Exhibit 99.2 Middlefield Banc Corp. Merger with Liberty Bancshares, Inc. May 26, 2022 (Nasdaq: MBCN)

Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995 concerning Middlefield Banc Corp.’s plans, strategies, objectives, expectations, intentions, financial condition and results of operations. These forward- looking statements reflect management’s current views and intentions and are subject to known and unknown risks, uncertainties, assumptions and other factors that could cause the actual results to differ materially from those contemplated by the statements. The significant risks and uncertainties related to Middlefield Banc Corp. of which management is aware are discussed in detail in the periodic reports that Middlefield Banc Corp. files with the Securities and Exchange Commission (the “SEC”), including in the “Risk Factors” section of its Annual Report on Form 10-K and its Quarterly Report on Form 10-Q. Investors are urged to review Middlefield Banc Corp.’s periodic reports, which are available at no charge through the SEC’s website at www.sec.gov and through Middlefield Banc Corp.’s website at www.middlefieldbank.bank on the “Investor Relations” page. Middlefield Banc Corp. assumes no obligation to update any of these forward- looking statements to reflect a change in its views or events or circumstances that occur after the date of this presentation. www.middlefieldbank.bank 2

Strategic Rationale § Experienced Ohio management team with deep roots in the market Liberty Business Model is a Strong § Shared banking approach and client centric cultures Cultural Fit (1) § Strong organic growth: 9% deposit and 7% loan CAGR since 2016 with strong asset quality § Enhances our presence in Columbus and surrounding markets Solidifies Our § Opportunity to meaningfully enter Hardin and Logan Counties where LBSI has the #1 and #3 deposit market share, Presence in Attractive respectively Ohio Markets th (2) § The combined company will be the 11 largest community bank in the state of Ohio by deposit market share (3) § Mr. Ron Zimmerly will assume the role of President of Middlefield Banc Corp. and The Middlefield Banking Company § Liberty leadership and key individuals will continue with the combined Company Our Emphasis on § Castle Creek Capital, a Liberty shareholder, will own approximately 7% of the pro forma Company Continuity § Mr. Zimmerly, Mr. Mark Watkins (Chairman of LBSI), and Spencer Cohn (a Castle Creek Capital representative), to join the Board of Directors (4) § Core deposits are ~97% of total deposits Liberty has an Attractive Deposit § ~40% non-interest bearing deposits to total deposits Franchise § Low cost of deposits, 14bps § Conservatively modeled transaction Financially Attractive § Acquisition of LBSI adds $437 million of assets, a ~33% increase Combination § Strong projected earnings accretion (9.5% in 2023, on a fully phased-in basis) § Minimal TBV dilution and an earnback period of approximately 3 years Source: S&P Global Market Intelligence Note: Deposit market share data as of 6/30/21 per S&P Global Market intelligence; Data pro forma for pending or recently completed acquisitions (1) CAGR as of the quarter ended 3/31/22 3 (2) Deposit market share ranking based on Ohio headquartered banks with less than $10 billion in assets (3) MBCN shareholders must approve amendments to the company’s Regulations that separate the positions of President and CEO (4) Data per bank level regulatory filings for the quarter ended 3/31/22

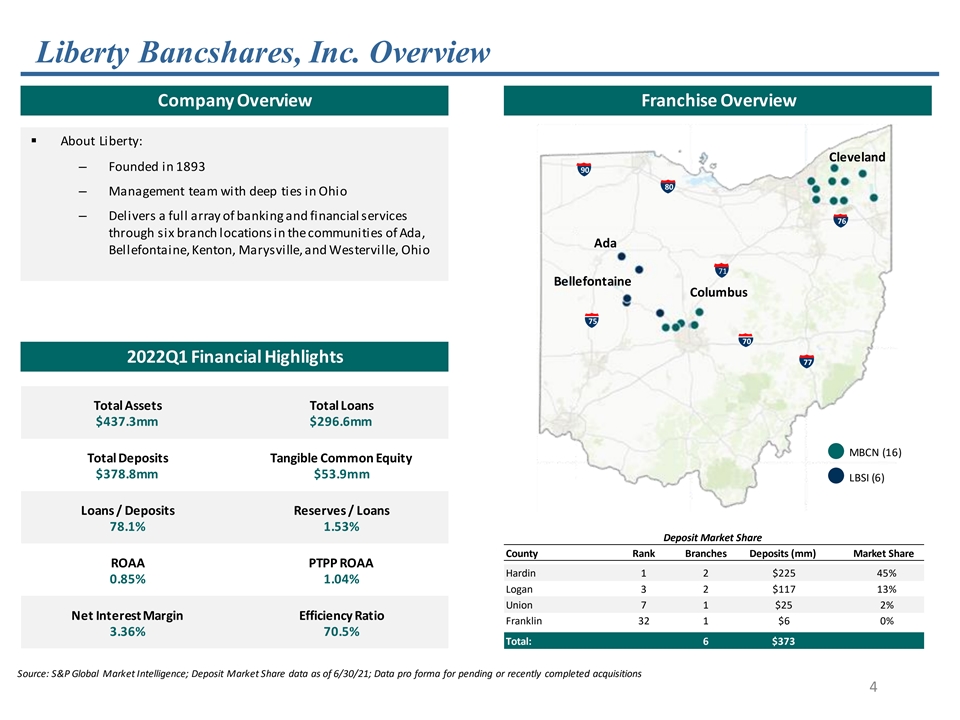

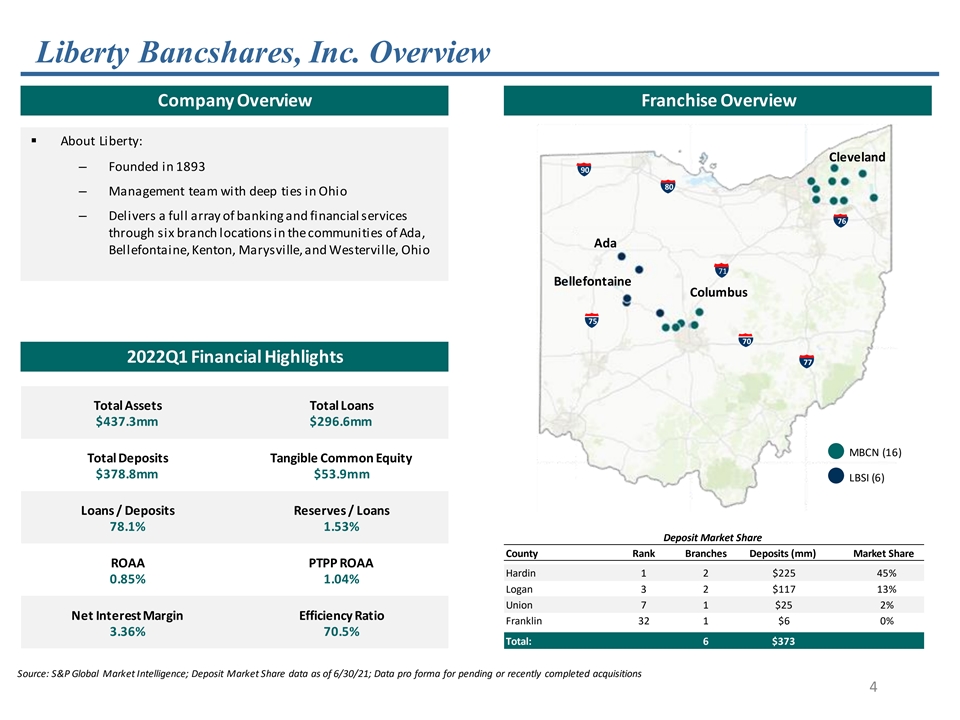

Liberty Bancshares, Inc. Overview Company Overview Franchise Overview § About Liberty: Cleveland ‒ Founded in 1893 90 80 ‒ Management team with deep ties in Ohio ‒ Delivers a full array of banking and financial services 76 through six branch locations in the communities of Ada, Ada Bellefontaine, Kenton, Marysville, and Westerville, Ohio 71 Bellefontaine Columbus 75 70 2022Q1 Financial Highlights 77 Total Assets Total Loans $437.3mm $296.6mm MBCN (16) Total Deposits Tangible Common Equity $378.8mm $53.9mm LBSI (6) Loans / Deposits Reserves / Loans 78.1% 1.53% Deposit Market Share County Rank Branches Deposits (mm) Market Share ROAA PTPP ROAA Hardin 1 2 $225 45% 0.85% 1.04% Logan 3 2 $117 13% Union 7 1 $25 2% Net Interest Margin Efficiency Ratio Franklin 32 1 $6 0% 3.36% 70.5% Total: 6 $373 Source: S&P Global Market Intelligence; Deposit Market Share data as of 6/30/21; Data pro forma for pending or recently completed acquisitions 4

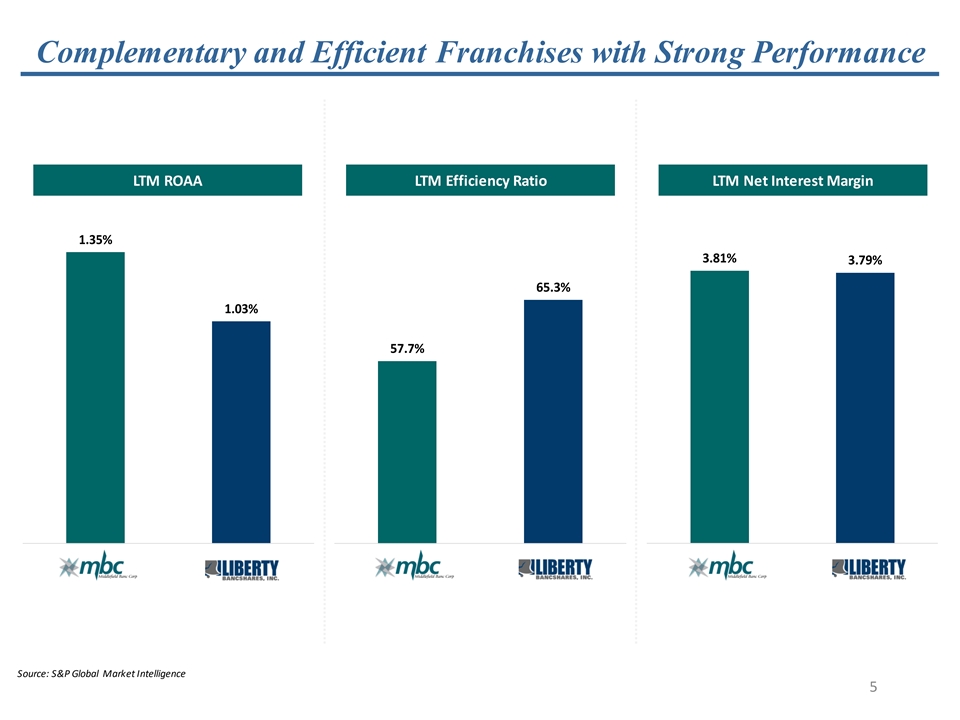

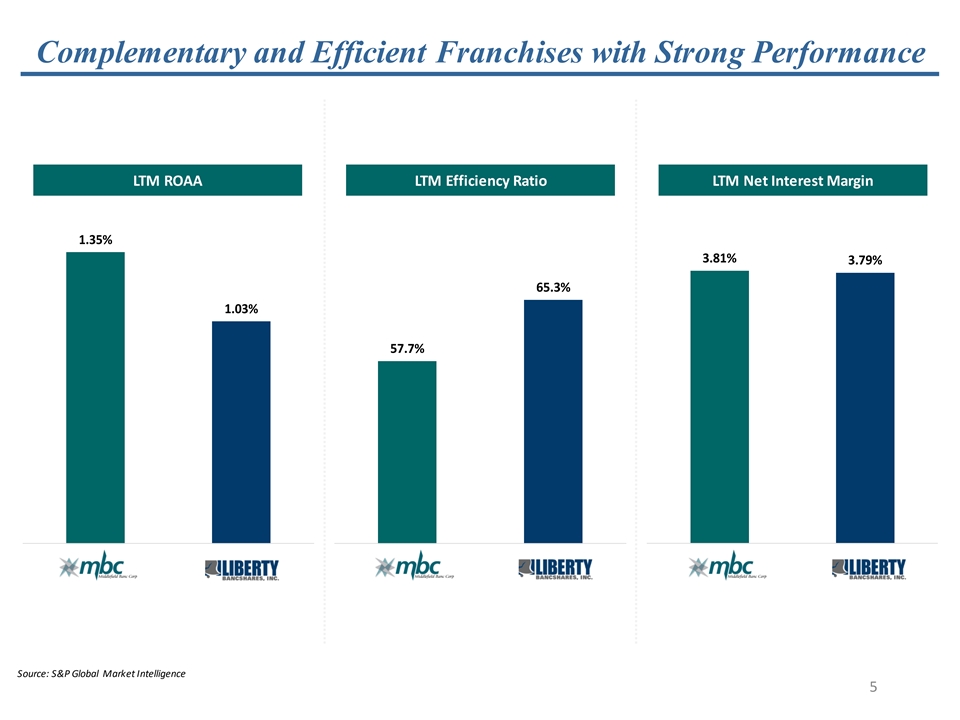

Complementary and Efficient Franchises with Strong Performance LTM ROAA LTM Efficiency Ratio LTM Net Interest Margin 1.35% 3.81% 3.79% 65.3% 1.03% 57.7% Source: S&P Global Market Intelligence 5

Well-Funded Loan Origination Engine Loan Growth Disciplined Underwriting Standards $ millions NPAs / Loans + OREO NCOs / Avg. Loans $297 0.90% $207 0.35% 0.29% (0.01%) 2016YE 2022Q1 2016YE 2022Q1 Deposit Growth High Quality Deposit Base $ millions Non-Interest Bearing Deposits / Total Deposits $379 40.3% $241 24.8% 2016YE 2022Q1 2016YE 2022Q1 Source: S&P Global Market Intelligence 6

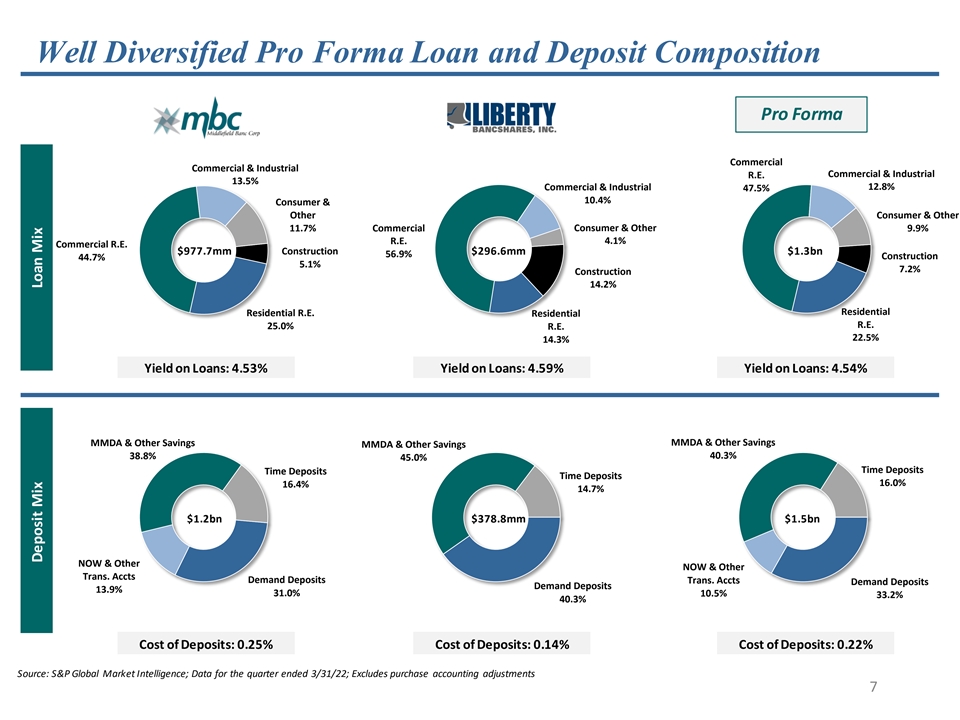

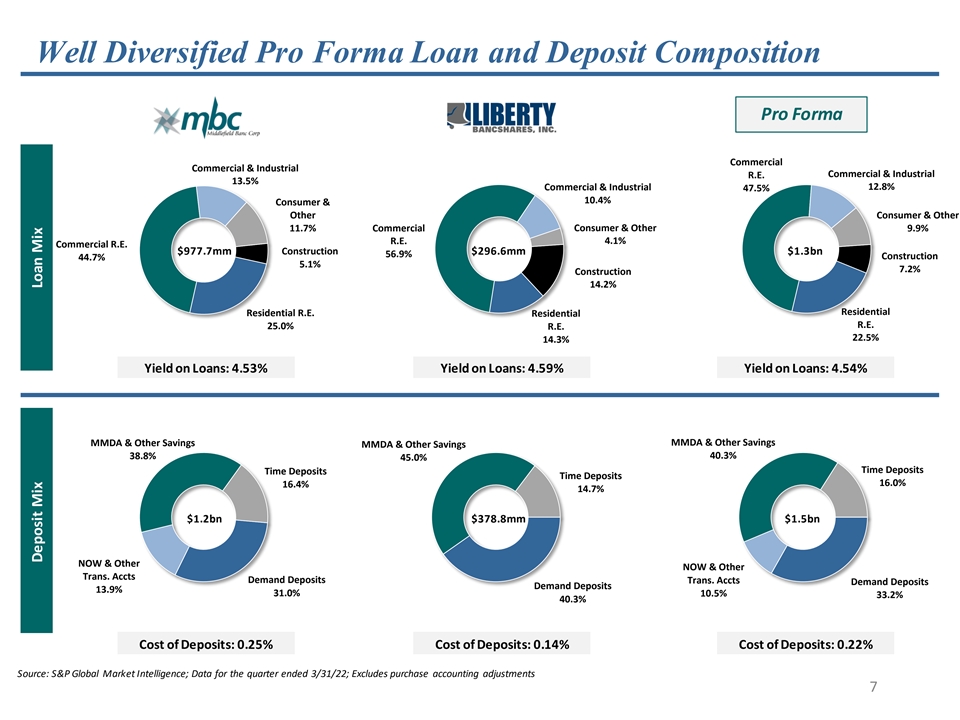

Well Diversified Pro Forma Loan and Deposit Composition Pro Forma Commercial Commercial & Industrial Commercial & Industrial R.E. 13.5% Commercial & Industrial 12.8% 47.5% 10.4% Consumer & Other Consumer & Other 11.7% Commercial Consumer & Other 9.9% R.E. 4.1% Commercial R.E. $977.7mm Construction $296.6mm $1.3bn 56.9% Construction 44.7% 5.1% 7.2% Construction 14.2% Residential Residential R.E. Residential R.E. 25.0% R.E. 22.5% 14.3% Yield on Loans: 4.53% Yield on Loans: 4.59% Yield on Loans: 4.54% MMDA & Other Savings MMDA & Other Savings MMDA & Other Savings 40.3% 38.8% 45.0% Time Deposits Time Deposits Time Deposits 16.0% 16.4% 14.7% $1.2bn $378.8mm $1.5bn NOW & Other NOW & Other Trans. Accts Demand Deposits Trans. Accts Demand Deposits Demand Deposits 13.9% 31.0% 10.5% 33.2% 40.3% Cost of Deposits: 0.25% Cost of Deposits: 0.14% Cost of Deposits: 0.22% Source: S&P Global Market Intelligence; Data for the quarter ended 3/31/22; Excludes purchase accounting adjustments 7 Deposit Mix Loan Mix

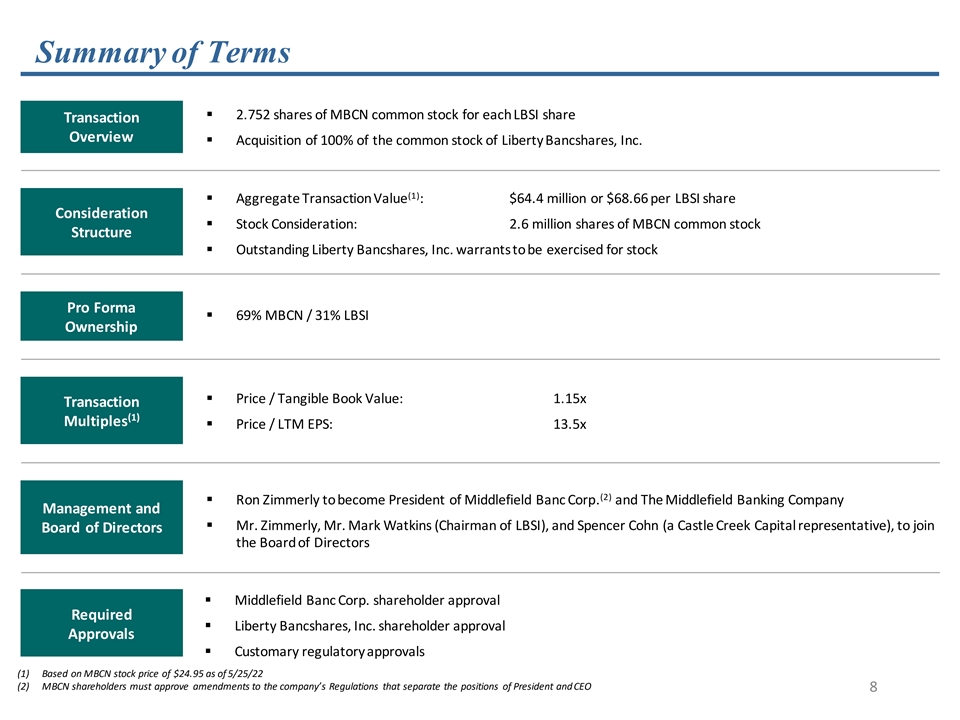

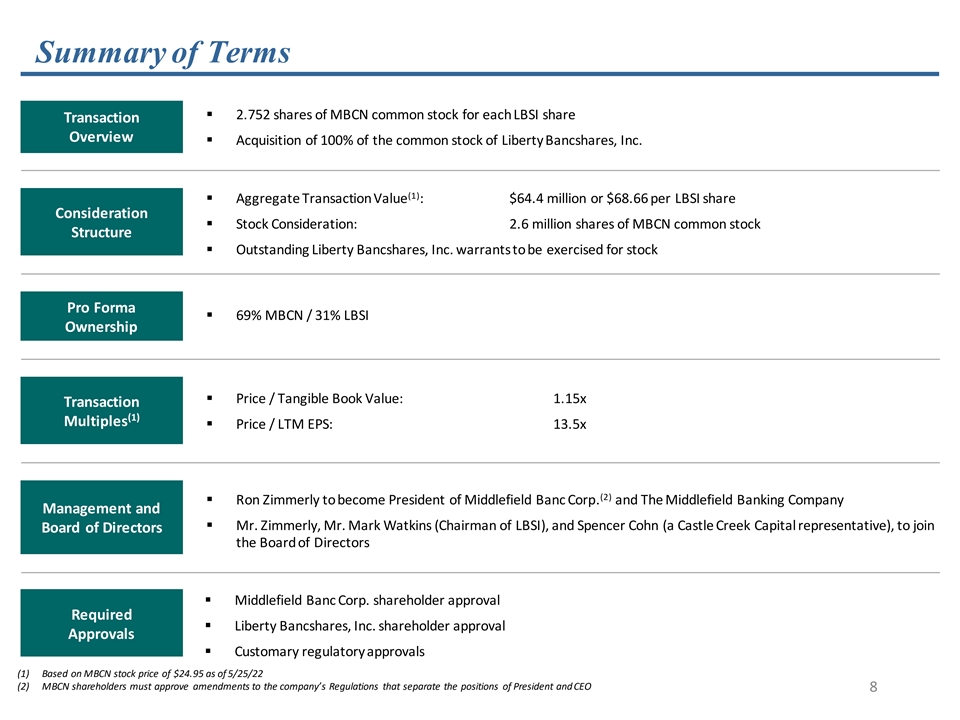

Summary of Terms § 2.752 shares of MBCN common stock for each LBSI share Transaction Overview § Acquisition of 100% of the common stock of Liberty Bancshares, Inc. (1) § Aggregate Transaction Value : $64.4 million or $68.66 per LBSI share Consideration § Stock Consideration: 2.6 million shares of MBCN common stock Structure § Outstanding Liberty Bancshares, Inc. warrants to be exercised for stock Pro Forma § 69% MBCN / 31% LBSI Ownership § Price / Tangible Book Value: 1.15x Transaction (1) Multiples § Price / LTM EPS: 13.5x (2) § Ron Zimmerly to become President of Middlefield Banc Corp. and The Middlefield Banking Company Management and § Mr. Zimmerly, Mr. Mark Watkins (Chairman of LBSI), and Spencer Cohn (a Castle Creek Capital representative), to join Board of Directors the Board of Directors § Middlefield Banc Corp. shareholder approval Required § Liberty Bancshares, Inc. shareholder approval Approvals § Customary regulatory approvals (1) Based on MBCN stock price of $24.95 as of 5/25/22 (2) MBCN shareholders must approve amendments to the company’s Regulations that separate the positions of President and CEO 8

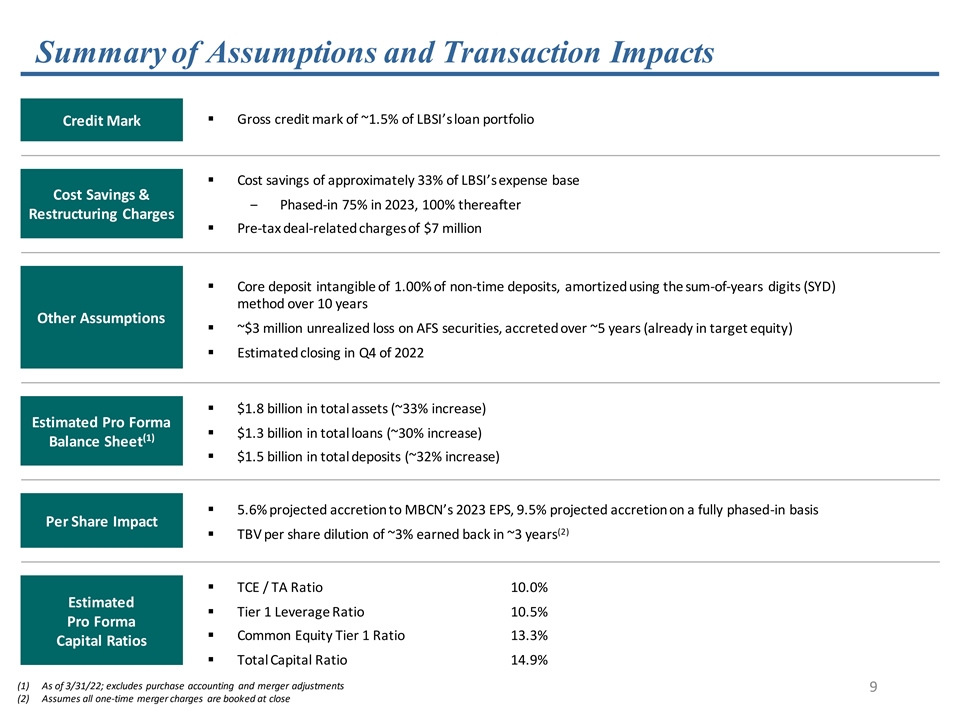

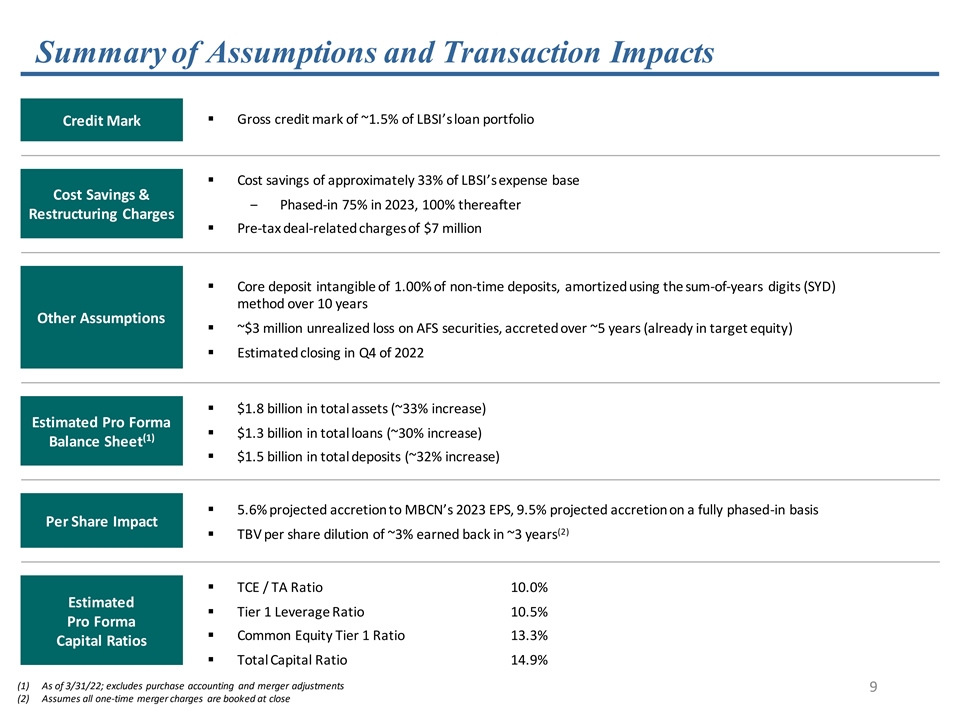

Summary of Assumptions and Transaction Impacts § Gross credit mark of ~1.5% of LBSI’s loan portfolio Credit Mark § Cost savings of approximately 33% of LBSI’s expense base Cost Savings & ‒ Phased-in 75% in 2023, 100% thereafter Restructuring Charges § Pre-tax deal-related charges of $7 million § Core deposit intangible of 1.00% of non-time deposits, amortized using the sum-of-years digits (SYD) method over 10 years Other Assumptions § ~$3 million unrealized loss on AFS securities, accreted over ~5 years (already in target equity) § Estimated closing in Q4 of 2022 § $1.8 billion in total assets (~33% increase) Estimated Pro Forma § $1.3 billion in total loans (~30% increase) (1) Balance Sheet § $1.5 billion in total deposits (~32% increase) § 5.6% projected accretion to MBCN’s 2023 EPS, 9.5% projected accretion on a fully phased-in basis Per Share Impact (2) § TBV per share dilution of ~3% earned back in ~3 years § TCE / TA Ratio 10.0% Estimated § Tier 1 Leverage Ratio 10.5% Pro Forma § Common Equity Tier 1 Ratio 13.3% Capital Ratios § Total Capital Ratio 14.9% (1) As of 3/31/22; excludes purchase accounting and merger adjustments 9 (2) Assumes all one-time merger charges are booked at close

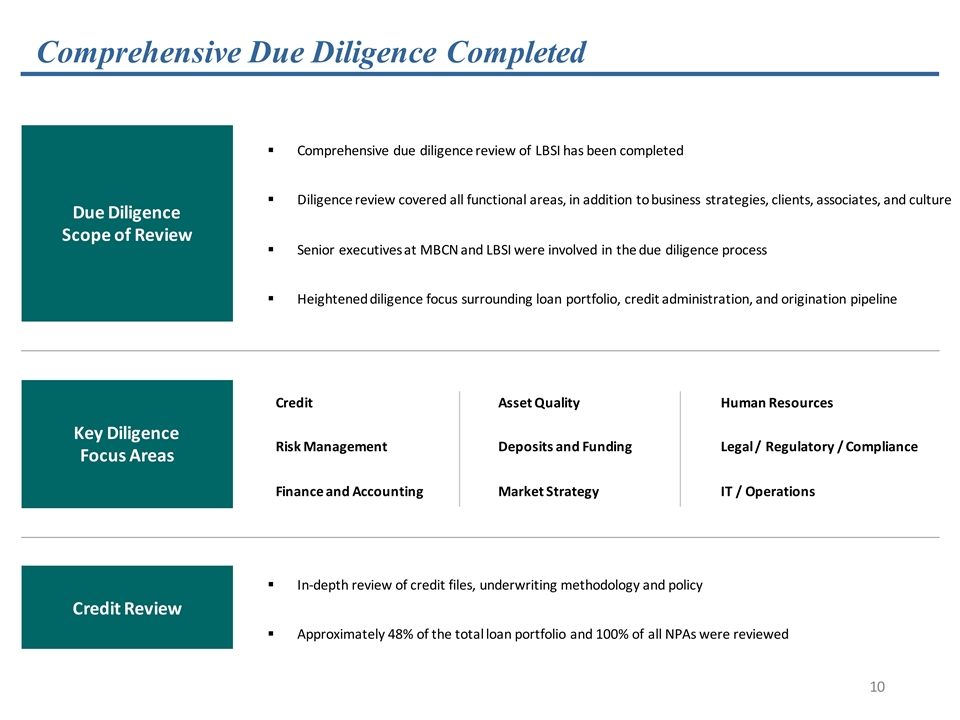

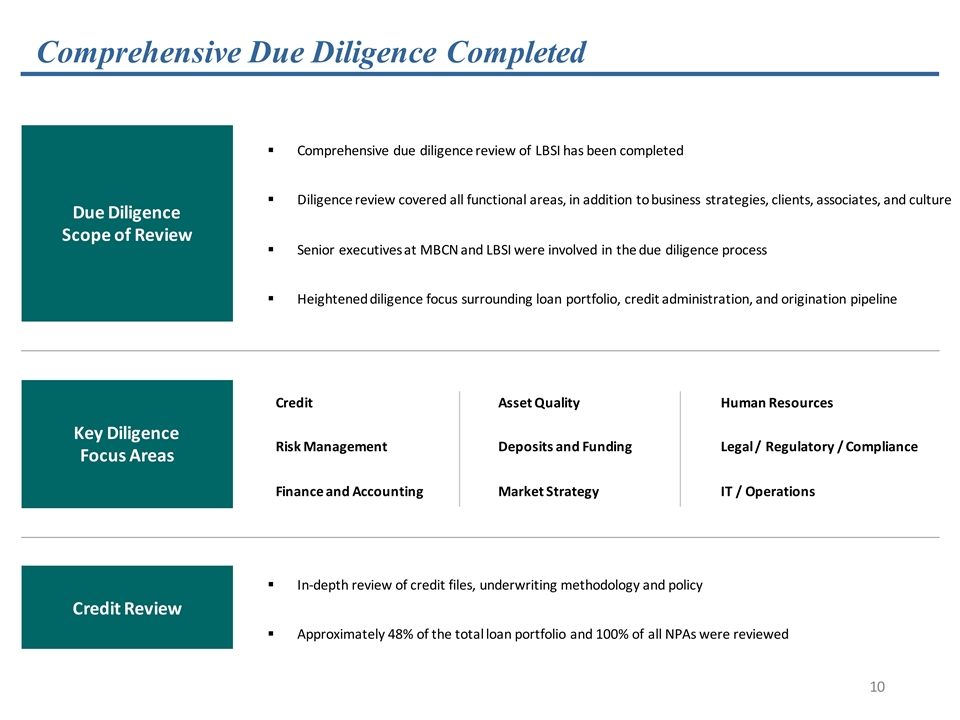

Comprehensive Due Diligence Completed § Comprehensive due diligence review of LBSI has been completed § Diligence review covered all functional areas, in addition to business strategies, clients, associates, and culture Due Diligence Scope of Review § Senior executives at MBCN and LBSI were involved in the due diligence process § Heightened diligence focus surrounding loan portfolio, credit administration, and origination pipeline Credit Asset Quality Human Resources Key Diligence Risk Management Deposits and Funding Legal / Regulatory / Compliance Focus Areas Finance and Accounting Market Strategy IT / Operations § In-depth review of credit files, underwriting methodology and policy Credit Review § Approximately 48% of the total loan portfolio and 100% of all NPAs were reviewed 10