Exhibit 99.8

Budget and Fiscal Plan

2015/16 — 2017/18

February 17, 2015

National Library of Canada Cataloguing in Publication Data

British Columbia.

Budget and fiscal plan. — 2002/03/2004/05-

Annual

Also available on the Internet.

Continues: British Columbia. Ministry of Finance and

Corporate Relations. Budget … reports. ISSN 1207-5841

ISSN 1705-6071 = Budget and fiscal plan — British Columbia.

1. Budget — British Columbia — Periodicals. 2. British

Columbia — Appropriations and expenditures — Periodicals.

I. British Columbia. Ministry of Finance. II. Title.

HJ12.B742 352.48’09711’05 C2003-960048-3

TABLE OF CONTENTS

Budget and Fiscal Plan 2015/16 — 2017/18 | February 17, 2015 |

Attestation by the Secretary to Treasury Board | | |

| | |

Summary | | 1 |

| | |

Part 1: | Three Year Fiscal Plan | | |

Introduction | | 5 |

Revenue | | 8 |

| Major Revenue Sources | | 10 |

Expense | | 18 |

| Consolidated Revenue Fund Spending | | 18 |

| Management of the BC Public Service | | 24 |

| Recovered Expenses | | 24 |

| Operating Transfers | | 25 |

| Service Delivery Agency Spending | | 25 |

Capital Spending | | 26 |

| Taxpayer-supported Capital Spending | | 26 |

| Self-supported Capital Spending | | 30 |

| Projects over $50 million | | 31 |

Provincial Debt | | 35 |

Risks to the Fiscal Plan | | 37 |

Tables: | | |

| 1.1 | Three Year Fiscal Plan | | 5 |

| 1.2 | Comparison of Major Factors Underlying Revenue | | 9 |

| 1.3 | Personal Income Tax Revenue | | 10 |

| 1.4 | Corporate Income Tax Revenue | | 11 |

| 1.5 | Sales Taxes Revenue | | 11 |

| 1.6 | Federal Government Contributions | | 13 |

| 1.7 | Revenue by Source | | 16 |

| 1.8 | Expense by Ministry, Program and Agency | | 17 |

| 1.9 | Health Per Capita Costs and Outcomes: Canadian Comparisons | | 19 |

| 1.10 | Increased Funding for K—12 Education | | 20 |

| 1.11 | Supporting Economic Development | | 21 |

| 1.12 | Benefiting the Environment | | 22 |

| 1.13 | Supporting Families and Individuals in Need | | 22 |

| 1.14 | Capital Spending | | 26 |

| 1.15 | Provincial Transportation Investments | | 29 |

| 1.16 | Capital Expenditure Projects Greater Than $50 million | | 32 |

| 1.17 | Provincial Debt Summary | | 35 |

| 1.18 | Provincial Borrowing Requirements | | 36 |

| 1.19 | Reconciliation of Summary Results to Provincial Debt Changes | | 36 |

| 1.20 | Key Fiscal Sensitivities | | 37 |

Budget and Fiscal Plan — 2015/16 to 2017/18

Table of Contents

Topic Boxes: | | |

| Managing Fair and Affordable Public Sector Compensation | | 41 |

| Strengthening Our Relationship with First Nations: BC’s Response to the Tsilhqot’in Decision | | 44 |

| A Pan-Canadian “Renminbi Hub” | | 46 |

| Opportunities for British Columbia Liquefied Natural Gas — Update | | 48 |

| Strategic Debt Management | | 50 |

| | | |

Part 2: | Tax Measures | | |

Tax Measures — Supplementary Information | | 54 |

Tables: | | |

| 2.1 | Summary of Tax Measures | | 53 |

| | | | |

Topic Box: | | |

| Carbon Tax Report and Plan | | 60 |

| | | | |

Part 3: | British Columbia Economic Review and Outlook | | |

Summary | | 63 |

British Columbia Economic Activity and Outlook | | 63 |

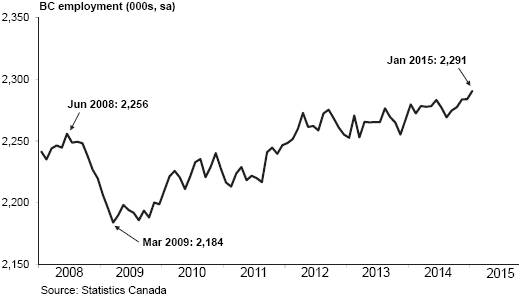

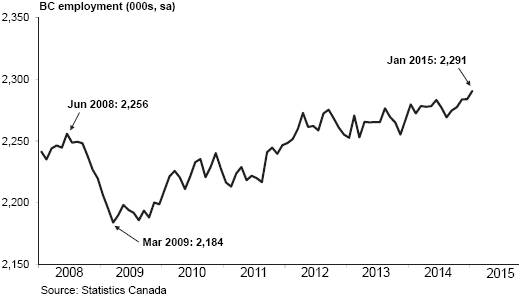

| The Labour Market | | 64 |

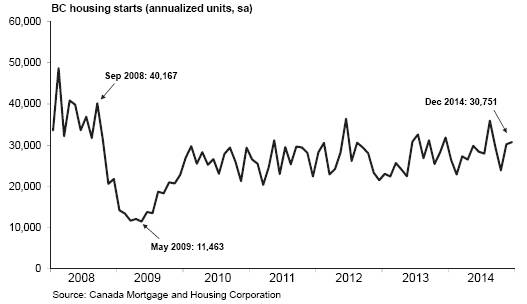

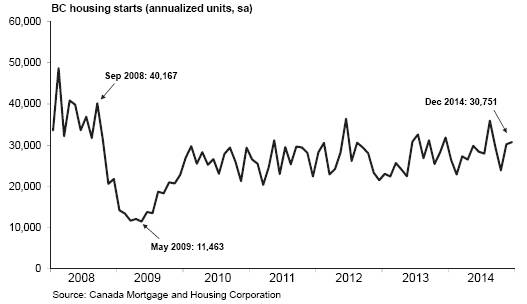

| Consumer Spending and Housing | | 65 |

| Business and Government | | 67 |

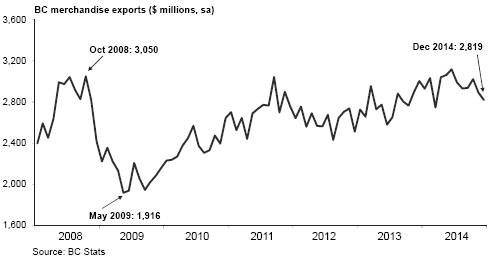

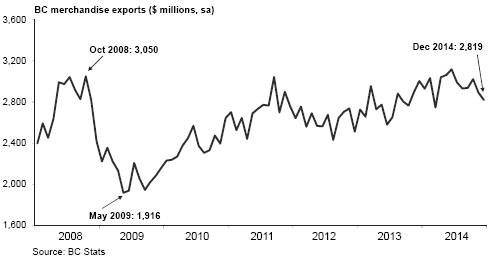

| External Trade and Commodity Markets | | 67 |

| Demographics | | 69 |

| Inflation | | 69 |

Risks to the Economic Outlook | | 70 |

External Outlook | | 70 |

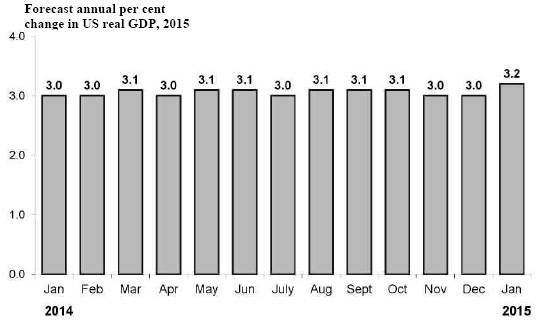

| United States | | 70 |

| Canada | | 73 |

| Europe | | 74 |

| China | | 76 |

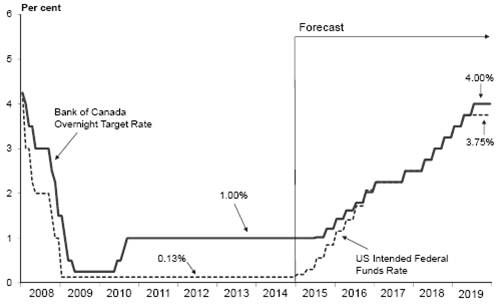

Financial Markets | | 76 |

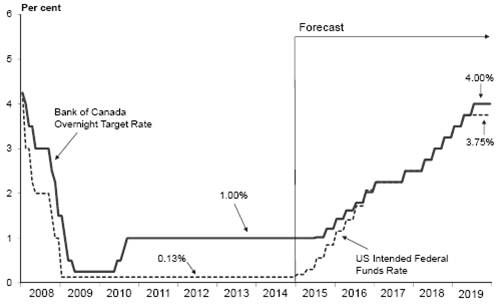

| Interest Rates | | 76 |

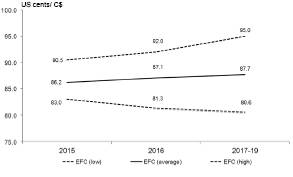

| Exchange Rate | | 77 |

Tables: | | |

| 3.1 | British Columbia Economic Indicators | | 64 |

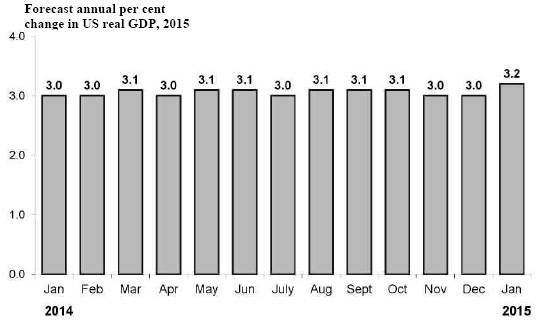

| 3.2 | US real GDP forecast: Consensus vs Ministry of Finance | | 73 |

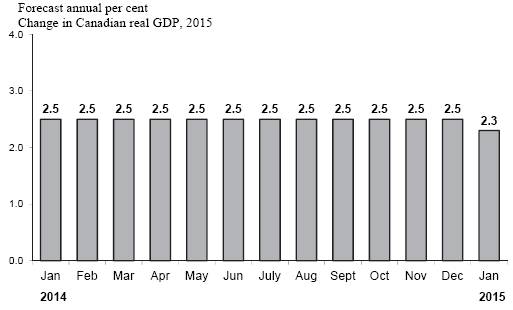

| 3.3 | Canadian real GDP forecast: Consensus vs Ministry of Finance | | 74 |

| 3.4 | Private Sector Canadian Interest Rate Forecasts | | 77 |

| 3.5 | Private Sector Exchange Rate Forecasts | | 78 |

| 3.6.1 | Gross Domestic Product: British Columbia | | 79 |

| 3.6.2 | Components of Nominal Income and Expenditure | | 80 |

| 3.6.3 | Labour Market Indicators | | 80 |

| 3.6.4 | Major Economic Assumptions | | 81 |

Topic Box: | | |

| The Economic Forecast Council, 2015 | | 82 |

Budget and Fiscal Plan — 2015/16 to 2017/18

ii

Table of Contents

Part 4: 2014/15 Updated Financial Forecast (Third Quarterly Report) | | |

Introduction | | 87 |

Revenue | | 89 |

Expense | | 89 |

| Contingencies | | 89 |

Government Employment (FTEs) | | 90 |

Provincial Capital Spending | | 90 |

Provincial Debt | | 91 |

Risks to the Fiscal Forecast | | 92 |

Supplementary Schedules | | 92 |

Tables: | | |

| 4.1 | 2014/15 Forecast Update | | 87 |

| 4.2 | 2014/15 Financial Forecast Changes | | 88 |

| 4.3 | 2014/15 Capital Spending Update | | 90 |

| 4.4 | 2014/15 Provincial Debt Update | | 91 |

| 4.5 | 2014/15 Operating Statement | | 92 |

| 4.6 | 2014/15 Revenue by Source | | 93 |

| 4.7 | 2014/15 Expense by Ministry, Program and Agency | | 94 |

| 4.8 | 2014/15 Expense by Function | | 95 |

| 4.9 | 2014/15 Capital Spending | | 96 |

| 4.10 | 2014/15 Provincial Debt | | 97 |

| 4.11 | 2014/15 Statement of Financial Position | | 98 |

| | | | |

Appendix | | 99 |

Budget and Fiscal Plan — 2015/16 to 2017/18

iii

| February 17, 2015 |

As required by Section 7(d) of the Budget Transparency and Accountability Act (BTAA), and Section 4a(v) of the Carbon Tax Act, I confirm that Budget 2015 contains the following elements:

· Fiscal forecasts for 2015/16 to 2017/18 (provided in Part 1) and economic forecasts for 2015 to 2019 (provided in Part 3).

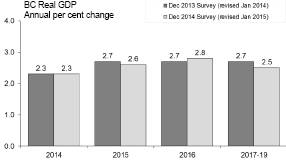

· A report on the advice received from the Economic Forecast Council (EFC) in early December 2014 (updated January 2015) on the economic growth outlook for British Columbia, including a range of forecasts for 2015 and 2016 (see Part 3, page 82).

· Material economic, demographic, fiscal, accounting policy and other assumptions and risks underlying Budget 2015 economic and fiscal forecasts In particular:

· The economic forecast reflects stable economic growth for British Columbia in an environment where the global economic situation remains mixed. While the US economy is improving, Europe’s outlook is uncertain, growth in China is slowing, and the Canadian economy is being impacted by low oil prices. Accordingly, the economic projections assumed in Budget 2015 are more prudent relative to the average of the forecasts provided by the Economic Forecast Council

· Personal and corporate income tax revenue forecasts include the final 2013 assessments and the latest projections for these taxation revenue sources received from the federal government.

· Natural gas forecasts continue to reflect the recommendations of an independent consultant on the natural gas price forecast methodology (see Budget 2013) in order to maintain prudence against volatility, but do not reflect any incremental revenue from liquefied natural gas development.

· Ministry budgets include base increases for the costs of collective agreements signed under government’s current wage mandate, including the recent teachers settlement; however any costs arising from the Economic Stability Dividend portion of the mandate will be addressed in the fiscal plan at such time they are triggered. Any costs arising from the outcome of the appeal regarding the BC Supreme Court decision on the teachers’ contract will be addressed in future fiscal plans

· Forecast prudence totals $600 million in 2015/16 and $750 million in each of 2016/17 and 2017/18, being the sum of the Contingencies vote and the forecast allowance in each fiscal year.

· The capital plan includes spending projections for the Site C dam project and initial funding for site preparation costs for the Massey Tunnel replacement project.

· Revenue and spending forecasts include three-year financial projections for school districts, post-secondary institutions and health authorities, as provided by the Ministries of Education, Advanced Education and Health, respectively, based on plans submitted to the ministries by those entities, and for the other service delivery agencies and the commercial Crown corporations, as submitted directly to the Ministry of Finance by those organizations.

· A Revenue Neutral Carbon Tax Report for 2013/14 and 2014/15, and the Revenue Neutral Carbon Tax Plan for 2015/16 to 2017/18 (see Part 2: Tax Measures, page 60).

To the best of my knowledge, the three-year fiscal plan contained in Budget 2015 conforms to the standards and guidelines of generally accepted accounting principles for senior government as outlined in Note 1 of the 2013/14 Public Accounts.

| /s/ Peter Milburn |

| Peter Milburn |

| Deputy Minister and |

| Secretary to Treasury Board |

Budget and Fiscal Plan — 2015/16 to 2017/18

Summary: BUDGET AND FISCAL PLAN — 2015/16 to 2017/18

| | Updated | | Budget | | | | | |

| | Forecast | | Estimate | | Plan | | Plan | |

($ millions) | | 2014/15 | | 2015/16 | | 2016/17 | | 2017/18 | |

Revenue | | 45,772 | | 46,365 | | 47,646 | | 48,617 | |

Expense | | (44,793 | ) | (45,831 | ) | (46,920 | ) | (47,868 | ) |

Surplus before forecast allowance | | 979 | | 534 | | 726 | | 749 | |

Forecast allowance | | (100 | ) | (250 | ) | (350 | ) | (350 | ) |

Surplus | | 879 | | 284 | | 376 | | 399 | |

Capital spending: | | | | | | | | | |

Taxpayer-supported capital spending | | 3,637 | | 3,731 | | 3,726 | | 3,199 | |

Self-supported capital spending | | 2,604 | | 2,518 | | 2,527 | | 2,944 | |

| | 6,241 | | 6,249 | | 6,253 | | 6,143 | |

Provincial Debt: | | | | | | | | | |

Taxpayer-supported debt | | 42,302 | | 43,182 | | 44,126 | | 44,733 | |

Self-supported debt | | 21,428 | | 22,528 | | 23,769 | | 25,321 | |

Total debt (including forecast allowance) | | 63,830 | | 65,960 | | 68,245 | | 70,404 | |

Taxpayer-supported debt-to-GDP ratio | | 17.7 | % | 17.4 | % | 17.1 | % | 16.6 | % |

Taxpayer-supported debt-to-revenue ratio | | 95.8 | % | 95.4 | % | 95.1 | % | 94.7 | % |

Economic Forecast: | | 2014 | | 2015 | | 2016 | | 2017 | |

Real GDP growth | | 2.2 | % | 2.3 | % | 2.4 | % | 2.3 | % |

Nominal GDP growth | | 3.9 | % | 3.8 | % | 4.3 | % | 4.3 | % |

Disciplined Fiscal Planning

Budget 2015 continues government’s commitment to fiscal prudence by projecting balanced budgets throughout the fiscal plan period. While economic growth remains modest, improving revenue growth has enabled government to provide funding for long term public sector wage settlements and key priorities such as core service caseload pressures.

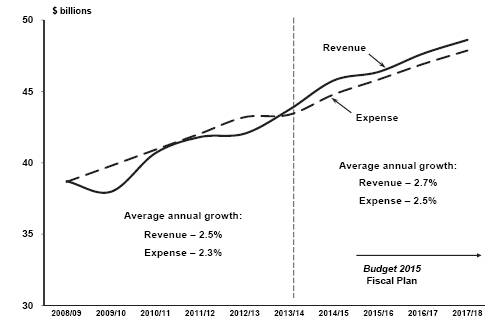

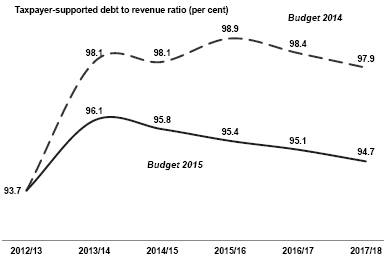

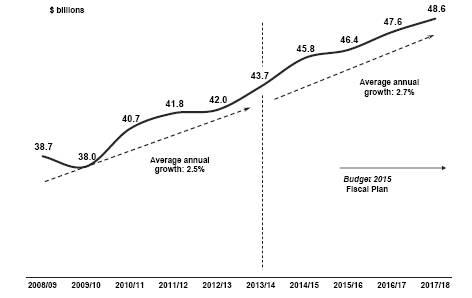

Revenue is expected to grow by 2.7 per cent annually over the four-year forecast period, while expenses are projected to increase 2.5 per cent annually over the same period. Keeping expense growth below revenue growth ensures the budget remains balanced in the future, which will enable government to continue to support important social and economic outcomes.

In addition to growing its Ministry of Health budget by 2.9 per cent annually, over the next three years government will provide budget increases for some limited key priorities, such as

· funding the 2014 Economic Stability Mandate compensation increases;

· measures to support economic and resource development; and

· additional support for families and individuals in need, including funding for Community

Disciplined fiscal planning

Living BC and the exemption of child support payments from the calculation of income and disability assistance.

Overall, ministry program funding is increasing by $2.3 billion.

In order to achieve social policy and economic development objectives, government will initiate a number of tax policy measures in Budget 2015, including:

· enhancements to the BC tax reduction credit, effective January 1, 2015;

· the introduction of a new children’s fitness equipment tax credit, effective January 1, 2015;

Budget and Fiscal Plan — 2015/16 to 2017/18

Summary

· extension of the BC training tax credits until the end of 2017;

· extension of the new mine allowance for four years to December 31, 2019; and

· extension of the BC interactive digital media tax credit for an additional three years to August 31, 2018.

Modest Economic Growth

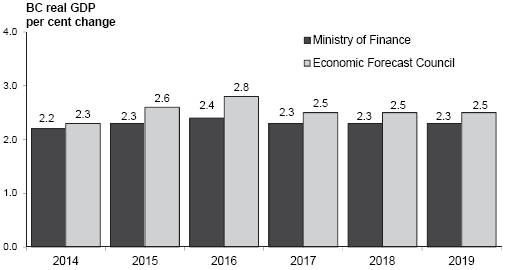

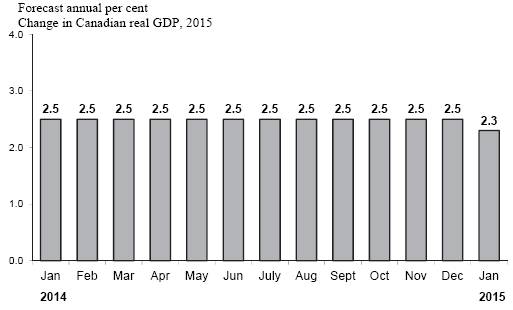

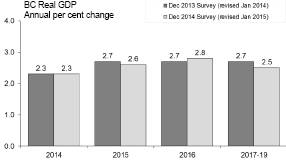

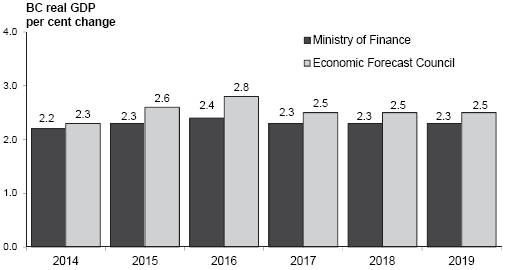

Following an estimated increase of 2.2 per cent in 2014, the Ministry of Finance forecasts British Columbia’s economy to grow by 2.3 per cent in 2015, 2.4 per cent in 2016 and 2.3 per cent per year in the medium-term.

Ministry forecast more prudent than private sector

The Ministry’s outlook for BC’s real GDP growth is 0.3 percentage points lower in 2015 and 0.4 percentage points lower in 2016 than the outlook provided by the Economic Forecast Council. This prudence acknowledges the downside risks to the economic forecast and is one of the levels of prudence built into the fiscal plan.

Indicators of BC’s economic performance in 2014 reveal increased domestic activity relative to the same period of 2013, and the Ministry’s outlook for 2015 and 2016 is relatively unchanged from Budget 2014.

The outlook for the medium-term is lower than last year due to softer business investment expectations and dampened demand for BC exports as the evolution of the external economic situation has been mixed. While the US outlook is relatively unchanged, expectations for other countries (in particular Canada and China) have worsened.

Downside risks to BC’s economic outlook include:

· potential for a slowdown in domestic economic activity, including weakness in employment and retail sales;

· renewed weakness in the US economy, particularly as interest rates increase;

· fragility in Europe as governments and the financial system deal with elevated sovereign debt amidst a weak economic recovery;

· slower than anticipated economic activity in Asia, particularly in China, resulting in weaker demand for BC’s exports and downward pressure on global commodity prices;

· weaker than expected inflation caused in part by lower oil prices; and

· exchange rate volatility.

Capital Spending

Taxpayer-supported infrastructure spending on hospitals, schools, post-secondary facilities, transit, and roads will total $10.7 billion over the fiscal plan period, and will be financed by $7.6 billion in borrowing with the remainder funded by third parties, such as the federal government, and from internal cash flows.

Self-supported spending on power projects, transportation infrastructure, and other capital assets will total $8.0 billion over the fiscal plan period, and will be financed by $3.9 billion in borrowing, with the remainder funded internally.

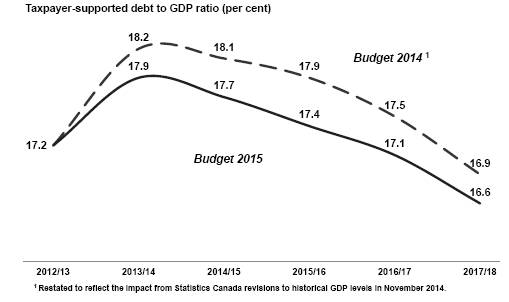

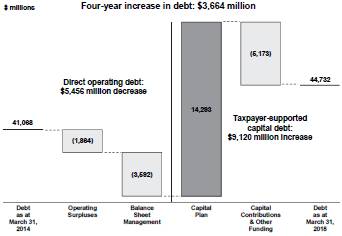

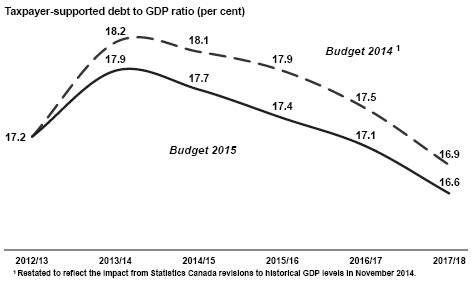

Strategic Debt Management

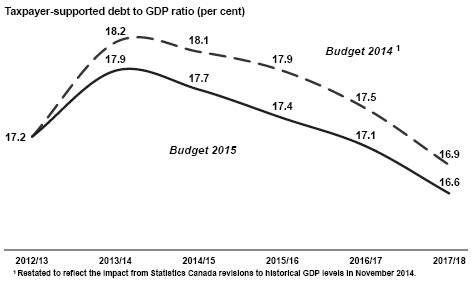

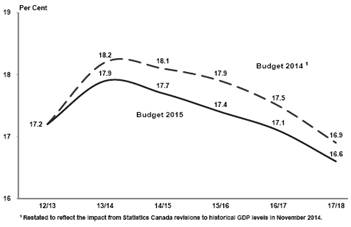

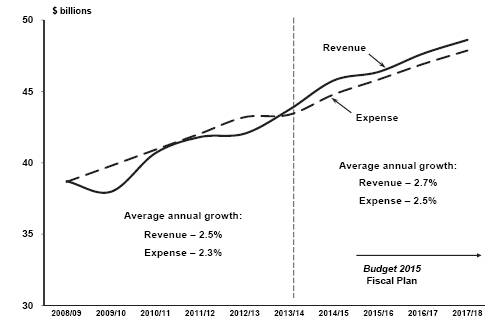

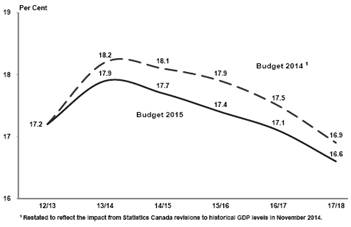

Due to government’s debt management strategy, the taxpayer-supported debt to GDP ratio peaked at17.9 per cent in 2013/14, and is projected to progressively decline to 16.6 per cent by 2017/18.

Debt to GDP trend improved

On average, the debt to GDP ratio track in Budget 2015 is 0.4 percentage points lower in each year compared to the same track in Budget 2014.

Budget and Fiscal Plan — 2015/16 to 2017/18

2

Summary

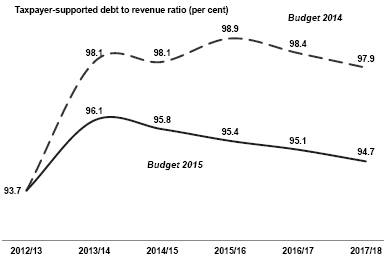

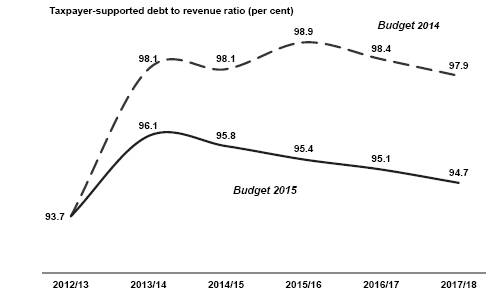

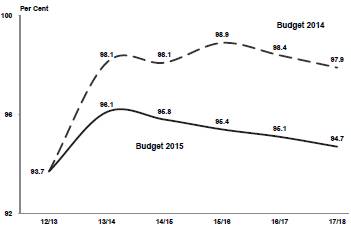

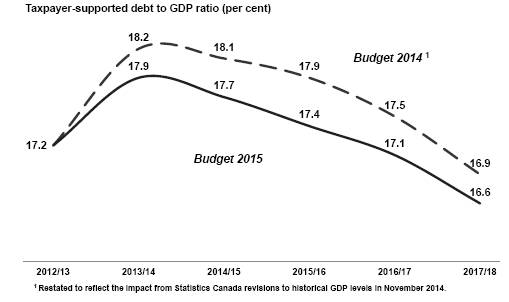

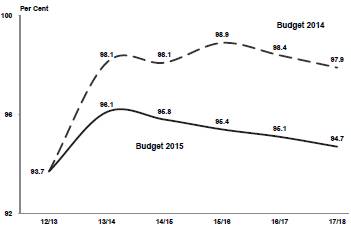

Just as significant, the debt to revenue track — a debt metric government has recently added to its debt management strategy — also has assumed a downward trend, with 2013/14 being the pivot year for both ratios.

Debt to revenue trend also improved

The 3.2 percentage point decrease in the debt to revenue ratio in 2017/18 compared to Budget 2014 represents a $1.5 billion improvement in this metric, primarily due to reductions in projected borrowing.

Over the next three years, government will borrow $14.0 billion and retire $7.6 billion in maturing debt. Overall, total provincial debt is projected to increase to $70.4 billion by 2017/18. However, direct operating debt is projected to decline to $4.8 billion, the lowest level since 1990/91.

Risks to the Fiscal Plan

The main risks to the government’s fiscal plan include:

· risks to the BC economic outlook, largely due to the continued uncertainty surrounding global economic activity;

· assumptions underlying revenue, including Crown corporation income forecasts, such as economic factors, commodity prices and weather conditions;

· potential changes to federal government allocations for health and social transfers and cost-sharing agreements, as well as impacts on the provincial income tax bases arising from federal government tax policy changes;

· utilization rates for government services such as health care, children and family services, and income assistance; and

· the outcome of litigation, arbitrations, and negotiations with third parties, including the appeal of the BC Supreme Court decision on the teachers’ contract issue.

Government incorporates four main levels of prudence in its projections to mitigate the risks to the fiscal plan:

· The Ministry outlook for BC’s real GDP growth is lower than the outlook provided by the Economic Forecast Council (0.3 percentage points lower in 2015 and 0.4 percentage points lower in 2016).

· The natural gas revenue forecast incorporates additional prudence by using a price forecast that is within the lowest 20th percentile of the private sector forecasts.

· Government has included a forecast allowance of $250 million in 2015/16, and $350 million in each of 2016/17 and 2017/18, to guard against revenue volatility.

· The fiscal plan includes a Contingencies vote allocation of $350 million in 2015/16, increasing to $400 million in each of 2016/17 and 2017/18, to help manage unexpected pressures and fund priority initiatives.

Conclusion

In summary, Budget 2015:

· provides a sustainable balanced budget framework built on modest economic growth and disciplined fiscal planning;

· augments priority program funding in health care, education, social services and economic development;

· introduces tax measures targeted towards achieving social policy objectives and supporting government’s balanced budget commitment;

· continues government’s infrastructure program in support of government initiatives and to create jobs over the next three years; and

· continues strategic debt management in order to achieve lower costs, maintain debt affordability and support a AAA credit rating.

Budget and Fiscal Plan — 2015/16 to 2017/18

3

Part 1: THREE YEAR FISCAL PLAN

Table 1.1 Three Year Fiscal Plan

| | Updated | | Budget | | | | | |

| | Forecast | | Estimate | | Plan | | Plan | |

($ millions) | | 2014/15 | | 2015/16 | | 2016/17 | | 2017/18 | |

Revenue | | 45,772 | | 46,365 | | 47,646 | | 48,617 | |

Expense | | (44,793 | ) | (45,831 | ) | (46,920 | ) | (47,868 | ) |

Surplus before forecast allowance | | 979 | | 534 | | 726 | | 749 | |

Forecast allowance | | (100 | ) | (250 | ) | (350 | ) | (350 | ) |

Surplus | | 879 | | 284 | | 376 | | 399 | |

Capital spending: | | | | | | | | | |

Taxpayer-supported capital spending | | 3,637 | | 3,731 | | 3,726 | | 3,199 | |

Self-supported capital spending | | 2,604 | | 2,518 | | 2,527 | | 2,944 | |

| | 6,241 | | 6,249 | | 6,253 | | 6,143 | |

Provincial Debt: | | | | | | | | | |

Taxpayer-supported debt | | 42,302 | | 43,182 | | 44,126 | | 44,733 | |

Self-supported debt | | 21,428 | | 22,528 | | 23,769 | | 25,321 | |

Total debt (including forecast allowance) | | 63,830 | | 65,960 | | 68,245 | | 70,404 | |

Taxpayer-supported debt-to-GDP ratio | | 17.7 | % | 17.4 | % | 17.1 | % | 16.6 | % |

Taxpayer-supported debt-to-revenue ratio | | 95.8 | % | 95.4 | % | 95.1 | % | 94.7 | % |

Introduction

Budget 2015 continues government’s commitment to fiscal prudence by projecting balanced budgets throughout the fiscal plan period. While economic growth remains modest, improving revenue growth has enabled government to provide funding for long term public sector wage settlements and key priorities such as core service caseload pressures. Government also is continuing the debt management strategy outlined in Budget 2014.

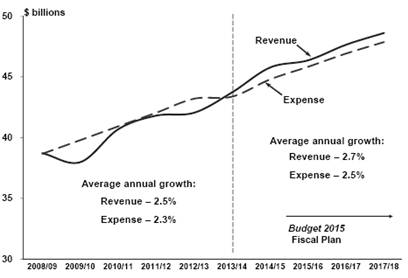

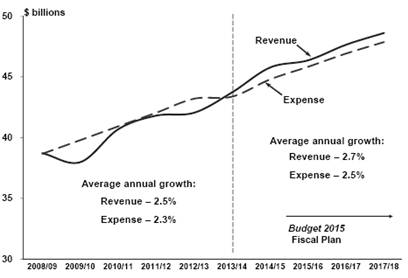

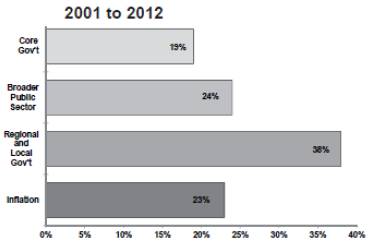

Chart 1.1 Disciplined fiscal planning

Budget and Fiscal Plan — 2015/16 to 2017/18

Three Year Fiscal Plan

Revenue is expected to grow by an average 2.7 per cent annually over the four-year forecast period, while expenses are projected to grow an average 2.5 per cent annually over the same period. Keeping expense growth below revenue growth ensures the budget remains balanced in the future, which will enable government to continue to support important social and economic outcomes.

Included in the expense growth are average annual increases of 2.9 per cent in health funding; increases that reflect government’s commitment to fund collective agreements negotiated under the Economic Stability Mandate; measures to support economic and resource development, diversification, and development of new market opportunities; and an additional $150 million to support families and individuals in need, including funding for Community Living BC and exemption of child support payments from the calculation of income and disability assistance.

Government’s disciplined fiscal planning enables continuing investments in important infrastructure projects while keeping debt affordable. Taxpayer-supported infrastructure spending on hospitals, schools, post-secondary facilities, transit, and roads will total $10.7 billion over the fiscal plan period, and will be financed by $7.6 billion in borrowing with the remainder funded by third parties, such as the federal government, and from internal cash flows.

Self-supported spending on power projects, transportation infrastructure and other capital assets will total $8.0 billion over the fiscal plan period, and will be financed by $3.9 billion in borrowing, with the remainder funded internally. More information on the three year capital spending plan is found on page 26.

Government’s debt management strategy has proven successful. On average, the debt to GDP ratio track in Budget 2015 is 0.4 percentage points lower in each year compared to the same track in Budget 2014. Just as significant, the debt to revenue track — a new metric of debt affordability being monitored by government — also has assumed a downward trend, with 2013/14 being the pivot year for both ratios.

Chart 1.2 Debt to GDP trend improved

Budget and Fiscal Plan — 2015/16 to 2017/18

6

Three Year Fiscal Plan

The 3.2 percentage point decrease in the debt to revenue ratio in 2017/18 compared to Budget 2014 represents a $1.5 billion improvement in this metric, primarily due to reductions in projected borrowing. See the Strategic Debt Management topic box on page 50.

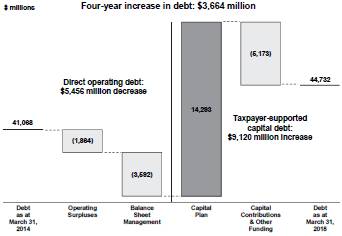

Chart 1.3 Debt to revenue trend also improved

Government borrowing projections include both the support of its operating and capital requirements and the retirement of existing debt that will mature during the fiscal plan period. Over the next three years, government will borrow $14.0 billion and retire $7.6 billion in maturing debt. Overall, total provincial debt is projected to increase to $70.4 billion by 2017/18. However, direct operating debt is projected to decline to $4.8 billion, the lowest level since 1990/91. Additional information on the debt outlook can be found beginning on page 35.

The major risks to the fiscal plan stem from changes in factors that government does not directly control. These include:

· risks to the BC economic outlook, largely due to the continued uncertainty surrounding global economic activity;

· assumptions underlying revenue, including commercial Crown corporation forecasts, such as economic factors, commodity prices and weather conditions;

· potential changes to federal transfer allocations, cost-sharing agreements with the federal government and impacts on the provincial income tax bases arising from federal tax policy and budget changes;

· utilization rates for government services such as health care, children and family services, and income assistance; and

· the outcome of litigation, arbitrations, and negotiations with third parties, including the appeal of the BC Supreme Court decision on the teachers’ contract issue.

Government incorporates four main levels of prudence in its projections to mitigate the risks to the fiscal plan:

· The Ministry outlook for BC’s real GDP growth is lower than the outlook provided by the Economic Forecast Council (0.3 percentage points lower in 2015 and 0.4 percentage points lower in 2016).

Budget and Fiscal Plan — 2015/16 to 2017/18

7

Three Year Fiscal Plan

· The natural gas revenue forecast incorporates additional prudence by using a price forecast that is within the lowest 20th percentile of the private sector forecasts.

· Government has included a forecast allowance of $250 million in 2015/16, and $350 million in each of 2016/17 and 2017/18, to guard against revenue volatility.

· The fiscal plan includes a Contingencies vote allocation of $350 million in 2015/16, increasing to $400 million in each of 2016/17 and 2017/18, to help manage unexpected pressures and fund priority initiatives.

A complete discussion of the risks to the fiscal plan can be found beginning on page 37. Economic risks are discussed in Part 3: British Columbia Economic Review and Outlook.

Revenue

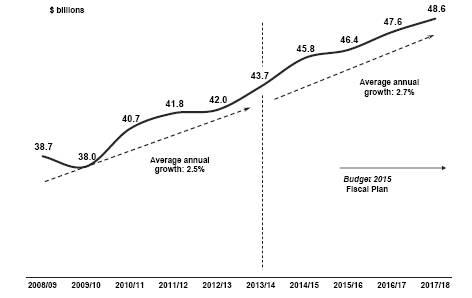

Chart 1.4 Revenue trends

Total revenue growth is expected to average 2.7 per cent annually over the four-year period to 2017/18. This reflects the impacts of 4.1 per cent average annual nominal GDP growth on taxation revenues and projected increases in fees revenues, federal government contributions and commercial Crown net income. These improving revenue sources are partly offset by forecasted declining natural resource revenues mainly due to falling Crown land lease revenue.

In 2014/15, strong projected annual revenue growth of 4.7 per cent is due in part to the impact of recording one-time taxation revenues and ICBC net income results in the year. As a result, annual growth in 2015/16 is forecast to be only 1.3 per cent as the effects of 3.8 per cent nominal GDP growth in 2015 are partly offset by the impacts of lower energy prices and one-time revenues recorded in 2014/15. Over the next two years, average growth is expected to be 2.4 per cent annually reflecting strengthening economic conditions, rising energy prices and increasing federal government transfers and commercial Crown corporation net income.

In 2015/16, taxation revenue is forecast to grow only 0.8 per cent as the impacts of 3.8 per cent nominal GDP growth are partly offset by the effects of one-time income and property transfer tax revenues recorded in 2014/15 that are not expected to carry forward. Taxation revenue is expected to average 3.2 per cent annual growth over the last

Budget and Fiscal Plan — 2015/16 to 2017/18

8

Three Year Fiscal Plan

Chart 1.5 Revenue forecast

two years of the fiscal plan, consistent with the Ministry of Finance economic projections for growth in nominal GDP, household income, net operating surplus, consumer expenditures and housing starts. The forecast also includes the impacts of tax measures detailed in Part 2: Tax Measures.

Natural resource revenue is forecast to decline 6.9 per cent in 2015/16 due to lower revenue from natural gas and other energy sources, reflecting lower natural gas, oil and electricity price projections. Over the next two years, natural resource revenue is expected to average a 1.3 per cent annual decline mainly due to falling revenue from Crown land tenures.

Table 1.2 Comparison of Major Factors Underlying Revenue

Calendar Year | | February 17, 2015 | | February 18, 2014 | |

Per cent growth unless otherwise indicated | | 2014 | | 2015 | | 2016 | | 2017 | | 2014 | | 2015 | | 2016 | | 2017 | |

Real GDP | | 2.2 | | 2.3 | | 2.4 | | 2.3 | | 2.0 | | 2.3 | | 2.5 | | 2.5 | |

Nominal GDP | | 3.9 | | 3.8 | | 4.3 | | 4.3 | | 3.6 | | 4.3 | | 4.4 | | 4.5 | |

Household income | | 3.0 | | 3.5 | | 3.8 | | 4.0 | | 3.3 | | 3.9 | | 4.0 | | 4.1 | |

Net operating surplus | | 5.3 | | 3.3 | | 6.3 | | 5.8 | | 1.8 | | 6.1 | | 6.7 | | 6.7 | |

Consumer expenditures | | 4.7 | | 4.3 | | 4.5 | | 4.5 | | 4.2 | | 4.7 | | 4.6 | | 4.7 | |

Consumer expenditures on durable goods | | 8.3 | | 1.3 | | 1.6 | | 1.5 | | 1.2 | | 1.5 | | 1.6 | | 1.6 | |

Business investment | | 5.6 | | 3.9 | | 4.5 | | 4.6 | | 4.4 | | 4.0 | | 4.7 | | 4.9 | |

Residential investment | | 6.0 | | 3.4 | | 4.7 | | 4.9 | | 3.4 | | 3.3 | | 4.7 | | 4.8 | |

Retail sales | | 5.4 | | 3.3 | | 3.7 | | 3.6 | | 3.0 | | 3.5 | | 3.7 | | 3.7 | |

Employment | | 0.6 | | 1.0 | | 1.2 | | 1.2 | | 1.0 | | 1.3 | | 1.4 | | 1.4 | |

BC Housing starts | | 4.8 | | -2.7 | | -0.2 | | -1.9 | | -7.8 | | 2.0 | | 2.2 | | 0.1 | |

US Housing starts | | 8.7 | | -0.6 | | 2.5 | | 2.4 | | 2.9 | | 5.3 | | 2.5 | | 2.4 | |

| | | | | | | | | | | | | | | | | |

SPF 2x4 price ($US/thousand board feet) | | $ | 353 | | $ | 344 | | $ | 340 | | $ | 340 | | $ | 345 | | $ | 335 | | $ | 335 | | $ | 335 | |

Pulp ($US/tonne) | | $ | 925 | | $ | 888 | | $ | 838 | | $ | 825 | | $ | 838 | | $ | 825 | | $ | 825 | | $ | 825 | |

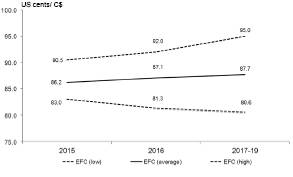

Exchange rate (US cents/Canadian dollar) | | 90.5 | | 85.3 | | 85.5 | | 87.0 | | 93.2 | | 92.7 | | 91.7 | | 91.0 | |

Fiscal Year | | 2014/15 | | 2015/16 | | 2016/17 | | 2017/18 | | 2014/15 | | 2015/16 | | 2016/17 | | 2017/18 | |

Natural gas price ($Cdn/GJ at plant inlet) | | $ | 2.69 | | $ | 2.09 | | $ | 2.32 | | $ | 2.54 | | $ | 2.45 | | $ | 2.65 | | $ | 2.90 | | $ | 3.28 | |

Bonus bid average bid price per hectare ($) | | $ | 2,404 | | $ | 1,000 | | $ | 1,025 | | $ | 1,100 | | $ | 750 | | $ | 750 | | $ | 800 | | $ | 850 | |

Electricity price ($US/mega-watt hour, Mid-C) | | $ | 33 | | $ | 28 | | $ | 31 | | $ | 35 | | $ | 40 | | $ | 38 | | $ | 39 | | $ | 40 | |

Metallurgical coal price ($US/tonne, fob west coast) | | $ | 119 | | $ | 128 | | $ | 138 | | $ | 138 | | $ | 176 | | $ | 210 | | $ | 216 | | $ | 222 | |

Copper price ($US/lb) | | $ | 3.10 | | $ | 3.02 | | $ | 3.05 | | $ | 3.04 | | $ | 3.16 | | $ | 3.10 | | $ | 3.05 | | $ | 2.99 | |

Crown harvest volumes (million cubic metres) | | 61.0 | | 63.0 | | 63.0 | | 64.0 | | 65.0 | | 66.0 | | 66.0 | | 66.0 | |

Budget and Fiscal Plan — 2015/16 to 2017/18

9

Three Year Fiscal Plan

Excluding Crown land tenures, natural resource revenue is expected to average 7.6 per cent annual growth over the next two years, in line with expected rising commodity prices and forest harvest stumpage rates.

Revenue from fees, investment earnings and other miscellaneous sources is expected to average 2.6 per cent growth annually over the next three years, mainly due to projected Medical Services Plan premium rate increases, higher projections for post-secondary fee revenues and incorporating forecasts provided by ministries and taxpayer-supported service delivery agencies.

Federal government contributions are expected to average 3.6 per cent annual growth over the next three years mainly due to expected increases in the Canada Health Transfer (CHT) and Canada Social Transfer (CST) programs, partly offset by lower transfers in support of other programs.

Commercial Crown net income is expected to decline by 10.4 per cent in 2015/16 from the previous year due to one-time gains in ICBC’s net income in 2014/15. This decline is followed by projected average annual growth of 3.3 per cent in the subsequent two years (2016/17 and 2017/18). More details on Crown corporation net income are provided beginning on page 14.

Major Revenue Sources

Key assumptions and sensitivities relating to revenue are provided in Appendix Table A5. The major revenue components are:

Taxation revenue

Personal income tax base revenue is forecast to average 4.2 per cent annual growth over the next three years, consistent with Budget 2015 projections of household and employee compensation income growth.

Due to the effect of prior-year adjustments in 2014/15, personal income tax revenue is expected to decrease 1.4 per cent in 2015/16, followed by more normalized growth of 2.0 per cent and 4.3 per cent, respectively, in the next two years.

Table 1.3 Personal Income tax Revenue

($ millions) | | 2014/15 | | 2015/16 | | 2016/17 | | 2017/18 | |

Base personal income tax revenue | | 7,459 | | 7,753 | | 8,080 | | 8,432 | |

Annual growth | | 2.5 | % | 3.9 | % | 4.2 | % | 4.4 | % |

Measures: | | | | | | | | | |

– personal income tax rate for income over $150,000 with a 2 year limit | | 227 | | 176 | | — | | — | |

– Budget 2015 tax mesasures - various credits | | (3 | ) | (13 | ) | (10 | ) | (13 | ) |

– Federal tax measures | | 8 | | 32 | | 34 | | 36 | |

Prior-Year adjustment | | 372 | | — | | — | | — | |

Budget 2014 revenue | | 8,063 | | 7,948 | | 8,104 | | 8,455 | |

Annual growth | | 17.5 | % | -1.4 | % | 2.0 | % | 4.3 | % |

| | | | | | | | | |

Household income growth (calendar year) | | 3.0 | % | 3.5 | % | 3.8 | % | 4.0 | % |

Employee compensation income growth (calendar year) | | 3.4 | % | 3.7 | % | 4.0 | % | 4.1 | % |

Elasticity1 (calendar year basis, policy neutral) | | 0.9 | | 1.1 | | 1.1 | | 1.1 | |

1 Per cent growth in current year tax relative to per cent growth in personal income.

Budget and Fiscal Plan — 2015/16 to 2017/18

10

Three Year Fiscal Plan

The forecast includes the effects of eliminating the temporary personal income tax rate of 16.8 per cent on individuals with incomes over $150,000, effective January 2016 as well as the federal tax measure enhancing the Universal Child Care benefit, announced in November 2014.

Corporate income tax revenue is recorded on a cash basis and annual estimates reflect BC’s payment share, instalments from the federal government and adjustments for the prior year. The revenue falls slightly in 2015/16 as the increase in instalments is offset by a reduction in the prior-year adjustment settlement payment. Average annual growth over the next two years is forecast at 5.2 per cent reflecting increases in instalments, the payment share and prior-year adjustments. The revenue forecast incorporates the general corporate income tax rate and the small business income tax rate remaining at 11.0 per cent and 2.5 per cent, respectively and calendar-year entitlement is forecast to rise in line with projected growth in the net operating surplus.

Table 1.4 Corporate Income Tax Revenue

($ millions) | | 2014/15 | | 2015/16 | | 2016/17 | | 2017/18 | |

Advance instalments from the federal government: | | | | | | | | | |

– Payment share | | 11.4 | % | 11.5 | % | 11.5 | % | 11.8 | % |

– Advances | | 2,562 | | 2,616 | | 2,760 | | 2,849 | |

International Business Activity Act refunds | | (20 | ) | (20 | ) | (20 | ) | (20 | ) |

Prior-year adjustment | | 94 | | 34 | | 49 | | 79 | |

Corporate income tax revenue | | 2,636 | | 2,630 | | 2,789 | | 2,908 | |

| | | | | | | | | |

Annual per cent growth | | 8.6 | % | -0.2 | % | 6.0 | % | 4.3 | % |

Sales tax revenue growth is expected to average 3.9 per cent annually over the next three years (excluding the impact on growth rates from a one-time $94 million HST repayment in 2014/15), in line with the nominal consumer expenditure and the nominal business investment growth.

Table 1.5 Sales Taxes Revenue

($ millions) | | 2014/15 | | 2015/16 | | 2016/17 | | 2017/18 | |

Provincial sales taxes | | 5,672 | 1 | 5,970 | | 6,212 | | 6,468 | |

Annual per cent change (calendar year) | | 2014 | | 2015 | | 2016 | | 2017 | |

Consumer expenditures | | 4.7 | % | 4.3 | % | 4.5 | % | 4.5 | % |

Residential investment | | 6.0 | % | 3.4 | % | 4.7 | % | 4.9 | % |

Government expenditures | | 3.1 | % | 2.7 | % | 2.7 | % | 2.4 | % |

Nominal GDP | | 3.9 | % | 3.8 | % | 4.3 | % | 4.3 | % |

Retail sales | | 5.4 | % | 3.3 | % | 3.7 | % | 3.6 | % |

1 2014/15 includes —$94 million Harmonized Sales Tax related to prior years.

Carbon tax revenue is forecast to increase on average at 1.8 per cent over the next three years. The forecast assumes that purchased volumes of natural gas will grow in line with real GDP and that consumption of gasoline is expected to remain constant. Carbon tax revenue is fully returned to taxpayers through tax reductions and credits. For more details on carbon tax recycling, see the Carbon Tax Report and Plan topic box on page 60.

Property tax revenue is expected to grow by an average of 4.1 per cent annually over the three year plan, in line with the outlook for BC housing starts and the inflation rate and reflects maintaining the threshold for the home owner grant phase-out at $1,100,000 for the 2015 tax year.

Budget and Fiscal Plan — 2015/16 to 2017/18

11

Three Year Fiscal Plan

Property transfer tax revenue is forecast to decline 10.7 per cent in 2015/16 reflecting an anticipated slowing of market activity as a portion of the strong revenues received in 2014/15 are not assumed to carry forward. This decline is expected to be followed by an average annual decline of 1.0 per cent over the next two years in line with the outlook for BC housing starts.

Details on the tax measures discussed above are in Part 2: Tax Measures.

Natural resource revenue

Natural gas royalties are expected to decline 36.5 per cent in 2015/16 mainly due to lower natural gas prices. The royalties are forecast to increase at a 19.6 per cent average annual rate over the next two years, reflecting higher prices and production volumes partially offset by increased utilization of royalty programs and credits.

The forecast assumes a price of $2.09 ($Cdn/gigajoule, plant inlet) in 2015/16, down from $2.69 in 2014/15. The 2015/16 assumption is within the 20th percentile of the private sector forecasters, continuing the prudence incorporated in recent budgets. Prices are expected to rise in the next two years, averaging $2.32 in 2016/17 and $2.54 in 2017/18, in line with the growth of the average of the private sector forecasters. Natural gas royalty rates are sensitive to price when the prices are between $1.25 and $2.75/gigajoule, therefore, the net effective royalty rate is expected to increase as natural gas prices increase.

See Appendix Table A6 for more details regarding natural gas price forecasts.

Chart 1.6 Revenue from energy, metals and minerals

Other energy, metals and minerals: Over the next three years, revenue from the sale of Crown land tenures is forecast to decline 52 per cent from $835 million in 2014/15 to $400 million in 2017/18. This revenue source consists of bonus bid cash receipts amortized over nine years as well as annual fees. Revenues decline over the forecast period as the amortization of strong cash sales in the 2006/07 to 2008/09 period are replaced with lower cash deferrals over the 2015/16 to 2017/18 period. Revenue from metals and minerals are expected to grow by an average of 14.9 per cent annually over the three years of the fiscal plan mainly due to rising coal prices. Revenue from other energy sources

Budget and Fiscal Plan — 2015/16 to 2017/18

12

Three Year Fiscal Plan

is expected to fall 9.3 per cent in 2015/16 due to a lower outlook for oil and Mid-C electricity prices, followed by an average annual increase of 8.9 per cent over the next two years as prices are forecast to rise.

Forests revenue is forecast to increase at a 6.2 per cent average annual rate over the three years of the fiscal plan mainly due to the impacts of higher stumpage rates.

Other revenue

Fees and licenses: Revenue growth is expected to average 3.4 per cent annually over the three year fiscal plan, mainly due to projected increases to Medical Services Plan premium rates in support of rising healthcare expenditures and increases in post-secondary fees.

Investment earnings are projected to grow at a 3.7 per cent annual rate over the three year fiscal plan, mainly due to increased earnings from fiscal agency loans and sinking funds. Investment income from fiscal agency loans and sinking funds has offsetting expenses resulting in no impact to the bottom line.

Miscellaneous revenue is forecast to average 0.4 per cent annual growth over the next three years. Over the fiscal plan, miscellaneous revenue includes the projected gains on sales of surplus properties, such as the Dogwood-Pearson redevelopment in Vancouver. As well, the transfer of selected lands and buildings to non-profit societies in support of building housing capacity in the non-profit sector and ensuring its long term sustainability will result in the net value of the properties being reported as gains when transferred.

Federal government transfers

Health and social transfers are expected to average 5.1 per cent annual growth over the three years of the fiscal plan, mainly reflecting increasing national cash transfers and a rising BC population share. The plan assumes the national CHT cash transfer increases 6 per cent per year in the first two years of the plan and rises 4.4 per cent in 2017/18. The national CHT cash transfer in 2017/18 is linked to a three year average (2015 to 2017) of Canada’s nominal GDP growth forecast. The national CST cash transfer increases 3 per cent annually, consistent with the federal government forecast.

Table 1.6 Federal Government Contributions

($ millions) | | 2014/15 | | 2015/16 | | 2016/17 | | 2017/18 | |

Canada Health Transfer (CHT) | | 4,154 | | 4,443 | | 4,720 | | 4,941 | |

Deferred health equipment grants | | 17 | | 7 | | 3 | | — | |

Canada Social Transfer (CST) | | 1,641 | | 1,692 | | 1,747 | | 1,804 | |

Total health and social transfers | | 5,812 | | 6,142 | | 6,470 | | 6,745 | |

Ministry cost recoveries | | 540 | | 541 | | 528 | | 524 | |

Transfers to post-secondary institutions | | 502 | | 506 | | 509 | | 506 | |

Transfers to taxpayer-supported Crown corporations | | 247 | | 230 | | 214 | | 207 | |

Transfers to other SUCH sector agencies | | 88 | | 83 | | 83 | | 83 | |

Disaster financial assistance contributions | | 43 | | 8 | | 8 | | 8 | |

Other transfers | | 147 | | 136 | | 137 | | 137 | |

Total other contributions | | 1,567 | | 1,504 | | 1,479 | | 1,465 | |

Total Federal Government Contributions | | 7,379 | | 7,646 | | 7,949 | | 8,210 | |

Budget and Fiscal Plan — 2015/16 to 2017/18

13

Three Year Fiscal Plan

Other federal contributions are expected to decline 2.2 per cent annually, on average, over the next three years. Reduced funding includes projected claims for disaster financial assistance, healthcare services for persons infected with Hepatitis C, contributions to the BC Housing Management Commission and ministry vote recoveries.

Commercial Crown corporations

British Columbia Hydro and Power Authority: For 2015/16 and 2016/17, BC Hydro’s net income is projected to be $653 million and $693 million, respectively, reflecting BC Hydro’s 11.84 per cent allowed return on deemed equity in each of those years. After 2016/17, net income will increase at the rate of inflation (for 2017/18, 2 per cent inflation yielding net income of $707 million.) BC Hydro forecasts annual rate increases of 6 per cent, 4 per cent and 3.5 per cent from 2015/16 to 2017/18, in each respective year.

Until 2016/17, BC Hydro will provide an annual dividend to the province of up to 85 per cent of its net income, within the requirement of maintaining at least an 80:20 debt to equity ratio. Beginning in 2017/18, BC Hydro will decrease dividends by $100 million per year over a four year period until they are eliminated in anticipation of the financing requirements for Site C. Over the next three years, BC Hydro’s dividends will be approximately 52 per cent of its net income.

British Columbia Liquor Distribution Branch: LDB’s net income is projected at $881 million in 2015/16, increasing to $910 million by 2017/18. The increase reflects average annual growth of 1.8 per cent in net sales revenue over the fiscal plan period.

British Columbia Lottery Corporation: BCLC’s net income is forecast to average $1.2 billion annually over the fiscal plan period. The projection reflects the moderate compounded annual net income growth in the lottery and casino/community gaming channels (0.2 per cent and 1.2 per cent respectively) and strong growth in eGaming income (19.3 per cent). Net income growth is mainly due to continuing product development (primarily in PlayNow internet gaming), distribution enhancements, and facility improvements to casinos and community gaming centres.

The government will distribute over 20 per cent (on average, $250 million annually) of its gaming income to charities and local governments over the next three years. As well, $147 million of the gaming income retained by government will be allocated each year to the Health Special Account in support of health services.

Insurance Corporation of British Columbia: ICBC’s net income is forecast to average $226 million annually over the fiscal plan period. The outlook assumes average annual growth of 1.7 per cent in the number of insured vehicles and a 2.9 per cent average annual increase in current claims costs. Over the fiscal plan period, ICBC is projected to remit $160 million annually from its Optional insurance earnings to the consolidated revenue fund to support core government services. The annual amount remitted by ICBC is limited by Optional insurance capital requirements.

Budget and Fiscal Plan — 2015/16 to 2017/18

14

Three Year Fiscal Plan

ICBC is in its fifth year of a multi-year $400 million Transformation Program that is designed to promote a fairer, customer-based risk pricing model, resulting in better rates for safer drivers; simplified systems and processes to facilitate better support for customers and business partners with less paperwork; and more efficient business practices. The Transformation Program, forecast to be complete in the fall of 2016, is being funded entirely from Optional insurance capital and therefore does not impact Basic insurance rates.

Transportation Investment Corporation: TI Corp manages the construction of the Port Mann/Highway 1 improvement project, which includes the new Port Mann Bridge, highway widening, and interchange improvements between Langley and Vancouver. Construction is nearing completion with finishing work along the corridor continuing through 2015/16. Off-corridor work will continue into 2016/17.

TI Corp also manages the tolling operation for the Port Mann Bridge. While TI Corp’s projections in the fiscal plan reflect net losses in the initial stages of implementing the tolling system, the corporation is projected to turn an annual net profit as traffic volumes mature. Debt accumulated for the project is expected to be fully re-paid by 2050.

Budget and Fiscal Plan — 2015/16 to 2017/18

15

Three Year Fiscal Plan

Table 1.7 Revenue by Source

| | Updated | | Budget | | | | | |

| | Forecast | | Estimate | | Plan | | Plan | |

($ millions) | | 2014/15 | | 2015/16 | | 2016/17 | | 2017/18 | |

Taxation revenue | | | | | | | | | |

Personal income | | 8,063 | | 7,948 | | 8,104 | | 8,455 | |

Corporate income | | 2,636 | | 2,630 | | 2,789 | | 2,908 | |

Sales 1 | | 5,672 | | 5,970 | | 6,212 | | 6,468 | |

Fuel | | 927 | | 934 | | 942 | | 949 | |

Carbon | | 1,240 | | 1,261 | | 1,284 | | 1,307 | |

Tobacco | | 770 | | 770 | | 770 | | 770 | |

Property | | 2,137 | | 2,225 | | 2,312 | | 2,408 | |

Property transfer | | 1,039 | | 928 | | 923 | | 909 | |

Insurance premium | | 454 | | 460 | | 465 | | 470 | |

| | 22,938 | | 23,126 | | 23,801 | | 24,644 | |

Natural resource revenue | | | | | | | | | |

Natural gas royalties | | 542 | | 344 | | 402 | | 492 | |

Forests | | 757 | | 835 | | 866 | | 907 | |

Other resource 2 | | 1,663 | | 1,578 | | 1,538 | | 1,285 | |

| | 2,962 | | 2,757 | | 2,806 | | 2,684 | |

Other revenue | | | | | | | | | |

Medical Services Plan premiums | | 2,277 | | 2,399 | | 2,529 | | 2,666 | |

Other fees 3 | | 3,131 | | 3,235 | | 3,268 | | 3,307 | |

Investment earnings | | 1,127 | | 1,137 | | 1,190 | | 1,257 | |

Miscellaneous 4 | | 2,716 | | 3,161 | | 3,053 | | 2,748 | |

| | 9,251 | | 9,932 | | 10,040 | | 9,978 | |

Contributions from the federal government | | | | | | | | | |

Health and social transfers | | 5,812 | | 6,142 | | 6,470 | | 6,745 | |

Other federal contributions 5 | | 1,567 | | 1,504 | | 1,479 | | 1,465 | |

| | 7,379 | | 7,646 | | 7,949 | | 8,210 | |

Commercial Crown corporation net income | | | | | | | | | |

BC Hydro | | 588 | | 653 | | 693 | | 707 | |

Liquor Distribution Branch | | 871 | | 881 | | 896 | | 910 | |

BC Lottery Corporation (net of payments to federal government) | | 1,198 | | 1,206 | | 1,233 | | 1,250 | |

ICBC 6 | | 600 | | 210 | | 231 | | 237 | |

Transportation Investment Corporation (Port Mann) | | (89 | ) | (101 | ) | (102 | ) | (106 | ) |

Other 7 | | 74 | | 55 | | 99 | | 103 | |

| | 3,242 | | 2,904 | | 3,050 | | 3,101 | |

Total revenue | | 45,772 | | 46,365 | | 47,646 | | 48,617 | |

1 Includes provincial sales tax, tax on designated property, HST/PST housing transition tax and harmonized sales tax related to prior years.

2 Columbia River Treaty, Crown land tenures, other energy and minerals, water rental and other resources.

3 Post-secondary, healthcare-related, motor vehicle, and other fees.

4 Includes reimbursements for healthcare and other services provided to external agencies, and other recoveries.

5 Includes contributions for health, education, community development, housing and social service programs, and transportation projects.

6 The 2014/15 amount represents ICBC’s projected earnings during government’s fiscal year. On ICBC’s fiscal year basis (December), the forecast for 2014 is $373 million. For 2015/16 to 2017/18, the fiscal year and calendar year projections are assumed to be the same.

7 Includes Columbia Power Corporation, BC Railway Company, Columbia Basin Trust power projects, and post-secondary institutions self-supported subsidiaries. Also includes gain on the sale of LDB’s liquor distribution warehouse (budget $34 million, actual $37 million).

Budget and Fiscal Plan — 2015/16 to 2017/18

16

Three Year Fiscal Plan

Table 1.8 Expense by Ministry, Program and Agency

| | Updated | | Budget | | | | | |

| | Forecast | | Estimate | | Plan | | Plan | |

($ millions) | | 2014/15 1 | | 2015/16 | | 2016/17 | | 2017/18 | |

Office of the Premier | | 9 | | 9 | | 9 | | 9 | |

Aboriginal Relations and Reconciliation | | 84 | | 87 | | 86 | | 88 | |

Advanced Education | | 1,972 | | 1,961 | | 1,975 | | 2,002 | |

Agriculture | | 80 | | 80 | | 80 | | 81 | |

Children and Family Development | | 1,339 | | 1,379 | | 1,385 | | 1,396 | |

Community, Sport and Cultural Development | | 221 | | 228 | | 259 | | 264 | |

Education | | 5,397 | | 5,498 | | 5,591 | | 5,648 | |

Energy and Mines | | 30 | | 28 | | 28 | | 28 | |

Environment | | 134 | | 150 | | 149 | | 148 | |

Finance | | 268 | | 220 | | 221 | | 222 | |

Forests, Lands and Natural Resource Operations | | 835 | | 608 | | 631 | | 637 | |

Health | | 16,928 | | 17,444 | | 17,934 | | 18,471 | |

International Trade | | 34 | | 49 | | 49 | | 49 | |

Jobs, Tourism and Skills Training | | 199 | | 199 | | 199 | | 199 | |

Justice | | 1,169 | | 1,172 | | 1,178 | | 1,184 | |

Natural Gas Development | | 401 | | 444 | | 449 | | 455 | |

Social Development and Social Innovation | | 2,530 | | 2,594 | | 2,646 | | 2,659 | |

Technology, Innovation and Citizens’ Services | | 491 | | 493 | | 493 | | 495 | |

Transportation and Infrastructure | | 812 | | 814 | | 814 | | 816 | |

Total ministries and Office of the Premier | | 32,933 | | 33,457 | | 34,176 | | 34,851 | |

Management of public funds and debt | | 1,221 | | 1,267 | | 1,338 | | 1,385 | |

Contingencies | | 300 | | 350 | | 400 | | 400 | |

Funding for capital expenditures | | 897 | | 1,001 | | 1,394 | | 1,219 | |

Refundable tax credit transfers | | 848 | | 975 | | 989 | | 1,003 | |

Legislative and other appropriations | | 133 | | 133 | | 130 | | 136 | |

Total appropriations | | 36,332 | | 37,183 | | 38,427 | | 38,994 | |

Elimination of transactions between appropriations 2 | | (17 | ) | (20 | ) | (24 | ) | (29 | ) |

Prior year liability adjustments | | (65 | ) | — | | — | | — | |

Consolidated revenue fund expense | | 36,250 | | 37,163 | | 38,403 | | 38,965 | |

Expenses recovered from external entities | | 2,618 | | 2,675 | | 2,750 | | 2,799 | |

Funding provided to service delivery agencies | | (21,746 | ) | (22,477 | ) | (23,186 | ) | (23,239 | ) |

Ministry and special office direct program spending | | 17,122 | | 17,361 | | 17,967 | | 18,525 | |

Service delivery agency expense: | | | | | | | | | |

School districts | | 5,407 | | 5,786 | | 5,806 | | 5,853 | |

Universities | | 4,177 | | 4,252 | | 4,344 | | 4,484 | |

Colleges and institutes | | 1,138 | | 1,130 | | 1,147 | | 1,156 | |

Health authorities and hospital societies | | 13,242 | | 13,446 | | 13,704 | | 13,885 | |

Other service delivery agencies | | 3,707 | | 3,856 | | 3,952 | | 3,965 | |

Total service delivery agency expense | | 27,671 | | 28,470 | | 28,953 | | 29,343 | |

Total expense | | 44,793 | | 45,831 | | 46,920 | | 47,868 | |

1 Restated to reflect government’s current organization and accounting policies.

2 Reflects payments made under an agreement where an expense from a voted appropriation is recorded as revenue by a special account.

Budget and Fiscal Plan — 2015/16 to 2017/18

17

Three Year Fiscal Plan

Expense

Budget 2015 demonstrates government’s continued commitment to deliver the core services of health care, education, and social services within a prudent fiscal framework. This commitment is managed within an affordable spending growth rate averaging 2.5 per cent per year over the four-year forecast period, with total government expense reaching $47.9 billion by 2017/18.

Chart 1.7 Expense trends

In deficit years, government kept expense growth to 2.3 per cent in order to be able to balance the budget by 2013/14. Since then, revenue growth improvements have allowed government to modestly increase spending growth to accommodate important initiatives, including labour settlements reached under the 2014 bargaining mandate (see topic box on page 41) and core service caseload pressures.

Ongoing expenditure discipline will continue throughout a period of forecasted operating surpluses as a means to manage the impact of revenue volatility and support government’s strategic debt management objectives (see topic box on page 50).

Consolidated Revenue Fund Spending

Budget increases have been targeted to key priorities, such as funding the 2014 Economic Stability Mandate compensation increases, managing growing caseload pressures in health and social services, and supporting economic development. As noted below, the three year average growth rate for the Ministry of Health’s spending is 2.9 per cent, which compares to an average of 1.5 per cent annually for the remaining ministries. Overall, ministry program funding is growing from $32.6 billion to $34.9 billion over the fiscal plan period.

Budget and Fiscal Plan — 2015/16 to 2017/18

18

Three Year Fiscal Plan

Health Care — Increasing Funding to Accommodate Growing Needs

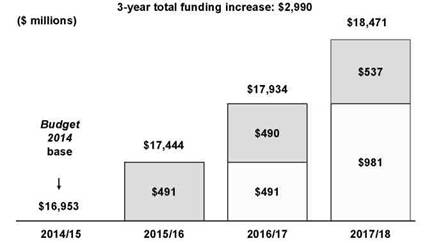

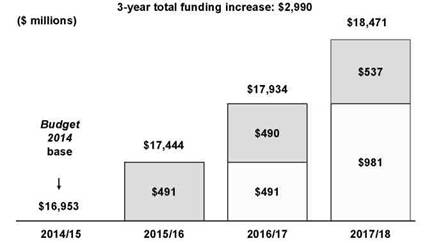

Incremental to the current 2014/15 base budget for the Ministry of Health of $16,953 million, its annual budget will increase by a further $491 million in 2015/16, and is targeted to reach $18,471 million by 2017/18. The average rate of growth over the three years will be 2.9 per cent, an increase over both the 2.6 per cent three-year average growth estimate in Budget 2014, as well as the 2.3 per cent single-year growth rates in 2013/14 and 2014/15.

Chart 1.8 Ministry of Health budget increases

BC still leads the nation in important health outcomes while maintaining control over cost escalation. BC continues to be only one of three provinces with healthcare costs under $4,000 annually per capita, while again ranking best in terms of Life Expectancy, Cancer Mortality, and Mortality related to Diseases of the Heart and second best for Infant Mortality.

Table 1.9 Health Per Capita Costs and Outcomes: Canadian Comparisons

| | 2014 Per | | Life | | Infant Mortality | | Cancer Mortality Rate | | Diseases of the Heart | |

| | Capita Health | | Expectancy at | | per 1000 Live | | per 100,000 | | Mortality Rate per | |

Province | | Care Costs ($) | | Birth (Years) | | Births | | Population | | 100,000 Population | |

| | | | | | | | | | | |

Quebec | | 3,660 | | 81.2 | | 4.3 | | 170.3 | | 83.6 | |

Ontario | | 3,768 | | 81.5 | | 4.6 | | 149.0 | | 88.3 | |

British Columbia | | 3,807 | | 81.7 | | 3.8 | | 138.7 | | 81.9 | |

New Brunswick | | 4,094 | | 80.2 | | 3.5 | | 155.8 | | 102.0 | |

Prince Edward Island | | 4,307 | | 80.2 | | 4.2 | | 150.4 | | 106.7 | |

Nova Scotia | | 4,345 | | 80.1 | | 4.9 | | 179.6 | | 100.7 | |

Manitoba | | 4,430 | | 79.5 | | 7.7 | | 157.8 | | 108.6 | |

Saskatchewan | | 4,461 | | 79.6 | | 6.7 | | 154.2 | | 110.8 | |

Alberta | | 4,699 | | 80.7 | | 5.3 | | 139.8 | | 110.8 | |

Newfoundland | | 5,087 | | 78.9 | | 6.3 | | 177.8 | | 122.5 | |

Sources: Canadian Institute for Health Information, 2014 (cost data) and Statistics Canada (outcomes data).

Note: Outcomes data for Life Expectancy is of 2009; all other outcome data are as of 2011, which is the most recent data available.

Budget and Fiscal Plan — 2015/16 to 2017/18

19

Three Year Fiscal Plan

Post-secondary Education — Continuing Efforts to find Efficiencies

Budget 2012 included a fiscal target of $50 million in cost reductions and administrative effciencies in the public post-secondary system over three years, which were not to be found through reductions in education or research programming. The sector has taken a number of measures to meet this target, including joint procurement for some goods/ services, negotiating lower banking and credit card fees, efficiencies in information technology, and cost reductions in other ancillary services. The sector is well on its way to meeting the target.

The Ministry of Advanced Education’s three-year allocations in Budget 2015 have also increased by $92 million over the amounts in Budget 2014, reflecting new funding for the 2014 Economic Stability Mandate compensation lifts within the post-secondary sector.

K–12 Education — Additional Funding and Labour Stability

The Ministry of Education has received a significant increase to its budget — $564 million over the three year fiscal plan — in order to provide increased funding for school districts, as shown in Table 1.10.

Table 1.10 Increased Funding for K–12 Education

($ millions) | | 2015/16 | | 2016/17 | | 2017/18 | |

Public schools instruction | | 126 | | 161 | | 198 | |

Public schools administration | | (29 | ) | (54 | ) | (54 | ) |

Learning Improvement Fund | | 23 | | 25 | | 25 | |

Other budget adjustments including ministry efficiencies | | (14 | ) | 68 | | 89 | |

Total | | 106 | | 200 | | 258 | |

During fiscal year 2014/15, labour settlements were reached with the public school teachers and support workers. The agreements reached in both cases expire on June 30, 2019, providing four years of certainty to students and parents, as well as to K–12 employees. The compensation increases in both agreements are affordable to the fiscal plan and are consistent with other provincial public sector groups bargaining under government’s 2014 Economic Stability Mandate.

In addition to general wage increases for teachers, this additional funding will also pay for seniority improvements to teachers on call (substitute teachers) and additional preparation time for elementary school teachers. Over three years, the increase in public school instruction funding for labour settlements totals $485 million.

In addition to the public schools instruction increase, $73 million over three years is being added to the Learning Improvement Fund (LIF), which by 2016/17 will reach $100 million annually, up from the current $75 million allocated in Budget 2014. The LIF was established as part of Budget 2012 to provide additional resources for complex classroom needs. The additional funding will be used to hire more teachers (or enhance teaching in other ways) and to increase the resources allocated to educational assistants (or for other classroom supports).

Budget and Fiscal Plan — 2015/16 to 2017/18

20

Three Year Fiscal Plan

In Budget 2012, the SUCH sector (school districts, universities, colleges and healthcare organizations) was tasked with identifying administrative and related efficiencies as part of government’s overall plan of expenditure management. The healthcare sector has achieved over $200 million in savings and as noted above, the post-secondary sector has a target of $50 million that was established as part of Budget 2012.

In Budget 2015, the K–12 sector will also be tasked with finding similar efficiencies. In 2015/16, $29 million in savings are targeted, along with a further $25 million in 2016/17 and future years. These savings are to be found in administrative and related areas of school district budgets, and will be similar in nature to the work that school districts already have been doing as part of the 2012 Cooperative Gains Mandate for collective bargaining.

Ministry of Education staff will work closely with district officials to support their efforts, similar to what has occurred in the Ministries of Health and Advanced Education. School Districts will have considerable flexibility in developing their savings plans, with the expectation that savings are to be confined to non-instructional budgets and will not impact the classroom.

Supporting Economic Development

Budget 2015 provides $31 million over three years to support mining and the ongoing development of a liquefied natural gas (LNG) industry in British Columbia, as detailed in Table 1.11.

Table 1.11 Supporting Economic Development

($ millions) | | 2015/16 | | 2016/17 | | 2017/18 | |

Mining | | 9 | | 9 | | 9 | |

Liquefied natural gas | | 2 | | 1 | | 1 | |

Total | | 11 | | 10 | | 10 | |

Incremental funding to the Ministry of Energy and Mines will maintain improved turnaround times for notice of work permits, support the major mines permitting process by creating a Major Mines Permitting Office, and provide additional staff resources to increase mines inspections and other compliance and enforcement activities. The ministry’s base budget increases by $6.3 million annually. In addition, new Mines Act fees are expected to generate $3 million annually, which will be retained by the ministry.

Budget 2014 provided $35 million over four years to ensure the appropriate management of the province’s LNG strategy and to foster the successful development and growth of the industry. Budget 2015 provides an incremental $4 million over three years to support ongoing activities as oil and gas companies from around the world continue to pursue LNG investment opportunities in British Columbia and work towards making final investment decisions.

Budget and Fiscal Plan — 2015/16 to 2017/18

21

Three Year Fiscal Plan

Benefiting the Environment

Overall, Budget 2015 provides $47 million over three years for initiatives benefiting the environment, as detailed in Table 1.12.

Table 1.12 Benefiting the Environment

($ millions) | | 2015/16 | | 2016/17 | | 2017/18 | |

Water Sustainability Act — Ministry of Forests, Lands and Natural Resource Operations | | 4 | | 8 | | 10 | |

Water Sustainability Act — Ministry of Environment | | 1 | | 1 | | 1 | |

Temporary incentives for the cement industry | | 9 | | 7 | | 6 | |

Total | | 14 | | 16 | | 17 | |

The Water Sustainability Act delivers on government’s commitments to modernize British Columbia’s water laws, regulate groundwater use and strengthen provincial water management in light of growing demands for water and a changing climate. Budget 2015 provides $25 million over three years to support the implementation of the Water Sustainability Act, which will come into effect in January 2016, in a phased approach.

Budget 2015 provides $22 million over three years for an incentive program for the cement industry to produce cement in a cleaner manner. Over the five year life of the program, the Province will offer up to $27 million in conditional incentives to encourage cement producers to meet or beat new emissions intensity benchmarks.

Budget 2015 delivers on government’s commitment to direct all revenues from freshwater fishing licenses to the Freshwater Fisheries Society for conservation activities. This will provide $10 million over three years in incremental funding to the society.

In addition, Budget 2015 reintroduces the Clean Energy Vehicle Incentive Program and a fuelling/charging infrastructure program which will provide British Columbians incentives when considering the variety of clean and green choices for their transportation needs. Additional energy efficiency and conservation initiatives will also be implemented.

Supporting Families and Individuals in Need

Budget 2015 provides an additional $150 million over the next three years to support families and individuals most in need as detailed in Table 1.13.

Table 1.13 Supporting Families and Individuals in Need

($ millions) | | 2015/16 | | 2016/17 | | 2017/18 | |

Increased contribution provided to Community Living BC | | 18 | | 29 | | 59 | |

Child support payments fully exempted from income assistance payments | | 6 | | 9 | | 9 | |

Income Assistance supports for those in need | | — | | 20 | | — | |

Total | | 24 | | 58 | | 68 | |

Budget and Fiscal Plan — 2015/16 to 2017/18

22

Three Year Fiscal Plan

Community Living British Columbia

In Budget 2015 government’s contribution to Community Living British Columbia will increase by $106 million over the next three years. An additional $69 million over the next three years is provided to maintain support services for individuals with developmental disabilities and their families, and to address continued caseload growth and demand for services. An additional $37 million over the next three years is provided for general wage increases recently negotiated for front line social services workers under the 2014 Economic Stability Mandate.

Child Support Payments Fully Exempted from Income Assistance

Based on ongoing consultations with families on income and disability assistance as well as interested stakeholders, effective September 1, 2015 government will no longer deduct child support payments from income and disability assistance calculations. Income and disability assistance clients will be able to keep every dollar they receive in child support payments over and above what they receive in income and disability assistance. Approximately 3,200 families and 5,400 children who are currently receiving income and disability assistance will benefit from this change.

Fully exempting child support payments will increase income and disability assistance costs by $13 million annually. This increase will be partially offset by savings of $4 million currently spent on administering the Family Maintenance Program. Government will continue to provide resources to assist income and disability assistance clients in pursuing support orders from non-custodial parents, if they wish to do so. Budget 2015 provides $6 million in additional funding in 2015/16 to implement the change effective September 1, 2015 and an additional $9 million starting in 2016/17 and ongoing.

Income Assistance

Budget 2015 provides net additional funding of $20 million for individuals and families in need of income assistance to address caseload growth in disability income assistance, supplementary assistance and program delivery costs, partially offset by an anticipated reduction in temporary income assistance caseloads.

Policing and Community Safety

In Budget 2015, government will invest an additional $15 million over the next three years to fund increased RCMP costs in support of government’s continued commitment to a strong provincial police force to keep communities safe. In 2015/16, government will provide over $365 million to fund RCMP costs, an increase of almost $5 million from 2014/15.

Strategic Investments to Non-Government Partners

While BC’s budget remains balanced, the margin of the projected surplus continues to be narrow and there remains uncertainty in the future economic situation. Therefore Budget 2015 is accelerating $107 million of grants and other payments to local governments, public libraries, and other non-government agencies into 2014/15, so as to provide more funding certainty to those entities. As a result, there will be reduced requirements for providing such payments through ministry budgets in 2015/16 and 2016/17.

Budget and Fiscal Plan — 2015/16 to 2017/18

23

Three Year Fiscal Plan

Management of the BC Public Service

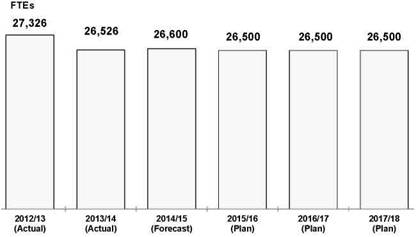

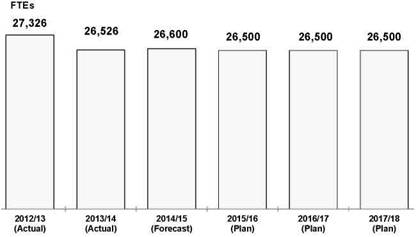

Full-time equivalent (FTE) staff utilization is projected to decrease from 26,600 FTEs in 2014/15 to 26,500 FTEs in 2015/16 due mainly to the expectation that the additional seasonal wildfire FTEs required in 2014/15 will not be required in 2015/16.

Chart 1.9 Managing FTEs

Going forward, FTE utilization is projected to remain flat in 2016/17 and 2017/18.

2014 Economic Stability Mandate for Public Sector Compensation

Of the approximately 313,000 unionized employees covered by over 180 collective agreements, over two-thirds have ratified or achieved tentative settlements under the 2014 Economic Stability Mandate (2014 Mandate). For planning purposes, Budget 2014 provided funding for the 2014 Mandate within the Contingencies vote allocations. In Budget 2015, funding has been reallocated from the Contingencies vote to ministry budgets in order to provide for modest wage increases under the 2014 Mandate.

The remaining employees who have yet to conclude new agreements include a significant number of post-secondary staff, nurses, and workers in some of the other service delivery agencies. There is adequate funding in the fiscal plan to accommodate the anticipated settlements for these groups. As well, current allocations to ministries are only for the base increase portion of the settlements; any Economic Stability Dividends will be funded from the Contingencies vote. See the topic box on page 41 for more information on the 2014 Mandate.

Recovered Expenses

Over the fiscal plan period (2015/16 to 2017/18), government projects it will incur $8.2 billion in program spending whose costs will be recovered from third parties.

Recovered costs include an estimated $3.0 billion in interest payments from commercial Crown corporations through the fiscal agency loan program and from sinking fund investment returns.

A total of $1.6 billion will be spent delivering programs on behalf of the federal government, such as the Labour Market Development Agreement, the Canada Jobs Fund, integrated workplace solutions, and child and family support programs.

Budget and Fiscal Plan — 2015/16 to 2017/18

24

Three Year Fiscal Plan

$1.2 billion in government spending is supported by other miscellaneous sources. For example, these include hospital expansion costs recovered from regional health boards, MSP and PharmaCare costs paid by agencies and other jurisdictions, and employee health benefits costs collected from participating government agencies.

The remaining $2.4 billion in recovered costs are incurred by a variety of programs, including industry-funded regulatory programs recovered through fees, fees recovered for collections services rendered, and distribution of free Crown grants recovered through the revaluation of the land being distributed.

The offsetting nature of the amounts recovered for the underlying expenses incurred, results in no net impact to government’s fiscal plan.

Operating Transfers

Transfers to service delivery agencies will total $68.9 billion over the fiscal plan period (2015/16 to 2017/18) in support of education, health care, social services, housing, and transportation programs delivered by the agencies on behalf of government. These service delivery agencies include the SUCH sector (schools, universities, colleges and health organizations), Community Living BC, BC Housing Management Commission, BC Transit, and the BC Transportation Financing Authority. Transfers to these organizations comprise over 60 per cent of ministry spending.

Service Delivery Agency Spending

Service delivery agency spending is projected to total $29.3 billion by 2017/18, reflecting an increase of $1.7 billion over the fiscal plan period.

School district spending is projected at $5.8 billion in 2017/18, an increase of $446 million (8.2 per cent) over the three year period. The increase is due to salary and benefits cost increases relating to the recent agreements reached under government’s negotiating mandates, partially offset by savings anticipated in administration.

Spending by the post-secondary institutions sector is forecast to increase by $325 million (6.1 per cent) over the three year period, to a total of $5.6 billion by 2017/18. The increase is largely due to increased salary costs relating to anticipated Economic Stability Mandate agreements, higher amortization costs in line with ongoing capital asset investments, and inflationary pressure on operating costs.

Health authority and hospital society spending is projected to rise from $13.2 billion in 2014/15 to $13.9 billion by 2017/18 — an increase of $643 million, or 4.9 per cent over the three year period. This spending increase is mainly due to additional staffing and operating costs incurred to meet the projected volume growth in healthcare services delivered by these organizations. The staffing cost increase does not reflect the impact of total wage/benefit cost adjustments for the ongoing contract negotiations. The Ministry of Health will be addressing this issue with the health authorities in the coming months.

Projected spending by other service delivery agencies is forecast to increase by $258 million by 2017/18. This 7.0 per cent increase is largely due to increased transportation sector spending and related interest costs.

Budget and Fiscal Plan — 2015/16 to 2017/18

25

Three Year Fiscal Plan

Capital Spending

In Budget 2015 capital spending on schools, hospitals, roads, bridges, hydro-electric projects and other infrastructure across the province is expected to total $18.7 billion over the fiscal plan period. These investments will support the ongoing implementation of the BC Jobs Plan, and key infrastructure needs in communities across the province.

Table 1.14 Capital Spending

| | Updated | | Budget | | | | | |

| | Forecast | | Estimate | | Plan | | Plan | |

($ millions) | | 2014/15 | | 2015/16 | | 2016/17 | | 2017/18 | |

Taxpayer-supported | | | | | | | | | |

Education | | | | | | | | | |

Schools (K–12) | | 405 | | 481 | | 541 | | 627 | |

Post-secondary institutions | | 781 | | 691 | | 739 | | 626 | |

Health | | 1,004 | | 983 | | 1,084 | | 678 | |

BC Transportation Financing Authority | | 828 | | 941 | | 706 | | 678 | |

BC Transit | | 88 | | 119 | | 137 | | 53 | |

Government ministries | | 392 | | 392 | | 431 | | 383 | |

Other 1 | | 139 | | 124 | | 88 | | 154 | |

Total taxpayer-supported | | 3,637 | | 3,731 | | 3,726 | | 3,199 | |

Self-supported | | | | | | | | | |

BC Hydro | | 2,268 | | 2,234 | | 2,277 | | 2,718 | |

Columbia River power projects 2 | | 36 | | 24 | | 14 | | 16 | |

Transportation Investment Corporation (Port Mann) | | 95 | | 16 | | 9 | | — | |

BC Railway Company | | 4 | | 5 | | 2 | | 1 | |

ICBC | | 81 | | 115 | | 50 | | 40 | |

BC Lotteries | | 90 | | 90 | | 110 | | 110 | |

Liquor Distribution Branch | | 30 | | 34 | | 65 | | 59 | |

Total self-supported commercial | | 2,604 | | 2,518 | | 2,527 | | 2,944 | |

Total capital spending | | 6,241 | | 6,249 | | 6,253 | | 6,143 | |

1 Includes BC Housing Management Commission, Provincial Rental Housing Corporation, and other service delivery agencies.

2 Joint ventures of the Columbia Power Corporation and Columbia Basin Trust.

Taxpayer-supported Capital Spending

Taxpayer-supported capital spending over the next three years will total $10.7 billion, and includes completion of existing approved projects along with new investments to expand and sustain provincial infrastructure including schools, universities and hospitals.

Investments in Schools

Over the three years of the capital plan, $1.6 billion will be invested to maintain, replace, renovate or expand K—12 facilities, including continued investment in new school space to accommodate increasing enrolment in growth districts, and continued investment in the program to seismically upgrade or replace schools.

Budget and Fiscal Plan — 2015/16 to 2017/18

26

Three Year Fiscal Plan