Exhibit 99.7

Budget and Fiscal Plan

2012/13 — 2014/15

February 21, 2012

National Library of Canada Cataloguing in Publication Data

British Columbia.

Budget and fiscal plan. — 2002/03/2004/05-

Annual

Also available on the Internet.

Continues: British Columbia. Ministry of Finance and

Corporate Relations. Budget ... reports. ISSN 1207-5841

ISSN 1705-6071 = Budget and fiscal plan — British Columbia.

1. Budget — British Columbia — Periodicals. 2. British

Columbia — Appropriations and expenditures — Periodicals.

I. British Columbia. Ministry of Finance. II. Title.

HJ12.B742 352.48’09711’05 C2003-960048-3

TABLE OF CONTENTS

Budget and Fiscal Plan 2012/13 — 2014/15 | | February 21, 2012 |

Attestation by the Secretary to Treasury Board

Summary | 1 |

| |

Part 1: Three Year Fiscal Plan | |

Introduction | 5 |

Changes from Budget 2011 Fiscal Plan | 8 |

Measures to Balance the Budget | 9 |

Revenue | 9 |

Major Revenue Sources | 11 |

Expense | 18 |

Consolidated Revenue Fund Spending | 19 |

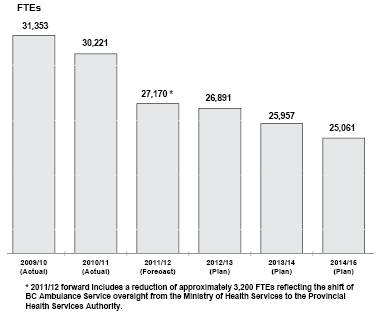

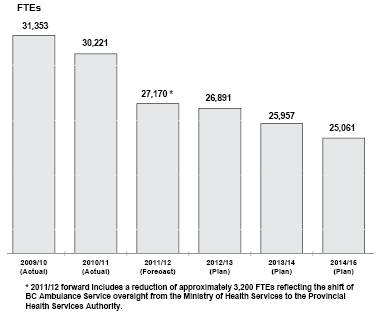

Management of the BC Public Service | 30 |

Recovered Expenses | 31 |

Operating Transfers | 32 |

Service Delivery Agency Spending | 32 |

Capital Spending | 33 |

Taxpayer-supported Capital Spending | 34 |

Self-supported Capital Spending | 38 |

Projects over $50 million | 39 |

Provincial Debt | 42 |

Risks to the Fiscal Plan | 45 |

Accounting Policy Changes | 50 |

Tables: | |

1.1 | Three Year Fiscal Plan | 5 |

1.2 | Fiscal Plan Update — Changes from Budget 2011 | 8 |

1.3 | Major Factors Underlying Revenue | 11 |

1.4 | Personal Income Tax Revenue | 11 |

1.5 | Corporate Income Tax Revenue | 12 |

1.6 | Sales Taxes Revenue | 12 |

1.7 | Federal Government Contributions | 14 |

1.8 | Revenue by Source | 16 |

1.9 | Expense by Ministry, Program and Agency | 17 |

1.10 | Health Per Capita Costs and Outcomes: Canadian Comparisons | 22 |

1.11 | Health Funding Plan | 23 |

1.12 | BC Post-secondary Annual Credentials Awarded and Student Satisfaction | 24 |

1.13 | High School Completion Rates for BC Students | 25 |

1.14 | Transition Rates from High School to Post-secondary Education | 26 |

1.15 | Justice System | 28 |

1.16 | Supports to Individuals and Families | 29 |

Budget and Fiscal Plan – 2012/13 to 2014/15

Table of Contents

1.17 | Capital Spending | 33 |

1.18 | Provincial Transportation Investments | 36 |

1.19 | Capital Expenditure Projects Greater Than $50 million | 40 |

1.20 | Provincial Debt Summary | 42 |

1.21 | Provincial Borrowing Requirements | 43 |

1.22 | Reconciliation of Summary Results to Provincial Debt Changes | 44 |

1.23 | Key Fiscal Sensitivities | 45 |

1.24 | Draw Down of the Contingencies Vote | 48 |

1.25 | Notional Allocations to Contingencies | 48 |

| |

Topic Boxes: | |

Release of Surplus Corporate Assets for Economic Generation | 51 |

Achieving Increased Efficiencies in the SUCH Sector | 52 |

The Justice System in British Columbia | 54 |

Community Living British Columbia | 55 |

| |

Part 2: | Tax Measures | |

Tax Measures — Supplementary Information | 57 |

Transition to Provincial Sales Tax | 64 |

| |

Tables: | |

2.1 Summary of Tax Measures | 56 |

| |

Topic Boxes: | |

Carbon Tax | 66 |

Return to PST | 69 |

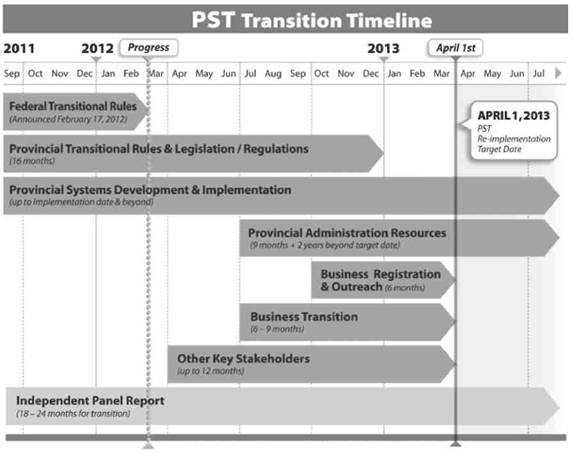

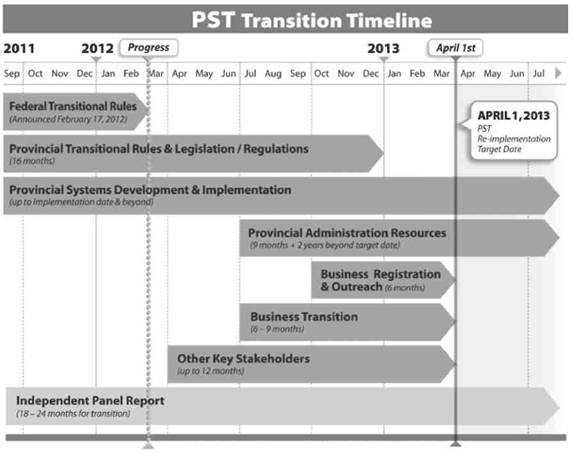

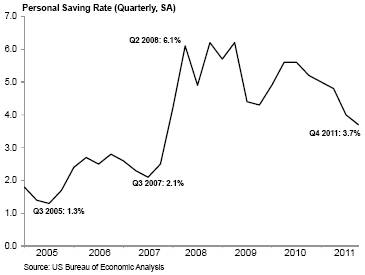

PST Re-implementation Timeline | 75 |

| |

Part 3: | British Columbia Economic Review and Outlook | |

Summary | 77 |

British Columbia Economic Activity and Outlook | 78 |

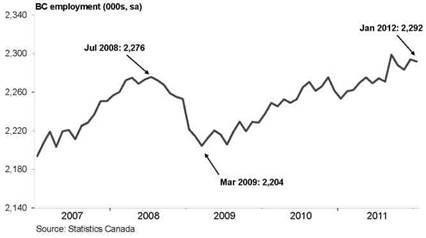

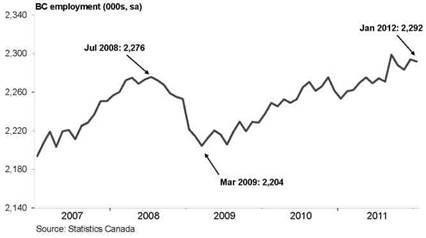

The Labour Market | 78 |

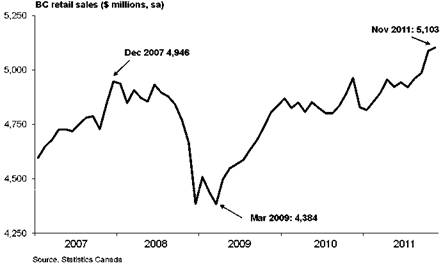

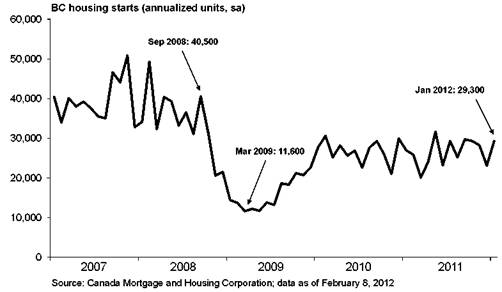

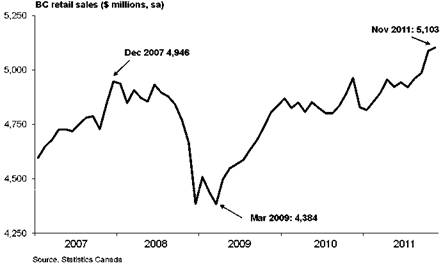

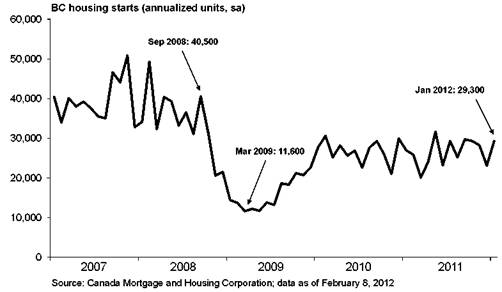

Consumer Spending and Housing | 79 |

Business and Government | 81 |

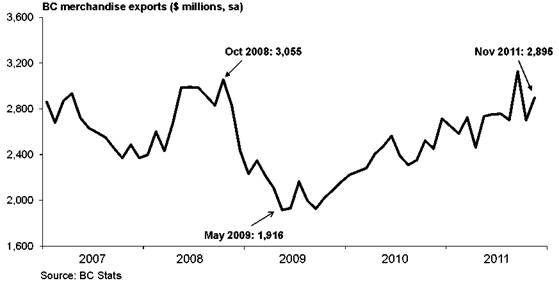

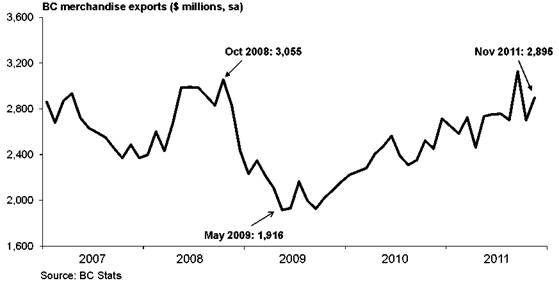

External Trade and Commodity Markets | 81 |

Demographics | 84 |

Inflation | 84 |

Risks to the Economic Outlook | 84 |

External Outlook | 85 |

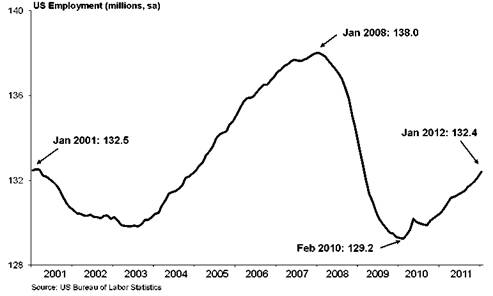

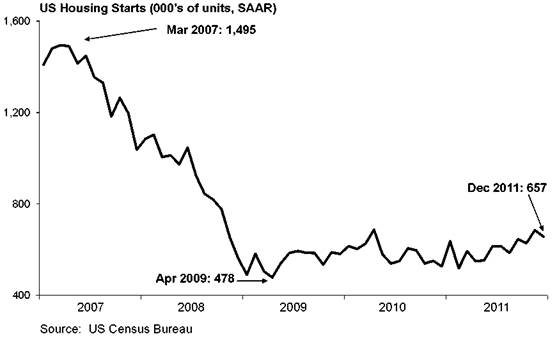

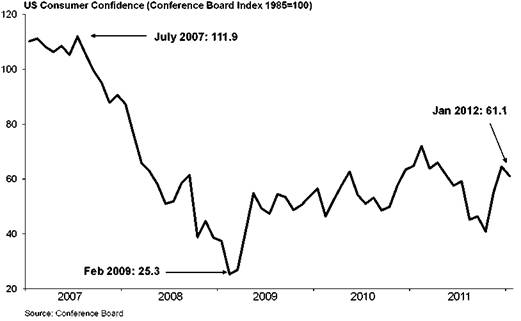

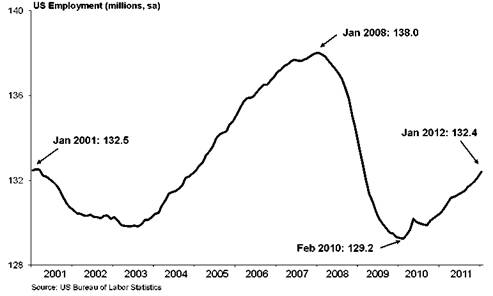

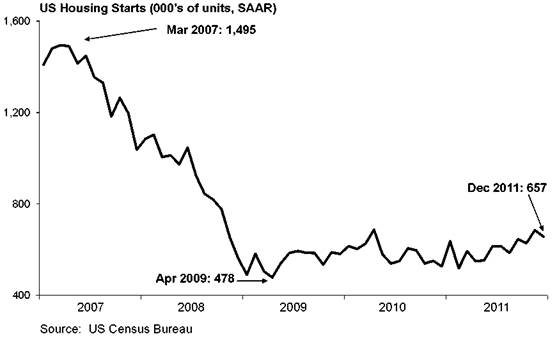

United States | 85 |

Canada | 88 |

Other economies | 90 |

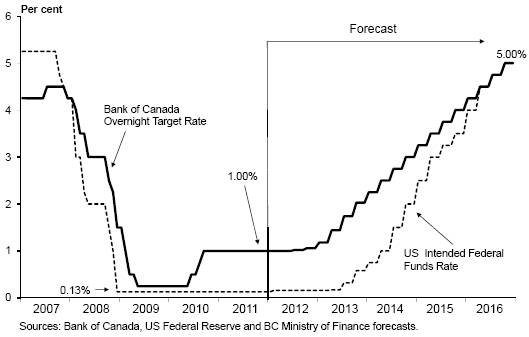

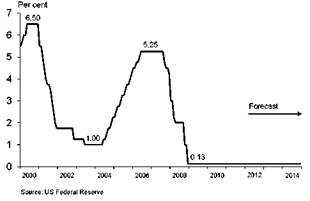

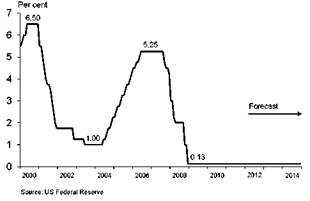

Financial Markets | 91 |

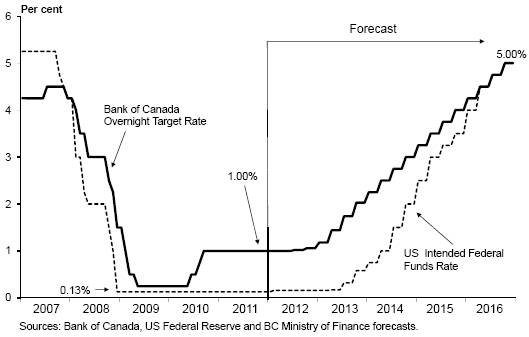

Interest Rates | 91 |

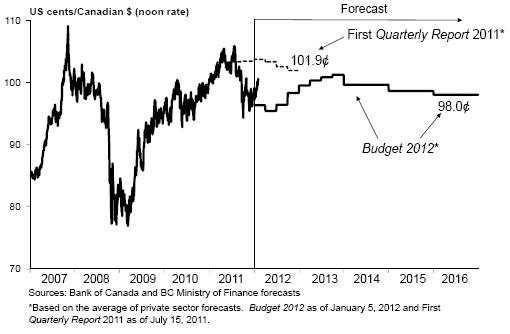

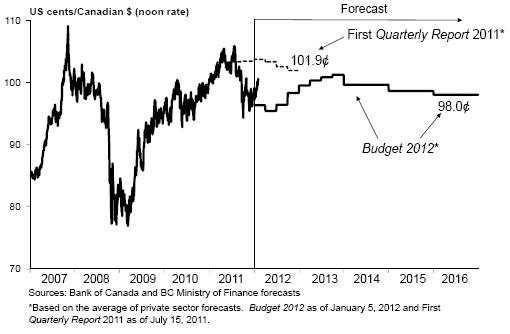

Exchange Rate | 93 |

| | | |

Budget and Fiscal Plan – 2012/13 to 2014/15

iv

Table of Contents

Tables: | |

3.1 | British Columbia Economic Indicators | 78 |

3.2 | Ministry of Finance Economic Forecast: Key Economic Indicators | 78 |

3.3 | US real GDP forecast: Consensus vs Ministry of Finance | 88 |

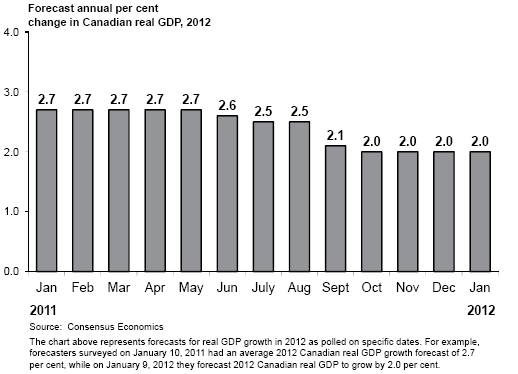

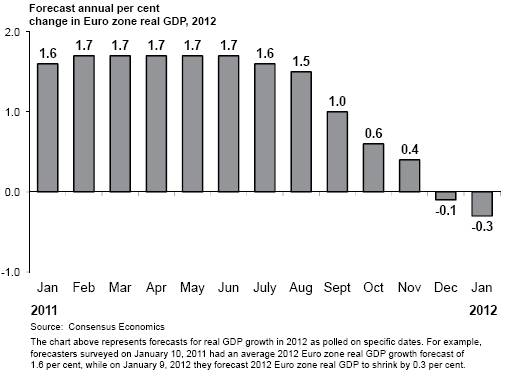

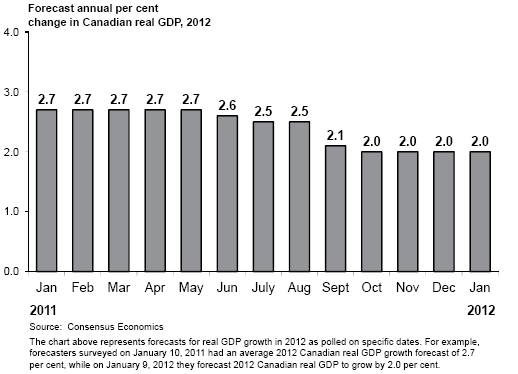

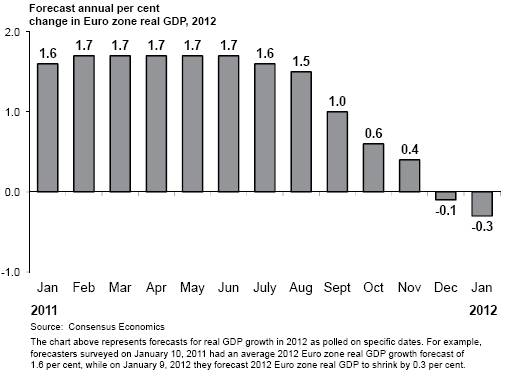

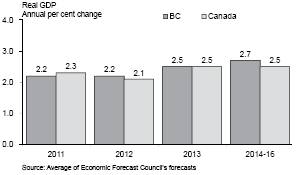

3.4 | Canadian real GDP forecast: Consensus vs Ministry of Finance | 89 |

3.5 | Private Sector Canadian Interest Rate Forecasts | 92 |

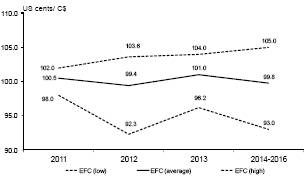

3.6 | Private Sector Exchange Rate Forecasts | 93 |

3.7.1 | Gross Domestic Product: British Columbia | 94 |

3.7.2 | Components of Nominal Income and Expenditure | 95 |

3.7.3 | Labour Market Indicators | 95 |

3.7.4 | Major Economic Assumptions | 96 |

| |

Topic Boxes: | |

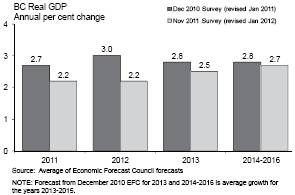

The Economic Forecast Council, 2012 | 97 |

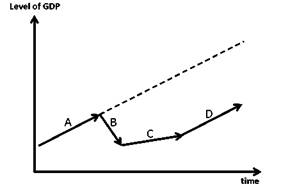

Balance Sheet Recessions | 101 |

| |

Part 4: 2011/12 Revised Financial Forecast (Third Quarterly Report) | |

2011/12 Fiscal Year in Review | 107 |

Changes Since the Second Quarterly Report | 108 |

Contingencies | 110 |

Health Funding Report | 110 |

Capital Spending | 111 |

Provincial Debt | 112 |

Risks to the 2011/12 Outlook | 113 |

2011/12 Third Quarterly Report and Full Year Forecast Tables | 113 |

Tables: | |

4.1 | Budget 2011 and Quarterly Report Forecasts | 107 |

4.2 | 2011/12 Forecast Update | 109 |

4.3 | 2011/12 Notional Allocations to Contingencies | 110 |

4.4 | Health Funding Report | 110 |

4.5 | 2011/12 Capital Spending Update | 111 |

4.6 | 2011/12 Provincial Debt Update | 112 |

4.7 | 2011/12 Operating Statement | 113 |

4.8 | 2011/12 Revenue by Source | 114 |

4.9 | 2011/12 Expense by Ministry, Program and Agency | 115 |

4.10 | 2011/12 Expense by Function | 116 |

4.11 | 2011/12 Capital Spending | 117 |

4.12 | 2011/12 Provincial Debt | 118 |

4.13 | 2011/12 Statement of Financial Position | 119 |

| | |

Appendices | 121 |

Budget and Fiscal Plan – 2012/13 to 2014/15

v

| | February 21, 2012 |

As required by Section 7(d) of the Budget Transparency and Accountability Act (BTAA), and Section 4a(v) of the Carbon Tax Act, I confirm that Budget 2012 contains the following elements:

· The fiscal and economic forecasts for 2012/13 and the next two years — provided in Parts 1 and 3.

· Advice received from the Economic Forecast Council in November 2011 (updated January 2012), on the economic growth outlook for BC, including a range of forecasts for 2012 and 2013 (see Part 3, page 97).

· Material economic, demographic, fiscal, accounting policy and other assumptions and risks underlying Budget 2012 economic and fiscal forecasts, including:

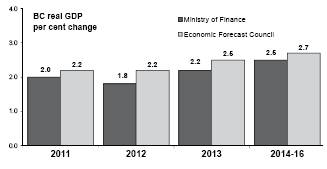

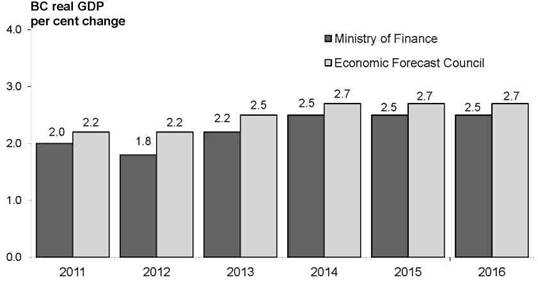

· An economic forecast that reflects slower growth in 2012 but steady improvement thereafter for BC, recognizing the ongoing challenges that remain as Europe enters into a recession and economic recovery for the US continues to be sluggish. Accordingly, the economic projections assumed in Budget 2012 are more prudent relative to the average of the forecasts provided by the Economic Forecast Council.

· Forecast allowances of $200 million for 2012/13 increasing to $250 million and $350 million in the two outer years of the fiscal plan respectively are included to help achieve operating and debt level targets. The growing level of these allowances is intended to recognize the increased uncertainty in revenue forecasts, commodity prices and the global economic recovery for projections further out in the fiscal plan.

· The spending (expense) forecast in Budget 2012 assumes that average annual growth in operating expenses (excluding tax transfers) will not exceed 2.0 per cent over the three years of the fiscal plan. This constraint on spending continues with the direction established in Budget 2009 but requires ongoing monitoring if the legislative requirement to balance the provincial budget by 2013/14 is to be met.

· Budget 2012 includes an allocation of $300 million to the Contingencies (All Ministries) and New Programs Vote in 2012/13, and $250 million in each of the following two fiscal years. These allocations are based on a review of ministry pressures and government’s priorities.

· Revenue forecasts are based on the economic forecasts assumed in Budget 2012 and assume the reinstatement of the provincial sales tax (PST) on April 1, 2013. Further details on the mechanics of the return to PST, including transitional rules, are provided in a topic box included on page 69. Budget 2012 assumes the full repayment of $1.6 billion in federal HST transitional assistance over five years beginning March 2012.

· The natural gas price forecast included in Budget 2012 is based on an average of private forecasts (see Table A6, page 137). The fiscal plan assumes no incremental revenue from Liquefied Natural Gas (LNG) development in the province.

· Revenue to be realized on the sale of surplus corporate assets is dependent on a successful marketing program and completed sales.

· Budget 2012 includes $369 million in project reserves in the three year capital plan in order to cover risks from higher than expected costs and to fund emerging government priorities. Any major new capital projects will have the added oversight of cross government sourced project board members.

· Budget 2012 assumes that public sector collective agreements expiring before December 31, 2011, for which negotiations have not yet been concluded (primarily teachers bargaining through the BC Teachers’ Federation), will be settled consistent with the 2010 two-year, net zero compensation mandate set by Cabinet.

· For public sector collective agreements expiring on or after December 31, 2011, Budget 2012 assumes that no incremental funding will be provided for such negotiations. The 2012 Cooperative Gains Mandate approved by Cabinet requires that any negotiated increases in public sector compensation must be fully offset by identified savings in existing public sector budgets.

· Budget 2012 assumes three-year financial projections for health authorities, K—12 school districts and post-secondary institutions, as provided by the Ministries of Health, Education, and Advanced Education, based on plans submitted by those sectors in preparation of Budget 2012.

· British Columbia Hydro and Power Authority’s (BC Hydro) forecasts for 2011/12 to 2013/14, included in Budget 2012, reflect its Amended Revenue Requirements Application that is currently before the BC Utilities Commission (BCUC), with a decision expected in the fall of 2012. The forecast for 2014/15 is based on the assumed allowed return on deemed equity for that year.

· The Insurance Corporation of British Columbia (ICBC) forecast included in Budget 2012 is based on its BCUC approved interim Basic insurance rate, pending a final decision on its rate application expected in the summer of 2012. As well, government is conducting an internal review of ICBC operations which may impact ICBC projections and by extension, Basic insurance rate increases.

· The provincial support for British Columbia Ferry Services Inc. remains as defined in the existing contract.

· To the best of my knowledge, the three-year fiscal plan contained in Budget 2012 conforms to the standards and guidelines of generally accepted accounting principles (GAAP) for senior governments and with Public Sector Accounting Board (PSAB) guidelines. The adoption of International Financial Reporting Standards (IFRS) on January 1, 2011, by commercial Crown corporations is assumed in Budget 2012.

· Major areas of risk to the Budget 2012 fiscal plan are shown in Part 1 and the Appendix tables.

· Carbon tax reports for 2010/11 and 2011/12, and a carbon tax plan for 2012/13 to 2014/15 — see Carbon Tax topic box at the end of Part 2: Tax Measures (page 66).

· A health funding report for 2010/11 and 2011/12 and a plan that includes a forecast for health spending and the specific revenue sources fully dedicated to these purposes for 2012/13 to 2014/15, are provided on page 110 and page 23 respectively.

|

|

| Peter Milburn |

| Deputy Minister and |

| Secretary to Treasury Board |

Ministry of | | Office of the | | Mailing Address: | | Location Address: |

Finance | | Deputy Minister | | PO Box 9417 Stn Prov Govt | | Room 109 |

| | | | Victoria BC V8W 9V1 | | 617 Government Street |

| | | | www.gov.bc.ca/fin | | Victoria BC |

Summary: BUDGET AND FISCAL PLAN — 2012/13 to 2014/15

| | Updated

Forecast | | Budget

Estimate | | Plan | | Plan | |

($ millions) | | 2011/12 | | 2012/13 | | 2013/14 | | 2014/15 | |

Revenue | | 41,945 | | 43,101 | | 44,603 | | 45,711 | |

Expense | | (44,392 | ) | (43,869 | ) | (44,199 | ) | (45,111 | ) |

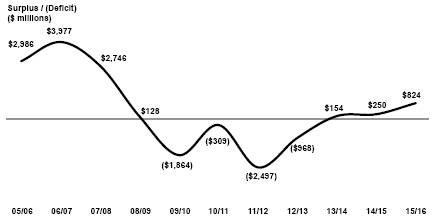

Surplus (deficit) before forecast allowance | | (2,447 | ) | (768 | ) | 404 | | 600 | |

Forecast allowance | | (50 | ) | (200 | ) | (250 | ) | (350 | ) |

Surplus (deficit) | | (2,497 | ) | (968 | ) | 154 | | 250 | |

Capital spending: | | | | | | | | | |

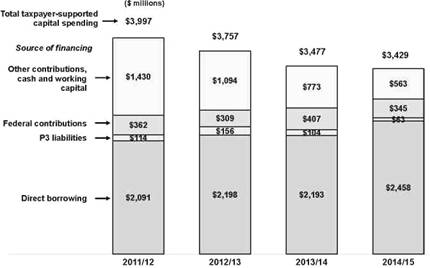

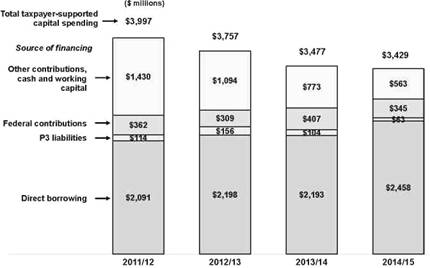

Taxpayer-supported capital spending | | 3,997 | | 3,757 | | 3,477 | | 3,429 | |

Self-supported capital spending | | 3,144 | | 3,346 | | 2,553 | | 2,606 | |

| | 7,141 | | 7,103 | | 6,030 | | 6,035 | |

Provincial debt: | | | | | | | | | |

Taxpayer-supported debt | | 34,786 | | 38,736 | | 41,656 | | 43,702 | |

Self-supported debt | | 16,149 | | 18,667 | | 20,808 | | 22,302 | |

Total debt (including forecast allowance) | | 50,985 | | 57,603 | | 62,714 | | 66,354 | |

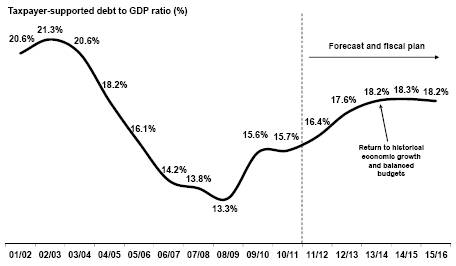

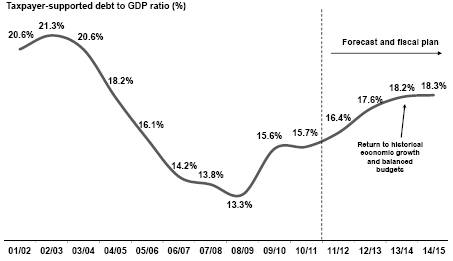

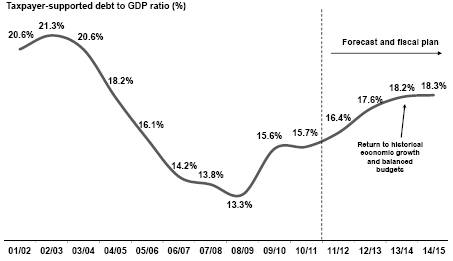

Taxpayer-supported debt-to-GDP ratio | | 16.4 | % | 17.6 | % | 18.2 | % | 18.3 | % |

| | 2011 | | 2012 | | 2013 | | 2014 | |

Economic Forecast: | | | | | | | | | |

Real GDP growth | | 2.0 | % | 1.8 | % | 2.2 | % | 2.5 | % |

Nominal GDP growth | | 4.3 | % | 3.7 | % | 4.1 | % | 4.4 | % |

Reinforcing Priorities

Budget 2012 confirms government’s ongoing commitment to its key fiscal plan objectives:

· protection of essential health care, education, and social services;

· a balanced budget by 2013/14; and

· a fiscally sustainable taxpayer-supported debt to GDP ratio that maintains a AAA credit rating.

In support of these priorities, government is continuing its management strategy of prudence and spending discipline.

Budget 2012 focuses on maintaining government services within existing budget allocations for most ministries, requiring them to continue to carefully manage priorities. Incremental funding has been provided to key core services, including healthcare, K-12 education, justice and social supports. Budget reallocations have been made through the drawdown of the Contingencies vote and from administrative efficiencies and reduced debt servicing costs.

Over the fiscal plan period, government will be redirecting over $1.0 billion to priority areas in ministries.

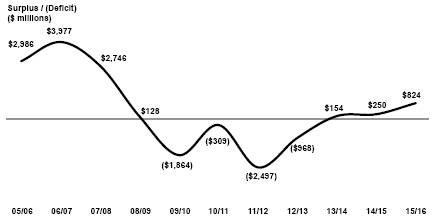

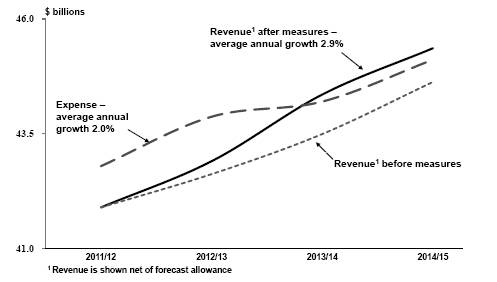

Balancing the Budget

Government projects it will be able to deliver on its commitment to return to balanced budgets by 2013/14. Average annual revenue growth of 2.9 per cent is consistent with the Ministry of Finance economic forecast, and reflects strengthening economic conditions and rising commodity prices over the next three years.

The revenue growth includes continuation of the small business corporate income tax rate at 2.5 per cent and a one percentage point increase in the general corporate income tax rate to 11 per cent in April 2014, to assist with achieving a balanced budget. Further revenue will be generated from a government initiative to identify surplus assets and release them for sale.

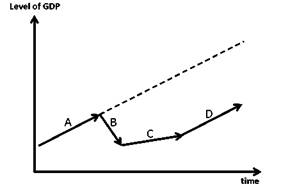

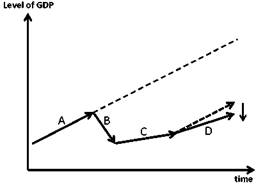

Emerging from the downturn

A cornerstone of government’s plan to balance the budget is management control of operating expenditures. Over the fiscal plan period, full realization of the efficiencies driven by government’s expenditure management strategies will result in an average annual growth rate of 2.0 per cent, enabling revenue growth to bridge the deficit gap by 2013/14.

Budget and Fiscal Plan – 2012/13 to 2014/15

1

Summary

Total spending also includes refundable tax credit transfers. These transfers previously were netted from revenue, but are now included as an expense due to an accounting policy change. Including these transfers, total spending will reach $45.1 billion by 2014/15.

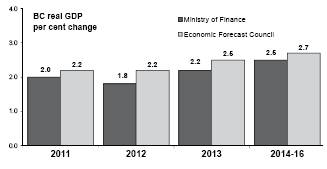

BC’s Economy still Vulnerable

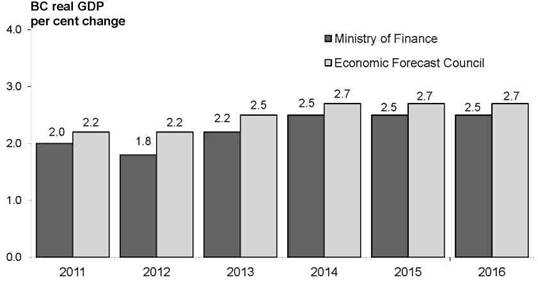

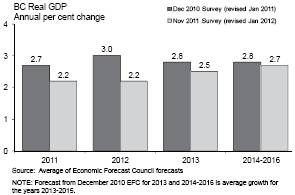

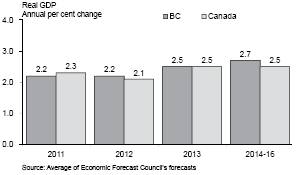

Following an estimated increase of 2.0 per cent in 2011, the Ministry of Finance forecasts British Columbia’s economy to grow by 1.8 per cent in 2012, 2.2 per cent in 2013 and 2.5 per cent per year in the medium term.

Ministry forecast more prudent than private sector

The Ministry’s outlook for BC’s real GDP growth is 0.4 percentage points lower in 2012 and 0.3 percentage points lower in 2013 than the outlook provided by the Economic Forecast Council. This level of prudence for both years acknowledges the significant downside risks to the forecast.

These downside risks, largely due to ongoing uncertainty around global economic activity, include:

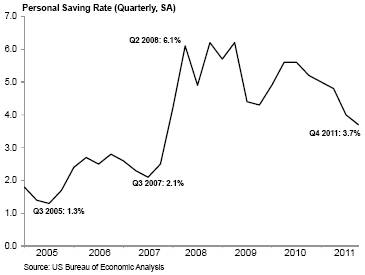

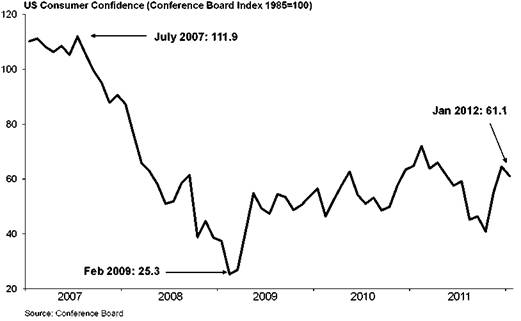

· a return to recession in the US (characterized by weaker consumer spending, widespread deleveraging causing slower investment, a very slow job market recovery, continued weakness in the housing market and further fiscal restraint by federal, state and local governments);

· the sovereign debt crisis in Greece, Ireland and Portugal spreading to larger European economies like Italy and Spain, and threatening the stability of global financial markets as well as another global credit crisis;

· slower than anticipated Asian demand resulting in weaker demand for BC’s exports;

· exchange rate volatility; and

· further weakening of the US dollar, resulting in significant disruptions to global financial and commodity markets.

If one or more of these risks materialize in a significant way it may create pressures that cannot be accommodated in the fiscal plan.

Capital Spending

Taxpayer-supported infrastructure spending on hospitals, schools, post-secondary facilities, transit, and roads will total $10.7 billion over the fiscal plan period, and will be financed by $7.2 billion in borrowing with the remainder funded by third parties such as the federal government, and from internal cash flows.

Self-supported infrastructure spending on electrical generation, transmission and distribution projects, the Port Mann Bridge and other capital assets will total $8.5 billion over the fiscal plan period, and will be financed by $6.2 billion in borrowing, with the remainder funded internally.

Keeping Debt Affordable

Government’s borrowing requirement for the next three years totals $23.6 billion, and includes $1.6 billion for operating needs and $8.5 billion to retire maturing debt in addition to the capital borrowing outlined above. Overall, total provincial debt is projected to increase to $66.4 billion by 2014/15.

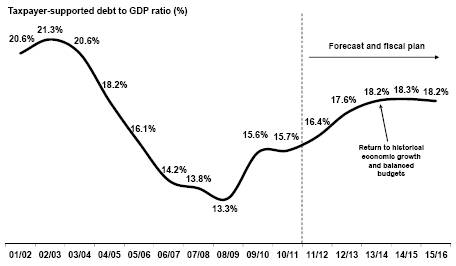

Due to the anticipated deficits, additional borrowing to support infrastructure spending, and lower GDP projections in the near term, the taxpayer-supported debt to GDP ratio will peak at 18.3 per cent in 2014/15.

Risks to the Fiscal Plan

The main risks to the government’s fiscal plan include:

· risks to the BC economic outlook, largely due to the continued uncertainty surrounding global economic activity;

· assumptions underlying revenue and Crown corporation forecasts, such as economic factors, commodity prices and weather conditions; and

· utilization rates for government services, such as health care, children and family services, and income assistance.

Budget and Fiscal Plan – 2012/13 to 2014/15

2

Summary

Government has three main levels of prudence in its projections to mitigate the risks to the fiscal plan, including:

· the lower Ministry outlook for BC’s real GDP growth relative to the outlook provided by the Economic Forecast Council;

· Contingencies of $300 million in 2012/13, and $250 million in each of 2013/14 and 2014/15 to help manage unexpected pressures and fund priority initiatives; and

· a forecast allowance of $200 million in 2012/13, increasing to $250 million in 2013/14 and $350 million in 2014/15 to guard against revenue volatility.

Conclusion

In summary, Budget 2012:

· maintains the core services of health care, education, and social services that British Columbians depend upon;

· augments priority program funding in the key areas of health, social services, and justice;

· delivers on government’s commitment to return to balanced budgets by 2013/14;

· continues government’s infrastructure program in support of government initiatives and to create jobs over the next three years;

· sets the stage for government to emerge from the economic downturn in a fiscally strong position.

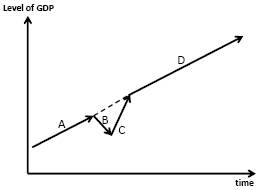

Looking Beyond the Fiscal Plan

As the economy improves, by 2015/16 the government will emerge from the economic downturn in a fiscally strong position. This is due in large part to government’s continuing focus on management of operating costs to ensure effective use of resources.

Sustainable fiscal outlook provides flexibility

Since the fall of 2008, government’s average annual spending growth of 5.9 per cent has been reduced to a more sustainable average annual spending growth of 2.0 per cent.

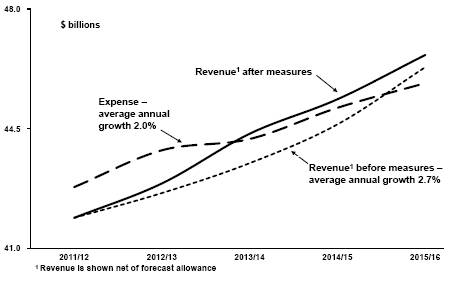

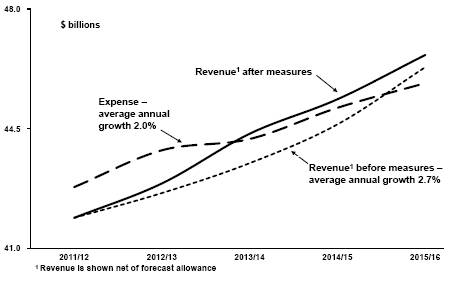

Maintaining this spending discipline has enabled revenue to recover and eliminate the deficit, even at a relatively modest growth of 2.7 per cent when projected forward to 2015/16.

By 2015/16, the base revenue excluding the measures introduced in Budget 2012 will exceed expense projections. This will give government the flexibility to re-evaluate its revenue measures, including the provisional corporate income tax increase.

Government is also committed to stabilizing capital expenditures at a level that ensures existing infrastructure will be maintained in good operating condition. New infrastructure will be targeted towards meeting the needs of a growing British Columbia.

The combination of spending discipline, revenue growth and holistic capital planning will ensure that debt remains at fiscally sustainable levels, as is demonstrated by the debt to GDP ratio projections.

It is government’s ongoing commitment to these principles of fiscal stability that will enable it to continue to protect essential services, and ensure they are there for British Columbians to depend on in the future.

Fiscally sustainable debt

Budget and Fiscal Plan – 2012/13 to 2014/15

3

Part 1: THREE YEAR FISCAL PLAN

Table 1.1 Three Year Fiscal Plan

| | Updated

Forecast | | Budget

Estimate | | Plan | | Plan | |

($ millions) | | 2011/12 | | 2012/13 | | 2013/14 | | 2014/15 | |

Revenue | | 41,945 | | 43,101 | | 44,603 | | 45,711 | |

Expense | | (44,392 | ) | (43,869 | ) | (44,199 | ) | (45,111 | ) |

Surplus (deficit) before forecast allowance | | (2,447 | ) | (768 | ) | 404 | | 600 | |

Forecast allowance | | (50 | ) | (200 | ) | (250 | ) | (350 | ) |

Surplus (deficit) | | (2,497 | ) | (968 | ) | 154 | | 250 | |

Capital spending: | | | | | | | | | |

Taxpayer-supported capital spending | | 3,997 | | 3,757 | | 3,477 | | 3,429 | |

Self-supported capital spending | | 3,144 | | 3,346 | | 2,553 | | 2,606 | |

| | 7,141 | | 7,103 | | 6,030 | | 6,035 | |

Provincial Debt: | | | | | | | | | |

Taxpayer-supported debt | | 34,786 | | 38,736 | | 41,656 | | 43,702 | |

Self-supported debt | | 16,149 | | 18,667 | | 20,808 | | 22,302 | |

Total debt (including forecast allowance) | | 50,985 | | 57,603 | | 62,714 | | 66,354 | |

Taxpayer-supported debt-to-GDP ratio | | 16.4 | % | 17.6 | % | 18.2 | % | 18.3 | % |

| | 2011 | | 2012 | | 2013 | | 2014 | |

Economic Forecast: | | | | | | | | | |

Real GDP growth | | 2.0 | % | 1.8 | % | 2.2 | % | 2.5 | % |

Nominal GDP growth | | 4.3 | % | 3.7 | % | 4.1 | % | 4.4 | % |

Introduction

Budget 2012 continues government’s ongoing commitment to its key fiscal plan objectives:

· protection of essential healthcare, education, and social services;

· a balanced budget by 2013/14; and

· a fiscally sustainable taxpayer-supported debt to GDP ratio that maintains a AAA credit rating.

In support of these priorities, government is continuing its management strategy of prudence and spending discipline.

Budget 2012 focuses on maintaining government services within existing budget allocations for most ministries, requiring them to continue to carefully manage priorities. Incremental funding has been provided to key core services, including healthcare, K-12 education, justice and social supports.

In recognition of the funding pressures and challenges faced by caseload ministries, Budget 2012 provides additional funding to the Ministries of Justice and Social Development through the drawdown of the Contingencies vote and the reallocation of resources from reduced debt servicing costs and targeted administrative efficiencies.

Resources have also been reallocated to the Ministries of Health and Education to ensure that the high standards of healthcare and education outcomes for British Columbians are maintained. Over the fiscal plan period government will be redirecting over $1.0 billion to priority areas in ministries.

Budget and Fiscal Plan – 2012/13 to 2014/15

4

Three Year Fiscal Plan

Trough prudent expense management, Budget 2012 also supports the BC Jobs Plan and provides additional funding for community gaming grants, the operation and maintenance of heritage properties, and the new Auditor General for Local Government.

Government projects it will be able to deliver on its commitment to return to balanced budgets by 2013/14. Average annual revenue growth of 2.9 per cent is consistent with the Ministry of Finance economic forecast, and reflects strengthening economic conditions and rising commodity prices over the next three years.

The revenue growth includes the continuation of the small business corporate income tax rate at 2.5 per cent and a one percentage point increase in the corporate income tax rate to 11 per cent in April 2014, to assist with achieving a balanced budget by 2013/14. Further revenue will be generated from a government initiative to identify surplus assets and release them for sale. Further information on tax policy changes is provided in Part 2: Tax Measures; and, on the sale of surplus assets, in the Release of Surplus Corporate Assets for Economic Generation topic box on page 51.

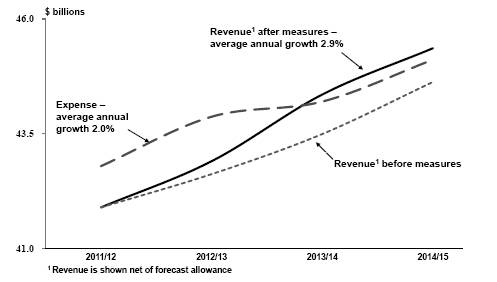

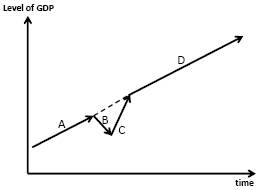

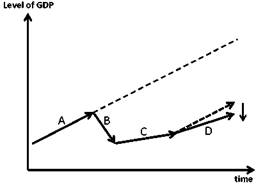

Chart 1.1 Bridging the deficit gap

A cornerstone of government’s plan to balance the budget is management control of operating expenditures. Over the fiscal plan period, full realization of the efficiencies driven by government’s expenditure management strategies will result in an average annual growth rate of 2.0 per cent, enabling revenue growth to bridge the deficit gap by 2013/14.

Taxpayer-supported infrastructure spending on hospitals, schools, post-secondary facilities, transit, and roads will total $10.7 billion over the fiscal plan period, and will be financed by $7.2 billion in borrowing with the remainder funded by third parties such as the federal government, and from internal cash flows.

Self-supported infrastructure spending on electrical generation, transmission and distribution projects, the Port Mann Bridge and other capital assets will total $8.5 billion over the fiscal plan period, and will be financed by $6.2 billion in borrowing, with the remainder funded internally. More information on the three year capital spending plan is found on page 33.

Budget and Fiscal Plan – 2012/13 to 2014/15

6

Three Year Fiscal Plan

Government’s borrowing requirement for the next three years totals $23.6 billion, and includes $1.6 billion for operating needs and $8.5 billion to retire maturing debt in addition to the capital borrowing outlined above. Overall, total provincial debt is projected to increase to $66.4 billion by 2014/15. Additional information on the debt outlook is found starting on page 42.

Due to the anticipated deficits, additional borrowing to support infrastructure spending, and lower GDP projections in the near term, the taxpayer-supported debt to GDP ratio will peak at 18.3 per cent in 2014/15. As government returns to balancing its budget and GDP growth returns to historical levels, government anticipates this measure of affordability will remain at fiscally sustainable levels that support a AAA credit rating.

Chart 1.2 Taxpayer-supported debt remains fiscally sustainable

The major risks to the fiscal plan stem from changes in factors that government does not directly control. These include:

· Risks to the BC economic outlook, largely due to the continued uncertainty surrounding global economic activity.

· Assumptions underlying revenue and Crown corporation forecasts such as economic factors, commodity prices and weather conditions.

· Utilization rates for government services such as healthcare, children and family services, and income assistance.

Government incorporates three main levels of prudence in its projections to mitigate the risks to the fiscal plan:

· A lower Ministry outlook for BC’s real GDP growth relative to the outlook provided by the Economic Forecast Council (0.4 percentage points lower in 2012 and 0.3 percentage points lower in 2013).

· Government has included a forecast allowance of $200 million in 2012/13, $250 million in 2013/14, and $350 million in 2014/15 to guard against revenue volatility.

Budget and Fiscal Plan – 2012/13 to 2014/15

7

Three Year Fiscal Plan

· The fiscal plan includes contingencies of $300 million in 2012/13, and $250 million in each of 2013/14 and 2014/15 to help manage unexpected pressures and fund priority initiatives.

A complete discussion of the risks to the fiscal plan can be found beginning on page 45. Economic risks are discussed in the introduction to Part 3: British Columbia Economic Review and Outlook.

Changes from Budget 2011 Fiscal Plan

Over the past year, the Budget 2011 fiscal plan (2011/12 to 2013/14) has deteriorated by $3.3 billion. Of this, $2.2 billion was due to the liability for repayment of the $1.6 billion HST transition funding plus the impacts of transitioning from an HST system to a PST/GST system by 2013/14, including $111 million in transition relief for the housing industry as follows:

· increasing the HST rebate threshold to $850,000 from $525,000 on the purchase of new homes intended as a primary residence;

· introducing a similar grant program for HST paid on new housing used as a second or recreational residence in certain geographical regions; and

· introducing a temporary tax credit for first time buyers of new homes.

Other tax relief being provided by government includes:

· introducing children’s fitness and children’s arts tax credits; and

· introducing a BC Seniors’ Home Renovation Tax Credit to assist seniors with the cost of renovations that provide increased independence, giving them the flexibility to remain in their homes longer.

Table 1.2 Fiscal Plan Update — Changes from Budget 2011

($ millions) | | 2011/12 | | 2012/13 | | 2013/14 | |

Budget 2011 Fiscal Plan | | (925 | ) | (440 | ) | 175 | |

Repayment of HST transition funding and revenue impacts of returning to PST | | (1,599 | ) | (7 | ) | (427 | ) |

Transition relief and other tax reductions | | (6 | ) | (145 | ) | (36 | ) |

Revenue losses | | (360 | ) | (609 | ) | (715 | ) |

Spending changes — net (increase) decrease | | 93 | | (198 | ) | 197 | |

Forecast allowance updates | | 300 | | 150 | | 100 | |

Fiscal plan before measures | | (2,497) | | (1,249 | ) | (706 | ) |

| | | | | | | |

Measures to balance the budget: | | | | | | | |

Corporate income tax measures: | | | | | | | |

Small business tax rate remains at 2.5 per cent | | — | | 281 | | 261 | |

General tax rate increased to 11.0 per cent | | — | | — | | 49 | |

Other tax measures | | — | | — | | 75 | |

Release of surplus assets | | — | | — | | 475 | |

Net changes | | — | | 281 | | 860 | |

Budget 2012 Fiscal Plan | | (2,497 | ) | (968 | ) | 154 | |

Budget and Fiscal Plan – 2012/13 to 2014/15

8

Three Year Fiscal Plan

Revenue projections deteriorated a further $1.7 billion due to the effects of slower economic growth, lower commodity prices and weaker commercial Crown corporation income.

Overall, spending from 2011/12 to 2013/14 is projected to increase by $92 million compared to the same period in the Budget 2011 fiscal plan. This slight increase reflects the reallocation of resources to priority program areas as well as between fiscal years. Further information on spending initiatives can be found starting on page 18.

Government also re-profiled its forecast allowance to reflect the increasing uncertainty in projecting future years’ revenue.

Measures to Balance the Budget

In support of balancing the budget by 2013/14, government initiated a number of strategies for bridging the deficit gap until the effects of strengthening economic growth provides sustainable improvements to government revenue (see Table 1.2).

These strategies include the following tax policy changes that are projected to generate $666 million in additional revenue:

· maintaining the small business corporate income tax rate at 2.5 per cent, previously assumed to decline to zero effective April 1, 2012;

· increasing the general corporate income tax rate to 11 per cent from 10 per cent, effective April 1, 2014, as a provisional measure; and

· increasing the tobacco tax rate effective April 1, 2013 to offset the reduction in tax due to the elimination of the HST.

As well, government intends to release surplus assets into the BC economy in order to generate revenue and help spur economic activity and development.

For further information on all the tax measures, including transitional relief, see Part 2: Tax Measures; for additional details on the release of surplus assets, see the topic box on page 51.

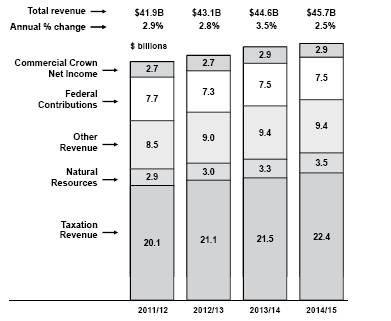

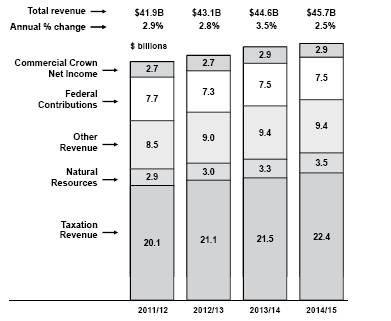

Revenue

Total revenue is expected to average 2.9 per cent annual growth over the fiscal plan period (2012/13 to 2014/15). This reflects strengthening economic conditions and rising energy prices over the next three years.

Over the three years of the Budget 2012 fiscal plan, taxation revenue is expected to average 3.5 per cent annual growth, consistent with the Ministry of Finance economic forecast including projections for growth in nominal GDP, personal income, corporate profits, consumer expenditures and housing starts. The forecast also includes the effects of the return to the PST system. A variety of tax measures and initiatives are detailed in Part 2.

Budget and Fiscal Plan – 2012/13 to 2014/15

9

Three Year Fiscal Plan

Chart 1.3 Revenue trends

Growth in natural resource revenue is forecast to average 7.2 per cent over the next three years reflecting the relatively low base in 2011/12 and increases in commodity prices and markets, in particular for natural gas, lumber and electricity. Revenue growth from fees, investment earnings and other miscellaneous sources excluding the gain on the disposal of surplus assets is expected to average 2.6 per cent annually based on projected Medical Services Plan premium rate increases and forecasts provided by taxpayer-supported Crown and SUCH sector agencies.

Excluding the $580 million HST transition payment in 2011/12, federal government transfers are expected to average 1.9 per cent annual growth over the next three years as the scheduled end of stimulus and other one-time transfers partially offset standard growth in the Canada Health Transfer and Canada Social Transfer programs.

Commercial Crown net income is expected to average 1.8 per cent annual growth over three years, mainly reflecting improvements from the Insurance Corporation of British Columbia and the BC Lottery Corporation. More details on Crown corporation net income are provided below.

Chart 1.4 Revenue forecast

Budget and Fiscal Plan – 2012/13 to 2014/15

10

Three Year Fiscal Plan

Table 1.3 Major Factors Underlying Revenue

Calendar Year | | February 21, 2012 | | May 3, 2011 | |

Per cent growth unless otherwise indicated | | 2011 | | 2012 | | 2013 | | 2014 | | 2011 | | 2012 | | 2013 | | 2014 | |

Real GDP | | 2.0 | | 1.8 | | 2.2 | | 2.5 | | 2.0 | | 2.6 | | 2.7 | | 2.8 | |

Nominal GDP | | 4.3 | | 3.7 | | 4.1 | | 4.4 | | 4.1 | | 4.9 | | 4.8 | | 4.8 | |

Personal income | | 3.7 | | 3.7 | | 3.8 | | 4.0 | | 3.5 | | 4.5 | | 4.4 | | 4.4 | |

Corporate profits | | 10.6 | | 3.6 | | 4.3 | | 6.5 | | 8.6 | | 6.5 | | 6.8 | | 7.7 | |

Consumer expenditures | | 3.6 | | 4.3 | | 3.8 | | 4.6 | | 4.6 | | 5.0 | | 4.9 | | 4.8 | |

Consumer expenditures on durable goods | | 3.1 | | 1.7 | | 2.1 | | 2.1 | | 2.3 | | 2.5 | | 2.2 | | 2.3 | |

Business investment | | 3.8 | | 4.2 | | 5.9 | | 4.5 | | 3.9 | | 5.8 | | 5.5 | | 5.7 | |

Residential investment | | 4.9 | | 2.8 | | 4.7 | | 3.5 | | 3.7 | | 6.7 | | 5.2 | | 6.0 | |

Retail sales | | 1.8 | | 3.3 | | 3.5 | | 4.0 | | 4.1 | | 4.5 | | 4.4 | | 4.4 | |

Employment | | 0.8 | | 0.9 | | 1.4 | | 1.4 | | 1.4 | | 1.8 | | 1.7 | | 1.7 | |

BC Housing starts | | -0.3 | | -5.4 | | 4.2 | | 2.7 | | -5.8 | | 6.4 | | 2.3 | | 3.6 | |

US Housing starts | | 3.4 | | -4.4 | | 20.7 | | 14.3 | | 3.8 | | 31.1 | | 12.5 | | 11.1 | |

SPF 2x4 price ($US/thousand board feet) | | $ | 255 | | $ | 260 | | $ | 288 | | $ | 300 | | $ | 263 | | $ | 288 | | $ | 300 | | $ | 300 | |

Pulp ($US/tonne) | | $ | 961 | | $ | 838 | | $ | 800 | | $ | 800 | | $ | 888 | | $ | 738 | | $ | 700 | | $ | 700 | |

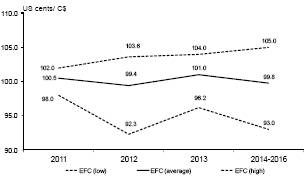

Exchange rate (US cents/Canadian dollar) | | 101.1 | | 96.6 | | 100.5 | | 99.6 | | 99.7 | | 100.5 | | 97.6 | | 97.6 | |

Fiscal Year | | 2011/12 | | 2012/13 | | 2013/14 | | 2014/15 | | 2011/12 | | 2012/13 | | 2013/14 | | 2014/15 | |

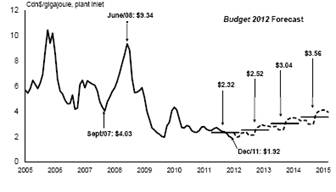

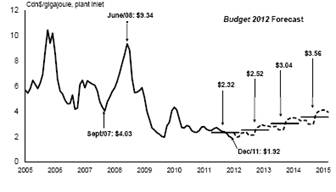

Natural gas price ($Cdn/GJ at plant inlet) | | $ | 2.32 | | $ | 2.52 | | $ | 3.04 | | $ | 3.56 | | $ | 3.02 | | $ | 3.60 | | $ | 4.20 | | $ | 4.85 | |

Bonus bids average bid price per hectare ($) | | $ | 1,167 | | $ | 1,200 | | $ | 1,200 | | $ | 1,000 | | $ | 500 | | $ | 550 | | $ | 575 | | $ | 600 | |

Electricity price ($US/mega-watt hour, Mid-C) | | $ | 30 | | $ | 32 | | $ | 37 | | $ | 41 | | $ | 37 | | $ | 43 | | $ | 46 | | $ | 49 | |

Metallurgical coal price ($US/tonne, fob west coast) | | $ | 257 | | $ | 218 | | $ | 219 | | $ | 212 | | $ | 224 | | $ | 218 | | $ | 212 | | $ | 205 | |

Copper price ($US/lb) | | $ | 3.78 | | $ | 3.68 | | $ | 3.74 | | $ | 3.31 | | $ | 3.65 | | $ | 3.40 | | $ | 3.04 | | $ | 2.73 | |

Crown harvest volumes (million cubic metres) | | 64.0 | | 65.0 | | 65.0 | | 66.0 | | 59.0 | | 60.0 | | 60.0 | | 62.0 | |

Major Revenue Sources

Key assumptions and sensitivities relating to revenue are provided in Appendix Table A5. The major revenue components are:

· Personal income tax — over the next three years, the revenue is forecast to average 5.7 per cent annual growth.

This is consistent with Budget 2012 projections of personal and labour incomes and includes the effect of reversing the basic personal amount tax credit enhancement introduced in 2010 with the implementation of HST.

Table 1.4 Personal Income Tax Revenue

($ millions) | | 2011/12 | | 2012/13 | | 2013/14 | | 2014/15 | |

Base personal income tax revenue | | 6,307 | | 6,594 | | 6,942 | | 7,323 | |

Measure: | | | | | | | | | |

– Reversal of basic personal amount tax credit enhancement | | — | | 36 | | 195 | | 206 | |

Prior-Year adjustment | | 63 | | — | | — | | — | |

Budget 2012 revenue | | 6,370 | | 6,630 | | 7,137 | | 7,529 | |

Annual growth | | 9.6 | % | 4.1 | % | 7.6 | % | 5.5 | % |

Personal income growth (calendar year) | | 3.7 | % | 3.7 | % | 3.8 | % | 4.0 | % |

Labour income growth (calendar year) | | 4.8 | % | 3.6 | % | 4.1 | % | 4.2 | % |

Elasticity(1) (calendar year bass, policy neutral) | | 1.0 | | 1.2 | | 1.4 | | 1.4 | |

(1) Per cent growth in current year tax relative to per cent growth in personal income.

Budget and Fiscal Plan – 2012/13 to 2014/15

11

Three Year Fiscal Plan

· Corporate income tax — revenue is recorded on a cash basis and annual changes reflect changes in payment share, instalments and adjustments for the prior year. Actual calendar-year entitlement before measures is forecast to rise in line with corporate profits. The revenue forecast incorporates the small business tax rate remaining at 2.5 per cent and a planned general corporate tax rate increase to 11 per cent from 10 per cent, effective April 1, 2014.

Table 1.5 Corporate Income Tax Revenue

($ millions) | | 2011/12 | | 2012/13 | | 2013/14 | | 2014/15 | |

Advance instalments from the federal government: | | | | | | | | | |

– Payment share | | 11.6 | % | 11.8 | % | 11.5 | % | 11.1 | % |

– Advances | | 1,883 | | 2,305 | | 2,184 | | 2,335 | |

International Business Activity Act refunds | | (25 | ) | (20 | ) | (20 | ) | (15 | ) |

Prior-year adjustment | | 157 | | (19 | ) | (122 | ) | (114 | ) |

Corporate income tax revenue | | 2,015 | | 2,266 | | 2,042 | | 2,206 | |

Annual per cent growth | | 0.6 | % | 12.5 | % | -9.9 | % | 8.0 | % |

· Sales taxes — over the next three years, sales taxes are expected to average 0.9 per cent annual growth as the effects of economic growth are partially offset by the impacts of returning to the provincial sales tax (PST) system. Sales tax revenues consist of HST, the tax on designated property, and the PST, which includes the former hotel room tax. HST revenue in 2012/13 includes the impact of increasing the HST rebate threshold to $850,000 from $525,000 on the purchase on new homes intended as a primary residence.

Table 1.6 Sales Taxes Revenue

($ millions) | | 2011/12 | | 2012/13 | | 2013/14 | | 2014/15 | |

Harmonized Sales Tax (BC’s portion of HST) | | | | | | | | | |

Gross | | 7,233 | | 7,527 | | — | | — | |

Temporary restrictions of input tax credits | | 139 | | 145 | | — | | — | |

Rebates | | (1,561 | ) | (1,669 | ) | — | | — | |

BC’s portion of HST | | 5,811 | | 6,003 | | — | | — | |

Social service tax | | 45 | | — | | 5,819 | | 6,011 | |

Tax on designated property | | 96 | | 98 | | 99 | | 101 | |

Annual per cent change (calendar year) | | 2011 | | 2012 | | 2013 | | 2014 | |

Consumer expenditure | | 3.6 | % | 4.3 | % | 3.8 | % | 4.6 | % |

Residential investment | | 4.9 | % | 2.8 | % | 4.7 | % | 3.5 | % |

Government expenditures | | 3.6 | % | 2.1 | % | 2.8 | % | 2.9 | % |

Nominal GDP | | 4.3 | % | 3.7 | % | 4.1 | % | 4.4 | % |

Retail sales | | 1.8 | % | 3.3 | % | 3.5 | % | 4.0 | % |

· Carbon tax — as announced in Budget 2008, the carbon tax rate per tonne of CO2-equivalent will increase by $5 each year to $30 per tonne by July 1, 2012. The forecast assumes that purchased volumes of natural gas will grow by 2.0 per cent annually, while consumption of gasoline is expected to remain constant. Revenue is expected to increase in line with these higher rates and assumed volume growth. Carbon tax revenue is fully returned to taxpayers through tax reductions. For more details on carbon tax recycling, see the Carbon Tax topic box on page 66.

Budget and Fiscal Plan – 2012/13 to 2014/15

12

Three Year Fiscal Plan

· Property tax — over the three year plan, revenue is expected to grow by an average of 4.2 per cent annually, in line with the outlook for BC housing starts and the inflation rate.

· Property transfer tax — consistent with the forecast for BC housing starts and trends in the housing market, annual revenue growth is forecast to average 0.6 per cent over the next three years. This reflects a 4.5 per cent decline in 2012/13 before averaging 3.3 per cent annual growth between 2012/13 and 2014/15.

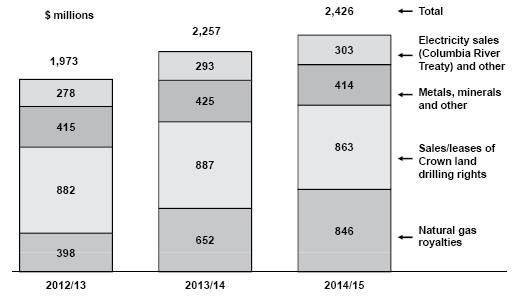

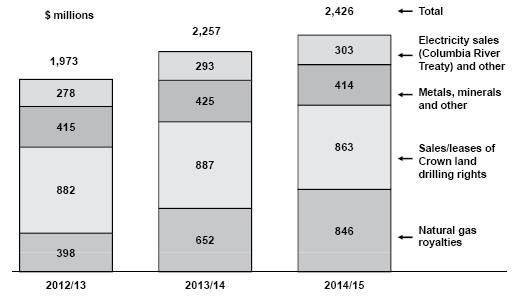

· Natural gas royalties — over the next three years, revenue increases on average by 32 per cent annually due to rising natural gas prices and production volumes, partially offset by increasing production from wells qualifying for royalty programs and credits. In 2013/14, natural gas royalties are expected to increase by 64 per cent due to higher volumes, prices, and an increase in gross royalty rates, which reach their maximum when prices are above $3.00 CDN per gigajoule (at plant inlet).

Although prices are forecast to average 15 per cent annual growth over the next three years, they are expected to remain below the $4 level. Growth in production volumes is due in part to the effects of the royalty programs and an expected increase in demand and prices with an improving North American economy. See Appendix Table A6 for more details regarding natural gas price forecasts.

Chart 1.5 Revenue from energy, metals and minerals

· Other energy, metals and minerals — average annual revenue growth from sales of Crown land tenures is forecast to decline 2.1 per cent over the three years due to the lower outlook for average bid prices per hectare. The revenue forecast from other energy, metals and minerals is relatively flat over the fiscal plan reflecting the outlook for electricity, coal and copper prices.

· Forests — revenue is forecast to increase $76 million or 16.6 per cent in 2012/13 mainly reflecting improving stumpage rates from very low levels in 2011/12. Over the next two years revenue is expected to increase $24 million and $49 million respectively, as increasing stumpage revenue is offset by declining border tax revenue collected under the Softwood Lumber Agreement (SLA). SLA border tax revenue is expected to decrease as the rate applied to US exports falls to 5 per cent from 10 per cent, consistent with the assumed recovery of lumber prices to US $300 per thousand feet.

Budget and Fiscal Plan – 2012/13 to 2014/15

13

Three Year Fiscal Plan

· Fees, licences and other miscellaneous sources — excluding the gain on the disposal of surplus assets, revenue is expected to average 1.7 per cent annual growth over the three year fiscal plan period reflecting projected increases to Medical Services Plan premium rates in support of rising healthcare expenditures and forecasts provided by taxpayer-supported agencies.

· Investment earnings — averaging 9.3 per cent annual growth over the three year fiscal plan period mainly due to rising earnings from fiscal agency loans. Earnings from fiscal agency loans have offsetting expenses resulting in no impact on the bottom line.

· Health and social transfers — Over the three years, revenue is expected to average 3.7 per cent annual growth reflecting national base growth and a rising BC population share. The forecast of Canada Health Transfer revenue in 2014/15 is based solely on per capita funding of the national base.

Table 1.7 Federal Government Contributions

($ millions) | | 2011/12 | | 2012/13 | | 2013/14 | | 2014/15 | |

Canada Health Transfer (CHT) | | 3,798 | | 4,051 | | 4,326 | | 4,289 | |

Wait Times Reduction Transfer | | 33 | | 33 | | 33 | | — | |

Deferred health equipment grants | | 23 | | 23 | | 22 | | 17 | |

Canada Social Transfer (CST) | | 1,519 | | 1,575 | | 1,627 | | 1,681 | |

Total health and social transfers | | 5,373 | | 5,682 | | 6,008 | | 5,987 | |

Other contributions | | 2,292 | | 1,575 | | 1,556 | | 1,511 | |

Total Federal Contributions | | 7,665 | | 7,257 | | 7,564 | | 7,498 | |

BC share of national population (June 1) | | 13.27 | % | 13.28 | % | 13.32 | % | 13.36 | % |

· Other federal contributions — excluding the $580 million HST transition payment in 2011/12, revenue falls $137 million or 8.0 per cent in 2012/13 primarily reflecting reduced funding for disaster financial assistance, vote recoveries (including the federal stimulus program) and transfers to taxpayer-supported service delivery agencies. Changes in vote recoveries do not affect the bottom line as expenses fall by the same amount. Over the next two years other federal contributions are expected to decline 1.2 per cent and 2.9 per cent respectively.

Commercial Crown Corporation Net Income

· British Columbia Hydro and Power Authority — BC Hydro’s net income is forecast to average $580 million annually over the fiscal plan period (2012/13 to 2014/15). BC Hydro’s projections reflect the utility’s amended Revenue Requirements Application (RRA), which is currently before the BC Utilities Commission (BCUC) with the commission’s decision expected in the Fall 2012. As the RRA ends with 2013/14, projections have been extended by one year based on BC Hydro’s current allowed return on deemed equity.

· British Columbia Liquor Distribution Branch — LDB’s liquor sales continue to be impacted by changes in consumer purchasing patterns that are affecting product mix and gross margins. As well, the reinstatement of the PST/GST system effective April 2013 will result in a downward adjustment to LDB margins that will have an ongoing impact on the sales revenue trend. As a result, total sales revenue is only expected to increase 1.3 per cent over the fiscal plan period.

Budget and Fiscal Plan – 2012/13 to 2014/15

14

Three Year Fiscal Plan

· British Columbia Lottery Corporation — BCLC’s net income is expected to grow by 12.4 per cent over the fiscal plan period reflecting moderate revenue growth in the lottery and casino/community gaming channels (5.7 per cent and 6.9 per cent respectively) and strong growth from e-Gaming (65.7 per cent). Revenue growth is mainly due to continuing product development (primarily in PlayNow internet gaming), distribution enhancements, and facility improvements to casinos and community gaming centres. As well, a return to the PST/GST system in 2013 will result in lower taxes paid by the corporation and an improvement to net income.

The government will distribute 20 per cent ($719 million) of its gaming income to charities and local governments over the next three years, reflecting a $15 million increase to charities in each year of the fiscal plan. As well, $441 million of the gaming income retained by government will be allocated to the Health Special Account in support of health services.

· Insurance Corporation of British Columbia — ICBC’s net income outlook is forecast at $146 million in 2012, $230 million in 2013 and $229 million in 2014. The outlook reflects an 11.2 per cent increase on Basic premiums and a 6 per cent decrease on Optional insurance, effective February 1, 2012 (the interim premium adjustments are subject to approval by the BCUC). The outlook also assumes average annual growth of 1.5 per cent in the number of insured vehicles and a 2.5 per cent average annual increase in claims costs. Over the fiscal plan period, ICBC is forecast to remit $497 million of its excess optional capital to the consolidated revenue fund to support core government services.

ICBC is in its second year of a multi-year $400 million Transformation Program that is designed to promote a fairer, customer-based risk pricing model, resulting in better rates for safer drivers; simplified systems and processes to facilitate better support for customers and business partners with less paperwork; and more efficient business practices. The Transformation Program, forecast to be complete in the fall of 2016, will be funded entirely from Optional insurance capital so as to not impact Basic insurance rates.

· Transportation Investment Corporation — TI Corp manages the construction of the new Port Mann Bridge, which is scheduled to open in December 2012. TI Corp’s projections in the fiscal plan reflect operating losses during the construction phase, changing to net income as tolls are introduced.

Budget and Fiscal Plan – 2012/13 to 2014/15

15

Three Year Fiscal Plan

Table 1.8 Revenue by Source

| | Updated | | Budget | | | | | |

| | Forecast | | Estimate | | Plan | | Plan | |

($ millions) | | 2011/12 | | 2012/13 | | 2013/14 | | 2014/15 | |

Taxation revenue | | | | | | | | | |

Personal income | | 6,370 | | 6,630 | | 7,137 | | 7,529 | |

Corporate income | | 2,015 | | 2,266 | | 2,042 | | 2,206 | |

Sales (1) | | 5,952 | | 6,101 | | 5,918 | | 6,112 | |

Fuel | | 939 | | 937 | | 946 | | 955 | |

Carbon | | 960 | | 1,172 | | 1,241 | | 1,261 | |

Tobacco | | 652 | | 652 | | 727 | | 727 | |

Property | | 1,925 | | 2,013 | | 2,094 | | 2,178 | |

Property transfer | | 935 | | 893 | | 928 | | 952 | |

Other (2) | | 407 | | 424 | | 434 | | 434 | |

| | 20,155 | | 21,088 | | 21,467 | | 22,354 | |

| | | | | | | | | |

Natural resource revenue | | | | | | | | | |

Natural gas royalties | | 367 | | 398 | | 652 | | 846 | |

Forests | | 457 | | 533 | | 557 | | 606 | |

Other resource (3) | | 2,048 | | 2,055 | | 2,102 | | 2,088 | |

| | 2,872 | | 2,986 | | 3,311 | | 3,540 | |

| | | | | | | | | |

Other revenue | | | | | | | | | |

Medical Services Plan premiums | | 1,915 | | 2,047 | | 2,158 | | 2,274 | |

Other fees (4) | | 2,803 | | 2,876 | | 2,867 | | 2,890 | |

Investment earnings | | 977 | | 1,083 | | 1,145 | | 1,274 | |

Miscellaneous (5) | | 2,845 | | 3,047 | | 2,765 | | 2,788 | |

Release of surplus assets | | — | | — | | 475 | | 231 | |

| | 8,540 | | 9,053 | | 9,410 | | 9,457 | |

| | | | | | | | | |

Contributions from the federal government | | | | | | | | | |

Health and social transfers | | 5,373 | | 5,682 | | 6,008 | | 5,987 | |

Harmonized sales tax transition payments | | 580 | | — | | — | | — | |

Other federal contributions (6) | | 1,712 | | 1,575 | | 1,556 | | 1,511 | |

| | 7,665 | | 7,257 | | 7,564 | | 7,498 | |

| | | | | | | | | |

Commercial Crown corporation net income | | | | | | | | | |

BC Hydro | | 595 | | 566 | | 599 | | 576 | |

Liquor Distribution Branch | | 899 | | 906 | | 844 | | 851 | |

BC Lotteries (net of payments to federal government) | | 1,068 | | 1,115 | | 1,190 | | 1,200 | |

ICBC (7) | | 140 | | 146 | | 230 | | 229 | |

Transportation Investment Corporation (Port Mann) | | (16 | ) | (48 | ) | (49 | ) | (28 | ) |

Other | | 27 | | 32 | | 37 | | 34 | |

| | 2,713 | | 2,717 | | 2,851 | | 2,862 | |

Total revenue | | 41,945 | | 43,101 | | 44,603 | | 45,711 | |

(1) Includes harmonized sales tax, provincial sales tax, tax on designated property and HST/PST housing transition tax.

(2) Corporation capital and insurance premium taxes.

(3) Columbia River Treaty, other energy and minerals, water rental and other resources.

(4) Post-secondary, healthcare-related, motor vehicle, and other fees.

(5) Includes reimbursements for healthcare and other services provided to external agencies, and other recoveries.

(6) Includes contributions for health, education, community development, housing and social service programs, and transportation projects.

(7) The amounts represent projected earnings on ICBC’s fiscal year basis (December).

Budget and Fiscal Plan – 2012/13 to 2014/15

16

Three Year Fiscal Plan

Table 1.9 Expense by Ministry, Program and Agency

| | Updated | | Budget | | | | | |

| | Forecast | | Estimate | | Plan | | Plan | |

($ millions) | | 2011/12 (1) | | 2012/13 | | 2013/14 | | 2014/15 | |

Office of the Premier | | 9 | | 9 | | 9 | | 9 | |

Aboriginal Relations and Reconciliation | | 80 | | 80 | | 81 | | 82 | |

Advanced Education | | 1,963 | | 1,972 | | 1,952 | | 1,922 | |

Agriculture | | 66 | | 66 | | 66 | | 66 | |

Children and Family Development | | 1,331 | | 1,333 | | 1,333 | | 1,333 | |

Community, Sport and Cultural Development | | 254 | | 311 | | 172 | | 211 | |

Education | | 5,242 | | 5,315 | | 5,321 | | 5,342 | |

Energy and Mines | | 437 | | 439 | | 421 | | 421 | |

Environment | | 130 | | 129 | | 129 | | 129 | |

Finance | | 175 | | 173 | | 161 | | 161 | |

Forests, Lands and Natural Resource Operations | | 590 | | 602 | | 555 | | 592 | |

Health | | 15,622 | | 16,180 | | 16,785 | | 17,281 | |

Jobs, Tourism and Innovation | | 238 | | 235 | | 235 | | 235 | |

Justice | | 1,106 | | 1,110 | | 1,123 | | 1,126 | |

Labour, Citizens’ Services and Open Government | | 543 | | 549 | | 544 | | 553 | |

Social Development | | 2,338 | | 2,457 | | 2,498 | | 2,505 | |

Transportation and Infrastructure | | 807 | | 807 | | 807 | | 807 | |

Total ministries and Office of the Premier | | 30,931 | | 31,767 | | 32,192 | | 32,775 | |

Management of public funds and debt | | 1,265 | | 1,287 | | 1,346 | | 1,398 | |

Contingencies | | 603 | | 300 | | 250 | | 250 | |

Funding for capital expenditures | | 1,306 | | 1,062 | | 970 | | 1,044 | |

Refundable tax credit transfers | | 957 | | 1,091 | | 748 | | 764 | |

Legislative and other appropriations | | 121 | | 124 | | 129 | | 126 | |

Subtotal | | 35,183 | | 35,631 | | 35,635 | | 36,357 | |

Liability for reimbursement of HST transition funding | | 1,599 | | — | | — | | — | |

Prior year liability adjustments | | (24 | ) | — | | — | | — | |

Consolidated revenue fund expense | | 36,758 | | 35,631 | | 35,635 | | 36,357 | |

Expenses recovered from external entities | | 2,777 | | 2,756 | | 2,792 | | 2,843 | |

Funding provided to service delivery agencies | | (21,267 | ) | (21,127 | ) | (21,454 | ) | (21,834 | ) |

Ministry and special office direct program spending | | 18,268 | | 17,260 | | 16,973 | | 17,366 | |

Service delivery agency expense: | | | | | | | | | |

School districts | | 5,532 | | 5,569 | | 5,601 | | 5,641 | |

Universities | | 3,909 | | 4,050 | | 4,089 | | 4,111 | |

Colleges and institutes | | 1,097 | | 1,095 | | 1,100 | | 1,107 | |

Health authorities and hospital societies | | 12,092 | | 12,431 | | 12,835 | | 13,139 | |

Other service delivery agencies | | 3,494 | | 3,464 | | 3,601 | | 3,747 | |

Total service delivery agency expense | | 26,124 | | 26,609 | | 27,226 | | 27,745 | |

Total expense | | 44,392 | | 43,869 | | 44,199 | | 45,111 | |

(1) Restated to reflect government’s current organization and accounting policies.

Budget and Fiscal Plan – 2012/13 to 2014/15

17

Three Year Fiscal Plan

Expense

Budget 2012 continues government’s commitment to maintaining the core services of healthcare, education, and social support that British Columbians depend upon. In support of these priorities, government is continuing its management strategy of prudence and spending discipline.

Budget 2012 focuses on maintaining government services within existing budget allocations, requiring ministries to continue to carefully manage priorities, and provides incremental funding to key core services, including healthcare, education, justice and social supports, through the drawdown of the Contingencies vote and the reallocation of resources from administrative efficiencies and reduced debt servicing costs.

Over the fiscal plan period, government will be redirecting over $1.0 billion to priority areas in ministries.

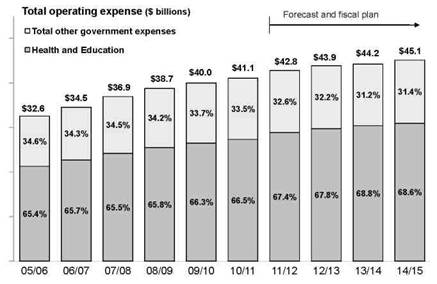

As a result of the expenditure management measures that were initiated after the economic downturn in the fall of 2008, government average annual spending growth of 5.9 per cent during the period leading up to the downturn was reduced to an average annual spending growth of 3.0 per cent from 2009/10 to 2011/12.

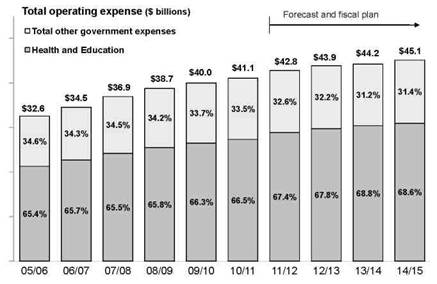

Chart 1.6 Expense trends (excluding refundable tax credit transfers) (1)

Budget 2012 continues to bend the spending curve downward by maintaining the Budget 2011 spending track of 2.0 per cent average annual spending growth. This rate of expense growth will still enable government to increase its program spending by $2.5 billion over the fiscal plan period (from $41.8 billion in 2011/12 to $44.3 billion by 2014/15, excluding refundable tax credit transfers).

Total spending also includes refundable tax credit transfers. These transfers previously were netted from revenue, but are now included as an expense due to an accounting policy change (see page 50). Including these transfers, total spending will reach $45.1 billion by 2014/15.

Budget and Fiscal Plan – 2012/13 to 2014/15

18

Three Year Fiscal Plan

Consolidated Revenue Fund Spending

Budget 2012 requires most ministries to continue providing general government services from within existing budget allocations, requiring them to carefully manage priorities. Potential funding pressures, such as the Public Sector Compensation Mandate, are being managed within existing budgets through productivity increases, efficiencies and savings.

Budget 2012 maintains government’s commitment to priority services by providing additional funding to healthcare, K-12 education, justice and social services through the drawdown of the Contingencies vote, the reallocation of resources from reduced debt servicing costs and other savings from targeted restraint and efficiency measures.

Creating Jobs and Sustaining Communities: The BC Jobs Plan and Other Measures

BC Jobs Plan

There are several initiatives underway, led mainly by the Ministry of Jobs, Tourism and Innovation, to fulfill the commitments made in Canada Starts Here: The BC Jobs Plan released in September 2011. Many of these are funded by reallocations from within the Ministry of Jobs, Tourism and Innovation, but Contingencies funding may be accessed for certain targeted programs. Initiatives include:

· Major Investments Office: This new entity will work with potential investors, ministries, and other public agencies to identify and propose solutions to barriers that may be impeding specific economic investment opportunities.

· Jobs and Investment Board: This new board, which replaces the Progress Board, will be comprised of appointed members who provide government with recommendations on how to attract investment and increase economic development.

· Aboriginal Business and Investment Council: Members of the council will be appointed to advise government, First Nations, and the business community on improvements that can be undertaken to improve aboriginal participation in the BC economy.

· Doubling the International Trade Presence: BC currently has 49 staff/contractors located in nine locations around the world. The Plan will expand this presence by a factor of two, in both existing and new locations, with an initial focus on key overseas markets. The key objectives are two-fold – identify more customers for BC products and encourage overseas investors to create or expand operations in BC.

· Growing our International Student Presence: Foreign students create a significant source of economic activity and add to the vibrancy of many communities across the province. British Columbians studying in foreign countries learn important information about how to work and live in those countries. The Ministry of Advanced Education is developing an international strategy to increase the number of foreign students in BC. This will include using BC’s overseas trade offices to help connect international students to BC’s educational opportunities.

Auditor General for Local Government

The new Auditor General for Local Government (AGLG) will be established as an office reporting through an independent Audit Council, with members selected for their relevant backgrounds and expertise. The AGLG will undertake “value for money” audits

Budget and Fiscal Plan – 2012/13 to 2014/15

19

Three Year Fiscal Plan

of the operations of local governments. This supports local governments and taxpayers by strengthening accountability, providing relevant new information, and making recommendations that support increased efficiency and effectiveness. Budget 2012 establishes an annual budget of $2.6 million for the AGLG.

Community Gaming Grants

Consistent with the feedback from the public consultation process undertaken by the government in the summer of 2011, the allocation for community gaming grants has been increased. The budgeted amount, fully recovered from gaming revenues, has risen from $120 million to $135 million annually in Budget 2012. This funding will re-institute eligibility for adult arts and sports organizations, and environmental and animal welfare groups, as well as increase funding for other charitable organizations.

Maintaining our Heritage Properties

Budget 2012 provides $21 million over three years for the maintenance and operation of provincial heritage property sites – these are significant regional tourism attractions that play a valuable local economic, educational and cultural role. Funding directed towards Barkerville Historic Town, Fort Steele Town and other provincially owned heritage sites will preserve existing assets and provide for their ongoing operations. Annually, approximately 200,000 British Columbians and other tourists visit and enjoy these heritage assets while learning about the province’s colorful history.

Re-profiling Grants/Payments to Communities and Others

In uncertain economic times, the fiscal challenges faced by governments require innovative solutions. For both the BC government and entities dependent on provincial funding, the current world economic volatility causes significant revenue uncertainty, which could reduce budget flexibility over the medium term as the government returns to balancing its budget in 2013/14.

Therefore, the province intends to re-profile $133 million of discretionary grants to external entities, including local governments and agencies, in 2011/12 and 2012/13 in order to increase financial certainty for recipients. As well, $10 million in additional silviculture, inventory, and forest and ecosystem health/restoration activities will be undertaken in 2012/13 by the Ministry of Forests, Lands and Natural Resource Operations to mitigate a one year reduction of $30 million in funding for similar activities in 2013/14.

Effective Management in the SUCH Sector with Limited Resources

The majority of the spending by the Ministries of Health, Education, and Advanced Education is devoted to funding their SUCH sector agencies (schools, universities, colleges, and health organizations). These organizations provide most of the services accounted for in the provincial budget under the broad categories of health and education.

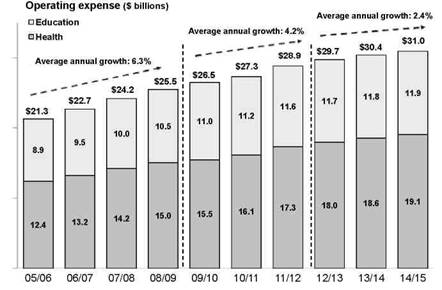

As shown in Chart 1.7 currently government’s expenditures on these important services comprise over two-thirds of all expenditures, and this proportion is rising.

Budget and Fiscal Plan – 2012/13 to 2014/15

20

Three Year Fiscal Plan

Chart 1.7 Health, K—12 and post-secondary education as a percentage of total government expenses

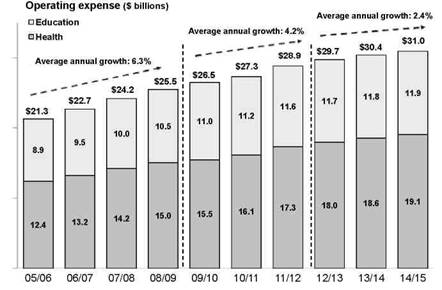

Since the onset of the world-wide economic crisis in 2008, BC has implemented an expenditure management program that has slowed the rate of growth of overall spending, including within the health and education sectors. This is demonstrated in Chart 1.8 — the growth rate for these sectors has been moderating significantly since 2008/09, and is projected in the current fiscal plan to continue to do so.

Chart 1.8 Expenditure growth trends for the SUCH sector

While the quantum of spending is often highlighted, success of these key government programs is best measured by performance outcomes. For some programming (such as healthcare), budget increases are needed to keep up with rapid population growth and fundamental demographic changes; however, improved outcomes can also be generated by simply using existing resources more efficiently (see the Achieving Increased Efficiencies in the SUCH Sector topic box on page 52).

Budget and Fiscal Plan – 2012/13 to 2014/15

21

Three Year Fiscal Plan

In general for the SUCH sector, a survey of the most recent available data demonstrates either positive results compared with other jurisdictions (for health) or improved results over time (for education). This indicates that our SUCH sector agencies are on a relatively strong footing to continue to produce quality results in the face of “flattening” expenditure profiles, more recently and moving forward.

Healthcare — Striving for Affordability and Maintaining Positive Outcomes

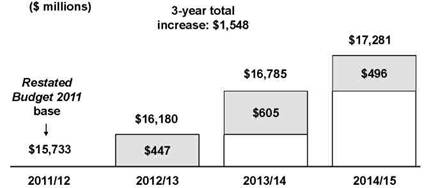

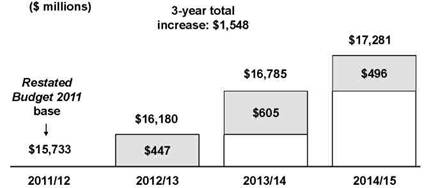

Incremental to the current 2011/12 base budget for the Ministry of Health of $15,733 million, the ministry’s annual budget is projected to increase by a further $1,548 million by 2014/15. In addition to the funding added in last year’s fiscal plan, this latter amount includes new funding of $496 million in 2014/15, as shown in Chart 1.9.

Chart 1.9 Ministry of Health budget increases

Notwithstanding the short term fiscal challenges in BC, given the mounting demographic pressures that are driving expenditures, it is imperative that costs be brought under control for the benefit of future generations. Even with a more modest increase in 2014/15, BC healthcare spending is still projected to reach 42.2 per cent of overall government spending by that year.

By focusing on identifying additional best practices in delivering care, as well as finding administrative savings, it is possible to manage expenditures while at the same time delivering results that compare favorably with other jurisdictions. As was the case last year when health outcomes were first reported in Budget 2011, the updated information reported in Table 1.10 shows that not only does BC continue to have the second lowest per capita costs of all the provinces, but our results continue to be at the forefront.

Table 1.10 Health Per Capita Costs and Outcomes: Canadian Comparisons

| | 2011 Per | | Life | | Infant Mortality | | Cancer Mortality Rate | | Diseases of the Heart |

| | Capita Health | | Expectancy at | | per 1000 Live | | per 100,000 | | Mortality Rate per |

Province | | Care Costs ($) | | Birth (Years) | | Births | | Population | | 100,000 Population |

Quebec | | 3,407 | | 81.0 | | 4.3 | | 179.9 | | 98.8 |

British Columbia | | 3,604 | | 81.4 | | 3.7 | | 147.4 | | 104.0 |

Ontario | | 3,645 | | 81.3 | | 5.3 | | 157.7 | | 105.5 |

Nova Scotia | | 3,972 | | 79.9 | | 3.5 | | 183.6 | | 114.4 |

New Brunswick | | 4,033 | | 80.2 | | 3.2 | | 178.1 | | 111.4 |

Prince Edward Island | | 4,058 | | 80.2 | | 2.0 | | 170.6 | | 127.5 |

Manitoba | | 4,266 | | 79.5 | | 6.5 | | 167.5 | | 128.2 |

Saskatchewan | | 4,348 | | 79.5 | | 6.2 | | 159.0 | | 127.4 |

Alberta | | 4,528 | | 80.6 | | 6.2 | | 153.1 | | 123.7 |

Newfoundland | | 5,077 | | 78.5 | | 5.1 | | 182.2 | | 143.7 |

Sources: Canadian Institute for Health Information (cost data) and Statistics Canada (outcomes data).

Budget and Fiscal Plan – 2012/13 to 2014/15

22

Three Year Fiscal Plan

More specifically, BC continues to rank best in Life Expectancy and Cancer Mortality, and is second best in terms of Mortality related to Diseases of the Heart. While this more recent data shows BC 4th best for Infant Mortality, the actual rate has improved since last year’s report from 4.0 per 1,000 Live Births down to 3.7.

Health Funding Plan

As required under Part 14 of the Consumption Tax Rebate and Transition Act the following table shows the health funding for 2012/13 to 2014/15.

Table 1.11 Health Funding Plan

($ millions) | | 2012/13 | | 2013/14 | | 2014/15 | |

Harmonized sales tax | | 6,003 | | — | | — | |

Medical Services Plan premiums | | 2,047 | | 2,158 | | 2,274 | |

Tobacco tax | | 652 | | 727 | | 727 | |

Health Special Account | | 147 | | 147 | | 147 | |

Canada Health Transfer | | 4,051 | | 4,326 | | 4,289 | |

Wait Times Reduction Transfer | | 33 | | 33 | | — | |

Total revenue from above sources | | 12,933 | | 7,391 | | 7,437 | |

Total government spending on health | | 17,970 | | 18,564 | | 19,047 | |

Health spending in excess of revenue | | 5,037 | | 11,173 | | 11,610 | |

The Act does not specify a provincial sales tax as a source of health funding; therefore, the table reflects funding from the HST. If PST were included, the health spending in excess of revenue would be $5,368 million in 2013/14 and $5,613 million in 2014/15. The Health Funding Report for 2010/11 and 2011/12 is found in Part 4 on page 110.

Post-secondary Education — Improved Results and Finding Efficiencies

After significant annual increases earlier in the last decade, spending by post-secondary institutions (PSIs) has been growing at a much less rapid pace in recent years. In fact the portion of post-secondary expenditures that is funded directly through transfers from the Ministry of Advanced Education has been essentially constant since 2009/10. Nonetheless, the most recent data indicates that the province’s 25 PSIs are continuing to offer high quality programming to British Columbians seeking higher education. In other words, the sector is demonstrating the ability to use the more limited funding while still delivering beneficial results.

Table 1.12 shows two clear trends worthy of note:

· The number of “credentials” (degrees, diplomas, etc.) awarded in BC has been increasing each year since at least 2004, for both university and other post-secondary programs; and

· Student satisfaction, as measured by rigorous surveys of thousands of graduates through the student outcomes surveys, is continually in the 93 per cent to 97 per cent range for both degree and career program offerings.

Budget and Fiscal Plan – 2012/13 to 2014/15

23

Three Year Fiscal Plan

Table 1.12 BC Post-secondary Annual Credentials Awarded and Student Satisfaction

| | | | | | | | Diploma and | | |

| | Graduate and | | Diplomas, | | Bachelors Degree | | Certificate Graduates: | | Apprenticeship |

| | Undergraduate | | Certificates and | | Graduates: Satisifed | | Satisifed or Very | | Students: Satisifed |

| | Degrees | | Other | | or Very Satisfied | | Satisfied | | or Very Satisfied |

2004 | | 23,585 | | 25,735 | | 97% | | 96% | | n/a |

2005 | | 23,985 | | 25,615 | | 97% | | 96% | | 95% |

2006 | | 25,495 | | 26,045 | | 96% | | 95% | | 93% |

2007 | | 25,705 | | 26,110 | | 96% | | 96% | | 93% |

2008 | | 26,175 | | 26,220 | | 95% | | 95% | | 94% |

2009 | | 26,930 | | 26,410 | | 94% | | 94% | | 93% |

2010 | | n/a | | n/a | | 95% | | 95% | | 95% |

Sources: Ministry of Advanced Education; Student Satisfaction from 2010 Student Outcomes Survey.

Note: “Credentials” includes university degrees, college/institute diplomas, trades accreditations, and developmental certificates (e.g. ESL).

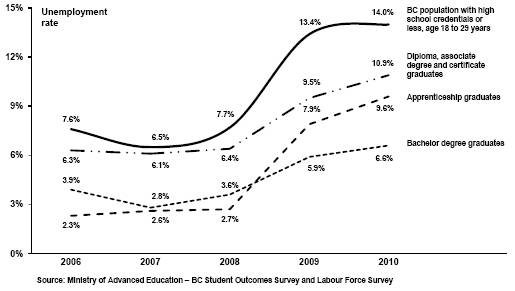

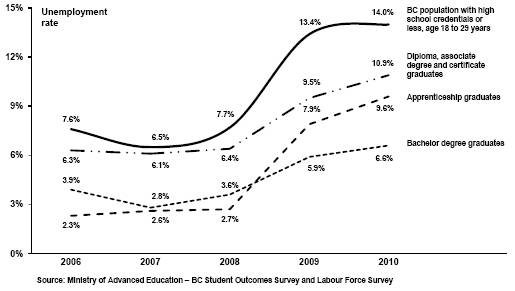

Likely the most important outcome for students graduating from BC’s post-secondary institutions is success in finding employment. Chart 1.10 shows that the unemployment rates in recent years for those subsets of the population holding career diploma, apprenticeship, or university degree accreditation is consistently lower over time when compared to those aged 18-29 who only have Grade 12 or less. Clearly, the public PSIs are instrumental in improving the chances that British Columbians obtain employment, regardless of the prevailing economic situation at the time.

Chart 1.10 BC unemployment rates by credential type

Meeting the commitment to achieve a balanced budget during tight fiscal times requires many difficult choices. Government is therefore challenging the public post-secondary sector to reduce its administrative (i.e. travel, executive overhead, support services, etc.) and any other expenditures not related to direct program delivery by a total of $20 million in 2013/14 and by $50 million in 2014/15.

Note that spending by the PSI’s in BC is over $5 billion annually; therefore $50 million represents less than 1 per cent of the total annual costs of the sector. That said, difficult decisions must be made and a thoughtful process must be established to achieve these savings.

Budget and Fiscal Plan – 2012/13 to 2014/15

24

Three Year Fiscal Plan

As discussed in the Achieving Increased Efficiencies in the SUCH Sector topic box, both the Health and K—12 sectors have undergone or are undergoing similar cost-savings exercises. Given that the projected savings outlined in Budget 2012 do not begin to take effect until 2013/14, the sector has a full year to plan and the Ministry of Advanced Education will work closely with the public PSIs to achieve these targets with the objective of protecting program quality.

Given the performance of the PSIs as demonstrated by the strong results noted above, government believes they are well-positioned to achieve these savings while maintaining the high standards to which British Columbians have become accustomed.

K—12 Education — Strong Performance with Continued Stable Funding

Despite continuing declining enrolment, block funding to school districts remains unchanged from Budget 2011, at $4.7 billion annually through to 2014/15. Similarly, the annual facilities grant to fund maintenance of schools, through a combination of operating and capital funding, again totals $110 million in 2012/13.

However, there is some increase in the Ministry of Education’s budget over the fiscal plan period, mainly due to the addition in Budget 2012 of $165 million over three years for the establishment of the Learning Improvement Fund. This fund is being established as part of the response to the issues surrounding the Bill 28 court ruling in the spring of 2011. Consultations with the BC Teachers Federation regarding how to address those issues occurred during the past summer and fall, and government announced this fund in October 2011. These new resources will target vulnerable learners and challenges regarding class composition in those classrooms with the highest needs.