UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

THE PAUL REVERE VARIABLE ANNUITY CONTRACT ACCUMULATION FUND

(Name of Registrant as specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

THE PAUL REVERE VARIABLE ANNUITY

CONTRACT ACCUMULATION FUND

18 CHESTNUT STREET

WORCESTER, MASSACHUSETTS 01608-1928

TELEPHONE: (508)799-4441

The Annual Meeting of Contractowners who hold contracts issued pursuant to The Paul Revere Variable Annuity Contract Accumulation Fund (the “Fund”) will be held at 10:00 a.m. (EDT) on Friday, May 23, 2008, at the Home Office of the Company, Legal Conference Room D, 18 Chestnut Street, Worcester, Massachusetts, 01608. You have the right to cast votes at this meeting.

Enclosed are the Notice of Annual Meeting, Proxy Statement and Proxy Card. Please sign and return the Proxy Card in the enclosed envelope so that it will be received by the Board of Managers of the FundNO LATER THAN May 22, 2008. You may keep all other material. If you are present at the meeting, you may vote in person even though you have sent in your Proxy Card.

Your contract/certificate number and the total number of votes you may cast are shown on the Proxy Card.

| Yours sincerely, |

/s/ Susan N. Roth |

| Susan N. Roth, Secretary |

Enclosures

THE PAUL REVERE VARIABLE ANNUITY

CONTRACT ACCUMULATION FUND

18 CHESTNUT STREET

WORCESTER, MASSACHUSETTS 01608-1928

TELEPHONE: (508)799-4441

NOTICE OF ANNUAL MEETING

TO BE HELD ON MAY 23, 2008

Notice is hereby given of a meeting of the owners of contracts for which reserves are held in The Paul Revere Variable Annuity Contract Accumulation Fund (the “Fund”) of The Paul Revere Variable Annuity Insurance Company (the “Company”), which meeting shall be held at 10:00 a.m. (EDT) on Friday, May 23, 2008, at the Home Office of the Company, Legal Conference Room D, 18 Chestnut Street, Worcester, Massachusetts, 01608. The purpose of the meeting is to consider the following:

| 1. | Election of one (1) member of the Board of Managers in accordance with the Rules and Regulations of the Fund; |

| 2. | Ratification of the selection and appointment of Ernst & Young LLP as the Independent Auditors for the Fund in accordance with the Rules and Regulations of the Fund; and |

| 3. | Transaction of such other business as may properly come before the meeting and any adjournment thereof. |

The date fixed by the Board of Managers as the Record Date for the determination of Contractowners entitled to notice of and to vote at the meeting was at the close of business on March 31, 2008. A Contractowner will be entitled to vote only if he/she was a Contractowner on the Record Date and is still a Contractowner on the date of the meeting.

It is important that your vote be represented at the meeting. Please refer to the enclosed material for detailed information on voting procedures and return the Proxy Card as soon as possible.

April 3, 2008

IMPORTANT

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, IT IS VERY IMPORTANT THAT YOU COMPLETE AND RETURN YOUR PROXY CARD PROMPTLY TO ENSURE THE PRESENCE OF A QUORUM. YOU MAY WITHDRAW YOUR PROXY IN THE EVENT OF YOUR PERSONAL ATTENDANCE AT THE MEETING.

/s/ Susan N. Roth |

| Susan N. Roth, Secretary |

PROXY STATEMENT

ANNUAL MEETING OF CONTRACTOWNERS OF

THE PAUL REVERE VARIABLE ANNUITY

CONTRACT ACCUMULATION FUND

18 CHESTNUT STREET

WORCESTER, MASSACHUSETTS 01608-1928

TELEPHONE: (508)799-4441

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Managers of The Paul Revere Variable Annuity Contract Accumulation Fund (the “Fund”) for use at the Annual Meeting of Contractowners to be held on Friday, May 23, 2008, at 10:00 a.m. (EDT) at the Home Office of the Company, Legal Conference Room D, 18 Chestnut Street, Worcester, Massachusetts, 01608. The cost of soliciting the proxies will be borne by Unum Group. Proxies may be solicited by telephone, by mail or in person by directors, officers, agents, or regular employees of Unum Group who will not be compensated for such services. The Variable Annuity Life Insurance Company (“VALIC”), 205 East 10th Street, Amarillo, Texas, 79105, has been retained as the Administrator of the Fund. The Administrator has contracted with Broadridge Financials Solutions, Inc. to provide Proxy mailing and collection services to the Fund. The costs of these services will be paid by Unum Group. Contractowners may revoke their proxies at any time prior to the voting thereof by submitting written notice of revocation to the Fund c/o Unum Group at 1 Fountain Square, Chattanooga, Tennessee, 37402. Any Contractowner attending the meeting may vote in person, whether or not a Proxy has been previously submitted. This Proxy Statement and the accompanying notice of meeting and Proxy Card are first being mailed to Contractowners on or about April 1, 2008.

The Annual Report to Contractowners covering operations of the Fund for the fiscal year ended December 31, 2007, including financial statements, has been previously provided.An additional copy of the Annual Report and the most recent Semi-Annual Report succeeding the Annual Report, will be provided free of charge, upon request, to any Contractowner.Contractowners may contact Linda Daughetee toll free at (800)718-8824, or by writing c/o Unum Group, Attention: Susan N. Roth, 1 Fountain Square, Chattanooga, Tennessee, 37402, to request the Annual and/or Semi-Annual Reports.

The Board of Managers has fixed the close of business on March 31, 2008 (the “Record Date”) as the record date for the determination of Contractowners entitled to notice of and to vote at the meeting. On the Record Date, (“Record Date”), there were 148,948.963 variable accumulation and annuity units outstanding of the Fund with a total value of $1,882,848.44 entitling the Contractowners to one vote for each dollar of value represented by units credited to such persons as of such Record Date. Contractowners of record at the close of business on the Record Date, who are still Contractowners on May 23, 2008, will be entitled to vote at the meeting.

Units eligible to be voted for which a Proxy Card is properly signed and returned prior to the beginning of the Annual Meeting will be voted as directed. If directions are not given or directions are not in accordance with the options listed on a signed and returned Proxy Card, such units will be voted FOR each proposition for which the Board of Managers recommends a vote FOR.

Unsigned or unreturned Proxy Cards will not be counted for quorum or voting purposes. For issues as to which there is a choice on the Proxy Card, a vote to abstain will be counted for purposes of determining the existence of a quorum, and counted as an “ABSTENTION” rather than as either a vote “FOR” or “AGAINST.”

For purposes of the Annual Meeting, a quorum is the presence in person or by Proxy Card of a majority in interest of the Contractowners. A quorum being present, vote of the majority of the quorum of outstanding units represented in person or by Proxy Card will determine the adoption or rejection of the matters specified in the Notice.

INFORMATION CONCERNING THE FUND, THE COMPANY

AND THE ADMINISTRATOR

The Fund is an open-end, diversified investment company registered under the Investment Company Act of 1940 (the “Act”), through which the Company sets aside, separate and apart from its general assets, assets attributable to its variable annuity contracts.

The Company is a stock life insurance company organized under Massachusetts General Laws and is a wholly-owned subsidiary of The Paul Revere Life Insurance Company (“PRL”), a Massachusetts corporation, which is indirectly and wholly-owned by Unum Group. The principal office of the Company is located at 18 Chestnut Street, Worcester, Massachusetts, 01608. The Company’s principal business is the sale and administration of life and annuity insurance policies. The Company serves as insurer and principal underwriter and as an investment adviser to the Fund under the Investment Advisory Agreement. The Company is registered with the Securities and Exchange Commission as an investment adviser.

The Company has historically also served as administrator of the Fund. On May 8, 1998, the Board of Managers approved a Separate Account Administrative Services Agreement, dated May 15, 1998, between the Company and VALIC, whereby VALIC became the Administrator of the Fund. The principal office of VALIC is located at 205 East 10th Street, Amarillo, Texas, 79105. The change in administrator did not result in any changes in administration and sales fees. On a periodic basis, the Administrator reports to the Board of Managers on the Fund and on the services provided pursuant to the Agreement.

INFORMATION CONCERNING THE INVESTMENT SUB-ADVISER

MFS Institutional Advisors, Inc. (“MFSI”), formerly MFS Asset Management, Inc., is a Delaware corporation with its principal offices located at 500 Boylston Street, Boston, Massachusetts, 02116. MFSI, together with its parent corporation, Massachusetts Financial Services Company (“MFS”) and its predecessor organizations, have a history of money management dating from 1924. MFSI is directly owned by Sun Life of Canada (US) Financial Services Holdings, Inc., which is in turn owned by Sun Life Assurance Company of Canada - US Operations Holdings, Inc., which in turn is owned by Sun Life Assurance Company of Canada, which is in turn owned by Sun Life Financial Services of Canada, Inc.

As of December 31, 2007, MFS and its subsidiaries, including MFSI, had over $197 billion in assets under management, which included over $45 billion in assets managed by MFSI.

MFSI serves as investment adviser to certain mutual fund and insurance company separate accounts, including serving as a sub-adviser to the Fund pursuant to a contract with the Company for such services.

ATTENDANCE AT ANNUAL MEETINGS

The Fund does not have a policy regarding director attendance at Annual Meetings of Contractowners. In 2007, all of the members of the Board of Managers attended the Annual Meeting.

AUDIT COMMITTEE OF THE BOARD OF MANAGERS

Due to the size and structure of the Fund and its Board, the Board does not have a standing audit committee, and as a result does not have an audit committee charter. The functions that would be performed by the audit committee are performed by the entire Board.

NOMINATING COMMITTEE OF THE BOARD OF MANAGERS

The Nominating Committee is responsible for the following functions:

| a. | Making nominations for Independent Director membership on the Board of Managers: and |

| b. | Review of the composition of the Board of Managers to determine whether it may be appropriate to add individuals with different backgrounds or skills from those already on the Board of Managers. |

Members of the Nominating Committee include H. C. Goodwin, Gordon T. Miller and Joan Sadowsky, none of whom is an “interested person” of the Fund within the meaning of section 2(a)(19) of the Investment Company Act of 1940 (the “Act”). The Nominating Committee did not meet during the last fiscal year (2007) of the Fund. The Board of Managers adopted a written charter for the Nominating Committee on May 18, 2005, a copy of which is attached hereto as Exhibit A. The Fund does not have a compensation committee or other standing committees.

REMUNERATION OF MEMBERS OF THE BOARD OF MANAGERS

Unum Group paid all expenses relative to the operation of the Fund, including Board of Managers’ fees. Accordingly, no member of the Board of Managers receives any remuneration from the Fund. The total aggregate remuneration paid by Unum Group to Mr. Goodwin, Mr. Miller and Mrs. Sadowsky for the fiscal year ended December 31, 2007, was $7,200.00. This amount represents consideration paid for attendance at meetings of the Board of Managers.

Those members of the Board of Managers deemed to be interested persons, Mr. Boggs and Mr. Fussell, received no remuneration for their service as members of Board of Managers of the Fund.

ITEM 1: ELECTION OF ONE MEMBER OF THE BOARD OF MANAGERS

Contractowners are asked to vote for the re-election of nominee H.C. Goodwin to serve as a member of the Board of Managers for a three year term or until his successor is duly elected and qualified. The nominee does not own or have any interest in the Fund units. The nominee has consented to serve if elected. If the proposed nominee should become unavailable for any reason, the Board of Managers may designate another person to serve in his place. Four (4) regular meetings of the Board of Managers were held in 2007, and each member of the Board attended these meetings.

The Board of Managers unanimously recommends a vote for the election of this nominee as manager.

INFORMATION CONCERNING MEMBERS OF THE BOARD OF MANAGERS

The following table provides information concerning the members of the Board of Managers and nominees who are not “interested persons” of the Fund within the meaning of section 2(a)(19) of the Act:

| (1) | (2) | (3) | (4) | (5) | (6) | |||||

Name, Address, and Age | Position(s) Held with Fund | Term of Office and | Principal Occupation(s) Years | Number of Portfolios in Fund Complex Overseen | Other Director or Nominee | |||||

H. C. Goodwin (73) 11 Waters Road Millbury, MA 01527 | Member, Board of Managers | 2008-2011 6 years of service | President of Manufacturers Service Center, Inc. (metal and plastic parts manufacturer) | 2 | None | |||||

Gordon T. Miller (85) 27 Briarwood Circle Worcester, MA 01606 | Vice Chairman, Board of Managers | 2007-2010 39 years of service | Retired; Former Vice President and Director of Industrial Relations of Barry Wright Corporation, Newton Lower Falls, MA. (antivibration products) | 2 | None | |||||

Joan Sadowsky (78) 770 Salisbury Street Apt. 576 Worcester, MA 01609 | Member, Board of Managers | 2006-2009 22 years of service | Retired; Former Vice President of Human Resources, Atlas Distributing Corporation, Auburn, MA (beverage distribution) | 2 | None | |||||

None of the members of the Board of Managers who are not “interested persons” of the Fund within the meaning of section 2(a)(19) of the Act owns beneficially or of record securities of the Company or any of its affiliates.

INFORMATION CONCERNING MEMBERS OF THE BOARD OF MANAGERS

(Continued)

The following table provides information concerning the members of the Board of Managers and nominees who are “interested persons” of the Fund within the meaning of section 2(a)(19) of the Act.

| (1) | (2) | (3) | (4) | (5) | (6) | |||||

Name, Address, and Age | Position(s) Held with Fund | Term of Office and | Principal Occupation(s) | Number of Portfolios in Fund Complex Overseen | Other | |||||

Donald E. Boggs* (62) 1 Fountain Square Chattanooga, TN 37402 | Chairman Board of Managers | 2007-2010 10 years of service | Retired, Senior Vice President of Unum Group Chattanooga, Tennessee | 2 | None | |||||

David G. Fussell* (60) 1 Fountain Square Chattanooga, TN 37402 | Member, Board of Managers | 2006-2009 6 years of service | Senior Vice President of Unum Group, Chattanooga, Tennessee | 2 | None | |||||

| * | Current and former officers of the Company, and other subsidiaries of Unum Group. |

The following table provides information concerning the dollar range of equity securities owned beneficially by each Manager and Nominee for election as Manager as of December 31, 2007:

| (1) | (2) | (3) | ||

Name of Director or Nominee | Dollar Range of Equity Securities in the Fund | Aggregate Dollar Range of Equity Securities in All Funds Overseen or to be Overseen by Director or Nominee in Family of Investment Companies | ||

H.C. Goodwin | None | None | ||

Gordon T. Miller | None | None | ||

Joan Sadowsky | None | None | ||

Donald E. Boggs | None | None | ||

David G. Fussell | None | None | ||

CONTRACTOWNER COMMUNICATIONS WITH THE BOARD

The Board of Managers has adopted a process for Contractowners to send communications to the Board. Contractowners interested in communicating with the Board of Managers or certain members thereof, may do so by writing to the Secretary of the Board of Managers (The Paul Revere Variable Annuity Contract Accumulation Fund), 1 Fountain Square, Chattanooga, Tennessee, 37402. Under the process adopted by the Board of Managers, the Secretary reviews all such correspondence and regularly provides to the Chairman a log and copies of all such correspondence. The Chairman shall determine whether further distribution of such correspondence is appropriate and to where it should be sent. Any member of the Board of Managers may at any time review this log and request copies of any such correspondence.

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

As of the Record Date, the members of the Board of Managers of the Fund and the directors and principal officers of the Company, as a group, owned beneficially and of record no Units.

The following Contractowners beneficially owned more than 5% of the units in the Fund as of the Record Date:

Name | Address | Number of Units Beneficially Owned | Percent | ||||

| Fred Dopheide | 773 Concord Road Glen Mills, PA 19342 | 14,405.058 | 9.67 | % | |||

| Margaret Baird | 30 North Franklin Street Montpelier, VT 05602 | 10,027.295 | 6.73 | % | |||

| Marilyn Pellet | 72 Whitehill Drive West Hartford, CT 06117 | 7,732.286 | 5.19 | % | |||

ITEM 2: RATIFICATION OF THE SELECTION AND APPOINTMENT OF

INDEPENDENT AUDITORS

The Board of Managers, including a majority of the Managers who are not deemed to be “interested persons” of the Fund within the meaning of section 2(a)(19) of the Act, has selected Ernst & Young LLP as our independent auditors to audit the accounts of the Fund for the current fiscal year. Ernst & Young LLP has audited the accounts of the Fund each year since 1968. The appointment of independent auditors is ratified or rejected annually by the Contractowners.

Ernst & Young LLP has advised the Board of Managers of the Fund that neither its firm nor any of its members or associates has any direct or any material indirect financial interest in the Fund or any of its affiliates other than as independent auditors. All audit and other fees paid to the auditors for work related to the Fund are paid by Unum Group and are not charged to or paid from the Fund.

There are no non-audit services provided by Ernst & Young LLP to the Fund, the investment adviser, or control persons of the investment adviser that provide ongoing services to the Fund.

In the event the Contractowners do not ratify the selection by the Board of Managers of this firm or if Ernst & Young LLP shall decline to act or otherwise become incapable of acting, or if its employment be otherwise discontinued, the Board of Managers will select other independent auditors.

Representatives of Ernst & Young LLP are not expected to be present at the Annual Meeting.

The Board of Managers recommends ratification of the selection and appointment of Ernst & Young LLP as independent auditors of the Fund for the current fiscal year.

Audit Fees – Ernst & Young LLP billed Unum Group $18,100.00 for the audit of the financial statements of the Fund for 2007, and $17,100.00 for the audit of the financial statements of the Fund for 2006.

Audit-Related Fees – The aggregate fees for audit-related services rendered by Ernst & Young LLP to the Fund, the investment adviser or any entity controlling, controlled by or under common control with the investment adviser in 2007 and 2006 for such services were $0.00 and $0.00.

Tax Fees– The aggregate fees related to tax compliance, tax advice and tax planning services to the Fund for fiscal years ended December 31, 2007, and December 31, 2006, were $0.00 and $0.00.

All Other Fees – The aggregate fees rendered by Ernst & Young LLP to the Fund, the investment adviser or any entity controlling, controlled by or under common control with the investment adviser, or Unum Group for such services to the Fund in 2007 and 2006 were $0.00 and $0.00.

LITIGATION

There are no material legal proceedings currently pending to which the Company or the Fund is a party, or to which its property is subject.

OTHER BUSINESS

Management is not aware of any other business to come before the meeting. In case of any such business properly brought before the meeting or any adjournments thereof, it is the intention of the persons named in the enclosed form of Proxy to vote such Proxy in accordance with their best judgment in the interest of the Fund.

CONTRACTOWNER PROPOSALS

Contractowner proposals intended to be presented at the 2009 Annual Meeting of Contractowners must be received by the Fund c/o Unum Group at 1 Fountain Square, Chattanooga, Tennessee, 37402, Attention: Susan N. Roth, no later than December 31, 2008, to be considered for inclusion in the Fund Proxy Statement and Proxy Card. No Contractowner proposals were received for this year’s meeting.

| BY ORDER OF THE BOARD OF MANAGERS |

/s/ Donald E. Boggs |

| Donald E. Boggs, Chairman |

Exhibit A

PAUL REVERE VARIABLE ANNUITY CONTRACT ACCUMULATION FUND

NOMINATING COMMITTEE CHARTER

Nominating Committee Membership

The Nominating Committee (“Committee”) of the Paul Revere Variable Annuity Contract Accumulation Fund (“Fund”) shall be composed entirely of Independent Managers and will be comprised of one or more of such Independent Managers. The Officers of the Fund and The Paul Revere Variable Annuity Insurance Company (“Adviser”), although not members of the committee, may nonetheless be candidates for the Board of Managers of the Fund (“Board”).

Board Nominations and Functions

| 1. | The Committee shall make nominations for Independent Director membership on the Board. The Committee shall evaluate candidates’ qualifications for Board membership and their independence from the Fund’s investment advisers and other principal service providers. The Committee shall give recommendations provided by the Officers of the Fund and the Adviser the same consideration as any other candidate. Personal selected must not be an “interested person” of the Fund as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”). The Committee shall also consider the effect of any relationships beyond those delineated in the 1940 Act that might impair independence, e.g. business, financial or family relationships with the investment adviser or the other principle service providers. In determining nominees’ qualifications for Board membership, the Committee may consider such other factors as it may determine to be relevant to fulfilling the role of being a member of the Board. |

The Committee shall periodically review the composition of the Board to determine whether it may be appropriate to add individuals with different backgrounds or skills from those already on the Board.

Committee Nominations and Functions

| 1. | The Committee shall make nominations for membership on all committees of the Fund and shall review Board committee assignments as necessary. |

| 2. | The Committee shall review as necessary the responsibilities of any committees of the Board, whether there is a continuing need for each committee, whether there is a need for additional committees, and whether committees should be combined or reorganized. The Committee shall make recommendations for any such action to the full Board. |

Independence of Counsel to the Independent Managers

| 1. | The Committee shall consider and review, at least annually, the independence of outside counsel, if any, to the Independent Managers of the Fund and the basis of the determination must be included in the minutes of the appropriate meeting of the Board. |

Other Powers and Responsibilities

| 1. | The Committee shall normally meet annually and is empowered to hold special meetings as circumstances require. |

| 2. | The Committee shall have the resources and authority appropriate to discharge its responsibilities, including authority to retain special counsel and other experts or consultants at the expense of the Fund. |

| 3. | The Committee shall review this Charter at least annually and recommend any changes to the full Board. |

Adopted by the Nominating Committee May 18, 2005.

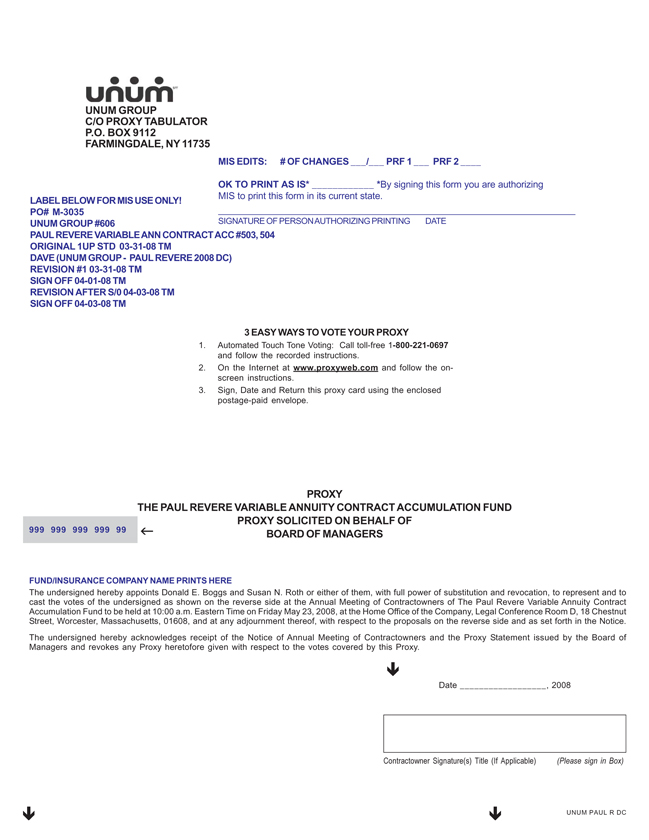

UNUM GROUP

C/O PROXY TABULATOR P.O. BOX 9112 FARMINGDALE, NY 11735

MIS EDITS: # OF CHANGES / PRF 1 PRF 2

OK TO PRINT AS IS* *By signing this form you are authorizing MIS to print this form in its current state.

SIGNATURE OF PERSON AUTHORIZING PRINTING DATE

LABEL BELOW FOR MIS USE ONLY! PO# M-3035 UNUM GROUP #606

ORIGINAL 1UP STD 03-31-08 TM

DAVE (UNUM GROUP—PAUL REVERE 2008 DC) REVISION #1 03-31-08 TM

SIGN OFF 04-01-08 TM

REVISION AFTER S/0 04-03-08 TM SIGN OFF 04-03-08 TM

3 EASY WAYS TO VOTE YOUR PROXY

1. Automated Touch Tone Voting: Call toll-free 1-800-221-0697 and follow the recorded instructions.

2. On the Internet at www.proxyweb.com and follow the on-screen instructions.

3. Sign, Date and Return this proxy card using the enclosed postage-paid envelope.

PROXY

THE PAUL REVERE VARIABLE ANNUITY CONTRACT ACCUMULATION FUND I PROXY SOLICITED ON BEHALF OF BOARD OF MANAGERS

999 999 999 999 99

FUND/INSURANCE COMPANY NAME PRINTS HERE

The undersigned hereby appoints Donald E. Boggs and Susan N. Roth or either of them, with full power of substitution and revocation, to represent and to cast the votes of the undersigned as shown on the reverse side at the Annual Meeting of Contractowners of The Paul Revere Variable Annuity Contract Accumulation Fund to be held at 10:00 a.m. Eastern Time on Friday May 23, 2008, at the Home Office of the Company, Legal Conference Room D, 18 Chestnut Street, Worcester, Massachusetts, 01608, and at any adjournment thereof, with respect to the proposals on the reverse side and as set forth in the Notice. The undersigned hereby acknowledges receipt of the Notice of Annual Meeting of Contractowners and the Proxy Statement issued by the Board of Managers and revokes any Proxy heretofore given with respect to the votes covered by this Proxy.

Date , 2008

Contractowner Signature(s) Title (If Applicable) (Please sign in Box)

UNUM PAUL R DC

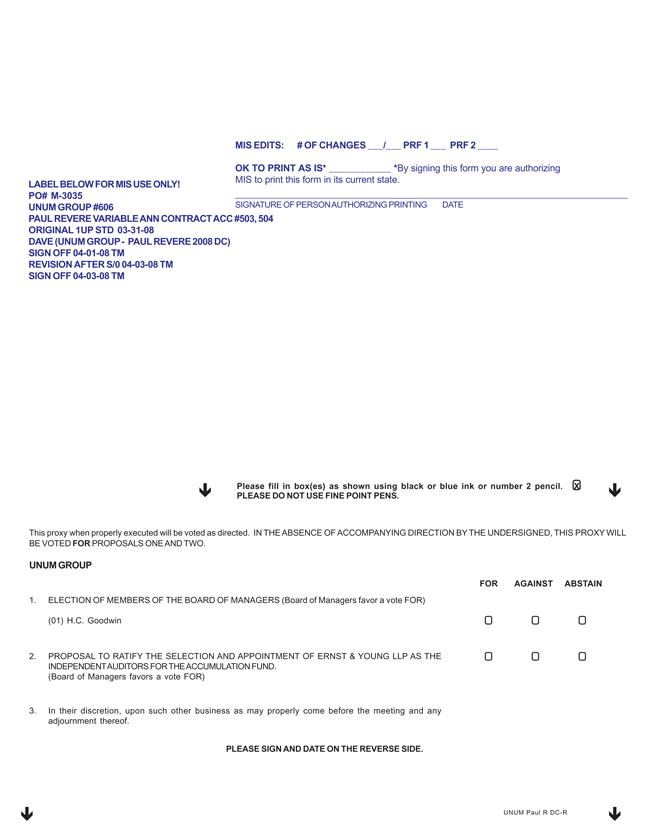

MIS EDITS: # OF CHANGES / PRF 1 PRF 2

OK TO PRINT AS IS* *By signing this form you are authorizing MIS to print this form in its current state.

SIGNATURE OF PERSON AUTHORIZING PRINTING DATE

LABEL BELOW FOR MIS USE ONLY! PO# M-3035 UNUM GROUP #606

ORIGINAL 1UP STD 03-31-08

DAVE (UNUM GROUP—PAUL REVERE 2008 DC) SIGN OFF 04-01-08 TM

REVISION AFTER S/0 04-03-08 TM SIGN OFF 04-03-08 TM

Please fill in box(es) as shown using black or blue ink or number 2 pencil. 0 X PLEASE DO NOT USE FINE POINT PENS.

This proxy when properly executed will be voted as directed. IN THE ABSENCE OF ACCOMPANYING DIRECTION BY THE UNDERSIGNED, THIS PROXY WILL BE VOTED FOR PROPOSALS ONE AND TWO.

UNUM GROUP

FOR AGAINST ABSTAIN

1. ELECTION OF MEMBERS OF THE BOARD OF MANAGERS (Board of Managers favor a vote FOR) (01) H.C. Goodwin

2. PROPOSAL TO RATIFY THE SELECTION AND APPOINTMENT OF ERNST & YOUNG LLP AS THE INDEPENDENTAUDITORS FOR THEACCUMULATION FUND.

(Board of Managers favors a vote FOR)

3. In their discretion, upon such other business as may properly come before the meeting and any adjournment thereof.

PLEASE SIGN AND DATE ON THE REVERSE SIDE.

UNUM Paul R DC-R