UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 |

THE GLENMEDE FUND, INC.

THE GLENMEDE PORTFOLIOS

(Name of Registrants as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

THE GLENMEDE FUND, INC.

THE GLENMEDE PORTFOLIOS

One Congress Street, Suite 1

Boston, MA 02114

(800) 442-8299

www.glenmedeim.com

September 28, 2023

Dear Shareholder:

I am writing to you on an important matter relating to The Glenmede Fund, Inc. (the “Glenmede Fund”) and The Glenmede Portfolios (the “Glenmede Portfolios” and, collectively with the Glenmede Fund, the “Funds”). The Board of Directors of the Glenmede Fund and the Board of Trustees of the Glenmede Portfolios (each a “Board” and together, the “Boards”, and the members thereof, the “Directors/Trustees”) have voted to approve a proposal, as explained in the accompanying Joint Proxy Statement for Special Joint Meeting of Shareholders (the “Joint Proxy Statement”), that is subject to shareholder approval. Accordingly, shareholders of each series of the Funds (the “Portfolio(s)”) will hold a special joint meeting of shareholders on November 17, 2023, and it will be held at the offices of Glenmede Investment Management L.P., One Liberty Place, 1650 Market Street, Suite 1200, Philadelphia, Pennsylvania 19103 and via video conference by following the instructions contained on your proxy card to register for virtual attendance, at 11:30 a.m. Eastern Time (with any postponements or adjournments, the “Special Meeting”).

At the Special Meeting, Portfolio shareholders will be asked to elect three Directors/Trustees to the Board of their Fund. One nominee would be a new Director/Trustee, and two of the nominees are current Directors/Trustees. Each Board currently consists of four Independent Directors/Trustees (i.e., Directors/Trustees who are not “interested persons,” as defined in the Investment Company Act of 1940 (the “1940 Act”), of Glenmede Investment Management L.P. (“GIM”), the Portfolios’ investment advisor, and two Interested Directors/Trustees who are considered to be “interested persons” of the Funds because of their current or prior affiliations with Glenmede Trust, the parent company of GIM, and/or their stock ownership in The Glenmede Corporation, of which GIM is an affiliate. Two of the three nominees would be Independent Directors/Trustees, while one would be an “interested person” of the Funds.

The increase in size and continued alignment of the Boards’ memberships would provide an opportunity to enhance the effectiveness of board oversight and structure and result in other potential benefits as described in the accompanying Joint Proxy Statement.

Shareholders will also be asked to consider and act upon any other business that may properly come before the Special Meeting.

Shareholders of record at the close of business on August 21, 2023, the record date for the Special Meeting, are entitled to receive notice of and to vote at the Special Meeting and at any postponements or adjournments thereof. While you are, of course, welcome to join us at the Special Meeting, most shareholders will cast their votes by completing and signing the enclosed Proxy Card.

WHETHER OR NOT YOU PLAN TO BE PRESENT AT THE SPECIAL MEETING, YOUR VOTE IS VERY IMPORTANT. After careful consideration, the Board of each of Fund unanimously recommends that shareholders vote “FOR” the Proposal (the election of each applicable nominee). However, before you vote, please read the Joint Proxy Statement for a complete description of the Proposal. If you do not plan to be present at the Special Meeting, you can vote by signing, dating and returning the enclosed proxy card promptly or by using the Internet or telephone voting options as described on your proxy card. If you have any questions regarding the proxy materials, please contact EQ Fund Solutions at (800) 330-4627. Your prompt response will help reduce proxy costs and will also mean that you can avoid receiving follow-up phone calls or mailings. IT IS IMPORTANT THAT YOUR VOTE BE RECEIVED BY 5:00 P.M. EST ON NOVEMBER 16, 2023.

|

| By order of the Board of Directors, |

|

| The Glenmede Fund, Inc. |

|

| By order of the Board of Trustees, |

|

| The Glenmede Portfolios |

|

/s/ Michael P. Malloy |

| Michael P. Malloy |

| Secretary |

September 28, 2023

IMPORTANT INFORMATION

FOR SHAREHOLDERS

For your convenience, the following “Questions and Answers” are a summary of, and are not intended to be as detailed as, the discussion found in the accompanying Joint Proxy Statement for Special Joint Meeting of Shareholders (the “Joint Proxy Statement”). The information in this “Questions and Answers” section is qualified in its entirety by reference to the Joint Proxy Statement. We encourage you to carefully review the information contained in the Joint Proxy Statement.

General

| Q. | Why am I receiving these proxy materials? |

| A. | You are receiving these proxy materials, which includes the Notice of Special Joint Meeting of Shareholders (“Notice”), the Joint Proxy Statement and your proxy card(s), because you have the right to notice of, and to vote on, an important governance matter concerning The Glenmede Fund, Inc. and The Glenmede Portfolios (together, the “Funds”). In particular, you are being asked to consider and act upon the Proposal (defined below), which requires shareholder approval. |

The Boards of Directors/Trustees of the Funds (the “Boards,” and the members thereof, the “Directors/Trustees”) separately determined that it is in the best interests of each series of the Funds (the “Portfolio(s)”) under their respective oversight to increase the size of the Boards and continue their alignment so that all of the Portfolios are overseen by the same Directors/Trustees. Accordingly, the Boards have proposed the election of three trustee nominees (the “Nominees”) to the Boards (the “Proposal”) as discussed below.

Each Board currently consists of four Independent Directors/Trustees (i.e., Directors/Trustees who are not “interested persons” of each Fund as defined in the Investment Company Act of 1940 (the “1940 Act”)) (the “Independent Directors/Trustees”), and two Interested Directors/Trustees who are considered to be “interested persons” of the Funds because of their current or prior affiliations with Glenmede Trust, the parent company of Glenmede Investment Management, L.P. (“GIM”), the Portfolios’ investment advisor, and/or their stock ownership in The Glenmede Corporation, of which GIM is an affiliate. In order to maintain a balance of skills, to replace Directors/Trustees who have recently retired, and to maintain flexibility for any future membership changes, the Boards wish to increase their membership. Two of the three nominees would be Independent Directors/Trustees, while one would be an “interested person” of the Funds (an “Interested Director/Trustee”).

The Boards believe that the increase in the size of the Boards’ membership from six members to seven and the continued alignment through the election of all of the Nominees would be beneficial to the shareholders of the Portfolios.

| Q. | Why am I being asked to vote? |

| A. | As of August 21, 2023 (the “Record Date”), the record date fixed by the Boards, you were a shareholder of record of one or more of the Portfolios listed in the attachment to the accompanying Notice. The Proposal requires the approval of shareholders of the Portfolios. |

After careful consideration, each Board unanimously recommends that shareholders of the Portfolio(s) under its oversight vote “FOR” the Proposal (the election of each applicable Nominee).

| Q. | Why am I being asked to elect each of the Nominees as Directors/Trustees? |

| A. | Two of the three Nominees are currently Directors/Trustees, one of whom is an Independent Director/Trustee and one of whom is an Interested Director/Trustee, and one is a new nominee to be an Independent Director/Trustee. The election of the Nominees is part of the intended increase in size of Board membership to its previous level of seven Directors/Trustees and to maintain the continued alignment of the Boards. |

In order to maintain a balance of skills, to replace Directors/Trustees who have recently retired, and to maintain flexibility for any future membership changes, the Boards have proposed increasing the size of the Boards to seven and to recommend that shareholders vote for the election of all of the Nominees. This increase in the size of Board membership and the continued alignment between the Boards would allow the Boards to continue to operate and provide an opportunity to enhance the effectiveness of board oversight and result in other potential benefits as described in the accompanying Joint Proxy Statement.

| Q. | Why have the Boards approved the Proposal (the election of each applicable Nominee)? |

| A. | At a meeting held on June 8, 2023, the Boards determined that increasing the size of the Boards and continuing their membership alignment could provide benefits to shareholders of the Portfolio(s) under their respective oversight. Each Board believes that each of the Nominees has the qualifications, experience, attributes and skills appropriate to their service as a Director/Trustee of each Portfolio in view of the Portfolios’ business and structure. Each Nominee has a demonstrated record of business and/or professional accomplishment, and two of the Nominees currently serve on the Boards. |

Voting

| Q. | Who is asking for my vote? |

| A. | Your vote is being solicited by and on behalf of the Board of your Portfolio for use at the special joint meeting of shareholders of the Portfolios to be held on November 17, 2023 (with any postponements or adjournments, the “Special Meeting”). As a shareholder of record of any of the Portfolios as of the close of business on the Record Date, you are entitled to notice of, and to vote at, the Special Meeting, even if you no longer own Fund shares. Accordingly, the other shareholders of record of any of the Portfolios as of the close of business on the Record Date are being sent these proxy materials. |

| Q. | How does the Board of my Fund recommend that I vote? |

| A. | After careful consideration, the Board unanimously recommends that shareholders vote “FOR” the Proposal (the election of each applicable Nominee). |

| Q. | Why am I receiving information about Portfolios I do not own? |

| A. | The Proposal is identical for each Fund, and the Boards have concluded that it is cost-effective to hold the Special Meeting concurrently for all shareholders of both Funds. |

| Q. | What vote is required to approve the Proposal? |

| A. | Each shareholder is entitled to one vote for each share held and a fractional vote proportionate to fractional shares held as of the Record Date. |

The presence in person or by proxy of shareholders owning shares representing one-third (1/3) or more of the total combined shares entitled to vote for each Fund at the Special Meeting shall constitute a quorum at the Special Meeting for that Fund.

For each Board, when a quorum is present, an affirmative vote by a plurality of the shares voted shall elect a Nominee as Trustee.

For each Board, the Proposal applies on a trust-wide basis, and all series (i.e., the respective Portfolios) will vote together on the Proposal.

| Q. | Will my vote make a difference? |

| A. | Yes! Your vote is needed to ensure that the Proposal can be acted upon, and your vote can make a difference in the governance of the Portfolio(s) that you own. We encourage all shareholders to participate in the governance of their Portfolio(s). Additionally, your immediate response on the enclosed proxy card, on the Internet or over the phone will help save the costs of any further solicitations. |

| Q. | If I am a small investor, why should I bother to vote? |

| A. | You should vote because every vote is important. If numerous shareholders just like you do not vote, the Portfolios may not receive enough votes to go forward with the Special Meeting. If this happens, the Portfolios will need to solicit votes again. This may delay the Special Meeting and the approval of the Proposal and generate unnecessary costs. |

| Q. | How do I place my vote? |

| A. | Shareholders can vote in any one of four ways: |

| | • | | By mailing the enclosed proxy card after signing and dating; |

| | • | | Over the Internet by going to the website indicated on your proxy card; |

| | • | | By telephone, with a toll free call to the number on your proxy card; or |

| | • | | By attending the Special Meeting in-person or virtually. |

We encourage you to vote over the Internet by going to the website provided on your enclosed proxy card, or by telephone by calling the toll-free number on your enclosed proxy card, in each case using the voting control number that appears on your proxy card. These voting methods will save money. However, whichever method you choose, please take the time to read the Proxy Statement before you vote.

| Q. | I plan to vote by mail. How should I sign my proxy card? |

| A. | Please see the instructions at the end of the Notice of Special Meeting, which is enclosed. |

| Q. | I plan to vote over the Internet. How does Internet voting work? |

| A. | To vote over the Internet, please log on to the website indicated on your proxy card and follow the instructions provided on the voting website. |

| Q. | I plan to vote by telephone. How does telephone voting work? |

| A. | To vote by telephone, please call toll free the number on your proxy card from within the United States and follow the instructions provided during your call. |

| Q. | Whom should I call with questions? |

| A. | If you have any additional questions about the Joint Proxy Statement or the upcoming Special Meeting, please contact EQ Fund Solutions at (800) 330-4627. |

| Q. | What is the relationship between the proxy solicitor, EQ Fund Solutions, and the Portfolios? |

| A. | The Portfolios have retained an outside firm, EQ Fund Solutions, which specializes in proxy solicitation to assist it with the proxy solicitation process, including the mailing of this Joint Proxy Statement, the collection of the proxies, and with any necessary follow-up. A proxy solicitor may contact shareholders on behalf of the Portfolios, but is not permitted to use personal information about shareholders for other purposes. |

THE ATTACHED PROXY STATEMENT CONTAINS MORE DETAILED INFORMATION ABOUT THE PROPOSAL. PLEASE READ IT CAREFULLY. YOUR VOTE IS IMPORTANT.

THE GLENMEDE FUND, INC.

THE GLENMEDE PORTFOLIOS

1650 Market Street

Suite 1200

Philadelphia, PA 19103

(800) 442-8299

www.glenmedeim.com

NOTICE OF SPECIAL JOINT MEETING OF SHAREHOLDERS (“NOTICE”)

TO BE HELD ON November 17, 2023

NOTICE IS HEREBY GIVEN THAT A SPECIAL JOINT MEETING OF SHAREHOLDERS of each of the series (collectively, the “Portfolios”) of each of The Glenmede Fund, Inc. and The Glenmede Portfolios (together, the “Funds”) will be held at the offices of Glenmede Investment Management L.P., One Liberty Place, 1650 Market Street, Suite 1200, Philadelphia, Pennsylvania 19103 and via video conference for registered shareholders, on November 17, 2023 at 11:30 a.m. Eastern Time (with any postponements or adjournments, the “Special Meeting”).

If you were a registered shareholder of the Funds as of the Record Date, August 21, 2023 (i.e., you held shares in your own name directly with the Fund’s transfer agent), please include your full name, address and the control number found on your enclosed proxy form in an email to the Solicitor at attendameeting@astfinancial.com. The Solicitor then will email you the instructions to register for the Meeting. After you register for the Meeting, you will receive an email confirmation of your registration.

The Meeting will begin promptly at 11:30 a.m. Eastern time. The Funds encourage you to access the Meeting a few minutes prior to the start time, leaving ample time for the check-in. For technical assistance in accessing the Meeting, shareholders can e-mail attendameeting@astfinancial.com. During the Meeting, instructions will be provided for shareholders in attendance to submit comments and questions.

At the Special Meeting, and as specified in greater detail in the Joint Proxy Statement for Special Joint Meeting of Shareholders (the “Joint Proxy Statement”) accompanying this Notice, shareholders of the Portfolios will be asked to consider and act upon the following proposal:

1. To elect nominees (the “Nominees”) to the Boards of Directors/Trustees (the “Boards,” and the members thereof, the “Directors/Trustees”) of their Fund (the “Proposal”) as follows:

2. To transact such other business as may properly come before the Special Meeting.

The matters referred to above are discussed in the Joint Proxy Statement attached to this Notice. Shareholders of record at the close of business on August 21, 2023, the record date for the Special Meeting, are entitled to receive notice of and to vote at the Special Meeting and at any postponements or adjournments thereof.

The Board of your Portfolio believes that the Proposal is in the best interests of the Portfolio and its shareholders. After careful consideration, the Board of each Fund unanimously recommends that shareholders vote “FOR” the Proposal (the election of each applicable Nominee).

As a shareholder, you are asked to attend the Special Meeting either in person or by proxy. If you are unable to attend the Special Meeting in person, we urge you to authorize proxies to cast your vote, commonly referred to as “proxy voting”. Whether or not you expect to attend the Special Meeting, please submit your vote by toll-free telephone or through the internet according to the enclosed voting instructions. You may also vote by completing, dating and signing your Proxy Card and mailing it in the enclosed postage prepaid envelope. Your prompt voting by proxy will help ensure a quorum at the Special Meeting. Voting by proxy will not prevent you from voting your shares in person at the Special Meeting. You may revoke your proxy before it is exercised at the Special Meeting, either by writing to the Secretary of the Funds at the address noted in the Proxy Statement or in person at the time of the Special Meeting. A prior proxy can also be revoked by voting your proxy again through the toll-free number or Internet website address listed in the enclosed voting instructions.

|

|

| By order of the Board of Directors, |

|

| The Glenmede Fund, Inc. |

|

| By order of the Board of Trustees, |

|

| The Glenmede Portfolios |

|

/s/ Michael P. Malloy |

| Michael P. Malloy |

| Secretary |

September 28, 2023

TABLE OF CONTENTS

THE GLENMEDE FUND, INC.

THE GLENMEDE PORTFOLIOS

1650 Market Street

Suite 1200

Philadelphia, PA 19103

(800) 442-8299

www.glenmedeim.com

JOINT PROXY STATEMENT FOR SPECIAL JOINT MEETING OF SHAREHOLDERS

TO BE HELD ON November 17, 2023

This joint proxy statement (“Joint Proxy Statement”) and enclosed Notice of Special Joint Meeting of Shareholders (“Notice”) and proxy card are being furnished in connection with the solicitation of proxies by and on behalf of the Boards of Directors/Trustees (the “Boards,” and the members thereof, the “Directors/Trustees”) of The Glenmede Fund, Inc. and The Glenmede Portfolios (collectively, the “Funds”). The proxies are being solicited for use at a special joint meeting of shareholders of each Fund on the list attached to the Notice to be held on November 17, 2023, at 11:30 a.m. Eastern Time (with any postponements or adjournments, the “Special Meeting”).

At the Special Meeting, and as described in this Joint Proxy Statement, shareholders of each series of each of the Funds (the “Portfolios”) will be asked to consider and act upon the following proposals:

| | 1. | To elect the following nominees (the “Nominees”) to the Boards of their Fund (the “Proposal”) as follows: |

| | 2. | To transact such other business as may properly come before the Special Meeting. |

After careful consideration, the Board of each Fund unanimously recommends that shareholders vote “FOR” the Proposal (the election of each applicable Nominee). The Proposal will be voted upon separately by each Fund. The Proposal applies on a Board-wide basis, and all Portfolios of each of the Funds will vote together on the Proposal. The Boards have determined that the use of this Joint Proxy Statement for the Special Meeting is in the best interests of each Portfolio and its shareholders because identical matters are being considered and voted on by the shareholders of each Fund.

This Joint Proxy Statement and the accompanying Notice and proxy card are anticipated to be first mailed to shareholders on or about September 28, 2023.

The Boards have fixed the close of business on August 21, 2023 (“Record Date”) as the date for the determination of shareholders entitled to notice of, and to vote at, the Special Meeting. Shareholders of record of the Portfolios on the Record Date are entitled to one vote per share at the Special Meeting. Appendix A to this Joint Proxy Statement sets forth the number of shares of beneficial interest of each Portfolio outstanding as of the Record Date. Appendix B to this Joint Proxy Statement sets forth the persons who owned beneficially more than 5% of any class of a Portfolio as of the Record Date.

1

Solicitation of Proxies

The Portfolios will pay their respective shares of the costs associated with the Proposal, with fixed costs allocated to the Portfolios equally and certain variable costs (e.g., costs of printing and mailing) allocated to the Portfolios on a pro rata basis based on the number of shareholders of each Portfolio. However, to the extent the costs associated with the Proposal to be borne by a Portfolio would increase such Portfolio’s total expense ratio above its capped net total operating expense ratio, the Portfolios’ investment advisor, Glenmede Investment Management, L.P. (“GIM” or “Advisor”), will also reimburse such Portfolio in an amount equal to the portion of the increase in the Portfolio’s total expense ratio that is above its capped limit. The Portfolios and the Advisor have retained EQ Fund Solutions, a proxy solicitation firm, to assist the solicitation and tabulation of proxies, and Broadridge to assist with the printing of proxy materials. The cost of EQ Fund Solutions’ and Broadridge’s services in connection with the proxy solicitation is approximately $300,000.

To vote by mail, sign, date and promptly return the enclosed proxy card or voting instruction form in the accompanying postage pre-paid envelope. To vote by Internet or telephone, please use the voting instruction form and follow the instructions as described on your proxy card or voting instruction form. If you have any questions regarding the proxy materials, please contact EQ Fund Solutions at (800) 330-4627. If the enclosed proxy card or voting instruction form is properly executed and received prior to the Special Meeting and has not been revoked, then the shares represented thereby will be voted in accordance with the instructions marked on the returned proxy card or voting instruction form or, if no instructions are marked on the returned proxy card or voting instruction form, the proxy card or voting instruction form will be voted “FOR” the election of the Nominees described in this Joint Proxy Statement, and in the discretion of the persons named as proxies in connection with any other matter that may properly come before the Special Meeting or any adjournment(s) or postponement(s) thereof.

Any person giving a proxy may revoke it at any time before it is exercised by submitting to the Secretary of the Portfolios, c/o The Glenmede Fund/Portfolios, 1650 Market Street, Suite 1200, Philadelphia PA 19103, a written notice of revocation or subsequently executed proxy or voting instruction form or by attending and voting at the Special Meeting. Attendance at the Meeting alone will not serve to revoke the proxy.

If (i) you are a member of a household in which multiple shareholders of a Portfolio share the same address, (ii) your shares are held in “street name” and (iii) your broker or bank has received consent to household material, then your broker or bank may have sent to your household only one copy of this Joint Proxy Statement, unless your broker or bank previously received contrary instructions from a shareholder in your household. If you are part of a household that has received only one copy of this Joint Proxy Statement, your Portfolio will deliver promptly a separate copy of this Joint Proxy Statement to you upon request. To receive a separate copy of this Joint Proxy Statement, please contact your Portfolio by calling toll free (800) 330-4627 or by mail at The Glenmede Fund/Portfolios, c/o Glenmede Investment Management, LP, 1650 Market Street, Suite 1200, Philadelphia, PA 19103. If your shares are held with certain banks, trust companies, brokers, dealers, investment advisors and other financial intermediaries (each, an “Authorized Institution”) and you would like to receive a separate copy of future proxy statements, prospectuses or annual reports or you are now receiving multiple copies of these documents and would like to receive a single copy in the future, please contact your Authorized Institution.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING TO BE HELD ON NOVEMBER 17, 2023

This Joint Proxy Statement is available online at https://vote.proxyonline.com.

2

In addition, copies of the Portfolios’ most recent annual and semi-annual report, including financial statements, have previously been mailed to shareholders. The Portfolios will furnish to any shareholder upon request, without charge, an additional copy of the Portfolios’ most recent annual report and semi-annual report to shareholders. Annual reports and semi-annual reports to shareholders may be obtained by writing to the Fund or by calling (800) 442-8299 or by visiting the Portfolios’ website at www.glenmedeim.com.

The date of this Joint Proxy Statement is September 28, 2023.

3

THE PROPOSAL

ELECTION OF NOMINEES TO THE BOARD OF DIRECTORS/TRUSTEES OF EACH OF THE GLENMEDE FUND, INC. AND THE GLENMEDE PORTFOLIOS

The Proposal relates to the election of the following Nominees to the Board of each of Fund:

Nominees to the Board of each Fund

The Board of each Fund is currently composed of six Directors/Trustees: Susan W. Catherwood, Mary Ann B. Wirts, H. Franklin Allen, William L. Cobb, Jr., Andrew Phillips, and Harry Wong.

H. Franklin Allen, William L. Cobb, Jr., Andrew Phillips, and Harry Wong are not deemed to be an “interested person,” as that term is defined under the Investment Company Act of 1940 (the “1940 Act”) (each, an “Independent Director/Trustee”), of each of the Funds. Susan W. Catherwood and Mary Ann B. Wirts, are considered to be “interested persons” under the 1940 Act (each, an “Interested Director/Trustee”).

For each Board, if elected, the applicable Nominees would hold their respective office for an indefinite term, until the earliest of: (i) the next meeting of shareholders, if any, called for the purpose of considering the election or re-election of such member and until the election and qualification of his/her successor, if any, elected at such meeting, (ii) the date he or she dies, resigns or retires, or is removed by the particular Board or shareholders, or, with respect to Ms. Duseau, if elected by shareholders, effective as of December 31 in the year she reaches the age of 80, pursuant to the Funds’ retirement policies. The Boards may fill future vacancies by appointment (subject to the requirement of the 1940 Act that, after such appointment, at least two-thirds of the Directors/Trustees holding office must have been elected by shareholders) without incurring the additional expense associated with calling one or more shareholder meetings to fill those vacancies.

Following discussions among members of the Nominating Committees of the Boards (the “Nominating Committees”) and each of the Nominees and meetings of the Nominating Committees and the Boards, each Nominating Committee selected and recommended, and each Board unanimously approved, the nomination of the Nominees for election as Directors/Trustees at a meeting of the Nominating Committee held on June 7, 2023 and a meeting of the Boards, dated June 8, 2023. The Boards also increased their respective sizes from six to seven members to accommodate the new Nominee who is not currently a Director/Trustee.

Summary of the Reasons for the Proposal

The Boards of the Funds have typically consisted of seven members. Following the appointment of Ms. Wirts in 2020 and the appointment of Mr. Phillips in 2022, along with Director/Trustee retirements in 2021 and 2022, four of the six members (two-thirds) of the current Boards have been elected by shareholders and any further changes to the Boards’ composition will require a shareholder vote. The Proposal also is the result of an effort on the part of the Boards to maintain a balance of skills, to replace Directors/Trustees who have recently retired, to maintain flexibility with respect to future Board changes, and to continue to align the membership of the Boards so that the same Directors/Trustees serve on each Board for the Funds, in order to further enhance the effectiveness of board oversight.

The Directors/Trustees met each other and with the Advisor representatives to consider and develop the Proposal. The Independent Directors/Trustees also met with their independent legal counsel to consider and discuss matters relating to the development of the Proposal.

4

In reaching the conclusion that the approval of the Proposal is in the best interests of the Portfolios and their shareholders, the Boards considered a number of factors, including the following:

| | 1) | that each Fund (and each of their Portfolios) would benefit from the additional experience, insights and oversight from the election of the Nominee that is not currently a member of its Board; |

| | 2) | that each of the Nominees has the qualifications, experience, attributes and skills appropriate to their service as a Director/Trustee of each Fund in view of the Portfolios’ business and structure; |

| | 3) | that the Boards with increased skill sets, backgrounds and depth of experience would be better positioned to respond to the increasing complexities of overseeing a number of funds; and |

| | 4) | whether the Nominees’ background, experience and skills will contribute to the overall diversity of perspective and experience of the Boards. |

Information concerning the Nominees and other relevant factors is provided below. Using the enclosed proxy card or voting instruction form or voting by the Internet or by telephone, a shareholder may authorize proxies to vote his or her shares for the Nominees or may withhold from the proxies authority to vote his or her shares for one or more of the Nominees. If the enclosed proxy card or voting instruction form is properly executed and received prior to the Special Meeting (and has not been revoked) but no instructions are marked, the proxies will vote “FOR” the Nominees. Each of the Nominees has consented to his or her nomination and has agreed to serve if elected. If, at the time of the Special Meeting, for any reason, any Nominee is not available for election or able to serve as a Director/Trustee, the proxies will exercise their voting power in favor of such substitute Nominee, if any, as the Directors/Trustees may designate. The Portfolios have no reason to believe that it will be necessary to designate a substitute Nominee. Each Portfolio proposes the election by all of its respective shareholders of the Nominees named in the table below to serve as members of its Board.

Each Nominating Committee considered each Nominee, including his or her qualifications and experience, selected each Nominee and recommended each individual’s nomination to its respective Board. Based on this recommendation, each of the Boards have recommended for election by shareholders each of the Nominees to such Board.

Information Regarding the Boards and Nominees

The following table lists the Directors/Trustees and Nominees, their year of birth, current position(s) held with the Funds, length of time served, principal occupations during the past five years, number of Portfolios currently overseen within the Glenmede Funds’ complex and other directorships held by the Nominees during the past five years, as of June 30, 2023.

5

| | | | | | | | |

| Interested Directors/Trustees(1) |

Name and Age | | Positions with the Funds and

Time Served | | Principal Occupation(s) During Past 5 Years | | Number of Portfolios in Fund Complex Overseen | | Other Directorships Held in Past 5 Years |

Susan W. Catherwood (2) Year of Birth: 1942 | | Director of The Glenmede Fund, Inc. and Trustee of The Glenmede Portfolios (since February 2007) | | Director (since 1988) and Member of the Investment Review/Relationship Oversight Committee (since 2001), Compensation Committee (since 1993) and Nominating Committee (since 2018), Glenmede Trust; Director, The Glenmede Corporation (since 1988); Board Member, The Pew Charitable Trusts; Charter Trustee, The University of Pennsylvania; Chairman Emeritus, The University Museum of The University of Pennsylvania; Chairman of the Board of Managers, The Christopher Ludwick Foundation; Director: Thomas Skelton Harrison Foundation and The Catherwood Foundation; Fellow and formerly served on Finance and Investment Committees, and former Board member, College of Physicians of Philadelphia; Former Member and Chair, The Women’s Committee and Penn Museum Board of Overseers of the University of Pennsylvania; Former Board Chair, University of Pennsylvania Health System (1991-1999). | | 19 | | None |

| | | | | | | | |

| Independent Directors/Trustees(3) |

Name and Age | | Positions with the Funds and Time Served | | Principal Occupation(s) During Past 5 Years | | Number of Portfolios in Fund Complex Overseen | | Other Directorships Held in Past 5 Years |

H. Franklin Allen, Ph.D. Year of Birth: 1956 | | Director of The Glenmede Fund, Inc. (since March 1991) and Trustee of The Glenmede Portfolios (since May 1992) | | Vice Dean Research and Faculty of the Imperial College Business School (since 2019), Professor of Finance and Economics and Director of the Brevan Howard Centre for Financial Analysis at the Imperial College London (since 2014); Professor Emeritus of Finance, The Wharton School of The University of Pennsylvania since June 2016; Professor of Finance and Economics (1990-1994); Vice Dean and Director of Wharton Doctoral Programs (1990-1993); Employed by The University of Pennsylvania (from 1980-2016). | | 19 | | None |

6

| | | | | | | | |

William L. Cobb, Jr. Year of Birth: 1947 | | Director of The Glenmede Fund, Inc. and Trustee of The Glenmede Portfolios (since February 2007) Chairman of the Fund (since December 2021) | | Former Executive Vice President and Former Chief Investment Officer, The Church Pension Fund (defined benefit plan for retired clergy of the Episcopal Church) (1999-2014); Chair and Member, Investment Committee, The Minister and Missionaries Benefit Board of the American Baptist Church (until 2013); Vice Chairman, J.P. Morgan Investment Management (1994-1999). | | 19 | | Director, TCW Direct Lending LLC (Business Development Company) |

| | | | |

Harry Wong Year of Birth: 1948 | | Director of The Glenmede Fund, Inc. and Trustee of The Glenmede Portfolios (since February 2007) | | Former Managing Director, Knight Capital Americas, L.P., an operating subsidiary of Knight Capital Group Inc. (investment banking) (2009- 2011); Managing Director, Long Point Advisors, LLC (business consulting) (2003-2012); Senior Managing Director, ABN AMRO (investment banking) (1990-2002); Adjunct Faculty Member, Sacred Heart University (2003-2007). | | 19 | | None |

|

| Nominee who is Currently an Interested Director/Trustee(1) |

| | | | |

Mary Ann B. Wirts (2) Year of Birth: 1952 | | Director of The Glenmede Fund, Inc. (since June 2020) and Trustee of The Glenmede Portfolios (since June 2020) | | Managing Director and Chief Administrative Officer of Glenmede Trust (until 2020); Managing Director and Chief Administrative Officer of Glenmede Investment Management LP (2006-2020); First Vice President and Managing Director of Fixed Income of Glenmede Advisers (2000-2006). | | 19 | | None |

|

| Nominee who is Currently an Independent Director/Trustee(3) |

| | | | |

Andrew Phillips Year of Birth: 1962 | | Director of The Glenmede Fund, Inc. and Trustee of The Glenmede Portfolios (since September 2022) | | Adjunct Professor - College of Management (since 2021), Long Island University; Senior Performance Officer (2013-2015), Global Head of Institutional and Alternatives Product Strategy (2012-2013), Global Chief Performance Officer (2010-2012), Global Chief Operating Officer (2007-2010) and Managing Director - Americas Fixed Income Executive Team, BlackRock, Inc. | | 19 | | None |

7

| | | | | | | | |

| Nominee for Independent Director/Trustee(3) who is Not Currently a Director/Trustee |

| | | | |

Rebecca E. Duseau Year of Birth: 1963 | | Nominee for Director of The Glenmede Fund, Inc. and Nominee for Trustee of The Glenmede Portfolios | | Cofounder and Chief Compliance Officer (since 2000), Adamas Partners, LLC (investment firm); Chair of Investment Advisory Board (since 2020) for Boston Family Advisors (multi-family office); Member of Investment Committees of Mass General Brigham (hospital) (since 2019) and Berklee School of Music (since 2019). | | None | | None |

| (1) | Interested Directors/Trustees are those Directors/Trustees who are “interested persons” of the Fund and The Glenmede Portfolios as defined in the 1940 Act. |

| (2) | Susan W. Catherwood and Mary Ann B. Wirts are considered to be “interested persons” of the Fund and The Glenmede Portfolios because of their current or prior affiliations with Glenmede Trust, the parent company of the Fund’s investment advisor, GIM, and/or their stock ownership in The Glenmede Corporation, of which GIM is an affiliate. |

| (3) | Independent Directors/Trustees are those Directors/Trustees who are not “interested persons” of the Fund as defined in the 1940 Act. |

The Board met four times during the fiscal year ended October 31, 2022.

Additional Information about the Boards and the Nominees

Individual Nominee Qualifications

The significance or relevance of a Nominee’s particular experience, qualifications, attributes and/or skills is considered by the Boards on an individual basis. Experience, qualifications, attributes and/or skills common to all Nominees include the ability to critically review, evaluate and discuss information provided to them and to interact effectively with the other Directors/Trustees and with representatives of the investment advisors and sub-advisors and their affiliates, other service providers, legal counsel and the Portfolios’ independent registered public accounting firm, the capacity to address financial and legal issues and exercise reasonable business judgment, and a commitment to the representation of the interests of the Portfolios and their Shareholders. The Nominating Committees’ charters contain certain other factors that are considered by the Nominating Committees in identifying and evaluating potential nominees to serve as Independent Directors/Trustees. Based on each Nominee’s experience, qualifications, attributes and/or skills, considered individually and with respect to the experience, qualifications, attributes and/or skills of other Nominees, the Boards have each concluded that each Nominee should serve as a Director/Trustee. Below is a brief discussion of the experience, qualifications, attributes and/or skills of each individual Nominee as of June 30, 2023 that led the Boards to conclude that such individual should serve as a Director/Trustee.

Mary Ann B. Wirts: Ms. Wirts has substantial business, financial services and investment management experience through her senior executive positions with the Advisor and its parent companies.

Andrew Phillips: Mr. Phillips has substantial management and business experience through his executive positions with an investment management firm.

Rebecca E. Duseau: Ms. Duseau has substantial investment management experience as a co-founder, executive and compliance professional of an investment management firm.

8

The Boards’ Leadership Structure

Overall responsibility for oversight of the Funds rests with the Boards. The Funds have engaged the Advisor and a sub-investment advisor (collectively, “investment advisors”) to manage their Portfolios on a day-to-day basis. The Boards are responsible for overseeing the investment advisors and other service providers in the operations of the Funds in accordance with the provisions of the 1940 Act, applicable provisions of state and other laws and the Funds’ Charters and By-laws. Each Board is currently composed of the same six members, four of whom are Independent Directors/Trustees. The Boards meet in-person at regularly scheduled meetings four times each year. In addition, the Boards may hold special in-person or telephonic meetings or informal conference calls to discuss specific matters that may arise or require action between regular meetings. The Boards may also meet via videoconference. The Boards and the Independent Directors/Trustees have access to the Funds’ Chief Compliance Officer (“CCO”), the Funds’ independent registered public accounting firm and independent legal counsel for consultation to assist them in performing their oversight responsibilities. As described below, the Boards have each established an Audit Committee, Valuation Committee, and Nominating Committee and may establish ad hoc committees or working groups from time to time to assist the Boards in fulfilling their oversight responsibilities.

The Boards have appointed William L. Cobb, Jr., an Independent Director/Trustee, to serve in the role of Chairman of the Boards. The Chairman’s role is to preside at all meetings of the Boards and to act as liaison with the investment advisors, other service providers, counsel and other Directors/Trustees generally between meetings. The Chairman may also perform such other functions as may be delegated by the Boards from time to time. The Boards review their leadership structures during their periodic self-assessments and based on that review, have determined that the Boards’ leadership structures are appropriate because they allow the Boards to exercise informed judgment over matters under their purview and they allocate areas of responsibility among committees of the Boards and the full Boards in a manner that enhances effective oversight.

Standing Board Committees

Audit Committee

Dr. Allen and Messrs. Cobb, Phillips and Wong (Chairman) and Mmes. Catherwood and Wirts serve on each Audit Committee of the Boards. The purposes of the Audit Committees include overseeing the accounting and financial reporting processes of the Funds and the audits of the Funds’ financial statements. Accordingly, the Committees assist the Boards in their oversight of (i) the integrity of the Funds’ financial statements; (ii) the independent accountants’ qualifications and independence; and (iii) the performance of the Funds’ internal audit function and independent accountants. The Audit Committees met two times during the fiscal year ended October 31, 2022.

9

Nominating Committee

Dr. Allen (Chairman) and Messrs. Cobb, Wong and Phillips serve on each Nominating Committee of the Boards. The Funds’ Nominating Committees, among other things, nominate persons to fill vacancies on the Boards and Board Committees. The Nominating Committees will consider nominees recommended by shareholders. Recommendations should be submitted to the appropriate Nominating Committee in care of the Funds’ Secretary. The Nominating Committees met four times during the fiscal year ended October 31, 2022.

Valuation Committee

Dr. Allen (Chairman) and Messrs. Cobb, Phillips, Wong, Weaver and McGuire and Mmes. Catherwood, Osborne and Wirts serve on each Valuation Committee of the Boards. The Funds’ Valuation Committees, or under certain circumstances the Valuation Committees’ Chairman or his designee, determine, in consultation with the Funds’ administrator and investment advisors, the fair value of certain securities pursuant to procedures adopted by the Boards. The Glenmede Fund, Inc.’s Valuation Committee did not meet during the fiscal year ended October 31, 2022.

Risk Oversight

The Funds are subject to a number of risks, including investment, compliance, operational and valuation risks, among others. Risk oversight forms part of the Boards’ general oversight of the Funds and is addressed as part of the Boards’ and their committees’ various activities. Day-to-day risk management functions are included within the responsibilities of the investment advisors and other service providers (depending on the nature of the risk), which carry out the Funds’ investment management and business affairs. The investment advisors and other service providers employ a variety of processes, procedures and controls to identify various events or circumstances that give rise to risks, to lessen the probability of their occurrence and/or to mitigate the effects of such events or circumstances if they do occur. Each of the investment advisors and other service providers have their own independent interests in risk management, and their policies and methods of risk management will depend on their functions and business models. The Boards recognize that it is not possible to identify all of the risks that may affect the Funds or to develop processes and controls to eliminate or mitigate their occurrence or effects. The Boards require senior officers of the Funds, including the President, Chief Financial Officer and CCO and the investment advisors, to report to the full Boards on a variety of matters at each regular meeting of the Boards, including matters relating to risk management. The Boards also receive reports from certain of the Funds’ other primary service providers on regular basis, including State Street as the Funds’ custodian, administrator, transfer agent and securities lending agent. The Funds’ CCO meets in executive session with the Boards at each regularly scheduled meeting and meets separately with the Independent Directors/Trustees at least annually to discuss relevant risk issues affecting the Funds. In addition, the CCO reports to the Chairman of the Audit Committees between meetings to discuss compliance related matters. The Audit Committees also receive regular reports from the Funds’ independent registered public accounting firm on internal control and financial reporting matters. The Boards and Independent Directors/Trustees meet with the Funds’ independent legal counsel each quarterly meeting and have access to legal counsel for consultation concerning any issues that may occur between regularly scheduled meetings. The Boards may, at any time and in their discretion, change the manner in which they conduct risk oversight.

10

Nominee Ownership of Fund Shares

The following table shows the dollar range of shares beneficially owned by each Nominee in the investment portfolios of the Portfolios and the Fund Complex as of December 31, 2022:

| | | | |

Name of Nominee | | Dollar Range of Equity Securities in the Portfolios | | Aggregate Dollar

Range of

Equity Securities in

All

Portfolios in Fund

Complex Overseen by

Nominee |

Mary Ann B. Wirts | | Core Fixed Income Portfolio – Over $100,000 | | Over $100,000 |

| | Quantitative U.S. Large Cap Core Equity Portfolio – $50,001-$100,000 | | |

Andrew Phillips | | None | | None |

Rebecca Duseau | | None | | None |

As of the Record Date, the Nominees, Directors/Trustees and Officers of the Portfolios as a group owned less than 1% of the outstanding shares of beneficial interest of each of the Portfolios in the Funds.

As of the Record Date, none of the Independent Directors/Trustees nor any member of their immediate family owned any securities issued by the Advisor or a sub-advisor or any other person (other than a registered investment company) directly or indirectly controlling, controlled by or under common control with the Advisor or a sub-advisor.

Board Compensation

As of January 1, 2023, the annual fee for each Glenmede Fund, Inc. Board member, other than officers of the Advisor, is $104,000. In addition, to the annual fee, the Glenmede Fund, Inc. pays each Board member, other than officers of the Advisor, $5,000 for each Board meeting attended and out-of-pocket expenses incurred in attending Board meetings, the Audit Committee Chairman receives an annual fee of $10,000 for his service as Chairman of the Audit Committee and the Chairman of the Board receives an annual fee of $15,000 for his service as Chairman of the Board. The Glenmede Portfolios pays each Board member, other than officers of the Advisor, an annual fee of $6,000 per year and out-of-pocket expenses incurred in attending Board meetings. Board members receive no compensation as members of the Audit, Valuation or Nominating Committees. The officers of the Funds receive no compensation as officers from the Funds.

Set forth in the table below is the compensation received by Board members for the fiscal year ended October 31, 2022.

11

| | | | | | | | | | | | | | | | |

| Name of Person, Position* | | Aggregate Compensation* from The

Glenmede Fund, Inc. | | | Aggregate Compensation* from The Glenmede Portfolios | | | Pension or Retirement Benefits

Accrued as Part of

Fund’s Expenses | | Estimated Annual Benefits Upon Retirement | | Total Compensation* from the Fund Complex** | |

Interested Directors/Trustees | | | | | | | | | | | | | | | | |

Susan W. Catherwood, Director/Trustee | | $ | 117,342 | | | $ | 6,000 | | | None | | None | | $ | 123,342 | |

Mary Ann B. Wirts Director/Trustee | | $ | 122,342 | | | $ | 6,000 | | | None | | None | | $ | 128,342 | |

Independent Directors/Trustees | | | | | | | | | | | | | | | | |

H. Franklin Allen, Ph.D., Director/Trustee | | $ | 124,195 | | | $ | 6,000 | | | None | | None | | $ | 130,195 | |

William L. Cobb, Jr., Director/Trustee | | $ | 136,774 | | | $ | 6,000 | | | None | | None | | $ | 142,774 | |

Andrew Phillips,*** Director/Trustee | | $ | 62,266 | | | $ | 3,000 | | | None | | None | | $ | 65,266 | |

Harry Wong, Director/Trustee | | $ | 132,978 | | | $ | 6,000 | | | None | | None | | $ | 138,978 | |

| * | Compensation includes reimbursement of out-of-pocket expenses incurred in attending Board meetings, where applicable. |

| ** | Includes $6,000 annual fee for service on the Board of Trustees of The Glenmede Portfolios. |

| *** | Effective September 8, 2022, Mr. Phillips was appointed Director/Trustee of The Glenmede Fund, Inc. and The Glenmede Portfolios. |

Additional Information about Officers of the Portfolios

Information pertaining to the officers of the Portfolios as the Record Date is set forth below. The officers serve until their successors are duly appointed and qualified. The Portfolios’ officers do not receive any compensation from the Portfolios for serving as such.

Officers

| | | | | | |

Name, Address, and Age | | Positions Held with the Fund | | Term of Office and Length of Time Served | | Principal Occupation(s) During Past 5 Years |

Kent E. Weaver 1650 Market Street, Suite 1200 Philadelphia, PA 19103 Year of birth: 1966 | | President of the Fund. | | President of the Fund since November 2019. | | President of Glenmede Investment Management LP (since 2021); Director of Sales and Client Service of Glenmede Investment Management LP (July 2015-2021). |

12

| | | | | | |

| | | |

Name, Address, and Age | | Positions Held with the Fund | | Term of Office and Length of Time Served | | Principal Occupation(s) During Past 5 Years |

Kimberly C. Osborne 1650 Market Street, Suite 1200 Philadelphia, PA 19103 Year of birth: 1966 | | Executive Vice President and Assistant Treasurer of the Fund. | | Executive Vice President of the Fund since December 1997; Assistant Treasurer of the Fund since December 2020. | | Client Service Manager of Glenmede Investment Management LP (since 2006). Vice President of Glenmede Trust and Glenmede Advisers (until 2008); Employed by Glenmede Trust (1993-2008) and Glenmede Advisers (2000-2008). |

| | | |

Christopher E. McGuire 1650 Market Street, Suite 1200 Philadelphia, PA 19103 Year of birth: 1973 | | Treasurer of the Fund. | | Treasurer of the Fund since December 2019. | | Director of Administration of Glenmede Investment Management LP (since October 2019); Managing Director, State Street Bank and Trust Company (2007-2019). |

| | | |

Michael P. Malloy One Logan Square Suite 2000 Philadelphia, PA 19103-6996 Year of birth: 1959 | | Secretary of the Fund. | | Secretary of the Fund since January 1995. | | Partner in the law firm of Faegre Drinker Biddle & Reath LLP. |

| | | |

Eimile J. Moore 3 Canal Plaza, Suite 100, 3rd Floor Portland, ME 04101 Year of birth: 1970 | | Chief Compliance Officer of the Fund. | | Chief Compliance Officer of the Fund since December 2017. | | Senior Principal Consultant, ACA Group (since 2011). |

| | | |

Daniel P. Bulger One Congress Street, Suite 1 Boston, MA 02114 Year of birth: 1966 | | Assistant Secretary of the Fund. | | Assistant Secretary of the Fund since December 2022. | | Vice President and Counsel, State Street Bank and Trust Company (since 2016). |

| | | |

Rebecca Tran Savage One Congress Street, Suite 1 Boston, MA 02114 Year of birth: 1981 | | Assistant Secretary of the Fund. | | Assistant Secretary of the Fund since December 2022. | | Assistant Vice President and Associate Counsel, State Street Bank and Trust Company (Since May 2022). |

13

Information about the Portfolios’ Independent Registered Public Accounting Firm

Each Audit Committee has selected and recommended, and its respective Board, including a majority of the Independent Directors/Trustees, has approved, the selection of PricewaterhouseCoopers LLP (“PwC”) to act as independent registered public accountant for the Portfolio(s) under its oversight for the current applicable fiscal years. Representatives of PwC are not expected to be present at the Special Meeting, but will be available by telephone to respond to appropriate questions from shareholders, if any.

Audit Fees

Fees included in the audit fees category are those associated with the annual audits of financial statements and services that are normally provided in connection with statutory and regulatory filings.

The aggregate fees billed by PwC to the Portfolios for professional services for the audit of the annual financial statements for the Portfolios’ last two fiscal years are reflected in the tables below.

| | | | | | | | |

| Fiscal Year | | The Glenmede Fund, Inc. | | | The Glenmede Portfolios | |

2022 | | $ | 484,488 | | | $ | 29,608 | |

2021 | | $ | 484,488 | | | $ | 29,608 | |

Audit-Related Fees

Audit-related fees are for any services rendered to the Portfolios that are reasonably related to the performance of the audits of the financial statements (but not reported as audit fees above). These services include attestation services that are not required by statute or regulation and consultations concerning financial accounting and reporting standards.

For the fiscal years ended October 31, 2022, and 2021, there were no other audit-related fees billed by PwC to the Portfolios.

Tax Fees

Fees included in the tax fees category comprise all services performed by professional staff in the independent registered public accountant’s tax division except those services related to the audits. This category comprises fees for tax compliance services provided in connection with the preparation and review of the Fund’s tax returns.

The aggregate fees billed by PwC to the Portfolios for services rendered to the Portfolios for tax compliance, tax advice and tax planning for the Portfolios’ last two fiscal years are reflected in the tables below.

| | | | | | | | |

| Fiscal Year | | The Glenmede Fund, Inc. | | | The Glenmede Portfolios | |

2022 | | $ | 92,700 | | | $ | 5,400 | |

2021 | | $ | 97,900 | | | $ | 5,400 | |

14

All Other Fees

The aggregate fees billed by PwC to the Portfolios for products and services provided to the Portfolios, other than the services reported in “Audit Fees,” “Audit Related Fees,” and “Tax Fees” above, for the Portfolios’ last two fiscal years are reflected in the tables below.

For the fiscal years ended October 31, 2023, and 2022, there were no other fees billed by PwC to the Portfolios.

Aggregate Non-Audit Fees

The aggregate non-audit fees billed by PwC to the Portfolios for the Portfolios’ last two fiscal years are reflected in the tables below. These include any non-audit services required to be pre-approved but excludes non-audit services that did not require pre-approval since they did not relate to the Portfolios’ operations or financial reporting.

The following tables set forth the aggregate fees billed by PwC for professional services rendered to the Portfolios during the two most recent fiscal years.

| | | | | | | | |

| Fiscal Year | | The Glenmede Fund, Inc. | | | The Glenmede Portfolios | |

2022 | | $ | 92,700 | | | $ | 5,400 | |

2021 | | $ | 97,900 | | | $ | 5,400 | |

Pre-Approval of Audit and Non-Audit Services Provided to the Fund

Each Fund’s Audit Committee has not adopted pre-approval policies and procedures. Instead, each Audit Committee approves on a case-by-case basis each audit or non-audit service before the engagement. The Audit Committee has delegated to the Chairman of each Fund’s Audit Committee the authority to pre-approve audit or non-audit services provided to each Fund by its independent registered public accounting firm provided that any such pre-approval decision is presented to such Fund’s Audit Committee at its next scheduled meeting.

Required Vote

The affirmative vote of a plurality of all votes cast by a Fund’s shareholders, voted in person or by proxy at the Meeting (shares of all Portfolios of the Fund voting together), is required for the election of each Nominee to the Board of that Fund. For The Glenmede Fund, Inc., under Maryland law, abstentions and broker “non-votes” will have no effect (i.e., will not be considered a vote “for” or “against”) and will be disregarded in determining the “votes cast” with respect to this Proposal. For The Glenmede Portfolios, abstentions and broker “non-votes” will have the effect of a “no” vote for purposes of obtaining the requisite approval of this Proposal. Cumulative voting in the election of Directors/Trustees is not permitted.

The Proposal applies on a Fund-wide basis, and all series (i.e., the respective Portfolios) will vote together on the Proposal. However, the vote on the Proposal or the election of a Nominee by the shareholders of one Fund will not affect the Proposal or the election of a Nominee with respect to the other Fund or Portfolios.

15

If at the time the Special Meeting is called to order a quorum is not present in person or by proxy, or if a quorum is present but sufficient votes in favor of the Proposal have not been received, the Special Meeting may be adjourned to a later date by the chair of the meeting, or by a vote of shareholders. In the event of a shareholder vote on adjournment, any such adjournment will require the affirmative vote of a majority of the shares of a Portfolio or a Portfolio present in person or by proxy at the session of the Special Meeting to be adjourned. The persons named as proxies will vote those proxies which they are entitled to vote in favor of the Proposal in favor of such an adjournment, and will vote those proxies required to be voted against the Proposal against any such adjournment. Abstentions effectively will be a vote “against” adjournment. Subject to the foregoing, the Special Meeting may be adjourned and re-adjourned without further notice to shareholders. However, if, after adjournment, a new record date is fixed for the adjourned meeting, the Secretary or an Assistant Secretary shall give notice of the adjourned meeting to Shareholders of record entitled to vote at such meeting.

If the Nominees are not elected, the Directors/Trustees, including Ms. Wirts and Mr. Phillips, who are currently members of the Boards, will continue to oversee their respective Portfolios.

The Boards’ Recommendation

EACH BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS OF THE PORTFOLIO(S)

UNDER ITS OVERSIGHT VOTE “FOR” THE PROPOSAL (ELECTION OF EACH NOMINEE)

OTHER BUSINESS

As of the date of this Joint Proxy Statement, the Directors/Trustees knew of no matter to be presented at the Special Meeting other than as set forth in this Joint Proxy Statement. If other business should properly come before the Special Meeting, proxies will be voted in accordance with the judgment of the persons named in the accompanying proxy.

ADDITIONAL INFORMATION

Shareholder Proposals

Each Board is not required and does not intend to hold a meeting of shareholders each year. Instead, meetings will be held only when and if required by law or as otherwise determined by the applicable Board. Any shareholder desiring to present a proposal for consideration at the next meeting of shareholders of his or her respective Portfolio(s) must submit the proposal in writing, so that it is received by the appropriate Portfolio(s) within a reasonable time before any meeting. The proposals should be sent to the Fund at its address stated on the first page of this Joint Proxy Statement.

Advisor and Sub-Advisor

Advisor

Glenmede Investment Management LP

One Liberty Place, 1650 Market Street, Suite 1200, Philadelphia, Pennsylvania 19103

16

Sub-Advisor (High Yield Municipal Portfolio only)

AllianceBernstein L.P.

501 Commerce Street, Nashville, TN 37203

Administrator, Custodian, Transfer Agent and Distributor

Distributor

Quasar Distributors, LLC

111 East Killbourn Avenue, Suite 2200, Milwaukee, WI 53202

Administrator, Custodian and Transfer Agent

State Steet Bank and Trust Company

One Congress Street – Suite 1, Boston, MA 02114, Attention: Fund Administration Legal Department.

17

APPENDIX A

OUTSTANDING SHARES OF EACH PORTFOLIO

Each Portfolio’s Shares outstanding as of the Record Date is set forth in the table below.

| | | | | | |

Fund | | Fund | | Shares Outstanding | |

THE GLENMEDE FUND, INC. | | Quantitative U.S. Large Cap Core Equity Portfolio | | | 36,505,066.579 | |

THE GLENMEDE FUND, INC. | | Quantitative U.S. Large Cap Growth Equity Portfolio | | | 71,641,503.310 | |

THE GLENMEDE FUND, INC. | | Quantitative U.S. Large Cap Value Equity Portfolio | | | 141,950.747 | |

THE GLENMEDE FUND, INC. | | Quantitative U.S. Small Cap Equity Portfolio | | | 126,286.611 | |

THE GLENMEDE FUND, INC. | | Quantitative International Equity Portfolio | | | 1,646,246.955 | |

THE GLENMEDE FUND, INC. | | Responsible ESG U.S. Equity Portfolio | | | 1,473,763.993 | |

THE GLENMEDE FUND, INC. | | Women in Leadership U.S. Equity Portfolio | | | 1,465,651.605 | |

THE GLENMEDE FUND, INC. | | Quantitative U.S. Long/Short Equity Portfolio | | | 3,545,679.598 | |

THE GLENMEDE FUND, INC. | | Quantitative U.S. Total Market Equity Portfolio | | | 2,131,134.448 | |

THE GLENMEDE FUND, INC. | | Strategic Equity Portfolio | | | 6,055,771.488 | |

THE GLENMEDE FUND, INC. | | Equity Income Portfolio | | | 1,354,771.021 | |

THE GLENMEDE FUND, INC. | | Small Cap Equity Portfolio | | | 32,489,465.327 | |

THE GLENMEDE FUND, INC. | | Secured Options Portfolio | | | 39,249,750.850 | |

THE GLENMEDE FUND, INC. | | Global Secured Options Portfolio | | | 4,610,830.328 | |

THE GLENMEDE FUND, INC. | | Core Fixed Income Portfolio | | | 36,595,277.072 | |

THE GLENMEDE FUND, INC. | | Short Term Tax Aware Fixed Income Portfolio | | | 4,088,652.824 | |

THE GLENMEDE FUND, INC. | | High Yield Municipal Portfolio | | | 19,359,400.160 | |

THE GLENMEDE PORTFOLIOS | | Muni Intermediate Portfolio | | | 33,045,354.744 | |

A-1

APPENDIX B

BENEFICIAL OWNERS OF MORE THAN 5% OF A CLASS OF EACH PORTFOLIO

As of the Record Date (or as otherwise indicated), the following persons or entities owned beneficially or of record more than 5% of the outstanding shares of any class, as applicable, of each Portfolio.

| | | | | | |

Fund and Class | | Shareholder | | Percentage of

Class Owned | |

Quantitative U.S. Large Cap Core Equity Portfolio – Advisor Shares (GTLOX) | | NSCC PLATFORM CHARLES SCHWAB PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 14.16 | % |

| | |

| | NSCC PLATFORM NATIONAL FINANCIAL PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 21.41 | % |

| | |

Quantitative U.S. Large Cap Core Equity Portfolio – Institutional Shares (GTLIX) | | NSCC PLATFORM MATRIX CAPITAL BANK PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 14.91 | % |

| | |

| | NSCC PLATFORM CHARLES SCHWAB PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 7.13 | % |

| | |

| | NSCC PLATFORM NATIONAL FINANCIAL PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 38.59 | % |

| | |

| | NSCC PLATFORM MERRILL LYNCH PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 11.38 | % |

| | |

| | VANGUARD 401K MUTUAL FDS PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 12.04 | % |

| | |

Quantitative U.S. Large Cap Growth Equity Portfolio – Advisor Shares (GTLLX) | | NSCC PLATFORM CHARLES SCHWAB PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 48.24 | % |

| | |

| | NSCC PLATFORM NATIONAL FINANCIAL PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 21.46 | % |

| | |

Quantitative U.S. Large Cap Growth Equity Portfolio – Institutional Shares (GTILX) | | NSCC PLATFORM CHARLES SCHWAB PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 80.60 | % |

| | |

| | NSCC PLATFORM NATIONAL FINANCIAL PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 7.89 | % |

B-1

| | | | | | |

Fund and Class | | Shareholder | | Percentage of

Class Owned | |

Quantitative U.S. Large Cap Value Equity Portfolio (GQLVX) | | THE GLENMEDE CORP 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 97.37 | % |

| | |

Quantitative U.S. Small Cap Equity Portfolio (GQSCX) | | THE GLENMEDE CORP 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 98.45 | % |

| | |

Quantitative International Equity Portfolio (GTCIX) | | THE GLENMEDE CORP 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 12.83 | % |

| | |

| | MONTGOMERY COUNTY SPCA 19 EAST RIDGE PIKE PO BOX 222 CONSHOHOCKEN, PA 19428 | | | 15.82 | % |

| | |

Responsible ESG U.S. Equity Portfolio (RESGX) | | THE GLENMEDE CORP 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 8.62 | % |

| | |

| | KIND 714 NORTH BETHLEHEM PIKE, SUITE 304 LOWER GWYNEDD, PA 19002 | | | 9.56 | % |

| | |

Women in Leadership U.S. Equity Portfolio (GWILX) | | NSCC PLATFORM CHARLES SCHWAB PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 7.58 | % |

| | |

| | THE GLENMEDE CORP 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 9.15 | % |

| | |

| | KIND 714 NORTH BETHLEHEM PIKE, SUITE 304 LOWER GWYNEDD, PA 19002 | | | 10.80 | % |

| | |

| | THE PUTNEY SCHOOL INC. ELM LEA FARM 418 HOUGHTON BROOK ROAD PUTNEY, VT 05346 | | | 7.51 | % |

| | |

| | NORD PO BOX 546 OBERLIN, OH 44074 | | | 6.71 | % |

| | |

| | NATIONAL COUNCIL OF JEWISH WOMEN INC. 2055 L STREET NW SUITE 650 WASHINGTON, DC 20036 | | | 5.52 | % |

B-2

| | | | | | |

Fund and Class | | Shareholder | | Percentage of

Class Owned | |

Quantitative U.S. Long/Short Equity Portfolio – Institutional Shares (GTLSX) | | NSCC PLATFORM MATRIX CAPITAL BANK PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 6.06% | |

| | |

| | NSCC PLATFORM NATIONAL FINANCIAL PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 17.73% | |

| | |

| | NSCC PLATFORM TDAMERITRADE PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 16.50% | |

| | |

| | NSCC PLATFORM PERSHING PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 58.55% | |

| | |

Quantitative U.S. Total Market Equity Portfolio (GTTMX) | | NSCC PLATFORM CHARLES SCHWAB PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 38.90% | |

| | |

| | NSCC PLATFORM NATIONAL FINANCIAL PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 31.07% | |

| | |

Equity Income Portfolio (GEQIX) | | THE GLENMEDE CORP 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 8.67% | |

| | |

Small Cap Equity Portfolio – Advisor Shares (GTCSX) | | NSCC PLATFORM CHARLES SCHWAB PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 24.80% | |

| | |

| | NSCC PLATFORM NATIONAL FINANCIAL PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 22.90% | |

| | |

| | NSCC PLATFORM MERRILL LYNCH PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 6.32% | |

| | |

Small Cap Equity Portfolio – Institutional Shares (GTSCX) | | NSCC PLATFORM NATIONAL FINANCIAL PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 33.63% | |

| | |

| | NSCC PLATFORM MERRILL LYNCH PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 56.37% | |

| | |

Secured Options Portfolio – Advisor Shares (GTSOX) | | NSCC PLATFORM CHARLES SCHWAB PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 22.61% | |

| | |

| | NSCC PLATFORM NATIONAL FINANCIAL PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 28.82% | |

| | |

| | RAYMOND JOHN WEAN FOUNDATION 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 5.94% | |

B-3

| | | | | | |

Fund and Class | | Shareholder | | Percentage of

Class Owned | |

Secured Options Portfolio – Institutional Shares (GLSOX) | | NSCC PLATFORM CHARLES SCHWAB PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 5.78% | |

| | |

| | NSCC PLATFORM NATIONAL FINANCIAL PRI 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 65.35% | |

| | |

| | NEVADA ST HIGHER ED 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 16.89% | |

| | |

| | NSCC PLATFORM FIRST CLEARING LLC 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 10.11% | |

| | |

Global Secured Options Portfolio (NOVIX) | | NSCC PLATFORM FIRST CLEARING LLC 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 93.72% | |

| | |

| | THE GLENMEDE CORP 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 6.01% | |

| | |

Short Term Tax Aware Fixed Income Portfolio (GTAWX) | | THE GLENMEDE CORP 1650 MARKET STREET, SUITE 1200 PHILADELPHIA, PA 19103 | | | 15.56% | |

| | |

| | MICHAEL G. RHODES 913 EDGEHILL ROAD WILMINGTON, DE 19807 | | | 5.06% | |

B-4

GLENMEDE FORM OF PROXY CARD MEETING AGENDA on reverse side VOTER PROFILE: Voter ID: XXXXXXXX Security ID: XXXXXXXXX Shares to Vote: **confidential** Household ID: 000000000 **please call the phone number to the right for more information VOTE REGISTERED TO: YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN. PLEASE CAST YOUR PROXY VOTE TODAY! VOTER CONTROL NUMBER: XXXX XXXX XXXX Vote by Internet: Go to the website below and enter your control number or simply use your camera on your smart phone to scan this QR code. https://vote.proxyonline.com Vote by Phone: Call (888) 227-9349 for automated touch-tone service or the number below to speak with a representative. (800) 330-4627 Toll Free Vote by Mail: Complete the reverse side of this proxy card and return it in the envelope provided. USPS Postage-Paid Envelope PORTFOLIO NAME MERGED HERE PROXY FOR A SPECIAL JOINT MEETING OF SHAREHOLDERS TO BE HELD ON NOVEMBER 17, 2023 The undersigned hereby revokes all previous proxies for his/her shares of the above listed fund (the “Fund”) and appoints Thomas Melcher, Adam Conish, and each of them, proxies of the undersigned with full power of substitution to vote all shares of the Fund that the undersigned is entitled to vote at the Fund’s Joint Special Meeting of Shareholders (“Meeting”) to be at the offices of Glenmede Investment Management L.P., One Liberty Place, 1650 Market Street, Suite 1200, Philadelphia, Pennsylvania 19103 and online via live webcast at 11:30 a.m., Eastern time on November 17, 2023, including any postponements or adjournments thereof, upon the matter set forth on the reverse side and instructs them to vote upon any other matters that may properly be acted upon at the Meeting. If you owned shares as of the Record Date and wish to participate in the Meeting, please email EQ Fund Solutions, LLC at attendameeting@equiniti.com in order to register to attend the Meeting, obtain the credentials to access the Meeting, and verify that you were a shareholder on the Record Date. Please include your 12-digit voter control number found above and full name and insert “Glenmede Funds” in the Subject Line. Requests for registration must be received by 3:00 p.m., Eastern time on November 16, 2023. Do you have questions? If you have any questions about how to vote your proxy or about the Meeting in general, please call toll-free (800) 330-4627. Representatives are available to assist you Monday through Friday, from 9 a.m. to 10 p.m., Eastern time. IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON NOVEMBER 17, 2023. The proxy statement and the accompanying Notice of Special Meeting of Shareholders are available at: https://vote.proxyonline.com/Glenmede/docs/SpecialMeeting2023.pdf SHAREHOLDER PRIVACY: To ensure your privacy there is no personal information required to view or request proxy materials and/or vote. The control number listed above is a unique identifier created for this proxy and this proxy only. It is not linked to your account number nor can it be used in any other manner other than this proxy.

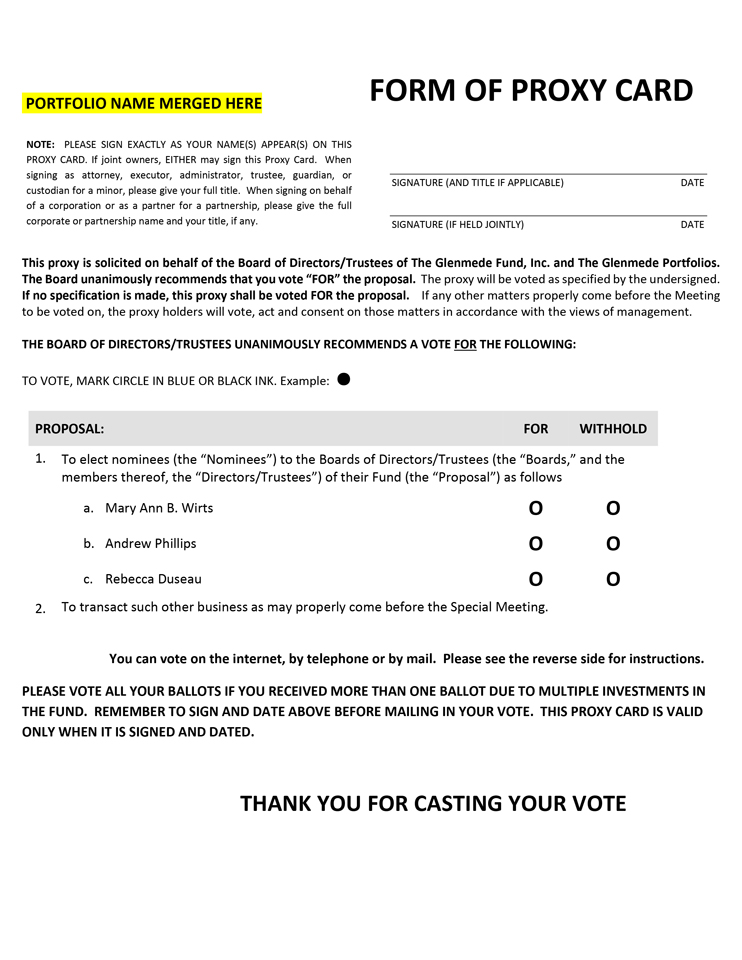

FORM OF PROXY CARD PORTFOLIO NAME MERGED HERE NOTE: PLEASE SIGN EXACTLY AS YOUR NAME(S) APPEAR(S) ON THIS PROXY CARD. If joint owners, EITHER may sign this Proxy Card. When signing as attorney, executor, administrator, trustee, guardian, or custodian for a minor, please give your full title. When signing on behalf of a corporation or as a partner for a partnership, please give the full corporate or partnership name and your title, if any. SIGNATURE (AND TITLE IF APPLICABLE) DATE SIGNATURE (IF HELD JOINTLY) DATE This proxy is solicited on behalf of the Board of Directors/Trustees of The Glenmede Fund, Inc. and The Glenmede Portfolios. The Board unanimously recommends that you vote “FOR” the proposal. The proxy will be voted as specified by the undersigned. If no specification is made, this proxy shall be voted FOR the proposal. If any other matters properly come before the Meeting to be voted on, the proxy holders will vote, act and consent on those matters in accordance with the views of management. THE BOARD OF DIRECTORS/TRUSTEES UNANIMOUSLY RECOMMENDS A VOTE FOR THE FOLLOWING: TO VOTE, MARK CIRCLE IN BLUE OR BLACK INK. Example: • PROPOSAL: FOR WITHHOLD 1. To elect nominees (the “Nominees”) to the Boards of Directors/Trustees (the “Boards,” and the members thereof, the “Directors/Trustees”) of their Fund (the “Proposal”) as follows a. Mary Ann B. Wirts O O b. Andrew Phillips O O c. Rebecca Duseau O O 2. To transact such other business as may properly come before the Special Meeting. You can vote on the internet, by telephone or by mail. Please see the reverse side for instructions. PLEASE VOTE ALL YOUR BALLOTS IF YOU RECEIVED MORE THAN ONE BALLOT DUE TO MULTIPLE INVESTMENTS IN THE FUND. REMEMBER TO SIGN AND DATE ABOVE BEFORE MAILING IN YOUR VOTE. THIS PROXY CARD IS VALID ONLY WHEN IT IS SIGNED AND DATED. THANK YOU FOR CASTING YOUR VOTE