Exhibit 99.10

July 14, 2020

Economic and Fiscal Scenario – Update 2020 - 2021

TECHNICAL BACKGROUNDER

Introduction

While B.C.’s economy has been significantly impacted by the COVID-19 pandemic, there are various elements of uncertainty that will influence the depth and duration of the economic slowdown. Given this uncertainty, a scenario has been developed by the Ministry of Finance to provide a possible economic and fiscal outcome for B.C., based on information that is currently available and assumptions about the future path of recovery. The scenario incorporates key data for the months of March, April and May (where available) that provide an early indication of the impact of COVID-19 on B.C.’s economy, including employment, retail sales, housing starts and international merchandise exports.

A major decline in economic activity is expected across all provinces. On average, private sector forecasters expect B.C. real GDP to decline by 5.4% in 2020, which is better than the expected decline of 6.6% on average across Canada and ranks B.C. fourth among provinces. The Ministry of Finance will be surveying the 13-member Economic Forecast Council prior to the release of the First Quarterly Report in September.

Economic Update

Current Economic Situation

B.C.’s economy has been significantly impacted by the COVID-19 pandemic, as demonstrated by wide-spread job losses and impacts to businesses. However, B.C. began easing restrictions in mid-May, and is now in Phase 3 of the Restart Plan. This re-opening, along with the relief measures and supports introduced by governments and the Bank of Canada, will support the economy along its recovery path.

Job losses in the province have been steep, with 235,100 fewer jobs in B.C. in June compared to February. The employment declines since February have been concentrated in the wholesale and retail trade sector, accommodation and food services sector, construction sector, and information, culture and recreation sector. Overall, the unemployment rate in B.C. increased to 13.0% in June from 5.0% in February.

Consumer spending pulled back during the month of April, due to a combination of reduced confidence and job losses along with reduced mobility as physical distancing restrictions were in place for the entire month. B.C. nominal retail sales declined by 20.7% in April compared to March, which was the largest monthly decline on record (data going back to 1991). Overall, B.C. retail sales were 23.6% lower in April compared to February 2020.

B.C. international merchandise exports have continued to decline this year, due to weaker global demand and declines in commodity prices. B.C. exports are down 1.6% in May compared to February, and are down 14.7% year-to-date compared to the January to May period of 2019.

Housing market activity is mixed. Homebuilding continues to be resilient, with housing starts averaging 35,794 annualized units since February. In June, B.C. housing starts totalled 39,089 annualized units. However, the province has experienced a steep decline in home sales, which were down 45.4% in May compared to February. Meanwhile, the average home sale price was down by 4.0% in May compared to February.

Economic Scenario Assumptions

The scenario is meant to provide a possible outcome for B.C.’s economy based on information that is currently available and assumptions about the future path of recovery. A scenario has been developed, rather than a typical forecast, given the unprecedented nature of COVID-19 as well as the high degree of uncertainty regarding the magnitude of the economic decline caused by the pandemic and the path of recovery.

There are various elements of uncertainty that will influence the depth and duration of the economic slowdown, including:

| • | future outbreaks in B.C. and among B.C.’s trading partners; |

| • | the evolution of public health policies and medical technologies such as development of treatments and vaccines; |

| • | the responses of the general public and impacts on consumer spending and confidence; |

| • | the responses of businesses with respect to investment decisions, impacts on confidence, supply chain and business model adaptations; |

| • | the success of relief measures and supports as well as the evolution of policies enacted by governments to support corporate cash flow and personal income, maximize job retention and curb infection rates; and |

| • | the success and evolution of policies enacted by central banks to provide liquidity in the financial system and laying the foundation for the recovery via low interest rates. |

The economic scenario was developed by analysing employment by industry data and developing assumptions around the timing and extent of the business recovery and the eventual rehiring of employees. Underlying the economic scenario is an assumption about the pace of rehiring, i.e. the extent to which industries start to rehire employees as they resume operations under the guidance and orders of the Public Health Officer. The pace of economic recovery in the scenario is also guided by consumer and business behaviour as the economy continues to re-open.

Underlying the scenario is an assumption that physical distancing measures remain in place and global travel remains somewhat restricted. Businesses in the tourism, restaurant, retail, and recreation sectors are expected to continue to be impacted for quite some time. As such, industries such as accommodation and food services, wholesale and retail trade, information,

culture and recreation, and transportation and warehousing are not expected to fully recover all of the recent job losses by the end of 2021.

Economic Scenario Results

In the scenario, B.C. real GDP could decline by 6.8% in 2020. As the economy recovers, and hiring and spending improves, B.C.’s economy could grow by 3.1% in 2021 (see Table 1 below for details). To put this into context, B.C. real GDP fell by 2.4% in 2009 and 6.4% in 1982 (the only annual declines in B.C. real GDP in recent records going back to 1981).

The Ministry of Finance’s scenario is prudent compared to the most recent average projection of six private sector forecasters, which calls for a real GDP decline of 5.4% in 2020, followed by a rebound of 5.4% in 2021.

Table 1: Economic Scenario

| | Budget 2020 | Scenario |

| | | | |

| | 2020 | 2021 | 2020 | 2021 |

| Real GDP (% change) | 2.0 | 1.9 | -6.8 | 3.1 |

| Nominal GDP (% change) | 3.9 | 3.9 | -8.2 | 4.1 |

| Corporate profits* (% change) | 2.0 | 2.6 | -36.4 | 16.3 |

| Employment (% change) | 1.0 | 1.0 | -9.8 | 4.4 |

| Unemployment rate (%) | 5.1 | 5.3 | 11.3 | 8.9 |

| Household income (% change) | 3.8 | 3.8 | -3.9 | 1.7 |

| Retail sales (% change) | 3.0 | 3.3 | -15.9 | 8.6 |

| Residential sales (% change) | 4.6 | 5.3 | -27.6 | 9.3 |

| Housing starts (units) | 35,021 | 32,040 | 27,000 | 29,000 |

*Corporate profits refers to the net operating surplus of corporations.

Many businesses are expected to experience a loss in revenue due to closures and restrictions introduced in B.C. and internationally. As such, B.C. corporate profits may decline by 36.4% in 2020, before recovering by 16.3% in 2021.

Some physical distancing measures and global travel restrictions are expected to be in place for quite some time. As such, the job losses that have occurred in B.C. are not expected to be fully recovered this year. Employment in the province could decline by 9.8% in 2020, which corresponds to an annual loss of 252,000 jobs. As businesses resume operations and employees are rehired, employment in B.C. could increase by 4.4% in 2021, representing an annual gain of 102,000 jobs.

Consumer spending has been impacted by job losses, lower income and the temporary closure of some retail stores. As such, retail sales in B.C. may decline by 15.9% in 2020. As employment and income prospects improve and businesses re-open, consumer spending is expected to pick up, with possible retail sales growth of 8.6% in 2021.

Housing market activity is expected to be impacted by elevated unemployment, lower income, and weaker migration and confidence, with improvements anticipated as the economy recovers. On the construction side, housing starts could total 27,000 units in 2020, increasing to 29,000 units in 2021. The value of residential sales may decline by 27.6% in 2020, followed by possible growth of 9.3% in 2021.

The economy may perform better and recover faster than depicted in this scenario. However, economic outcomes may be worse. There is considerable uncertainty in the outlook, and as such the Ministry has also developed alternative economic scenarios described in Appendix B.

Impact on the Fiscal Plan

The economic scenario results in revenue losses in 2020/21. The effects of COVID-19 on various revenue sources is expected to result in a decline of $6.3 billion (see Table 2 below for details). With the cost of government pandemic response measures, the total operating deficit is $12.5 billion.

Table 2: Fiscal Scenario

| Effects of COVID-19 | $ millions |

| Personal income tax | (999) |

| Corporate income tax | (973) |

| Employer health tax | (238) |

| Refundable tax transfers (tax credits) | 141 |

| Provincial sales tax | (1,305) |

| Property transfer and property taxes | (465) |

| Fuel and carbon taxes | (353) |

| Natural resource revenues | (293) |

| All other CRF revenues | (77) |

| Commercial Crown corporation net income | (882) |

| Taxpayer-supported agency impacts | (869) |

| Total Effects of COVID-19 | (6,313) |

| Pandemic Response Measures | |

| Supplementary Estimates spending | (5,000) |

| Other business relief and tax measures | (762) |

| Climate Action Tax Credit | (500) |

| Debt Servicing Costs | (176) |

| Total changes compared to Budget 2020: | (12,751) |

| Budget 2020 Operating Surplus | 227 |

| Potential deficit: | (12,524) |

Most of the impacts on revenues affect taxation revenue sources, which are down $4.2 billion in the scenario. Lower employment, personal incomes and consumer spending result in reduced personal income, employer health and consumption tax revenues (consumption taxes are PST, carbon, fuel and tobacco). Lower corporate income tax revenue is based on a scenario

prepared by the federal government of reduced national corporate income tax and instalments to B.C. Lower tax transfers (refundable tax credit expenses) are mainly due to lower expected film and production service activity. Lower property transfer tax revenue reflects reduced housing market activity.

Lower natural resource revenues, down $293 million, are mainly due to lower prices and global demand for petroleum products, coal and metals.

Lower net income results from commercial Crown corporations are mainly due to the impact of the closure of casinos on the operating results of British Columbia Lottery Corporation. Net income of the Liquor Distribution Branch reflects the consumer shift from visiting pubs, restaurants and other establishments to staying at home. Increased sales to wholesale customers, with lower margins, as well as the gradual opening of pubs, restaurants and other establishments are anticipated to result in a lower net income for the year. The fiscal scenario does not include changes in the outlook for ICBC finances at this time, compared to Budget 2020. Fewer accidents early in the year – due to lower transportation activity – may be offset by increased accidents as more vehicles return to the roads. As well, there is much uncertainty on the outlook for investment markets and ICBC’s investment earnings. The scenario does not include any changes for BC Hydro results as it is assumed that the impacts of COVID relief measures and electricity demand reductions will be absorbed within the corporation’s regulatory accounts.

Taxpayer-supported agency impacts mainly reflect lower international student tuition fees and other external revenues of post-secondary institutions and K–12 school districts.

Pandemic Response Measures

On March 23, 2020, the government announced the B.C. COVID-19 Action Plan to support critical health and social services, provide immediate financial relief to individuals and businesses, and to help boost economic recovery once the crisis has passed. As part of the Action Plan, government passed supplementary estimates of $5 billion through a new Contingencies Vote 52, otherwise known as the “Pandemic Contingencies allocation”. No other changes were made to the Budget 2020 Estimates including the existing Contingencies allocations (Vote 45).

Government has allocated $3.5 billion of the $5 billion Pandemic Contingencies allocation for critical services and financial relief measures that are currently underway.

| · | Critical services include health and mental health related response, supports for child care providers, and providing essential social services to vulnerable populations such as adults with developmental disabilities, people experiencing homelessness, and children, youth and young adults receiving provincial supports. |

| · | Financial relief measures include income supports, such as the BC Emergency Benefit for Workers and the crisis supplement for income and disability assistance clients including |

| low-income seniors. Measures also include rental relief assistance for individuals, families and businesses,and the temporary pandemic pay for front-line workers in the health and social service during the height of the pandemic in B.C. Government has set aside $1.5 billion of the $5 billion Pandemic Contingencies allocation for economic recovery measures that will be implemented in the coming weeks and months, and will be informed by the Economic Recovery Task Force and public consultation process. Details on the Pandemic Contingencies allocations are shown in Table 3. Table 3-Pandemic Contingencies Allocations vulnerable populations * Notional allocations have been set aside for these measures with additional prudence in the event of a prolonged resurgence of cases. In addition to the $5 billion Pandemic Contingencies spending measures,government has implemented other tax or revenue measures as part of the Action Plan.This includes a one-time Climate Action Tax Credit enhancement,a reduction in school tax for commercial properties by an average of 25% in the 2020 calendar year, and delays to increasing the carbon tax rate and other new Budget 2020 tax measures. Other temporary measures from Crown corporations include temporary wholesale pricing model for restaurants,bars and tourism operators with liquor licences and ICBC relief and deferrals. The estimated impacts of these Category Allocation Measures Critical services Over $1billion* Health and mental health Over $250 million Child care services $90 million Temporary housing,meal and health supports for $50 million Essential services for adults with developmental disabilities and for vulnerable children and youth Financial supports Over $1billion* B.C. Emergency Benefit for Workers Over $350 million* Crisis Supplement $150 million Temporary Rental Supplement $106 million Temporary Pandemic Pay $79 million Canada Emergency Commercial Rent Assistance Program $40 million Emergency financial relief for organizations providing animal care, the agriculture sector,park operators and community tourism organizations Economic Recovery $1.5 billion TBD Total $5 billion Pandemic Contingencies Spending Measures |

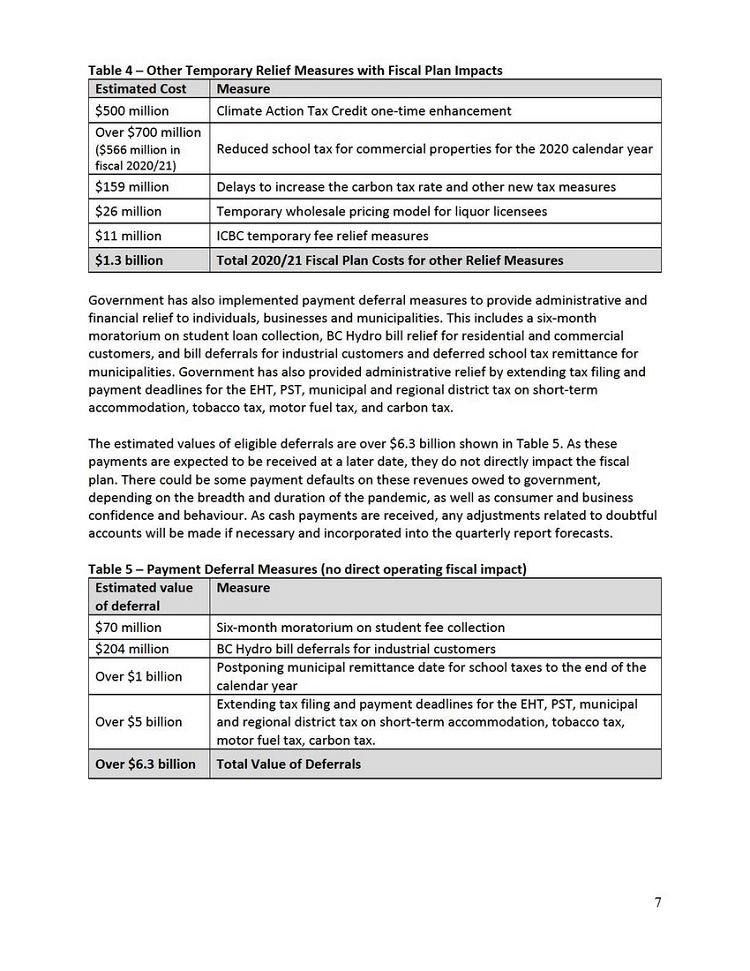

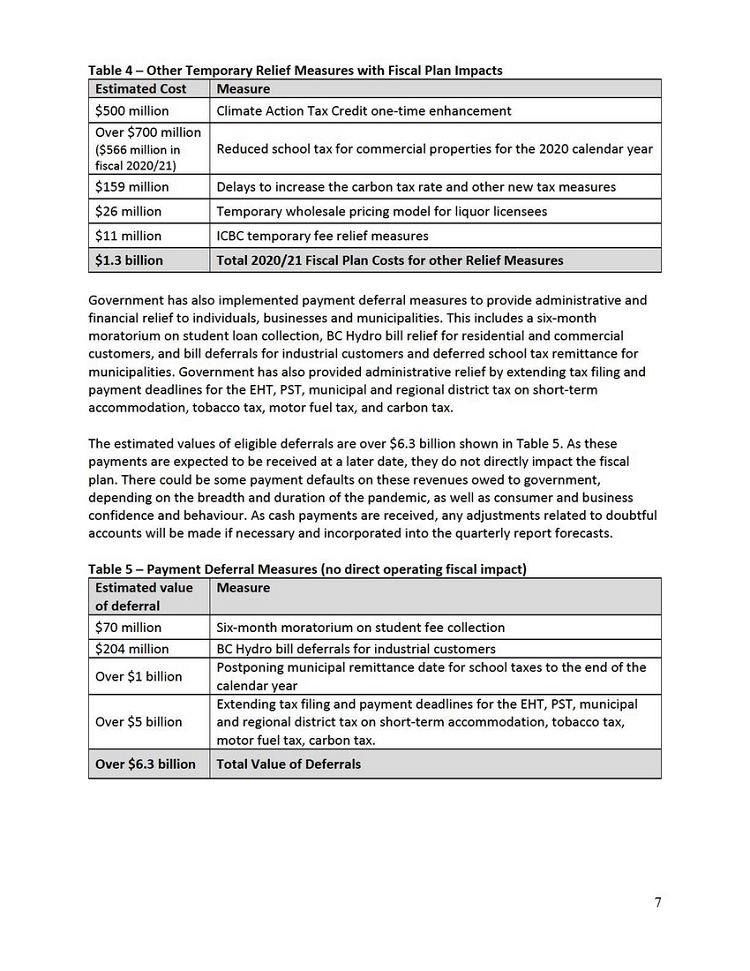

| Table 4-Other Temporary Relief Measures with Fiscal Plan Impacts Government has also implemented payment deferral measures to provide administrative and financial relief to individuals,businesses and municipalities. This includes a six-month moratorium on student loan collection,BC Hydro bill relief for residential and commercial customers,and bill deferrals for industrial customers and deferred school tax remittance for municipalities.Government has also provided administrative relief by extending tax filing and payment deadlines for the EHT,PST,municipal and regional district tax on short-term accommodation, tobacco tax,motor fuel tax, and carbon tax. The estimated values of eligible deferrals are over $6.3 billion shown in Table 5. As these payments are expected to be received at a later date, they do not directly impact the fiscal plan. There could be some payment defaults on these revenues owed to government, depending on the breadth and duration of the pandemic,as well as consumer and business confidence and behaviour. As cash payments are received,any adjustments related to doubtful accounts will be made if necessary and incorporated into the quarterly report forecasts. Table 5-Payment DeferralMeasures (no direct operating fiscal impact) Estimated value of deferral Measure $70 million Six-month moratorium on student fee collection $204 million BC Hydro bill deferrals for industrial customers Over $1billion Postponing municipal remittance date for school taxes to the end of the calendar year Over $5 billion Extending tax filing and payment deadlines for the EHT, PST,municipal and regional district tax on short-term accommodation,tobacco tax, motor fuel tax,carbon tax. Estimated Cost Measure $500 million Climate Action Tax Credit one-time enhancement Over $700 million ($566 million in fiscal 2020/21) Reduced school tax for commercial properties for the 2020 calendar year $159 million Delays to increase the carbon tax rate and other new tax measures $26 million Temporary wholesale pricing model for liquor licensees $11million ICBC temporary fee relief measures $1.3 billion Total2020/21Fiscal Plan Costs for other Relief Measures |

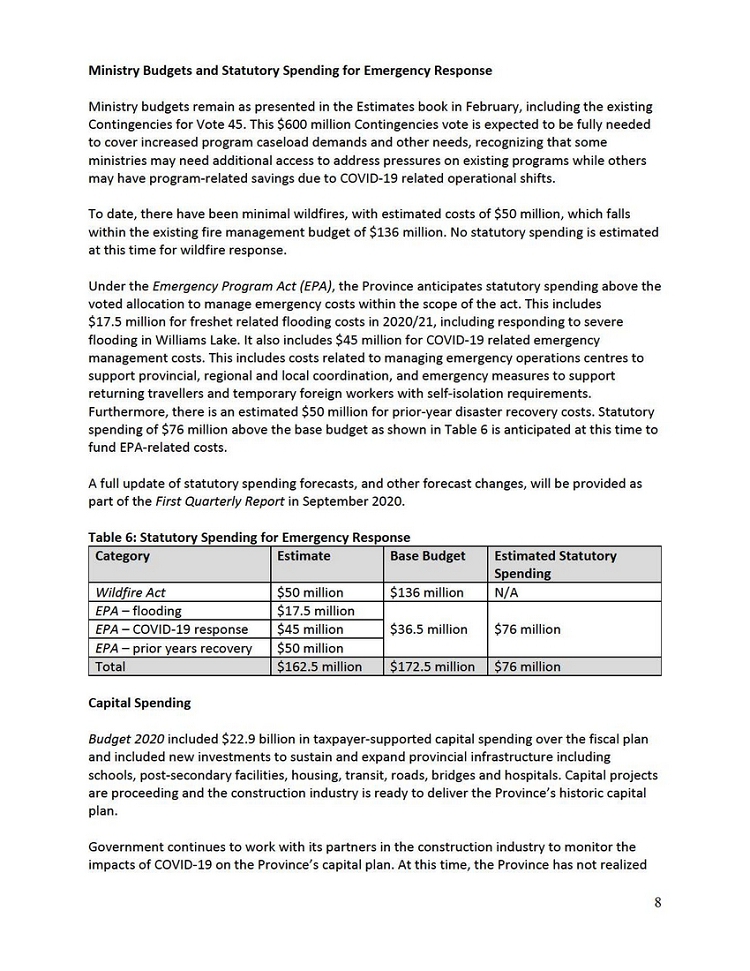

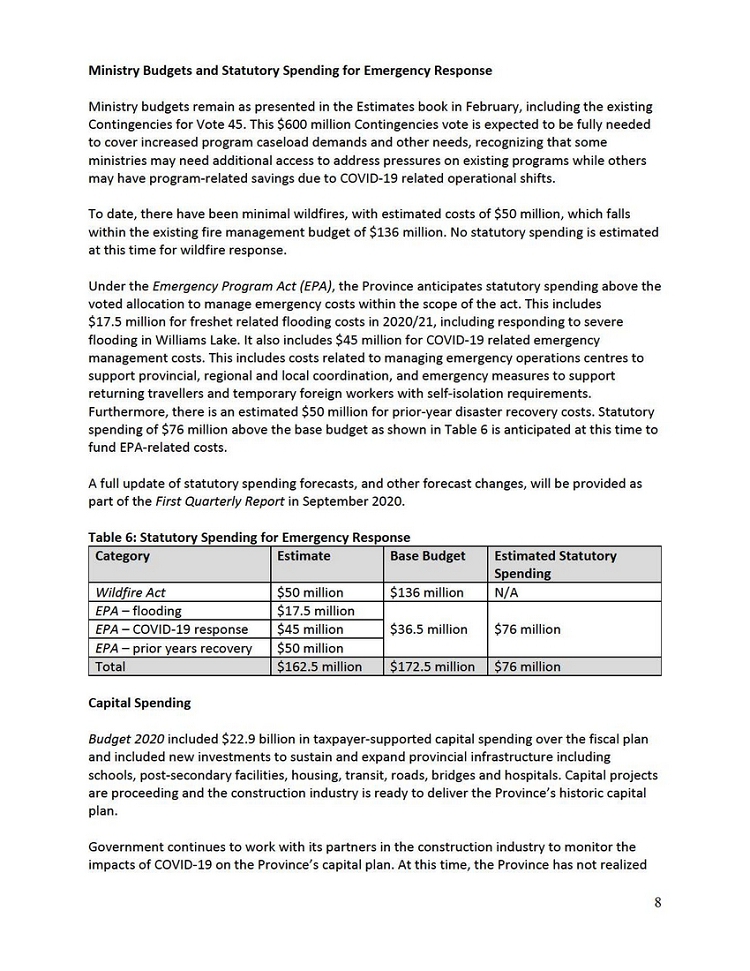

| Ministry Budgets and Statutory Spending for Emergency Response Ministry budgets remain as presented in the Estimates book in February,including the existing Contingencies for Vote 45. This $600 million Contingencies vote is expected to be fully needed to cover increased program caseload demands and other needs,recognizing that some ministries may need additional access to address pressures on existing programs while others may have program-related savings due to COVID-19 related operational shifts. To date,there have been minimal wildfires,with estimated costs of $50 million,which falls within the existing fire management budget of $136 million. No statutory spending is estimated at this time for wildfire response. Under the Emergency Program Act (EPA), the Province anticipates statutory spending above the voted allocation to manage emergency costs within the scope of the act. This includes $17.5 million for freshet related flooding costs in 2020/21,including responding to severe flooding in Williams Lake. It also includes $45 million for COVID-19 related emergency management costs.This includes costs related to managing emergency operations centres to support provincial,regional and local coordination,and emergency measures to support returning travellers and temporary foreign workers with self-isolation requirements. Furthermore,there is an estimated $50 million for prior-year disaster recovery costs. Statutory spending of $76 million above the base budget as shown in Table 6 is anticipated at this time to fund EPA-related costs. A full update of statutory spending forecasts, and other forecast changes,will be provided as part of the First Quarterly Report in September 2020. Table 6:Statutory Spending for Emergency Response Capital Spending Budget 2020 included $22.9 billion in taxpayer-supported capital spending over the fiscal plan and included new investments to sustain and expand provincial infrastructure including Category Estimate Base Budget Estimated Statutory Spending Wildfire Act $50 million $136 million N/A EPA - flooding $17.5 million $36.5 million $76 million EPA - COVID-19 response $45 million EPA - prior years recovery $50 million Total $162.5 million $172.5 million $76 million |

any broad based impacts related to COVID-19 that are materially impacting the Province’s continued capital investment, with the majority of noted delays in the municipal and private sectors projects. It is important to note that given the ongoing uncertainly, government continues to closely monitor its projects to proactively address any impacts as they present. Any material changes to Provincial capital investment will be reflected on the Over $50 million table as part of the First Quarterly Report in September 2020.

Debt Levels

Governments, like the private sector, borrow to finance the building of long-lasting capital infrastructure, such as schools, hospitals, and highways. As these investments provide services over several years, the government borrows to fund these assets and amortizes the costs over the assets’ useful life. Borrowing may also be required to finance operating deficits, in times when revenues are insufficient to cover the expenses in a fiscal year, and for other operating requirements, such as providing loans and advances. The government direct operating debt will rise during periods of deficits but declines as surpluses accumulate.

Under the scenario, the taxpayer-supported debt level (which excludes the debt of commercial Crown corporations) is $61.9 billion at the end of 2020/21. The projection in Budget 2020 was $49.2 billion at the end of 2020/21.

Flowing from the changes to debt levels, the taxpayer-supported debt- to-GDP ratio increases in 2020/21 under this scenario to 22%. This increase from 15.5% forecast in Budget 2020 is due to higher debt levels and lower GDP assumed under the scenario. In recent years, B.C. has had among the best debt metrics and credit rating compared to all of the other provinces in Canada.

B.C. is faced with increased borrowing and higher debt levels, while operating in times of very low interest rates. The measures of debt affordability – interest as a percentage of revenue, and interest as a percentage of GDP – continue to remain at levels that are lower than they have been historically.

Appendix A : Description of Measures

Pandemic Contingencies Spending Measures

Health and mental health supports (over $1 billion): health care response measures include lab testing, supports for long-term care facilities, health prevention and contact tracing, and staffing and surge capacity building. Mental health supports include expanded virtual mental health supports including free online, video and phone-based skills-building for seniors, adults and youth experiencing low mood, mild to moderate depression, anxiety, stress or worry and a Mobile Response Team to support the mental well-being and psychological safety of front-line health-care workers.

Child care services (over $250 million): temporary emergency funding to ensure child care spaces remain available for essential service workers and to provide financial relief and preserve spaces for parents during any temporary closures. Licensed child care providers staying open can receive funding to keep operations going. These centres are eligible to receive seven times their average monthly funding from government which is expected to cover approximately 75% of a group facility’s average monthly operating expenses. Licensed child care providers who close will be eligible to receive two times their average monthly government funding which is expected to cover approximately 20% of an average group facility's monthly operating expenses.

Temporary housing, meal and health supports for vulnerable populations (nearly $90 million): spaces at hotels, motels and community centres are assisting a range of people, including people experiencing homelessness, to self-isolate and follow health orders as well as receive food and health related supports. In addition to these supports, the province has made capital investments (estimated $110 million) to purchase hotels to help move people living in unsafe, dense encampments at Oppenheimer Park, Pandora Avenue and Topaz Park into safe spaces.To date nearly 4,000 spaces have been secured at sites throughout B.C.’s health regions to enable safe physical distancing in homeless shelter and help people self-isolate, with close to 300 spaces in communities secured for people leaving violent or unstable situations.

Essential services for adults with developmental disabilities and for vulnerable children and youth ($50 million): funding to ensure continuity of services for adults with developmental disabilities receiving care from Community Living BC. Funding also supports a range of supports for children and youth that access provincial supports including $225 per month for eligible B.C. families with children with special needs to Sept 30, 2020 and continuing existing care-giver arrangements for youth aging out of foster care and extend the maximum duration of Agreements with Young Adults program beyond 48 months.

B.C. Emergency Benefit for Workers (over $1 billion): provides a one -time, tax -free $1,000 payment to British Columbians who are losing income because of COVID-19. B.C. residents who lost their employment or self-employment income for reasons related to COVID-19 on or after March 1 and that are eligible for the Canada Emergency Response Benefit (CERB) are eligible for the B.C. Emergency Benefit for Workers (BCEBW). Over 600,000 British Columbians to date have received the BCEBW.

Crisis Supplement (over $350 million): temporary supplement of $300 per month for income and disability assistance clients, including low-income seniors receiving the Seniors Supplement, from April through August. This new emergency funding was put in place to ensure that those in greatest need do not encounter additional barriers while some service organizations closed or reduced service hours during the pandemic, and to help cover the increased costs of food and shelter. Over 200,000 people, including clients and their families, have benefited from the crisis supplement.

Temporary Rental Supplement ($150 million): a new temporary rental supplement of $500 per month for eligible households with dependents and $300 per month for eligible households with no dependents. The rental supplement is available for the months of April through to August on a per-household basis for low-to-middle income households where the income has been affected by COVID-19. Over 81,000 applications have been approved for the supplement to date.

Temporary Pandemic Pay ($106 million): This is a federal-provincial cost share program to provide a one-time temporary wage boost that supports health, social services and corrections employees delivering in-person, front -line care during the COVID-19 pandemic. Pandemic pay will benefit over 250,000 frontline workers in health and social services by providing an hourly wage boost over the 16-week period starting on March 15, 2020, at the height of the Province’s response to the pandemic.

Canada Emergency Commercial Rent Assistance Program ($79 million): This is a federal-provincial cost share program that provides forgivable loans to qualifying commercial property owners to cover 50% of monthly rent payments that are payable by eligible small business tenants who are experiencing financial hardship during April, May, June and July. The loans will be forgiven if the mortgaged property owner agrees to reduce the small business tenants’ rent by at least 75% under a rent forgiveness agreement, which will include a term not to evict the tenant while the agreement is in place. The small business tenant would cover the remainder, up to 25% of the rent.

Emergency financial relief for organizations ($40 million): targeted funding to support organizations providing animal care, the agriculture sector, park operators and community tourism organizations ($40 million). This funding is intended to support ongoing operational needs and to support the tourism sector to restart safely.

Tax and Other Relief Measures

B.C. Climate Action Tax Credit one-time enhancement ($500 million): Approximately 80% of British Columbians will benefit from a one-time enhancement to the B.C. Climate Action Tax Credit in July 2020 of up to $174.50 for adults and up to $51.25 per child. With this enhancement and the regular credit amount, an eligible family of four will receive a combined payment of up to $564 and eligible individuals will receive a combined payment up to $218. This boosts the regular Climate Action Tax Credit payment of up to $112.50 per family of four and up to $43.50 per adult.

Reduced school tax for commercial properties for the 2020 calendar year (over $ 700 million): reduced the school property tax rate for commercial properties (property classes 4, 5, 6, 7, and 8) to achieve an average 25% reduction in the total property tax bill for most businesses for the 2020 calendar year.

Delays to increase the carbon tax rate and other new tax measures (over $150 million): postponing the scheduled increase to the carbon tax rate and delaying the implementation of the PST on sweetened, carbonated drinks and change to PST registration requirements to Oct 1, 2020.

Temporary wholesale pricing model for liquor licenses ($26 million): wholesale pricing model that will allow liquor licensees, such as restaurants, bars and tourism operators, to purchase beer, wine and spirits at reduced cost from the end of July 2020 to March 31, 2021.

ICBC temporary fee relief measures ($11 million): Temporary changes in effect to August include:

| Ÿ | Waiving the $30 fee when you cancel insurance |

| Ÿ | Waiving the $18 plating fee when you choose to reinstate the policy on your vehicle |

| Ÿ | Suspension of insurance for fleet vehicle customers |

Six-month moratorium on student fee collection ($70 million in deferrals): Starting March 30, 2020, all B.C. student loan repayments are automatically frozen until Sept. 30, 2020.

BC Hydro bill deferrals for industrial customers ($200 million): Major industries, like pulp and paper mills and mines, can defer 50% of their bill payments for six months, to the end of August 2020. BC Hydro is also providing bill relief and credit to residential and commercial customers.

Postponing municipal remittance date for school taxes to the end of the calendar year (over $1 billion in deferrals): Delaying the remittances from the summer to the end of the year to provide significant relief to local governments facing cash flow issues.

Extending tax filing and payment deadlines (over $5 billion in deferrals): Providing administrative relief to businesses by postponing the filing and payment date by six months for the EHT, PST, municipal and regional district tax on short-term accommodation, tobacco tax, motor fuel tax, and carbon tax.

For more details, visit: https://www2.gov.bc.ca/gov/content/safety/emergency-preparedness-response-recovery/covid-19-provincial-support

Appendix B: Alternative Economic Scenarios

There is a high degree of uncertainty regarding the magnitude of the economic decline caused by the COVID-19 pandemic and the path of recovery. Therefore, in addition to the economic scenario presented above, the Ministry of Finance developed two alternative scenarios (see Table B1 below for details).

These scenarios are provided to help inform understanding about a range of possible outcomes, which will ultimately be determined by how the economy actually performs in the coming months. As the economy continues to re-open, households and businesses will make choices around spending and hiring.

In a more optimistic scenario than the scenario presented previously, consumer and business confidence could improve to support substantial spending and rehiring decisions, which may result in a softer decline in economic activity and a faster recovery.

Under a less optimistic scenario than the scenario presented previously, household and business confidence may decline and hinder spending and rehiring plans, especially if there is a resurgence of the virus and an increase in transmission rates in the coming months. In this case, spending and rehiring plans are delayed and result in a steeper decline in economic activity and a weaker recovery.

If local and global health conditions worsen significantly, households and businesses may remain cautious in their decisions for longer and international trade may be further disrupted. In this case the negative economic impacts may be deeper and any rebounds in economic activity could be delayed further into the future, compared to the alternative scenarios presented here.

Table B1: Alternative Economic Scenarios

| | More Optimistic Scenario | Less Optimistic Scenario |

| | | | | |

| | 2020 | 2021 | 2020 | 2021 |

| Real GDP (% change) | -4.7 | 4.9 | -9.8 | 1.4 |

| Nominal GDP (% change) | -5.2 | 6.1 | -11.6 | 1.9 |

| Corporate profits* (% change) | -25.2 | 25.6 | -45.3 | 6.6 |

| Employment (% change) | -6.8 | 6.9 | -12.2 | 1.8 |

| Unemployment rate (%) | 8.8 | 6.6 | 13.3 | 12.5 |

| Household income (% change) | -1.7 | 2.7 | -7.0 | 1.0 |

| Retail sales (% change) | -9.8 | 9.6 | -19.6 | 6.2 |

| Residential sales (% change) | -17.8 | 14.0 | -36.2 | -6.7 |

| Housing starts (units) | 31,000 | 33,000 | 23,000 | 25,000 |

*Corporate profits refers to the net operating surplus of corporations.