Middlefield Banc Corp. Annual Shareholder Meeting May 11, 2016 Exhibit 99.1

Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995 concerning Middlefield Banc Corp.’s plans, strategies, objectives, expectations, intentions, financial condition and results of operations. These forward-looking statements reflect management’s current views and intentions and are subject to known and unknown risks, uncertainties, assumptions and other factors that could cause the actual results to differ materially from those contemplated by the statements. The significant risks and uncertainties related to Middlefield Banc Corp. of which management is aware are discussed in detail in the periodic reports that Middlefield Banc Corp. files with the Securities and Exchange Commission (the “SEC”), including in the “Risk Factors” section of its Annual Report on Form 10-K and its Quarterly Report on Form 10-Q. Investors are urged to review Middlefield Banc Corp.’s periodic reports, which are available at no charge through the SEC’s website at www.sec.gov and through Middlefield Banc Corp.’s website at www.middlefieldbank.com on the “Investor Relations” page. Middlefield Banc Corp. assumes no obligation to update any of these forward-looking statements to reflect a change in its views or events or circumstances that occur after the date of this presentation. 2

Board of Directors Thomas G. Caldwell James R. Heslop, II Eric W. Hummel Kenneth E. Jones Darryl E. Mast Clayton W. Rose, III James J. McCaskey William J. Skidmore Robert W. Toth Carolyn J. Turk 3

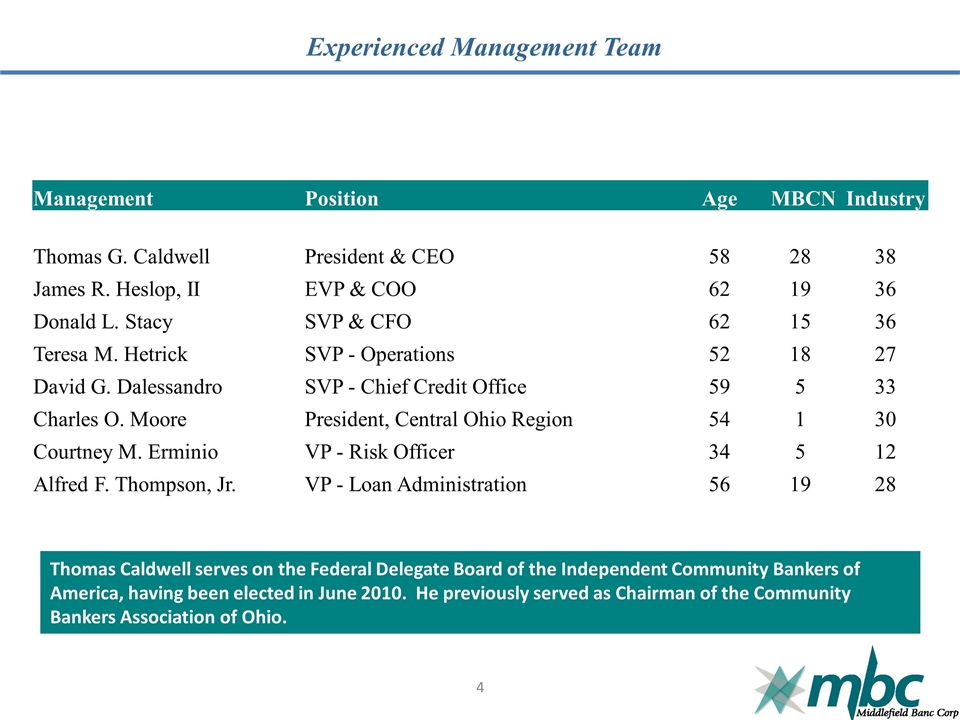

Experienced Management Team Management Position Age MBCN Industry Thomas G. Caldwell President & CEO 58 28 38 James R. Heslop, II EVP & COO 62 19 36 Donald L. Stacy SVP & CFO 62 15 36 Teresa M. Hetrick SVP - Operations 52 18 27 David G. Dalessandro SVP - Chief Credit Office 59 5 33 Charles O. Moore President, Central Ohio Region 54 1 30 Courtney M. Erminio VP - Risk Officer 34 5 12 Alfred F. Thompson, Jr. VP - Loan Administration 56 19 28 Thomas Caldwell serves on the Federal Delegate Board of the Independent Community Bankers of America, having been elected in June 2010. He previously served as Chairman of the Community Bankers Association of Ohio. 4

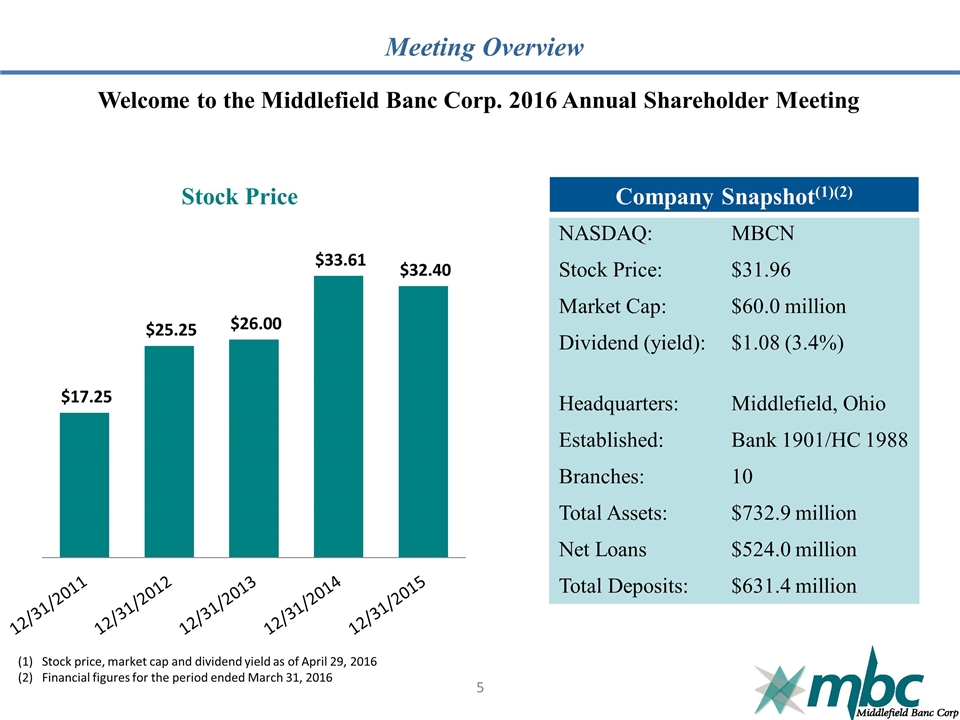

Meeting Overview Welcome to the Middlefield Banc Corp. 2016 Annual Shareholder Meeting Company Snapshot(1)(2) NASDAQ: MBCN Stock Price: $31.96 Market Cap: $60.0 million Dividend (yield): $1.08 (3.4%) Headquarters: Middlefield, Ohio Established: Bank 1901/HC 1988 Branches: 10 Total Assets: $732.9 million Net Loans $524.0 million Total Deposits: $631.4 million Stock price, market cap and dividend yield as of April 29, 2016 Financial figures for the period ended March 31, 2016 5 Stock Price

6 CEO Report

Business Overview Ended 2015 with record assets and loans outstanding, and experienced higher year-over-year net interest income and noninterest income. Profitable throughout the economic cycle and never reported a quarterly loss History of quarterly cash dividend payments, and increased dividend amount in 2015 Excellent asset quality, strong liquidity profile, and robust core deposit base Strong returns and efficiency ratios Two strong Ohio banking markets For over 100 years, Middlefield Banc Corp. has supported its communities by offering customers superior financial products, exceptional service, and modern banking amenities 7

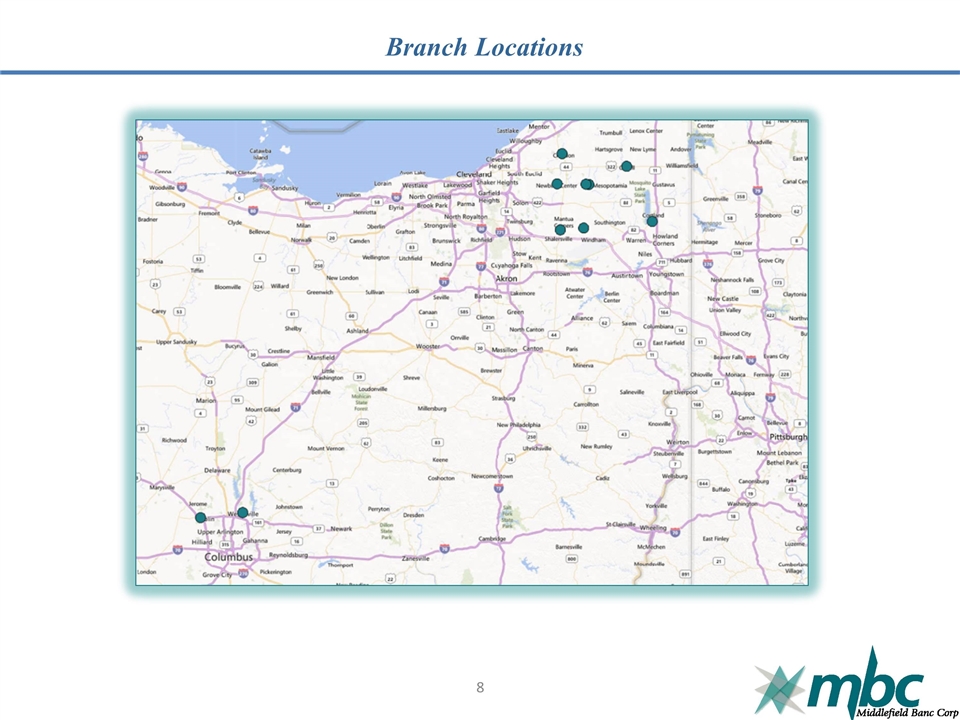

Branch Locations 8

2016 Ranking Source: (1)American Banker April 25, 2016 http://www.americanbanker.com/ American Banker(1) Middlefield Banc Corp. was ranked 42nd out of the top 200 community banks and thrifts by 3-year Avg. ROE according to an April 25, 2016 American Banker article. Of the top 200, 11 Ohio financial institutions made the list and Middlefield ranked 4th in Ohio-based institutions. 9

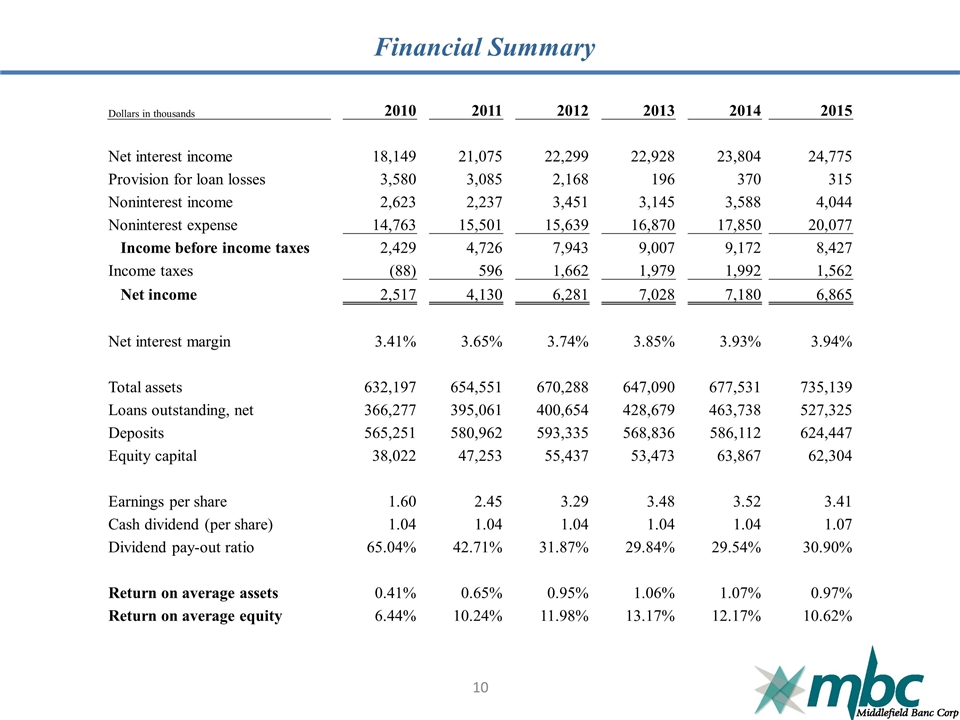

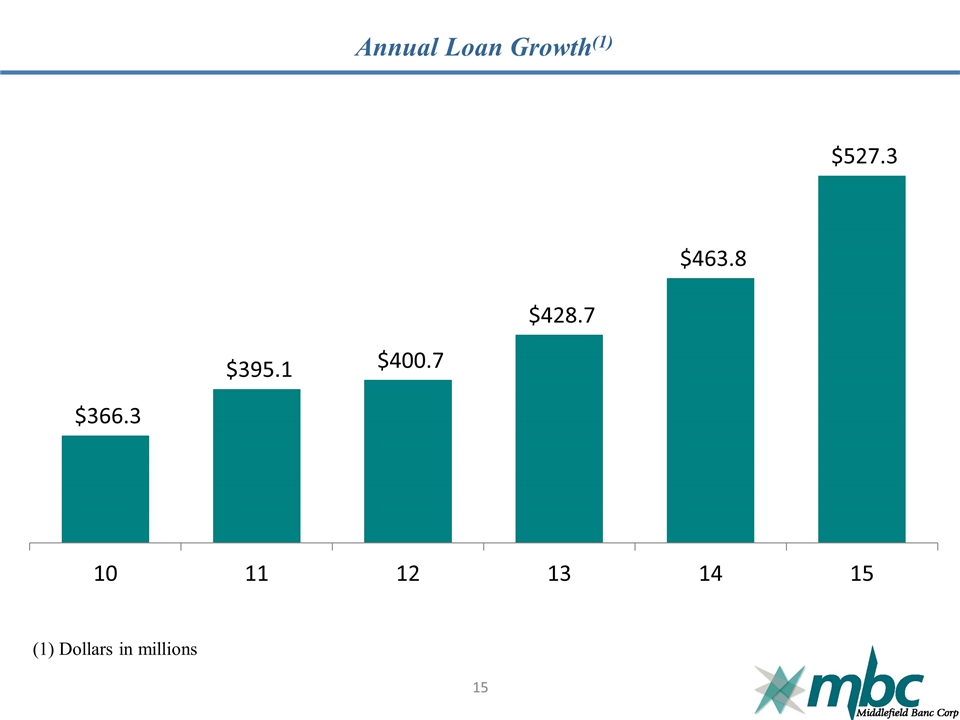

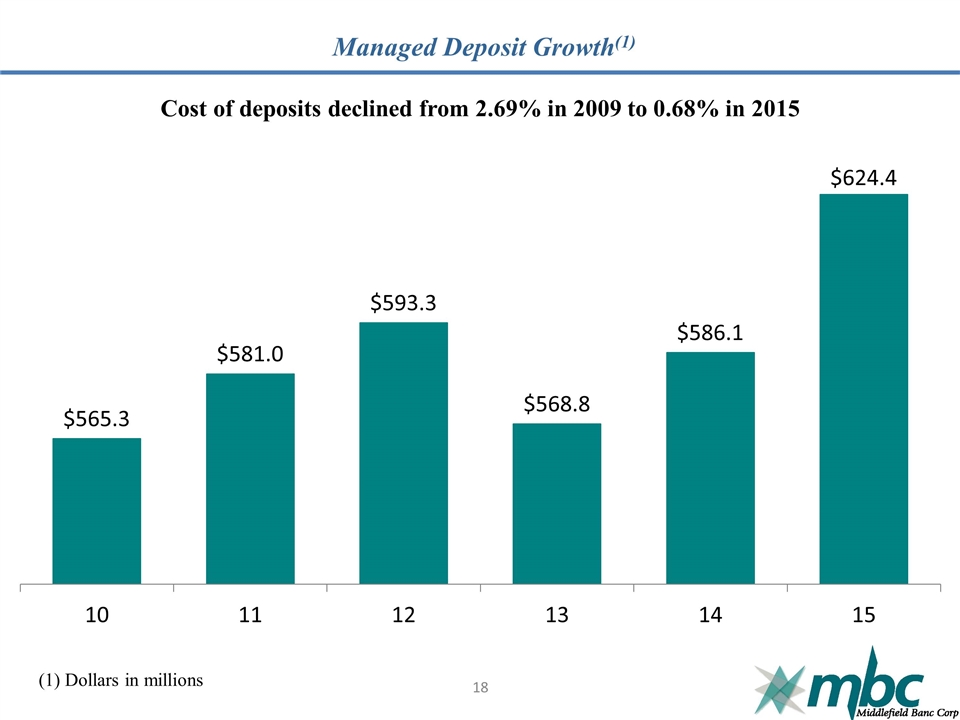

Financial Summary Dollars in thousands 2010 2011 2012 2013 2014 2015 Net interest income 18,149 21,075 22,299 22,928 23,804 24,775 Provision for loan losses 3,580 3,085 2,168 196 370 315 Noninterest income 2,623 2,237 3,451 3,145 3,588 4,044 Noninterest expense 14,763 15,501 15,639 16,870 17,850 20,077 Income before income taxes 2,429 4,726 7,943 9,007 9,172 8,427 Income taxes (88) 596 1,662 1,979 1,992 1,562 Net income 2,517 4,130 6,281 7,028 7,180 6,865 Net interest margin 3.41% 3.65% 3.74% 3.85% 3.93% 3.94% Total assets 632,197 654,551 670,288 647,090 677,531 735,139 Loans outstanding, net 366,277 395,061 400,654 428,679 463,738 527,325 Deposits 565,251 580,962 593,335 568,836 586,112 624,447 Equity capital 38,022 47,253 55,437 53,473 63,867 62,304 Earnings per share 1.60 2.45 3.29 3.48 3.52 3.41 Cash dividend (per share) 1.04 1.04 1.04 1.04 1.04 1.07 Dividend pay-out ratio 65.04% 42.71% 31.87% 29.84% 29.54% 30.90% Return on average assets 0.41% 0.65% 0.95% 1.06% 1.07% 0.97% Return on average equity 6.44% 10.24% 11.98% 13.17% 12.17% 10.62% 10

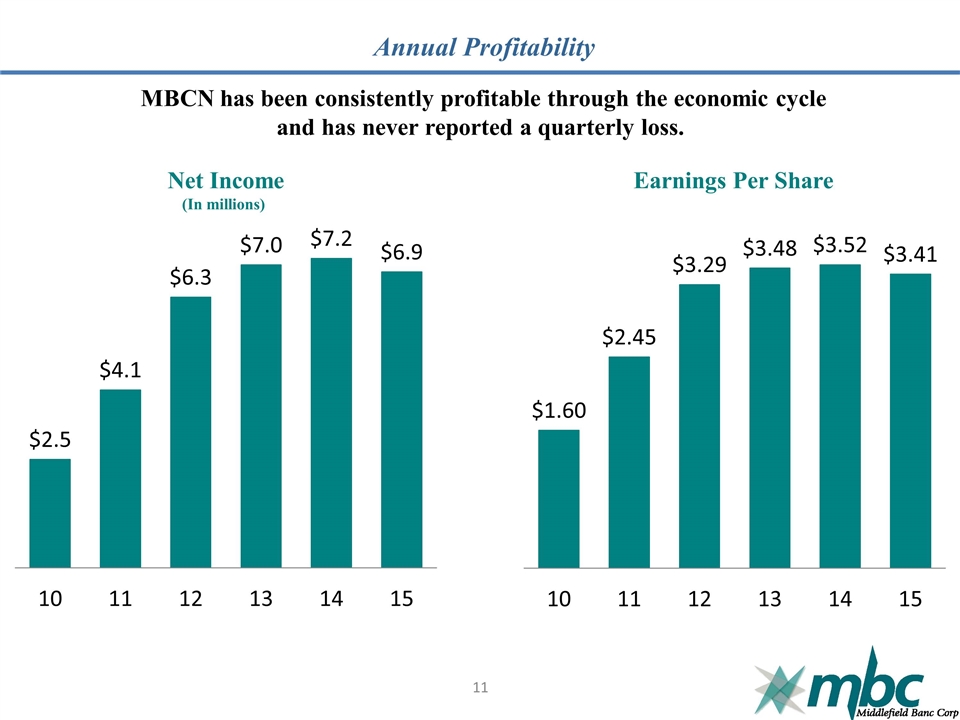

Annual Profitability Net Income (In millions) Earnings Per Share MBCN has been consistently profitable through the economic cycle and has never reported a quarterly loss. 11

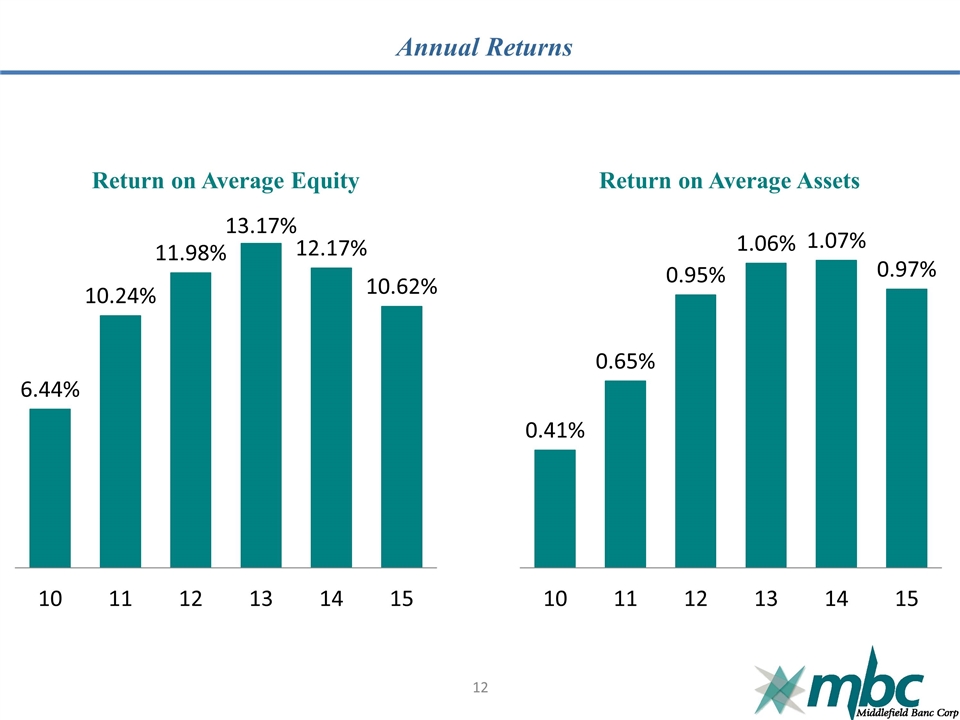

Annual Returns Return on Average Equity Return on Average Assets 12

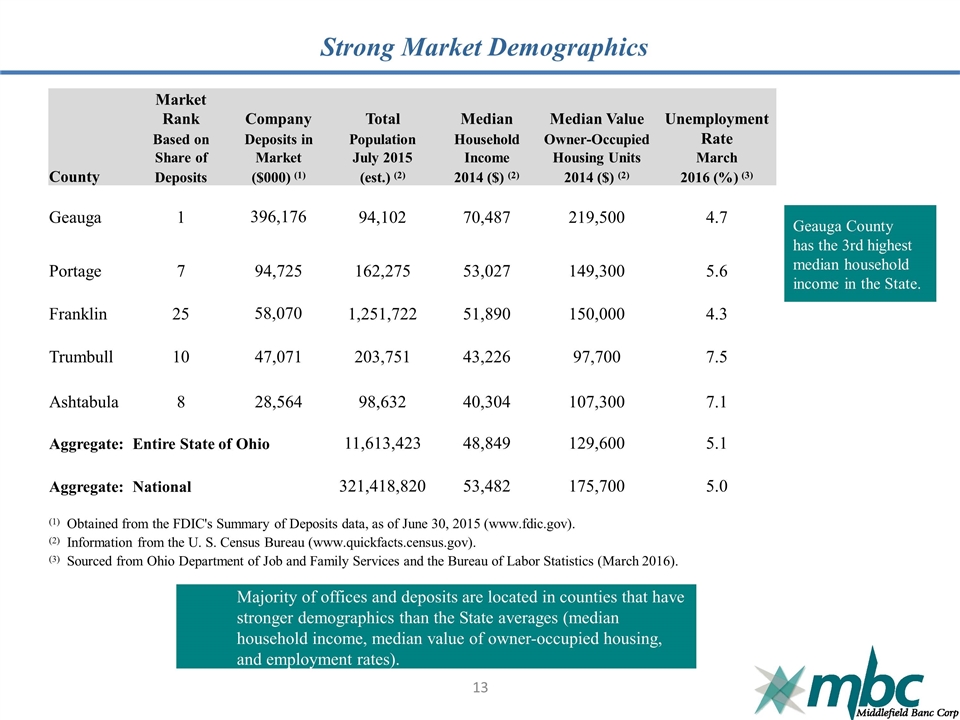

Strong Market Demographics Market Rank Company Total Median Median Value Unemployment Based on Deposits in Population Household Owner-Occupied Rate Share of Market July 2015 Income Housing Units March County Deposits ($000) (1) (est.) (2) 2014 ($) (2) 2014 ($) (2) 2016 (%) (3) Geauga 1 396,176 94,102 70,487 219,500 4.7 Geauga County has the 3rd highest median household income in the State. Portage 7 94,725 162,275 53,027 149,300 5.6 Franklin 25 58,070 1,251,722 51,890 150,000 4.3 Trumbull 10 47,071 203,751 43,226 97,700 7.5 Ashtabula 8 28,564 98,632 40,304 107,300 7.1 Aggregate: Entire State of Ohio 11,613,423 48,849 129,600 5.1 Aggregate: National 321,418,820 53,482 175,700 5.0 (1) Obtained from the FDIC's Summary of Deposits data, as of June 30, 2015 (www.fdic.gov). (2) Information from the U. S. Census Bureau (www.quickfacts.census.gov). (3) Sourced from Ohio Department of Job and Family Services and the Bureau of Labor Statistics (March 2016). Majority of offices and deposits are located in counties that have stronger demographics than the State averages (median household income, median value of owner-occupied housing, and employment rates). 13

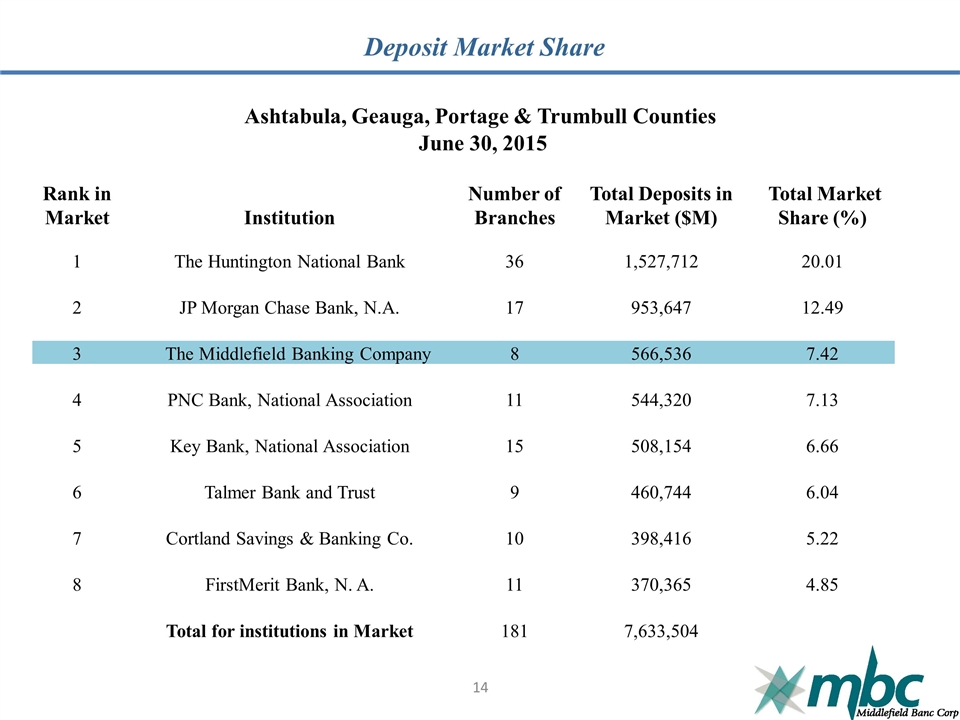

Deposit Market Share Ashtabula, Geauga, Portage & Trumbull Counties June 30, 2015 Rank in Market Institution Number of Branches Total Deposits in Market ($M) Total Market Share (%) 1 The Huntington National Bank 36 1,527,712 20.01 2 JP Morgan Chase Bank, N.A. 17 953,647 12.49 3 The Middlefield Banking Company 8 566,536 7.42 4 PNC Bank, National Association 11 544,320 7.13 5 Key Bank, National Association 15 508,154 6.66 6 Talmer Bank and Trust 9 460,744 6.04 7 Cortland Savings & Banking Co. 10 398,416 5.22 8 FirstMerit Bank, N. A. 11 370,365 4.85 Total for institutions in Market 181 7,633,504 14

Annual Loan Growth(1) (1) Dollars in millions 15

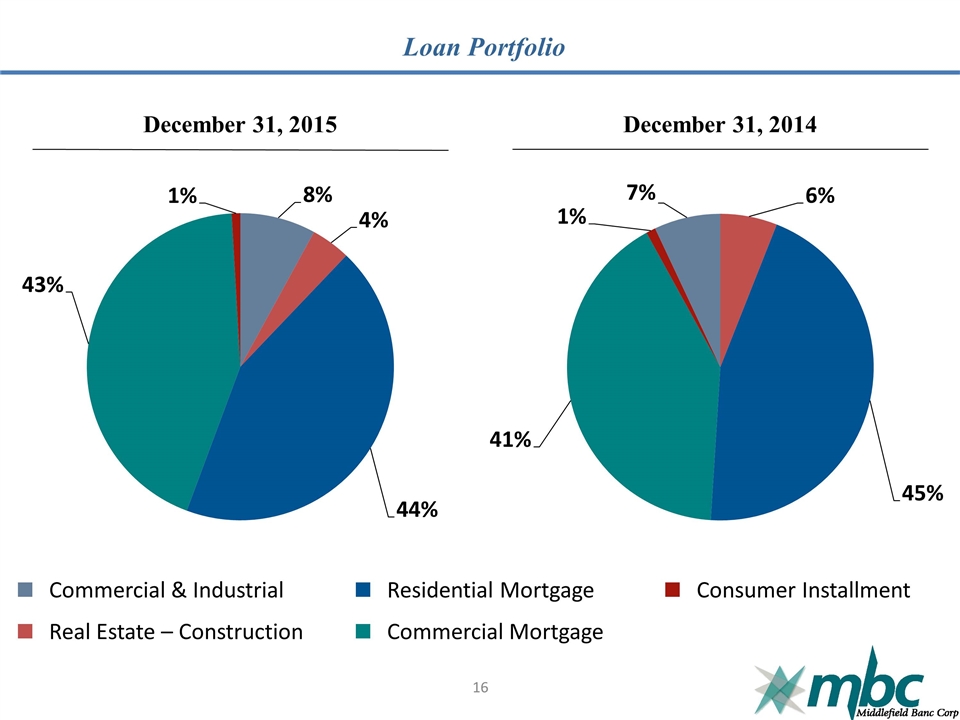

Loan Portfolio 16 December 31, 2015 December 31, 2014 Commercial & Industrial Real Estate – Construction Residential Mortgage Commercial Mortgage Consumer Installment

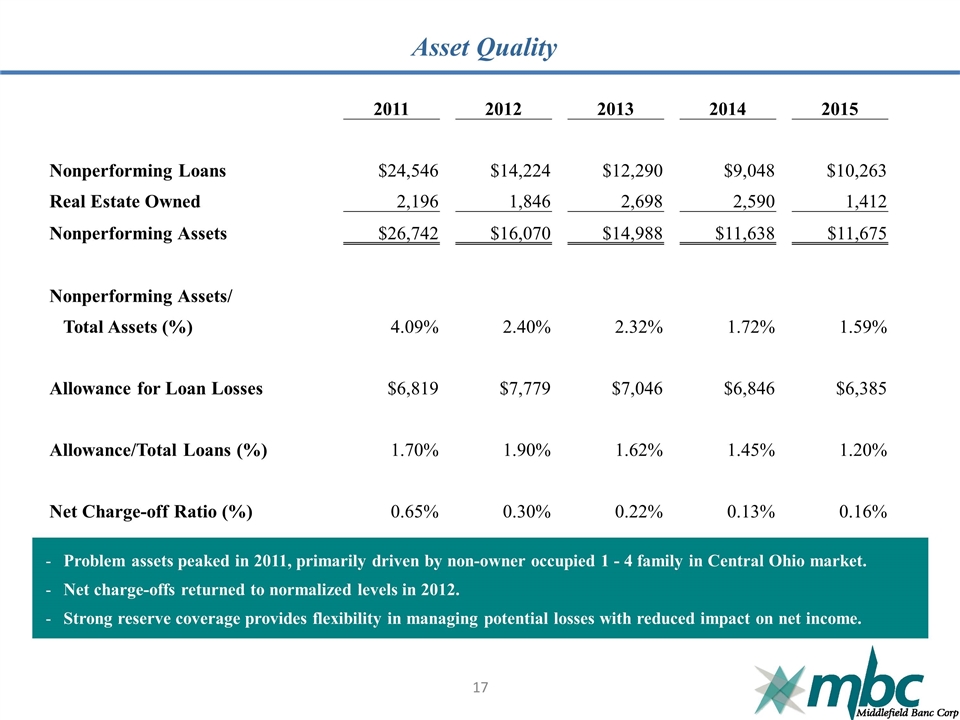

Asset Quality 2011 2012 2013 2014 2015 Nonperforming Loans $24,546 $14,224 $12,290 $9,048 $10,263 Real Estate Owned 2,196 1,846 2,698 2,590 1,412 Nonperforming Assets $26,742 $16,070 $14,988 $11,638 $11,675 Nonperforming Assets/ Total Assets (%) 4.09% 2.40% 2.32% 1.72% 1.59% Allowance for Loan Losses $6,819 $7,779 $7,046 $6,846 $6,385 Allowance/Total Loans (%) 1.70% 1.90% 1.62% 1.45% 1.20% Net Charge-off Ratio (%) 0.65% 0.30% 0.22% 0.13% 0.16% Problem assets peaked in 2011, primarily driven by non-owner occupied 1 - 4 family in Central Ohio market. Net charge-offs returned to normalized levels in 2012. Strong reserve coverage provides flexibility in managing potential losses with reduced impact on net income. 17

Managed Deposit Growth(1) Cost of deposits declined from 2.69% in 2009 to 0.68% in 2015 (1) Dollars in millions 18

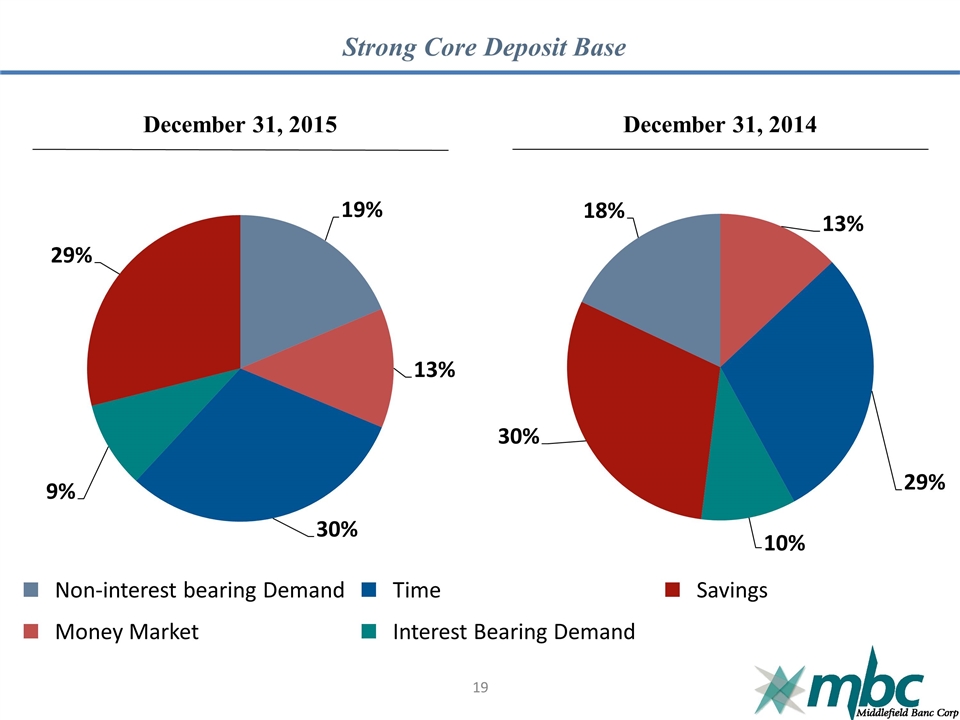

Strong Core Deposit Base 19 December 31, 2015 December 31, 2014 Non-interest bearing Demand Money Market Time Interest Bearing Demand Savings

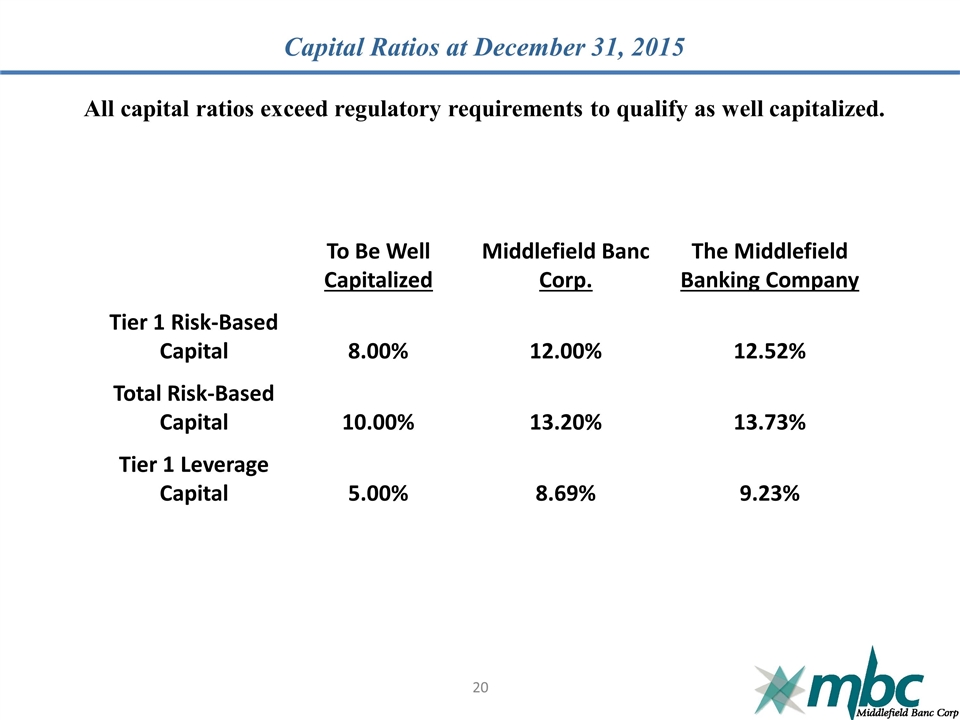

Capital Ratios at December 31, 2015 To Be Well Capitalized Middlefield Banc Corp. The Middlefield Banking Company Tier 1 Risk-Based Capital 8.00% 12.00% 12.52% Total Risk-Based Capital 10.00% 13.20% 13.73% Tier 1 Leverage Capital 5.00% 8.69% 9.23% All capital ratios exceed regulatory requirements to qualify as well capitalized. 20

Operating Initiatives Personnel/Talent Strong management to drive performance growth Sales-orientation and cultural fit Operations/Risk Management Expanded technology Scaled to support growth initiatives Diligent risk management incorporating regulatory environment Expand Share of Market/Share of Customer Identify target markets and customer segments Commercial relationship opportunities De novo expansion and strategic acquisitions 21

Today’s Banking Landscape High level of competition for share of wallet Increasing regulatory concerns with added costs for smaller banks Industry continues to consolidate Economic challenges with a continued low rate environment and slow growth 22

2016 and Forward Grow Secondary Mortgage Offering Execute against Strategic Plan: Market position Product and service offerings Growth initiatives Continue to Expand Share of Market/Share of Customer Identify target markets and customer segments Commercial relationship opportunities De novo expansion and strategic acquisitions 23

Questions, Comments, and Discussion 24

Voting Results Election of four Directors to serve until the 2019 annual meeting Election of one Director to serve until the 2018 annual meeting Non-binding proposal on compensation Ratification of appointment of S.R. Snodgrass, P.C. 25

Thank you for your support! May 11, 2016 26