Exhibit 99.11

BUDGET AND FISCAL PLAN

2011/12 — 2013/14

Presented to the Legislative Assembly on

May 3, 2011

Budget and Fiscal Plan

2011/12 — 2013/14

May 3, 2011

National Library of Canada Cataloguing in Publication Data

British Columbia.

Budget and fiscal plan. — 2002/03/2004/05-

Annual

Also available on the Internet.

Continues: British Columbia. Ministry of Finance and

Corporate Relations. Budget ... reports. ISSN 1207-5841

ISSN 1705-6071 = Budget and fiscal plan — British Columbia.

1. Budget — British Columbia — Periodicals. 2. British

Columbia — Appropriations and expenditures — Periodicals.

I. British Columbia. Ministry of Finance. II. Title.

HJ12.B742 352.48’09711’05 C2003-960048-3

TABLE OF CONTENTS

Budget and Fiscal Plan 2011/12 – 2013/14 | May 3, 2011 |

Attestation by the Secretary to Treasury Board

Summary | | 1 |

| | |

Part 1: Three-Year Fiscal Plan | | |

Introduction | | 5 |

Changes since Budget 2010 | | 8 |

Revenue | | 9 |

Major Revenue Sources | | 11 |

Expense | | 18 |

Consolidated Revenue Fund Spending | | 18 |

Management of the BC Public Service | | 22 |

Recovered Expenses | | 23 |

Operating Transfers | | 24 |

Service Delivery Agency Spending | | 24 |

Capital Spending | | 25 |

Taxpayer-supported Capital Spending | | 26 |

Self-supported Capital Spending | | 28 |

Projects over $50 million | | 29 |

Provincial Debt | | 32 |

Risks to the Fiscal Plan | | 35 |

Tables: | | |

1.1 | Three-Year Fiscal Plan – Operating Statement | | 5 |

1.2 | Fiscal Plan Update – Changes from Budget 2010 | | 8 |

1.3 | Major Factors Underlying Revenue | | 10 |

1.4 | Personal Income Tax Revenue | | 11 |

1.5 | Corporate Income Tax Revenue | | 11 |

1.6 | Sales Taxes Revenue | | 12 |

1.7 | Federal Government Contributions | | 14 |

1.8 | Revenue by Source | | 16 |

1.9 | Expense by Ministry, Program and Agency | | 17 |

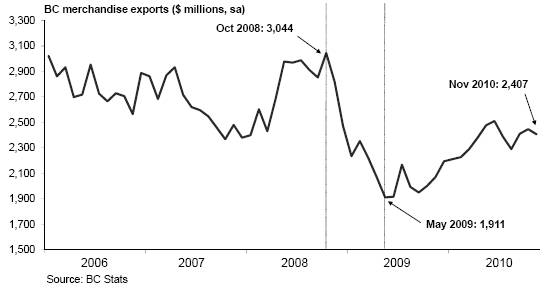

1.10 | Health Per Capita Costs and Outcomes: Canadian Comparisons | | 20 |

1.11 | Health Funding Report and Plan | | 21 |

1.12 | Capital Spending | | 25 |

1.13 | Provincial Transportation Investments | | 27 |

1.14 | Capital Expenditure Projects Greater Than $50 million | | 30 |

1.15 | Provincial Debt Summary | | 32 |

1.16 | Provincial Borrowing Requirements | | 33 |

1.17 | Reconciliation of Summary Results to Provincial Debt Changes | | 34 |

1.18 | Key Fiscal Sensitivities | | 35 |

1.19 | Notional Allocations to Contingencies | | 38 |

Budget and Fiscal Plan – 2011/12 to 2013/14

Table of Contents

Part 2: Tax Measures | | |

Tax Measures – Supplementary Information | | 42 |

Tables: | | |

2.1 Summary of Tax Measures | | 41 |

Topic Box: | | |

Revenue Neutral Carbon Tax | | 45 |

| | |

Part 3: British Columbia Economic Review and Outlook | | |

Summary | | 47 |

British Columbia Economic Activity and Outlook | | 48 |

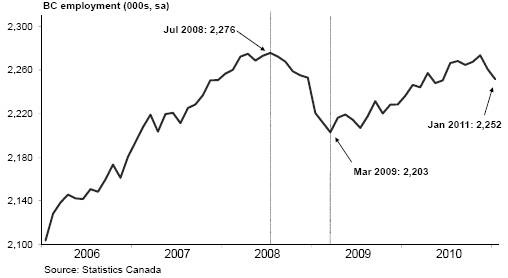

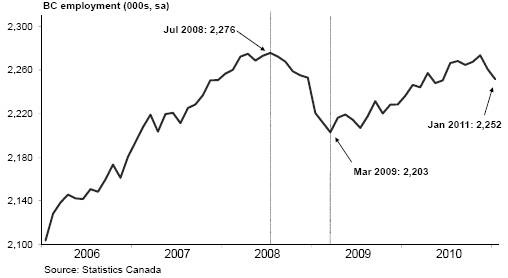

The Labour Market | | 49 |

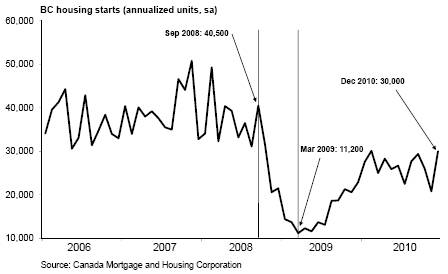

Consumer Spending and Housing | | 49 |

Business and Government | | 51 |

External Trade and Commodity Markets | | 52 |

Inflation | | 53 |

Risks to the Economic Outlook | | 54 |

External Outlook | | 54 |

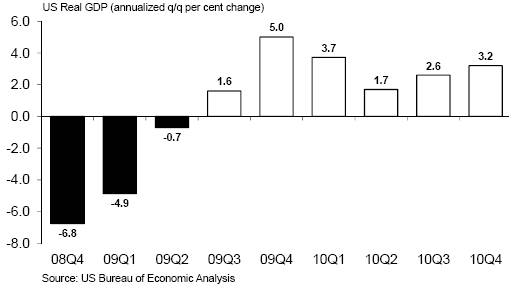

United States | | 54 |

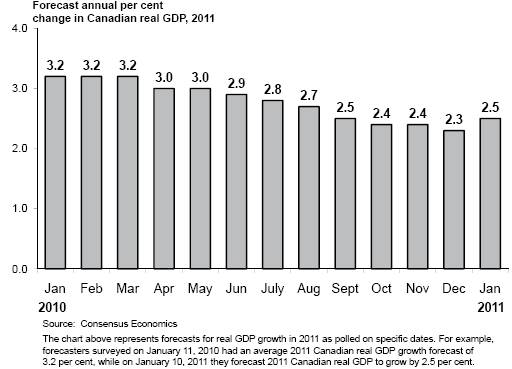

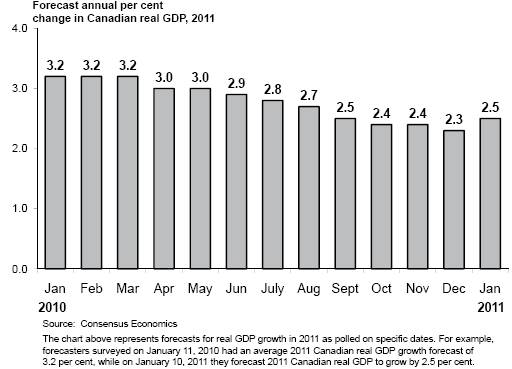

Canada | | 56 |

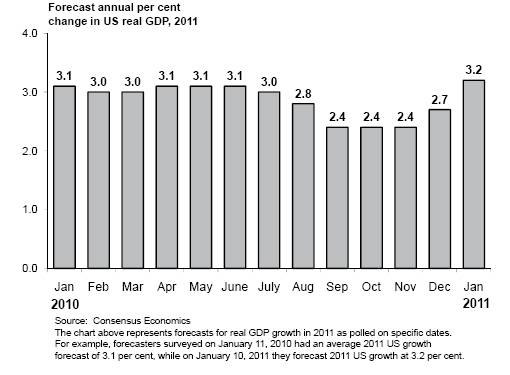

Financial Markets | | 57 |

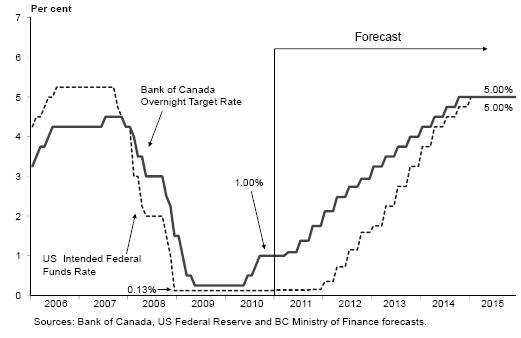

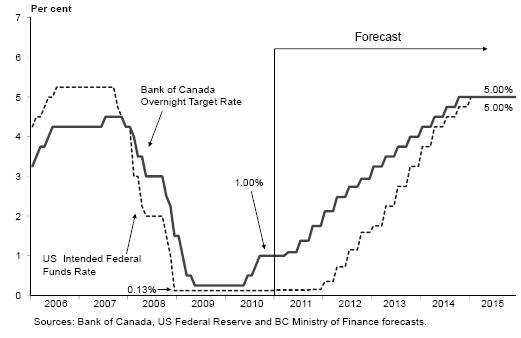

Interest Rates | | 57 |

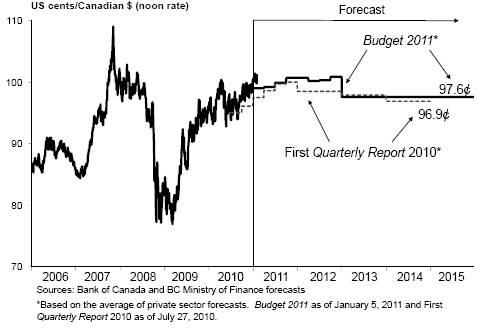

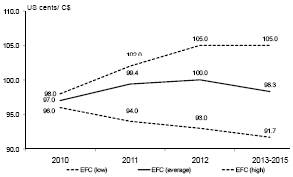

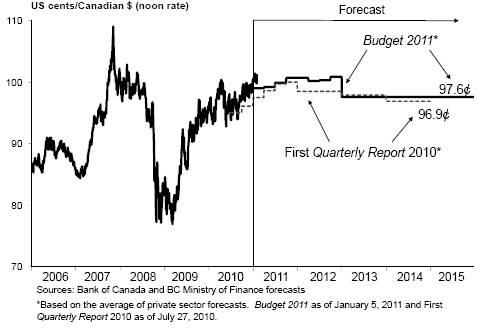

Exchange Rate | | 58 |

Tables: | | |

3.1 | British Columbia Economic Indicators | | 48 |

3.2 | Ministry of Finance Economic Forecast: Key Economic Indicators | | 48 |

3.3 | US real GDP forecast: Consensus vs Ministry of Finance | | 56 |

3.4 | Canadian real GDP forecast: Consensus vs Ministry of Finance | | 57 |

3.5 | Private Sector Canadian Interest Rate Forecasts | | 58 |

3.6 | Private Sector Exchange Rate Forecasts | | 59 |

3.7.1 | Gross Domestic Product: British Columbia | | 60 |

3.7.2 | Components of Nominal Income and Expenditure | | 61 |

3.7.3 | Labour Market Indicators | | 61 |

3.7.4 | Major Economic Assumptions | | 62 |

Topic Box: | | |

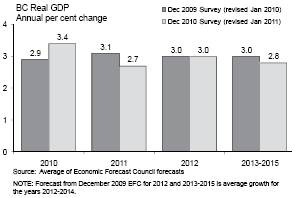

The Economic Forecast Council, 2011 | | 63 |

| | |

Appendices | | 67 |

Budget and Fiscal Plan – 2011/12 to 2013/14

ii

May 3, 2011

Budget 2011, as tabled in the British Columbia Legislature on May 3, 2011, replaces the document tabled on February 15, 2011, with the exception of Part 4 - 2010/11 Revised Financial Forecast (Third Quarterly Report).

I have reviewed the economic and revenue forecasts since the tabling of Budget 2011 in February. In my opinion, there have not been material changes to the underlying assumptions that would require a change to the overall fiscal forecast presented in Budget 2011.

While the government has announced an intention to hold a referendum in relation to the provincial Harmonized Sales Tax (HST), the outcome of that referendum is unknown at this time. Consequently, Budget 2011 assumes a continuation of the current laws and agreements that prevail today. In particular, Budget 2011 as presented on May 3, 2011 assumes that the provincial HST will continue over the years covered by Budget 2011, and it does not accommodate any changes to revenue or costs that a change to the legal framework might cause.

As required by Section 7(d) of the Budget Transparency and Accountability Act (BTAA), and Section 4a(v) of the Carbon Tax Act, I confirm that Budget 2011 contains the following elements:

· Fiscal and economic forecasts for 2011/12 and the next two years — provided in Parts 1 and 3.

· Advice received from the Economic Forecast Council in December 2010 (updated January 2011), on the economic growth outlook for BC, including a range of forecasts for 2011 and 2012 (see Part 3, page 63).

· Material economic, demographic, fiscal, accounting policy and other assumptions and risks underlying the 2011/12 economic and fiscal forecasts, including:

· The Budget 2011 economic forecast reflects a slow but steady recovery for the BC economy, but recognizes ongoing challenges in the US economy and global financial market volatility. Accordingly, the economic projections assumed in Budget 2011 are more prudent than the average of the forecasts provided by the Economic Forecast Council. While recent events around the world (for example, Japan and the Middle East) have placed added pressure on the international economy, it is believed that there is still a significant amount of prudence in the provincial economic forecast at this time.

· Part 4 - 2010/11 Revised Financial Forecast (Third Quarterly Report) is not reproduced in the May 3, 2011 tabling of Budget 2011. Final results for 2010/11 will be available when the government releases its annual Public Accounts in the coming months.

· Forecast allowances of $350 million are included in each of fiscal years 2011/12 — 2013/14 to help achieve operating and debt level targets. These allowances are intended to help recognize uncertainty in revenue forecasts, commodity prices and the global economic recovery in general.

Ministry of | Office of the | Mailing Address: | Location Address: |

Finance | Deputy Minister | PO Box 9417 Stn Prov Govt | Room 109 |

| | Victoria BC V8W 9V1 | 617 Government Street |

| | www.gov.bc.ca/fin | Victoria BC |

· Given the current economic and revenue forecasts assumed in Budget 2011 and the legislative requirement to balance the provincial budget by 2013/14, the spending (expense) forecast in Budget 2011 assumes that annual spending growth will not exceed an average of 2.0 per cent over the three years of the fiscal plan. As this assumption is below actual historic spending growth levels, to achieve this will require continued financial discipline.

· Budget 2011 includes an allocation of $603 million to the Contingencies (All Ministries) and New Programs Vote in 2011/12, and $453 million in each of the following two fiscal years. These allocations were based on a review of ministry budgets, pressures and other government priorities.

· A capital funding contingency allocation, totalling $600 million over 2011/12 — 2013/14, is included in Budget 2011 to address costs associated with potential project scope changes, revised schedules or completion delays.

· Budget 2011 assumes the current public sector compensation negotiating mandate. This mandate requires two-year agreements with a net-zero cost to employers over the term of such agreements and applies to all public sector compensation contracts expiring between December 31, 2009 to December 31, 2011. No compensation mandate has been developed yet for contracts expiring after December 31, 2011.

· Budget 2011 assumes three-year financial projections for health authorities, K–12 education and post secondary institutions, as provided by the Ministries of Health, Education, and Advanced Education based on plans submitted by those entities in preparation of Budget 2011.

· Government and the BC Utilities Commission are reviewing a rate increase request of British Columbia Hydro and Power Authority. As the results of those reviews will be accommodated within Budget 2011, the overall fiscal forecast has remained unchanged.

· To the best of my knowledge, the three-year fiscal plan contained in Budget 2011 conforms to the standards and guidelines of generally accepted accounting principles (GAAP) for senior governments and with Public Sector Accounting Board (PSAB) guidelines. The adoption of International Financial Reporting Standards (IFRS) on January 1, 2011, by commercial Crown corporations is assumed in Budget 2011.

· Major areas of risk to the Budget 2011 fiscal plan are shown in Part 1 and the Appendix tables.

· Carbon tax reports for 2009/10 and 2010/11, and a carbon tax plan for 2011/12 to 2013/14 — see Revenue Neutral Carbon Tax topic box at the end of Part 2: Tax Measures (page 45).

· A health funding report for 2010/11 and a plan that includes a forecast for health spending and the specific revenue sources fully dedicated to these purposes for 2011/12 to 2013/14 (see page 21).

|

|

| Peter Milburn Deputy Minister and Secretary to Treasury Board |

Summary: BUDGET AND FISCAL PLAN – 2011/12 to 2013/14

| | 2010/11 | | Budget | | | | | |

| | | | Updated | | Estimate | | Plan | | Plan | |

($ millions) | | Budget | | Forecast | | 2011/12 | | 2012/13 | | 2013/14 | |

Revenue | | 39,153 | | 39,893 | | 41,337 | | 42,446 | | 44,091 | |

Expense | | (40,568 | ) | (41,008 | ) | (41,912 | ) | (42,536 | ) | (43,566 | ) |

Surplus (deficit) before forecast allowance | | (1,415 | ) | (1,115 | ) | (575 | ) | (90 | ) | 525 | |

Forecast allowance | | (300 | ) | (150 | ) | (350 | ) | (350 | ) | (350 | ) |

Surplus (deficit) | | (1,715 | ) | (1,265 | ) | (925 | ) | (440 | ) | 175 | |

Capital spending: | | | | | | | | | | | |

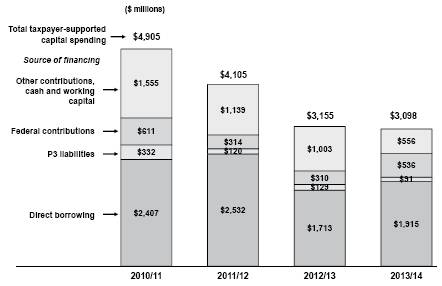

Taxpayer-supported capital spending | | 5,388 | | 4,905 | | 4,105 | | 3,155 | | 3,098 | |

Self-supported capital spending | | 2,771 | | 2,688 | | 3,243 | | 3,011 | | 2,415 | |

| | 8,159 | | 7,593 | | 7,348 | | 6,166 | | 5,513 | |

Provincial debt: | | | | | | | | | | | |

Direct operating debt | | 7,511 | | 7,987 | | 8,763 | | 9,267 | | 8,599 | |

Taxpayer-supported debt | | 33,748 | | 33,388 | | 36,816 | | 39,162 | | 40,500 | |

Self-supported debt | | 13,709 | | 13,743 | | 16,271 | | 18,060 | | 19,505 | |

Total debt (including forecast allowance) | | 47,757 | | 47,281 | | 53,437 | | 57,572 | | 60,355 | |

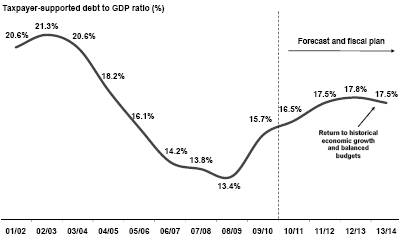

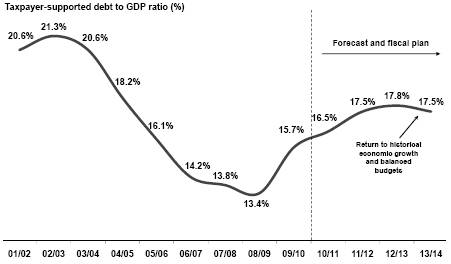

Taxpayer-supported debt-to-GDP ratio | | 17.2 | % | 16.5 | % | 17.5 | % | 17.8 | % | 17.5 | % |

| | | | | | | | | | | |

| | 2010 | | 2011 | | 2012 | | 2013 | |

Economic Forecast: | | | | | | | | | | | |

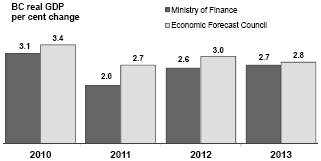

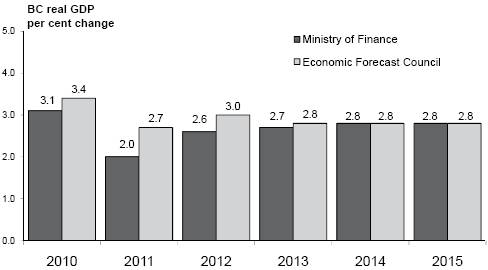

Real GDP growth | | 2.2 | % | 3.1 | % | 2.0 | % | 2.6 | % | 2.7 | % |

Nominal GDP growth | | 4.5 | % | 5.6 | % | 4.1 | % | 4.9 | % | 4.8 | % |

Achieving Key Fiscal Plan Objectives

Budget 2011 reflects government’s ongoing commitment to its key fiscal plan objectives:

· protection of essential health care, education, and social services;

· a balanced budget by 2013/14; and

· returning to a downward trend in the taxpayer supported debt to GDP ratio to support maintaining a AAA credit rating.

As announced in November 2010, Budget 2011 is a status quo budget that confirms government’s commitment to maintaining the core services of health care, education and social services that British Columbians depend upon.

Maintaining Core Services

In support of these priorities, Budget 2011 provides operating funding increases in the following areas:

· a $604 million increase in the Ministry of Health in 2013/14 — when added to the increases provided in Budget 2010, this represents an almost $2.0 billion increase in health funding over the fiscal plan period;

· a $65 million increase in the Ministry of Social Development over three years for income assistance to individuals and families in need; and

· a $153 million increase to the Contingencies Vote in 2011/12 to address unforeseen issues and provide fiscal management flexibility for the next Executive Council.

As well, school district funding will reach $8,357 per student full time equivalent by 2011/12, an increase of over 33 per cent since 2000/01.

Balancing the Budget

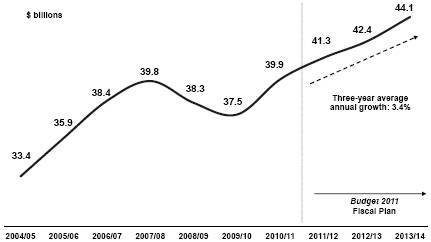

Average annual revenue growth of 3.4 per cent is consistent with the Ministry of Finance economic forecast, and reflects strengthening economic conditions, rising commodity prices and improving forest harvest volumes expected over the next three years.

Bridging the deficit gap

Budget and Fiscal Plan – 2011/12 to 2013/14

Summary

Over the fiscal plan period, full realization of the efficiencies driven by government’s expenditure management strategies that were implemented over the last two years will result in an average annual expense growth rate of 2.0 per cent, enabling revenue growth to bridge the deficit gap by 2013/14.

This rate of growth in expense will still enable government to increase its spending by $2.6 billion over the fiscal plan period, in order to maintain its commitment to core services. The return to balanced budgets will enable government to focus on and address the future needs of British Columbia’s families.

BC’s Economy Improving, but still Vulnerable

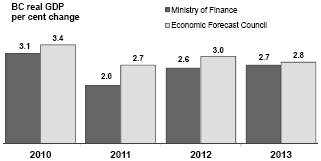

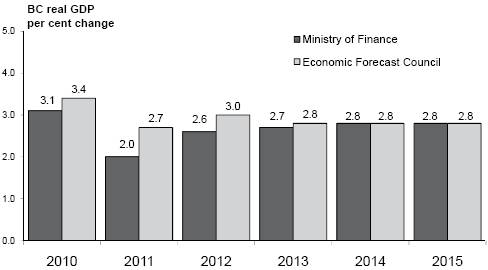

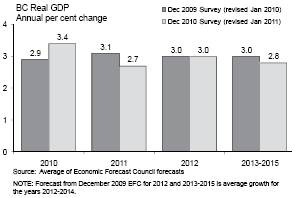

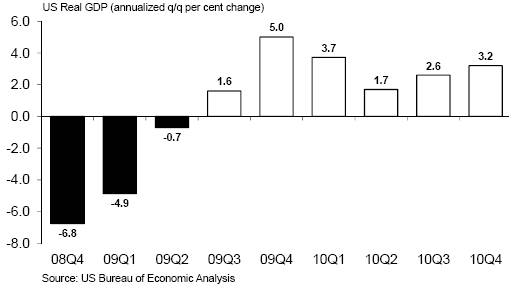

While BC’s economy showed considerable improvement in 2010, growing by an estimated 3.1 per cent, the Ministry’s forecast of 2.0 per cent growth for 2011 reflects the likelihood of much slower global activity this year.

The Ministry of Finance forecasts BC’s economy to grow by 2.6 per cent in 2012, before returning to more historical levels in the medium term.

Ministry forecast more prudent than private sector

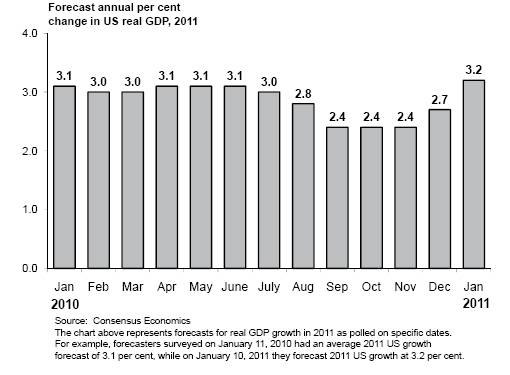

The Ministry’s outlook for BC’s real GDP growth is 0.7 percentage points lower in 2011 and 0.4 percentage points lower in 2012 than the outlook provided by the Economic Forecast Council.

Risks to the Ministry’s outlook are weighted to the downside, largely due to continued uncertainty surrounding global economic activity. The risks include:

· continued weakness in the US economy (characterized by weaker consumer spending, widespread deleveraging causing slower investment, a very slow job market recovery and further fiscal restraint — particularly at the state and local level);

· the sovereign debt crisis in some European countries threatening the stability of global financial markets;

· slower than anticipated global demand resulting in weaker demand for BC’s exports;

· greater than anticipated moderation in the Canadian housing market; and

· a sudden rise in the value of the Canadian dollar, resulting in further downward pressure on Canadian exports.

If one or more of these risks materialize in a significant way it may create pressures that cannot be accommodated in the fiscal plan.

Capital Spending Returns to Historical Levels

Infrastructure spending on hospitals, schools, post-secondary facilities, transit, roads, electrical generation, transmission and distribution projects, and other capital assets will total $19.0 billion over the fiscal plan period, and will be financed by $12.3 billion in borrowing, with the remainder funded by third parties such as the federal government and from internal cash flows.

Capital spending is projected to return to historical levels as the accelerated infrastructure program is wound down by the end of October 2011. Overall, total provincial debt is projected to increase to $60.4 billion by 2013/14.

Keeping Debt Affordable

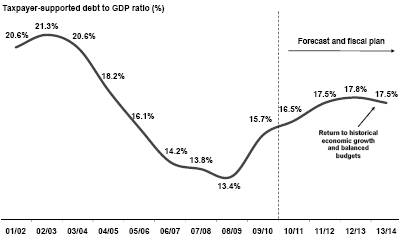

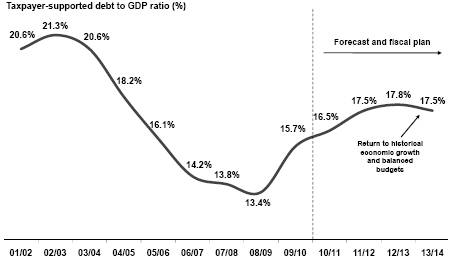

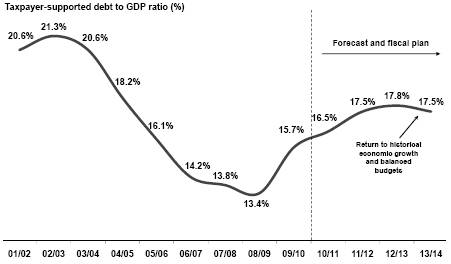

Due to the anticipated deficits, additional borrowing to support infrastructure spending, and lower GDP projections in the near term, the taxpayer-supported debt to GDP ratio will peak at 17.8 per cent in 2012/13.

Taxpayer-supported debt remains affordable

Budget and Fiscal Plan – 2011/12 to 2013/14

2

Summary

As government returns to balancing its budget, the accelerated infrastructure program winds down, and GDP growth and capital spending return to historical levels, this measure of affordability will return to a downward trend and fall to 17.5 per cent in 2013/14.

Risks to the Fiscal Plan

The main risks to the government’s fiscal plan include:

· risks to the BC economic outlook, largely due to the continued uncertainty surrounding global economic activity;

· assumptions underlying revenue and Crown corporation forecasts, such as economic factors, commodity prices and weather conditions; and

· utilization rates for government services, such as health care, children and family services, and income assistance.

Government has three main levels of prudence in its projections to mitigate the risks to the fiscal plan, including:

· the lower Ministry outlook for BC’s real GDP growth relative to the outlook provided by the Economic Forecast Council;

· Contingencies of $603 million in 2011/12, and $453 million in each of 2012/13 and 2013/14 to help manage unexpected pressures and fund priority initiatives; and

· a forecast allowance of $350 million in each year of the fiscal plan to guard against revenue volatility.

Conclusion

In summary, Budget 2011:

· maintains the core services of health care, education, and social services that British Columbians depend upon;

· augments priority program funding in the key areas of health and social services;

· delivers on government’s commitment to return to balanced budgets by 2013/14;

· continues government’s infrastructure program in support of government initiatives and to create jobs over the next three years;

· ensures the resumption of a downward trend in the debt to GDP ratio as the initial step in returning to the debt affordability levels enjoyed prior to the economic slowdown.

Budget and Fiscal Plan – 2011/12 to 2013/14

3

Part 1: THREE-YEAR FISCAL PLAN

Table 1.1 Three-Year Fiscal Plan — Operating Statement

| | 2010/11 | | Budget | | | | | |

| | | | Updated | | Estimate | | Plan | | Plan | |

($ millions) | | Budget | | Forecast | | 2011/12 | | 2012/13 | | 2013/14 | |

Revenue | | 39,153 | | 39,893 | | 41,337 | | 42,446 | | 44,091 | |

Expense | | (40,568 | ) | (41,008 | ) | (41,912 | ) | (42,536 | ) | (43,566 | ) |

Surplus (deficit) before forecast allowance | | (1,415 | ) | (1,115 | ) | (575 | ) | (90 | ) | 525 | |

Forecast allowance | | (300 | ) | (150 | ) | (350 | ) | (350 | ) | (350 | ) |

Surplus (deficit) | | (1,715 | ) | (1,265 | ) | (925 | ) | (440 | ) | 175 | |

Capital spending: | | | | | | | | | | | |

Taxpayer-supported capital spending | | 5,388 | | 4,905 | | 4,105 | | 3,155 | | 3,098 | |

Self-supported capital spending | | 2,771 | | 2,688 | | 3,243 | | 3,011 | | 2,415 | |

| | 8,159 | | 7,593 | | 7,348 | | 6,166 | | 5,513 | |

Provincial Debt: | | | | | | | | | | | |

Direct operating debt | | 7,511 | | 7,987 | | 8,763 | | 9,267 | | 8,599 | |

Taxpayer-supported debt | | 33,748 | | 33,388 | | 36,816 | | 39,162 | | 40,500 | |

Self-supported debt | | 13,709 | | 13,743 | | 16,271 | | 18,060 | | 19,505 | |

Total debt (including forecast allowance) | | 47,757 | | 47,281 | | 53,437 | | 57,572 | | 60,355 | |

Taxpayer-supported debt-to-GDP ratio | | 17.2 | % | 16.5 | % | 17.5 | % | 17.8 | % | 17.5 | % |

| | 2010 | | 2011 | | 2012 | | 2013 | |

Economic Forecast: | | | | | | | | | | | |

Real GDP growth | | 2.2 | % | 3.1 | % | 2.0 | % | 2.6 | % | 2.7 | % |

Nominal GDP growth | | 4.5 | % | 5.6 | % | 4.1 | % | 4.9 | % | 4.8 | % |

Introduction

Budget 2011 reflects government’s ongoing commitment to its key fiscal plan objectives:

· protection of essential health care, education, and social services;

· a balanced budget by 2013/14; and

· returning to a downward trend in the taxpayer-supported debt to GDP ratio to support maintaining a AAA credit rating.

As announced in November 2010, Budget 2011 is a status quo budget that confirms government’s commitment to maintaining the core services of health care, education, and social services that British Columbians depend upon.

In support of these priorities, Budget 2011 provides operating funding increases in the following areas:

· a $60 million increase in the Ministry of Health in 2013/14 — when added to the increases provided in Budget 2010, this represents an almost $2.0 billion increase in health funding over the fiscal plan period;

· a $65 million increase in the Ministry of Social Development over three years for income assistance to individuals and families in need; and

· a $153 million increase to the Contingencies Vote in 2011/12 to address unforeseen issues and provide fiscal management flexibility for the next Executive Council.

As well, school district funding will reach $8,357 per student full time equivalent by 2011/12, an increase of over 33 per cent since 2000/01.

Budget and Fiscal Plan – 2011/12 to 2013/14

Three-Year Fiscal Plan

The commitment to return to balanced budgets by 2013/14 was initially outlined in September Update 2009 and reaffirmed last year in Budget 2010. Following deficits of $925 million in 2011/12 and $440 million in 2012/13 the fiscal plan projects a surplus of $175 million in 2013/14. The return to balanced budgets will enable government to focus on and address the future needs of British Columbia’s families.

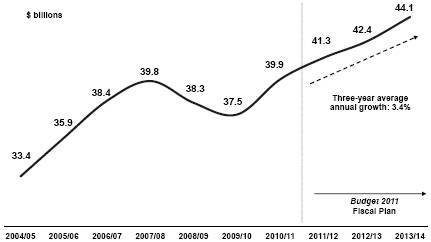

Chart 1.1 Bridging the deficit gap

Average annual revenue growth of 3.4 per cent is consistent with the Ministry of Finance economic forecast, and reflects strengthening economic conditions, rising commodity prices and improving forest harvest volumes expected over the next three years. The Ministry of Finance forecasts BC’s economy to grow by 2.0 per cent in 2011 and by 2.6 per cent in 2012, before returning to more historical levels in the medium term.

A cornerstone of government’s five year plan to balance the budget is management control of operating expenditures as identified in the expenditure management topic box in Budget 2010. Over the fiscal plan period, full realization of the efficiencies driven by the expenditure management strategy will result in an average annual growth rate of 2.0 per cent, enabling revenue growth to bridge the deficit gap by 2013/14.

Budget 2011 continues government’s commitment to an infrastructure spending plan that includes the completion of a number of projects that were part of the accelerated infrastructure plan to keep British Columbians working and help stimulate the economy during the global economic downturn.

Taxpayer-supported infrastructure spending on hospitals, schools, post-secondary facilities, transit, and roads will total $10.3 billion over the fiscal plan period, and will be financed by $6.5 billion in borrowing with the remainder funded by third parties such as the federal government, and from internal cash flows.

Self-supported infrastructure spending on electrical generation, transmission and distribution projects, the Port Mann Bridge and other capital assets will total $8.7 billion over the fiscal plan period, and will be financed by $5.8 billion in borrowing, with the remainder funded internally.

Budget and Fiscal Plan – 2011/12 to 2013/14

6

Three-Year Fiscal Plan

Capital spending is projected to return to historical levels as the accelerated infrastructure program winds down. More information on the three-year capital spending plan is found on page 25.

Government’s borrowing requirement for the next three years totals $21.4 billion, and includes $0.6 billion for operating needs and $8.5 billion to retire maturing debt in addition to the capital borrowing outlined above. Overall, total provincial debt is projected to increase to $60.4 billion by 2013/14. Additional information on the debt outlook is found starting on page 32.

Due to the anticipated deficits, additional borrowing to support infrastructure spending, and lower GDP projections in the near term, the taxpayer-supported debt to GDP ratio will peak at 17.8 per cent in 2012/13. As government returns to balancing its budget, the accelerated infrastructure program winds down, and GDP growth and capital spending return to historical levels, this measure of affordability will return to a downward trend and fall to 17.5 per cent in 2013/14.

Chart 1.2 Taxpayer-supported debt burden remains affordable

The major risks to the fiscal plan stem from changes in factors that government does not directly control. These include:

· Risks to the BC economic outlook, largely due to the continued uncertainty surrounding global economic activity.

· Assumptions underlying revenue and Crown corporation forecasts such as economic factors, commodity prices and weather conditions.

· Utilization rates for government services such as health care, children and family services, and income assistance.

Government incorporates three main levels of prudence in its projections to mitigate the risks to the fiscal plan:

· A lower Ministry outlook for BC’s real GDP growth relative to the outlook provided by the Economic Forecast Council (0.7 percentage points lower in 2011 and 0.4 percentage points lower in 2012).

Budget and Fiscal Plan – 2011/12 to 2013/14

7

Three-Year Fiscal Plan

· Government has included a forecast allowance of $350 million in each year of the fiscal plan to guard against revenue volatility.

· The fiscal plan includes contingencies of $60 3 million in 2011/12, and $45 3 million in each of 2012/13 and 2013/14 to help manage unexpected pressures and fund priority initiatives.

A complete discussion of the risks to the fiscal plan can be found beginning on page 35. Economic risks are discussed in the introduction to Part 3: Economic Review and Outlook.

Changes since Budget 2010

Since Budget 2010, changes in revenue and expense projections resulted in an improvement in the 2010/11 forecast and deterioration in the 2012/13 and 2013/14 projections, with 2011/12 relatively unchanged.

Table 1.2 Fiscal Plan Update — Changes from Budget 2010

($ millions) | | 2010/11 | | 2011/12 | | 2012/13 | | 2013/14 | |

Budget 2010 — Five Year Fiscal Plan | | (1,715 | ) | (945 | ) | (145 | ) | 410 | |

Revenue changes: | | | | | | | | | |

Taxation | | 744 | | 356 | | 349 | | 65 | |

Natural resources | | (454 | ) | (583 | ) | (685 | ) | (388 | ) |

Miscellaneous | | 321 | | 599 | | 56 | | 156 | |

Federal transfers | | 218 | | 297 | | 236 | | 260 | |

Commercial Crown corporation income | | (89 | ) | (155 | ) | (175 | ) | (147 | ) |

Total revenue changes | | 740 | | 514 | | (219 | ) | (54 | ) |

Forecast allowance updates | | 150 | | (50 | ) | 50 | | 50 | |

Projected spending lift in 2013/14 | | — | | — | | — | | 624 | |

Expense changes: | | | | | | | | | |

Forest firefighting and emergency costs | | 207 | | — | | — | | — | |

Contingencies | | — | | 153 | | 3 | | 3 | |

Health funding increase | | — | | — | | — | | 604 | |

Additional income assistance funding | | — | | 20 | | 30 | | 15 | |

Spending funded by third parties | | 259 | | 207 | | 21 | | 25 | |

Post secondary institutions | | 126 | | 154 | | 177 | | 219 | |

Other changes | | (152 | ) | (90 | ) | (105 | ) | (11 | ) |

Expense increases (decreases) | | 440 | | 444 | | 126 | | 855 | |

Net changes | | 450 | | 20 | | (295 | ) | (235 | ) |

Budget 2011 — Fiscal Plan | | (1,265 | ) | (925 | ) | (440 | ) | 175 | |

The change in revenue projections is due to:

· higher corporation income tax revenue and the impact of increases to the 2009 harmonized sales tax base, partially offset by lower personal income tax revenue and property transfer tax receipts;

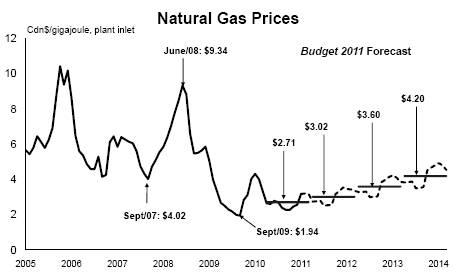

· lower natural resource revenue, mainly due to the effects of lower natural gas and electricity prices, a reduced outlook for bonus bid prices per hectare, and weaker stumpage rates, partly offset by improvements in coal and metal prices and Crown forest harvest volumes;

· improvement in other revenue sources, reflecting higher Medical Services Plan premium collections and increased post-secondary fee revenue; and

Budget and Fiscal Plan – 2011/12 to 2013/14

8

Three-Year Fiscal Plan

· increased federal contributions for health and social transfers, infrastructure projects and programs delivered by ministries on its behalf; and

· lower commercial Crown corporation net income.

The increases to expense primarily reflect the additional income assistance funding, and spending increases in programs funded by third parties and by post-secondary institutions. As well, 2010/11 includes higher than expected forest firefighting and emergency program costs, 2011/12 includes a $15 3 million lift to the Contingencies Vote, and 2013/14 includes the health funding increase.

Further details on the changes to the five year fiscal plan from the 2010/11 first Quarterly Report can be found in Appendix Table A5.

Revenue

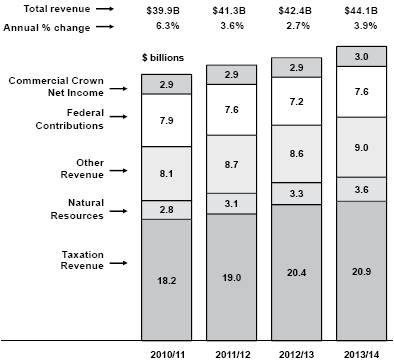

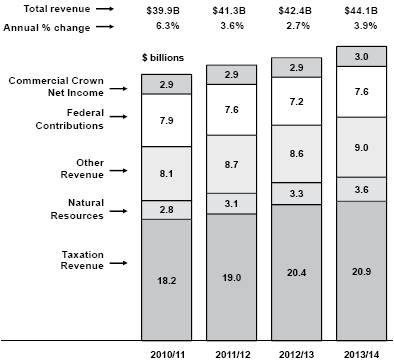

Chart 1.3 Revenue trends

Total revenue is expected to average 3.4 per cent annual growth over the fiscal plan period (2011/12 to 2013/14). This reflects strengthening economic conditions, rising natural gas and electricity prices and improving forest harvest volumes expected over the next three years.

Over the three years of the Budget 2011 fiscal plan, taxation revenue is expected to average 4.9 per cent annual growth, consistent with the Ministry of Finance economic forecast including projections for growth in nominal GDP, personal income, corporate profits, consumer expenditures, housing starts and residential investment. Growth in natural resource revenue is forecast to average 9.4 per cent over the next three years reflecting the relatively low base in 2010/11 and increases in commodity prices and markets, in particular for natural gas, lumber, electricity and coal. Revenue growth from fees, investment earnings and other miscellaneous sources is expected to average 3.3 per cent annually based on projected Medical Services Plan premium rate increases and forecasts provided by taxpayer supported Crown and SUCH sector agencies.

Excluding HST transition payments, federal government transfers are expected to average 1.9 per cent annual growth over the next three years as the scheduled end of stimulus and other one-time transfers partially offset standard growth in the Canada Health Transfer and Canada Social Transfer programs.

Budget and Fiscal Plan – 2011/12 to 2013/14

9

Three-Year Fiscal Plan

Chart 1.4 Revenue forecast

Commercial Crown net income is expected to average 0.8 per cent annual growth over three years reflecting improvements from BC Hydro, LDB and BCLC, partly offset by declining net income from ICBC. More detail on Crown corporation net income is provided in this chapter.

Table 1.3 Major Factors Underlying Revenue

Calendar Year | | February 15, 2011 | | First Quarterly Report | |

Per cent growth unless otherwise indicated | | 2010 | | 2011 | | 2012 | | 2013 | | 2010 | | 2011 | | 2012 | | 2013 | |

Real GDP | | 3.1 | | 2.0 | | 2.6 | | 2.7 | | 3.1 | | 2.2 | | 2.8 | | 2.8 | |

Nominal GDP | | 5.6 | | 4.1 | | 4.9 | | 4.8 | | 5.0 | | 4.0 | | 5.1 | | 5.1 | |

Personal income | | 3.0 | | 3.5 | | 4.5 | | 4.4 | | 2.7 | | 3.6 | | 4.6 | | 4.6 | |

Corporate profits | | 19.4 | | 8.6 | | 6.5 | | 6.8 | | 19.6 | | 9.3 | | 7.8 | | 7.6 | |

Consumer expenditures | | 4.0 | | 4.6 | | 5.0 | | 4.9 | | 4.4 | | 4.6 | | 5.0 | | 5.1 | |

Consumer expenditures on durable goods | | 4.0 | | 2.3 | | 2.5 | | 2.2 | | 6.1 | | 2.2 | | 2.5 | | 2.5 | |

Business investment | | 7.0 | | 3.9 | | 5.8 | | 5.5 | | 2.6 | | 4.5 | | 5.0 | | 5.7 | |

Residential investment | | 21.7 | | 3.7 | | 6.7 | | 5.2 | | 14.6 | | 6.6 | | 4.9 | | 5.2 | |

Retail sales | | 4.3 | | 4.1 | | 4.5 | | 4.4 | | 5.2 | | 4.1 | | 4.5 | | 4.6 | |

Employment | | 1.7 | | 1.4 | | 1.8 | | 1.7 | | 1.9 | | 1.4 | | 1.8 | | 1.8 | |

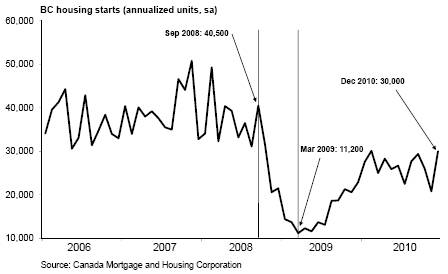

BC Housing starts | | 64.7 | | -5.8 | | 6.4 | | 2.3 | | 46.8 | | 1.3 | | 4.8 | | 4.6 | |

US Housing starts | | 6.1 | | 3.8 | | 31.1 | | 12.5 | | 1.9 | | 15.1 | | 26.2 | | 11.0 | |

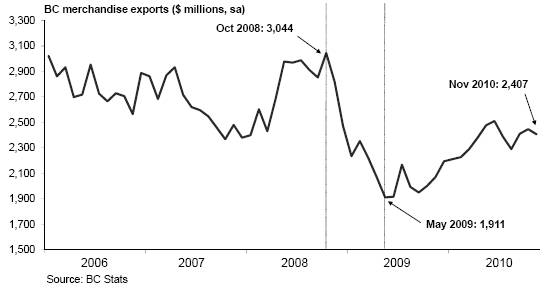

SPF 2x4 price ($US/thousand board feet) | | $ | 256 | | $ | 263 | | $ | 288 | | $ | 300 | | $ | 240 | | $ | 238 | | $ | 288 | | $ | 300 | |

Pulp ($US/tonne) | | $ | 932 | | $ | 888 | | $ | 738 | | $ | 700 | | $ | 920 | | $ | 865 | | $ | 738 | | $ | 700 | |

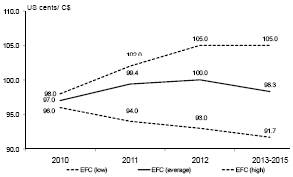

Exchange rate (US cents/Canadian dollar) | | 97.1 | | 99.7 | | 100.5 | | 97.6 | | 96.1 | | 98.9 | | 98.5 | | 97.9 | |

| | | | | | | | | | | | | | | | | |

Fiscal Year | | 2010/11 | | 2011/12 | | 2012/13 | | 2013/14 | | 2010/11 | | 2011/12 | | 2012/13 | | 2013/14 | |

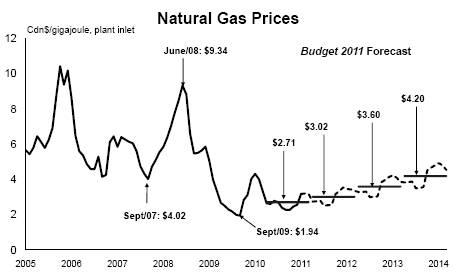

Natural gas price ($Cdn/GJ at plant inlet) | | $ | 2.71 | | $ | 3.02 | | $ | 3.60 | | $ | 4.20 | | $ | 3.35 | | $ | 4.02 | | $ | 4.64 | | $ | 5.31 | |

Bonus bids average bid price per hectare ($) | | $ | 1,908 | | $ | 500 | | $ | 550 | | $ | 575 | | $ | 1,500 | | $ | 943 | | $ | 1,198 | | $ | 1,113 | |

Electricity price ($US/mega-watt hour, Mid-C) | | $ | 34 | | $ | 37 | | $ | 43 | | $ | 46 | | $ | 40 | | $ | 45 | | $ | 48 | | $ | 51 | |

Metallurgical coal price ($US/tonne, fob west coast) | | $ | 212 | | $ | 224 | | $ | 218 | | $ | 212 | | $ | 222 | | $ | 232 | | $ | 234 | | $ | 222 | |

Copper price ($US/lb) | | $ | 3.44 | | $ | 3.65 | | $ | 3.40 | | $ | 3.04 | | $ | 2.91 | | $ | 3.00 | | $ | 2.75 | | $ | 2.50 | |

Crown harvest volumes (million cubic metres) | | 57.5 | | 59.0 | | 60.0 | | 60.0 | | 50.0 | | 52.0 | | 55.0 | | 55.0 | |

Budget and Fiscal Plan – 2011/12 to 2013/14

10

Three-Year Fiscal Plan

Major Revenue Sources

Key assumptions and sensitivities relating to revenue are provided in Appendix Table A6. The major revenue components are:

· Personal income tax — over the next three years, the base revenue is forecast to average 5.9 per cent annual growth over the three year plan, consistent with Budget 2011 projections of personal and labour incomes. Actual revenue realized by government incorporates almost $1.3 billion of personal income tax reductions provided to BC residents to help mitigate the impacts of the introduction of HST.

Table 1.4 Personal Income Tax Revenue

($ millions) | | 2011/12 | | 2012/13 | | 2013/14 | |

Base personal income tax revenue | | 6,182 | | 6,579 | | 6,997 | |

Annual growth | | 4.9 | % | 6.4 | % | 6.4 | % |

Previously announced measures: | | | | | | | |

– Basic personal amount tax credit increased to $11,000 | | (183 | ) | (196 | ) | (209 | ) |

– Elimination of sales tax & introduction of BC HST tax credit | | (232 | ) | (232 | ) | (232 | ) |

– Federal government | | (8 | ) | (9 | ) | (9 | ) |

– Dividend tax credit | | 33 | | 36 | | 37 | |

– Other measures | | 4 | | 11 | | 12 | |

Budget 2011 revenue | | 5,796 | | 6,189 | | 6,596 | |

Personal income growth (calendar year) | | 3.5 | % | 4.5 | % | 4.4 | % |

Labour income growth (calendar year) | | 4.0 | % | 4.7 | % | 4.6 | % |

Elasticity(1) (calendar year basis, policy neutral) | | 1.2 | | 1.4 | | 1.4 | |

(1) Per cent growth in current year tax relative to per cent growth in personal income.

Adjusting for the tax measures and the prior-year adjustment in 2010/11, actual annual growth is up 8.3 per cent in 2011/12, and rising 6.8 per cent and 6.6 per cent over the next two years. The higher growth in 2011/12 is mainly due to the $230 million prior-year adjustment reducing 2010/11 revenue.

· Corporate income tax — declining $67 million in 2011/12 as the higher instalment payments resulting from the improvement in the federal outlook of the national tax base are offset by a lower prior-year adjustment payment forecast from the federal government. Revenue increases 19.2 per cent in 2012/13, but falls 22 per cent in the following year, reflecting changes in payment share, instalments and year-end settlement payments with the federal government with respect to 2011 and 2012. The revenue forecast incorporates the tax rate reductions supporting the Revenue Neutral Carbon Tax Plan — namely the general rate reduction to 10.0 per cent in 2011 and the planned reduction of the small business tax rate to zero per cent, effective April 1, 2012. For more details on carbon tax recycling, see the Revenue Neutral Carbon Tax topic box on page 45.

Table 1.5 Corporate Income Tax Revenue

($ millions) | | 2011/12 | | 2012/13 | | 2013/14 | |

Advance instalments from the federal government: | | | | | | | |

– Payment share | | 11.6 | % | 13.6 | % | 12.9 | % |

– Advances | | 1,498 | | 1,677 | | 1,638 | |

International Business Activity Act refunds | | (20 | ) | (20 | ) | (15 | ) |

Prior-year adjustment | | 93 | | 215 | | (162 | ) |

Corporate income tax revenue | | 1,571 | | 1,872 | | 1,461 | |

Annual per cent growth | | -4.1 | % | 19.2 | % | -22.0 | % |

Budget and Fiscal Plan – 2011/12 to 2013/14

11

Three-Year Fiscal Plan

· Sales taxes — the combined revenue from harmonized sales tax (HST), provincial sales tax (PST) and the tax on designated property is expected to average 5.8 per cent annual growth over the fiscal plan in line with nominal consumer expenditure and residential investment. In 2011/12, the forecast assumes $30 million in PST revenue representing expected audit collections in respect of prior years.

Table 1.6 Sales Taxes Revenue

($ millions) | | 2011/12 | | 2012/13 | | 2013/14 | |

Harmonized Sales Tax (BC’s portion of HST) | | | | | | | |

Gross | | 7,230 | | 7,646 | | 8,068 | |

Temporary restrictions of input tax credits | | 163 | | 171 | | 180 | |

Rebates | | (1,573 | ) | (1,653 | ) | (1,732 | ) |

BC’s portion of HST | | 5,820 | | 6,164 | | 6,516 | |

Social service tax | | 30 | | — | | — | |

Tax on designated property | | 86 | | 87 | | 88 | |

| | | | | | | |

Annual per cent change (calendar year) | | 2011 | | 2012 | | 2013 | |

Consumer expenditure | | 4.6 | % | 5.0 | % | 4.9 | % |

Residential investment | | 3.7 | % | 6.7 | % | 5.2 | % |

Government expenditures | | 1.0 | % | 2.2 | % | 2.8 | % |

Nominal GDP | | 4.1 | % | 4.9 | % | 4.8 | % |

Retail sales | | 4.1 | % | 4.5 | % | 4.4 | % |

· Carbon tax — as announced in Budget 2008, the carbon tax rate per tonne of CO2- equivalent will increase by $5 each year to $30 per tonne by July 1, 2012. The forecast assumes that purchased volumes of natural gas and consumption of gasoline will each grow by 1.0 per cent annually. Revenue is expected to increase in line with these higher rates and assumed volume growth. Carbon tax revenue is fully returned to taxpayers through tax reductions. For more details on carbon tax recycling, see the Revenue Neutral Carbon Tax topic box on page 45.

· Property tax — revenue is expected to grow by only 0.4 per cent in 2011/12 reflecting the effects of introducing the Industrial Property Tax Credit for light and major industrial properties and other tax measures including the Northern and Rural Homeowner Benefit announced in Budget 2010. Over the next two years, revenue is forecast to average 4.7 per cent growth, in line with expected inflation and new construction activity.

· Property transfer tax — consistent with the outlook for BC housing starts, the 2011/12 revenue is expected to decline 4.7 per cent from 2010/11. Over the next two years, annual revenue growth is forecast to average 4.0 per cent — in line with expected return to trend levels and the average growth in BC housing starts.

· Natural gas royalties — over the next three years, revenue increases on average by 33 per cent per year due to rising natural gas prices and production volumes, partially offset by increasing production from wells qualifying for royalty programs and credits. Although prices are forecast to average 16 per cent annual growth over the next three years, they are expected to remain below recent historical levels until 2013/14. Growth in production volumes is due in part to the effects of the royalty programs and expected increase in demand and prices with an improving North American economy. The government continues to provide royalty programs and credits to foster industry investment in exploration and development. See Appendix Table A7 for more details regarding natural gas price forecasts.

Budget and Fiscal Plan – 2011/12 to 2013/14

12

Three-Year Fiscal Plan

Chart 1.5 Revenue from energy, metals and minerals

· Other energy, metals and minerals — average annual revenue growth from sales of Crown land tenures is forecast to decline only 1.0 per cent over the three years as the lower outlook for average bid prices per hectare compared to 2010/11 is offset by the nine-year deferral of revenue recognition. Revenue from other energy, metals and minerals increases $128 million (20.0 per cent) in 2011/12 mainly due to the improvement in the outlook of coal and metal prices. Revenue increases $16 million (2.1 per cent) and $10 million (1.3 per cent) over the next two years mainly due to higher Columbia River Treaty electricity sales reflecting rising electricity prices.

· Forests — revenue is forecast to increase $104 million or 25 per cent in 2011/12 as lumber prices and US housing markets including lumber exports are expected to recover. Despite this strong annual growth, revenue is projected to be well below historical levels of over a billion dollars. Over the next two years revenue is expected to increase $8 million and $56 million respectively, as increasing stumpage revenue is offset by declining border tax revenue collected under the Softwood Lumber Agreement (SLA). SLA border tax revenue is expected to decrease as the rate applied to US exports falls to 5 per cent from 10 per cent, consistent with the assumed recovery of lumber prices to US$300 per thousand feet.

· Fees, investment earnings and other miscellaneous sources — averaging 3.3 per cent annual growth over the three year fiscal plan period reflecting projected increases to Medical Services Plan premium rates in support of rising health care expenditures; increasing ministry recoveries and earnings from fiscal agency loans; and forecasts provided by the SUCH sector and taxpayer supported Crown corporations. Ministry recoveries and earnings from fiscal agency loans are forecast to grow 15.6 per cent over the next three years with offsetting expenses resulting in no impact on the bottom line.

· Health and social transfers — Over the three years, revenue is expected to average 5.2 per cent annual growth reflecting national base growth and a rising BC population share.

Budget and Fiscal Plan – 2011/12 to 2013/14

13

Three-Year Fiscal Plan

Table 1.7 Federal Government Contributions

($ millions) | | 2011/12 | | 2012/13 | | 2013/14 | |

Canada Health Transfer (CHT) | | 3,806 | | 4,050 | | 4,312 | |

Wait Times Reduction Transfer | | 33 | | 34 | | 34 | |

Deferred health equipment grants | | 23 | | 23 | | 22 | |

Canada Social Transfer (CST) | | 1,536 | | 1,589 | | 1,643 | |

Total health and social transfers | | 5,398 | | 5,696 | | 6,011 | |

| | 4.5 | % | 5.5 | % | 5.5 | % |

BC share of national population (June 1) | | 13.34 | % | 13.40 | % | 13.45 | % |

Harmonized sales tax transition payments | | 580 | | — | | — | |

Other contributions | | 1,602 | | 1,519 | | 1,548 | |

· HST transitional funding — in order to facilitate the participation of the province in the harmonized sales tax system, Canada committed to provide $1.6 billion in transitional funding over the three years 2009/10 to 2011/12. The province has received the first two instalments totalling $1,019 million. The last instalment in 2011/12 will be $580 million.

· Other federal contributions — down 18.5 per cent or $364 million in 2011/12 primarily reflecting the scheduled end of stimulus funding for community development, police officer recruitment, the contribution associated with the elimination of the corporation capital tax and reduced funding for local government, labour market development, disaster financial assistance and strategic training and transition. In 2012/13, revenue is expected to decline by $83 million mainly due to reduced funding for BC Housing Management Commission (with offsetting expenses). Other federal contributions are expected to grow 1.9 per cent in 2013/14.

Commercial Crown Corporation Net Income

· British Columbia Hydro and Power Authority — BC Hydro’s net income is forecast to average approximately $600 million per year over the fiscal plan period. The stable forecast reflects BC Hydro’s allowed return on equity (ROE), which will decline from 14.38 per cent for 2011/12 to 12.75 per cent in each of the next two fiscal years. The impact of the ROE decline is offset by projected increases to BC Hydro’s equity.

Government recently introduced two changes that will mitigate rate increases to taxpayers:

· BC Hydro’s deemed equity for rate-setting purposes is now based on assets-in-service rather than debt plus equity in order to more closely mirror the more widely used method for regulated utilities.

· Water rental rates paid by hydro power producers have been indexed to CPI changes instead of BC Hydro’s general rate increase to be consistent with other operating expense assumptions.

Budget and Fiscal Plan – 2011/12 to 2013/14

14

Three-Year Fiscal Plan

· British Columbia Liquor Distribution Branch — LDB’s revenue projections have been reduced by 4.6 per cent compared to the Budget 2010 outlook for the fiscal plan period, reflecting a change in consumer purchasing patterns resulting from the recent economic downturn. While the change has reduced LDB’s revenue base, a modest annual growth of 2.4 per cent is projected.

· British Columbia Lottery Corporation — BCLC’s net income was also affected by the economic downturn, as consumers reduced their discretionary spending on lottery games and casino gambling. Revenues are down 4.7 per cent over the fiscal plan period compared to the projections in Budget 2010. However, BCLC is projecting moderate annual growth of 3.4 per cent as a result of continuing product development (primarily in PlayNow internet gaming), distribution enhancements, and facility improvements to casinos and gaming community centres.

The government projects it will distribute 20 per cent ($669 million) of its gaming income to charities and local governments over the next three years. As well, $441 million of the gaming income retained by government will be allocated to the Health Special Account in support of health services.

· Insurance Corporation of British Columbia — ICBC’s net income outlook is forecast at $290 million in 2011, declining to $235 million by 2013. The outlook reflects moderate growth in the number of insured vehicles and longer term claims trends. The decline in net income is primarily due to a decrease in investment income reflecting the remittance of ICBC’s excess optional capital to the consolidated revenue fund in support of core government services.

ICBC is undertaking a multi-year $400 million Transformation Program that is expected to promote a fairer, customer-based risk pricing model, resulting in better rates for safer drivers; simplified systems and processes to facilitate better support for customers and business partners with less paperwork; and more efficient business practices that will promote operating cost savings. The Transformation Program will be funded entirely from Optional insurance capital so as to not impact Basic insurance rates.

· Transportation Investment Corporation (TI Corp) — TI Corp manages the construction of the new Port Mann Bridge, which is scheduled to open ahead of schedule in December 2012. TI Corp’s projections in the fiscal plan reflect operating losses during the construction phase, changing to net income as tolls are introduced.

Budget and Fiscal Plan – 2011/12 to 2013/14

15

Three-Year Fiscal Plan

Table 1.8 Revenue by Source

| | 2010/11 | | Budget | | | | | |

| | | | Updated | | Estimate | | Plan | | Plan | |

($ millions) | | Budget | | Forecast | | 2011/12 | | 2012/13 | | 2013/14 | |

Taxation revenue | | | | | | | | | | | |

Personal income | | 5,861 | | 5,354 | | 5,796 | | 6,189 | | 6,596 | |

Corporate income | | 847 | | 1,638 | | 1,571 | | 1,872 | | 1,461 | |

Harmonized sales | | 3,784 | | 4,171 | | 5,820 | | 6,164 | | 6,516 | |

Other sales (1) | | 1,399 | | 1,399 | | 116 | | 87 | | 88 | |

Fuel | | 877 | | 946 | | 964 | | 969 | | 985 | |

Carbon | | 727 | | 740 | | 950 | | 1,166 | | 1,232 | |

Tobacco | | 686 | | 737 | | 676 | | 676 | | 676 | |

Property | | 1,906 | | 1,891 | | 1,898 | | 1,987 | | 2,080 | |

Property transfer | | 900 | | 850 | | 810 | | 854 | | 876 | |

Other (2) | | 435 | | 440 | | 413 | | 424 | | 434 | |

| | 17,422 | | 18,166 | | 19,014 | | 20,388 | | 20,944 | |

Natural resource revenue | | | | | | | | | | | |

Natural gas royalties | | 698 | | 365 | | 447 | | 597 | | 856 | |

Forests | | 491 | | 422 | | 526 | | 534 | | 590 | |

Other resource (3) | | 2,019 | | 1,967 | | 2,127 | | 2,138 | | 2,163 | |

| | 3,208 | | 2,754 | | 3,100 | | 3,269 | | 3,609 | |

Other revenue | | | | | | | | | | | |

Medical Services Plan premiums | | 1,741 | | 1,798 | | 1,945 | | 2,081 | | 2,193 | |

Other fees (4) | | 2,615 | | 2,749 | | 2,762 | | 2,734 | | 2,773 | |

Investment earnings (5) | | 910 | | 891 | | 1,037 | | 1,170 | | 1,334 | |

Miscellaneous (6) | | 2,560 | | 2,709 | | 2,958 | | 2,656 | | 2,682 | |

| | 7,826 | | 8,147 | | 8,702 | | 8,641 | | 8,982 | |

Contributions from the federal government | | | | | | | | | | | |

Health and social transfers | | 5,165 | | 5,168 | | 5,398 | | 5,696 | | 6,011 | |

Harmonized sales tax transition payments | | 769 | | 769 | | 580 | | — | | — | |

Other federal contributions (7) | | 1,751 | | 1,966 | | 1,602 | | 1,519 | | 1,548 | |

| | 7,685 | | 7,903 | | 7,580 | | 7,215 | | 7,559 | |

Commercial Crown corporation net income | | | | | | | | | | | |

BC Hydro | | 617 | | 571 | | 611 | | 584 | | 626 | |

Liquor Distribution Branch | | 974 | | 897 | | 925 | | 946 | | 967 | |

BC Lotteries (net of payments to federal government) | | 1,106 | | 1,071 | | 1,096 | | 1,137 | | 1,179 | |

ICBC (8) | | 303 | | 361 | | 290 | | 277 | | 235 | |

Transportation Investment Corporation (Port Mann) | | (19 | ) | (9 | ) | (15 | ) | (49 | ) | (48 | ) |

Other (5) | | 31 | | 32 | | 34 | | 38 | | 38 | |

| | 3,012 | | 2,923 | | 2,941 | | 2,933 | | 2,997 | |

Total revenue | | 39,153 | | 39,893 | | 41,337 | | 42,446 | | 44,091 | |

(1) Includes social service tax and, after June 30, 2010, continuation of the tax on private sales of vehicles now at 12%. More details are available in Table A6.

(2) Corporation capital, insurance premium and hotel room taxes.

(3) Columbia River Treaty, other energy and minerals, water rental and other resources.

(4) Post-secondary, healthcare-related, motor vehicle, and other fees.

(5) The 2010/11 budget was restated to reflect the continued accounting of the BC Railway Company as a commercial entity.

(6) Includes asset dispositions, reimbursements for healthcare and other services provided to external agencies, and other recoveries.

(7) Includes contributions for health, education, community development, housing and social service programs, and transportation projects.

(8) The amounts represent projected earnings on ICBC’s fiscal year basis (December).

Budget and Fiscal Plan – 2011/12 to 2013/14

16

Three Year Fiscal Plan

Table 1.9 Expense by Ministry, Program and Agency

| | 2010/11 (1) | | Budget | | | | | |

($ millions) | | Budget | | Updated

Forecast | | Estimate

2011/12 | | Plan

2012/13 | | Plan

2013/14 | |

Office of the Premier | | 10 | | 10 | | 9 | | 9 | | 9 | |

Aboriginal Relations and Reconciliation | | 81 | | 81 | | 80 | | 80 | | 81 | |

Advanced Education | | 1,978 | | 1,978 | | 1,980 | | 1,989 | | 1,989 | |

Agriculture | | 69 | | 69 | | 66 | | 66 | | 66 | |

Attorney General | | 458 | | 458 | | 443 | | 443 | | 443 | |

Children and Family Development | | 1,334 | | 1,334 | | 1,331 | | 1,331 | | 1,331 | |

Community, Sport and Cultural Development | | 340 | | 340 | | 254 | | 254 | | 254 | |

Education | | 5,164 | | 5,164 | | 5,242 | | 5,264 | | 5,264 | |

Energy and Mines | | 424 | | 424 | | 418 | | 420 | | 389 | |

Environment | | 136 | | 136 | | 130 | | 130 | | 130 | |

Finance | | 189 | | 274 | | 157 | | 154 | | 143 | |

Forests, Lands and Natural Resource Operations | | 633 | | 801 | | 590 | | 587 | | 582 | |

Health | | 14,796 | | 14,796 | | 15,714 | | 16,161 | | 16,765 | |

Jobs, Tourism and Innovation | | 269 | | 269 | | 237 | | 234 | | 234 | |

Labour, Citizens’ Services and Open Government | | 581 | | 581 | | 566 | | 566 | | 566 | |

Public Safety and Solicitor General | | 637 | | 676 | | 635 | | 635 | | 635 | |

Social Development | | 2,355 | | 2,355 | | 2,339 | | 2,349 | | 2,334 | |

Transportation and Infrastructure | | 753 | | 753 | | 807 | | 807 | | 807 | |

Total ministries and Office of the Premier | | 30,207 | | 30,499 | | 30,998 | | 31,479 | | 32,022 | |

Management of public funds and debt | | 1,301 | | 1,256 | | 1,349 | | 1,403 | | 1,502 | |

Contingencies | | 450 | | 450 | | 603 | | 453 | | 453 | |

Funding for capital expenditures | | 1,751 | | 1,284 | | 1,543 | | 887 | | 591 | |

Legislative and other appropriations | | 123 | | 123 | | 125 | | 125 | | 126 | |

Subtotal | | 33,832 | | 33,612 | | 34,618 | | 34,347 | | 34,694 | |

Prior year liability adjustments | | — | | (55 | ) | — | | — | | — | |

Consolidated revenue fund expense | | 33,832 | | 33,557 | | 34,618 | | 34,347 | | 34,694 | |

Expenses recovered from external entities | | 2,654 | | 2,913 | | 2,651 | | 2,682 | | 2,856 | |

Funding provided to service delivery agencies | | (20,704 | ) | (20,250 | ) | (21,369 | ) | (20,817 | ) | (21,024 | ) |

Ministry and special office direct program spending | | 15,782 | | 16,220 | | 15,900 | | 16,212 | | 16,526 | |

Service delivery agency expense: | | | | | | | | | | | |

School districts | | 5,440 | | 5,505 | | 5,513 | | 5,533 | | 5,535 | |

Universities | | 3,680 | | 3,785 | | 3,880 | | 3,954 | | 4,005 | |

Colleges and institutes | | 1,047 | | 1,068 | | 1,063 | | 1,068 | | 1,075 | |

Health authorities and hospital societies | | 11,141 | | 11,102 | | 11,989 | | 12,269 | | 12,709 | |

Other service delivery agencies | | 3,478 | | 3,328 | | 3,567 | | 3,500 | | 3,716 | |

Total service delivery agency expense | | 24,786 | | 24,788 | | 26,012 | | 26,324 | | 27,040 | |

Total expense | | 40,568 | | 41,008 | | 41,912 | | 42,536 | | 43,566 | |

(1) The 2010/11 budget estimate and revised forecast have been restated to reflect government’s current organization and accounting policies.

Budget and Fiscal Plan – 2011/12 to 2013/14

17

Three Year Fiscal Plan

Expense

Budget 2011 is a status quo budget that confirms government’s commitment to maintaining the core services of health care, education, and social services that British Columbians depend upon. Key to maintaining this commitment is effective management control of operating expenditures, including the targeting of resources to these core services as a first priority.

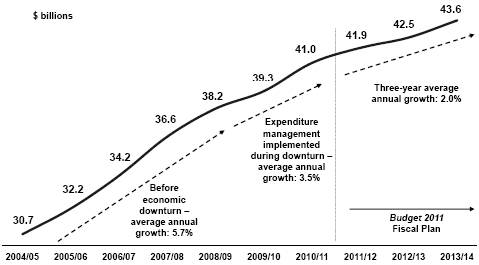

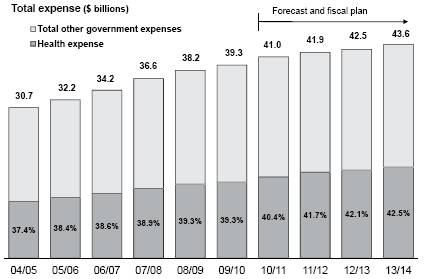

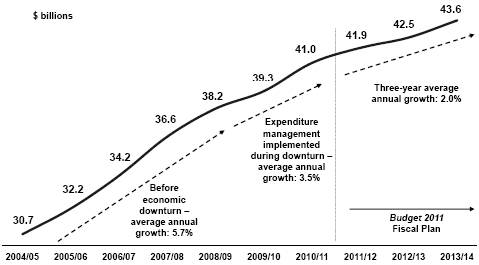

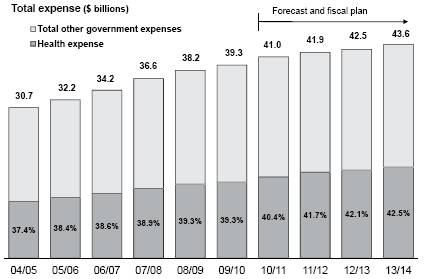

Chart 1.6 Expense trends

During the four years leading up to the economic downturn in the fall of 2008, government spending grew by an average annual rate of 5.7 per cent. As a result of the expenditure management measures that were initiated in Budget 2009 and expanded upon in the September Update 2009, the annual rate of growth decreased to an average of 3.5 per cent in the two fiscal years since 2008/09.

In Budget 2010, government continued the implementation of significant expenditure management strategies initiated in the previous year. A number of the measures announced in Budget 2010 had adjustments to ministry budgets in 2011/12. No additional expenditure management strategies or program reductions are implemented in Budget 2011. While there are some time-limited programs that conclude during the current three year fiscal plan, government may decide at a later date to continue these programs.

As a result of government’s expenditure management, the average annual growth in expense over the next three years is limited to 2.0 per cent, enabling revenue growth to bridge the deficit gap. This rate of expense growth will still enable government to increase its spending by $2.6 billion over the fiscal plan period, with total spending to reach $43.6 billion by 2013/14.

Consolidated Revenue Fund Spending

In support of government’s priority in maintaining core services, Budget 2011 provides operating funding increases in the following areas:

· a $604 million increase in the Ministry of Health in 2013/14 — when added to the increases provided in Budget 2010, this represents a $2.0 billion increase in health funding over the fiscal plan period; and

Budget and Fiscal Plan – 2011/12 to 2013/14

18

Three-Year Fiscal Plan

· a $65 million increase in the Ministry of Social Development over three years for income assistance to individuals and families in need.

As well, the Contingencies Vote will increase by $153 million in 2011/12 to address unforeseen issues and provide fiscal management flexibility for the next Executive Council.

Maintaining our Health Care System

Budget 2011 confirms government’s ongoing commitment to health care. By 2013/14, the Ministry of Health’s budget will increase by almost $2.0 billion, or over 13 per cent, compared to 2010/11.

Chart 1.7 Ministry of Health budget increases

Funding increases for the Ministry of Health are focused on sustaining front-line service delivery:

· $1.4 billion for the Regional Health Sector for services delivered by health authorities and other service delivery partners, including acute care services, community and home-based services, assisted living and residential care services, mental health and addictions services, health promotion, disease prevention and other public health services.

· $438 million for the Medical Services Plan to fund increased volumes of physician and laboratory services, and recruitment and retention of specialists and family physicians, particularly in rural and remote communities.

· $144 million for PharmaCare for coverage of new drugs and volume and price increases for prescription drugs.

It should also be noted that all health authorities have provided balanced budget plans to the Ministry of Health for each year of the fiscal plan period.

Total health spending (see Appendix Table A12) includes all health care related spending by the Ministry of Health, other ministries such as Children and Family Development and Social Development, and health authorities/hospital societies. As a proportion of total government expenses, health spending will soon approach 43 per cent, and therefore it is essential that costs be managed effectively and innovative cost controls continue to be sought.

Budget and Fiscal Plan – 2011/12 to 2013/14

19

Three-Year Fiscal Plan

Chart 1.8 Health spending as a percentage of total government expenses

Health Care Costs and Outcomes

While costs must be managed to keep the system sustainable, health outcomes are also a critical consideration. As indicated in Table 1.10, not only is BC comparatively efficient in providing health services, but the province also ranks highly in terms of results when compared to other Canadian jurisdictions.

Table 1.10 Health Per Capita Costs and Outcomes: Canadian Comparisons

Province | | Per Capita

Health Care

Costs ($) | | Life

Expectancy at

Birth (Years) | | Infant Mortality

per 1000 Live

Births | | Cancer Mortality Rate

per 100,000

Population | | Diseases of the Heart

Mortality Rate per

100,000 Population | |

Quebec | | 3,341 | | 80.7 | | 4.5 | | 181.6 | | 103.6 | |

British Columbia | | 3,544 | | 81.2 | | 4.0 | | 152.7 | | 102.3 | |

Ontario | | 3,548 | | 81.0 | | 5.2 | | 159.1 | | 109.8 | |

New Brunswick | | 3,789 | | 80.0 | | 4.3 | | 172.1 | | 115.5 | |

Nova Scotia | | 3,944 | | 79.7 | | 3.3 | | 186.4 | | 122.4 | |

Prince Edward Island | | 3,988 | | 80.2 | | 5.0 | | 160.9 | | 148.0 | |

Saskatchewan | | 4,077 | | 79.5 | | 5.8 | | 161.3 | | 126.1 | |

Manitoba | | 4,155 | | 79.3 | | 7.3 | | 172.5 | | 125.5 | |

Alberta | | 4,295 | | 80.5 | | 6.0 | | 155.1 | | 122.4 | |

Newfoundland | | 4,564 | | 78.3 | | 7.5 | | 195.4 | | 156.9 | |

Sources: Canadian Institute for Health Information, 2010 (cost data) and Ministry of Health (outcomes data).

While our per-capita costs are the second lowest in Canada as of 2010, key health outcomes are among the highest. Of the four health indicators shown, BC has the best outcomes in terms of high Life Expectancy and low rates of Cancer Mortality and Mortality Related to Diseases of the Heart compared to the other provinces; and second best outcome in terms of low Infant Mortality Rates.

Health Funding Report and Plan

As required under Part 14 of the Consumption Tax Rebate and Transition Act the following table shows the health funding report for 2010/11 and the health funding plan for 2011/12 to 2013/14.

Budget and Fiscal Plan – 2011/12 to 2013/14

20

Three-Year Fiscal Plan

Table 1.11 Health Funding Report and Plan

($ millions) | | 2010/11 | | 2011/12 | | 2012/13 | | 2013/14 | |

Harmonized sales tax | | 4,171 | | 5,820 | | 6,164 | | 6,516 | |

Medical Services Plan premiums | | 1,798 | | 1,945 | | 2,081 | | 2,193 | |

Tobacco tax | | 737 | | 676 | | 676 | | 676 | |

Health Special Account | | 147 | | 147 | | 147 | | 147 | |

Canada Health Transfer | | 3,597 | | 3,806 | | 4,050 | | 4,312 | |

Wait Times Reduction Transfer | | 33 | | 33 | | 34 | | 34 | |

Total revenue from above sources | | 10,483 | | 12,427 | | 13,152 | | 13,878 | |

Total government spending on health | | 16,557 | | 17,477 | | 17,914 | | 18,519 | |

Health spending in excess of revenue | | 6,074 | | 5,050 | | 4,762 | | 4,641 | |

For 2010/11, the government spending on health services by function (see Appendix Table A12) is projected to exceed forecasted revenues from the harmonized sales tax, Medical Services Plan premiums, tobacco tax, Health Special Account, Canada Health Transfer and Wait Times Reduction Transfer by $6,074 million. Next year’s health funding report for 2010/11 will be based on actual revenues for 2010/11 as reported in the 2010/11 Public Accounts.

For 2011/12 to 2013/14, total government spending on health services by function is projected to exceed forecasted revenues from the harmonized sales tax, Medical Services Plan premiums, tobacco tax, Health Special Account, Canada Health Transfer and Wait Times Reduction Transfer by a total of $14.5 billion over the three year fiscal plan.

Maintaining Education Funding

K–12 Education

Total operating funding for School Districts remains at $4.7 billion per year, however the average funding per student FTE is estimated to increase slightly to $8,357. This includes funding for full day kindergarten (FDK) for five year olds, and the teacher’s compensation increase that forms part of the current collective agreement.

Chart 1.9 Student enrolment and per pupil funding (public schools)

Budget and Fiscal Plan – 2011/12 to 2013/14

21

Three-Year Fiscal Plan

In 2010/11, more than 15,500 additional students were funded and enrolled in FDK in 52 public school districts, transitioning approximately 50 per cent of the estimated 30,200 kindergarten students to full day programs. During the second phase of FDK roll out in 2011/12, all 30,000-plus kindergarten students will be enrolled and funded in FDK.

Budget 2011 also includes annual facilities grant funding of $110 million in 2011/12 to provide for maintenance and repairs in schools.

Post-Secondary Education

Funding for post-secondary institutions (PSIs) in 2011/12 is $1.9 billion, continuing government’s commitment to funding higher education. As shown in Chart 1.10, since 2001/02, there have been significant increases in operational funding for this sector.

As part of government’s recent accelerated infrastructure program, $510 million has been spent from 2009/10 to 2012/13, of which $260 million was provincially funded. All PSIs have benefited from the Knowledge Infrastructure Program component of this funding, which contributed to 40 projects that resulted in renewed or additional buildings.

Chart 1.10 Post-secondary funding

Management of the BC Public Service

Since 2001/02, the core BC public service (ministries and special offices), as measured in full-time equivalents (FTEs), has been approximately 30,000 FTEs. Consistent with recent budget presentations, BC public service FTEs are presented in Budget 2011 on an aggregate basis, as shown in Appendix Table A14.

In 2010/11, oversight of the BC Ambulance Service transferred from the Ministry of Health to the Provincial Health Services Authority, which is part of the SUCH sector (schools, universities, colleges and health organizations). Under the Budget Transparency and Accountability Act, SUCH sector FTEs are not included in government reporting on staff levels, therefore projections starting in 2011/12 have been reduced by approximately 3,000 FTEs in accordance with this change in status.

Budget and Fiscal Plan – 2011/12 to 2013/14

22

Three-Year Fiscal Plan

Excluding the impact of the BC Ambulance Service transfer, the 2.7 per cent average annual reduction in FTEs in the fiscal plan is similar to government’s experience over the last two years, as shown in Chart 1.11.

The forecasted decline in FTEs reflects the continued budgetary requirement for government to prioritize key government services and programs and achieve savings and improved effectiveness in their delivery. While some involuntary staff reductions were implemented in 2009/10 and 2010/11 with a target of limiting overall staff impacts to 5 per cent of the workforce to the end of 2011/12, impacts to date have been only 2.5 per cent. With government’s improved fiscal outlook, no further involuntary reductions are anticipated over the new three year fiscal plan.

Chart 1.11 Managing FTEs

It is expected that the projected decrease for the next three years will be achieved through attrition — that is, through normal annual voluntary exits, including retirements, which are expected to continue at consistent rates across the fiscal plan. In addition, government also continues its policy of limited external hiring in order to manage within available salary budgets.

Recovered Expenses

Over the fiscal plan period (2011/12 to 2013/14), government projects it will incur $8.2 billion in program spending whose costs will be recovered from third parties. This includes a total of $2.1 billion spent on delivering programs on behalf of the federal government, such as the Labour Market Development and Labour Market Agreements, immigration initiatives, and local government services transfers.

In addition, an estimated $2.7 billion in interest costs will be recovered from the commercial Crown corporations through the fiscal agency loan program and from sinking fund investment returns. The remaining $3.4 billion in recoveries costs are incurred by a variety of programs, including hospital expansion recovered from regional health boards, industry-funded regulatory programs recovered through fees, and distribution of free Crown grants recovered through the revaluation of the land being distributed.

Budget and Fiscal Plan – 2011/12 to 2013/14

23

Three-Year Fiscal Plan

Operating Transfers

Transfers to service delivery agencies will total $63 billion over the fiscal plan period (2011/12 to 2013/14) in support of education, healthcare, social services, housing, and transportation programs delivered by the agencies on behalf of government. These service delivery agencies include the SUCH sector (schools, universities, colleges and health organizations), Community Living BC, BC Housing Management Commission, BC Transit, and the BC Transportation Financing Authority. Transfers to these organizations comprise over 60 per cent of ministry spending.

Service Delivery Agency Spending

Service delivery agency spending is projected to total $27.0 billion by 2013/14, reflecting an increase of $2.3 billion over the fiscal plan period.

School district spending is projected at $5.5 billion in 2013/14 — an increase of $30 million over the three-year period. This includes spending on full-day kindergarten and other pressures, partially offset by reduced spending in relation to federally funded programs. Other influences on school district spending are a diminishing demand to increase the total number of teachers due to stable enrolment projections, and government’s wage mandate (over 80 per cent of school district spending is on salaries).

Spending by universities is forecast to increase by $220 million over the three-year period, and will total $4.0 billion by 2013/14. The increase mainly reflects additional faculty and operating costs for education and research programs and amortization for capital assets resulting from provincial and federal government stimulus spending.

Projected spending by colleges and institutes will remain virtually unchanged at $1.1 billion, with only a minor increase of $7 million over the three-year period. This increase mainly relates to additional operating costs for facilities and education programs.

Spending by health authorities and hospital societies is projected to rise from $11.1 billion in 2010/11 to $12.7 billion by 2013/14 — an increase of $1.6 billion. This increase reflects the projected growth in demand for the health services delivered by these organizations on behalf of government. It also includes additional spending resulting from the integration of the BC Ambulance Service with the Provincial Health Services Authority.

Projected spending by other service delivery agencies is forecast to increase from $3.3 billion in 2010/11 to $3.7 billion in 2013/14, reflecting a total increase of $388 million over the three-year period. The increase is primarily due to additional spending on accelerated social housing programs by the BC Housing Management Commission and on transportation initiatives by the BC Transportation Financing Authority.

Budget and Fiscal Plan – 2011/12 to 2013/14

24

Three-Year Fiscal Plan

Capital Spending(1)

Capital spending on schools, hospitals, roads, bridges, hydro-electric projects and other infrastructure across the province over the next three years (2011/12 to 2013/14) is expected to total $19.0 billion. Provincial capital infrastructure investments are made through school districts, health authorities, post-secondary institutions, Crown agencies and ministries.

The total capital investment of $19.0 billion is comprised of $10.3 billion in taxpayer-supported capital investments and $8.7 billion in capital investments by commercial Crown corporations.

The capital spending forecast for 2011/12 reflects completion of approved projects, including accelerated capital investments to stimulate the economy and keep people at work in the construction sector, and investments by self-supported commercial Crown corporations in power projects and the Port Mann Bridge replacement project.

Table 1.12 Capital Spending

| | 2010/11 | | Budget | | | | | |

| | Budget | | Updated | | Estimate | | Plan | | Plan | |

($ millions) | | 2010 | | Forecast | | 2011/12 | | 2012/13 | | 2013/14 | |

Taxpayer-supported | | | | | | | | | | | |

Education | | | | | | | | | | | |

Schools (K-12) | | 481 | | 430 | | 520 | | 412 | | 308 | |

Post-secondary | | 743 | | 928 | | 599 | | 444 | | 286 | |

Health | | 1,161 | | 1,049 | | 859 | | 599 | | 451 | |

BC Transportation Financing Authority | | 1,457 | | 1,327 | | 986 | | 1,018 | | 1,343 | |

BC Transit | | 89 | | 61 | | 162 | | 207 | | 311 | |

Vancouver Convention Centre expansion project | | 8 | | 10 | | — | | — | | — | |

BC Place redevelopment | | 390 | | 298 | | 147 | | — | | — | |

Government ministries | | 355 | | 396 | | 332 | | 210 | | 148 | |

Other(1) | | 404 | | 277 | | 300 | | 65 | | 51 | |

Capital spending contingencies | | 300 | | 129 | | 200 | (2) | 200 | | 200 | |

Total taxpayer-supported | | 5,388 | | 4,905 | | 4,105 | | 3,155 | | 3,098 | |

| | | | | | | | | | | |

Self-supported | | | | | | | | | | | |

BC Hydro | | 1,784 | | 1,566 | | 2,195 | | 2,037 | | 2,020 | |

Columbia River power projects(3) | | 12 | | 63 | | 98 | | 120 | | 62 | |

Transportation Investment Corporation (Port Mann) | | 735 | | 871 | | 717 | | 586 | | 72 | |

BC Railway Company(4) | | 26 | | 14 | | 18 | | 27 | | 20 | |

ICBC | | 83 | | 44 | | 81 | | 84 | | 88 | |

BC Lotteries | | 107 | | 107 | | 109 | | 130 | | 125 | |

Liquor Distribution Branch | | 24 | | 23 | | 25 | | 27 | | 28 | |

Total self-supported commercial | | 2,771 | | 2,688 | | 3,243 | | 3,011 | | 2,415 | |

Total capital spending | | 8,159 | | 7,593 | | 7,348 | | 6,166 | | 5,513 | |

(1) Includes BC Housing Management Commission, Provincial Rental Housing Corporation, other service delivery agencies and project reserves held by the Ministry of Finance.

(2) Includes $50 million for ministry capital contingencies.

(3) Joint ventures of the Columbia Power Corporation and Columbia Basin Trust.

(4) The 2010/11 budget was restated to reflect the continued accounting of the BC Railway Company as a commercial entity.

(1) Capital investments are not included in the government’s annual surplus or deficit. In accordance with generally accepted accounting principles (GAAP), annual amortization expenses that recognize the estimated wear and tear of capital assets during the fiscal year are included in the government’s annual expenses instead of recording the full capital costs as they occur.

Budget and Fiscal Plan – 2011/12 to 2013/14

25

Three-Year Fiscal Plan

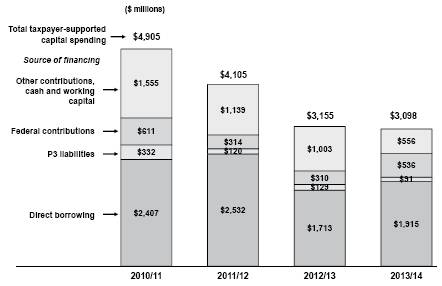

Since October 2008, $5.5 billion has been committed to accelerated infrastructure investments across the province. BC has successfully leveraged $1.4 billion in infrastructure funding from the federal government infrastructure stimulus plan announced in January 2009 in support of this program.

In December 2010, the federal government extended the deadline for substantial completion of projects under the Infrastructure Stimulus, Knowledge Infrastructure, and Build Canada Top-Up Funds from March 31, 2011 to October 31, 2011 upon application by the Province for specific project extensions. As a result, the timing of some accelerated expenditures has moved to fiscal 2011. Taxpayer-supported capital spending is projected to return to historical levels as the accelerated infrastructure program is wound down by the end of October 2011.

Taxpayer-supported capital spending

Taxpayer-supported capital spending includes capital infrastructure for school districts, health authorities, post-secondary institutions, taxpayer-supported Crown agencies, and ministries.

Taxpayer-supported capital spending is projected at $4.1 billion in 2011/12, declining to $3.1 billion in 2012/13 and 2013/14, reflecting completion of approved projects within the capital plan, including accelerated capital projects.

Significant elements of the projected spending include the following:

· Over the three years of the capital plan, $1.2 billion will be invested to replace, renovate or expand K-12 facilities. This includes continued investment in the program to seismically upgrade or replace schools and provide space for full day kindergarten for five year olds.

· Budget 2011 includes $1.3 billion in capital spending by post-secondary institutions throughout the province. Projects include building replacements and renewals, a number of which are accelerated though the Knowledge Infrastructure Program, and the TRIUMF Advanced Rare Isotope Laboratory.

Post-secondary capital spending also includes a significant level of investment funded through other sources, including foundations, donations, cash balances, federal funding and revenues generated from services.

· Capital spending in the health sector will total $1.9 billion over the next three years. These investments support new major construction and upgrading of health facilities, medical and diagnostic equipment, and information management technology systems, and include funding from the province as well as other sources, such as regional hospital districts and foundations. Investments include the Children’s and Women’s Hospital.