QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

AMERICAN POWER CONVERSION CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

AMERICAN POWER CONVERSION CORPORATION

132 Fairgrounds Road

West Kingston, Rhode Island 02892

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To the Shareholders:

The Annual Meeting of Shareholders of American Power Conversion Corporation, a Massachusetts corporation (the "Company"), will be held on Thursday, June 19, 2003 at 10:00 a.m., local time, in The Regency Room at the Radisson Hotel Milford, located at 11 Beaver Street, Milford, Massachusetts, for the following purposes:

- 1.

- To fix the number of directors at seven.

- 2.

- To elect a Board of Directors for the ensuing year.

- 3.

- To consider and act upon a shareholder proposal regarding the composition of the Company's Board of Directors, which proposal is OPPOSED by the Company's Board of Directors.

- 4.

- To transact such other business as may properly come before the meeting and any adjournments thereof.

Shareholders of record at the close of business on April 24, 2003 will be entitled to vote at the meeting or any adjournments thereof.

IF YOU PLAN TO ATTEND:

Please be aware that seating may be limited. Registration and seating will begin at 9:00 a.m. Please bring valid picture identification, such as a driver's license or passport. You may be required to provide this upon entry to the meeting. Shareholders holding stock in brokerage accounts ("street name" holders) will also need to bring a copy of a brokerage statement reflecting stock ownership as of the record date. Cameras, cell phones, recording devices and other electronic devices will not be permitted at the meeting.

| | | By Order of the Board of Directors, |

|

|

Jeffrey J. Giguere

Vice President, General Counsel & Clerk |

April 29, 2003

SHAREHOLDERS ARE REQUESTED TO EITHER SIGN THE ENCLOSED PROXY CARD AND

RETURN IT IN THE ENCLOSED STAMPED ENVELOPE BY RETURN MAIL OR, WHERE

AVAILABLE, VOTE BY TELEPHONE OR OVER THE INTERNET

AMERICAN POWER CONVERSION CORPORATION

132 Fairgrounds Road

West Kingston, Rhode Island 02892

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS

To Be Held on June 19, 2003

Proxies in the form enclosed with this proxy statement are solicited by the Board of Directors of American Power Conversion Corporation, a Massachusetts corporation (the "Company"), for use at the Annual Meeting of Shareholders to be held on Thursday, June 19, 2003 at 10:00 a.m., local time, in The Regency Room at the Radisson Hotel Milford, located at 11 Beaver Street, Milford, Massachusetts (the "Meeting").

Only shareholders of record as of the close of business on April 24, 2003 will be entitled to vote at the Meeting and any adjournments thereof. As of that date, 196,489,387 shares of Common Stock, par value $.01 per share, of the Company were issued and outstanding. Each share of Common Stock outstanding as of the record date will be entitled to one vote, and shareholders may vote in person or by proxy. Execution of a proxy will not in any way affect a shareholder's right to attend the Meeting and vote in person. Any shareholder giving a proxy has the right to revoke it by delivering written notice to the Clerk of the Company at any time before it is exercised or by delivering a later executed proxy to the Clerk of the Company at any time before the original proxy is exercised.

Each of the persons named as proxies in the proxy is a director and officer of the Company. All properly executed proxies returned in time to be cast at the Meeting will be voted. With respect to the election of a Board of Directors, any shareholder submitting a proxy has the right to withhold authority to vote for any individual nominee to the Board of Directors by writing the name of such individual or group of individuals in the space provided on the proxy. In addition to the election of directors, the shareholders will consider and vote upon proposals to: (i) fix the number of directors at seven; and (ii) to consider and act upon one shareholder proposal. Where a choice has been specified on the enclosed proxy with respect to the foregoing matters, the shares represented by the proxy will be voted in accordance with the shareholders' specifications contained therein. In the absence of specifications, the shares represented by the enclosed proxy will be voted FOR fixing the number of directors at seven; FOR the seven nominees for director named in this proxy statement; AGAINST the shareholder proposal set forth in this proxy statement if the shareholder proposal is properly presented by the proponent's qualified representative for action at the Meeting; and according to the discretion of the proxies on any other matters to properly come before the Meeting.

The representation in person or by proxy of at least a majority of the outstanding shares of Common Stock entitled to vote at the Meeting is necessary to establish a quorum for the transaction of business. Votes withheld from any nominee, abstentions and broker non-votes are counted as present or represented for purposes of determining the presence or absence of a quorum at the Meeting. A "non-vote" occurs when a broker holding shares for a beneficial owner votes on one proposal, but does not vote on another proposal because, with respect to such other proposal, the broker does not have discretionary voting power and has not received instructions from the beneficial owner. Directors are elected by a plurality of the votes cast by shareholders entitled to vote at the Meeting. All other matters being submitted to shareholders require the affirmative vote of a majority of the shares of Common Stock of the Company present in person or represented by proxy and entitled to vote at the Meeting. An automated system administered by the Company's transfer agent tabulates the votes. The vote on each matter submitted to shareholders is tabulated separately. Abstentions are included in the number of shares present or represented and voting on each matter. Broker "non-vote" shares are not so included.

The Board of Directors knows of no other matter to be presented at the Meeting. If any other matter should be presented at the Meeting upon which a vote may be properly taken, shares represented by all proxies received by the Board of Directors will be voted with respect thereto in accordance with the judgment of the persons named as attorneys in the proxies.

An Annual Report to Shareholders, containing financial statements for the fiscal year ended December 31, 2002, is being distributed together with this proxy statement to all shareholders entitled to vote. This proxy statement and the accompanying proxy are intended to be distributed to shareholders on or about May 8, 2003.

MANAGEMENT AND PRINCIPAL HOLDERS OF VOTING SECURITIES

Unless otherwise noted, the following table sets forth as of March 17, 2003, certain information regarding beneficial ownership of the Company's Common Stock (i) by each person who, to the knowledge of the Company, beneficially owned more than 5% of the outstanding shares of Common Stock of the Company outstanding at such date, (ii) by each director or nominee for director of the Company, (iii) by each executive officer named in the Summary Compensation Table in this proxy statement, and (iv) by all directors, nominees for director and executive officers of the Company as a group.

Name

| | Amount and Nature

of Beneficial Ownership(1)

| | Percentage of Common

Stock Outstanding(2)

|

|---|

|

|---|

|

|

|

|

|

Rodger B. Dowdell, Jr.

132 Fairgrounds Road

West Kingston, RI 02892 | | 16,693,953(3) | | 8.4% |

Neil E. Rasmussen |

|

9,735,742(4) |

|

4.9% |

Emanuel E. Landsman |

|

2,318,869(5) |

|

1.2% |

James D. Gerson |

|

589,476(6) |

|

* |

Ervin F. Lyon |

|

808,480(7) |

|

* |

John G. Kassakian |

|

2,500 |

|

* |

John F. Keane, Sr. |

|

— |

|

* |

Edward W. Machala |

|

513,057(8) |

|

* |

Donald M. Muir |

|

251,596(9) |

|

* |

Aaron L. Davis |

|

441,871(10) |

|

* |

All directors and executive officers as a group

(11 persons) |

|

31,474,999(11) |

|

15.8% |

|

- *

- Less than 1.0%

- (1)

- Unless otherwise indicated, the named person possesses sole voting and investment power with respect to the shares listed.

- (2)

- The number of shares of Common Stock deemed outstanding on March 17, 2003 includes (i) 196,465,711 shares outstanding on such date and (ii) all options that are currently exercisable or will become exercisable within 60 days thereafter by the persons or group in question.

- (3)

- Includes 1,034,800 shares of Common Stock issuable to Mr. Dowdell pursuant to options which may be exercised within the next 60 days; 753,014 shares of Common Stock currently allocated to Mr. Dowdell under the Company's Employee Stock Ownership Plan (the "ESOP"); and 2,115 shares held by Mr. Dowdell under the Company's 401(k) Plan.

2

- (4)

- Includes 391,000 shares of Common Stock issuable to Mr. Rasmussen pursuant to options which may be exercised within the next 60 days; 609,786 shares of Common Stock allocated to Mr. Rasmussen under the Company's ESOP; and 212 shares held by Mr. Rasmussen under the Company's 401(k) Plan. Does not include 88,820 shares held by the Neil and Anna Rasmussen Foundation, a charitable trust. Mr. Rasmussen disclaims beneficial ownership of the shares held by such trust.

- (5)

- Includes 70,900 shares of Common Stock issuable to Dr. Landsman pursuant to options which may be exercised within the next 60 days; 254,393 shares of Common Stock allocated to Dr. Landsman under the Company's ESOP; and 1,670 shares held by Dr. Landsman under the Company's 401(k) Plan. Does not include 130,000 shares held by the Landsman Charitable Trust. Dr. Landsman disclaims beneficial ownership of the shares held by such trust.

- (6)

- Includes 62,500 shares of Common Stock issuable to Mr. Gerson pursuant to options which may be exercised within the next 60 days. Does not include 8,000 shares held by Mr. Gerson's wife for the benefit of his children. Mr. Gerson disclaims beneficial ownership of the shares held by his wife for the benefit of his children.

- (7)

- Includes 62,500 shares of Common Stock issuable to Dr. Lyon pursuant to options which may be exercised within the next 60 days. Does not include 99,484 shares held by a trust for the benefit of Dr. Lyon's daughter. Dr. Lyon disclaims beneficial ownership of the shares held by such trust.

- (8)

- Includes 418,271 shares of Common Stock issuable to Mr. Machala pursuant to options which may be exercised within the next 60 days; 94,174 shares of Common Stock allocated to Mr. Machala under the Company's ESOP; and 212 shares held by Mr. Machala under the Company's 401(k) Plan.

- (9)

- Includes 245,542 shares of Common Stock issuable to Mr. Muir pursuant to options which may be exercised within the next 60 days; 3,121 shares of Common Stock allocated to Mr. Muir under the Company's ESOP; and 2,933 shares held by Mr. Muir under the Company's 401(k) Plan.

- (10)

- Includes 370,020 shares of Common Stock issuable to Mr. Davis pursuant to options which may be exercised within the next 60 days; 31,508 shares allocated to Mr. Davis under the Company's ESOP; and 5,563 shares held by Mr. Davis under the Company's 401(k) Plan.

- (11)

- Includes 2,803,583 shares issuable to the directors and executive officers of the Company pursuant to options which may be exercised within the next 60 days; 1,755,157 shares allocated to the accounts of the executive officers of the Company under the Company's ESOP; and 14,947 shares held by the accounts of the executive officers of the Company under the Company's 401(k) Plan. Also see footnotes (3) through (10).

3

ITEMS NOs. 1 & 2: NUMBER AND ELECTION OF DIRECTORS

At the Meeting, the shareholders will vote on fixing the number of directors at seven and electing the entire Board of Directors. The directors of the Company are elected annually and hold office until the next annual meeting of shareholders and until their successors shall have been chosen and qualified.

Shares represented by all proxies received by the Board of Directors and not so marked as to oppose or abstain from voting on fixing the number of directors will be voted for fixing the number of directors for the ensuing year at seven.

Shares represented by all proxies received by the Board of Directors and not so marked as to withhold authority to vote for any individual director or for all directors will be voted (unless one or more nominees is unable or unwilling to serve) for the election of the nominees named in the table below. The Board of Directors knows of no reason why any such nominee should be unable or unwilling to serve, but if such should be the case, proxies will be voted for the election of some other person or for fixing the number of directors at a lesser number. All of the nominees are currently directors of the Company and were elected at the Annual Meeting of Shareholders held in June 2002. The following table sets forth the year each nominee first became a director of the Company, each nominee's age, and the positions each nominee currently holds with the Company.

Nominee

| | Director Since

| | Age

| | Position(s) Held with Company

|

|---|

|

|---|

|

|

|

|

|

|

|

| Rodger B. Dowdell, Jr. | | 1985 | | 53 | | Chairman of the Board of Directors, President and Chief Executive Officer |

Emanuel E. Landsman |

|

1981 |

|

66 |

|

Director and Vice President |

Neil E. Rasmussen |

|

1981 |

|

48 |

|

Director, Senior Vice President and Chief Technical Officer |

Ervin F. Lyon(1)(2)(3) |

|

1981 |

|

67 |

|

Director |

James D. Gerson(1)(2)(3) |

|

1988 |

|

59 |

|

Director |

John G. Kassakian(1)(3) |

|

2001 |

|

60 |

|

Director |

John F. Keane, Sr.(2)(3) |

|

2001 |

|

71 |

|

Director |

|

- (1)

- Member, Compensation and Stock Option Committee

- (2)

- Member, Audit Committee

- (3)

- Member, Corporate Governance and Nominating Committee

The By-laws of the Company provide that each director is elected to hold office until the next annual meeting of shareholders, and until his successor is chosen and qualified. The officers of the Company are elected annually at the first meeting of the Board of Directors following the annual meeting of shareholders and hold office until their respective successors are chosen and qualified.

4

Rodger B. Dowdell, Jr. has been President and a Director since August 1985 and Chairman of the Board of Directors since June 1988. From January to August 1985, Mr. Dowdell worked for the Company as a consultant, developing a marketing and production strategy for uninterruptible power supply products. From 1978 to December 1984, he was President of Independent Energy, Inc., a manufacturer of electronic temperature controls.

Emanuel E. Landsman has been Vice President and a Director of the Company since its inception. Dr. Landsman was Clerk of the Company from inception until June 2001. From 1966 to 1981, Dr. Landsman worked at the Massachusetts Institute of Technology's ("MIT") Lincoln Laboratory, where he was in the Space Communications Group from 1966 to 1977 and the Energy Systems Engineering Group from 1977 to 1981.

Neil E. Rasmussen has been a Director of the Company since its inception and Chief Technical Officer of the Company since May 1998. Mr. Rasmussen was Vice President of the Company from its inception until June 2001, at which time he became Senior Vice President. From 1979 to 1981, Mr. Rasmussen worked in the Energy Systems Engineering Group at MIT's Lincoln Laboratory.

Ervin F. Lyon has been a Director of the Company since its inception. From September 1986 to March 1993, Dr. Lyon worked for MIT's Lincoln Laboratory, from which he retired in March 1993. From the inception of the Company through August 1985, Dr. Lyon was President of the Company and from inception of the Company through June 1988, Dr. Lyon was Chairman of the Board of Directors of the Company. From 1977 to 1981, Dr. Lyon was a member of the technical staff at MIT's Lincoln Laboratory.

James D. Gerson has been a Director of the Company since August 1988. Mr. Gerson has been a private investor since April 2003 and previously was a Vice President of Fahnestock & Co. for more than five years. Mr. Gerson is also a member of the Board of Directors of Ag Services of America, Inc., Fuel Cell Energy, Inc., and Evercel, Inc.

John G. Kassakian has been a Director of the Company since June 2001. Dr. Kassakian has been Professor of Electrical Engineering at MIT since 1973 and is Director of the MIT Laboratory for Electromagnetic and Electronic Systems. Dr. Kassakian is also a member of the Board of Directors of Ault, Inc.

John F. Keane, Sr. has been a Director of the Company since June 2001. Mr. Keane is Chairman of Keane, Inc., a software application development, outsourcing and integration services firm, which he founded in 1965. Mr. Keane previously served as President and Chief Executive Officer of Keane, Inc. Mr. Keane is also a member of the Board of Directors of Firstwave Technologies, Inc.

There are no family relationships between directors and executive officers of the Company, except that Mr. Dowdell is the uncle of Aaron L. Davis, Vice President, Marketing and Communications.

THE BOARD OF DIRECTORS BELIEVES THAT FIXING THE NUMBER OF DIRECTORS AT SEVEN AND ELECTING ALL OF THE NOMINEES AS DIRECTORS IS IN THE BEST INTEREST OF THE COMPANY AND ITS SHAREHOLDERS AND RECOMMENDS A VOTEFOR THESE PROPOSALS.

Meetings of the Board of Directors and Committees

The Board of Directors of the Company met six times and took action by unanimous written consent two times during the fiscal year ended December 31, 2002. The Board of Directors of the Company consists of seven Directors. In accordance with Board policy (the "Independence Policy"), the Board of Directors will nominate candidates for the Board so that, if elected, a majority of directors will be "independent directors" and, if sufficient directors are elected, the Board will only appoint "independent directors" to serve on the committees of the Board. For purposes of the Independence Policy, "independent director" means a director who (i) has not within the prior five years been an employee of the Company or of any of its affiliates, (ii) has not accepted from the Company or any of its affiliates more than $60,000 during the previous fiscal year, other than compensation for board service, benefits under a tax-qualified retirement plan, or non-discretionary compensation, (iii) is not an

5

immediate family member of an individual who is or was an executive officer of the Company or of any of its affiliates within the last five years (with "immediate family member" meaning a person's spouse, parents, children, siblings, mother-in-law, father-in-law, brother-in-law, sister-in-law, and anyone who resides in such person's home), (iv) is not a partner, controlling shareholder or executive officer of any for-profit business organization to which the Company made, or from which the Company received, payments within the last five years (other than those arising solely from investments in the Company's securities) that exceed 5% of the Company's or business organization's consolidated gross revenues for that year, or $200,000, whichever is more, or (v) is not employed as an executive of another entity if any of the Company's executives serve on that entity's compensation committee. The definition of "independent director" contained in the Independence Policy is more stringent than the definition of "independent director" contained in Rule 4200 of the Marketplace Rules of the National Association of Securities Dealers, Inc. (the "Marketplace Rules") in that the time horizon for disqualifying independence events in the Independence Policy has been increased from the three years contained in the Marketplace Rules to five years. Four of the seven Directors of the Company are "independent directors" in accordance with the Independence Policy and the Marketplace Rules.

The Company's Compensation and Stock Option Committee met eight times during the fiscal year ended December 31, 2002. The Compensation and Stock Option Committee is comprised of Drs. Kassakian and Lyon and Mr. Gerson. The Compensation and Stock Option Committee makes recommendations to the Board of Directors regarding compensation and benefits for employees, consultants and directors of the Company, determines the compensation of executive officers and is responsible for the administration of the Company's 1987 Stock Option Plan, 1993 Non-Employee Director Stock Option Plan, Amended and Restated 1997 Stock Option Plan ("1997 Stock Option Plan"), 1997 Non-Employee Director Stock Option Plan and 1997 Employee Stock Purchase Plan. Each of the members of the Committee is an "independent director" as defined in the Independence Policy and the Marketplace Rules.

The Company's Audit Committee met seven times during the fiscal year ended December 31, 2002. The Audit Committee is comprised of Messrs. Gerson and Keane and Dr. Lyon. The Audit Committee oversees the accounting, tax and financial functions of the Company, including matters relating to the appointment and activities of the Company's auditors. The Audit Committee operates under a written charter adopted by the Board. Each of the members of the Audit Committee is an "independent director" as defined in the Independence Policy and the Marketplace Rules.

In June 2002, the Board of Directors of the Company formed a Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee met one time during the fiscal year ended December 31, 2002. The Committee is comprised of Messrs. Keane and Gerson and Drs. Kassakian and Lyon. The Corporate Governance and Nominating Committee is responsible for developing and implementing policies related to corporate governance matters and also makes recommendations to the Board of Directors regarding candidates for membership on the Board. The Committee considers nominees proposed by shareholders. Any shareholder wishing to propose a nominee should submit a written recommendation in writing to the Company's General Counsel, indicating the nominee's qualifications and other relevant biographical information and providing confirmation of the nominee's consent to serve as a director. Each of the members of the Committee is an "independent director" as defined in the Independence Policy and the Marketplace Rules.

6

During the fiscal year ended December 31, 2002, each director attended or participated in at least 75% of (i) the total number of meetings of the Board of Directors, and (ii) the total number of meetings held by all committees of the Board on which such director served, except for Dr. Lyon who attended five of seven (or 71%) of the meetings of the Audit Committee. Overall attendance at meetings of the Board of Directors and its committees was in excess of 92%.

Compensation of Directors

As compensation for serving on the Board of Directors, each non-employee director receives (i) $20,000 per year, (ii) $1,500 for attendance at a meeting of the Board of Directors, and (iii) $1,500 for attendance at a meeting of a Committee of the Board of Directors held on a day on which no meeting of the Board of Directors is held. Non-employee directors are also reimbursed for reasonable expenses incurred in connection with attending meetings.

EXECUTIVE COMPENSATION

The following table sets forth the annual and long-term compensation for services in all capacities to the Company for the fiscal years ended December 31, 2002, 2001 and 2000, of those persons who were at December 31, 2002 (i) the chief executive officer and (ii) the four other most highly compensated executive officers of the Company (collectively, the "Named Officers").

Summary Compensation Table

| | Annual Compensation

| | Long-Term

Compensation(1)

| |

|

|---|

Name and Principal Position

| | Year

| | Salary

| | Bonus(2)

| | Securities

Underlying

Options(#)

| | All Other

Compensation

|

|---|

|

|

|

|

|

|

|

|

|

|

|

Rodger B. Dowdell, Jr.

Chairman of the Board of Directors,

President & Chief Executive

Officer | | 2002

2001

2000 | | $650,384

535,000

535,000 | | $318,038

—

— | | —

—

588,000 | | $17,353(3)

16,163(3)

15,613(3) |

Neil E. Rasmussen

Senior Vice President, Chief Technical

Officer & Director |

|

2002

2001

2000 |

|

313,076

282,635

320,000 |

|

153,094

—

— |

|

—

—

200,000 |

|

6,500(4)

6,370(4)

5,970(4) |

Edward W. Machala

Senior Vice President, Operations &

Chief Operations Officer |

|

2002

2001

2000 |

|

401,730

320,000

320,000 |

|

196,446

—

— |

|

152,000

—

250,000 |

|

6,219(5)

6,129(5)

5,739(5) |

Donald M. Muir

Senior Vice President, Finance &

Administration, Treasurer & Chief

Financial Officer |

|

2002

2001

2000 |

|

298,423

259,000

259,000 |

|

145,928

—

— |

|

112,000

—

180,000 |

|

11,683(6)

10,949(6)

10,764(6) |

Aaron L. Davis

Vice President, Marketing &

Communications |

|

2002

2001

2000 |

|

263,269

220,000

220,000 |

|

128,739

—

— |

|

100,000

—

120,000 |

|

9,971(7)

9,601(7)

9,111(7) |

|

- (1)

- Represents the number of stock options granted during the fiscal years ended December 31, 2002, 2001 or 2000. The Company did not grant any restricted stock awards or stock appreciation rights ("SARs") or make any long term incentive plan payouts during the fiscal years ended December 31, 2002, 2001 or 2000.

7

- (2)

- Includes bonus payments earned by the Named Officers in the years indicated, for services rendered in such years, which were paid in subsequent years.

- (3)

- Includes $8,853, $8,363 and $7,963, respectively, in premiums on term life and disability insurance policies for Mr. Dowdell's benefit for fiscal years ended December 31, 2002, 2001 and 2000; and $8,500, $7,800 and $7,650, respectively, contributed to Mr. Dowdell's account by the Company pursuant to the Company's 401(k) Plan for fiscal years ended December 31, 2002, 2001 and 2000.

- (4)

- Includes $6,500, $6,220 and $5,970, respectively, in premiums on term life and disability insurance policies for Mr. Rasmussen's benefit for fiscal years ended December 31, 2002, 2001 and 2000; and $150 contributed to Mr. Rasmussen's account by the Company pursuant to the Company's 401(k) Plan for the fiscal year ended December 31, 2001.

- (5)

- Includes $6,219, $5,979 and $5,739, respectively, in premiums on term life and disability insurance policies for Mr. Machala's benefit for fiscal years ended December 31, 2002, 2001 and 2000; and $150 contributed to Mr. Machala's account by the Company pursuant to the Company's 401(k) Plan for the fiscal year ended December 31, 2001.

- (6)

- Includes $3,183, $3,149 and $3,114, respectively, in premiums on term life and disability insurance policies for Mr. Muir's benefit for fiscal years ended December 31, 2002, 2001 and 2000; and $8,500, $7,800 and $7,650, respectively, contributed to Mr. Muir's account by the Company pursuant to the Company's 401(k) Plan for fiscal years ended December 31, 2002, 2001 and 2000.

- (7)

- Includes $1,471, $1,801 and, $1,461, respectively, in premiums on term life and disability insurance policies for Mr. Davis' benefit for fiscal years ended December 31, 2002, 2001 and 2000; and $8,500, $7,800 and $7,650, respectively, contributed to Mr. Davis' account by the Company pursuant to the Company's 401(k) Plan for fiscal years ended December 31, 2002, 2001 and 2000.

8

Option Grants in the Last Fiscal Year

The following table sets forth grants of stock options pursuant to the Company's 1997 Stock Option Plan granted during the fiscal year ended December 31, 2002 to the Named Officers. The Company did not grant any stock appreciation rights to the Named Officers during the fiscal year ended December 31, 2002.

| | Individual Grants(1)

| | Potential Realizable Value at Assumed

Annual Rate of Stock Price Appreciation

for Option Term (2)

|

|---|

Name

| | Number of

Securities

Underlying

Options Granted

| | Percent of Total

Options Granted to Employees in Fiscal Year

| | Exercise Price

Per Share

| | Expiration

Date(3)

| | 5%

| | 10%

|

|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Rodger B. Dowdell, Jr. | | — | | — | | — | | — | | — | | — |

Neil E. Rasmussen |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

Edward W. Machala |

|

152,000 |

|

3.31% |

|

$11.00 |

|

10/29/12 |

|

$1,051,512 |

|

$2,664,737 |

Donald M. Muir |

|

112,000 |

|

2.44% |

|

$11.00 |

|

10/29/12 |

|

774,798 |

|

1,963,491 |

Aaron L. Davis |

|

100,000 |

|

2.18% |

|

$11.00 |

|

10/29/12 |

|

691,784 |

|

1,753,117 |

|

- (1)

- All options were granted by the Compensation and Stock Option Committee at the fair market value on the date of grant.

- (2)

- Amounts reported in these columns represent amounts that may be realized upon exercise of the options and subsequent sale of the underlying shares immediately prior to the expiration of their term assuming the specified rates of appreciation (5% and 10%) on the market value of the Company's Common Stock on the date of option grant, compounded annually from the date the respective options were granted, over the term of the options. The gains shown are net of the option exercise price but do not reflect deductions for taxes or other expenses associated with the exercise of the options or sale of the underlying shares. These numbers are calculated based on rules promulgated by the Securities and Exchange Commission and do not reflect the Company's estimate of future stock price growth. Actual gains, if any, on stock option exercises and Common Stock holdings are dependent on the timing of such exercise and the future performance of the Company's Common Stock. There can be no assurance that the rates of appreciation assumed in this table can be achieved or that the amounts reflected will be received by the individuals.

- (3)

- The grant date of all options is 10 years prior to the expiration date. Options vest at the rate of 25% on the first anniversary of the grant date and 12.5% each six months thereafter.

9

Option Exercises and Fiscal Year-End Values

The following table sets forth information with respect to options to purchase the Company's Common Stock granted under the 1987 Stock Option Plan and the 1997 Stock Option Plan including (i) the number of shares purchased upon exercise of options in 2002, (ii) the net value realized upon such exercise, (iii) the number of unexercised options outstanding at December 31, 2002 and (iv) the value of such unexercised options at December 31, 2002:

| |

| |

| | Number of Unexercised

Options at

December 31, 2002

| | Value of Unexercised

In-the-Money Options at

December 31, 2002(1)

|

|---|

| | Number of

Shares

Acquired on

Exercise

| |

|

|---|

Name

| | Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Rodger B. Dowdell, Jr. | | — | | — | | 937,136 | | 318,164 | | $2,204,088 | | $725,837 |

Neil E. Rasmussen |

|

— |

|

— |

|

355,250 |

|

110,750 |

|

810,622 |

|

249,003 |

Edward W. Machala |

|

— |

|

— |

|

376,271 |

|

292,125 |

|

915,683 |

|

939,803 |

Donald M. Muir |

|

— |

|

— |

|

214,116 |

|

210,926 |

|

586,571 |

|

688,276 |

Aaron L. Davis |

|

— |

|

— |

|

332,845 |

|

182,175 |

|

614,576 |

|

565,281 |

|

- (1)

- Value is based on the difference between the option exercise price and $15.15, the closing price as quoted on The Nasdaq Stock Market on the last trading day of the fiscal year, multiplied by the number of shares underlying the option.

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth information regarding outstanding options and shares reserved for future issuance under the Company's existing equity compensation plans as of December 31, 2002.

| |

| |

| | C

| |

|---|

| | A

| |

| | Number of Shares Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Shares Reflected in Column(A))

| |

|---|

| | B

| |

|---|

| | Number of Shares to be

Issued Upon Exercise of

Outstanding Options,

Warrants and Rights

| |

|---|

Plan Category

| | Weighted-Average Exercise

Price of Outstanding

Options, Warrants and Rights

| |

|---|

|

|

|

|

|

|

|

|

| Equity compensation plans approved by security holders(1) | | 20,183,668 | (2) | $14.27 | | 11,084,182 | (3) |

Equity compensation plans not approved by security holders |

|

— |

|

— |

|

— |

|

Total |

|

20,183,668 |

|

$14.27 |

|

11,084,182 |

|

|

|

- (1)

- Consists of the Company's 1987 Stock Option Plan, 1993 Non-Employee Director Stock Option Plan, 1997 Stock Option Plan and 1997 Non-Employee Director Stock Option Plan.

10

- (2)

- Excludes purchase rights accruing under the Company's 1997 Employee Stock Purchase Plan ("ESPP"), which has a shareholder-approved reserve of 2,000,000 shares. Under the ESPP, each eligible employee may purchase up to 3,000 shares of Common Stock at semi-annual intervals on the first business day of each May and November at a purchase price per share equal to 85% of the lower of the closing selling price per share on either (i) the first business day of the preceding six-month period or (ii) the last business day of the preceding six-month period.

- (3)

- Includes 1,320,686 shares available for issuance under the ESPP.

REPORT OF THE COMPENSATION AND STOCK OPTION COMMITTEE

The Company's executive officer compensation policy is administered by the Compensation and Stock Option Committee of the Board of Directors (the "Compensation Committee"). The Compensation Committee is comprised of three of the Company's independent, non-employee directors. Pursuant to the authority delegated by the Board of Directors, the Compensation Committee establishes the compensation of senior management.

General Compensation Philosophy

The Company's executive compensation philosophy is based on the belief that competitive compensation is essential to attract, motivate and retain highly qualified and effective leaders. The Company's philosophy is to provide a total compensation opportunity that matches competitive standards for commensurate performance. The compensation policy includes various components of compensation that are intended to align management behaviors and priorities directly with the Company's strategic objectives and to encourage management to act in the best long-term interest of the Company and its shareholders. The Compensation Committee's executive compensation policy is designed to achieve the following objectives: (i) enhance profitability of the Company and shareholder value, (ii) align compensation with the Company's annual and long-term performance goals, (iii) reward above-average long-term corporate performance, (iv) structure executive performance measures to emphasize team achievement, (v) reinforce individual growth in leadership capabilities and contribution over an individual's career, and (vi) encourage long-term retention.

Executive Officer Compensation Policy

The Company's executive officer compensation policy generally consists of three elements: base salary, annual cash bonus and long-term incentive compensation in the form of stock options.

Cash Compensation

Annual cash compensation consists of two elements: base salary and annual cash bonus. Each officer is offered a base salary that is commensurate for the role that he or she is performing. In setting the annual cash compensation for Company executive officers (other than the Chief Executive Officer), the Compensation Committee reviews compensation for comparable positions in a group of companies selected by the Compensation Committee for comparison purposes. Most of these companies are engaged in the manufacture and sale of computer hardware, peripherals and components, and are industry peers, competitors, and those successful organizations that the Company wishes to emulate. The Company also compares its compensation practices with other leading companies through reviews of benchmark surveys and proxy data.

Increases in base salary are based on a periodic review and evaluation of the performance of the operation or function for which the executive has responsibility. The executive is also reviewed according to his or her competence as an effective leader in the Company, which includes an evaluation of the skills and experience required for the job, coupled with a comparison of these elements with similar elements for other executives both within and outside of the Company. As a result of such review and evaluation, the base salary of the executive officers was increased in 2002.

11

The ratio of bonus ("variable" pay) to base salary ("fixed" pay) varies significantly across the levels in the organization and reflects the ability of the individual to impact the performance of the Company and to absorb the risk of variable pay. At the executive officer level, the annual cash bonus is dependent principally on corporate performance, with each bonus subject to review and approval by the Compensation Committee.

The purpose of the cash bonus is to promote world-class performance and to recognize and reward the contribution of all executives in achieving or exceeding the Company's established goals and objectives. The 2002 cash bonus provided for an annual payment based on the weighted average of (i) customer satisfaction, (ii) the Company's actual annual revenues as a percentage of target annual revenues, and (iii) the Company's actual net income as a percentage of target net income. The initial target for the 2002 cash bonus was set at 60% of an executive's base salary. Following review of the final 2002 results, bonuses were paid to the executive officers of the Company at the rate of approximately 49% of base salary.

The Chief Executive Officer's employment agreement provides that his cash compensation shall be in accordance with standards for chief executive officers of similar size electronics companies. After determining appropriate salary and bonus, then reviewing it against data from peer comparison companies (defined as those with sustained high growth in sales, net income and EPS, with a range of one-half to two times the Company's annual revenues), the Compensation Committee believes the Chief Executive Officer's cash compensation is commensurate with his individual and organizational performance.

Long-term Incentive Compensation

Incentive compensation in the form of stock options is designed to provide long-term incentives to executive officers (including the Chief Executive Officer) and other employees, to encourage the executive officers and other employees to remain with the Company and to enable optionees to develop and maintain a significant, long-term stock ownership position in the Company's Common Stock. The Company's 1997 Stock Option Plan, administered by the Compensation Committee, is the vehicle for the granting of stock options.

The 1997 Stock Option Plan permits the Compensation Committee to grant stock options to eligible employees, including executive officers. The value realizable from exercisable options is dependent upon the extent to which the Company's performance is reflected in the market price of the Company's Common Stock at any particular point in time. During 2002, the Compensation Committee did not grant any options to the Company's CEO or CTO, but did award stock option grants to other executive officers of the Company.

Tax Considerations

In general, under Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code"), the Company cannot deduct, for federal income tax purposes, compensation in excess of $1,000,000 paid to certain executive officers. This deduction limitation does not apply, however, to compensation that constitutes "qualified performance-based compensation" within the meaning of Section 162(m) of the Code and the regulations promulgated thereunder. The Company has considered the limitations on deductions imposed by Section 162(m) of the Code, and it is the Company's present intention, so long as it is consistent with its overall objective, to structure executive compensation to minimize the application of the deduction limitations of Section 162(m) of the Code.

This report has been submitted by the members of the Compensation Committee.

James D. Gerson

John G. Kassakian

Ervin F. Lyon

Compensation Committee Interlocks and Insider Participation

Mr. Gerson and Drs. Lyon and Kassakian served as the members of the Compensation and Stock Option Committee during 2002. Prior to 1986, Dr. Lyon was an executive officer of the Company.

12

EMPLOYMENT CONTRACT AND CHANGE-IN-CONTROL AGREEMENTS

The Company has entered into an employment agreement with its Chief Executive Officer. The agreement is automatically renewed annually unless either party notifies the other 60 days prior to the renewal date. Pursuant to the agreement, the Company pays the Chief Executive Officer an annual salary and a bonus which are based on the salaries and bonuses paid to Chief Executive Officers of electronics companies having approximately the same revenues as the Company. The Chief Executive Officer is obligated under the agreement not to compete with the Company while he is employed by the Company and for a period of one year thereafter. The Company does not have employment agreements with any other executive officers.

The Company has also entered into separate Change-In-Control Severance Agreements with Rodger B. Dowdell, Jr., Neil E. Rasmussen, Edward W. Machala, Donald M. Muir and Aaron L. Davis which are designed to provide an incentive to each executive to remain with the Company leading up to and following a Change in Control. For purposes of the agreements, "Change in Control" means (i) the members of the Board of Directors of the Company at the beginning of any consecutive 24-calendar month period ("Incumbent Directors") cease for any reason other than death to constitute at least a majority of the Board, provided that any director whose election, or nomination for election, was approved by at least a majority of the members of the Board then still in office who were members of the Board at the beginning of the 24-calendar month period shall be deemed to be an Incumbent Director; (ii) any consolidation or merger whereby the stockholders of the Company immediately prior to the consolidation or merger do not, immediately after the consolidation or merger, beneficially own shares representing 50% or more of the combined voting power of the securities of the corporation (or its ultimate parent corporation) issuing cash or securities in the consolidation or merger; (iii) any sale or other transfer of all or substantially all of the assets of the Company to another entity, other than an entity of which at least 50% of the combined voting power is owned by shareholders in substantially the same proportion as their ownership of the Company prior to the transaction, or (iv) any approval by the shareholders of the Company of a plan for liquidation or dissolution of the Company. Upon a Change in Control, all of the executive's unvested stock options automatically vest and become immediately exercisable. In the event of a subsequent termination of the executive's employment for any reason, all of the executive's stock options become exercisable for the lesser of (i) the remaining applicable term of the particular stock option or (ii) three years from the date of termination. The provisions regarding acceleration of vesting upon a Change of Control and extension of the period of exercisability are subject to certain limitations applicable to "incentive stock options" contained in Section 422 of the Internal Revenue Code. If within two years following a Change in Control the executive's employment is terminated (i) by the Company other than for specified cause, death or disability, or (ii) by the executive for specified good reason, the executive shall be entitled to the following: (a) a multiple (the "Multiple") of the executive's annual base salary and the executive's bonus for the preceding year; (b) continued health, life and disability benefits for a period of years equal to the Multiple; (c) outplacement services for up to one year following termination; (d) up to $5,000 of financial planning services; and (e) accrued vacation pay. The Multiple for Messrs. Dowdell and Rasmussen is three and for Messrs. Machala, Muir and Davis is two. If all or any portion of the benefits and payments provided to the executive would constitute an excess parachute payment within the meaning of Section 280G of the Internal Revenue Code resulting in the imposition on the executive of an excise tax, the payments and benefits will be "grossed-up" so as to place the executive in the same after-tax position as if no excise tax had been imposed.

ITEM NO. 3: SHAREHOLDER PROPOSAL REGARDING COMPOSITION OF THE BOARD OF DIRECTORS

The following supporting statement and shareholder proposal have been co-submitted by Connecticut Retirement Plans & Trust Funds, 55 Elm Street, Hartford, Connecticut, who has represented that it is the beneficial owner of 505,200 shares of the Company's Common Stock, Mary Hohenberg, c/o 721 NW 9th Avenue, Portland, Oregon, who has represented that she is the beneficial owner of 1,550 shares of the Company's Common Stock, Vicki L. Quist, c/o P.O. Box 117, Garvin Hill Road, Greensboro, Vermont, who has represented that she is the beneficial owner of 2,000 shares of the Company's Common Stock, and Calvert Asset Management Co., 4550

13

Montgomery Avenue, Bethesda, Maryland, who has represented that it is the beneficial owner of shares of 5,004 shares of the Company's Common Stock:

"WHEREAS: Employees, customers, and stockholders have a greater diversity of backgrounds than ever before in our nation's history. We believe that the Board of Directors of major corporations should be drawn from the broadest pool of talent and expertise. We also believe that Board diversity enhances business performance by enabling a company to respond effectively to the needs of customers worldwide.

As investors in American Power Conversion Corporation (APCC), we believe that supporting diversity should be reflected from entry-level jobs to our Board. At the moment our Board is composed of all white men.

If we are to be prepared for the 21st Century, we must learn how to compete in an increasingly diverse global marketplace, by promoting and selecting the best qualified people regardless of race, gender or physical challenge. Sun Oil's CEO Robert Campbell stated (Wall Street Journal, 8/12/96): "Often what a woman or minority person can bring to the board is some perspective a company has not had before—adding some modern-day reality to the deliberation process. Those perspectives are great of value, and often missing from an all-white, male gathering. They can also be inspirational to the company's diverse workforce."

A growing proportion of stockholders attach value to board inclusiveness, since the board is responsible for representing shareholder interests. The Teachers Insurance and Annuity Association and College Retirement Equities Fund (TIAA-CREF), the largest U.S. institutional investor, has issued a set of corporate governance guidelines which include a call for "diversity of directors by experience, sex, age, and race."

This year, in response to the corporate scandals of the preceding year, the stock exchanges, the SEC and the U.S. Congress have taken actions which embrace many of the corporate governance initiatives that have been promoted by concerned shareholders over the past decade. Both the NASDAQ and the NYSE have raised the bar for board and committee independence.

As companies seek new board members to meet these new independence standards there is also an opportunity to enhance diversity on the board. This is an opportunity for American Power Conversion to increase the independence of the board, create nominating, compensation and audit committees comprised entirely of independent directors, as while doing so, move beyond a all white male board.

RESOLVED: The Shareholders of APCC request that:

- 1.

- The Board Of Directors makes a greater effort to locate qualified women and persons of color as candidates for nomination to the board.

- 2.

- The Board issue a public statement committing the company to a policy of board inclusiveness, with a program of steps to be taken and a timeline during which the company is expected to move in that direction.

- 3.

- The company provide to shareholders, at reasonable expense, a report by September 2003, which includes a description of:

- a.

- Efforts to encourage diversified representation on the board

- b.

- Criteria for board qualification

- c.

- The process of selecting board nominees, and board committee members"

Board of Directors Opposition to Shareholder Proposal

The Board of Directors continues to believe this proposal does not serve the best interests of the Company or its shareholders and recommends a voteAGAINST it. A substantively identical proposal was submitted for consideration by the Company's shareholders at each of the last three Annual Meetings of Shareholders. Each

14

time the proposal was defeated by substantially more than a majority of shareholders who voted on the issue, and in 2002 nearly three-quarters of voters were against the proposal. The percent of voters against the proposal has grown each year and clearly indicates that shareholders do not believe this proposal is in the best interests of APC.

The Company agrees with the merits of pursuing and developing a diverse work force and as a global company APC benefits from having employees of all backgrounds throughout the organization. We seek to employ individuals based on relevant job criteria regardless of race, creed, color, gender, age, religion, national origin, sexual orientation or physical limitations. For Board membership we seek to select and recommend the best-qualified candidates based on relevant business experience, expertise, abilities and the desire and time to commit to a dynamic and fast moving Board such as ours. We do so without regard to race, creed, color, gender, age, religion, national origin, sexual orientation or physical limitations. In addition, a majority of the members of the Board, and all members of the Board's Audit, Compensation and Stock Option, and Corporate Governance and Nominating Committees, are "independent" under the rules that apply to Nasdaq listed companies.

APC's Board has been extremely successful in building and maintaining a fiscally strong global company. APC is ranked among leading firms worldwide and is listed in theFortune "1000" ranking of America's largest companies, the S&P 500 index, the Nasdaq 100 Index and theForbes "Platinum 400" listing of "The Best Big Companies in America." The Company exited 2002 in an extremely strong competitive and financial position with nearly $700 million in cash and investments and no long-term debt.

The proposal, as it is put forward, would unduly burden the Board and the Company with requirements that are overly restrictive, would limit the Company in its selection of qualified Board members, would result in incremental costs and the consumption of Company resources without corresponding benefit to the Company and would, therefore, be detrimental to the best interests of the Company and its shareholders.

THE BOARD OF DIRECTORS BELIEVES THAT THIS PROPOSAL IS NOT IN THE BEST INTEREST OF THE COMPANY AND ITS SHAREHOLDERS AND RECOMMENDS A VOTEAGAINST THIS PROPOSAL.

15

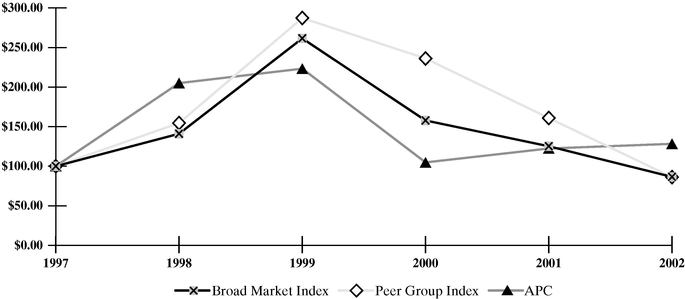

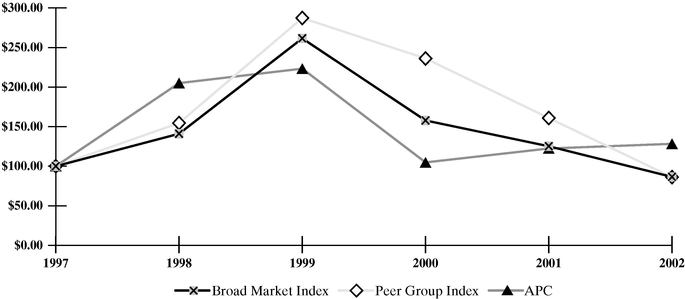

PERFORMANCE GRAPH

The following graph illustrates a five-year comparison of cumulative total shareholder return among the Company, the University of Chicago's Center for Research in Security Prices ("CRSP") Index for The Nasdaq Stock Market and the CRSP Index for Nasdaq Electronic Components Stocks (SIC 367, a peer group index which includes electronic components companies). The comparison assumes $100 was invested on December 31, 1997 in the Company's Common Stock and in each of the foregoing indices and assumes reinvestment of dividends, if any.

COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN AMONG THE COMPANY,

THE NASDAQ STOCK MARKET AND NASDAQ ELECTRONIC COMPONENTS STOCKS

| |

| | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

| |

|

|---|

| | |

| | |

| | | Broad Market Index(1) | | $100.00 | | $141.00 | | $261.5 | | $157.80 | | $125.20 | | $ 86.50 | | |

| | | Peer Group Index(2) | | 100.00 | | 154.50 | | 287.30 | | 236.10 | | 160.90 | | 86.20 | | |

| | | APC | | 100.00 | | 205.00 | | 223.30 | | 104.80 | | 122.40 | | 128.30 | | |

| | |

| | |

| | (1) | | CRSP Index for Nasdaq Stock Market |

| | (2) | | CRSP Index for Nasdaq Electronic Components Stocks |

INDEPENDENT ACCOUNTANTS

The Company has again retained KPMG LLP ("KPMG") as its independent auditors for the fiscal year ending December 31, 2003. A representative of KPMG will be at the Meeting and will be given the opportunity to make a statement if so desired and will be available to respond to appropriate questions from the shareholders.

16

Audit Fees

The following table presents the fees for professional audit services rendered by KPMG for audit and other services for the fiscal year ended December 31, 2002.

| Audit Fees | | $1,456,160 |

| Audit-Related Fees | | 30,000 |

| Tax Fees | | 13,843 |

| All Other Fees | | 206,907 |

| | |

|

| |

Total |

|

$1,706,910 |

In the above table, in accordance with new Securities and Exchange Commission definitions and rules, which APC elected to adopt with respect to fiscal 2002 for this year's proxy statement, "audit fees" are fees for professional services for the audit of the Company's consolidated financial statements included in Form 10-K and review of financial statements included in Form 10-Qs, or for services that are normally provided by KPMG in connection with statutory and regulatory filings or engagements; "audit-related fees" are fees for the audit of employee benefit plans; "tax fees" are fees for international tax assistance; and "all other fees" are fees for a benchmarking study and for foreign pension fund valuation and assistance services. There were no fees related to financial information system design and implementation in fiscal 2002.

In April 2003, in accordance with the Sarbanes-Oxley Act of 2002, the Company's Audit Committee adopted a policy governing the services provided by the Company's independent auditor, which policy supersedes the Company's former policy relating to the provision of audit services. The new policy requires pre-approval by the Audit Committee, or by an independent director serving on the Audit Committee to whom pre-approval authority has been delegated, of the following categories of services to be performed by the Company's independent auditor: audit services, audit-related services, tax services and non-audit services which are not otherwise prohibited by Securities and Exchange Commission rules or regulations. Pre-approval of services provided by the Company's independent auditor will allow the Audit Committee to consider whether the proposed services would impair the auditor's independence.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Board of Directors is composed of three non-employee directors, each of whom is an "independent director" under the rules of The Nasdaq Stock Market. The Audit Committee operates under a written charter adopted by the Board of Directors.

The Audit Committee has reviewed and discussed the Company's audited financial statements with management. The Audit committee has discussed with KPMG, the Company's independent auditors, the matters required to be discussed byStatement on Auditing Standards No. 61 (Communication with Audit Committees). The Audit Committee has also received from KPMG the written disclosures and the letter required byIndependence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and has discussed with KPMG matters relating to its independence from the Company.

Based on the review and discussions referred to above, the Audit Committee recommended to the Company's Board of Directors that the Company's audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2002.

This report has been submitted by the members of the Audit Committee.

James D. Gerson

John F. Keane, Sr.

Ervin F. Lyon

17

SECTION 16 REQUIREMENTS

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company's directors and officers, and persons who own more than 10% of a registered class of the Company's equity securities, to file initial reports of ownership and reports of changes in ownership with the Securities and Exchange Commission. Such persons are required by Securities and Exchange Commission regulations to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on its review of the copies of such forms received by it with respect to fiscal 2002, or written representations from certain reporting persons, the Company believes that all of its directors, executive officers and persons who own more than 10% of a registered class of the Company's equity securities complied with all filing requirements applicable to them with respect to transactions during 2002.

SHAREHOLDER PROPOSALS

The deadline for submission of proposals by shareholders pursuant to Rule 14a-8 issued under the Exchange Act, which are intended for inclusion in the proxy statement to be furnished to all shareholders entitled to vote at the next annual meeting of shareholders of the Company, is December 30, 2003. The deadline for submission of proposals of shareholders intended to be presented at the next annual meeting of shareholders of the Company (which are not otherwise submitted for inclusion in the proxy statement in accordance with the preceding sentence) is March 23, 2004. In submitting such proposals, shareholders must comply with the requirements set forth in both the Amended and Restated By-Laws of the Company and in Rule 14a-4(c)(2)(i)-(iii) under the Exchange Act. In order to curtail any controversy as to the date on which a proposal was received by the Company, it is suggested that proponents submit their proposals by Certified Mail, Return Receipt Requested.

EXPENSES AND SOLICITATION

The cost of solicitation of proxies will be borne by the Company. In addition to soliciting shareholders by mail or by its regular employees, the Company may request banks and brokers to solicit their customers who have stock of the Company registered in the name of a nominee and, if so, will reimburse such banks and brokers for their reasonable out-of-pocket costs. Solicitation by officers and employees of the Company, none of whom will receive additional compensation therefor, may also be made of some shareholders in person or by mail, telephone or telegram, following the original solicitation. The Company has retained Morrow & Co. Incorporated to assist in the solicitation of proxies, and will pay this company a fee of approximately $7,000 plus expenses.

18

DIRECTIONS TO APC'S ANNUAL SHAREHOLDER MEETING

The meeting will take place on Thursday, June 19, 2003 at 10:00 a.m., local time, in The Regency Room at the Radisson Hotel Milford, located at 11 Beaver Street, Milford, Massachusetts 01757 (Tel: 508-478-7010)

From Logan Airport and Points East:

Follow airport directions to I-90 (Massachusetts Turnpike) West

Take I-90 (Massachusetts Turnpike) West to Exit 11A (I-495 South)

Take I- 495 South to Exit 19 (Milford/Medway Route 109) and take a right at the end of the ramp and a right at the first light onto Beaver Street. The hotel is1/4 mile on the left.

From T.F. Green Airport and Points South:

Take I-95 North to I-495 North. Continue on I-495 to Exit 19.

At the bottom of the ramp, make a left onto Route 109 West. At the first light make a right onto Beaver Street. The hotel is1/4 mile on the left.

From Points West:

Connect To I-90 (Massachusetts Turnpike) East to Exit 11A to I-495 South to Exit 19.

Take a right at the end of the ramp and a right at the first light onto Beaver Street. The hotel is1/4 mile on the left.

From Points North:

Take I-95 South to I-495 South. Follow I-495 to Exit 19. At end of ramp take right and at the first light take a right onto Beaver Street. The hotel is1/4 mile on the left.

Upon arrival please proceed through the main entrance. The Regency Room will open to shareholders at 9:00 a.m. Please allow adequate time to find parking, complete any check-in and to be seated prior to the 10:00 a.m. starting time.

Please be aware that seating may be limited. Please bring valid picture identification, such as a driver's license or passport. You may be required to provide this upon entry to the meeting. Shareholders holding stock in brokerage accounts ("street name" holders) will also need to bring a copy of a brokerage statement reflecting stock ownership as of the record date. Cameras, cell phones, recording devices and other electronic devices will not be permitted at the meeting.

| Part # 996-2670A | | APOCM-PS-03 |

|

|

|

PROXY

AMERICAN POWER CONVERSION CORPORATION

Proxy for Annual Meeting of Shareholders

June 19, 2003

SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints Rodger B. Dowdell, Jr. and Emanuel E. Landsman, and each of them, proxies, with full power of substitution, to vote all shares of stock of American Power Conversion Corporation (the "Company") which the undersigned is entitled to vote at the Annual Meeting of Shareholders of the Company to be held on Thursday, June 19, 2003, at 10:00 a.m. local time, in The Regency Room at the Radisson Hotel Milford, located at 11 Beaver Street, Milford, Massachusetts, and at any adjournments thereof, upon matters set forth in the Notice of Annual Meeting of Shareholders and Proxy Statement dated April 29, 2003, a copy of which has been received by the undersigned. The proxies are further authorized to vote, in their discretion, upon such other business as may properly come before the meeting or any adjournments thereof. Execution of a proxy will not in any way affect a shareholder's right to attend the meeting and vote in person. Any shareholder giving a proxy has the right to revoke it by written notice to the Clerk of the Company at any time before it is exercised or by delivering a later executed proxy to the Clerk of the Company at any time before the original proxy is exercised.

CONTINUED AND TO BE SIGNED ON REVERSE SIDE

SEE REVERSE SIDE

ý Please mark votes as in this example.

THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED AS DIRECTED OR, IF NO DIRECTION IS GIVEN, WILL BE VOTED "FOR" ITEMS 1 AND 2 AND "AGAINST" ITEM 3.

The Board of Directors recommends a vote

"FOR" Items 1 and 2

| | | FOR | AGAINST | ABSTAIN |

| 1. | To fix the number of directors at seven. | o | o | o |

| 2. | To elect the Board of Directors for the ensuing year: | | | |

| | Nominees: Rodger B. Dowdell, Jr., Emanuel E. Landsman, Neil E. Rasmussen, Ervin F. Lyon, James D. Gerson, John G. Kassakian and John F. Keane, Sr. | | | |

| | | FOR | WITHHELD |

| | | o | o |

| | o ______________________________

For all nominees except as noted above | | | |

The Board of Directors recommends a vote

"AGAINST" Item 3

| | | FOR | AGAINST | ABSTAIN |

| 3. | To consider and act upon a shareholder proposal regarding the composition of the Company's Board of Directors. | o | o | o |

o MARK HERE IF YOU PLAN TO ATTEND THE MEETING

o MARK HERE FOR ADDRESS CHANGE AND NOTE IT BELOW

If signing as attorney, executor, trustee or guardian, please give your full title as such. If stock is held jointly, each owner should sign.

Signature ______________________________ Date _____________________

Signature ______________________________ Date _____________________

QuickLinks

NOTICE OF ANNUAL MEETING OF SHAREHOLDERSPROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERSDIRECTIONS TO APC'S ANNUAL SHAREHOLDER MEETINGPROXY