Exhibit 99.9

Budget and Fiscal Plan

2008/09 – 2010/11

February 19, 2008

National Library of Canada Cataloguing in Publication Data

British Columbia.

Budget and fiscal plan. — 2002/03/2004/05-

Annual

Also available on the Internet.

Continues: British Columbia. Ministry of Finance and

Corporate Relations. Budget ... reports. ISSN 1207-5841

ISSN 1705-6071 = Budget and fiscal plan — British Columbia.

1. Budget — British Columbia — Periodicals. 2. British

Columbia — Appropriations and expenditures — Periodicals.

I. British Columbia. Ministry of Finance. II. Title.

HJ12.B742 352.48’09711’05 C2003-960048-3

TABLE OF CONTENTS |

|

Budget and Fiscal Plan 2008/09 – 2010/11 | February 19, 2008 |

Attestation by the Secretary to Treasury Board | | |

| | |

Summary | | 1 |

| | |

Part One: A Budget for Climate Action | | |

| | |

Summary | | 7 |

| | |

Carbon Tax and Revenue Recycling | | 11 |

Introduction | | 11 |

Principles | | 11 |

How does the tax work? | | 12 |

Revenue Recycling | | 14 |

Carbon Tax Implications | | 16 |

Carbon Tax Conclusions | | 22 |

| | |

Existing Climate Action and Related Initiatves in BC: A Track Record of Action | | 22 |

The 2007 Throne Speech and Budget 2007: Ramping up to Address Climate Change | | 22 |

2007 Energy Plan: Continued Actions for Conservation and Greener Energy | | 25 |

Results of Public Consultations to Prepare for Budget 2008 | | 26 |

| | |

Budget 2008: Expenditures to Support Climate Action | | 27 |

Total Climate Action Expenditures and the Federal Ecotrust Contribution | | 34 |

Environmental, Economic and Health Implications | | 35 |

| | |

Looking Ahead | | 36 |

| | |

Tables: | | |

1.1 | Rate per Tonne of CO2-equivalent | | 12 |

1.2 | Selected Carbon Tax Rates by Fuel Type | | 14 |

1.3 | British Columbia Tax Cut – Impact on Taxpayers | | 16 |

1.4 | Annual Carbon Tax Cost for Gasoline Fueled Vehicles | | 17 |

1.5 | Annual Carbon Tax Cost for Diesel Fueled Vehicles | | 17 |

1.6 | Annual Carbon Tax Cost of Home Fuel Use | | 17 |

1.7 | Revenue Neutral Climate Action Measures – Impact on Taxpayers | | 18 |

1.8 | Carbon Tax Cost of Selected Late Model Vehicles at $10 per tonne | | 19 |

1.9 | Additional Budget 2008 Climate Action Tax Initiatives | | 20 |

1.10 | A Track Record of Action on Energy and Climate Issues | | 23 |

1.11 | Key 2007 Throne Speech Directions: Strengthening the Commitment to Climate Action | | 26 |

1.12 | Key 2007 Energy Plan Initiatives that Support Climate Action | | 26 |

1.13 | Budget 2008: Total Climate Action Expenditure Initiatives | | 27 |

1.14 | LiveSmartBC – Efficiency Incentive Program | | 29 |

| | |

Topic Boxes: | | |

A Climate Change Backgrounder | | 8 |

What is Taxed – the Carbon Tax Base | | 13 |

A Revenue Neutral Carbon Tax Plan | | 15 |

What Can I Do to Reduce Carbon Emissions? | | 21 |

“Cap and Trade” System for Large Emitters | | 38 |

BC as a Climate Action Leader: A Comparison with Other Jurisdictions | | 40 |

| | | | | |

Budget and Fiscal Plan – 2008/09 to 2010/11

| | |

Part Two: Three-Year Fiscal Plan | | |

| | |

Introduction | | 43 |

Consolidated Revenue Fund Spending | | 48 |

Climate Action | | 48 |

New Investments in the Economy and Communities | | 49 |

Vancouver Convention Centre Expansion Project | | 54 |

2010 Olympic and Paralympic Winter Games | | 55 |

Provincial Transportation Investments | | 55 |

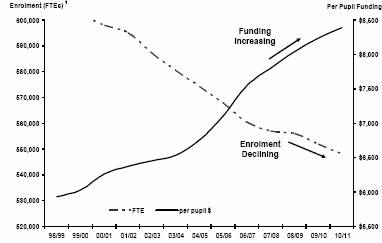

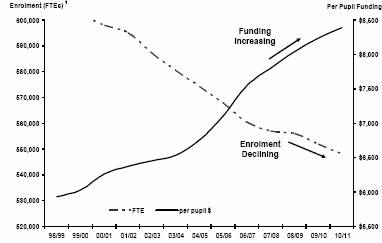

K–12 Education | | 56 |

Enhancing Health Care | | 57 |

Strengthening Social Services | | 59 |

Justice and Public Safety | | 62 |

Expenses Recovered from External Entities | | 63 |

Service Delivery Agency Expenses | | 63 |

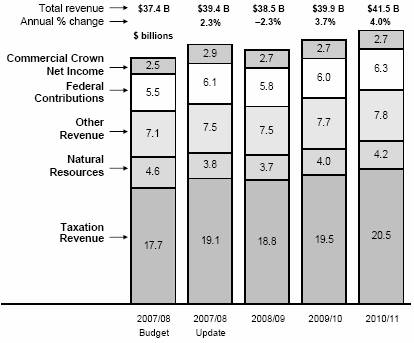

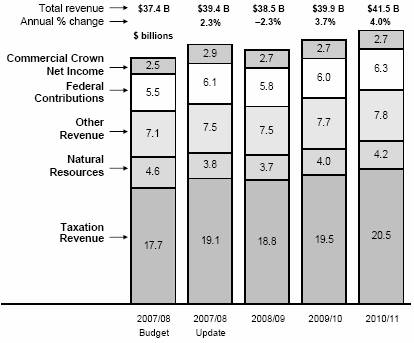

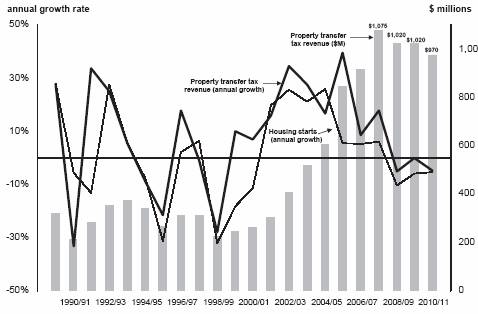

Revenue | | 64 |

Budget 2008 Plan | | 64 |

Commercial Crown Corporation Income | | 70 |

Full-Time Equivalents | | 71 |

Capital Spending | | 72 |

Projects over $50 million | | 76 |

Provincial Debt | | 78 |

Risks to the Fiscal Plan | | 81 |

| | |

Tables: | | |

2.1 | Three-Year Fiscal Plan – Operating Statement | | 43 |

2.2 | Three-Year Fiscal Plan Update – Changes from Budget 2007 | | 44 |

2.3 | Revenue by Source | | 46 |

2.4 | Expense by Ministry, Program and Agency | | 47 |

2.5 | New Investments in the Economy and Communities (in addition to Climate Action) | | 49 |

2.6 | Vancouver Convention Centre Expansion Project Funding | | 54 |

2.7 | 2010 Olympics Funding | | 55 |

2.8 | Provincial Transportation Investments | | 56 |

2.9 | Enhancing Health Care | | 59 |

2.10 | Strengthening Social Services | | 60 |

2.11 | Reducing Homelessness | | 60 |

2.12 | Justice and Public Safety | | 62 |

2.13 | Budget 2008 Tax Measures – 2007/08 to 2010/11 | | 65 |

2.14 | Personal income tax revenue | | 66 |

2.15 | Corporate income tax revenue | | 66 |

2.16 | Social service tax revenue | | 67 |

2.17 | Health and social transfers | | 70 |

2.18 | Full-Time Equivalents (FTE’s) – Changes from Budget 2007 | | 72 |

2.19 | Capital Spending | | 73 |

2.20 | Capital Expenditure Projects Greater Than $50 million | | 77 |

2.21 | Provincial Debt Summary | | 79 |

2.22 | Reconciliation of Summary Surpluses to Provincial Debt Changes | | 80 |

2.23 | Provincial Financing | | 80 |

2.24 | Key Fiscal Sensitivities | | 81 |

2.25 | Notional Allocations to Contingencies | | 84 |

| | | |

Topic Boxes: | | |

Capital Financing and Debt Management | | 88 |

Building on British Columbia’s Strengths | | 92 |

Budget and Fiscal Plan – 2008/09 to 2010/11

ii

Part Three: Tax Measures | | |

| | |

Tax Measures – Supplementary Information | | 102 |

Revenue Neutral Climate Action Initatives | | 102 |

Other Climate Action Initiatives | | 106 |

Other Revenue Measures | | 110 |

Victoria Regional Transit Commission Tax Increased by 1 Cent Per Litre | 118 |

| |

Tables: | | |

3.1 | Summary of Tax Measures | | 100 |

3.2 | British Columbia Personal Income Tax Brackets and Rates | 104 |

3.3 | British Columbia Tax Cut – Impact on Taxpayers | 104 |

3.4 | British Columbia Personal Income Taxes Payable | |

| Before 2001 and After 2009 Tax Cuts | | 105 |

3.5 | Tax Reductions for Fuel Efficient Vehicles | 107 |

3.6 | Corporation Capital Tax Rates | | 111 |

| | | |

Topic Box: | | |

Provincial Sales Tax Review | | 119 |

| | | |

Part Four: British Columbia Economic Review and Outlook | |

| |

Summary | | 121 |

Recent Developments | | 122 |

The Outlook for the External Environment | | 123 |

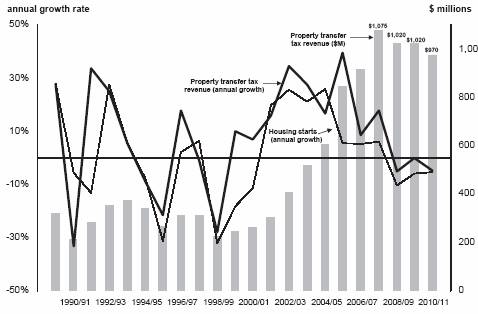

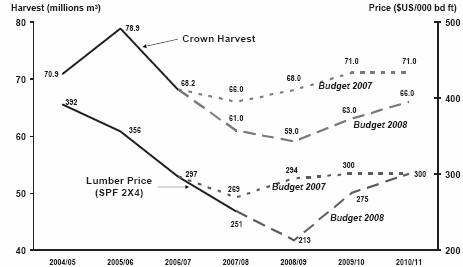

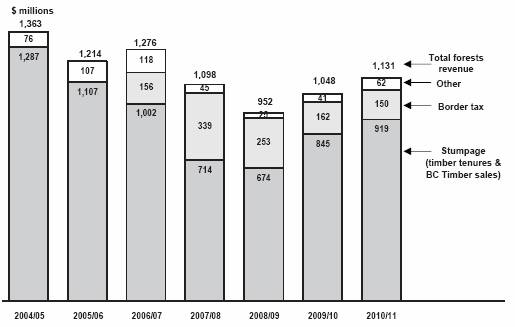

Financial Markets | | 128 |

The British Columbia Economic Outlook | | 131 |

Risks to the Economic Outlook | | 139 |

| | |

Tables: | | | |

4.1 | British Columbia Economic Indicators | 122 |

4.2 | Ministry of Finance Economic Forecast: | Key Assumptions | 128 |

4.3 | Private Sector Canadian Three Month Treasury Bill Interest Rate Forecasts | 129 |

4.4 | Private Sector Canadian 10-year Government Bond Interest Rate Forecasts | 130 |

4.5 | Private Sector Exchange Rate Forecasts | | 131 |

4.6 | British Columbia Economic Outlook | | 131 |

4.7 | Ministry of Finance Economic Forecast: Key Economic Indicators | 132 |

4.8 | British Columbia Economic Review | | 140 |

4.9.1 | Gross Domestic Product: British Columbia | 141 |

4.9.2 | Components of Nominal Income and Expenditure | 142 |

4.9.3 | Labour Market Indicators | | 142 |

4.9.4 | Major Economic Assumptions | | 143 |

| | | |

Topic Box: | | |

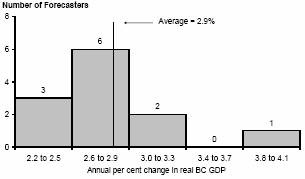

The Economic Forecast Council, 2008 | | 144 |

| | | | | | |

Budget and Fiscal Plan – 2008/09 to 2010/11

iii

Part Five: 2007/08 Updated Financial Forecast (Third Quarterly Report) | |

| |

2007/08 Fiscal Year in Review | 151 |

Changes since the Second Quarterly Report | 152 |

Capital Spending and Provincial Debt | 157 |

| |

Tables: | |

5.1 | Budget 2007 and Quarterly Updates – Operating Statement | 151 |

5.2 | Operating Statement Update Since the Second Quarterly Report | 153 |

5.3 | 2007/08 Priority Initiatives | 154 |

5.4 | 2007/08 Notional Allocations to Contingencies | 156 |

5.5 | Budget 2007 and Quarterly Updates – Capital Spending and Provincial Debt | 157 |

5.6 | Capital Spending and Provincial Debt Update Since the Second Quarterly Report | 158 |

5.7 | 2007/08 Operating Statement | 159 |

5.8 | 2007/08 Forecast Update – Changes from Budget 2007 | 160 |

5.9 | 2007/08 Revenue by Source | 161 |

5.10 | 2007/08 Expense by Ministry, Program and Agency | 162 |

5.11 | 2007/08 Expense by Function | 163 |

5.12 | 2007/08 Service Delivery Agency Operating Results | 164 |

5.13 | 2007/08 Capital Spending | 166 |

5.14 | 2007/08 Provincial Debt | 167 |

5.15 | 2007/08 Statement of Financial Position | 168 |

| |

Appendices | | 169 |

| | | |

Budget and Fiscal Plan – 2008/09 to 2010/11

iv

| February 19, 2008 |

As required by Section 7(d) of the Budget Transparency and Accountability Act (BTAA), I am confirming that the Budget and Fiscal Plan contains the following elements:

· The fiscal and economic forecasts for 2008/09 and future years, which are detailed in Part 2 and Part 4.

· All material economic, demographic, taxation, accounting policy and other assumptions underlying the 2008/09 economic, revenue, expenditure, surplus and debt forecasts are also disclosed. In particular:

· The status quo policy is assumed for federal government transfer revenues. No revenues or expenditures have been included in this budget either for the recently legislated federal Community Development Trust, or for the transfer of labour market programs from the federal government which was still being finalized when the budget went to press. These will be included in future fiscal updates as detailed agreements are complete and accounting treatments confirmed. While both initiatives will result in increased revenue and expenditure, the net impact on the three-year fiscal plan is expected to be small;

· Similarly, no assumptions have been made regarding measures that may be included in the federal budget expected to be tabled on February 26, 2008; and

· Many of the wage agreements reached in the last round of public sector negotiations expire by the end of the 2009/10. In 2010/11, Ministry of Health funding growth is maintained at the same rate as for the previous year to accommodate wage increases in that sector; an increased contingency vote allocation has been provided for other sectors.

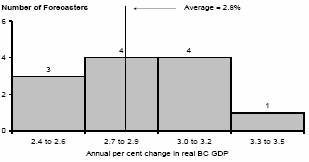

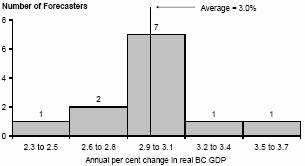

· The report on the advice received from the Minister’s Economic Forecast Council on the economic growth outlook for British Columbia, including the range of forecasts for 2008 and 2009.

· The major areas of risk to the plan known at this time are disclosed in the risks section in Part 2, and in the material assumptions tables in the Appendix.

Government continues to work towards providing funding information to health authorities and post-secondary institutions sufficiently early in the fiscal year for them to develop board approved plans for the budget; however, this was not possible for Budget 2008. As a result, the financial forecasts for school districts, universities, colleges and health authorities (the SUCH sector) have all been developed by the Ministries of Health, Advanced Education and Education on an aggregate basis for their respective sectors. Individual organizational plans for health authorities and post-secondary institutions will be developed over the coming months and reflected in the updated fiscal plan in the first Quarterly Report.

The accounting policies followed in the Budget and Fiscal Plan comply, in all material respects, with generally accepted accounting principles (GAAP) for senior governments.

As required under section 7(e) of the BTAA, the forecast allowance, which is an adjustment to the most likely forecast of the 2008/09 surplus, is also disclosed. The 2008/09 to 2010/11 forecast allowances help to mitigate against revenue risks arising from a worse-than-expected economic slowdown in the US and in particular its housing sector, unexpected costs such as natural disasters, changes in key commodity prices or out-year funding pressures.

I would like to recognize staff in government ministries and agencies for their contribution to this document. I would like to especially acknowledge staff in the Ministry of Finance, whose professionalism, commitment and expertise were essential to the completion of this budget.

|

|

| Chris Trumpy |

| Deputy Minister and

Secretary to Treasury Board |

Ministry of

Finance | | Office of the

Deputy Minister | | Mailing Address:

PO Box 9417 Stn Prov Govt

Victoria BC V8W 9V1

www.gov.bc.ca/fin | | Location Address:

Room 109

617 Government Street

Victoria BC |

Summary: BUDGET AND FISCAL PLAN – 2008/09 to 2010/11

| | 2007/08 | | Budget | | | | | |

($ millions) | | Budget | | Updated | | Estimate | | Plan | | Plan | |

| | Forecast | | 2008/09 | | 2009/10 | | 2010/11 | |

Revenue | | 37,390 | | 39,400 | | 38,490 | | 39,925 | | 41,525 | |

Expense | | (36,240 | ) | (37,280 | ) | (37,690 | ) | (39,100 | ) | (40,700 | ) |

Surplus before forecast allowance | | 1,150 | | 2,120 | | 800 | | 825 | | 825 | |

Forecast allowance | | (750 | ) | (150 | ) | (750 | ) | (675 | ) | (675 | ) |

Surplus | | 400 | | 1,970 | | 50 | | 150 | | 150 | |

Capital spending: | | | | | | | | | | | |

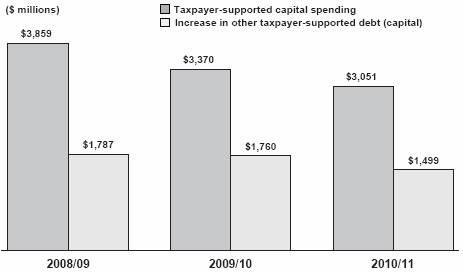

Taxpayer-supported capital spending | | 3,864 | | 4,149 | | 3,859 | | 3,370 | | 3,051 | |

Total capital spending | | 5,156 | | 5,525 | | 5,766 | | 5,479 | | 5,440 | |

Provincial Debt: | | | | | | | | | | | |

Government direct operating debt | | 9,125 | | 8,246 | | 7,408 | | 6,880 | | 6,452 | |

Taxpayer-supported debt | | 27,803 | | 26,792 | | 27,741 | | 28,973 | | 30,044 | |

Total debt | | 36,837 | | 35,003 | | 37,741 | | 39,980 | | 42,473 | |

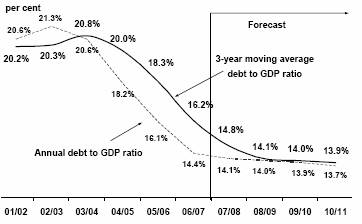

Government direct operating debt-to-GDP ratio | | 4.9 | % | 4.3 | % | 3.7 | % | 3.3 | % | 2.9 | % |

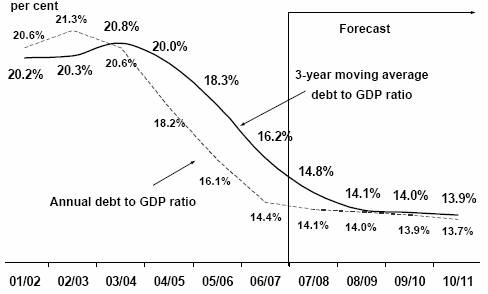

Taxpayer-supported debt-to-GDP ratio | | 14.8 | % | 14.1 | % | 14.0 | % | 13.9 | % | 13.7 | % |

Total debt-to GDP ratio | | 19.6 | % | 18.4 | % | 19.0 | % | 19.1 | % | 19.4 | % |

A BUDGET FOR CLIMATE ACTION

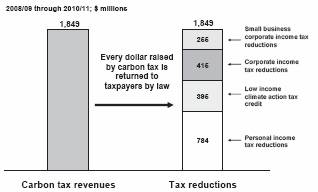

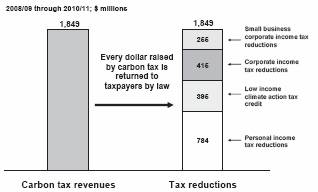

Budget 2008 supports and adds momentum to government’s plan to reduce greenhouse gas emissions by providing the fiscal framework to implement government’s climate action initiatives. At the same time, BC maintains its commitment to a strong, vibrant and competitive economy that promotes investment, innovation and job creation. Consistent with these two objectives, government intends to introduce legislation to implement a new carbon tax effective July 1, 2008. Under a three year revenue neutral carbon tax plan, 100 per cent of revenues from the tax will be returned to British Columbians through offsetting tax reductions.

Revenue Neutral Carbon Tax

The carbon tax will initially be based on a rate of $10 per tonne of greenhouse gas (GHG) emissions, and will increase to $30 per tonne by 2012.

To return the revenues from the carbon tax back into the economy, government is:

· introducing a new low income refundable Climate Action Tax Credit of $100 per adult and $30 per child for low income families, which will be paid quarterly;

· reducing personal income taxes by 5 per cent on the first $70,000 of income by 2009;

· lowering the general corporate income tax rate to 11 per cent from 12 per cent and the small business rate to 3.5 per cent from 4.5 per cent; and

· introducing additional increases to the Climate Action Tax Credit and reductions to personal and corporate income taxes. The goal is to lower the general corporate income tax rate to 10 per cent and the small business rate to 2.5 per cent by 2011.

Revenue Neutral Carbon Tax Plan

($ millions) | | 2008/09 | | 2009/10 | | 2010/11 | | Total | |

Carbon tax revenue | | 338 | | 631 | | 880 | | 1,849 | |

Low income climate action tax credit | | 104 | | 145 | | 146 | | 395 | |

Personal income tax reductions | | 113 | | 270 | | 401 | | 784 | |

General corporate income tax cuts | | 75 | | 134 | | 206 | | 415 | |

Small business corporate income tax cuts | | 46 | | 82 | | 127 | | 255 | |

Total tax reductions | | 338 | | 631 | | 880 | | 1,849 | |

In total, carbon tax revenues of $1.85 billion over three years will be returned to taxpayers through offsetting tax cuts and tax credits.

By taxing all of the fossil fuel combustion emissions in BC that are included in the national emissions inventory, the province is taking responsibility for its own emissions and providing a key tool to meet its GHG reduction targets.

Budget and Fiscal Plan – 2008/09 to 2010/11

Summary

The tax is initially being set at a relatively low rate and being increased over five years to give people and businesses an opportunity to adjust.

Climate Action Dividend

To help British Columbians make lifestyle changes to reduce their use of fossil fuels, each resident will receive a Climate Action Dividend payment of $100 in June 2008, paid out of the 2007/08 surplus. The total value of these benefits is $440 million.

Personal income tax reductions since 2001

Significant tax reductions since 2001

The latest personal income tax cut of 5 per cent on the first $70,000 in income builds on the 25 percent tax cut in 2001, the BC Tax Reduction in 2005 and the 10 per cent tax cut on the first $100,000 in income in 2007. As a result of these changes, 250,000 people no longer pay BC personal income taxes and all taxpayers have received substantial cuts. More than 85 per cent of taxpayers with incomes of $70,000 or less have received tax cuts of at least 37 per cent.

The general corporate income tax rate has been cut by a third to 11 per cent from 16.5 per cent in 2001, while the small business rate has been reduced by more than 20 per cent to 3.5 per cent from 4.5 per cent in 2001.

Corporate income tax reductions since 2001

Over $ 1 billion additional commitments to support Climate Action

In addition to the carbon tax and offsetting tax reductions, Budget 2008 also includes a further $64 million of tax measures and $986 million of spending commitments for climate action initiatives.

Other Climate Action Tax Measures

($ millions) | | 2008/09 | | 2009/10 | | 2010/11 | | Total | |

Increase equity capital tax credits for clean technology | | 5 | | 5 | | 5 | | 15 | |

Tax relief for conventional fuel efficient vehicles | | 11 | | 11 | | 11 | | 33 | |

PST exemption for ENERGY STAR® appliances | | 5 | | 5 | | — | | 10 | |

Other climate action measures | | 3 | | 3 | | — | | 6 | |

Total other climate action measures | | 24 | | 24 | | 16 | | 64 | |

Budget 2008 includes further tax measures to promote climate action for a total three year revenue commitment of $64 million. These comprise:

· Small Business Venture Capital Act tax credit budget increased by $5 million annually and allocating $7.5 million to clean technology businesses;

· tax relief for fuel efficient conventional vehicles qualifying for the federal ecoAuto rebate, equal to the federal rebate. This is in addition to the existing tax relief for hybrid and alternative fuel vehicles; and

· provincial sales tax exemptions for a variety of energy efficient goods, including washing machines, refrigerators and freezers as well as electric power-assisted bicycles and tricycles and electric motorcycles.

On the spending side, $690 million of operating expenditures over four years are committed to support greater energy efficiency and reduce carbon emissions, to promote research into new energy efficient technologies, expand public transit and to help achieve a carbon-neutral government by 2010. These include:

Budget and Fiscal Plan – 2008/09 to 2010/11

2

Summary

· $60 million for the LiveSmartBC incentives to households for energy audits and retrofits; and energy assessments for small businesses;

· $33 million for the BC Green Ports Initiative to help reduce emissions from short-haul trucks servicing BC ports, and to fund port electrification to allow ships to turn their engines off while in port; and to reduce truck emissions at inspection stations; and

· up to $10 million for incentives to encourage biodiesel production.

Funding for Climate Action Initiatives

($ millions) | | 2007/08 | | 2008/09 | | 2009/10 | | 2010/11 | | Total | |

Throne Speech 2007 & Energy Plan | | — | | 3 | | 3 | | 3 | | 9 | |

Individuals, families, communities | | 19 | | 23 | | 28 | | 28 | | 98 | |

Provincial Transit Plan | | 52 | | 20 | | 23 | | 56 | | 151 | |

Other transportation initiatives | | 0.3 | | 12 | | 11 | | 10 | | 33 | |

Bioenergy and alternative energy | | 30 | | 18 | | 4 | | 5 | | 57 | |

Research into climate change solutions | | 98 | | — | | — | | — | | 98 | |

Improving BC’s ability to adapt | | — | | 14 | | 16 | | 17 | | 47 | |

Policy development and outreach | | — | | 39 | | 37 | | 35 | | 111 | |

Carbon neutral public sector | | 24 | | 9 | | 10 | | 12 | | 55 | |

Managing BC’s forests in a changing climate | | 29 | | 0.6 | | 0.6 | | 0.6 | | 31 | |

Transit and public sector capital outlays | | — | | 47 | | 93 | | 156 | | 296 | |

Total | | 252 | | 186 | | 226 | | 322 | | 986 | |

In addition, government has committed to $296 million of capital spending that includes:

· $219 million for public transit projects including three new rapid transit lines in the Lower Mainland, RapidBus expansion, and additional buses for use in many BC communities; and

· $75 million towards energy efficient retrofits for public sector buildings.

The total spending commitment is $986 million.

In total, these tax reductions and spending commitments exceed $1 billion over four years.

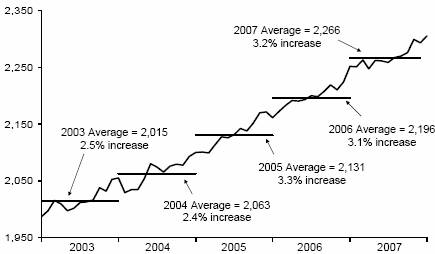

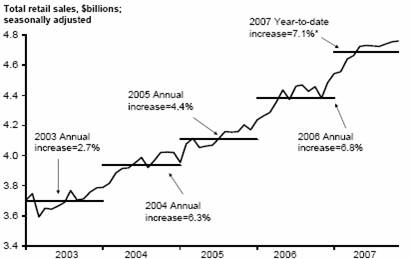

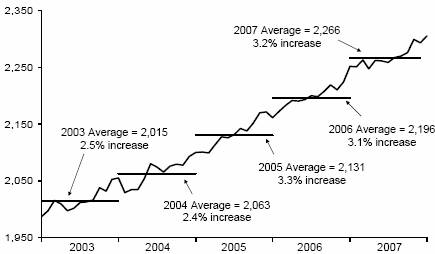

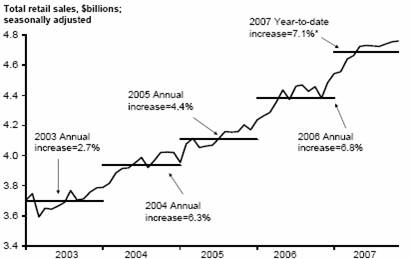

Domestic economy remained strong in 2007

British Columbia Economic Indicators

(annual per cent change) | | Year-to-date

Jan to Dec 2007/

Jan to Dec 2006 | |

Employment | | +3.2 | |

Retail sales | | +7.1 | * |

Housing starts | | +7.6 | |

Non-residential building permits | | +0.2 | |

Manufacturing shipments | | -2.4 | * |

Exports | | -5.1 | * |

Note: * data available to November only

The government is committed to maintaining both a strong, competitive economy and a robust, affordable fiscal framework. This budget will be the fifth consecutive balanced budget.

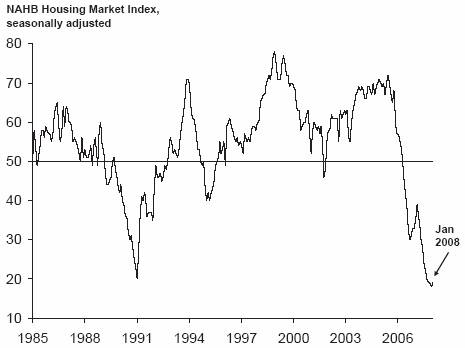

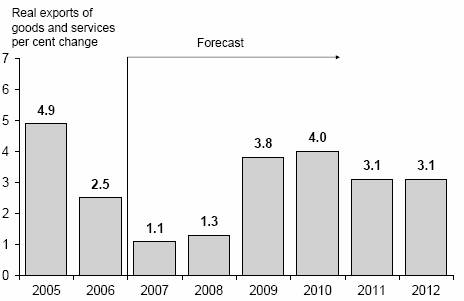

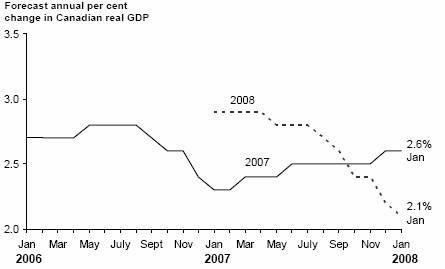

Through 2007, the domestic economy posted a fourth consecutive year of strong growth led by high employment, retail sales, and housing construction. However, exports and manufacturing declined reflecting weakness largely due to the high Canadian dollar and a significant slowing in the US housing market, related in large part to the sub-prime mortgage market.

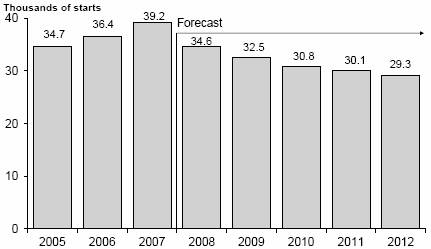

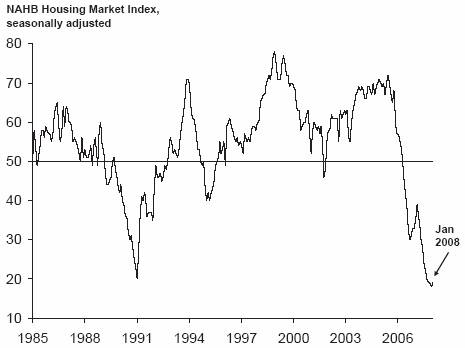

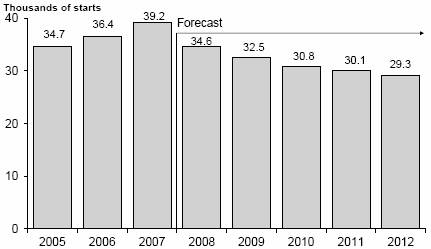

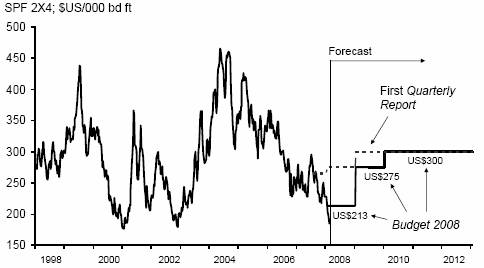

US housing market in decline

Source: National Association of Home Builders

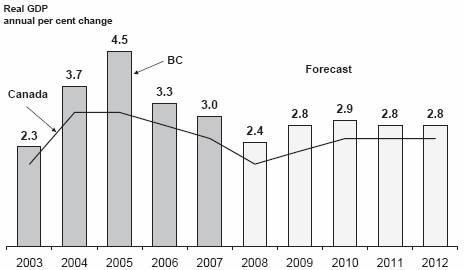

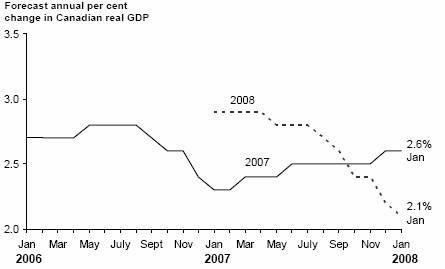

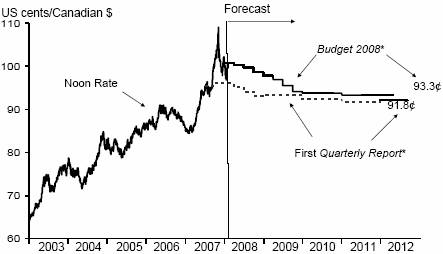

Growth to pick up after slowing in 2008

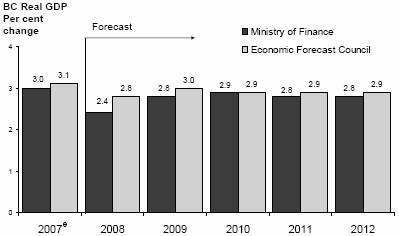

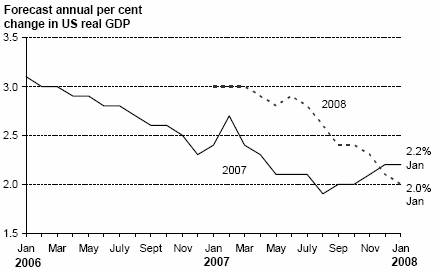

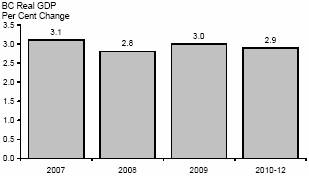

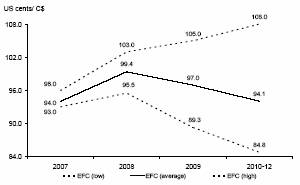

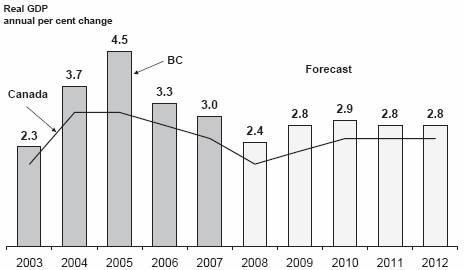

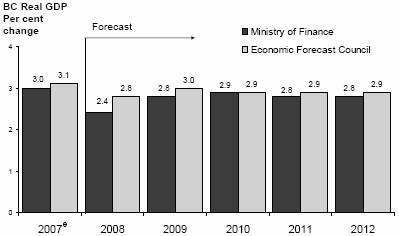

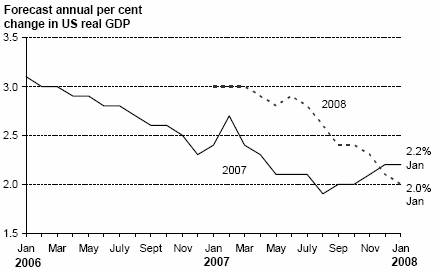

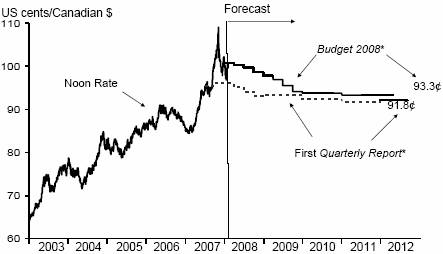

Looking ahead, significantly slower growth is expected in the US for 2008, with US housing starts falling well below trend. This results in some slowing of economic growth in BC, with BC real gross domestic product expected to grow by 2.4 per cent. In the medium term, growth is expected to pick up to average 2.8 per cent.

BC to outperform Canada

Sources: Statistics Canada, BC Ministry of Finance

Budget and Fiscal Plan – 2008/09 to 2010/11

3

Summary

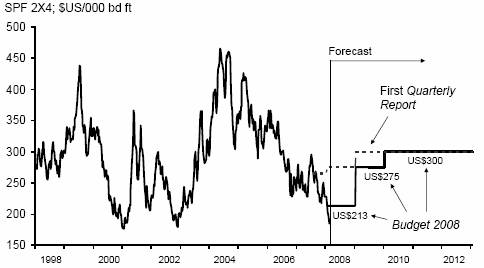

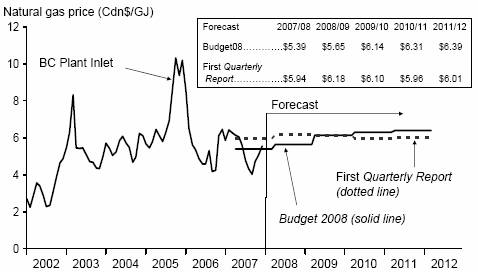

Prudence remains important to achieving a balanced budget plan

The main risks to the fiscal plan lie in the potential for a larger than expected slowdown in the US economy and the US housing sector, particularly in 2008/09. The volatility of natural gas, lumber prices and the Canadian dollar also pose significant risks. To help manage the higher level of risk in 2008/09, government is continuing its prudent fiscal planning practices by:

· using economic planning assumptions that are generally lower than forecasts provided by external experts;

· maintaining a $375 million contingency vote, equivalent to 1 per cent of operating expenditures;

· retaining a $750 million forecast allowance to protect the bottom line from revenue declines and unexpected natural disaster costs;

· targeting a surplus of $50 million in 2008/09, returning to $150 million in subsequent years as economic conditions improve; and

· maintaining a $200 million capital contingency in 2008/09 or 5 per cent of taxpayer-supported capital outlays.

Balanced budgets supported by prudent forecast allowances

Debt remains affordable

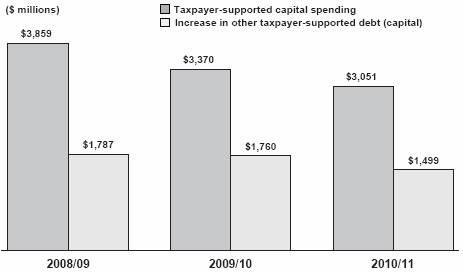

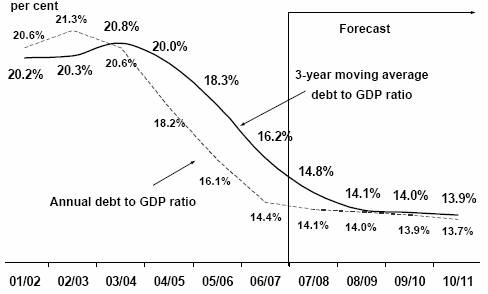

Government is committed to a significant capital spending program over the next three years, to build much needed hospitals, roads, transit facilities, and bridges. Taxpayer-supported capital spending is forecast to total $10.3 billion over the next three years. As a result, taxpayer-supported debt is forecast to grow by $3.3 billion over the next three fiscal years to $30 billion in 2010/11. However, government continues to manage its capital spending plan to ensure that the growth in taxpayer-supported debt is less than the growth in the overall economy.

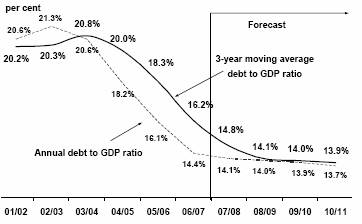

As a result, the taxpayer-supported debt to GDP ratio, a key measure of fiscal sustainability used by credit rating agencies, is forecast to decline over the next three years.

Taxpayer-supported debt to GDP ratio trends down

Government intends to continue its commitment to maintaining this downward trend in the taxpayer-supported debt to GDP ratio. Consistent with the recommendations of the Economic Forecast Council, a moving average is used to track the debt to GDP ratio trend. This strategy keeps debt affordable for future generations of British Columbians.

Additional Competitiveness Tax Measures

($ millions) | | 2008/09 | | 2009/10 | | 2010/11 | | Total | |

Increase film tax credit rates and enhance regional credits | | 47 | | 47 | | 18 | | 112 | |

Reduce school property tax rates for major industry | | 12 | | 24 | | 24 | | 60 | |

Expand international financial activity program | | 2 | | 2 | | 2 | | 6 | |

Phase out capital tax for financial institutions | | 36 | | 74 | | 110 | | 220 | |

PST review measures | | 3 | | 3 | | 3 | | 9 | |

Total tax reductions | | 100 | | 150 | | 157 | | 407 | |

Building on BC’s economic strengths

To ensure British Columbia’s economy remains strong and competitive, further tax reductions totaling $407 million over three years are introduced in Budget 2008. The changes include ensuring the film sector remains competitive with other jurisdictions, addressing the competitive pressures facing BC’s export-oriented businesses, and promoting BC as an attractive location for financial services:

Budget and Fiscal Plan – 2008/09 to 2010/11

4

Summary

· the basic Film Incentive tax credit rate and the basic Production Services tax credit rate are increased and the regional film tax credit rate is increased for production activities that are distant from the Lower Mainland and Southern Vancouver Island;

· the school property tax rate for major industrial property is reduced over two years to equal the business class rate in 2009, providing relief to export-related industries including the forest sector;

· to enhance Vancouver’s attractiveness as an International Financial Centre, eligible activities under the International Financial Activity Act will be expanded; and

· the capital tax on financial institutions is phased-out over three years, and then replaced by a minimum tax.

In addition, to ease pressures faced by first time home buyers, the First Time Home Buyers’ exemption threshold is increased to $425,000 from $375,000 and first time buyers are no longer required to have a mortgage of at least 70 per cent.

Tax reductions provided to British Columbians in Budget 2008 total $2.3 billion over three years, of which $1.85 billion is recycled from the carbon tax.

In addition to tax reductions, spending initiatives that stimulate economic growth remain a vital component of the province’s fiscal plan. New investments totaling $346 million over four years are included in this budget supporting environmentally responsible resource development, engagement with Aboriginal peoples regarding land and resource activities, post-secondary research opportunities and community development.

New Investments in the Economy and Communities

(in addition to Climate Action)

($ millions) | | 2007/08 | | 2008/09 | | 2009/10 | | 2010/11 | | Total | |

Economic development | | 12 | | 29 | | 29 | | 39 | | 109 | |

Education, research & a skilled workforce | | 60 | | 6 | | 2 | | 4 | | 72 | |

Developing community infrastructure | | — | | 16 | | 7 | | 37 | | 60 | |

Expanding community arts & culture | | 78 | | 9 | | 10 | | 8 | | 105 | |

Total | | 150 | | 60 | | 48 | | 88 | | 346 | |

Sustaining and strengthening social services

Budget 2008 also commits funding to sustaining and enhancing education and other key services upon which British Columbians depend. Budget 2008 provides:

· $144 million over three years for K-12 education, despite declining enrolments. This funding enables the opening of up to 400 Strong Start centres by 2010; and

· $787 million over four years invested in programs that reduce homelessness; support adults and children at risk; implementation of a positive aging action plan; maintain justice and public safety; and sustain a wide range of supports for those in need.

Strengthening Social Services

($ millions) | | 2007/08 | | 2008/09 | | 2009/10 | | 2010/11 | | Total | |

Reducing homelessness | | 3 | | 39 | | 31 | | 31 | | 104 | |

Childcare spaces/subsidies (federal) | | 33 | | 33 | | 34 | | 35 | | 135 | |

Children at risk and with special needs | | — | | 14 | | 14 | | 27 | | 55 | |

Persons with developmental disabilities | | — | | 8 | | 14 | | 20 | | 42 | |

Income assistance supplements | | — | | 10 | | 10 | | 11 | | 31 | |

Action plan for positive aging | | — | | 5 | | 8 | | 10 | | 23 | |

Services to victims of crime | | — | | 5 | | 6 | | 6 | | 17 | |

Other service enhancements | | — | | 11 | | 10 | | 10 | | 31 | |

Justice and public safety | | 16 | | 44 | | 48 | | 57 | | 165 | |

Improvements to BC driver licences | | — | | 6 | | 7 | | 7 | | 20 | |

Increased capacity in correctional centres | | 7 | | 22 | | 79 | | 56 | | 164 | |

Total | | 59 | | 197 | | 261 | | 270 | | 787 | |

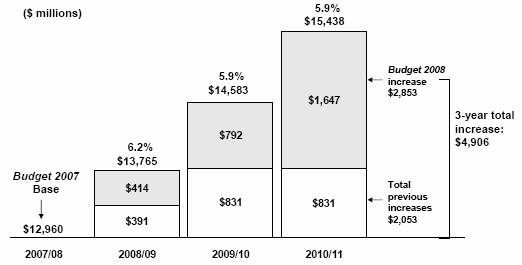

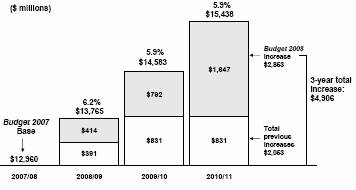

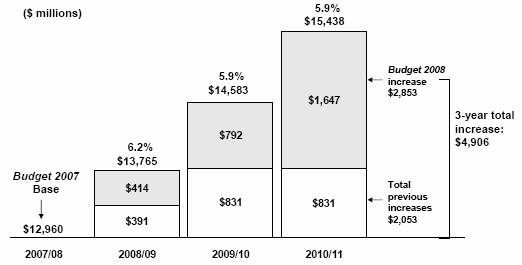

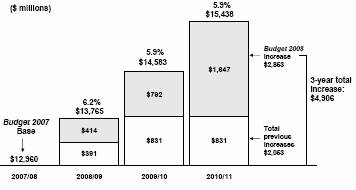

$2.9 billion to support health care

Budget 2008 commits $2.9 billion in new funding to health care to provide a sustainable growth track averaging six per cent a year. The new funding accounts for about two-thirds of the consolidated revenue fund budget increases allocated in Budget 2008. Included in this funding is a $300 million Transformation Fund to help implement a broad package of changes impacting many areas of the system, as well as the recently announced range of legislative and regulatory initiatives. An Innovation and Integration fund totaling $75 million is set aside in the contingencies vote to:

· support patient focused service enhancement and best practices;

· facilitate innovation; and

· improve integration and coordination of health service delivery.

Budget and Fiscal Plan – 2008/09 to 2010/11

5

Government is also supporting major new health projects in Victoria, Kelowna, Vernon and Fort St John with $543 million over four years contributed to those projects, and new projects at the planning stage at the BC Children’s Hospital and in Prince George.

Health Budget increases

Conclusion

In summary, Budget 2008:

· introduces a revenue neutral carbon tax as a key climate action tool;

· provides the fiscal resources to support the development and implementation of the climate action plan;

· commits to additional tax cuts for business and individuals to support climate action and enhance competitiveness;

· makes continued investments to strengthen competitiveness and promote economic growth;

· includes significant prudence in face of the economic risks in the US; and

· provides new funding to sustain health care and other key public services in the years ahead.

Budget and Fiscal Plan – 2008/09 to 2010/11

6

Part 1: A BUDGET FOR CLIMATE ACTION

Section 1.1: Summary

· There is considerable evidence that global temperatures are warming and that there are more frequent severe weather events causing increased economic and related damage. The overwhelming scientific consensus is that the main cause is the creation of greenhouse gases (GHGs) due to extensive use of fossil fuels by humans.

· BC has a clear track record of climate action initiatives going back several years, including the 2002 Energy Plan, the 2004 “Weather, Climate, and the Future: BC’s Plan,” and additional targeted measures.

· The 2007 Throne Speech signaled that even more efforts are needed. Also over the past year, the 2007 Energy Plan was released, the Greenhouse Gas Reduction Targets Act was legislated, and work has continued on the development of effective climate change actions.

· Budget 2008 provides the fiscal tools to meet the climate challenge. Its cornerstone is government’s intention to introduce a revenue neutral carbon tax effective July 1, 2008.

· The carbon tax has a broad base, so that it will affect emissions throughout the provincial economy, but it is being introduced gradually to give individuals and businesses time to adjust. All of the revenue raised will be offset by cutting other taxes; none of the revenue will be used to fund government programs. As part of the revenue recycling, a refundable tax credit will help offset the tax for low income individuals and families.

· In 2008, a Climate Action Dividend of $100 for all BC residents will help British Columbians make adjustments to begin to move towards a lower carbon lifestyle.

· Budget 2008 also provides for almost $1 billion of new operating and capital expenditures on climate action over four years to create incentives to change behavior, implement new regulatory requirements, undertake cutting-edge research, and make needed “low carbon” investments.

· These actions place BC among the most progressive jurisdictions in the world in terms of climate action policies.

· The climate action challenge cannot be confronted in isolation from what other governments are doing. BC will continue to work with its partners in other jurisdictions on cooperative solutions, through mechanisms such as the Western Climate Initiative.

· Key next steps include implementation of: enhanced tailpipe emission standards for new passenger vehicles; a “cap and trade” system for large emitters; emission reductions from landfills; fuel standards that increase use of biomass fuels; and planning for more sustainable community development.

· In summary, Budget 2008 introduces a carbon tax as a key climate action tool and provides the needed fiscal resources to support the development and implementation of the climate action plan.

Budget and Fiscal Plan – 2008/09 to 2010/11

7

A Budget for Climate Action

A Climate Change Backgrounder

What is the problem?

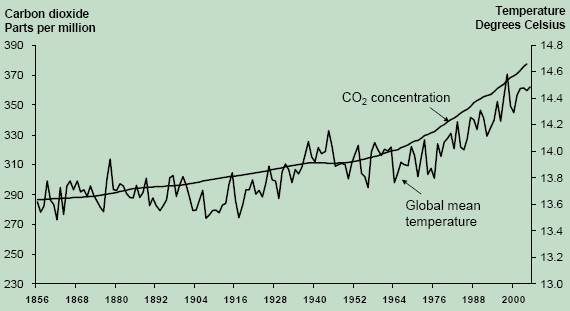

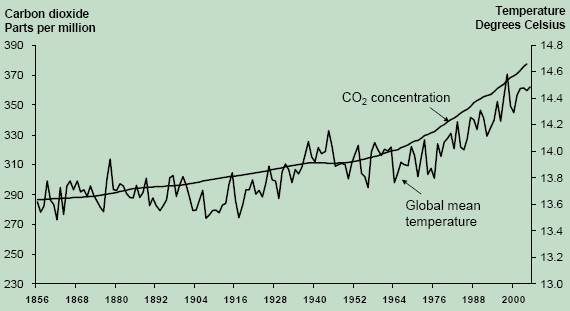

There is considerable evidence that the climate is changing, that it is being caused by human activities, and its effects will worsen if no action is taken. Virtually all of the world’s top scientific experts in the subject area agree with these conclusions, drawn from the most recent report(1) by the Intergovernmental Panel on Climate Change (IPCC). The IPCC concludes that 11 of the last 12 years (1995–2006) rank among the warmest since 1850. It has also concluded that atmospheric carbon dioxide equivalent (CO2-equivalent) concentrations increased from a relatively stable 280 parts per million (ppm) to 380 ppm over the past 150 years, as shown in Chart 1, and that current concentrations are the highest on record for 650,000 years according to analysis of ice cores.

These increases are primarily due to fossil fuel combustion and land use changes, releasing increased amounts of carbon dioxide, methane, and nitrous oxide into the atmosphere. These gases act to trap more solar heat within the earth’s atmosphere than was the case in pre-industrial times, much like a greenhouse, hence the term “greenhouse gases.” The likely key global effects of these atmospheric changes as described by the IPCC, if no action is taken, include:

· estimated global warming of 1.8 to 4.0 degrees Celsius by 2100 (average annual best estimate) is projected, with the higher value refl ecting the impact of higher emissions;

· rising sea levels, decreased snowpacks, and glacial melting;

· increased heat waves and drought occurrences; and

· increased tropical storm intensities and frequency of extreme precipitation events, leading to increased flood risks.

Chart 1 shows the close correlation between CO2-equivalent concentrations and average world temperature since the 1850s.

Chart 1 – Global carbon dioxide concentration and temperatures 1856-2004

Source: Pacific Climate Impacts Consortium

(1) Intergovernmental Panel and Climate Change, Fourth Assessment Report: Climate Change 2007: Synthesis Report, November 17, 2007. See http://www.ipcc.ch.

Budget and Fiscal Plan – 2008/09 to 2010/11

8

A Budget for Climate Action

What is the Intergovernmental Panel on Climate Change?

The IPCC was established by the World Meteorological Organization (WMO) and United Nations Environment Programme (UNEP) in 1988 to evaluate climate change science, impacts and options for adaptation and mitigation. The IPCC is open to all member countries of WMO and UNEP. The IPCC has coordinated four major assessments of climate change, published in 1990, 1995, 2001 and 2007.

The drafting and review process for the most recent assessment involved 450 lead authors working with 800 contributors and 2,500 expert reviewers from 130 countries. Hundreds of scientists all over the world contribute to the work of the IPCC as authors, contributors and reviewers. Over 25 of those collaborating on the fourth assessment report (2007) are Canadians from leading universities, government, and other organizations, and 11 of these work in British Columbia.

Why should we be concerned?

Changes in climate affect everything from food production, the abundance of water resources, the frequency of catastrophic weather events, forest health, and recreational activities. For North America, the IPCC concludes that there will be:

· lower snowpacks in the western mountainous areas, with more winter flooding and competition for already over-allocated water resources;

· challenges for crops that are already susceptible to warm weather events or depend on highly-utilized water resources; and

· more extreme heat waves, causing increased health problems in cities.

On a world-wide basis, the IPCC also concludes that there are increased risks of:

· extinction for approximately 20 to 30 per cent of plant and animal species; and

· decreases in global food production if local average annual warming exceeds the 1 to 3 degrees Celsius range.

Global average temperature increases greater than 2 degrees Celsius (relative to pre-industrial temperatures) are generally viewed by scientists as leading to impacts in many regions that may be beyond society’s capacity to adapt.(2) The 2007 IPCC report concludes that based on the current understanding of the sensitivity of the global climate system to greenhouse gas emissions, avoiding a global increase greater than 2.0-2.4 degrees Celsius above pre-industrial levels requires that emissions by 2050 be reduced by 50-85 per cent relative to 2000 levels. This implies stabilization of atmospheric concentrations of greenhouse gases at 445-490 ppm CO2 -equivalent.

However, it is not only scientists and governments that are concerned. A recent report by Lloyd’s, the world’s leading insurer, states that “The frequency and magnitude of catastrophes – especially weather related catastrophes – has increased significantly in recent years. Climate change is expected to exacerbate this further, and by 2050 mega-catastrophes like Hurricane Katrina, which used to occur every 100 years, are predicted to happen every 25 years. Businesses need to prepare for the prospect of growing natural hazard risks now.”(3)

How is all this relevant to British Columbia?

The Pacific Climate Impacts Consortium (PCIC) at the University of Victoria concludes that BC’s climate has also changed over the last 50-100 years, with the data showing temperatures up by an average 0.6 to 1.7 degrees, depending on the region. Winters have warmed faster than summers.

(2) Based on IPCC Working Group 2 “Impacts, Adaptation, and Vulnerability” Report (2007) and reports submitted to the Exeter “Avoiding Dangerous Climate Change” conference (2005).

(3) See www.lloyds.com/360.

Budget and Fiscal Plan – 2008/09 to 2010/11

9

A Budget for Climate Action

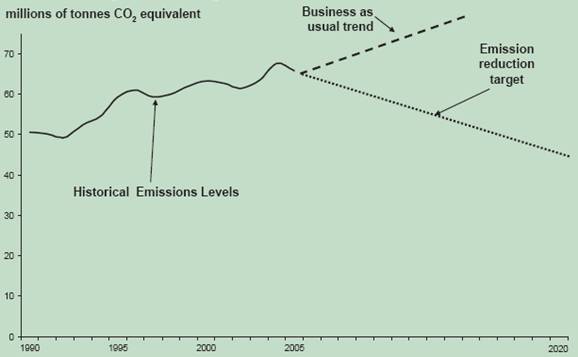

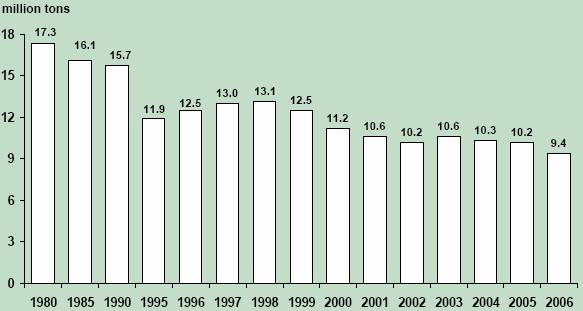

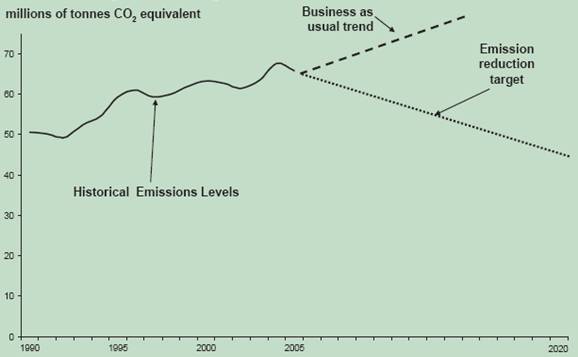

Chart 2 – BC greenhouse gas emissions

While this increase seems small, it has been enough to contribute to large losses in snowpack (-25 per cent to -50 per cent in lower elevations) during the past 50 years. In addition this warming is causing spring snowmelt events to occur 10 to 30 days earlier. While there are regional variations, total province-wide annual precipitation has increased roughly 20 per cent across the province over the last 100 years.

Warmer winters are also a contributing factor to the Mountain Pine Beetle epidemic that is devastating much of the BC interior’s pine forests. There are also growing concerns about summer water shortages in the agriculturally-significant Okanagan region and the risks to electricity generation in the Columbia-Kootenays due to the decline in snowmelt runoff and the impending loss of glaciers.

What are the main sources of emissions and what is the trend if we do nothing?

In BC, 65.9 million tonnes of CO2-equivalent were released in 2005. Under a “business as usual” scenario, emissions are anticipated to continue to rise as they have in the past. However, government is legally committed to reducing 2020 emissions to 33 per cent below the 2007 level, as indicated in Chart 2.

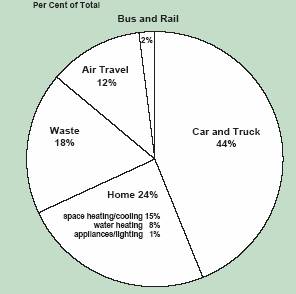

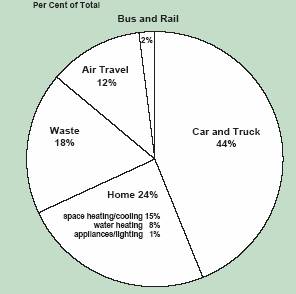

In order to design effective strategies to reduce emissions, it is important to know which types of human activities generate greenhouse gases. Because fossil fuels play such an important role in providing energy for most industries and for our daily activities, emissions originate from a variety of sectors as shown in Chart 3.

Chart 3 – BC greenhouse gas emissions by sector (2005)

Source: Environment Canada, 1990-2005 National Inventory Report

Budget and Fiscal Plan – 2008/09 to 2010/11

10

A Budget for Climate Action

Section 1.2: Carbon Tax and Revenue Recycling

Introduction

The government of British Columbia intends to introduce legislation to implement a revenue neutral carbon tax based on GHG emissions from fossil fuel combustion effective July 1, 2008.

A rare consensus has formed in BC among individuals, certain business interests, environmental organizations, and economists that a carbon tax is a key and necessary tool in the move to reduce GHG emissions, with one significant proviso. With few exceptions, the advice of all these groups has been “if there is a new tax, the additional revenue must be recycled to taxpayers through reductions to other taxes”.

A carbon tax is usually defined as a tax based on GHG emissions generated from the burning of fossil fuels within a jurisdiction.(1) It puts a price on each tonne of GHG emitted, sending a price signal that will, over time, elicit a powerful market response across the entire economy resulting in reduced emissions. It has the advantage of providing an incentive without favouring any one way of reducing emissions over another. Businesses and individuals will be free to choose whether to pay the tax or to avoid it by reducing usage, increasing efficiency, changing fuels, adopting new technology or any combination of these approaches.

The National Roundtable on the Environment and the Economy (NRTEE) in its January 7, 2008 report, Getting to 2050 – Canada’s Transition to a Low Carbon Future(2), provides a compelling argument as to why putting a price on GHG emissions is important and how a carbon tax is an important element of an effective climate action strategy, along with other types of measures that will be facilitated by Budget 2008.

Principles

The British Columbia carbon tax is based on the following principles:

· All carbon tax revenue will be recycled through tax reductions – The government intends to introduce legislation that includes a legal requirement to present an annual three year plan to the legislature demonstrating how all of the carbon tax revenue will be returned to taxpayers through tax reductions. The money will not be used to fund government programs.

· The tax rate will start low and increase gradually – Starting low gives individuals and businesses time to make adjustments and respects decisions made prior to the announcement of the tax. There is also certainty about rates for the first five years.

· Low income individuals and families will be protected – A refundable Climate Action Tax Credit will ensure that those with lower incomes are compensated for the tax, and that most will be better off.

(1) Some experts have suggested that a carbon tax should also include the GHG emissions generated by industrial processes and all fugitive emissions. The government will consider expanding the tax base in the future to include these GHG sources.

(2) http://www.nrtee-trnee.ca/eng/publications/getting-to-2050/intro-page-getting-to-2050-eng.html.

Budget and Fiscal Plan – 2008/09 to 2010/11

11

A Budget for Climate Action

· The tax will have the broadest possible base – All emissions from fossil fuel combustion in BC captured in Environment Canada’s National Inventory Report will be taxed, with no exemptions except those required for integration with other climate action policies in the future and for efficient administration.

· The tax will be integrated with other measures – The carbon tax will not, on its own, meet BC’s emission reduction targets but it is a key element in the strategy. To avoid unfairness and what might effectively be double taxation, the carbon tax and complementary measures such as the “cap and trade” system will be integrated as these other measures are designed and implemented.

How does the tax work?

The carbon tax applies to the purchase or use of fossil fuel within the province. The amount of GHGs emitted when a unit of fossil fuel is burned depends fundamentally on the chemical makeup of the fuel, particularly on the amount of carbon in the fuel. That fact allows for a relatively simple administrative principle for applying the carbon tax.

Administratively, the carbon tax will be applied and collected at the wholesale level in essentially the same way that motor fuel taxes are currently applied and collected. This minimizes the cost of administration to government and the compliance cost to those collecting the tax on government’s behalf. Even though the carbon tax applies to a broader range of fuels and fuel uses than existing motor fuel taxes, with few exceptions, the same mechanism and administrative infrastructure can be used for both purposes. See the accompanying Topic Box for more detail on the tax base.

The tax rates starting on July 1, 2008 are based on $10 per tonne of CO2-equivalent(3) emissions, increasing by $5 per tonne each year for the next four years to $30 per tonne in 2012 (see Table 1.1). Some environmentalists and economists have suggested starting with a higher level of tax, arguing that a low initial tax rate will have little immediate effect. However, allowing this relatively long phase-in period up to the $30 per tonne level is intended to give people and business time to adjust their habits and purchasing patterns, and to respect decisions taken before the tax was announced, such as vehicle purchases.

Table 1.1 Rate per Tonne of CO2-equivalent

Effective Date | | Rate

$/tonne of CO2-e | |

July 1, 2008 | | $ | 10 | |

July 1, 2009 | | $ | 15 | |

July 1, 2010 | | $ | 20 | |

July 1, 2011 | | $ | 25 | |

July 1, 2012 | | $ | 30 | |

(3) There are several greenhouse gases, three of which are produced by fossil fuel combustion - CO2, methane and nitrous oxide. Both methane and nitrous oxide have a greater impact per tonne on the greenhouse effect than CO2. CO2-equivalent is a measure of the total greenhouse effect created from all GHG emissions, with the non-CO2 emission levels adjusted to a CO2-equivalent basis. See the National Inventory Report, 1990-2005, Environment Canada, Section 1.1, page 18. (http://www.ec.gc.ca/pdb/ghg/inventory_report/2005_report/tdm-toc_eng.cfm)

Budget and Fiscal Plan – 2008/09 to 2010/11

12

A Budget for Climate Action

What is Taxed – the Carbon Tax Base

The tax base is made up of those items that are subject to tax. For the carbon tax, the purpose is to effectively tax all of the GHG emissions in BC from the combustion of fossil fuels that are captured in the National Inventory Report.(1) In practice, this means that the tax base includes all of the fossil fuels:

· purchased for use in the province, or

· used by those importing or producing the fuel.

The tax base includes fossil fuels used for transportation by individuals and in all industries, including the combustion of natural gas to operate pipelines, as well as road, rail, marine and air transportation. As well, the tax base includes fuel used to create heat for households and industrial processes, such as producing cement and drying coal.

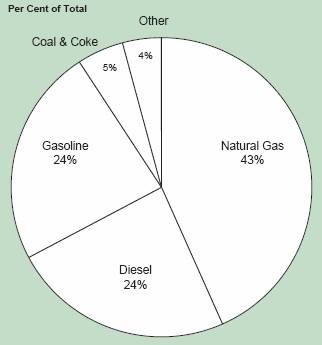

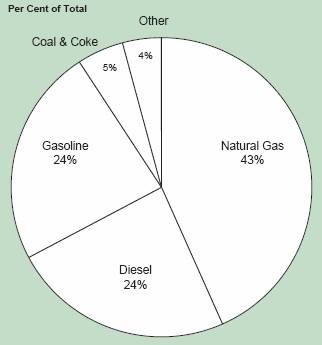

There are some exemptions to minimize administrative and compliance costs, such as small sealed containers of fuel. The chart shows the 2007 GHG emissions resulting from the burning of the main types of fossil fuel used in British Columbia. Natural gas, gasoline, diesel fuel and coal and coke account for 96 per cent of emissions from the combustion of fossil fuels in British Columbia. Other fossil fuels include propane, light and heavy fuel oil, aviation gasoline, aviation turbo fuel and kerosene.

The only fuel types not included in the tax base are those that are not “fossil fuels.” These are generally referred to as biomass fuels or biofuels, which include firewood, wood-waste, ethanol, bio-diesel and bio-heating oil.(2) Under the international protocol used for the National Inventory Report, the CO2 produced from the combustion of biomass is not included in the inventory because the carbon released by combustion was first drawn from the atmosphere by the plants through photosynthesis. Fuels that include both fossil fuel and biomass fuel, such as blended gasoline and ethanol, will only be subject to tax on the fossil fuel content of the fuel.

GHG emissions from fossil fuels

Certain fuel uses are not subject to tax. These exemptions, such as for inter-jurisdictional commercial marine and aviation purposes and fuel to be exported, are needed to ensure that the tax applies only to combustion and thus emissions produced in BC. The province is taking responsibility for the emissions in our province that are included in the inventory but recognizes that other jurisdictions will need to introduce their own GHG reduction policies. Thus, neither the emissions released elsewhere to produce fuel imported to BC or the emissions released elsewhere from burning fuel exported from BC are included in the tax base. The intention is to effectively tax the emissions from burning fossil fuels within the province.

The fossil fuels included in the tax base account for about 70 per cent of British Columbia’s total current GHG emissions. Other emissions, including those resulting from industrial processes such as production of oil, gas, aluminum and cement, as well as emissions from landfills and other sources, will not be subject to the tax initially. More work is needed to determine whether emissions from other sources should be subject to the carbon tax. There are technical measurement issues with these other GHG emissions, many of which are created during the production process and vary considerably from facility to facility. Also, many of these emissions will be subject to the cap and trade system or other GHG reduction measures under development. Further work will be needed to ensure the carbon tax is appropriately integrated with these other measures.

(1) A full description of what emissions are measured under the Kyoto Protocol is found in the National Inventory Report, 1990-2005: Greenhouse Gas Sources and Sinks in Canada, November, 2007

(http://www.ec.gc.ca/pdb/ghg/inventory_report/2005_report/tdm-toc_eng.cfm)

(2) Hydrogen is another potential fuel that is neither a fossil fuel or a biomass fuel. When and if hydrogen becomes generally used as a fuel type, it will not be subject to the carbon tax because its use does not generate any GHGs.

Budget and Fiscal Plan – 2008/09 to 2010/11

13

A Budget for Climate Action

Since different fuels generate different amounts of GHG when burned, $10 per tonne of CO2-equivalent must be translated into tax rates for each specific type of fuel. Table 1.2 shows the per unit rates for selected fossil fuels in 2008. For example, in 2008 the rate for gasoline will be 2.41 cents per litre. The tax rate for diesel used for road transportation will be slightly higher at 2.76 cents per litre due to the higher carbon content of the fuel while the tax on propane will be lower on a per litre basis.

Table 1.2 Selected Carbon Tax Rates by Fuel Type

| | Units for

Tax Rates | | Tax Rate

July 1, 2008 | |

Gasoline | | ¢/litre | | 2.41 | |

Diesel | | ¢/litre | | 2.76 | |

Jet fuel | | ¢/litre | | 2.62 | |

Natural gas | | ¢/gigajoule | | 49.88 | |

Propane | | ¢/litre | | 1.53 | |

Coal - Canadian bituminous | | $/tonne | | 20.79 | |

Coal - sub-bituminous | | $/tonne | | 17.72 | |

Revenue Recycling

A key principle, reinforced in legislation, is that all the revenue generated by the carbon tax will be recycled through tax reductions. None of the carbon tax revenue will be used to increase spending.

In addition, Budget 2008 includes a Climate Action Dividend, an initial payment of $440 million to all British Columbians to help begin the transition to a lower carbon lifestyle. This payment is not part of the 2008 revenue recycling and is being paid out of the 2007/08 surplus.

Accountability for full revenue recycling will be achieved primarily through a legislated requirement that each year the budget include a three-year plan for carbon tax revenue recycling. The first plan is included in the Revenue Neutral Carbon Tax Plan topic box. It shows that for 2008, the revenue will be recycled through a refundable tax credit, the Climate Action Tax Credit, as well as reductions in personal and corporation income tax rates. The legislation implementing the recycling tax cuts for 2008 and 2009 is tabled with Budget 2008. Failure to table a revenue neutral plan will mean that the Minister of Finance is ineligible to receive the 10 per cent salary holdback.

There will also be annual reporting on the actual amount of carbon tax collected and revised estimates of revenue reductions due to the revenue recycling measures. In next year’s budget, a revised estimate for 2008/09 will be provided based on results for the first three fiscal quarters. In future years, the report will also include year end amounts as reported in the Public Accounts.

By necessity, the revenue recycling plan in the budget must be based on estimates and the actual carbon tax revenue and revenue recycling costs may vary from those estimates for a number of reasons. If the actual amount of revenue recycled is less than the amount of carbon tax revenue collected for a given year, the plan will also show how the government intends to return the excess to taxpayers through additional tax reductions. This ensures that there will be full, transparent, ongoing revenue recycling.

Budget and Fiscal Plan – 2008/09 to 2010/11

14

A Budget for Climate Action

A Revenue Neutral Carbon Tax Plan

The table below contains the first plan that demonstrates how the carbon tax will be recycled. In future years this plan will be a legislated requirement. Revenue neutrality means that there must be tax reductions that fully recycle the estimated revenue from the carbon tax in a given fiscal year. The plan shows estimated revenue from the tax for the next three fiscal years and tax measures that will recycle at least that amount of revenue in each year.

In the future, the plan will also show how any excess carbon tax revenue collected in earlier years will be returned to taxpayers.

Revenue Neutral Carbon Tax Plan

($ millions) | | 2008/09 | | 2009/10 | | 2010/11 | |

Carbon tax revenue (amount to be returned to taxpayers) | | (338 | ) | (631 | ) | (880 | ) |

| | | | | | | |

Personal Tax Cuts | | | | | | | |

– Low income refundable tax credit * | | 104 | | 145 | | 146 | |

– Reduce bottom two tax bracket rates by 2 per cent for 2008and by 5 per cent for 2009 and subsequent years * | | 113 | | 230 | | 244 | |

– Additional personal income tax rate cuts | | — | | 40 | | 157 | |

Total tax cuts for individuals | | 217 | | 415 | | 547 | |

| | | | | | | |

Business Tax Cuts | | | | | | | |

– Reduce general corporate rate to 11 per cent July 1, 2008 * | | 75 | | 128 | | 133 | |

– Reduce general corporate rate to 10.5 per cent January 1, 2010 and to 10 per cent January 1, 2011 | | — | | 6 | | 73 | |

– Reduce small business corporate income tax rate to 3.5 per cent July 1, 2008 * | | 46 | | 79 | | 82 | |

– Reduce small business corporate income tax rate to 3 per cent January 1, 2010 and to 2.5 per cent January 1, 2011 | | — | | 3 | | 45 | |

Total tax cuts for businesses | | 121 | | 216 | | 333 | |

| | | | | | | |

Total tax cuts | | 338 | | 631 | | 880 | |

* Legislation introduced with Budget 2008 .

Budget and Fiscal Plan – 2008/09 to 2010/11

15

A Budget for Climate Action

Table 1.3 shows the impact of the personal income tax revenue recycling reductions on various taxpayers. It also demonstrates how the Climate Action Tax Credit will assist those with low incomes. This refundable tax credit will be paid quarterly, along with the GST Tax Credit, ensuring that low income earners do not have to wait until they file their tax returns to receive the benefit.

The tax reductions apply regardless of how much carbon tax an individual pays. This will allow individuals and families to make their own choices about how to adjust to a lower carbon lifestyle.

Table 1.3 British Columbia Tax Cut – Impact on Taxpayers*

| | | | 2008 | | 2009 | |

Family Type | | Income | | Low income

Climate Action

Credit | | Personal

Income Tax

cut | | Total | | Low income

Climate Action

Credit | | Personal

Income Tax

cut | | Total | |

Single | | $ | 20,000 | | $ | 50 | | $ | 11 | | $ | 61 | | $ | 103 | | $ | 28 | | $ | 131 | |

| | $ | 60,000 | | $ | 0 | | $ | 68 | | $ | 68 | | $ | 0 | | $ | 179 | | $ | 179 | |

| | | | | | | | | | | | | | | | | | | | | | |

Senior couple | | $ | 30,000 | | $ | 100 | | $ | 0 | | $ | 100 | | $ | 205 | | $ | 0 | | $ | 205 | |

| | | | | | | | | | | | | | | |

Single parent - one child | | $ | 35,000 | | $ | 100 | | $ | 17 | | $ | 117 | | $ | 205 | | $ | 46 | | $ | 251 | |

| | | | | | | | | | | | | | | |

Two earner family of four | | $ | 40,000 | | $ | 65 | | $ | 22 | | $ | 87 | | $ | 152 | | $ | 56 | | $ | 208 | |

| | | | | | | | | | | | | | | |

| | $ | 90,000 | | $ | 0 | | $ | 85 | | $ | 85 | | $ | 0 | | $ | 224 | | $ | 224 | |

* Calculated for taxpayers with wage income and claiming basic credits.

Carbon Tax Implications

Carbon Tax Impact on Individuals

The main impacts of the carbon tax on individuals are related to their transportation and heating costs.

For those who use private vehicles for transportation, the impact of the tax will depend on four factors – distance driven, fuel efficiency of the vehicle, the type of fuel used, and driving habits. All of these can be adjusted over time to reduce the impact of the tax. For example, in the near term by careful planning, trips can be combined to reduce kilometers driven. In the first year, driving roughly 10 km less per week would reduce fuel cost by enough to offset the impact of the carbon tax.

Tables 1.4 and 1.5 show the annual carbon tax cost based on $10 and $30 per tonne of GHG for a variety of fuel efficiency and annual distance driven for gasoline and diesel vehicles. Table 1.8 shows the carbon tax cost for select late model vehicles.

The amount of carbon tax associated with heating and cooling of residential buildings and domestic hot water depend on the type of energy used, the energy efficiency of the equipment, the outside temperature, the level at which the thermostat is set and the energy efficiency of the building. Table 1.6 outlines the carbon tax costs that would result from various energy sources based on provincial averages.

Budget and Fiscal Plan – 2008/09 to 2010/11

16

A Budget for Climate Action

Table 1.4 Annual Carbon Tax Cost for Gasoline Fueled Vehicles

| | Fuel Efficiency | |

Litres/100 km | | 5.0 | | 7.5 | | 10.0 | | 12.5 | | 15.0 | |

| | | | | | | | | | | |

$10 per tonne | | | | | | | | | | | |

10,000 km | | $ | 12.05 | | $ | 18.08 | | $ | 24.10 | | $ | 30.13 | | $ | 36.15 | |

20,000 km | | $ | 24.10 | | $ | 36.15 | | $ | 48.20 | | $ | 60.25 | | $ | 72.30 | |

30,000 km | | $ | 36.15 | | $ | 54.23 | | $ | 72.30 | | $ | 90.38 | | $ | 108.45 | |

40,000 km | | $ | 48.20 | | $ | 72.30 | | $ | 96.40 | | $ | 120.50 | | $ | 144.60 | |

| | | | | | | | | | | |

$30 per tonne | | | | | | | | | | | |

10,000 km | | $ | 36.15 | | $ | 54.23 | | $ | 72.30 | | $ | 90.38 | | $ | 108.45 | |

20,000 km | | $ | 72.30 | | $ | 108.45 | | $ | 144.60 | | $ | 180.75 | | $ | 216.90 | |

30,000 km | | $ | 108.45 | | $ | 162.68 | | $ | 216.90 | | $ | 271.13 | | $ | 325.35 | |

40,000 km | | $ | 144.60 | | $ | 216.90 | | $ | 289.20 | | $ | 361.50 | | $ | 433.80 | |

Table 1.5 Annual Carbon Tax Cost for Diesel Fueled Vehicles

| | Fuel Efficiency | |

Litres/100 km | | 5.0 | | 7.5 | | 10.0 | | 12.5 | | 15.0 | |

| | | | | | | | | | | |

$10 per tonne | | | | | | | | | | | |

10,000 km | | $ | 13.80 | | $ | 20.70 | | $ | 27.60 | | $ | 34.50 | | $ | 41.40 | |

20,000 km | | $ | 27.60 | | $ | 41.40 | | $ | 55.20 | | $ | 69.00 | | $ | 82.80 | |

30,000 km | | $ | 41.40 | | $ | 62.10 | | $ | 82.80 | | $ | 103.50 | | $ | 124.20 | |

40,000 km | | $ | 55.20 | | $ | 82.80 | | $ | 110.40 | | $ | 138.00 | | $ | 165.60 | |

| | | | | | | | | | | |

$30 per tonne | | | | | | | | | | | |

10,000 km | | $ | 41.40 | | $ | 62.10 | | $ | 82.80 | | $ | 103.50 | | $ | 124.20 | |

20,000 km | | $ | 82.80 | | $ | 124.20 | | $ | 165.60 | | $ | 207.00 | | $ | 248.40 | |

30,000 km | | $ | 124.20 | | $ | 186.30 | | $ | 248.40 | | $ | 310.50 | | $ | 372.60 | |

40,000 km | | $ | 165.60 | | $ | 248.40 | | $ | 331.20 | | $ | 414.00 | | $ | 496.80 | |

Table 1.6 Annual Carbon Tax Cost of Home Fuel Use

| | $ 10 per tonne | | $ 30 per tonne | |

Home Heating | | | | | |

– Electricity | | $ | 0 | | $ | 0 | |

– Fuel oil | | $ | 47 | | $ | 141 | |

– Standard efficiency gas | | $ | 35 | | $ | 105 | |

– Mid-efficiency gas | | $ | 29 | | $ | 86 | |

– Highest-efficiency gas | | $ | 24 | | $ | 72 | |

| | | | | |

Domestic Hot Water | | | | | |

– Electricity | | $ | 0 | | $ | 0 | |

– Standard efficiency gas | | $ | 11 | | $ | 32 | |

– Mid-efficiency gas | | $ | 10 | | $ | 29 | |

– Highest-efficiency gas | | $ | 7 | | $ | 21 | |

Note: Based on average household consumption across mainland British Columbia.

Source: BC Hydro

Budget and Fiscal Plan – 2008/09 to 2010/11

17

A Budget for Climate Action

Table 1.7 shows the net impact of the carbon tax and the associated tax cuts in 2008 and 2009 for two representative family types. It demonstrates that for many typical families the tax cuts will exceed the cost of the carbon tax.

Table 1.7 Revenue Neutral Climate Action Measures - Impact on Taxpayers

| | Tax (Benefit) | |

| | 2008* | | 2009 | |

Double earner family of four with $60,000/year income | | | | | |

– Van – 10 L/100km fuel efficiency driving 20,000 km/year | | 24 | | 60 | |

– Natural gas heat and hot water | | 21 | | 53 | |

– Personal income tax reduction | | (45 | ) | (118 | ) |

Net impact | | 0 | | (5 | ) |

| | | | | |

Senior couple with $30,000/year income | | | | | |

– Gas guzzler – 12 L/100km fuel efficiency driving 7,000 km/year | | 10 | | 25 | |

– Oil furnace using 2000 litres of heating oil per year | | 28 | | 70 | |

– Personal income tax reduction (Climate Action Tax Credit) | | (100 | ) | (105 | ) |

Net impact | | (62 | ) | (10 | ) |

*July 1, to December 31, 2008

Carbon Tax Impact on Business

Every business or other organization that purchases or uses fossil fuel for combustion in British Columbia will be subject to the carbon tax. The main uses of the fuel are for transportation, heating of buildings and providing heat for industrial processes.

The relative amount of tax paid and the impact on the business will depend on many things, including the industry, the particular configuration of each facility, the ability to use alternative fuel sources, and to make new investments to reduce the use of fossil fuels. As with individuals, in both the near term and further into the future, businesses will have choices that can be made in terms of how things are shipped, how much business travel is undertaken and what equipment and fuel is used, all of which will affect the amount of tax that will be paid.

The low initial tax rate is not expected to significantly affect the business community and the five year phase-in will allow time for businesses to adjust. The province hopes that other jurisdictions will also put effective mechanisms in place that put a reasonable price on GHG emissions. The cap and trade system, which will be implemented across a number of western jurisdictions will be an important step in that direction. Much of the carbon tax revenue will be recycled to business, initially through significant corporation income tax reductions, mitigating the net impact on the business community. In addition, the reduction to school property tax rates for the major industrial class announced in Budget 2008, while not a revenue recycling measure, will provide important tax relief to industrial facilities across the province and will help improve their competitiveness.

Impact on GHG Emissions

The carbon tax is purposely being started at a low rate compared to the rates at which some experts have suggested will ultimately be required to encourage significant changes in behavior. Even at $30 per tonne in 2012, some experts

Budget and Fiscal Plan – 2008/09 to 2010/11

18

A Budget for Climate Action

Table 1.8 Carbon Tax Cost of Selected Late Model Vehicles at $10 per tonne

Top 5 Most Fuel Efficient Passenger Cars – 2008 Model

Rank | | Manufacturer | | Model | | Class | | Engine Size | | Transmission | | Vehicles

Sold | | Average

L/100km | | Annual

Carbon Tax

Cost ($) | |

#1 | | Toyota | | Prius Hybrid | | C | | 1.5L | | V | | N/A | | 4.1 | | 20 | |

#2 | | Honda | | Civic Hybrid | | C | | 1.3L | | V | | N/A | | 4.5 | | 22 | |

#3 | | Smart | | ForTwo | | SC | | 1.5L | | S5 | | N/A | | 5.4 | | 26 | |

#4 | | Toyota | | Camry Hybrid | | INT | | 2.4L | | V | | N/A | | 5.7 | | 27 | |

#5 | | Nissan | | Altima Hybrid | | INT | | 2.5L | | V | | N/A | | 5.8 | | 28 | |

Top 5 Most Fuel Efficient Light Trucks – 2008 Model

Rank | | Manufacturer | | Model | | Class | | Engine Size | | Transmission | | Vehicles

Sold | | Average

L/100km | | Annual

Carbon Tax

Cost ($) | |

#1 | | Ford | | Escape Hybrid AWD | | CSU | | 2.3L | | V | | N/A | | 7.0 | | 34 | |

#2 | | Saturn | | VUE Hybrid | | ISU | | 2.4L | | E4 | | N/A | | 7.3 | | 35 | |

#3 | | Toyota | | Highlander Hybrid 4WD | | ISU | | 3.3L | | V | | N/A | | 7.9 | | 38 | |

#4 | | Jeep | | Compass/Patriot | | CSU | | 2.4L | | M5 | | N/A | | 8.1 | | 39 | |

#5 | | Lexus | | RX 400H | | LSU | | 3.3L | | V | | N/A | | 8.1 | | 39 | |

Top 10 BC Passenger Car Sales – 2006

Rank | | Manufacturer | | Model | | Class | | Vehicles

Sold | | Average

L/100km | | Annual

Carbon Tax

Cost ($) | |

#1 | | Honda | | Civic Sedan/Coupe | | C | | 9543 | | 6.8 | | 33 | |

#2 | | Mazda | | Mazda3 | | C | | 5661 | | 7.9 | | 38 | |

#3 | | Toyota | | Corolla | | C | | 5450 | | 7.0 | | 34 | |

#4 | | Toyota | | Yaris | | SC | | 4582 | | 6.4 | | 31 | |

#5 | | Toyota | | Matrix | | C | | 3673 | | 7.7 | | 37 | |

#6 | | Toyota | | Camry | | INT | | 3394 | | 9.1 | | 44 | |

#7 | | Ford | | Focus | | C | | 3021 | | 8.2 | | 39 | |

#8 | | Chevrolet | | Cobalt | | C | | 2755 | | 8.2 | | 40 | |

#9 | | Honda | | Accord | | INT | | 2580 | | 8.7 | | 42 | |

#10 | | Volkswagen | | Jetta | | C | | 2524 | | 8.8 | | 42 | |

Top 10 BC Light Truck Sales – 2006

Rank | | Manufacturer | | Model | | Class | | Vehicles

Sold | | Average

L/100km | | Annual

Carbon Tax

Cost ($) | |

#1 | | Ford | | F-Series Pick-Up | | LP | | 10361 | | 14.0 | | 68 | |

#2 | | Dodge | | Ram Pickup | | LP | | 5269 | | 14.1 | | 68 | |

#3 | | Chevrolet | | Silverado | | LP | | 4948 | | 13.8 | | 67 | |

#4 | | Dodge | | Caravan | | SV | | 4802 | | 10.5 | | 51 | |

#5 | | GMC | | Sierra | | LP | | 4415 | | 14.0 | | 67 | |

#6 | | Ford | | Ranger | | SP | | 3272 | | 11.6 | | 56 | |

#7 | | Ford | | Escape | | CSU | | 3217 | | 9.2 | | 44 | |

#8 | | Honda | | CR-V | | CSU | | 2646 | | 9.7 | | 47 | |

#9 | | Toyota | | RAV4 | | CSU | | 2249 | | 9.3 | | 45 | |

#10 | | Honda | | Odyssey | | SV | | 2069 | | 10.4 | | 50 | |

Notes: | 1. Assumes 55% city and 45% highway driving to calculate average fuel consumption. |

| |

| 2. Assumes 20,000 km per year, $10 per tonne carbon tax rate. |

Legend | | | | |

| | | | |

1.Transmission | | | | |

| | | | |

E - Electronic automatic | | | | |

M - Manual | | | | |

S - Automatic with manual mode | | | | |

V - Continuously variable | | | | |

| | | | |

2. Class | | | | |

| | | | |

C - Compact | | | | |

SC - SubCompact | | | | |

INT - Intermediate | | | | |

CSU - Compact Sport Utility | | | | |

ISU - Intermediate Sport Utility | | | | |

LSU - Luxury Sport Utility | | | | |

LP - Large Pickup | | | | |

SP - Small Pickup | | | | |

SV - Small Van | | | | |

Budget and Fiscal Plan – 2008/09 to 2010/11

19

A Budget for Climate Action

argue that a higher price will ultimately be required. As noted above, this phase-in is intended to provide individuals and businesses with time to adjust and to provide certainty about initial rates.

After being phased-in, further tax rate changes will depend on a number of factors including:

· whether BC is meeting its emissions targets;

· the expected future impact on emissions of other policies such as cap and trade and low carbon fuel standards;

· the actions taken by other governments to reduce their GHG emissions and to set a price on carbon; and

· the advice of the Climate Action Team.

A preliminary estimate by M. K. Jaccard and Associates suggests that in the absence of other GHG reduction policies, the carbon tax could reduce BC’s GHG emissions in 2020 by up to 3 million tonnes of CO2 -equivalent annually. This is based on introducing the tax, increasing it to $30 per tonne of CO2 -equivalent over 4 years, and then leaving tax rates unchanged thereafter. When formally assessed in combination with the other GHG reduction policies being implemented, the impact of the carbon tax will be somewhat lower.

Other Climate Action Tax Initiatives

To help families with the transition to a lower carbon lifestyle, the government is also introducing new incentives through the tax system totaling $64 million over three years. These measures are described in Table 1.9

Table 1.9 Additional Budget 2008 Climate Action Tax Initiatives

· | PST reduction for certain conventional fuel efficient vehicles that meet the fuel efficiency criteria set out in the federal government’s ecoAuto rebate program. The tax reduction is $1,000, $1,500, or $2,000, and is based on fuel efficiency and vehicle type.* |

| |

· | PST exemption for ENERGY STAR qualified residential refrigerators, clothes washers and freezers (expires March 31, 2010). |

| |

· | PST exemption for energy efficient residential gas-fired water heaters with an energy factor of 0.80 or greater (expires December 31, 2009). |

| |

· | PST exemption for production machinery and equipment for local governments for power production and cogeneration. |

| |

· | Exemption from passenger vehicle rental tax for rentals of eight hours or less. |

| |

· | PST exemption for electric power-assisted two and three wheel cycles* and non-motorized adult-sized tricycles. |

| |

· | PST reduction for hydrogen fuel cell buses of 50% of the tax payable to a maximum of $10,000.* |

| |

· | PST reduction for electric motorcycles of 50% of the tax payable to a maximum of $1,000.* |

| |

· | PST exemption for insulation designed to prevent heat or cold loss from hot water tanks, hot and cold water pipes, and ductwork. |

| |

· | PST exemption for biodiesel fuel, including the portion of biodiesel fuel used in a furnace oil blend, when used for heating or other non-motive uses. |

| |

· | PST exemption for certain aerodynamic devices purchased for use on commercial motor vehicles. |

| |

· | PST applied to coal and coke, except when purchased for use in a residential dwelling unit. |

| |

· | Biodiesel and ethanol classified as alternative motor fuels for all purposes and are exempt from tax. |

| |

· | Eligible intellectual property expanded to include green-related patents (patents with World Patent Office classifications related to power generation using forces of nature such as wind, solar and tidal). |

| |

· | Equity tax credit budget increased by $5 million per year, with $7.5 million of tax credit budget dedicated to clean technology. |

* Measures have a sunset date of March 31, 2011.

Budget and Fiscal Plan – 2008/09 to 2010/11

20

A Budget for Climate Action

What Can I Do to Reduce Carbon Emissions?

One of the most common questions people have about climate change is “What can I do to reduce greenhouse gas emissions?”

The table below provides examples of the emissions reductions and financial savings that can result from some specific choices.

Savings from Carbon Emission Reductions

| | | | Carbon Tax Rate | |

| | Source of savings | | $10 | | $15 | | $20 | | $25 | | $30 | |

| | | | dollars | |

Regularly tune up vehicle: tune and maintain proper tire inflation can reduce fuel consumption by 10%: vehicle with fuel efficiency of 10 L/100km. | | Fuel | | 200 | | 200 | | 200 | | 200 | | 200 | |

| Carbon tax | | 5 | | 7 | | 10 | | 12 | | 14 | |

| | | | | | | | | | | | |

| Total | | 205 | | 207 | | 210 | | 212 | | 214 | |

| | | | | | | | | | | | | |

Drive one day less per week: vehicle with fuel efficiency of 8 L/100km. | | Fuel | | 228 | | 228 | | 228 | | 228 | | 228 | |

| Carbon tax | | 5 | | 8 | | 11 | | 14 | | 16 | |

| | | | | | | | | | | | |

| Total | | 233 | | 236 | | 239 | | 242 | | 244 | |

| | | | | | | | | | | | | |

Walk to work: 5 kilometre commute and vehicle with fuel efficiency of 8 L/100km. | | Fuel | | 192 | | 192 | | 192 | | 192 | | 192 | |

| Carbon tax | | 5 | | 7 | | 9 | | 12 | | 14 | |

| | | | | | | | | | | | |

| Total | | 197 | | 199 | | 201 | | 204 | | 206 | |

| | | | | | | | | | | | | |

Switch to transit: assumes distance to work is 25km, vehicle with fuel efficiency of 10 L/100km and a two zone transit pass at $87 per month | | Fuel | | 1,200 | | 1,200 | | 1,200 | | 1,200 | | 1,200 | |

| Carbon tax | | 29 | | 43 | | 58 | | 72 | | 87 | |

| Total | | 1,229 | | 1,243 | | 1,258 | | 1,272 | | 1,287 | |

| Less transit cost | | (1,044 | ) | (1,044 | ) | (1,044 | ) | (1,044 | ) | (1,044 | ) |

| Net savings | | 185 | | 199 | | 214 | | 228 | | 243 | |

| | | | | | | | | | | | | |

Replace inefficient vehicle: 20,000 km per year and replace vehicle with fuel efficiency of 12 L/100km with 10 L/100km efficiency | | Fuel | | 400 | | 400 | | 400 | | 400 | | 400 | |

| Carbon tax | | 10 | | 14 | | 19 | | 24 | | 29 | |

| | | | | | | | | | | | |

| Total | | 410 | | 414 | | 419 | | 424 | | 429 | |

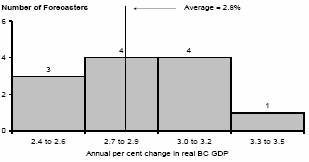

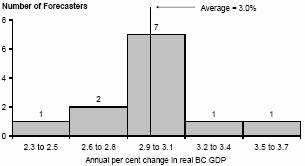

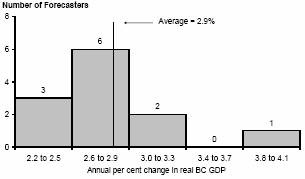

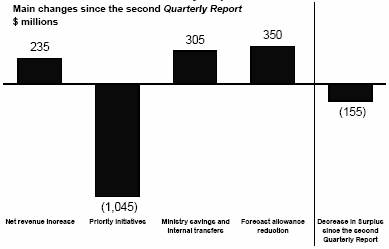

| | | | | | | | | | | | | |