UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the registrantx Filed by a party other than the registrant¨

Check the appropriate box:

| ¨ | Preliminary proxy statement |

| ¨ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive proxy statement |

| ¨ | Definitive additional materials |

| x | Soliciting material pursuant to §240.14a-12 |

AMERICAN POWER CONVERSION CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement)

Payment of filing fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transactions applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, schedule or registration statement no.: |

October 30, 2006

I am writing to share with you some very important and exciting news.

Today APC announced that we have signed an agreement to be purchased by Schneider Electric for approximately $6.1 billion. APC will be combined with Schneider’s MGE UPS Systems and will become a subsidiary of Schneider Electric. This transaction and its value reflect the confidence and potential Schneider sees in APC’s products, businesses and people. Together with Schneider, the APC brand will continue and we will be a global leader in both single-phase and three-phase Uninterruptible Power Supplies (UPS) and a preeminent provider of integrated systems.

Like APC, Schneider is an international company with global capabilities and an excellent reputation. Based in France, Schneider employs nearly 100,000 people, operates in 190 countries, and is a leader in providing solutions for electrical distribution, industrial control and automation projects.

We have shared our vision of APC’s business potential with the Schneider management team. They have embraced this vision and expect us to execute a strategy to achieve it. I want you to know that APC’s and Schneider’s management teams have each gained a firm understanding of our respective businesses’ strengths, strategic objectives and cultures. We share core beliefs about what makes our companies successful, including: a passion for delivering superior products and services to customers; an unrelenting focus on product innovation; a global mindset; and a belief that our employees are at the heart of what makes our companies great.

This combination has the right elements to thrive. As part of Schneider, APC will gain access to greater resources that will enable us to better produce and distribute our current product lines even as we seek to develop and produce new products and technologies and jointly sell them to customers around the world. This merger will accelerate our efforts in key areas, including building our data center and enterprise accounts, capitalizing on emerging geographic market opportunities such as those in China, and expanding the distribution of our solutions. Most importantly, we will be even better suited to provide career opportunities for our employees and to meet and exceed the needs of our valued customers.

We expect to complete this transaction in the first quarter of 2007. Until then, you should continue to focus on your responsibilities just as before. These will not be changing. We must remain competitive and focused on profitability. We must continue to make progress on our initiatives or risk losing momentum in the marketplace.

We have included a list of frequently asked questions with this letter. I encourage you to attend the meetings and participate on the conference calls we will be holding over the next couple of days to discuss the news. My counterpart at Schneider, Jean-Pascal Tricoire, has sent a video introduction to share with all APC employees. This video will be shown during these meetings and archived on our communications intranet site. That

site will be populated with information and updated periodically with news about important developments. We will also be providing you with materials to assist you in communicating the news with our customers, vendors, and strategic partners.

Finally, should you receive inquiries from shareholders or the media, please forward them to your regional media relations contact or to Debbie Hancock in Investor Relations, as they are the authorized individuals who will be coordinating all external communications.

This day is made possible by your hard work over the years to establish the outstanding reputation of APC’s brand and its high quality, innovative products. You have contributed greatly to our company’s strength and success.

Thank you for your continued enthusiasm and support. We have a bright future ahead.

Best regards,

Rob Johnson

President and Chief Executive Officer

FREQUENTLY ASKED QUESTIONS FOR APC EMPLOYEES

1. What did we announce today?

Briefly stated, we announced that APC and Schneider Electric SA have executed a definitive merger agreement under which Schneider Electric has agreed to acquire all outstanding shares of APC for $31.00 per share in cash in a transaction valued at approximately $6.0 billion.

When the transaction is completed, which we expect will occur in the first quarter of 2007, the combined enterprise will be a leading global provider for both single-phase and three-phase uninterruptible power supply (UPS) systems, as well as a preeminent provider of integrated systems for IT and data center applications.

2. Why is this transaction good for APC?

This merger delivers tremendous opportunities to our employees, customers and our other stakeholders. APC will be joining a world class, well-financed organization with leading global capabilities in providing the best technology solutions for customers in the industry.

For our customers, this means that as part of Schneider Electric, APC will have additional capital resources and a stronger global presence, enabling us to offer a broader selection

of products than ever before while continuing to enhance our current product portfolio and services. Together, we can leverage our assets, pursue new business opportunities and achieve success in growing markets such as China. As a result of this transaction, our combined customers will benefit from a continuity of outstanding service and support, more distribution channels, and more complete, one-stop-shop solutions.

Both companies have outstanding name recognition and extensive industry experience and expertise. This combination is an excellent opportunity to build a solid foundation for future growth in resources, innovative product solutions and services offerings, and dynamic career opportunities for employees.

Furthermore, APC and Schneider Electric share similar values, including placing the highest priority on our customers, innovation and people.

3. What can we expect from a non-U.S. parent company? How will it be different than being owned by an U.S. company?

It is important to recognize that both APC and Schneider Electric are international companies with global reach. Each company, regardless of country of origin, has a unique and ever-changing culture. We anticipate there will be differences in the way we communicate, make decisions, and generally operate our businesses. However, at this time, we can not detail how those differences will impact us, other than to say that Schneider Electric has a history of successfully integrating new organizations, and has done so with a great deal of respect for the employees of those organizations and their culture.

4. When will I know the impact, if any, this news will have on me, my job, my responsibilities, etc.?

While the combination with Schneider Electric will provide enhanced career opportunities for many employees, it is too early in the process for us to know the details. As soon as more specific information is available, we will share it with all employees. Meanwhile, it is very important for every employee, and for the company, that all of us continue to stay focused on priorities and tasks and on servicing our customers.

5. Will Schneider Electric retain all APC employees once the merger is complete?

The combination with Schneider Electric will provide enhanced career opportunities for many employees. Schneider Electric has indicated that it plans to allow APC to continue operating primarily as an independent company. However, it is too early in the process for us to have any specific details about the integration of our two companies. We will share with you more specific information as soon as it is available after the close of the transaction, which we expect to occur in the first quarter of 2007.

6. Will our jobs be moved to other locations?

It is too early in the process for us to have any details about the integration of our two companies. We will share with you more specific information as soon as it is available following the close of the transaction, which we expect to occur in the first quarter of 2007.

7. Will there be opportunities to transfer to the new company?

The combination with Schneider Electric will provide enhanced career opportunities for many employees. However, until the transaction is completed, which we expect will occur in the first quarter of 2007, APC and Schneider Electric will continue to operate as separate, competing companies. After that, the opportunities available to APC employees should be consistent with opportunities available to other Schneider Electric employees.

8. Will there be changes in my compensation and/or the benefits program?

Generally speaking, after the transition to new ownership you will receive compensation and other employee benefits that are similar to those you currently receive. The ESPP program in the United States will be discontinued after the current purchase period (ending October 31, 2006) and there will be no new purchase period. Additionally, the Ireland Shares for Bonus program is being discontinued effective immediately.

As we have previously announced, APC is revising its bonus program and our plan is to continue this work going forward. We are also reviewing our U.S. Health & Dental insurance programs and you will receive more information on this shortly.

9. What will the impact be on the equity compensation I have through Options and Restricted Stock Units (RSUs)?

After giving effect to any exercise price payable in connection with your vested and unvested options and RSUs, you will receive cash for those options and RSUs when the transaction closes.

10. What will happen to the Employee Stock Purchase Plan? What about the funds currently allocated for this purchase period?

Those employees who participate in the Employee Stock Purchase Plan (ESPP) in the United States will continue to participate through the purchase period ending October 31, 2006. Those shares will be placed into your account on the normal schedule. Any shares remaining in your account as of the close of the deal, which we expect will occur in the first quarter of 2007, will be converted to cash. No additional funds will be set aside for stock purchases after October 31, 2006. Any funds collected as a result of the transition will be paid to you upon formal discontinuation of the plan.

Other plans, such as the Ireland Shares for Bonus program, where APC stock is purchased by employees through the company, will be discontinued effective immediately.

11. What will happen to the APC stock in our 401(k) plan? What will happen to the 401(k) plan?

APC stock held in individual accounts with the 401(k) plan in the United States will be converted to cash upon closing of the deal. If you have a 401(k) plan through Fidelity, you will be receiving additional information from them on your investment options. We recommend you talk with your investment advisor to adjust your plan holdings as appropriate for your individual needs.

At this time we do not have any information with respect to changes that may be proposed in connection with the 401(k) plan after the deal closes. We will communicate with employees as we learn more on this important issue.

12. What will happen to my APC stock? When can I trade in APC stock?

APC’s stock trading restrictions, including stock trading windows, will continue to apply until the transaction is completed, which we expect will occur in the first quarter of 2007. We have an earnings release scheduled for November 2. The stock trading window is scheduled to re-open on November 7. After the transaction is completed, which we expect will occur in the first quarter of 2007, APC common stock will be delisted from NASDAQ, and APC will no longer be required to file periodic reports and other information with the SEC. Detailed information and instructions regarding what to do with your stock transaction will be sent to all shareholders in due course.

13. What are Schneider Electric’s plans for our products?

APC will be combined with MGE UPS Systems and operate as a subsidiary of Schneider Electric. Our wide range of products will complement Schneider Electric’s current product offerings and will support a dramatically enhanced line of business that will be focused on delivering comprehensive customer solutions in critical power and energy management, and will provide new focus where Schneider Electric has not built a core competence in areas such as the Infrastructure IT where APC’s technology has made us a market leader.

14. Will APC and Schneider Electric enter into any joint marketing programs prior to the completion of the merger?

No. Until the transaction is completed, both companies will continue to pursue their respective business activities as separate, competitive companies.

15. As an APC employee, should I contact my counterpart at Schneider Electric?

No. Until the transaction is completed, both companies will continue to pursue their respective business activities as separate, competitive companies.

16. How should employees respond to customers, vendors, business partners, the media or Schneider Electric employees who ask me questions about the deal?

During the next several months while the transaction is being completed, our companies will continue to operate as two separate, competing companies. It is critical, as always, to maintain confidentiality regarding company business. If you are approached by reporters, or shareholders, or people other than vendors partners or customers, from outside our company requesting information that is not public about the transaction, please direct these inquiries to your local PR/MarCom Manager or Debbie Hancock in Investor Relations at (401) 789-5735 ext. 2994.

For vendor and customer inquiries, we have developed letters and talking points for your use in communicating with these stakeholders if it is typically your responsibility to do so. It is important that you keep your comments to the points in the documents and if you are asked questions that are not addressed in these documents, please do not attempt to make up an answer. Instead, please contact your manager for guidance on how best to respond. Keep in mind that the Q&A we provide you are for internal use only and are not to be distributed outside the company.

17. What should employees do during the transition period before the transaction is completed? What do we do about our current business plans?

Employees should continue to do their jobs and serve our customers as they did before.

18. Who should I talk with if I have additional questions?

If you have additional questions not addressed here or in the other meetings taking place, please refer to the Communications intranet site or email questions, concerns and ideas topossibility@apcc.com. Additionally, you may contact John Pyle in St. Louis atjohn.pyle@apcc.com.

TRANSCRIPT OF VIDEO PRESENTATION BY JEAN-PASCAL TRICOIRE

Hi, my name is Jean-Pascal Tricoire. I am the CEO of Schneider Electric. I am talking to you over the weekend because Rob Johnson, your CEO and myself thought it was necessary to do so. Because we just signed an agreement, which is planning to merge APC together with Schneider Electric in the next coming six months.

I have to tell you, I am extremely thrilled to be writing with you a new chapter in this area of APC, as well as a new chapter in this area of Schneider Electric. You guys are leading the space of UPS and the space of critical power. We are very focused on leading the space of electrical distribution on building automation. By combining our forces, we have the unique opportunity to build complete solutions, complete proposals for the people who need critical power.

Let me tell you a few words about Schneider Electric because while some of you might not know our company. Our company is a very global company. We sell in 190 countries where our biggest market actually is the U.S. where you might know the brand of Square D, for instance, which is our reference brand. We also operate in your space with a company called MGE UPS Systems, which I’m sure, I hope that we are sometimes we are competing. Well, our company this year will be invoicing more than 16 billion U.S., we have 100,000 employees in the world and having talked quite a lot of time over the past month with your management, I really think we share a lot of key values: patience for customers, commitment to innovation, global mindset and the deep belief that people are the only one that makes the difference between companies. People are the one making the difference.

Well, I believe also that this merger is also very good news for the employees of APC. It opens more possibilities, more potential to their career in a wider and even more global environment. I want to tell you also that we, at Schneider Electric, the management and every people that face you in the market have a great respect for the tremendous strengths and the fantastic image of APC in front of its customers. And we are very proud today, to be contemplating the possibility that you will join our group in the middle of other entities while also the reference of the market. What we want to build here is a reference [s]ector of the market, combining forces of MGUPS Systems on APC and backing it with all the capacities of Schneider Electric. What we want to realize, what we want to accomplish, is an APC on steroids, an APC which is stronger, which is more capable, more global and totally capable of delivering complex solutions to its customers.

Obviously, the process will take some time. We are just at the beginning of the process. We’ve got to get through the regulatory approvals; we’ve got to go through the vote of the present shareholders of APC for them to approve the operations. Until this is done, which should be probably around the end of the first quarter 2007, we are two independent companies. And we totally, on my side, I totally trust the management — the new management of APC, Rob and his team — to be driving the operation through the merger as an independent and autonomous companies. And well, you have certainly many questions and we’re going to answer them all. The fact is that today we cannot answer them all. Your managers have received kits of presentation of Schneider Electric with a lot of elements about our company with a lot elements about the rationale of this merger, the reasons why we are very enthusiastic about this merger. I’m sure you’re going to get a lot of answers talking with your managers. In the meantime, I guess I will deliver the same message to you as I deliver to my teams at Schneider Electric. First, that I am very proud to have such brilliant teams with me. And second thing one only message, let’s stay focused on business, as usual, let’s stay focused on customers and see you as soon as possible.

Additional Information Relating to the Merger and Where to Find It

APC will file a proxy statement with the U.S. Securities and Exchange Commission (SEC) in connection with the proposed transaction. Investors are urged to read any such proxy statement, when available, which will contain important information. The proxy statement will be, and other documents filed by APC with the SEC are, available free of charge at the SEC’s website (www.sec.gov) or from APC by directing a request to American Power Conversion Corporation, 132 Fairgrounds Road, West Kingston, Rhode Island 02892, Attention: Investor Relations (telephone 401-789-5735), or from APC’s website atwww.apcc.com.

APC, Schneider and their respective directors, executive officers and other employees may be deemed to be participating in the solicitation of proxies from APC shareholders in connection with the approval of the proposed transaction. Information about APC’s directors and executive officers is available in APC’s proxy statements and Annual Reports on Form 10-K previously filed with the SEC. Information about Schneider’s directors and executive officers is available from its 2005 Annual Report, which can be obtained for free from its website at www.schneider-electric.com, and will also be available in a Schedule 13D to be filed by Schneider with the SEC. Additional information about the interests of potential participants will be included in the proxy statement APC will file with the SEC.

Safe Harbor Provision

This document contains forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. All statements in this press release that do not describe historical facts, such as statements concerning APC’s future plans or prospects are forward-looking statements. All forward-looking statements are not guarantees and are subject to risks and uncertainties that could cause actual results to differ from those projected. While not exhaustive, the factors that could cause actual results to differ include the following: The ability of APC and Schneider to gain regulatory and shareholder approval for the proposed merger; successful completion of the transaction; ability to achieve expected growth, savings and benefits of merger; potential disruption in business or relationships with customers, vendors, partners and employees as a result of the proposed merger; the pervasive and intensifying competition in all markets where we operate; prolonged adverse economic and employment conditions in the markets we serve; changes in available technology that make our existing technology obsolete or expensive to upgrade; the availability and cost of capital; the impact of any industry consolidation; the outcome of pending or threatened complaints and litigation and the risks described from time to time in APC’s filings with the Securities and Exchange Commission. APC disclaims any obligation to update or revise statements contained in this news release based on new information or otherwise.

APC and Schneider Electric: A Powerful Combination October 30, 2006 |

© 2006 American Power Conversion Corporation. APC Confidential. 2 What has happened Why we are stronger together Who is Schneider Electric? What is the plan? |

© 2006 American Power Conversion Corporation. APC Confidential. 3 APC and Schneider Electric: A Powerful Combination APC and Schneider Electric have signed a definitive merger agreement Schneider Electric is purchasing APC for $31.00 per share or approximately $6.1 billion Upon closing of the deal, which is expected to occur in the first quarter of 2007, APC will become part of the Schneider Electric family, joining SquareD, MGE UPS Systems, Power Measurement Inc. and others |

© 2006 American Power Conversion Corporation. APC Confidential. 4 Two Premier Companies Joining Forces APC is a Leader in Key Market Categories APC is a leading provider of single-phase UPSs APC is the channel’s favorite UPS vendor APC is a leading IT vendor recommended by CIOs APC is a leading provider of racks APC is a leading innovator in cooling APC is a leading provider of data center infrastructure management Schneider Electric is a Leader in Key Market Categories SE is a leading provider of three- phase UPSs SE has an established enterprise sales and services organization SE has a strong position with facility decision makers SE provides access to incremental electrical distribution markets (Square D) SE brings resources of a $16 B corporation SE/MGE has experience & skills in deployment of services in data centers |

© 2006 American Power Conversion Corporation. APC Confidential. 5 Time Table for Closing the Merger Merger Agreement Signed: October 28, 2006 Regulatory Approval Shareholder Meeting and Approval Merger Closing Integration Begins October 28, 2006 Q1 2007 Signed Agreement Obtain Regulatory and Shareholder Approvals Close Merger Begin Integration |

© 2006 American Power Conversion Corporation. APC Confidential. 6 What has happened Why we are stronger together Who is Schneider Electric? What is the plan? |

Building a New Electric World |

JPT - APC employees ’ presentation - 30 October 2006 8 A Global Leader in Power and Control Control and protect machines and installations Electrical Distribution A worldwide leader Make electricity safe, available and reliable Energy Management Automation & Control A worldwide leader |

JPT - APC employees ’ presentation - 30 October 2006 9 Rest of the World Asia-Pacific North America Europe 26% 21 000 46 Schneider Electric $16 billion revenue 100 000 employees 190 countries 6 500 R&D people 5% of revenue spent in R&D 207 factories 124 logistics centers 48% 44 000 95 8% 6 000 23 18% 18 000 43 A Global Company APC and Schneider Electric are International Companies - Not American and French |

JPT - APC employees ’ presentation - 30 October 2006 10 An Ambitious Growth Strategy combining innovation and differentiation Expand our geographic coverage Invest in R&D & innovation Develop services Develop new growth platforms This is a Shared Vision Between APC and Schneider Electric |

JPT - APC employees ’ presentation - 30 October 2006 11 For our customers RoHS program : www.rohs.schneider-electric.com Eco-design & Eco-production Drastic reduction our sites’ energy consumption For our people Health care : our main objective Encouraging mobility Substantial & sustained investment in training For the planet Energy efficiency For our host communities Education and training for young people Schneider Electric Foundation, Luli, reconstruction programs : Katrina ($1M), Tsunami ($3M) Schneider Electric : Committed to Sustainable Development |

© 2006 American Power Conversion Corporation. APC Confidential. 12 What has happened Why we are stronger together Who is Schneider Electric? What is the plan? |

JPT - APC employees ’ presentation - 30 October 2006 13 Through MGE, an Early Presence and a Continuous Development in Critical Power First three-phase 5-15 kVA UPS produced by Merlin Gerin 2000 1964 1996 2006 Creation of MGE UPS SYSTEMS |

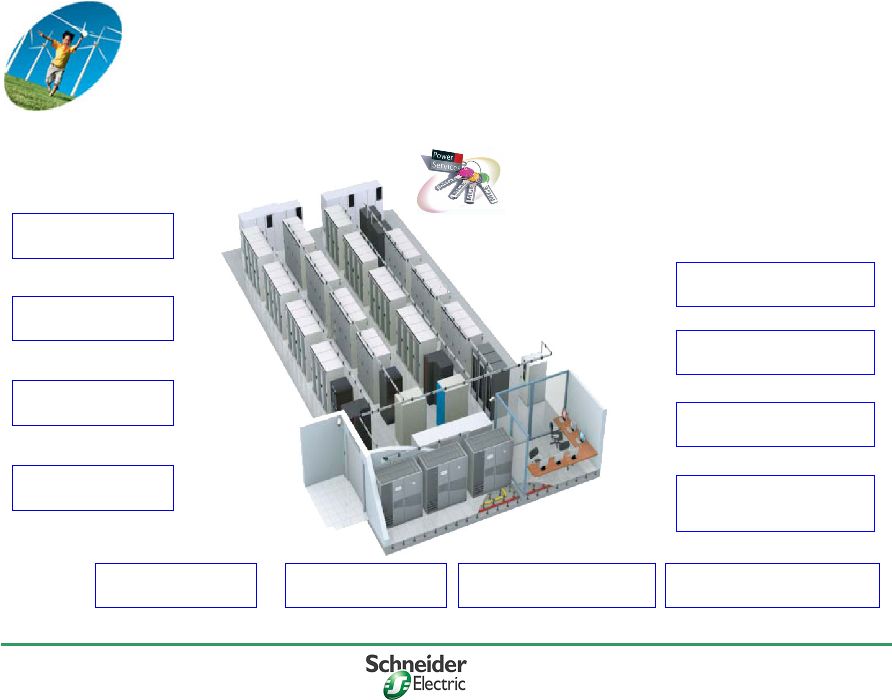

JPT - APC employees ’ presentation - 30 October 2006 14 A Unique Combined Offer Electrical distribution, building automation & critical power High quality electrical distribution Energy consumption monitoring Energy quality & availability Temperature control and security A capacity to tailor a solution bringing value to each customer Engineering and software capabilities Comprehensive services throughout the life cycle Dedicated high skills teams Solving the equation of total cost of ownership, availability & scalability |

JPT - APC employees ’ presentation - 30 October 2006 15 A Fantastic Complement Between APC, MGE and Schneider Electric Small UPS Cooling Services MGE / SE APC Cable managt Supervision Large UPS Combined business Racks Harmonic filtering Power monitoring Electrical & facility managers CIOs |

JPT - APC employees ’ presentation - 30 October 2006 16 Expanding Our Market Well Beyond UPS in Data Centers Genset PDU UPS/Gear Emergency Switchgear Automatic Transfer Switch Static Transfer Switch Utility Switchgear Generator Paralleling Switchgear Energy management Harmonics Filter SCADA interface Transient Voltage Surge Suppressor Services architecture engineering, Installation auditing, e-monitoring and analysis, training & maintenance |

JPT - APC employees ’ presentation - 30 October 2006 17 Schneider Electric Addresses 60% of the Data Center Market Climate Racks 8% UPS 18% ED 14% Cabling 2% Control 2% Security 3% 5% Room 16% Installation 12% AV services 10% Genset 10% SE Accessible Market |

JPT - APC employees ’ presentation - 30 October 2006 18 A New Blend of Similar Values and Culture Customers are our passion Moving from products to solutions and services Innovating to help our customers be successful Business is the first driver of any acquisition decision Innovation is our commitment Serve and anticipate customers’ needs Venture into new areas, think outside of the box A global mindset Diversity and world wide presence People are our most valuable asset Loyalty : Very high retention rate in almost all countries Open and fair management This is a Shared Vision Between APC and Schneider Electric |

© 2006 American Power Conversion Corporation. APC Confidential. 19 APC management is confident we can thrive as part of the Schneider Electric family Why This Deal Makes Sense for APC Today? Complementary products and channels expand customer opportunities APC can benefit from Schneider Electric’s management system, services, engineered systems capabilities, and employee development Tremendous collaborative opportunities to address emerging geographic markets such as China |

© 2006 American Power Conversion Corporation. APC Confidential. 20 What has happened Why we are stronger together Who is Schneider Electric? What is the plan? |

© 2006 American Power Conversion Corporation. APC Confidential. 21 How Will the Combined Company be Organized? APC continues as a subsidiary of Schneider APC’s management team continues… “APC has a talented management team, supportive of a combination with Schneider Electric. We intend to leverage on the skills of APC and MGE’s management to drive the development of the combined entity.” Jean-Pascal Tricoire |

© 2006 American Power Conversion Corporation. APC Confidential. 22 What is Our Plan? The new APC management team has a plan which Schneider Electric wants us to execute against The APC management team is united and excited about our plan Joining with Schneider Electric will actually help us accelerate our plans APC and Schneider Electric have respective integration planning teams to prepare for integration upon closing the transaction We remain separate and competing companies until closing the transaction |

© 2006 American Power Conversion Corporation. APC Confidential. 23 What You Can Expect Now Business as usual Ongoing communications from APC management Communications Web Site Letters from the CEO Written and verbal communications Schneider Electric CEO to conduct introductory meetings at select locations Workshops to assist in managing integration and change Open dialogue between managers and employees Integration begins only after closing |

© 2006 American Power Conversion Corporation. APC Confidential. 24 Outstanding Questions You May Have What impact will this have on our facilities? Will there be organizational changes within my team? Will my job change? What about my benefits? Answers to these and others questions are in the FAQ from our CEO or will be developed over time Your manager can also assist in answering and finding answers to questions |

Schneider Electric is not paying $6B to take this company apart, they bought it because they value its most important asset: YOU! |

© 2006 American Power Conversion Corporation. APC Confidential. 28 Message From the CEO of Schneider Electric |

© 2006 American Power Conversion Corporation. APC Confidential. 29 Additional Information APC will file a proxy statement with the U.S. Securities and Exchange Commission (SEC) in connection with the proposed transaction. Investors are urged to read any such proxy statement, when available, which will contain important information. The proxy statement will be, and other documents filed by APC with the SEC are, available free of charge at the SEC's website (www.sec.gov) or from APC by directing a request to American Power Conversion Corporation, 132 Fairgrounds Road, West Kingston, Rhode Island 02892, Attention: Investor Relations (telephone 401-789-5735), or from APC’s website at www.apcc.com. APC, Schneider and their respective directors, executive officers and other employees may be deemed to be participating in the solicitation of proxies from APC shareholders in connection with the approval of the proposed transaction. Information about APC’s directors and executive officers is available in APC’s proxy statements and Annual Reports on Form 10-K previously filed with the SEC. Information about Schneider’s directors and executive officers is available from its 2005 Annual Report, which can obtained for free from its website at www.schneider- electric.com, and will also be available in a Schedule 13D to be filed by Schneider with the SEC. Additional information about the interests of potential participants will be included in the proxy statement APC will file with the SEC. |

© 2006 American Power Conversion Corporation. APC Confidential. 30 Safe Harbor Provision This document contains forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. All statements in this press release that do not describe historical facts, such as statements concerning APC’s future plans or prospects are forward-looking statements. All forward-looking statements are not guarantees and are subject to risks and uncertainties that could cause actual results to differ from those projected. While not exhaustive, the factors that could cause actual results to differ include the following: The ability of APC and Schneider to gain regulatory and shareholder approval for the proposed merger; successful completion of the transaction; ability to achieve expected growth, savings and benefits of merger; potential disruption in business or relationships with customers, vendors, partners and employees as a result of the proposed merger; the pervasive and intensifying competition in all markets where we operate; prolonged adverse economic and employment conditions in the markets we serve; changes in available technology that make our existing technology obsolete or expensive to upgrade; the availability and cost of capital; the impact of any industry consolidation; the outcome of pending or threatened complaints and litigation and the risks described from time to time in APC’s filings with the Securities and Exchange Commission. APC disclaims any obligation to update or revise statements contained in this news release based on new information or otherwise. |