4th Quarter Fiscal 2019 Earnings Slide Deck Exhibit 99.2

Safe-Harbor Statement This presentation contains forward-looking statements that are subject to risks and uncertainties and which reflect management’s current beliefs and estimates of future economic circumstances, industry conditions, Company performance, financial results and planned financing. You can find a discussion of many of these risks and uncertainties in the annual, quarterly and current reports that the Company files with the Securities and Exchange Commission. Investors should understand that a number of factors could cause future economic and industry conditions, and the Company’s actual financial condition and results of operations, to differ materially from management’s beliefs expressed in the forward-looking statements contained in this presentation. These factors include those outlined in the “Risk Factors” section of the Company’s most recent annual report on Form 10-K filed with the Securities and Exchange Commission, and investors are urged to review these factors when considering the forward-looking statements contained in this presentation. For these statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. For full financial statement information, please see the Company’s earnings release dated October 29, 2019.

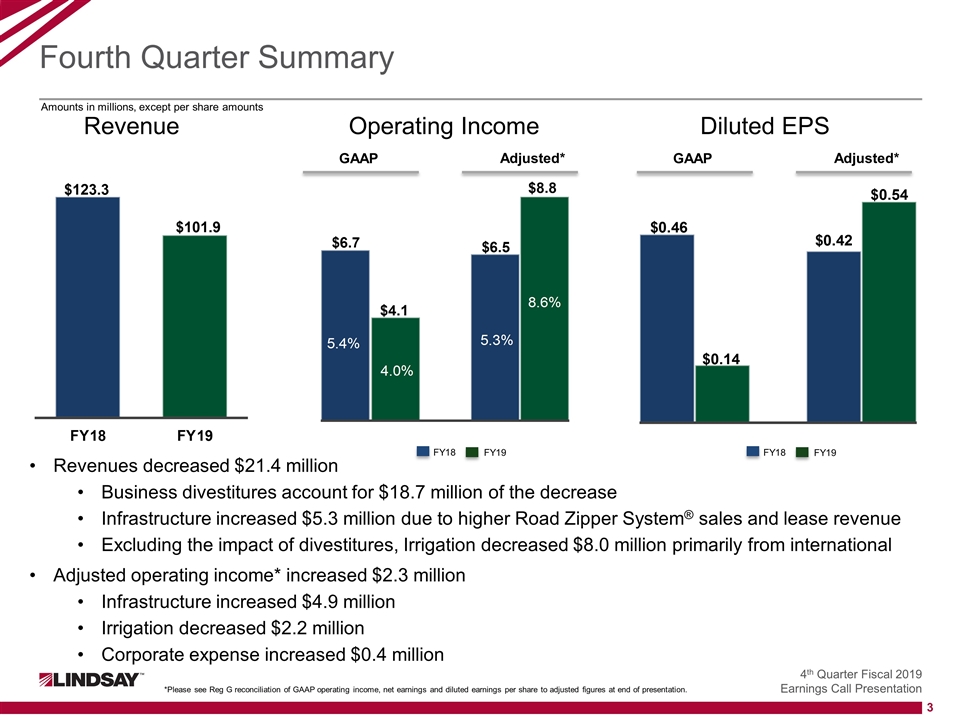

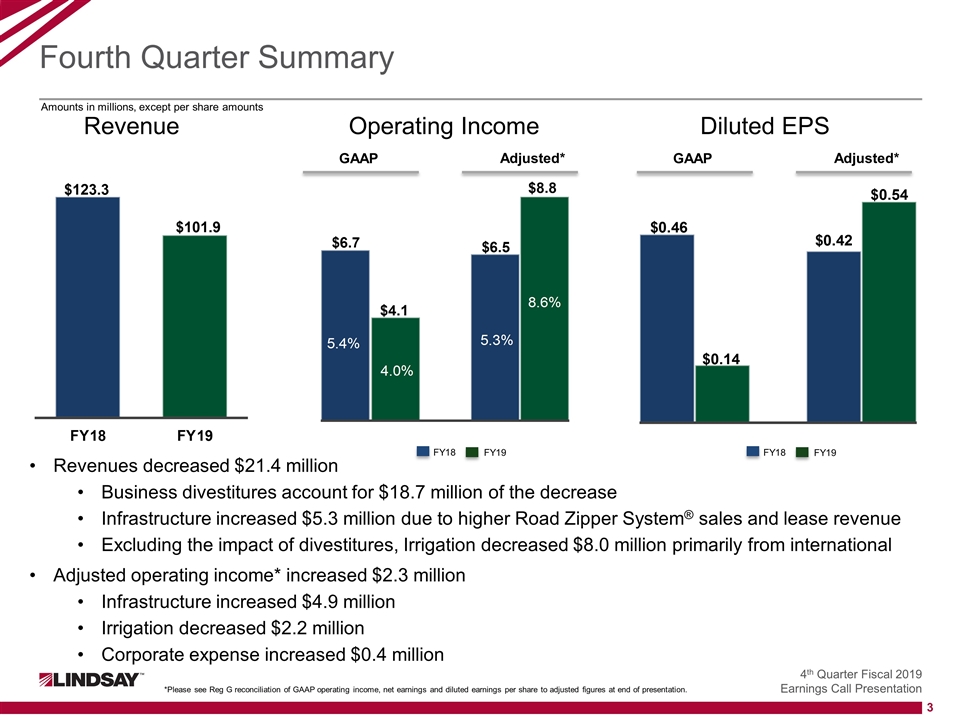

Fourth Quarter Summary *Please see Reg G reconciliation of GAAP operating income, net earnings and diluted earnings per share to adjusted figures at end of presentation. Revenue Operating Income Diluted EPS Revenues decreased $21.4 million Business divestitures account for $18.7 million of the decrease Infrastructure increased $5.3 million due to higher Road Zipper System® sales and lease revenue Excluding the impact of divestitures, Irrigation decreased $8.0 million primarily from international Adjusted operating income* increased $2.3 million Infrastructure increased $4.9 million Irrigation decreased $2.2 million Corporate expense increased $0.4 million GAAP Adjusted* GAAP Adjusted* Amounts in millions, except per share amounts FY18 FY19 FY18 FY19

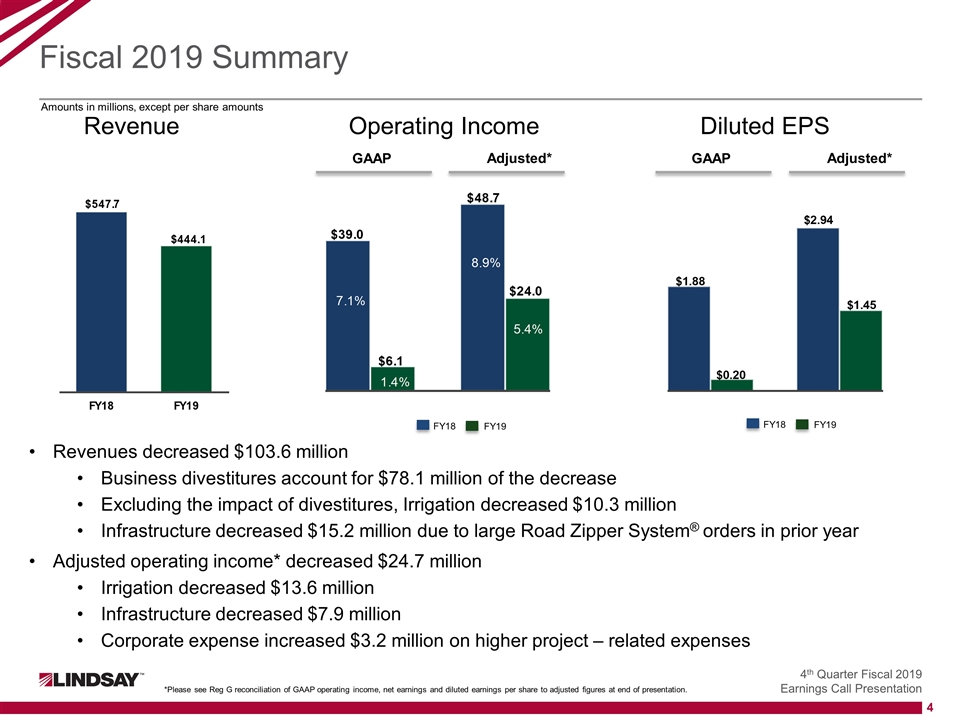

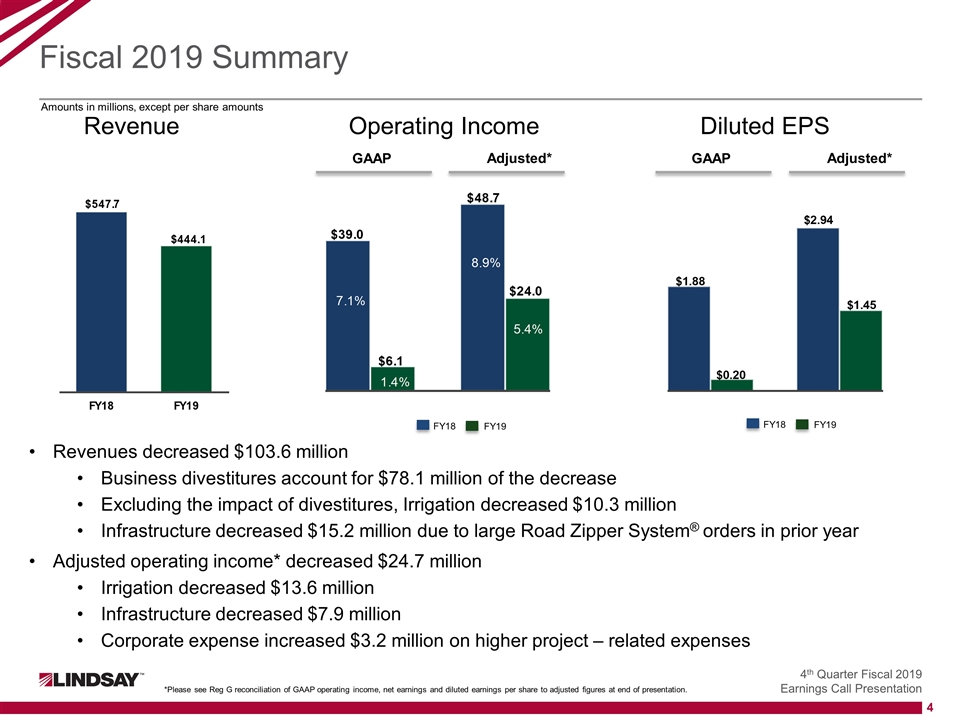

Fiscal 2019 Summary *Please see Reg G reconciliation of GAAP operating income, net earnings and diluted earnings per share to adjusted figures at end of presentation. Revenue Operating Income Diluted EPS Revenues decreased $103.6 million Business divestitures account for $78.1 million of the decrease Excluding the impact of divestitures, Irrigation decreased $10.3 million Infrastructure decreased $15.2 million due to large Road Zipper System® orders in prior year Adjusted operating income* decreased $24.7 million Irrigation decreased $13.6 million Infrastructure decreased $7.9 million Corporate expense increased $3.2 million on higher project – related expenses GAAP Adjusted* GAAP Adjusted* Amounts in millions, except per share amounts FY18 FY19 FY18 FY19

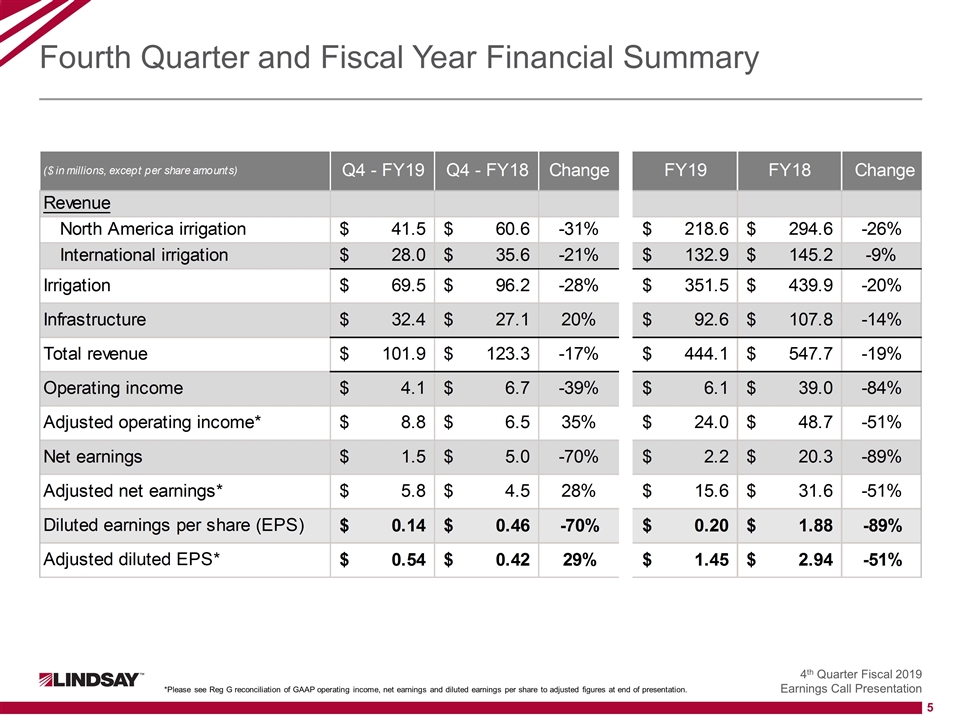

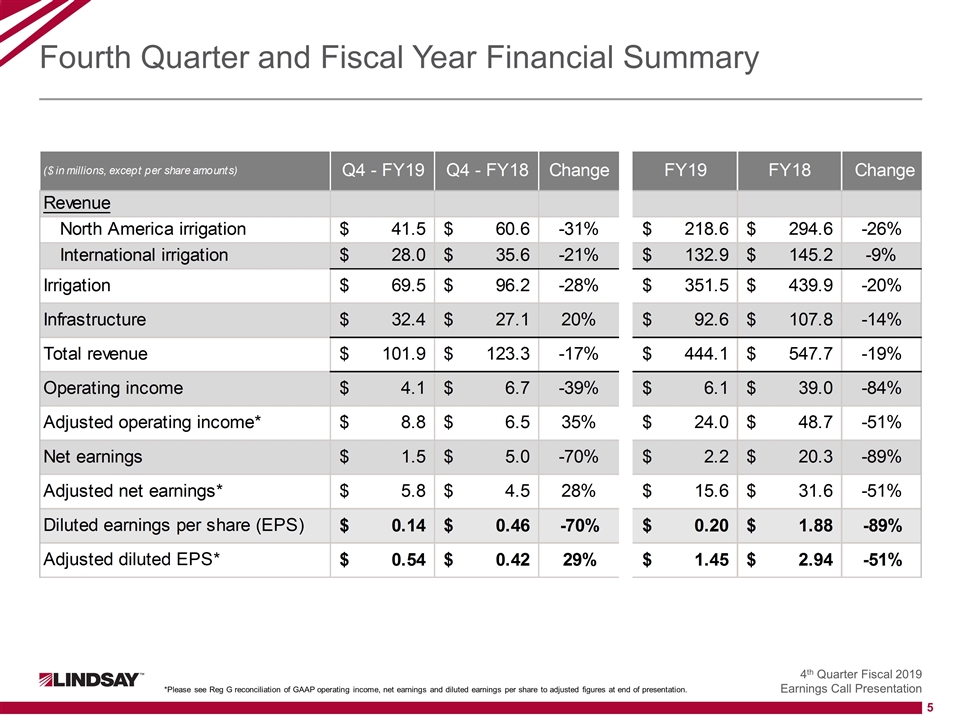

Fourth Quarter and Fiscal Year Financial Summary *Please see Reg G reconciliation of GAAP operating income, net earnings and diluted earnings per share to adjusted figures at end of presentation.

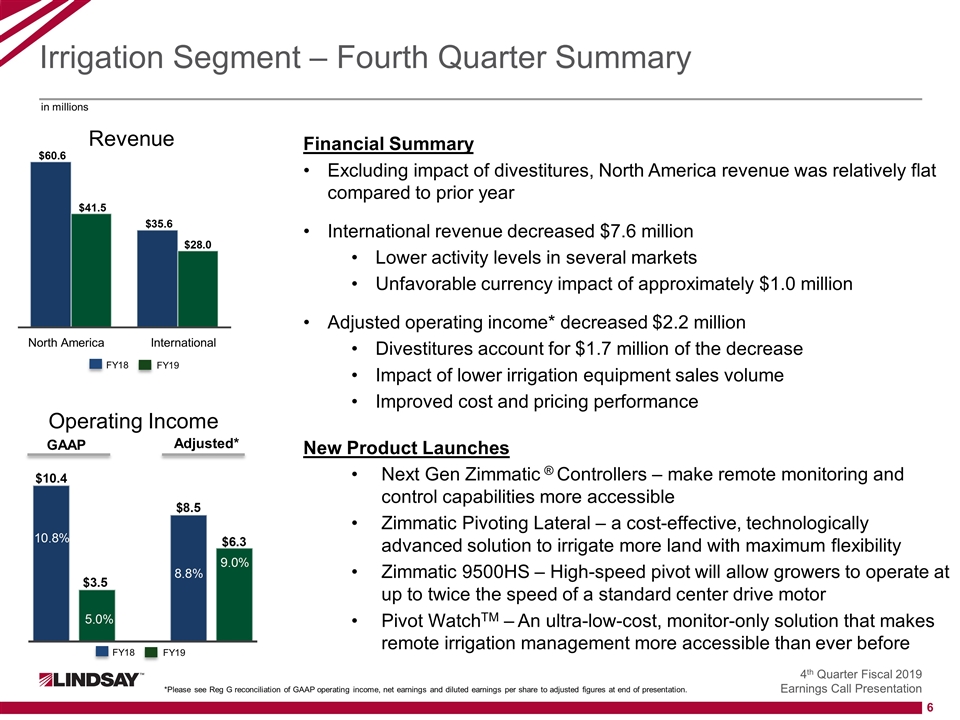

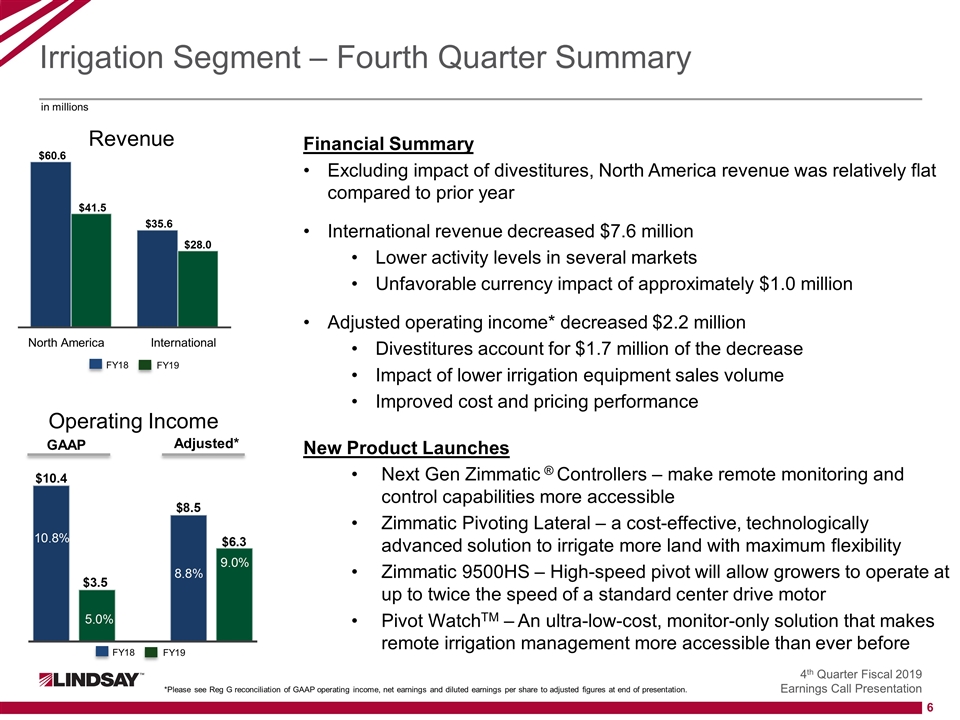

Irrigation Segment – Fourth Quarter Summary Financial Summary Excluding impact of divestitures, North America revenue was relatively flat compared to prior year International revenue decreased $7.6 million Lower activity levels in several markets Unfavorable currency impact of approximately $1.0 million Adjusted operating income* decreased $2.2 million Divestitures account for $1.7 million of the decrease Impact of lower irrigation equipment sales volume Improved cost and pricing performance New Product Launches Next Gen Zimmatic ® Controllers – make remote monitoring and control capabilities more accessible Zimmatic Pivoting Lateral – a cost-effective, technologically advanced solution to irrigate more land with maximum flexibility Zimmatic 9500HS – High-speed pivot will allow growers to operate at up to twice the speed of a standard center drive motor Pivot WatchTM – An ultra-low-cost, monitor-only solution that makes remote irrigation management more accessible than ever before Revenue Operating Income GAAP Adjusted* in millions North America International FY18 FY19 FY18 FY19 *Please see Reg G reconciliation of GAAP operating income, net earnings and diluted earnings per share to adjusted figures at end of presentation.

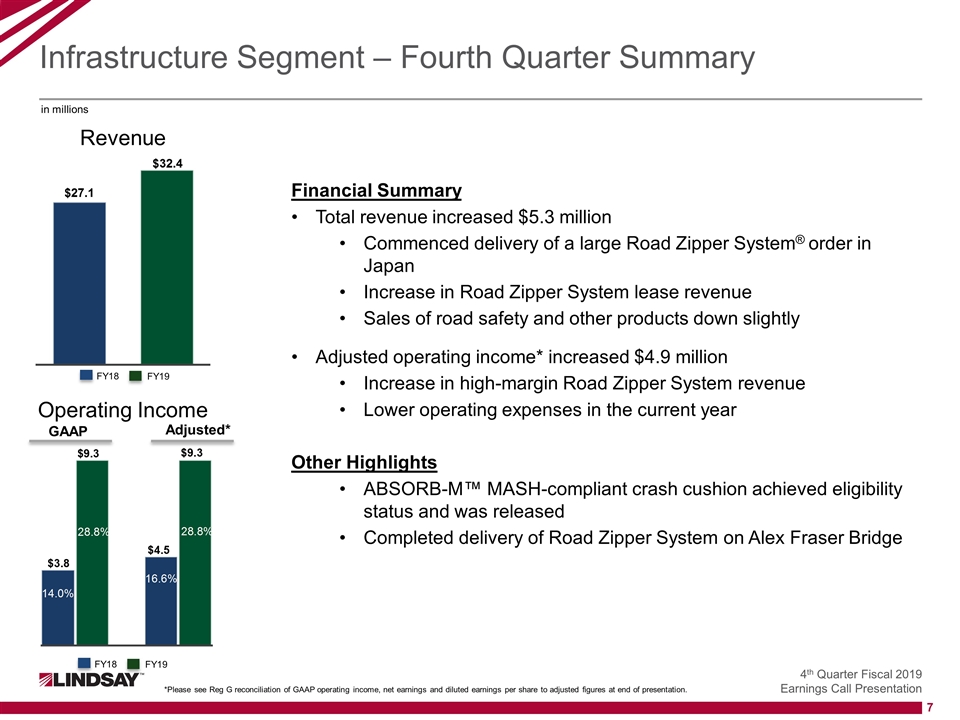

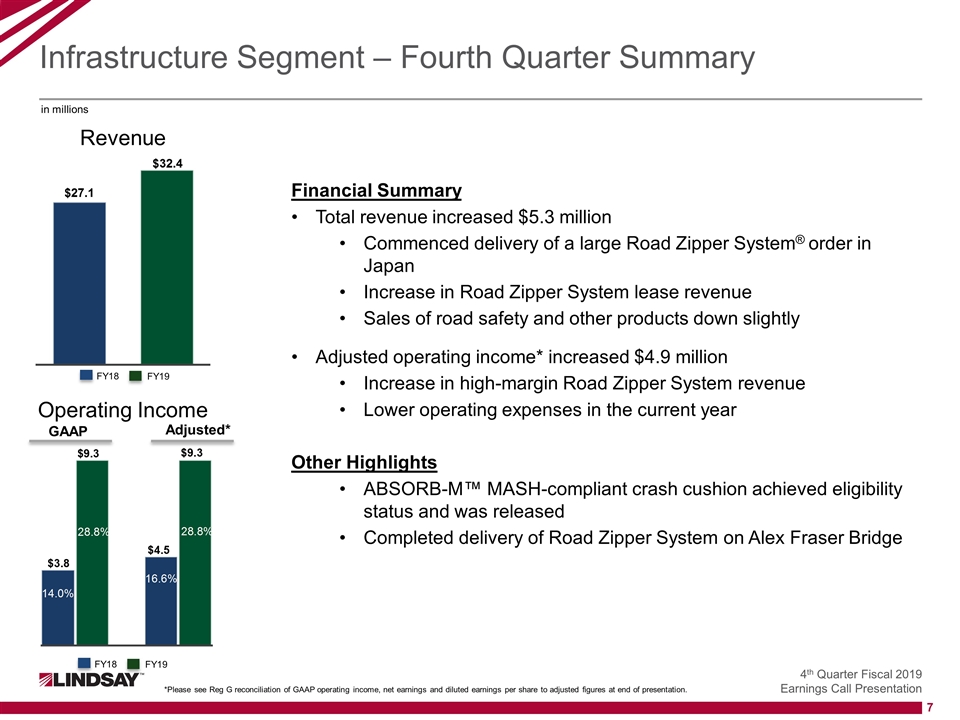

Infrastructure Segment – Fourth Quarter Summary Financial Summary Total revenue increased $5.3 million Commenced delivery of a large Road Zipper System® order in Japan Increase in Road Zipper System lease revenue Sales of road safety and other products down slightly Adjusted operating income* increased $4.9 million Increase in high-margin Road Zipper System revenue Lower operating expenses in the current year Other Highlights ABSORB-M™ MASH-compliant crash cushion achieved eligibility status and was released Completed delivery of Road Zipper System on Alex Fraser Bridge Revenue Operating Income GAAP Adjusted* in millions FY18 FY19 FY18 FY19 *Please see Reg G reconciliation of GAAP operating income, net earnings and diluted earnings per share to adjusted figures at end of presentation.

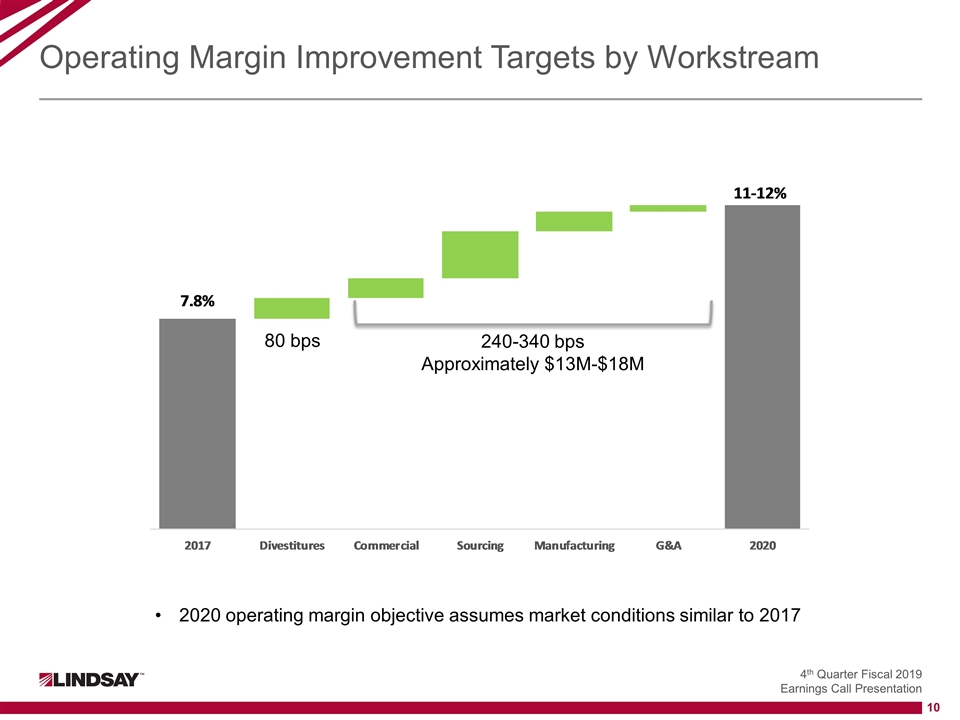

Foundation for Growth Initiative – 2020 Objectives Financial Performance 11% to 12% operating margin* Shareholder value creation External perception Fully leverage the global organization Viewed by customers as the innovation leader in core markets Culture and Health Highly engaged employees One common culture and identity © 2018 Lindsay Corporation * 2020 operating margin objective assumes market conditions similar to 2017

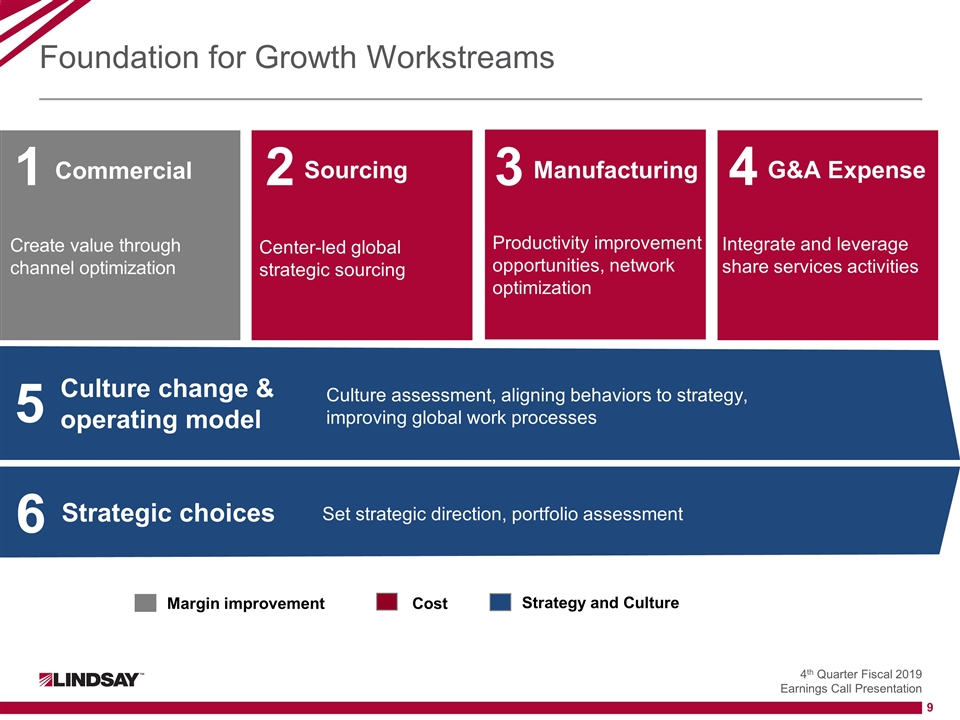

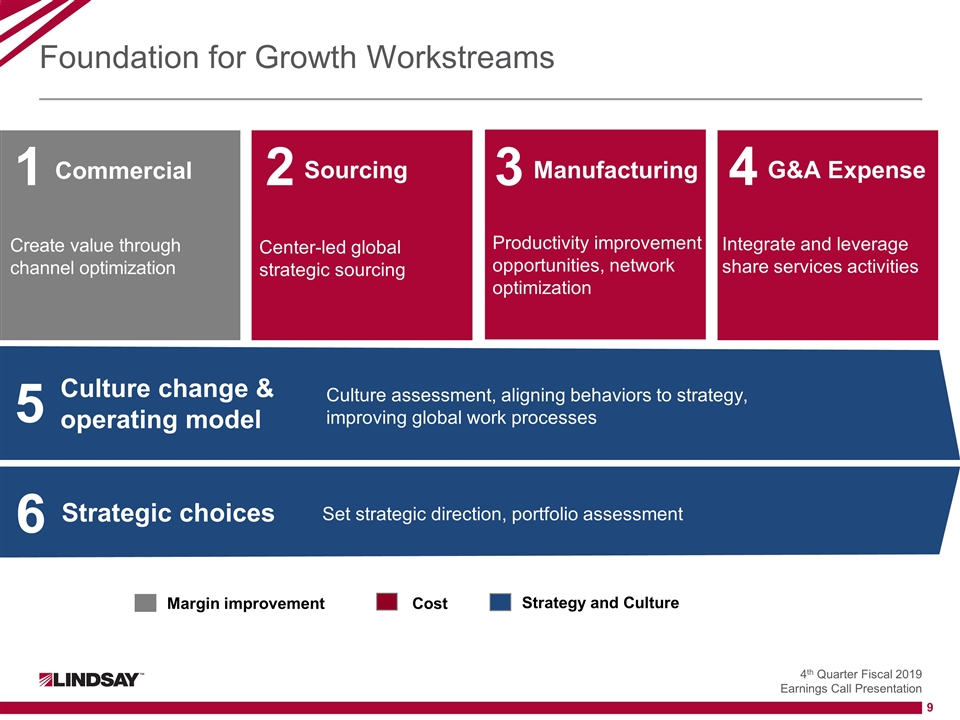

Foundation for Growth Workstreams Strategic choices 6 Culture change & operating model 5 Culture assessment, aligning behaviors to strategy, improving global work processes Set strategic direction, portfolio assessment Commercial 1 Manufacturing 3 Sourcing 2 G&A Expense 4 Create value through channel optimization Center-led global strategic sourcing Productivity improvement opportunities, network optimization Integrate and leverage share services activities Margin improvement Cost Strategy and Culture

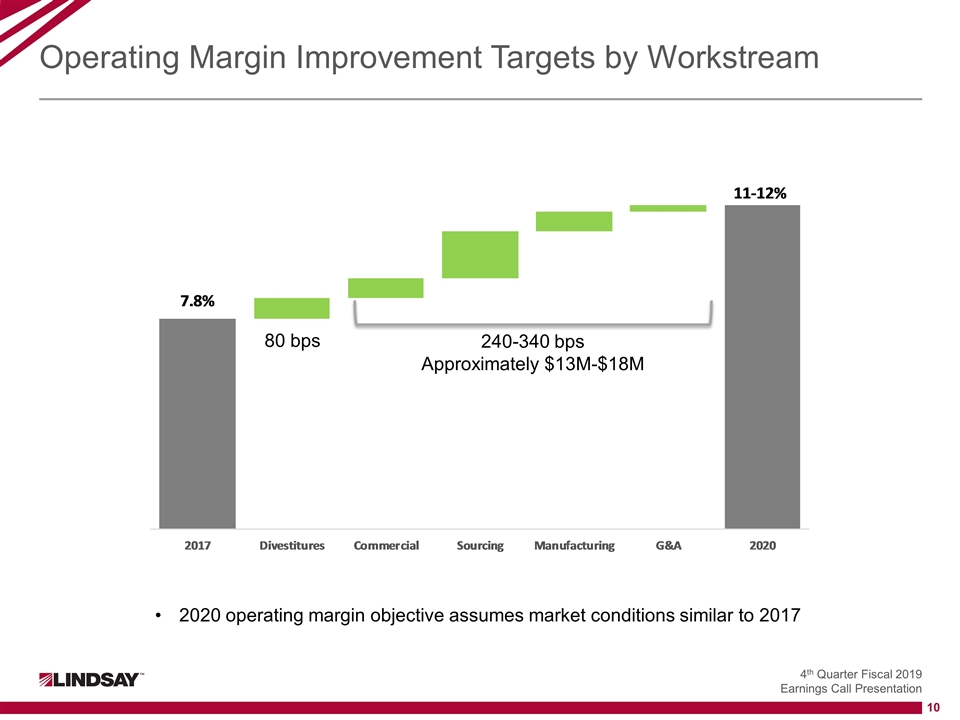

Operating Margin Improvement Targets by Workstream 2020 operating margin objective assumes market conditions similar to 2017 240-340 bps Approximately $13M-$18M 80 bps

Foundation for Growth Accomplishments Through Fiscal 2019 Divested four non-core businesses with operating margin below the Company average Closed an infrastructure facility and consolidated its operations into an existing irrigation facility Consolidated three office locations into a new global headquarters Established a centralized shared services organization Made tangible progress in culture change and aligning behaviors to strategy Projects in each of the four margin-improvement workstreams have moved to implementation and realization stage

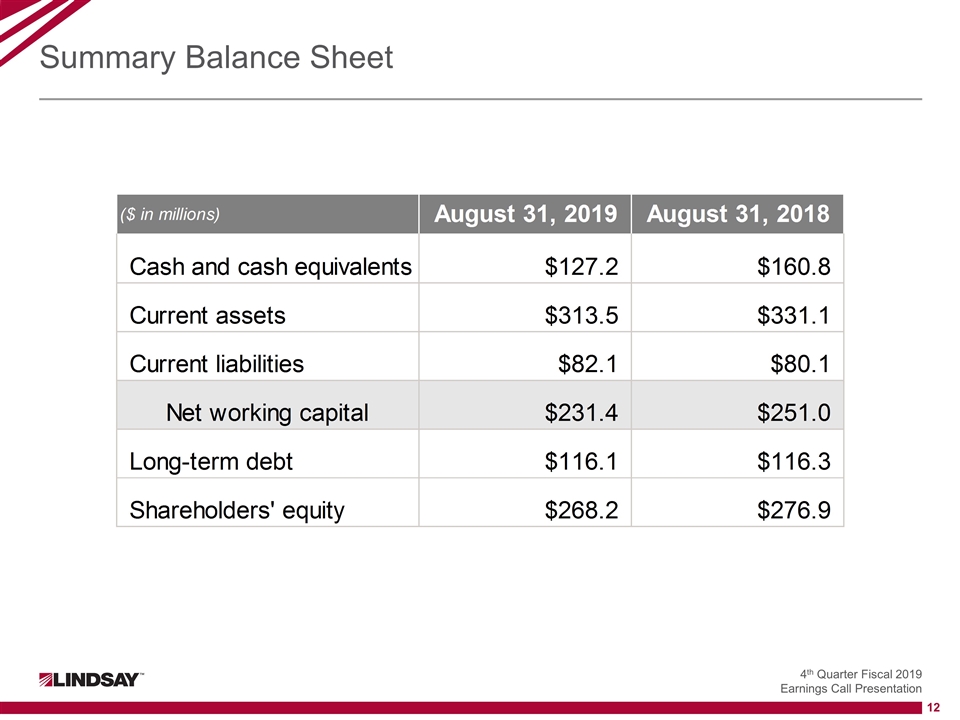

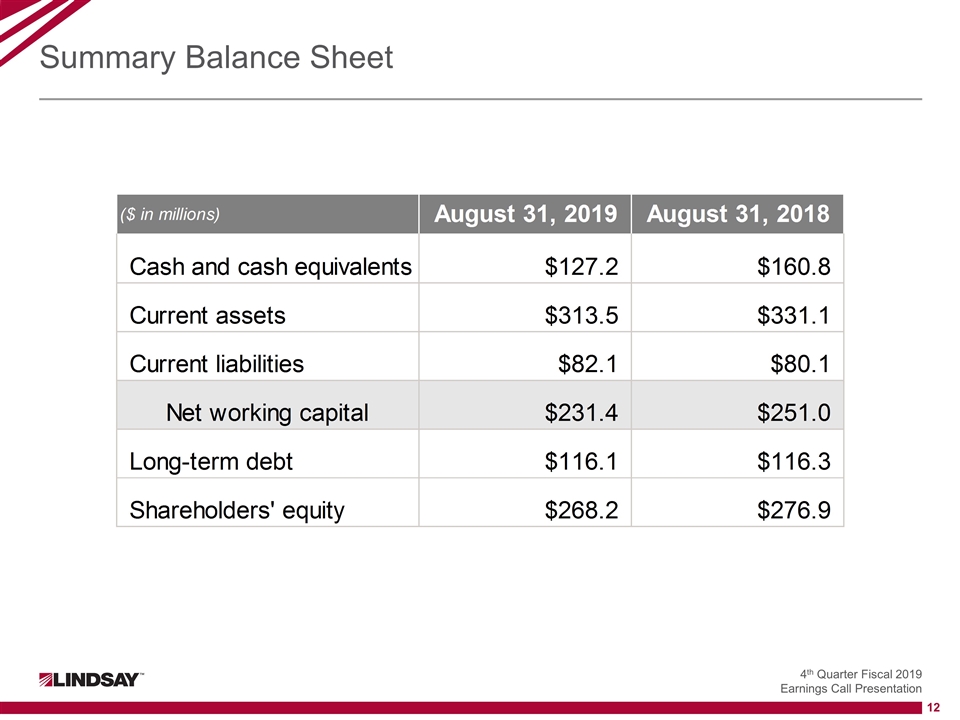

Summary Balance Sheet

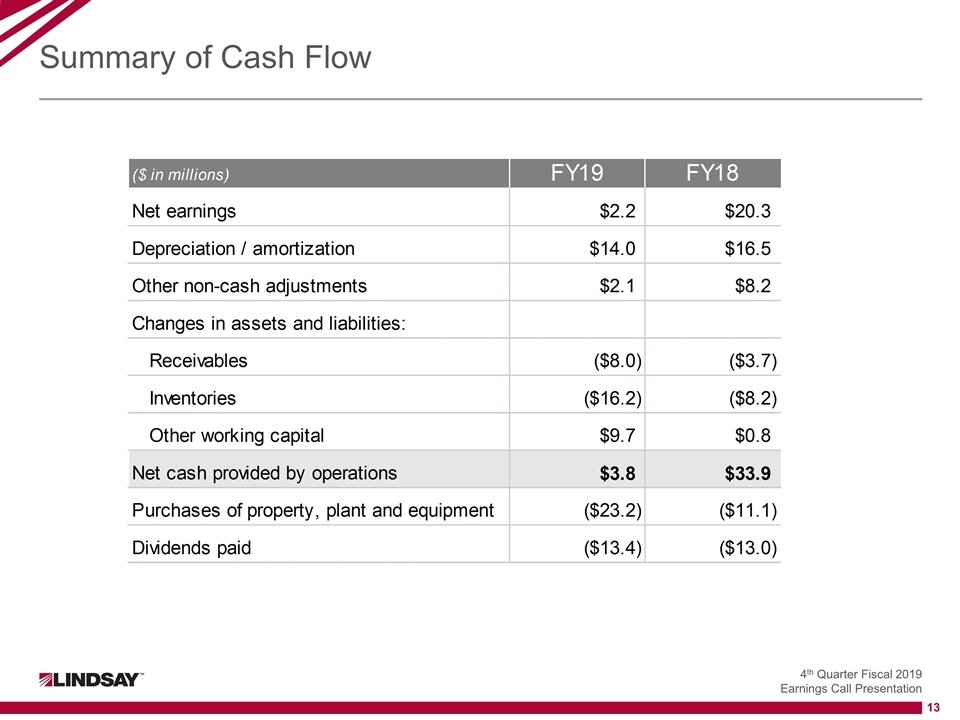

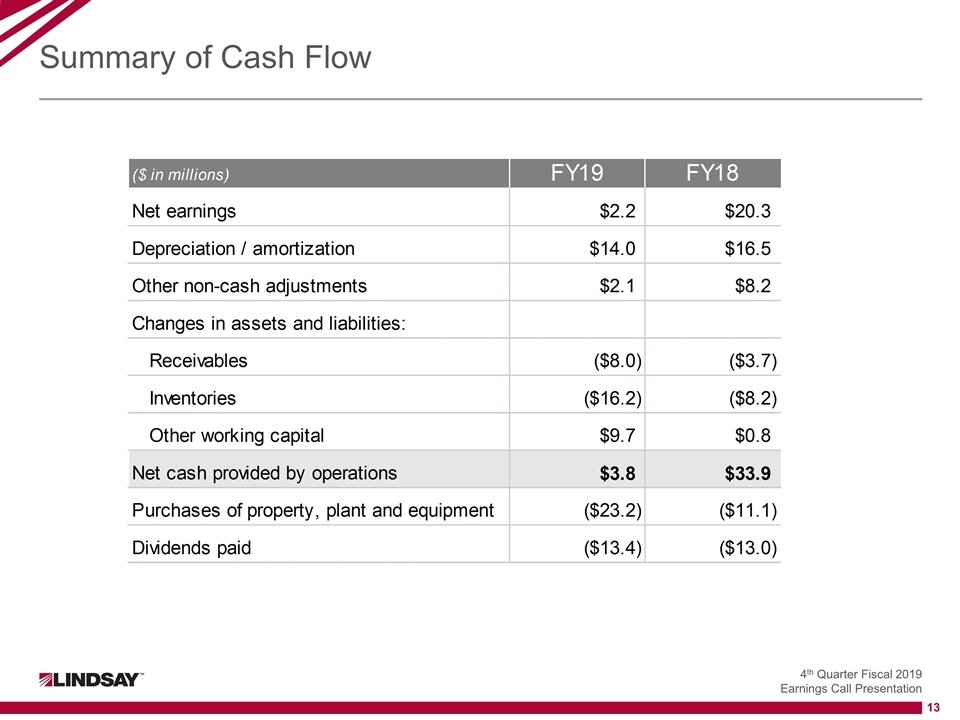

Summary of Cash Flow

Attractive Long-Term Market Drivers Water Conservation Alternative Fuels Increase Yields Improve Road Safety Population Growth Advancing Technology

Current Market Factors The 2018 Farm Bill was signed into law in December 2018. It continues many of the programs that were in the Agricultural Act of 2014, which expired in September 2018. USDA estimated average corn price at midpoint of $3.60 per bushel Net Farm Income in 2019 projected to be $88.0 billion, a 4.8% increase from 2018 EPA 2019 ethanol production target levels modestly increase volume requirements Increased tax incentives provide additional support for capital investment Irrigation project markets continue to be active but timing remains variable Irrigation Infrastructure Five-year $305 billion U.S. highway bill enacted in December 2015 (FAST Act) provides stability but funding level increases were modest. The bill is scheduled to be reauthorized in September 2020. The highway reauthorization bill, America’s Transportation Infrastructure Act of 2019, was advanced by a Senate committee in July 2019. The bill would fund repair and maintenance of roads and bridges over five years and would increase spending by 27% over the current authorization. There is uncertainty whether the bill will advance at this point. States are transitioning to new MASH testing standards for road safety products Road Zipper System ® gaining interest globally as a solution to traffic congestion and air quality

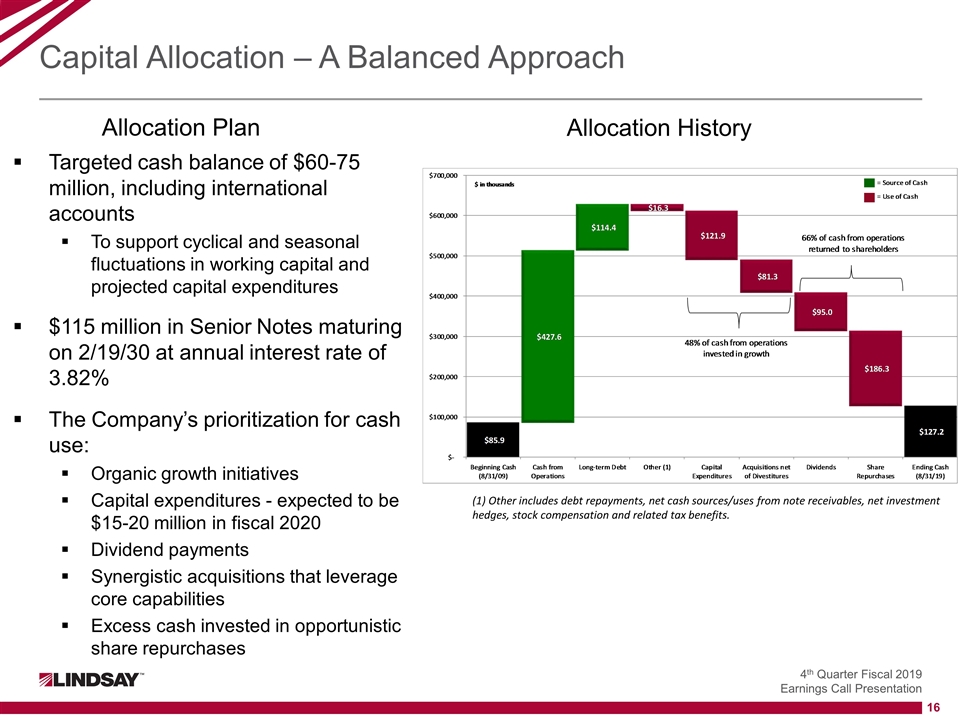

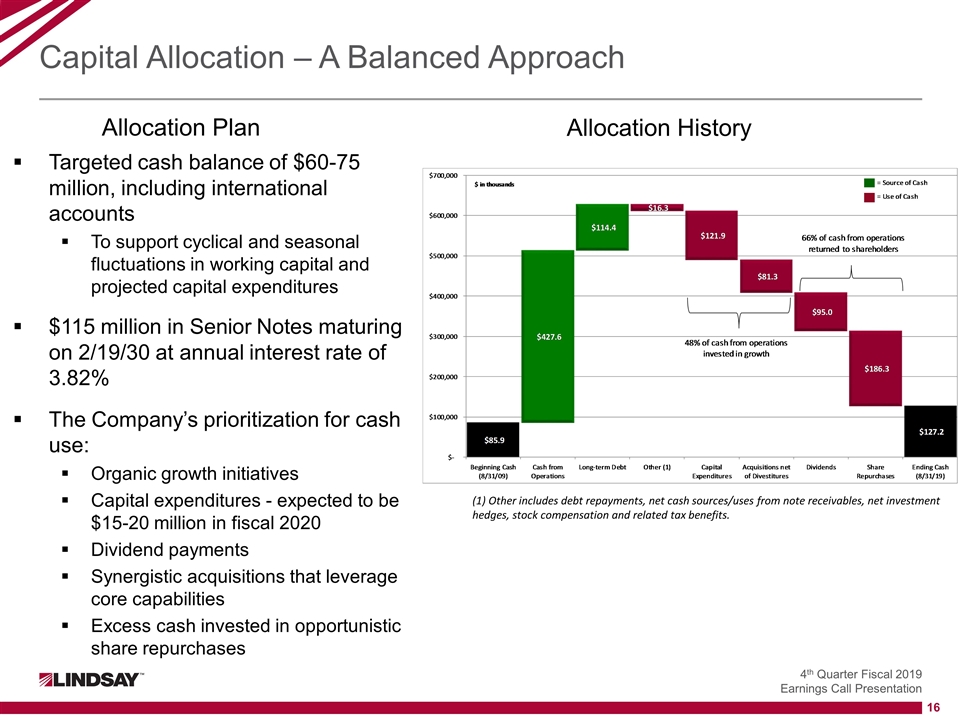

Capital Allocation – A Balanced Approach Allocation History (1) Other includes debt repayments, net cash sources/uses from note receivables, net investment hedges, stock compensation and related tax benefits. Targeted cash balance of $60-75 million, including international accounts To support cyclical and seasonal fluctuations in working capital and projected capital expenditures $115 million in Senior Notes maturing on 2/19/30 at annual interest rate of 3.82% The Company’s prioritization for cash use: Organic growth initiatives Capital expenditures - expected to be $15-20 million in fiscal 2020 Dividend payments Synergistic acquisitions that leverage core capabilities Excess cash invested in opportunistic share repurchases Allocation Plan

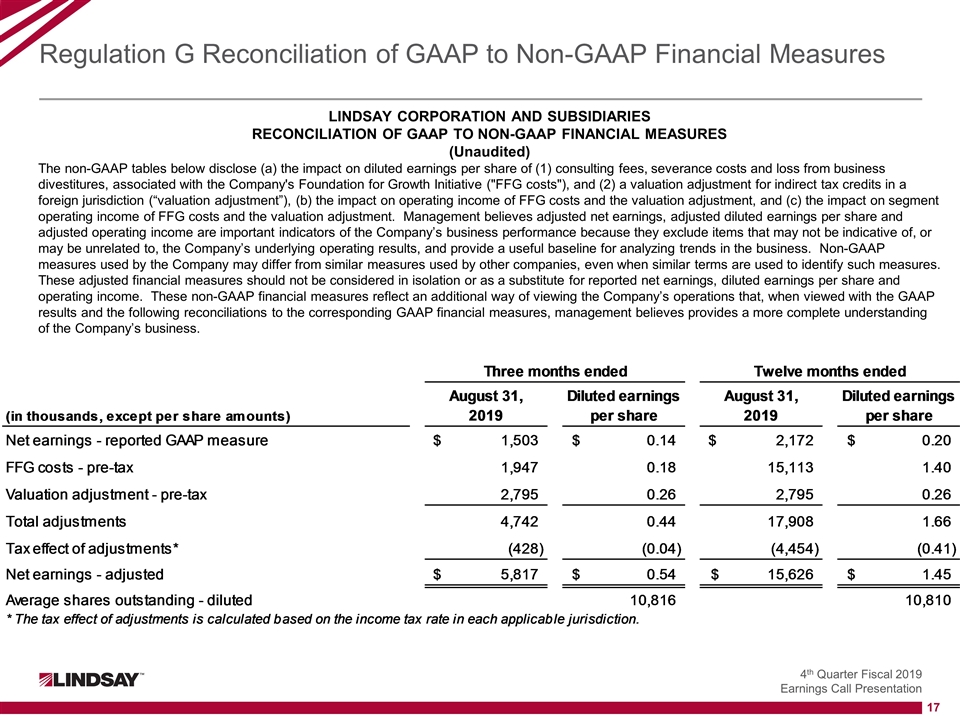

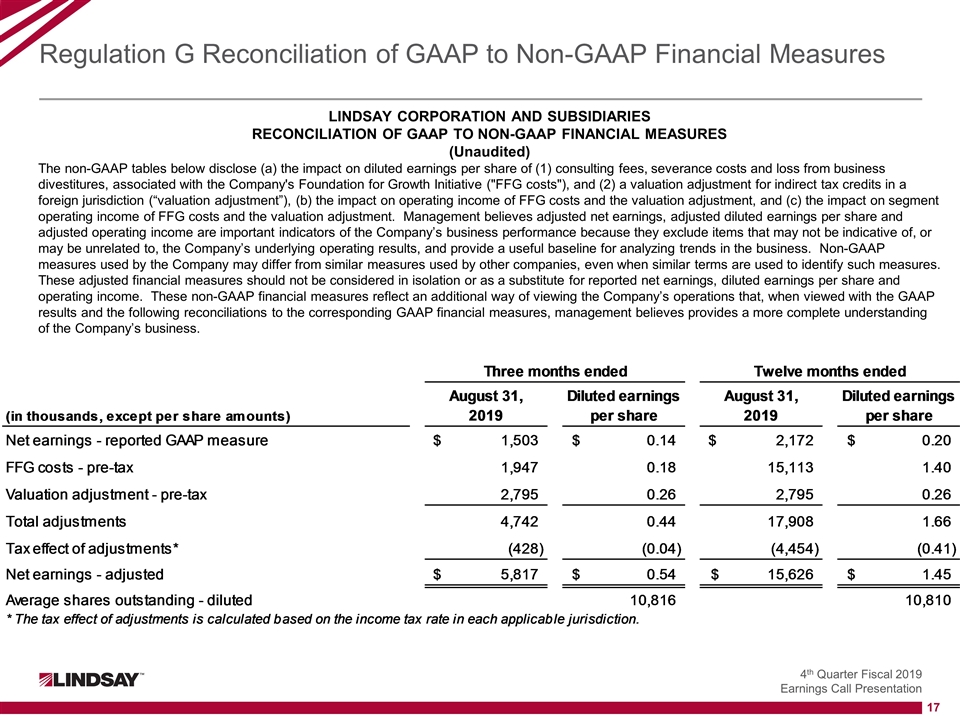

Regulation G Reconciliation of GAAP to Non-GAAP Financial Measures LINDSAY CORPORATION AND SUBSIDIARIES RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (Unaudited) The non-GAAP tables below disclose (a) the impact on diluted earnings per share of (1) consulting fees, severance costs and loss from business divestitures, associated with the Company's Foundation for Growth Initiative ("FFG costs"), and (2) a valuation adjustment for indirect tax credits in a foreign jurisdiction (“valuation adjustment”), (b) the impact on operating income of FFG costs and the valuation adjustment, and (c) the impact on segment operating income of FFG costs and the valuation adjustment. Management believes adjusted net earnings, adjusted diluted earnings per share and adjusted operating income are important indicators of the Company’s business performance because they exclude items that may not be indicative of, or may be unrelated to, the Company’s underlying operating results, and provide a useful baseline for analyzing trends in the business. Non-GAAP measures used by the Company may differ from similar measures used by other companies, even when similar terms are used to identify such measures. These adjusted financial measures should not be considered in isolation or as a substitute for reported net earnings, diluted earnings per share and operating income. These non-GAAP financial measures reflect an additional way of viewing the Company’s operations that, when viewed with the GAAP results and the following reconciliations to the corresponding GAAP financial measures, management believes provides a more complete understanding of the Company’s business.

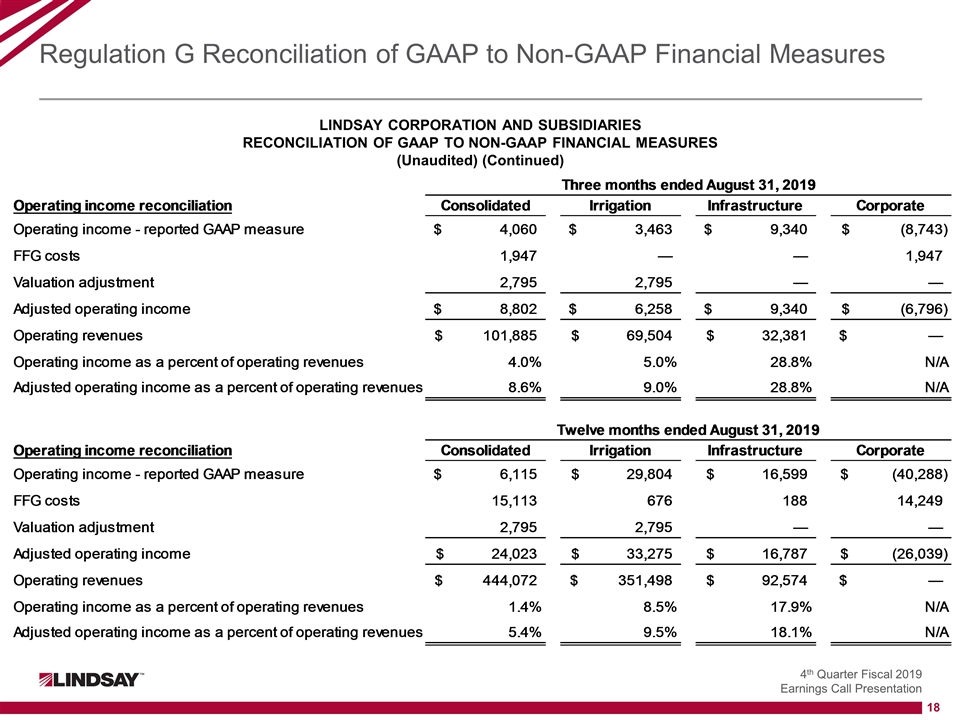

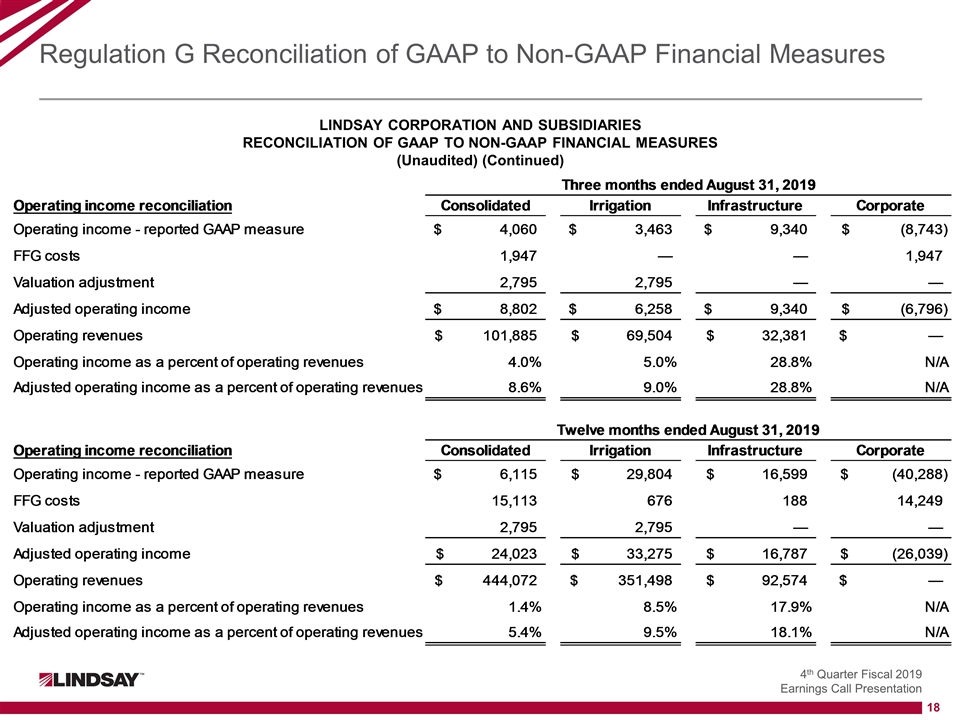

Regulation G Reconciliation of GAAP to Non-GAAP Financial Measures LINDSAY CORPORATION AND SUBSIDIARIES RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (Unaudited) (Continued)

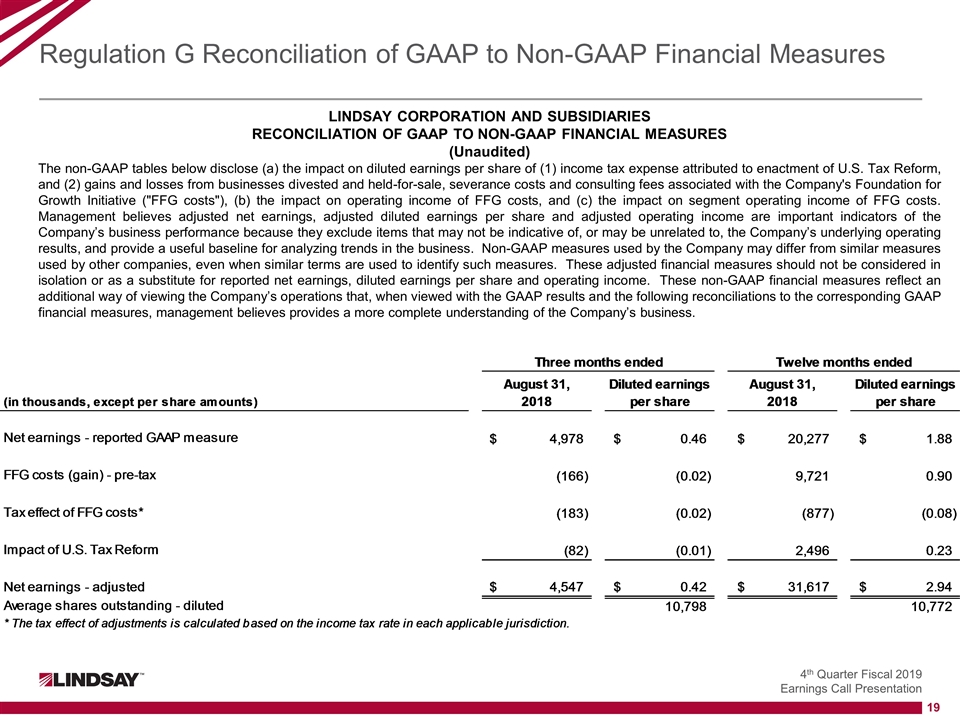

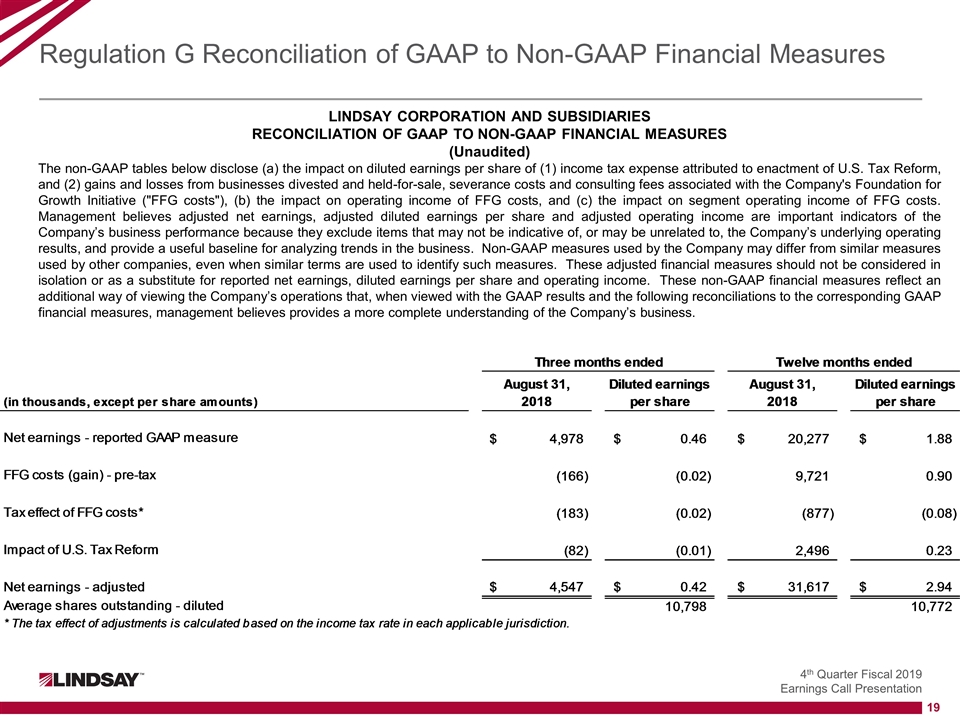

Regulation G Reconciliation of GAAP to Non-GAAP Financial Measures LINDSAY CORPORATION AND SUBSIDIARIES RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (Unaudited) The non-GAAP tables below disclose (a) the impact on diluted earnings per share of (1) income tax expense attributed to enactment of U.S. Tax Reform, and (2) gains and losses from businesses divested and held-for-sale, severance costs and consulting fees associated with the Company's Foundation for Growth Initiative ("FFG costs"), (b) the impact on operating income of FFG costs, and (c) the impact on segment operating income of FFG costs. Management believes adjusted net earnings, adjusted diluted earnings per share and adjusted operating income are important indicators of the Company’s business performance because they exclude items that may not be indicative of, or may be unrelated to, the Company’s underlying operating results, and provide a useful baseline for analyzing trends in the business. Non-GAAP measures used by the Company may differ from similar measures used by other companies, even when similar terms are used to identify such measures. These adjusted financial measures should not be considered in isolation or as a substitute for reported net earnings, diluted earnings per share and operating income. These non-GAAP financial measures reflect an additional way of viewing the Company’s operations that, when viewed with the GAAP results and the following reconciliations to the corresponding GAAP financial measures, management believes provides a more complete understanding of the Company’s business.

Regulation G Reconciliation of GAAP to Non-GAAP Financial Measures LINDSAY CORPORATION AND SUBSIDIARIES RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (Unaudited) (Continued)