Exhibit 99.5

Budget and Fiscal Plan

2022/23 – 2024/25

February 22, 2022

National Library of Canada Cataloguing in Publication Data

British Columbia.

Budget and fiscal plan. –- 2002/03/2004/05-

Annual

Also available on the Internet.

Continues: British Columbia. Ministry of Finance and

Corporate Relations. Budget ... reports. ISSN 1207-5841

ISSN 1705-6071 = Budget and fiscal plan — British Columbia.

1. Budget — British Columbia — Periodicals. 2. British

Columbia — Appropriations and expenditures — Periodicals.

I. British Columbia. Ministry of Finance. II. Title.

HJ12.B742 352.48’09711’05 C2003-960048-3

| BUDGET AND FISCAL PLAN 2022/23 to 2024/25 | | | TABLE OF CONTENTS |

| February 22, 2022 | | |

| Attestation by the Secretary to Treasury Board | |

| | |

| Summary | 1 |

| | |

| Part 1: Three Year Fiscal Plan | |

| Introduction | 7 |

| Expense | 9 |

| Consolidated Revenue Fund Spending | 9 |

| Building a Stronger Society by Putting People First | 9 |

| A Healthy British Columbia | 9 |

| Investing in Mental Health and Responding to the Overdose Crisis | 11 |

| Supports for Individuals Experiencing Homelessness | 11 |

| Affordable, Accessible, and High-Quality Child Care | 13 |

| Putting People First | 15 |

| Building a Stronger Economy for Everyone | 18 |

| Government’s Economic Plan | 18 |

| Addressing the Housing Challenge | 18 |

| Connecting Communities | 20 |

| Transitioning to a Sustainable Economy | 20 |

| Building the Skills for Tomorrow’s Economy | 22 |

| Working Together Towards Reconciliation | 24 |

| Building a Stronger Environment for Our Future | 24 |

| CleanBC | 24 |

| Protecting People and Communities from Climate-Related Disasters | 28 |

| COVID-19 Response and Recovery | 30 |

| BC Public Service | 52 |

| BC Public Sector Compensation | 52 |

| Spending Recovered from Third Parties | 52 |

| Transfers to Service Delivery Agencies | 53 |

| Service Delivery Agency Spending | 53 |

| Revenue | 56 |

| Major Revenue Sources | 58 |

| Capital Spending | 63 |

| Taxpayer-Supported Capital Spending | 63 |

| Self-Supported Capital Spending | 72 |

| Projects Over $50 Million | 73 |

| Provincial Debt | 78 |

| Risks to the Fiscal Plan | 81 |

Budget and Fiscal Plan - 2022/23 to 2024/25

i

Table of Contents

Tables:

| 1.1 | Three Year Fiscal Plan | 7 |

| 1.2.1 | Support for Individuals Experiencing or At Risk of Homelessness | 13 |

| 1.2.2 | Investments for a Strong Economy | 22 |

| 1.2.3 | Investments for CleanBC (including Contingencies Allocations) | 25 |

| 1.2.4 | Investments to Support Communities Against Climate Events | 29 |

| 1.2.5 | Pandemic Recovery Contingencies 2022/23 | 30 |

| 1.3 | Expense by Ministry, Program and Agency | 54 |

| 1.4 | Revenue by Source | 55 |

| 1.5.1 | Comparison of Major Factors Underlying Revenue | 57 |

| 1.5.2 | Corporate Income Tax Revenue | 58 |

| 1.5.3 | Sales Tax Revenue | 58 |

| 1.5.4 | Federal Government Contributions | 62 |

| 1.6 | Capital Spending | 63 |

| 1.7 | Provincial Transportation Investments | 71 |

| 1.8 | Capital Expenditure Projects Greater Than $50 Million | 75 |

| 1.9 | Provincial Debt Summary | 78 |

| 1.10 | Provincial Borrowing Requirements | 79 |

| 1.11 | Provincial Debt Changes | 80 |

| 1.12 | Key Fiscal Sensitivities | 81 |

| | | |

| Topic Boxes: | |

| Flood Response and Recovery | 31 |

| Committed to Building for the Future | 35 |

| A Responsible Approach to Budgeting and Fiscal Planning | 37 |

| A New Vision for Health Care Funding | 44 |

| B.C.’s Environmental, Social and Governance Values | 46 |

| | | |

| Part 2: Tax Measures |

| Tax Measures – Supplementary Information | 88 |

| | | |

| Tables: | | |

| 2.1 | Summary of Tax Measures | 87 |

Budget and Fiscal Plan - 2022/23 to 2024/25

ii

Table of Contents

| | | |

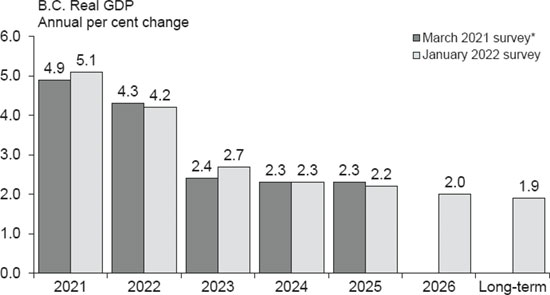

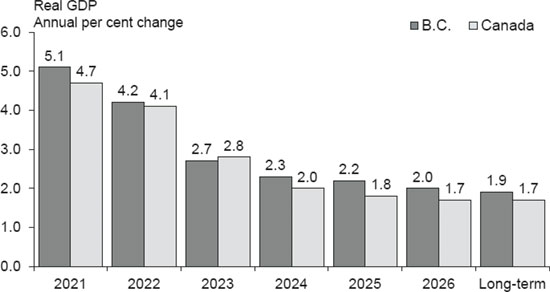

| Part 3: British Columbia Economic Review and Outlook | |

| Summary | 95 |

| British Columbia Economic Activity and Outlook | 96 |

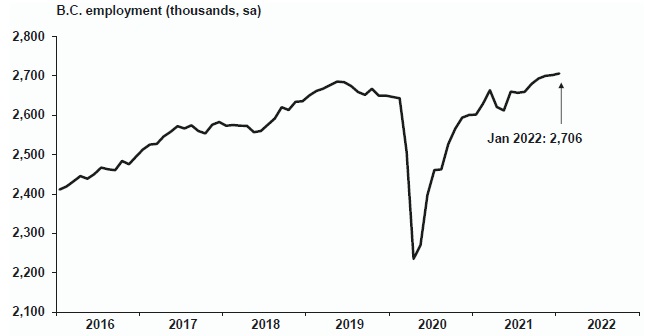

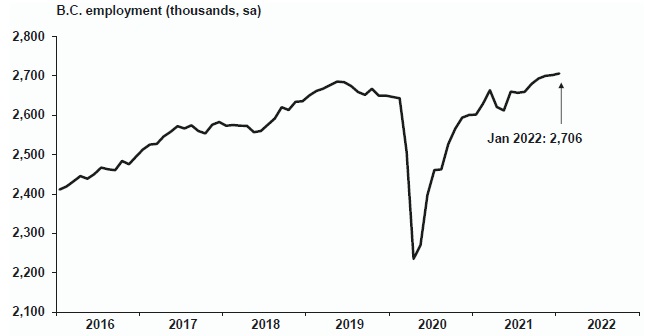

| Labour Market | 97 |

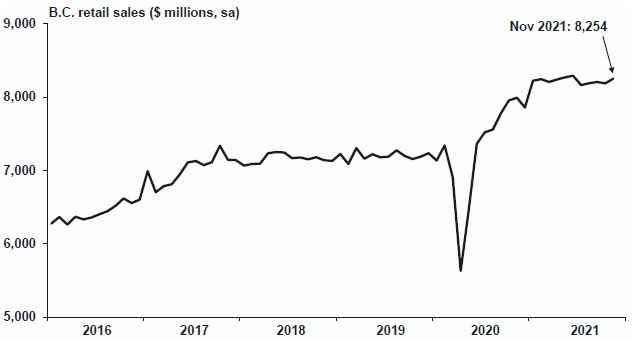

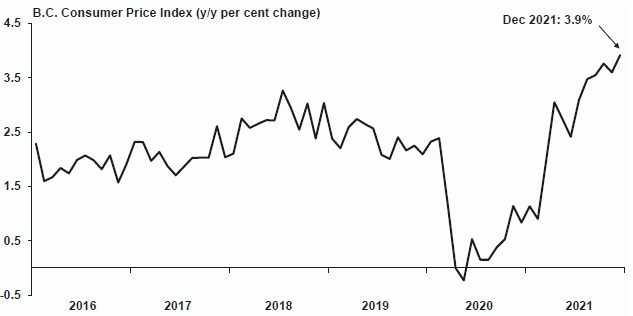

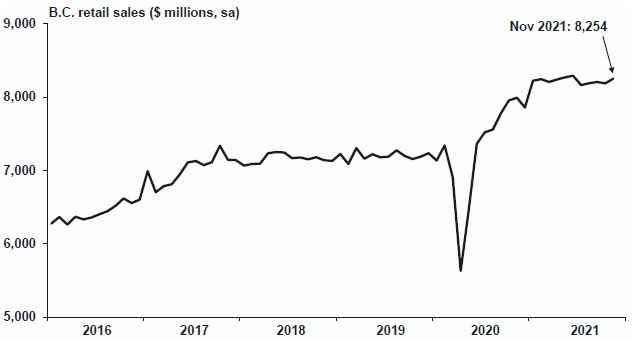

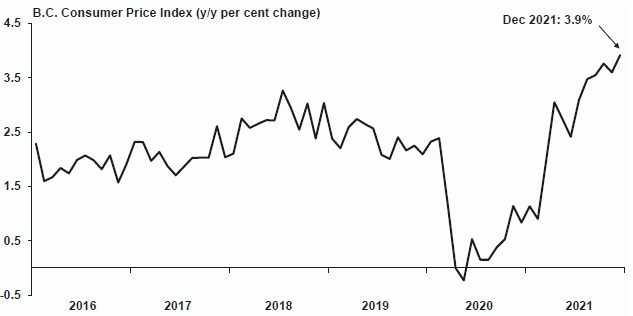

| Consumer Spending and Inflation | 98 |

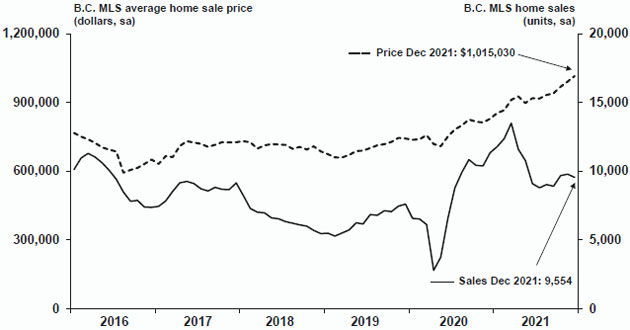

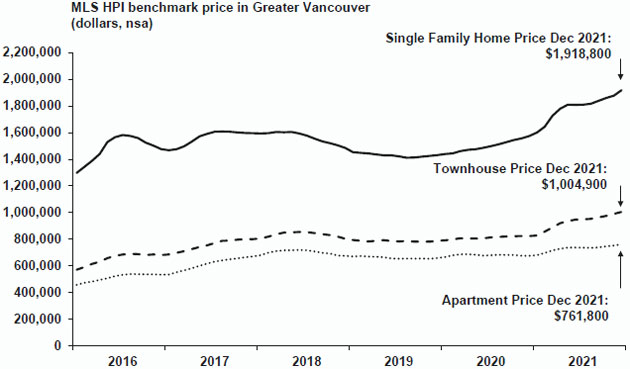

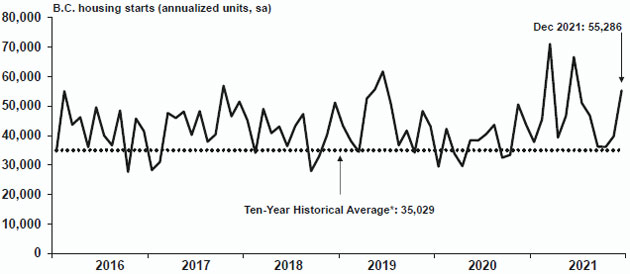

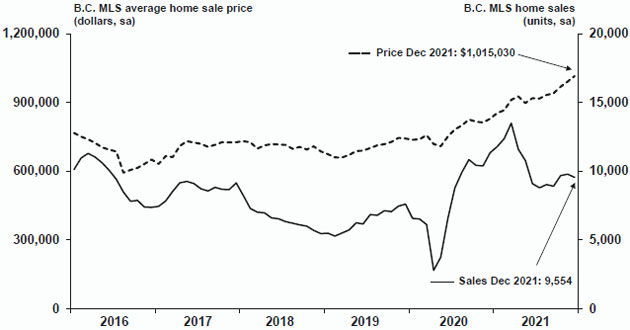

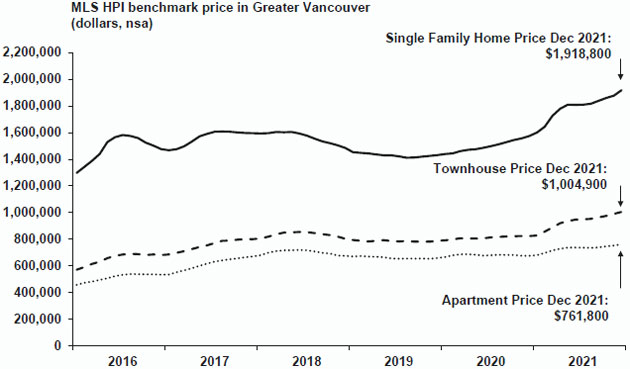

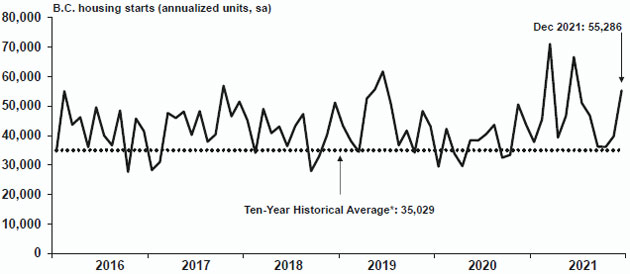

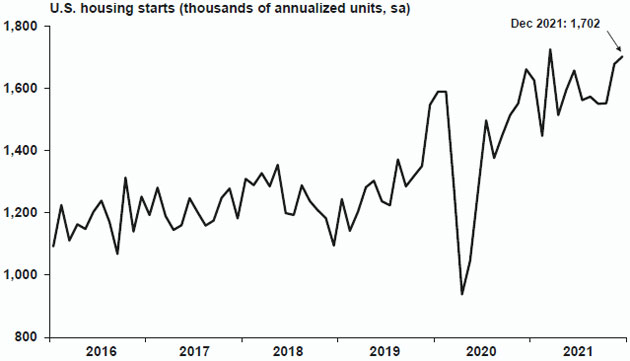

| Housing | 101 |

| Business and Government | 103 |

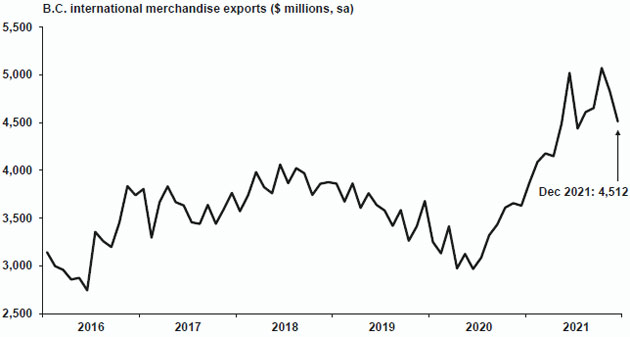

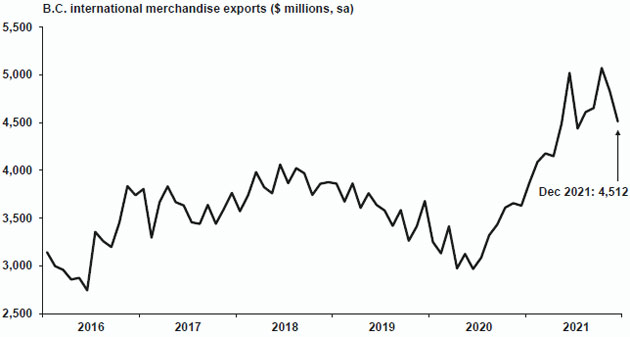

| External Trade and Commodity Markets | 104 |

| Demographics | 106 |

| Risks to the Economic Outlook | 106 |

| External Outlook | 107 |

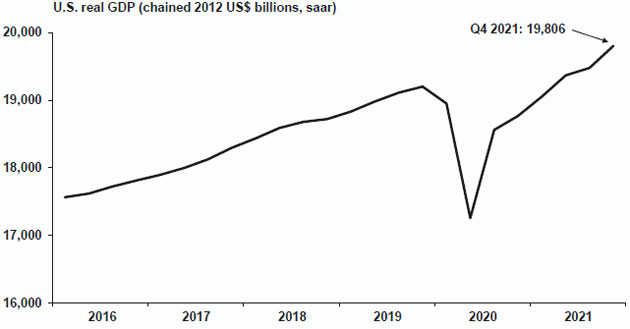

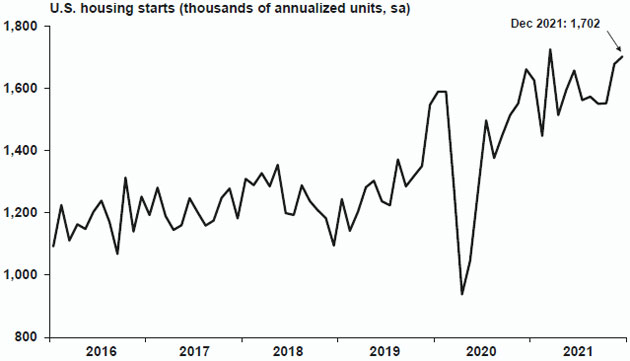

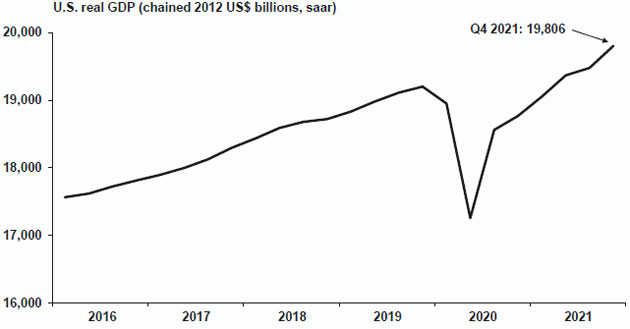

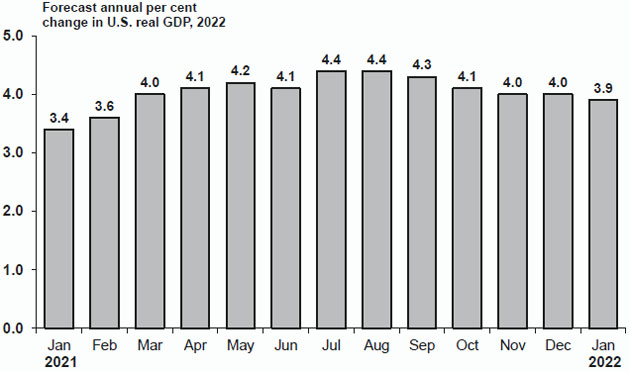

| United States | 107 |

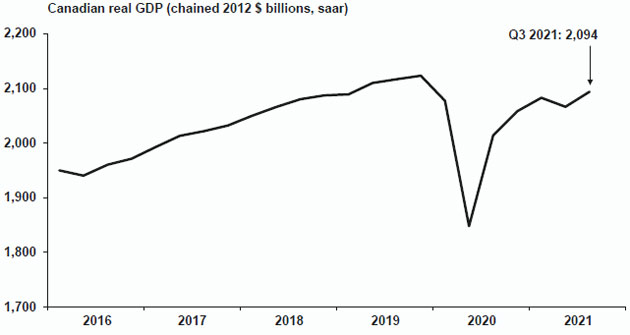

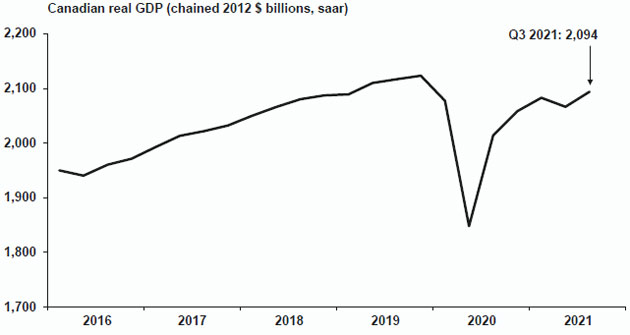

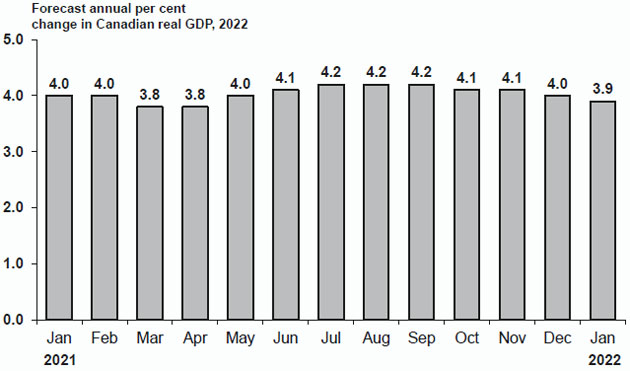

| Canada | 110 |

| Asia | 112 |

| Europe | 113 |

| Financial Markets | 113 |

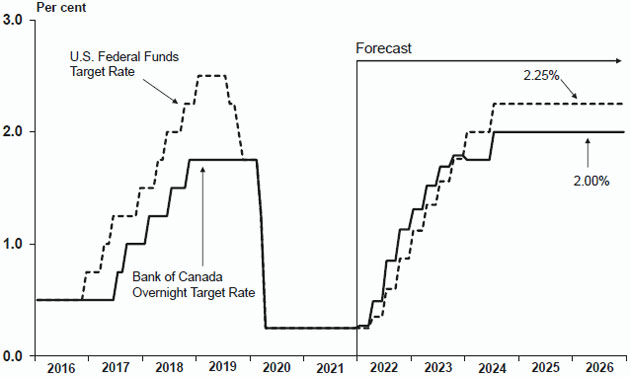

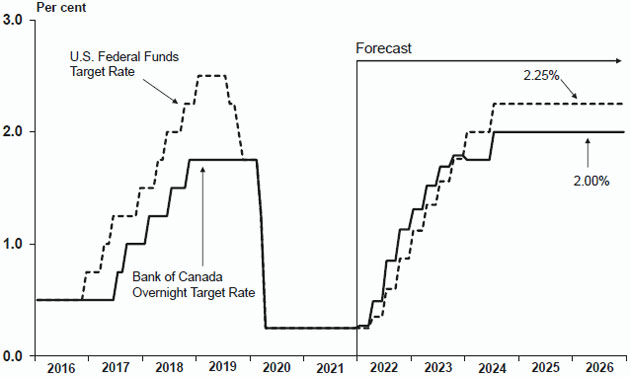

| Interest Rates | 113 |

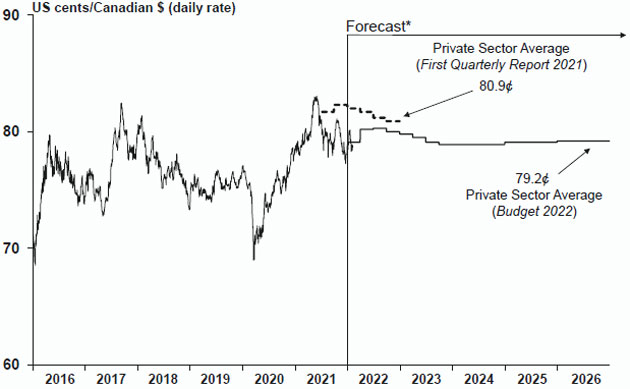

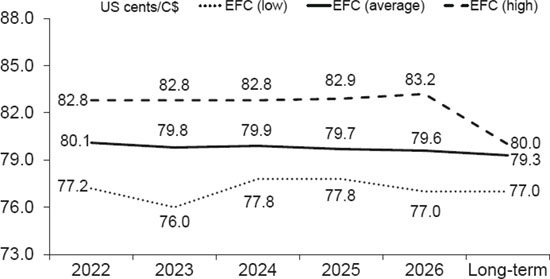

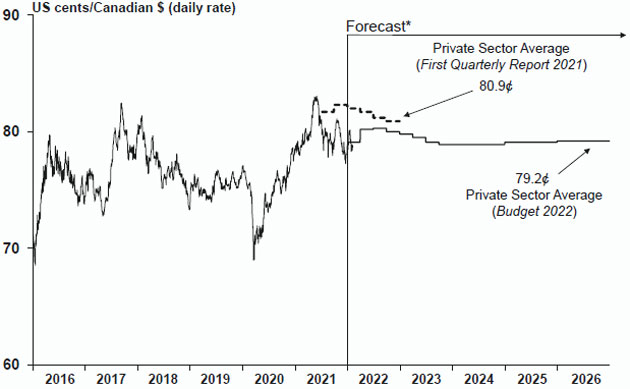

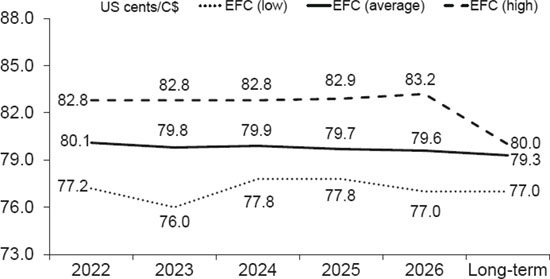

| Exchange Rate | 115 |

| | | |

| Tables: | | |

| 3.1 | British Columbia Economic Indicators | 96 |

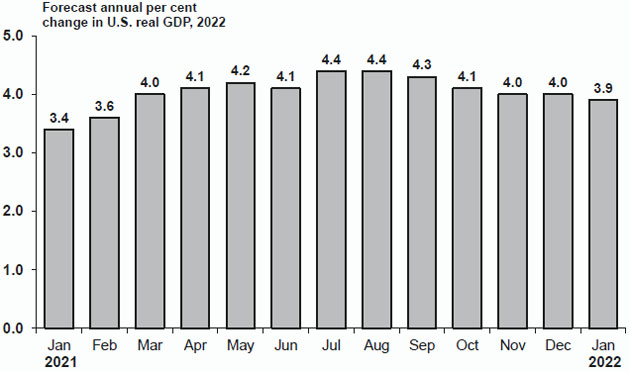

| 3.2 | U.S. Real GDP Forecast: Consensus versus B.C. Ministry of Finance | 109 |

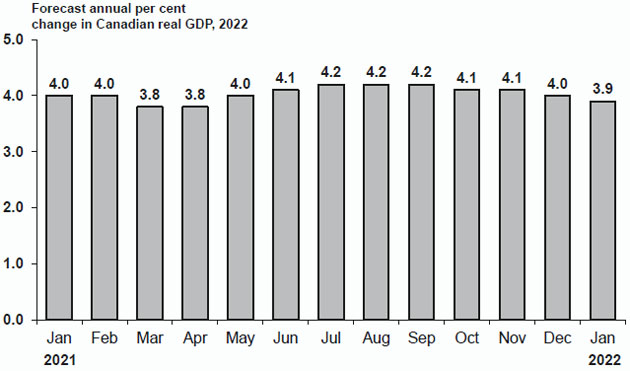

| 3.3 | Canadian Real GDP Forecast: Consensus versus B.C. Ministry of Finance | 111 |

| 3.4 | Private Sector Canadian Interest Rate Forecasts | 115 |

| 3.5 | Private Sector Exchange Rate Forecasts | 116 |

| 3.6.1 | Gross Domestic Product (GDP): British Columbia | 117 |

| 3.6.2 | Selected Nominal Income and Other Indicators: British Columbia | 118 |

| 3.6.3 | Labour Market Indicators: British Columbia | 118 |

| 3.6.4 | Major Economic Assumptions | 119 |

| | | |

| Topic Box: | | |

| The Economic Forecast Council, Budget 2022 | 120 |

Budget and Fiscal Plan - 2022/23 to 2024/25

iii

Table of Contents

| | | |

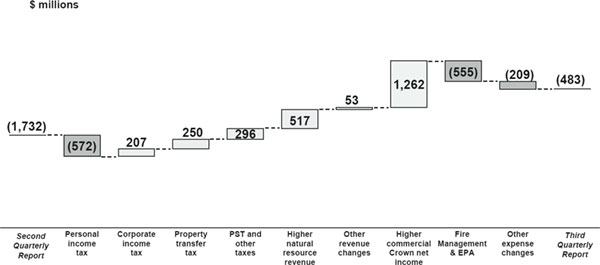

| Part 4: 2021/22 Updated Financial Forecast (Third Quarterly Report) | |

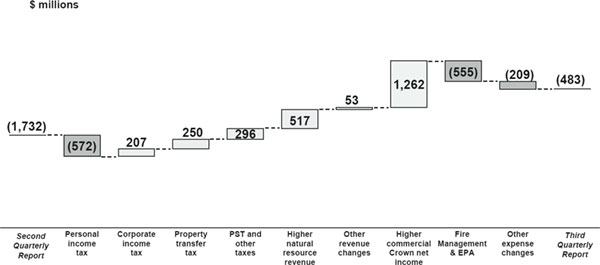

| Introduction | 125 |

| Revenue | 127 |

| Expense | 128 |

| Government Employment (FTEs) | 129 |

| COVID-19 Pandemic Response Measures | 130 |

| Provincial Capital Spending | 133 |

| Provincial Debt | 134 |

| Risks to the Fiscal Forecast | 135 |

| Supplementary Schedules | 135 |

| | |

| Tables: | |

| 4.1 | 2021/22 Forecast Update | 125 |

| 4.2 | 2021/22 Financial Forecast Changes | 126 |

| 4.3 | 2021/22 Pandemic and Recovery Contingencies | 129 |

| 4.4 | 2021/22 Capital Spending Update | 133 |

| 4.5 | 2021/22 Provincial Debt Update | 134 |

| 4.6 | 2021/22 Operating Statement | 135 |

| 4.7 | 2021/22 Revenue by Source | 136 |

| 4.8 | 2021/22 Expense by Ministry, Program and Agency | 137 |

| 4.9 | 2021/22 Expense by Function | 138 |

| 4.10 | 2021/22 Capital Spending | 139 |

| 4.11 | 2021/22 Provincial Debt | 140 |

| 4.12 | 2021/22 Statement of Financial Position | 141 |

| | | |

| Appendix | 143 |

Budget and Fiscal Plan - 2022/23 to 2024/25

iv

| February 22, 2022 |

As required by Section 7(1)(d) of the Budget Transparency and Accountability Act, I confirm that Budget 2022 contains the following elements:

| • | Fiscal forecasts for 2022/23 to 2024/25 (provided in Part 1) and economic forecasts for 2022 to 2026 (provided in Part 3). |

| • | A report on the advice received from the Economic Forecast Council (EFC) in December 2021 (updated in January 2022) on the economic growth outlook for British Columbia, including a range of forecasts for 2022 and 2023 (see Part 3, page 121). |

| • | Material economic, demographic, fiscal, accounting policy, and other assumptions and risks underlying Budget 2022 economic and fiscal forecasts. In particular: |

| − | The economic forecast reflects an improved outlook for British Columbia amidst ongoing uncertainty associated with the global COVID-19 pandemic. In recognition of downside risks, the economic projections assumed in Budget 2022 are prudent relative to the average of the forecasts provided by the Economic Forecast Council. |

| − | The economic forecast does not fully incorporate fiscal policy measures announced in the current budget (Budget 2022), since the timing of budget decisions generally coincides with the development of the economic forecast. However, a preliminary estimate of government spending for the current budget was included to improve completeness. The full budget policy measures will be incorporated into the economic outlook in the updated forecast included in the First Quarterly Report. |

| − | The corporate income tax revenue forecast is based on projections for national corporate taxable income provided by the federal government. |

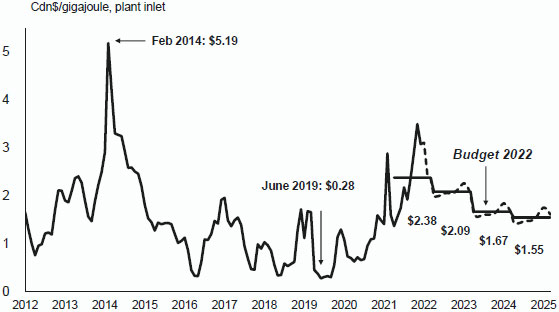

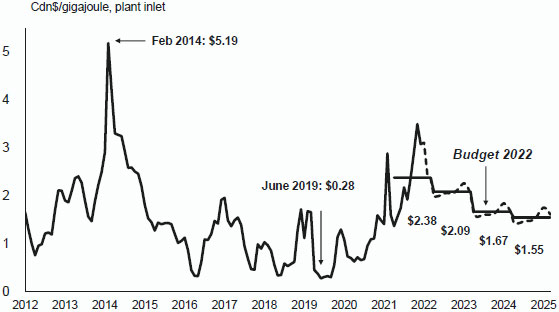

| − | Natural gas royalty forecasts continue to adopt a lower natural gas price forecast compared to the private sector average in order to maintain prudence against volatility. |

| − | The fiscal plan includes three-year financial projections for school districts, post-secondary institutions and health authorities, based on plans submitted by those entities to the Ministries of Education and Child Care, Advanced Education and Skills Training, and Health, respectively, and for the other service delivery agencies and the commercial Crown corporations. |

| − | The fiscal plan includes a Pandemic Recovery Contingencies allocation of $2.0 billion in 2022/23 and $1.0 billion in 2023/24, as part of the Contingencies vote totalling $4.848 billion in 2022/23, $4.412 billion in 2023/24, and $3.987 billion in 2024/25. The forecast allowance is $1.0 billion in each year of the fiscal plan. Government’s economic and fiscal prudence measures generally have resulted in government exceeding its budget targets. |

To the best of my knowledge, the three-year fiscal plan contained in Budget 2022 conforms to the standards and guidelines of generally accepted accounting principles for senior governments as outlined in Note 1 of the 2020/21 Public Accounts.

I would like to recognize staff in government ministries and agencies for their contribution to this document. I would especially like to acknowledge staff in the Ministry of Finance, whose professionalism, commitment and expertise were essential to the completion of this budget and fiscal plan.

| | /s/ Heather Wood |

| | Heather Wood |

| | Deputy Minister and Secretary to Treasury Board |

Budget and Fiscal Plan - 2022/23 to 2024/25

SUMMARY | BUDGET AND FISCAL PLAN - 2022/23 to 2024/25

| | | | | | | | | | | | | |

| ($ millions) | | Updated

Forecast

2021/22 | | | Budget

Estimate

2022/23 | | | Plan

2023/24 | | | Plan

2024/25 | |

| Revenue | | | 70,220 | | | | 68,552 | | | | 70,177 | | | | 72,325 | |

| Expense | | | (66,453 | ) | | | (71,013 | ) | | | (72,359 | ) | | | (74,506 | ) |

| Pandemic Recovery Contingencies | | | (3,250 | ) | | | (2,000 | ) | | | (1,000 | ) | | | — | |

| Forecast allowance | | | (1,000 | ) | | | (1,000 | ) | | | (1,000 | ) | | | (1,000 | ) |

| Deficit | | | (483 | ) | | | (5,461 | ) | | | (4,182 | ) | | | (3,181 | ) |

| | | | | | | | | | | | | | | | | |

| Capital spending: | | | | | | | | | | | | | | | | |

| Taxpayer-supported capital spending | | | 7,157 | | | | 9,279 | | | | 9,333 | | | | 8,815 | |

| Self-supported capital spending | | | 3,828 | | | | 4,374 | | | | 4,437 | | | | 3,144 | |

| Total capital spending | | | 10,985 | | | | 13,653 | | | | 13,770 | | | | 11,959 | |

| Provincial Debt: | | | | | | | | | | | | | | | | |

| Taxpayer-supported debt | | | 61,731 | | | | 73,475 | | | | 83,302 | | | | 90,846 | |

| Self-supported debt | | | 28,814 | | | | 30,956 | | | | 33,004 | | | | 33,930 | |

| Total debt (including forecast allowance) | | | 91,545 | | | | 105,431 | | | | 117,306 | | | | 125,776 | |

| Taxpayer-supported debt to GDP ratio | | | 17.8 | % | | | 20.0 | % | | | 21.8 | % | | | 22.8 | % |

| Taxpayer-supported debt to revenue ratio | | | 92.9 | % | | | 110.9 | % | | | 122.7 | % | | | 129.8 | % |

| | | | | | | | | | | | | | | | | |

| | | 2021 | | | | 2022 | | | | 2023 | | | | 2024 | |

| Economic Forecast: | | | | | | | | | | | | | | | | |

| Real GDP growth | | | 5.0 | % | | | 4.0 | % | | | 2.5 | % | | | 2.1 | % |

| Nominal GDP growth | | | 12.4 | % | | | 5.8 | % | | | 4.1 | % | | | 4.0 | % |

Building a Stronger BC Together

The province has been challenged by the COVID-19 pandemic and weather events that have been fueled by climate change. Through these emergencies, British Columbians have stood together, supported each other, and have demonstrated the province’s collective strength. There is more to be done: the pandemic and recent climate-related disasters have highlighted the need to continue to strengthen the public services that people rely on, from health care and education to child care and housing. In addition, they have shown the need to continue to build a stronger B.C. with an economy that meets the needs of tomorrow, while fighting climate change.

Budget 2022 expands on historic investments made since 2017 to build a stronger society, a stronger economy, and a stronger environment. This includes $6.6 billion in new operating funding over the three-year fiscal plan period.

There remains ongoing uncertainty regarding the course of the COVID- 19 pandemic and natural disaster recovery costs. Budget 2022 provides Pandemic Recovery Contingencies funding of $2 billion in 2022/23, and $1 billion in 2023/24 to ensure the Province can continue to provide ongoing health responses and can continue to help people, businesses and communities that are still recovering from the pandemic’s impacts. Additionally, more than $1.1 billion is earmarked in General Programs Contingencies for disaster recovery costs over the next three years in recognition of the need to have the flexibility to be responsive and support communities as the costs of recovery become better known. This is in addition to $400 million in 2022/23 provided for disaster recovery in the Emergency Program Act budget and the $5 billion expected from the Government of Canada that is designated for disaster recovery in B.C.

Budget and Fiscal Plan - 2022/23 to 2024/25

1

Summary

Building a Stronger Society

The health and safety of British Columbians continues to remain government’s top priority. The pandemic has shown the need to continue work to strengthen the health care system that so many British Columbians have relied on. Budget 2022 continues to prioritize the health and safety of British Columbians with more than $3.2 billion in new funding over the fiscal plan period for B.C.’s health care system. This includes funding to expand primary care services and First Nations’ primary care in all regions of the province, to address wait lists for surgeries and diagnostic imaging, to support cancer care services and to strengthen B.C.’s ambulance system in order to improve response times. In addition, $875 million is allocated in Pandemic Recovery Contingencies in 2022/23 to support ongoing COVID-19 health response needs.

The Province is investing more than $633 million over the next three years to implement a cross-government approach to prevent homelessness and respond quickly to assist people experiencing homelessness to become stably housed. This includes supports for youth aging out of care who are at increased risk of becoming homeless, rent supplements with wraparound supports for individuals who are experiencing homelessness, complex care housing for individuals with significant mental health and/or substance use challenges, and a continuation of strategies to provide permanent housing options for people that are temporarily housed as part of the response to the COVID-19 pandemic.

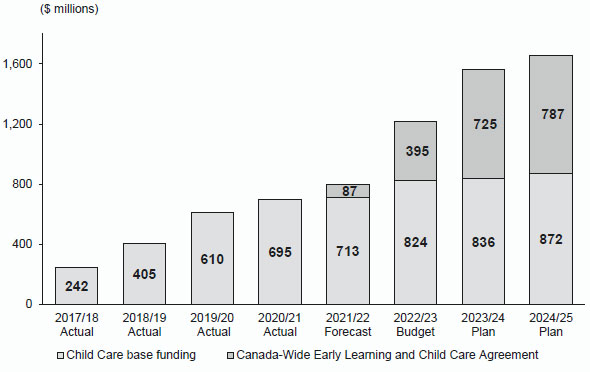

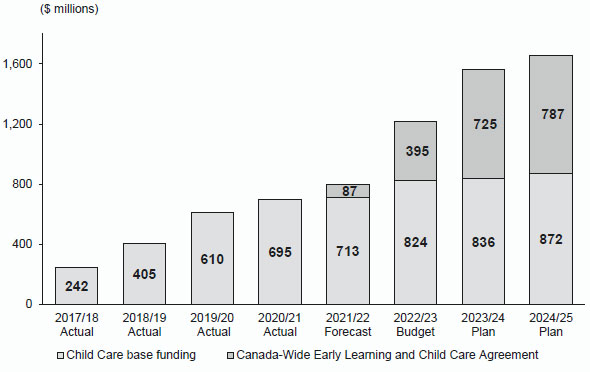

Budget 2022 builds on the $2.4 billion in investments made in the first four years of the ChildCareBC plan by investing $284 million in new provincial funding on top of previous investments. In addition, a historic agreement has been signed with the Government of Canada which delivers over $3.2 billion over five years. Combined, federal and provincial spending will total $4.4 billion over the fiscal plan period to continue to build a child care system that will provide more affordable, accessible, inclusive and high quality child care to support families. This will lower fees for before- and after-school care and preschool beginning in 2023/24, expand wage enhancements to more early childhood educators, and create more child care spaces across the province.

Significant new funding to support other essential public services includes: $664 million in the K-12 education sector; $259 million for children, youth and family services, and $326 million for justice and public safety services.

Building a Stronger Economy

Government’s economic plan, ‘StrongerBC: A Plan for Today, a Vision for Tomorrow’ outlines how we can grow an economy that works for everyone by preparing for jobs of the future, closing the digital divide, and driving new innovation. It includes a generational commitment to develop the talent B.C. needs to support growth in the future. Budget 2022 makes progress on the StrongerBC plan with $50 million to support inclusive and sustainable growth by delivering additional, targeted strategies and investments, including those that grow B.C.’s life sciences, manufacturing and agricultural sectors and to support reconciliation through economic development. An additional $195 million is targeted to the B.C. life sciences sector in 2021/22.

More than $289 million in new funding over the next five years will be provided to expand high-speed internet access throughout the province, bringing total investments to expand connectivity to remote, rural, and Indigenous communities to over $509 million by 2026/27. Through this investment, more than 280 communities will be connected to high-speed internet, improving access to education and health care, and expanding the ability for local businesses to reach the international marketplace.

The Province is also developing a comprehensive workforce readiness plan titled Future Ready: Skills for the Jobs of Tomorrow, to proactively address both systemic and emerging workforce challenges, such as shifting demographics and climate adaptation. This plan will help to fill the one million job openings forecasted by 2031. Budget 2022

Budget and Fiscal Plan - 2022/23 to 2024/25

2

Summary

provides more than $67 million in funding for skills and jobs training. This funding will create more training seats for health care assistants and in the skilled trades, in addition to more training seats for early childhood educators funded under ChildCareBC.

Funding of more than $185 million is provided over the fiscal plan to support communities through the deferral of logging in old growth forests. This includes funding to connect workers to employment opportunities, to provide skills training to community members, and to forge partnerships with businesses and communities to transition and create jobs through diversified economies and infrastructure projects.

A stronger British Columbia requires moving forward together through true and lasting reconciliation with Indigenous Peoples. In 2021, the Province released a draft Action Plan to support ongoing consultation and further collaboration with Indigenous Peoples. Once finalized, the Action Plan will help advance reconciliation by defining a set of long-term goals and outcomes, and identifying specific actions covering the whole of government. The budget continues to support a number of measures that promote reconciliation with Indigenous Peoples. This includes funding for the creation of a Declaration Act Secretariat to implement the Declaration on the Rights of Indigenous Peoples Act, and funding for Indigenous primary care and Aboriginal Head Start. Establishing a new Ministry of Land, Water and Resource Stewardship will also support reconciliation by helping to bring the Province’s natural resource policy framework in line with the UN Declaration on the Rights of Indigenous Peoples.

A Stronger Environment

Government reaffirmed its role as a global leader in climate action with the launch of the CleanBC Roadmap to 2030. In addition, the devastating climate-related disasters in the past year have highlighted the importance of protecting people and communities from the effects of the changing climate. More than $1 billion in new funding is provided over the fiscal plan period to continue the fight against climate change and to implement new initiatives identified in the CleanBC Roadmap to 2030. This includes $651 million in new operating funding to support clean transportation, energy efficient buildings, and to support industry and communities to manage the transition to a low-carbon economy.

Budget 2022 also includes significant investments to help the Province protect people and communities from climate-related disasters. In addition to the $1.5 billion in allocations to support community recovery from disaster events, $600 million in operating and capital funding is provided to continue the response to climate-related disasters, for local government and First Nation disaster and recovery projects, and to begin to implement the Climate Preparedness and Adaptation Strategy to support British Columbians through future emergencies.

Capital Investments

Budget 2022 makes significant capital commitments in the health, transportation, and education sectors. Taxpayer-supported infrastructure spending on hospitals, schools, post-secondary facilities, transit, and roads is forecast to be $27.4 billion, the highest level ever, over the three-year fiscal plan.

Capital spending of self-supported Crown corporations is expected to total $12.0 billion over three years, relating primarily to electrical generation, transmission and distribution projects.

Economic Outlook

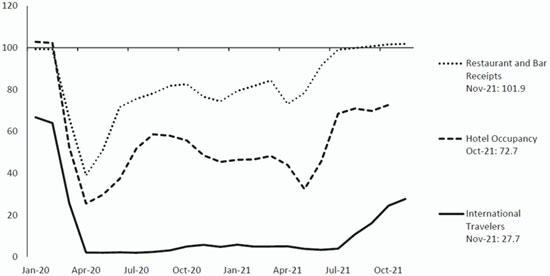

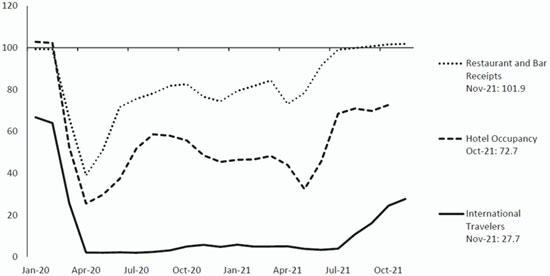

B.C.’s economy rebounded in 2021 from the initial impacts of the COVID-19 pandemic, despite significant pandemic and climate-related disruptions. The economy has proven resilient to pandemic interruptions, aided by government emergency response programs, cooperation with public health orders and a strong vaccination program, and easing of restrictions. While the recovery has broadened over the past year, it remains uneven with sectors like tourism,

Budget and Fiscal Plan - 2022/23 to 2024/25

3

Summary

hospitality, recreation, and live events yet to fully recover. The path of the ongoing economic recovery in B.C. and its trading partners remains highly uncertain amid the evolution of the pandemic and supply-chain disruptions. However, expenditures and hiring to permanently rebuild damaged infrastructure from the November 2021 floods and landslides will have a positive effect on jobs and economic activity in the province.

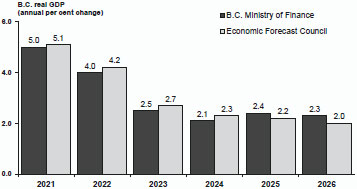

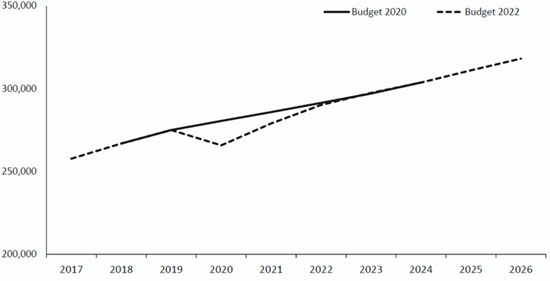

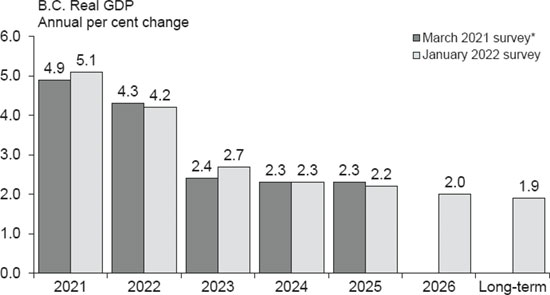

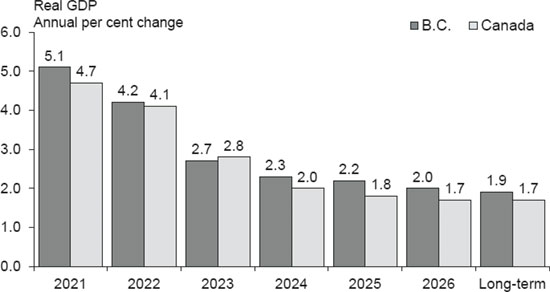

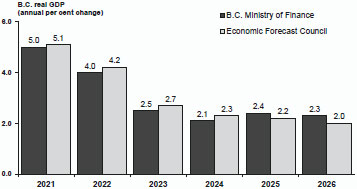

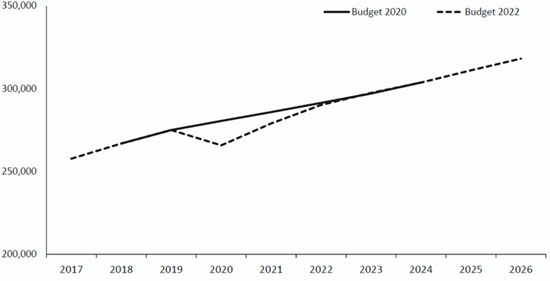

It is estimated that the B.C. economy expanded by 5.0 per cent in 2021, following a 3.4 per cent decline in 2020. The economy is forecast to expand by 4.0 per cent in 2022 and 2.5 per cent in 2023. Over the medium-term (2024 to 2026), growth is expected to range between 2.1 per cent and 2.4 per cent annually.

The Budget 2022 B.C. real GDP forecast over the three-year fiscal plan is below the average outlook provided by the Economic Forecast Council (EFC). This is one of the levels of prudence built into the fiscal plan. The outlook for 2025 and 2026 is slightly higher than the average EFC forecast as LNG production is anticipated to provide more support to the economy over that period.

Prudent Economic Forecast

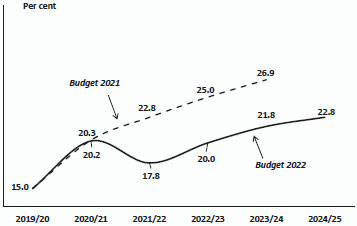

Debt Affordability

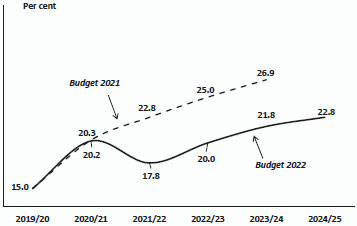

Debt affordability metrics have improved from Budget 2021 due to significantly better operating results in the current fiscal year. The taxpayer-supported debt at the end of 2021/22 is forecast to be $61.7 billion, which is almost $10 billion less than forecast in Budget 2021. However, the debt is expected to increase over the fiscal plan to finance the operating and capital investment needs of the province, with taxpayer-supported debt forecast to be $90.8 billion at the end of 2024/25, and the debt-to-GDP ratio rising to 22.8 per cent.

Debt to GDP

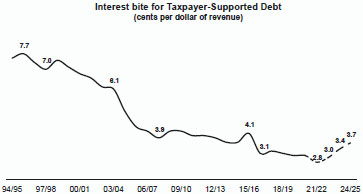

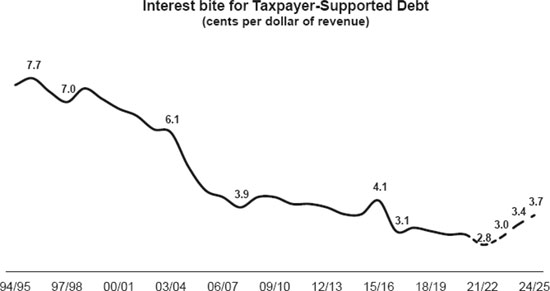

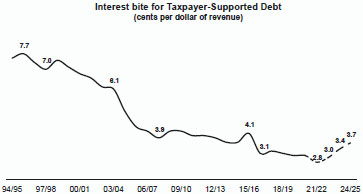

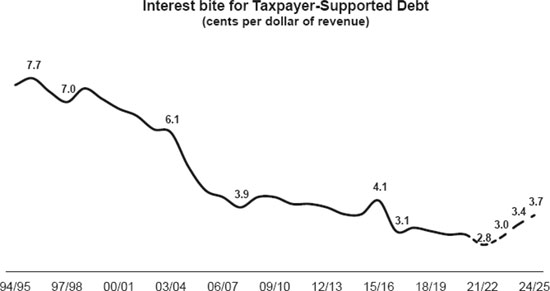

The Province’s debt-servicing costs remain at a historically low level due to prevailing low interest rates. A common metric of financing affordability is the “interest bite,” representing the taxpayer-supported interest costs as a percentage of provincial government revenue, which is at 2.8 cents per dollar in 2021/22, lower than it has been in the past, as shown below.

Risks to the Fiscal Plan

The main risks to the government’s fiscal plan include:

| • | Ongoing health-related uncertainty relating to the pandemic, including the extent of the spread and containment of the virus in BC and across the world; |

| • | Uncertainty relating to the pace and timing of full recovery from the pandemic, which contributes to the potential volatility in the economic and fiscal outlooks; |

| • | Increased demands for government services, such as health care, COVID-19 response or recovery; |

| • | Demands to support the rebuild and recovery from the climate-related disasters; and |

Budget and Fiscal Plan - 2022/23 to 2024/25

4

Summary

| • | Changes in timing of capital projects and related spending which may be influenced by several factors, such as COVID-19 safety measures, market conditions, and weather. |

To mitigate the risks to the fiscal plan, government has the following levels of prudence in its projections:

| • | Forecast allowance of $1.0 billion in each year of the fiscal plan; |

| • | Pandemic Recovery Contingencies of $2.0 billion in 2022/23 and $1.0 billion in 2023/24; |

| • | General Programs Contingencies of $2.8 billion in 2022/23, $3.4 billion in 2023/24, and $4.0 billion in 2024/25; and |

| • | A forecast for B.C.’s real GDP growth that is lower than the outlook provided by the Economic Forecast Council (0.2 percentage points lower in 2022, 2023 and 2024). |

Conclusion

Budget 2022 helps to build a stronger B.C. by prioritizing investments that make a stronger society, a stronger economy, and a stronger environment. These investments harness the collective energy, spirit, and strength of all British Columbians to overcome the pandemic, recover from climate-related disasters, create new jobs, and strengthen the important public services that people rely on throughout the province. There is much reason for hope and optimism in the future. B.C. enters into this next period from a position of strength and government will continue to work with people, businesses, communities, and Indigenous Peoples to build a stronger B.C. together.

Budget and Fiscal Plan - 2022/23 to 2024/25

5

| | PART 1 | THREE YEAR FISCAL PLAN |

| Table 1.1 Three Year Fiscal Plan | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| ($ millions) | | Updated

Forecast

2021/22 | | | Budget

Estimate

2022/23 | | | Plan

2023/24 | | | Plan

2024/25 | |

| Revenue | | | 70,220 | | | | 68,552 | | | | 70,177 | | | | 72,325 | |

| Expense | | | (66,453 | ) | | | (71,013 | ) | | | (72,359 | ) | | | (74,506 | ) |

| Pandemic Recovery Contingencies | | | (3,250 | ) | | | (2,000 | ) | | | (1,000 | ) | | | — | |

| Forecast allowance | | | (1,000 | ) | | | (1,000 | ) | | | (1,000 | ) | | | (1,000 | ) |

| Deficit | | | (483 | ) | | | (5,461 | ) | | | (4,182 | ) | | | (3,181 | ) |

| Capital spending: | | | | | | | | | | | | | | | | |

| Taxpayer-supported capital spending | | | 7,157 | | | | 9,279 | | | | 9,333 | | | | 8,815 | |

| Self-supported capital spending | | | 3,828 | | | | 4,374 | | | | 4,437 | | | | 3,144 | |

| Total capital spending | | | 10,985 | | | | 13,653 | | | | 13,770 | | | | 11,959 | |

| Provincial Debt: | | | | | | | | | | | | | | | | |

| Taxpayer-supported debt | | | 61,731 | | | | 73,475 | | | | 83,302 | | | | 90,846 | |

| Self-supported debt | | | 28,814 | | | | 30,956 | | | | 33,004 | | | | 33,930 | |

| Total debt (including forecast allowance) | | | 91,545 | | | | 105,431 | | | | 117,306 | | | | 125,776 | |

| Taxpayer-supported debt to GDP ratio | | | 17.8 | % | | | 20.0 | % | | | 21.8 | % | | | 22.8 | % |

| Taxpayer-supported debt to revenue ratio | | | 92.9 | % | | | 110.9 | % | | | 122.7 | % | | | 129.8 | % |

Introduction

Budget 2022 builds on historic investments made since 2017 to continue building a stronger society, a stronger economy and a stronger environment. Projected deficits will decline over the fiscal plan period from $5.5 billion in 2022/23 to $3.2 billion in 2024/25, and debt-to-GDP ratios are below 25 per cent in each year of the fiscal plan. By taking a responsible and thoughtful approach to budgeting and fiscal planning, government continues to help British Columbians and communities overcome the pandemic, build back better from climate events and prepare for future challenges together.

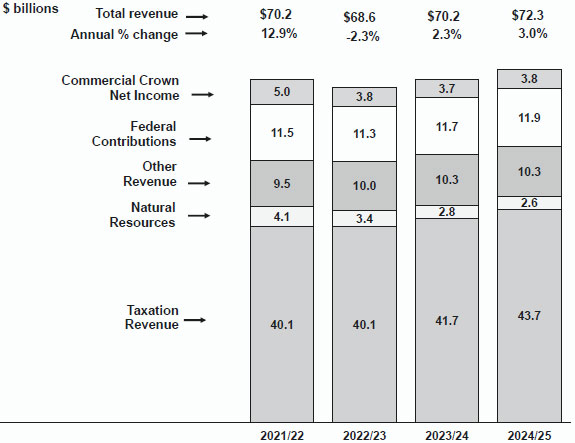

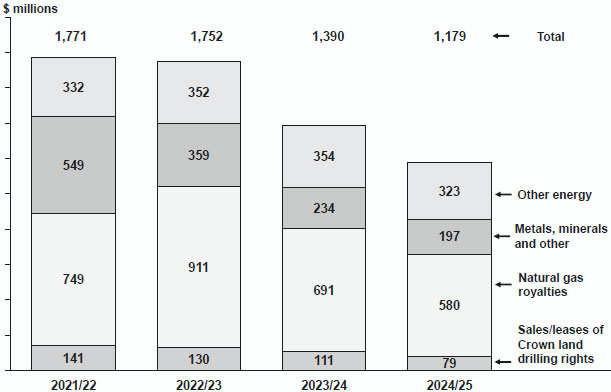

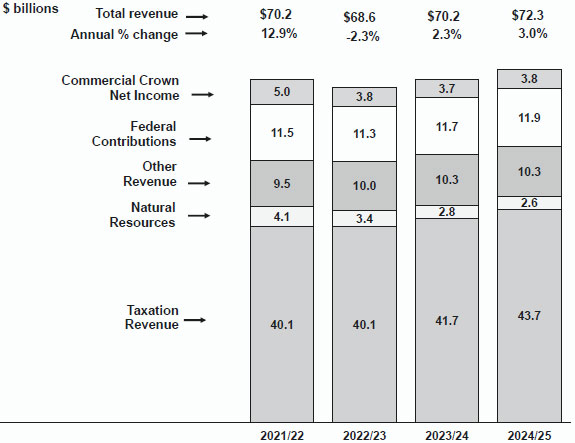

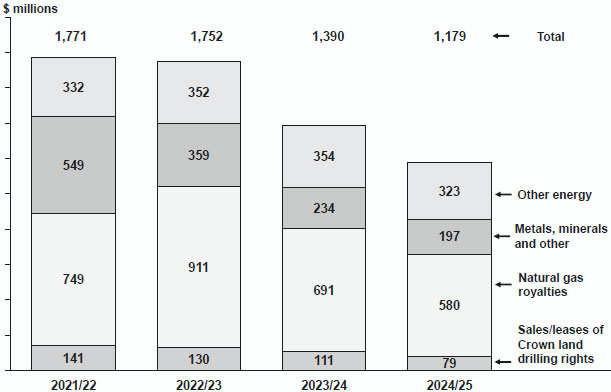

Government’s consolidated operating expense totals $73.0 billion in 2022/23, $73.4 billion in 2023/24, and $74.5 billion in 2024/25. This includes ministry operating budget increases of almost $6.6 billion over the fiscal plan period and a $3.0 billion time-limited allocation in Pandemic Recovery Contingencies ($2.0 billion in 2022/23 and $1.0 billion in 2023/24). More than $10.0 billion in funding is provided over the next three years in General Programs Contingencies for: expected flood-related costs ($1.15 billion currently allocated), uncertain costs related to collective bargaining, and other spending uncertainties for new and existing programs. The revenue forecast rises from $68.6 billion in 2022/23 to $72.3 billion in 2024/25. Revenue growth reflects increased economic activity and policy measures introduced and implemented in Budget 2022, partly offset by declining natural resource revenues over the next three years and the effects of assumed one-time revenues recorded in 2021/22 that will not carry forward.

Capital spending on schools, universities, hospitals, affordable housing, long-term care facilities, highways, bridges, and other taxpayer-supported infrastructure is expected to reach a record $27.4 billion over the three-year fiscal plan period. These investments will support future growth while helping to ensure that people and communities fully recover from the experience of the past two years, and harness the opportunities of a clean and inclusive economy. These investments will also create jobs in communities throughout the province, contributing to a strong and sustainable economy.

Budget and Fiscal Plan - 2022/23 to 2024/25

6

Three Year Fiscal Plan

The new operating funding initiatives are discussed in the expense section starting on page 9. Details on the Province’s revenue forecasts are provided in the revenue section, starting on page 55. The capital investments section begins on page 63. This is followed by the debt section on page 78 and a discussion on the risks to the fiscal plan on page 81.

Budget 2022 demonstrates government’s ongoing commitment to incorporate Gender Based Analysis Plus (GBA+) into its policy and budget processes. Since 2018, the Province has used GBA+ to ensure that comprehensive, evidence-based policy advice is provided to decision makers to achieve better results for all British Columbians. Budget 2022 uses GBA+ analysis to monitor economic trends and inform all spending and tax decisions. This analytical tool helps to assess, where appropriate, the effect of different spending or tax measures on different groups, including people of different genders, incomes, ethnicities, geographic locations, ages, abilities, or sexual orientations.

The use of the GBA+ lens informed many budget priorities. The pandemic brought to light many disparities in the provision of services and the lived experiences of different populations around the province. Rural, remote and Indigenous communities are disconnected from necessary services and the global marketplace. Budget 2022 addresses this divide through accelerated investments in internet connectivity, the continuation of health care service improvements for rural and remote communities, and investments in Indigenous primary care. Analysis showed that homeless populations are not a singular entity and that services must be tailored towards the needs of different individuals. The cross-government approach funded through Budget 2022 provides an array of services along the continuum of individuals who experience homelessness in order to meet intended outcomes. In 2018 almost one in three women and just over one in eight men over the age of 15 felt unsafe or uncomfortable as a result of unwanted sexual behaviour they experienced. The rate of self-reported sexual assault among Indigenous women is three times the rate among non-Indigenous women. These experiences are informing the government’s approach to the delivery of resources and supports for victims of violence and sexual assault - with long-term dedicated funding for these services provided in this budget. These examples show how the GBA+ lens helps to build a province where everyone has equal access to opportunities and services that are inclusive, respectful, and representative of the diverse population of British Columbia.

Meaningful reconciliation with Indigenous Peoples is embedded into government’s decision making processes. Budget 2022 includes new investments to support reconciliation and stronger Indigenous communities. This includes funding for a Declaration Act Secretariat, expanded Indigenous primary care, continued investments under the Homes for BC housing plan to deliver culturally appropriate social housing in Indigenous communities and off- reserve, increased access to justice for Indigenous People through a virtual Indigenous Justice Centre, Indigenous -led emergency management priorities, and culturally- based child care through the Aboriginal Head Start program. Funding is provided in 2021/22 to support Indigenous communities and First Nations to repatriate cultural belongings from museums and institutions, both in B.C. and globally. These new initiatives are further discussed throughout this document and are in addition to other priorities that support Indigenous Peoples and communities, such as accelerating the connection of homes to high-speed internet and the creation of the Ministry of Land, Water and Resource Stewardship.

Budget and Fiscal Plan - 2022/23 to 2024/25

7

Three Year Fiscal Plan

Expense

Consolidated Revenue Fund Spending

Consolidated Revenue Fund (core government) planned spending over the fiscal plan period is $62.5 billion in 2022/23, $62.9 billion in 2023/24, and $64.2 billion in 2024/25 as shown in Table 1.3 on page 54. This includes incremental expenses of $2.2 billion in 2022/23, $1.7 billion in 2023/24, and $2.7 billion in 2024/25, totaling $6.6 billion across the three-year fiscal plan. Government remains committed to investing in ways that build a stronger society, a stronger economy and a stronger environment. Funding decisions are underpinned by government’s five foundational principles: to put people first; to engage in lasting and meaningful reconciliation with Indigenous Peoples; to support equity and anti -racism in the province; to build a better future through fighting climate change; and to build a strong, sustainable economy that works for everyone.

Building a Stronger Society by Putting People First

A Healthy British Columbia

Improving the quality of health care services and keeping British Columbians safe from the COVID-19 pandemic remains the Province’s highest priority, with over $3.2 billion provided for health care spending over the next three years. This is comprised of over $2.9 billion to increase accessibility and quality of health and mental health services throughout the province and $299 million for other health-related costs that are part of strategies such as complex care housing; expanding services for homeless individuals; climate preparedness and adaptation in the health care system; and ChildCareBC. These strategies are discussed in other sections of this document.

In addition, Budget 2022 provides $875 million in 2022/23 from Pandemic Recovery Contingencies for the Ministry of Health to continue to manage the COVID-19 pandemic. This includes funding for ongoing COVID-19 and influenza vaccination programs, the provision of personal protective equipment for health care workers, and COVID-19 testing. This improves care through enhanced screenings and additional measures to limit the risk of spreading COVID-19 to vulnerable residents in long-term care facilities, assisted living facilities, and provincial mental health facilities. Initiatives will continue to ensure that people living in rural, remote, and Indigenous communities in B.C. have access to critical health care. This includes funding to improve medical transportation options, access to virtual care, and increased mental health supports for Indigenous and non -Indigenous communities. Funding is also allocated for the BC Centre for Disease Control to produce real-time data, modelling, and epidemiological analysis; support decision making to manage the pandemic; provide educational materials to the public; and maintain enhanced lab testing throughout the province.

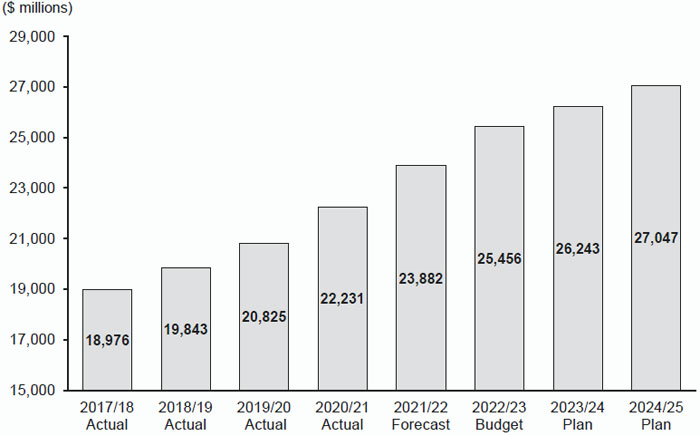

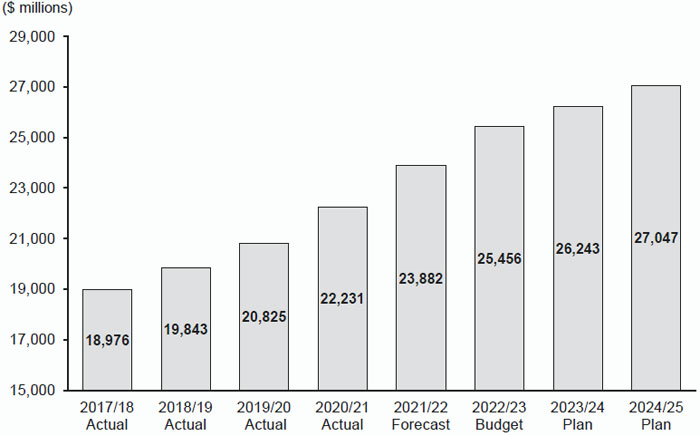

Budget 2022 builds upon investments since Budget 2017 Update by increasing base budget health funding to $27 billion by 2024/25. This includes funding to manage the growing demand for all health services including cancer care, surgical care and primary care in British Columbia. Capital spending on health sector infrastructure in Budget 2022 totals $8.6 billion over three years as detailed on page 63.

Budget and Fiscal Plan - 2022/23 to 2024/25

8

Three Year Fiscal Plan

Effective primary care helps patients to manage complex medical conditions and determine specialist referral requirements. Primary care also minimizes the number of patients who enter emergency departments for routine health care issues. Budget 2022 provides $102 million over three years to continue advancing the Primary Care Strategy, including:

| • | $57 million to increase the number of Urgent and Primary Care Centres throughout the province. There are currently 26 centres that provide urgent and primary care services which have been instrumental in responding to the COVID-19 pandemic, administering influenza immunization campaigns, and providing patient care during extreme weather events. |

| • | $45 million to implement primary care networks and bring additional traditional wellness providers closer to Indigenous communities, which will provide culturally safe care for these populations. Funding supports the operations of up to 15 First Nations Primary Health Care Centres. These centres will improve access to primary care for Indigenous Peoples and attachment to a team of care providers supporting both western and Indigenous health and wellness practices. |

Budget 2022 provides $303 million in funding over the next three years to continue a strategy to support timely surgeries and diagnostic imaging. Additional dedicated funding will continue this progress and help to address increased wait lists resulting from postponed surgeries due to the COVID-19 pandemic and the province’s growing and aging population.

The COVID-19 pandemic and recent extreme weather events have demonstrated the need for additional resources for the ambulance system’s emergency dispatchers and responders. The Province is providing $148 million over the fiscal plan period to continue to implement the BC Emergency Health Services Action Plan. This provides funding to reduce call wait times and emergency response times by increasing the number of paramedics and dispatchers to respond to emergencies throughout the province.

Government is committed to providing people in acute care facilities with more consistent, safe, and stable patient care. Budget 2022 provides $231 million over the next three years to bring thousands of service and support service workers back to working directly for health authorities after 20 years of contracting this work through private companies. This will improve the ability to recruit workers, while improving wages and benefits, working conditions, job security and stability for over 2,900 workers — a large majority of whom are racialized women — that patients count on daily.

Budget and Fiscal Plan - 2022/23 to 2024/25

9

Three Year Fiscal Plan

Chart 1.1.1 Investments in People’s Health and Mental Health*

* Funding for the Ministry of Health. Does not include time-limited funding initiatives related to pandemic response and economic recovery.

Investing in Mental Health and Responding to the Overdose Crisis

This past year has been very difficult for people in British Columbia. People have endured two public health emergencies — the pandemic and the opioid crisis — as well as floods, wildfires and heat waves. These devastating events have taken a toll on individual and collective mental health.

Since Budget 2017 Update, government has prioritized expanding mental health and addictions services throughout the province. Budget 2022 provides $10 million across three years to the Ministry of Mental Health and Addictions for staffing to continue advancing the expansion of services, including support services for the complex care housing initiative discussed on page 12. This will bring the incremental annual funding for mental health and addictions services since the Budget 2017 Update to more than $375 million.

Supports for Individuals Experiencing Homelessness

The Province is implementing a collaborative cross-government approach to focus on the root causes of homelessness. The approach includes both preventing homelessness from occurring and responding quickly to assist people experiencing homelessness to become stably housed. Government is investing more than $633 million over the fiscal plan period towards providing services and supports for people experiencing or at risk of homelessness. This builds on previous investments and begins implementation of the new, more coordinated approach which recognizes the importance of consistent, accessible, and integrated services.

Budget and Fiscal Plan - 2022/23 to 2024/25

10

Three Year Fiscal Plan

Supporting Youth at Risk of Homelessness

There is clear evidence that youth who have interacted with the government care system are more likely to experience homelessness relative to their peers, with almost 50 per cent of former youth in care experiencing homelessness at some point in their lives. Budget 2022 provides $35 million over the next three years to change this situation by supporting these youth beyond their 19th birthday to decrease their risk of becoming homeless. This funding will expand upon the supports available to young adults as they age out of the government care system. Beginning in 2022/23, temporary housing and support arrangements that had been provided in 2020 will be made permanent and new rent supplements will be introduced for program participants. Over the course of 2023/24 and 2024/25, dedicated provincial funding grows to facilitate expanded income supports and enhancements to the Agreement with Young Adults program to include counselling, medical benefits and expanded life-skills programming. Funding will also support new Youth Transitions navigators who will assist up to 8,830 youth up to their 27th birthday. Navigators will help successfully transition these youth from government care by facilitating access to this better-designed continuum of services.

Expanded Response to Support People Experiencing Homelessness

Budget 2022 provides $170 million to begin implementation of enhanced and expanded responses to homelessness. In partnership with the Government of Canada, Budget 2022 includes a program offering rent supplements of up to $600 per month to help people access market housing. By 2024/25, more than 3,000 clients will be supported through this program, providing additional housing options to build on existing and ongoing government investments in supportive housing. Recipients of rent supplements and those in supportive housing will be provided an integrated range of provincial supports through partnerships with community organizations. These will include supports to address physical health, mental wellness, substance use, personal care, and food security in a culturally safe, gender and trauma-informed environment.

Funding of $4 million is included for BC Housing to provide supports for individuals experiencing homelessness at encampments around the province. These supports include site management, engagement, and support for food, sanitation, storage, and the safety of those living in the encampments, while reducing the impact on people in surrounding communities. In addition, the Province will provide funding to support the 2023 provincial homelessness count, and research to identify the unique needs of women experiencing homelessness including: Indigenous women, women of colour, transgender women, and women who are homeless with children. The response will also double the number of community integration specialists throughout the province to help individuals navigate government programs and supports.

Complex Care Housing

In January 2022, the Province launched a first-of-its-kind complex-care housing program. Complex care housing goes beyond the current housing model. It is a ground-breaking approach to address the needs of people who often have overlapping mental-health challenges, substance-use issues, trauma and acquired brain injuries, and who often end up facing the most significant housing barriers. This program will provide an enhanced level of integrated health and social supports to serve people where they live.

Budget and Fiscal Plan - 2022/23 to 2024/25

11

Three Year Fiscal Plan

Budget 2022 builds on this initial investment by providing $164 million for at least 20 additional sites across B.C. with plans underway to support approximately 500 individuals. Services will be health-focused and will seek to meet the individual needs of participants, ranging from intensive supportive housing, interim housing for those transitioning out of hospitals or correctional facilities, and high-intensity housing for those with the most complex needs.

Continued Response to COVID-19 for People Experiencing Homelessness

At the outset of the pandemic, some of the province’s most vulnerable residents risked being without housing, shelter and other living arrangements as a result of necessary provincial health orders related to physical distancing. Government responded by leasing and purchasing over 3,000 spaces at hotels, motels, and community centres to provide alternative shelter for these individuals in need.

Budget 2022 allocates $264 million over the next three years to continue housing arrangements for these residents as they are transitioned to permanent housing. This includes more than $63 million in capital funding and $50 million in operating funding over the next three years to acquire and implement permanent housing solutions for a portion of those now temporarily housed. It also includes $150 million in Pandemic Recovery Contingencies to continue to extend the temporary spaces for remaining individuals while permanent housing options become available and maintains support, safety, and outreach services for those who will continue to be housed in temporary arrangements.

Table 1.2.1 Support for Individuals Experiencing or At Risk of Homelessness

| ($ millions) | | 2022/23 | | | 2023/24 | | | 2024/25 | | | Total | |

| Youth Transitions Program | | 5 | | | 10 | | | 20 | | | 35 | |

| Homelessness Supports | | 94 | | | 37 | | | 39 | | | 170 | |

| Complex Care Housing | | 55 | | | 54 | | | 54 | | | 164 | |

| Permanent Housing Plan (COVID-19) | | 230 | * | | 17 | | | 17 | | | 264 | |

| | | | | | | | | | | | | |

| Total | | 384 | | | 119 | | | 130 | | | 633 | |

Note: Table may not sum due to rounding

*Includes Pandemic and Recovery Contingencies allocation

Affordable, Accessible, and High-Quality Child Care

Since launching the ChildCareBC plan in Budget 2018, government has invested over $2.4 billion toward building affordable, accessible, and high-quality child care services to ensure that more people – especially women - can participate in the workforce.

In 2021, B.C. signed a historic agreement with the Government of Canada that will deliver more than $3.2 billion over five years to build on the progress made under ChildCareBC. This complements the Province’s plan and accelerates improved access to quality, affordable, flexible, and inclusive child care services. By the end of 2022, British Columbians will see a 50 per cent reduction in average parent fees, resulting in fees of approximately $20 per day on average, for children under the age of six in licensed child care.

Budget and Fiscal Plan - 2022/23 to 2024/25

12

Three Year Fiscal Plan

Budget 2022 invests $284 million more in provincial funding for child care services over the fiscal plan. This includes over $118 million to reduce parent fees for preschool and before- and after-school care to be more consistent with the fee reduction under the federal-provincial agreement. These fee reductions will be in place for the beginning of the 2023/24 school year and will benefit over 50,000 children and their families. These investments, including those under the federal-provincial agreement, are displayed on Chart 1.1.2.

Chart 1.1.2 Child Care Services*

* Does not include time-limited funding initiatives related to pandemic response and economic recovery.

The goal of ChildCareBC is to ensure that child care services are available for anyone who wants or needs them. This goal will be achieved through child care facilities built to a standard for quality, accessibility and inclusivity, and to ensure long-lasting infrastructure investments. To date, more than 26,000 spaces have been funded and announced through provincial investments. The new shared agreement with the federal government will lead to the creation of 30,000 new licensed child care spaces within five years, and 40,000 spaces within seven years. Budget 2022 further builds on these investments and includes $33 million to create more before- and after-school spaces, and more than $11 million to enable an increase in the number of school districts providing the Seamless Day program from 24 to 44. Building on Budget 2021 investments, $11 million is also provided to support the Aboriginal Head Start program and engagement, community planning, and capacity building with Indigenous stakeholders.

Budget 2022 invests $80 million to continue to ensure that the workforce behind child care is highly trained and fairly compensated. This includes expanding the wage enhancement program for certified early childhood educators who spend under 50 per cent of their time in direct child care functions but are still working within child care services. To keep up with the pace of new space creation, Budget 2022 provides $7 million for more licensing officers to ensure that more child care facilities can be permitted to open once they are complete. In addition, Budget 2022 invests $8 million to expand the dual credit program to 150 students and to create 130 more training seats in

Budget and Fiscal Plan - 2022/23 to 2024/25

13

Three Year Fiscal Plan

post-secondary institutions. This will increase the number of early childhood educators that are trained to meet the needs of the growing sector. An additional $16 million is devoted to several additional targeted measures to improve program delivery and to support the integration of child care into the broader learning environment.

Finally, starting next fiscal year, the delivery of child care programs will be moved from the Ministry of Children and Family Development to be administered within the Ministry of Education and Child Care.

Putting People First

Investing in K-12 Education

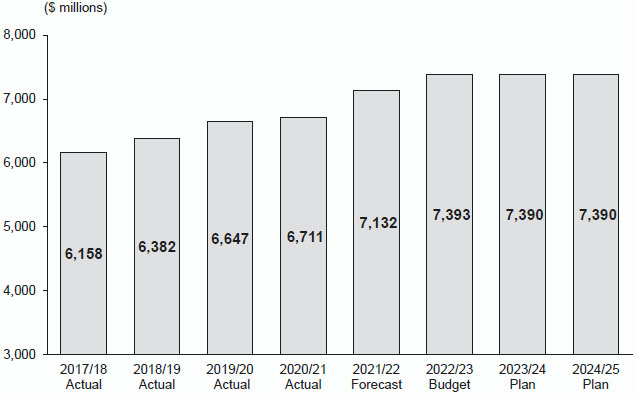

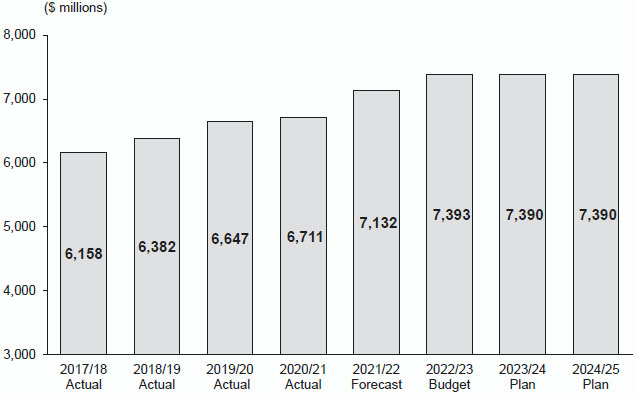

Budget 2022 invests more than $664 million over the fiscal plan to respond to growing K-12 enrolment in British Columbia’s public and independent school systems. This funding will help students acquire the foundations that support a strong economy into the future. It will also continue supplements to school districts for children and youth in care, Indigenous learners, rural school districts, and students with support needs. This funding includes $105 million for the Classroom Enhancement Fund which supports nearly 4,500 teachers, including over 700 special education teachers, and more than 200 teacher psychologists and counsellors. These investments will bring the total annual funding for K-12 education to over $7.3 billion by 2024/25 as indicated in Chart 1.1.3. In addition, the Province’s capital plan includes $3.1 billion over the next three years to build new schools to respond to enrolment growth, and to maintain and seismically upgrade schools throughout the province. This is further discussed on page 64.

Chart 1.1.3 Investing in K-12 Education*

* Does not include time-limited funding initiatives related to pandemic response and economic recovery.

Budget and Fiscal Plan - 2022/23 to 2024/25

14

Three Year Fiscal Plan

Improving the Lives of Children and Youth

Budget 2022 provides more than $259 million across the fiscal plan period to improve the lives of children and youth throughout the province. More than $87 million of this funding is dedicated to support children and youth in ministry care or in the care of a family member. Government continues to implement its strategy of reducing the number of children in care and keeping families together through the promotion of adoption services, family reunification arrangements, and provision of other custody options. Incremental funding will ensure the continued care and support for more than 10,000 children and youth in government care, or in alternatives to care. Funding will also support the Devices for Youth in Care program, which provides youth in care access to a smartphone to help caregivers, who otherwise would be responsible for this cost, enhance communication and safety.

Funding includes more than $172 million over the fiscal plan for ongoing assistance for children and youth with support needs, and for the transition to a more responsive, flexible, and needs-based system for children, youth, and their families. Of this, $58 million is dedicated to increases in anticipated demand growth costs for children and youth with support needs. Funding of $114 million is provided to begin the transition of services to a needs-based system throughout the province and, beginning on April 1, 2022, to fully cover the cost of essential medical equipment and supplies, such as wheelchairs. This transition of services begins with the establishment of early implementation in two regions of the province in 2023. These will offer accessible and inclusive services through a community agency to all families, regardless of whether they have a diagnosis, based on their child or youth’s unique needs. Consultation will continue with families, service providers and Indigenous leaders and rights holders to ensure a smooth transition for all families. Findings from the early implementation will inform a full provincial roll-out in 2024.

Supporting Vulnerable British Columbians

From the outset of the pandemic, the Province has provided the most vulnerable British Columbians with income and disability financial assistance and other resources to access medical services, support their children to start the school year, and access transportation, while navigating the challenges of COVID-19. Budget 2022 provides $36 million over the fiscal plan period to provide for anticipated growth in demand and ensure that these financial supports remain strong in uncertain times. This funding builds on the historic investments made as part of TogetherBC, B.C.’s first poverty reduction strategy. These investments have provided: $325 per month in total increases to income and disability assistance rates since 2017; a $50 monthly increase to the Senior’s Supplement benefiting over 80,000 seniors; and other family supports like the Child Care Fee Reduction Initiative, the Affordable Child Care Benefit, and the B.C. Child Opportunity Benefit.

Budget 2022 provides more than $3 million in new funding over the fiscal plan period to support greater accessibility of services throughout the province. In June 2021, British Columbia passed the Accessible British Columbia Act. This legislation commits to the development of an accessibility plan and regulations, to build a tool to provide feedback to government, and to establish a Provincial Accessibility Committee to support the government in these actions.

Budget and Fiscal Plan - 2022/23 to 2024/25

15

Three Year Fiscal Plan

Almost $49 million across the next three years is dedicated to Community Living BC, which provides critical services and supports to approximately 25,000 adults with developmental disabilities and their families. This includes funding for residential and employment supports, initiatives to develop skills so that participants can be more involved with their communities, and respite supports to allow families and caregivers the opportunity to rest and recharge. Maintaining the quality of life for all British Columbians is a government priority, including adults with developmental disabilities who are in home-sharing arrangements with Community Living BC. Budget 2022 provides funding to improve monitoring of home-sharing providers and provide issues management, critical response, and ensure the quality of services that they provide.

A Responsive Justice System

Budget 2022 provides more than $46 million over the fiscal plan period to support timely access to justice services, alleviate wait time to trials, and help victims and their families resolve disputes more quickly. An additional $12 million is provided to continue the digitization of justice services that were implemented during the COVID-19 pandemic, including online traffic court, virtual bail, and a virtual Indigenous Justice Centre. The expansion of these services has reduced court backlogs, saved residents of rural and remote communities extensive travel time, and helped to build a more responsive justice system.

Keeping British Columbians Safe

Budget 2022 allocates $233 million over the fiscal plan period to fund public safety initiatives and negotiated wage enhancements for Royal Canadian Mounted Police to continue public safety measures, especially in rural and remote regions of the province. This includes funding to make B.C.’s communities safer, and to assist youth by giving them tools to avoid a life of gang and drug violence. Government is providing $5 million of dedicated funding over three years for the Expect Respect and a Safe Education, and Gang Intervention and Exiting Programs. These programs have been successful in their intent to divert youth from gang-associated activities through the education system, and to support youth to voluntarily exit from gangs.

Incremental funding totaling $22 million over three years is budgeted to provide services to victims of sexual assault and exploitation. Through this allocation, the Province will create dedicated and ongoing funding to support approximately 50 service centres that provide crisis response, counselling, preventative medication, forensic exams, mechanisms to report to the police, and child protection services.

More than $12 million is provided to increase capacity and reduce backlogs in the BC Coroners Service stemming from pressures related to the COVID-19 pandemic, the overdose crisis, and recent climate-related events. This funding will increase the number of annual autopsies performed by 250 per year, increase the number of coroner investigations by 2,850 per year, and will provide staff support to address call volumes that bring information and closure to the families and communities that are impacted by cases brought to the BC Coroners Service.

Budget and Fiscal Plan - 2022/23 to 2024/25

16

Three Year Fiscal Plan

Building a Stronger Economy for Everyone

Government’s Economic Plan

In February 2022, government released an economic plan with a vision for B.C.’s economic future: an inclusive, sustainable, and innovative economy that works for everyone. StrongerBC: A Plan for Today, a Vision for Tomorrow charts the path to meeting two big goals — inclusive growth and clean growth — to build a strong economy that works for more people and establishes sustainability as the foundation for the economy of tomorrow.

Inclusive growth means investing in actions that expand economic opportunity for all British Columbians, such as the development of a workforce readiness plan and closing the digital divide. New priorities include the development of the Future Ready: Skills for the Jobs of Tomorrow, a workforce readiness plan that will address the challenge of filling more than one million job openings in B.C. over the next ten years. More information on Budget 2022 investments in skills and job training can be found on page 22. The pandemic has highlighted how important internet connectivity is to access job training, to connect families, and to foster economic growth. The plan also highlights the need to provide more communities with high-speed internet to connect to the digital economy. Budget 2022 investments in connectivity are further highlighted on page 20.

Clean growth means achieving government’s climate commitments through innovative economic growth, leveraging B.C.’s position as a leader in environmental and social responsibility, and the creation of high-value, sustainable resource jobs. Further discussion on government’s Budget 2022 investments for CleanBC can be found on page 24.

Budget 2022 provides an allocation of $50 million over the fiscal plan to deliver additional, targeted strategies and investments to support both clean and inclusive growth. Funding will help grow B.C.’s life sciences, manufacturing and agricultural sectors, and support reconciliation through economic development. Budget 2022 also provides funding to support ongoing tracking and reporting on the progress of the plan’s intended outcomes. The funding will include support for an Integrated Marketplace to speed up the adoption of made-in-B.C. clean technologies and establishing a world leading standard for Environmental, Social and Governance reporting. In addition, the Province has provided funding of $195 million in 2021/22 to support B.C.’s growing life sciences sector, which is further highlighted on page 21.

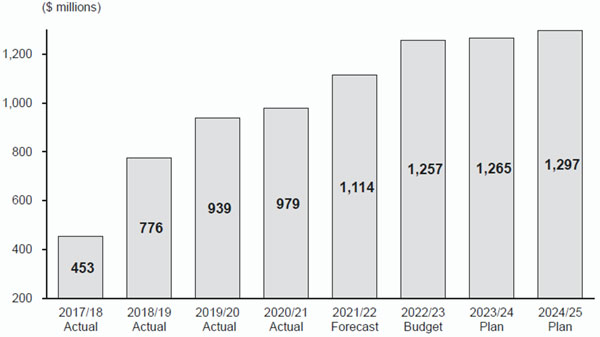

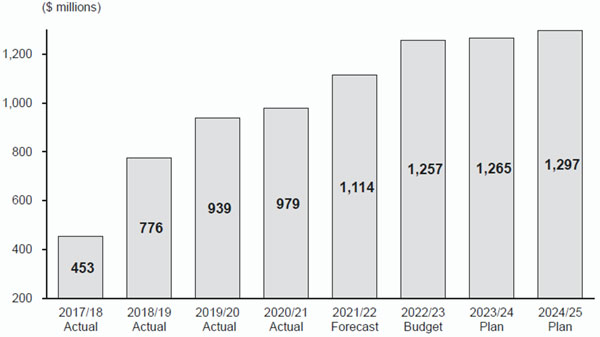

Addressing the Housing Challenge

In addition to funding for the Province’s plan to combat homelessness in British Columbia, Budget 2022 builds on investments made in Budget 2021 with an additional $166 million across the fiscal plan period to continue and accelerate progress towards building 114,000 affordable housing units in British Columbia over 10 years. This brings the level of housing investments and homelessness supports to over $1.2 billion per year by 2024/25 as indicated in Chart 1.1.4. More than 32,000 new homes have been completed or are underway since Homes for BC was launched in Budget 2018.

Budget and Fiscal Plan - 2022/23 to 2024/25

17

Three Year Fiscal Plan

This includes funding for Building BC, a suite of programs that have increased permanent supportive housing for those experiencing homelessness, housing for women and children fleeing abuse, housing for Indigenous People, and mixed-income rental housing for families and individuals. As a component of the $166 million, Budget 2022 accelerates funding of $100 million into 2022/23 for Building BC’s Community Housing Fund, which will support the development of mixed-income rental housing for low-income families and seniors sooner than originally planned.

Budget 2021 provided $2 billion in new low-interest financing for HousingHub, which works with community, government, non-profit and private sector partners to create new affordable rental housing and homeownership options for middle-income British Columbians. This new funding has led to a significant increase in participation in the program, with 4,200 units now underway or completed under HousingHub. To respond to the heightened interest, Budget 2022 provides $8 million of funding to support HousingHub’s project development capacity.

Chart 1.1.4 Investments in Housing Affordability and Homelessness Supports*

* Does not include time-limited funding initiatives related to pandemic response and economic recovery.

Budget and Fiscal Plan - 2022/23 to 2024/25

18

Three Year Fiscal Plan

Connecting Communities

Enhancing Digital Connectivity

Budget 2022 provides more than $289 million in new funding over the next five years to aggressively accelerate the connection of homes to high-speed internet and further close the digital divide. Through Budget 2022 investments more than 280 rural, remote and Indigenous communities will be connected to high-speed internet, improving access to education and health care, diversifying their economies, and expanding the ability for local businesses to reach the international marketplace. Coupled with previous investments of $220 million since 2017, this funding will bring the total provincial spending to expand connectivity to over $509 million by 2026/27.

Moving British Columbians and Goods

Recent supply interruptions have reinforced how critical infrastructure and transportation services are to ensuring the movement of people and goods. Beyond capital funding that will invest in building and strengthening critical transportation infrastructure around the province as outlined on page 69, Budget 2022 provides more than $78 million across the fiscal plan to keep British Columbians moving. An allocation of $30 million is provided to keep provincial highways and roads in good repair and in safe conditions for the traveling public — including road and bridge maintenance, electrical maintenance on highways and pavement markings. Funding of $48 million over three years is provided to BC Transit and BC Ferries services, ensuring that more than 1.8 million British Columbians have access to local and regional transit services in over 130 communities. The Province has also responded with funding to address the severe damage to the provincial highway network that occurred during the November 2021 storms, to ensure that people and goods continue to move as quickly as possible. This is further discussed on page 31.

Transitioning to a Sustainable Economy

Old Growth Strategic Review

In November 2021, the Province announced its intention to work in partnership with First Nations to defer the harvest of ancient, rare and priority large stands of old growth within 2.6 million hectares of B.C.’s most at-risk old-growth forests. Logging deferrals were established to prevent irreversible biodiversity loss while First Nations, the Province, and industry develop a new approach to sustainable forest management that prioritizes ecosystem health and community prosperity throughout British Columbia.

Budget 2022 provides more than $185 million over the next three years to bring forth coordinated and comprehensive supports to help forest workers and contractors, industry, communities, and First Nations to adapt and respond to the impacts of deferrals. This includes connecting workers with short-term employment opportunities, and education and skills training for community members. It also includes funding of partnerships with businesses and communities to assist them through the transition to create jobs through diversified economies and infrastructure projects. Funding will also support the Bridging to Retirement program, which will support eligible forestry workers and contractors 55 years or older to transition to retirement.

Budget and Fiscal Plan - 2022/23 to 2024/25

19

Three Year Fiscal Plan

Sustainable Lands, Water and Resource Management

The stewardship of British Columbia’s land and marine environments has become increasingly important and complex. These environments are impacted by climate change, increased demands to access natural resources and the need to ensure British Columbia’s biodiversity is well managed. Budget 2022 provides over $44 million in new funding to support the creation of the Ministry of Land, Water and Resource Stewardship and support government’s goals of economic activity, environmental sustainability, and reconciliation with Indigenous Peoples. The new ministry will incorporate programs that are currently housed in other ministries, including: land use policy and planning; fisheries and coastal policy and planning; and aquatic and terrestrial habitat management. In addition, the ministry will have a leadership role working with Indigenous governments and organizations to develop a new vision and policies for land, water and resource management to bring government’s natural resource policy framework in line with the Declaration on the Rights of Indigenous Peoples Act.

Advancing Mining Opportunities

British Columbia’s mining sector can play a critical role supporting the transition to a low-carbon future both locally and globally. Metals and minerals found within B.C. are used to create green technology, such as electric vehicles and wind turbines, and B.C. mining operations stand out as having a lower greenhouse gas intensity than most global competitors. In addition, B.C.’s mining sector saw near record levels of investment in mineral exploration in 2021, totalling nearly $700 million. Budget 2022 provides $18 million over the next three years to continue the Regulatory Excellence in Mining strategy and support robust and efficient decision-making processes across regulatory agencies. This funding will help to attract investment in mining and create jobs, advance reconciliation, and enhance environmental outcomes in support of a safe and thriving mining sector in British Columbia.

Investing in Life Sciences Research

The province’s life sciences sector is made up of more than 2,000 companies, employing 18,000 British Columbians and creating medical innovations and research that improve health care delivery around the world. The pandemic has displayed the importance of a thriving life sciences sector. In 2021/22, government is investing in further developing and providing training opportunities in B.C.’s expanding life sciences sector through $195 million in grant funding to Genome BC and Michael Smith Health Research BC. This funding represents a significant increase in the Province’s investments in these organizations and will enable them to increase funding provided for researchers and research projects in B.C.

Grant funding will provide significant benefit to workforce readiness and job creation in B.C. Since its inception in 2000, Genome BC has generated over $1.2 billion of investments in more than 450 B.C.-based research and innovation projects, brought in more than $900 million in funding to B.C. researchers, and created over 32,000 jobs in the province. Funding provided to Genome BC will enable it to invest in research projects, supporting researchers in applying genomics to new and improved products, services and commercial opportunities.

Budget and Fiscal Plan - 2022/23 to 2024/25

20

Three Year Fiscal Plan

Michael Smith Health Research BC has a mandate to develop, retain and attract people whose research improves the health of British Columbians, address health system priorities, create jobs, and add to the knowledge economy. Researchers funded by the organization leverage government investments by attracting additional funding from both public and private organizations, resulting in further job creation and economic benefits. In 2020/21, researchers received eight times the value of their award in additional research funding, totalling $730,000 per scholar.

Through the research it funds, Michael Smith Health Research BC trains the next generation of health researchers, many of whom stay in B.C. Funding provided to the organization will enable it to provide grants to researchers to develop their talent, advance patient-orientated research and address B.C.-specific health and health system priorities.

Table 1.2.2 Investments for a Strong Economy

| ($ millions) | | | 2021/22 | | | | 2022/23 | | | | 2023/24 | | | | 2024/25 | | | | Total | |

| Stronger BC Economic Plan | | | — | | | | 11 | | | | 21 | | | | 21 | | | | 54 | |

| Addressing the Housing Challenge | | | — | | | | 111 | | | | 12 | | | | 43 | | | | 166 | |

| Enhancing Digital Connectivity* | | | — | | | | 5 | | | | 7 | | | | 91 | | | | 104 | |

| Moving British Columbians and Goods | | | — | | | | 26 | | | | 26 | | | | 26 | | | | 78 | |

| Old Growth Supports | | | — | | | | 112 | | | | 44 | | | | 31 | | | | 185 | |

| Land, Water and Resource Stewardship | | | — | | | | 10 | | | | 17 | | | | 17 | | | | 44 | |

| Advancing Mining Opportunities | | | — | | | | 8 | | | | 8 | | | | 2 | | | | 18 | |

| Life Sciences Research | | | 195 | | | | — | | | | — | | | | — | | | | 195 | |

| Job Training and Skills Development | | | — | | | | 39 | | | | 14 | | | | 14 | | | | 67 | |

| Declaration Act Secretariat | | | — | | | | 4 | | | | 4 | | | | 4 | | | | 12 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total | | | 195 | | | | 326 | | | | 154 | | | | 250 | | | | 925 | |

Table may not sum due to rounding. Table includes Contingencies allocations.

*Funding to enhance digital connectivity builds on $40 million of new funding in Budget 2021 , and includes funding commitments to 2026/27. The total Budget 2022 investment is $289 million through 2026/27.

Building the Skills for Tomorrow’s Economy

Strengthening B.C.’s Training System

The pandemic has demonstrated the importance of a diverse workforce supply to meet the challenges caused by skills shortages and business volatility, and to continue to ensure a strong and sustainable recovery. The BC Labour Market Outlook forecasts that B.C.’s economy will be strong over the next decade, with over one million job openings forecasted by 2031. Almost 80 per cent of these jobs are in high-growth sectors such as health care and technology and will require post-secondary education or training.

Since 2017, government has been actively investing in new post-secondary education and skills training initiatives and has created nearly 2,900 new technology student spaces at public post-secondary institutions, provided new funding for hiring and training critical health care workers, expanded access to short-term education and skills training, and provided additional funding for Indigenous skills training.

Government is now developing a comprehensive workforce readiness plan titled Future Ready: Skills for the Jobs of Tomorrow, to proactively address both systemic and emerging workforce challenges, such as shifting demographics and climate adaptation. This strategy will build upon StrongerBC investments of $48 million in 2020/21 and Budget 2021 investments of $32 million in 2021/22 that have provided short-term skills training for unemployed or precariously employed people, and Indigenous-led training with an aim to prepare participants for long-term jobs in tomorrow’s economy.

Budget and Fiscal Plan - 2022/23 to 2024/25

21

Three Year Fiscal Plan

An early component of the action plan is the inclusion of $25 million in 2022/23 as part of Budget 2022 to continue to expand training for health care assistants to address critical staffing shortages in the long-term care, assisted living and home care sectors. This builds on previous investments of $75 million in Budget 2021 and will enable the Province to create 2,000 post-secondary seats for health care assistants in 2022/23, which will enable the Province to hire more than 5,000 new health care assistants by 2022/23. In addition, the Province’s capital plan includes $4.3 billion over the next three years for capital investments at post-secondary institutions. This is further discussed on page 66.

An additional $21 million of funding is provided over the next three years to meet the growing demand for adult education through the Graduated Adult Program. In September 2017, government announced the restoration of tuition-free Academic Upgrading and Literacy Foundations that provides for pre-post-secondary programs designed to improve learners’ literacy, numeracy, language, and academic skills. This enables learners to continue into post-secondary education and find new or better employment.

Skilled Trades Certification

In 2021, government introduced a Skilled Trades Certification policy that will initially apply to 10 electrical, mechanical, and automotive trades. This policy will require tradespeople to be either a certified journeyperson or a registered apprentice to practice their trade. Uncertified workers are often paid less and have lower rates of employment stability and mobility. This policy will raise skill levels in the trades to enhance productivity, increase the prestige of the trades to attract workers, and provide more opportunities for trades workers to benefit from post-secondary training.

To support these goals, government is investing $21 million over three years to create trades training seats, expand targeted programs and services to support uncertified workers to become apprentices or obtain certifications, and engage in monitoring and compliance activities at worksites. Funding will be provided to the Industry Training Authority.

Community Benefits Agreements

Community Benefit Agreements (CBAs) allow government to leverage record levels of capital project investments in transportation, post-secondary, and health care projects to deliver community benefits in the form of training the next generation of skilled workers, increase opportunities for locals and underrepresented groups, and expand the construction workforce. This encourages the adoption of trades skills by a broader cross section of British Columbians and helps address the anticipated skilled labour needs of the construction sector.