UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-02215-99

T. Rowe Price Small-Cap Value Fund, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about Small-Cap Value Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Small-Cap Value Fund - Investor Class | $81 | 0.77% |

|---|

What drove fund performance during the past 12 months?

U.S. equities posted strong returns, lifted by favorable economic data and corporate earnings reports, easing inflationary pressures, and short-term interest rate reductions by the Federal Reserve. The results of the U.S. presidential election ended a lengthy period of uncertainty, boosting stocks further in the fourth quarter. Small-cap stocks significantly lagged large-cap peers, and growth outperformed value across all market capitalizations.

Versus the style-specific Russell 2000 Value Index, stock selection in the consumer discretionary sector was the leading contributor to relative performance. Shares of Cava, the largest Mediterranean restaurant company in the U.S., advanced on industry-leading traffic growth. Stock choices in energy also added value. Shares of TechnipFMC, a global offshore oil field service and equipment company, benefited from strong performance in its subsea segment.

Conversely, stock selection in health care detracted from relative results. Health care diagnostics company QuidelOrtho was a key detractor due to headwinds from a “COVID-off” overhang and execution issues that ultimately led to a change in management. Stock choices in materials also hindered performance. Weak end markets and tightening aluminum scrap spreads pressured downstream aluminum mining company Constellium.

The fund adheres to a contrarian, bottom-up investing approach and seeks to identify under-followed companies that we believe are inefficiently priced. Fundamental research, anchored by face-to-face meetings with company management, is critical to uncovering successful investment opportunities, and a long-term orientation allows for full exploitation of valuation anomalies.

How has the fund performed?

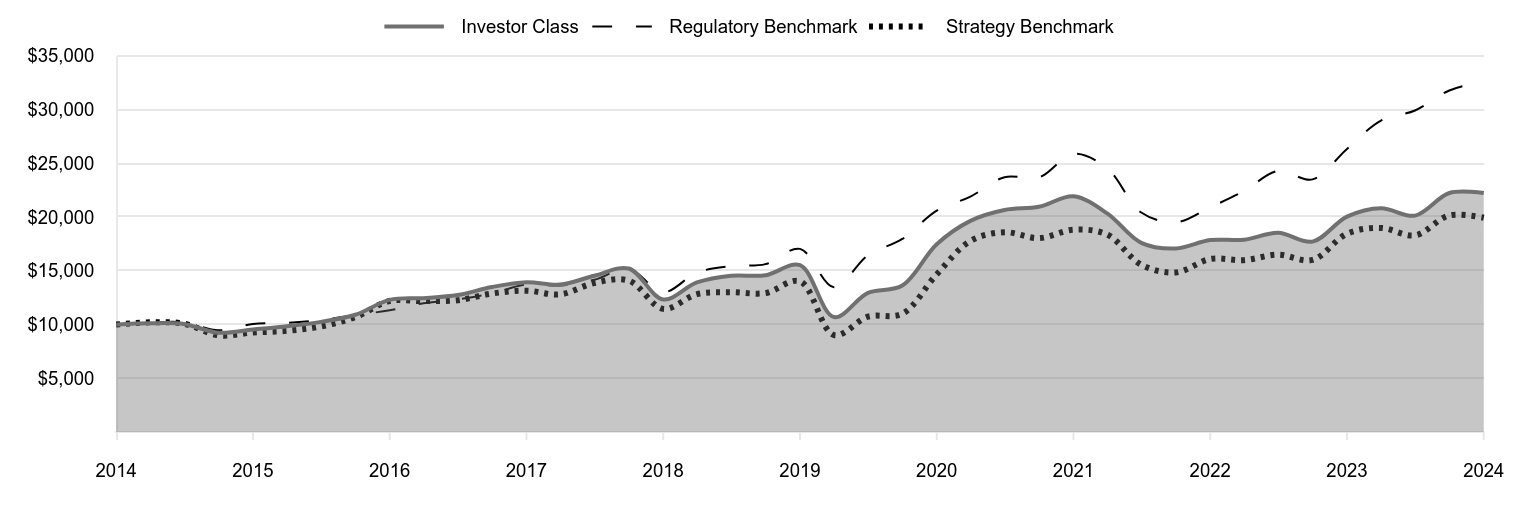

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Investor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 2014 | 10,000 | 10,000 | 10,000 |

|---|

| 2015 | 10,113 | 10,180 | 10,198 |

|---|

| 2015 | 10,051 | 10,194 | 10,076 |

|---|

| 2015 | 9,233 | 9,455 | 8,994 |

|---|

| 2015 | 9,530 | 10,048 | 9,253 |

|---|

| 2016 | 9,832 | 10,145 | 9,411 |

|---|

| 2016 | 10,244 | 10,412 | 9,816 |

|---|

| 2016 | 10,905 | 10,870 | 10,686 |

|---|

| 2016 | 12,291 | 11,327 | 12,190 |

|---|

| 2017 | 12,452 | 11,978 | 12,174 |

|---|

| 2017 | 12,738 | 12,339 | 12,256 |

|---|

| 2017 | 13,490 | 12,903 | 12,882 |

|---|

| 2017 | 13,935 | 13,721 | 13,146 |

|---|

| 2018 | 13,710 | 13,633 | 12,799 |

|---|

| 2018 | 14,534 | 14,163 | 13,861 |

|---|

| 2018 | 15,204 | 15,172 | 14,084 |

|---|

| 2018 | 12,333 | 13,002 | 11,455 |

|---|

| 2019 | 13,909 | 14,828 | 12,821 |

|---|

| 2019 | 14,537 | 15,435 | 12,997 |

|---|

| 2019 | 14,580 | 15,614 | 12,923 |

|---|

| 2019 | 15,520 | 17,035 | 14,020 |

|---|

| 2020 | 10,690 | 13,475 | 9,020 |

|---|

| 2020 | 12,941 | 16,443 | 10,726 |

|---|

| 2020 | 13,622 | 17,957 | 11,000 |

|---|

| 2020 | 17,460 | 20,593 | 14,669 |

|---|

| 2021 | 19,639 | 21,900 | 17,775 |

|---|

| 2021 | 20,651 | 23,705 | 18,585 |

|---|

| 2021 | 20,949 | 23,681 | 18,031 |

|---|

| 2021 | 21,919 | 25,877 | 18,816 |

|---|

| 2022 | 20,333 | 24,512 | 18,365 |

|---|

| 2022 | 17,595 | 20,418 | 15,559 |

|---|

| 2022 | 17,070 | 19,506 | 14,842 |

|---|

| 2022 | 17,854 | 20,907 | 16,091 |

|---|

| 2023 | 17,880 | 22,408 | 15,986 |

|---|

| 2023 | 18,532 | 24,288 | 16,494 |

|---|

| 2023 | 17,708 | 23,497 | 16,006 |

|---|

| 2023 | 20,035 | 26,334 | 18,448 |

|---|

| 2024 | 20,817 | 28,973 | 18,983 |

|---|

| 2024 | 20,127 | 29,904 | 18,291 |

|---|

| 2024 | 22,231 | 31,767 | 20,148 |

|---|

| 2024 | 22,226 | 32,604 | 19,934 |

|---|

202501-4140694, 202502-4108906

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years |

|---|

| Small-Cap Value Fund (Investor Class) | 10.93% | 7.45% | 8.31% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 13.86 | 12.55 |

|---|

| Russell 2000 Value Index (Strategy Benchmark) | 8.05 | 7.29 | 7.14 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$10,472,939

- Number of Portfolio Holdings381

- Investment Advisory Fees Paid (000s)$46,994

- Portfolio Turnover Rate32.4%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Financials | 28.1% |

| Industrials & Business Services | 14.4 |

| Real Estate | 10.5 |

| Consumer Discretionary | 9.7 |

| Health Care | 8.5 |

| Energy | 7.8 |

| Information Technology | 6.7 |

| Utilities | 5.2 |

| Materials | 4.4 |

| Other | 4.7 |

Top Ten Holdings (as a % of Net Assets)

| Pinnacle Financial Partners | 1.6% |

| PennyMac Financial Services | 1.4 |

| TechnipFMC | 1.3 |

| Columbia Banking System | 1.3 |

| Matador Resources | 1.2 |

| SouthState | 1.2 |

| Houlihan Lokey | 1.1 |

| East West Bancorp | 1.0 |

| Terreno Realty | 0.9 |

| TXNM Energy | 0.9 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Small-Cap Value Fund

Investor Class (PRSVX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about Small-Cap Value Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Small-Cap Value Fund - Advisor Class | $122 | 1.16% |

|---|

What drove fund performance during the past 12 months?

U.S. equities posted strong returns, lifted by favorable economic data and corporate earnings reports, easing inflationary pressures, and short-term interest rate reductions by the Federal Reserve. The results of the U.S. presidential election ended a lengthy period of uncertainty, boosting stocks further in the fourth quarter. Small-cap stocks significantly lagged large-cap peers, and growth outperformed value across all market capitalizations.

Versus the style-specific Russell 2000 Value Index, stock selection in the consumer discretionary sector was the leading contributor to relative performance. Shares of Cava, the largest Mediterranean restaurant company in the U.S., advanced on industry-leading traffic growth. Stock choices in energy also added value. Shares of TechnipFMC, a global offshore oil field service and equipment company, benefited from strong performance in its subsea segment.

Conversely, stock selection in health care detracted from relative results. Health care diagnostics company QuidelOrtho was a key detractor due to headwinds from a “COVID-off” overhang and execution issues that ultimately led to a change in management. Stock choices in materials also hindered performance. Weak end markets and tightening aluminum scrap spreads pressured downstream aluminum mining company Constellium.

The fund adheres to a contrarian, bottom-up investing approach and seeks to identify under-followed companies that we believe are inefficiently priced. Fundamental research, anchored by face-to-face meetings with company management, is critical to uncovering successful investment opportunities, and a long-term orientation allows for full exploitation of valuation anomalies.

How has the fund performed?

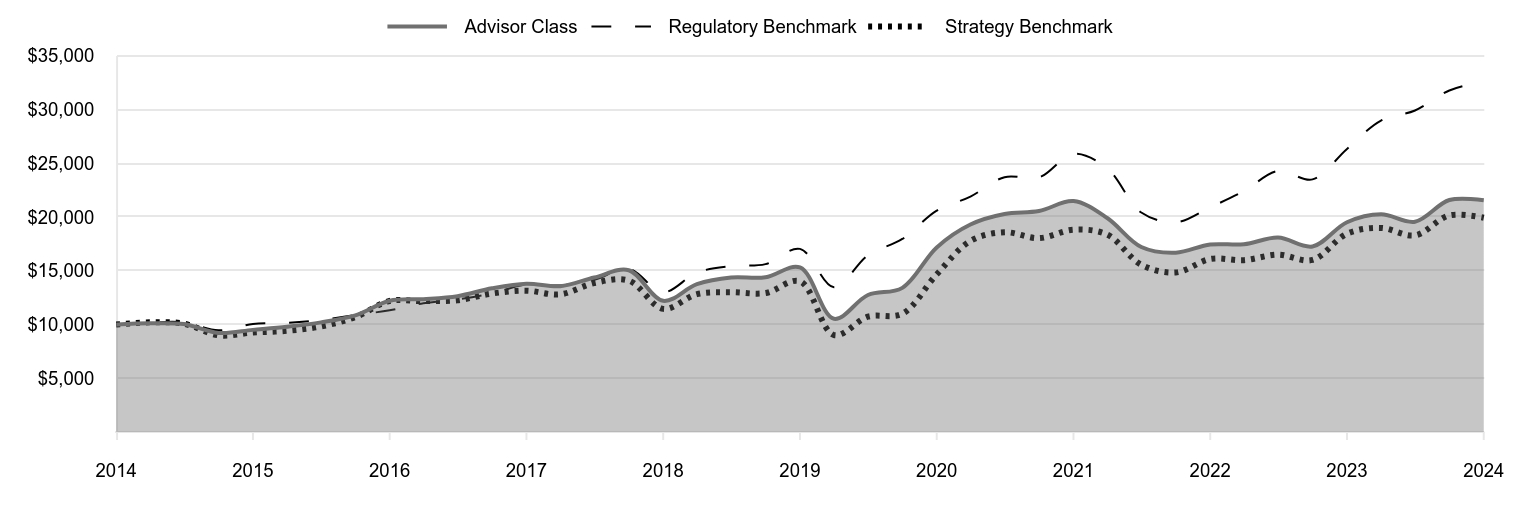

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Advisor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 2014 | 10,000 | 10,000 | 10,000 |

|---|

| 2015 | 10,105 | 10,180 | 10,198 |

|---|

| 2015 | 10,037 | 10,194 | 10,076 |

|---|

| 2015 | 9,213 | 9,455 | 8,994 |

|---|

| 2015 | 9,500 | 10,048 | 9,253 |

|---|

| 2016 | 9,794 | 10,145 | 9,411 |

|---|

| 2016 | 10,196 | 10,412 | 9,816 |

|---|

| 2016 | 10,845 | 10,870 | 10,686 |

|---|

| 2016 | 12,209 | 11,327 | 12,190 |

|---|

| 2017 | 12,359 | 11,978 | 12,174 |

|---|

| 2017 | 12,633 | 12,339 | 12,256 |

|---|

| 2017 | 13,368 | 12,903 | 12,882 |

|---|

| 2017 | 13,798 | 13,721 | 13,146 |

|---|

| 2018 | 13,560 | 13,633 | 12,799 |

|---|

| 2018 | 14,369 | 14,163 | 13,861 |

|---|

| 2018 | 15,047 | 15,172 | 14,084 |

|---|

| 2018 | 12,201 | 13,002 | 11,455 |

|---|

| 2019 | 13,751 | 14,828 | 12,821 |

|---|

| 2019 | 14,362 | 15,435 | 12,997 |

|---|

| 2019 | 14,389 | 15,614 | 12,923 |

|---|

| 2019 | 15,308 | 17,035 | 14,020 |

|---|

| 2020 | 10,533 | 13,475 | 9,020 |

|---|

| 2020 | 12,743 | 16,443 | 10,726 |

|---|

| 2020 | 13,406 | 17,957 | 11,000 |

|---|

| 2020 | 17,166 | 20,593 | 14,669 |

|---|

| 2021 | 19,296 | 21,900 | 17,775 |

|---|

| 2021 | 20,274 | 23,705 | 18,585 |

|---|

| 2021 | 20,551 | 23,681 | 18,031 |

|---|

| 2021 | 21,478 | 25,877 | 18,816 |

|---|

| 2022 | 19,906 | 24,512 | 18,365 |

|---|

| 2022 | 17,211 | 20,418 | 15,559 |

|---|

| 2022 | 16,684 | 19,506 | 14,842 |

|---|

| 2022 | 17,439 | 20,907 | 16,091 |

|---|

| 2023 | 17,461 | 22,408 | 15,986 |

|---|

| 2023 | 18,082 | 24,288 | 16,494 |

|---|

| 2023 | 17,260 | 23,497 | 16,006 |

|---|

| 2023 | 19,509 | 26,334 | 18,448 |

|---|

| 2024 | 20,250 | 28,973 | 18,983 |

|---|

| 2024 | 19,562 | 29,904 | 18,291 |

|---|

| 2024 | 21,581 | 31,767 | 20,148 |

|---|

| 2024 | 21,557 | 32,604 | 19,934 |

|---|

202501-4140694, 202502-4108906

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years |

|---|

| Small-Cap Value Fund (Advisor Class) | 10.49% | 7.09% | 7.98% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 13.86 | 12.55 |

|---|

| Russell 2000 Value Index (Strategy Benchmark) | 8.05 | 7.29 | 7.14 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$10,472,939

- Number of Portfolio Holdings381

- Investment Advisory Fees Paid (000s)$46,994

- Portfolio Turnover Rate32.4%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Financials | 28.1% |

| Industrials & Business Services | 14.4 |

| Real Estate | 10.5 |

| Consumer Discretionary | 9.7 |

| Health Care | 8.5 |

| Energy | 7.8 |

| Information Technology | 6.7 |

| Utilities | 5.2 |

| Materials | 4.4 |

| Other | 4.7 |

Top Ten Holdings (as a % of Net Assets)

| Pinnacle Financial Partners | 1.6% |

| PennyMac Financial Services | 1.4 |

| TechnipFMC | 1.3 |

| Columbia Banking System | 1.3 |

| Matador Resources | 1.2 |

| SouthState | 1.2 |

| Houlihan Lokey | 1.1 |

| East West Bancorp | 1.0 |

| Terreno Realty | 0.9 |

| TXNM Energy | 0.9 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Small-Cap Value Fund

Advisor Class (PASVX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about Small-Cap Value Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Small-Cap Value Fund - I Class | $70 | 0.66% |

|---|

What drove fund performance during the past 12 months?

U.S. equities posted strong returns, lifted by favorable economic data and corporate earnings reports, easing inflationary pressures, and short-term interest rate reductions by the Federal Reserve. The results of the U.S. presidential election ended a lengthy period of uncertainty, boosting stocks further in the fourth quarter. Small-cap stocks significantly lagged large-cap peers, and growth outperformed value across all market capitalizations.

Versus the style-specific Russell 2000 Value Index, stock selection in the consumer discretionary sector was the leading contributor to relative performance. Shares of Cava, the largest Mediterranean restaurant company in the U.S., advanced on industry-leading traffic growth. Stock choices in energy also added value. Shares of TechnipFMC, a global offshore oil field service and equipment company, benefited from strong performance in its subsea segment.

Conversely, stock selection in health care detracted from relative results. Health care diagnostics company QuidelOrtho was a key detractor due to headwinds from a “COVID-off” overhang and execution issues that ultimately led to a change in management. Stock choices in materials also hindered performance. Weak end markets and tightening aluminum scrap spreads pressured downstream aluminum mining company Constellium.

The fund adheres to a contrarian, bottom-up investing approach and seeks to identify under-followed companies that we believe are inefficiently priced. Fundamental research, anchored by face-to-face meetings with company management, is critical to uncovering successful investment opportunities, and a long-term orientation allows for full exploitation of valuation anomalies.

How has the fund performed?

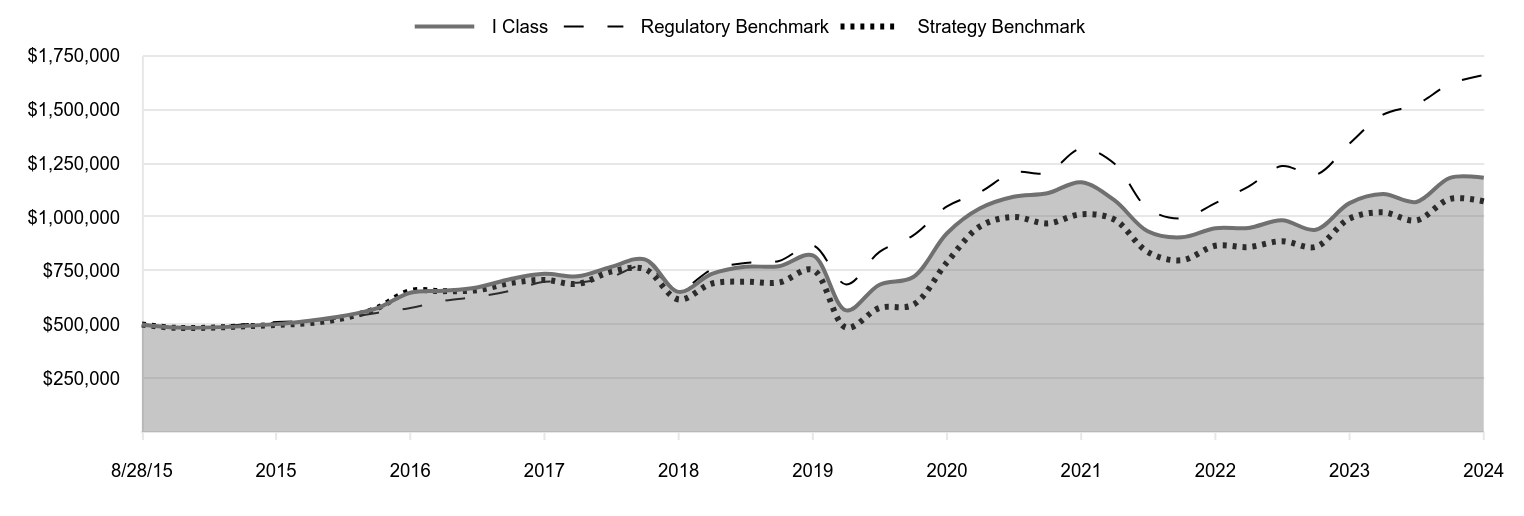

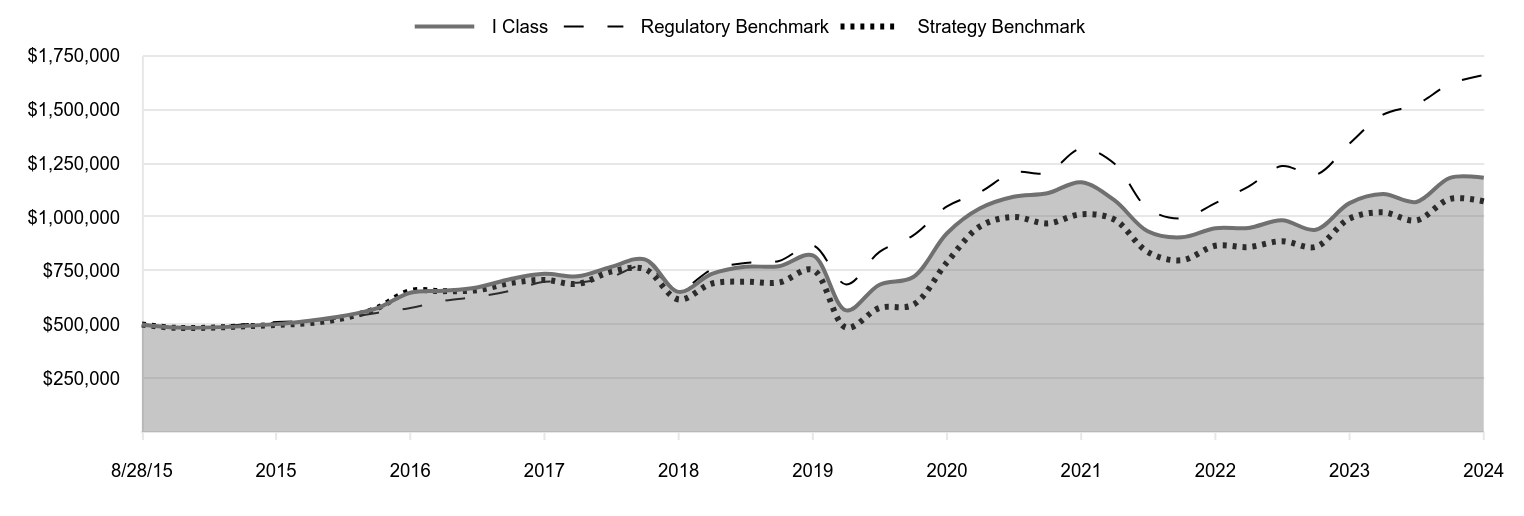

Cumulative Returns of a Hypothetical $500,000 Investment as of December 31, 2024

| I Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 8/28/15 | 500,000 | 500,000 | 500,000 |

|---|

| 9/30/15 | 486,055 | 481,606 | 484,012 |

|---|

| 12/31/15 | 501,703 | 511,802 | 497,933 |

|---|

| 3/31/16 | 517,731 | 516,758 | 506,411 |

|---|

| 6/30/16 | 539,562 | 530,351 | 528,219 |

|---|

| 9/30/16 | 574,658 | 553,674 | 575,051 |

|---|

| 12/31/16 | 647,786 | 576,980 | 655,981 |

|---|

| 3/31/17 | 656,544 | 610,118 | 655,128 |

|---|

| 6/30/17 | 671,905 | 628,516 | 659,518 |

|---|

| 9/30/17 | 711,674 | 657,248 | 693,215 |

|---|

| 12/31/17 | 735,592 | 698,900 | 707,396 |

|---|

| 3/31/18 | 723,897 | 694,395 | 688,721 |

|---|

| 6/30/18 | 767,678 | 721,399 | 745,910 |

|---|

| 9/30/18 | 803,214 | 772,791 | 757,879 |

|---|

| 12/31/18 | 651,758 | 662,265 | 616,396 |

|---|

| 3/31/19 | 735,190 | 755,270 | 689,913 |

|---|

| 6/30/19 | 768,564 | 786,199 | 699,399 |

|---|

| 9/30/19 | 771,181 | 795,339 | 695,393 |

|---|

| 12/31/19 | 821,035 | 867,693 | 754,432 |

|---|

| 3/31/20 | 565,758 | 686,348 | 485,398 |

|---|

| 6/30/20 | 684,910 | 837,534 | 577,165 |

|---|

| 9/30/20 | 721,084 | 914,650 | 591,917 |

|---|

| 12/31/20 | 924,415 | 1,048,935 | 789,395 |

|---|

| 3/31/21 | 1,040,229 | 1,115,510 | 956,493 |

|---|

| 6/30/21 | 1,094,019 | 1,207,426 | 1,000,110 |

|---|

| 9/30/21 | 1,110,139 | 1,206,198 | 970,296 |

|---|

| 12/31/21 | 1,161,758 | 1,318,104 | 1,012,560 |

|---|

| 3/31/22 | 1,078,183 | 1,248,528 | 988,267 |

|---|

| 6/30/22 | 933,434 | 1,040,009 | 837,287 |

|---|

| 9/30/22 | 905,576 | 993,577 | 798,687 |

|---|

| 12/31/22 | 947,646 | 1,064,936 | 865,907 |

|---|

| 3/31/23 | 949,232 | 1,141,402 | 860,219 |

|---|

| 6/30/23 | 984,323 | 1,237,129 | 887,588 |

|---|

| 9/30/23 | 940,708 | 1,196,875 | 861,323 |

|---|

| 12/31/23 | 1,064,525 | 1,341,360 | 992,733 |

|---|

| 3/31/24 | 1,106,392 | 1,475,756 | 1,021,530 |

|---|

| 6/30/24 | 1,070,066 | 1,523,216 | 984,297 |

|---|

| 9/30/24 | 1,182,121 | 1,618,099 | 1,084,220 |

|---|

| 12/31/24 | 1,182,189 | 1,660,708 | 1,072,694 |

|---|

202501-4140694, 202502-4108906

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 8/28/15 |

|---|

| Small-Cap Value Fund (I Class) | 11.05% | 7.56% | 9.65% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 13.86 | 13.71 |

|---|

| Russell 2000 Value Index (Strategy Benchmark) | 8.05 | 7.29 | 8.51 |

|---|

The preceding line graph shows the value of a hypothetical $500,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$10,472,939

- Number of Portfolio Holdings381

- Investment Advisory Fees Paid (000s)$46,994

- Portfolio Turnover Rate32.4%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Financials | 28.1% |

| Industrials & Business Services | 14.4 |

| Real Estate | 10.5 |

| Consumer Discretionary | 9.7 |

| Health Care | 8.5 |

| Energy | 7.8 |

| Information Technology | 6.7 |

| Utilities | 5.2 |

| Materials | 4.4 |

| Other | 4.7 |

Top Ten Holdings (as a % of Net Assets)

| Pinnacle Financial Partners | 1.6% |

| PennyMac Financial Services | 1.4 |

| TechnipFMC | 1.3 |

| Columbia Banking System | 1.3 |

| Matador Resources | 1.2 |

| SouthState | 1.2 |

| Houlihan Lokey | 1.1 |

| East West Bancorp | 1.0 |

| Terreno Realty | 0.9 |

| TXNM Energy | 0.9 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Small-Cap Value Fund

I Class (PRVIX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about Small-Cap Value Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Small-Cap Value Fund - Z Class | $0 | 0.00% |

|---|

What drove fund performance during the past 12 months?

U.S. equities posted strong returns, lifted by favorable economic data and corporate earnings reports, easing inflationary pressures, and short-term interest rate reductions by the Federal Reserve. The results of the U.S. presidential election ended a lengthy period of uncertainty, boosting stocks further in the fourth quarter. Small-cap stocks significantly lagged large-cap peers, and growth outperformed value across all market capitalizations.

Versus the style-specific Russell 2000 Value Index, stock selection in the consumer discretionary sector was the leading contributor to relative performance. Shares of Cava, the largest Mediterranean restaurant company in the U.S., advanced on industry-leading traffic growth. Stock choices in energy also added value. Shares of TechnipFMC, a global offshore oil field service and equipment company, benefited from strong performance in its subsea segment.

Conversely, stock selection in health care detracted from relative results. Health care diagnostics company QuidelOrtho was a key detractor due to headwinds from a “COVID-off” overhang and execution issues that ultimately led to a change in management. Stock choices in materials also hindered performance. Weak end markets and tightening aluminum scrap spreads pressured downstream aluminum mining company Constellium.

The fund adheres to a contrarian, bottom-up investing approach and seeks to identify under-followed companies that we believe are inefficiently priced. Fundamental research, anchored by face-to-face meetings with company management, is critical to uncovering successful investment opportunities, and a long-term orientation allows for full exploitation of valuation anomalies.

How has the fund performed?

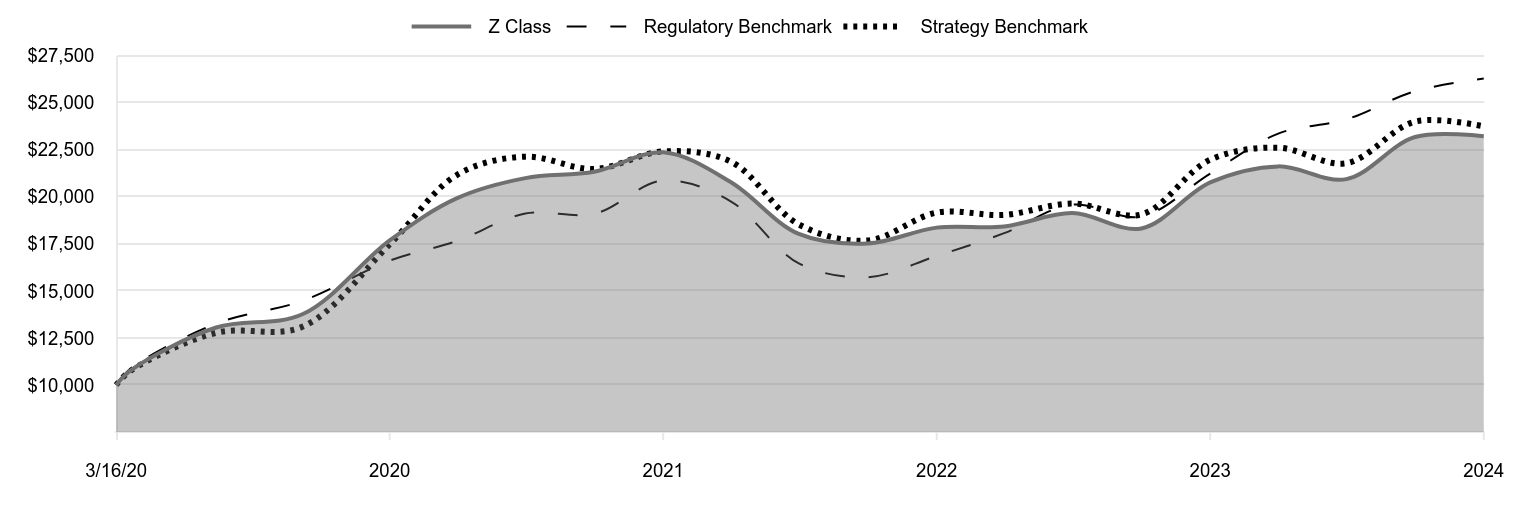

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Z Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 3/16/20 | 10,000 | 10,000 | 10,000 |

|---|

| 3/31/20 | 10,766 | 10,865 | 10,744 |

|---|

| 6/30/20 | 13,056 | 13,259 | 12,775 |

|---|

| 9/30/20 | 13,770 | 14,480 | 13,102 |

|---|

| 12/31/20 | 17,684 | 16,606 | 17,473 |

|---|

| 3/31/21 | 19,930 | 17,659 | 21,172 |

|---|

| 6/30/21 | 20,994 | 19,115 | 22,137 |

|---|

| 9/30/21 | 21,336 | 19,095 | 21,477 |

|---|

| 12/31/21 | 22,367 | 20,867 | 22,413 |

|---|

| 3/31/22 | 20,788 | 19,765 | 21,875 |

|---|

| 6/30/22 | 18,026 | 16,464 | 18,533 |

|---|

| 9/30/22 | 17,520 | 15,729 | 17,679 |

|---|

| 12/31/22 | 18,364 | 16,859 | 19,166 |

|---|

| 3/31/23 | 18,425 | 18,069 | 19,041 |

|---|

| 6/30/23 | 19,137 | 19,585 | 19,646 |

|---|

| 9/30/23 | 18,321 | 18,948 | 19,065 |

|---|

| 12/31/23 | 20,766 | 21,235 | 21,974 |

|---|

| 3/31/24 | 21,619 | 23,362 | 22,611 |

|---|

| 6/30/24 | 20,941 | 24,114 | 21,787 |

|---|

| 9/30/24 | 23,179 | 25,616 | 23,999 |

|---|

| 12/31/24 | 23,217 | 26,290 | 23,744 |

|---|

202501-4140694, 202502-4108906

Average Annual Total Returns

| | 1 Year | Since Inception 3/16/20 |

|---|

| Small-Cap Value Fund (Z Class) | 11.81% | 19.20% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 22.33 |

|---|

| Russell 2000 Value Index (Strategy Benchmark) | 8.05 | 19.76 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$10,472,939

- Number of Portfolio Holdings381

- Investment Advisory Fees Paid (000s)$46,994

- Portfolio Turnover Rate32.4%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Financials | 28.1% |

| Industrials & Business Services | 14.4 |

| Real Estate | 10.5 |

| Consumer Discretionary | 9.7 |

| Health Care | 8.5 |

| Energy | 7.8 |

| Information Technology | 6.7 |

| Utilities | 5.2 |

| Materials | 4.4 |

| Other | 4.7 |

Top Ten Holdings (as a % of Net Assets)

| Pinnacle Financial Partners | 1.6% |

| PennyMac Financial Services | 1.4 |

| TechnipFMC | 1.3 |

| Columbia Banking System | 1.3 |

| Matador Resources | 1.2 |

| SouthState | 1.2 |

| Houlihan Lokey | 1.1 |

| East West Bancorp | 1.0 |

| Terreno Realty | 0.9 |

| TXNM Energy | 0.9 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Small-Cap Value Fund

Z Class (TRZVX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| | | | | | | | | | | | | | |

| | | | 2024 | | | | | | 2023 | |

| | Audit Fees | | | $46,029 | | | | | | | | $46,733 | |

| | Audit-Related Fees | | | - | | | | | | | | - | |

| | Tax Fees | | | 9,200 | | | | | | | | 15,809 | |

| | All Other Fees | | | - | | | | | | | | - | |

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,262,000 and $1,524,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

Financial

Highlights

Portfolio

of

Investments

Financial

Statements

and

Notes

Additional

Fund

Information

Financial

Statements

and

Other

Information

For

more

insights

from

T.

Rowe

Price

investment

professionals,

go

to

troweprice.com

.

T.

ROWE

PRICE

PRSVX

Small-Cap

Value

Fund

PASVX

Small-Cap

Value

Fund–

.

Advisor Class

PRVIX

Small-Cap

Value

Fund–

.

I Class

TRZVX

Small-Cap

Value

Fund–

.

Z Class

T.

ROWE

PRICE

Small-Cap

Value

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Investor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

51

.99

$

47

.90

$

61

.79

$

52

.79

$

47

.91

Investment

activities

Net

investment

income

(1)(2)

0

.38

0

.36

0

.20

0

.18

0

.23

Net

realized

and

unrealized

gain/loss

5

.58

5

.43

(

11

.56

)

13

.13

5

.72

Total

from

investment

activities

5

.96

5

.79

(

11

.36

)

13

.31

5

.95

Distributions

Net

investment

income

(

0

.48

)

(

0

.33

)

(

0

.18

)

(

0

.21

)

(

0

.19

)

Net

realized

gain

(

4

.68

)

(

1

.37

)

(

2

.35

)

(

4

.10

)

(

0

.88

)

Total

distributions

(

5

.16

)

(

1

.70

)

(

2

.53

)

(

4

.31

)

(

1

.07

)

NET

ASSET

VALUE

End

of

period

$

52

.79

$

51

.99

$

47

.90

$

61

.79

$

52

.79

Ratios/Supplemental

Data

Total

return

(2)(3)

10

.93

%

12

.22

%

(

18

.55

)

%

25

.54

%

12

.50

%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0

.77

%

0

.78

%

0

.79

%

0

.75

%

0

.76

%

Net

expenses

after

waivers/

payments

by

Price

Associates

0

.77

%

0

.78

%

0

.79

%

0

.75

%

0

.76

%

Net

investment

income

0

.70

%

0

.74

%

0

.37

%

0

.29

%

0

.53

%

Portfolio

turnover

rate

32

.4

%

27

.5

%

20

.7

%

25

.1

%

28

.0

%

Net

assets,

end

of

period

(in

millions)

$4,225

$4,532

$4,565

$7,722

$6,301

0

%

0

%

0

%

0

%

0

%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Small-Cap

Value

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Advisor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

51

.88

$

47

.76

$

61

.60

$

52

.64

$

47

.80

Investment

activities

Net

investment

income

(loss)

(1)(2)

0

.17

0

.22

0

.02

(

0

.02

)

0

.11

Net

realized

and

unrealized

gain/loss

5

.53

5

.39

(

11

.51

)

13

.08

5

.66

Total

from

investment

activities

5

.70

5

.61

(

11

.49

)

13

.06

5

.77

Distributions

Net

investment

income

(

0

.19

)

(

0

.12

)

—

—

(

0

.05

)

Net

realized

gain

(

4

.68

)

(

1

.37

)

(

2

.35

)

(

4

.10

)

(

0

.88

)

Total

distributions

(

4

.87

)

(

1

.49

)

(

2

.35

)

(

4

.10

)

(

0

.93

)

NET

ASSET

VALUE

End

of

period

$

52

.71

$

51

.88

$

47

.76

$

61

.60

$

52

.64

Ratios/Supplemental

Data

Total

return

(2)(3)

10

.49

%

11

.87

%

(

18

.81

)

%

25

.12

%

12

.14

%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

1

.16

%

1

.08

%

1

.14

%

1

.08

%

1

.06

%

Net

expenses

after

waivers/

payments

by

Price

Associates

1

.16

%

1

.08

%

1

.14

%

1

.08

%

1

.06

%

Net

investment

income

(loss)

0

.32

%

0

.44

%

0

.03

%

(

0

.04

)

%

0

.25

%

Portfolio

turnover

rate

32

.4

%

27

.5

%

20

.7

%

25

.1

%

28

.0

%

Net

assets,

end

of

period

(in

millions)

$49

$65

$77

$105

$97

0

%

0

%

0

%

0

%

0

%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Small-Cap

Value

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

I

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

51

.87

$

47

.80

$

61

.72

$

52

.76

$

47

.89

Investment

activities

Net

investment

income

(1)(2)

0

.44

0

.42

0

.28

0

.25

0

.27

Net

realized

and

unrealized

gain/loss

5

.57

5

.41

(

11

.55

)

13

.12

5

.72

Total

from

investment

activities

6

.01

5

.83

(

11

.27

)

13

.37

5

.99

Distributions

Net

investment

income

(

0

.56

)

(

0

.39

)

(

0

.30

)

(

0

.31

)

(

0

.24

)

Net

realized

gain

(

4

.68

)

(

1

.37

)

(

2

.35

)

(

4

.10

)

(

0

.88

)

Total

distributions

(

5

.24

)

(

1

.76

)

(

2

.65

)

(

4

.41

)

(

1

.12

)

NET

ASSET

VALUE

End

of

period

$

52

.64

$

51

.87

$

47

.80

$

61

.72

$

52

.76

Ratios/Supplemental

Data

Total

return

(2)(3)

11

.05

%

12

.33

%

(

18

.43

)

%

25

.67

%

12

.59

%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0

.66

%

0

.67

%

0

.67

%

0

.65

%

0

.66

%

Net

expenses

after

waivers/payments

by

Price

Associates

0

.66

%

0

.67

%

0

.67

%

0

.65

%

0

.66

%

Net

investment

income

0

.81

%

0

.86

%

0

.52

%

0

.40

%

0

.63

%

Portfolio

turnover

rate

32

.4

%

27

.5

%

20

.7

%

25

.1

%

28

.0

%

Net

assets,

end

of

period

(in

millions)

$3,025

$2,975

$2,900

$2,388

$1,507

0

%

0

%

0

%

0

%

0

%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Small-Cap

Value

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Z

Class

(1)

..

Year

..

..

Ended

.

3/16/20

(1)

Through

12/31/20

12/31/24

12/31/23

12/31/22

12/31/21

NET

ASSET

VALUE

Beginning

of

period

$

52

.06

$

47

.95

$

61

.88

$

52

.83

$

30

.66

Investment

activities

Net

investment

income

(2)(3)

0

.81

0

.75

0

.63

0

.64

0

.43

Net

realized

and

unrealized

gain/loss

5

.63

5

.44

(

11

.59

)

13

.16

23

.08

Total

from

investment

activities

6

.44

6

.19

(

10

.96

)

13

.80

23

.51

Distributions

Net

investment

income

(

0

.91

)

(

0

.71

)

(

0

.62

)

(

0

.65

)

(

0

.46

)

Net

realized

gain

(

4

.68

)

(

1

.37

)

(

2

.35

)

(

4

.10

)

(

0

.88

)

Total

distributions

(

5

.59

)

(

2

.08

)

(

2

.97

)

(

4

.75

)

(

1

.34

)

NET

ASSET

VALUE

End

of

period

$

52

.91

$

52

.06

$

47

.95

$

61

.88

$

52

.83

Ratios/Supplemental

Data

Total

return

(3)(4)

11

.81

%

13

.08

%

(

17

.90

)

%

26

.48

%

76

.84

%

Ratios

to

average

net

assets:

(3)

Gross

expenses

before

waivers/payments

by

Price

Associates

0

.64

%

0

.65

%

0

.65

%

0

.64

%

0

.64

%

(5)

Net

expenses

after

waivers/

payments

by

Price

Associates

0

.00

%

0

.00

%

0

.00

%

0

.00

%

0

.00

%

(5)

Net

investment

income

1

.48

%

1

.53

%

1

.17

%

1

.04

%

1

.26

%

(5)

Portfolio

turnover

rate

32

.4

%

27

.5

%

20

.7

%

25

.1

%

28

.0

%

Net

assets,

end

of

period

(in

millions)

$3,174

$3,004

$2,754

$4,046

$3,420

0

%

0

%

0

%

0

%

0

%

(1)

Inception

date

(2)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(3)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(4)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

Total

return

is

not

annualized

for

periods

less

than

one

year.

(5)

Annualized

T.

ROWE

PRICE

Small-Cap

Value

Fund

December

31,

2024

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

COMMON

STOCKS

96.7%

COMMUNICATION

SERVICES

1.7%

Diversified

Telecommunication

Services

0.2%

AST

SpaceMobile (1)(2)

1,082,844

22,848

GCI

Liberty,

Class

A,

EC (2)(3)

399,039

—

22,848

Entertainment

0.7%

Liberty

Media

Corp-Liberty

Live,

Class

C (2)

665,183

45,272

Madison

Square

Garden

Sports (2)

111,078

25,068

70,340

Media

0.8%

Advantage

Solutions (1)(2)

5,550,809

16,208

Advantage

Solutions,

Warrants,

12/31/26 (2)

400,000

5

New

York

Times,

Class

A

1,390,572

72,379

88,592

Total

Communication

Services

181,780

CONSUMER

DISCRETIONARY

9.6%

Automobile

Components

1.0%

Dorman

Products (2)

358,869

46,491

LCI

Industries

169,912

17,567

Modine

Manufacturing (2)

155,072

17,978

Visteon (2)

228,869

20,305

102,341

Broadline

Retail

0.3%

Etsy (2)

993

53

Ollie's

Bargain

Outlet

Holdings (2)

153,602

16,855

Savers

Value

Village (1)(2)

1,492,046

15,293

32,201

Distributors

0.1%

Pool

Corp

39,451

13,450

13,450

Diversified

Consumer

Services

0.9%

Grand

Canyon

Education (2)

67,664

11,084

Strategic

Education

927,084

86,608

97,692

Hotels,

Restaurants

&

Leisure

1.4%

Cava

Group (2)

30,048

3,390

Dutch

Bros,

Class

A (2)

581,413

30,454

Marriott

Vacations

Worldwide

454,421

40,807

T.

ROWE

PRICE

Small-Cap

Value

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Papa

John's

International (1)

941,001

38,647

Torchys

Holdings,

Class

A,

Acquisition

Date:

11/13/20,

Cost $12,311 (2)(3)(4)(5)

1,439,856

5,356

United

Parks

&

Resorts (2)

85,743

4,818

Wyndham

Hotels

&

Resorts

271,128

27,327

150,799

Household

Durables

0.9%

Champion

Homes (2)

373,331

32,890

Meritage

Homes

296,428

45,597

Taylor

Morrison

Home (2)

222,411

13,614

92,101

Leisure

Products

0.7%

Peloton

Interactive,

Class

A (1)(2)

7,769,013

67,591

Rad

Power

Bikes,

Class

A,

Acquisition

Date:

1/22/21

-

9/16/21,

Cost $21,320 (2)(3)(5)

3,355,939

671

68,262

Specialty

Retail

3.2%

Abercrombie

&

Fitch,

Class

A (2)

132,236

19,765

Asbury

Automotive

Group (2)

149,237

36,269

Boot

Barn

Holdings (1)(2)

102,034

15,491

Carvana (2)

396,797

80,693

Chewy,

Class

A (2)

327,468

10,967

Floor

&

Decor

Holdings,

Class

A (2)

563

56

Framebridge

Expense

Fund

Payment,

EC,

Acquisition

Date:

5/19/20,

Cost $9 (2)(3)(5)

9,353

9

Group

1

Automotive (1)

122,931

51,813

Monro (6)

1,582,537

39,247

RH (2)

39,878

15,695

Urban

Outfitters (2)

512,458

28,124

Victoria's

Secret (2)

917,932

38,021

336,150

Textiles,

Apparel

&

Luxury

Goods

1.1%

Bombas,

Acquisition

Date:

2/12/21,

Cost $14,601 (2)(3)(5)

3,303,766

9,977

Figs,

Class

A (1)(2)

6,198,149

38,367

Kontoor

Brands

138,195

11,803

Steven

Madden

734,887

31,247

Under

Armour,

Class

A (1)(2)

1,976,047

16,362

VF

582,819

12,507

120,263

Total

Consumer

Discretionary

1,013,259

T.

ROWE

PRICE

Small-Cap

Value

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

CONSUMER

STAPLES

2.2%

Beverages

0.0%

Boston

Beer,

Class

A (2)

7,306

2,192

Coca-Cola

Consolidated

518

653

Primo

Brands

38,979

1,199

4,044

Consumer

Staples

Distribution

&

Retail

0.0%

Grocery

Outlet

Holding (1)(2)

121,500

1,897

1,897

Food

Products

1.5%

Farmers

Business

Network,

Warrants,

9/29/33,

Acquisition

Date:

9/29/23,

Cost $— (2)(3)(5)

10,691,000

9,087

Nomad

Foods

2,300,990

38,611

Post

Holdings (2)

463,369

53,037

Simply

Good

Foods (2)

463,075

18,051

TreeHouse

Foods (2)

749,112

26,316

Utz

Brands (1)

926,800

14,514

159,616

Personal

Care

Products

0.7%

BellRing

Brands (2)

943,894

71,113

Olaplex

Holdings (1)(2)

4,005,848

6,930

78,043

Total

Consumer

Staples

243,600

ENERGY

7.8%

Energy

Equipment

&

Services

3.4%

Cactus,

Class

A

1,024,497

59,790

ChampionX

686,766

18,673

Enerflex

(CAD) (1)

5,988,755

59,619

Energy

Reservoir

Holdings,

Class

A-1,

Acquisition

Date:

4/30/19,

Cost $20,874 (2)(3)(4)(5)(6)

20,874,541

11,272

Expro

Group

Holdings (2)

2,939,936

36,661

Liberty

Energy,

Class

A (1)

1,094,432

21,768

Solaris

Energy

Infrastructure (1)

467,181

13,445

TechnipFMC

4,722,174

136,660

357,888

Oil,

Gas

&

Consumable

Fuels

4.4%

Advantage

Energy

(CAD) (1)(2)

2,754,108

18,892

Expand

Energy

828,398

82,467

Gulfport

Energy (2)

168,959

31,122

Magnolia

Oil

&

Gas,

Class

A

2,492,371

58,272

T.

ROWE

PRICE

Small-Cap

Value

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Matador

Resources

2,185,272

122,943

PBF

Energy,

Class

A (1)

752,829

19,988

Permian

Resources

3,965,370

57,022

Range

Resources

2,019,933

72,677

463,383

Total

Energy

821,271

FINANCIALS

27.8%

Banks

19.4%

Banc

of

California

3,320,430

51,334

BankUnited

1,319,570

50,368

Blue

Foundry

Bancorp (2)

876,891

8,602

Cadence

Bank

901,366

31,052

Cathay

General

Bancorp

702,719

33,457

Coastal

Financial (2)(6)

759,737

64,509

Columbia

Banking

System

5,045,220

136,271

Columbia

Financial (1)(2)

763,875

12,077

CRB

Group,

Acquisition

Date:

4/14/22,

Cost $3,215 (2)(3)(5)

30,579

1,935

CrossFirst

Bankshares,

Class

A (2)

877,019

13,287

Dogwood

State

Bank,

Voting

Shares,

Acquisition

Date:

5/6/19

-

4/5/24,

Cost $4,795 (2)(3)(5)

479,510

7,658

East

West

Bancorp

1,093,588

104,722

Eastern

Bankshares

3,414,069

58,893

FB

Financial

1,556,941

80,198

Flagstar

Financial (1)

1,723,600

16,081

FS

Bancorp (6)

655,496

26,915

Grasshopper

Bancorp,

Acquisition

Date:

10/12/18

-

5/2/19,

Cost $5,034 (2)(3)(5)

503,404

2,265

Grasshopper

Bancorp,

Warrants,

10/12/28,

Acquisition

Date:

10/12/18,

Cost $— (2)(3)(5)

100,220

68

HarborOne

Bancorp

1,729,121

20,456

Home

BancShares

2,837,501

80,301

John

Marshall

Bancorp (6)

1,240,165

24,903

Live

Oak

Bancshares (6)

2,448,316

96,831

National

Bank

Holdings,

Class

A

1,304,539

56,173

Origin

Bancorp

632,073

21,042

Pacific

Premier

Bancorp

1,683,706

41,958

Pinnacle

Financial

Partners

1,494,118

170,912

Ponce

Financial

Group (1)(2)(6)

1,541,212

20,036

Popular

806,868

75,894

Preferred

Bank

658,020

56,840

Prosperity

Bancshares

820,827

61,849

Southern

First

Bancshares (2)(6)

473,013

18,802

SouthState

1,226,202

121,983

T.

ROWE

PRICE

Small-Cap

Value

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Synovus

Financial

495,740

25,397

Texas

Capital

Bancshares (2)

1,171,527

91,613

Towne

Bank

2,524,818

85,995

Webster

Financial

1,709,330

94,389

Western

Alliance

Bancorp

1,147,523

95,864

WSFS

Financial

1,329,856

70,655

2,031,585

Capital

Markets

2.0%

Hamilton

Lane,

Class

A

190,869

28,258

Houlihan

Lokey

640,388

111,210

OTC

Markets

Group,

Class

A

397,176

20,341

Sprott

105,056

4,430

StepStone

Group,

Class

A

499,760

28,926

StoneX

Group (2)

206,882

20,268

213,433

Consumer

Finance

0.2%

PRA

Group (2)

1,073,279

22,421

22,421

Financial

Services

3.1%

Flywire (2)

558,367

11,514

HA

Sustainable

Infrastructure

Capital (1)

2,730,425

73,257

Marqeta,

Class

A (2)

4,702,176

17,821

PennyMac

Financial

Services

1,404,615

143,467

Stash

Financial,

Acquisition

Date:

1/6/21

-

1/26/21,

Cost $1,244 (2)(3)(5)

38,630

185

Voya

Financial

82,761

5,697

Walker

&

Dunlop

696,496

67,706

319,647

Insurance

2.7%

Baldwin

Insurance

Group (1)(2)

456,105

17,679

Coalition,

Series

A,

Acquisition

Date:

9/13/21,

Cost $357 (2)(3)

(5)

21,587

190

First

American

Financial

174,945

10,924

Goosehead

Insurance,

Class

A (1)(2)

298,085

31,961

Hanover

Insurance

Group

134,166

20,750

James

River

Group

Holdings (6)

2,452,007

11,941

Primerica

92,635

25,143

ProAssurance (2)

2,321,562

36,936

RLI

84,366

13,906

Root,

Class

A (1)(2)

178,922

12,988

Ryan

Specialty

Holdings,

Class

A (1)

1,015,719

65,168

Selective

Insurance

Group

147,891

13,831

T.

ROWE

PRICE

Small-Cap

Value

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

TWFG (2)

185,789

5,722

White

Mountains

Insurance

Group

9,353

18,192

285,331

Mortgage

Real

Estate

Investment

Trusts

0.4%

PennyMac

Mortgage

Investment

Trust,

REIT (1)

3,444,164

43,362

43,362

Total

Financials

2,915,779

HEALTH

CARE

7.9%

Biotechnology

2.8%

ACELYRIN (1)(2)

2,838,233

8,912

Akero

Therapeutics (2)

108,495

3,018

Applied

Therapeutics (1)(2)

3,384,666

2,898

Arcellx (2)

37,484

2,875

Arrowhead

Pharmaceuticals (2)

432,899

8,139

Ascendis

Pharma,

ADR (2)

81,836

11,266

Black

Diamond

Therapeutics (1)(2)

2,424,301

5,188

Blueprint

Medicines (2)

30,384

2,650

Cabaletta

Bio (1)(2)

1,933,017

4,388

Celldex

Therapeutics (2)

258,223

6,525

Centessa

Pharmaceuticals,

ADR (1)(2)

657,169

11,008

CRISPR

Therapeutics (1)(2)

122,135

4,807

Cytokinetics (1)(2)

1,296,448

60,985

Erasca (2)

4,191,151

10,520

Icosavax,

CVR (2)(3)

1,240,955

—

Immatics (1)(2)

2,864,376

20,366

Immunocore

Holdings,

ADR (1)(2)

1,258,246

37,118

Immunome (1)(2)

705,181

7,489

Immunovant (1)(2)

288,943

7,157

Ionis

Pharmaceuticals (2)

540,307

18,889

Iovance

Biotherapeutics (1)(2)

1,015,996

7,519

Jasper

Therapeutics (2)

51,600

1,103

Merus (2)

74,750

3,143

Nurix

Therapeutics (2)

507,479

9,561

Prime

Medicine (1)(2)

1,300,100

3,796

Tango

Therapeutics (1)(2)

1,664,754

5,144

Vaxcyte (2)

41,240

3,376

Vera

Therapeutics (1)(2)

76,875

3,251

Verve

Therapeutics (1)(2)

1,175,491

6,630

Xenon

Pharmaceuticals (2)

317,954

12,464

290,185

Health

Care

Equipment

&

Supplies

1.4%

Avanos

Medical (2)

1,741,891

27,731

T.

ROWE

PRICE

Small-Cap

Value

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

DENTSPLY

SIRONA

453,340

8,604

Lantheus

Holdings (2)

413,025

36,949

Neogen (1)(2)

1,014,555

12,317

Novocure (2)

150,010

4,470

Pax

Labs,

Class

A,

Acquisition

Date:

4/18/19,

Cost $9,910 (2)

(3)(5)

2,631,808

1,079

QuidelOrtho (2)

1,257,933

56,041

147,191

Health

Care

Providers

&

Services

2.3%

Alignment

Healthcare (2)

1,766,279

19,871

Capsule,

Acquisition

Date:

4/7/21,

Cost $3,065 (2)(3)(5)

211,518

273

Concentra

Group

Holdings

Parent

3,095,687

61,233

Ensign

Group

389,530

51,753

Innovage

Holding (2)

3,254,017

12,788

NeoGenomics (2)

128,100

2,111

Oscar

Health,

Class

A (1)(2)

2,239,242

30,095

Pennant

Group (2)

378,871

10,048

Privia

Health

Group (1)(2)

401,118

7,842

Select

Medical

Holdings

2,532,021

47,728

243,742

Health

Care

Technology

0.5%

Doximity,

Class

A (2)

670,485

35,797

Phreesia (2)

532,827

13,406

49,203

Life

Sciences

Tools

&

Services

0.2%

Pacific

Biosciences

of

California (1)(2)

3,079,647

5,636

Sotera

Health (1)(2)

1,357,459

18,570

24,206

Pharmaceuticals

0.7%

Arvinas (2)

344,587

6,606

Elanco

Animal

Health (2)

3,043,139

36,852

Neumora

Therapeutics (1)(2)

1,295,999

13,738

Rapport

Therapeutics (2)

382,487

6,785

Third

Harmonic

Bio (1)(2)

873,133

8,985

72,966

Total

Health

Care

827,493

INDUSTRIALS

&

BUSINESS

SERVICES

13.9%

Aerospace

&

Defense

1.2%

BWX

Technologies

135,049

15,043

Leonardo

DRS (2)

1,236,957

39,966

Loar

Holdings (2)

119,320

8,819

T.

ROWE

PRICE

Small-Cap

Value

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

MDA

Space

(CAD) (2)

302,836

6,221

Moog,

Class

A

271,481

53,439

123,488

Building

Products

1.1%

AZZ

212,144

17,379

UFP

Industries

529,446

59,642

Zurn

Elkay

Water

Solutions (1)

1,044,947

38,976

115,997

Commercial

Services

&

Supplies

1.8%

Brady,

Class

A

568,675

41,997

BrightView

Holdings (2)

1,389,267

22,214

Casella

Waste

Systems,

Class

A (2)

359,677

38,058

MSA

Safety

172,409

28,580

Tetra

Tech

594,901

23,701

UniFirst

23,594

4,037

VSE (1)

350,287

33,312

191,899

Construction

&

Engineering

0.9%

Arcosa

327,382

31,671

MYR

Group (2)

97,812

14,552

Valmont

Industries

82,357

25,256

WillScot

Holdings (2)

567,321

18,977

90,456

Electrical

Equipment

0.3%

Thermon

Group

Holdings (2)

969,300

27,887

27,887

Ground

Transportation

0.7%

Covenant

Logistics

Group

101,704

5,544

Landstar

System

368,112

63,264

68,808

Machinery

3.4%

AGCO

100

9

Alamo

Group

55,342

10,289

Crane

228,194

34,628

Douglas

Dynamics

576,060

13,612

Enpro

173,370

29,898

Esab

590,271

70,797

ESCO

Technologies

190,299

25,350

Federal

Signal

58,378

5,394

Helios

Technologies

350,876

15,663

Hillman

Solutions (2)

1,117,086

10,880

T.

ROWE

PRICE

Small-Cap

Value

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

John

Bean

Technologies (1)

294,343

37,411

RBC

Bearings (2)

215,538

64,476

Shyft

Group (6)

1,869,947

21,953

SPX

Technologies (2)

101,778

14,811

355,171

Marine

Transportation

0.3%

Matson

216,077

29,136

29,136

Passenger

Airlines

0.6%

Allegiant

Travel (1)

523,041

49,228

Sun

Country

Airlines

Holdings (2)

1,174,752

17,128

66,356

Professional

Services

1.9%

Checkr,

Acquisition

Date:

6/29/18,

Cost $866 (2)(3)(5)

211,422

1,298

Conduent (2)

2,700,092

10,908

First

Advantage (2)

566,444

10,610

FTI

Consulting (2)

245,539

46,930