QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on December 17, 2002.

Registration No. 333-100740.

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

POST-EFFECTIVE AMENDMENT NO. 1 TO

FORM SB-2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

BROOKE CORPORATION

(Name of Registrant as Specified in its Charter)

Kansas

(State or other jurisdiction of

incorporation or organization) | | [ ]

(Primary Standard Industrial

Classification Code Number) | | 48-1009756

(I.R.S. Employer

Identification No.) |

10895 Grandview Drive, Suite 250

Overland Park, Kansas

(913) 661-0123

(Address and telephone number of principal executive offices and principal place of business)

Leland G. Orr

Assistant Secretary, Treasurer and

Chief Financial Officer

Brooke Corporation

205 F. Street

Phillipsburg, Kansas 67661

(785) 543-3199

(Name, address, and telephone number of agent for service)

With copies to:

Robert J. Ahrenholz, Esq.

Colin L. Barnacle, Esq.

Kutak Rock LLP

1801 California Street, Suite 3100

Denver, Colorado 80202

(303) 297-2400

Approximate date of commencement of proposed sale to the public: From time to time as soon as practicable after the effective date of this Registration Statement.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(d) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

Dated December 11, 2002

PROSPECTUS

BROOKE CORPORATION

Up to $5,000,000

Unsecured Subordinated Debentures

Series A and Series B

Brooke Corporation is offering up to $5,000,000 in aggregate principal amount of unsecured debentures described in this prospectus. You must purchase $5,000 in principal amount of debentures, as a minimum. We will offer the debentures in two series and they will have the following terms:

Series

| | Stated Maturity

| | Annual Interest Rate

| |

|---|

| Series A | | December 1, 2005 | | 8 | % |

| Series B | | December 1, 2007 | | 9.25 | % |

|

|

Per Debenture

|

|

Total if all Debentures are Sold

|

|---|

| Public offering price | | $ | 1,000 | | $ | 5,000,000 |

| Sales commissions(2) | | $ | 70 | | $ | 350,000 |

| Maximum proceeds to us before expenses(2) | | $ | 1,000 | | $ | 5,000,000 |

- (1)

- Minimum investment is $5,000. Debentures will be issued in denominations of $1,000.

- (2)

- Assumes an average sales commission of 7%. You will not incur a direct sales charge since we are paying them on your behalf. Debentures earn interest on the full principal amount without deduction for sales commissions.

You should carefully consider the risk factors beginning on page 5 of this prospectus and the following:

- •

- The debentures are unsecured debt instruments currently senior only to our outstanding equity securities.

- •

- There is no minimum amount of debentures that must be sold before we use any of the proceeds. Proceeds will not be returned to you if we sell less than all of the debentures being offered. The proceeds from the sales of the debentures will be paid directly to us promptly following each sale and will not be placed in an escrow account.

- •

- The debentures rank equally with our unsecured debt and are subordinate to all of our secured debt.

- •

- There currently is no trading market for the debentures, we do not anticipate listing the debentures on a national securities exchange or the Nasdaq Stock Market and we cannot assure you that a public market for the debentures will develop.

- •

- You may not purchase debentures under this prospectus after January 30, 2004.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

We intend to engage Chapman Securities, Inc., a registered broker-dealer and a member of the NASD, to sell the debentures on a best efforts basis. Chapman Securities, Inc. reserves the right to engage one or more additional NASD member broker-dealers to assist in the distribution of the debentures on a best-efforts basis.

The date of this prospectus is December 11, 2002.

PROSPECTUS SUMMARY

This summary highlights the key information contained in this prospectus. Because it is a summary, it does not contain all of the information you should consider before making your investment decision. You should read the entire prospectus carefully, including the section titled "Risk Factors" and the financial statements and the notes relating to those statements.

BROOKE CORPORATION

Background

Brooke Corporation was incorporated in the State of Kansas on January 17, 1986 under the name Brooke Financial Services, Inc., and on June 1, 1987, we changed our name to Brooke Corporation. Our principal executive offices are located at, and our mailing address is, 10895 Grandview Drive, Suite 250, Overland Park, Kansas 66210. Our telephone number is (913) 661-0123.

Our Company

We are an insurance agency with more than one hundred fifty (150) franchise agent locations in sixteen states. We provide processing services, supplier access and marketing assistance to our franchise agents through a "master agent" program that we pioneered. Most of our revenues are derived from the sale of property and casualty insurance policies. We also generate a significant amount of revenues from consulting with our franchise agents and facilitating agency acquisitions by our franchise agents. In the future, we plan to sell financial services other than insurance. We believe that our franchise agents, as independent business owners, can distribute financial services less expensively than larger firms because our franchise agents are more motivated than employed sales representatives and are willing to defer some compensation until their agency business is sold. Accordingly, we have developed processing, lending and legal standards that increase the value and liquidity of a franchise agent's business.

Our Subsidiaries and Affiliates

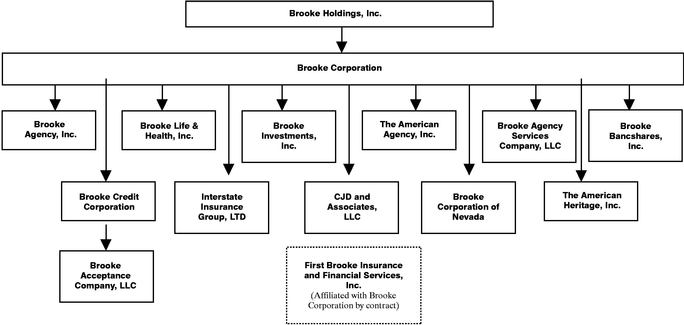

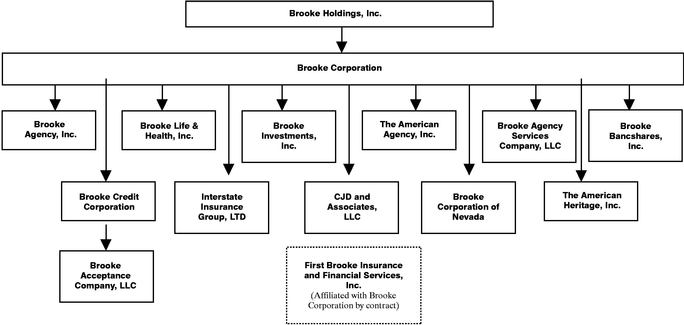

Organizational Chart

Brooke Holdings, Inc. We are controlled by Brooke Holdings, Inc., a Kansas corporation, which owns 512,946 shares of our common stock as of October 1, 2002.

Brooke Credit Corporation, a Kansas corporation, is a licensed finance company that originates loans primarily to our agents.

Brooke Life and Health, Inc., a Kansas corporation, is an licensed insurance agency that sells life and health insurance programs through our network of franchise agents, subagents, bank agents, broker agents and insurance producers.

Brooke Agency, Inc., a Kansas corporation, is a licensed insurance agency that sells property and casualty insurance through our network of franchise agents, subagents, bank agents, broker agents and insurance producers.

Brooke Investments, Inc., a Kansas corporation, may offer insurance annuities and mutual funds for sale through our network of franchise agents, subagents and insurance producers. Brooke Investments, Inc. will determine whether registration as a broker-dealer is required and will register, if required, before investment services and securities are offered.

Interstate Insurance Group, LTD., a Missouri corporation, is a licensed insurance agency that may sell insurance programs and "targeted market" policies (i.e., specific niche market policies covering risks that are typically difficult to insure and require special knowledge and expertise to write) through our network of agents and through agents not necessarily affiliated with us under the trade name of American Interstate Insurance Agency.

The American Agency, Inc., a Kansas corporation, consults with and otherwise assists agent sellers and buyers under the trade name of Agency Business Brokers. This subsidiary is also a licensed insurance agency that sells insurance programs and "targeted market" policies (i.e., specific niche market policies covering risks that are typically difficult to insure and require special knowledge and expertise to write) through our network of agents and through agents not necessarily affiliated with us under the trade names of American Insurance Agency and American Interstate Insurance Agency.

The American Heritage, Inc., a Kansas corporation, consults with and otherwise assists agent buyers under the trade name of Heritage Agency Consultants. This consultant is also a licensed insurance agency that sells insurance programs and "targeted market" policies (i.e., specific niche market policies covering risks that are typically difficult to insure and require special knowledge and expertise to write) through our network of agents and through agents not necessarily affiliated with us under the trade name of American Heritage Insurance Agency.

Brooke Corporation of Nevada, a Nevada corporation, is a licensed insurance agency that sells insurance through our network of franchise agents, subagents, broker agents, and insurance producers. This subsidiary may also sell the programs and "targeted market" policies (i.e., specific niche market policies covering risks that are typically difficult to insure and require special knowledge and expertise to write) in Nevada through our network of agents and through agents not necessarily affiliated with us.

Brooke Bancshares, Inc., a Kansas corporation, was incorporated in January of 2002 for the specific purpose of acquiring and owning one or more commercial banks that will distribute banking services and products through our agents. If we are successful in acquiring a bank, then this subsidiary will become a bank holding company as defined in the Bank Holding Company Act of 1956, as amended.

Brooke Agency Services Company LLC, a Delaware limited liability company, is a bankruptcy-remote licensed insurance agency that sells insurance through our network of franchise agents, subagents, bank agents, broker agents and insurance producers. Furthermore, Brooke Agency Services Company is the master agent with respect to many of the franchise agents with loans originated by Brooke Credit Corporation.

Brooke Acceptance Company LLC, a Delaware limited liability company, is a bankruptcy-remote special purpose entity of Brooke Credit Corporation and is the anticipated purchaser of Brooke Credit Corporation loans and issuer of certain floating rate asset-backed notes.

2

CJD & Associates, L.L.C., a Kansas limited liability company, is a licensed insurance agency that sells insurance programs and "targeted market" policies (i.e.—specific niche market policies covering risks that are typically difficult to insure and require special knowledge and expertise to write) through our network of agents and through agents not necessarily affiliated with us under the trade name of Davidson Babcock.

GI Agency, Inc., a Kansas corporation, is 100% owned by our principals, Robert D. Orr, Leland G. Orr and Michael Hess. GI Agency, Inc., owns franchise agencies that purchase certain services and obtain loans from us.

For licensing purposes, we also control First Brooke Insurance and Financial Services, Inc. First Brooke Insurance and Financial Services, Inc., a Texas corporation owned by both resident and non-resident licensed Texas insurance agents, is controlled by us through a contractual arrangement.

From time to time throughout this prospectus, the terms "we," "us" and "our" may also include references to actions performed on our behalf by these affiliates and subsidiaries, as the context requires.

Summary of the Terms of the Offering

| Debentures | | We are offering up to $5,000,000 in principal amount of our unsecured and subordinated debentures. The debentures will be issued at the minimum investment amounts, and on the terms and rates listed on the cover page of this prospectus. There is no minimum amount of debentures that must be sold before we use the proceeds or terminate the offering. |

Interest payments |

|

We will pay interest on the debentures on a semi-annual basis on June 1st and December 1st, with respect to interest accruing during the preceding semi-annual periods. Each series of debentures accrues interest at different rates as shown on the cover page of this prospectus. We may change the minimum investment amounts and interest rates on unissued debentures offered by this prospectus from time to time by supplementing this prospectus. The terms of debentures issued prior to the date of any change will not be affected by any change. |

Principal payments |

|

We will pay the principal balance of each debenture at maturity. |

Collateral |

|

The debentures are unsecured debt obligations, senior only to our outstanding equity securities. The debentures rank equally with our unsecured debt and are subordinate to all of our secured debt. |

Risk Factors |

|

Your purchase of debentures involves risks. You should carefully review the risks described in this prospectus. See "RISK FACTORS" beginning on page 5 for a discussion of the risks associated with investing in the debentures. |

Use of proceeds |

|

We will use the proceeds from the sale of the debentures to make investments, which may include the acquisition of insurance agencies for inventory, corporate acquisitions, or temporary investments in loan participation certificates issued by our finance company subsidiary, Brooke Credit Corporation, for short term working capital loans made to insurance agents or our other subsidiaries. See "USE OF PROCEEDS." |

3

Plan of distribution |

|

We are offering up to $5,000,000 in principal amount of debentures through our engagement with Chapman Securities, Inc., as placement agent, on a best-efforts basis. The debentures will be sold at their face value, $1,000 per debenture. You cannot purchase less than $5,000 in principal amount of debentures. We expect to establish approximately three closing dates. There is no minimum amount of debentures that must be sold before we may use the proceeds and proceeds will not be returned to you if we sell less than all of the $5,000,000 in debentures being offered in this prospectus. See "PLAN OF DISTRIBUTION." |

Maturity |

|

The Series A debentures will mature on December 1, 2005 and the Series B debentures will mature on December 1, 2007. |

Redemption |

|

The debentures will not be subject to any sinking fund. The Series A debentures are not subject to any redemption prior to maturity. We can, however, redeem the Series B debentures, at our option, in whole or in part, at any time on or after the date of the third year anniversary of the issuance of the debentures. The redemption price of the Series B debentures will be equal to 100% of the principal amount of the debentures being redeemed plus accrued interest to the date set for redemption. If we make a partial redemption, selection of the debentures for redemption will be made by the trustee by lot or by other methods as the trustee in its sole discretion shall deem to be fair and appropriate. |

4

RISK FACTORS

Your investment in the debentures involves a high degree of risk. You should carefully consider the risks and uncertainties described below before purchasing any debentures in this offering. These risks and uncertainties are not the only ones facing our company. Additional risks and uncertainties that we are unaware of or currently deem immaterial may also become important factors that may harm our business.

Risks Related to Our Business

Internet sales may adversely impact independent property and casualty insurance agents and result in a decline in the demand for our services.

The primary market for our services is independent property and casualty insurance agents. The popularity of Internet sales may adversely impact independent property and casualty insurance agents and result in a general decline in the demand for our services. In addition, the enactment of the Financial Services Modernization Act allows highly capitalized competitors, such as banks, to offer certain insurance services, which are competitive with our products.

Our reliance on the Internet could have a material adverse effect on our operations and our ability to meet customer expectations.

We rely heavily on the Internet in conducting our operations. A main component of our master agent program is to provide agency personnel access to agency documents over the Internet. This service requires efficient operation of Internet connections from agencies and agency personnel to our system. These connections, in turn, depend on efficient operation of Web browsers, Internet service providers and Internet backbone service providers, all of which have experienced periodic operational problems or outages in the past. Any system delays, failures or loss of data, whatever the cause, could reduce customer satisfaction with our services and products. Moreover, despite the implementation of security measures, our computer system may be vulnerable to computer viruses, program errors, attacks by third parties or similar disruptive problems. These events could have a material adverse effect on our operations and our ability to meet customer expectations.

Our processing center may be insufficient to accommodate expected growth.

Our processing services are completed at a processing center located in Phillipsburg, Kansas. Although contrary to our expectations, the processing center's management, facilities, and labor force may be insufficient to accommodate our expected growth. We have safeguards for emergencies. However, we do not have back-up facilities to process information if the processing center in Phillipsburg, Kansas is not functioning. The occurrence of a major catastrophic event or other system failure at our processing center in Phillipsburg, Kansas could interrupt document processing or result in the loss of stored data.

We have guaranteed the repayment of bonds issued by our subsidiary, Brooke Credit Corporation, which may adversely affect us if our subsidiary incurs significant loan losses or its ability to repay its bonds is otherwise impaired. We also have guaranteed the performance of Brooke Credit Corporation with respect to certain of its duties in connection with a structured financing.

We have guaranteed the repayment of bonds issued by our finance company subsidiary, Brooke Credit Corporation, and, if Brooke Credit Corporation incurs significant loan losses or its ability to repay the bonds is otherwise impaired, then our financial condition may be adversely affected. In some instances, Brooke Credit Corporation has sold loans to investors with full recourse, which may cause an adverse financial effect on us in the event we are required to repurchase loans of poor quality. In addition, in connection with our activities of matching agency purchasers and sellers, we sometimes guarantee payments to agency sellers, which may cause an adverse financial effect on us in the event the purchasers default on their obligations to the sellers. Also, we have guaranteed the performance of

5

Brooke Credit Corporation with respect to certain of its duties in connection with the issuance by Brooke Acceptance Company LLC of certain floating rate asset backed notes in a private placement to qualified institutional buyers. See "DESCRIPTION OF BUSINESS-OVERVIEW."

We could be adversely affected if Brooke Credit Corporation does not have alternative sources of funds to repay bonds as they mature.

Loans made by Brooke Credit Corporation are usually amortized for a period of 10-12 years. If, as expected, Brooke Credit Corporation funds an increasing portion of its loan portfolio with bonds maturing in 6 years or less, then we will be adversely affected if Brooke Credit Corporation does not have alternative sources of funds to repay bonds as they mature.

If we, through our subsidiary Brooke Credit Corporation, repurchase loans sold to loan participants or make additional variable rate loans and market interest rates decrease, then we may collect less interest than we pay for its funding.

The interest rate on most of our existing loans is adjusted annually to an outside index that is not controlled by us. Although most of our existing loans have been sold to loan participants, if we repurchase these variable rate loans or make additional variable rate loans and market interest rates decrease, then we may collect less interest than we pay on our bonds or other funding sources.

The collateral for our loans to agents for the purpose of acquiring insurance agencies may be adversely affected by a reduction in the value of the insurance agency's assets.

We make loans to agents through a subsidiary primarily for the purpose of insurance agency acquisitions. These loans are secured by, among other things, insurance agency assets. Insurance agency assets in some cases are intangible, and the value of these assets may rapidly deteriorate if borrowers do not adequately serve their policyholders or if the policies offered are not competitively priced. Reduction in the value of the insurance agency's assets would result in a reduction of the value of our secured interest. This could result in these loans being inadequately secured, which could adversely affect us in the event of default on these loans.

We are dependent on third parties, particularly property and casualty insurance companies, to supply the products marketed by our agents.

We are dependent on others, particularly property and casualty insurance companies, to supply the products marketed by our agents. Five property and casualty insurance companies supply a majority of our products. Our contracts with these suppliers can be terminated by the supplier without cause upon advance written notice. The loss of the contract relationship with any one of these companies, for any reason, would adversely affect our financial condition. While we believe we maintain strong relationships with these companies, there can be no assurance that these companies will not impose conditions to the relationship, such as lower commission rates, larger premium volume requirements, or loss ratios that we will not be able to satisfy.

We are dependent on key personnel.

We are dependent upon the continued services of senior management, particularly the services of Robert D. Orr, Leland G. Orr and Michael Hess. The loss of the services of any of these key personnel, by termination, death or disability, could have a material adverse effect on us.

Termination of our professional liability insurance policy may adversely impact our financial prospects and our ability to continue our relationships with insurance companies.

Without professional liability insurance, it is unlikely that we can continue our relationships with insurance companies. Although we have an acceptable claims history, termination of our professional liability insurance policy would adversely impact our financial prospects.

6

We are under common control with our affiliated companies, which could result in a conflict of interest.

Through their ownership in Brooke Holdings, Inc., Robert D. Orr, Leland G. Orr and Michael Hess control all aspects of Brooke Corporation and, even if all shares of our outstanding preferred stock are converted into common stock, will be in a position to elect all of our directors. A common management group directs the activities of the companies in the affiliated group. As a result of these affiliated relationships, conflicts of interests may exist or may arise in the future. In addition, some of our business relationships with these affiliates were not arranged through independent arms-length negotiations. We cannot assure you that any conflicts, which may arise, will be resolved in our best interests or in your best interests as a debenture holder. In addition, we cannot assure you that there are not now, or may not in the future, be unrelated businesses that might be able to provide similar services to us in a more efficient, competent and less costly manner than our affiliates. Because of our relationship with these affiliates and our centralized management, we may not be in a position to take advantage of the services of these unrelated businesses. We also cannot assure you that our affiliates will be able to continue to provide services to us. In the event one of our affiliates is not able to perform its services, we cannot assure you that a suitable replacement can be located without incurring substantial expense, or that any replacement will provide an acceptable quality of services to us.

We could be adversely affected if we fail to comply with government regulations.

Our activities are subject to comprehensive regulation in the various states in which we do business. Our success will depend in part upon our ability to satisfy these regulations and to obtain and maintain all required licenses and permits.

Although we believe that we are currently in material compliance with statutes and regulations applicable to our business, we cannot assure you that we will be able to maintain compliance without incurring significant expense. Our failure to comply with any current or subsequently enacted statutes and regulations could have a material adverse effect on us. Furthermore, the adoption of additional statutes and regulations, changes in the interpretation and enforcement of current statutes and regulations, or the expansion of our business into jurisdictions that have adopted more stringent regulatory requirements than those in which we currently conduct business could have a material adverse effect on us.

We could be adversely affected if Brooke Bancshares receives regulatory mandates or sustains losses.

Although we have not yet acquired a bank, if we were to do so as the parent company of Brooke Bancshares, we could be required to inject additional capital into any bank owned by Brooke Bancshares in the event any bank experiences adverse financial results, has a financial condition deemed unacceptable by its regulators or is the subject of an unsatisfactory review. Furthermore, in addition to being required to inject additional capital, adverse financial results, unacceptable financial condition or an unsatisfactory audit could result in our being subject to increased regulatory scrutiny and/or increased restriction on the conduct of our business which could decrease our profitability or otherwise have an adverse effect on our condition.

We could be adversely affected in the future if our trademark is infringed and we are unable to defend our trademark.

Franchise agents do business under the "Brooke" trademark and name of Brooke Financial Services or Brooke Insurance and Financial Services, and prominently display the trademark symbol in all advertising, correspondence, and signs. Our trademark was registered with the United States Patent and Trademark Office principal register on March 20, 1990. If this trademark is infringed and we could not defend our trademark right then this could adversely affect our business. Although at this point, the risk associated with the loss of trademark protection would not have a materially adverse impact on the company, as our brand name recognition grows, the risk of a negative impact may increase.

7

Risks Related to this Offering

You could lose your entire investment if we are unable to sell a sufficient amount of debentures.

There is no minimum amount of debentures that we have to sell before issuing any debentures and using the proceeds from those sales. There is no minimum amount of debentures that we have to sell before terminating the offering. The debentures are being sold on a best efforts basis and we may not be able to sell the entire $5,000,000 in debentures that we are offering in this prospectus. If we are unable to sell a sufficient amount of debentures, we may have insufficient funds to successfully implement our business plan. If this occurs, you could lose your entire investment in the debentures. This risk is further heightened because you may purchase no less than $5,000 in debentures. See "USE OF PROCEEDS" beginning on Page 9 below.

You may not be able to sell your debentures due to the absence of an established trading market.

There is no trading market for the debentures and we do not anticipate that an active market will develop. We are not obligated to redeem your debentures until they mature. Because you may be unable to sell your debentures prior to the maturity date, you should consider whether you may need to liquidate your investment prior to its maturity. You should be prepared to hold any debentures purchased in this offering until their maturity. Although Chapman Securities intends to make a secondary market in the debentures, it has no obligation to do so and we cannot assure you that any market will be available.

Because the debentures are structurally subordinated to the obligations of our subsidiaries, you may not be fully repaid if we become insolvent.

Holders of preferred stock of any of our subsidiaries and creditors of any of our subsidiaries, including bondholders and trade creditors, have and will have claims relating to the assets of each of these subsidiaries that are senior to the debentures and our other outstanding debentures. As a result, the debentures and all of our other debts are structurally subordinated to debts, preferred stock and other obligations of our subsidiaries. The indenture does not prevent our subsidiaries from incurring debt or issuing preferred stock in the future. The indenture does not give holders of the debentures a claim to the assets of any of our subsidiaries. If we should become insolvent, debenture holders may not have access to the assets of our subsidiaries. That circumstance could cause you to receive less than the full amounts owed to you on the debentures.

We have no restriction on our ability to incur additional debt.

The indenture governing your and our rights and obligations relating to the debentures does not restrict our ability to issue additional debentures or to incur other debt. Additional debt may be senior or junior in right of payment to the debentures. Further, we do not have any limitation on the amount or percentage of indebtedness that we may incur. In addition, because we intend to expand our business, we may require additional capital or other funds for the expansion of our operations. We may obtain these funds through the sale of the debentures or additional debentures on terms we cannot now predict. The indenture provides that we may issue additional series of debentures without your prior review or approval. These series may include terms and provisions that would be unique to that particular series. We cannot assure you that a new series would not cause reductions or delays in payments on your debentures.

The lack of a sinking fund or the requirement to maintain financial ratios increases the risk that we will be unable to repay the principal and interest on the debentures when due.

The indenture does not require us to maintain a sinking fund for payment of the debentures or that we maintain any specified financial ratios. Generally, a sinking fund would be a separate account that would be funded on a regular basis in order to ensure that sufficient funds would be available to pay the debentures at maturity. The lack of a sinking fund increases the risk that we will not have

8

sufficient cash on hand to pay the principal amount of the debentures at maturity. Since there is no sinking fund for the debentures, we will be required to use available cash flow, sell assets or borrow additional funds to pay the principal due on the debentures at maturity. The lack of a requirement to maintain any specified financial ratios allows us to operate our business in an unrestricted manner. This increases the risk that our method of operation could turn out to be financially imprudent and could result in us being unable to repay our obligations on the debentures when due.

Risks Related to Our Industry

We are in a highly competitive market, which could result in reduced profitability.

Our agents face significant competition. The popularity of Internet sales and passage of the Financial Services Modernization Act has increased the number of potential competitors. If our prediction that the number of agents will increase is accurate, we will face greater competition for the services we provide to our agents. Many of our potential competitors have greater financial resources and market acceptance.

FORWARD-LOOKING STATEMENTS

Some of the statements in this prospectus that are not historical facts are "forward-looking" statements. Forward-looking statements can be identified by the use of words like "believes," "could," "possibly," "probably," "anticipates," "estimates," "projects," "expects," "may," "will," "should," "intend," "plan," "consider" or the negative of these expressions or other variations, or by discussions of strategy that involve risks and uncertainties. We based these forward-looking statements on our current expectations and projections about future events and information currently available to us. Although we believe that the assumptions for these forward-looking statements are reasonable, any of the assumptions could prove to be inaccurate. Some of the risks, uncertainties and assumptions are identified in the risk factors discussed above.

We wish to caution you that the forward-looking statements in this prospectus are only estimates and predictions. Our actual results could differ materially from those anticipated in the forward-looking statements due to risks, uncertainties or actual events differing from the assumptions underlying these statements. These risks, uncertainties and assumptions include, but are not limited to, those discussed in this prospectus.

USE OF PROCEEDS

If all of the debentures that we are offering in this prospectus are sold, we expect proceeds to total $5,000,000 before deducting sales commissions and other expenses, such as organizational and administrative fees. We cannot assure you, however, that any or all of the debentures can or will be sold. Offering expenses are estimated to be approximately $400,000 and sales commissions will not exceed 7% of the principal amount of the debentures sold.

Intended Use of Proceeds

We currently intend to use the proceeds received from the sale of the debentures to make investments in companies and other assets that relate to the insurance industry. Our first priority for use of the proceeds is for acquisitions of companies that sell insurance and financial services on a brokerage basis or direct basis. The acquired companies would be held for long-term investment. For instance, we recently acquired CJD & Associates, L.L.C. for a purchase price of $2,025,000, CJD & Associates, L.L.C. typically sells insurance policies through retail agents and not directly to consumers. We have not identified specific target companies at this time, but the proceeds will allow us to proceed quickly when an appropriate company is identified.

9

Until such time as a company is identified, we expect to use the proceeds to acquire insurance agencies to be held in inventory for franchise agents. Investment in agencies acquired for inventory are typically short-term investments because we acquire such assets with the expectation of selling them to franchise agents.

During such times that proceeds are not needed for either of the above-described purposes, or if only a small number of debentures are sold, we may make temporary investments in loan participation certificates to be issued by our finance company subsidiary, Brooke Credit Corporation, for short-term working capital loans made to insurance agents or to our other subsidiaries. We consider our loans as liquid and "available for sale," so these loans could be participated to others when the proceeds are needed for carrying agency inventory or corporate acquisitions.

We do not have any commitments or agreements for material acquisitions or the commencement of new business ventures. However, we will continue to evaluate possible acquisition candidates. We anticipate that some of the proceeds from this offering will be invested in money market funds, bank repurchase agreements, commercial paper, U.S. Treasury Bills and similar securities investments while awaiting use as described above.

Since we do not know the principal amount of debentures that will be sold, we are unable to accurately forecast the total net proceeds generated by this offering. The following table, however, demonstrates the percentages and dollar amounts of proceeds we anticipate would be used for particular purposes in the event all of the debentures are sold and in the alternative event that only a small portion of the debentures are sold.

| | Maximum

| | Minimum(1)

| |

|---|

| | $ Amount

| | % of net proceeds

| | $ Amount

| | % of net proceeds

| |

|---|

| Estimated cash proceeds | | $ | 5,000,000 | | | | $ | 500,000 | (1) | | |

| Offering expenses | | | | (2) | | | | | (2) | | |

| Sales commissions | | $ | 350,000 | | | | $ | 35,000 | | | |

| Estimated net proceeds | | $ | 4,650,000 | | | | $ | 465,000 | | | |

| Acquisitions | | $ | 4,650,000 | | 100 | % | | 0 | | 0 | % |

| Loan participations | | | 0 | (3) | 0 | % | $ | 465,000 | | 100 | % |

- (1)

- Although there is no minimum amount and no escrow arrangement for this offering, the above amount is included to show how proceeds would be applied if only a small number of debentures were to be sold.

- (2)

- The maximum expenses of this offering are estimated to be $400,000. All expenses of this offering have been, or will be, paid by us from funds currently available and are therefore not included in the net proceeds amount shown here.

- (3)

- If all debentures are sold, we intend to apply net proceeds to acquisitions. It is likely, however, that some of the proceeds will, at least temporarily, be applied to loan participations. We have not attempted to estimate that amount.

Changes in Intended Use of Proceeds

We do not anticipate any material changes to our planned use or priority of use of proceeds from those described above. While the above represents our present intention with respect to the use of the offering proceeds, a change in capital requirements or business opportunities could cause us to elect to use the proceeds for other purposes not contemplated at this time. We have the discretion to use the proceeds in any manner we deem appropriate.

10

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Management's discussion and analysis of the results of operations and financial condition should be read in conjunction with the Financial Statements and related Notes.

Results of Operations

Our consolidated results of operations have been significantly impacted by our expansion of territory and personnel in recent years. Revenues are expected to continue to increase in 2002 as a result of the foregoing.

Although we plan to eventually market our master agent, facilitator and programs services to other financial services professionals, currently virtually all of our financial activity results from insurance sales or lending to insurance agents. As such, management has organized a portion of its discussion and analysis into an insurance agency segment and a finance company segment.

Our revenues are comprised primarily of commissions paid by insurance companies in connection with our insurance agency operations. Commission revenues typically represent a percentage of insurance premiums paid by policyholders. Premium amounts and commission percentage rates are established by insurance companies, so we have little or no control of the commission amount generated from the sale of a specific insurance policy. We primarily rely on the recruitment of additional agents to increase commission revenue.

Our finance subsidiary generates most of its revenues from interest margins resulting from the origination of loans to our agents and from gains on the sale of agent loan participations. The finance subsidiary funds its loan portfolio primarily through the sale of loan participation interests to other lenders and the sale of bonds to investors. The finance subsidiary also expects to issue asset backed notes and has recently organized two special purpose entities for this purpose. Covenants related to the issue of bonds by the finance company restrict the payment of dividends by the finance company subsidiary.

Three Months Ended September 30, 2002 Compared to Three Months Ended September 30, 2001

Net income for the third quarter of 2002 was $316,458 or $.34 per share, compared with net income in the third quarter of 2001 of $55,503 or $.06 per share. Total operating income for the third quarter of 2002 was $10,548,411, which is an increase of approximately 65% from total operating income of $6,395,014 during the comparable period of the prior year. This increase is primarily the result of our recent expansion of our insurance agency operations.

Payroll and other operating expenses also increased primarily as a result of our expansion of our insurance agency operations and our recent acquisition of CJD & Associates. Payroll expenses increased to $1,946,650 in the third quarter of 2002 from $1,045,636 in the third quarter of 2001, which is an increase of approximately 86%. Other operating expenses increased to $1,088,860 in the third quarter of 2002 from $483,581 in the third quarter of 2001, which is an increase of approximately 125%. Other operating expenses increased much faster than revenues largely as a result of opening additional insurance service center locations.

Depreciation and amortization expenses increased to $238,600 in the third quarter of 2002 from $123,064 in the third quarter of 2001, which is an increase of approximately 94%. The increase is primarily attributable to amortization expense associated with our recent loan participation sales activity and our recent acquisition of CJD & Associates.

11

Bond interest expense increased to $124,099 in the third quarter of 2002 from $88,725 in the third quarter of 2001, which is an increase of approximately 40%. The increase is primarily attributable to the sale of additional bonds by our finance company subsidiary.

Our effective tax rate on income was 34% in the third quarter of 2002 and 34% in the third quarter of 2001. We have recorded income taxes payable of $112,889 as of September 30, 2002 and a deferred tax asset of $452,122 as of September 30, 2001. Our deferred tax asset decreased as tax benefits resulting from prior period losses were used to offset current tax expense.

On September 30, 2002, our largest asset category was accounts and notes receivables, which totaled $7,597,138 and was comprised of notes receivable balances, accrued interest on notes receivables and customer receivable balances. Although a loss allowance was made for our long-term loss exposure related to our recourse liability on loans sold to participating lenders, no loss allowance has been made for our accounts and notes receivables because these assets have a short term exposure to loss and we have experienced minimal credit losses. All of our notes receivables are held for sale and typically sold within a short period of time. Most of our accounts receivables are agent obligations that are paid at the next monthly statement settlement so accounts receivables are typically paid within 30 days.

On September 30, 2002, customer receivables were $5,767,726, which is an increase of approximately 35% from $4,264,117 at September 30, 2001. Customer receivables increased because total revenues increased, however customer receivables increased at a lower rate than the rate at which our revenues increased. On September 30, 2002, notes receivables were $1,490,464, which is an increase of approximately 37% from $1,084,838 at September 30, 2001. Notes receivables increased primarily as a result of management's decision to temporarily retain more loans in its "held for sale" portfolio because we had the funds temporarily available to retain additional loans and the investment returns on these loans were greater than alternative investments. Furthermore, with funds temporarily available to retain loans longer, we can spend more time marketing and seasoning these loans which typically improves our prospects for profits when the loans are ultimately sold. On September 30, 2002, accrued interest on notes receivables was $338,948, which is a decrease of approximately 50% from $675,523 at September 30, 2001. This decrease is primarily attributable to the scheduling of more frequent interest payments from borrowers.

On September 30, 2002, other receivables were $1,743,222, which is an increase of approximately 329% from $406,314 at September 30, 2001. This increase is primarily attributable to the increased level of agent advances that are due more than 30 days from the date of the advance and therefore not included in agents' monthly statement balances that must be paid each month. The due date for these advances is extended beyond 30 days because these advances are typically repaid from receipts that have been delayed. The most common source of delayed receipts is the delayed payment of commissions by insurance companies during the transition period when an agency is first purchased and the increased level of agency sales is the primary reason for the increased level of delayed receipts.

On September 30, 2002, deposits were $50,156, which is a decrease of approximately 1% from $50,769 at September 30, 2001.

On September 30, 2002, prepaid expenses were $230,714, which is a decrease of approximately 26% from $311,787 at September 30, 2001. This decrease is primarily attributable to expenses associated with the sale of our publicly offered bonds that are amortized over a period ending at bond maturity.

On September 30, 2002, premiums payable to insurance companies were $3,579,581, which is an increase of approximately 43% from $2,499,368 at September 30, 2001. This increase is primarily a result of our expansion of our insurance agency operations and our recent acquisition of CJD & Associates.

12

On September 30, 2002, current maturities of long-term debt were $1,661,500, which is a decrease of approximately 26% from $2,246,363 at September 30, 2001. This decrease is primarily attributable to the prepayment of balances due to sellers in return for seller discounts.

Nine Months Ended September 30, 2002 Compared to Nine Months Ended September 30, 2001

Net income for the nine months ended September 30, 2002 was $1,181,619 or $1.37 per share, compared with net income for the comparable period of the prior year of $780,244 or $1.09 per share. Total operating income for the nine months ended September 30, 2002 was $28,610,489, which is an increase of approximately 59% from total operating income of $17,995,712 during the comparable period of the prior year. This increase is primarily the result of our recent expansion of our insurance agency operations.

Payroll and other operating expenses also increased primarily as a result of our expansion of our insurance agency operations and our recent acquisition of CJD & Associates. Payroll expenses increased to $4,930,801 for the nine months ended September 30, 2002 from $2,878,608 in the comparable period of the prior year, which is an increase of approximately 71%. Other operating expenses increased to $3,010,865 for the nine months ended September 30, 2002 from $1,316,801 in the comparable period of the prior year, which is an increase of approximately 129%. Other operating expenses increased much faster than revenues largely as a result of opening additional insurance service center locations.

Depreciation and amortization expenses increased to $544,455 for the nine months ended September 30, 2002 from $353,712 in the comparable period of the prior year, which is an increase of approximately 54%. The increase is primarily attributable to amortization expense associated with our recent loan participation sales activity and our recent acquisition of CJD & Associates.

Bond interest expense increased to $372,298 for the nine months ended September 30, 2002 from $226,942 in the comparable period of the prior year, which is an increase of approximately 64%. The increase is primarily attributable to the sale of additional bonds by our finance company subsidiary.

Analysis by Segment

We separate insurance agency operations from finance company operations when analyzing performance. In the first nine months of 2002 and 2001, most of our revenues were generated from our insurance agency operations. However, most of our profits for the first nine months of 2002 were generated from finance company operations.

Insurance Agency Segment

For performance comparisons of insurance agency operations, we typically analyze operating profits and operating profit margins. Operating profits for our insurance agency operations are defined as earnings before interest, taxes, depreciation and amortization. We typically expect operating profit margins, including insurance related facilitator profits, from insurance agency operations in excess of 10%. For the three months ending September 30, 2002, our insurance agency operating profits, including insurance related facilitator profits, were $385,167 on insurance commissions and fees of $10,013,353, resulting in an operating profit margin of approximately 3.9%. During the comparable period of 2001, insurance agency operating profits, including insurance related facilitator profits, were $99,350 on insurance commissions and fees of $5,983,434, resulting in an operating profit margin of approximately 1.7%. For the nine months ending September 30, 2002, our insurance agency operating profits, including insurance related facilitator profits, were $726,530 on insurance commissions and fees of $26,434,311, resulting in an operating profit margin of approximately 2.7%. During the comparable period of 2001, insurance agency operating profits, including insurance related facilitator profits, were $1,269,322 on insurance commissions and fees of $17,178,048, resulting in an operating profit margin of

13

approximately 7.4%. The significant decrease of operating profit margins in the three months and nine month periods ending September 30, 2002 from the comparable periods in 2001 occurred because insurance commission income increased at a much slower rate than expenses for this segment, especially other operating expenses and commissions expense paid to agents.

Insurance commissions in the third quarter of 2002 increased to $8,712,811 or approximately 61%, from $5,409,844 in the third quarter of 2001. Insurance commissions in the third quarter increased primarily as a result of our recent expansion. Commissions expense paid to our agents in the third quarter of 2002 increased to $6,599,645 or approximately 51%, from $4,360,995 in the third quarter of 2001. Commission expense increased because insurance commission income increased and agents are typically paid a share of insurance commissions income. Insurance commission income in the first nine months of 2002 increased to $22,210,504 or approximately 42%, from $15,662,675 in the comparable period of 2001. Insurance commissions in the first nine months of 2002 increased primarily as a result of our recent expansion. Commissions expense paid to our agents in the first nine months of 2002 increased to $17,810,382, or approximately 52%, from $11,738,522 in the comparable period of the prior year. Commission expense increased because insurance commission income increased and agents are typically paid a share of insurance commissions income, however commissions expense paid to agents increased at a faster rate than insurance commission income because we increased the share of sales commissions paid to agents and because a smaller share of our insurance commissions result from the sales of "targeted market" policies for which the commission rates paid to agents are generally less.

Included in insurance commission income are profit sharing commissions, which are our share of insurance company profits on policies written by our agents. Profit sharing commissions were $95,145 for the three-month period ending September 30, 2002 or approximately 1.1% of insurance commission income. During the comparable period of 2001, profit sharing commissions were $57,681 or approximately 1.1% of insurance commission income. Profit sharing commissions were $592,494 for the nine month period ending September 30, 2002 or approximately 2.7% of insurance commission income. During the comparable period of 2001, profit sharing commissions were $690,233 or approximately 4.4% of insurance commission income. The profit sharing commissions we received decreased in the three months and nine month periods ending September 30, 2002 from the comparable periods in 2001 because insurance company profits on policies written by our agents decreased.

Insurance commissions are reduced by the estimated amount of commission refunds resulting from future policy cancellations and revenue was correspondingly increased by $5,460 and reduced by $11,915 for the quarters ending September 30, 2002 and September 30, 2001, respectively, and reduced by $24,004 and $45,566 for the nine month periods ending September 30, 2002 and September 30, 2001, respectively. A corresponding liability has accrued in the amounts of $320,846 and $279,132 as of September 30, 2002 and September 30, 2001, respectively.

Fee income from our insurance related facilitator activities, such as consulting, agency finders fees, gains on agency sales and agency seller discounts increased to $1,286,512 in the third quarter of 2002 from $573,590 in the comparable period of the prior year and increased to $4,223,807 for the first nine months of 2002 from $1,515,373 in the comparable period of the prior year. Facilitator fee income increased in the three months and nine month periods ending September 30, 2002 from the comparable periods in 2001 because of our increasing emphasis on fee income and increased agency sales activity. Revenues from buyer's finder fees have been differentiated from revenues for gains on sale of agencies because finder's fees represent amounts received from prospective agency buyers for our efforts in locating an agency to acquire from an unaffiliated third party seller. In these instances, we do not purchase the agency into inventory. On the other hand, gains on sale of agencies represent the net gains received for the sale of agencies that we directly acquired and held in our inventory. When we purchase agencies directly into our inventory, a portion of the purchase price is usually deferred. Several months after the agency purchase, if we are reasonably confident that the purchase agreement representations were accurate and no significant transitioning problems are identified, then we offer to

14

prepay the remaining amounts due to sellers if the remaining balance is discounted. Although recorded as "Gains on extinguishment of debt", seller discounts are not considered extraordinary income because they occur frequently and are considered recurring factors in the evaluation of our operating processes. Revenues from finders fees, gains on sale of agencies and seller discounts are recognized immediately because we have no continuing obligation. We provide consulting and other assistance to agency owners during the first months of agency ownership through a Buyers Assistance Plan ("BAP") program. We record BAP income using the percentage of completion accounting method, so $1,893,745 of BAP fees were deferred as of September 30, 2002 and we recorded a corresponding liability. Our profitability is substantially the result of fee income from our facilitator activities which are typically associated with the purchase and sale of insurance agencies. As such, the value of those agencies and the financial performance of insurance agency buyers are important to our prospects. We are not aware of any systemic adverse profitability or cash flow trends being experienced by buyers of our agencies. The performance of our loan portfolio appears to substantiate this conclusion.

Our business includes the buying and selling of insurance agencies held in inventory. One of the agencies we sold during the nine months ended September 30, 2002, was previously sold by us in a prior period. We re-acquired this agency into our inventory in 2001 and sold it in 2002 for a $223,402 loss. When we sell agencies from our inventory, agency value is usually dependent to a significant extent on the cooperation of the original agency seller during ownership transition. Although the seller's cooperation is provided for in the corresponding purchase agreement, it is our experience that seller cooperation is more likely and enthusiastic if the seller has a continuing financial investment. As such, we negotiate to defer payment of a portion of the purchase price as additional leverage for seller cooperation. Sellers usually prefer that we, not the ultimate agency buyer, remain obligated for the amounts due sellers because sellers have indicated that they believe repayment is more likely from us than from agency buyers. However, we do not receive any reimbursement from agency buyers for interest expenses on amounts due to sellers, so we negotiate with sellers for low interest rates, preferably zero interest rates. We do not pay off sellers when an agency is sold to the ultimate agency buyer but instead wait until such time as we believe that no significant ownership transitioning issues remain.

During the first nine months of 2002, William Tyer and Gerald Lanio agreed to cancel any debt we owed to them resulting from our acquisition of Interstate Insurance Group, LTD in June 2000. Messrs. Tyer and Lanio were motivated to cancel this debt because the purchase agreement structure resulted in some potential adverse income tax consequences to the sellers. As consideration for the cancellation of the remaining principal balance of $643,246 that we owed to Messrs. Tyer and Lanio, we amended Tyer's and Lanio's employment agreements to provide for bonus payments equal to 30% of the amount that Interstate Insurance Group's net quarterly commissions exceed $20,691 during the period beginning on June 30, 2002 and ending June 30, 2005.

Finance Company Segment

Finance company operations consist primarily of lending to insurance agents. Agent loans are typically annually adjustable rate loans made for the purpose of acquiring insurance agencies. Net interest income and gross servicing income for the quarter ending September 30, 2002 was a net expense of $101,458 and for the quarter ending September 30, 2001 was a net income of $109,879. The significant reduction of net interest income resulted from a temporary increase in interest expense paid to loan participants. Net interest income and gross servicing income for the nine months ending September 30, 2002 and September 30, 2001 were $63,273 and $72,524, respectively.

The decrease in net interest margins and gross servicing income for the three month and nine month periods ending September 30, 2002 from the comparable periods in 2001 is primarily the result of a larger loan portfolio and the resulting loan participation sales. When analyzing the impact that net interest margins and gross servicing income have on our overall finance company operations,

15

consideration should be given to amortization of our servicing asset and subsequent adjustments to our interest receivable asset referenced in the following discussion on loan participation sales.

Revenues of $505,448 and $43,971 were recorded during the quarters ending September 30, 2002 and September 30, 2001, respectively, to realize a gain on the sale of notes receivables from recognition of the servicing asset and interest receivable asset resulting from the sale of loan participations. Revenues of $1,696,340 and $330,116 were recorded during the nine month periods ending September 30, 2002 and September 30, 2001 to realize a gain on the sale of notes receivables from recognition of the servicing asset and interest receivable asset resulting from the sale of loan participations. The increase in revenues from gains on sales of notes receivables for the three month and nine month periods ending September 30, 2002 from the comparable periods in 2001 is primarily the result of a larger loan portfolio and the resulting loan participation sales.

As part of our finance company's operations, we typically sell most of the insurance agent loans it originates to participating lenders. As such, gains or losses were recognized, loans were removed from the balance sheet and residual assets, representing the present value of future cash flows, were recorded. Loan participation sales have made a significant impact on our financial condition and results of operations. The following discussion describes this impact on the Consolidated Statements of Income, Consolidated Balance Sheets and the credit quality of the off-balance sheet loans sold with recourse.

In all sales of participations in insurance agent loans, we retain servicing responsibilities for which we typically receive annual servicing fees ranging from .25% to 1.375% of the outstanding balance. A gain is recognized immediately upon the sale of a loan participation when the annual servicing fees exceed the cost of servicing, which is estimated at .25% of the outstanding loan balance. In those instances where the annual service fees we received are less than the cost of servicing, a loss is immediately recorded. The gain or loss associated with loan servicing is determined based on a present value calculation of future cash flows from servicing the underlying loans, net of prepayment assumptions. For the quarters ending September 30, 2002 and September 30, 2001, the net gains from loan servicing totaled $234,506 and $18,659, respectively, which included gains from servicing benefits of $245,685 and $46,203, respectively, and losses from servicing liabilities of $11,179 and $27,544, respectively. For the nine month periods ending September 30, 2002 and September 30, 2001, the net gains from loan servicing totaled $761,939 and $166,523, respectively, which included gains from servicing benefits of $780,963 and $213,170, respectively, and losses from servicing liabilities of $19,024 and $46,647, respectively. The increase in net gains from loan servicing benefits and servicing losses for the three month and nine month periods ending September 30, 2002 from the comparable periods in 2001 is primarily the result of a larger loan portfolio and the resulting loan participation sales.

In addition to loan servicing fees, we often retain interest income when we sell participations in insurance agent loans. We record a gain on sale for the interest benefit based on a present value calculation of future cash flows of the underlying loans. Our right to interest income is not subordinate to the investor's interests and we share interest income with investors on a prorata basis. Although not subordinate to investor's interests, our retained interest is subject to credit and prepayment risks on the transferred financial assets. In those instances where we provide recourse, a loss is recorded based on a present value calculation of future cash flows of the underlying loans. For the quarters ending September 30, 2002 and September 30, 2001, the net gains from interest benefits totaled $270,942 and $25,312, respectively, which included gross gains from interest benefits of $341,345 and $34,273, respectively, and losses from recourse liabilities of $70,403 and $8,961, respectively. For the nine month periods ending September 30, 2002 and September 30, 2001, the net gains from interest benefits totaled $934,401 and $163,593, respectively, which included gross gains from interest benefits of $1,055,885 and $183,373, respectively, and losses from recourse liabilities of $121,484 and $19,780, respectively. The increase in net gains from interest benefits for the three month and nine month periods ending September 30, 2002 from the comparable periods in 2001 is primarily the result of a larger loan

16

portfolio and the resulting loan participation sales. Gains from servicing and interest benefits are typically non-cash gains as we receive cash equal to the carrying value of the loans sold. We have allocated the previous carrying amount between the assets sold and the corresponding retained interests, however cash in excess of the previous carrying amount is not generated by loan sales. A corresponding adjustment has been made on the Statement of Cash Flows to reconcile net income to net cash flows from operating activities.

Underlying assumptions used in the initial determination of future cash flows on the participation loans accounted for as sales include the following:

| | Agency Loans

(Adjustable Rate Stratum)

| | Agency Loans

(Fixed-Rate Stratum)

| |

|---|

| Prepayment speed* | | 10% | | 10 | % |

| Weighted average life* | | 103.2 months | | N/A | |

| Expected credit losses* | | 5.0% | | 5.0 | % |

| Discount Rate* | | 8.5% | | 11.00 | % |

- *

- Annual rates

Gain-on-sale accounting requires management to make assumptions regarding prepayment speeds and credit losses for the participated loans. The performances of these loans are extensively monitored, and adjustments to these assumptions will be made if necessary.

The impact from the sale of loan participations can be seen in several areas of our balance sheet. The most significant has been the removal of insurance agent loans that we continue to service. On September 30, 2002 and September 30, 2001, the balances of those off-balance sheet managed assets totaled $49,038,829 and $33,521,508, respectively. During the quarters ending September 30, 2002 and September 30, 2001, we sold $13,357,407 and $4,679,532, respectively, of participations in insurance agent loans. During the nine month periods ending September 30, 2002 and September 30, 2001, we sold $40,921,663 and $14,864,351, respectively, of participations in insurance agent loans. The increased level of off-balance sheet managed assets and loan participation sales for the three month and nine month periods ending September 30, 2002 from the comparable periods in 2001 is primarily the result of a larger loan portfolio and the resulting loan participation sales.

In connection with the recognition of non-cash gains for the servicing benefits of loan participation sales, the present value of future cash flows were recorded as a servicing asset. Components of the servicing asset as of September 30, 2002 were as follows:

| Estimated cash flows from loan servicing fees | | $ | 1,740,306 | |

| Less: | | | | |

| | Servicing Expense | | | (421,741 | ) |

| | Discount to Present Value | | | (434,661 | ) |

| | |

| |

| Carrying Value of Retained Servicing Interest in Loan Participations | | $ | 876,904 | |

In connection with the recognition of non-cash losses for the servicing liabilities of loan participation sales, the present value of future cash flows were recorded as a servicing liabilities. Components of the servicing liability as of September 30, 2002 were as follows:

| Estimated cash flows from loan servicing fees | | $ | 0 | |

| Less: | | | | |

| | Servicing expense | | | 71,431 | |

| | Discount to present value | | | (16,010 | ) |

| | |

| |

| Carrying Value of Retained Servicing Liability in Loan Participations | | $ | 55,421 | |

17

In connection with the recognition of non-cash gains for the interest benefits of loan participation sales, the present value of future cash flows were recorded as an interest receivable asset and included in investment securities. Components of the interest receivable asset as of September 30, 2002 were as follows:

| Estimated cash flows from interest income | | $ | 1,814,437 | |

| Less: | | | | |

| | Estimated credit losses * | | | (271,672 | ) |

| | Discount to present value | | | (319,639 | ) |

| | |

| |

| Carrying Value of Retained Interest in Loan Participations | | $ | 1,223,126 | |

- *

- Estimated credit losses from liability on sold recourse loans with balances totaling $10,797,768 on September 30, 2002. Credit loss estimates are based upon experience, delinquency rates, collateral adequacy, market conditions and other pertinent factors.

The following table presents a summary of various indicators of the credit quality of off-balance sheet recourse loans at September 30, 2002:

| | Net charge offs* | | $ | 0 | |

| | Recourse loans sold | | $ | 10,797,768 | |

| | Estimated credit losses provided for | | $ | 271,672 | |

| | Estimated credit losses to recourse loans sold at period end | | | 2.51 | % |

| Estimated Credit Loss Rates: | | | | |

| | Annual basis | | | 5.00 | % |

| | Percentage of original balance | | | 2.15 | % |

| Delinquency rates: | | | | |

| | 30 to 89 days* | | | 0 | % |

| | 90 days or more* | | | 0 | % |

- *

- Although no amounts of recourse loans were charged off for the three month and nine month periods ending September 30, 2002 and no loans were delinquent 30 days or more as of September 30, 2002, it is likely that loan delinquencies and loan charge offs will occur during the life of the sold recourse loans.

Liquidity and Capital Resources

The balances of our cash and cash equivalents were $5,121,129 and $4,212,022 at September 30, 2002 and September 30, 2001, respectively. Our current ratios (current assets to current liabilities) were 1.63 and 1.58 at September 30, 2002 and September 30, 2001, respectively. We have improved our current ratio and increased our cash balances to take advantage of business opportunities such as increasing agency inventory, negotiating seller discounts and attracting suppliers. Correspondingly, our current ratio and cash balances will be adversely affected if agency inventory increases or seller loan balances are prepaid.

For the nine month period ending September 30, 2002, net cash of $2,367,224 was provided from operating activities. Cash of $1,322,849 was provided by an increase in premiums due to insurance companies and cash of $965,513 was provided by an increase in unearned BAP fees. Cash of $864,150 was used to fund an increase in other receivables. For the nine month period ending September 30, 2002, net cash of $2,963,025 was provided by investing activities. A large net cash inflow resulted from insurance agency inventory transactions as cash proceeds of $9,553,106 from sales of agency inventory exceeded cash payments of $3,833,605 for purchases of agency inventory primarily because cash payments for part of the agency purchase prices were deferred. Cash payments of $2,224,816 were used

18

for purchases of long term investments in agencies that were not classified as inventory. For the nine month period ending September 30, 2002, net cash of $4,996,989 was used in financing activities with $6,035,911 of cash used for payments on long-term seller debt. Our cash balances increased by $333,260 from December 31, 2001 to September 30, 2002.

For the nine month period ending September 30, 2001, net cash of $800,781 was used for operating activities. The largest use of operating cash was $3,133,166, which was used to fund an increase in accounts and notes receivables. For the nine month period ending September 30, 2001, net cash of $558,904 was used for investing activities and net cash of $3,888,194 was provided by financing activities primarily from the issuance of bonds by our finance company subsidiary. Our cash balances increased by $2,528,509 from December 31, 2000 to September 30, 2001.

If necessary, we believe we can increase cash flow within a relatively short period of time by liquidating our notes receivable inventory or by liquidating our insurance agency inventory.

Our "Other Assets" account balance totaled $3,245,625 and $1,380,941 on September 30, 2002 and September 30, 2001, respectively. Included in Other Assets are intangible accounts such as goodwill, excess of cost over fair value of net asset, deferred tax assets and servicing assets. If our total assets are adjusted to exclude Other Assets, then our adjusted total assets exceed our total liabilities by $512,817 on September 30, 2002, and our total liabilities exceed adjusted total assets by $586,953 on September 30, 2001. Our future acquisitions will likely increase the Other Assets account balances and could result in total liabilities exceeding adjusted total assets in future periods. Our "Investment in Agencies" account balances of $0 and $999,584 represent the cost, or market value if lower, of insurance agencies held in inventory for resale to franchise agents on September 30, 2002 and September 30, 2001, respectively. Although intangible, we believe that agency inventory assets differ from other intangible assets, such as goodwill, because agency inventory is held for a relatively short period of time and has a recently demonstrated value.

We believe that our existing cash, cash equivalents and funds generated from operating, investing and financing activities will be sufficient to satisfy our normal financial needs. Additionally, we believe that funds generated from future operating, investing and financing activities will be sufficient to satisfy our future financing needs, including the required annual principal payments of our long-term debt and any potential future tax liabilities.

Related Party Loans

Our related party loans and other information are summarized in footnote number 13 to our Consolidated Financial Statements for the fiscal quarter ended September 30, 2002.

Critical Accounting Policies

Our established accounting policies are summarized in footnote number 1 to our Consolidated Financial Statements for the fiscal quarter ended September 30, 2002. As part of its oversight responsibilities, management continually evaluates the propriety of its accounting methods as new events occur. Management believes that its policies are applied in a manner which are intended to provide the user of the company's financial statements a current, accurate and complete presentation of information in accordance with Generally Accepted Accounting Principles.

When recognizing insurance commission revenues, management makes assumptions regarding future policy cancellations which may result in commission refunds and sets up a corresponding reserve. When recognizing consulting and other revenues associated with the assistance provided to agent buyers, management makes assumptions regarding when service is performed and the amount of assistance provided. When recognizing the gain on sale revenues associated with the sale of loan participations, management makes key economic assumptions regarding loan prepayment speeds, credit

19

losses and discount rates as required by SFAS No. 140, "Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities."

We apply the purchase method of accounting to our acquisitions. Under this method, the purchase price is allocated to the underlying tangible and intangible assets acquired and liabilities assumed based upon their respective fair market values, with the excess recorded as goodwill. Such fair market value assessments require judgments and estimates. Pursuant to SFAS No. 142, "Goodwill and Other Intangible Assets," amounts recorded as goodwill will be subject to annual evaluation of impairment which can result in declines in the carrying value of assets recorded as goodwill.

With respect to the previously described critical accounting policies, management believes that the application of judgments and assumptions are consistently applied and produce financial information which fairly depicts the results of operations for all years presented.

Effect of Recently Issued Accounting Pronouncements

Footnote numbers 11 and 14 to our Consolidated Financial Statements for the fiscal quarter ended September 30, 2002 provide additional information on the effect to us of the following recently issued accounting pronouncements: SFAS No. 141, "Business Combinations", SFAS No. 142, "Goodwill and Other Intangible Assets", SFAS No. 143, "Accounting for Asset Retirement Obligations" and SFAS No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets".

20

DESCRIPTION OF BUSINESS

Overview

We are engaged in the business of marketing insurance and financial services through independent agents and brokers. Most of our current revenues are derived from the sale of property and casualty insurance policies, although we intend to expand our offerings of other insurance and financial services, including life and health insurance, credit services, investment services and other related financial services.