Exhibit 99.4

SECOND QUARTERLY REPORT

2023/24 FINANCIAL UPDATE,

ECONOMIC OUTLOOK

&

SIX MONTH FINANCIAL RESULTS

APRIL - SEPTEMBER 2023

British Columbia Cataloguing in Publication Data

British Columbia. Ministry of Finance.

Quarterly report on the economy, fiscal situation and Crown corporations. — ongoing—

Quarterly.

Title on cover: Quarterly report.

Continues: British Columbia. Ministry of Finance.

Quarterly financial report. ISSN 0833-1375.

ISSN 1192-2176 — Quarterly Report on the economy, fiscal situation and Crown corporations.

1. Finance, Public — British Columbia — Accounting — Periodicals. 2. British Columbia — Economic conditions — 1945— — Periodicals.*

3. Corporations, Government — British Columbia — Accounting — Periodicals. I. Title.

HJ13.B77 354.711'007231'05

2023/24 SECOND QUARTERLY REPORT

NOVEMBER 28, 2023 | | TABLE OF CONTENTS |

| Part One — Updated Financial Forecast | |

| | |

| Introduction | 3 |

| | |

| Revenue | 5 |

| | |

| Expense | 8 |

| Consolidated Revenue Fund (CRF) Spending | 8 |

| Service Delivery Agency Spending | 9 |

| | |

| Full-Time Equivalents for the BC Public Service | 9 |

| | |

| Provincial Capital Spending | 10 |

| Projects Over $50 Million | 10 |

| | |

| Provincial Debt | 12 |

| | |

| Risks to the Fiscal Forecast | 14 |

| | |

| Supplementary Schedules | 15 |

| | |

| Tables: | |

| 1.1 | Forecast Update | 3 |

| 1.2 | Financial Forecast Changes | 4 |

| 1.3 | Comparison of Major Factors Underlying Revenue | 6 |

| 1.4 | Pandemic Recovery Contingencies | 9 |

| 1.5 | Capital Spending Update | 10 |

| 1.6 | Provincial Debt Update | 12 |

| 1.7 | Operating Statement | 15 |

| 1.8 | Revenue by Source | 16 |

| 1.9 | Expense by Ministry, Program and Agency | 17 |

| 1.10 | Expense by Function | 18 |

| 1.11 | Capital Spending | 19 |

| 1.12 | Capital Expenditure Projects Greater Than $50 million | 20 |

| 1.13 | Provincial Debt | 24 |

| 1.14 | Statement of Financial Position | 25 |

| 1.15 | Material Assumptions – Revenue | 26 |

| 1.16 | Material Assumptions – Expense | 31 |

| 1.17 | Full-Time Equivalents (FTEs) | 34 |

| | Second Quarterly Report 2023/24 | | i |

Table Of Contents

| Part Two — Economic Review and Outlook | |

| | |

| Summary | 35 |

| | |

| British Columbia Economic Activity and Outlook | 36 |

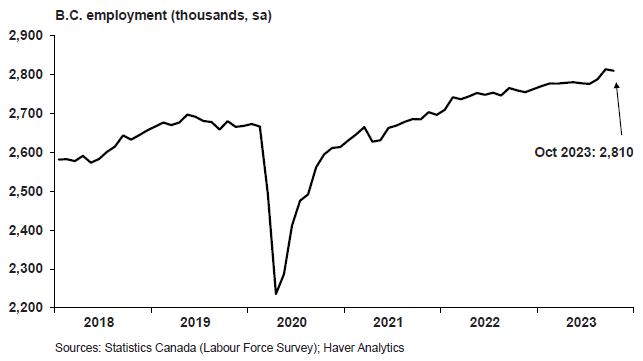

| Labour Market | 37 |

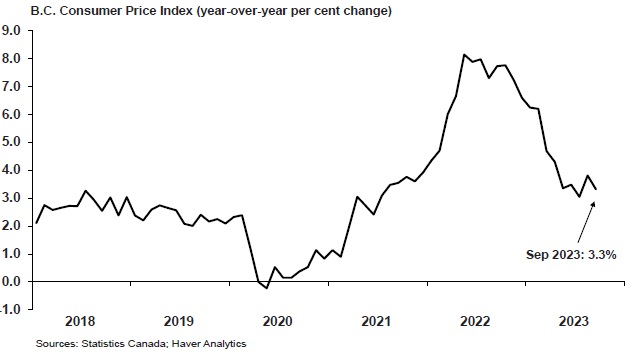

| Consumer Spending and Inflation | 38 |

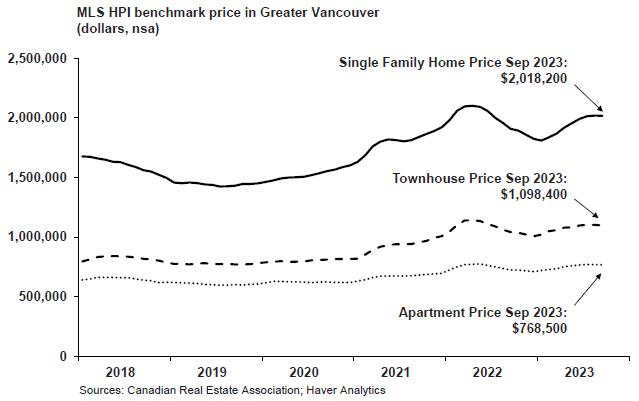

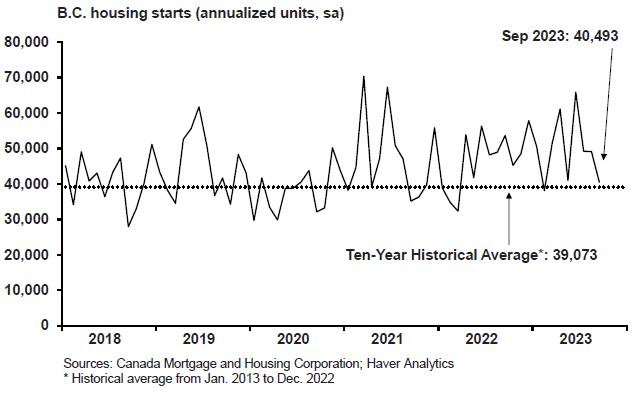

| Housing | 40 |

| Business and Government | 43 |

| External Trade and Commodity Markets | 44 |

| Demographics | 45 |

| | |

| Risks to the Economic Outlook | 46 |

| | |

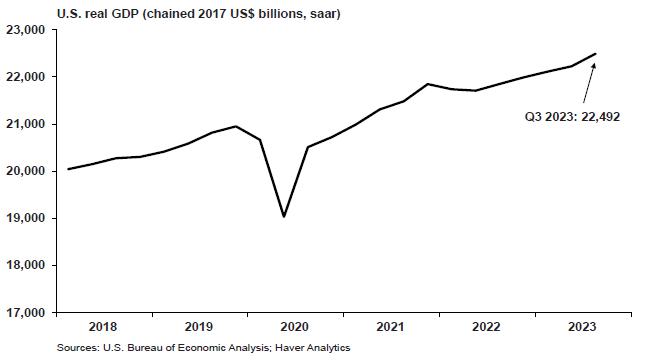

| External Outlook | 46 |

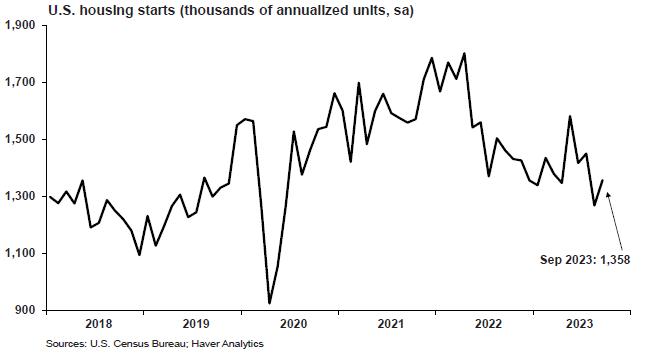

| United States | 46 |

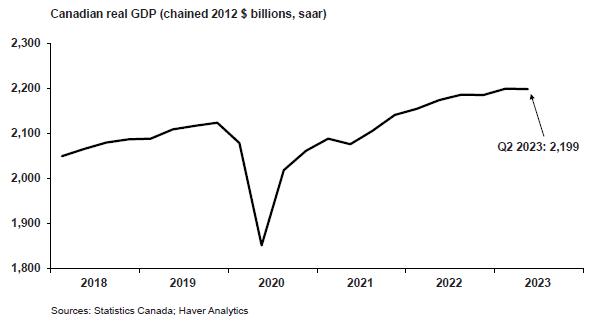

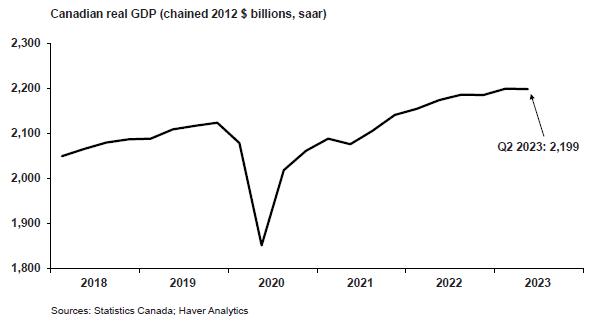

| Canada | 49 |

| Asia | 51 |

| Europe | 51 |

| | |

| Financial Markets | 52 |

| Interest Rates | 52 |

| Exchange Rate | 54 |

| | |

| Tables: | |

| 2.1 | British Columbia Economic Indicators | 36 |

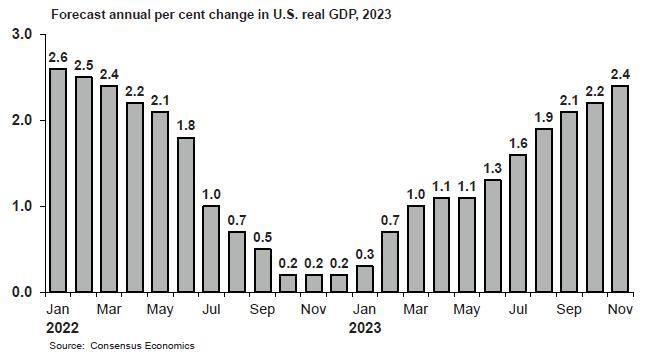

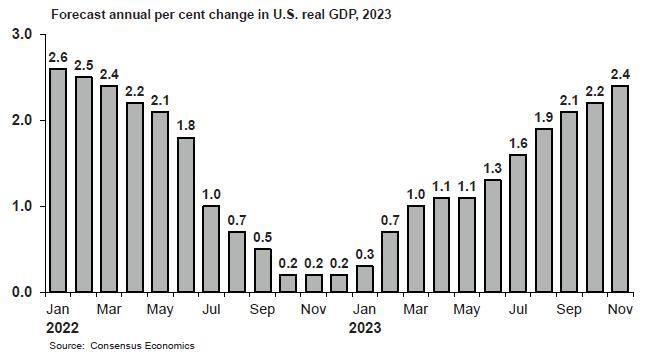

| 2.2 | U.S. Real GDP Forecast: Consensus versus B.C. Ministry of Finance | 48 |

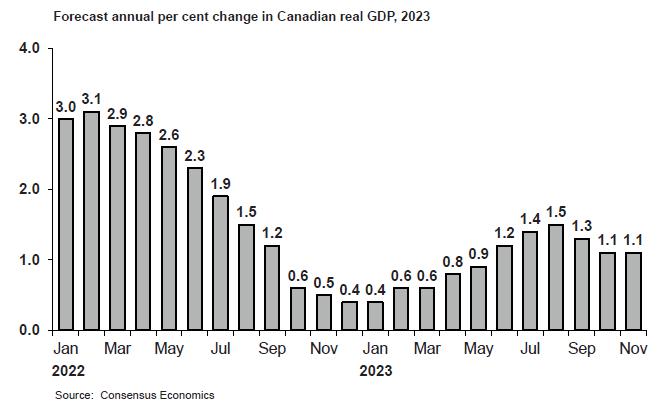

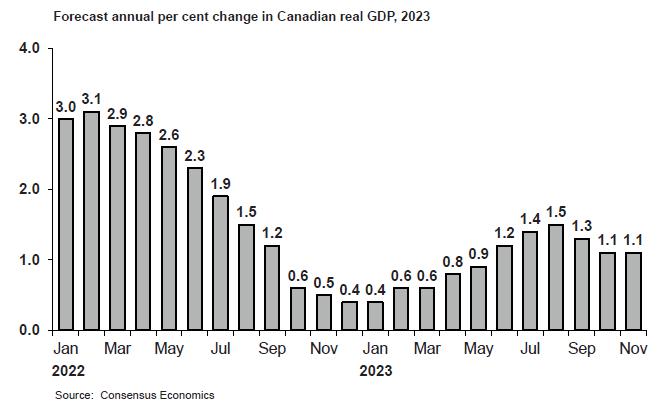

| 2.3 | Canadian Real GDP Forecast: Consensus versus B.C. Ministry of Finance | 50 |

| 2.4 | Private Sector Canadian Interest Rate Forecasts | 53 |

| 2.5 | Private Sector Exchange Rate Forecasts | 54 |

| 2.6.1 | Gross Domestic Product (GDP): British Columbia | 55 |

| 2.6.2 | Selected Nominal Income and Other Indicators: British Columbia | 56 |

| 2.6.3 | Labour Market Indicators: British Columbia | 56 |

| 2.6.4 | Major Economic Assumptions | 57 |

| | |

| Topic Box: | |

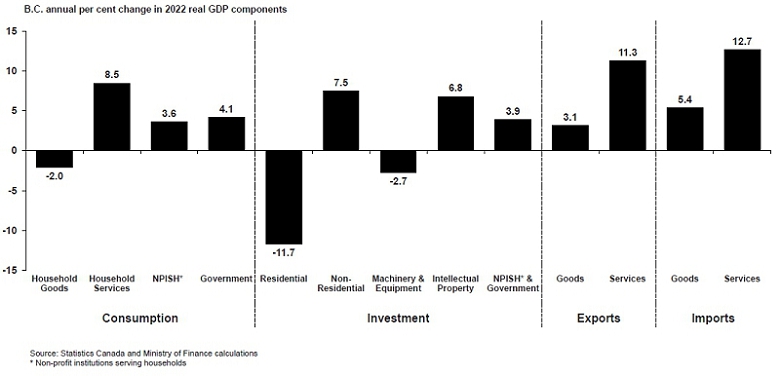

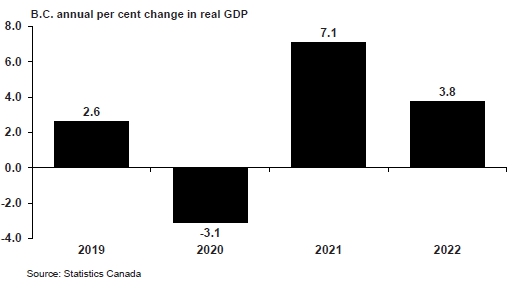

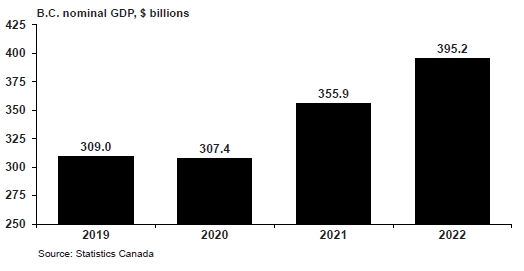

| Provincial Economic Accounts Update | 59 |

| ii | | Second Quarterly Report 2023/24 | |

PART 1 | UPDATED FINANCIAL FORECAST

Introduction

Table 1.1 2023/24 Forecast Update

| ($ millions) | | Budget

2023 | | | First

Quarterly

Report | | | Second

Quarterly

Report | |

| Revenue | | | 77,690 | | | | 76,228 | | | | 77,663 | |

| Expense | | | (80,206 | ) | | | (81,202 | ) | | | (81,520 | ) |

| Pandemic Recovery Contingencies | | | (1,000 | ) | | | (1,000 | ) | | | (1,000 | ) |

| Forecast allowance | | | (700 | ) | | | (700 | ) | | | (700 | ) |

| Deficit | | | (4,216 | ) | | | (6,674 | ) | | | (5,557 | ) |

| Capital Spending: | | | | | | | | | | | | |

| Taxpayer-supported capital spending | | | 11,813 | | | | 12,180 | | | | 11,171 | |

| Self-supported capital spending | | | 4,027 | | | | 4,073 | | | | 4,055 | |

| | | | 15,840 | | | | 16,253 | | | | 15,226 | |

| Provincial Debt: | | | | | | | | | | | | |

| Taxpayer-supported debt | | | 75,617 | | | | 70,772 | | | | 69,301 | |

| Self-supported debt | | | 31,607 | | | | 31,562 | | | | 31,603 | |

| Total debt (including forecast allowance) | | | 107,924 | | | | 103,034 | | | | 101,604 | |

| Taxpayer-supported debt-to-GDP ratio | | | 18.9 | % | | | 17.6 | % | | | 17.0 | % |

| Taxpayer-supported debt-to-revenue ratio | | | 100.1 | % | | | 95.5 | % | | | 91.6 | % |

The Second Quarterly Report shows an improvement to the 2023/24 deficit forecast from $6.7 billion to $5.6 billion. The lower deficit forecast is mainly from income tax projections based on updated 2022 income tax assessment information from the Canada Revenue Agency, and expected federal government contributions towards the spending related to the recent wildfires.

Income tax revenue forecasts are based on delayed information from tax returns that are filed and assessed after a year has ended. These forecasts have been subject to higher than normal adjustments in an environment of uncertainties such as inflation, high interest rates, effects of the pandemic, and global developments. In September, the Province's projections for personal and corporate income tax revenue were revised downwards based on the preliminary 2022 tax assessment results, and the latest data shows more positive results.

Details of the revenue and expense forecast changes are shown in Table 1.2 and Chart 1.1.

(continued on page 5)

| | Second Quarterly Report 2023/24 | | 3 |

Updated Financial Forecast

| Table 1.2 2023/24 Financial Forecast Changes | | | | | | | | | | | | |

| | | | ($ millions) | |

| 2023/24 deficit at Budget 2023 (February 28, 2023) | | | (4,216 | ) | | | | | | | (4,216 | ) |

| 2023/24 deficit at the First Quarterly Report (September 27, 2023) | | | | | | | (6,674 | ) | | | | |

| | | | | | | | | | | | | |

| | | | Q1 | | | | Q2 | | | | Total | |

| | | | Update | | | | Update | | | | Changes | |

| Revenue1 changes: | | | | | | | | | | | | |

| Personal income tax – changes based on preliminary 2022 tax assessment and improvement in 2023 household income | | | (522 | ) | | | 551 | | | | 29 | |

| Corporate income tax – gain in prior-year settlement payment, and increase in instalments reflecting revised outlook of 2023 national corporate taxable income | | | 99 | | | | 579 | | | | 678 | |

| Provincial sales tax – higher 2022/23 carry forward and year-to-date sales activity | | | 175 | | | | - | | | | 175 | |

| Property transfer tax – due to higher than expected sales results | | | 151 | | | | - | | | | 151 | |

| Carbon tax – lower sales volume in most fuel types reflecting prior year and year-to-date results | | | (111 | ) | | | (50 | ) | | | (161 | ) |

| Tobacco tax – reflecting lower prior year and year-to-date sales results | | | (45 | ) | | | - | | | | (45 | ) |

| Other taxation sources – mainly reflecting the impacts of the 2022/23 year-end and year-to-date results | | | 122 | | | | (12 | ) | | | 110 | |

| Natural gas royalties – changes in prices, volumes and utilization of royalty and infrastructure programs/credits, lower natural gas liquids royalties | | | (1,179 | ) | | | 61 | | | | (1,118 | ) |

| Mining – lower production and changes in coal and copper prices | | | (174 | ) | | | (35 | ) | | | (209 | ) |

| Electricity sales under the Columbia River Treaty – lower Mid-C electricity prices | | | (44 | ) | | | (12 | ) | | | (56 | ) |

| Forests – mainly changes in stumpage rates and lower harvest volumes | | | 40 | | | | (94 | ) | | | (54 | ) |

| Other natural resources – mainly changes in water rental revenues, lower petroleum royalties and rental tenure revenue | | | (23 | ) | | | (1 | ) | | | (24 | ) |

| Fees, licences, investment earnings and miscellaneous revenue: | | | | | | | | | | | | |

| Post-secondary institutions | | | 36 | | | | 157 | | | | 193 | |

| Other sources – mainly lower vote recoveries related to interest from agencies | | | 111 | | | | (100 | ) | | | 11 | |

| Canada health and social transfers – mainly higher B.C. share of national population | | | 282 | | | | 134 | | | | 416 | |

| Other federal government transfers – mainly changes in claims under the Disaster Financial Assistance Arrangements. Addition of 2023 wildfire claims offset by lower 2021 rainstorm claims | | | (383 | ) | | | 260 | | | | (123 | ) |

| Commercial Crown corporation net income | | | 3 | | | | (3 | ) | | | - | |

| Total revenue changes | | | (1,462 | ) | | | 1,435 | | | | (27 | ) |

| | | | | | | | | | | | | |

| Less: expense1 increases (decreases): | | | | | | | | | | | | |

| Consolidated Revenue Fund changes: | | | | | | | | | | | | |

| Statutory spending: | | | | | | | | | | | | |

| Fire management costs | | | 762 | | | | 20 | | | | 782 | |

| Housing Priority Initiatives Special Account | | | 104 | | | | - | | | | 104 | |

| Other statutory spending | | | 17 | | | | 16 | | | | 33 | |

| Refundable tax credits – mainly reflects preliminary 2022 tax assessment information | | | (81 | ) | | | (44 | ) | | | (125 | ) |

| Other expense changes – mainly higher interest costs | | | 91 | | | | 98 | | | | 189 | |

| Spending recovered from external parties | | | (73 | ) | | | 130 | | | | 57 | |

| Changes in spending profile of service delivery agencies: | | | | | | | | | | | | |

| School districts | | | 177 | | | | - | | | | 177 | |

| Universities | | | 165 | | | | 93 | | | | 258 | |

| Colleges and institutes | | | 152 | | | | 30 | | | | 182 | |

| Health authorities and hospital societies | | | 1,170 | | | | 1,450 | | | | 2,620 | |

| Other service delivery agencies2 | | | 455 | | | | (28 | ) | | | 427 | |

| (Increase) decrease in transfers to service delivery agencies - accounting elimination | | | (1,943 | ) | | | (1,447 | ) | | | (3,390 | ) |

| Total expense changes | | | 996 | | | | 318 | | | | 1,314 | |

| Total changes | | | (2,458 | ) | | | 1,117 | | | | (1,341 | ) |

| 2023/24 deficit at the First Quarterly Report | | | (6,674 | ) | | | | | | | | |

| 2023/24 deficit at the Second Quarterly Report | | | | | | | (5,557 | ) | | | (5,557 | ) |

1 Detailed descriptions of changes are provided in the revenue and expense sections of this report.

2 Includes BC Transportation Financing Authority, BC Transit, BC Housing Management Commission, Community Living BC, and other entities.

| 4 | | Second Quarterly Report 2023/24 | |

Updated Financial Forecast

Projected taxpayer-supported capital spending in 2023/24 is $11.2 billion, which is $1.0 billion lower than the First Quarterly Report, mainly due to timing of projects in the transportation sector. The self-supported capital spending forecast is $4.1 billion, with minimal changes from the First Quarterly Report.

As a result of higher revenues and lower capital spending forecast, taxpayer-supported debt at the end of 2023/24 is forecast at $69.3 billion, lower by $1.5 billion compared to the First Quarterly Report. The lower debt balance results in improved debt metrics, with B.C.'s taxpayer-supported debt-to-GDP ratio now forecast to be 17.0 per cent, and debt-to-revenue at 91.6 per cent.

Chart 1.1 2023/24 Deficit – Major Changes from the First Quarterly Report

Improvement of $1.1 billion

$ millions

Revenue

Revenue for 2023/24 is forecast to be $77.7 billion — $1.4 billion higher than the projection in the First Quarterly Report. The forecast for taxation revenues has increased by $1.1 billion, reflecting higher than expected 2022 income tax assessments and improved household income and wages growth. The remaining $300 million increase to revenue mainly reflects higher federal funding for wildfire spending under the Disaster Financial Assistance Arrangements, and increased Canada health and social transfers.

Detailed revenue projections are disclosed in Table 1.8, and key assumptions and sensitivities relating to revenue are provided in Table 1.15. An analysis on historical volatility of major economic drivers of revenue can be found in the 2023 British Columbia Financial and Economic Review (pages 17-18).

| | Second Quarterly Report 2023/24 | | 5 |

Updated Financial Forecast

Table 1.3 Comparison of Major Factors Underlying Revenue

| Calendar Year | | Second Quarterly Report | | | First Quarterly Report | |

| Per cent growth unless otherwise indicated | | 2022 | | | 2023 | | | 2024 | | | 2022 | | | 2023 | | | 2024 | |

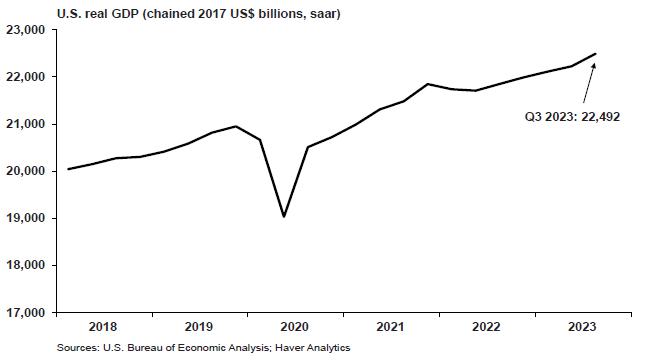

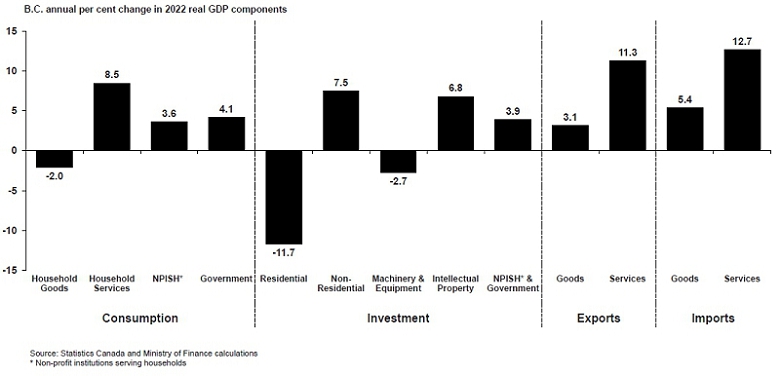

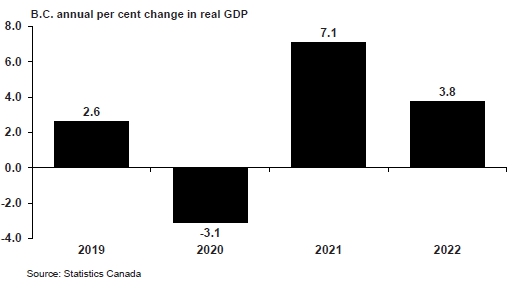

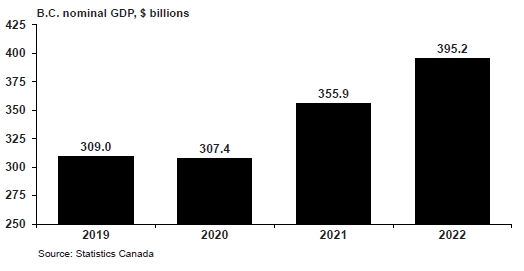

| Real GDP | | | 3.8 | | | | 1.0 | | | | 0.7 | | | | 3.3 | | | | 1.2 | | | | 0.8 | |

| Nominal GDP | | | 11.0 | | | | 3.1 | | | | 3.5 | | | | 11.7 | | | | 2.9 | | | | 3.3 | |

| Household income | | | 6.8 | | | | 6.7 | | | | 4.2 | | | | 6.7 | | | | 6.3 | | | | 4.2 | |

| Wages and salaries | | | 9.7 | | | | 6.2 | | | | 5.2 | | | | 10.7 | | | | 5.9 | | | | 5.1 | |

| Corporations net operating surplus | | | 9.3 | | | | -12.3 | | | | -6.6 | | | | 20.8 | | | | -11.8 | | | | -9.1 | |

| Employment | | | 3.2 | | | | 1.4 | | | | 0.6 | | | | 3.2 | | | | 1.1 | | | | 0.8 | |

| Consumer expenditures on durable goods | | | 2.2 | | | | 2.1 | | | | 0.6 | | | | -2.6 | | | | 2.0 | | | | 0.8 | |

| Consumer expenditures on goods and services | | | 9.8 | | | | 5.2 | | | | 4.9 | | | | 10.4 | | | | 6.4 | | | | 4.7 | |

| Business investment | | | 7.9 | | | | 4.8 | | | | 4.6 | | | | 12.7 | | | | 4.0 | | | | 4.8 | |

| Residential investment | | | 1.0 | | | | 5.2 | | | | 3.7 | | | | 8.6 | | | | 3.3 | | | | 3.5 | |

| Retail sales | | | 3.1 | | | | 0.7 | | | | 2.2 | | | | 3.1 | | | | 2.4 | | | | 2.5 | |

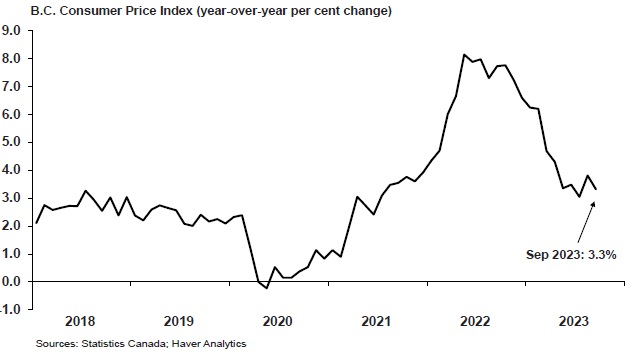

| Consumer Price Index | | | 6.9 | | | | 4.0 | | | | 2.7 | | | | 6.9 | | | | 3.9 | | | | 2.5 | |

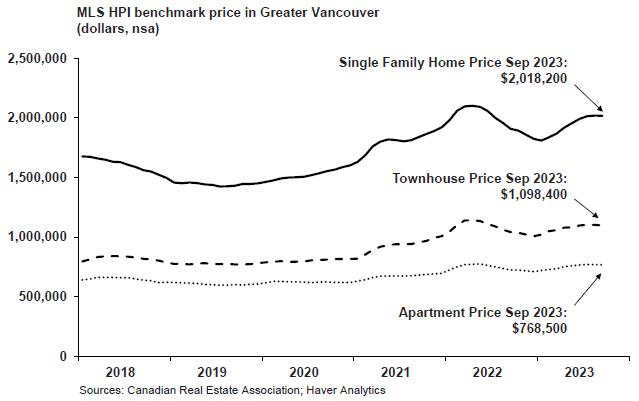

| Residential sales value | | | -30.2 | | | | -9.5 | | | | 11.8 | | | | -30.4 | | | | -11.6 | | | | 16.9 | |

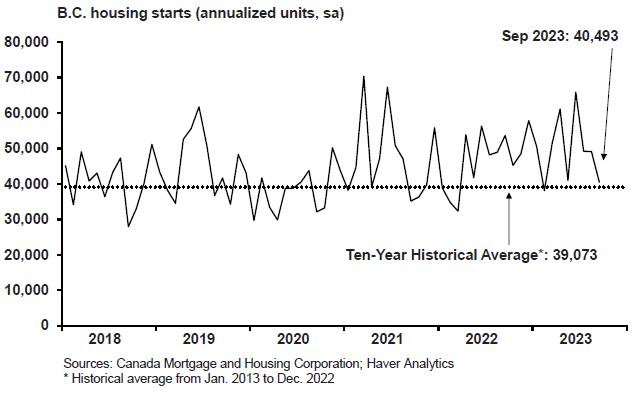

| B.C. Housing starts | | | -1.9 | | | | 1.4 | | | | -9.3 | | | | -1.9 | | | | 0.0 | | | | -9.8 | |

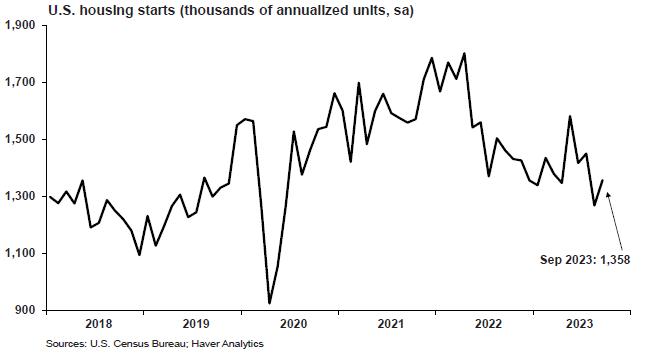

| U.S. Housing starts | | | -3.0 | | | | -10.5 | | | | -1.4 | | | | -3.0 | | | | -11.1 | | | | -2.5 | |

| SPF 2x4 price ($US/thousand board feet) | | $ | 814 | | | $ | 400 | | | $ | 450 | | | $ | 814 | | | $ | 400 | | | $ | 450 | |

| Exchange rate (US cents/Canadian dollar) | | | 76.8 | | | | 74.2 | | | | 74.9 | | | | 76.8 | | | | 74.7 | | | | 75.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal Year | | 2022/23 | | | 2023/24 | | | 2024/25 | | | 2022/23 | | | 2023/24 | | | 2024/25 | |

| Natural gas price ($Cdn/GJ at plant inlet) | | $ | 4.09 | | | $ | 1.40 | | | $ | 1.97 | | | $ | 4.09 | | | $ | 1.29 | | | $ | 2.03 | |

| Bonus bid average bid price per hectare ($) | | $ | 0 | | | $ | 200 | | | $ | 200 | | | $ | 0 | | | $ | 200 | | | $ | 200 | |

| Electricity price ($US/mega-watt hour, Mid-C) | | $ | 85 | | | $ | 89 | | | $ | 92 | | | $ | 85 | | | $ | 93 | | | $ | 90 | |

| Metallurgical coal price ($US/tonne, fob Australia) | | $ | 322 | | | $ | 249 | | | $ | 223 | | | $ | 322 | | | $ | 248 | | | $ | 222 | |

| Copper price ($US/lb) | | $ | 3.87 | | | $ | 3.80 | | | $ | 3.90 | | | $ | 3.87 | | | $ | 3.82 | | | $ | 3.96 | |

| Average stumpage rates ($Cdn/cubic metre) | | $ | 38.05 | | | $ | 18.45 | | | $ | 18.92 | | | $ | 38.05 | | | $ | 19.04 | | | $ | 19.42 | |

| Crown harvest volumes (million cubic metres) | | | 37.2 | | | | 34.0 | | | | 34.0 | | | | 37.2 | | | | 38.0 | | | | 38.0 | |

The major changes from the First Quarterly Report forecast include the following:

Income Tax Revenues

The personal income tax revenue forecast is up $551 million due to stronger 2022 preliminary tax assessment information, and slightly improved 2023 household income. The forecast reflects a prior year impact of $352 million and a $199 million on-going base effect.

Corporate income tax revenue is up $579 million mainly reflecting stronger preliminary assessments of the 2022 corporate income tax results. The forecast includes a higher prior year settlement payment of $414 million and an improvement of $165 million in advance instalment payments from the federal government.

Other Tax Revenues

Carbon tax revenues are down $50 million due to the impacts of lower year-to-date sales volumes on major fuel types.

Fuel tax revenues are down $12 million due to the impact of lower year-to-date sales volumes.

| 6 | | Second Quarterly Report 2023/24 | |

Updated Financial Forecast

Natural Resource Revenue

Revenue from natural gas royalties is up $61 million mainly due to higher natural gas prices and increased production volumes, partially offset by increased utilization of royalty program credits. The updated natural gas price forecast is $1.40 ($Cdn/gigajoule, plant inlet), up from the First Quarterly Report estimate ($1.29). Prices remain significantly lower than the Budget 2023 forecast of $3.04.

Revenue from coal, metals, minerals and other mining-related sources is down $35 million mainly due to lower coal production volume and year-to-date mineral tax instalment payments.

Forest revenue is down $94 million mainly due to lower harvest volumes which have resulted in lower BC Timber Sales and timber tenures stumpage revenue. Harvest volumes of Crown land timber are forecast to be 34 million cubic metres, down 4 million cubic metres from the First Quarterly Report. Total stumpage rates are forecast to be $18.45 Cdn/cubic metre in 2023/24, down from the First Quarterly Report estimate ($19.04).

Revenue from other natural resources is down $13 million mainly due to lower revenue from electricity sales under the Columbia River Treaty reflecting lower Mid-Columbia electricity prices. Mid-Columbia electricity prices are forecast to be $89.30 ($US/mega-watt hours) in 2023/24, down from the First Quarterly Report estimate ($92.90).

Other Revenue

Other revenue consists of revenue from fees, licences, investment earnings and miscellaneous sources. These revenue sources are now expected to total $10.7 billion, up $57 million from the First Quarterly Report. The updated forecast for fee revenues totals $5.3 billion, up $44 million mainly due to higher projections from health authorities. The revised forecast for investment earnings is $1.3 billion, down $103 million mainly due to lower interest recoveries from agencies to reflect the adoption of changes in accounting standards related to financial instruments, as well as lower expected investment incomes for universities. The lower vote recovery funding has an equal and offsetting expense decrease. The miscellaneous revenue outlook of $4.1 billion is up $116 million mainly due to increased projections from universities.

Federal Government Transfers

Federal government contributions are expected to be $13.9 billion, up $394 million.

Canada health and social transfers have increased by $134 million mainly due to an improved B.C. share of the national population, reflecting the most recent analysis of 2021 census population data. The changes to the estimates include $55 million related to the 2022/23 fiscal year and $79 million related to 2023/24.

| | Second Quarterly Report 2023/24 | | 7 |

Updated Financial Forecast

Other federal government contributions are up $260 million mainly reflecting higher funding in support of Disaster Financial Assistance Arrangements consistent with spending forecasts, and higher transfers for the SUCH1 sector entities. Funding in support of Disaster Financial Assistance Arrangements increased $237 million reflecting $358 million funding for 2023 wildfires, partly offset by revised spending forecasts for other events.

Commercial Crown Corporations

The BC Lottery Corporation's net income2 forecast is $14 million lower due to reduced revenue from online gaming and casino revenue. This is partly offset by higher net income of the Liquor Distribution Branch.

Expense

The Second Quarterly Report expense forecast for 2023/24 is $318 million higher than the First Quarterly Report mainly due to higher spending recovered from external revenues, increased debt servicing costs and higher net spending by service delivery agencies.

Consolidated Revenue Fund (CRF) Spending

Total statutory spending is projected to be mainly unchanged since the First Quarterly Report due to the following updates:

| · | $20 million higher for fire management costs - total spending forecast remains at historic high of $986 million; |

| · | $16 million increase in various other statutory spending; offset by |

| · | $44 million lower refundable tax credits. |

Other changes in CRF spending are mainly due to $100 million higher debt servicing costs as a result of higher interest rates.

Contingencies

Budget 2023 includes a Contingencies vote of $5.5 billion in 2023/24, with $1.0 billion in the Pandemic Recovery sub-vote, $2.2 billion allocated to Shared Recovery Mandate, and $2.3 billion allocated to General Programs, CleanBC and Climate & Emergency Response. Contingencies help fund unexpected costs such as flood recovery, increased costs for government services, and emerging priorities. These total allocations remain unchanged in the Second Quarterly Report.

| 1 | SUCH: School districts, universities, colleges and institutes, and health organizations. |

| 2 | Net of payments to the federal government and payments to the BC First Nations Gaming Revenue Sharing Limited Partnership in accordance with section 14.3 of the Gaming Control Act (B. C.). |

| 8 | | Second Quarterly Report 2023/24 | |

Updated Financial Forecast

Table 1.4 provides a forecast on the notional allocations of the Province's pandemic measures as of September 30, 2023.

| Table 1.4 2023/24 Pandemic Recovery Contingencies | |

| | |

| | | Updated Forecast | |

| $ millions | | Q1 | | | Q2 | |

| Initiative | | | | | | | | |

| Health COVID-19 Management | | | 875 | | | | 875 | |

| Supports for Vulnerable Populations | | | 20 | | | | 20 | |

| Tourism Initiative Envelope | | | 20 | | | | 20 | |

| Unallocated: available for additional health or recovery measures | | | 85 | | | | 85 | |

| Total | | | 1,000 | | | | 1,000 | |

Spending Recovered from External Revenues

Expenses funded by third parties are forecast to increase by $130 million. This is mainly due to transfers to First Nations as part of natural resources revenue-sharing agreements, partly offset by lower interest expense recoveries from commercial Crown corporations.

Operating Transfers to Service Delivery Agencies

Operating transfers to service delivery agencies are forecast to be $1.4 billion higher than the First Quarterly Report mainly due to higher allocations to health organizations. These additional transfers generally do not represent incremental government spending; they are reallocations of ministries' existing budgets to better reflect funding to service delivery agencies. These funding increases are related to spending forecast changes noted below.

Service Delivery Agency Spending

Service delivery agency expenses are forecast to increase by $1.5 billion in 2023/24 compared to the First Quarterly Report.

| · | Post-secondary sector expenses are forecast to increase by $123 million mainly due to in-year wage ratifications, including retroactive settlements, and higher operating costs. |

| · | The health authority and hospital society expense forecast increased by $1.4 billion to fully reflect salary increases under the Shared Recovery Mandate, expected pandemic related costs, and increased spending to improve health care services. |

| · | Other service delivery agency spending is forecast to be $28 million lower due to various updates across a number of agencies. |

Detailed expense projections are in Table 1.9. Key spending assumptions and sensitivities are provided in Table 1.16.

Full-Time Equivalents for the BC Public Service

The projection of full-time equivalent (FTE) staff utilization for 2023/24 is 36,200, an increase of 700 FTEs since the First Quarterly Report. These FTEs reflect the response to a significant wildfire season. The growth is also related to continued implementation of key government priorities (such as natural resource sector initiatives) and caseload driven programs such as children and family services and justice and public safety.

| | Second Quarterly Report 2023/24 | | 9 |

Updated Financial Forecast

Provincial Capital Spending

Capital spending is projected to total $15.2 billion in 2023/24 — $1.0 billion lower than the forecast in the First Quarterly Report (see Tables 1.5 and 1.11).

Taxpayer-supported capital spending is projected at $11.2 billion. The $1.0 billion decrease since the First Quarterly Report is primarily due to changes in the timing of capital spending in the transportation sector.

These changes do not represent a reduction in capital spending; rather the spending has been shifted to future years within the provincial capital plan.

| Table 1.5 2023/24 Capital Spending Update | |

| | |

| | | ($ millions) | |

| | | Q1 | | | Q2 | | | Total | |

| | | Update | | | Update | | | Changes | |

| Taxpayer-supported capital spending at Budget 2023 | | | 11,813 | | | | | | | | 11,813 | |

| Taxpayer-supported capital spending at the First Quarterly Report | | | | | | | 12,180 | | | | | |

| School districts | | | (29 | ) | | | (36 | ) | | | (65 | ) |

| Post-secondary institutions | | | (33 | ) | | | 19 | | | | (14 | ) |

| Health sector | | | 288 | | | | (35 | ) | | | 253 | |

| Transportation sector | | | (3 | ) | | | (909 | ) | | | (912 | ) |

| Social housing | | | 133 | | | | (36 | ) | | | 97 | |

| Other net adjustments to capital schedules | | | 11 | | | | (12 | ) | | | (1 | ) |

| Total taxpayer-supported changes | | | 367 | | | | (1,009 | ) | | | (642 | ) |

| Taxpayer-supported capital spending - updated forecast | | | 12,180 | | | | 11,171 | | | | 11,171 | |

| Self-supported capital spending at Budget 2023 | | | 4,027 | | | | | | | | 4.027 | |

| Self-supported capital spending at the First Quarterly Report | | | | | | | 4,073 | | | | | |

| BC Hydro | | | 46 | | | | - | | | | 46 | |

| BC Lottery Corporation | | | - | | | | (18 | ) | | | (18 | ) |

| Total self-supported changes | | | 46 | | | | (18 | ) | | | 28 | |

| Self-supported capital spending - updated forecast | | | 4,073 | | | | 4,055 | | | | 4,055 | |

| 2023/24 capital spending at the First Quarterly Report | | | 16,253 | | | | | | | | | |

| 2023/24 capital spending at the Second Quarterly Report | | | | | | | 15,226 | | | | 15,226 | |

At $4.1 billion, self-supported capital spending is $18 million lower than the First Quarterly Report, primarily due to changes in the timing of BC Lottery Corporation expenditures.

Projects Over $50 Million

Capital spending on projects greater than $50 million is presented in Table 1.12. Eight projects have been added to the table since the First Quarterly Report:

| · | Nanaimo Long-Term Care ($286 million); |

| · | St. Paul's Hospital Clinical Support and Research Centre ($638 million); |

| · | University Hospital of Northern BC Redevelopment – Phase 1 (Site Preparation) ($103 million); |

| · | Highway 1 Corridor – Nicomen Bridge ($144 million); |

| · | Highway 95 Bridge Replacement ($90 million); |

| · | Highway 1 Fraser Valley Corridor Improvements 264th St. to Mount Lehman Rd. ($2,340 million); |

| 10 | | Second Quarterly Report 2023/24 | |

Updated Financial Forecast

| · | Highway 1 Fraser Valley Corridor Improvements Mount Lehman Rd. to Highway 11 Site Preparation ($100 million); and |

| · | BC Hydro – Burrard switchyard - control building upgrade project ($57 million). |

Since the First Quarterly Report, three projects have been completed and are no longer listed in the table:

| · | Capilano University – New Squamish Campus; |

| · | BC Hydro – UBC load increase stage 2 project; and |

| · | BC Hydro – Mount Lehman substation upgrade project. |

Changes for existing projects since the First Quarterly Report include:

| · | British Columbia Institute of Technology – Student Housing project's anticipated total cost increased from $120 million to $140 million due to additional shoring costs. Internal borrowing increased from $108 million to $128 million; |

| · | Royal Roads University – West Shore Learning Centre project's year of completion was amended from 2024 to 2025 to align with revised project schedule; |

| · | Simon Fraser University – Student Housing project's anticipated total cost increased from $108 million to $111 million to reflect the final budget. Contributions from other funding sources increased by $3 million to $38 million; |

| · | Burnaby Hospital Redevelopment – Phase 1 project's year of completion was amended from 2027 to 2028 due to revised project scope; |

| · | Centre for Children and Youth Living with Health Complexity project's anticipated total cost increased from $222 million to $267 million to reflect revised project budget. Internal borrowing increased from $193 million to $224 million and contributions from other sources increased from $29 million to $43 million; |

| · | FW Green Long-Term Care project's name was updated to Dr. F.W. Green Memorial Home; |

| · | Nanaimo Regional General Hospital – ICU/HAU Redevelopment project's year of completion was amended from 2024 to 2025 to align with revised project schedule; |

| · | New Surrey Hospital and BC Cancer Centre project's year of completion was amended from 2027 to 2029 to align with revised project schedule. The project's anticipated total cost increased from $1.724 billion to $2.881 billion to reflect the updated post-tender budget. Internal borrowing increased from $1.664 billion to $2.816 billion and contributions from other sources increased from $60 million to $65 million; |

| · | Vancouver General Hospital – Operating Rooms Renewal – Phase 1 project's anticipated total cost decreased from $102 million to $101 million to reflect the final budget. Internal borrowing decreased from $35 million to $34 million; |

| · | West Fraser Road Realignment project's anticipated total costs decreased from $103 million to $94 million to reflect revised budget. Internal borrowing decreased from $103 million to $94 million; |

| · | Highway 7 Widening – 266th St. to 287th St. project's anticipated total cost increased from $106 million to $130 million to reflect revised project budget. Internal borrowing increased from $77 million to $101 million; |

| · | Highway 1 216th St. to 264th St. widening project's year of completion was amended from 2025 to 2026 to align with revised project schedule; |

| | Second Quarterly Report 2023/24 | | 11 |

Updated Financial Forecast

| · | BC Hydro – 5L063 Telkwa relocation project's anticipated total cost decreased from $66 million to $53 million due to lower cost of transmission line and access road works; |

| · | BC Hydro – Peace Region Electricity Supply (PRES) project's financing sources were amended to recognize $58 million contribution from the Federal Government. Internal borrowing decreased from $219 million to $161 million; |

| · | BC Hydro – Various Sites - NERC Critical Infrastructure Protection implementation project for cyber assets anticipated total cost of $60 million decreased to $56 million due to lower contractor labour costs; |

| · | BC Hydro – Natal - 60-138 kV switchyard upgrade project's anticipated cost increased from $84 million to $101 million due to equipment supply challenges, higher inflation, and additional archaeological work; and |

| · | BC Hydro – Treaty Creek Terminal - Transmission Load Interconnection (KSM) project's anticipated year of completion was amended from 2026 to 2027 due to a change in procurement strategy, geotechnical challenges, and design changes during site preparation work. |

Provincial Debt

The provincial debt, including a $700 million forecast allowance, is projected to total $101.6 billion by the end of the fiscal year — $1.4 billion lower than the forecast in the First Quarterly Report primarily due to higher revenues and lower capital spending.

Table 1.6 2023/24 Provincial Debt Update 1

| | | ($ millions) | |

| | | Q1

Update | | | Q2

Update | | | Total

Changes | |

| Taxpayer-supported debt forecast at Budget 2023 | | | 75,617 | | | | | | | | 75,617 | |

| Taxpayer-supported debt at the First Quarterly Report | | | | | | | 70,772 | | | | | |

| Changes: | | | | | | | | | | | | |

| Lower debt level from 2022/23 | | | (3,767 | ) | | | - | | | | (3,767 | ) |

| Changes in operating results (before forecast allowance) | | | 2,458 | | | | (1,117 | ) | | | 1,341 | |

| Non-cash items | | | 57 | | | | (77 | ) | | | (20 | ) |

| Changes in cash balances 2 | | | (3,760 | ) | | | (1,011 | ) | | | (4,771 | ) |

| Changes in other working capital balances 3 | | | (200 | ) | | | 1,743 | | | | 1,543 | |

| Taxpayer-supported capital spending | | | 367 | | | | (1,009 | ) | | | (642 | ) |

| Total taxpayer-supported changes | | | (4,845 | ) | | | (1,471 | ) | | | (6,316 | ) |

| Taxpayer-supported debt - updated forecast | | | 70,772 | | | | 69,301 | | | | 69,301 | |

| Self-supported debt forecast at Budget 2023 | | | 31,607 | | | | | | | | 31,607 | |

| Self-supported debt at the First Quarterly Report | | | | | | | 31,562 | | | | | |

| Changes: | | | | | | | | | | | | |

| Lower debt level from 2022/23 | | | (296 | ) | | | - | | | | (296 | ) |

| Changes in capital spending | | | 46 | | | | (18 | ) | | | 28 | |

| Changes in internal financing | | | 205 | | | | 59 | | | | 264 | |

| Total self-supported changes | | | (45 | ) | | | 41 | | | | (4 | ) |

| Self-supported debt - updated forecast | | | 31,562 | | | | 31,603 | | | | 31,603 | |

| Forecast allowance | | | 700 | | | | 700 | | | | 700 | |

| 2023/24 provincial debt forecast at the First Quarterly Report | | | 103,034 | | | | | | | | | |

| 2023/24 provincial debt forecast at the Second Quarterly Report | | | | | | | 101,604 | | | | 101,604 | |

| 1 | Provincial debt is prepared in accordance with Generally Accepted Accounting Principles and presented consistent with the Debt Summary Report included in the Public Accounts. Debt is shown net of sinking funds and unamortized discounts, excludes accrued interest, and includes non-guaranteed debt directly incurred by commercial Crown corporations and debt guaranteed by the Province. |

| 2 | Reflects changes in cash balances at April 1, 2023 and includes all cash balances from the Consolidated Revenue Fund, School Districts, Universities, Colleges, Health Authorities, Hospital Societies and other taxpayer-supported agencies. |

| 3 | Changes in other working capital balances include changes in accounts receivables, accounts payable, accrued liabilities, deferred revenue, investments, restricted assets and other assets. |

| 12 | | Second Quarterly Report 2023/24 | |

Updated Financial Forecast

Taxpayer-supported debt is forecast to be $69.3 billion at the end of 2023/24 — $1.5 billion lower than the forecast in the First Quarterly Report. The reduction reflects a $1.2 billion improvement in operating results (excluding non-cash items), and $1.0 billion lower capital spending, offset by a $732 million net change of cash and other working capital balances.

The lower debt forecast has resulted in a 0.6 percentage point reduction in the taxpayer-supported debt-to-GDP ratio since the First Quarterly Report; it is now forecast to end the year at 17.0 per cent. The taxpayer-supported debt-to-revenue ratio is forecast to end the fiscal year at 91.6 per cent — 3.9 percentage points lower than forecast in the First Quarterly Report.

Self-supported debt is forecast to be $31.6 billion at the end of 2023/24, with minimal changes from the First Quarterly Report.

The forecast allowance remains unchanged at $700 million.

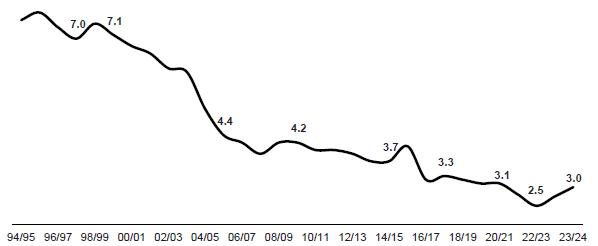

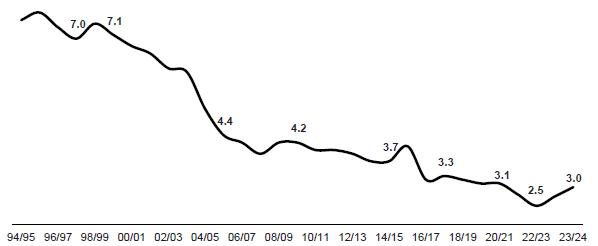

B.C.'s taxpayer-supported debt is expected to increase by $9.4 billion over the year. However, the Province is able to borrow at low interest rates, with debt affordability remaining at levels that are lower than they have been historically. The Province's taxpayer-supported interest bite is forecast at 3.0 cents per dollar of revenue, as shown in Chart 1.2.

Chart 1.2 Debt Affordability

Interest bite for Taxpayer-Supported Debt

(cents per dollar of revenue) 1

1 The ratio of interest costs (less sinking fund interest) to revenue. Figures include capitalized interest expense in order to provide a more comparable measure to outstanding debt.

Further details on provincial debt are shown in Table 1.13.

Total provincial debt is presented consistent with the Debt Summary Report included in the Public Accounts. Debt is shown net of sinking fund investments and unamortized discounts, excludes accrued interest, and includes non-guaranteed debt directly incurred by commercial Crown corporations and debt guaranteed by the Province. The reconciliation between provincial debt and the financial statement debt is shown in Table 1.14.

| | Second Quarterly Report 2023/24 | | 13 |

Updated Financial Forecast

Risks to the Fiscal Forecast

The main risks to B.C.'s economic and fiscal forecast include persistent price pressures leading to higher than anticipated interest rates for longer, as well as weaker global demand. Other risks include climate change impacts, housing affordability, volatility in commodity and financial markets, and the evolution of international geopolitical conflicts.

Personal and corporate income tax assessments take over a year to finalize. For example, the 2022 tax year will not be finalized until March 2024. Property transfer tax and provincial sales tax revenues are impacted by the number of residential transactions, average home sale prices and the amount of taxable purchases of goods and services. Natural resource revenues are affected by international commodity prices, and the health of B.C.'s major trading partners. These and other factors affecting own source revenues are a source of risk and may result in changes to the current forecast.

The spending forecast contained in the fiscal plan is based on ministry and service delivery agency plans. Risks include changes in planning assumptions such as demand for government services in the health care, education, and community social services sectors, as well as costs associated with fighting forests fires and responding to floods and other natural disasters.

Capital spending may be influenced by several factors including the cost of construction materials, design development, procurement activity, weather, geotechnical conditions and interest rates. Risks associated with operating results and capital spending could also affect debt levels.

As a result of these uncertainties, the actual operating result, capital spending and debt figures may differ from the current forecast. Government will update the fiscal outlook in the third quarterly report.

The potential fiscal impacts from these risks may be partly offset by the prudence incorporated in the updated forecast, including the $5.5 billion Contingencies vote allocation and the $700 million forecast allowance.

| 14 | | Second Quarterly Report 2023/24 | |

Updated Financial Forecast

Supplementary Schedules

The following tables provide the financial results for the six months ended September 30, 2023 and the 2023/24 full-year forecast.

Table 1.7 2023/24 Operating Statement

| | | Year-to-Date to September 30 | | | Full Year | |

| | | 2023/24 | | | Actual | | | 2023/24 | | | Actual | |

| ($ millions) | | Budget | | | Actual | | | Variance | | | 2022/23 1 | | | Budget | | | Forecast | | | Variance | | | 2022/23 | |

| Revenue | | | 38,346 | | | | 38,520 | | | | 174 | | | | 39,635 | | | | 77,690 | | | | 77,663 | | | | (27 | ) | | | 81,536 | |

| Expense | | | (35,399 | ) | | | (37,886 | ) | | | (2,487 | ) | | | (32,631 | ) | | | (81,206 | ) | | | (82,520 | ) | | | (1,314 | ) | | | (80,832 | ) |

| Surplus (deficit) before forecast allowance | | | 2,947 | | | | 634 | | | | (2,313 | ) | | | 7,004 | | | | (3,516 | ) | | | (4,857 | ) | | | (1,341 | ) | | | 704 | |

| Forecast allowance | | | - | | | | - | | | | - | | | | - | | | | (700 | ) | | | (700 | ) | | | - | | | | - | |

| Surplus (deficit) | | | 2,947 | | | | 634 | | | | (2,313 | ) | | | 7,004 | | | | (4,216 | ) | | | (5,557 | ) | | | (1,341 | ) | | | 704 | |

| Accumulated surplus (deficit) beginning of the year before remeasurement gains and losses | | | 8,355 | | | | 2,905 | | | | (5,450 | ) | | | 2,211 | | | | 8,355 | | | | 2,905 | | | | (5,450 | ) | | | 2,201 | |

| Adjustments to accumulated surplus (deficit) 1 | | | - | | | | 903 | | | | 903 | | | | 645 | | | | - | | | | - | | | | - | | | | - | |

| Accumulated surplus (deficit) before remeasurement gains and losses | | | 11,302 | | | | 4,442 | | | | (6,860 | ) | | | 9,860 | | | | 4,139 | | | | (2,652 | ) | | | (6,791 | ) | | | 2,905 | |

| Effect of remeasurement gains and (losses) | | | (836 | ) | | | (226 | ) | | | 610 | | | | (241 | ) | | | (836 | ) | | | (202 | ) | | | 634 | | | | (202 | ) |

| Accumulated surplus (deficit) end of period | | | 10,466 | | | | 4,216 | | | | (6,250 | ) | | | 9,619 | | | | 3,303 | | | | (2,854 | ) | | | (6,157 | ) | | | 2,703 | |

1 Restated to reflect government's current accounting policies.

| | Second Quarterly Report 2023/24 | | 15 |

Updated Financial Forecast

Table 1.8 2023/24 Revenue by Source

| | | Year-to-Date to September 30 | | | Full Year | |

| | | 2023/24 | | | Actual | | | 2023/24 | | | Actual | |

| ($ millions) | | Budget | | | Actual | | | Variance | | | 2022/23 1 | | | Budget | | | Forecast | | | Variance | | | 2022/23 | |

| Taxation | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Personal income | | | 7,884 | | | | 7,628 | | | | (256 | ) | | | 7,594 | | | | 15,953 | | | | 15,982 | | | | 29 | | | | 17,268 | |

| Corporate income | | | 4,614 | | | | 4,482 | | | | (132 | ) | | | 6,392 | | | | 5,938 | | | | 6,616 | | | | 678 | | | | 9,156 | |

| Employer health | | | 1,366 | | | | 1,375 | | | | 9 | | | | 1,186 | | | | 2,731 | | | | 2,750 | | | | 19 | | | | 2,720 | |

| Sales 2 | | | 5,081 | | | | 5,354 | | | | 273 | | | | 4,901 | | | | 10,187 | | | | 10,362 | | | | 175 | | | | 9,818 | |

| Fuel | | | 513 | | | | 513 | | | | - | | | | 538 | | | | 1,072 | | | | 1,030 | | | | (42 | ) | | | 1,021 | |

| Carbon | | | 1,301 | | | | 1,211 | | | | (90 | ) | | | 1,016 | | | | 2,811 | | | | 2,650 | | | | (161 | ) | | | 2,161 | |

| Tobacco | | | 320 | | | | 300 | | | | (20 | ) | | | 355 | | | | 565 | | | | 520 | | | | (45 | ) | | | 531 | |

| Property | | | 1,729 | | | | 1,773 | | | | 44 | | | | 1,561 | | | | 3,488 | | | | 3,591 | | | | 103 | | | | 3,253 | |

| Property transfer | | | 969 | | | | 1,206 | | | | 237 | | | | 1,478 | | | | 1,799 | | | | 1,950 | | | | 151 | | | | 2,293 | |

| Insurance premium | | | 390 | | | | 404 | | | | 14 | | | | 353 | | | | 780 | | | | 810 | | | | 30 | | | | 804 | |

| | | | 24,167 | | | | 24,246 | | | | 79 | | | | 25,374 | | | | 45,324 | | | | 46,261 | | | | 937 | | | | 49,025 | |

| Natural resource | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Natural gas royalties | | | 1,008 | | | | 377 | | | | (631 | ) | | | 1,056 | | | | 2,016 | | | | 898 | | | | (1,118 | ) | | | 2,255 | |

| Forests | | | 358 | | | | 327 | | | | (31 | ) | | | 916 | | | | 846 | | | | 792 | | | | (54 | ) | | | 1,887 | |

| Other natural resource revenues 3 | | | 932 | | | | 816 | | | | (116 | ) | | | 1,131 | | | | 1,902 | | | | 1,613 | | | | (289 | ) | | | 2,056 | |

| | | | 2,298 | | | | 1,520 | | | | (778 | ) | | | 3,103 | | | | 4,764 | | | | 3,303 | | | | (1,461 | ) | | | 6,198 | |

| Other revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Post-secondary education fees | | | 1,054 | | | | 1,098 | | | | 44 | | | | 1,009 | | | | 2,770 | | | | 2,832 | | | | 62 | | | | 2,651 | |

| Fees and licenses 4 | | | 1,077 | | | | 1,158 | | | | 81 | | | | 1,081 | | | | 2,412 | | | | 2,475 | | | | 63 | | | | 2,277 | |

| Investment earnings | | | 741 | | | | 892 | | | | 151 | | | | 632 | | | | 1,349 | | | | 1,306 | | | | (43 | ) | | | 1,316 | |

| Miscellaneous 5 | | | 1,732 | | | | 2,341 | | | | 609 | | | | 1,999 | | | | 3,989 | | | | 4,111 | | | | 122 | | | | 4,445 | |

| | | | 4,604 | | | | 5,489 | | | | 885 | | | | 4,721 | | | | 10,520 | | | | 10,724 | | | | 204 | | | | 10,689 | |

| Contributions from the federal government | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Health and social transfers | | | 4,485 | | | | 4,760 | | | | 275 | | | | 4,450 | | | | 8,970 | | | | 9,386 | | | | 416 | | | | 8,769 | |

| Other federal government contributions 6 | | | 1,425 | | | | 1,052 | | | | (373 | ) | | | 1,145 | | | | 4,623 | | | | 4,500 | | | | (123 | ) | | | 3,757 | |

| | | | 5,910 | | | | 5,812 | | | | (98 | ) | | | 5,595 | | | | 13,593 | | | | 13,886 | | | | 293 | | | | 12,526 | |

| Commercial Crown corporation net income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BC Hydro | | | 98 | | | | 68 | | | | (30 | ) | | | 92 | | | | 712 | | | | 712 | | | | - | | | | 360 | |

| Liquor Distribution Branch | | | 598 | | | | 612 | | | | 14 | | | | 626 | | | | 1,150 | | | | 1,157 | | | | 7 | | | | 1,199 | |

| BC Lottery Corporation 7 | | | 688 | | | | 682 | | | | (6 | ) | | | 800 | | | | 1,456 | | | | 1,442 | | | | (14 | ) | | | 1,584 | |

| ICBC 8 | | | (61 | ) | | | (12 | ) | | | 49 | | | | (770 | ) | | | - | | | | - | | | | - | | | | (197 | ) |

| Other 9 | | | 44 | | | | 103 | | | | 59 | | | | 94 | | | | 171 | | | | 178 | | | | 7 | | | | 152 | |

| | | | 1,367 | | | | 1,453 | | | | 86 | | | | 842 | | | | 3,489 | | | | 3,489 | | | | - | | | | 3,098 | |

| Total revenue | | | 38,346 | | | | 38,520 | | | | 174 | | | | 39,635 | | | | 77,690 | | | | 77,663 | | | | (27 | ) | | | 81,536 | |

| 1 | Restated to reflect government's current accounting policies. |

| 2 | Includes provincial sales tax and HST/PST housing transition tax related to prior years. |

| 3 | Columbia River Treaty, other energy and minerals, water rental and other resources. |

| 4 | Healthcare-related, motor vehicle, and other fees. |

| 5 | Includes reimbursements for health care and other services provided to external agencies, and other recoveries. |

| 6 | Includes contributions for health, education, community development, housing and social service programs, and transportation projects. |

| 7 | Net of payments to the federal government and payments to the BC First Nations Gaming Revenue Sharing Limited Partnership in accordance with section 14.3 of the Gaming Control Act (B.C.). |

| 8 | 2022/23 full year actual does not include non-controlling interest and will be restated in future quarterly reports to reflect the adoption of IFRS 9 and IFRS 17. |

| 9 | Includes Columbia Power Corporation, BC Railway Company, Columbia Basin power projects, and post-secondary institutions' self-supported subsidiaries. |

| 16 | | Second Quarterly Report 2023/24 | |

Updated Financial Forecast

Table 1.9 2023/24 Expense by Ministry, Program and Agency

| | | Year-to-Date to September 30 | | | Full Year | |

| | | | 2023/24 | | Actual | | | 2023/24 | | | Actual | |

| ($ millions) | | | Budget | | | | Actual | | | | Variance | | 2022/23 1 | | | | Budget | | | | Forecast | | | | Variance | | | 2022/23 | |

| Office of the Premier | | | 8 | | | | 7 | | | | (1 | ) | | 7 | | | | 16 | | | | 16 | | | | - | | | | 14 | |

| Agriculture and Food | | | 61 | | | | 56 | | | | (5 | ) | | 99 | | | | 112 | | | | 124 | | | | 12 | | | | 292 | |

| Attorney General | | | 375 | | | | 394 | | | | 19 | | | 392 | | | | 773 | | | | 777 | | | | 4 | | | | 807 | |

| Children and Family Development | | | 988 | | | | 1,071 | | | | 83 | | | 830 | | | | 1,912 | | | | 1,912 | | | | - | | | | 1,743 | |

| Citizens' Services | | | 314 | | | | 357 | | | | 43 | | | 314 | | | | 683 | | | | 683 | | | | - | | | | 768 | |

| Education and Child Care | | | 4,514 | | | | 4,677 | | | | 163 | | | 4,179 | | | | 8,874 | | | | 8,874 | | | | - | | | | 8,233 | |

| Emergency Management and Climate Readiness | | | 40 | | | | 65 | | | | 25 | | | 165 | | | | 101 | | | | 101 | | | | - | | | | 821 | |

| Energy, Mines and Low Carbon Innovation | | | 43 | | | | 102 | | | | 59 | | | 41 | | | | 129 | | | | 134 | | | | 5 | | | | 399 | |

| Environment and Climate Change Strategy | | | 130 | | | | 224 | | | | 94 | | | 246 | | | | 255 | | | | 266 | | | | 11 | | | | 574 | |

| Finance | | | 792 | | | | 812 | | | | 20 | | | 334 | | | | 1,578 | | | | 1,682 | | | | 104 | | | | 4,059 | |

| Forests | | | 529 | | | | 979 | | | | 450 | | | 557 | | | | 925 | | | | 1,707 | | | | 782 | | | | 1,190 | |

| Health | | | 13,172 | | | | 14,328 | | | | 1,156 | | | 12,210 | | | | 28,674 | | | | 28,674 | | | | - | | | | 26,385 | |

| Housing | | | 447 | | | | 438 | | | | (9 | ) | | 413 | | | | 897 | | | | 897 | | | | - | | | | 897 | |

| Indigenous Relations and Reconciliation | | | 63 | | | | 98 | | | | 35 | | | 160 | | | | 188 | | | | 188 | | | | - | | | | 777 | |

| Jobs, Economic Development and Innovation | | | 48 | | | | 50 | | | | 2 | | | 50 | | | | 113 | | | | 113 | | | | - | | | | 225 | |

| Labour | | | 10 | | | | 20 | | | | 10 | | | 10 | | | | 21 | | | | 21 | | | | - | | | | 34 | |

| Mental Health and Addictions | | | 9 | | | | 9 | | | | - | | | 6 | | | | 27 | | | | 27 | | | | - | | | | 198 | |

| Municipal Affairs | | | 250 | | | | 219 | | | | (31 | ) | | 271 | | | | 269 | | | | 269 | | | | - | | | | 1,923 | |

| Post-Secondary Education and Future Skills | | | 1,411 | | | | 1,641 | | | | 230 | | | 1,309 | | | | 2,770 | | | | 2,770 | | | | - | | | | 2,691 | |

| Public Safety and Solicitor General | | | 510 | | | | 509 | | | | (1 | ) | | 462 | | | | 1,028 | | | | 1,028 | | | | - | | | | 1,126 | |

| Social Development and Poverty Reduction | | | 2,333 | | | | 2,390 | | | | 57 | | | 2,208 | | | | 4,745 | | | | 4,745 | | | | - | | | | 4,689 | |

| Tourism, Arts, Culture and Sport | | | 105 | | | | 95 | | | | (10 | ) | | 113 | | | | 182 | | | | 182 | | | | - | | | | 427 | |

| Transportation and Infrastructure | | | 505 | | | | 505 | | | | - | | | 479 | | | | 1,021 | | | | 1,021 | | | | - | | | | 2,044 | |

| Water, Land and Resource Stewardship | | | 53 | | | | 247 | | | | 194 | | | 68 | | | | 124 | | | | 124 | | | | - | | | | 464 | |

| Total ministries and Office of the Premier | | | 26,710 | | | | 29,293 | | | | 2,583 | | | 24,924 | | | | 55,417 | | | | 56,335 | | | | 918 | | | | 60,780 | |

| Management of public funds and debt | | | 602 | | | | 712 | | | | 110 | | | 661 | | | | 1,309 | | | | 1,500 | | | | 191 | | | | 1,314 | |

| Contingencies - Shared Recovery Mandate | | | - | | | | - | | | | - | | | - | | | | 2,200 | | | | 2,200 | | | | - | | | | - | |

| Contingencies - General programs, CleanBC and Climate & Emergency Response | | | - | | | | - | | | | - | | | - | | | | 2,300 | | | | 2,300 | | | | - | | | | 1 | |

| Pandemic Recovery Contingencies | | | - | | | | - | | | | - | | | 247 | | | | 1,000 | | | | 1,000 | | | | - | | | | - | |

| Funding for capital expenditures | | | 1,279 | | | | 1,071 | | | | (208 | ) | | 665 | | | | 4,540 | | | | 4,350 | | | | (190 | ) | | | 2,248 | |

| Refundable tax credit transfers | | | 1,492 | | | | 1,462 | | | | (30 | ) | | 1,030 | | | | 3,159 | | | | 3,034 | | | | (125 | ) | | | 3,920 | |

| Legislative Assembly and other appropriations | | | 104 | | | | 98 | | | | (6 | ) | | 81 | | | | 214 | | | | 216 | | | | 2 | | | | 181 | |

| Total appropriations | | | 30,187 | | | | 32,636 | | | | 2,449 | | | 27,608 | | | | 70,139 | | | | 70,935 | | | | 796 | | | | 68,444 | |

Elimination of transactions between appropriations 2 | | | - | | | | (16 | ) | | | (16 | ) | | (9 | ) | | | (32 | ) | | | (35 | ) | | | (3 | ) | | | (24 | ) |

| Prior year liability adjustments | | | - | | | | - | | | | - | | | - | | | | - | | | | - | | | | - | | | | (98 | ) |

| Consolidated revenue fund expense | | | 30,187 | | | | 32,620 | | | | 2,433 | | | 27,599 | | | | 70,107 | | | | 70,900 | | | | 793 | | | | 68,322 | |

| Expenses recovered from external entities | | | 1,906 | | | | 1,927 | | | | 21 | | | 1,616 | | | | 4,909 | | | | 4,966 | | | | 57 | | | | 4,919 | |

| Elimination of funding provided to service delivery agencies | | | (19,564 | ) | | | (19,518 | ) | | | 46 | | | (16,842 | ) | | | (41,212 | ) | | | (44,412 | ) | | | (3,200 | ) | | | (38,236 | ) |

| Total direct program spending | | | 12,529 | | | | 15,029 | | | | 2,500 | | | 12,373 | | | | 33,804 | | | | 31,454 | | | | (2,350 | ) | | | 35,005 | |

| Service delivery agency expense | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| School districts | | | 3,601 | | | | 3,645 | | | | 44 | | | 3,333 | | | | 8,356 | | | | 8,533 | | | | 177 | | | | 7,933 | |

| Universities | | | 3,002 | | | | 3,106 | | | | 104 | | | 2,840 | | | | 6,369 | | | | 6,627 | | | | 258 | | | | 6,053 | |

| Colleges and institutes | | | 767 | | | | 806 | | | | 39 | | | 747 | | | | 1,574 | | | | 1,756 | | | | 182 | | | | 1,591 | |

| Health authorities and hospital societies | | | 11,628 | | | | 11,702 | | | | 74 | | | 10,150 | | | | 22,645 | | | | 25,265 | | | | 2,620 | | | | 22,814 | |

| Other service delivery agencies | | | 3,872 | | | | 3,598 | | | | (274 | ) | | 3,188 | | | | 8,458 | | | | 8,885 | | | | 427 | | | | 7,436 | |

| Total service delivery agency expense | | | 22,870 | | | | 22,857 | | | | (13 | ) | | 20,258 | | | | 47,402 | | | | 51,066 | | | | 3,664 | | | | 45,827 | |

| Total expense | | | 35,399 | | | | 37,886 | | | | 2,487 | | | 32,631 | | | | 81,206 | | | | 82,520 | | | | 1,314 | | | | 80,832 | |

| 1 | Restated to reflect governments current organization and accounting policies. |

| 2 | Reflects payments made under an agreement where an expense from a voted appropriation is recorded as revenue by a special account. |

| | Second Quarterly Report 2023/24 | | 17 |

Updated Financial Forecast

Table 1.10 2023/24 Expense by Function

| | | Year-to-Date to September 30 | | | Full Year | |

| | | 2023/24 | | | | Actual | | | 2023/24 | | | Actual | |

| ($ millions) | | Budget | | | Actual | | | Variance | | | 2022/231 | | | Budget | | | | Forecast | | | Variance | | | 2022/23 | |

| Health 2 | | | 14,379 | | | | 15,833 | | | | 1,454 | | | | 13,301 | | | | 30,927 | | | | 31,120 | | | | 193 | | | | 30,322 | |

| Education 3 | | | 7,898 | | | | 8,183 | | | | 285 | | | | 7,432 | | | | 17,600 | | | | 17,862 | | | | 262 | | | | 16,991 | |

| Social services | | | 4,431 | | | | 4,461 | | | | 30 | | | | 3,633 | | | | 9,158 | | | | 9,138 | | | | (20 | ) | | | 9,652 | |

| Protection of persons and property | | | 1,120 | | | | 1,172 | | | | 52 | | | | 1,226 | | | | 2,324 | | | | 2,326 | | | | 2 | | | | 3,483 | |

| Transportation | | | 1,209 | | | | 1,115 | | | | (94 | ) | | | 1,054 | | | | 2,616 | | | | 2,660 | | | | 44 | | | | 3,319 | |

| Natural resources and economic development | | | 1,925 | | | | 2,771 | | | | 846 | | | | 1,947 | | | | 4,432 | | | | 5,419 | | | | 987 | | | | 6,284 | |

| Other | | | 2,001 | | | | 1,740 | | | | (261 | ) | | | 1,463 | | | | 3,485 | | | | 3,423 | | | | (62 | ) | | | 5,736 | |

| Contingencies - Shared Recovery Mandate | | | - | | | | - | | | | - | | | | - | | | | 2,200 | | | | 2,200 | | | | - | | | | - | |

| Contingencies - General programs, CleanBC and Climate & Emergency Response 4 | | | - | | | | - | | | | - | | | | - | | | | 2,300 | | | | 2,300 | | | | - | | | | - | |

| Pandemic Recovery Contingencies 4 | | | - | | | | - | | | | - | | | | 247 | | | | 1,000 | | | | 1,000 | | | | - | | | | - | |

| General government | | | 906 | | | | 1,003 | | | | 97 | | | | 881 | | | | 1,929 | | | | 1,815 | | | | (114 | ) | | | 2,326 | |

| Debt servicing | | | 1,530 | | | | 1,608 | | | | 78 | | | | 1,447 | | | | 3,235 | | | | 3,257 | | | | 22 | | | | 2,719 | |

| Total expense | | | 35,399 | | | | 37,886 | | | | 2,487 | | | | 32,631 | | | | 81,206 | | | | 82,520 | | | | 1,314 | | | | 80,832 | |

| 1 | Restated to reflect government's current organization and accounting policies. |

| 2 | Payments for healthcare services by the Ministry of Social Development and Poverty Reduction and the Ministry of Children and Family Development made on behalf of their clients are reported in the Health function. |

| 3 | Payments for training costs by the Ministry of Social Development and Poverty Reduction made on behalf of its clients are reported in the Education function. |

| 4 | Contingencies for the prior fiscal year are reported in the relevant functions; the current year forecast is not yet allocated to functions. |

| 18 | | Second Quarterly Report 2023/24 | |

Updated Financial Forecast

Table 1.11 2023/24 Capital Spending

| | | Year-to-Date to September 30 | | | Full Year | |

| | | 2023/24 | | | Actual | | | 2023/24 | | | Actual | |

| ($ millions) | | Budget | | | Actual | | | Variance | | | 2022/231 | | | Budget | | | Forecast | | | Variance | | | 2022/23 | |

| Taxpayer-supported | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Education | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| School districts | | | 506 | | | | 393 | | | | (113 | ) | | | 464 | | | | 1,019 | | | | 954 | | | | (65 | ) | | | 934 | |

| Post-secondary institutions | | | 684 | | | | 558 | | | | (126 | ) | | | 427 | | | | 1,716 | | | | 1,702 | | | | (14 | ) | | | 1,071 | |

| Health | | | 816 | | | | 719 | | | | (97 | ) | | | 482 | | | | 3,243 | | | | 3,496 | | | | 253 | | | | 1,915 | |

| BC Transportation Financing Authority | | | 2,148 | | | | 1,236 | | | | (912 | ) | | | 992 | | | | 3,947 | | | | 3,043 | | | | (904 | ) | | | 1,823 | |

| BC Transit | | | 144 | | | | 49 | | | | (95 | ) | | | 62 | | | | 232 | | | | 224 | | | | (8 | ) | | | 100 | |

| Government ministries | | | 224 | | | | 199 | | | | (25 | ) | | | 150 | | | | 701 | | | | 699 | | | | (2 | ) | | | 470 | |

| Social housing 2 | | | 358 | | | | 323 | | | | (35 | ) | | | 158 | | | | 808 | | | | 905 | | | | 97 | | | | 357 | |

| Other | | | 45 | | | | 56 | | | | 11 | | | | 26 | | | | 147 | | | | 148 | | | | 1 | | | | 85 | |

| Total taxpayer-supported | | | 4,925 | | | | 3,533 | | | | (1,392 | ) | | | 2,761 | | | | 11,813 | | | | 11,171 | | | | (642 | ) | | | 6,755 | |

| Self-supported | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BC Hydro | | | 2,206 | | | | 2,370 | | | | 164 | | | | 1,883 | | | | 3,815 | | | | 3,861 | | | | 46 | | | | 3,919 | |

| Columbia Basin power projects 3 | | | 4 | | | | 3 | | | | (1 | ) | | | 3 | | | | 9 | | | | 9 | | | | - | | | | 10 | |

| BC Railway Company | | | 4 | | | | 2 | | | | (2 | ) | | | 3 | | | | 7 | | | | 7 | | | | - | | | | 6 | |

| ICBC | | | 36 | | | | 35 | | | | (1 | ) | | | 24 | | | | 65 | | | | 65 | | | | - | | | | 41 | |

| BC Lottery Corporation 4 | | | 39 | | | | 27 | | | | (12 | ) | | | 21 | | | | 103 | | | | 85 | | | | (18 | ) | | | 95 | |

| Liquor Distribution Branch | | | 13 | | | | 4 | | | | (9 | ) | | | 5 | | | | 28 | | | | 28 | | | | - | | | | 16 | |

| Other 5 | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 78 | |

| Total self-supported | | | 2,302 | | | | 2,441 | | | | 139 | | | | 1,939 | | | | 4,027 | | | | 4,055 | | | | 28 | | | | 4,165 | |

| Total capital spending | | | 7,227 | | | | 5,974 | | | | (1,253 | ) | | | 4,700 | | | | 15,840 | | | | 15,226 | | | | (614 | ) | | | 10,920 | |

| 1 | Taxpayer-supported figures have been restated to reflect government's current accounting policies. |

| 2 | Includes BC Housing Management Commission and Provincial Rental Housing Corporation. |

| 3 | Joint ventures of the Columbia Power Corporation and Columbia Basin Trust. |

| 4 | Excludes right-of-use assets except for full year actual. |

| 5 | Includes post-secondary institutions' self-supported subsidiaries. |

| | Second Quarterly Report 2023/24 | | 19 |

Updated Financial Forecast

Table 1.12 Capital Expenditure Projects Greater Than $50 million 1

Note: Information in bold type denotes changes from the 2023/24 First Quarterly Report released on September 27, 2023.

| | | | | | Project | | | Estimated | | | Anticipated | | | Project Financing | |

| ($ millions) | | Year of

Completion | | | Cost to

Sept. 30, 2023 | | | Cost to

Complete | | | Total

Cost | | | Internal/

Borrowing | | | P3

Liability | | | Federal

Gov't | | | Other

Contrib'ns | |

| Schools | | | | | | | | | | | | | | | | | | | | | | | | |

| Centennial Secondary 2 | | | 2017 | | | | 59 | | | | 2 | | | | 61 | | | | 61 | | | | - | | | | - | | | | - | |

| Grandview Heights Secondary 2 | | | 2021 | | | | 78 | | | | 5 | | | | 83 | | | | 63 | | | | - | | | | - | | | | 20 | |

| New Westminster Secondary 2 | | | 2021 | | | | 94 | | | | 13 | | | | 107 | | | | 107 | | | | - | | | | - | | | | - | |

| Handsworth Secondary 2 | | | 2022 | | | | 66 | | | | 3 | | | | 69 | | | | 69 | | | | - | | | | - | | | | - | |

| Pexsisen Elementary and Centre Mountain Lellum Middle 2 | | | 2022 | | | | 88 | | | | 1 | | | | 89 | | | | 89 | | | | - | | | | - | | | | - | |

| Quesnel Junior School 2 | | | 2022 | | | | 47 | | | | 5 | | | | 52 | | | | 52 | | | | - | | | | - | | | | - | |

| Stitó:s Lá:lém totí:lt Elementary Middle School 2 | | | 2022 | | | | 52 | | | | 2 | | | | 54 | | | | 49 | | | | - | | | | - | | | | 5 | |

| Coast Salish Elementary 3 | | | 2023 | | | | 24 | | | | 19 | | | | 43 | | | | 38 | | | | - | | | | - | | | | 5 | |

| Burnaby North Secondary | | | 2024 | | | | 99 | | | | 9 | | | | 108 | | | | 99 | | | | | | | | | | | | 9 | |

| Cowichan Secondary | | | 2024 | | | | 44 | | | | 42 | | | | 86 | | | | 84 | | | | - | | | | - | | | | 2 | |

| Eric Hamber Secondary | | | 2024 | | | | 75 | | | | 31 | | | | 106 | | | | 94 | | | | - | | | | - | | | | 12 | |

| Victoria High School | | | 2024 | | | | 82 | | | | 18 | | | | 100 | | | | 97 | | | | - | | | | - | | | | 3 | |

| North East Latimer Elementary | | | 2025 | | | | - | | | | 52 | | | | 52 | | | | 52 | | | | - | | | | - | | | | - | |

| Burke Mountain Secondary | | | 2026 | | | | 7 | | | | 153 | | | | 160 | | | | 135 | | | | - | | | | - | | | | 25 | |

| Carson Elementary | | | 2026 | | | | - | | | | 61 | | | | 61 | | | | 61 | | | | - | | | | - | | | | - | |

| New East Side Elementary | | | 2026 | | | | - | | | | 59 | | | | 59 | | | | 59 | | | | - | | | | - | | | | - | |

| New Cloverley Elementary | | | 2026 | | | | - | | | | 64 | | | | 64 | | | | 61 | | | | - | | | | - | | | | 3 | |

| Pineview Valley Elementary | | | 2026 | | | | - | | | | 65 | | | | 65 | | | | 65 | | | | - | | | | - | | | | - | |

| George Pringle Secondary (formerly Westside Secondary) | | | 2027 | | | | 7 | | | | 99 | | | | 106 | | | | 103 | | | | - | | | | - | | | | 3 | |

| La Vallée (Pemberton) Elementary | | | 2027 | | | | - | | | | 66 | | | | 66 | | | | 66 | | | | - | | | | - | | | | - | |

| Prince Rupert Middle | | | 2027 | | | | - | | | | 127 | | | | 127 | | | | 127 | | | | - | | | | - | | | | - | |

| Guildford Park Secondary | | | 2028 | | | | - | | | | 65 | | | | 65 | | | | 60 | | | | - | | | | - | | | | 5 | |

| Tamanawis Secondary | | | 2028 | | | | - | | | | 57 | | | | 57 | | | | 52 | | | | - | | | | - | | | | 5 | |

| Seismic mitigation program 4 | | | 2030 | | | | 1,426 | | | | 600 | | | | 2,026 | | | | 2,026 | | | | - | | | | - | | | | - | |

| Total schools | | | | | | | 2,248 | | | | 1,618 | | | | 3,866 | | | | 3,769 | | | | - | | | | - | | | | 97 | |

| Post-secondary institutions | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Simon Fraser University – Student Housing 2 | | | 2023 | | | | 110 | | | | 1 | | | | 111 | | | | 73 | | | | - | | | | - | | | | 38 | |

| University of Victoria – Student Housing 2 | | | 2023 | | | | 220 | | | | 16 | | | | 236 | | | | 128 | | | | - | | | | - | | | | 108 | |

| Capilano University – Student Housing | | | 2024 | | | | 6 | | | | 52 | | | | 58 | | | | 41 | | | | - | | | | - | | | | 17 | |

| Okanagan College – Student Housing | | | 2024 | | | | 25 | | | | 50 | | | | 75 | | | | 74 | | | | - | | | | - | | | | 1 | |

| British Columbia Institute of Technology – Student Housing | | | 2025 | | | | 45 | | | | 95 | | | | 140 | | | | 128 | | | | - | | | | - | | | | 12 | |

| North Island College – Student Housing | | | 2025 | | | | 8 | | | | 70 | | | | 78 | | | | 76 | | | | - | | | | - | | | | 2 | |

| The University of British Columbia | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| – School of Biomedical Engineering | | | 2025 | | | | 51 | | | | 88 | | | | 139 | | | | 25 | | | | - | | | | - | | | | 114 | |

| Royal Roads University – West Shore Learning Centre | | | 2025 | | | | 41 | | | | 65 | | | | 106 | | | | 80 | | | | - | | | | - | | | | 26 | |

| University of the Fraser Valley – Student Housing | | | 2025 | | | | 1 | | | | 74 | | | | 75 | | | | 63 | | | | - | | | | - | | | | 12 | |

| University of Victoria | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| – Engineering and Computer Science Building Expansion | | | 2026 | | | | 5 | | | | 128 | | | | 133 | | | | 97 | | | | - | | | | - | | | | 36 | |

| Vancouver Island University – Student Housing and Dining | | | 2026 | | | | - | | | | 88 | | | | 88 | | | | 87 | | | | - | | | | - | | | | 1 | |

| British Columbia Institute of Technology | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| – Trades and Technology Complex | | | 2027 | | | | 2 | | | | 176 | | | | 178 | | | | 152 | | | | - | | | | - | | | | 26 | |

| Douglas College – Academic and Student Housing | | | 2027 | | | | 5 | | | | 288 | | | | 293 | | | | 203 | | | | - | | | | - | | | | 90 | |

| Vancouver Community College | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| – Centre for Clean Energy & Automotive Innovation | | | 2027 | | | | - | | | | 291 | | | | 291 | | | | 271 | | | | - | | | | - | | | | 20 | |

| Total post-secondary institutions | | | | | | | 519 | | | | 1,482 | | | | 2,001 | | | | 1,498 | | | | - | | | | - | | | | 503 | |

| 20 | | Second Quarterly Report 2023/24 | |

Updated Financial Forecast

Table 1.12 Capital Expenditure Projects Greater Than $50 million 1

Note: Information in bold type denotes changes from the 2023/24 First Quarterly Report released on September 27, 2023.

| | | | | | | Project | | | Estimated | | | Anticipated | | | Project Financing | |

| ($ millions) | | Year of

Completion | | | Cost to

Sept. 30, 2023 | | | Cost to

Complete | | | Total

Cost | | | Internal/

Borrowing | | | P3

Liability | | | Federal

Gov't | | | Other

Contrib'ns | |

| Health facilities | | | | | | | | | | | | | | | | | | | | | | | | |

| Royal Columbian Hospital Redevelopment – Phase 1 2 | | | 2020 | | | | 247 | | | | 4 | | | | 251 | | | | 242 | | | | - | | | | - | | | | 9 | |

| Red Fish Healing Centre for Mental Health and Addiction - θəqiʔ ɫəwʔənəq leləm 2 | | | 2021 | | | | 129 | | | | 2 | | | | 131 | | | | 131 | | | | - | | | | - | | | | - | |

| Vancouver General Hospital – Operating Rooms Renewal – Phase 1 2 | | | 2021 | | | | 101 | | | | - | | | | 101 | | | | 34 | | | | - | | | | - | | | | 67 | |

| Peace Arch Hospital Renewal 2 | | | 2022 | | | | 86 | | | | 1 | | | | 87 | | | | 8 | | | | - | | | | - | | | | 79 | |

| Penticton Regional Hospital Patient Care Tower 2 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| – Direct procurement | | | 2022 | | | | 65 | | | | 11 | | | | 76 | | | | 18 | | | | - | | | | - | | | | 58 | |

| – P3 contract | | | 2019 | | | | 232 | | | | - | | | | 232 | | | | - | | | | 139 | | | | - | | | | 93 | |

| Dogwood Lodge Long-term Care Home Replacement | | | 2023 | | | | 61 | | | | 4 | | | | 65 | | | | - | | | | - | | | | - | | | | 65 | |

| Lions Gate Hospital – New Acute Care Facility | | | 2024 | | | | 167 | | | | 143 | | | | 310 | | | | 144 | | | | - | | | | - | | | | 166 | |

| Stuart Lake Hospital Replacement | | | 2024 | | | | 81 | | | | 77 | | | | 158 | | | | 140 | | | | - | | | | - | | | | 18 | |

| Clinical and Systems Transformation | | | 2025 | | | | 746 | | | | 53 | | | | 799 | | | | 702 | | | | - | | | | - | | | | 97 | |

| iHealth Project – Vancouver Island Health Authority | | | 2025 | | | | 136 | | | | 19 | | | | 155 | | | | 55 | | | | - | | | | - | | | | 100 | |

| Nanaimo Regional General Hospital – ICU/HAU Redevelopment | | | 2025 | | | | 33 | | | | 27 | | | | 60 | | | | 22 | | | | - | | | | - | | | | 38 | |

| University Hospital of Northern BC Redevelopment – Phase 1 (Site Preparation) | | | 2025 | | | | - | | | | 103 | | | | 103 | | | | 62 | | | | - | | | | - | | | | 41 | |

| Mills Memorial Hospital Replacement | | | 2026 | | | | 481 | | | | 152 | | | | 633 | | | | 513 | | | | - | | | | - | | | | 120 | |

| Royal Columbian Hospital Redevelopment Phases 2 & 3 5 | | | 2026 | | | | 536 | | | | 708 | | | | 1,244 | | | | 1,182 | | | | - | | | | - | | | | 62 | |

| Abbotsford Long-Term Care | | | 2027 | | | | - | | | | 211 | | | | 211 | | | | 157 | | | | - | | | | - | | | | 54 | |

| Campbell River Long-Term Care | | | 2027 | | | | - | | | | 134 | | | | 134 | | | | 80 | | | | - | | | | - | | | | 54 | |

| Cowichan District Hospital Replacement | | | 2027 | | | | 138 | | | | 1,308 | | | | 1,446 | | | | 1,148 | | | | - | | | | - | | | | 298 | |

| Dawson Creek and District Hospital Replacement | | | 2027 | | | | 36 | | | | 554 | | | | 590 | | | | 413 | | | | - | | | | - | | | | 177 | |

| Delta Long-Term Care | | | 2027 | | | | - | | | | 180 | | | | 180 | | | | 162 | | | | - | | | | - | | | | 18 | |

| Nanaimo Long-Term Care | | | 2027 | | | | - | | | | 286 | | | | 286 | | | | 172 | | | | - | | | | - | | | | 114 | |

| New St. Paul's Hospital | | | 2027 | | | | 678 | | | | 1,502 | | | | 2,180 | | | | 1,327 | | | | - | | | | - | | | | 853 | |

| Richmond Long-Term Care | | | 2027 | | | | - | | | | 178 | | | | 178 | | | | 178 | | | | - | | | | - | | | | - | |

| Royal Inland Hospital Phil and Jennie Gaglardi Tower | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| – Direct procurement | | | 2027 | | | | 70 | | | | 59 | | | | 129 | | | | 39 | | | | - | | | | - | | | | 90 | |

| – P3 contract | | | 2022 | | | | 288 | | | | - | | | | 288 | | | | - | | | | 164 | | | | - | | | | 124 | |

| Western Communities Long-Term Care | | | 2027 | | | | - | | | | 224 | | | | 224 | | | | 157 | | | | - | | | | - | | | | 67 | |

| Burnaby Hospital Redevelopment – Phase 1 6 | | | 2028 | | | | 100 | | | | 583 | | | | 683 | | | | 633 | | | | - | | | | - | | | | 50 | |

| Centre for Children and Youth Living with Health Complexity | | | 2028 | | | | 3 | | | | 264 | | | | 267 | | | | 224 | | | | - | | | | - | | | | 43 | |

| Dr. F.W. Green Memorial Home | | | 2029 | | | | - | | | | 156 | | | | 156 | | | | 94 | | | | - | | | | - | | | | 62 | |

| St. Vincent's Heather Long-Term Care | | | 2028 | | | | 2 | | | | 205 | | | | 207 | | | | 207 | | | | - | | | | - | | | | - | |

| Cariboo Memorial Hospital Redevelopment | | | 2029 | | | | 29 | | | | 338 | | | | 367 | | | | 257 | | | | - | | | | - | | | | 110 | |

| New Surrey Hospital and BC Cancer Centre | | | 2029 | | | | 10 | | | | 2,871 | | | | 2,881 | | | | 2,816 | | | | - | | | | - | | | | 65 | |

| St. Paul's Hospital Clinical Support and Research Centre | | | 2029 | | | | - | | | | 638 | | | | 638 | | | | 332 | | | | - | | | | - | | | | 306 | |

| Vancouver General Hospital – Operating Rooms Renewal – Phase 2 | | | 2029 | | | | 15 | | | | 317 | | | | 332 | | | | 312 | | | | - | | | | - | | | | 20 | |

| Burnaby Hospital Redevelopment – Phase 2 and BC Cancer Centre | | | 2030 | | | | - | | | | 1,731 | | | | 1,731 | | | | 1,703 | | | | - | | | | - | | | | 28 | |

| Richmond Hospital Redevelopment 7 | | | 2031 | | | | 8 | | | | 853 | | | | 861 | | | | 791 | | | | - | | | | - | | | | 70 | |

| Total health facilities | | | | | | | 4,478 | | | | 13,896 | | | | 18,374 | | | | 14,455 | | | | 303 | | | | - | | | | 3,616 | |

| | Second Quarterly Report 2023/24 | | 21 |

Updated Financial Forecast

Table 1.12 Capital Expenditure Projects Greater Than $50 million 1

Note: Information in bold type denotes changes from the 2023/24 First Quarterly Report released on September 27, 2023.

| | | | | | Project | | | Estimated | | | Anticipated | | | Project Financing |

| | | Year of | | | Cost to | | | Cost to | | | Total | | | Internal/ | | | P3 | | | Federal | | | Other | |

| ($ millions) | | Completion | | | Sept. 30, 2023 | | | Complete | | | Cost | | | Borrowing | | | Liability | | | Gov't | | | Contrib'ns | |

| Transportation | | | | | | | | | | | | | | | | | | | | | | | | |

| Highway 91 Alex Fraser Bridge Capacity Improvements 2 | | | 2019 | | | | 67 | | | | 3 | | | | 70 | | | | 37 | | | | - | | | | 33 | | | | - | |

| Highway 1 Illecillewaet Four-Laning and Brake Check improvements 2 | | | 2021 | | | | 74 | | | | 1 | | | | 75 | | | | 59 | | | | - | | | | 16 | | | | - | |

| Highway 99 10-Mile Slide 2 | | | 2021 | | | | 75 | | | | 9 | | | | 84 | | | | 84 | | | | - | | | | - | | | | - | |

| Highway 4 Kennedy Hill Safety Improvements 2 | | | 2022 | | | | 54 | | | | - | | | | 54 | | | | 40 | | | | | | | | 14 | | | | - | |

| Highway 14 Corridor improvements | | | 2023 | | | | 68 | | | | 9 | | | | 77 | | | | 48 | | | | - | | | | 29 | | | | - | |

| Highway 1 Chase Four-Laning | | | 2023 | | | | 109 | | | | 87 | | | | 196 | | | | 184 | | | | - | | | | 12 | | | | - | |

| Highway 1 Salmon Arm West | | | 2023 | | | | 90 | | | | 50 | | | | 140 | | | | 109 | | | | - | | | | 31 | | | | - | |

| Highway 91 to Highway 17 and Deltaport Way Corridor improvements | | | 2023 | | | | 243 | | | | 17 | | | | 260 | | | | 87 | | | | - | | | | 82 | | | | 91 | |

| Kootenay Lake ferry service upgrade | | | 2023 | | | | 54 | | | | 31 | | | | 85 | | | | 68 | | | | - | | | | 17 | | | | - | |

| West Fraser Road Realignment | | | 2023 | | | | 66 | | | | 28 | | | | 94 | | | | 94 | | | | - | | | | - | | | | - | |

| Highway 1 Quartz Creek Bridge Replacement | | | 2024 | | | | 73 | | | | 46 | | | | 119 | | | | 69 | | | | - | | | | 50 | | | | - | |

| Highway 1 Ford Road to Tappen Valley Road Four-Laning | | | 2024 | | | | 51 | | | | 192 | | | | 243 | | | | 161 | | | | - | | | | 82 | | | | - | |

| Highway 1 Kicking Horse Canyon Phase 4 8 | | | 2024 | | | | 540 | | | | 61 | | | | 601 | | | | 386 | | | | - | | | | 215 | | | | - | |

| Pattullo Bridge Replacement 9 | | | 2024 | | | | 772 | | | | 605 | | | | 1,377 | | | | 1,076 | | | | 301 | | | | - | | | | - | |

| Highway 5 Corridor | | | 2024 | | | | 173 | | | | 177 | | | | 350 | | | | 350 | | | | - | | | | - | | | | - | |

| Highway 1 Corridor – Falls Creek | | | 2024 | | | | 7 | | | | 136 | | | | 143 | | | | 143 | | | | - | | | | - | | | | - | |

| BC Transit Victoria HandyDART Facility | | | 2025 | | | | 32 | | | | 52 | | | | 84 | | | | 41 | | | | - | | | | 21 | | | | 22 | |

| Highway 1 Corridor – Nicomen Bridge | | | 2025 | | | | 10 | | | | 134 | | | | 144 | | | | 144 | | | | - | | | | - | | | | - | |

| Highway 7 Widening – 266th St. to 287th St. | | | 2025 | | | | 37 | | | | 93 | | | | 130 | | | | 101 | | | | - | | | | 29 | | | | - | |

| Highway 99 / Steveston Interchange, Transit & Cycling Improvements 10 | | | 2025 | | | | 47 | | | | 90 | | | | 137 | | | | 137 | | | | - | | | | - | | | | - | |

| Highway 17 Keating Cross Overpass | | | 2025 | | | | 17 | | | | 60 | | | | 77 | | | | 58 | | | | - | | | | 17 | | | | 2 | |

| Broadway Subway 11 | | | 2026 | | | | 1,263 | | | | 1,564 | | | | 2,827 | | | | 1,380 | | | | 450 | | | | 897 | | | | 100 | |

| Blackwater North Fraser Slide | | | 2026 | | | | - | | | | 203 | | | | 203 | | | | 203 | | | | - | | | | - | | | | - | |

| Cottonwood Hill at Highway 97 Slide | | | 2026 | | | | - | | | | 335 | | | | 335 | | | | 335 | | | | - | | | | - | | | | - | |

| Highway 1 216th St. to 264th St. widening | | | 2026 | | | | 68 | | | | 277 | | | | 345 | | | | 226 | | | | - | | | | 96 | | | | 23 | |

| Highway 1 Fraser Valley Corridor Improvements Mount Lehman Rd. to Highway 11 Site Preparation | | | 2026 | | | | - | | | | 100 | | | | 100 | | | | 100 | | | | - | | | | - | | | | - | |