Taking MGPI to a Higher Level Ladd Seaberg, Chairman & CEO Tim Newkirk, President & COO Roth Capital Partners Conference 19th Annual OC Conference Febr

uary 21, 2007

Safe Harbor Statement Please note that this presentation was created as of February 16, 2007 and reflects management’s views as of that date. Certain of the information discussed in this presentation may contain forward-looking statements relating to the operations, financial condition and operating results of MGP Ingredients, Inc. and such statements involve a number of risks and uncertainties. We wish to caution you that these statements are only estimates and that actual results may differ materially from those projected in the forward-looking statements. Additional information concerning factors that could cause actual results to materially differ from those in the forward-looking statements is contained in MGPI’s SEC filings.

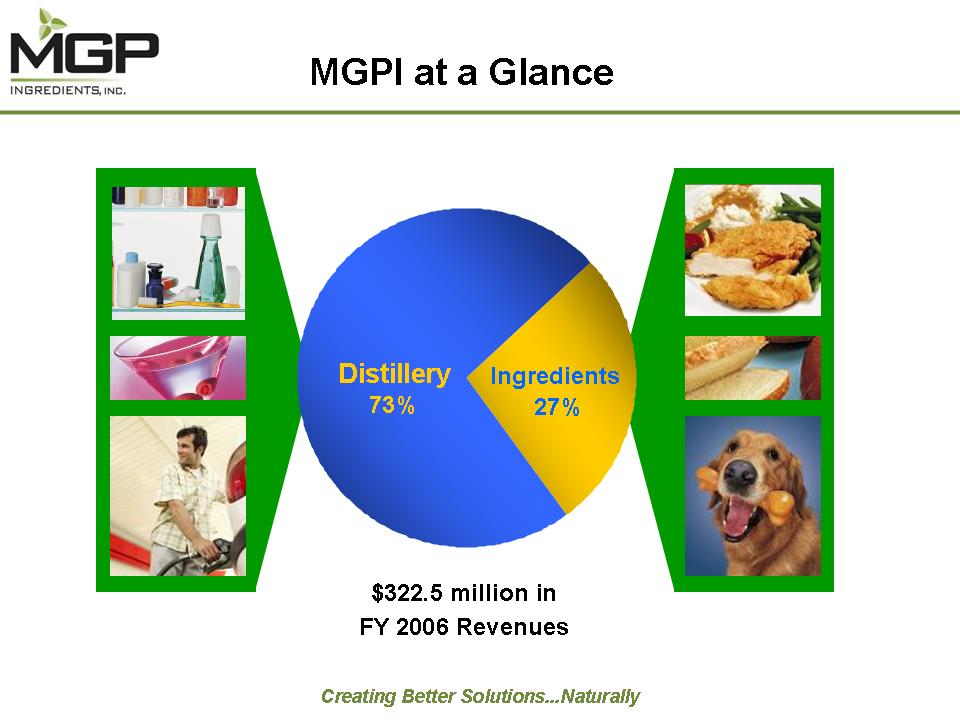

MGPI at a Glance $322.5 million in FY 2006 Revenues

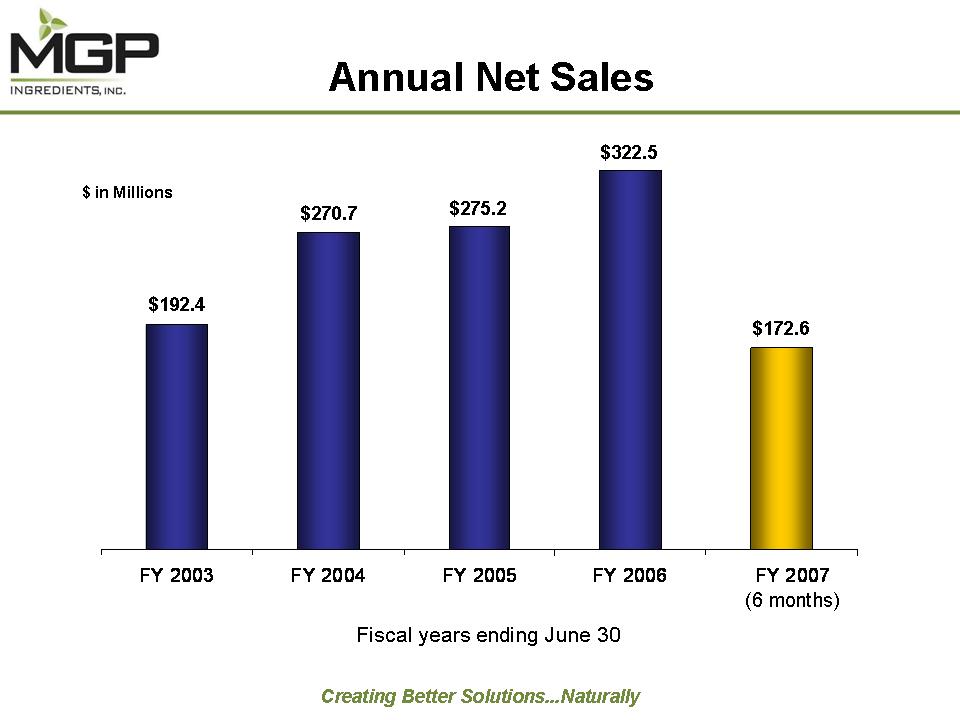

Annual Net Sales $ in Millions $192.4 $270.7 $275.2 $322.5 $172.6 (6 months) Fiscal years ending June 30

Nearing Record Annual Net Income $ in Millions $5.2 $9.5 $4.0 $14.0 $13.8 Fiscal years ending June 30

Key Distiller of High-Quality Alcohol Distillery Sales Distillery By-Products Fuel Grade Alcohol Food Grade Alcohol FY 07 (6 months) (in millions) Fiscal years ending June 30

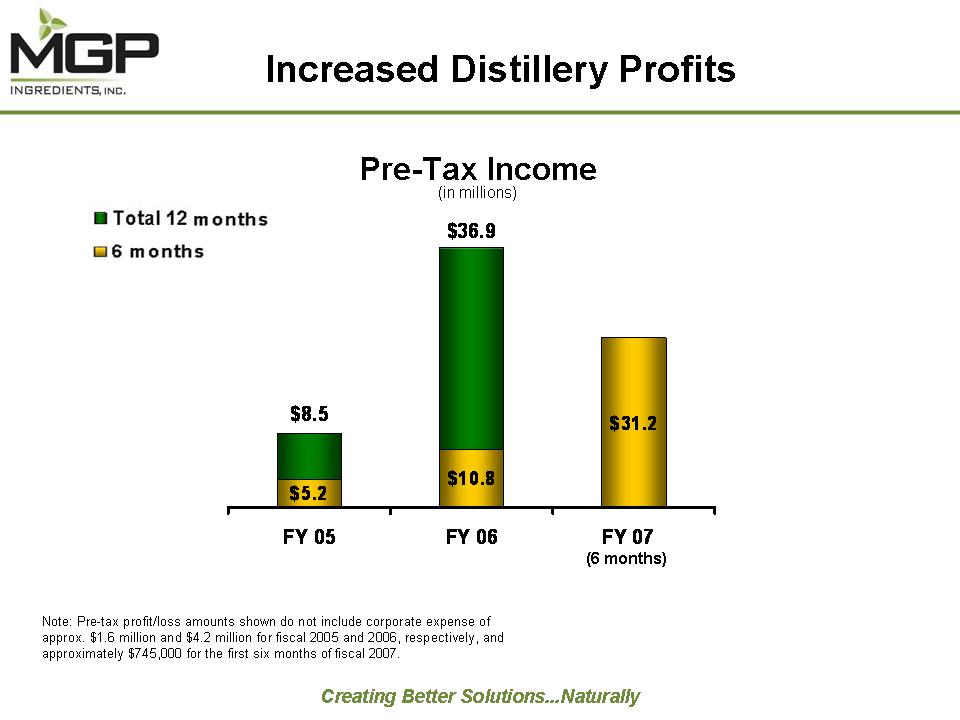

Increased Distillery Profits Note: Pre-tax profit/loss amounts shown do not include corporate expense of approx. $1.6 million and $4.2 million for fiscal 2005 and 2006, respectively, and approximately $745,000 for the first six months of fiscal 2007.

Recent Distillery Gains Driven by Strong Pricing Alcohol price % change per gallon Base Index = 100 at Q4 2004 (June FY) Food Grade Alcohol Fuel Grade Alcohol 40% 33%

Starch & Protein Technologies Ingredients Sales Commodity Ingredients Specialty Food Ingredients 15% 61% 24% Specialty FY 07 (6 months) Non-Food Ingredients (in millions) Fiscal years ending June 30

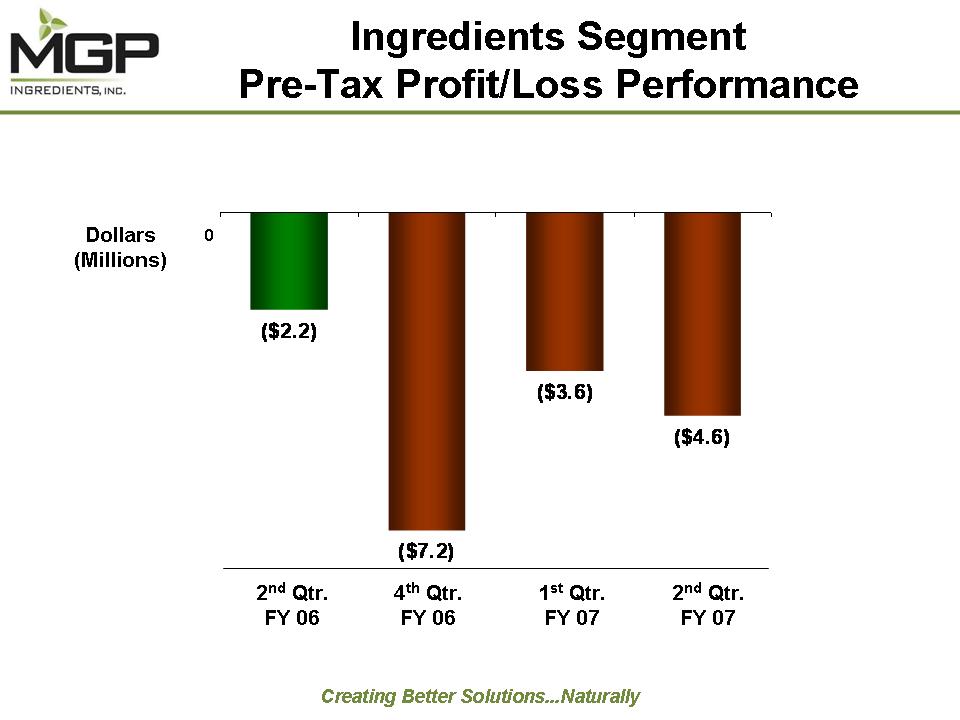

Ingredients Segment Pre-Tax Profit/Loss Performance Dollars (Millions) 2nd Qtr. FY 06 4th Qtr. FY 06 1st Qtr. FY 07 2nd Qtr. FY 07

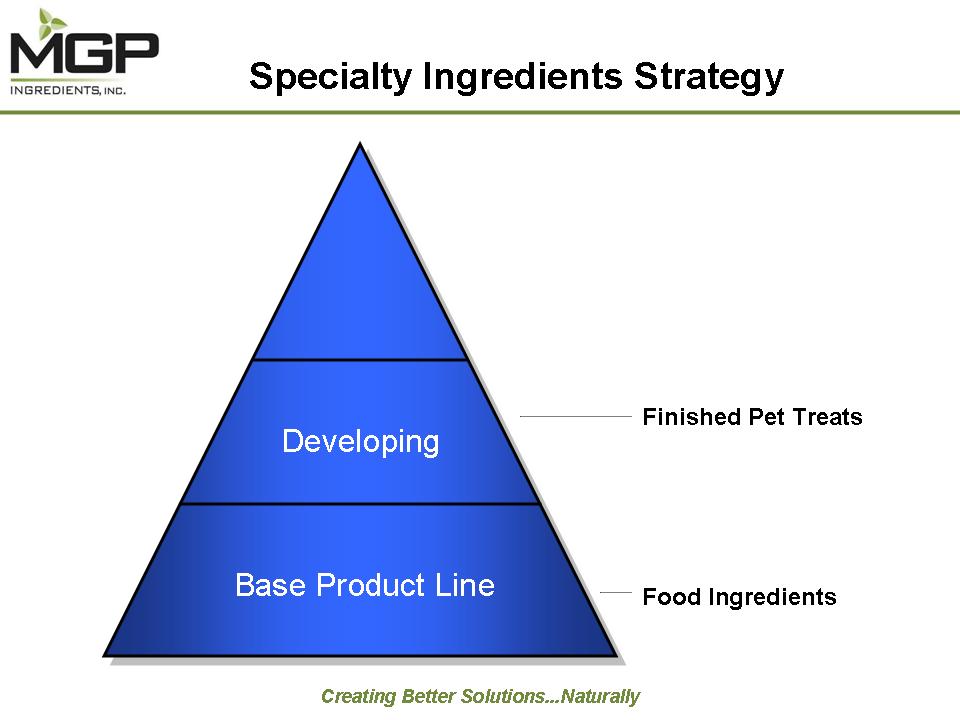

Specialty Ingredients Strategy Base Product Line Food Ingredients

A Focus on Applied Food Science Resistant starch technologies Textured protein technologies Protein isolate technologies

Promising New Products FiberRite™RW RediShred High fiber, reduced fat prepared foods High protein, meat substitutes and meat extensions

Specialty Ingredients Strategy Finished Pet Treats Developing Base Product Line Food Ingredients

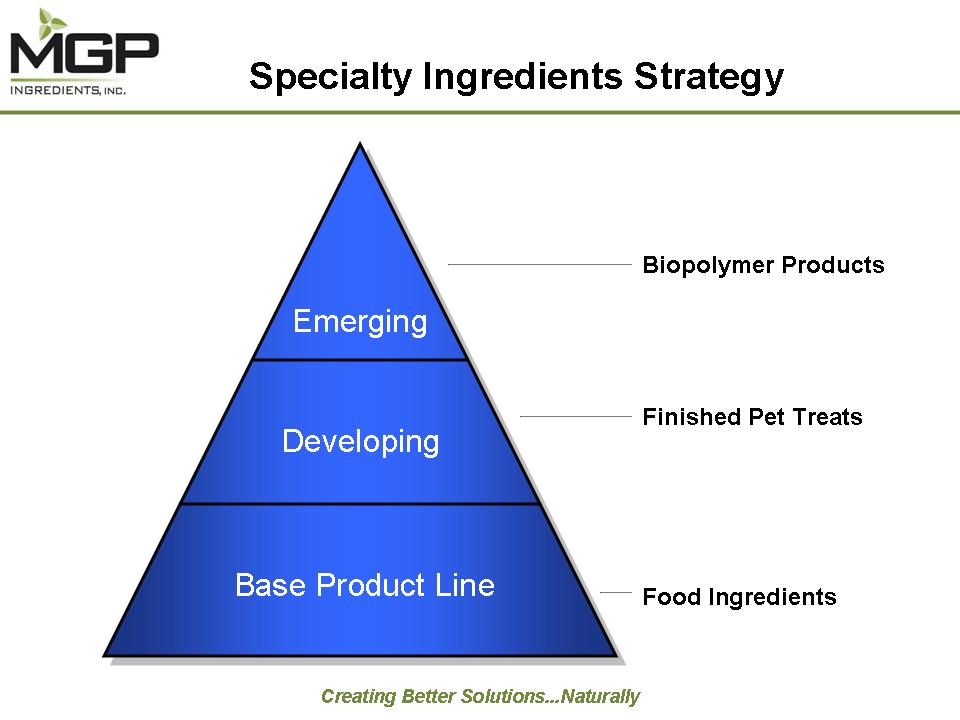

Pet Industry Applications Finished Pet Products Co-extruded Injection molded Retail packaging options Pet Ingredients Pet treats Pet food

Specialty Ingredients Strategy Emerging Developing Base Product Line Biopolymer Products Finished Pet Treats Food Ingredients

Growing Interest in Biopolymers Biopolymers Grain-based resins Bio-based Biodegradable

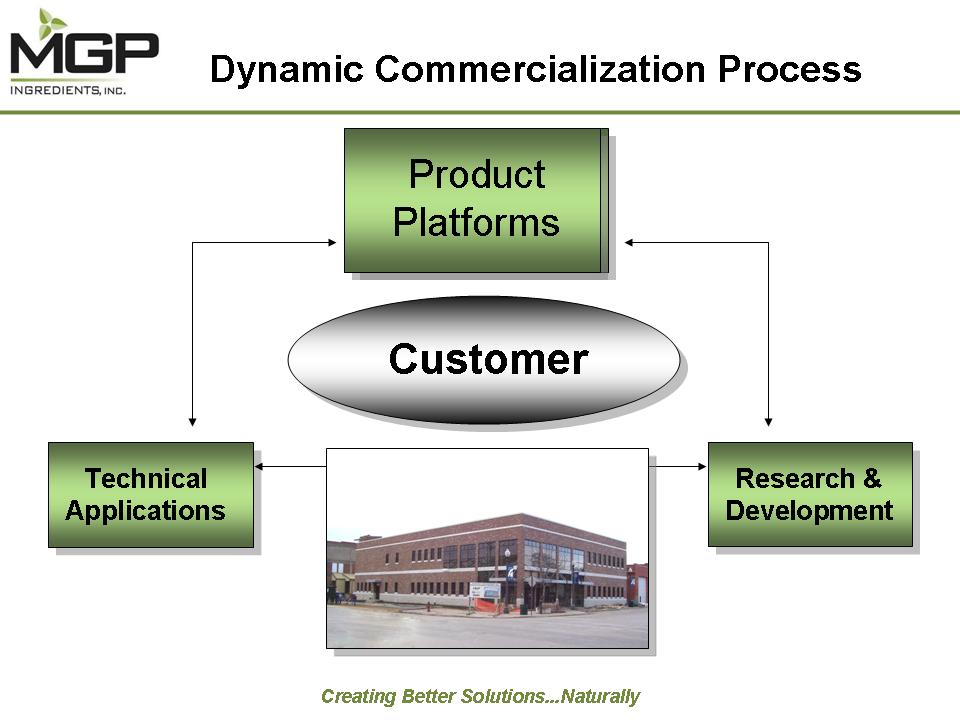

Dynamic Commercialization Process Product Platforms Customer Technical Applications Research & Development

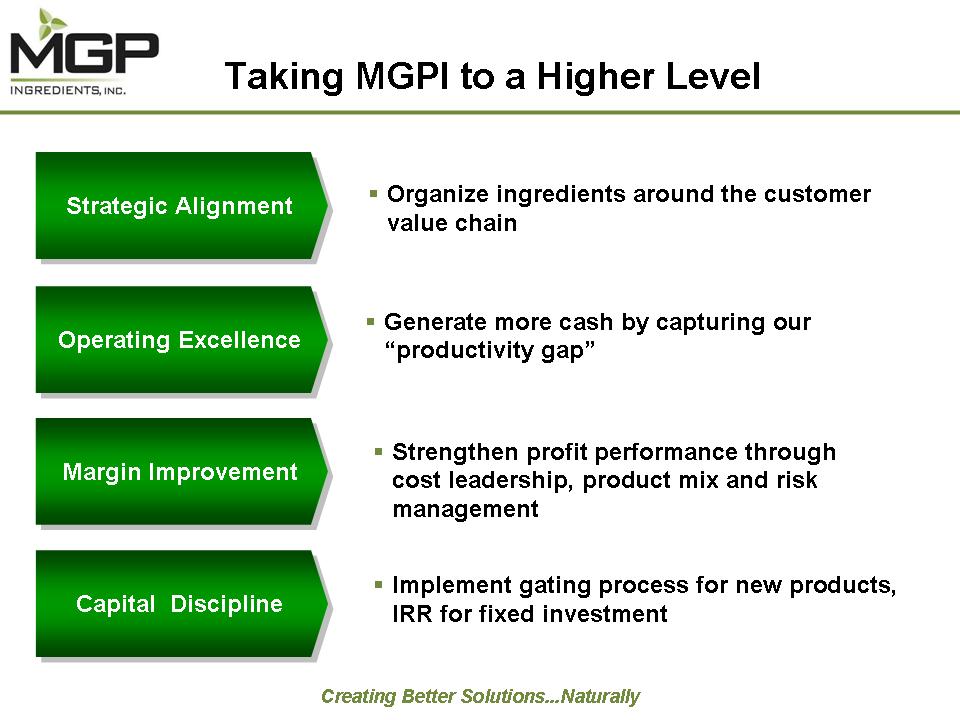

Taking MGPI to a Higher Level Strategic Alignment Organize ingredients around the customer value chain

Reorganized for Value Creation Management Structure Marketing International Product Platforms Specialty Protein Innovations Isolates Concentrates Resistant Starch Innovations Fibersym® FiberRite™ Textured Protein Innovations Wheatex ® Resin Technology Chewtex ® Biopolymer Innovations Terratek ™ Heritage Ingredients Proteins Starches Bakery Prepared foods Bakery Prepared foods Meats/analogs Prepared foods Pet foods Pet treats/chews Finished pet products Pet foods Bio-Based Biodegradable Bakery Prepared foods

Taking MGPI to a Higher Level Strategic Alignment Organize ingredients around the customer value chain Operating Excellence Generate more cash by capturing our “productivity gaps”

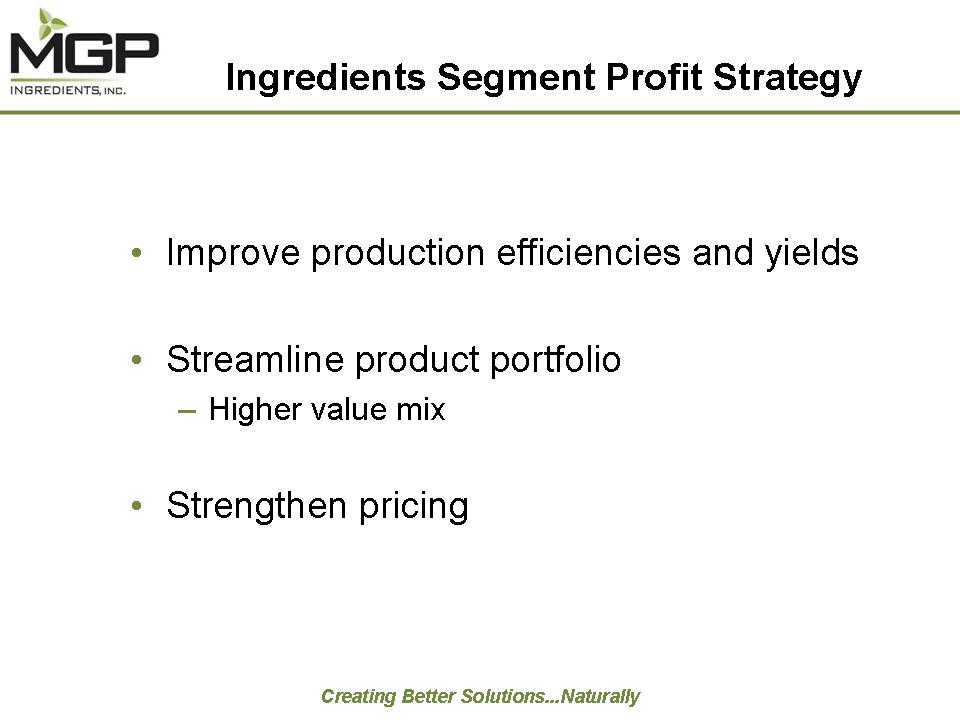

Ingredients Segment Profit Strategy Improve production efficiencies and yields Streamline product portfolio Higher value mix Strengthen pricing

Wheatex® Margin Gains From Improved Efficiencies/Product Mix Percent Margin Improvement 36 Products 28 Products 4th Qtr. FY 06 Efficiency 2nd Qtr. FY 07

Taking MGPI to a Higher Level Strategic Alignment Organize ingredients around the customer value chain Operating Excellence Generate more cash by capturing our “productivity gap” Margin Improvement Strengthen profit performance through cost leadership, product mix and risk management

Managing Commodity Risk a Priority Energy and grain combined make up close to 74%* of our total COGS Other 26% Energy 20% Grain 54% * Based on 5-year average

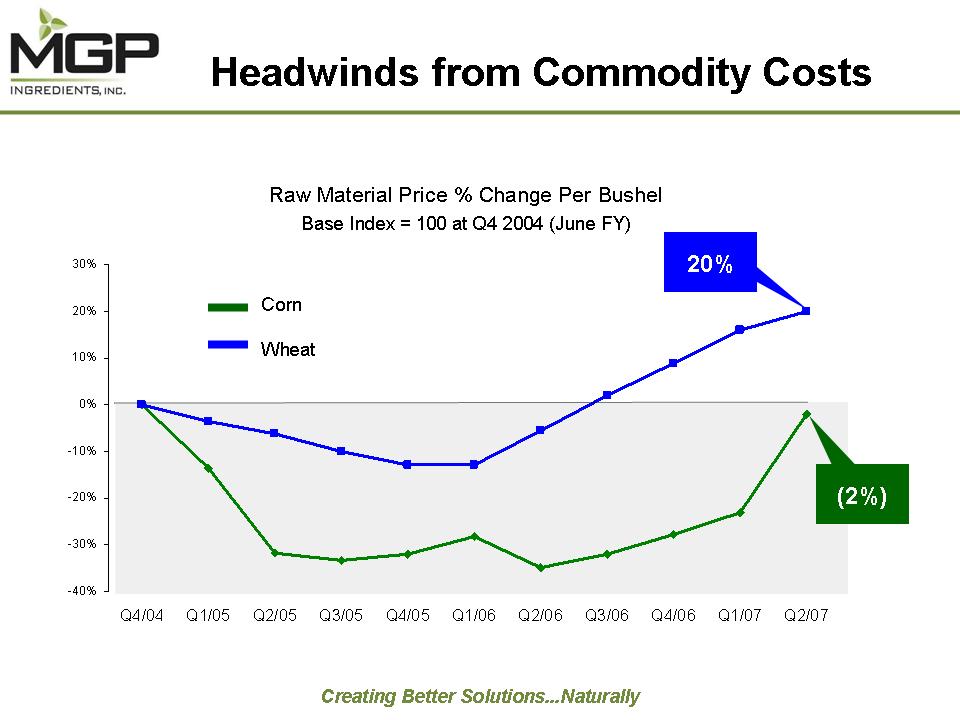

Headwinds from Commodity Costs Raw Material Price % Change Per Bushel Base Index = 100 at Q4 2004 (June FY) Corn Wheat 20% (2%)

Managing Volatility: Hedging Dollar Change per Bushel Relative to 07/01/2005 Baseline Period

Targeting Stable Gross Margins Gross margin as % of net sales 18% June FY High-value products Materials sourcing Labor & energy costs Starch recovery Process changes

Taking MGPI to a Higher Level Strategic Alignment Operating Excellence Margin Improvement Capital Discipline Organize ingredients around the customer value chain Generate more cash by capturing our “productivity gap” Strengthen profit performance through cost leadership, product mix and risk management Implement gating process for new products, IRR for fixed investment

Capital for Distillery Enhancements Incremental volume increases Energy efficiency Environmental compliance

Positive Trends Drive Our Opportunities Growth of biofuels Stable demand for industrial and beverage alcohol Health and wellness lifestyles Nutritious, tasty and convenient foods Increased spending on pets Environmental initiatives

Thank You Ladd Seaberg, Chairman & CEO Tim Newkirk, President & COO Roth Capital Partners Conference 19th Annual OC Conference February 21, 2007 Ticker symbol: MGPI Traded on NASDAQ Global Select Market www.mgpingredients.com