National Library of Canada Cataloguing in Publication Data

British Columbia. Office of the Comptroller General.

Public accounts for the year ended… – 2000/2001

Annual.

Report year ends Mar. 31.

Continues: British Columbia. Ministry of Finance.

Public accounts. ISSN 1187–8657.

ISSN 1499–1659 = Public accounts–British Columbia.

Office of the Comptroller General

1. British Columbia–Appropriations and

expenditures–Periodicals. 2. Revenue–British

Columbia–Periodicals.

3. Finance, Public–British Columbia–Periodicals. 1.

British Columbia. Ministry of Finance. 2. Title.

HJ13.B74 352.4’09711’05 C2001–960204–9

July 18, 2019

Victoria, British Columbia

Lieutenant Governor of the Province of British Columbia

MAY IT PLEASE YOUR HONOUR:

The undersigned has the honour to present the Public Accounts of the Government of the Province of British Columbia for the fiscal year ended March 31, 2019.

CAROLE JAMES

Minister of Finance

Ministry of Finance

Victoria, British Columbia

Honourable Carole James

Minister of Finance

I have the honour to submit herewith the Public Accounts of the Government of the Province of British Columbia for the fiscal year ended March 31, 2019.

Respectfully submitted,

CARL FISCHER

Comptroller General

British Columbia’s Public Accounts

The Public Accounts include the Summary Financial Statements of the provincial Government Reporting Entity which includes the financial results of all ministries and Crown agencies presented on a consolidated basis. The supporting notes and schedules define the accounting policies followed in preparing the province’s financial statements and form an integral part of the overall financial picture of the province’s financial activities in the fiscal year ending March 31, 2019.

Responsibility for the preparation of the government’s financial statements rests with the Office of the Comptroller General. The accounting standards followed by the province are established in section 23.1 of the Budget Transparency and Accountability Act. Although accounting policies are based on Public Sector Accounting Standards (PSAS), the application of standards to specific programs and transactions is the responsibility of the preparer who must use professional judgement to determine the treatment that is most representative of the underlying economic substance and best serves the information requirements of the users of government financial statements. To ensure due diligence in the application of accounting policies, decisions are based on comprehensive understanding of the substance of transactions, reference to existing and emerging accounting standards, and consultation with standard setters, other jurisdictions and the audit community.

In September 1999 the final report of the Budget Process Review Panel established clear principles for financial reporting based on user needs and led to the introduction of the Budget Transparency and Accountability Act which forms the basis of British Columbia’s legislated reporting framework. British Columbia is at the forefront of financial accountability by providing all financial reporting on a full accrual basis with direct comparability between budget and actual results. Conflicts can arise between the legislated requirement for comparable and consistent financial reporting and the national and international standards that guide accounting or the interpretation of those standards. Our obligation is to ensure financial reporting meets the accountability requirements of the public and stakeholders, within the framework established in legislation.

Despite the growing complexity of the reporting process, British Columbia remains committed to timely delivery of the Public Accounts each year and continues to focus on consistency in budgeting and financial reporting based on the comparability of its Estimates and Public Accounts, and the focus on “one bottom line”; that is, the Summary Financial Statements of the province.

Throughout the year, we work with the Office of the Auditor General to implement changes in accounting standards, address audit findings and recommendations, and improve the transparency of financial reporting. In doing so, we are mindful of the need to maintain consistency in the fundamental principles of accounting, and the comparability of financial information over a long period of time. This continuity allows the users of financial information to compare government’s financial performance against their fiscal plan, and to understand the province’s financial performance over longer periods of time. These objectives help demonstrate accountability for financial performance to the public, both in the current year and over the longer term.

The audit opinion on this year’s Public Accounts includes one point of reservation. The previous years reservation related to rate–regulated accounting has been resolved, though the Auditor General continues to monitor the implementation of governments policy direction.

A reservation remains in relation to the deferral of revenue, which has been a qualification since Public Accounts 2011/12. At that time government made the policy decision to maintain the longstanding accounting treatment of recognizing restricted contributions in the same period that programs and services are delivered. Adopting the auditors recommended approach of immediate recognition would result in:

· restricted contributions no longer being disclosed as a provincial obligation for future service delivery;

· budget and actual results no longer being directly comparable;

· future program spending being artificially constrained during economic downturns when services are most urgently needed.

We will continue to work with standard setters, other jurisdictions, the accounting community, and the Office of the Auditor General towards a resolution of the reservation identified in the audit opinion.

I would like to thank the Select Standing Committee on Public Accounts of the Legislative Assembly, government ministries, Crown corporations and agencies, and the Auditor General and her staff for their cooperation and support in preparing the Public Accounts.

Comments or questions regarding the Public Accounts document are encouraged and much appreciated. Please direct your comments or questions to me by mail at PO Box 9413 STN PROV GOVT, Victoria BC V8W 9V1; e–mail at: Carl.Fischer@gov.bc.ca; by telephone at 250–387–6692; or by fax at 250–356–2001.

Further information on the government’s financial performance is also provided through the Consolidated Revenue Fund Extracts (available on the Internet – website http://gov.bc.ca/publicaccounts). These extracts compare actual to planned spending of ministries on an appropriation basis, fulfilling ministries accountability back to the Legislative Assembly.

| CARL FISCHER |

| Comptroller General |

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Contents

Overview (Unaudited) | |

Public Accounts Content | 9 |

Legislative Compliance and Accounting Policy Report | 10 |

Financial Statement Discussion and Analysis Report | 11 |

Highlights | 11 |

Discussion and Analysis | 13 |

Economic Highlights | 28 |

| |

Summary Financial Statements | |

Statement of Responsibility for the Summary Financial Statements of the Government of the Province of British Columbia | 31 |

Report of the Auditor General of British Columbia | 32 |

Consolidated Statement of Financial Position | 39 |

Consolidated Statement of Operations | 40 |

Consolidated Statement of Change in Net Liabilities | 41 |

Consolidated Statement of Cash Flow | 42 |

Notes to Consolidated Summary Financial Statements | 44 |

Reporting Entity | 85 |

Consolidated Statement of Financial Position by Sector | 88 |

Consolidated Statement of Operations by Sector | 92 |

Statement of Financial Position for Self–supported Crown Corporations and Agencies | 96 |

Summary of Results of Operations and Statement of Equity for Self–supported Crown Corporations and Agencies | 98 |

Consolidated Statement of Tangible Capital Assets | 100 |

Consolidated Statement of Guaranteed Debt | 101 |

| |

Supplementary Information (Unaudited) | |

Adjusted Net Income of Crown Corporations, Agencies and the SUCH Sector | 105 |

SUCH Statement of Financial Position | 108 |

SUCH Statement of Operations | 110 |

Consolidated Staff Utilization | 111 |

| |

Consolidated Revenue Fund Extracts (Unaudited) | |

Statement of Financial Position | 115 |

Statement of Operations | 116 |

General Fund Statement of Financial Position | 117 |

General Fund Statement of Operations | 118 |

BC Prosperity Fund Statement of Financial Position | 119 |

BC Prosperity Fund Statement of Operations | 119 |

Statement of Cash Flow | 120 |

Schedule of Net Revenue by Source | 122 |

Schedule of Comparison of Estimated Expenses to Actual Expenses | 124 |

Schedule of Financing Transaction Disbursements | 126 |

Schedule of Write–offs, Extinguishments and Remissions | 127 |

| |

Provincial Debt Summary | |

Overview of Provincial Debt (Unaudited) | 131 |

Provincial Debt (Unaudited) | 132 |

Change in Provincial Debt (Unaudited) | 133 |

Reconciliation of Summary Financial Statements’ Deficit (Surplus) to Change in Taxpayer–supported Debt and Total Debt (Unaudited) | 134 |

Reconciliation of Total Debt to Summary Financial Statements’ Debt (Unaudited) | 134 |

Change in Provincial Debt, Comparison to Budget (Unaudited) | 135 |

Interprovincial Comparison of Taxpayer–supported Debt as a Percentage of Gross Domestic Product (Unaudited) | 136 |

Interprovincial Comparison of Taxpayer–supported Debt Service Costs as a Percentage of Revenue (Unaudited) | 137 |

Report of the Auditor General of British Columbia on the Summary of Provincial Debt, Key Indicators of Provincial Debt, and Summary of Performance Measures | 138 |

Summary of Provincial Debt | 143 |

Key Indicators of Provincial Debt | 145 |

Summary of Performance Measures | 146 |

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Contents — Continued

Definitions (Unaudited) | 147 |

Acronyms (Unaudited) | 150 |

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Public Accounts Content

Financial Statement Discussion and Analysis Unaudited)—this section provides a written commentary on the Summary Financial Statements plus additional information on the financial performance of the provincial government.

Summary Financial Statements—these audited statements have been prepared to disclose the financial impact of the government’s activities. They aggregate the Consolidated Revenue Fund (CRF) the taxpayer–supported Crown corporations and agencies (government organizations), the self–supported Crown corporations and agencies (government business enterprises) and the school districts, universities, colleges, institutes and health organizations (SUCH) sector.

Supplementary Information (Unaudited)—this section provides supplementary schedules containing detailed information on the results of those Crown corporations and agencies that are part of the government reporting entity and the impact of the SUCH sector on the province’s financial statements.

Consolidated Revenue Fund Extracts (Unaudited)—the CRF reflects the core operations of the province as represented by the operations of government ministries and legislative offices. Its statements are included in an abridged form. The CRF Extracts include a summary of the CRF Statement of Financial Position, the CRF Statement of Operating Results, the General Fund Statement of Financial Position, the General Fund Statement of Operations, the BC Prosperity Fund Statement of Financial Position, the BC Prosperity Fund Statement of Operations, the CRF Statement of Cash Flow, a CRF Schedule of Net Revenue by Source, a CRF Schedule of Expenses, a CRF Schedule of Financing Transactions, and a CRF Schedule of Write–offs, Extinguishments and Remissions, as required by statute.

Provincial Debt Summary—this section presents unaudited schedules and unaudited statements that provide further details on provincial debt and reconcile the Summary Financial Statements debt to the province’s total debt. Also included are the audited Summary of Provincial Debt, Key Indicators of Provincial Debt and Summary of Performance Measures.

This publication is available on the Internet at: http://gov.bc.ca/finance

Additional Information Available (Unaudited)

The following information is available only on the Internet at: http://gov.bc.ca/finance

Consolidated Revenue Fund Supplementary Schedules—this section contains schedules that provide details of financial activities of the CRF, including details of expenses by ministerial appropriations, an analysis of statutory appropriations, Special Accounts and Special Fund balances and operating statements, and financing transactions.

Consolidated Revenue Fund Detailed Schedules of Payments—this section contains detailed schedules of salaries, wages, travel expenses, grants and other payments.

Financial Statements of Government Organizations and Enterprises—this section contains links to the audited financial statements of those Crown corporations, agencies and SUCH sector entities that are included in the government reporting entity.

9

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Legislative Compliance and Accounting Policy Report

The focus of the province’s financial reporting is the Summary Financial Statements, which consolidate the operating and financial results of the province’s Crown corporations, agencies, school districts, universities, colleges, institutes and health organizations with the Consolidated Revenue Fund. These are general–purpose statements designed to meet, to the extent possible, the information needs of a variety of users.

The Public Accounts are prepared in accordance with the Financial Administration Act and the Budget Transparency and Accountability Act (BTAA).

The BTAA was amended in 2001 with the passing of Bill 5. Under section 20 of that Bill, the government has mandated that “all accounting policies and practices applicable to documents required to be made public under this Act for the government reporting entity must conform to generally accepted accounting principles.”

For senior governments, generally accepted accounting principles (GAAP) is generally considered to be the recommendations and guidelines of the Canadian Public Sector Accounting Board.

Section 4.1 of the BTAA established an Accounting Policy Advisory Committee (APAC) to advise Treasury Board on the implementation of GAAP for the government reporting entity (GRE). With the government’s transition to full GAAP for the 2004/05 year, the role of APAC changed to include the provision of advice on evolving developments in accounting standards by the accounting profession, as well as emerging issues within government.

10

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Financial Statement Discussion and Analysis Report

Highlights

The highlights section provides a summary of the key events affecting the financial statements based on information taken from the Summary Financial Statements and Provincial Debt Summary included in the Public Accounts. The budget figures are from pages 139, 145, 148 and 149 of the Budget and Fiscal Plan 2018/19–2020/21.

Budget and Actual Results 2018/19

| | In Millions | | Variance | |

| | | | 2018/19 | | | | | | 2018/19 | | 2018/19 | |

| | 2018/19 | | Updated | | 2018/19 | | 2017/18 | | Actual to | | vs | |

| | Budget | | Forecast | | Actual | | Actual | | Budget | | 2017/18 | |

| | $ | | $ | | $ | | $ | | $ | | $ | |

Revenue | | 54,193 | | 56,636 | | 57,128 | | 52,020 | | 2,935 | | 5,108 | |

Expense | | (53,624 | ) | (55,762 | ) | (55,593 | ) | (51,706 | ) | (1,969 | ) | (3,887 | ) |

Surplus(deficit) before forecast allowance | | 569 | | 874 | | 1,535 | | 314 | | 966 | | 1,221 | |

Forecast allowance | | (350 | ) | (500 | ) | | | | | 350 | | | |

Surplus (deficit) for the year | | 219 | | 374 | | 1,535 | | 314 | | 1,316 | | 1,221 | |

| | | | | | | | | | | | | |

Capital spending: | | | | | | | | | | | | | |

Taxpayer–supported capital spending | | 5,174 | | 4,771 | | 4,452 | | 3908 | | (722 | ) | 544 | |

Self–supported capital spending | | 4,061 | | 4,192 | | 4,106 | | 2,729 | | 45 | | 1,377 | |

Total capital spending | | 9,235 | | 8,963 | | 8,558 | | 6,637 | | (677 | ) | 1,921 | |

| | | | | | | | | | | | | |

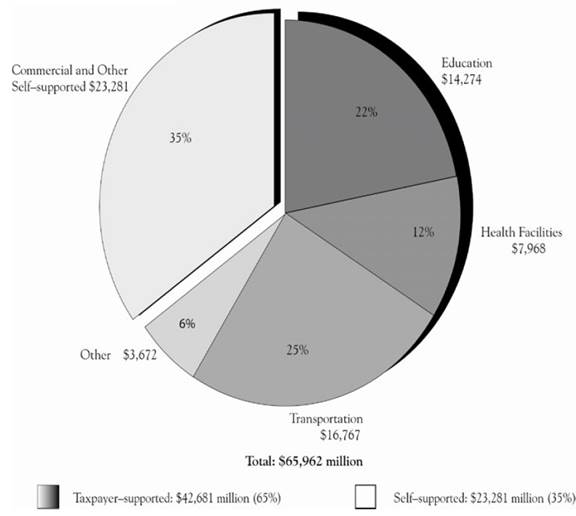

Provincial debt: | | | | | | | | | | | | | |

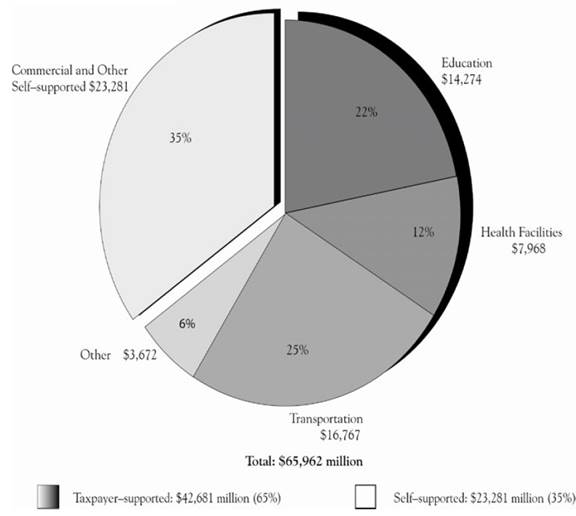

Taxpayer–supported | | 45,198 | | 43,957 | | 42,681 | | 43,607 | | (2,517 | ) | (926 | ) |

Self–supported | | 23,824 | | 23,459 | | 23,281 | | 21,312 | | (543 | ) | 1,969 | |

Total provincial debt | | 69,022 | | 67,416 | | 65,962 | | 64,919 | | (3,060 | ) | 1,043 | |

| | | | | | | | | | | | | |

Taxpayer–supported debt to GDP ratio | | 15.5 | % | 14.9 | % | 14.5 | % | 15.6 | % | (1.0 | ) | (1.1 | ) |

Summary Accounts Surplus (Deficit)

The province ended the year with a surplus of $1,535 million, which was $1,316 million higher than the surplus forecast in the Budget and Fiscal Plan 2018/19–2020/21. The 2018/19 surplus of $1,535 million was $1,221 million greater than the surplus of $314 million in fiscal year 2017/18.

Revenue increased by $5,108 million over fiscal year 2017/18 and was $2,935 million higher than budget. The annual increase in revenue in the current year was mainly in taxation revenue reflecting economic growth, new tax policy measures and higher prior year income tax assessments.

Expense increased by $3,887 million over fiscal year 2017/18 and was higher than budget by $1,969 million. The increases in spending in the current year were mainly in the natural resources, health, protection of persons and property and education sectors for service delivery requirements and wildfire activities. Additional spending over budget was authorized through Supplementary Estimates and various statutory appropriations.

11

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Financial Statement Discussion and Analysis Report

Capital Spending

Taxpayer–supported infrastructure spending on hospitals, schools, post–secondary facilities, transit, and roads totaled $4,452 million in 2018/19, $722 million lower than budget mainly due to project scheduling changes. This spending has been deferred to future years.

Self–supported infrastructure spending on electrical generation, transmission and distribution projects and other capital assets totaled $4,106 million in 2018/19. Self–supported capital spending was $45 million higher than budget.

Provincial Debt

When calculating total provincial debt, the province adds to its financial statement debt, all debt guarantees and the debt directly incurred by self–supported Crown corporations, reduced by sinking fund assets. This balance is referred to as the total provincial debt.

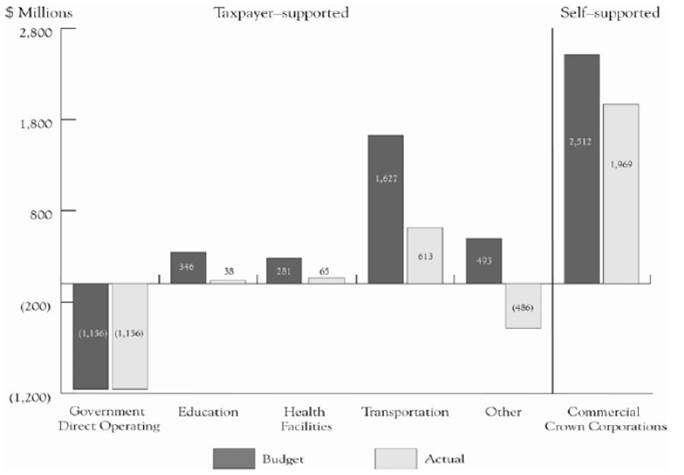

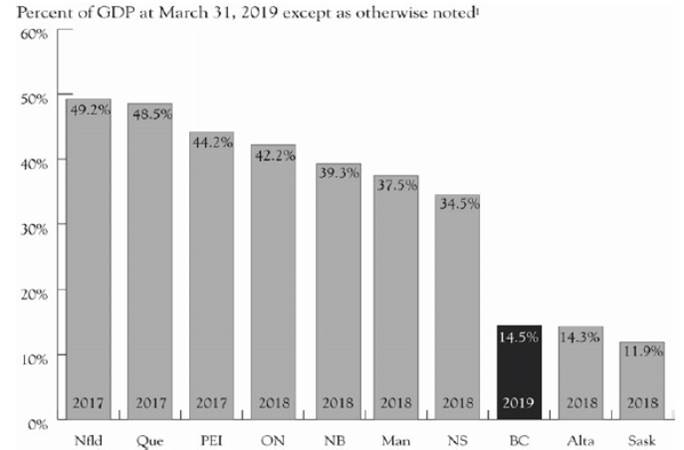

Taxpayer–supported provincial debt decreased by $926 million in 2018/19 mainly due to the elimination of provincial government direct operating debt. Self–supported provincial debt increased by $1,969 million due to an increase in capital infrastructure related to power projects. The increase in total provincial debt of $1,043 million was $3,060 million less than the budgeted increase in total debt of $4,103 million. The key measure of taxpayer–supported debt to GDP ended the year at 14.5%, which is lower than the 15.5% forecasted in the budget.

12

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Financial Statement Discussion and Analysis Report

Discussion and Analysis

The detailed analysis section provides an overview of significant trends relating to the Statement of Operations, Statement of Financial Position and Provincial Debt.

Revenue Analysis

Revenue analysis helps users understand the government’s finances in terms of its revenue sources and allows them to evaluate the revenue producing capacity of the government.

Revenue by Source

Revenue by source provides an outline of the primary sources of provincial revenue and how results change between those sources over time. Revenues are broken down into separate components of taxation, contributions from the federal government, natural resources and other sources, which include fees and licenses, contributions from self–supported Crown corporations, and investment income.

| | In Millions | |

| | 2014/15 | | 2015/16 | | 2016/17 | | 2017/18 | | 2018/19 | |

| | Actual | | Actual | | Actual | | Actual | | Actual | |

| | $ | | $ | | $ | | $ | | $ | |

Taxation | | 23,056 | | 24,326 | | 27,093 | | 28,321 | | 32,714 | |

Contributions from federal government | | 7,279 | | 7,647 | | 8,167 | | 9,055 | | 9,052 | |

Fees and licences | | 5,425 | | 5,836 | | 6,213 | | 6,249 | | 5,593 | |

Miscellaneous | | 2,860 | | 3,298 | | 3,508 | | 3,543 | | 3,413 | |

Net earnings of self–supported Crown corporations | | 3,437 | | 2,710 | | 2,525 | | 1,056 | | 2,005 | |

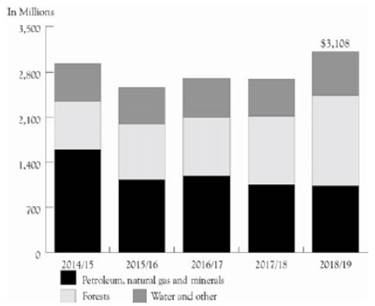

Natural resources | | 2,937 | | 2,571 | | 2,711 | | 2,695 | | 3,108 | |

Investment income | | 1,171 | | 1,213 | | 1,232 | | 1,101 | | 1,243 | |

Total revenue | | 46,165 | | 47,601 | | 51,449 | | 52,020 | | 57,128 | |

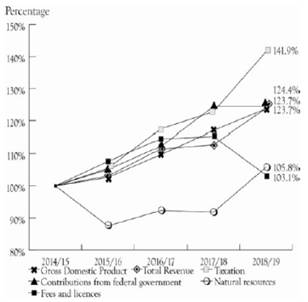

Provincial revenues increased by $5,108 million in 2018/19. The improvement in provincial revenue was primarily due to increases in taxation revenue of $4,393 million, net earnings of self–supported Crown corporations of $949 million, natural resource revenue of $413 million and an increase in the other sources of revenue of $9 million. Increases in these significant sources of revenue were offset by a decrease in fees and licences of $656 million.

2014/15 to 2018/19

In 2018/19, tax revenue increased by $4,393 million (15.5%). Personal income tax revenue increased by $2,441 million (27.4%) mainly reflecting estimated household income growth, higher prior year tax assessments and new tax policy measures. Corporate income tax revenue increased by $1,015 million (24.4%) due to increased federal government installments and prior year settlements. Employer health tax, which came into effect in fiscal 2018/19, was $464 million. Property transfer tax revenue decreased by $315 million (14.7%) due to weaker housing sales. All other tax revenues increased by $788 million over the same period.

13

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Financial Statement Discussion and Analysis Report

The net earnings of self–supported Crown corporations were $949 million higher than 2017/18 due to an adjustment of $950 million to the regulatory assets reported by the British Columbia Hydro and Power Authority (BC Hydro) made in fiscal 2017/18. The net earnings in the Insurance Corporation of British Columbia (ICBC) were $173 million higher than the previous year and were offset by a decrease of $162 million in BC Hydro earnings and by decreased earnings in other self–supported Crown corporations of $12 million.

Natural resource revenues were $413 million higher than 2017/18, mainly the result of improvements in the forestry sector.

The decrease in fees and licences of $656 million was due to the reduction in Medical Service Plan premiums offset by increases in tuition revenues in post–secondary institutions.

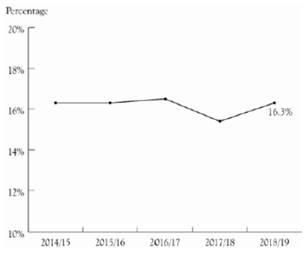

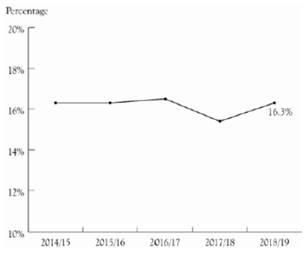

Own–source Revenue to GDP

The ratio of own–source revenue to GDP represents the amount of revenue the provincial government is taking from the provincial economy in the form of taxation, natural resource revenue, earnings of self–supported Crown corporations and user fees and licences (own–source revenue is all revenue except for federal transfers).

Own–source revenue to GDP has remained stable ending the year at 16.3%.

2014/15 to 2018/19

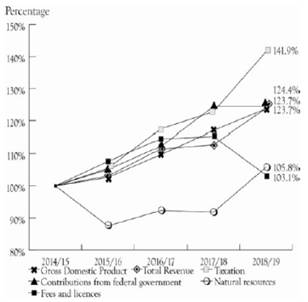

Percentage Change in Revenue

Trend analysis of revenue provides users with information about significant changes in revenue over time and between sources. This enables users to evaluate past performance and assess potential implications for the future.

Over the five years since 2014/15, total revenue has increased in relation with the increase in GDP. Taxation revenue has continued to exceed the growth in GDP. Natural resource revenues have increased by 14.0% over fiscal 2017/18 due to improvements in the forestry sector. Fees and licences revenue have declined due to the reduction in Medical Service Plan premiums.

2014/15 to 2018/19

14

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Financial Statement Discussion and Analysis Report

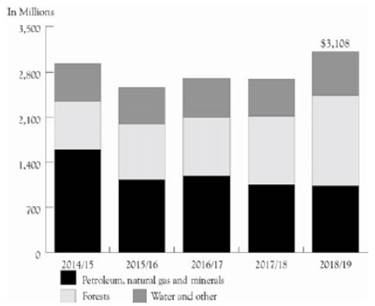

Natural Resource Revenue

The chart of natural resource revenue by source explains past trends of natural resource revenue in total and by major category.

Forestry revenue increased by $341 million in 2018/19. The proportion of natural resource revenue derived from forestry increased to 45.2% in 2018/19 from 39.5% in 2017/18.

Petroleum, natural gas and mineral revenues decreased slightly by $21 million from 2017/18. These categories of natural resource revenue account for 33.3% of natural resource revenue compared to 39.2% in 2017/18.

Water and other resource revenues increased by $93 million in the year. They comprise 21.5% of provincial natural resource revenue.

2014/15 to 2018/19

Government–to–Government Transfers to Total Revenue

The ratio of government–to–government transfers to total revenue is an indicator of how dependent the province is on transfers from the federal government. An increasing trend shows more reliance and a decreasing trend shows less.

Federal transfers decreased slightly in 2018/19, resulting in a stable ratio of 15.8%, indicating that there is no increase in dependence on federal transfers.

2014/15 to 2018/19

15

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Financial Statement Discussion and Analysis Report

Expense Analysis

The following analysis helps users to understand the impact of the government’s spending on the economy, the government’s allocation and use of resources, and the cost of government programs.

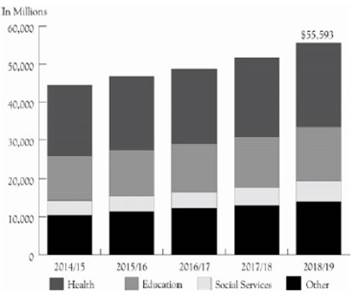

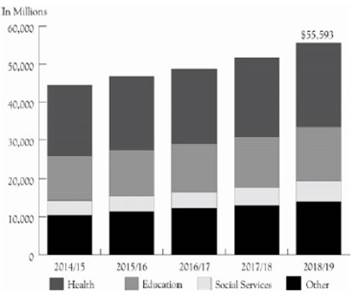

Expense by Function

Expense by function provides a summary of the major areas of government spending, and changes in spending over time. Functions, which indicate the purpose of expenditures, are defined by Statistics Canada’s Financial Management System of Government Statistics. The province uses the following functions: health, education, social services, interest, natural resources and economic development, other, transportation, protection of persons and property, and general government. The health, education and social services functions account for approximately three quarters of the province’s total operating costs.

| | In Millions | |

| | 2014/15 | | 2015/16 | | 2016/17 | | 2017/18 | | 2018/19 | |

| | Actual | | Actual | | Actual | | Actual | | Actual | |

| | $ | | $ | | $ | | $ | | $ | |

Health | | 18,370 | | 19,203 | | 19,689 | | 20,927 | | 22,151 | |

Education | | 11,827 | | 12,212 | | 12,468 | | 13,091 | | 14,085 | |

Social services | | 3,847 | | 4,106 | | 4,243 | | 4,737 | | 5,343 | |

Interest | | 2,498 | | 2,786 | | 2,587 | | 2,623 | | 2,684 | |

Natural resources and economic development | | 2,191 | | 2,477 | | 2,465 | | 3,374 | | 3,825 | |

Other | | 1,288 | | 1,264 | | 2,260 | | 1,553 | | 1,810 | |

Transportation | | 1,608 | | 1,670 | | 1,784 | | 1,931 | | 2,021 | |

Protection of persons and property | | 1,451 | | 1,572 | | 1,655 | | 1,930 | | 2,004 | |

General government | | 1,359 | | 1,501 | | 1,532 | | 1,540 | | 1,670 | |

Total expense | | 44,439 | | 46,791 | | 48,683 | | 51,706 | | 55,593 | |

Government spending on programs and services increased by $3,887 million in 2018/19.

The province increased spending on the health sector by $1,224 million (5.8%), the education sector by $994 million (7.6%), the social services sector by $606 million (12.8%), the natural resources and economic development sector by $451 million (13.4%), the other sector by $257 million (16.5%) and spending in all of the remaining sectors increased by $355 million over 2017/18.

2014/15 to 2018/19

16

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Financial Statement Discussion and Analysis Report

In 2018/19, provincial operating expenses were $55,593 million, a $3,887 million (7.5%) increase from 2017/18. Program spending has increased by $11,154 million (25.1%) since 2014/15. This is compared to increases in GDP of 23.7% over the same period.

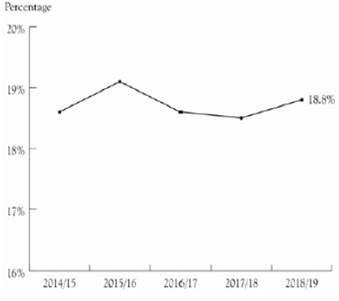

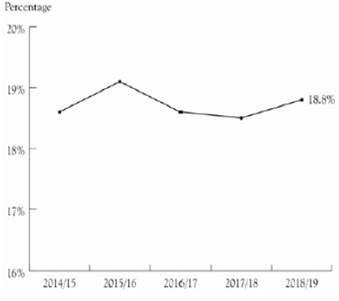

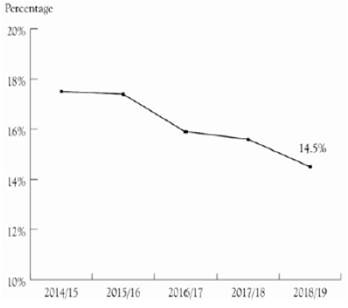

Expense to GDP

The ratio of expense to GDP represents the amount of government spending in relation to the overall provincial economy.

Government spending as a percentage of GDP increased slightly from 18.5% to 18.8% in 2018/19, indicating that government spending continues to grow moderately in relation to the provincial economy.

2014/15 to 2018/19

17

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Financial Statement Discussion and Analysis Report

Changes in Actual Results from 2017/18 to 2018/19

| | In Millions | |

| | Revenue | | Expense | | Surplus | |

| | $ | | $ | | $ | |

2017/18 Surplus | | 52,020 | | 51,706 | | 314 | |

Increase in taxation revenue | | 4,393 | | | | 4,393 | |

Increase in natural resources revenue | | 413 | | | | 413 | |

Increase in net earnings of self–supported Crown corporations | | 949 | | | | 949 | |

Decrease in fees and licences | | (656 | ) | | | (656 | ) |

Increase in other revenues | | 9 | | | | 9 | |

Increase in health spending | | | | 1,224 | | (1,224 | ) |

Increase in education spending | | | | 994 | | (994 | ) |

Increase in social services spending | | | | 606 | | (606 | ) |

Increase in natural resources and economic development spending | | | | 451 | | (451 | ) |

Increase in other sector spending | | | | 257 | | (257 | ) |

Increase in other program spending | | | | 355 | | (355 | ) |

Subtotal of changes in actual results | | 5,108 | | 3,887 | | 1,221 | |

| | 57,128 | | 55,593 | | | |

2018/19 Surplus | | | | | | 1,535 | |

| | | | | | | |

2017/18 Accumulated Surplus before Accumulated Other Comprehensive income | | | | | | 7,016 | |

2018/19 Accumulated Surplus before Accumulated Other Comprehensive income | | | | | | 8,551 | |

Accumulated other comprehensive income from self–supported Crown corporations and agencies | | | | | | 31 | |

2018/19 Accumulated Surplus | | | | | | 8,582 | |

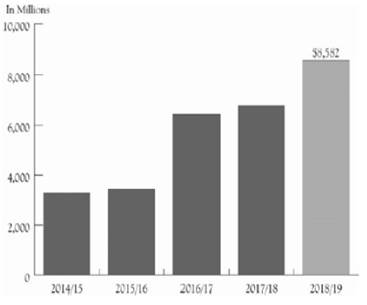

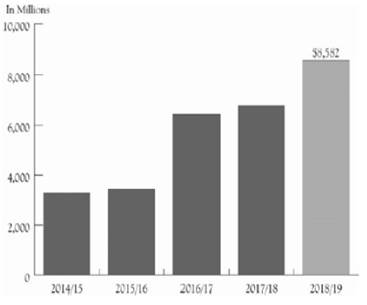

The year over year increase in total revenue of $5,108 million, offset by the increase in total expense of $3,887 million, resulted in a surplus that was $1,221 million higher than 2017/18. Accumulated surplus, including accumulated other comprehensive income, increased from $6,781 million in 2017/18 to $8,582 million at the end of 2018/19.

18

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Financial Statement Discussion and Analysis Report

Changes from 2018/19 Budget

| | In Millions | |

| | | | | | Forecast | | | |

| | Revenue | | Expense | | Allowance | | Surplus | |

| | $ | | $ | | $ | | $ | |

Surplus per 2018/19 Budget | | 54,193 | | 53,624 | | (350 | ) | 219 | |

Increased taxation revenue | | 2,122 | | | | | | 2,122 | |

Increased natural resources revenue | | 695 | | | | | | 695 | |

Decreased net earnings of self–supported Crown corporations | | (559 | ) | | | | | (559 | ) |

Increased other revenues | | 677 | | | | | | 677 | |

Increased natural resources and economic development spending | | | | 1,392 | | | | (1,392 | ) |

Increased health spending | | | | 500 | | | | (500 | ) |

Increased protection of persons and property spending | | | | 354 | | | | (354 | ) |

Decreased other sector spending | | | | (557 | ) | | | 557 | |

Increased other program spending | | | | 280 | | | | (280 | ) |

Forecast allowance | | | | | | 350 | | 350 | |

Subtotal of changes in actual results compared to budget | | 2,935 | | 1,969 | | 350 | | 1,316 | |

Actual Results | | 57,128 | | 55,593 | | 0 | | 1,535 | |

Revenue was $2,935 million (5.4%) higher than the budgeted amount of $54,193 million and expenses were $1,969 million (3.7%) higher than the budgeted amount of $53,624 million. Additional spending over budget was authorized through Supplementary Estimates and various statutory appropriations.

Net Liabilities and Accumulated Surplus

In accordance with Canadian generally accepted accounting principles, the government’s Consolidated Statement of Financial Position is presented on a net liabilities basis. Net liabilities represent net future cash outflows resulting from past transactions and events. An analysis of net liabilities and accumulated surplus helps users to assess the government’s overall financial position and the future revenue required to pay for past transactions and events.

| | In Millions | | Variance | |

| | | | | | | | 2018/19 | | 2018/19 | |

| | 2018/19 | | 2018/19 | | 2017/18 | | Budget | | vs | |

| | Budget | | Actual | | Actual | | to Actual | | 2017/18 | |

| | $ | | $ | | $ | | $ | | $ | |

Financial assets | | 44,858 | | 44,569 | | 43,083 | | (289 | ) | 1,486 | |

Less: liabilities | | (89,601 | ) | (86,703 | ) | (84,917 | ) | 2,898 | | (1,786 | ) |

Net Liabilities | | (44,743 | ) | (42,134 | ) | (41,834 | ) | 2,609 | | (300 | ) |

Less: non–financial assets | | 51,756 | | 50,716 | | 48,615 | | (1,040 | ) | 2,101 | |

Accumulated surplus | | 7,013 | | 8,582 | | 6,781 | | 1,569 | | 1,801 | |

19

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Financial Statement Discussion and Analysis Report

The accumulated surplus represents the sum of the current and prior years’ operating results, and accumulated changes in other comprehensive income. At March 31, 2019, the accumulated surplus was $8,582 million, $1,569 million higher than budget.

Financial assets were $1,486 million higher than 2017/18 as the result of increases in loans for the purchase of assets, recoverable from agencies of $2,013 million and accounts receivable of $719 million. These increases were offset by decreases in cash, cash equivalents and temporary investments of $411 million, equity in self–supported Crown corporations and agencies of $394 million and $441 million in other financial assets.

Liabilities increased by $1,786 million from 2017/18. This increase was the result of an increase in self–supported debt of $2,036 million due to investment in government power projects and an increase of $1,293 million in other liabilities, including accounts payable and deferred revenue. These increases were offset by a decrease of $1,543 million in taxpayer–supported debt due to the elimination of government direct operating debt.

Non–financial assets typically represent resources, such as tangible capital assets, that the government can use in the future to provide services. Non–financial assets increased by $2,101 million over 2017/18 representing government’s investment in current year infrastructure spending.

Accumulated Surplus

The accumulated surplus represents current and all prior years’ operating results. In 2018/19, the province had an accumulated surplus of $8,582 million, $1,801 million higher than in 2017/18. The positive operating results of prior years and the current year provide the flexibility to sustain core public services.

2014/15 to 2018/19

20

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Financial Statement Discussion and Analysis Report

Components of Net Liabilities

Financial Assets

Trend analysis of financial assets provides users with information regarding the amount of resources available to the government that can be converted to cash to meet obligations or fund operations.

| | In Millions | |

| | 2014/15 | | 2015/16 | | 2016/17 | | 2017/18 | | 2018/19 | |

| | Actual | | Actual | | Actual | | Actual | | Actual | |

| | $ | | $ | | $ | | $ | | $ | |

Cash, cash equivalents, temporary investments | | 3,675 | | 3,892 | | 4,232 | | 3,440 | | 3,029 | |

Accounts receivable | | 3,489 | | 3,761 | | 4,163 | | 4,586 | | 5,305 | |

Equity in self–supported Crown corporations and agencies | | 8,254 | | 7,514 | | 7,494 | | 6,111 | | 5,717 | |

Loans for the purchase of assets, recoverable from agencies | | 20,624 | | 22,041 | | 23,809 | | 20,534 | | 22,547 | |

Other financial assets | | 6,603 | | 7,455 | | 7,067 | | 8,412 | | 7,971 | |

Total financial assets | | 42,645 | | 44,663 | | 46,765 | | 43,083 | | 44,569 | |

In 2018/19, financial assets increased by $1,486 million primarily due to an increase in capital loans to Crown corporations and agencies. Recoverable capital loans increased by $2,013 million due to investments in power projects. Equity in self–supported Crown corporations decreased by $394 million related to the loss in earnings recorded by ICBC. The remaining financial assets decreased by $133 million.

Liabilities

Trend analysis of liabilities provides users with information to understand and assess the demands on financial assets and the revenue raising capacity of government.

| | In Millions | |

| | 2014/15 | | 2015/16 | | 2016/17 | | 2017/18 | | 2018/19 | |

| | Actual | | Actual | | Actual | | Actual | | Actual | |

| | $ | | $ | | $ | | $ | | $ | |

Taxpayer–supported debt | | 42,693 | | 44,119 | | 42,390 | | 44,752 | | 43,209 | |

Self–supported debt | | 20,465 | | 21,892 | | 23,699 | | 20,619 | | 22,655 | |

Total financial statement debt | | 63,158 | | 66,011 | | 66,089 | | 65,371 | | 65,864 | |

Accounts payable and other liabilities | | 8,312 | | 8,486 | | 8,898 | | 9,618 | | 10,435 | |

Deferred revenue | | 9,771 | | 9,743 | | 9,525 | | 9,928 | | 10,404 | |

Total liabilities | | 81,241 | | 84,240 | | 84,512 | | 84,917 | | 86,703 | |

In 2018/19, total liabilities increased by $1,786 million. Liabilities are obligations that must be settled at a future date by the transfer or use of assets. Self–supported financial statement debt increased by $2,036 million, while taxpayer–supported financial statement debt decreased in 2018/19 by $1,543 million. Information relating to the government’s debt management can be found in more detail in the analysis of the total provincial debt on page 25. Deferred revenue increased by $476 million and accounts payable and other liabilities increased by $817 million. Deferred revenue represents unearned revenues and restricted contributions that will be recognized as revenue in future periods.

21

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Financial Statement Discussion and Analysis Report

Non–financial Assets

Trend analysis of non–financial assets provides users with information to assess the management of a government’s infrastructure and long–term non–financial assets.

| | In Millions | |

| | 2014/15 | | 2015/16 | | 2016/17 | | 2017/18 | | 2018/19 | |

| | Actual | | Actual | | Actual | | Actual | | Actual | |

| | $ | | $ | | $ | | $ | | $ | |

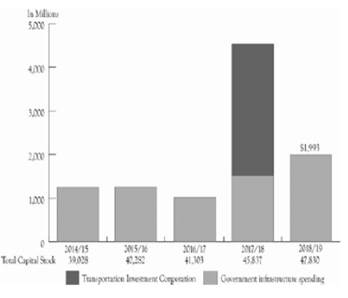

Tangible capital assets | | 39,028 | | 40,282 | | 41,303 | | 45,837 | | 47,830 | |

Other non–financial assets | | 2,834 | | 2,724 | | 2,875 | | 2,778 | | 2,886 | |

Total non–financial assets | | 41,862 | | 43,006 | | 44,178 | | 48,615 | | 50,716 | |

Management of non–financial assets has a direct impact on the level and quality of services a government is able to provide to the public. Non–financial assets typically represent resources that government can use in the future to provide services. At March 31, 2019, non–financial assets were $50,716 million which was $2,101 million higher than 2017/18 and $8,854 million higher than fiscal 2014/15. The majority of the province’s non–financial assets represent capital expenditures for tangible capital assets net of amortization. The government has increased its investment in infrastructure spending by $1,993 million, to ensure service potential is available to deliver programs and services in future periods. Capital expenditures are not included on the Consolidated Statement of Operations and have no effect on the current surplus. They reduce future surpluses in the form of amortization expense as the service potential of assets is used to deliver programs and services.

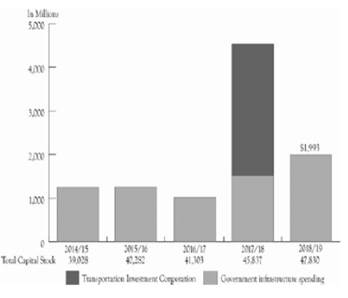

Change in Capital Stock

This measure shows the impact of net changes to the government’s stock of physical capital. Positive amounts demonstrate an investment in infrastructure to replace existing capital and provide service potential in future periods.

The net annual investment in capital was $1,993 million in 2018/19, and $10,052 million since the start of fiscal 2014/15 (including the Transportation Investment Corporation which was fully consolidated in fiscal 2017/18). Total capital stock has also increased steadily over that period which indicates that capital infrastructure is available to continue providing programs and services in future periods.

2014/15 to 2018/19

22

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Financial Statement Discussion and Analysis Report

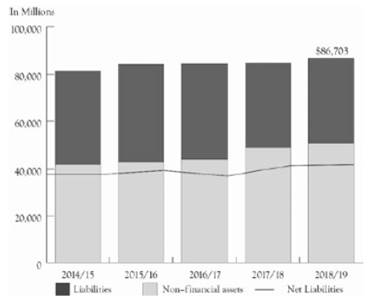

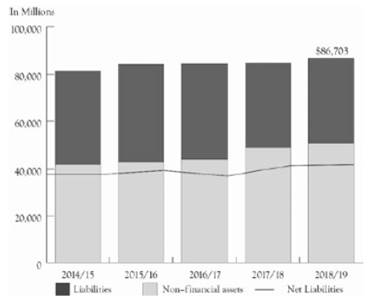

Net Liabilities and Accumulated Surplus

| | In Millions | |

| | 2014/15 | | 2015/16 | | 2016/17 | | 2017/18 | | 2018/19 | |

| | Actual | | Actual | | Actual | | Actual | | Actual | |

| | $ | | $ | | $ | | $ | | $ | |

Financial assets | | 42,645 | | 44,663 | | 46,765 | | 43,083 | | 44,569 | |

Less: liabilities | | (81,241 | ) | (84,240 | ) | (84,512 | ) | (84,917 | ) | (86,703 | ) |

Net liabilities | | (38,596 | ) | (39,577 | ) | (37,747 | ) | (41,834 | ) | (42,134 | ) |

Less: non–financial assets | | 41,862 | | 43,006 | | 44,178 | | 48,615 | | 50,716 | |

Accumulated surplus | | 3,266 | | 3,429 | | 6,431 | | 6,781 | | 8,582 | |

Net liabilities increased by $300 million in 2018/19. Liabilities include deferred revenue of $10,404 million which represents unearned revenues and restricted contributions that will be recognized as revenue in future periods.

The financial measure of net liabilities has remained stable while investments in infrastructure have increased resulting in an increase in accumulated surplus. The accumulated surplus of the province was $8,582 million at the end of 2018/19, indicating that the cumulative result of all past annual surpluses and deficits is positive, or that the province remains in a positive net financial position.

Non–financial Assets as a Portion of Liabilities

The chart provides an indication of what proportion of liabilities are used to fund capital infrastructure as opposed to funding working capital requirements including accounts payable and other operating liabilities, as well as revenue deferred to future periods. Over the past five years, non–financial assets have increased while the measure of net liabilities has remained stable.

2014/15 to 2018/19

23

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Financial Statement Discussion and Analysis Report

Net Liabilities to GDP

The net liabilities to GDP ratio provides an indication of the province’s ability to maintain existing programs and meet existing creditor requirements without increasing the debt burden on the economy as a whole.

The slight decrease in net liabilities to GDP is the result of net liabilities decreasing over and above the increase in economic growth as represented by GDP in 2018/19. Net liabilities include deferred revenue that will be recognized as revenue in future periods, and obligations to outside parties including accounts payable and debt.

2014/15 to 2018/19

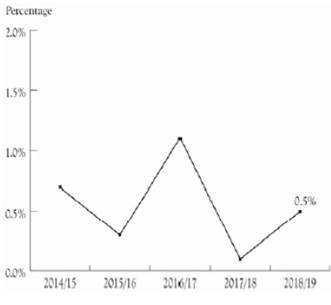

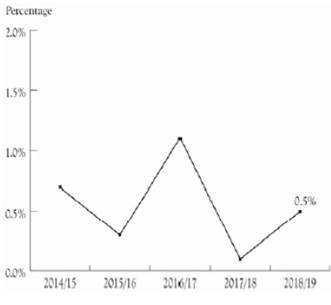

Surplus (Deficit) to GDP

The surplus (deficit) to GDP ratio is an indicator of sustainability that compares the province’s financial results to the overall results of the economy.

Results in the positive range of the chart indicate that the economy is growing faster than net government spending.

2014/15 to 2018/19

24

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Financial Statement Discussion and Analysis Report

Total Provincial Debt

Total provincial debt is calculated differently than financial statement debt. Analysis of total provincial debt helps users to assess the extent of long–term liabilities and the government’s ability to meet future debt obligations.

| | In Millions | |

| | 2014/15 | | 2015/16 | | 2016/17 | | 2017/18 | | 2018/19 | |

| | Actual | | Actual | | Actual | | Actual | | Actual | |

| | $ | | $ | | $ | | $ | | $ | |

Gross debt | | 63,158 | | 66,011 | | 66,089 | | 65,371 | | 65,864 | |

Less: sinking fund assets | | (977 | ) | (1,580 | ) | (1,087 | ) | (1,348 | ) | (752 | ) |

Third party guarantees and non–guaranteed debt | | 739 | | 820 | | 835 | | 896 | | 850 | |

Total provincial debt | | 62,920 | | 65,251 | | 65,837 | | 64,919 | | 65,962 | |

When reporting to rating agencies, the province adds to its financial statement debt, all debt guarantees and the debt directly incurred by self–supported Crown corporations, reduced by sinking fund assets. This balance is referred to as the total provincial debt.

Total provincial debt is $98 million higher than the amounts reported in the province’s financial statements after deducting sinking funds held to pay down the debt, and including guaranteed debt and the debt of self–supported Crown corporations.

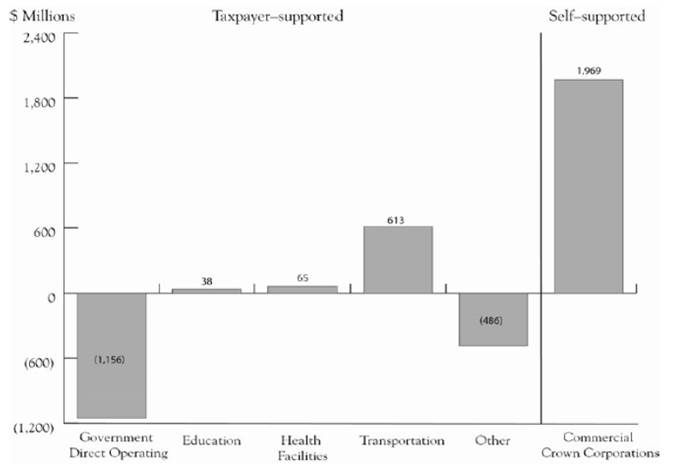

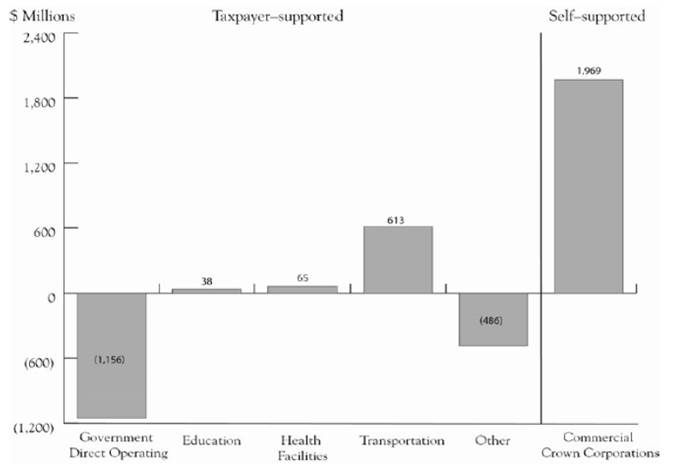

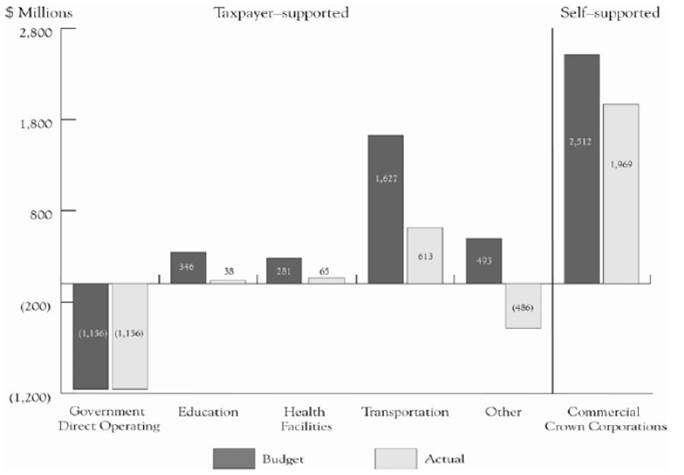

Total provincial debt increased by $1,043 million in 2018/19 to fund capital projects. The debt of self–supported Crown corporations and agencies increased for investments in power projects. Taxpayer–supported debt decreased by $926 million as a result of the elimination of provincial government direct operating debt of $1,156 million and other decreases in taxpayer–supported debt of $778 million. These decreases were offset by increases in debt for BC Transportation Financing Authority of $905 million, health sector of $65 million, and education sector of $38 million.

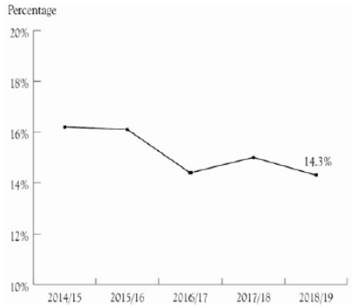

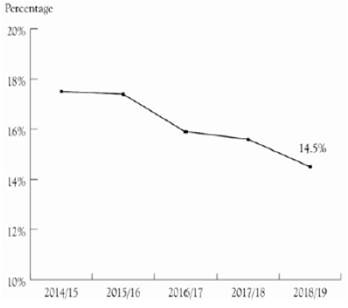

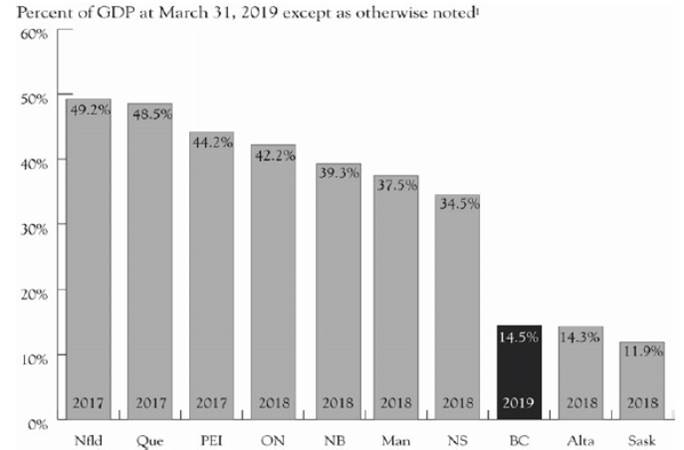

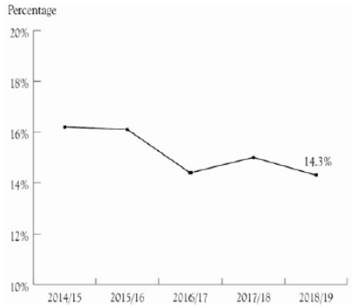

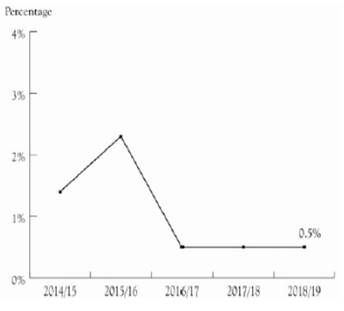

Taxpayer–supported debt to GDP

The ratio of taxpayer–supported debt to GDP is a key measure used by financial analysts and investors to assess a province’s ability to repay debt and is a key measure monitored by the bond rating agencies. A decreasing ratio means that debt is growing slower than the growth of the economy as measured by GDP.

At the end of 2018/19, taxpayer–supported debt to GDP was 14.5%, which was lower than the budgeted level of 15.5% and lower than the results for the past four years.

2014/15 to 2018/19

25

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Financial Statement Discussion and Analysis Report

Strong Credit Rating

Reflecting the province’s fiscal performance, British Columbia has maintained a strong and stable credit rating with all three credit rating agencies. In 2018/19, Moody’s Investors Service Inc. gave the province an Aaa credit rating (2018: Aaa); Standard and Poor’s gave the province an AAA credit rating (2018: AAA); and Dominion Bond Rating Service gave the province an AA(high) credit rating (2018: AA(high)).

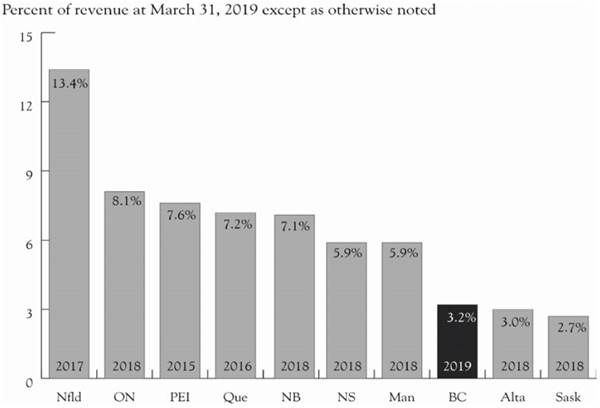

Credit Ratings March 31, 2019

Rating Agency1

| | Moody’s Investors | | | | Dominion Bond | |

Jurisdiction | | Service Inc. | | Standard and Poor’s | | Rating Service | |

British Columbia | | Aaa | | AAA | | AA(high) | |

Alberta | | Aa1 | | A+ | | AA | |

Saskatchewan | | Aaa | | AA | | AA | |

Manitoba | | Aa2 | | A+ | | A(high) | |

Ontario | | Aa3 | | A+ | | AA(low) | |

Quebec | | Aa2 | | AA– | | A(high) | |

New Brunswick | | Aa2 | | A+ | | A(high) | |

Nova Scotia | | Aa2 | | AA– | | A(high) | |

Prince Edward Island | | Aa2 | | A | | A(low) | |

Newfoundland | | Aa3 | | A | | A(low) | |

Canada | | Aaa | | AAA | | AAA | |

1The rating agencies assign letter ratings to borrowers. The major categories, in descending order of credit quality, are: AAA/Aaa; AA/Aa; A; BBB/Baa; BB/Ba; and B. The “1”, “2”, “3”, “high”, “low”, “–”, and “+” modifiers show relative standing within the major categories. For example, AA+ exceeds AA.

A more comprehensive overview of provincial debt, including key debt indicators is located on pages 131–146.

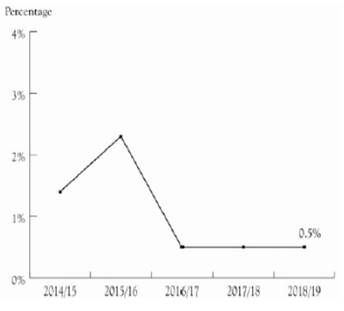

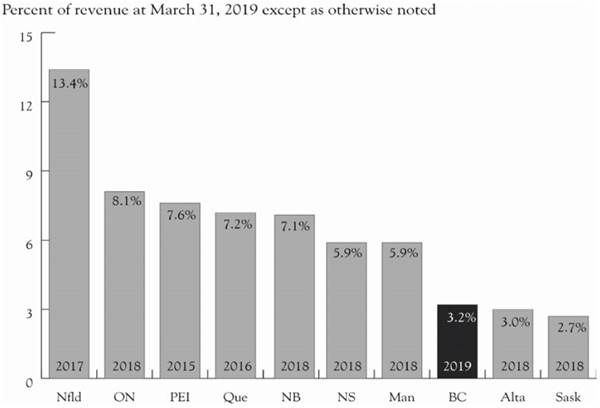

Public Debt Charges to Revenue (the Interest Bite)

The public debt charges to revenue indicator is often referred to as the “interest bite”. This provides users with the percentage of the province’s revenue used to pay interest on debt. The ratio is sensitive to the cost of debt arising from either increasing interest rates or increasing debt, as well as decreases in revenue.

If an increasing proportion of provincial revenue is required to pay interest on provincial debt, less money is available to provide core public services. The interest bite has remained stable over the last five years. In 2018/19, the province spent 3.2 cents of each revenue dollar on interest on the provincial taxpayer–supported debt.

2014/15 to 2018/19

26

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Financial Statement Discussion and Analysis Report

Non–Hedged Foreign Currency Debt to Total Provincial Debt

The ratio of non–hedged foreign currency debt to total provincial debt shows the degree of vulnerability of a government’s public debt position to swings in exchange rates.

Non–hedged foreign currency debt directly offset by instruments in the same foreign currency are considered “natural hedges”. These amounts are excluded from the ratio.

In 2018/19, the province had the equivalent of CAD$303 million in natural hedges.

2014/15 to 2018/19

27

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Financial Statement Discussion and Analysis Report

Economic Highlights

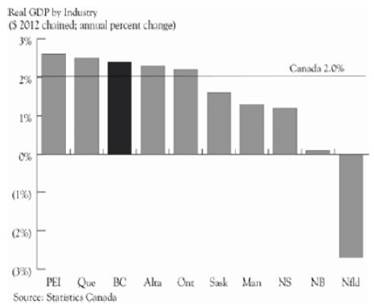

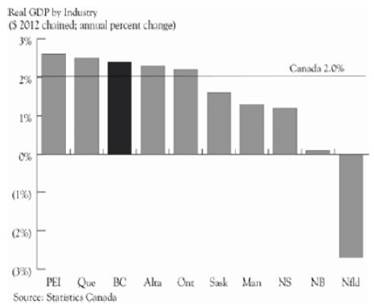

British Columbia’s economy grew by an estimated 2.4% in the 2018 calendar year, the third highest rate among the provinces, according to preliminary GDP by industry data from Statistics Canada. The estimated 2.4% growth for British Columbia in 2018 is higher than the government’s Budget 2019 estimate of 2.2%.

Real Gross Domestic Product in Calendar Year 2018

Growth was led by goods–producing industries (up 3.3%) with gains across most major industries in 2018 Notable increases were observed in mining, quarrying and oil and gas extraction (up 10.5%) largely due to increased natural gas extraction, construction (up 3.1%) and manufacturing (up 2.1%). Total construction expanded, although the pace of growth slowed from the pace observed in 2017. Growth was observed in both residential and non–residential building construction (up 3.7% and 13.2%, respectively), the latter experiencing growth after three consecutive annual declines.

Service–producing industries, which account for just over three–quarters of BC’s GDP, grew by 2.2%. Slower growth was broad–based across most industries. Transportation and warehousing (up 3.8%) and health care and social assistance (up 3.0%) were strong drivers of growth. Real estate and rental and leasing (up 1.5%) also contributed significantly, although growth in the industry has noticeably slowed.

Provincial Comparison

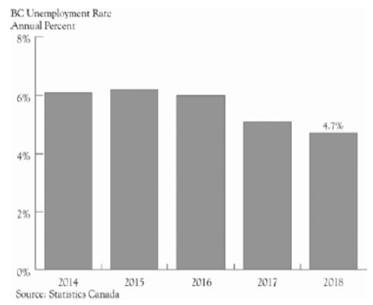

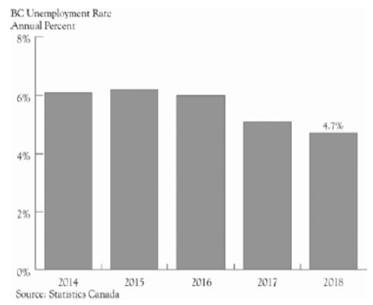

Unemployment Rate

British Columbia’s annual unemployment rate was 4.7% in 2018, a decrease from 5.1% observed in 2017. The unemployment rate in BC in 2018 was lower than the national unemployment rate of 5.8%. The average level of employment in BC increased by 1.1% in 2018, following a 3.7% increase in 2017.

2014 to 2018

28

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Financial Statement Discussion and Analysis Report

Risks and Uncertainties

The government’s main exposure to risks and uncertainties arises from variables, which the government does not directly control. These include:

· assumptions underlying revenue and Crown corporation forecasts such as economic factors, commodity prices and weather conditions;

· the outcome of litigation, arbitration, and negotiations with third parties;

· potential changes to federal transfer allocations, cost–sharing agreements with the federal government and impacts on the provincial income tax bases arising from federal tax policy and budget changes;

· utilization rates for government services such as health care, children and family services, and income assistance;

· exposure to interest rate fluctuations, foreign exchange rates and credit risk; and

· changes in Canadian generally accepted accounting principles.

The following are the approximate effect of changes in some of the key variables on the surplus:

Key Fiscal Sensitivities | | | | | |

| | | | Annual Fiscal Impact | |

Variable | | Increase Of | | ($ millions) | |

Nominal GDP | | 1% | | $150 to $250 | |

Lumber prices (US$/thousand board feet) | | $50 | | $150 to $1751 | |

Natural gas prices (Cdn$/gigajoule) | | 25 cents | | $10 to $402 | |

US exchange rate (US cents/Cdn$) | | 1 cent | | $(25) to $(50) | |

Interest rates | | 1 percentage point | | $(93) | |

Debt | | $500 million | | $(16) to $(17) | |

1Sensitivity relates to stumpage revenue only.

2Sensitivities can vary significantly, especially at lower prices.

Although the government is unable to directly control these variables, strategies have been implemented to mitigate these risks and uncertainties. The development of taxation, financial and corporate regulatory policy to reinforce British Columbia’s position as an attractive place to invest and create jobs will help offset the increase in competition for investment as a result of globalization of economic and financial markets. As in previous years, the government applied a forecast allowance in the budget to account for risks to revenue, expenditure, Crown corporations’, school districts’, universities’, colleges’, institutes’, and health organizations’ (SUCH sector) forecasts. The use of forecast allowances recognizes the uncertainties in predicting future economic developments.

Risk management in relation to debt is discussed in Note 20 on page 67 of the Notes to the Consolidated Summary Financial Statements.

29

Summary Financial Statements

Province of British Columbia

For the Fiscal Year Ended

March 31, 2019

BRITISH

COLUMBIA

Statement of Responsibility for the Summary Financial Statements of the Government of the Province of British Columbia

Responsibility for the integrity and objectivity of the Summary Financial Statements for the Government of the Province of British Columbia rests with the government. The Comptroller General prepares these financial statements in accordance with the Budget Transparency and Accountability Act (BTAA), which requires generally accepted accounting principles (GAAP) for senior governments in Canada, supported by regulations of Treasury Board under the BTAA. The fiscal year of the government is from April 1 to March 31 of the following year.

To fulfill its accounting and reporting responsibilities, the government maintains financial management and internal control systems. These systems give due consideration to costs, benefits and risks, and are designed to provide reasonable assurance that transactions are properly authorized by the Legislative Assembly, are executed in accordance with prescribed regulations and are properly recorded. This is done to maintain accountability of public money and safeguard the assets and properties of the Province of British Columbia under government administration. The Comptroller General of British Columbia maintains the accounts of British Columbia, a centralized record of the government’s financial transactions, and obtains additional information as required from ministries, Crown corporations, agencies, school districts, universities, colleges, institutes and health organizations to meet accounting and reporting requirements.

The Auditor General of British Columbia provides an independent opinion on the financial statements prepared by the government. The duties of the Auditor General in that respect are contained in section 11 of the Auditor General Act.

Annually, the financial statements are tabled in the legislature as part of the Public Accounts, and are referred to the Select Standing Committee on Public Accounts of the Legislative Assembly. The Select Standing Committee on Public Accounts reports to the Legislative Assembly with the results of its examination and any recommendations it may have with respect to the financial statements and accompanying audit opinions.

Approved on behalf of the Government of the Province of British Columbia:

| /s/ Carole James |

| CAROLE JAMES |

| Chair, Treasury Board |

INDEPENDENT AUDITOR’S REPORT

To the Legislative Assembly of the Province of British Columbia

Qualified Opinion

I have audited the summary financial statements of the Government of the Province of British Columbia (Government) using my staff and resources. The Engagement Leader, Peter Bourne, CPA, CA is responsible for this audit and its performance. The summary financial statements of Government comprise the consolidated statement of financial position at March 31, 2019, and the consolidated statements of operations, change in net liabilities and cash flow for the year then ended, and notes to the financial statements including a summary of significant accounting policies.

In my opinion, except for the effects of the matters described in the Basis for Qualified Opinion section of my report, the summary financial statements present fairly, in all material respects, the financial position of the Government as at March 31, 2019, and the results of its operations, change in its net liabilities, and its cash flows for the year then ended in accordance with Canadian Public Sector Accounting Standards.

Basis for Qualified Opinion

I believe that the audit evidence I have obtained is sufficient and appropriate to provide a basis for my qualified opinion.

I conducted my audit in accordance with Canadian generally accepted auditing standards. My responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of my report. I am independent of Government in accordance with the ethical requirements that are relevant to my audit of the summary financial statements in Canada, and I have fulfilled my other ethical responsibilities in accordance with these requirements.

Deferral of revenues

Government’s accounting treatment for funds received from other governments and for externally restricted funds received from non-government sources is to initially record them as deferred revenue (a liability) and then recognize revenue in the statement of operations either on the same basis as the related expenditures occur or, in the case of funds for the purchase or construction of capital assets, to recognize revenue on the same basis as the related assets are amortized.

Under Canadian Public Sector Accounting Standards, Government’s method of accounting for contributions is only appropriate in circumstances where the funding meets the definition of a

LEGISLATIVE ASSEMBLY OF THE PROVINCE OF BRITISH COLUMBIA

Independent Auditor’s Report

liability. Otherwise, the appropriate accounting treatment is to record contributions as revenue when they are received or receivable. In my opinion, certain contributions from others do not meet the definition of a liability, and as such Government’s method of accounting for those contributions represents a departure from Canadian Public Sector Accounting Standards.

This departure has existed since the inception of the standard, which applies to periods beginning on or after April 1, 2012. Had Government made an adjustment for this departure in the current year, the liability for deferred revenue as at March 31, 2019 would have been lower by $5,739 million, contribution revenue, surplus for the year and accumulated surplus would have been higher by $5,739 million, and net liabilities would have been lower by $5,739 million.

Use of rate-regulated accounting

As discussed in my previous year’s opinion on the March 31, 2018 summary financial statements, BC Hydro did not meet the requirements of a rate-regulated entity. Because the framework for the use of rate-regulated accounting was not in place, the accounting for BC Hydro’s results in the summary financial statements was incorrect, and this constituted a departure from Canadian Public Sector Accounting Standards. This caused me to modify my opinion on the summary financial statements for that year.

For the year ending March 31, 2019, BC Hydro has implemented International Financial Reporting Standards (IFRS), including IFRS 14 (Regulatory Deferral Accounts). Government has made a number of changes to the regulatory framework, giving the regulator the ability to influence costs and rates. I believe the changes made to the regulatory framework are sufficient to allow me to remove my qualification on the use of rate-regulated accounting for the year ending March 31, 2019. However, my opinion is modified as the regulatory assets and liabilities are incorrectly reflected in the summary financial statements in the comparative figures as at and for the year ended March 31, 2018.

Other Accompanying Information

Government is responsible for the information they reported in the annual Public Accounts report.

My opinion on the summary financial statements does not cover other information accompanying the financial statements and, except for my independent auditor’s opinion on the debt-related statements, I do not express any form of assurance conclusion thereon.

In connection with my audit of the summary financial statements, my responsibility is to read other information and, in doing so, consider whether the other information is materially inconsistent with the summary financial statements or my knowledge obtained during the audit or otherwise appears to be materially misstated.

LEGISLATIVE ASSEMBLY OF THE PROVINCE OF BRITISH COLUMBIA

Independent Auditor’s Report

If, based on the work I have performed on the other information, I conclude that there is a material misstatement therein, I am required to report that fact in this auditor’s report. As described in the Basis for Qualified Opinion section above, I believe there are material misstatements in Government’s accounting for the deferral of revenues. I have concluded that the other information is materially misstated for the same reason with respect to the amounts or other items in the annual report affected by this departure from Canadian Public Sector Accounting Standards.

Responsibilities of Treasury Board for the Summary Financial Statements

The Treasury Board of British Columbia is responsible for the oversight of the financial reporting process including the approval of significant accounting policies. The Comptroller General of British Columbia (Comptroller General) is responsible for the preparation and fair presentation of the summary financial statements in accordance with the Budget Transparency and Accountability Act (BTAA), and for such internal control as the Comptroller General determines is necessary to enable the preparation of the summary financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the summary financial statements, the Comptroller General is responsible for assessing Government’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting when the Government will continue its operations for the foreseeable future.

Auditor’s Responsibilities for the Audit of the Financial Statements

My objectives are to obtain reasonable assurance about whether the summary financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes my opinion in accordance with generally accepted accounting principles, being Public Sector Accounting Standards for senior governments in Canada. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Canadian generally accepted auditing standards will always detect a material misstatement, when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in aggregate, they could reasonably be expected to influence the economic decision of users taken on the basis of these financial statements.

As part of an audit in accordance with Canadian generally accepted auditing standards, I exercise professional judgment and maintain professional skepticism throughout the audit. I also:

· Identify and assess the risks of material misstatement of the summary financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for my opinion. The risk of not detecting a material misstatement resulting from fraud is higher than one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

LEGISLATIVE ASSEMBLY OF THE PROVINCE OF BRITISH COLUMBIA

Independent Auditor’s Report

· Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of Government’s internal control.

· Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by the Comptroller General.

· Conclude on the appropriateness of the Comptroller General’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on Government’s ability to continue as a going concern. If I conclude that a material uncertainty exists, I am required to draw attention in my auditor’s report to the related disclosures in the summary financial statements or, if such disclosures are inadequate, to modify my opinion. My conclusions are based on the audit evidence obtained up to the date of my auditor’s report. However, future events or conditions may cause Government to cease to continue as a going concern.

· Evaluate the overall presentation, structure and content of the summary financial statements, including the disclosures, and whether the summary financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

The audit of the summary financial statements is a group audit engagement. As such I also obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the group to express an opinion on the summary financial statements. I am responsible for the direction, supervision and performance of the group audit and I remain solely responsible for my audit opinion.

I communicate with the Chair of Treasury Board regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that I identify during my audit.

I also provide the Chair of Treasury Board with a statement that I have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on my independence, and where applicable, related safeguards.

| /s/ Carol Bellringer |

Victoria, British Columbia, Canada | Carol Bellringer, FCPA, FCA |

June 28, 2019 | Auditor General |

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Summary Financial Statements

Consolidated Statement of Financial Position

as at March 31, 2019

| | | | In Millions | |

| | Note | | 2019 | | 2018 | |

| | | | $ | | $ | |

Financial Assets | | | | | | | |

Cash and cash equivalents | | | | 2,598 | | 2,969 | |

Temporary investments | | | | 431 | | 471 | |

Accounts receivable | | 3 | | 5,305 | | 4,586 | |

Inventories for resale | | 4 | | 77 | | 76 | |

Due from other governments | | 5 | | 1,273 | | 1,425 | |

Due from self-supported Crown corporations and agencies | | 6 | | 493 | | 514 | |

Equity in self-supported Crown corporations and agencies | | 7 | | 5,717 | | 6,111 | |

Loans, advances and mortgages receivable | | 8 | | 2,373 | | 2,318 | |

Other investments | | 9 | | 3,003 | | 2,731 | |

Sinking fund investments | | 10 | | 752 | | 1,348 | |

Loans for purchase of assets, recoverable from agencies | | 11 | | 22,547 | | 20,534 | |

| | | | 44,569 | | 43,083 | |

Liabilities | | | | | | | |

Accounts payable and accrued liabilities | | 12 | | 7,299 | | 6,486 | |

Employee future benefits | | 13 | | 2,449 | | 2,370 | |

Due to other governments | | 14 | | 544 | | 564 | |

Due to Crown corporations, agencies and trust funds | | 15 | | 78 | | 79 | |

Deferred revenue | | 16 | | 10,404 | | 9,928 | |

Employee pension plans | | 17 | | 65 | | 119 | |

Taxpayer-supported debt | | 18 | | 43,209 | | 44,752 | |

Self-supported debt | | 19 | | 22,655 | | 20,619 | |

| | | | 86,703 | | 84,917 | |

Net assets (liabilities) | | 21 | | (42,134 | ) | (41,834 | ) |

| | | | | | | |

Non–financial Assets | | | | | | | |

Tangible capital assets | | 22 | | 47,830 | | 45,837 | |

Restricted assets | | 23 | | 1,834 | | 1,768 | |

Prepaid program costs | | 24 | | 847 | | 768 | |

Other assets | | 25 | | 205 | | 242 | |

| | | | 50,716 | | 48,615 | |

Accumulated surplus (deficit) | | 26 | | 8,582 | | 6,781 | |

| | | | | | | |

Measurement uncertainty | | 2 | | | | | |

Contingent assets and contractual rights | | 27 | | | | | |

Contingent liabilities and contractual obligations | | 28 | | | | | |

Subsequent events | | 39 | | | | | |

The accompanying notes and supplementary statements are an integral part of these financial statements.

Prepared in accordance with Canadian generally accepted accounting principles.

| /s/ Carl Fischer |

| CARL FISCHER |

| Comptroller General |

39

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Summary Financial Statements

Consolidated Statement of Operations

for the Fiscal Year Ended March 31, 2019

| | In Millions | |

| | 2019 | | 2018 | |

| | Estimates | | | | | |

| | (Note 34) | | Actual | | Actual | |

| | $ | | $ | | $ | |

Revenue | | | | | | | |

Taxation (Note29) | | 30,592 | | 32,714 | | 28,321 | |

Contributions from the federal government | | 8,930 | | 9,052 | | 9,055 | |

Fees and licenses | | 5,363 | | 5,593 | | 6,249 | |

Miscellaneous | | 3,152 | | 3,413 | | 3,543 | |

Net earnings of self–supported Crown corporations and agencies (Note 7) | | 2,564 | | 2,005 | | 1,056 | |

Natural resources (Note 30) | | 2,413 | | 3,108 | | 2,695 | |

Investment income | | 1,179 | | 1,243 | | 1,101 | |

| | 54,193 | | 57,128 | | 52,020 | |

Expense (Note 31) | | | | | | | |

Health | | 21,651 | | 22,151 | | 20,927 | |

Education | | 13,897 | | 14,085 | | 13,091 | |

Social services | | 5,317 | | 5,343 | | 4,737 | |

Interest | | 2,739 | | 2,684 | | 2,623 | |

Natural resources and economic development | | 2,433 | | 3,825 | | 3,374 | |

Other | | 2,367 | | 1,810 | | 1,553 | |

Transportation | | 2,134 | | 2,021 | | 1,931 | |

Protection of persons and property | | 1,650 | | 2,004 | | 1,930 | |

General government | | 1,436 | | 1,670 | | 1,540 | |

| | 53,624 | | 55,593 | | 51,706 | |

Surplus (deficit) for the year before unusual items | | 569 | | 1,535 | | 314 | |

Forecast allowance | | (350 | ) | | | | |

Surplus (deficit) for the year | | 219 | | 1,535 | | 314 | |

| | | | | | | |

Accumulated surplus (deficit)—beginning of year as restated (Note 26) | | | | 7,016 | | 6,702 | |

Accumulated surplus (deficit)—before other comprehensive income | | | | 8,551 | | 7,016 | |

Accumulated other comprehensive income from self–supported Crown corporations and agencies (see page 99)—beginning of year | | | | (235 | ) | (271 | ) |

Other comprehensive income from self–supported Crown corporations and agencies (see page 99) | | | | 266 | | 36 | |

Accumulated other comprehensive income from self–supported Crown Corporation and agencies (see page 99)—end of year | | | | 31 | | (235 | ) |

Accumulated surplus(deficit)—end of year | | | | 8,582 | | 6,781 | |

The accompanying notes and supplementary statements are an integral part of these financial statements.

40

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Summary Financial Statements

Consolidated Statement of Change in Net Liabilities

for the Fiscal Year Ended March 31, 2019

| | In Millions | |

| | 2019 | | 2018 | |

| | Estimates | | Actual | | Actual | |

| | $ | | $ | | $ | |

Surplus (deficit) for the year | | 219 | | 1,535 | | 314 | |

Effect of change in tangible capital assets: | | | | | | | |

Acquisition of tangible capital assets | | (5,174 | ) | (4,452 | ) | (3,908 | ) |

(Gain) or loss on sale of tangible capital assets | | (94 | ) | (19 | ) | (286 | ) |

Amortization of tangible capital assets | | 2,380 | | 2,367 | | 2,250 | |

Disposals and valuation adjustments | | 57 | | 111 | | (2,590 | ) |

| | (2,831 | ) | (1,993 | ) | (4,534 | ) |

Effect of change in: | | | | | | | |

Restricted assets | | (54 | ) | (66 | ) | (73 | ) |

Prepaid program costs | | (1 | ) | (79 | ) | 213 | |

Other assets | | 21 | | 37 | | (43 | ) |

| | (34 | ) | (108 | ) | 97 | |

Effect of self–supported Crown corporations’ and agencies’ other comprehensive income | | 227 | | 266 | | 36 | |

(Increase) in net liabilities | | (2,419 | ) | (300 | ) | (4,087 | ) |

Net (liabilities)—beginning of year | | (42,324 | ) | (41,834 | ) | (37,747 | ) |

Net (liabilities)—end of year (Note 21) | | (44,743 | ) | (42,134 | ) | (41,834 | ) |

The accompanying notes and supplementary statements are an integral part of these financial statements.

41

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Summary Financial Statements

Consolidated Statement of Cash Flow

for the Fiscal Year Ended March 31, 2019

| | In Millions | |

| | 2019 | | 2018 | |

| | Receipts | | Disbursements | | Net | | Net | |

| | $ | | $ | | $ | | $ | |

Operating Transactions | | | | | | | | | |

Surplus (deficit) for the year1 | | | | | | 1,535 | | 314 | |

Non–cash items included in surplus (deficit): | | | | | | | | | |

Amortization of tangible capital assets | | | | | | 2,367 | | 2,250 | |

Amortization of public debt deferred revenue and deferred charges | | | | | | 31 | | 204 | |

Concessionary loan adjustments increase (decrease) | | | | | | 208 | | (1 | ) |

(Gain) or loss on sale of tangible capital assets | | | | | | (19 | ) | (286 | ) |

Valuation adjustment | | | | | | 207 | | 238 | |

Net earnings of self–supported Crown corporations and agencies | | | | | | (2,005 | ) | (1,056 | ) |

Unrealized gain on transfer of assets | | | | | | 65 | | | |

Reclassification of self–supported status | | | | | | | | 179 | |

Change in self–supported opening unremitted | | | | | | (93 | ) | | |

Temporary investments decrease (increase) | | | | | | 40 | | (47 | ) |

Accounts receivable (increase) | | | | | | (875 | ) | (552 | ) |

Due from other governments decrease (increase) | | | | | | 152 | | (416 | ) |

Due from self–supported Crown corporations and agencies decrease (increase) | | | | | | 21 | | (218 | ) |

Accounts payable and accrued liabilities increase | | | | | | 813 | | 391 | |

Employee future benefits increase | | | | | | 79 | | 298 | |

Due to other governments (decrease) increase | | | | | | (20 | ) | 78 | |

Due to Crown corporations, agencies and funds (decrease) | | | | | | (1 | ) | (6 | ) |

Employee pension plan (decrease) | | | | | | (54 | ) | (68 | ) |

Items applicable to future operations increase | | | | | | 436 | | 625 | |

Contributions from self–supported Crown corporations and agencies | | | | | | 2,694 | | 2,830 | |

Cash derived from operations | | | | | | 5,581 | | 4,757 | |

| | | | | | | | | |

Capital Transactions | | | | | | | | | |

Tangible capital assets dispositions (acquisitions) | | 73 | | (4,452 | ) | (4,379 | ) | (3,531 | ) |

Cash (used for) capital | | 73 | | (4,452 | ) | (4,379 | ) | (3,531 | ) |

| | | | | | | | | |

Investment Transactions | | | | | | | | | |

Investment in self–supported Crown corporations and agencies | | | | (1 | ) | (1 | ) | (1 | ) |

Loans, advances and mortgages receivable (issues) | | 225 | | (501 | ) | (276 | ) | (174 | ) |

Other investments—net (increase) | | | | (272 | ) | (272 | ) | (286 | ) |

Restricted assets—net (increase) | | | | (66 | ) | (66 | ) | (73 | ) |

Sinking fund investments—net decrease (increase) | | 593 | | (32 | ) | 561 | | (221 | ) |

Cash (used for) investments | | 818 | | (872 | ) | (54 | ) | (755 | ) |

Sub–total cash excess | | | | | | 1,148 | | 471 | |

42

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2018/19

Summary Financial Statements