.13%, 5/01/13 (f) | | 1,000 | 631,735 |

| Central European Distribution Corp., | | | |

| 3.00%, 3/15/13 (f) | | 4,843 | 4,358,700 |

| Chesapeake Energy Corp. (f): | | | |

| 2.50%, 5/15/37 | | 95,592 | 78,743,910 |

| 2.25%, 12/15/38 | | 115,709 | 85,480,024 |

| China Milk Products Group Ltd., | | | |

| 21.88%, 1/05/12 (e)(f) | | 39,800 | 17,986,695 |

| Cie de Financement Foncier, | | | |

| 2.13%, 4/22/13 (b) | | 89,700 | 90,307,090 |

| Consol Energy, Inc., 8.00%, 4/01/17 (b) | | 60,750 | 64,167,187 |

| Crown Cork & Seal Co., Inc., | | | |

| 7.50%, 12/15/96 | | 5,827 | 4,428,520 |

| Ford Motor Credit Co. LLC, 7.00%, 4/15/15 | | 16,811 | 17,095,795 |

| Gilead Sciences, Inc. (f): | | | |

| 0.50%, 5/01/11 | | 12,788 | 14,114,755 |

| 0.63%, 5/01/13 | | 22,379 | 26,295,325 |

| Hana Bank, 4.50%, 10/30/15 (b) | | 14,402 | 14,445,073 |

| Helix Energy Solutions Group, Inc., | | | |

| 3.25%, 12/15/25 (f) | | 15,252 | 13,974,645 |

| Hologic, Inc., 2.00%, 12/15/37 (f)(l) | | 156,135 | 140,521,500 |

| IOI Capital Bhd, Series IOI, | | | |

| 0.00% 12/18/11 (e)(f) | | 39,096 | 48,772,260 |

| Intel Corp. (f): | | | |

| 2.95%, 12/15/35 | | 69,940 | 70,814,250 |

| 3.25%, 8/01/39 (b) | | 90,939 | 111,286,601 |

| Kinetic Concepts, Inc., | | | |

| 3.25%, 4/15/15 (b)(f) | | 8,287 | 8,763,503 |

| King Pharmaceuticals, Inc., | | | |

| 1.25%, 4/01/26 (f) | | 15,913 | 14,242,135 |

| Kraft Foods, Inc.: | | | |

| 2.63%, 5/08/13 | | 44,194 | 45,186,199 |

| 4.13%, 2/09/16 | | 78,761 | 80,769,169 |

| LifePoint Hospitals, Inc. (f): | | | |

| 3.50%, 5/15/14 | | 5,911 | 6,132,663 |

| 3.25%, 8/15/25 | | 29,410 | 29,079,137 |

| | | |

| | | Par | |

| Corporate Bonds | | (000) | Value |

| United States (concluded) | | | |

| McMoRan Exploration Co. (f): | | | |

| 5.25%, 10/06/11 | USD | 11,129 | $ 11,337,669 |

| 5.25%, 10/06/11 (b) | | 6,342 | 6,460,913 |

| Medtronic, Inc. (f): | | | |

| 1.50%, 4/15/11 | | 7,909 | 7,988,090 |

| 1.63%, 4/15/13 | | 76,922 | 81,441,167 |

| Mylan, Inc., 1.25%, 3/15/12 (f) | | 68,827 | 76,225,902 |

| Omnicare, Inc., Series OCR, | | | |

| 3.25%, 12/15/35 (f) | | 29,982 | 25,672,087 |

| Omnicom Group, Inc. (e)(f): | | | |

| 0.04%, 7/31/32 | | 23,969 | 23,729,310 |

| 0.02%, 7/01/38 | | 16,249 | 16,228,689 |

| Paka Capital Ltd., 5.54%, 3/12/13 (e)(f) | | 20,000 | 20,525,000 |

| Pemex Project Funding Master Trust, | | | |

| 5.50%, 2/24/25 | EUR | 49,970 | 64,769,519 |

| Pontis Ltd., 6.25%, 7/20/10 (b) | USD | 5,474 | 5,473,562 |

| Preferred Term Securities XXIV, Ltd. (a)(b) | | 12,100 | 121 |

| Preferred Term Securities XXV, Ltd. (a) | | 12,150 | 122 |

| Preferred Term Securities XXVI, Ltd. (a) | | 9,900 | 99 |

| Preferred Term Securities XXVII, Ltd. (a) | | 7,100 | 71 |

| Ranbaxy Laboratories Ltd., | | | |

| 33.19%, 3/18/11 (e)(f) | | 19,863 | 24,045,611 |

| SBA Communications Corp. (f): | | | |

| 1.88%, 5/01/13 | | 21,355 | 22,342,669 |

| 4.00%, 10/01/14 (b) | | 13,464 | 17,957,610 |

| SanDisk Corp., 1.00%, 5/15/13 (f) | | 99,091 | 87,819,399 |

| Sino-Forest Corp., 5.00%, 8/01/13 (f) | | 3,578 | 4,075,771 |

| SonoSite, Inc., 3.75%, 7/15/14 (f) | | 12,479 | 13,539,715 |

| St. Mary Land & Exploration Co., | | | |

| 3.50%, 4/01/27 (f) | | 3,404 | 3,561,435 |

| Suzlon Energy Ltd. (e)(f): | | | |

| 17.71%, 10/11/12 | | 37,802 | 39,503,090 |

| 0.00%, 7/25/14 | | 35,295 | 32,270,254 |

| Tenet Healthcare Corp., 9.25%, 2/01/15 | | 9,870 | 10,560,900 |

| Thermo Fisher Scientific, Inc., | | | |

| 3.20%, 5/01/15 | | 20,459 | 20,580,158 |

| Transocean, Inc. (f): | | | |

| 1.50%, 12/15/37 | | 284,700 | 274,735,500 |

| Series A, 1.63%, 12/15/37 | | 73,343 | 71,967,819 |

| Series C, 1.50%, 12/15/37 | | 20,504 | 19,299,390 |

| Uno Restaurant Corp., | | | |

| 10.00%, 2/15/11 (a)(b)(g) | | 4,728 | 1,004,700 |

| Yanlord Land Group Ltd., | | | |

| 9.50%, 5/04/17 (b)(h) | | 32,038 | 31,964,736 |

| | | | 2,533,630,297 |

| Total Corporate Bonds — 14.3% | | | 5,859,804,803 |

| Floating Rate Loan Interests | | | |

| Indonesia — 0.2% | | | |

| PT Bumi Resources, Term Loan, | | | |

| 10.25%, 10/08/12 | | 42,000 | 42,000,000 |

| PT Multi Daerah Bersaing, Term Loan, | | | |

| 7.30%, 4/13/12 | | 41,700 | 41,700,000 |

| | | | 83,700,000 |

| Total Floating Rate Loan Interests — 0.2% | | | 83,700,000 |

See Notes to Consolidated Financial Statements.

BLACKROCK GLOBAL ALLOCATION FUND, INC.

APRIL 30, 2010

15

Consolidated Schedule of Investments (continued)

(Percentages shown are based on Net Assets)

| | | |

| | | Par | |

| Foreign Agency Obligations | | (000) | Value |

| Australian Government Bonds, | | | |

| 5.75%, 6/15/11 | AUD | 95,366 | $ 89,474,068 |

| Brazil Notas do Tesouro Nacional: | | | |

| Series B, 6.00%, 5/15/17 | BRL | 22,700 | 24,931,711 |

| Series F, 10.00%, 1/01/17 | | 697,929 | 359,171,247 |

| Series F, 10.00%, 1/01/21 | | 172,465 | 84,669,485 |

| Bundesrepublik Deutschland: | | | |

| 4.00%, 7/04/16 | EUR | 217,769 | 317,404,129 |

| 4.25%, 7/04/17 | | 135,609 | 200,372,922 |

| 3.50%, 7/04/19 | | 128,806 | 179,480,508 |

| Series 07, 4.00%, 1/04/18 | | 52,509 | 76,240,332 |

| Series 08, 4.25%, 7/04/18 | | 36,223 | 53,400,783 |

| Bundesschatzanweisungen, Series 1, | | | |

| 4.75%, 6/11/10 | | 111,850 | 149,579,605 |

| Caisse d’Amortissement de la Dette Sociale: | | | |

| 3.25%, 4/25/13 | | 21,650 | 30,192,246 |

| 4.00%, 10/25/14 | | 23,195 | 33,202,024 |

| Canadian Government Bond: | | | |