Earnings Call Presentation 4th Quarter Fiscal 2018 ADVANCING INNOVATION TO SOLVE GLOBAL CHALLENGES EXHIBIT 99.2

Safe-Harbor Statement This presentation contains forward-looking statements that are subject to risks and uncertainties and which reflect management’s current beliefs and estimates of future economic circumstances, industry conditions, Company performance, financial results and planned financing. You can find a discussion of many of these risks and uncertainties in the annual, quarterly and current reports that the Company files with the Securities and Exchange Commission. Investors should understand that a number of factors could cause future economic and industry conditions, and the Company’s actual financial condition and results of operations, to differ materially from management’s beliefs expressed in the forward-looking statements contained in this presentation. These factors include those outlined in the “Risk Factors” section of the Company’s most recent annual report on Form 10-K filed with the Securities and Exchange Commission, and investors are urged to review these factors when considering the forward-looking statements contained in this presentation. For these statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. For full financial statement information, please see the Company’s earnings release dated October 18th, 2018.

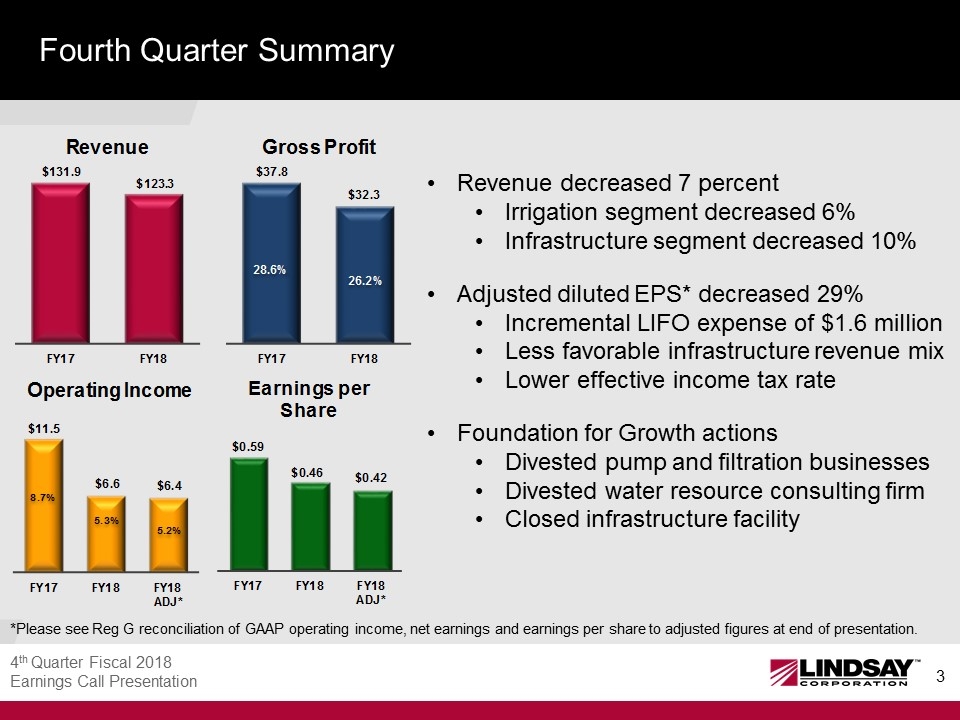

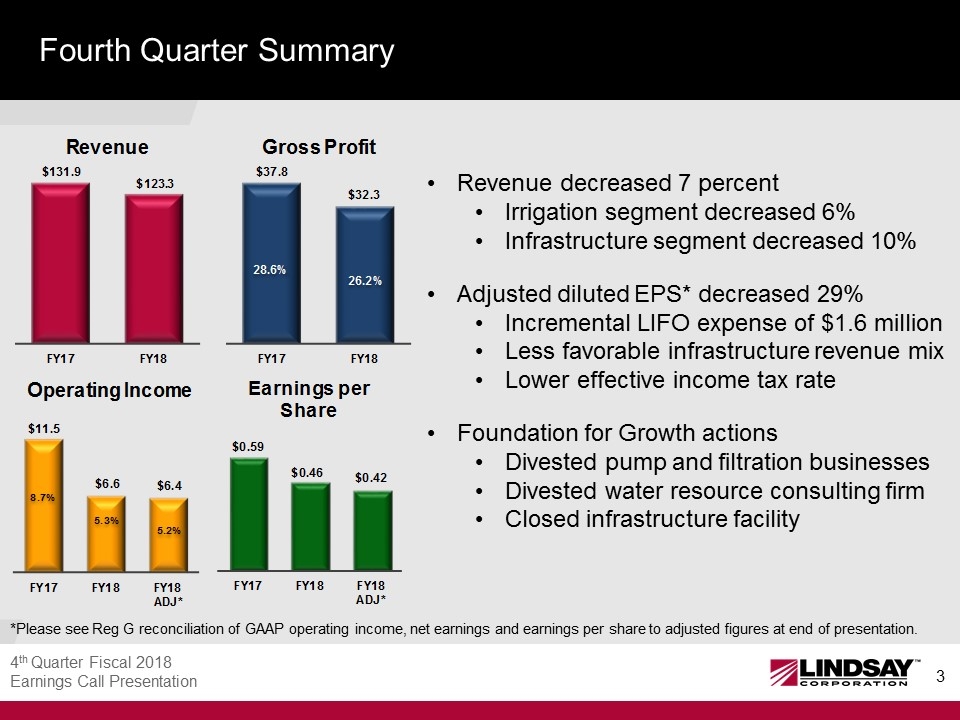

Fourth Quarter Summary Revenue decreased 7 percent Irrigation segment decreased 6% Infrastructure segment decreased 10% Adjusted diluted EPS* decreased 29% Incremental LIFO expense of $1.6 million Less favorable infrastructure revenue mix Lower effective income tax rate Foundation for Growth actions Divested pump and filtration businesses Divested water resource consulting firm Closed infrastructure facility *Please see Reg G reconciliation of GAAP operating income, net earnings and earnings per share to adjusted figures at end of presentation.

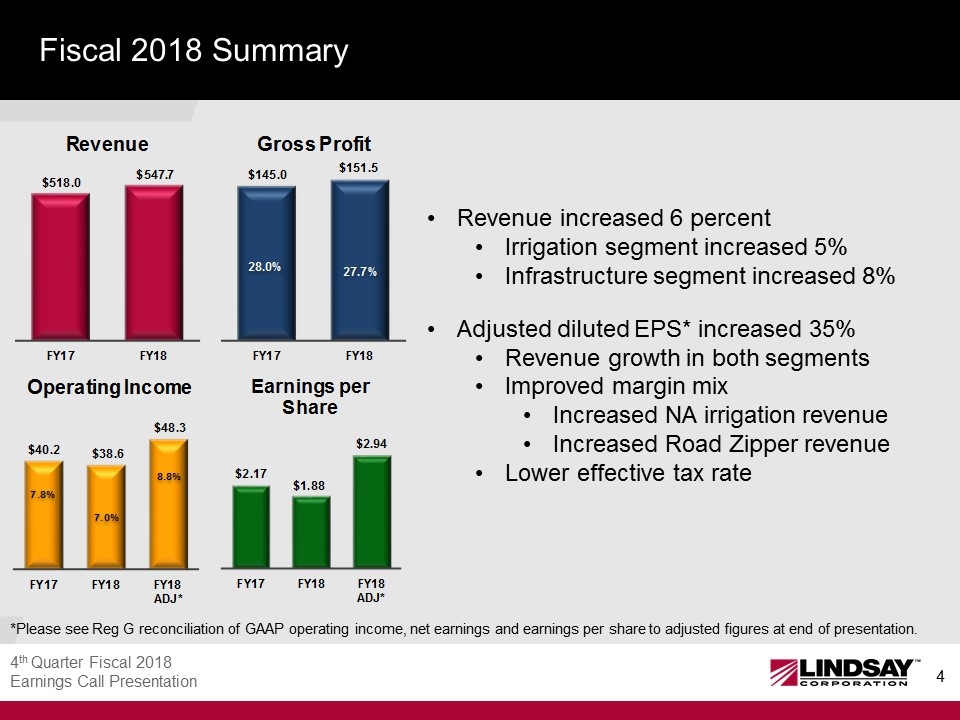

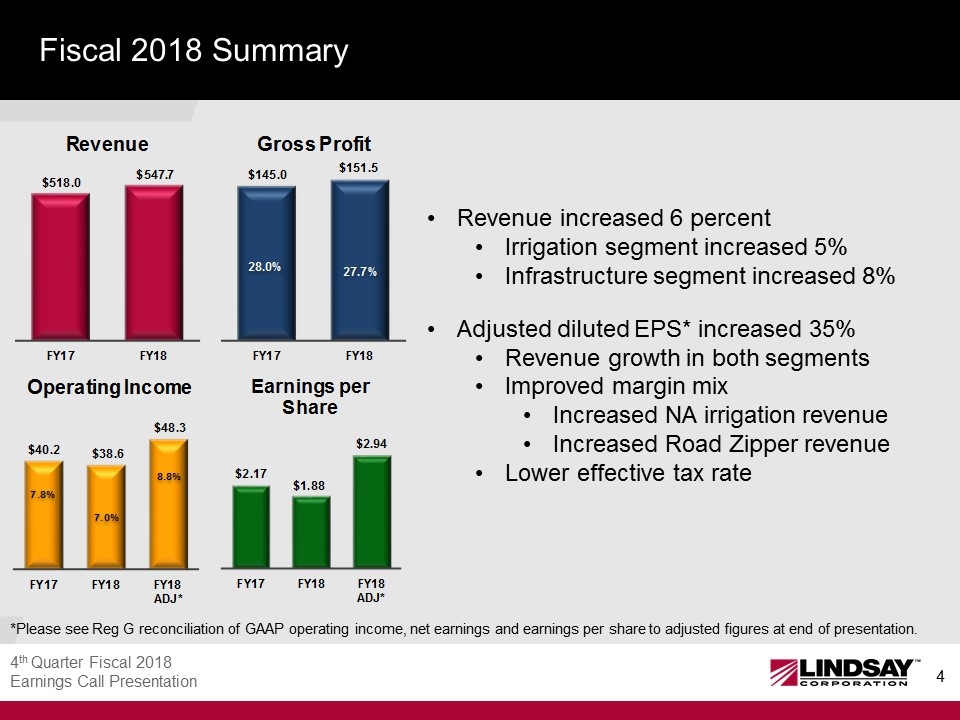

Fiscal 2018 Summary Revenue increased 6 percent Irrigation segment increased 5% Infrastructure segment increased 8% Adjusted diluted EPS* increased 35% Revenue growth in both segments Improved margin mix Increased NA irrigation revenue Increased Road Zipper revenue Lower effective tax rate *Please see Reg G reconciliation of GAAP operating income, net earnings and earnings per share to adjusted figures at end of presentation.

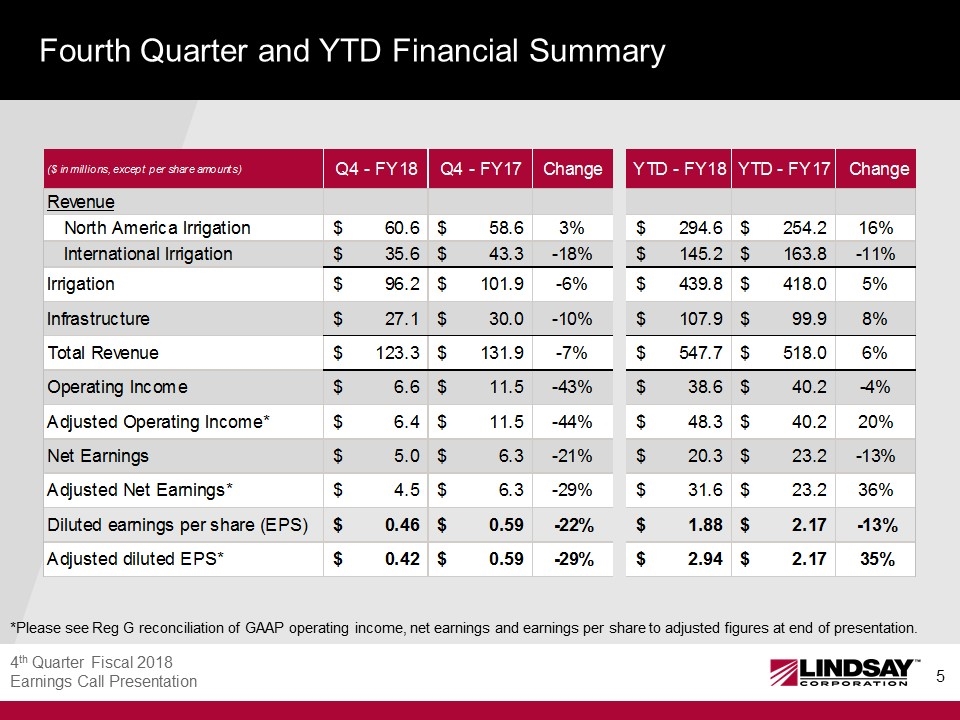

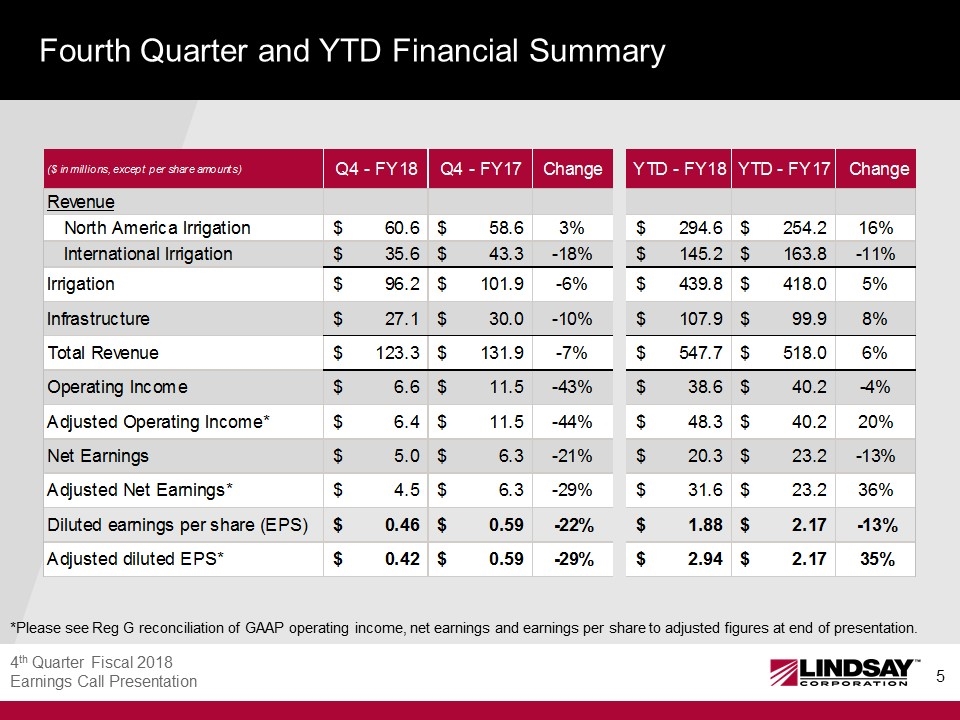

Fourth Quarter and YTD Financial Summary *Please see Reg G reconciliation of GAAP operating income, net earnings and earnings per share to adjusted figures at end of presentation.

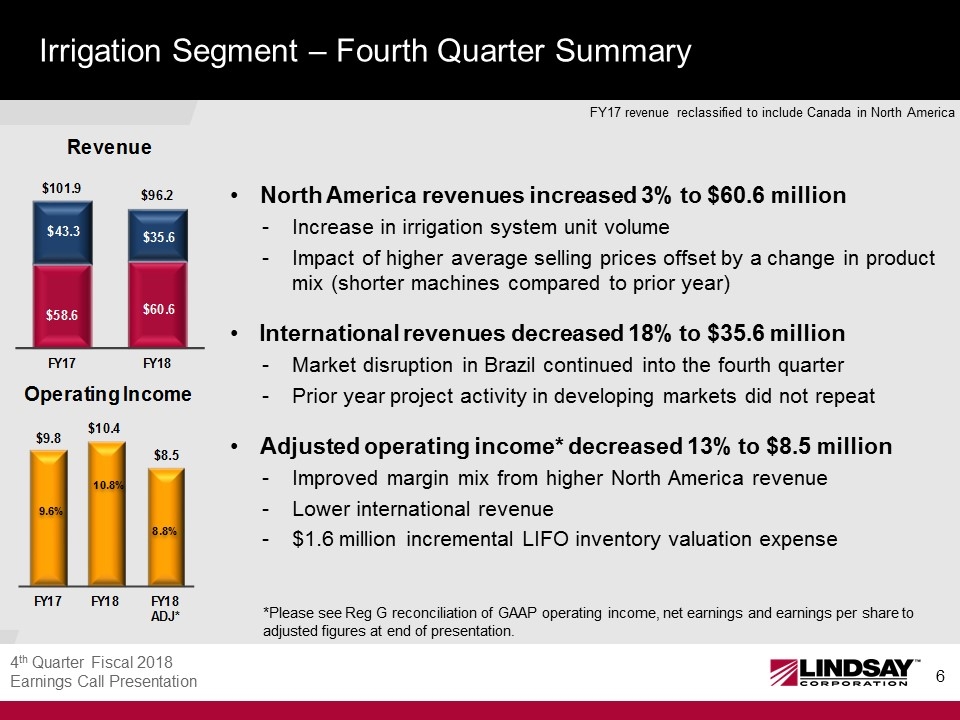

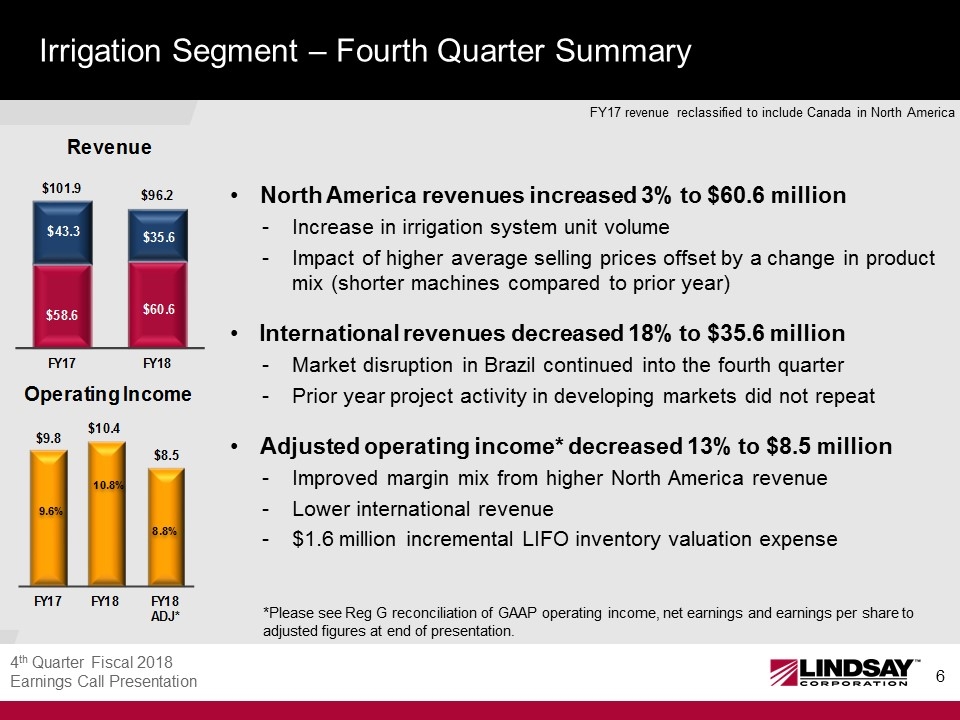

Irrigation Segment – Fourth Quarter Summary North America revenues increased 3% to $60.6 million Increase in irrigation system unit volume Impact of higher average selling prices offset by a change in product mix (shorter machines compared to prior year) International revenues decreased 18% to $35.6 million Market disruption in Brazil continued into the fourth quarter Prior year project activity in developing markets did not repeat Adjusted operating income* decreased 13% to $8.5 million Improved margin mix from higher North America revenue Lower international revenue $1.6 million incremental LIFO inventory valuation expense FY17 revenue reclassified to include Canada in North America *Please see Reg G reconciliation of GAAP operating income, net earnings and earnings per share to adjusted figures at end of presentation.

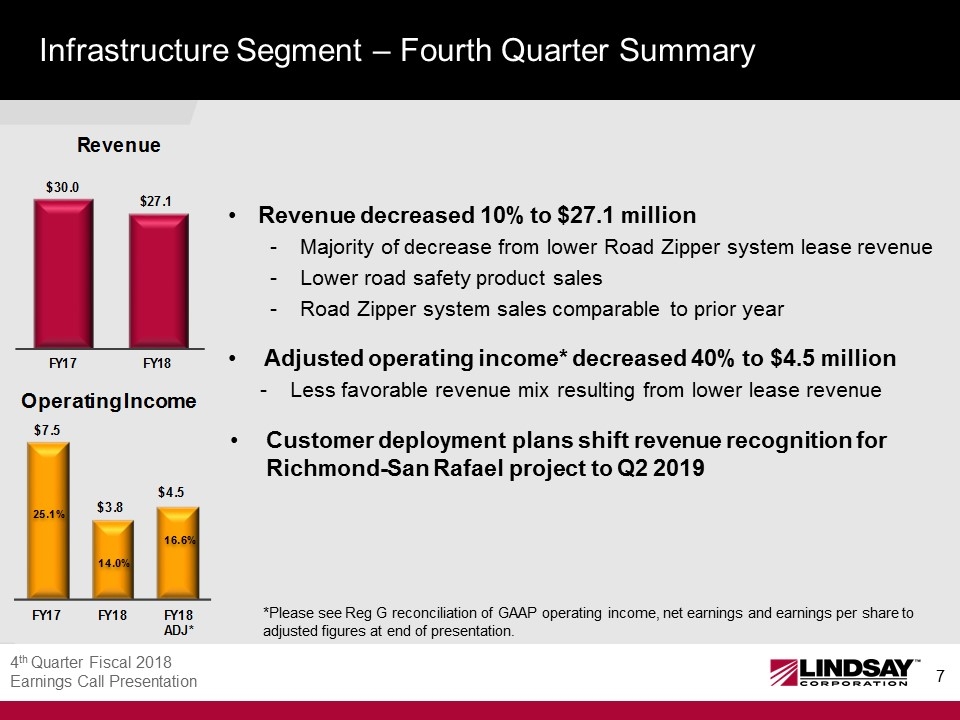

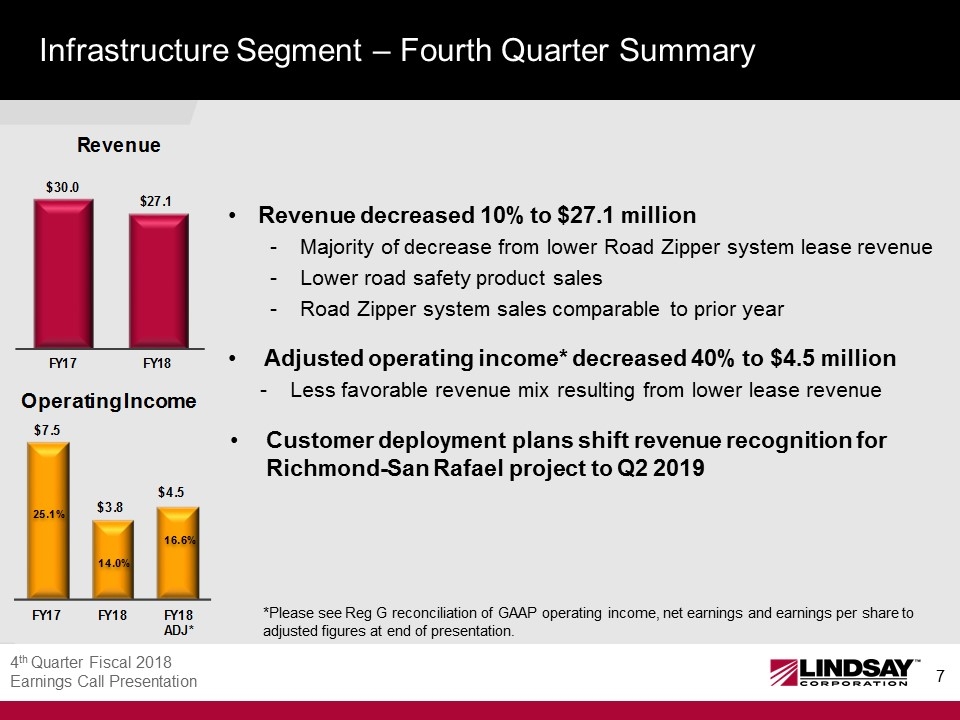

Infrastructure Segment – Fourth Quarter Summary Revenue decreased 10% to $27.1 million Majority of decrease from lower Road Zipper system lease revenue Lower road safety product sales Road Zipper system sales comparable to prior year Adjusted operating income* decreased 40% to $4.5 million Less favorable revenue mix resulting from lower lease revenue Customer deployment plans shift revenue recognition for Richmond-San Rafael project to Q2 2019 *Please see Reg G reconciliation of GAAP operating income, net earnings and earnings per share to adjusted figures at end of presentation.

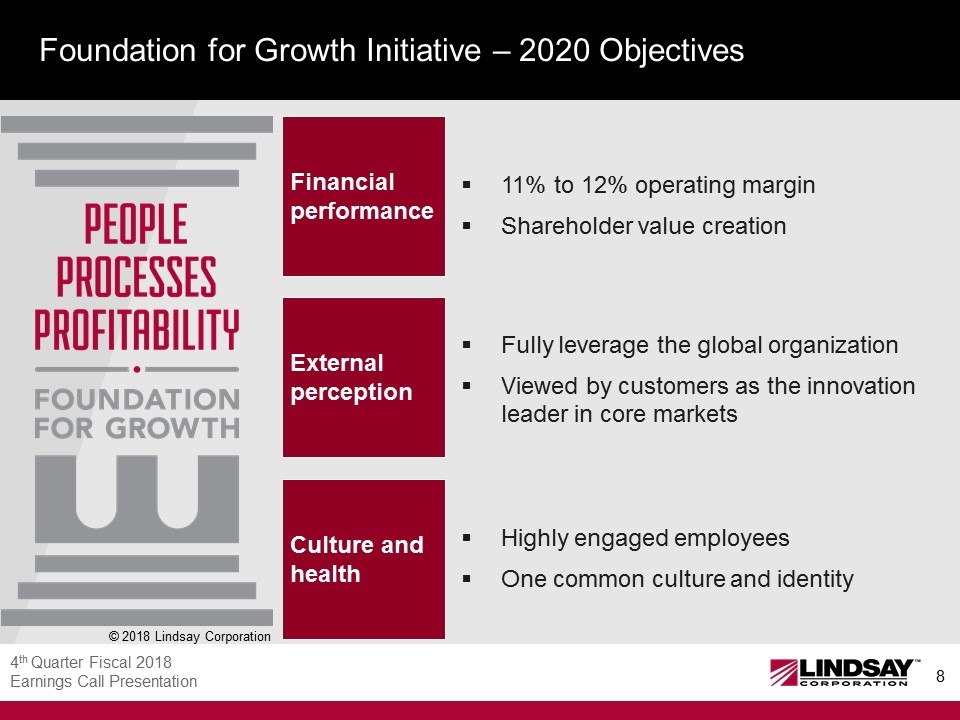

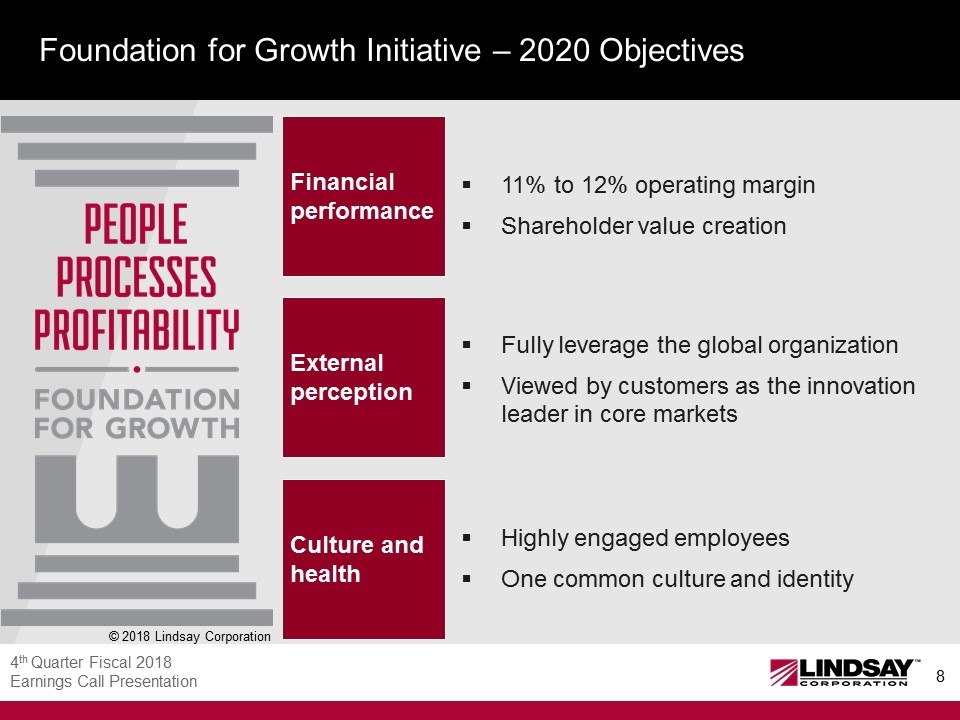

Foundation for Growth Initiative – 2020 Objectives 11% to 12% operating margin Shareholder value creation Fully leverage the global organization Viewed by customers as the innovation leader in core markets Highly engaged employees One common culture and identity Financial performance External perception Culture and health © 2018 Lindsay Corporation

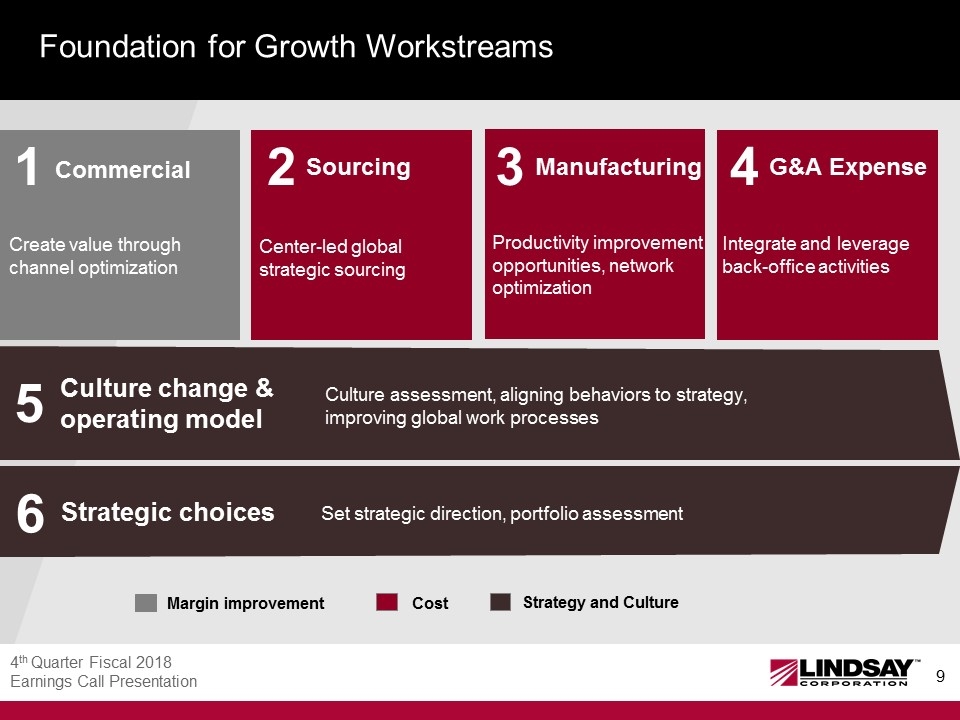

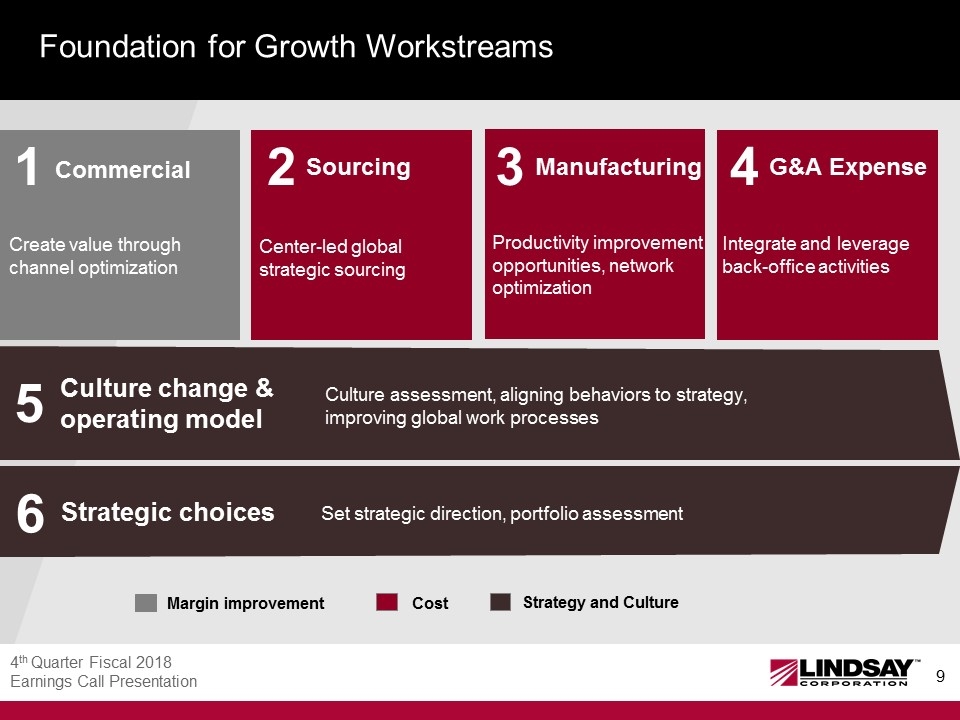

Foundation for Growth Workstreams Strategic choices 6 Culture change & operating model 5 Culture assessment, aligning behaviors to strategy, improving global work processes Set strategic direction, portfolio assessment Commercial 1 Manufacturing 3 Sourcing 2 G&A Expense 4 Create value through channel optimization Center-led global strategic sourcing Productivity improvement opportunities, network optimization Integrate and leverage back-office activities Margin improvement Cost Strategy and Culture

Summary Balance Sheet *The net working capital amount at August 31, 2018 includes $10.8 million of net assets held-for-sale which were previously classified as noncurrent.

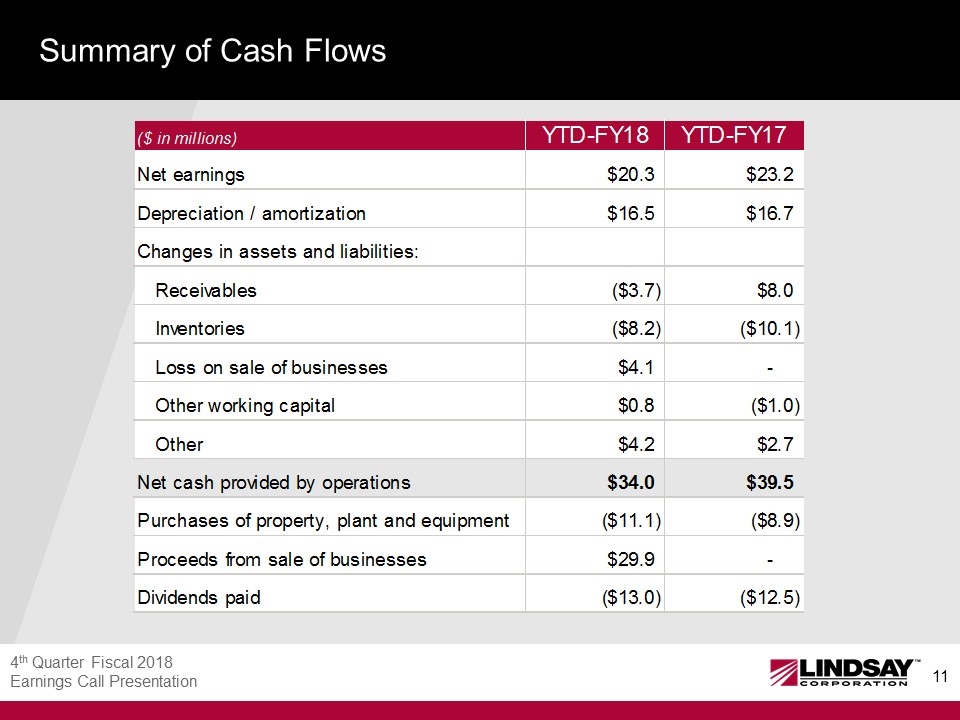

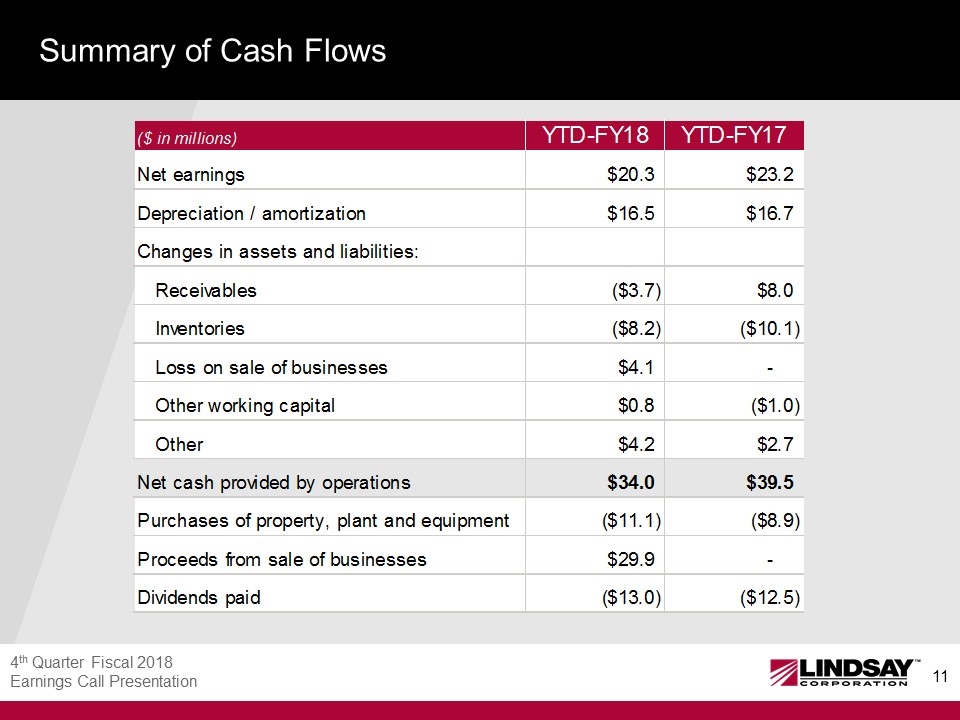

Summary of Cash Flows

Attractive Long-Term Market Drivers Water Conservation Alternative Fuels Increase Yields Improve Road Safety Population Growth Advancing Technology

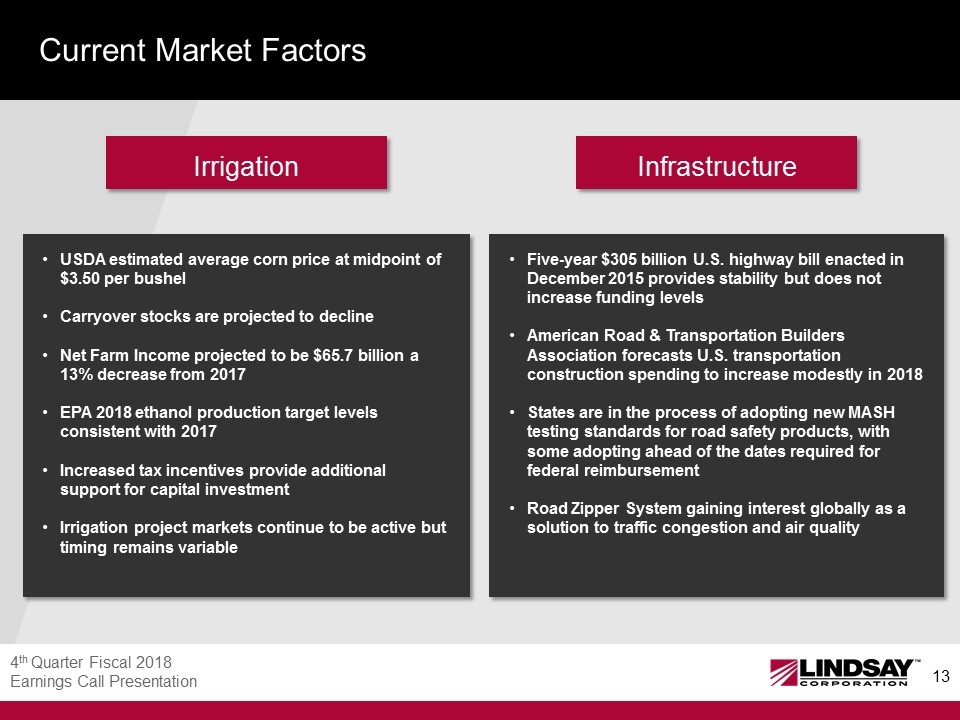

Current Market Factors USDA estimated average corn price at midpoint of $3.50 per bushel Carryover stocks are projected to decline Net Farm Income projected to be $65.7 billion a 13% decrease from 2017 EPA 2018 ethanol production target levels consistent with 2017 Increased tax incentives provide additional support for capital investment Irrigation project markets continue to be active but timing remains variable Five-year $305 billion U.S. highway bill enacted in December 2015 provides stability but does not increase funding levels American Road & Transportation Builders Association forecasts U.S. transportation construction spending to increase modestly in 2018 States are in the process of adopting new MASH testing standards for road safety products, with some adopting ahead of the dates required for federal reimbursement Road Zipper System gaining interest globally as a solution to traffic congestion and air quality Irrigation Infrastructure

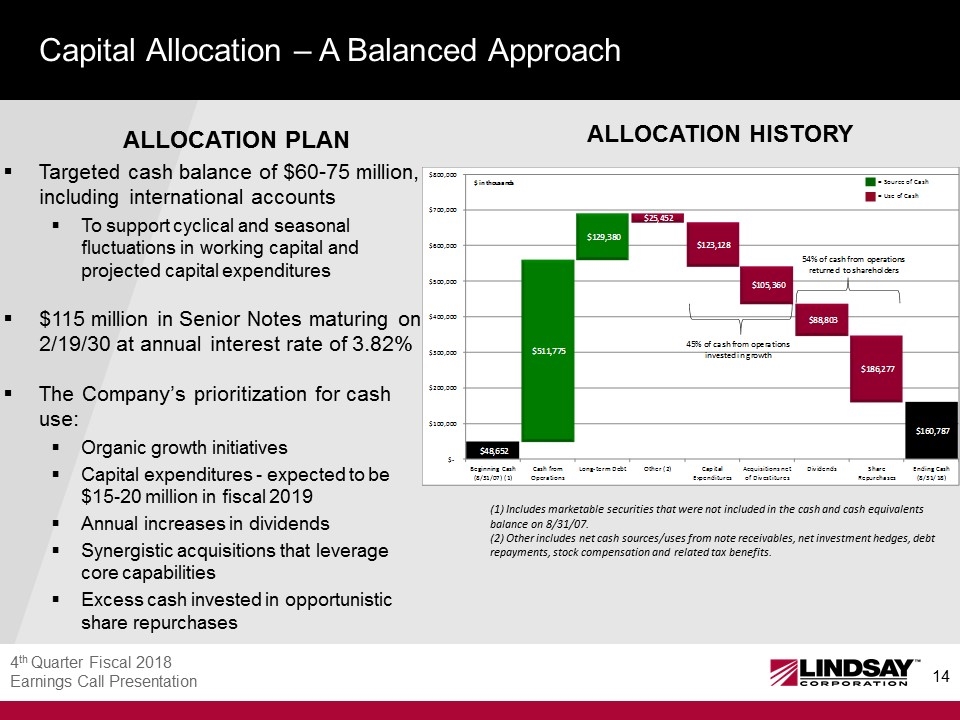

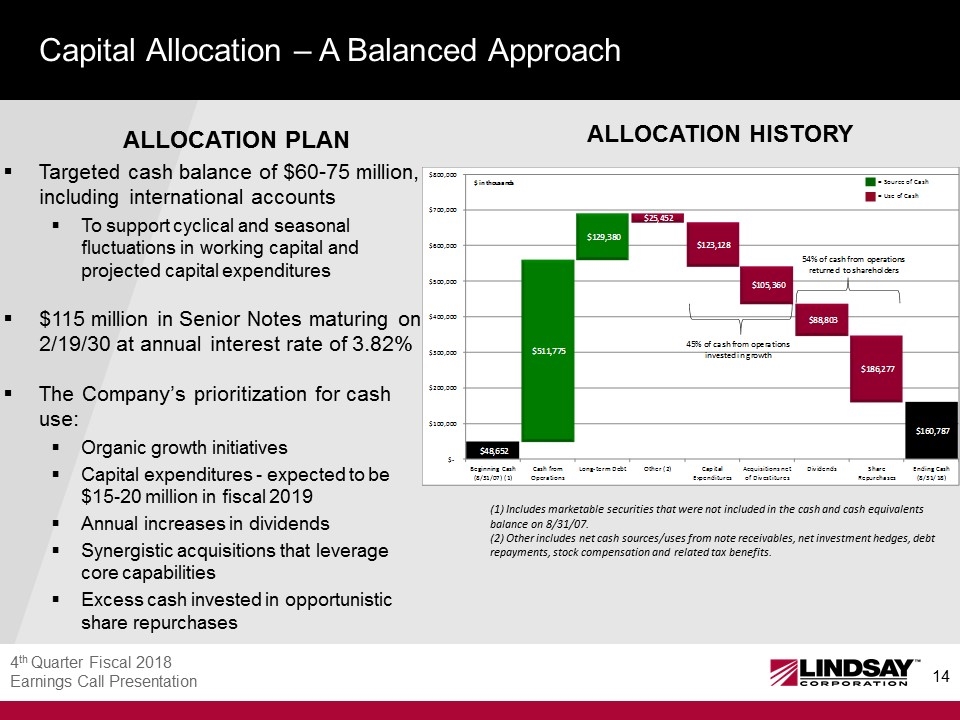

Capital Allocation – A Balanced Approach Targeted cash balance of $60-75 million, including international accounts To support cyclical and seasonal fluctuations in working capital and projected capital expenditures $115 million in Senior Notes maturing on 2/19/30 at annual interest rate of 3.82% The Company’s prioritization for cash use: Organic growth initiatives Capital expenditures - expected to be $15-20 million in fiscal 2019 Annual increases in dividends Synergistic acquisitions that leverage core capabilities Excess cash invested in opportunistic share repurchases (1) Includes marketable securities that were not included in the cash and cash equivalents balance on 8/31/07. (2) Other includes net cash sources/uses from note receivables, net investment hedges, debt repayments, stock compensation and related tax benefits. ALLOCATION PLAN ALLOCATION HISTORY

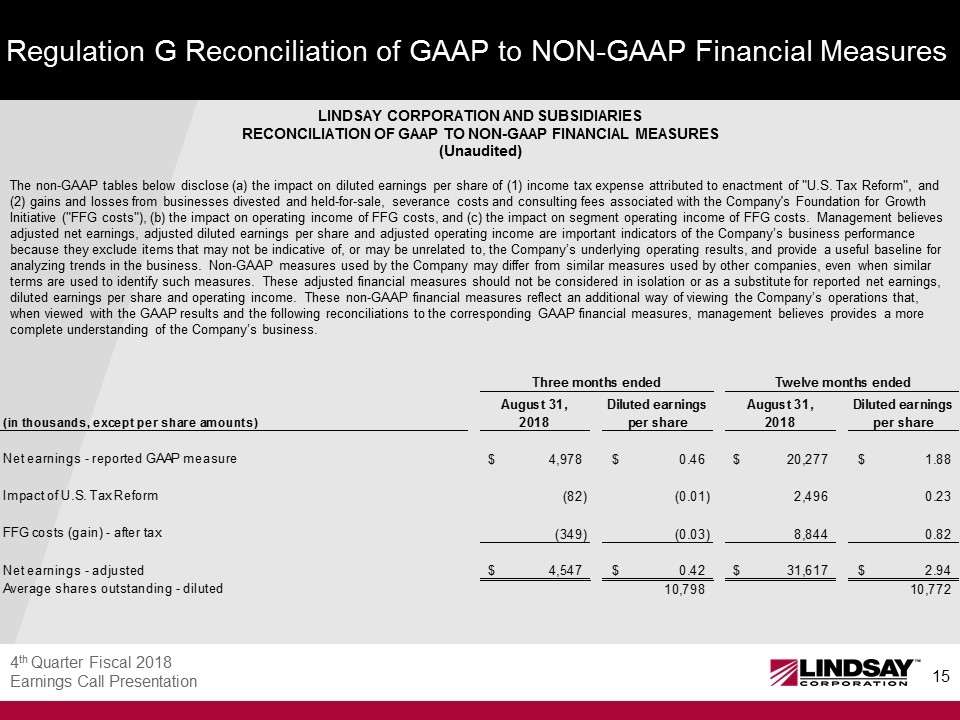

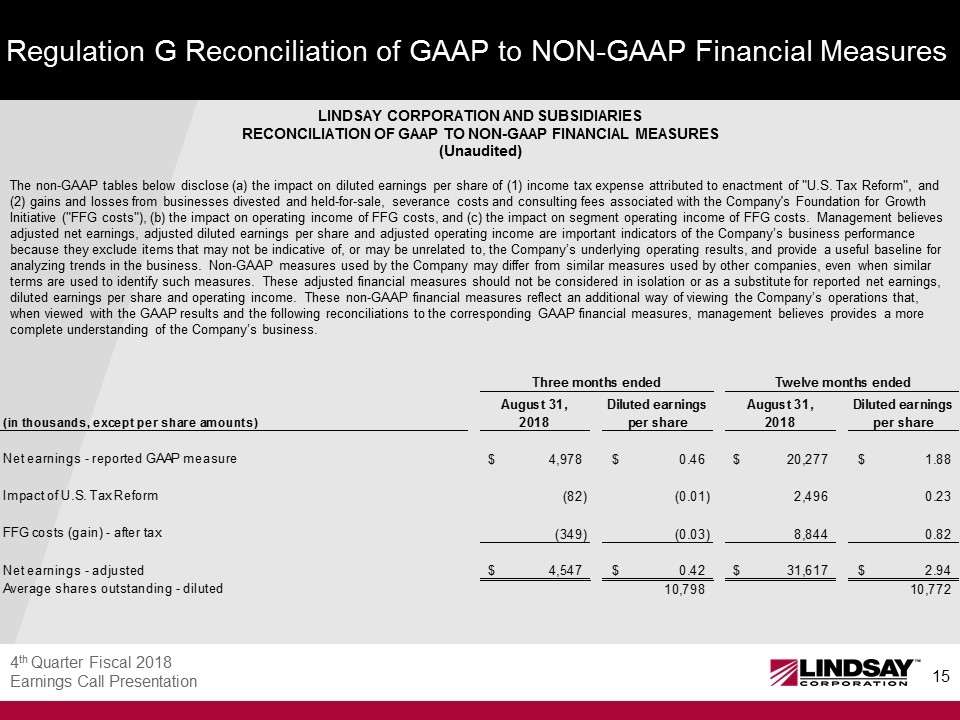

Regulation G Reconciliation of GAAP to NON-GAAP Financial Measures LINDSAY CORPORATION AND SUBSIDIARIES RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (Unaudited) The non-GAAP tables below disclose (a) the impact on diluted earnings per share of (1) income tax expense attributed to enactment of "U.S. Tax Reform", and (2) gains and losses from businesses divested and held-for-sale, severance costs and consulting fees associated with the Company's Foundation for Growth Initiative ("FFG costs"), (b) the impact on operating income of FFG costs, and (c) the impact on segment operating income of FFG costs. Management believes adjusted net earnings, adjusted diluted earnings per share and adjusted operating income are important indicators of the Company’s business performance because they exclude items that may not be indicative of, or may be unrelated to, the Company’s underlying operating results, and provide a useful baseline for analyzing trends in the business. Non-GAAP measures used by the Company may differ from similar measures used by other companies, even when similar terms are used to identify such measures. These adjusted financial measures should not be considered in isolation or as a substitute for reported net earnings, diluted earnings per share and operating income. These non-GAAP financial measures reflect an additional way of viewing the Company’s operations that, when viewed with the GAAP results and the following reconciliations to the corresponding GAAP financial measures, management believes provides a more complete understanding of the Company’s business.

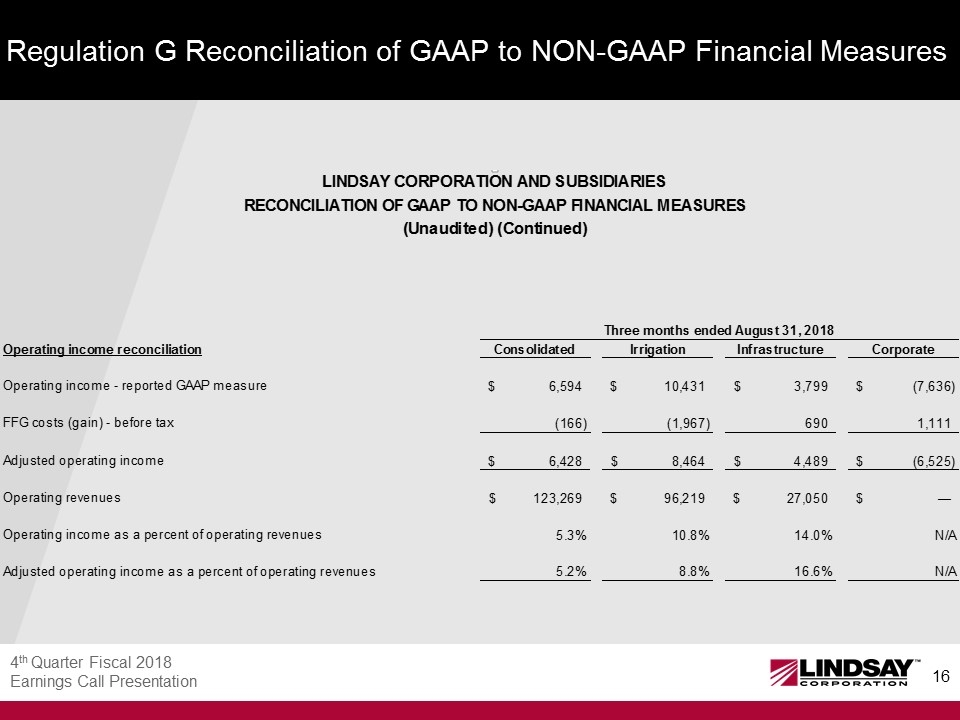

Regulation G Reconciliation of GAAP to NON-GAAP Financial Measures

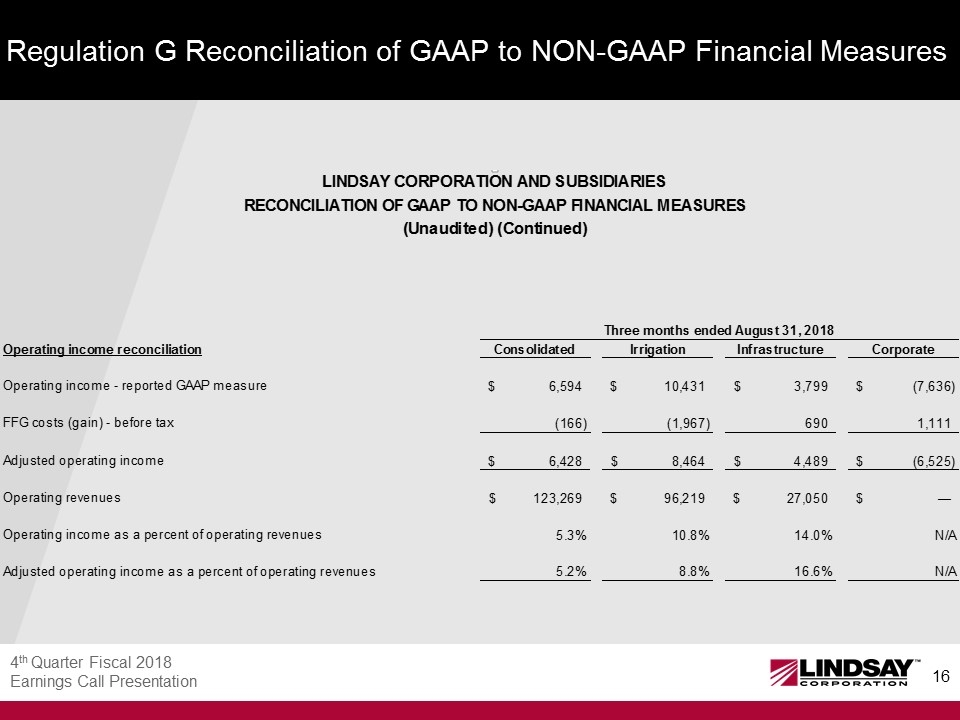

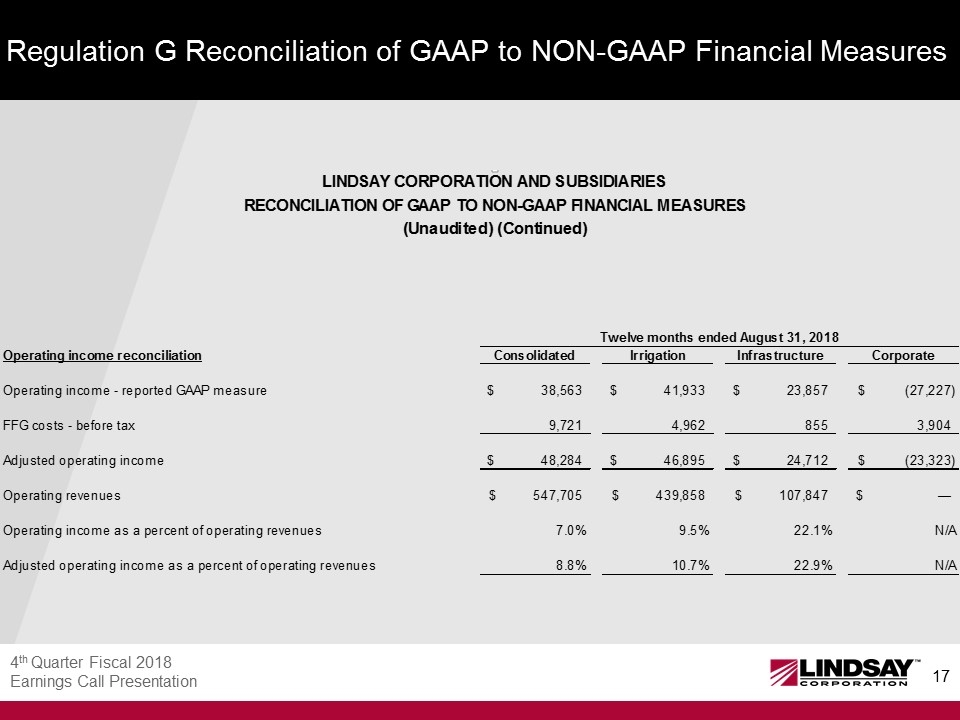

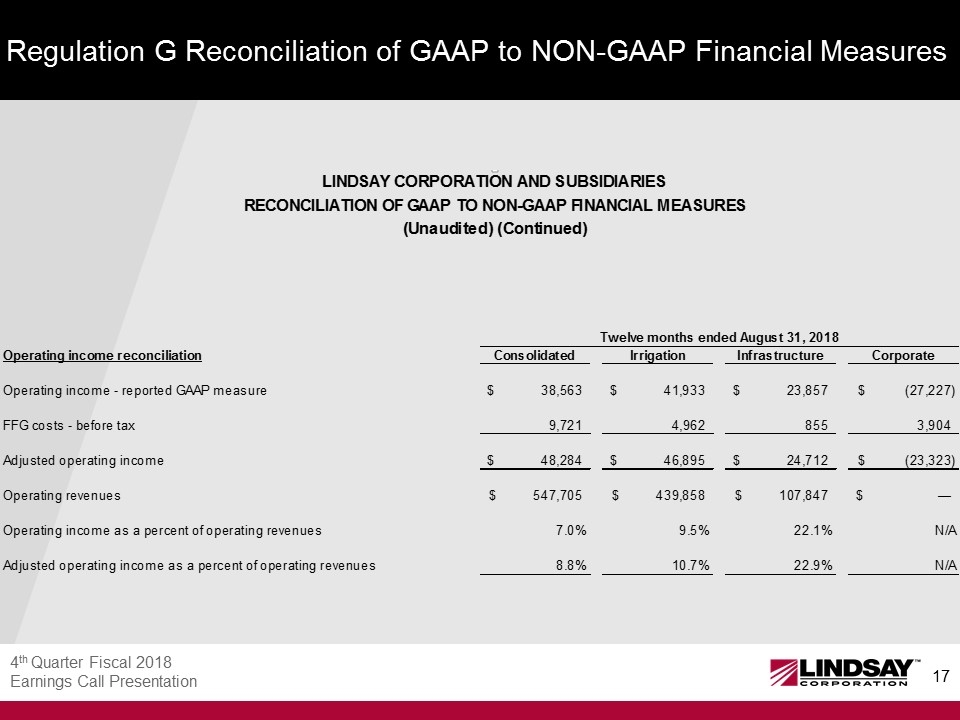

Regulation G Reconciliation of GAAP to NON-GAAP Financial Measures