- MBCN Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Middlefield Banc (MBCN) 425Business combination disclosure

Filed: 1 Aug 22, 3:34pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2022

MIDDLEFIELD BANC CORP.

(Exact name of registrant as specified in its charter)

| Ohio | 001-36613 | 34-1585111 | ||

| (State or other jurisdiction of incorporation) | (Commission File No.) | (IRS Employer I.D. No.) |

15985 East High Street, Middlefield, Ohio 44062

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (440) 632-1666

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| Common Stock, no par value | MBCN | The NASDAQ Stock Market, LLC (NASDAQ Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Other Events.

Middlefield Banc Corp. (NASDAQ: MBCN) intends to use the materials furnished herewith in one or more meetings with investors/analysts during the third quarter of 2022.

The information in this current Report on Form 8-K is being furnished under item 7.01 and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01(d) Exhibits

The following exhibit is furnished as Regulation FD Disclosure to this Current Report on Form 8-K.

(a) Exhibits.

| 99.1 | 2022 Second Quarter Investor Presentation | |

| 104 | Cover Page Interactive File (embedded within the Inline XBRL document) | |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| MIDDLEFIELD BANC CORP. | ||

| By: | /s/ James R. Heslop, II | |

| James R. Heslop, II | ||

| President and CEO | ||

Date: August 1, 2022

3

Middlefield Banc Corp. 2022 Second Quarter Investor Presentation (Nasdaq: MBCN) Exhibit 99.1

Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995 concerning Middlefield Banc Corp.’s plans, strategies, objectives, expectations, intentions, financial condition and results of operations. These forward-looking statements reflect management’s current views and intentions and are subject to known and unknown risks, uncertainties, assumptions and other factors that could cause the actual results to differ materially from those contemplated by the statements. The significant risks and uncertainties related to Middlefield Banc Corp. of which management is aware are discussed in detail in the periodic reports that Middlefield Banc Corp. files with the Securities and Exchange Commission (the “SEC”), including in the “Risk Factors” section of its Annual Report on Form 10-K and its Quarterly Report on Form 10-Q. Investors are urged to review Middlefield Banc Corp.’s periodic reports, which are available at no charge through the SEC’s website at www.sec.gov and through Middlefield Banc Corp.’s website at www.middlefieldbank.bank on the “Investor Relations” page. Middlefield Banc Corp. assumes no obligation to update any of these forward-looking statements to reflect a change in its views or events or circumstances that occur after the date of this presentation. www.middlefieldbank.bank

Middlefield Banc Corp. Middlefield Banc Corp. (Nasdaq: MBCN) Providing financial services throughout Central and Northeast Ohio Profitably serving its communities, customers, employees, and shareholders by its commitment to quality, safety and soundness, and maximizing shareholder value www.middlefieldbank.bank

www.middlefieldbank.bank Middlefield: A community bank that is safe, strong and committed Highlights Strategic Strengths People: Average tenure of leadership team at Middlefield is approximately 14 years Strong bench of management talent Communities: Serving two of Ohio's most attractive banking markets Optimally positioned between rural and metropolitan communities Customers: Balanced mix of retail and commercial customers Geauga County is home to the 4th largest Amish population in the world Community Banking Values and Focus: Providing superior and responsive financial services since 1901 Committed to quality, safety and soundness Financial Strength: Profitable throughout the economic cycle and never reported a loss Maintained dividend during the global financial crisis and the Covid-19 pandemic 16 Branches 120 Years of Service 2 Strong Ohio Markets #1 Community Bank in Core Market 9.5% Increase in 2021 Book Value per Share

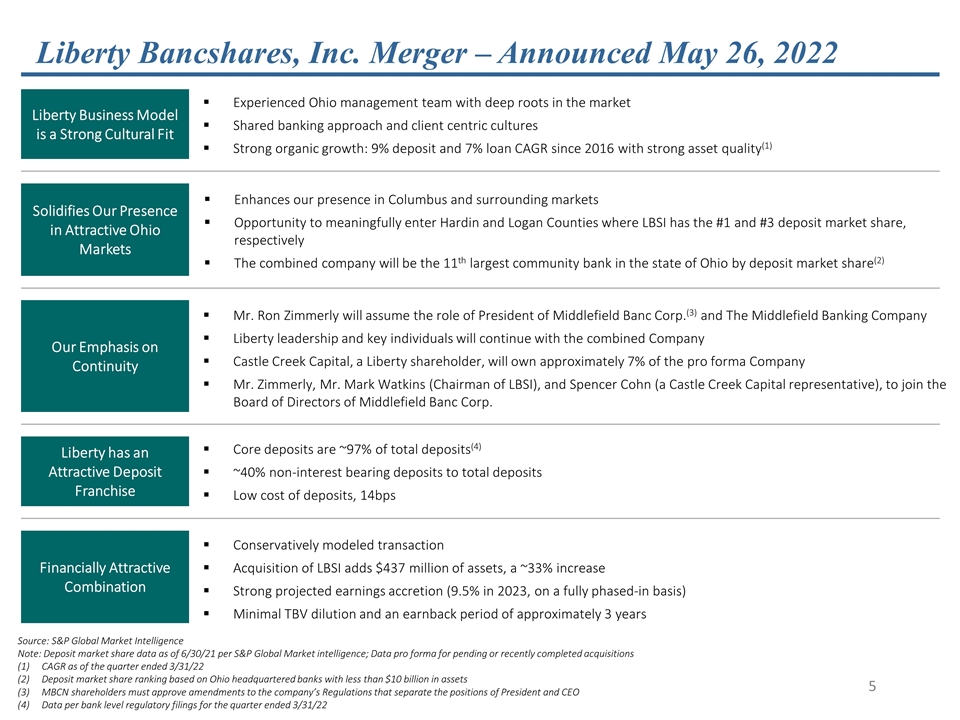

Liberty Bancshares, Inc. Merger – Announced May 26, 2022 0 102 102 51 102 153 0 0 0 149 179 215 166 166 166 Solidifies Our Presence in Attractive Ohio Markets Financially Attractive Combination Our Emphasis on Continuity Liberty has an Attractive Deposit Franchise Enhances our presence in Columbus and surrounding markets Opportunity to meaningfully enter Hardin and Logan Counties where LBSI has the #1 and #3 deposit market share, respectively The combined company will be the 11th largest community bank in the state of Ohio by deposit market share(2) Conservatively modeled transaction Acquisition of LBSI adds $437 million of assets, a ~33% increase Strong projected earnings accretion (9.5% in 2023, on a fully phased-in basis) Minimal TBV dilution and an earnback period of approximately 3 years Mr. Ron Zimmerly will assume the role of President of Middlefield Banc Corp.(3) and The Middlefield Banking Company Liberty leadership and key individuals will continue with the combined Company Castle Creek Capital, a Liberty shareholder, will own approximately 7% of the pro forma Company Mr. Zimmerly, Mr. Mark Watkins (Chairman of LBSI), and Spencer Cohn (a Castle Creek Capital representative), to join the Board of Directors of Middlefield Banc Corp. Core deposits are ~97% of total deposits(4) ~40% non-interest bearing deposits to total deposits Low cost of deposits, 14bps Source: S&P Global Market Intelligence Note: Deposit market share data as of 6/30/21 per S&P Global Market intelligence; Data pro forma for pending or recently completed acquisitions CAGR as of the quarter ended 3/31/22 Deposit market share ranking based on Ohio headquartered banks with less than $10 billion in assets MBCN shareholders must approve amendments to the company’s Regulations that separate the positions of President and CEO Data per bank level regulatory filings for the quarter ended 3/31/22 Liberty Business Model is a Strong Cultural Fit Experienced Ohio management team with deep roots in the market Shared banking approach and client centric cultures Strong organic growth: 9% deposit and 7% loan CAGR since 2016 with strong asset quality(1)

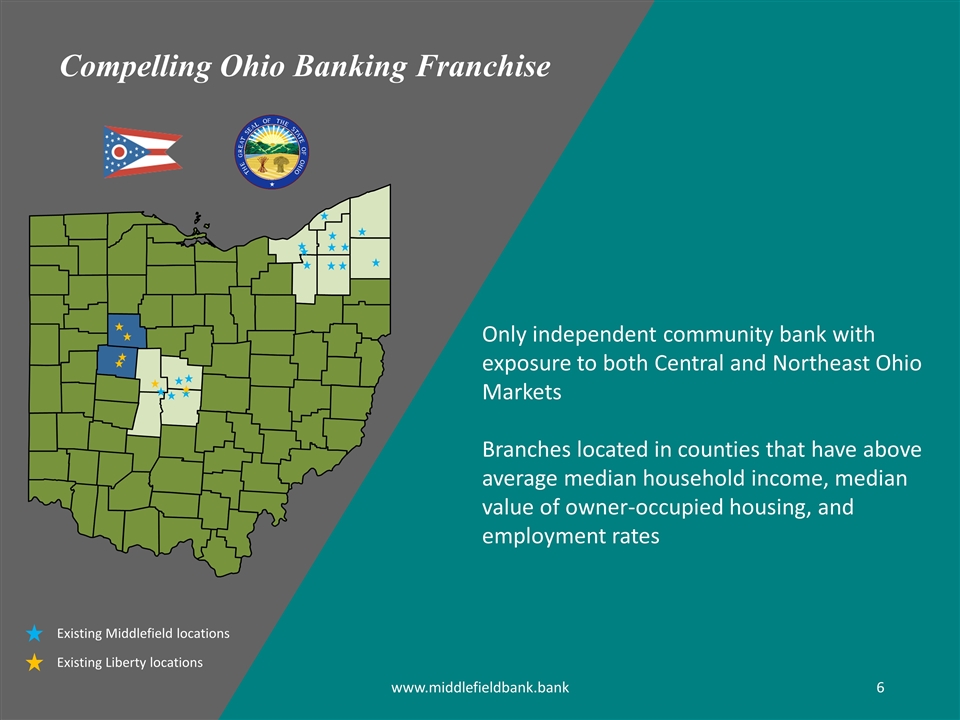

Only independent community bank with exposure to both Central and Northeast Ohio Markets Branches located in counties that have above average median household income, median value of owner-occupied housing, and employment rates www.middlefieldbank.bank Compelling Ohio Banking Franchise Existing Middlefield locations Existing Liberty locations

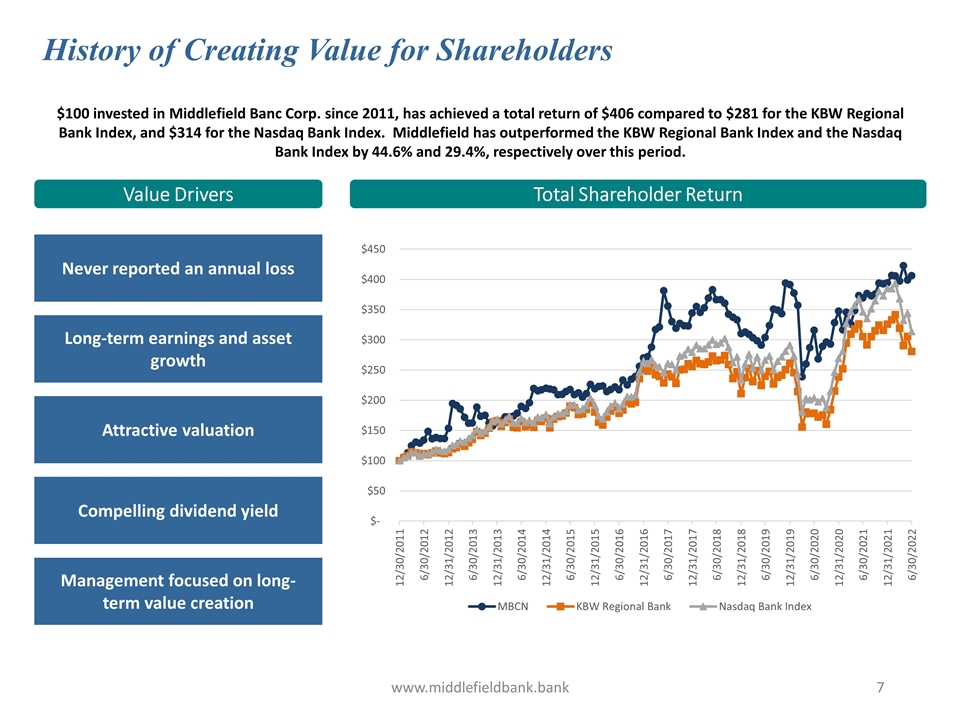

www.middlefieldbank.bank History of Creating Value for Shareholders Total Shareholder Return Value Drivers $100 invested in Middlefield Banc Corp. since 2011, has achieved a total return of $406 compared to $281 for the KBW Regional Bank Index, and $314 for the Nasdaq Bank Index. Middlefield has outperformed the KBW Regional Bank Index and the Nasdaq Bank Index by 44.6% and 29.4%, respectively over this period. Never reported an annual loss Compelling dividend yield Attractive valuation Long-term earnings and asset growth Management focused on long-term value creation

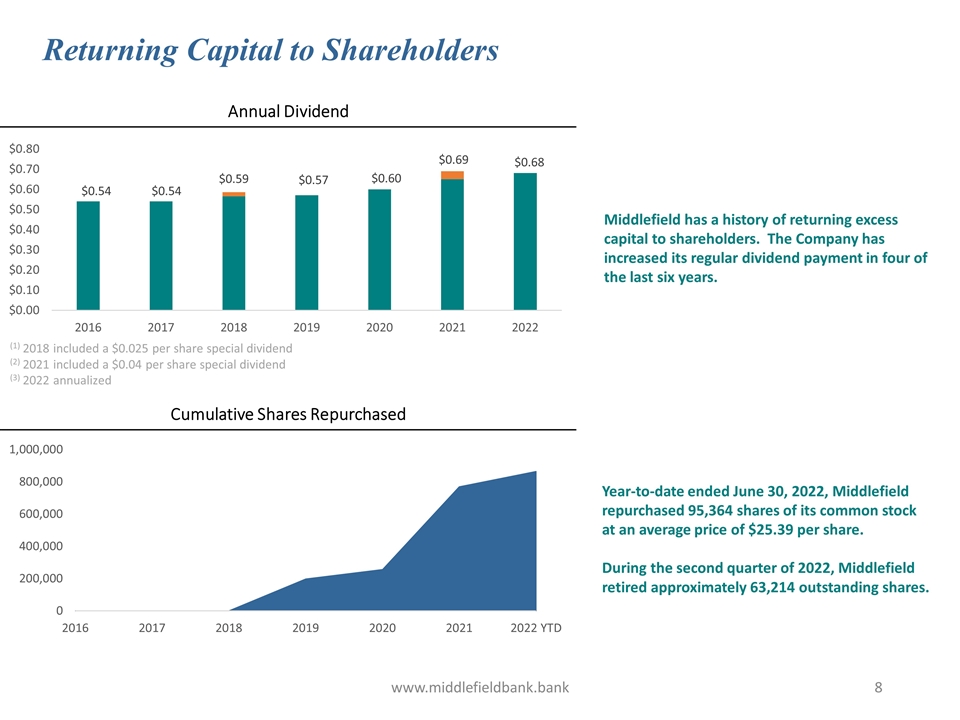

www.middlefieldbank.bank Returning Capital to Shareholders Annual Dividend Cumulative Shares Repurchased Middlefield has a history of returning excess capital to shareholders. The Company has increased its regular dividend payment in four of the last six years. Year-to-date ended June 30, 2022, Middlefield repurchased 95,364 shares of its common stock at an average price of $25.39 per share. During the second quarter of 2022, Middlefield retired approximately 63,214 outstanding shares. (1) 2018 included a $0.025 per share special dividend (2) 2021 included a $0.04 per share special dividend (3) 2022 annualized

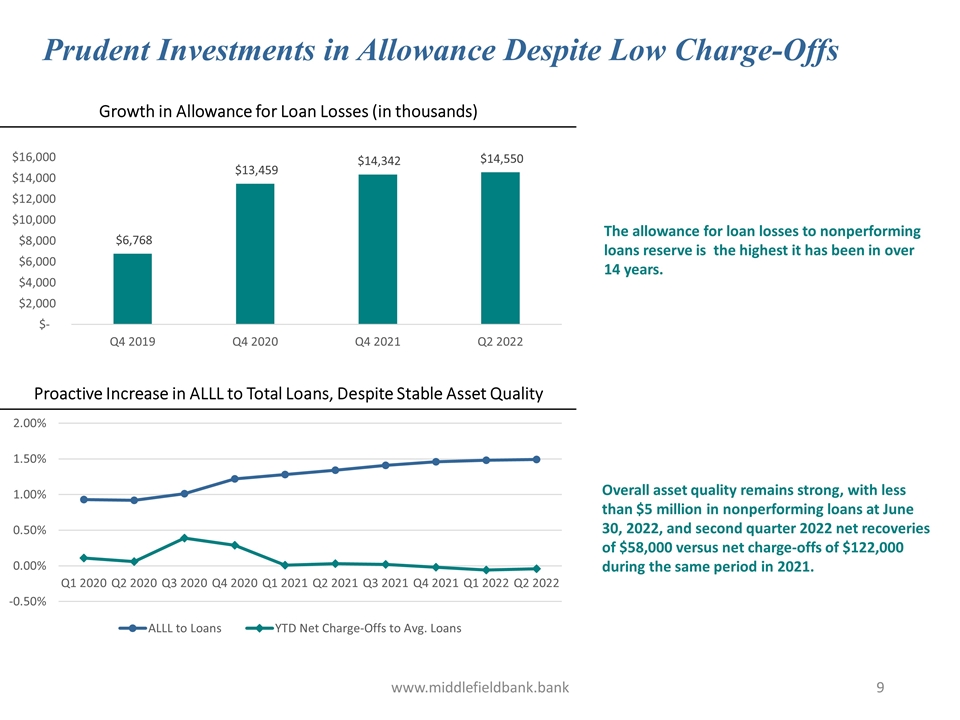

www.middlefieldbank.bank Prudent Investments in Allowance Despite Low Charge-Offs Growth in Allowance for Loan Losses (in thousands) Proactive Increase in ALLL to Total Loans, Despite Stable Asset Quality The allowance for loan losses to nonperforming loans reserve is the highest it has been in over 14 years. Overall asset quality remains strong, with less than $5 million in nonperforming loans at June 30, 2022, and second quarter 2022 net recoveries of $58,000 versus net charge-offs of $122,000 during the same period in 2021.

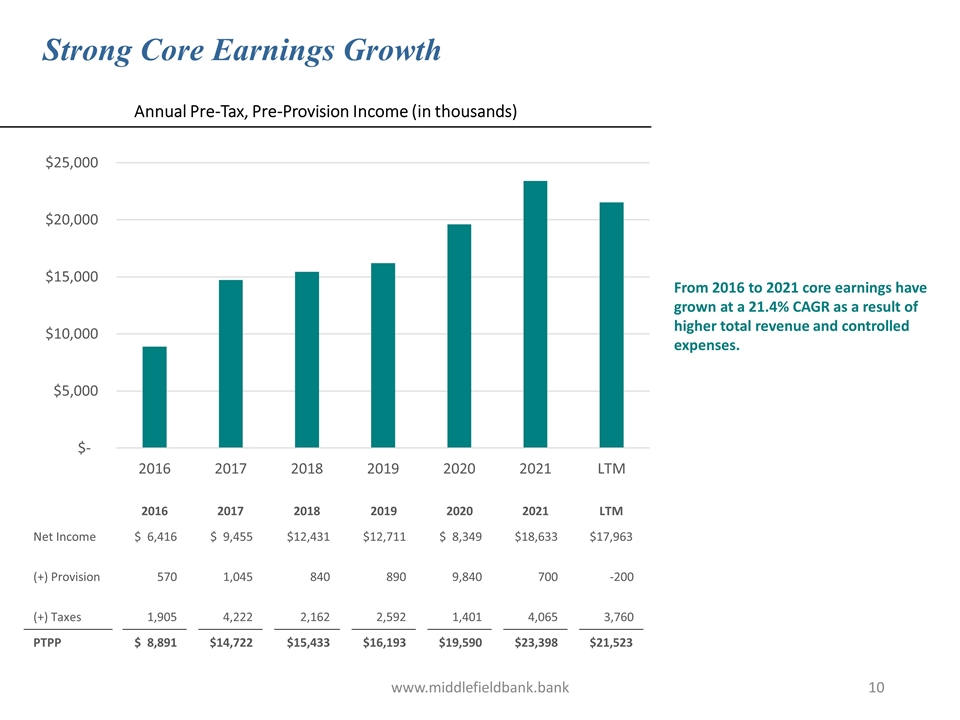

www.middlefieldbank.bank Strong Core Earnings Growth Annual Pre-Tax, Pre-Provision Income (in thousands) From 2016 to 2021 core earnings have grown at a 21.4% CAGR as a result of higher total revenue and controlled expenses. Net Income (+) Provision (+) Taxes PTPP LTM $17,963 -200 3,760 $21,523 2019 $12,711 890 2,592 $16,193 2018 $12,431 840 2,162 $15,433 2017 $ 9,455 1,045 4,222 $14,722 2016 $ 6,416 570 1,905 $ 8,891 2020 $ 8,349 9,840 1,401 $19,590 2021 $18,633 700 4,065 $23,398

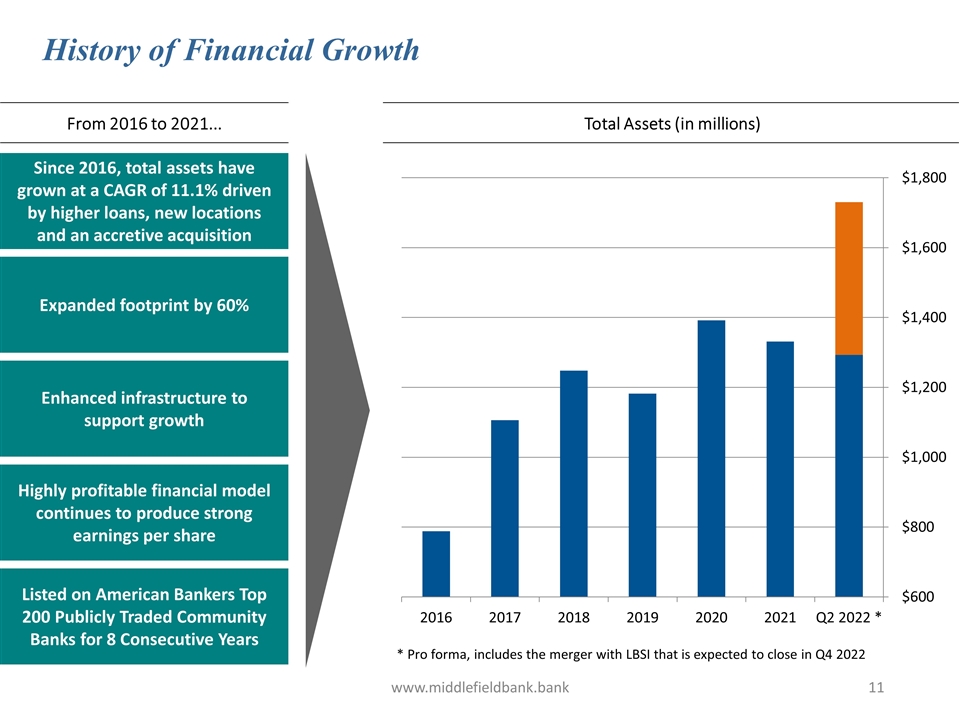

www.middlefieldbank.bank History of Financial Growth Since 2016, total assets have grown at a CAGR of 11.1% driven by higher loans, new locations and an accretive acquisition Expanded footprint by 60% Enhanced infrastructure to support growth Highly profitable financial model continues to produce strong earnings per share Listed on American Bankers Top 200 Publicly Traded Community Banks for 8 Consecutive Years From 2016 to 2021... Total Assets (in millions) * Pro forma, includes the merger with LBSI that is expected to close in Q4 2022

www.middlefieldbank.bank Growth Oriented Platform Supports Long-Term Strategic Plan Middlefield is focused on expanding in high growth markets with favorable demographics and exploiting changing market dynamics. Middlefield has invested in creating an infrastructure to support a bank in excess of $2 billion in assets. Attract, Develop and Retain Talent Strengthen and empower associates Added important members to leadership team Enhance Products and Services Expanding product and service offerings Strategic focus on products and services that grow noninterest income Advance Customer Interactions Enhancing online and digital banking New modern bank layout and engagement Expand Geographies and Market Share Focus on growth in compelling Central Ohio Market Increase share in core Northeast Ohio Markets Invest in Systems and Security Continual investments in security, privacy, and compliance Platform and Growth Strategies

www.middlefieldbank.bank “I put together an aggressive growth strategy for my business Exscape Designs. The need for a local relationship-based approach made clear sense. In my experience over the years with Middlefield Bank we have been able to achieve a lot of growth together. With Middlefield you're not just numbers, it's the relationship and community that matters to them.” “Ease Logistics was looking for a small community bank to help us grow our business. We needed a credit line to support our 40% growth. Middlefield bank was able to step up and provide us the working capital we needed, and the process was seamless. When Ease Logistics needed a mortgage for their new headquarters in Dublin, Middlefield Bank was there. We love the staff too!” “It has been a pleasure to do business with Middlefield Bank for these past 20 years. When all of the other local major banks turned away from the business, Middlefield Bank welcomed it with open arms. This relationship started with trust and that trust is the foundation in which we continue to use Middlefield for all of our banking needs.” Strategy Dependent on Customers and Communities Local Strong Committed

www.middlefieldbank.bank Fully automated Digital Account Opening (DAO) solution provides our customers a modern, flexible approach to opening accounts. New digital insurance agency platform. Offers a full-service insurance agency solution to our retail and commercial customers. Provides simple, seamless access to competitive options. New fraud prevention platform for checks and ACH transactions. Platform empowers customers with the ability to customize actionable alerts and accept or reject suspicious ACH and checks in real-time. Adding Digital Tools and Services to Improve Our Customer Experience and Enhance Our Relationships Digital Account Opening Digital Insurance Agency Digital Fraud Prevention

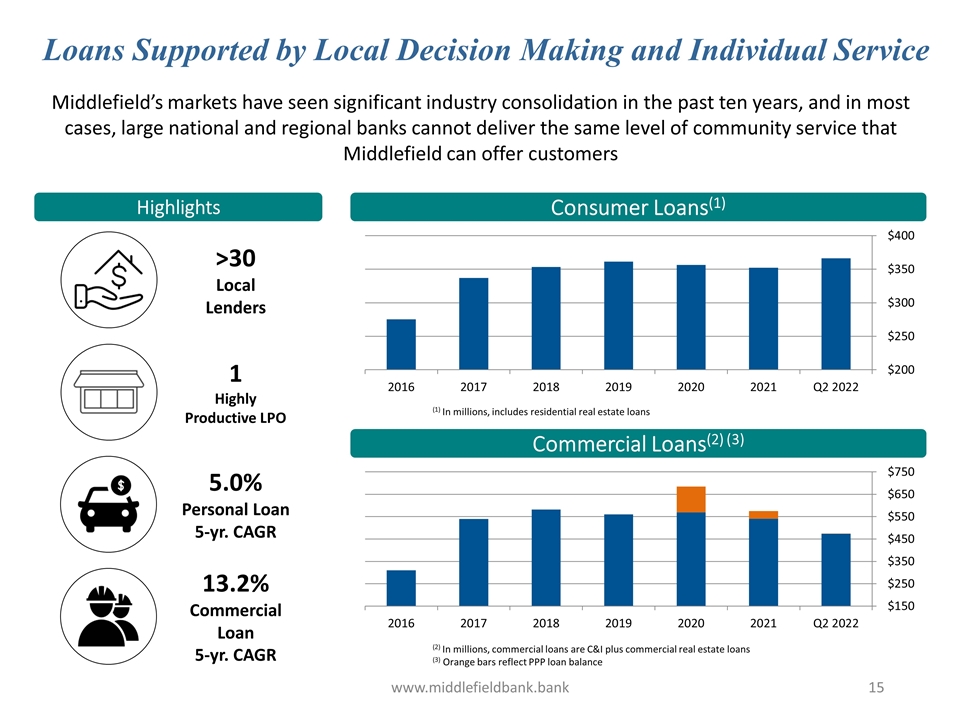

www.middlefieldbank.bank Loans Supported by Local Decision Making and Individual Service Middlefield’s markets have seen significant industry consolidation in the past ten years, and in most cases, large national and regional banks cannot deliver the same level of community service that Middlefield can offer customers Highlights Consumer Loans(1) Commercial Loans(2) (3) (2) In millions, commercial loans are C&I plus commercial real estate loans (3) Orange bars reflect PPP loan balance (1) In millions, includes residential real estate loans >30 Local Lenders 1 Highly Productive LPO 13.2% Commercial Loan 5-yr. CAGR 5.0% Personal Loan 5-yr. CAGR

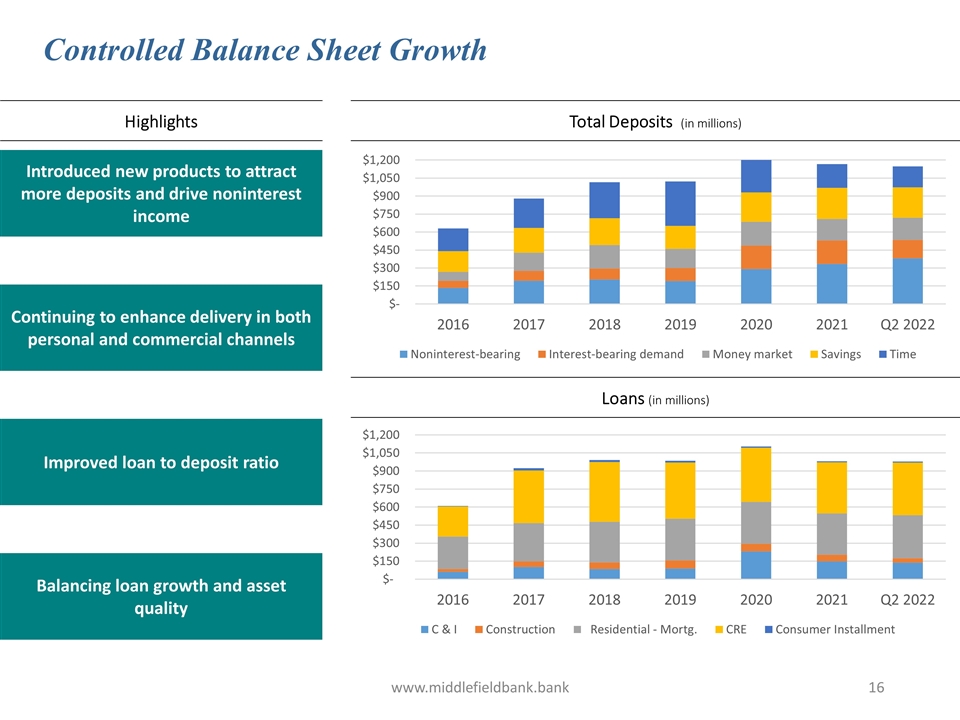

www.middlefieldbank.bank Controlled Balance Sheet Growth Highlights Total Deposits (in millions) Loans (in millions) Introduced new products to attract more deposits and drive noninterest income Improved loan to deposit ratio Balancing loan growth and asset quality Continuing to enhance delivery in both personal and commercial channels

Supplemental Financial Data (Nasdaq: MBCN)

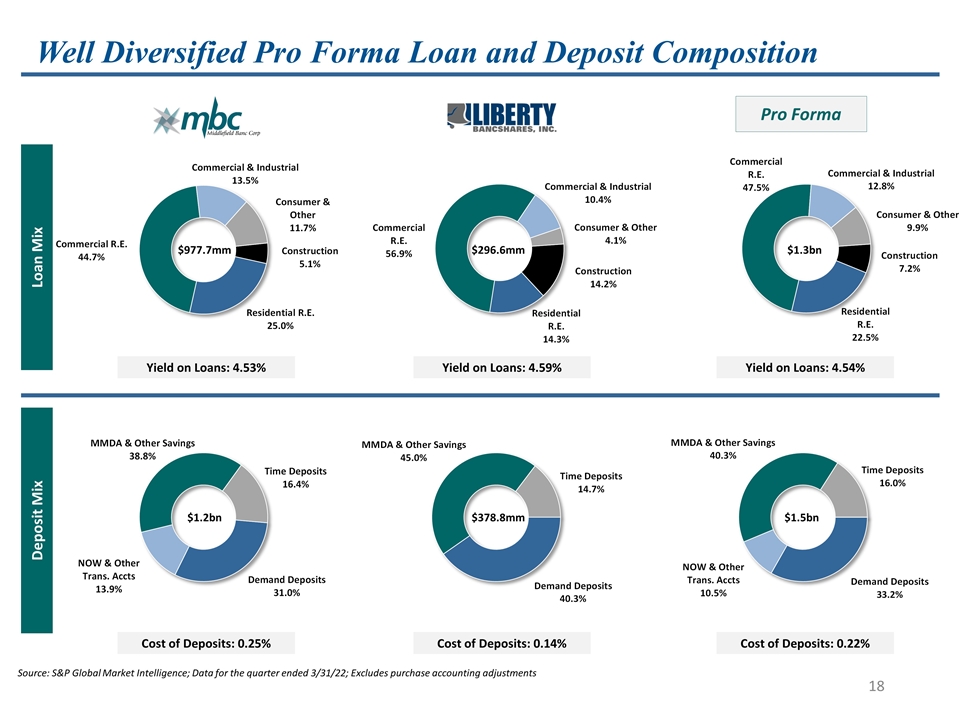

Well Diversified Pro Forma Loan and Deposit Composition 0 102 102 51 102 153 0 0 0 149 179 215 166 166 166 Loan Mix Deposit Mix Pro Forma Yield on Loans: 4.53% Cost of Deposits: 0.25% Yield on Loans: 4.59% Cost of Deposits: 0.14% Yield on Loans: 4.54% Cost of Deposits: 0.22% $977.7mm $1.2bn $296.6mm $378.8mm $1.3bn $1.5bn Source: S&P Global Market Intelligence; Data for the quarter ended 3/31/22; Excludes purchase accounting adjustments Ties to SNL and Company Docs 5/25/22

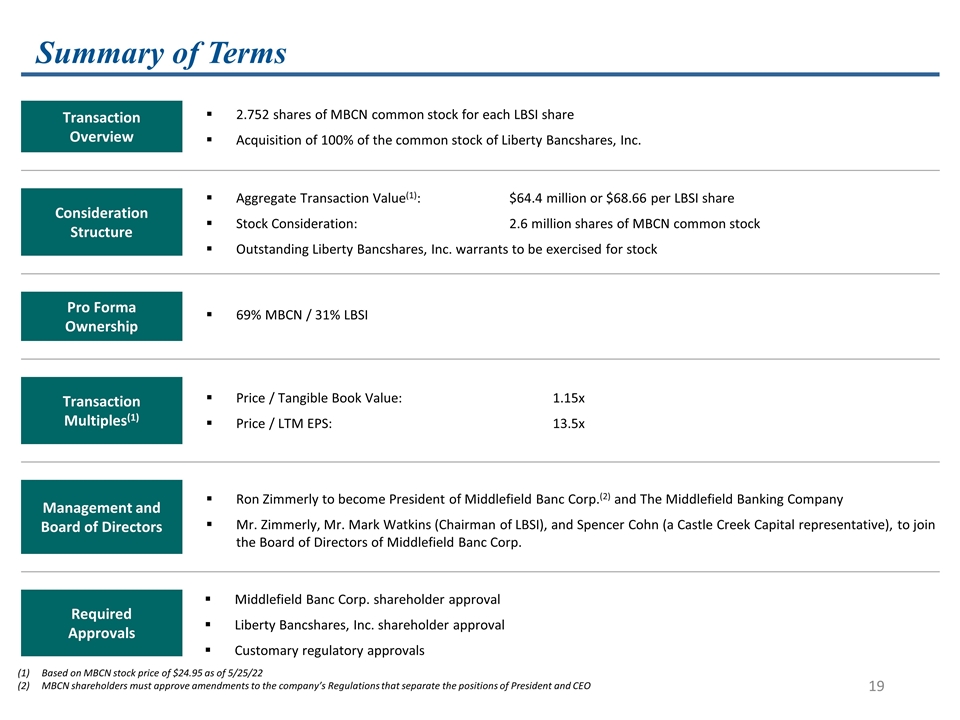

Summary of Terms 0 102 102 51 102 153 0 0 0 149 179 215 166 166 166 Transaction Overview Consideration Structure Required Approvals 2.752 shares of MBCN common stock for each LBSI share Acquisition of 100% of the common stock of Liberty Bancshares, Inc. Aggregate Transaction Value(1): $64.4 million or $68.66 per LBSI share Stock Consideration: 2.6 million shares of MBCN common stock Outstanding Liberty Bancshares, Inc. warrants to be exercised for stock Middlefield Banc Corp. shareholder approval Liberty Bancshares, Inc. shareholder approval Customary regulatory approvals Pro Forma Ownership 69% MBCN / 31% LBSI Transaction Multiples(1) Price / Tangible Book Value:1.15x Price / LTM EPS:13.5x Management and Board of Directors Ron Zimmerly to become President of Middlefield Banc Corp.(2) and The Middlefield Banking Company Mr. Zimmerly, Mr. Mark Watkins (Chairman of LBSI), and Spencer Cohn (a Castle Creek Capital representative), to join the Board of Directors of Middlefield Banc Corp. Based on MBCN stock price of $24.95 as of 5/25/22 MBCN shareholders must approve amendments to the company’s Regulations that separate the positions of President and CEO

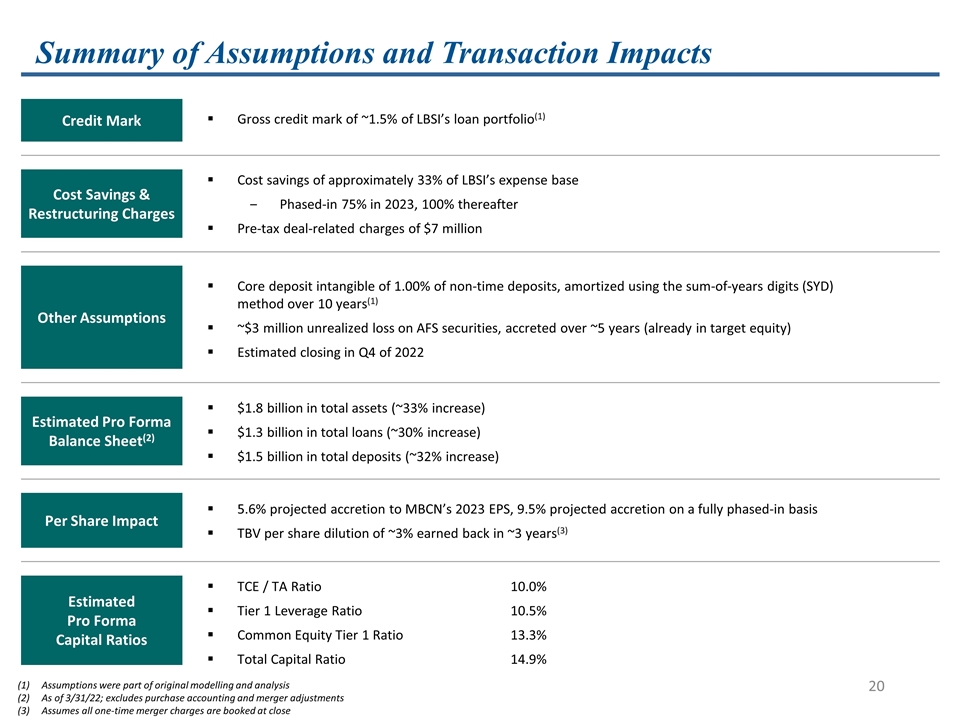

Summary of Assumptions and Transaction Impacts 0 102 102 51 102 153 0 0 0 149 179 215 166 166 166 Credit Mark Gross credit mark of ~1.5% of LBSI’s loan portfolio(1) Cost Savings & Restructuring Charges Cost savings of approximately 33% of LBSI’s expense base Phased-in 75% in 2023, 100% thereafter Pre-tax deal-related charges of $7 million Other Assumptions Core deposit intangible of 1.00% of non-time deposits, amortized using the sum-of-years digits (SYD) method over 10 years(1) ~$3 million unrealized loss on AFS securities, accreted over ~5 years (already in target equity) Estimated closing in Q4 of 2022 Estimated Pro Forma Balance Sheet(2) Per Share Impact Estimated Pro Forma Capital Ratios $1.8 billion in total assets (~33% increase) $1.3 billion in total loans (~30% increase) $1.5 billion in total deposits (~32% increase) 5.6% projected accretion to MBCN’s 2023 EPS, 9.5% projected accretion on a fully phased-in basis TBV per share dilution of ~3% earned back in ~3 years(3) TCE / TA Ratio10.0% Tier 1 Leverage Ratio 10.5% Common Equity Tier 1 Ratio13.3% Total Capital Ratio14.9% Assumptions were part of original modelling and analysis As of 3/31/22; excludes purchase accounting and merger adjustments Assumes all one-time merger charges are booked at close

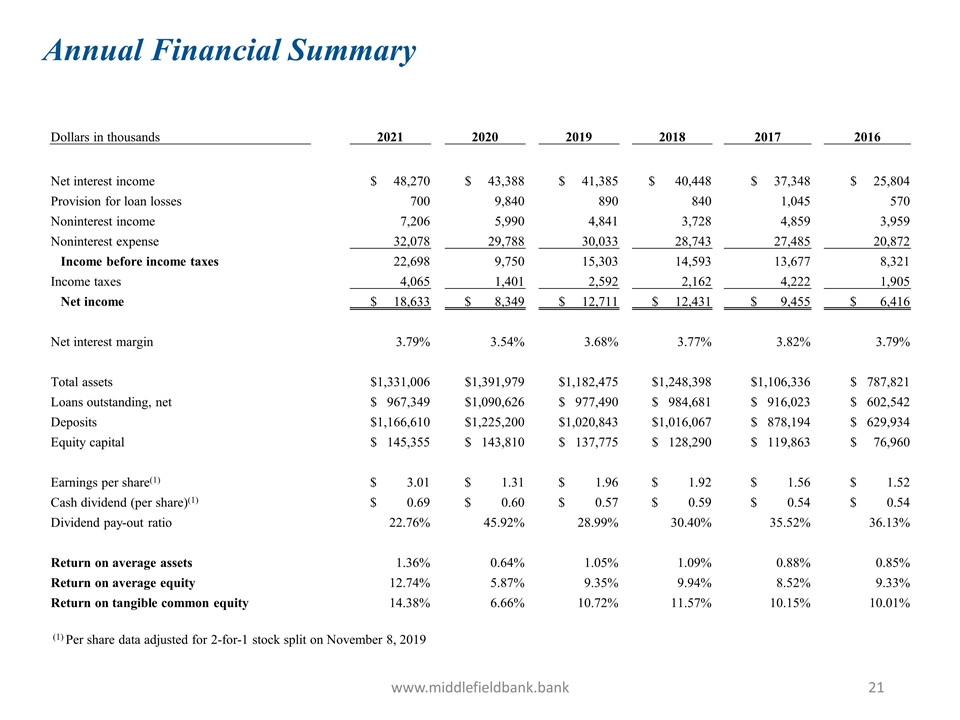

Annual Financial Summary www.middlefieldbank.bank (1) Per share data adjusted for 2-for-1 stock split on November 8, 2019 Dollars in thousands 2021 2020 2019 2018 2017 2016 Net interest income $ 48,270 $ 43,388 $ 41,385 $ 40,448 $ 37,348 $ 25,804 Provision for loan losses 700 9,840 890 840 1,045 570 Noninterest income 7,206 5,990 4,841 3,728 4,859 3,959 Noninterest expense 32,078 29,788 30,033 28,743 27,485 20,872 Income before income taxes 22,698 9,750 15,303 14,593 13,677 8,321 Income taxes 4,065 1,401 2,592 2,162 4,222 1,905 Net income $ 18,633 $ 8,349 $ 12,711 $ 12,431 $ 9,455 $ 6,416 Net interest margin 3.79% 3.54% 3.68% 3.77% 3.82% 3.79% Total assets $1,331,006 $1,391,979 $1,182,475 $1,248,398 $1,106,336 $ 787,821 Loans outstanding, net $ 967,349 $1,090,626 $ 977,490 $ 984,681 $ 916,023 $ 602,542 Deposits $1,166,610 $1,225,200 $1,020,843 $1,016,067 $ 878,194 $ 629,934 Equity capital $ 145,355 $ 143,810 $ 137,775 $ 128,290 $ 119,863 $ 76,960 Earnings per share(1) $ 3.01 $ 1.31 $ 1.96 $ 1.92 $ 1.56 $ 1.52 Cash dividend (per share)(1) $ 0.69 $ 0.60 $ 0.57 $ 0.59 $ 0.54 $ 0.54 Dividend pay-out ratio 22.76% 45.92% 28.99% 30.40% 35.52% 36.13% Return on average assets 1.36% 0.64% 1.05% 1.09% 0.88% 0.85% Return on average equity 12.74% 5.87% 9.35% 9.94% 8.52% 9.33% Return on tangible common equity 14.38% 6.66% 10.72% 11.57% 10.15% 10.01%

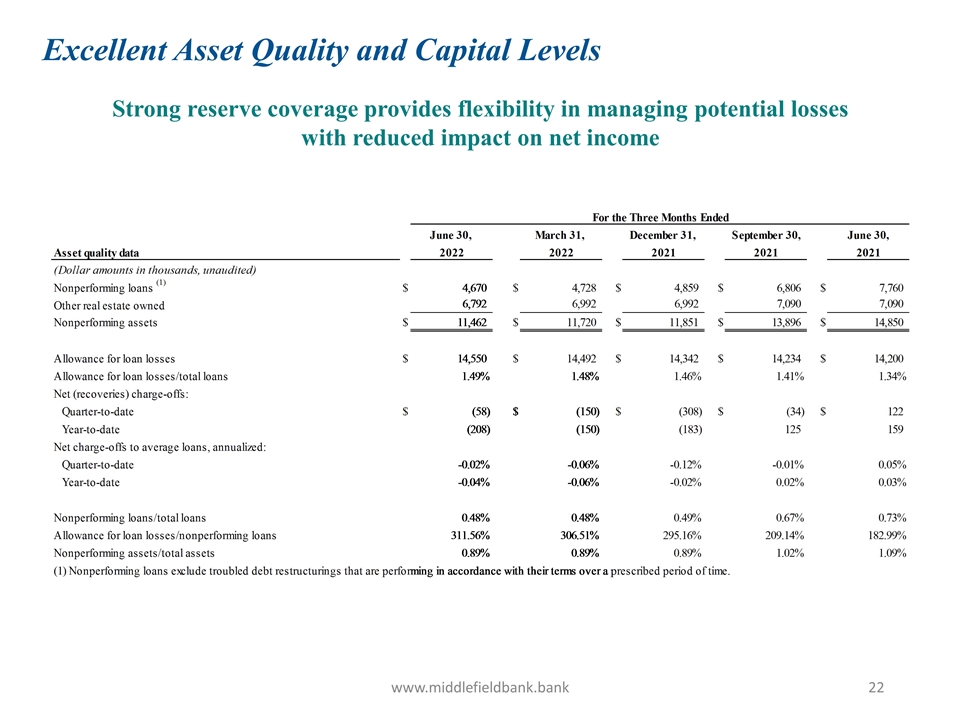

Excellent Asset Quality and Capital Levels www.middlefieldbank.bank Strong reserve coverage provides flexibility in managing potential losses with reduced impact on net income

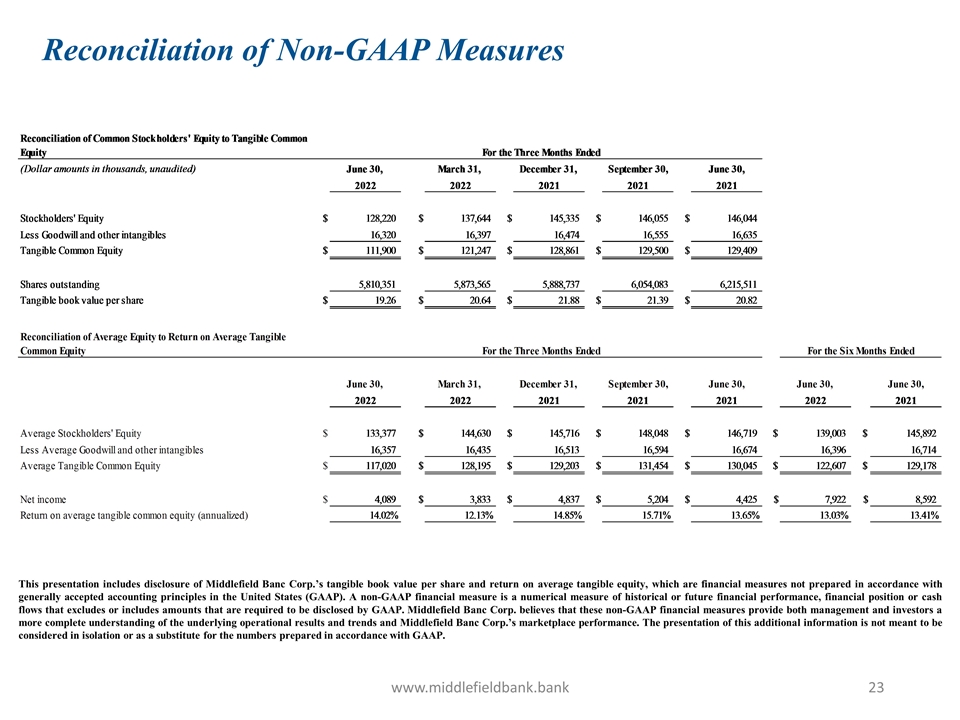

Reconciliation of Non-GAAP Measures www.middlefieldbank.bank This presentation includes disclosure of Middlefield Banc Corp.’s tangible book value per share and return on average tangible equity, which are financial measures not prepared in accordance with generally accepted accounting principles in the United States (GAAP). A non-GAAP financial measure is a numerical measure of historical or future financial performance, financial position or cash flows that excludes or includes amounts that are required to be disclosed by GAAP. Middlefield Banc Corp. believes that these non-GAAP financial measures provide both management and investors a more complete understanding of the underlying operational results and trends and Middlefield Banc Corp.’s marketplace performance. The presentation of this additional information is not meant to be considered in isolation or as a substitute for the numbers prepared in accordance with GAAP.