Exhibit 99.6

September Budget Update

2005/06 – 2007/08

September 14, 2005

www.gov.bc.ca

National Library of Canada Cataloguing in Publication Data

British Columbia.

Budget and fiscal plan. — 2002/03/2004/05/2005/06/2007/08-

Annual

Also available on the Internet.

Continues: British Columbia. Ministry of Finance and

Corporate Relations. Budget ... reports. ISSN 1207-5841

ISSN 1705-6071 = Budget and fiscal plan — British Columbia.

1. Budget — British Columbia — Periodicals. 2. British

Columbia — Appropriations and expenditures — Periodicals.

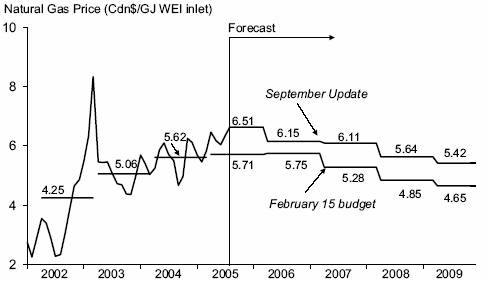

I. British Columbia. Ministry of Finance. II. Title.

HJ12.B742 | | 352.48’09711’05 | | C2003-960048-3 |

TABLE OF CONTENTS | | |

| | |

September Budget Update 2005/06 — 2007/08 | | September 14, 2005 |

September Budget Update – 2005/06 to 2007/08

September 14, 2005

As required by Section 7(d) of the Budget Transparency and Accountability Act (BTAA), I am confirming that this September Budget Update contains the following elements in support of the forthcoming Estimates debate:

• The fiscal and economic forecasts for 2005/06, which are detailed in Part 1 and Part 3.

• All material economic, demographic, taxation, accounting policy and other assumptions underlying the 2005/06 economic, revenue, expenditure, surplus and debt forecasts are also disclosed. We have disclosed key assumptions regarding ongoing or anticipated negotiations. In particular:

• For budget planning purposes the status quo is assumed to prevail in the U.S. lumber dispute;

• No equalization revenues have been assumed beyond 2005/06. The federal government has indicated they will determine a new mechanism for allocating equalization funding among provinces by March 2006, based on the advice of an independent panel. Given the uncertainty, government made a prudent assumption that there would be no equalization revenues in 2006/07 or 2007/08; and

• The current compensation mandate that has been in place since January 2002 will remain unchanged until March 31, 2006. As the next mandate is still under development, no compensation increase has been assumed in the fiscal plan. Details of the next wage mandate that commences April 1, 2006, will be released by the next budget in February 2006. The forecast allowances included in this fiscal plan cover the potential costs of future public sector wage settlements, in addition to revenue risks such as a sudden fall in energy prices, or the costs of natural disasters.

These and other major areas of risk to the plan known at this time are disclosed in the risks section in Part 1 and in the material assumption tables in the appendix.

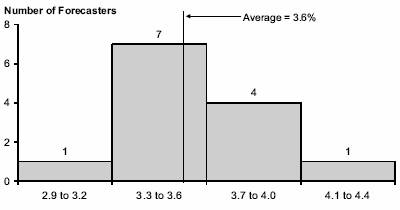

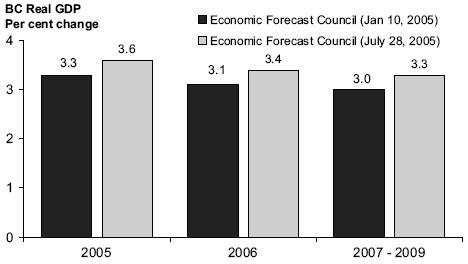

• The report on the current advice of the Minister’s Economic Forecast Council on economic growth, including the range of forecasts for 2005 and 2006. This is found at the end of Part 3.

The September Budget Update reflects the ministry responsibilities announced on June 16, 2005, including the assignment of Land and Water BC activities among various government ministries effective September 30, 2005. BC Buildings Corporation will be converted to ministry status in 2006/07. Therefore, BC Buildings Corporation has been incorporated in the budget update on a status quo basis, as plans for its integration have not yet been finalized.

Some post-secondary institutions have forecast deficits. Government has not approved these forecasts since a funding review is currently underway and will be completed later this fall. Upon completion, it is expected that revised forecasts with balanced budgets will be submitted by the institutions reflecting the results of this review. These forecasts will be included in Budget 2006.

The accounting policies followed in the September Budget Update comply, in all material respects, with generally accepted accounting principles (GAAP) for senior governments as prescribed by the Public Sector Accounting Board (PSAB).

As required under section 7(e) of the BTAA, the forecast allowance, which is an adjustment to the most likely forecast of the 2005/06 surplus, is also disclosed.

I would like to thank staff in all government ministries, Crown corporations and the SUCH sector for their work in developing the plans and preparing these multi-year economic and financial forecasts. I would like to especially acknowledge the hard work and dedication of my colleagues in the Ministry of Finance for their efforts in preparing this updated fiscal plan and a second set of Estimates for the 2005/06 fiscal year.

| | /s/ Tamara Vrooman | |

| | TAMARA VROOMAN | |

| | Deputy Minister and | |

| | Secretary to Treasury Board | |

Ministry of | | Office of the | | Mailing Address: | | Location Address: |

Finance | | Deputy Minister | | PO Box 9417 Stn Prov Govt | | Room 109 |

| | | | Victoria BC V8W 9V1 | | 617 Government Street |

| | | | www.gov.bc.ca/fin | | Victoria BC |

Summary: BUDGET AND FISCAL PLAN – 2005/06 TO 2007/08

Fiscal Plan Summary – 2005/06 to 2007/08

| | | | | | Budget | | | | | |

| | Budget | | Actual | | Estimate | | Plan | | Plan | |

($ millions) | | 2004/05 | | 2004/05 | | 2005/06 | | 2006/07 | | 2007/08 | |

Revenue | | 30,492 | | 33,233 | | 34,476 | | 34,398 | | 35,131 | |

Expense | | (30,292 | ) | (30,658 | ) | (32,876 | ) | (33,198 | ) | (33,831 | ) |

Surplus before forecast allowance | | 200 | | 2,575 | | 1,600 | | 1,200 | | 1,300 | |

Forecast allowance | | (100 | ) | — | | (300 | ) | (600 | ) | (900 | ) |

Surplus | | 100 | | 2,575 | | 1,300 | | 600 | | 400 | |

Capital spending: | | | | | | | | | | | |

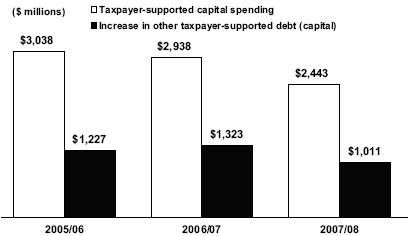

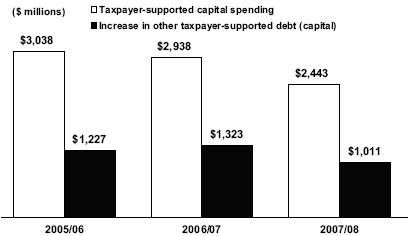

Taxpayer-supported capital spending | | 1,943 | | 2,322 | | 3,038 | | 2,938 | | 2,443 | |

Total capital spending | | 2,934 | | 3,182 | | 4,167 | | 4,199 | | 3,725 | |

Provincial Debt: | | | | | | | | | | | |

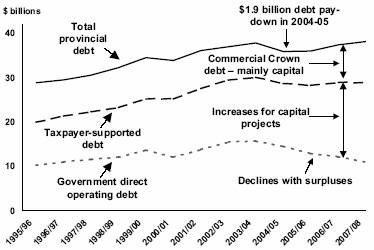

Provincial government direct operating debt | | 16,558 | | 14,481 | | 12,871 | | 12,180 | | 11,003 | |

Taxpayer-supported debt | | 32,115 | | 28,657 | | 28,274 | | 28,906 | | 28,740 | |

Total debt | | 39,395 | | 35,826 | | 35,910 | | 37,350 | | 38,033 | |

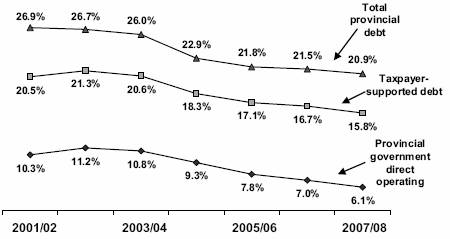

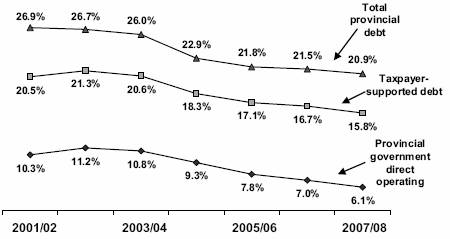

Provincial government direct operating | | 11.3 | % | 9.3 | % | 7.8 | % | 7.0 | % | 6.1 | % |

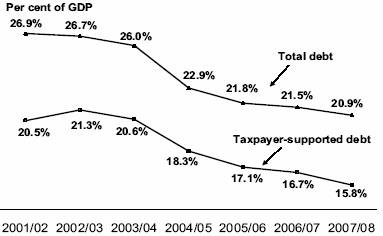

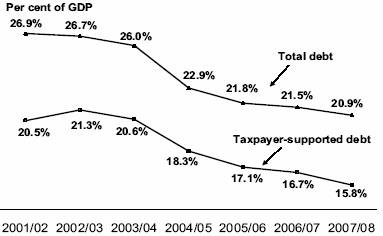

Taxpayer-supported debt to GDP ratio | | 21.8 | % | 18.3 | % | 17.1 | % | 16.7 | % | 15.8 | % |

Total debt to GDP ratio | | 26.8 | % | 22.9 | % | 21.8 | % | 21.5 | % | 20.9 | % |

BC’s fiscal position improves

Driven by stronger economic performance, the fiscal outlook of the BC government has improved since the February 15 budget. This has allowed:

• program enhancements for seniors ($242 million over three years); and

• a commitment to help build a new relationship with First Nations and Aboriginal communities ($100 million in 2005/06).

In addition to the small business threshold adjustment, the personal income tax reduction and medical service plan premium assistance enhancements for BC’s low and modest income earners, announced in the February 15 budget, two new competitiveness measures are included in the September Update:

• a reduction in the general corporate income tax rate to 12 per cent from 13.5 per cent; and

• a tax refund for the commercialization of intellectual property in the form of life science related patents.

Since the February 15 budget, the province has also negotiated funding agreements with the federal government that enable expansion of key childhood development programs and programs in the forest sector:

• expansion of early learning and child care services ($329 million over three years); and

• support for the Mountain Pine Beetle Action Plan ($100 million over three years).

The September Update also reconfirms the spending and revenue initiatives tabled with the February 15 budget.

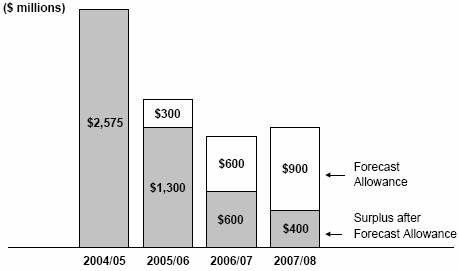

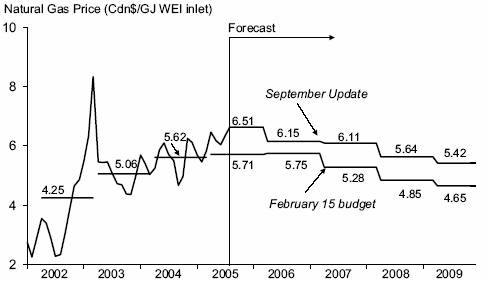

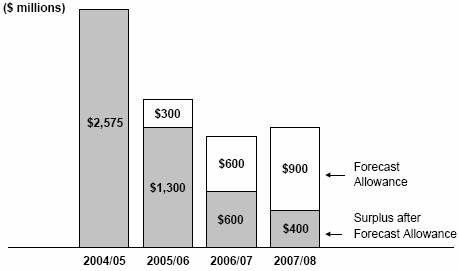

Budget plan remains prudent

With the September Update, government continues its legislated commitment to balanced budgets. The updated fiscal plan includes a forecast surplus of $1.3 billion for 2005/06, and surpluses of $600 million in 2006/07 and $400 million in 2007/08. The updated fiscal plan includes forecast allowances of $300 million in 2005/06, $600 million in 2006/07 and $900 million in 2007/08. These provisions protect the fiscal plan from revenue risks such as a sudden fall in energy prices, natural disasters and other unexpected spending requirements.

The forecast allowances must also cover potential wage and benefit increases arising from the next round of public sector bargaining, as no compensation increases have been included in this fiscal plan. Details of the next wage mandate will be released by the next budget in February 2006.

Surplus allocated to reduce borrowing requirements

To meet the transportation, health and education infrastructure needs of a growing economy, significant capital project investments are planned in the coming years for health care facilities, universities, colleges and highways. This leads to increases in debt over the course of the three-year plan, reflecting the borrowing requirements for planned capital projects. The three-year fiscal plan assumes that funds from the operating surplus are applied to reduce these borrowing requirements.

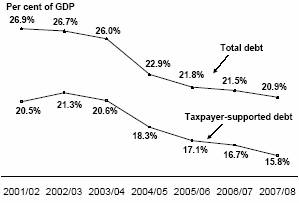

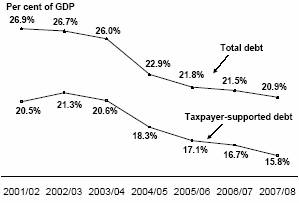

Debt to remain affordable

Government is committed to keeping debt affordable for future generations of British Columbians. Government will monitor the borrowing requirements for capital projects to ensure that debt does not grow faster than the overall economy. Consistent with this commitment, both total debt and taxpayer-supported debt are forecast to decline as a per cent of GDP in each of the next three years.

Debt-to-GDP ratio to decline

A strong economic foundation

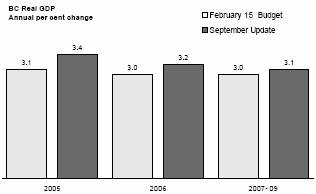

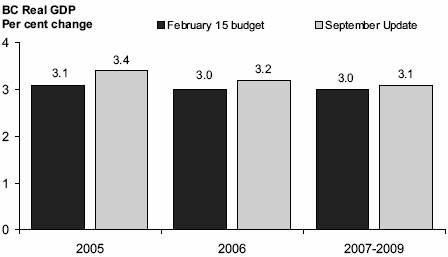

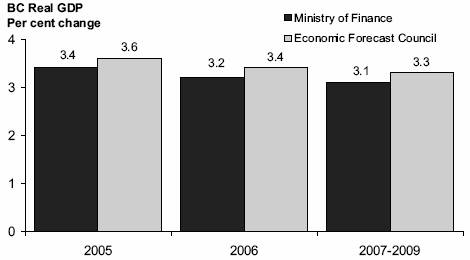

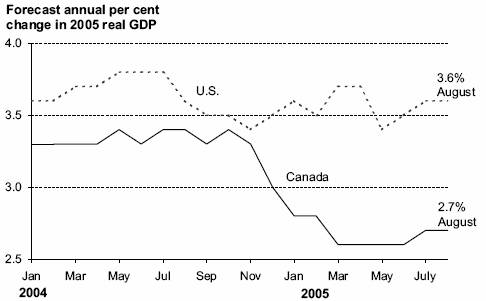

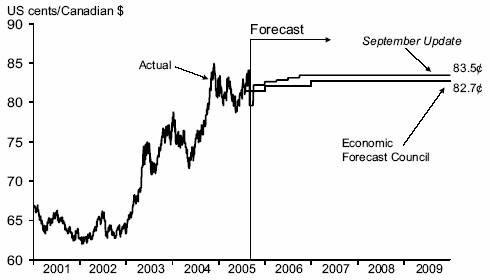

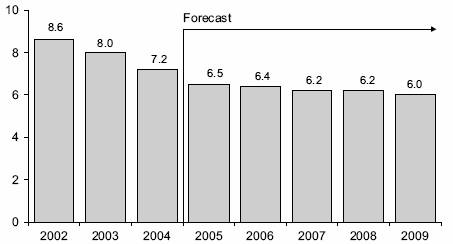

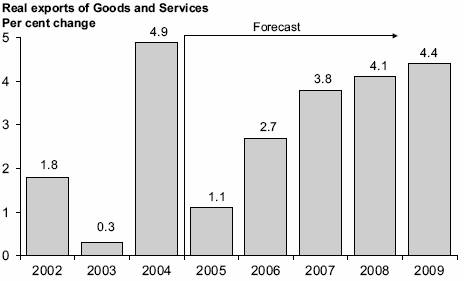

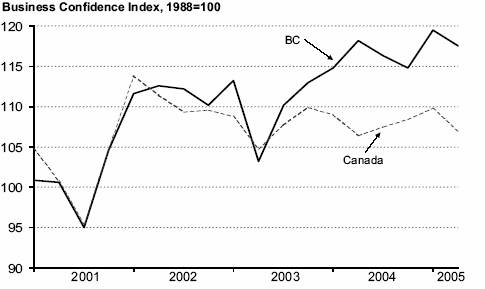

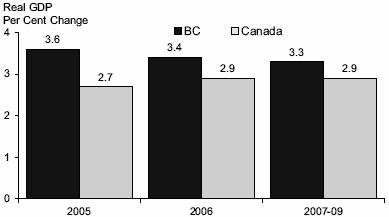

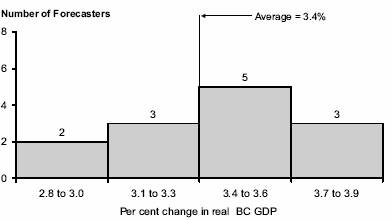

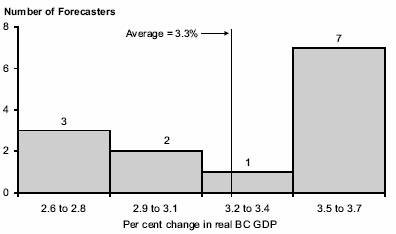

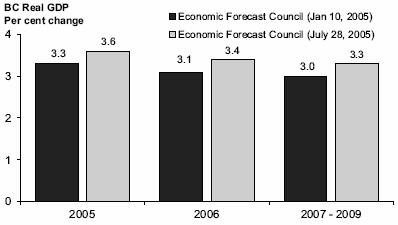

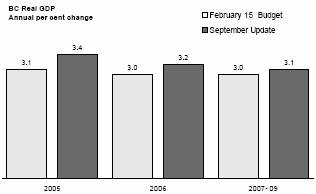

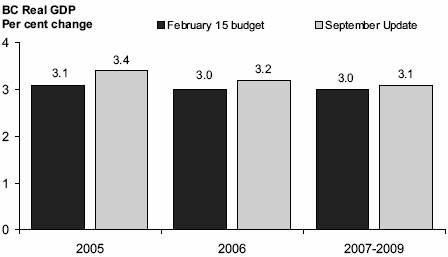

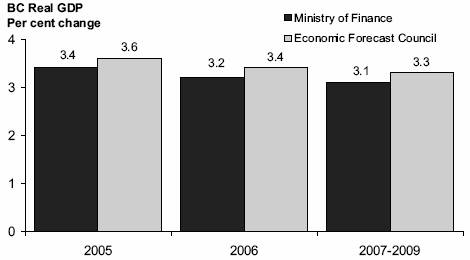

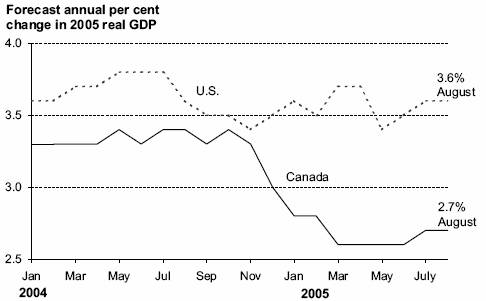

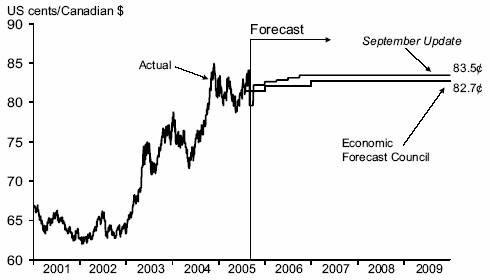

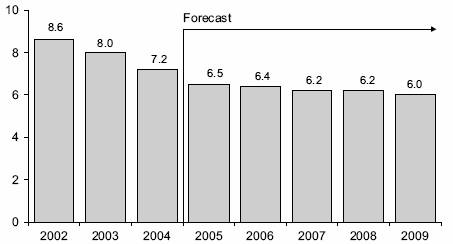

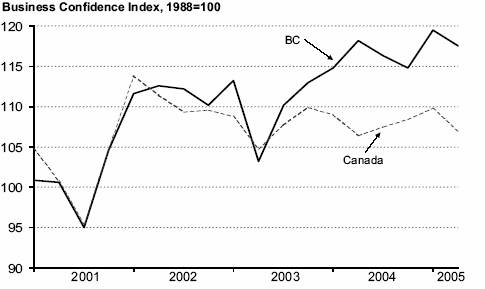

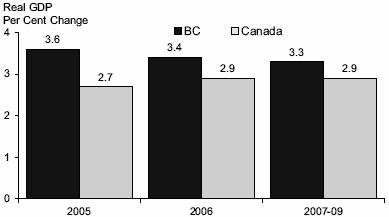

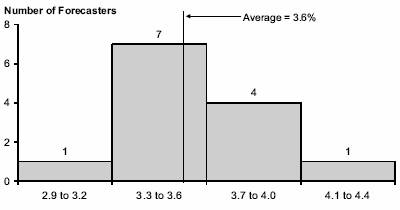

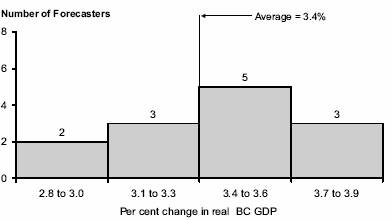

The BC economy performed impressively in 2004, posting a real GDP growth rate of 3.9 per cent. Momentum continues in employment, consumer spending, home construction and non-residential investment, maintaining high levels of consumer and business confidence. This broadly based economic growth is expected to continue in 2005 and 2006. The Ministry of Finance forecasts economic growth of 3.4 per cent for 2005 and 3.2 per cent in 2006, up from the forecast in the February 15 budget.

The revenue outlook has similarly improved since February primarily due to higher taxation and energy revenues consistent with the updated economic forecast, as well as new federal government transfer payments. A strong economy and an improved financial position provide the underpinnings for continued enhancement of priority program areas, and for maintaining a competitive economic environment.

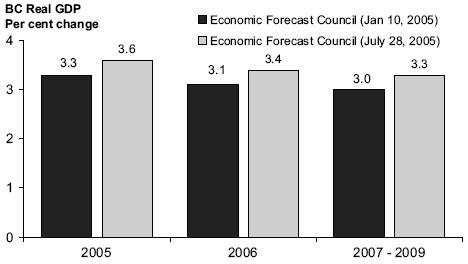

BC economic growth forecast improved

Seniors first to share in new benefits

The new commitments in this September Update incorporate initiatives to improve the lives of senior citizens. These include funds for:

• the renewal of the Seniors’ Supplement for those with lower incomes;

• increased ceilings for eligibility under the Shelter Aid for Elderly Renters (SAFER) rent subsidy program; and

• strengthening and modernizing the full range of health care services for seniors.

Building a new First Nations relationship

The provincial government is committed to building a new relationship with First Nations and Aboriginal communities. In 2005/06, the provincial government plans to invest $100 million of one-time funding to help First Nations and Aboriginal communities build appropriate capacity to provide effective input and participate in the management of lands, resources and social programs. This will assist First Nations and Aboriginal communities in becoming active, supporting partners in relationships with government, business and other organizations.

3

Spending Initiatives

($ millions) | | 2005/06 | | 2006/07 | | 2007/08 | |

September Update | | | | | | | |

Enhanced services for seniors | | 93 | | 112 | | 37 | |

First Nations New Relationships fund | | 100 | | — | | — | |

Other changes | | 54 | | 104 | | 66 | |

| | 247 | | 216 | | 103 | |

Funded by new federal transfers | | | | | | | |

Early learning and child care | | 55 | | 122 | | 152 | |

Mountain pine beetle | | 27 | | 37 | | 36 | |

September Update sub-total | | 329 | | 375 | | 291 | |

| | | | | | | |

February 15 Budget | | | | | | | |

Health services | | 624 | | 555 | | 848 | |

K-12 and post-secondary education | | 108 | | 19 | | 119 | |

Services to children | | 75 | | 82 | | 87 | |

Community services | | 155 | | 158 | | 210 | |

Safety | | 57 | | 68 | | 73 | |

Economic development and job creation | | 367 | | 89 | | 116 | |

Olympics funding | | — | | — | | 40 | |

Environment | | 41 | | 40 | | 42 | |

February 15 budget sub-total | | 1,427 | | 1,011 | | 1,535 | |

Total spending initiatives | | 1,756 | | 1,386 | | 1,826 | |

Early learning and child care

Additional revenues from a five-year agreement with the federal government will allow for expansion of the Child Care Subsidy program and creation of new child care spaces.

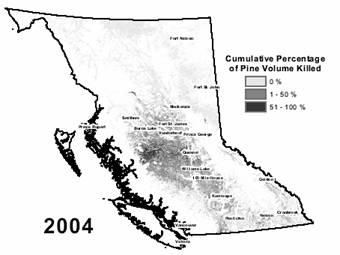

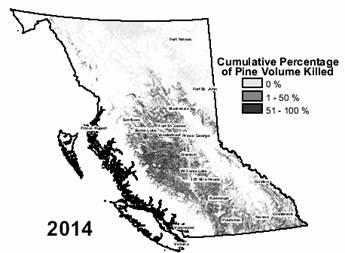

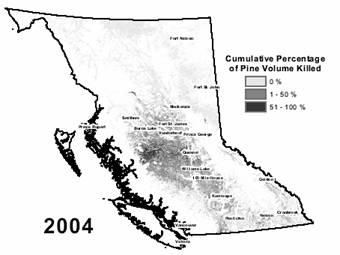

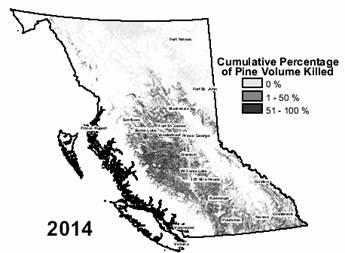

Mountain pine beetle

In addition to the $89 million provincial funding increase in the February 15 budget, a further $100 million received from the federal government will support the province’s Mountain Pine Beetle Action Plan, and help respond to the increasing devastation of the pine forest in BC’s interior.

Other changes

Other changes since the February 15 budget include a $50 million annual increase in the contingency vote to allow for unexpected costs or new initiatives. The contingency vote is now set at approximately 1 per cent of total government expense.

Maintaining a competitive environment

In addition to the tax relief measures in the February 15 budget, and already passed into law, the September Update includes measures to enhance BC as a competitive location for new business investment and to support job creation. The September Update includes a reduction in the general corporate income tax rate and a tax incentive to help keep intellectual property within the province.

Tax reductions

($ millions) | | 2005/06 | | 2006/07 | | 2007/08 | |

September Update | | | | | | | |

General corporate income tax rate reduction to 12% from 13.5% | | 71 | | 143 | | 143 | |

Intellectual property | | — | | 20 | | 20 | |

September Update sub-total | | 71 | | 163 | | 163 | |

| | | | | | | |

February 15 Budget | | | | | | | |

BC tax reduction for low and modest income earners | | 120 | | 122 | | 124 | |

Social service tax reduction | | 270 | | 288 | | 298 | |

First time home buyers’ property transfer tax exemption | | 15 | | 15 | | 15 | |

Enhanced MSP premium assistance | | 30 | | 40 | | 40 | |

Small business income tax threshold | | 10 | | 10 | | 10 | |

Other | | 42 | | 21 | | 14 | |

February 15 budget sub-total | | 487 | | 496 | | 501 | |

Total tax reductions | | 558 | | 659 | | 664 | |

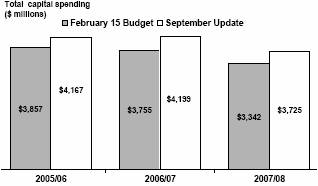

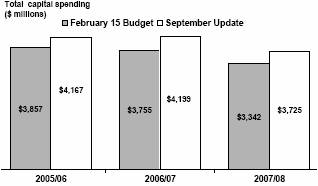

Expanded capital plan

The September Update includes a capital plan for ministries and Crown corporations, reflecting a three-year increase of $1.1 billion compared to the February 15 budget. This is mainly due to higher planned capital outlays by the post-secondary sector and health authorities based on updated plans from these sectors. Plan changes also include the increase for the Vancouver Convention Centre Expansion Project.

Expanded capital plan reflects demand for new infrastructure

4

Infrastructure is costly to build, operate and maintain. But it is long-lived and delivers benefits across generations. Today’s British Columbians are reaping the benefits of infrastructure investments made by their parents and grandparents. Infrastructure is clearly important to all British Columbians. Careful planning and budgeting is important so government can build new infrastructure, overhaul and update existing infrastructure and avoid bottlenecks, so that the province is left in good order for future generations.

Given the recent rise in construction material and labour prices, government will bring increased focus on capital spending proposals during the annual budget priority setting process, and will continue to monitor its infrastructure plan to ensure that all planned projects are managed within a declining debt-to-GDP track.

First Quarterly Report

In addition to the updated fiscal plan and its underlying assumptions, the September Update includes financial results for the April-to-June quarter of the 2005/06 fiscal year. These show a three-month surplus of $469 million mainly due to lower-than-expected spending in the first three months of the fiscal year.

2006/07 budget process

Due to the timing of the September Update, the debate on the 2005/06 Estimates will occur at the same time that the budget development process for 2006/07 gets underway. The Minister of Finance has released the 2006/07 Budget Consultation Paper with the September Update. This paper stands referred to a Select Standing Committee of the Legislative Assembly, which will seek public input on the February 2006 budget and hold public meetings in selected communities around British Columbia during late September and October.

5

Part 1: THREE-YEAR FISCAL PLAN

Table 1.1 Three Year Fiscal Plan – Operating Statement

| | 2004/05 | | Budget | | | | | |

| | Budget | | | | Estimate | | Plan | | Plan | |

($ millions) | | Estimate | | Actual | | 2005/06 | | 2006/07 | | 2007/08 | |

Taxpayer-supported programs and agencies: | | | | | | | | | | | |

Revenue | | 28,420 | | 30,821 | | 32,202 | | 32,139 | | 32,934 | |

Expense | | (30,292 | ) | (30,658 | ) | (32,876 | ) | (33,198 | ) | (33,831 | ) |

Taxpayer-supported balance | | (1,872 | ) | 163 | | (674 | ) | (1,059 | ) | (897 | ) |

Commercial Crown corporation income | | 2,072 | | 2,412 | | 2,274 | | 2,259 | | 2,197 | |

Surplus before forecast allowance | | 200 | | 2,575 | | 1,600 | | 1,200 | | 1,300 | |

Forecast allowance | | (100 | ) | — | | (300 | ) | (600 | ) | (900 | ) |

Surplus | | 100 | | 2,575 | | 1,300 | | 600 | | 400 | |

Introduction

The September Update continues government’s legislated commitment to balance the provincial budget. Following a record surplus of $2.6 billion in 2004/05, the updated fiscal plan forecasts a surplus of $1.3 billion for 2005/06, and surpluses of $600 million in 2006/07 and $400 million for 2007/08.

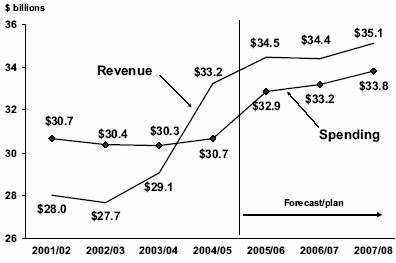

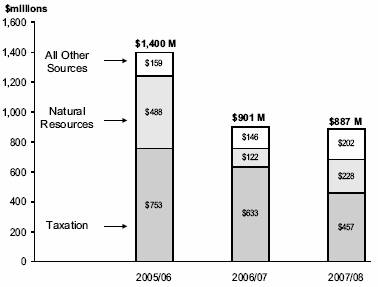

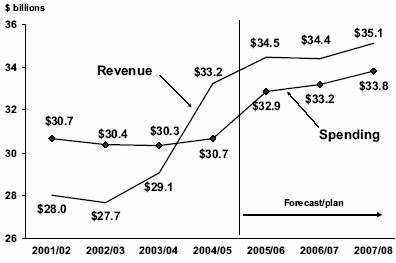

Chart 1.1 Revenue gains improve fiscal outlook

Since the February 15 budget, the surplus outlook has improved by $1.1 billion in 2005/06, $400 million in 2006/07 and by $200 million in 2007/08, driven by a stronger economic performance. This allows for new funding for government initiatives in priority areas including:

• program enhancements for seniors ($242 million over three years); and

• a commitment to help build a new relationship with First Nations and Aboriginal communities ($100 million in 2005/06).

In addition, since the February 15 budget the province has negotiated funding agreements with the federal government that fund the following initiatives:

• expansion of early learning and child care ($329 million over three years); and

6

• support for the Mountain Pine Beetle Action Plan ($100 million over three years).

The September Update includes an infrastructure plan to meet the needs of a growing economy and demands for new and upgraded health care and educational facilities. Total infrastructure spending for ministries and taxpayer-supported agencies is higher than the February 15 budget, and funds an additional $243 million in 2005/06, $430 million in 2006/07 and $371 million in 2007/08. This mainly reflects needed infrastructure in the colleges and universities and for health care facilities. More information on the capital spending forecast is found on page 37.

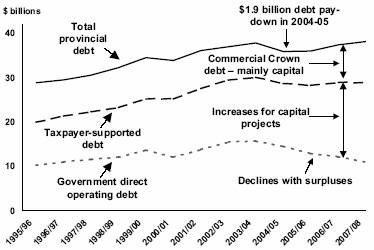

Following a record $1.9 billion reduction in provincial debt in 2004/05, debt is forecast to increase slightly in 2005/06 to total $35.9 billion, and is forecast to rise to $38.0 billion by 2007/08. The increase in debt reflects borrowing needed to support planned infrastructure spending including health facilities, post-secondary institutions, and highways.

Government is committed to keeping debt affordable for future generations of British Columbians. Consistent with this commitment, both the total debt to GDP and the taxpayer-supported debt to GDP ratios continue to fall over the three-year fiscal plan. Additional information on the debt outlook is found starting on page 41 and in the topic box on page 58.

The September Update is prepared on the basis of the ministry and Cabinet structure announced on June 16, 2005. The responsibilities for Land and Water BC (LWBC) are being formally transferred to eight government ministries effective September 30, 2005. Increases to those ministries’ budgets are offset by the elimination of LWBC spending over the three-year plan.

To cover potential ministry pressures relating to the reorganization, $20 million has been notionally set aside within the contingencies vote in 2005/06.

The budget plan for BC Buildings Corporation is included in the September Update on a status-quo basis, as details for its incorporation into government have not yet been finalized.

The government revenue forecast is based on income growth, demand, commodity prices, the exchange rate and other related assumptions included in the economic forecast. Revenue also includes forecasts submitted by Crown corporations, and organizations in the SUCH sector (school districts; universities, colleges and university colleges and institutes; and health authorities and hospital societies).

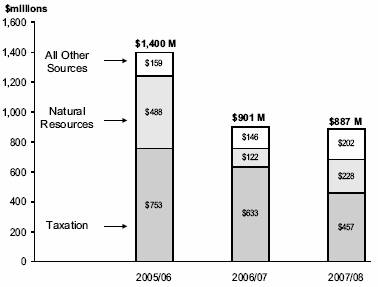

By comparison to the February 15 budget, revenues (before tax measures) are forecast to have increased by $1.5 billion in 2005/06, and by $1.1 billion in 2006/07 and 2007/08. These increases reflect the improved economic outlook, higher commodity prices, additional federal funding and the better than expected results in 2004/05. After deducting the impact of new tax measures in this budget, the change in revenues becomes $1.4 billion in 2005/06, $901 million in 2006/07 and $887 million in 2007/08 (as shown in Table 1.2).

7

Table 1.2 Three-Year Fiscal Plan Update – Changes from February 15 Budget

($ millions) | | 2005/06 | | 2006/07 | | 2007/08 | |

February 15 Budget | | 220 | | 200 | | 200 | |

Revenue changes: | | | | | | | |

Taxation | | 824 | | 796 | | 620 | |

Natural resources | | 488 | | 122 | | 228 | |

Other taxpayer-supported revenue | | 84 | | 6 | | (23 | ) |

Federal transfers | | 131 | | 133 | | 158 | |

Commercial Crown corporation operating results | | (56 | ) | 7 | | 67 | |

Total revenue changes before tax measures | | 1,471 | | 1,064 | | 1,050 | |

Less : tax measures | | (71 | ) | (163 | ) | (163 | ) |

Total revenue changes after tax measures | | 1,400 | | 901 | | 887 | |

Less : expense increases (decreases): | | | | | | | |

Consolidated revenue fund (CRF) increases: | | | | | | | |

Ministry of Health (Seniors) | | 75 | | 75 | | — | |

Ministry of Advanced Education (tuition policy/seat growth) | | 15 | | — | | — | |

Ministry of Attorney General (Crown prosecutors) | | — | | 10 | | 11 | |

Ministry of Children and Family Development (Community Living BC) | | 4 | | 2 | | 2 | |

Ministry of Children and Family Development (Early Learning and Child Care) (1) | | 55 | | 122 | | 152 | |

Ministry of Employment and Income Assistance (seniors supplement) | | 10 | | 20 | | 20 | |

Ministry of Forests and Range (housing) | | 8 | | 17 | | 17 | |

Ministry of Forests and Range (BC timber sales) | | (18 | ) | — | | — | |

Ministry of Forests and Range (mountain pine beetle) (1) | | 27 | | 37 | | 36 | |

Ministry of Tourism, Sport and the Arts (Vancouver Convention Centre Expansion) | | — | | 39 | | — | |

Other spending changes (including contingency vote increase) | | 53 | | 53 | | 53 | |

Subtotal | | 229 | | 375 | | 291 | |

Transfer from Land and Water BC (various ministries) | | 19 | | 38 | | 38 | |

Reduction in MOPD debt servicing costs | | (46 | ) | (36 | ) | (73 | ) |

First Nations New Relationships Fund | | 100 | | — | | — | |

Net increase in CRF spending | | 302 | | 377 | | 256 | |

Change in expenses recovered from external entities | | (21 | ) | (38 | ) | (32 | ) |

Land and Water BC – transfer to ministries | | (19 | ) | (38 | ) | (38 | ) |

Other taxpayer-supported Crown agencies – net spending | | 36 | | (21 | ) | 22 | |

SUCH sector – net spending | | 122 | | 71 | | 129 | |

Total expense increases | | 420 | | 351 | | 337 | |

Net changes before forecast allowance adjustment | | 980 | | 550 | | 550 | |

Forecast allowance (increase)/decreases | | 100 | | (150 | ) | (350 | ) |

Total changes | | 1,080 | | 400 | | 200 | |

September Update Updated Fiscal Plan | | 1,300 | | 600 | | 400 | |

(1) Funded through increases in federal transfers.

The revenue forecast is described starting on page 31. The revenue forecast also includes the effect of new revenue measures since the February 15 budget totaling $71 million in 2005/06 and $163 million in 2006/07 and 2007/08. These revenue policy changes are detailed in Part 2: Revenue Measures.

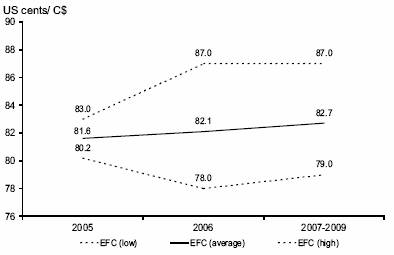

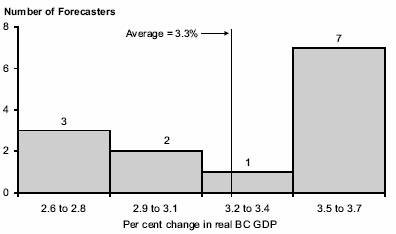

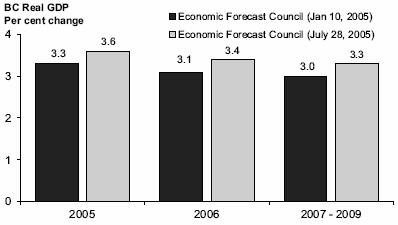

The fiscal plan is based on the Ministry of Finance’s economic forecast that projects economic growth of 3.4 per cent for 2005, 3.2 per cent in 2006 and 3.1 per cent in 2007, slightly less than the independent Economic Forecast Council average. Full details of the economic forecast are found in Part 3: British Columbia Economic Review and Outlook.

8

Chart 1.2 Revenue and spending trends

Based on projections for the economy and for commodity prices, total revenues are expected to increase by 3.7 per cent in 2005/06, followed by growth of 0.9 per cent per year on average for the next two years.

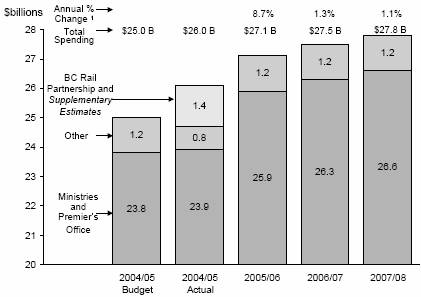

The spending plan confirms the spending initiatives tabled with the February 15 budget and provides new funding for government priorities including key program enhancements for seniors. Overall spending is forecast to increase by 7.2 per cent between 2004/05 and 2005/06, as funding is increased in most ministry budgets. Further information on the spending forecast, including the consolidated revenue fund (CRF) spending plan, follows on page 12.

The main risks to the government fiscal plan include economic fluctuations such as exchange rate or sudden commodity price changes, as well as wage and service demand pressures on the expenditure side. These and other risks are more fully described starting on page 44.

A $300 million forecast allowance is provided in 2005/06 to protect the bottom line against unanticipated revenue shortfalls or spending pressures that may arise before the end of the fiscal year. The fiscal plan also includes forecast allowances of $600 million in 2006/07, and $900 million in 2007/08, to protect the fiscal plan from revenue risks such as sudden changes in energy prices and from unexpected spending pressures such as natural disasters. The forecast allowances also cover the potential costs of future public sector wage settlements.

The three-year fiscal plan conforms to the standards set by the accounting profession for senior governments in Canada referred to as generally accepted accounting principles or “GAAP”. As with the February 15 budget and Budget 2004, this budget integrates financial forecasts for the SUCH sector into government’s revenue, spending and balance sheet projections.

9

Table 1.3 Revenue by Source(1)

| | 2004/05 | | Budget | | | | | |

| | Budget | | | | Estimate | | Plan | | Plan | |

($ millions) | | Estimate | | Actual | | 2005/06 | | 2006/07 | | 2007/08 | |

Taxation revenue | | | | | | | | | | | |

Personal income | | 5,005 | | 5,050 | | 5,484 | | 5,674 | | 6,008 | |

Corporate income | | 893 | | 1,255 | | 1,215 | | 1,223 | | 1,099 | |

Social service | | 4,156 | | 4,156 | | 4,213 | | 4,427 | | 4,649 | |

Fuel | | 891 | | 904 | | 915 | | 947 | | 979 | |

Tobacco | | 676 | | 699 | | 690 | | 690 | | 690 | |

Property | | 1,655 | | 1,661 | | 1,717 | | 1,789 | | 1,859 | |

Property transfer | | 432 | | 604 | | 650 | | 600 | | 550 | |

Other | | 477 | | 588 | | 561 | | 546 | | 556 | |

| | 14,185 | | 14,917 | | 15,445 | | 15,896 | | 16,390 | |

Natural resource revenue | | | | | | | | | | | |

Natural gas royalties | | 1,213 | | 1,439 | | 1,754 | | 1,714 | | 1,764 | |

Columbia River Treaty | | 215 | | 258 | | 305 | | 285 | | 265 | |

Other energy and minerals | | 603 | | 612 | | 775 | | 796 | | 731 | |

Forests | | 999 | | 1,363 | | 1,246 | | 1,007 | | 1,008 | |

Water and other resources | | 402 | | 301 | | 326 | | 380 | | 384 | |

| | 3,432 | | 3,973 | | 4,406 | | 4,182 | | 4,152 | |

Other revenue | | | | | | | | | | | |

Medical Services Plan premiums | | 1,398 | | 1,465 | | 1,438 | | 1,437 | | 1,444 | |

Post secondary education fees | | 763 | | 836 | | 904 | | 935 | | 974 | |

Other healthcare-related fees | | 195 | | 189 | | 179 | | 173 | | 173 | |

Motor vehicle licences and permits | | 370 | | 381 | | 398 | | 410 | | 424 | |

Other fees and licences | | 852 | | 750 | | 746 | | 700 | | 665 | |

Investment earnings | | 889 | | 833 | | 818 | | 836 | | 885 | |

Sales of goods and services | | 681 | | 741 | | 655 | | 673 | | 703 | |

Miscellaneous | | 1,309 | | 1,505 | | 1,590 | | 1,535 | | 1,545 | |

| | 6,457 | | 6,700 | | 6,728 | | 6,699 | | 6,813 | |

Contributions from the federal government | | | | | | | | | | | |

Health and social transfers | | 3,224 | | 3,421 | | 4,180 | | 4,545 | | 4,860 | |

Equalization | | 402 | | 979 | | 590 | | — | | — | |

Other cost-shared agreements | | 720 | | 831 | | 853 | | 817 | | 719 | |

| | 4,346 | | 5,231 | | 5,623 | | 5,362 | | 5,579 | |

Taxpayer-supported programs and agencies | | 28,420 | | 30,821 | | 32,202 | | 32,139 | | 32,934 | |

Commercial Crown corporation income | | | | | | | | | | | |

BC Hydro (before regulatory transfers) | | 388 | | 240 | | 329 | | 333 | | 256 | |

Liquor Distribution Branch | | 760 | | 779 | | 779 | | 794 | | 809 | |

BC Lotteries (net of payments to federal government) | | 842 | | 811 | | 892 | | 942 | | 1,021 | |

BC Rail (2) | | 29 | | 178 | | 39 | | 46 | | 26 | |

ICBC (3) | | 52 | | 399 | | 224 | | 125 | | 61 | |

Other | | 1 | | 5 | | 11 | | 19 | | 24 | |

| | 2,072 | | 2,412 | | 2,274 | | 2,259 | | 2,197 | |

Total revenue | | 30,492 | | 33,233 | | 34,476 | | 34,398 | | 35,131 | |

(1) | The 2004/05 budget estimate and actual results have been restated to reflect government’s current accounting policies. |

(2) | BC Rail’s fiscal plan projections represent their earnings during government’s fiscal year. On BC Rail’s fiscal year basis (December), the outlook is – 2004 (budget): $211 million; 2004 (actual): $195 million; 2005: $39 million; 2006: $46 million; 2007:$26 million. |

(3) | ICBC’s fiscal plan projections represent their earnings during government’s fiscal year. On ICBC’s fiscal year basis (December), the outlook is – 2004 (budget): $52 million; 2004 (actual): $389 million; 2005: $285 million; 2006: $125 million; 2007:$61 million. |

10

Table 1.4 Expense by Ministry, Program and Agency(1)

| | 2004/05 | | Budget | | | | | |

| | Budget | | | | Estimate | | Plan | | Plan | |

($ millions) | | Estimate | | Actual | | 2005/06 | | 2006/07 | | 2007/08 | |

Advanced Education | | 1,828 | | 1,827 | | 1,898 | | 1,948 | | 2,024 | |

Education | | 4,922 | | 4,919 | | 5,074 | | 5,166 | | 5,190 | |

Health | | 10,545 | | 10,589 | | 11,470 | | 11,870 | | 12,089 | |

Subtotal | | 17,295 | | 17,335 | | 18,442 | | 18,984 | | 19,303 | |

Office of the Premier | | 9 | | 8 | | 11 | | 12 | | 12 | |

Aboriginal Relations and Reconciliation | | 39 | | 35 | | 34 | | 33 | | 32 | |

Agriculture and Lands | | 314 | | 227 | | 294 | | 255 | | 221 | |

Attorney General | | 445 | | 446 | | 459 | | 481 | | 483 | |

Children and Family Development | | 1,498 | | 1,467 | | 1,637 | | 1,735 | | 1,789 | |

Community Services | | 190 | | 178 | | 261 | | 247 | | 221 | |

Economic Development | | 104 | | 83 | | 444 | | 155 | | 149 | |

Employment and Income Assistance | | 1,262 | | 1,259 | | 1,355 | | 1,367 | | 1,395 | |

Energy, Mines and Petroleum Resources | | 59 | | 71 | | 72 | | 72 | | 70 | |

Environment | | 149 | | 128 | | 175 | | 219 | | 220 | |

Finance | | 78 | | 81 | | 81 | | 81 | | 81 | |

Forests and Range | | 709 | | 785 | | 856 | | 922 | | 955 | |

Labour and Citizen’s Services | | 190 | | 234 | | 193 | | 192 | | 179 | |

Public Safety and Solicitor General | | 480 | | 488 | | 525 | | 528 | | 531 | |

Small Business and Revenue | | 44 | | 36 | | 44 | | 43 | | 43 | |

Tourism, Sport and the Arts | | 133 | | 166 | | 180 | | 190 | | 113 | |

Transportation | | 828 | | 834 | | 829 | | 830 | | 830 | |

Total ministries and Office of the Premier | | 23,826 | | 23,861 | | 25,892 | | 26,346 | | 26,627 | |

Legislation | | 46 | | 42 | | 51 | | 47 | | 47 | |

Officers of the Legislature | | 27 | | 27 | | 46 | | 21 | | 21 | |

BC Family Bonus | | 59 | | 57 | | 39 | | 32 | | 32 | |

Management of Public Funds and Debt | | 800 | | 677 | | 684 | | 711 | | 698 | |

Contingencies (All Ministries) and New Programs | | 191 | | — | | 320 | | 320 | | 360 | |

Other Appropriations | | 8 | | 8 | | 6 | | 6 | | 6 | |

Subtotal | | 24,957 | | 24,672 | | 27,038 | | 27,483 | | 27,791 | |

First Nations New Relationships Fund | | — | | — | | 100 | | — | | — | |

Priority initiatives | | — | | 452 | | — | | — | | — | |

Transportation infrastructure funding | | — | | 750 | | — | | — | | — | |

Disbursement of BC Rail Partnership gain | | — | | 169 | | — | | — | | — | |

Consolidated revenue fund expense | | 24,957 | | 26,043 | | 27,138 | | 27,483 | | 27,791 | |

Expenses recovered from external entities | | 1,632 | | 1,705 | | 1,674 | | 1,689 | | 1,662 | |

Grants to agencies and other internal transfers: | | | | | | | | | | | |

Taxpayer-supported Crown agencies | | (735 | ) | (1,752 | ) | (974 | ) | (1,000 | ) | (933 | ) |

School districts | | (4,267 | ) | (4,262 | ) | (4,438 | ) | (4,486 | ) | (4,514 | ) |

Universities | | (818 | ) | (893 | ) | (981 | ) | (993 | ) | (1,021 | ) |

Colleges, university colleges, and institutes | | (778 | ) | (848 | ) | (741 | ) | (757 | ) | (770 | ) |

Health authorities and hospital societies | | (6,912 | ) | (7,198 | ) | (7,583 | ) | (7,700 | ) | (7,785 | ) |

Children and Family Development governance authorities | | — | | (1 | ) | (395 | ) | (592 | ) | (1,140 | ) |

| | (13,510 | ) | (14,954 | ) | (15,112 | ) | (15,528 | ) | (16,163 | ) |

Taxpayer-supported Crown agencies | | 1,904 | | 2,130 | | 2,137 | | 2,046 | | 2,210 | |

SUCH sector and regional authorities: | | | | | | | | | | | |

School districts | | 4,451 | | 4,533 | | 4,781 | | 4,829 | | 4,846 | |

Universities | | 1,936 | | 2,073 | | 2,454 | | 2,574 | | 2,682 | |

Colleges, university colleges, and institutes | | 1,324 | | 1,345 | | 1,258 | | 1,280 | | 1,323 | |

Health authorities and hospital societies (2) | | 7,598 | | 7,782 | | 8,159 | | 8,241 | | 8,347 | |

Children and Family Development governance authorities | | — | | 1 | | 387 | | 584 | | 1,133 | |

| | 17,213 | | 17,864 | | 19,176 | | 19,554 | | 20,541 | |

Net spending of Crown agencies and the SUCH sector | | 3,703 | | 2,910 | | 4,064 | | 4,026 | | 4,378 | |

Total taxpayer-supported expense | | 30,292 | | 30,658 | | 32,876 | | 33,198 | | 33,831 | |

(1) | The 2004/05 budget estimate and actual results have been restated to reflect government’s current organization and accounting policies. |

(2) | Excludes inter-entity transactions between health authorities and hospital societies. |

11

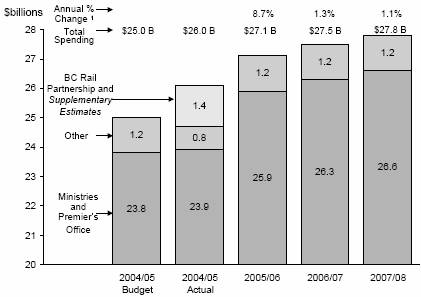

Consolidated Revenue Fund Spending

Consolidated Revenue Fund (CRF) spending will increase from an initial estimate of $25.0 billion in 2004/05 to $27.8 billion by 2007/08 – an 11.3 per cent increase.

This budget confirms government’s commitment to health care and education as government’s funding priority areas, while taking advantage of the new choices provided by increased revenues to provide additional support to BC’s seniors, children, First Nations and the mountain pine beetle response.

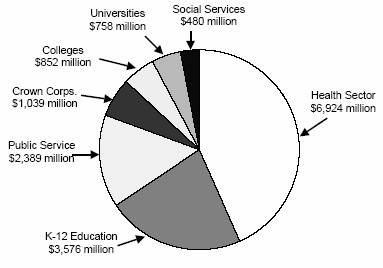

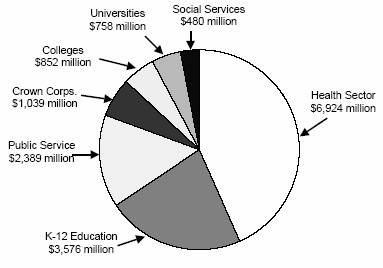

Chart 1.3 Consolidated Revenue Fund spending (1)

(1) Change from prior year budget.

Seniors

The September Update builds on government’s ongoing commitment for a system of supports for seniors by providing an additional $242 million over three years to assist low-income seniors with the increased cost of living and housing and to strengthen and modernize the full range of services for seniors.

The Ministry of Employment and Income Assistance budget includes an additional $50 million over three years for the Senior’s Supplement. Effective in October 2005, eligible seniors receiving the federal guaranteed income supplement will receive a provincial monthly supplement of up to a maximum of $49 per single senior or up to $60 per partner in a married couple. An estimated 39,500 low-income seniors will benefit from this provincial supplement.

Table 1.5 Enhancing Services to Seniors

($ millions) | | 2005/06 | | 2006/07 | | 2007/08 | | Total | |

September Update | | | | | | | | | |

Seniors’ supplement | | 10 | | 20 | | 20 | | 50 | |

SAFER | | 8 | | 17 | | 17 | | 42 | |

Transition support/Seniors care | | 75 | | 75 | | — | | 150 | |

Total changes | | 93 | | 112 | | 37 | | 242 | |

12

The September Update also provides an additional $42 million over three years to fund rent ceiling increases to the Shelter Aid for Elderly Renters (SAFER). The maximum monthly rent ceiling under SAFER will increase by $90 in low cost areas and $180 in high cost areas effective in October 2005 and the program will be expanded to include owners of manufactured homes paying pad rental. These significant rent ceiling increases are the first since 1990, and coupled with the inclusion of owners of manufactured homes, are expected to increase the number of eligible program participants from 12,000 to 19,200 – a 60 per cent increase.

The Ministry of Health will achieve the commitment to add 5,000 new residential, Assisted Living and Supportive Housing beds by 2008. However, many facilities also need to be modernized and updated. The September Update provides an additional $150 million over two years to strengthen and modernize the full range of services for seniors, to support a smooth transition as new beds come on stream and to ensure seniors can age in place where appropriate. This funding will be used to benefit seniors in a number of ways, including:

• the purchase of equipment, such as beds and lifts for improved patient care and comfort, and to reduce strain and injuries for health care providers;

• facility improvements to accommodate higher levels of care; and

• training of case managers in the use of new assessment tools;

Of this new funding, $40 million will be invested directly in services provided by partners such as SUCCESS, Kiwanis and the Salvation Army.

More information on programs for seniors is provided in the topic box on page 51.

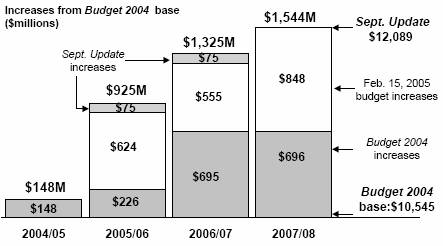

Health Care

The September Update reconfirms the investment of growing provincial revenues in British Columbia’s funding priorities for health care. Over three years, health care will receive the largest share of funding increases.

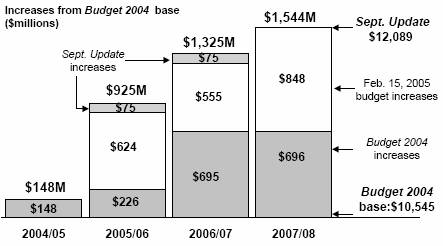

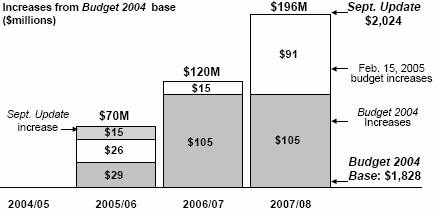

Chart 1.4 Ministry of Health budget increases

13

Table 1.6 Continued Commitment to Health Care

($ millions) | | 2005/06 | | 2006/07 | | 2007/08 | | Total | |

Lifts in Budget 2004 | | 226 | | 695 | | 696 | | 1,617 | |

| | | | | | | | | |

Post Budget 2004 | | | | | | | | | |

Additional 2004/05 Health Accord funding | | 148 | | 18 | | 130 | | 296 | |

Federal funding adjustment – population and equipment | | 17 | | (4 | ) | (1 | ) | 12 | |

Abbotsford Regional Hospital and Cancer Centre | | — | | — | | 3 | | 3 | |

Net health changes 2004 | | 391 | | 709 | | 828 | | 1,928 | |

| | | | | | | | | |

February 15, 2005 Budget | | | | | | | | | |

New 10-year federal health agreement | | 444 | | 523 | | 544 | | 1,511 | |

New provincial funding | | 15 | | 18 | | 172 | | 205 | |

September Update | | | | | | | | | |

Transition support/Seniors care | | 75 | | 75 | | — | | 150 | |

Total changes | | 925 | | 1,325 | | 1,544 | | 3,794 | |

Per cent increase from Budget 2004 base | | 8.8 | % | 12.6 | % | 14.6 | % | | |

By 2007/08, the Ministry of Health budget will increase by over 14.6 per cent or $1.5 billion since Budget 2004 was delivered on February 17, 2004. This is a result of additional new provincial funding and government’s continued commitment to reinvest every new federal dollar from the First Ministers’ Accord on Health Care Renewal funding and the new federal health funding agreement.

The $1.5 billion increase from 2004/05 to 2007/08 has been allocated to the following major program areas:

Regional Health Sector ($1,041 million) for services such as:

• effective health promotion, disease prevention and other public health services;

• enhancing primary care;

• cancer treatment, heart surgeries, diagnostic imaging, joint replacement, sight restoration services, renal care and palliative care;

• delivering effective community and home-based services;

• increasing options for frail seniors in the assisted living and residential care sector;

• increasing the supply and training of health care professionals; and

• patient safety initiatives.

Medical Services Plan ($120 million):

• To provide for increased volume related to population growth and aging.

PharmaCare ($254 million):

• For new drugs and anticipated volume and price increases for prescription drugs.

Debt Service and Amortization ($64 million):

• To support new provincial capital investment of $735 million over three years in the health sector.

14

Emergency Health Services (BC Ambulance) ($47 million):

• Additional capacity for emergency transport services.

Examples of spending initiatives that will increase access and services for the public, include:

• $10 million over three years for screening mammography;

• $14 million over three years for children and youth with special needs to provide additional diagnosis and assessment services for children who have developmental behavioural conditions including fetal alcohol syndrome disorder;

• $70 million is the Ministry of Health’s portion of the $73 million for Early Childhood Screening initiatives targeted at children below the age of six. Funding is provided for dental screening and services, hearing screening (A Sound Start), and vision screening;

• $77 million over 3 years for recruitment, training and retention of nurses;

• $100 million over three years for public health initiatives including ActNow BC, which promotes healthy lifestyles including physical activity, healthy eating, living tobacco free and healthy choices during pregnancy; and expanding public health capacity including prevention activities such as immunization programs, drinking water and food safety, and health emergency preparedness;

• $75 million in 2005/06 and 2006/07 to strengthen and modernize the full range of health care services for seniors;

• $70 million budgeted in 2007/08 for the Michael Smith Health Research Foundation which, when combined with the $30 million provided in 2004/05, completes government’s commitment of $100 million for the Michael Smith Foundation. This funding will support health system research including strategies to attract and keep health researchers and trainees in BC and to leverage research funding from other sources; and

• $125 million over three years for life supporting drugs and services for cancer, cardiac, renal and transplant patients.

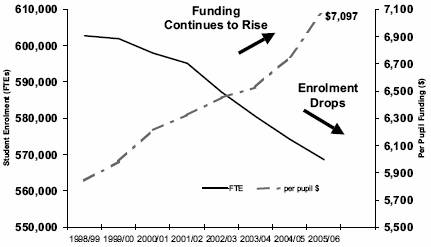

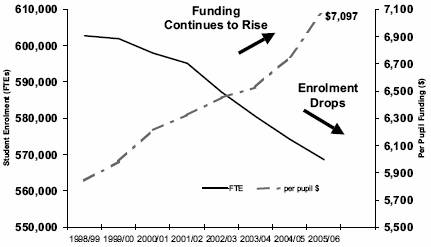

Education: K–12

The September Update builds on government’s ongoing commitment to education. Annual funding for K–12 will increase $268 million by 2007/08 compared to 2004/05 funding in Budget 2004. This represents 5.4 per cent growth in annual funding by 2007/08.

Per pupil funding for 2005/06 is estimated at $7,097 per student, a 5.1 per cent increase over 2004/05. This represents a $150 million increase in funding for the 2005/06 school year. Per pupil funding continues to grow to support student achievement despite declining enrolment projections.

This increased funding for K–12 students is linked to locally developed plans that will ensure every student has access to:

• school libraries and quality learning resources;

• music and arts programs; and

• improved services to support every special needs student.

15

Chart 1.5 K–12 budget increases

* Public library funding resulting from the government reorganization after the February 15 budget.

These plans indicate that school districts will use this funding to hire 1,600 more staff, including 630 teachers and 507 educational assistants. Further information on how individual school districts will be spending these funds is available on the Ministry of Education website at: www.bced.gov.bc.ca.

Chart 1.6 Student enrolment and per pupil funding (public schools)

In addition to increased per pupil funding, the September Update provides funding for a $1.5 billion seismic mitigation program to upgrade all at-risk schools within 15 years. A long-term plan for the program will be established with school boards and the Ministry of Education.

The September Update also reflects the transfer of public library funding to the Ministry of Education, including $12 million in new funding announced in the February 15 budget to provide broadband internet access to every branch, operating a 24-hour virtual reference desk and setting up a one-card system to give the public access to books from any library in the province.

16

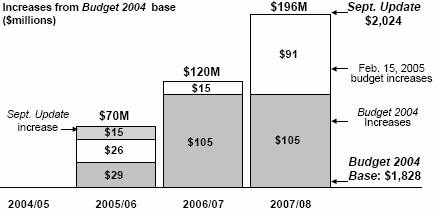

Post-Secondary Education

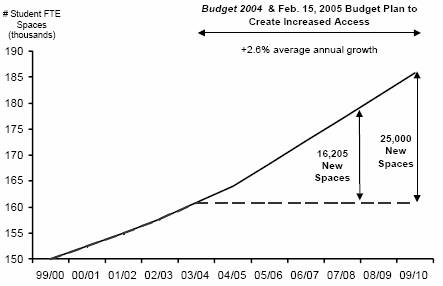

The September Update builds on government’s ongoing commitment to increasing access to post-secondary education. Annual funding for post-secondary education will increase by $196 million by 2007/08 compared to 2004/05 funding in Budget 2004. This represents 10.7 per cent growth in annual funding by 2007/08.

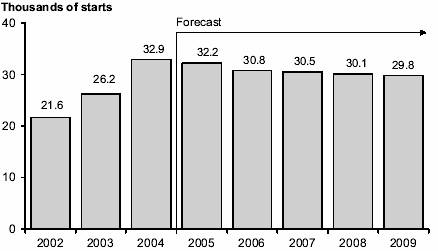

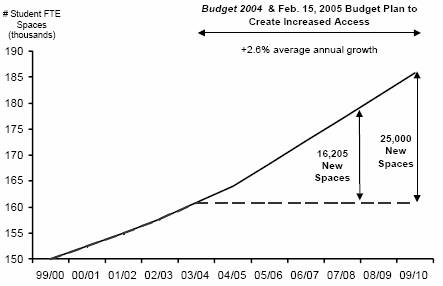

Chart 1.7 Post-secondary education budget increases

In partnership with the post-secondary sector, 25,000 new student spaces will be created by 2010. This represents average seat growth of 2.6 per cent annually. By the end of 2007/08, there will be 16,205 new seats in the post-secondary system. Through the September Update the province will fund these new seats at an average of $9,200 per space.

Chart 1.8 Public post-secondary student spaces increase

In the February 2005 throne speech, government committed to limit future tuition increases to the rate of inflation, effective September 2005. Recognizing this change will impact the ability of some institutions to raise revenues, and to ensure that provincial seat growth targets continue to be met, the September Update includes $15 million in new funding for universities in 2005/06. Government is continuing to work with post-secondary institutions to ensure that appropriate funding is available to meet government’s seat growth targets for 2005/06 and beyond.

17

In addition to providing funding for the annual costs for seat growth, the province is also providing almost $800 million in capital funding for infrastructure to accommodate seat growth, replace existing infrastructure and facilitate research activities throughout the post-secondary system.

The province provides over $300 million annually for loans to post-secondary students. As part of a comprehensive student financial assistance system, the September Update also provides over $450 million over three years in funding for loan reductions, targeting funds towards students who are most in need, grants for students with disabilities, debt relief programs and a loan-forgiveness program that encourages doctors, nurses and other health professionals to practice in under-served regions.

Children

Government will spend an additional $573 million over three years to enhance programs and services for children and their families.

Table 1.7 Enhancing Services to Children

($ millions) | | 2005/06 | | 2006/07 | | 2007/08 | | Total | |

September Update | | | | | | | | | |

Early Learning and Child Care | | 55 | | 122 | | 152 | | 329 | |

| | | | | | | | | |

February 15, 2005 Budget | | | | | | | | | |

Increased access to childcare | | 4 | | 1 | | — | | 5 | |

Children in care and family development | | 8 | | 9 | | 9 | | 26 | |

Early childhood screening | | 21 | | 25 | | 27 | | 73 | |

Children and youth with special needs | | | | | | | | | |

• Assessments | | 3 | | 5 | | 6 | | 14 | |

• Reduced waitlists | | 11 | | 14 | | 17 | | 42 | |

• Services for school-aged children | | 28 | | 28 | | 28 | | 84 | |

Total changes | | 130 | | 204 | | 239 | | 573 | |

The September Update includes an additional $329 million over three years for Early Learning and Child Care (ELCC). In the 2005 Federal Budget, the Government of Canada committed $5 billion over 5 years to ELCC. The provincial government is investing every dollar of BC’s share, estimated at $633 million over five years, in regulated early learning and child care for children under 6 years of age. The new ELCC funding will be targeted to improve access to quality child care programs and services, for groups such as lower income families, aboriginal people and children with special needs.

The province will develop and release in November 2005 an Action Plan on ELCC covering the five years of federal funding. The federal government and the province have committed to conclude a detailed multi-year funding agreement, for the period 2006/07 to 2009/10, by December 15, 2005.

This funding will enable the provincial government to help more families meet the challenge of affording quality child care in BC. This will be done by increasing child care subsidy rates and increasing the income exemption for parents with children under six in regulated child care. The province will also be addressing child care operating funding grants to providers as well as capital grants. More information will be available with the release of the Action Plan in November 2005.

18

The September Update reconfirms $73 million over three years to implement an integrated strategy for infant and early childhood screening programs as one method for improving early childhood development. Programs will focus on newborn hearing screening (A Sound Start), dental screening for infants and preschoolers, and a population health-based case finding approach to identify preschool children with vision impairments. This strategy will involve service providers in the health, school and community social services sectors.

The September Update reconfirms $140 million over three years to enhance programs and services for children and youth with special needs and their families. This includes $14 million for enhanced diagnostic and assessment services for children who have developmental behavioral conditions (including Fetal Alcohol Syndrome Disorder (FASD)); $42 million to provide new intervention and support services for children affected by FASD; for reducing waitlists in direct intervention services and key family support services; and $84 million for enhanced services to children and youth with special needs in the education system.

Communities

The September Update reconfirms the investment of growing provincial revenues in services and programs that support BC’s communities. Communities benefit from the additional funding that the September Update provides to persons with disabilities, people who are homeless, and recent immigrants to increase their self-reliance and maximize involvement in their local communities, as well as from the expansion of local arts, literacy and cultural initiatives.

Table 1.8 Enhancing Services to Communities(1)

($ millions) | | 2005/06 | | 2006/07 | | 2007/08 | | Total | |

September Update | | | | | | | | | |

Community Living BC - capital grants | | 4 | | 2 | | 2 | | 8 | |

| | | | | | | | | |

February 15, 2005 Budget | | | | | | | | | |

Income assistance caseload | | 8 | | 24 | | 46 | | 78 | |

Persons with disabilities | | 56 | | 58 | | 62 | | 176 | |

Adult community living services | | 22 | | 28 | | 41 | | 91 | |

Homelessness | | 15 | | 8 | | 17 | | 40 | |

Social housing | | 12 | | 10 | | 14 | | 36 | |

Family law funding | | 5 | | 5 | | 5 | | 15 | |

Traffic fine revenue sharing | | 29 | | 17 | | 17 | | 63 | |

Arts funding | | 3 | | 3 | | 3 | | 9 | |

BC Skills Connect for immigrants | | 5 | | 5 | | 5 | | 15 | |

Total changes | | 159 | | 160 | | 212 | | 531 | |

(1) As a result of the government reorganization, funding for public libraries announced in the February 15 budget is now included in the Ministry of Education.

The September Update invests in services that assist individuals and families in need, and includes $78 million over three years to fund increased costs due to growth and changes in the composition of the income assistance caseload.

19

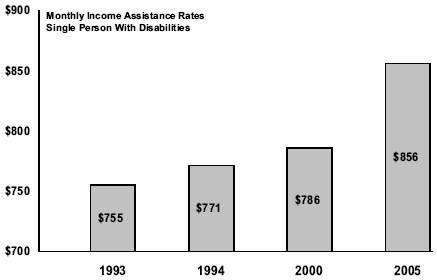

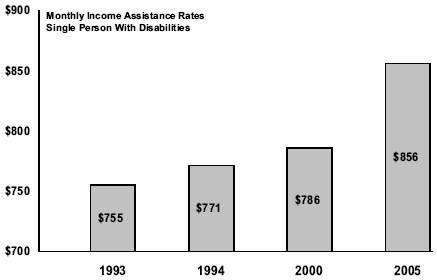

For the past three years, the Ministry of Employment and Income Assistance has been focusing on programs and services designed to assist persons with disabilities to enhance their self-reliance. Effective December 22, 2004, income assistance rates for persons with disabilities were increased by $70 per month or 9 per cent for a single person with disabilities. This is the third highest support rate for persons with disabilities in Canada. The September Update provides $176 million to fund the cost of the rate increase.

Income assistance rates for persons with disabilities were last increased in August 2000, when a general increase of 2 per cent was provided. Since the time of this rate increase, the cost of living has increased 7.4 per cent. For a single person with disabilities, the $70 per month increase is the largest support rate increase in the past 30 years and the largest percentage increase since 1981.

Chart 1.9 Persons with disabilities – monthly income assistance rates

The number of adults with developmental disabilities accessing residential and day support services and their acuity of need are increasing as a result of demographic trends and advancing technologies. An additional $91 million has been provided in the Ministry of Children and Family Development over three years to manage this expected caseload growth.

On July 1, 2005, Community Living BC (CLBC) was established as a Crown agency with the mandate to provide community-based services to individuals with developmental disabilities. Prior to July 1, the Ministry of Children and Family Development (MCFD) delivered adult community living services with program services funded through the ministry’s operating and capital budgets. Government transfers through the Adult Community Living Services (ALCS) vote wholly fund CLBC’s annual operating budget. In addition, MCFD received a budget increase to the ALCS vote to cover the capital requirements of CLBC. As the additional funding will be used for capital spending, there is no net impact to government’s bottom line.

The September Update provides $40 million over three years for emergency shelter programs, housing and support services for people who are homeless.

20

The Minister Responsible for Housing will provide an additional $15 million through community organizations to provide year-round emergency shelter beds, food and other services in BC communities for people with basic safety, comfort, nutrition and hygiene needs. The Ministry of Children and Family Development will provide an additional $1 million for youth beds. An additional $24 million is also being provided through the BC Housing Management Commission (BCHMC) for transition and supportive housing projects that focus on moving people into stable housing arrangements, while related health and other support services will be provided by health authorities and the Ministries of Employment and Income Assistance and Children and Family Development.

The September Update includes $31 million in funding for BCHMC to provide operating subsidies for independent living spaces provided through Independent Living BC. BCHMC will also receive an additional $5 million, which will leverage additional funding from federal programs to upgrade public housing.

The Ministry of Attorney General has piloted several successful family law initiatives designed to balance the needs of citizens with the capacity of the legal system. The September Update reconfirms the provision of an additional $15 million to ensure these programs continue for the next three years. The funding enhances current services where domestic violence is involved; the Family Duty Counsel programs (Provincial and Supreme Court) that assist self-represented litigants in family matters; and the Supreme Court Family referral program that assists unrepresented parties who must access the Supreme Court in complex matters to resolve a family justice matter.

Beginning in 2005/06, the province is committing $5 million annually to BC Skills Connect for assisting skilled immigrants to obtain accreditation and employment that better matches their training, skills and experience.

The September Update provides for 100 per cent of net traffic fine revenue to be returned to municipalities for community policing, crime prevention and other initiatives to help make communities safer.

The September Update confirms that the BC Arts Council will receive an additional $3 million in annual funding beginning in 2005/06.

Safety

The September Update invests growing provincial revenues to help prevent violence against women, and to protect communities from crime.

The September Update reconfirms the investment of significant funding over three years to help keep communities safe. This investment includes $93 million in policing to provide 215 new RCMP positions to be allocated to detachment policing, first nations policing, major and serious crime investigations, cyber crime, an Indo-Canadian task force, and other policing initiatives.

21

Table 1.9 Commitment to Safety

($ millions) | | 2005/06 | | 2006/07 | | 2007/08 | | Total | |

September Update | | | | | | | | | |

Crown prosecutor wages | | — | | 10 | | 11 | | 21 | |

| | | | | | | | | |

February 15, 2005 Budget | | | | | | | | | |

Policing strategy (215 additional RCMP officers) | | 35 | | 42 | | 45 | | 122 | |

Corrections (workload and safety) and Attorney General capacity | | 9 | | 14 | | 16 | | 39 | |

Personal safety for women | | 13 | | 12 | | 12 | | 37 | |

Total changes | | 57 | | 78 | | 84 | | 219 | |

This increased level of policing is anticipated to create additional demands on the legal system; this will be addressed by adding $25 million to the Ministry of Attorney General for the processing of new cases and $4 million to the Ministry of Public Safety and Solicitor General for the related pressures in the correction system. Funding will provide additional capacity in the system by adding prosecutors, sheriffs, and corrections related costs over three years. The September Update also provides $21 million to fund wage increases for crown counsel in accordance with the provisions contained in the Crown Counsel Agreement Continuation Act (Bill 21).

The Corrections Branch houses persons sentenced or remanded into custody until trial. Additional funding of $32 million over three years has been allocated to address trends in inmate population and to enhance safety in both the community corrections programs and the province’s correctional facilities. The Ministry of Attorney General has been allocated $7 million over three years to accommodate the impact on the justice system of hiring additional police.

The September Update reconfirms an additional $37 million to increase personal safety for women and girls through increased funding for transition house services, outreach programs, support services for traumatized children, additional counseling and initiatives to prevent violence.

Economic Development

The September Update reconfirms significant initiatives targeting economic development throughout the province.

Agriculture and Aquaculture Initiatives

The September Update provides $8 million for initiatives aimed at enhancing the province’s agricultural and aquaculture industries, and protecting food safety:

• $2 million for enhanced surveillance and testing, as part of the provincial response to BSE and avian flu.

• $6 million for fisheries initiatives including inspection, monitoring and improvements in aquatic animal health.

22

Table 1.10 Economic Development Initiatives

($ millions) | | 2005/06 | | 2006/07 | | 2007/08 | | Total | |

September Update | | | | | | | | | |

Mountain pine beetle response | | 27 | | 37 | | 36 | | 100 | |

First Nations New Relationships Fund | | 100 | | — | | — | | 100 | |

| | | | | | | | | |

February 15, 2005 Budget | | | | | | | | | |

Agriculture and aquaculture | | 4 | | 2 | | 2 | | 8 | |

Forestry | | | | | | | | | |

• Beetle response and reforestation | | 31 | | 7 | | 51 | | 89 | |

• Filmon response and fuel management | | 20 | | 12 | | 12 | | 44 | |

• Rural access | | 10 | | — | | — | | 10 | |

Oil & Gas, Mining | | | | | | | | | |

• Heartlands oil and gas roads | | 32 | | — | | — | | 32 | |

• Mining plan, data acquisition | | 6 | | 5 | | 5 | | 16 | |

• Oil and gas initiatives | | 7 | | 6 | | 4 | | 17 | |

Infrastructure | | | | | | | | | |

• Municipal infrastructure | | 5 | | — | | — | | 5 | |

• Major regional sports facilities | | 50 | | — | | — | | 50 | |

• Post-secondary sports training facilities | | 20 | | 27 | | 13 | | 60 | |

Tourism | | 24 | | 22 | | 21 | | 67 | |

Peace River, North East BC | | 8 | | 8 | | 8 | | 24 | |

Regional development trusts | | 150 | | — | | — | | 150 | |

Total economic development initiatives | | 494 | | 126 | | 152 | | 772 | |

As part of the government re-organization announced on June 16, 2005 the functions and staff of Land and Water British Columbia (LWBC) will transfer to various ministries effective September 30, 2005. Most of these functions and staff are being transferred to the Ministries of Agriculture and Lands and Environment. The expense by ministry, program and agency shown in Table 1.4, reflects the transfers of LWBC functions and staff to the respective ministries.

Forestry

The September Update includes $243 million in funding for initiatives to address the economic impacts of the mountain pine beetle outbreak and forest fires, while providing new opportunities to industry and communities.

• $189 million is allocated for incremental manufacturing and economic diversification planning in communities impacted by the mountain pine beetle outbreak. A major reforestation program targeting areas of the province impacted by the mountain pine beetle outbreak and forest fires is also included.

This spending includes $100 million of funding announced by the federal government in March 2005 to be dedicated to costs arising from the mountain pine beetle outbreak. The province continues to pursue additional federal funding for these forestry initiatives in recognition of the potential impact of the mountain pine beetle and forest fires on communities and industry, the need for adjustments in this sector and the continuing contribution of a sustainable provincial forest to Canada’s climate change initiatives.

23

Further information on the province’s initiatives to address the mountain pine beetle outbreak can be found in the topic box on page 56.

• $44 million for fuel management and the commitment to fully implement the recommendations of the Filmon Report. This includes the addition of two air tankers, hiring seven additional unit crews and funding for Community Wildfire Protection Plans.

• $10 million to replace bridges providing access to remote communities.

Oil and Gas, Mining

The September Update provides $65 million for initiatives to facilitate exploration and continued development of the provincial oil and gas and mining sectors:

• $32 million investment in the heartlands oil and gas road rehabilitation strategy, to upgrade roads and lengthen the winter drilling season. This investment will be funded through the transportation investment plan.

• $16 million to implement the mining plan, including measures to improve mine safety and safety of workers and improved services to the mining sector.

• $17 million for additional oil and gas initiatives, including community and stakeholder engagement.

Infrastructure

The September Update provides $115 million in funding for community infrastructure across the province:

• $5 million in 2005/06 for the new BC Community Water Improvement Program in the Ministry of Community Services targeting projects to improve drinking water and waste management.

• $50 million for major regional sports facilities funded through the Ministry of Economic Development.

• $60 million for major post-secondary sports training facilities funded through the Ministry of Economic Development.

Combined with the $150 million of provincial funding to be provided through existing infrastructure programs from 2005/06 to 2007/08, provincial funding for community infrastructure in the September Update will total $265 million. This provincial funding will leverage additional investments in municipal and regional infrastructure from other levels of government and the private sector.

On April 15, 2005 the province, federal government and the Union of BC Municipalities (UBCM) signed an Agreement in Principle to share a portion of federal gas tax revenues with local municipalities. Between 2005/06 and 2009/10, $636 million in federal funding will flow directly to the UBCM to support environmentally sustainable municipal infrastructure and improvements to transportation infrastructure. As this funding is not flowing through the province, it is not included in either the revenues or expenses of the province.

24

Tourism

The September Update provides $67 million over three years for Tourism BC, supporting the objective of doubling the tourism industry by 2015. This funding, combined with revenues allocated from the provincial hotel room tax, will allow Tourism BC to double its marketing budget to $50 million per year.

Peace River Regional District Memorandum of Understanding

The September Update provides $24 million in new funding for a new memorandum of understanding with the Peace River Regional District (PRRD). The province has budgeted $20 million annually from 2005/06 to 2007/08 for grants to the PRRD, an increase of $8 million per year.

Regional Development Trusts

The September Update provides $150 million in one-time funding for three $50 million trust contributions to support investments in natural resource, tourism and economic development in the north, southern interior and north island coastal regions. This includes additional funding of $30 million to assist northern communities respond to the pine beetle infestation.

First Nations New Relationships Fund

The provincial government is committed to building a new relationship with First Nations and Aboriginal communities. In 2005/06 the provincial government plans to invest $100 million of one-time funding to help First Nations and Aboriginal communities build appropriate capacity to provide effective input and participate in the management of lands, resources and social programs. This will assist First Nations and Aboriginal communities in becoming active, supporting partners in relationships with government, business and other organizations. Further information is provided in the topic box on page 54.

2010 Olympic and Paralympic Winter Games (2010 Olympics)

The province has committed $600 million toward the 2010 Olympics. This includes funding for venues, an endowment to support the ongoing operation of certain venues, medical and security costs, legacies for sports, First Nations and municipalities, and a contingency allocation of $140 million to protect against unbudgeted costs.

Table 1.11 2010 Olympics Funding

($ millions) | | 2003/04 | | 2004/05 | | 2005/06 | | 2006/07 | | 2007/08 | | Total | |

| | | | | | | | | | | | | |

February 15, 2005 Budget | | | | | | | | | | | | | |

Venues | | 51 | | 30 | | 96 | | 12 | | 18 | | 207 | |

Venues endowment | | 55 | | — | | — | | — | | — | | 55 | |

Medical and security | | — | | — | | 2 | | 2 | | 5 | | 9 | |

First Nations and municipal legacies | | 3 | | — | | 18 | | 13 | | 4 | | 38 | |

Total contribution to provincial commitment | | 109 | | 30 | | 116 | | 27 | | 27 | | 309 | |

Olympic contingency allocations (1) | | — | | — | | — | | — | | 40 | | | |

(1) Notionally allocated within the contingencies vote.

25

As a prudent planning assumption the province has allocated $40 million of the Olympic contingency to the government contingencies vote in 2007/08, for unforeseen expenditures associated with the Olympic funding envelope. Treasury Board maintains control over access to the Olympic contingency funding.

Through the September Update, the province will have funded $309 million of its $600 million commitment to the 2010 Olympics by 2007/08.

Further details on the provincial commitment to the 2010 Olympics can be found in the British Columbia Olympic and Paralympic Winter Games Secretariat Progress Report at www.sbed.gov.bc.ca/2010secretariat/

Vancouver Convention Centre Expansion Project (VCCEP)

The province has approved an increase in the total project budget for the VCCEP from $565 million to $615 million. This increases the total provincial funding commitment to $272.5 million, including an increase of up to $39.4 million in the provincial contribution in 2006/07, and $3.1 million in-kind contribution from the transfer of pipe for pilings from the windup of the Vancouver Trade and Convention Center Authority in 2004/05.

Other sources of funding for the project include $222.5 million from the federal government, $90 million from Tourism Vancouver, and $30 million in commercial revenues. The provincial contribution may be reduced if up-front payments from commercial revenues exceed $30 million.

Further information on the VCCEP can be found on the VCCEP Ltd. website at www.vccep.bc.ca

Table 1.12 Vancouver Convention Centre Expansion Project Funding

($ millions) | | 2003/04 | | 2004/05 | | 2005/06 | | 2006/07 | | 2007/08 | | Total | |

Funding Sources | | | | | | | | | | | | | |

Provincial contribution | | 67 | | 65 | (1) | 70 | | 71 | | — | | 273 | |

Contribution funded on behalf of Tourism Vancouver | | — | | 9 | | 19 | | 30 | | 25 | | 83 | |

Total funding by province (Ministry of Tourism, Sport and the Arts) | | 67 | | 74 | | 89 | | 101 | | 25 | | 356 | |

(1) Includes $3.1 million of steel pipe transferred on windup of the Vancouver Trade and Convention Centre Authority.

Transportation Investment Plan

The September Update updates the next three years of the transportation investment plan to reflect current estimates. The plan continues to be based on the following principles:

• the province will dedicate revenue or funding sources to finance its contributions;

• federal cost-sharing will be secured on all eligible projects and programs;

• additional transportation investment will be leveraged through partnerships with private partners; and

• the taxpayer-supported debt limit of the BC Transportation Financing Authority (BCTFA) is set at $3.4 billion.

26

Table 1.13 Transportation Investment Plan

($ millions) | | 2005/06 | | 2006/07 | | 2007/08 | | Total | |

New fuel tax revenues | | 222 | | 228 | | 235 | | 685 | |

Additional provincial investments: | | | | | | | | | |

• Rehabilitation | | 146 | | 146 | | 146 | | 438 | |

• Interior and rural side roads | | 75 | | 75 | | 75 | | 225 | |

• Airports and ports | | 12 | | 10 | | 10 | | 32 | |

• Border crossing infrastructure | | 50 | | 26 | | 15 | | 91 | |

• William R. Bennett Bridge and east approach | | 8 | | 2 | | 2 | | 12 | |

• Okanagan Valley corridor | | 14 | | 10 | | 29 | | 53 | |

• Highway 1 – Kicking Horse Canyon | | 16 | | 11 | | 5 | | 32 | |

• Gateway initiatives | | 50 | | 143 | | 96 | | 289 | |

• Sea-to-Sky highway | | 68 | | 133 | | 56 | | 257 | |

• Cariboo connector program | | 16 | | 28 | | 21 | | 65 | |

• Oil and gas roads | | 32 | | — | | — | | 32 | |

• Other highway corridors and projects | | 140 | | 96 | | 46 | | 282 | |

• Richmond-Airport-Vancouver Rapid Transit Project | | 82 | | — | | 118 | | 200 | |

Total provincial investment | | 709 | | 680 | | 619 | | 2,008 | |

Investments funded through contributions from other partners | | | | | | | | | |

• Richmond-Airport-Vancouver Rapid Transit Project (contributions from the federal government; Greater Vancouver Transportation Authority; Vancouver Airport Authority; and private sector partner | | 305 | | 596 | | 524 | | 1,425 | |

• Border crossing infrastructure (federal contribution) | | 23 | | 16 | | 16 | | 55 | |

• Other contributions to projects (federal contributions) | | 23 | | 21 | | 26 | | 70 | |

Total investments funded through contributions from other partners | | 351 | | 633 | | 566 | | 1,550 | |

The updated transportation plan provides:

• $2 billion of provincial investment in transportation infrastructure between 2005/06 and 2007/08; and

• $1.6 billion of investment leveraged through federal cost-sharing and partnerships with private partners, local governments and other agencies.

Environment

The September Update reconfirms $123 million for initiatives aimed at environmental protection and land use certainty to facilitate sustainable economic development.

• $16 million to increase the number of park rangers and conservation officers, as well as to provide seasonal employment opportunities for youth and training for potential future employment opportunities in the field of environmental management through the BC Conservation Corps.

• $66 million for the investigation and remediation of contaminated sites on Crown land.

• $8 million to implement the Drinking Water Protection Act, including research into the protection of surface and ground water from contaminated sites.

• $5 million to increase the capacity of the Environmental Assessment Office to address environmental assessments throughout the province.

27

Table 1.14 Environment

($ millions) | | 2005/06 | | 2006/07 | | 2007/08 | | Total | |

February 15, 2005 Budget | | | | | | | | | |

BC Conservation Corps and park services | | 5 | | 5 | | 6 | | 16 | |

Investigation and remediation of contaminated sites | | 21 | | 22 | | 23 | | 66 | |

Drinking water action plan | | 2 | | 3 | | 3 | | 8 | |

Environmental Assessment Office capacity | | 1 | | 2 | | 2 | | 5 | |

Land-use planning | | 12 | | 8 | | 8 | | 28 | |

Total environment initiatives | | 41 | | 40 | | 42 | | 123 | |

• $28 million for cross-government land use planning activities including completion and implementation of Land and Resource Management Plans. This will result in increased certainty for communities, First Nations and industry by confirming environmental, economic and cultural objectives on provincial lands.

Other changes

The contingency vote has been increased by $50 million annually to allow for unexpected costs or new initiatives. The contingency vote is now set at approximately 1 per cent of total government expense. The September Update also includes $6.3 million over three years for cross-government strategic policy support. This provides for formalization of the Deputy Ministers’ Policy Secretariat and inclusion of social priorities, and coordination and management of government’s corporate planning process. Since 2004, the Secretariat has been a shared resource for natural resource ministries to work on inter-ministry issues, reporting to participating ministries through a Deputy Ministers’ committee. The September Update also includes $1.3 million over three years for communications, research, issues management and policy coordination support for the Office of the Premier.

Public Sector Compensation

The current compensation mandate that has been in place since January 2002 will remain unchanged until March 31, 2006. The majority of public sector unions have settled under this mandate. The remaining groups will continue to be bound by the current mandate.

Collective agreements for almost 90 per cent of public sector employees will be up for renegotiation over the next nine months. The Minister of Finance, as Chair of the Public Sector Employers’ Council, is working with public sector employers to create a new bargaining mandate that will succeed the current mandate and will be effective April 1, 2006. That mandate will continue to balance a number of priorities including the need to recruit and retain employees while allowing flexibility to innovate and improve services to British Columbians. Any compensation increase must be sustainable and affordable for taxpayers over the long-term. As the next mandate is still under development, no compensation increase has been assumed in this fiscal plan. Details of the next mandate will be released by the next budget in February 2006.

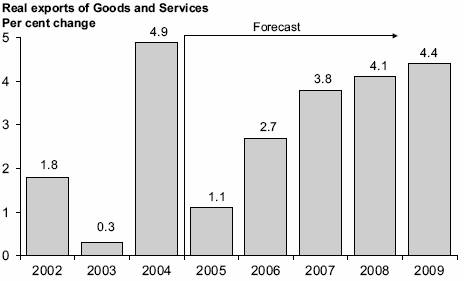

28