Exhibit 99.6

First Quarterly Report

on the Economy, Fiscal Situation, and Outlook

Fiscal Year 2007/08

Three Months

April – June 2007

British Columbia Cataloguing in Publication Data |

|

British Columbia. Ministry of Finance. |

Quarterly report on the economy, fiscal situation and Crown corporations. — ongoing– |

|

Quarterly. |

Title on cover: Quarterly report. |

Continues: British Columbia. Ministry of Finance. |

Quarterly financial report. ISSN 0833-1375. |

ISSN 1192-2176 — Quarterly Report on the economy, fiscal situation and Crown corporations. |

|

1. Finance, Public — British Columbia — Accounting — Periodicals. 2. British Columbia — Economic conditions — 1945 – — Periodicals.* |

3. Corporations, Government — British Columbia — Accounting — Periodicals. I. Title. |

|

HJ13.B77 | 354.711’007231’05 |

TABLE OF CONTENTS | |

| |

2007/08 First Quarterly Report | September 14, 2007 |

Summary | 3 |

Part One — Updated Financial Forecast | |

| |

Introduction | 5 |

| |

Revenue | 7 |

Changes from Budget 2007 | 7 |

First Quarterly Report plan | 10 |

| |

Commercial Crown corporations income | 15 |

| |

Expense | 16 |

Consolidated revenue fund expense | 16 |

Contingencies | 17 |

Service delivery agency expenses | 18 |

| |

Full-time equivalents (FTE’s) | 19 |

| |

Provincial capital spending | 19 |

| |

Provincial debt | 23 |

Taxpayer-supported debt | 25 |

Self-supported debt | 25 |

| |

Risks to the fiscal plan | 25 |

| |

Tables: | |

1.1 | Fiscal Plan Update – Changes from Budget 2007 | 6 |

1.2 | Revenue by Source: 2006/07 – 2009/10 | 8 |

1.3 | Expense by Ministry, Program and Agency: 2006/07 – 2009/10 | 9 |

1.4 | Assumptions Underlying Main Revenue Changes | 10 |

1.5 | Personal Income Tax Revenue | 11 |

1.6 | Corporate Income Tax Revenue | 11 |

1.7 | Social Service Tax Revenue | 12 |

1.8 | Forests Revenue | 13 |

1.9 | Health and Social Transfers | 14 |

1.10 | Notional Allocations to Contingencies | 17 |

1.11 | Capital Spending – Changes from Budget 2007 | 19 |

1.12 | Capital Spending: 2006/07 – 2009/10 | 20 |

1.13 | Capital Expenditure Projects Greater Than $50 Million | 22 |

1.14 | Debt Summary – Changes from Budget 2007 | 23 |

1.15 | Debt Summary: 2006/07 – 2009/10 | 24 |

| | |

Part Two — Economic Review and Outlook | |

| |

Summary | 27 |

| |

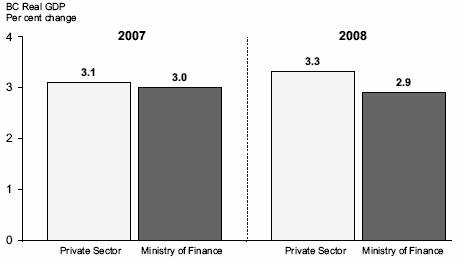

Comparison to private sector forecasts | 27 |

| |

Recent economic developments | 28 |

| |

External environment | 29 |

United States | 29 |

Canada | 31 |

First Quarterly Report 2007/08

Table of Contents

Europe | 32 |

Japan | 32 |

China | 33 |

Financial markets | 33 |

Commodity markets | 36 |

| |

British Columbia economic forecast | 37 |

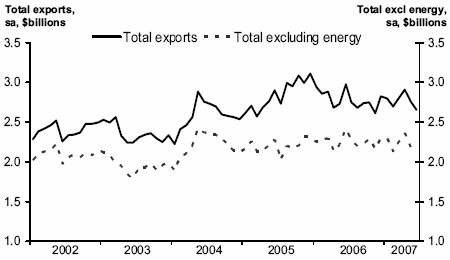

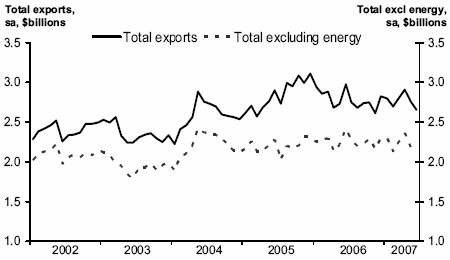

External trade | 37 |

Labour market | 38 |

Demographic developments | 39 |

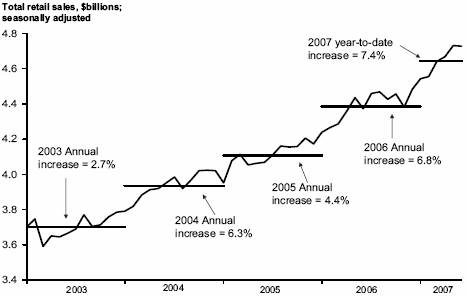

Domestic demand | 40 |

| |

Medium-term outlook | 43 |

| |

Risks to the forecast | 43 |

| |

Tables: | |

2.1 | British Columbia Economic Indicators | 29 |

2.2 | First Quarterly Economic Forecast: Key Assumptions | 32 |

2.3 | Private Sector Canadian Three Month Treasury Bill Interest Rate Forecasts | 33 |

2.4 | Private Sector Exchange Rate Forecasts | 35 |

2.5 | First Quarterly Economic Forecast: Key Indicators | 37 |

2.6 | Current Economic Statistics | 45 |

2.7.1 | Gross Domestic Product: British Columbia | 46 |

2.7.2 | Components of Nominal Income and Expenditure | 47 |

2.7.3 | Labour Market Indicators | 47 |

2.7.4 | Major Economic Assumptions | 48 |

| | |

Topic Box: | |

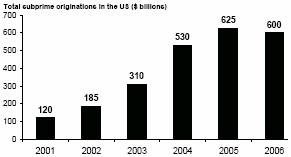

The US Subprime Mortgage Market | 49 |

| |

Appendix | |

| |

Financial Results: Three Months Ended June 30, 2007 and 2007/08 Full-Year Forecast | |

| |

Tables: | |

A.1 | Operating Statement | 56 |

A.2 | Revenue by Source | 57 |

A.3 | Expense by Ministry, Program and Agency | 58 |

A.4 | Expense by Function | 59 |

A.5 | Capital Spending | 60 |

A.6 | Provincial Debt | 61 |

| |

Updated Financial Plan: 2007/08 - 2009/10 | |

A.7 | Revenue Assumptions | 62 |

A.8 | Natural Gas Price Forecasts | 66 |

A.9 | Expense Assumptions | 67 |

A.10 | Expense by Function | 68 |

A.11 | Service Delivery Agency Operating Results | 69 |

A.12 | Full-Time Equivalents | 71 |

A.13 | Statement of Financial Position | 72 |

| | | |

2

SUMMARY | | |

| | |

2007/08 First Quarterly Report | | September 14, 2007 |

| | | | 2007/08 | | | | | |

| | 2006/07 | | | | Updated | | Updated Plan | |

($ millions) | | Actual | | Budget | | Forecast | | 2008/09 | | 2009/10 | |

Revenue | | 38,504 | | 37,390 | | 38,530 | | 38,580 | | 39,850 | |

Expense | | (34,184 | ) | (36,240 | ) | (36,430 | ) | (36,830 | ) | (37,975 | ) |

Negotiating Framework incentive payments | | (264 | ) | — | | — | | — | | — | |

Surplus before forecast allowance | | 4,056 | | 1,150 | | 2,100 | | 1,750 | | 1,875 | |

Forecast allowance | | — | | (750 | ) | (500 | ) | (1,000 | ) | (1,050 | ) |

Surplus | | 4,056 | | 400 | | 1,600 | | 750 | | 825 | |

| | | | | | | | | | | |

Capital spending: | | | | | | | | | | | |

Taxpayer-supported capital spending | | 3,366 | | 3,864 | | 4,257 | | 3,590 | | 2,867 | |

Total capital spending | | 4,349 | | 5,156 | | 5,598 | | 5,328 | | 4,633 | |

Provincial Debt: | | | | | | | | | | | |

Taxpayer-supported debt | | 25,874 | | 27,803 | | 26,231 | | 26,781 | | 26,490 | |

Total debt | | 33,347 | | 36,837 | | 34,760 | | 36,802 | | 37,463 | |

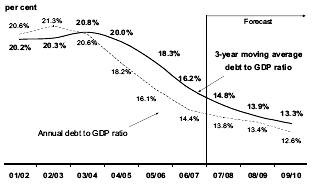

Taxpayer-supported debt-to-GDP ratio | | 14.4 | % | 14.8 | % | 13.8 | % | 13.4 | % | 12.6 | % |

Total debt-to GDP ratio | | 18.6 | % | 19.6 | % | 18.3 | % | 18.5 | % | 17.8 | % |

3-year moving average | | | | | | | | | | | |

Taxpayer-supported debt-to-GDP ratio | | 16.2 | % | 15.2 | % | 14.8 | % | 13.9 | % | 13.3 | % |

Total debt-to GDP ratio | | 20.6 | % | 19.7 | % | 19.1 | % | 18.4 | % | 18.2 | % |

Fiscal position improves

• BC’s fiscal outlook has improved since budget. The surplus for 2007/08 is now forecast to be $1.6 billion, up from the $400 million expected at budget.

Fiscal outlook improved

• The improved fiscal outlook offers government the flexibility to address some additional priority items this fiscal year. Updates on these items, including their impact on the surplus and debt projections will be provided in the second Quarterly Report and in Budget 2008.

• Improved surpluses are also expected in 2008/09 and 2009/10. Significant forecast allowances are retained in the updated fiscal plan in recognition of risks to the economic forecast, volatile natural resource revenues and the interim nature of health spending allocations for 2008/09 and 2009/10.

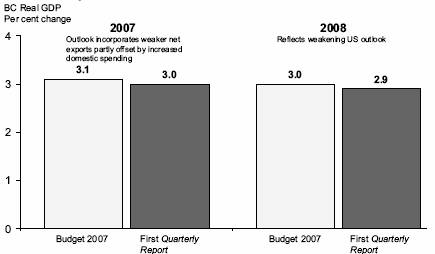

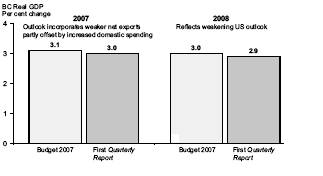

Updated economic forecast remains robust

Source: BC Ministry of Finance

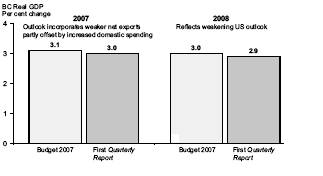

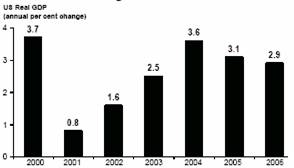

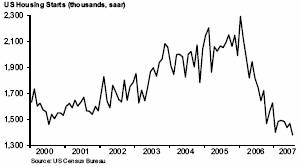

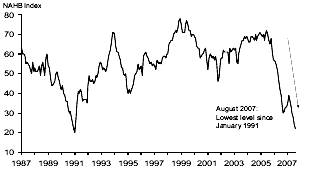

• Economic growth is expected to remain robust at 3.0 per cent in 2007, down from the 3.1 per cent forecast at budget. This revision reflects weakness in lumber and natural gas markets and lower US economic growth, but is partially offset by stronger domestic demand and continued strength in retail trade. For 2008, BC’s economic growth forecast is revised to 2.9 per cent, down from the 3.0 per cent forecast at budget time, recognizing increased risks to the outlook posed by continued deterioration of the US economy and a weakening US housing market, recent instability in financial markets and the higher than expected Canadian dollar.

• The main revenue improvements arise from increased taxation revenue forecasts, higher federal transfers, including one-time trusts in 2007/08, and higher net income for ICBC.

3

Summary

These improvements are partially offset by reduced natural gas revenues.

• Updated spending forecasts include fire fighting and flood related costs, additional child care spending (funded through federal transfers), and recent changes to MLA compensation and pensions, partially offset by lower interest expense forecasts.

• Taxpayer-supported capital spending is up $691 million across the three-year plan, reflecting new health projects in Victoria, Kelowna and Vernon, and additional investments in the education sector and social housing. The forecast also reflects the carry-over of slower than expected capital spending in 2006/07 for roads and post secondary projects and the updated budget for the Vancouver Convention Centre expansion project. The increased spending is being financed through allocations from the capital contingencies, use of accumulated cash balances and cost sharing with partners, rather than additional borrowing.

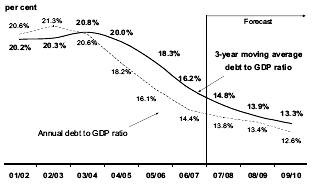

• Government remains committed to ensuring its infrastructure spending is affordable. Consistent with this commitment the updated capital spending plan remains within the three year debt allocations established in Budget 2007. The taxpayer-supported

debt-to-GDP ratio, a key measure of fiscal sustainability, is forecast to continue its downward trend by falling from 14.4 per cent at March 31, 2007 to 12.6 per cent by the end of 2009/10, assuming the projected surpluses are applied to debt reduction. However, should government allocate some of these surpluses to other areas, the debt forecast would change accordingly.

Taxpayer debt to GDP ratio trends down

Risks remain

• Although economic growth is forecast to remain robust, the fiscal plan continues to face uncertainty relating to factors the government does not directly control.

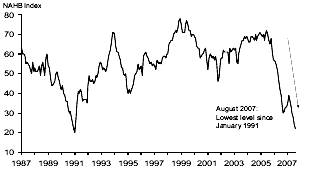

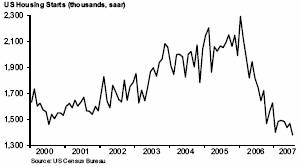

• These risks include, but are not limited to, a further deterioration in the US economy beyond that assumed in the quarterly forecast, caused by a worse than expected performance in the US housing sector and continuing instability in financial markets.

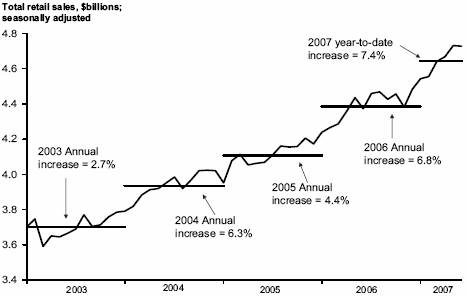

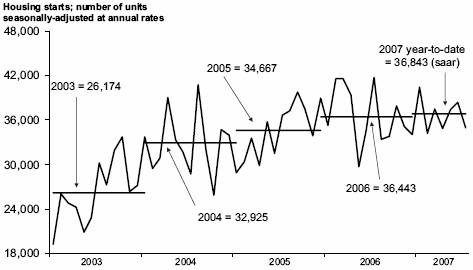

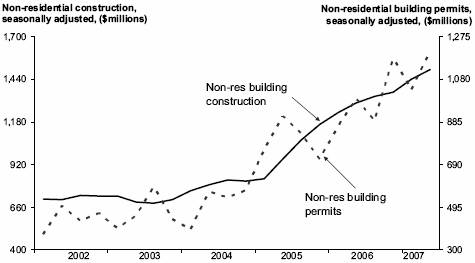

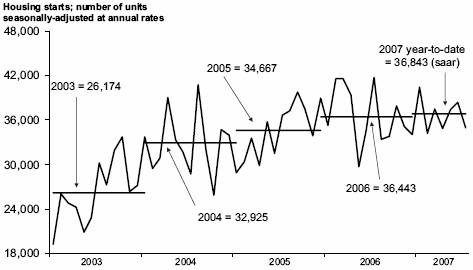

US housing market continues to weaken

Source: National Assoication of Home Builders

• The volatility of natural resource revenues continues to pose risks to the fiscal plan. Although natural gas prices have been reduced in the forecast, further risk exists should prices fall further.

• The main potential changes to spending include the impacts of natural disasters, changing caseloads and demands for health care.

2008 Budget Consultation

• Increased surpluses provide choices for British Columbians. These include ways to encourage environmentally responsible choices for consumers, businesses and government; increased spending for health care and other government programs; and lower taxes or reduced debt. However, commitments to these areas must be affordable today as well as being sustainable in the years ahead.

• A committee of the Legislative Assembly will be seeking public input to the February 2008 budget and will be holding public meetings in selected communities throughout BC beginning in late September through to October. The committee will issue a report on its findings to the Legislature no later than November 15, 2007.

4

PART ONE — UPDATED FINANCIAL FORECAST (1) | | |

| | |

2007/08 First Quarterly Report | | September 14, 2007 |

Introduction

Higher surpluses are forecast in the three year fiscal plan, reflecting improved revenues. The surplus for 2007/08 is forecast to be $1.6 billion, up from the $400 million expected at budget. Improved surpluses are also expected for 2008/09 and 2009/10.

The improved fiscal outlook offers government the flexibility to address some additional priority items this fiscal year. Updates on these items, including their impact on the surplus and debt projections, will be provided in the second Quarterly Report and in Budget 2008.

Compared to budget, total revenues are up $1.1 billion in 2007/08, $710 million in 2008/09 and $775 million in 2009/10. Higher taxation revenues, higher federal transfers (including one-time trusts in 2007/08), and improved net income from ICBC are expected in all three years of the fiscal plan. These increases are partially offset by reductions in natural gas revenues.

Total government spending is now forecast to be $190 million higher than budget in 2007/08, due to higher forest fire and flood related costs, inclusion of additional child care spending (funded through additional federal transfers), the impact of recent changes to MLA compensation and pensions, and ministry expenses recovered from the federal government primarily for post-secondary assistance programs including the Millennium Scholarship Fund. This additional spending is partially offset by reduced interest costs due to lower than forecast debt levels.

Updated taxpayer-supported capital spending is $691 million higher than budget over the three years, reflecting additional investments in health facilities, the education sector and social housing. The forecast also reflects changes in timing of capital spending for roads, post-secondary facilities and the updated budget for the Vancouver Convention Centre expansion project. These investments are financed through allocations from the capital contingency, use of accumulated cash balances and cost-sharing with partners rather than additional borrowing.

Government continues its commitment to ensuring capital spending for schools, roads and hospitals is affordable, as the updated capital plan is within the three-year debt allocations established in Budget 2007. The debt forecast is lower than budget in each of the next three years, and the key taxpayer-supported debt to GDP ratio is projected to decline from 14.4 per cent at March 31, 2007 to 12.6 per cent by the end of 2009/10, assuming the projected surpluses are applied to debt reduction. However, should government allocate some of these surpluses to other areas, the debt forecast would change accordingly.

(1) Reflects information available and government policy as at August 31, 2007.

5

Table 1.1 Fiscal Plan Update – Changes from Budget 2007

($ millions) | | 2007/08 | | 2008/09 | | 2009/10 | |

Budget 2007 Fiscal Plan (February 20, 2007) | | 400 | | 150 | | 150 | |

First Quarterly Report Forecast Updates: | | | | | | | |

Revenue increases (decreases): | | | | | | | |

Personal income tax: | | | | | | | |

Base – improved economic growth and continuation of robust earnings from higher-income taxpayers in 2007 | | 124 | | 129 | | 133 | |

Prior-year adjustment – weaker 2006 tax assessments | | (75 | ) | | | | |

Corporate income tax – improved 2006 corporate profits and tax assessments including higher impact of duty deposit refunds on forest firms’ income | | 377 | | 46 | | 93 | |

Social service tax – higher 2006/07 results and stronger 2007 sales growth | | 200 | | 208 | | 219 | |

Property tax – lower than expected property tax base | | (69 | ) | (63 | ) | (58 | ) |

Property transfer tax – strong year-to-date results and improved short-term outlook | | 96 | | 171 | | 221 | |

Natural gas royalties – lower natural gas prices and volumes | | (369 | ) | (420 | ) | (413 | ) |

Coal, metals and other minerals – higher coal and metal prices | | 1 | | 40 | | 118 | |

Other energy and sales of Crown land leases – offsetting effects of higher Canadian dollar and stronger electricity and oil prices | | (31 | ) | (5 | ) | 4 | |

Forest revenue – lower harvest volumes, lower price in 2008, higher Canadian dollar, offset by higher Softwood Lumber Agreement border tax collections in 2008/09 | | (99 | ) | 98 | | (29 | ) |

Medical Services Plan premiums – higher 2006/07 results and a change in accounting treatment | | 53 | | 55 | | 61 | |

Federal transfers: | | | | | | | |

Health Transfers: | | | | | | | |

One-time trusts: HPV immunization and Patient wait times guarantee | | 116 | | — | | — | |

Mainly higher national tax points, partially offset by higher BC tax point deductions | | 60 | | 43 | | 53 | |

Canada Social Transfer – mainly federal budget impact of higher national base with equal per capita cash funding (elimination of tax point transfers) | | 50 | | 94 | | 132 | |

Other transfers – one-time eco-Trust, multiculturalism and immigration funding, Millennium Scholarship Fund and direct post-secondary research grant funding | | 368 | | 77 | | 78 | |

All other taxpayer supported changes | | 84 | | 68 | | 71 | |

Commercial Crown corporation net income: | | | | | | | |

Liquor Distribution Branch – lower operating costs | | 12 | | 14 | | 15 | |

BC Rail – timing of asset dispositions | | (13 | ) | 80 | | (3 | ) |

ICBC – primarily higher premium revenue and, in 2007/08, the sale of Surrey Central City Mall | | 259 | | 74 | | 78 | |

Other Crown corporation changes – mainly timing of BCRC asset dispositions | | (4 | ) | 1 | | 2 | |

Total revenue changes | | 1,140 | | 710 | | 775 | |

Less: expense increases (decreases): | | | | | | | |

Forest fire costs | | 57 | | — | | — | |

Children and Family Development – federal child care funding (2007/08 amount shown as a recovery) | | — | | 33 | | 33 | |

Forests and Range – increase in BC Timber Sales costs | | 15 | | 10 | | 10 | |

Public Safety and Solicitor General – flood costs and disaster assistance | | 53 | | — | | — | |

Tourism, Sport and the Arts – additional construction funding for VCCEP | | — | | 268 | | — | |

Changes to MLA compensation and pensions | | 43 | | 9 | | 9 | |

Interest costs – mainly reduced operating debt levels | | (23 | ) | (61 | ) | (95 | ) |

CRF expense changes | | 145 | | 259 | | (43 | ) |

Increased ministry expenditures recoverable mainly from the federal government | | 114 | | 45 | | 49 | |

Service delivery agency net spending changes: | | | | | | | |

School districts – additional grants/timing of grants in 2007/08 and increased operating costs for the out-years | | (29 | ) | 33 | | 12 | |

Post-secondary institutions – additional grants in 2007/08 in part for Aboriginal programs and increased faculty and operating costs for out-years | | (22 | ) | 54 | | 93 | |

Health authorities – implementation of efficiency/cost saving strategies | | (33 | ) | — | | — | |

Other service delivery agencies – in 2008/09, primarily the impact of VCCEP funding | | 15 | | (281 | ) | (11 | ) |

Total expense changes | | 190 | | 110 | | 100 | |

Subtotal | | 950 | | 600 | | 675 | |

Forecast allowance decrease | | 250 | | — | | — | |

Total changes to Fiscal Plan | | 1,200 | | 600 | | 675 | |

Updated Fiscal Plan | | 1,600 | | 750 | | 825 | |

6

Despite a robust economy and improved fiscal outlook, there are a number of risks and pressures to the fiscal plan, including economic fluctuations such as exchange rate movements, or sudden natural gas or other commodity price changes. In addition, the forecast allowances in 2008/09 and 2009/10 continue to recognize the interim nature of the health spending allocations for 2008/09 and 2009/10. Significant forecast allowances have been retained within the fiscal plan to help ensure fiscal plan targets continue to be met.

The main changes to the fiscal plan are summarized in Table 1.1.

Financial results for the April to June quarter show a $912 million surplus for the period, $790 million higher than expected. Revenues were $539 million ahead of forecast, and spending $251 million less than expected for the three-month period. Details are found in Tables A.1 to A.6.

Revenue

The revised revenue forecast incorporates updated economic and commodity price forecasts since the Budget 2007 projections, final results for 2006/07 released in the Public Accounts on July 11, 2007 and actual revenue results recorded for the April to June 2007 period. The updated forecast also incorporates federal government budget announcements (March 19, 2007) unavailable at the time of the BC Budget 2007 release – including $315 million of new trusts and the decision to fund the Canada Social Transfer on an equal per capita basis. In addition, the forecast includes the effects of new 2006 tax assessment information provided by the federal government since the Budget 2007 release.

Changes from Budget 2007

Government revenue is expected to be $1,140 million, $710 million and $775 million higher than the budget forecast over the 2007/08 to 2009/10 period reflecting:

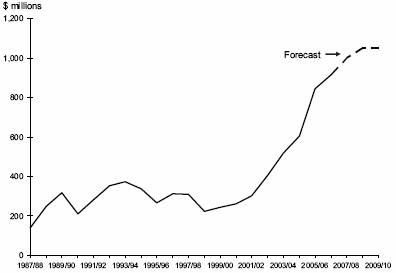

• the one-time effect in 2007/08 of federal government trusts to support initiatives to reduce wait times and to protect women and girls from cervical cancer, and projects to reduce air pollutant and greenhouse gas emissions (announced in the federal budget on March 19, 2007);

• the effects on tax and other own-source revenues (excluding natural resources) of robust economic growth over the next two years;

• the impact of changes in lumber prices and Crown harvest volumes on stumpage revenue, partly offset by changes in border tax collections;

• improved revenue from coal, metals and other mineral sources mainly due to stronger prices for these commodities; and

• higher commercial Crown corporation net income mainly attributable to improved outlooks for BC Rail (BCRC) in 2007/08 and ICBC and LDB during the plan period.

These improvements are partially offset by lower natural gas royalties due to lower price and volume projections.

7

Table 1.2 Revenue by Source: 2006/07 – 2009/10

| | Actual | | Forecast | | Updated Plan | |

($ millions) | | 2006/07 | | 2007/08 | | 2008/09 | | 2009/10 | |

Taxation: | | | | | | | | | |

Personal income | | 6,905 | | 6,438 | | 6,706 | | 7,126 | |

Corporate income | | 1,538 | | 1,772 | | 1,438 | | 1,544 | |

Social service | | 4,714 | | 5,090 | | 5,337 | | 5,625 | |

Fuel | | 901 | | 919 | | 937 | | 958 | |

Tobacco | | 726 | | 705 | | 705 | | 705 | |

Property | | 1,732 | | 1,794 | | 1,880 | | 1,966 | |

Property transfer | | 914 | | 1,000 | | 1,050 | | 1,050 | |

Other (1) | | 588 | | 615 | | 633 | | 655 | |

| | 18,018 | | 18,333 | | 18,686 | | 19,629 | |

Natural Resources: | | | | | | | | | |

Natural gas royalties | | 1,207 | | 1,330 | | 1,358 | | 1,324 | |

Columbia River Treaty | | 223 | | 270 | | 285 | | 325 | |

Other energy, metals and minerals | | 935 | | 887 | | 833 | | 837 | |

Forests | | 1,276 | | 1,296 | | 1,372 | | 1,282 | |

Water and other resources | | 341 | | 341 | | 391 | | 398 | |

| | 3,982 | | 4,124 | | 4,239 | | 4,166 | |

Other Revenue | | | | | | | | | |

Medical Services Plan premiums | | 1,524 | | 1,550 | | 1,567 | | 1,586 | |

Post-secondary education fees | | 928 | | 957 | | 994 | | 1,029 | |

Other health-care related fees | | 216 | | 225 | | 219 | | 219 | |

Motor vehicle licences and permits | | 424 | | 433 | | 445 | | 456 | |

Other fees and licences | | 699 | | 780 | | 739 | | 723 | |

Investment earnings | | 1,032 | | 898 | | 934 | | 986 | |

Sales of goods and services | | 693 | | 672 | | 716 | | 765 | |

Miscellaneous (2) | | 1,917 | | 1,664 | | 1,625 | | 1,653 | |

| | 7,433 | | 7,179 | | 7,239 | | 7,417 | |

Contributions from the federal government | | | | | | | | | |

Health and social transfers | | 4,473 | | 4,870 | | 4,787 | | 4,996 | |

Equalization | | 459 | | — | | — | | — | |

Other federal contributions (3) | | 1,454 | | 1,267 | | 947 | | 983 | |

| | 6,386 | | 6,137 | | 5,734 | | 5,979 | |

Taxpayer-supported programs and agencies | | 35,819 | | 35,773 | | 35,898 | | 37,191 | |

Commercial Crown corporation net income | | | | | | | | | |

BC Hydro | | 407 | | 365 | | 401 | | 420 | |

Liquor Distribution Branch | | 840 | | 822 | | 842 | | 854 | |

BC Lotteries (net of payments to the federal government) | | 1,011 | | 1,024 | | 1,078 | | 1,133 | |

BCRC (4) | | 29 | | 47 | | 85 | | 2 | |

ICBC (5) | | 381 | | 484 | | 257 | | 228 | |

Other | | 17 | | 15 | | 19 | | 22 | |

| | 2,685 | | 2,757 | | 2,682 | | 2,659 | |

Total revenue | | 38,504 | | 38,530 | | 38,580 | | 39,850 | |

(1) | Composed of revenue from corporation capital tax, insurance premium tax and hotel room tax. |

(2) | Includes asset dispositions, reimbursements for health care and other services provided to external agencies, and other recoveries. |

(3) | Includes contributions for health, education, housing and social service programs, and transportation projects. |

(4) | The 2007/08 forecast represents BCRC’s projected earnings during government’s fiscal year. On BCRC’s fiscal year basis (December), the outlook for 2007 is also $47 million. For 2008/09 and 2009/10, the fiscal year and calendar year projections are assumed to be the same. |

(5) | The 2007/08 forecast represents ICBC’s projected earnings during government’s fiscal year. On ICBC’s fiscal year basis (December), the outlook for 2007 is $526 million. For 2008/09 and 2009/10, the fiscal year and calendar year projections are assumed to be the same. |

8

Table 1.3 Expense by Ministry, Program and Agency: 2006/07 – 2009/10

| | Actual | | Forecast | | Updated Plan | |

($ millions) | | 2006/07 | | 2007/08 | | 2008/09 | | 2009/10 | |

Advanced Education | | 2,027 | | 2,151 | | 2,243 | | 2,336 | |

Education | | 5,312 | | 5,494 | | 5,637 | | 5,747 | |

Health | | 12,124 | | 12,967 | | 13,358 | | 13,798 | |

Contingencies – Health Innovation Fund | | — | | 100 | | — | | — | |

Subtotal | | 19,463 | | 20,712 | | 21,238 | | 21,881 | |

Office of the Premier | | 12 | | 14 | | 14 | | 14 | |

Aboriginal Relations and Reconciliation | | 43 | | 55 | | 61 | | 49 | |

Agriculture and Lands | | 238 | | 270 | | 240 | | 242 | |

Attorney General | | 485 | | 520 | | 525 | | 530 | |

Children and Family Development | | 1,852 | | 1,867 | | 1,967 | | 2,015 | |

Community Services | | 267 | | 274 | | 296 | | 298 | |

Economic Development | | 282 | | 266 | | 199 | | 240 | |

Employment and Income Assistance | | 1,358 | | 1,480 | | 1,509 | | 1,551 | |

Energy, Mines and Petroleum Resources | | 75 | | 77 | | 78 | | 78 | |

Environment | | 193 | | 223 | | 245 | | 252 | |

Finance | | 75 | | 91 | | 92 | | 94 | |

Forests and Range | | 1,000 | | 1,150 | | 1,157 | | 1,126 | |

Labour and Citizen’s Services | | 210 | | 97 | | 92 | | 95 | |

Public Safety and Solicitor General | | 594 | | 656 | | 618 | | 632 | |

Small Business and Revenue | | 45 | | 60 | | 61 | | 62 | |

Tourism, Sport and the Arts | | 214 | | 130 | | 354 | | 76 | |

Transportation | | 842 | | 882 | | 884 | | 909 | |

Total ministries and Office of the Premier | | 27,248 | | 28,824 | | 29,630 | | 30,144 | |

Legislation | | 49 | | 101 | | 68 | | 70 | |

Officers of the Legislature | | 24 | | 34 | | 33 | | 33 | |

BC Family Bonus | | 23 | | 17 | | 15 | | 13 | |

Management of public funds and debt | | 544 | | 535 | | 454 | | 395 | |

Contingencies – new programs | | 53 | | 360 | | 365 | | 375 | |

Contingencies – Negotiating Framework | | — | | 39 | | 77 | | 142 | |

Other appropriations | | 4 | | 10 | | 6 | | 6 | |

Consolidated revenue fund expense before Negotiating Framework incentive payments | | 27,945 | | 29,920 | | 30,648 | | 31,178 | |

Negotiating Framework incentive payments | | 264 | | — | | — | | — | |

Consolidated revenue fund total expense | | 28,209 | | 29,920 | | 30,648 | | 31,178 | |

Expenses recovered from external entities | | 2,117 | | 1,941 | | 1,855 | | 1,933 | |

Grants to service delivery agencies and other internal transfers: | | | | | | | | | |

School districts | | (4,677 | ) | (4,774 | ) | (4,888 | ) | (4,990 | ) |

Universities | | (1,109 | ) | (1,239 | ) | (1,282 | ) | (1,353 | ) |

Colleges, university colleges and institutes | | (842 | ) | (847 | ) | (851 | ) | (876 | ) |

Health authorities and hospital societies | | (8,132 | ) | (8,730 | ) | (8,783 | ) | (8,982 | ) |

Children and family development agencies | | (629 | ) | (684 | ) | (715 | ) | (742 | ) |

Other service delivery agencies | | (913 | ) | (763 | ) | (1,092 | ) | (749 | ) |

| | (16,302) | | (17,037 | ) | (17,611 | ) | (17,692 | ) |

Service delivery agency expense: | | | | | | | | | |

School districts | | 5,041 | | 5,151 | | 5,283 | | 5,361 | |

Universities | | 2,593 | | 2,826 | | 2,984 | | 3,132 | |

Colleges, university colleges and institutes | | 1,310 | | 1,373 | | 1,420 | | 1,465 | |

Health authorities and hospital societies | | 8,892 | | 9,437 | | 9,395 | | 9,600 | |

Children and family development agencies | | 631 | | 687 | | 716 | | 744 | |

Other service delivery agencies | | 1,957 | | 2,132 | | 2,140 | | 2,254 | |

| | 20,424 | | 21,606 | | 21,938 | | 22,556 | |

Net spending of service delivery agencies | | 4,122 | | 4,569 | | 4,327 | | 4,864 | |

Total taxpayer-supported expense | | 34,448 | | 36,430 | | 36,830 | | 37,975 | |

9

Table 1.4 Assumptions Underlying Main Revenue Changes

Annual per cent change unless otherwise indicated

| | Budget 2007 | | First Quarterly Report Forecast | |

| | 2006 | | 2007 | | 2008 | | 2009 | | 2006 | | 2007 | | 2008 | | 2009 | |

Personal income | | 6.5 | % | 4.2 | % | 4.6 | % | 4.7 | % | 7.2 | % | 4.7 | % | 4.6 | % | 4.7 | % |

Labour income | | 7.8 | % | 4.1 | % | 5.1 | % | 5.2 | % | 8.2 | % | 5.6 | % | 5.1 | % | 5.2 | % |

Corporate profits | | 1.9 | % | 5.2 | % | 4.7 | % | 4.6 | % | 8.3 | % | 5.0 | % | 2.8 | % | 7.1 | % |

Personal consumption | | 6.0 | % | 5.2 | % | 5.1 | % | 5.2 | % | 6.7 | % | 6.1 | % | 5.4 | % | 5.3 | % |

Investment | | 11.0 | % | 5.8 | % | 5.2 | % | 6.6 | % | 12.4 | % | 10.0 | % | 4.5 | % | 5.6 | % |

Housing starts | | 4.9 | % | -7.7 | % | -6.1 | % | -0.7 | % | 5.1 | % | 0.2 | % | -8.4 | % | -4.3 | % |

Nominal GDP | | 5.9 | % | 5.0 | % | 4.9 | % | 5.0 | % | 6.4 | % | 5.7 | % | 4.9 | % | 5.5 | % |

Real GDP | | 3.9 | % | 3.1 | % | 3.0 | % | 3.1 | % | 3.6 | % | 3.0 | % | 2.9 | % | 3.1 | % |

Employment | | 3.1 | % | 1.9 | % | 1.9 | % | 1.9 | % | 3.1 | % | 2.9 | % | 1.7 | % | 1.9 | % |

Population | | 1.2 | % | 1.1 | % | 1.1 | % | 1.2 | % | 1.2 | % | 1.3 | % | 1.2 | % | 1.2 | % |

Exchange rate | | 88.2 | | 86.9 | | 88.1 | | 88.5 | | 88.2 | | 92.0 | | 94.6 | | 93.5 | |

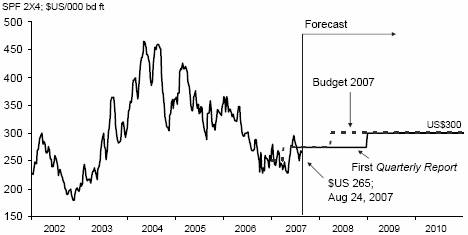

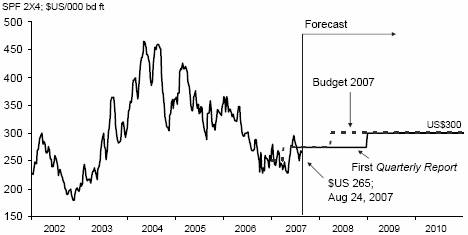

SPF 2X4 price

($US/1000 bd ft) | | $ | 296 | | $ | 269 | | $ | 294 | | $ | 300 | | $ | 296 | | $ | 265 | | $ | 275 | | $ | 300 | |

Pulp price ($US/tonne) | | $ | 674 | | $ | 713 | | $ | 700 | | $ | 700 | | $ | 674 | | $ | 776 | | $ | 731 | | $ | 725 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2006/07 | | 2007/08 | | 2008/09 | | 2009/10 | | 2006/07 | | 2007/08 | | 2008/09 | | 2009/10 | |

| | | | | | | | | | | | | | | | | |

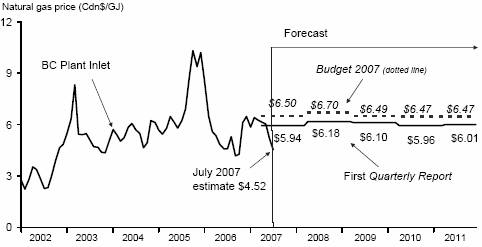

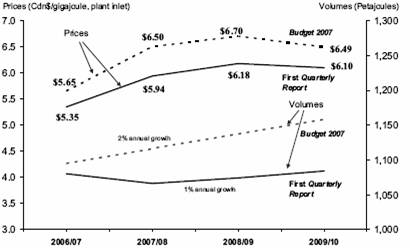

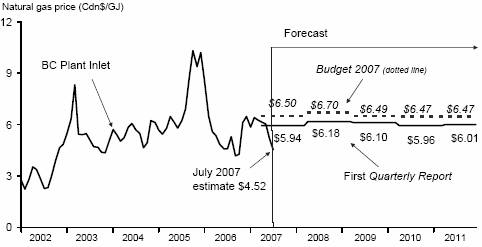

Natural gas price

($Cdn/gigajoule, plant inlet) | | $ | 5.65 | | $ | 6.50 | | $ | 6.70 | | $ | 6.49 | | $ | 5.35 | | $ | 5.94 | | $ | 6.18 | | $ | 6.10 | |

Natural gas volumes | | | | | | | | | | | | | | | | | |

Petajoules | | 1,095 | | 1,116 | | 1,137 | | 1,158 | | 1,080 | | 1,066 | | 1,074 | | 1,084 | |

Annual per cent change | | 1.2 | % | 1.9 | % | 1.9 | % | 1.8 | % | -0.2 | % | -1.3 | % | 0.8 | % | 0.9 | % |

| | | | | | | | | | | | | | | | | |

Electricity price

(Mid-Columbia, $US/mega-watt hour) | | $ | 53 | | $ | 65 | | $ | 67 | | $ | 65 | | $ | 50 | | $ | 66 | | $ | 72 | | $ | 71 | |

Metallurgical coal price

($US/tonne, fob west coast) | | $ | 105 | | $ | 90 | | $ | 85 | | $ | 75 | | $ | 108 | | $ | 92 | | $ | 95 | | $ | 95 | |

Copper price ($US/lb) | | $ | 3.20 | | $ | 2.55 | | $ | 1.85 | | $ | 1.45 | | $ | 3.17 | | $ | 3.15 | | $ | 2.40 | | $ | 2.15 | |

Molybdenum ($US/lb) | | $ | 26.00 | | $ | 22.00 | | $ | 12.50 | | $ | 7.00 | | $ | 25.39 | | $ | 28.00 | | $ | 19.25 | | $ | 13.75 | |

Crown harvest volumes (million cubic metres) | | | | | | | | | | | | | | | | | |

Interior | | 54.0 | | 52.0 | | 53.0 | | 55.0 | | 53.6 | | 51.0 | | 51.0 | | 53.0 | |

Coast | | 15.0 | | 14.0 | | 15.0 | | 16.0 | | 14.6 | | 12.8 | | 15.0 | | 16.0 | |

Total | | 69.0 | | 66.0 | | 68.0 | | 71.0 | | 68.2 | | 63.8 | | 66.0 | | 69.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

First Quarterly Report plan

The updated revenue forecast is expected to increase 0.1 per cent in 2007/08 over 2006/07 as higher revenues from taxation, natural resources and commercial Crown corporation net incomes are offset by the loss of equalization entitlement, lower trust funds established by the federal government and the effects on personal income tax revenue of tax cuts introduced in Budget 2007 and lower prior-year adjustments.

Revenue growth continues to be relatively flat in 2008/09 as the effects of 4.9 per cent nominal GDP growth are partially offset by:

• the second stage of personal income tax cuts introduced in Budget 2007;

• lower corporate income tax revenue mainly reflecting the one-time impact recorded in 2007/08 of the receipt of duty deposit refunds by forest-sector firms;

• the effects of falling metal prices; and

• reduced federal government contributions as no additional trust funding is assumed beyond 2007/08.

10

In 2009/10, revenue growth of 3.3 per cent or $1,270 million incorporates the impacts of 5.5 per cent nominal GDP growth and the partially offsetting impacts of falling natural resource revenues and commercial Crown corporation net income. Forest revenues are expected to decline reflecting lower federal government border tax collections on softwood lumber exports as lumber prices are forecast to rise resulting in lower export tax rates applied to US lumber shipments. All other natural resource revenues are forecast to be relatively flat in 2009/10 reflecting energy and metal price projections.

Key assumptions and sensitivities relating to revenue are provided in Appendix Table A.7. The major revenue components are:

• After accounting for tax measures and prior year adjustments, personal income tax base revenue is forecast to average 6.3 per cent growth over the next three years consistent with personal and labour income growth assumptions. The updated forecast also incorporates the continuation of strong earnings from higher income individuals in 2007.

Table 1.5 Personal Income Tax Revenue

| | | | | | | | | | Average | |

| | | | | | | | | | Annual | |

($ millions) | | 2006/07 | | 2007/08 | | 2008/09 | | 2009/10 | | Growth (1) | |

Personal Income tax revenue | | 6,905 | | 6,438 | | 6,706 | | 7,126 | | | |

Tax Measures: | | | | | | | | | | | |

Budget 2007 | | 63 | | 321 | | 547 | | 575 | | | |

Announced prior to budget | | | | | | | | | | | |

(dividend and training tax credits) | | 64 | | 75 | | 75 | | 75 | | | |

Federal government measures (income splitting) | | — | | 40 | | 40 | | 40 | | | |

Prior-year adjustment | | (491 | ) | 75 | | — | | — | | | |

Other one-time adjustments | | (33 | ) | — | | — | | — | | | |

Base revenue | | 6,508 | | 6,949 | | 7,368 | | 7,816 | | 6.3 | % |

Annual growth | | 10.3 | % | 6.8 | % | 6.0 | % | 6.1 | % | | |

Personal income growth (calendar year basis) | | 7.2 | % | 4.7 | % | 4.6 | % | 4.7 | % | 4.7 | % |

Labour income growth (calendar year basis) | | 8.2 | % | 5.6 | % | 5.1 | % | 5.2 | % | 5.3 | % |

(1) Average annual growth between 2006/07 and 2009/10.

• Strong corporate income tax revenue growth in 2007/08 mainly reflects the one-time impact of duty deposit refunds received by the forest sector firms in 2006. Preliminary tax return information indicates that 2006 tax entitlement will be higher than assumed at budget, consistent with updated 2006 corporate profits growth. Revenue returns to more normal levels over the next two years as instalments rise and adjustments for prior years decline.

Table 1.6 Corporate Income Tax Revenue

($ millions) | | 2006/07 | | 2007/08 | | 2008/09 | | 2009/10 | |

Advance instalments: | | | | | | | | | |

Base | | 1,237 | | 1,342 | | 1,411 | | 1,567 | |

Softwood lumber duty deposits refunds | | 25 | | 13 | | — | | — | |

Total advances | | 1,262 | | 1,355 | | 1,411 | | 1,567 | |

International Financial Activity Act refunds | | (2 | ) | (25 | ) | (25 | ) | (25 | ) |

| | 2005 | | 2006 | | 2007 | | 2008 | |

Prior-year adjustment: | | | | | | | | | |

Base year | | 207 | | 92 | | 35 | | 2 | |

Duty deposits refunds | | — | | 275 | | 17 | | — | |

Prior years | | 71 | | 75 | | — | | — | |

| | 278 | | 442 | | 52 | | 2 | |

Corporate income tax revenue | | 1,538 | | 1,772 | | 1,438 | | 1,544 | |

11

• In 2007/08 social service tax revenue growth, forecast at 8 per cent, reflects strong year-to-date collections. Over the next two years, average annual growth is expected to be 5.1 per cent, consistent with consumer expenditure, business investment and overall economic growth.

Table 1.7 Social Service Tax Revenue

($ millions) | | 2006/07 | | 2007/08 | | 2008/09 | | 2009/10 | |

Social service tax revenue | | 4,714 | | 5,090 | | 5,337 | | 5,625 | |

Annual Per Cent Change | | 7.9 | % | 8.0 | % | 4.9 | % | 5.4 | % |

Annual per cent change (calendar year basis) | | | | | | | | | |

Personal Consumption | | 6.7 | % | 6.1 | % | 5.4 | % | 5.3 | % |

Investment | | 12.4 | % | 10.0 | % | 4.5 | % | 5.6 | % |

Nominal GDP | | 6.4 | % | 5.7 | % | 4.9 | % | 5.5 | % |

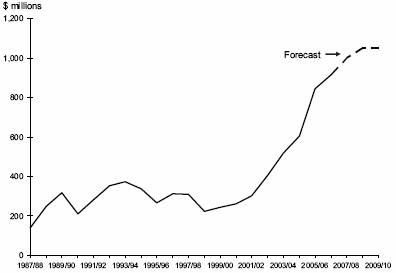

• Property transfer tax revenue is forecast to grow 9.4 per cent in 2007/08 reflecting year-to-date sales. Over the next two years, growth in this revenue source is expected to moderate as the effects of higher interest rates in 2007 and 2008 and high prices slow market sales compared to recent years.

Chart 1.1 Property transfer tax revenue growth expected to moderate

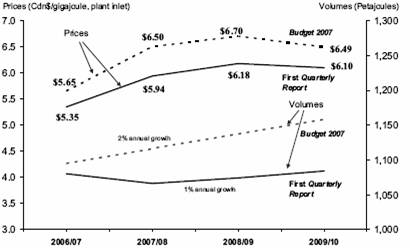

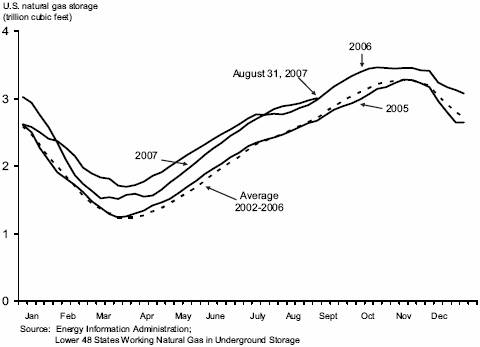

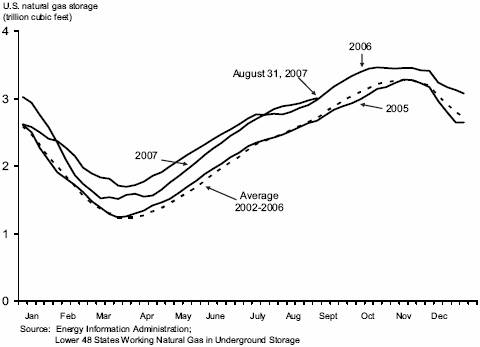

• Natural gas royalties are forecast to rise 10 per cent in 2007/08 over 2006/07 as higher natural gas prices are partially offset by declining volumes. Revenue is expected to remain relatively flat over the next two years reflecting a stable price outlook and moderate volume growth.

See Appendix Tables A.7 and A.8 for more details regarding natural gas price forecasts and a comparison of 2007 storage inventory with historical levels.

As Chart 1.2 shows, the updated forecast assumes lower price and volume projections compared to the budget forecast, illustrating the volatility associated with natural gas royalties.

12

Chart 1.2 Lower natural gas prices and volumes

Source: Ministry of Energy, Mines and Petroleum Resources

• Revenue from sales of electricity under the Columbia River Treaty increases each year over the plan due to higher electricity prices in the first two years and higher volumes in the third year of the plan. Other energy and mineral revenue is expected to fall in 2007/08 mainly due to the impact of a higher Canadian dollar on mining profits. Revenue continues to decline in 2008/09 mainly due to weaker metal prices and is relatively flat in 2009/10 as higher revenue from coal and sales of Crown land drilling rights are offset by impacts of declining oil and metal prices.

• Forests revenue is up slightly in 2007/08 as higher softwood lumber border tax collections are partially offset by lower stumpage and logging tax revenues due to lower harvest volumes.

Over the next two years, stumpage revenue is expected to increase reflecting rising harvest volumes and moderate price growth. However, the assumption of rising prices has an offsetting impact on border tax collections revenue as prices are expected to rise to US $300 per thousand board feet by early 2009 and the export tax rate to fall to 5 per cent from the current 15 per cent level. Over the medium term, assuming flat prices, interior stumpage rates are expected to decline, reflecting reduced log values and higher handling costs due to the effects of the mountain pine beetle infestation.

Table 1.8 Forests Revenue

($ millions) | | 2006/07 | | 2007/08 | | 2008/09 | | 2009/10 | |

Stumpage | | 1,002 | | 947 | | 1,057 | | 1,085 | |

Softwood Lumber Agreement – border tax | | 156 | | 305 | | 270 | | 142 | |

Logging tax | | 98 | | 20 | | 20 | | 30 | |

Other | | 20 | | 24 | | 25 | | 25 | |

Forest Revenue | | 1,276 | | 1,296 | | 1,372 | | 1,282 | |

Average export tax rate | | 15.0 | % | 12.5 | % | 11.2 | % | 5.0 | % |

Total Crown harvest volumes (million cubic metres) | | 68.2 | | 63.8 | | 66.0 | | 69.0 | |

Spruce-pine-fir 2X4 prices ($US/1000 bd ft) | | 273 | | 270 | | 281 | | 300 | |

13

• Revenue from health and social transfers is expected to rise $397 million in 2007/08 reflecting normal base growth and $116 million of new trust money established by the federal government. These additional funds are intended to support initiatives to reduce wait times and the purchase of the human papillomavirus vaccine with the goal of protecting women and girls from cervical cancer.

Table 1.9 Health and Social Transfers

($ millions) | | 2006/07 | | 2007/08 | | 2008/09 | | 2009/10 | |

Canada Health Transfer | | 2,808 | | 3,098 | | 3,281 | | 3,488 | |

Wait times (1) | | 158 | | 158 | | 79 | | 33 | |

2007 trusts | | — | | 116 | | — | | — | |

Health deferral | | 104 | | 130 | | 24 | | 24 | |

Canada Social Transfer | | 1,213 | | 1,311 | | 1,403 | | 1,451 | |

Early learning and childcare | | 148 | | — | | — | | — | |

2007 Child care spaces funding | | — | | 33 | | — | | — | |

Prior-year adjustments | | 42 | | 25 | | — | | — | |

Total Health and Social Transfers | | 4,473 | | 4,870 | | 4,787 | | 4,996 | |

(1) Due to lump sum payment by the federal government, the 2006/07 to 2008/09 wait time revenue represents deferred revenue.

Revenue continues to decline in 2008/09 as base growth is offset by the loss of one-time trust funding and lower recognition of deferred funding from federal government advances. Revenue growth returns to normal in 2009/10 as one-time funding for specific purposes is reduced to a relatively small level recognizing the depreciation of capital assets.

The forecast incorporates the federal budget measure to fund the Canada Social Transfer on an equal per capita basis (elimination of tax point transfers).

• In 2007/08, other federal transfers include a one-time $199 million eco-Trust funding for reducing air pollutant and greenhouse gas emissions, $25 million for multiculturalism and immigration, and $17 million in disaster financial assistance.

Chart 1.3 Federal government contributions

14

In 2008/09, other transfers decline reflecting support that is one-time in nature, as well as uncertainty of federal government commitment or the timing of some funding sources expected in 2007/08. This includes funding in support of combating the mountain pine beetle infestation, the Pan-Canadian health surveillance, providing services for immigrants, and grants to local governments through the Canada Infrastructure Program.

Commercial Crown corporations income

• BC Hydro’s three year earnings projections are virtually unchanged from Budget 2007, as fluctuations in operating results are offset by changes to regulatory account transfers. A $155 million improvement in operating results for 2007/08 is primarily due to higher than expected inflows to reservoirs (109 per cent of normal), and enabled a $114 million transfer to the regulatory accounts to help offset future rate increases. Operating results for 2008/09 and 2009/10 are slightly lower than the projections in Budget 2007, primarily due to higher than expected operations and maintenance costs. These reductions will be offset by additional transfers from the regulatory accounts. The regulatory accounts and their use are subject to ongoing review by the BC Utilities Commission.

• LDB has improved its annual net income projections by an average $14 million per year over the forecast period. The improvement is due to lower operating costs, primarily resulting from the implementation of the new Beverage Container Stewardship Program. This reflects a shift of the responsibility for beverage containers from the LDB to industry stakeholders.

• BC Lottery Corporation’s projections are unchanged from Budget 2007. BCLC is currently developing strategies for implementing the recommendations from the May 2007 Ombudsman Report, and for addressing the impact of the smoking ban in public buildings beginning in January 2008. BCLC will revise its projections once the strategies are finalized.

• BCRC’s earnings forecast continues to show a certain degree of volatility due to the uncertainty in forecasting both the timing and gain from asset disposals, which are primarily property sales. The current projections reflect a shift of asset disposals from 2007/08 to 2008/09, and an increase in estimated value.

• ICBC’s impact on the government’s bottom line is expected to improve by $259 million in 2007/08, by $74 million in 2008/09, and by $78 million in 2009/10. The improvement in 2007/08 is mainly due to income from the sale of Surrey Central City Mall (an ICBC Properties Ltd. investment), and a $105 million reduction to expected claims costs. Claims incurred costs have moderated from the Budget 2007 projections, and a re-estimation of the current value of unpaid claims has resulted in a positive prior years’ claims adjustment. The improvements to 2008/09 and 2009/10 are primarily due to increases in projected premium revenue resulting from higher optional insurance sales.

15

Expense

Government expense includes spending for ministries and other programs of the Consolidated Revenue Fund (CRF), combined with the expense of service delivery agencies, including the SUCH sector (schools, universities, colleges and health authorities/hospital societies).

Total expenses are now forecast to total $36.4 billion in 2007/08, $36.8 billion in 2008/09 and $38.0 billion in 2009/10.

Total expense for 2007/08 is up $190 million from Budget 2007, due to:

• higher than expected forest fire fighting and other natural disaster costs ($110 million);

• the impact of changes to MLA compensation and pensions ($43 million); and

• increased spending funded by one-time recoveries, primarily from the federal government ($114 million). Included in this amount is the initial year of an annual $33 million lift to federal child care funding.

Other spending changes in 2007/08 include higher costs for the BC Timber Sales program ($15 million). The above increases are partially offset by reduced interest costs ($23 million) and a reduction in spending by service delivery agencies ($69 million).

Total expense for 2008/09 and 2009/10 is up $110 million and $100 million, respectively. The increases are due to higher child care funding by the federal government, increased BC Timber Sales program costs, the impact of changes to MLA compensation, and higher spending by service delivery agencies in the education sector, partially offset by lower interest costs.

Consolidated revenue fund expense

The updated forecast for 2007/08 includes $113 million for forest fire fighting costs, $57 million above budget. BC Timber Sales expenses are projected at $200 million, $15 million above budget primarily due to a write-down of inventory. Full-year flood-related costs under the Emergency Program Act are projected at $53 million above budget, including expenses for mitigation work and response and recovery costs. Legislature expenses are $43 million above budget related to recent changes to MLA compensation and pensions and assumes that all MLAs purchase past pensionable service in 2007/08. Funding for forest fire fighting, BC Timber Sales, Emergency Program Act and MLA compensation and pension related costs is statutorily provided for and does not require additional approval of the legislature.

All other ministries are forecast to be on budget for 2007/08.

16

Subsequent to Budget 2007, the three year spending plan has been increased by $52 million in each of 2008/09 and 2009/10, due to the following changes:

• Ministry of Children and Family Development – spending targets have been increased by $33 million in each of 2008/09 and 2009/10 due to increased funding from the federal government for child care.

• Legislature – spending targets have been increased by $9 million in each of 2008/09 and 2009/10 to reflect increases in MLA compensation.

• Ministry of Forests and Range and Minister Responsible for Housing – spending targets have been increased by $10 million in each of 2008/09 and 2009/10 as a result of BC Timber Sales expenses related to a write-down of inventory.

• The spending plan also includes a $268 million allocation to the Vancouver Convention Centre expansion project in 2008/09 to fund additional construction costs identified earlier this year. As this is a grant to VCCEP, there is no impact on total expense in 2008/09 as it relates to increased capital spending.

Contingencies

General program spending commitments and pressures totaling $28 million in 2007/08, $25 million in 2008/09 and $54 million in 2008/09 have been notionally allocated to the contingencies vote. These allocations include:

Table 1.10 Notional Allocations to Contingencies

($ millions) | | 2007/08 | | 2008/09 | | 2009/10 | |

2010 Olympics – preliminary allocation of contingency amount | | — | | 20 | | 49 | |

Corrections caseload and safety issues | | 13 | | — | | — | |

Major trials | | 8 | | — | | — | |

Norman B. Keevil Institute of Mining Engineering at UBC | | 5 | | — | | — | |

Traffic fines revenue sharing – potential changes in estimates | | — | | 5 | | 5 | |

Enhanced driver’s license pilot program | | 2 | | — | | — | |

Subtotal notional allocations | | 28 | | 25 | | 54 | |

Unallocated contingencies | | 332 | | 340 | | 321 | |

Total contingencies | | 360 | | 365 | | 375 | |

• Up to $20 million in 2008/09 and $49 million in 2009/10 has been allocated for the 2010 Olympic and Paralympic Winter Games (2010 Olympics), unchanged from budget. The provincial contingency allocation is included in the province’s $600 million commitment to the 2010 Olympics.

• Up to $13 million in 2007/08 to address caseload and safety issues within correctional facilities in BC.

• Up to $8 million for expected costs related to the Pickton trial and other major trials in 2007/08.

• Up to $5 million in 2007/08 for the Norman B. Keevil Institute of Mining Engineering at UBC to create a global centre of excellence in mining science and engineering to support BC’s mining industry.

• Up to $5 million in 2008/09 and 2009/10 for potential changes in estimates for traffic fine revenue sharing.

• Up to $2 million in 2007/08 for the Enhanced Driver’s License pilot program.

17

Negotiating Framework

Budget 2007 included $39 million in 2007/08, $77 million in 2008/09, and $142 million in 2009/10 for the wage and benefit impacts of agreements yet to be concluded. These amounts continue to be held in contingencies and will be distributed by the Minister of Finance once settlements are reached.

Health Innovation Fund

Budget 2007 also included a $100 million Health Innovation Fund, open to health authorities for proposals to promote innovation and facilitate improvements in patient care within the public health-care system. Based on proposals submitted by health authorities, $85 million has been approved for 29 pilot projects and $15 million for smaller, short-term projects.

Service delivery agency expenses

Service delivery agency net spending (i.e. expenses in excess of government transfers) is forecast to decrease by $69 million in 2007/08 and $194 million in 2008/09, and increase by $94 million in 2009/10 compared to the projections in Budget 2007.

Projected net spending by school districts is down $29 million in 2007/08, and up $33 million and $12 million in 2008/09 and 2009/10 respectively. The decrease in net spending in 2007/08 in part reflects additional grants and the timing of grants. The net spending increases in 2008/09 and 2009/10 are due to increased operating cost forecasts.

Projected net spending by health authorities and hospital societies is down $33 million in 2007/08, reflecting efficiency and cost saving strategies being implemented by the health authorities.

This forecast update only reflects updated projections for 2007/08 from health authorities and hospital societies. Health authorities have projected lower deficits totaling $55 million in 2007/08 (Vancouver Coastal Health Authority, including Providence $35 million; Fraser Health Authority $20 million) compared to $119 million as presented in Budget 2007 (Vancouver Coastal Health Authority $54 million; Fraser Health Authority $65 million).

To alleviate the forecast deficits, health authorities have assumed in their updated projections a number of revenue growth and efficiency/cost savings measures to be implemented in 2007/08. Some of these measures will be funded by the $100 million Health Innovation Fund announced by the government in Budget 2007.

The 2008/09 and 2009/10 projections from these health organizations have not been updated from Budget 2007, pending the outcome of the Conversation on Health initiative. The Ministry of Health will continue to work with the health authorities on their financial plans in the context of this initiative as part of the budget process.

To ensure that the Province’s three-year fiscal plan remains balanced, the forecast allowances for 2008/09 and 2009/10 will continue to recognize the interim nature of the health spending allocations and can accommodate some additional growth in health funding.

18

Projected net spending (spending net of government grants) by universities and colleges is down $22 million in 2007/08, and up $54 million and $93 million in 2008/09 and 2009/10 respectively. The decrease in net spending in 2007/08 reflects additional funding grants to support Aboriginal post-secondary education and an increase in annual capital allowance funding for facility upgrades. Funding is provided by the Ministry of Advanced Education through allocations within its existing budget. The net spending increases in 2008/09 and 2009/10 reflects additional faculty and operating cost forecasts.

Full-time equivalents (FTEs)

The updated projection for taxpayer-supported FTEs – including ministries, special offices, and service delivery agencies (excluding the SUCH sector) – is unchanged from Budget 2007 (see Appendix Table A.12).

Provincial capital spending

Capital spending is needed to build, acquire or replace assets such as roads, schools, post-secondary facilities, hospitals and related major equipment.

Capital spending is not directly counted in the government’s annual surplus or deficit. Instead, generally accepted accounting principles require capital costs to be spread out over the useful lives of the related assets through annual amortization expenses. These amortization expenses are charged annually against the surplus. However, the cash requirements for capital projects have an immediate impact on debt, except where cash balances can be drawn down or new revenue sources applied.

Table 1.11 Capital Spending – Changes from Budget 2007

($ millions) | | 2007/08 | | 2008/09 | | 2009/10 | |

Budget 2007 capital spending | | 5,156 | | 4,916 | | 4,567 | |

| | | | | | | |

Taxpayer-supported changes: | | | | | | | |

Education – computer, furniture and equipment and vehicle purchases financed from cash balances | | 57 | | — | | — | |

Post-secondary education – mainly carry-over of slower-than-expected 2006/07 capital spending | | 103 | | 52 | | (32 | ) |

Health – mainly priority spending for Victoria Royal Jubilee Hospital, Kelowna General Hospital and Vernon Jubilee Hospital | | 135 | | 213 | | 209 | |

BCTFA – mainly timing of capital spending | | 151 | | 14 | | 1 | |

Vancouver Convention Centre expansion project – updated project budget | | 84 | | 147 | | 22 | |

Social housing – acquisition of single room occupancy hotels for social housing | | 49 | | 5 | | 5 | |

Capital spending contingencies – mainly reflects reallocation for health priority projects and the Vancouver Convention Centre expansion project | | (190 | ) | (150 | ) | (190 | ) |

Other | | 4 | | 1 | | 1 | |

Total taxpayer-supported | | 393 | | 282 | | 16 | |

| | | | | | | |

Self-supported changes: | | | | | | | |

BC Hydro – mainly higher costs to strengthen the power system from extreme weather, support for independent power producers and transmission system upgrades | | 68 | | 123 | | 34 | |

Other | | (19 | ) | 7 | | 16 | |

Total self-supported | | 49 | | 130 | | 50 | |

Total Changes | | 442 | | 412 | | 66 | |

Updated capital spending | | 5,598 | | 5,328 | | 4,633 | |

19

Table 1.12 Capital Spending: 2006/07 – 2009/10

| | Actual | | Forecast | | Updated Plan | |

($ millions) | | 2006/07 | | 2007/08 | | 2008/09 | | 2009/10 | |

| | | | | | | | | |

Taxpayer-supported | | | | | | | | | |

Education | | | | | | | | | |

Schools (K–12) | | 322 | | 422 | | 411 | | 411 | |

Post-secondary | | 874 | | 960 | | 642 | | 443 | |

Health | | 760 | | 954 | | 882 | | 858 | |

BC Transportation Financing Authority | | 821 | | 1,073 | | 830 | | 634 | |

Vancouver Convention Centre expansion project | | 108 | | 290 | | 290 | | 37 | |

Government operating (ministries) | | 309 | | 325 | | 257 | | 256 | |

Other (1) | | 172 | | 128 | | 98 | | 88 | |

Capital spending contingencies (2.5% of total taxpayer-supported capital spending in 2007/08, 5% in 2008/09 and 2009/10) | | — | | 105 | | 180 | | 140 | |

Total taxpayer-supported | | 3,366 | | 4,257 | | 3,590 | | 2,867 | |

| | | | | | | | | |

Self-supported | | | | | | | | | |

BC Hydro | | 807 | | 1,063 | | 1,419 | | 1,407 | |

BC Transmission Corporation | | 50 | | 85 | | 16 | | 8 | |

Columbia River power projects (2) | | 19 | | 29 | | 148 | | 198 | |

BC Rail | | 19 | | 33 | | 24 | | 9 | |

ICBC (3) | | 22 | | 29 | | 30 | | 45 | |

BC Lotteries | | 44 | | 84 | | 80 | | 80 | |

Liquor Distribution Branch | | 22 | | 18 | | 21 | | 19 | |

Total self-supported | | 983 | | 1,341 | | 1,738 | | 1,766 | |

Total capital spending | | 4,349 | | 5,598 | | 5,328 | | 4,633 | |

(1) | Includes BC Housing Management Commission, Provincial Rental Housing Corporation, Rapid Transit Project 2000, BC Transit and other service delivery agencies. |

| |

(2) | Joint ventures of the Columbia Power Corporation and Columbia Basin Trust. |

| |

(3) | Includes ICBC Properties Ltd. |

Total capital spending is forecast to be $5.6 billion in 2007/08, $5.3 billion in 2008/09 and $4.6 billion in 2009/10. These amounts are $442 million, $412 million and $66 million higher than the Budget 2007 projections (see Tables 1.11 and 1.12).

Taxpayer-supported capital spending is forecast to be $393 million higher than budget in 2007/08, $282 million higher in 2008/09 and $16 million higher in 2009/10. The increases include:

• priority investments in the health sector including the Victoria Royal Jubilee Hospital, Kelowna General Hospital and Vernon Jubilee Hospital (approvals in principle for the projects were made in Budget 2007, and funds were set aside in capital contingencies);

• higher spending for computers, furniture and equipments, and vehicles in K–12 schools;

• post-secondary projects carried over from slower-than-expected spending in 2006/7;

• highway infrastructure improvements throughout the province, and projects carried over from slower-than-expected spending in 2006/07;

20

• revised estimates for the Vancouver Convention Center expansion project; and

• acquisition of single room occupancy hotels for social housing.

These investments are mainly being financed through a combination of cash balances or own source revenues (such as donations), and are being made without further increases in taxpayer-supported debt.

Self-supported commercial Crown corporation capital spending is forecast to be $49 million higher than budget in 2007/08, $130 million higher in 2008/09 and $50 million higher in 2009/10. These forecasts mainly reflect additional BC Hydro costs to strengthen the power system from extreme weather conditions, support for independent power producers and transmission system upgrades.

Significant capital projects (those with multi-year budgets totaling $50 million or more) are shown in Table 1.13. Total spending for these projects over the next three years is forecast at $1.9 billion, up $630 million from the Budget 2007 projections. The higher forecast mainly reflects the addition of the Victoria Royal Jubilee, Kelowna General and Vernon Jubilee hospitals; addition of BC Hydro’s Revelstoke Dam Unit 5 project; and revised estimates for the Vancouver Convention Centre expansion project.

21

Table 1.13 Capital Expenditure Projects Greater Than $50 million (1)

Note: Information in bold type denotes changes from 2006/07 Public Accounts.

| | | | | | Estimated | | | | | |

| | | | Forecast | | Cumulative | | | | | | | | Cumulative | | | | | |

| | Start | | Completion | | Spending at | | Spending | | Spending | | Spending | | Spending at | | Total Project | |

($ millions) | | Date | | Date | | Mar. 31, 2007(2) + | | 2007/08 + | | 2008/09 + | | 2009/10 | | = Mar. 31, 2010 | | Budget(3) | | Forecast (3) | |

| | | | | | | | | | | | | | | | | | | |

Health facilities (4) | | | | | | | | | | | | | | | | | | | |

Vancouver General Hospital, redevelopment project | | Sept. 2000 | | Fall 2007 | | 155 | | 1 | | — | | — | | 156 | | 156 | | 156 | |

Abbotsford Regional Hospital and Cancer Centre | | Fall 2004 | | Summer/08 | | 182 | | 119 | | 15 | | — | | 316 | | 316 | | 316 | |

Surrey Outpatient Facility | | Spring 2006 | | Spring/10 | | 2 | | 5 | | 74 | | 61 | | 142 | | 151 | | 151 | |

Victoria Royal Jubilee Hospital inpatient facility | | Spring/07 | | Spring/10 | | — | | 20 | | 67 | | 56 | | 143 | | 150 | | 150 | |

Kelowna General Hospital Ambulatory Care Centre and Emergency Department | | Spring/07 | | Spring/10 | | — | | 1 | | 20 | | 22 | | 43 | | 61 | | 61 | |

Vernon Jubilee Hospital Diagnostic and Treatment Building | | Spring/07 | | Spring/10 | | — | | 2 | | 15 | | 16 | | 33 | | 49 | | 49 | |

Total health facilities | | | | | | 339 | | 148 | | 191 | | 155 | | 833 | | 883 | | 883 | |

| | | | | | | | | | | | | | | | | | | |

Transportation | | | | | | | | | | | | | | | | | | | |

Trans Canada Highway – 10 Mile (Park) Bridge | | Oct. 2005 | | Jan. 2008 | | 54 | | 14 | | — | | — | | 68 | | 68 | (6) | 68 | (6) |

Pitt River Bridge (5) | | Feb. 2006 | | Fall 2009 | | 20 | | 30 | | 42 | | 16 | | 108 | | 108 | (6) | 108 | (6) |

Sea-to-Sky Highway (5) | | April 2003 | | July 2009 | | 356 | | 142 | | 73 | | 29 | | 600 | | 600 | | 600 | (7) |

William R. Bennett Bridge (5) | | Mar. 2005 | | July 2008 | | 83 | | 46 | | 15 | | — | | 144 | | 144 | | 144 | |

Total transportation | | | | | | 513 | | 232 | | 130 | | 45 | | 920 | | 920 | | 920 | |

| | | | | | | | | | | | | | | | | | | |

Power generation | | | | | | | | | | | | | | | | | | | |

BC Hydro | | | | | | | | | | | | | | | | | | | |

– Mica Dam – generator stator replacement | | Feb. 2004 | | Mar. 2011 | | 37 | | 16 | | 17 | | 6 | | 76 | | 76 | | 76 | |

– Peace Canyon Dam – generator stator replacement and rotor modification | | Feb. 2004 | | Oct. 2009 | | 28 | | 14 | | 14 | | 11 | | 67 | | 67 | | 67 | |

– Coquitlam Dam seismic upgrade | | Oct. 2003 | | Aug. 2007 | | 42 | | 16 | | — | | — | | 58 | | 58 | | 58 | |

– Aberfeldie redevelopment | | Apr. 2005 | | Aug. 2008 | | 13 | | 54 | | 25 | | — | | 92 | | 92 | | 92 | |

– GM Shrum G2–G4 stator replacement | | Sept. 2004 | | Aug. 2010 | | 16 | | 18 | | 22 | | 10 | | 66 | | 66 | | 66 | |

– Peace Canyon G1–G4 turbine overhaul | | Oct. 2005 | | Oct. 2009 | | 9 | | 14 | | 16 | | 16 | | 55 | | 55 | | 55 | |

– Revelstoke Unit 5 project | | May 2005 | | Oct. 2011 | | 8 | | 22 | | 42 | | 92 | | 164 | | 330 | | 330 | |

BC Transmission Corporation | | | | | | | | | | | | | | | | | | | |

– System control centre modernization project | | Feb. 2005 | | Oct. 2008 | | 57 | | 75 | | 2 | | — | | 134 | | 133 | | 134 | |

Brilliant Expansion Power Corporation (8) | | | | | | | | | | | | | | | | | | | |

– Brilliant Dam power expansion | | Oct. 2002 | | Aug. 2007 | | 191 | | 14 | | — | | — | | 205 | | 205 | | 205 | |

Total power generation | | | | | | 401 | | 243 | | 138 | | 135 | | 917 | | 1,082 | | 1,083 | |

| | | | | | | | | | | | | | | | | | | |

Other | | | | | | | | | | | | | | | | | | | |

ICBC Properties Ltd. | | | | | | | | | | | | | | | | | | | |

– Surrey City Centre Mall Ltd. | | Sept. 1999 | | July 2007 | (9) | 270 | | 5 | | — | | — | | 275 | | 312 | | 275 | |

Vancouver Convention Centre expansion project | | 2003 | | 2009 | | 112 | | 162 | | 229 | | 38 | | 541 | | 541 | | 541 | (10) |

Total other | | | | | | 382 | | 167 | | 229 | | 38 | | 816 | | 853 | | 816 | |

(1) | Only projects that have been approved by Treasury Board and/or Crown corporation boards are included in this table. Ministry service plans may include projects that still require final approval. Only the provincial share of funding is presented. Total costs for some of these projects could be higher as they are cost-shared with the federal government, municipal authorities or the private sector. |

| |

(2) | Total expenditures since commencement of each project. |

| |

(3) | Represents sum of annual budgeted expenditures to complete each project. |

| |

(4) | Amounts shown may include cost of construction, equipment, deferred development costs and land, less funding contributed by Regional Hospital Districts, and exclude interest costs incurred during construction. |

| |

(5) | Amounts shown exclude interest costs incurred during construction. |

| |

(6) | Amount represents the provincial portion of this cost-shared project with the federal government. |

| |

(7) | Represents capital construction costs before the addition of enhanced rehabilitation and safety features. The total estimated outlays (including both capital construction and operating activities) for the project over 25 years is $1.983 billion, which assumes 2 per cent inflation per year and maximum performance payments. |

| |

(8) | A joint venture of the Columbia Power Corporation and the Columbia Basin Trust. |

| |

(9) | The base building was substantially completed in January 2003; however, work to prepare space for new tenants is still required. Effective August 1, 2007, ownership of the Central City development was transferred to a consortium of Canadian pension funds. |

| |

(10) | Amount represents the provincial portion of this cost-shared project with the federal government and the tourism industry. The total project forecast (including federal and private sector partners) has been revised to $883 million following a review of the impact of higher than expected construction costs. |

22

Provincial debt

The government and its Crown corporations borrow to finance construction of capital projects or other investments, to refinance maturing debt and to finance working capital needs.

Total provincial debt is projected to total $34.8 billion at March 31, 2008 (18.3 per cent of provincial GDP), $36.8 billion at March 31, 2009 (18.5 per cent of GDP) and $37.5 billion at March 31, 2010 (17.8 per cent of GDP). These amounts are significantly lower than the Budget 2007 projections (see Tables 1.14 and 1.15), reflecting higher expected revenues over the next three years and a $1.0 billion lower than expected debt balance at March 31, 2007.

Table 1.14 Debt Summary – Changes from Budget 2007

($ millions) | | 2007/08 | | 2008/09 | | 2009/10 | |

Budget 2007 total debt | | 36,837 | | 38,681 | | 39,981 | |

Taxpayer-supported debt changes: | | | | | | | |

Government operating – mainly opening cash and revenue improvements | | (1,404 | ) | (1,820 | ) | (2,587 | ) |

Education facilities – mainly impact of capital spending changes offset by use of cash balances and own source revenues, and reclassification of post-secondary institutions’ subsidiaries debt to self-supported | | (107 | ) | (112 | ) | (124 | ) |

Health facilities – mainly priority health projects offset by lower than expected debt at March 31, 2007 | | (48 | ) | 70 | | 96 | |

Transportation – mainly impact of capital spending changes | | 69 | | 19 | | (15 | ) |

Social housing – mainly impact of lower than expected debt at April 1, 2007 | | (59 | ) | (45 | ) | (30 | ) |

Other changes | | (23 | ) | (23 | ) | (21 | ) |

Total taxpayer-supported | | (1,572 | ) | (1,911 | ) | (2,681 | ) |

| | | | | | | |

Self-supported debt changes: | | | | | | | |

BC Hydro – mainly impact of improved cash flows from operations | | (154 | ) | (9 | ) | 74 | |

BC Transmission Corporation – mainly impact of stronger cash flows from operations | | 3 | | (16 | ) | (14 | ) |

Columbia River power projects – timing of borrowing for Waneta Dam expansion | | (157 | ) | 4 | | 50 | |

Post-secondary institutions’ subsidiaries – reclassification from taxpayer-supported | | 53 | | 53 | | 53 | |

Total self-supported | | (255 | ) | 32 | | 163 | |

Forecast allowance changes: (1) | | | | | | | |

Adjustment to mirror operating statement forecast allowance change | | (250 | ) | — | | — | |

Total changes | | (2,077 | ) | (1,879 | ) | (2,518 | ) |

Updated total debt | | 34,760 | | 36,802 | | 37,463 | |

(1) Forecast allowance is not cumulative – only the relevant year forecast allowance is included in the debt forecast for each of the fiscal years.

Total provincial debt includes an allowance to mirror the operating statement forecast allowance. The forecast allowance has been reduced from the original budgeted $750 million in 2007/08 to $500 million, reflecting reduced risks in the natural gas price forecast and assessment of other risks to the end of the fiscal year. The forecast allowances of $1,000 million in 2008/09, and $1,050 million in 2009/10 remain unchanged from budget. This forecast allowance is not cumulative – only the relevant year forecast allowance is included in the debt forecast for each of the fiscal years.

23

Table 1.15 Debt Summary (1): 2006/07 – 2009/10

| | Actual | | Forecast | | Updated Plan | |

($ millions) | | 2006/07 | | 2007/08 | | 2008/09 | | 2009/10 | |

Taxpayer-supported debt | | | | | | | | | |

Provincial government direct operating | | 9,505 | | 7,721 | | 6,595 | | 4,840 | |

Other taxpayer-supported debt (mainly capital) | | | | | | | | | |

Education facilities (2) | | | | | | | | | |

Schools | | 4,724 | | 4,956 | | 5,232 | | 5,510 | |

Post-secondary institutions | | 2,909 | | 3,336 | | 3,532 | | 3,839 | |

| | 7,633 | | 8,292 | | 8,764 | | 9,349 | |

Health facilities (2) | | 2,813 | | 3,300 | | 3,809 | | 4,184 | |

Highways and public transit | | | | | | | | | |

BC Transportation Financing Authority | | 3,237 | | 4,115 | | 4,715 | | 5,167 | |

Public transit | | 892 | | 915 | | 946 | | 993 | |

Sky Train extension | | 1,153 | | 1,150 | | 1,150 | | 1,150 | |

BC Transit | | 96 | | 91 | | 102 | | 103 | |

| | 5,378 | | 6,271 | | 6,913 | | 7,413 | |

Other | | | | | | | | | |

Social housing (3) | | 216 | | 213 | | 211 | | 209 | |

Homeowner Protection Office | | 110 | | 148 | | 159 | | 166 | |

Other (4) | | 219 | | 286 | | 330 | | 329 | |

| | 545 | | 647 | | 700 | | 704 | |

Total other taxpayer-supported debt | | 16,369 | | 18,510 | | 20,186 | | 21,650 | |

Total taxpayer-supported debt | | 25,874 | | 26,231 | | 26,781 | | 26,490 | |

Self-supported debt | | | | | | | | | |

Commercial Crown corporations and agencies | | | | | | | | | |

BC Hydro | | 7,144 | | 7,652 | | 8,494 | | 9,320 | |

BC Transmission Corporation | | 37 | | 98 | | 78 | | 63 | |

Columbia River power projects (5) | | 236 | | 224 | | 395 | | 486 | |

Liquor Distribution Branch | | 3 | | 2 | | 1 | | 1 | |

Post-secondary institutions’ subsidiaries | | 53 | | 53 | | 53 | | 53 | |

Total self-supported debt | | 7,473 | | 8,029 | | 9,021 | | 9,923 | |

Total debt before forecast allowance | | 33,347 | | 34,260 | | 35,802 | | 36,413 | |

Forecast allowance | | — | | 500 | | 1,000 | | 1,050 | |

Total provincial debt | | 33,347 | | 34,760 | | 36,802 | | 37,463 | |

Debt as a per cent of GDP | | | | | | | | | |

Taxpayer-supported | | 14.4 | % | 13.8 | % | 13.4 | % | 12.6 | % |

Total provincial debt | | 18.6 | % | 18.3 | % | 18.5 | % | 17.8 | % |

(1) | Debt is after deduction of sinking funds and unamortized discounts, and excludes accrued interest. Government direct and fiscal agency accrued interest is reported in the government’s accounts as an accounts payable. |

| |

(2) | Includes debt and guarantees incurred by the government on behalf of school districts, universities, colleges, and health authorities/hospital societies (SUCH), as well as debt directly incurred by these entities. |

| |

(3) | Includes the BC Housing Management Commission and the Provincial Rental Housing Corporation. |

| |

(4) | Includes debt of other taxpayer-supported Crown corporations and agencies and fiscal agency loans to local governments. Also includes student loan guarantees, loan guarantees to agricultural producers, guarantees under economic development and home mortgage assistance programs, and loan guarantee provisions. |

| |

(5) | A joint venture of the Columbia Power Corporation and Columbia Basin Trust. |

24

Taxpayer-supported debt

Taxpayer-supported debt is projected to total $26.2 billion at March 31, 2008 (down $1.6 billion from budget), $26.8 billion at March 31, 2009 (down $1.9 billion from budget), and $26.5 billion at March 31, 2010 (down $2.7 billion from budget). These projections reflect the impacts of stronger taxation and increased federal contributions, and lower than forecast debt balances at the end of the 2006/07 fiscal year.

The debt forecast incorporates the updated capital spending plan and assumes that the expected surpluses will be fully applied to debt reduction. However, should the government allocate some of these surpluses to other areas, the debt forecast would change accordingly.

Based on these assumptions, taxpayer-supported debt is projected at 13.8 per cent of GDP at the end of 2007/08, 13.4 per cent of GDP at the end of 2008/09 and 12.6 per cent of GDP at the end of 2009/10.

Self-supported debt

Self-supported debt is incurred mainly to finance power generation and distribution projects throughout the province. Self-supported debt is projected to total $8.0 billion at March 31, 2008 (down $255 million from budget), $9.0 billion at March 31, 2009 (up $32 million from budget), and $9.9 billion at March 31, 2010 (up $163 million from budget).

The lower projection for 2007/08 is mainly due to delayed borrowing for the Waneta Dam power project and reduced working capital requirements for BC Hydro. Higher debt in the next two fiscal years mainly reflect the impact of higher capital spending and the reclassification of debt related to post-secondary institutions’ subsidiaries to the self-supported category.

Risks to the fiscal plan

The major risks to the fiscal plan include, but are not limited to, changes to economic variables, including the economic growth of BC’s trading partners, commodity prices (especially natural gas, lumber and electricity), instability in financial markets and exchange rate fluctuations.

The main changes to the three year fiscal plan risk profile described in Budget 2007 are summarized below.

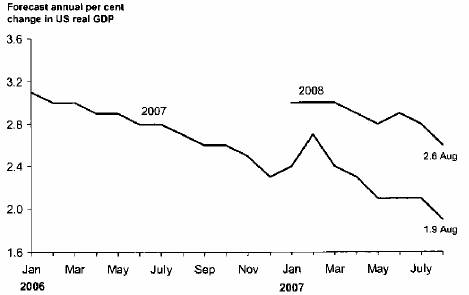

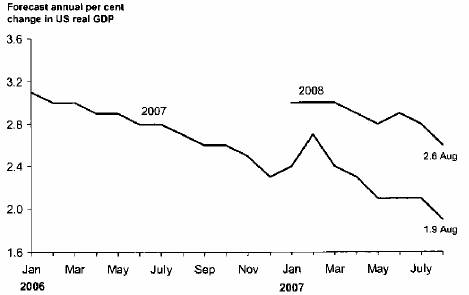

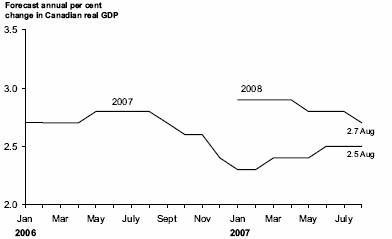

Further deterioration in the US economy in line with further weakness in the US housing market poses risk to the economic outlook for both BC and Canada.

Although the fiscal plan incorporates significant reductions in projected natural gas revenues across the three year plan, the risk of further revenue declines has been reduced but not eliminated.

25

The forecast incorporates reduced forest sector activity due to the labour disruption in the coastal forest industry. The more prolonged the strike, the greater would be the downside risk, with additional challenges to industry regarding an insufficient supply of logs for lumber mills and chips for pulp mills.

The spending forecast contained in the fiscal plan is based on ministry and taxpayer-supported Crown corporation and agency spending plans and strategies. Changes to planned assumptions, such as utilization or demand rates for government services represent a spending risk. In particular, health spending plans have only been established for 2007/08. The 2008/09 and 2009/10 are interim allocations, which only include funding to cover negotiating framework costs.

In addition, changes in accounting treatment or revised interpretations of generally accepted accounting principles could have impacts on the bottom line. For example, the accounting treatment for resource roads is under review and could result in changes to the fiscal plan forecast.

Natural disasters are also a continued risk to the plan.

26

PART TWO — ECONOMIC REVIEW AND OUTLOOK (1) |

| |

2007/08 First Quarterly Report | September 14, 2007 |

Summary

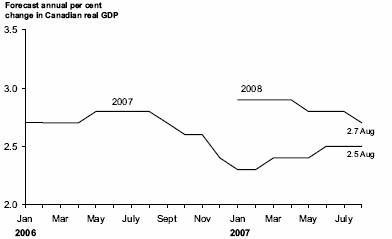

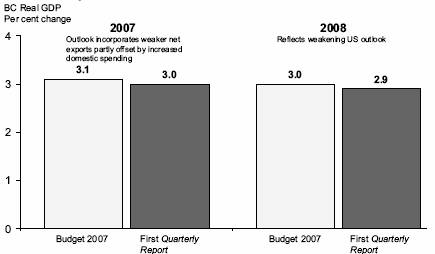

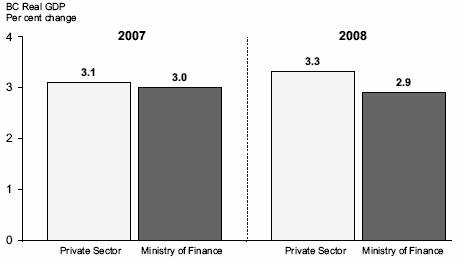

Chart 2.1 Updated BC forecast remains robust

Source: BC Ministry of Finance